This chapter provides an overview of the fiduciary duties of the board of directors’ and how company law defines the purpose of a corporation in Asian economies. It outlines the various responsibilities related to sustainability in the governance of companies and how jurisdictions are using measures to promote sustainability disclosure and other initiatives by companies.

Sustainability Policies and Practices for Corporate Governance in Asia

3. The board of directors

Abstract

In order to provide a framework for boards to function effectively, corporate law generally presents a definition of directors’ duties based on two main elements: the duty of care and the duty of loyalty. As set out by the G20/OECD Principles of Corporate Governance, “the duty of care requires boards to act on a fully informed basis, in good faith, with due diligence and care”. The duty of loyalty requires directors to place the interests of the company and its shareholders before their personal interests. It “underpins the effective implementation of other principles relating to, for example, the equitable treatment of shareholders, monitoring of related party transactions and the establishment of the remuneration policy for key executives and board members” (OECD, 2023[1]).

In relation to these responsibilities of boards, sustainability-related developments have increasingly important implications for companies. As a result, policy makers in several jurisdictions have introduced regulatory frameworks governing how boards should manage risks related to sustainability issues while contributing to the sustainability and resilience of their corporations. Several jurisdictions have already amended their legislation to highlight the importance of stakeholders’ interests, shifting from the shareholder‑focused paradigm. The potential implications of sustainability-related matters on the responsibilities of the board relate to four key issues, namely: i) flexibility in the interpretation of directors’ fiduciary duties; ii) the emergence of social enterprises with a public purpose; iii) practices regarding executive compensation plans; and iv) the use of board committees.

3.1. Legal frameworks for the responsibility of the boards

In the context of sustainability, the duty of loyalty, while not always as straightforward as the duty of care, could imply a wider range of factors and stakeholder considerations that a board can and should consider when making decisions about how the company is governed, rather than only considering shareholder primacy. In this respect, the G20/OECD Principles were revised in 2023 with the overarching goal of supporting the sustainability and resilience of corporations, advocating for the inclusion of the interest of stakeholders to the extent that this interest serves the company’s long-term success and performance within the responsibilities of boards. The G20/OECD Principles recommend that “Board members should take account of, among other things, the interests of stakeholders, when making business decisions in the interest of the company’s long-term success and performance and in the interest of its shareholders” (OECD, 2023[1]).

Jurisdictions differ in their approach to the subject of directors’ duty of loyalty. This tends to fall into two main categories: the “shareholder primacy” view, which still requires attention to stakeholders’ interests, but typically this would be limited in its scope to those interests that may also add to shareholder’s value in the long‑term; and “stakeholders capitalism” where directors need to balance shareholders’ financial interests with the best interests of stakeholders, and fulfil a number of public interests (OECD, 2022[2]).

Broader stakeholder and sustainability‑related considerations have also had an impact on the application of the business judgement rule in some jurisdictions.1 In addition, in recent years, there has been an increasing number of companies establishing sustainability committees and including ESG metrics in their performance measures.

3.1.1. Fiduciary duties of boards

The public policy debate regarding the fiduciary duties of corporate boards has evolved over time. For decades, it was assumed that the goal of equity investors was to maximise their financial returns relative to their acceptable risk, while the stakeholders of the company (e.g. employees) and the general public were expected to turn to contracts and statutes to protect their interests (OECD, 2023[3]; Friedman, 1970[4]). However, in recent years there have been increasing calls from company stakeholders for a greater focus on sustainability in company decision-making. Companies and regulators have also been giving increased consideration to sustainability risks and opportunities in response to demands by investors, who are requesting better information to assess companies’ value and their investment and/or voting decisions.

A company’s commitment to all its stakeholders can serve its long-term profitability. As noted in the G20/OECD Principles of Corporate Governance, taking account of the interests of stakeholders when making business decisions “[m]ay help companies to attract, retain and develop more productive employees, to be supported by the communities in which they operate, and to have more loyal customers, thus creating value for their shareholders” (OECD, 2023[1]). Because corporate law does not generally fully adhere to the “shareholder primacy” view, companies have scope to prioritise the interests of stakeholders in some circumstances (OECD, 2022[2]).

Overall, most jurisdictions require directors to act in the best interest of the company, which indirectly implies a consideration of stakeholders’ interests, as stakeholders are important to the long-term interest of the company. As shown in Table 3.1, in many jurisdictions it has been established that directors would have also to consider stakeholders’ interests and the social and environmental stakes of a company’s activity (14 of 18 jurisdictions), even while their core duty may be to act in shareholders’ best interests. Among the jurisdictions covered by this report, there are several where the fiduciary duties of directors are to the company and it is not explicit that this requires directors to consider or take into account stakeholders’ interests, and the social and environmental impacts of a company’s activity, however it is not precluded and can be interpreted to mean that best interests of the company or shareholders imply a consideration of stakeholders’ interests for the long‑term success of the company. For example, in Bangladesh, Hong Kong (China) and Indonesia the duties are towards the company, while in Korea the directors’ fiduciary duty is to the company and to shareholders in general.

In the Philippines, the Code of Corporate Governance for Publicly-Listed Companies defines “stakeholders” broadly as “any individual, organization or society at large who can either affect and/or be affected by the company’s strategies, policies, business decisions and operations, in general. This includes, among others, customers, creditors, employees, suppliers, investors, as well as the government and community in which it operates.” Under Principle 1 of the Code, to establish a competent board, the board is tasked with fostering “the long‑term success of the corporation” and to sustain “its competitiveness and profitability in a manner consistent with its corporate objectives and the long‑term best interests of its shareholders and other stakeholders”. The Code recommends that “Board members should act on a fully informed basis, in good faith, with due diligence and care, and in the best interest of the company and all shareholders” and explains that “[t]here are two key elements of the fiduciary duty of board members: the duty of care and the duty of loyalty." Further, Principle 16 requires the company to “be socially responsible in all its dealings with the communities where it operates. It should ensure that its interactions serve its environment and stakeholders in a positive and progressive manner that is fully supportive of its comprehensive and balanced development” (SEC Memorandum Circular No. 19, Series of 2016, 2016[5]).

In Mongolia, the Company Law requires board members and senior management to make decisions “in compliance with the interest of a company” and to avoid conflicts of interest when making company decisions and to notify if a conflict arises (Law on Company, 2020[6]). Further, the Company Governance Code requires under Principle 7 that "(t)he company will respect the interests of other stakeholders in its operations” and have “a policy document on communication and cooperation with other stakeholders approved by the board of directors.” Further, Principle 9 requires the company to provide investors and stakeholders with certain information and stresses the need for “regular communication with and reporting to stakeholders on environmental, social, and governance issues” (FRC Mongolia, 2022[7]). As such, while shareholders’ interests would be central for governing members of companies, they would still need to consider the interests of stakeholders.

In Lao PDR, the Decision on Board of Directors sets out that the board of directors must protect the interest of shareholders, be transparent and fair, and follow the principles of the duty of loyalty and the duty of care (Decision on Board of Directors (No. 10/LSC), 2019[8]). The Enterprise Law specifies that enterprises have the obligation to, among others, “protect the legitimate rights and interests of workers, preserve the environment…[and]…contribute toward the national and public security”, making it clear the that obligation of companies is broader than just to company shareholders (Enterprise Law (No. 46/NA), 2013[9]).

In China, directors and senior staff are required to “assume the duty of loyalty and duty of care to the company”, per article 147 of the Company Law (National People's Congress, 2018[10]). Further, article 3 of the Municipal Corporate Governance Guidelines requires directors to “protect the legitimate rights of shareholders and ensure that they are treated fairly, respect the basic rights and interests of stakeholders, and effectively enhance the overall value of the enterprise”. Further, article 26 requires the board to “pay attention to the legitimate rights and interests of other stakeholders” and Section VIII is dedicated to “Stakeholders, Environmental Protection and Social Responsibility” (CSRC, 2018[11]).

The approach in Korea, is to specify that the duty is to the company and to shareholders in general. Under the Commercial Act 2020, article 382-3 sets out a duty of loyalty by directors, requiring them to “perform their duties in good faith for the interest of the company in accordance with statutes, and the articles of incorporation.” Further, the general standard is to act with the “due care of a good manager” (Commercial Act (No. 17362), 2020[12]; Civil Act (No. 19098), 2022[13]). This approach is supported by the Korean KOSPI Market Disclosure Regulation (article 24-2), the Enforcement Rules (article 7-2) and the Core Principles of Corporate Governance (in Annex 1 of the Regulations) (Korea Exchange, 2023[14]; Korea Exchange, 2023[15]). In particular, the Core Principles set out under Principle 3 on “Functions of the Board”, state that the Board must “establish the business objectives and strategies in the best interests of the corporation and its shareholders, and effectively supervise the activities of the management” (Korea Exchange, 2019[16]).2

In Hong Kong (China), the governance regime for listed companies derives from the common law and key legislation, non-statutory rules, codes and best practices. The duty of care of directors is set out in the Companies Ordinance (Cap. 622, section 465), involving both an objective and subjective test that requires a director to exercise a standard of care, skill and diligence that would be exercised by a reasonably diligent person (Hong Kong Department of Justice, 2014[17]). A company director must “act honestly and in good faith in the interests of the company as a whole” according to the listing rules, and interests of the company has generally been interpreted to mean shareholders’ (both present and future) financial interests (Lo and Qu, 2018[18]; Companies Registry, 2014[19]). Further, under the listing rules a “listed issuer must ensure that its directors accept full responsibility, collectively and individually, for the listed issuer’s compliance with the Exchange Listing Rules.” This includes ESG-related disclosure obligations under the listing rules.

Table 3.1. Legal frameworks for the responsibility of the boards

|

Jurisdiction |

Fiduciary duties |

Business judgement rule |

Legislation for public benefit corporations (PBCs) or similar |

Controls in PBCs or similar entities |

Requirement to convert to a PBC or similar entity |

|---|---|---|---|---|---|

|

Bangladesh |

-1 |

No |

No |

- |

- |

|

Cambodia |

Shareholders and have regard to stakeholders |

No |

No |

- |

- |

|

China |

Shareholders and have regard to stakeholders |

No |

No |

- |

- |

|

Hong Kong (China) |

-2 |

Yes |

No |

- |

- |

|

India |

Shareholders and have regard to stakeholders |

Yes |

No |

- |

- |

|

Indonesia |

-3 |

Yes |

No |

- |

- |

|

Jurisdiction |

Fiduciary duties |

Business judgement rule |

Legislation for public benefit corporations (PBCs) or similar |

Controls in PBCs or similar entities |

Requirement to convert to a PBC or similar entity |

|

Japan |

Shareholders and have regard to stakeholders4 |

Yes |

No |

- |

- |

|

Korea |

Shareholders5 |

Yes |

Yes |

Controls around use of profits6 |

Must satisfy certain government requirements |

|

Lao PDR |

Shareholders and have regard to stakeholders |

No |

No |

- |

- |

|

Malaysia |

Shareholders and have regard to stakeholders |

Yes |

No7 |

- |

- |

|

Mongolia |

Shareholders and have regard to stakeholders |

No |

No |

- |

- |

|

Pakistan |

Shareholders and have regard to stakeholders |

Yes |

No |

- |

- |

|

Philippines |

Shareholders and have regard to stakeholders |

Yes |

No |

- |

- |

|

Singapore |

Shareholders and have regard to stakeholders |

Yes |

No8 |

- |

- |

|

Chinese Taipei |

Shareholders and have regard to stakeholders |

Yes9 |

No |

- |

- |

|

Thailand |

Shareholders and have regard to stakeholders |

Yes |

Yes |

Controls around revenue source and reinvestment of profits |

Must register as a social enterprise |

|

Sri Lanka |

Shareholders and have regard to stakeholders |

No |

No |

- |

- |

|

Viet Nam |

Shareholders and have regard to stakeholders |

No10 |

Yes |

Inform the competent authority when a social or environmental objective is terminated, or profit is not used for re-investment |

Must register as a social enterprise |

Notes:

1 The Companies Act does not mention the duties, the draft Corporate Governance Guidelines 2020 refers to the “company” (Companies Act (No.18), 1994[20]).

2 The legislation refers to the “company”. While directors owe a fiduciary duty to the company and shareholders, the HKEX Listing Rule 3.16 could be interpreted that directors must ensure compliance with all of the ESG-related disclosure obligations under the Listing Rules (HKEX, 2023[21]). The reporting requirements in sections 388 and 389 of the Companies Ordinance may also imply that directors need to consider the environment (Hong Kong Department of Justice, 2014[17]).

3 The Company Law 2007 refers to the “company” (Company Law (No. 40), 2007[22]).

4 While the Companies Act refers to the “company”, the Corporate Governance Code mentions that directors would have also to coordinate with stakeholders taking into account that company’s sustainable growth and long-term value creation can benefit from contributions by stakeholders including employees, customers, creditors, etc.

5 The framework for Korea is set out in the (Commercial Act (No. 17362), 2020[12]; Korea Exchange, 2019[16]).

6 A social enterprise must use at least two-thirds of its profits towards the realisation of its social objectives, if it generates distributable profits in any given fiscal year. A social purpose must be specified in the articles of incorporation.

7 There is no legislation for public benefit corporations, however, the Companies Act 2016 of Malaysia, Section 45/(h) sets out that a company limited by guarantee, which cannot be formed with share capital, could promote any other object useful for the community or country. Additionally, there are no provisions in the local legal/regulatory framework which prohibits public and private companies other than a company limited by guarantee to pursue explicit objectives related to environmental and social matters. Section 38/(3) of the Companies Act 2016 states that the constitution of a company limited by a guarantee must state the objectives of the company.

8 Singapore has the concept of social enterprises, however they tend to be private limited companies (British Council, 2020[23]).

9 While not explicit, the Supreme Court recognises and describes the connotation of the law of commercial judgement (110 Tai Shang Zi No. 117, 2010[24]).

10 The responsibilities of members of the Board of Directors, members of the Supervisory Board, the Director (General Director) and other executives of public companies are specified in Clause 1, Article 48, Appendix I of (Circular on corporate governance applicable to public companies (116/2020/TT-BTC), 2020[25]). The Model Charter in this Circular suggests the rights and obligations of the Board of Directors: “to have full authority on behalf of the Company to decide and perform the rights and obligations of the company, except for rights and obligations under the authority of the General Meeting of Shareholders" and the responsibility to be honest and avoid conflicts of interest while also ensuring compliance with other relevant laws (e.g. (National Assembly of Viet Nam, 2020[26]; Law on Securities (No. 54/2019/QH14), 2019[27]; Decree No. 155/2020/ND-CP, 2020[28])).

Source: Please see Annex B of this report for relevant sources by jurisdictions.

3.1.2. Application of the business judgement rule

While directors can play an important role in addressing environmental and societal changes through fulfilling their duties, it is not the sole responsibility of corporate directors to solve these issues. As such, the G20/OECD Principles of Corporate Governance suggest that to “guide corporate activities, sectoral policies that make companies internalise environmental and social externalities as well as corporate governance frameworks that set predictable boundaries within which directors have to exercise their fiduciary duties should be considered by policy makers” (OECD, 2023[1]). Such policies and frameworks are anticipated to assist with determining if a director has carried out their fiduciary duties and the application of the business judgement rule to their decisions.

The business judgement rule acts as a presumption that the board of directors acted in the best interest of the company unless plaintiffs can prove negligence or bad faith (Baraka, 2013[29]). Similarly, if there is a conflict of interest for a director, the court will not typically uphold the presumption of the business judgement rule applying. As highlighted by the G20/OECD Principles, “[t]here is some risk that a legal system that enables any investor to challenge corporate activity in the courts can become prone to excessive litigation. Thus, many legal systems have introduced provisions to protect management and board members against litigation abuse in the form of screening mechanisms, such as a pre-trial procedure to evaluate whether the claim is non-meritorious, and safe harbours for management and board member actions (such as the business judgement rule) as well as safe harbours for the disclosure of information. In the end, a balance must be struck between allowing investors to seek remedies for infringement of ownership rights and avoiding excessive litigation” (OECD, 2023[1]).

The business judgement rule is a safe harbour for determining whether directors have complied with their fiduciary duties in their decision‑making. Even if a company board member has a strictly defined shareholder primacy rule in their jurisdiction, the business judgement rule has been adopted in many legal systems and legislation in Asia. This can, for example, authorise companies to donate money, which indicates that there is some flexibility for boards to consider different stakeholders’ interests (Fisch and Davidoff Solomon, 2021[30]). Under the business judgement rule, it has been unlikely in practice that an executive would be held liable in court if they prioritised a stakeholder’s interest within reasonable limits at the expense of a company’s current profits (except where there is a conflict of interest, gross negligence or fraud). Generally, the case law in this area would defer to the board member’s assessment of what would likely be in the best interests of the company in the long‑term, without the benefit of hindsight (OECD, 2023[3]).

Among the 18 Asian jurisdictions covered in this report, 11 apply the business judgement rule or a similar safe harbour for directors in their decision‑making (Table 3.1).

Some jurisdictions, such as Indonesia, Malaysia and Thailand,3 have incorporated the business judgement rule in their statutory law. For instance, Malaysia has a statutory business judgement rule in the Companies Act (section 214). Within the Companies Act, business judgement is defined as any decision on whether or not to take action in relation to a matter relevant to the company. The law deems a director who makes a business judgement to have met the requirement to exercise reasonable care, skill and diligence if they satisfy four conditions: i) they made the business judgement for a proper purpose and in good faith; ii) they do not have a material personal interest in the subject; iii) they are informed about the subject matter to the extent that the director reasonably believes is appropriate in the circumstances; and iv) they reasonably believe that the business judgement is in the best interest of the company (Companies Act (No. 777), 2016[31]).

On the other hand, some jurisdictions, such as Hong Kong (China), India, Japan, Korea, the Philippines, Singapore and Chinese Taipei have developed the business judgement rule via the courts. In Singapore, case law has established the application of the business judgement rule, rather than a statutory rule. The case law establishes that courts do not second‑guess the commercial decisions of directors in acting in the best interests of the company. As such, the courts generally will not interfere with business decisions as long as the directors acted in good faith, and the decisions were independently made and diligently informed. However, this is unlikely to be the case if there are allegations of fraud, breach of fiduciary duty or conspiracy. Although decisions by directors are subjective in nature, the court usually applies an objective test of some form, for instance whether an honest and diligent person in the position of the directors, taking an objective view, could reasonably have concluded that the transactions were in the interests of the company, without the benefit of hindsight. This requires attempting to understand the transaction as it appeared at the time to the board.4

3.1.3. Public benefit corporations or similar regimes

Traditionally organisations could be registered as for‑profit or not-for‑profit, resulting in a clear difference in their purpose and how they operate (Resor, 2012[32]). Generally, despite some differences in corporate law, a company still cannot significantly divert from its profit‑making goal without being authorised by its shareholders. The primary basis for this constraint can be found in the fiduciary duties of directors explained in Section 3.1.1 (OECD, 2023[3]). Around the world, some jurisdictions have recently amended their legislation to create the corporate model of public benefit corporations (PBCs), or similar models that enable companies to have both for-profit and public benefit objectives. This has in part been due to some shareholders expressing interest for companies to adopt objectives that, for example, allow them to pursue explicit objectives related to environmental and social matters, other than the sole objective to maximise profits in the long-term. Jurisdictions that have implemented this type of legislation include Colombia, Ecuador, France, Italy, Korea, Peru, Thailand, the United States and Viet Nam.

However, the public benefit corporation model is less prominent in Asia. As shown in Table 3.1, there are three jurisdictions covered by this report that have created a separate legal form for social enterprises: Korea (Government of Korea, 2007[33]); Thailand (Government of Thailand, 2019[34]); and Viet Nam (National Assembly of Viet Nam, 2020[26]; The Government of Vietnam, 2021[35]; Lim, 2022[36]). Accordingly, while the specifics differ between jurisdictions, directors of PBCs or similar social enterprise companies are required, in line with the mission of the company, to balance the impact of their decisions on their shareholders and stakeholders, which can include employees, customers, the public or the environment in general (Dalessandro, 2019[37]).

In Korea, under the Social Enterprise Promotion Act a ‘social enterprise’ is an entity certified by the Minister of Employment and Labour, that pursues social objectives while engaging in business activities such as production and sales of goods and services. As of 2019, there were estimated to be 2 435 social enterprises.5 In terms of form, a social enterprise may be a corporation or association defined in the Civil Act, a company or limited partnership under the Commercial Act, or a corporation or a non-profit, non‑governmental organisation established under any Special Act.6 If a social enterprise generates distributable profits for a fiscal year, it needs to use at least two-thirds of these profits towards the realisation of its social objectives.7 The social purpose must be specified in the articles of incorporation. There are also special rules governing the process for winding up these companies (Government of Korea, 2007[33]; Peter, 2023[38]). Further, the concept of a ‘social venture’ was recently established by the Act on Special Measures for the Promotion of Venture Businesses. A social venture is a business venture that pursues both social and economic values, and must have a social purpose and an innovative growth potential. Their social purpose needs to be specified in the articles of incorporation (Ministry of SMEs and Startups, 2020[39]).

In Viet Nam, the framework is established by the Law on Enterprises and Decree No. 47/2021 (National Assembly of Viet Nam, 2020[26]; The Government of Vietnam, 2021[35]).8 It establishes that ‘social enterprises’ operate for the purposes of resolving social and environmental issues for public interests and that they are required to use at least 51% of their annual post-tax profit for re-investment to achieve registered targets. The entity must inform the competent authority when they stop pursuing a social or environmental objective or fail to reinvest profits. In terms of the legal form, the Act permits social enterprises to be registered as limited liability companies, joint stock companies, partnerships and sole proprietorships. The Act also commits the government to adopt policies to encourage and assist in development of social enterprises.

In Thailand, the Social Enterprise Promotion Act of 2019 provides a policy mechanism for the promotion of registered social enterprises that aim to deliver a positive social impact while making a profit. There are two registration types according to the Act: profit-sharing (more restrictive criteria compared to non‑profit‑sharing entities, profit‑sharing entities must generate half their revenues from the business and reinvest 70% of profits); and non-profit-sharing (eligible for corporate tax to be waived). In terms of form, the registration requirements include that the entity must be a legal person and can be structured as a limited company, co-operative or foundation. The Securities and Exchange Commission of Thailand (SEC) allows registered entities to raise public funds without having to change from a limited company to a public limited company and without applying for the SEC’s permission.9 Benefits also include preferential treatment in government procurement as well as access to loans or grants (Government of Thailand, 2019[34]; British Council, 2020[40]; Prateeppornnarong and Nuchpiam, 2022[41]).

In Asian jurisdictions where there is no separate legal form or framework, these enterprises are often structured as a private limited company. It may be possible for models that give similar outcomes to public benefit corporations to operate in many Asian jurisdictions under their current legal frameworks. However, there are arguments that under the current frameworks there is the risk that social enterprises could deviate from the social purpose or prioritise maximising profit over the pursuit of social benefits, particularly where conflicts of interest are difficult to manage (Lim, 2023[42]).10 As such, a key decision point arises when there is a choice for a company to either prioritise achieving a public benefit or to maximise profit for the company (and it is not possible to do both). Practically, under the current frameworks in many Asian jurisdictions, a company limited by shares can amend the company constitution to include a social mission.11 However, the constitution can later be amended or removed by special resolution, for instance, depending on the specific law, if the majority shareholders change and decide the company should only pursue profits instead (Lim, 2022[36]). As recommended in the G20/OECD Principles, “[s]uch frameworks should provide for due consideration of dissenting shareholder rights”. Further, when a for-profit company decides to also pursue public benefit objectives, safeguarding mechanisms can include “requiring the consent of minority shareholders or a supermajority shareholders’ approval for a company to add public benefit goals to its articles of association, or by providing the right for dissenting shareholders to sell their shares back to the company at a fair price” (OECD, 2023[1]).

In Malaysia, the Social Enterprise Accreditation Guidelines provide a definition of social enterprise: a “[b]usiness entity that is registered under any written law in Malaysia that proactively creates positive social or environmental impact in a way that is financially sustainable” (MED Malaysia, 2019[43]). There is an accreditation process for such enterprises in Malaysia, but a specific corporate form is not required. These social enterprises tend to be private limited companies. Furthermore, the Guidelines state that the “[s]ocial/environmental goal does not need to be the organisation’s main goal or its top priority – it is acceptable for organisations to have pursuit of profit as their main aim”. They must be financially sustainable,12 contribute significant resources to the social or environmental mission and comply with reporting requirements.

While Indonesia has no specific legal entity for a social enterprise, there are informal social ventures, which often tend to be in the form of: a foundation, an association, a cooperative, a private limited company or a commanditaire vennootschap (a type of social enterprise established by one or more people but with no separation of assets) (Maria R.N. Radyati, 2019[44]; British Council, 2021[45]; Aluisius Hery Pratono, 2016[46]). Similarly, there are provisions in the Philippines’ Corporation Code that allow corporations to include social and environmental objectives in their Articles of Incorporation, indicating a commitment to a social and environmental purpose, but there is not a specific form for this type of organisation. This is also the case for many Asian jurisdictions.

3.2. Executive renumeration and sustainability committees

In addition to sustainability disclosure and assurance, the inclusion of ESG metrics in compensation plans could further serve as a tool to ensure accountability of management for companies’ ESG performance. The G20/OECD Principles recommend that company disclosure should include “material policies and performance metrics related to environmental and social matters”. They also highlight the link between remuneration and a company’s long-term performance, sustainability and resilience. They elaborate that “[t]he use of sustainability indicators in remuneration may also warrant disclosure that allows investors to assess whether indicators are linked to material sustainability risks and opportunities and incentivise a long-term view” (Principle IV.A.6) (OECD, 2023[1]).

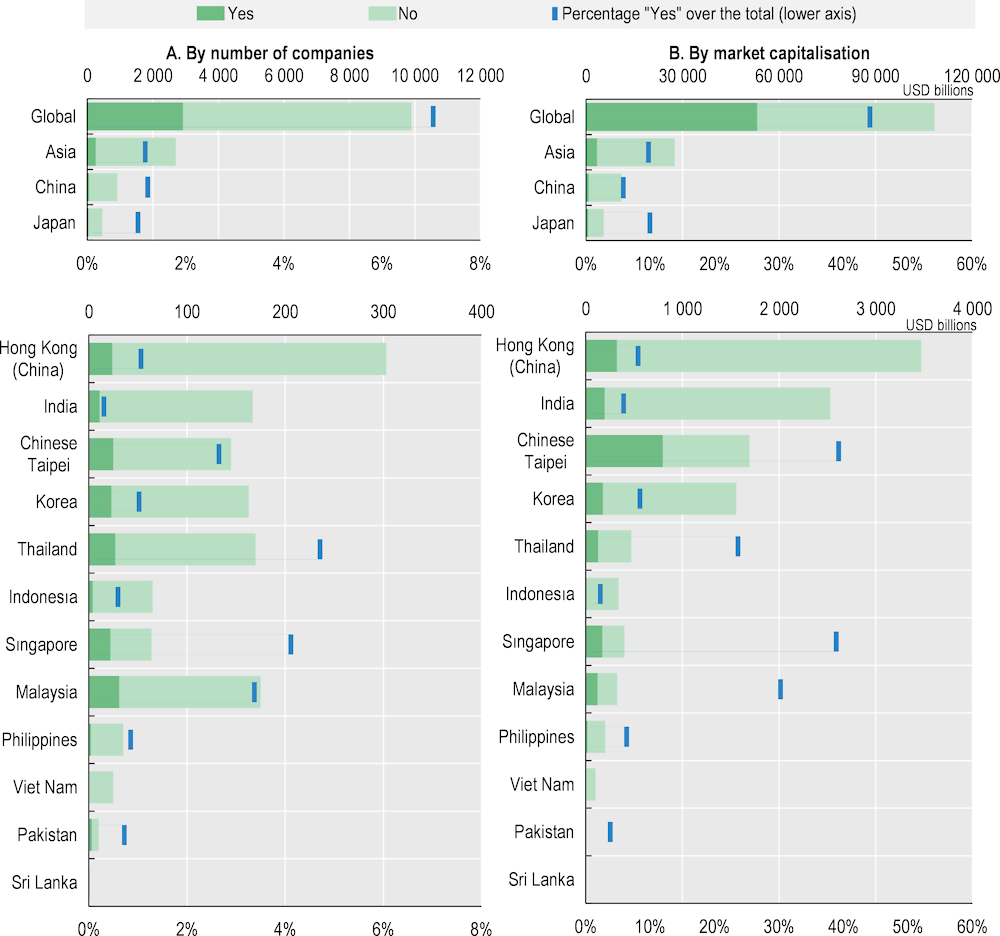

Globally, companies representing 85% of global market capitalisation have executive compensation policies that are linked to some type of performance measure, including financial metrics. In recent years, there has been an increasing number of companies including sustainability-related metrics in their performance measures. By the end of 2021, around 3 000 companies globally representing 44% of market capitalisation include a variable component of executive remuneration based on sustainability factors (Figure 3.1, Panels A and B). For Asian listed companies, these numbers are lower. In the region, 66% of companies by market capitalisation have performance-based incentives for executives, and only 9% have a performance compensation policy linked to sustainability factors. Within the region, Chinese Taipei (39%), Singapore (38%), Malaysia (30%), Thailand (23%) and Japan (10%) stand out with percentages above the Asian average.

The G20/OECD Principles recommend that boards should fulfil certain key functions, one of which is risk management. Notably, as part of the overall risk management strategy, directors should ensure that the structure, composition and procedures are adapted as necessary to integrate the consideration of sustainability risks. If sustainability risks are financially material for a company, they would have to be properly managed by senior executives and overseen by the board (OECD, 2020[47]). For that purpose, the creation of a committee responsible for overseeing the management of sustainability risks and opportunities has become increasingly common (OECD, 2023[48]). It is worth mentioning that a board committee responsible for sustainability is one way for a company to manage “social and environmental risks, opportunities, goals and strategies, including related to climate” (OECD, 2023[1]). However, the necessity of such a board might not be evident for certain enterprises, as noted in the G20/OECD Principles: “[t]he establishment of committees to advise on additional issues should remain at the discretion of the company and should be flexible and proportional according to the needs of the board” (OECD, 2023[1]).

Figure 3.1. Executive compensation linked to sustainability matters, end-2021

Note 1: The “total” in “percentage of ‘Yes’ over the total” includes all listed companies within each category, including those for which there is no available information. For instance, in the case of the global category, the percentage is calculated over 41 802 worldwide listed companies, while in Asia the percentage is calculated over 23 304 companies.

Note 2: The compensation policy includes remuneration for the CEO, executive directors, non-board executives and other management bodies based on “ESG or sustainability factors”.

Note 3: Asian data on sustainability does not include relevant information about Bangladesh, Cambodia, Lao PDR and Mongolia.

Note 4: The information provided in these tables was retrieved from LSEG and Bloomberg, therefore, it may differ from the national statistics. Source: OECD Corporate Sustainability dataset, LSEG. See Annex for details.

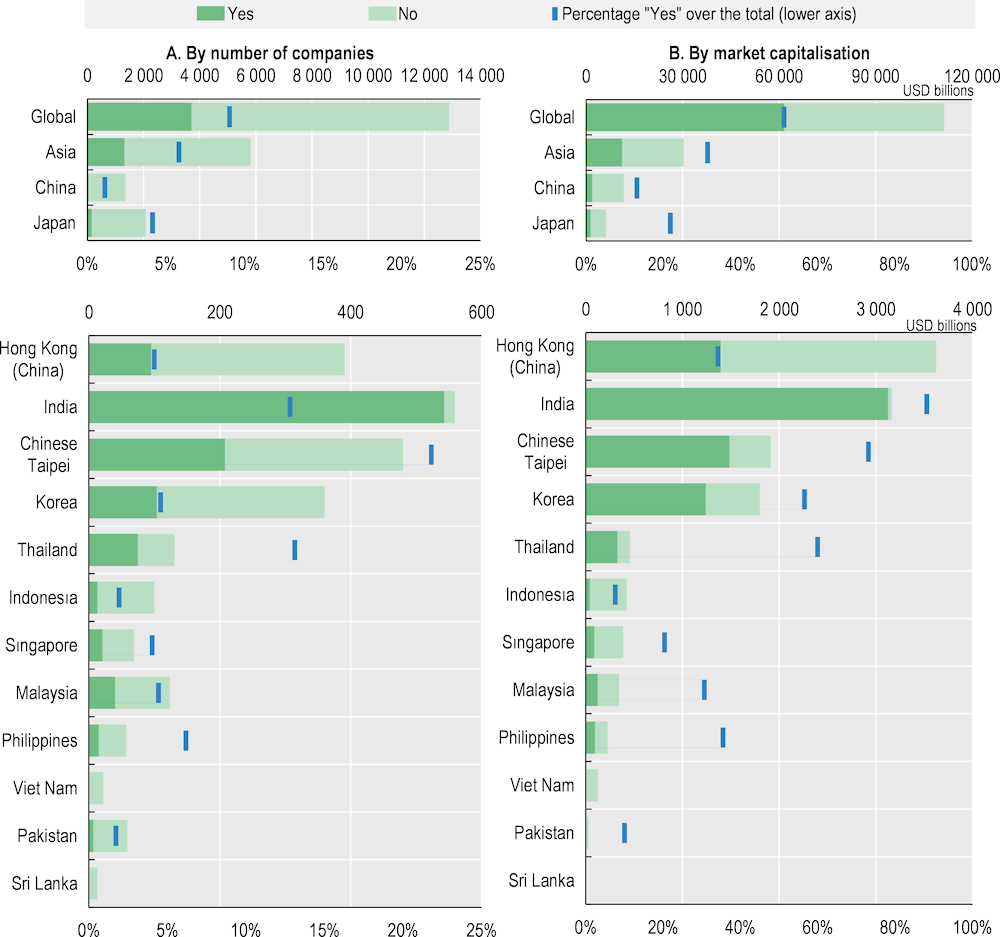

Companies representing around half of the world’s market capitalisation have established a committee responsible for overseeing the management of sustainability risks and opportunities, reporting directly to the board. Notably, these companies represent less than 10% of the number of listed companies globally, suggesting that companies establishing a sustainability committee are in its majority large companies. Among Asian listed companies, it is around a third and the share of companies is even lower at 5.7% (Figure 3.2, Panel B). However, there are significant differences across jurisdictions. Several Asian jurisdictions exceed the global average by market capitalisation, such as India with 88%, Chinese Taipei with 72%, Thailand with 59% and Korea with 56%. This contrasts with very low shares in Viet Nam and Sri Lanka (Figure 3.2, Panel B).

Figure 3.2. Board committees responsible for sustainability, end-2021

Note 1: The “total” in “percentage of ‘Yes’ over the total” includes all listed companies within each category, including those for which there is no available information. For instance, in the case of the global category, the percentage is calculated over 41 802 worldwide listed companies, while in Asia the percentage is calculated over 23 304 companies.

Note 2: A company is considered to have a board committee responsible for sustainability if the responsibilities of the committee explicitly include oversight of corporate social responsibility, sustainability, health and safety, and energy efficiency activities, regardless of the name of the committee. For example, a company with a “risk management committee” would be included in the category “Yes” if mentioned committee is responsible for managing sustainability risks.

Note 3: Asian data on sustainability does not include relevant information about Bangladesh, Cambodia, Lao PDR and Mongolia.

Note 4: The information provided in these tables was retrieved from Bloomberg, therefore, it may differ from the national statistics.

Source: Corporate Sustainability dataset, Bloomberg. See Annex for details.

References

[24] 110 Tai Shang Zi No. 117 (2010), Supreme Court in Chinese Taipei- The Duty of Fidelity and the Rules of Business Judgment of Company Leaders, https://plus.public.com.tw/article-20230206-3195-1.

[46] Aluisius Hery Pratono, P. (2016), “Social Enterprise in Indonesia: Emerging Models under Transition Government”, ICSEM Working Papers 36, https://www.researchgate.net/publication/310773831_Social_Enterprise_in_Indonesia_Emerging_Models_under_Transition_Government.

[45] British Council (2021), “Supporting Social Enterprises in Indonesia”, https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/---ilo-jakarta/documents/meetingdocument/wcms_815538.pdf.

[40] British Council (2020), “Global Social Enterprise: The State of Social Enterprise in Thailand”, https://www.britishcouncil.org/sites/default/files/state_of_social_enterprise_in_thailand_2020_final_web.pdf.

[23] British Council (2020), The State of Social Enterprises in Singapore, https://www.britishcouncil.org/sites/default/files/the_state_of_social_enterprise_in_singapore_0.pdf.

[25] Circular on corporate governance applicable to public companies (116/2020/TT-BTC) (2020), Government of Viet Nam, https://thuvienphapluat.vn/van-ban/EN/Doanh-nghiep/Circular-116-2020-TT-BTC-guidelines-for-implementation-of-administration-o-public-companies/466659/tieng-anh.aspx.

[13] Civil Act (No. 19098) (2022), Government of Korea, https://elaw.klri.re.kr/eng_mobile/subjectViewer.do?hseq=61788&type=subject&key=korean&pCode=3&pName=Would-be-wed.

[12] Commercial Act (No. 17362) (2020), Government of Korea, https://elaw.klri.re.kr/kor_service/lawView.do?hseq=54525&lang=ENG.

[31] Companies Act (No. 777) (2016), Government of Malaysia, https://www.ssm.com.my/Pages/Legal_Framework/Companies%20-Act%20-1965-(Repealed)/aktabi_20160915_companiesact2016act777_0.pdf.

[20] Companies Act (No.18) (1994), Government of Bangladesh, http://bdlaws.minlaw.gov.bd/act-788.html.

[19] Companies Registry (2014), “A Guide on Directors’ Duties”, https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Corporate-Governance-Practices/director_guide_e.pdf.

[22] Company Law (No. 40) (2007), Indonesian Government, https://cdn.indonesia-investments.com/documents/Company-Law-Indonesia-Law-No.-40-of-2007-on-Limited-Liability-Companies-Indonesia-Investments.pdf.

[11] CSRC (2018), Municipal Corporate Governance Guidelines, China Securities Regulatory Commission, https://www.gov.cn/gongbao/content/2019/content_5363087.htm.

[37] Dalessandro, D. (2019), “The Development of Social Enterprise and Rise of Benefit Corporations: A Global Solution?”, Hastings Bus. L.J., Vol. 15/294, https://repository.uchastings.edu/hastings_business_law_journal/vol15/iss2/4.

[8] Decision on Board of Directors (No. 10/LSC) (2019), Lao PDR, Securities Commission, https://www.lsc.gov.la/Doc_legal/agreement%20on%20bord%20of%20director%2010%20lsc%2026%2004%202019.pdf.

[28] Decree No. 155/2020/ND-CP (2020), Government of Viet Nam, https://thuvienphapluat.vn/van-ban/EN/Chung-khoan/Decree-155-2020-ND-CP-elaboration-of-some-Articles-of-the-Law-on-Securities/484721/tieng-anh.aspx.

[9] Enterprise Law (No. 46/NA) (2013), Lao PDR, http://lsp.moic.gov.la/index.php?r=site%2Fdisplaylegal&id=115#129.

[52] Exemption for Share Offering of Social Enterprise Being a Limited Company in General Case or to the General Public (No. Tor Jor. 1/2563) (2020), Capital Market Supervisory Board, https://sc.cgs.or.kr/common/aboutdown.jsp?fp=agMgb5yRtiV6r6qmSXlBSw%3D%3D&fnm=fPT20vKlTVaBTmwVIXQKWRY7h1HGP329JwlrMs0U9YGMI2jGfUWXUHjQXo63NONjOKfdEeoXt%2FZGxHDQEgQoXQAp71n60naW8uLQCSglNbs%3D (in Thai) (accessed on 2023).

[30] Fisch, J. and S. Davidoff Solomon (2021), ““Should Corporations have a Purpose?”, Texas Law Review, Vol. 99, p. 1309, 2021, U of Penn, Inst for Law & Econ Research Paper No. 20-22, European Corporate Governance Institute - Law Working Paper No. 510/2020, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3561164.

[7] FRC Mongolia (2022), Code of Corporate Governance, Mongolian Financial Regulatory Commission, https://track.unodc.org/uploads/documents/BRI-legal-resources/Mongolia/8_-Corporate_governance_code.pdf.

[4] Friedman, M. (1970), “The Social Responsibility Of Business Is to Increase Its Profits”, https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html.

[50] Gibson Dunn (2021), “Directors’ Duties & Responsibilities (Singapore): Updated Primer,”, https://www.gibsondunn.com/wp-content/uploads/2021/03/Directors-Duties-and-Responsibilities-in-Singapore-February-2021.pdf.

[33] Government of Korea (2007), Social Enterprise Promotion Act (No. 8217), https://elaw.klri.re.kr/kor_mobile/viewer.do?hseq=24346&type=part&key=40.

[34] Government of Thailand (2019), “Social Enterprise Promotion Act (B.E. 2562)”, https://www.osep.or.th/en/%e0%b8%81%e0%b8%8e%e0%b8%ab%e0%b8%a1%e0%b8%b2%e0%b8%a2%e0%b8%97%e0%b8%b5%e0%b9%88%e0%b9%80%e0%b8%81%e0%b8%b5%e0%b9%88%e0%b8%a2%e0%b8%a7%e0%b8%82%e0%b9%89%e0%b8%ad%e0%b8%87-eng/.

[21] HKEX (2023), “Main Board Listing Rules”, https://en-rules.hkex.com.hk/rulebook/main-board-listing-rules (accessed on 29 June 2023).

[17] Hong Kong Department of Justice (2014), “Companies Ordinance”, Chapter 622, https://www.elegislation.gov.hk/hk/cap622!en.

[15] Korea Exchange (2023), “Enforcement Rules of KOSPI Market Disclosure Regulation”, https://sribond.krx.co.kr/en/05/05040000/SRI05040000.jsp#.

[14] Korea Exchange (2023), “KOSPI Market Disclosure Regulation”, https://sribond.krx.co.kr/en/05/05040000/SRI05040000.jsp#.

[16] Korea Exchange (2019), “Guidelines on Disclosure of Corporate Governance”, https://kind.krx.co.kr/disclosureinfo/searchmaterials.do?method=searchMaterialsMain.

[53] Korea Social Enterprise Promotion Agency (2023), Korea Social Enterprise Promotion Agency, https://www.socialenterprise.or.kr/_engsocial/?m_cd=0102 (accessed on 23 June 2023).

[6] Law on Company (2020), revised version, Mongolian Financial Regulatory Commission, http://www.frc.mn/resource/frc/Document/2020/09/01/4uupffsbdbdow2fj/2020.09.01%20Law%20on%20Company.pdf.

[27] Law on Securities (No. 54/2019/QH14) (2019), Government of Viet Nam, https://thuvienphapluat.vn/van-ban/EN/Chung-khoan/Law-54-2019-QH14-Securities/436329/tieng-anh.aspx.

[42] Lim, E. (2023), Social Enterprises in Asia: A New Legal form, Cambridge University Press, https://doi.org/10.1017/9781108937313.006.

[36] Lim, E. (2022), “A New Legal Form for Social Enterprises in Asia”, American Journal of Comparative Law, Vol. 69, https://ssrn.com/abstract=3780666.

[18] Lo, S. and C. Qu (2018), Law of Companies in Hong Kong, Sweet & Maxwell.

[44] Maria R.N. Radyati, T. (2019), Social Enterprises in Indonesia: Country Report, Fab Move, https://fabmove.eu/wp-content/uploads/2019/02/Country-Report-Indonesia.pdf.

[43] MED Malaysia (2019), “Ministry of Entrepreneur Development, Social Enterprise Accreditation (SE.A) Guidelines”, https://s3-ap-southeast-1.amazonaws.com/mymagic-misc/SEA_Guideline-en.pdf.

[39] Ministry of SMEs and Startups (2020), “Act on Special Measures for the Promotion of Venture Businesses (No. 17764)”, https://elaw.klri.re.kr/kor_service/lawView.do?hseq=55375&lang=ENG.

[26] National Assembly of Viet Nam (2020), Law on Enterprises (No. 59/2020/QH14), http://bross.vn/images/advertise/AUO5E94O_LOE-LOI2020_EN.pdf.

[10] National People’s Congress (2018), Company Law of the People’s Republic of China, http://www.npc.gov.cn/zgrdw/npc/xinwen/2018-11/05/content_2065671.htm.

[48] OECD (2023), “Corporate finance and corporate governance in ASEAN economies”, OECD Publishing, Paris, https://www.oecd.org/corporate/background-note-corporate-finance-and-corporate-governance-ASEAN-economies.htm.

[1] OECD (2023), G20/OECD Principles of Corporate Governance 2023, OECD Publishing, Paris, https://doi.org/10.1787/ed750b30-en.

[3] OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en.

[2] OECD (2022), Climate Change and Corporate Governance, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/272d85c3-en.

[47] OECD (2020), OECD Business and Finance Outlook 2020: Sustainable and Resilient Finance, OECD Publishing, Paris, https://doi.org/10.1787/eb61fd29-en.

[38] Peter, H. (ed.) (2023), The International Handbook of Social Enterprise Law (Chapter: Social Enterprises and Benefit Corporations in South Korea by Kil, H.J.), Springer, https://doi.org/10.1007/978-3-031-14216-1_38.

[41] Prateeppornnarong, D. and P. Nuchpiam (2022), “Development of Social Enterprises in Thailand: A Critical Investigation of the Social Enterprise Promotion Act 2019 within a Theoretical Framework of Law and Development”, NIDA Development Journal, Vol. 62/2/22, https://so04.tci-thaijo.org/index.php/NDJ/article/view/258141.

[32] Resor, F. (2012), “Benefit Corporation Legislation”, Wyoming Law Review, Vol. 12: No. 1, Article 5, https://scholarship.law.uwyo.edu/wlr/vol12/iss1/5.

[29] Samuel O. Idowu, N. (ed.) (2013), Encyclopedia of Corporate Social Responsibility, Springer Berlin, https://doi.org/10.1007/978-3-642-28036-8_307.

[5] SEC Memorandum Circular No. 19, Series of 2016 (2016), SEC Philippines, The Securities and Exchange Commission Philippines, https://www.sec.gov.ph/mc-2016/mc-no-19-s-2016/#gsc.tab=0.

[49] Securities and Exchange Act (B.E. 2535 (1992), Government of Thailand, https://www.sec.or.th/cgthailand/EN/Documents/Regulation/SECAct_amend_index.pdf.

[35] The Government of Vietnam (2021), Decree 47/2021/ND-CP, Government of Viet Nam, https://thuvienphapluat.vn/van-ban/EN/Doanh-nghiep/Decree-47-2021-ND-CP-elaboration-of-some-Articles-of-the-Law-on-Enterprises/476560/tieng-anh.aspx.

[51] Viet Nam Ministry of Planning and Investment (2016), Circular No. 04/2016/TT-BKHDT, https://nguonluat.com/docs/042016tt-bkhdt-circular-no-042016tt-bkhdt-dated-may-17th-2016-forms-for-social-enterprise-registration-under-the-governments-decree-no-962015nd-cp-detailing-a-number-1658830515.

Notes

← 1. The business judgement rule acts as a presumption that the board of directors acted in the best interest of the company unless plaintiffs can prove negligence or bad faith.

← 2. Further, the Korean Code of the Best Practices Corporate Governance (article 2-3) requires that “Directors should not exercise their authority for their own benefit or that of a third party. They should pursue the best interest of the corporation and shareholders all the time”.

← 3. See the (Securities and Exchange Act (B.E. 2535, 1992[50]), Chapter 3/1, sections 89/7 to 89/9.

← 4. There is substantive case law: Intraco v Multi-Pak Singapore [1995] 1 SLR 313; ECRC Land Pte Ltd v Ho Wing on Christopher and Others [2003] SGHC 298 at 49; MacarthurCook Property Investment Pte Ltd and Another v Khai Wah Development Pte Ltd [2007] SGHC 93; Australian Property Group Pte Ltd v H.A. & Chung Partnership and others [2015] SGHC 147 at 51. This is summarised in: (Gibson Dunn, 2021[51]).

← 5. Korea Social Enterprise Promotion Agency (Korea Social Enterprise Promotion Agency, 2023[54]).

← 7. This requirement only applies to social enterprises that are a company or limited partnership under the Commercial Act: (Government of Korea, 2007[33]).

← 8. The framework is established by the Law on Enterprises of Viet Nam 2020 and the Decree No. 47/2021, while the forms are specified in Circular No. 04/2016 (National Assembly of Viet Nam, 2020[26]; The Government of Vietnam, 2021[35]; Viet Nam Ministry of Planning and Investment, 2016[52]).

← 9. See (Exemption for Share Offering of Social Enterprise Being a Limited Company in General Case or to the General Public (No. Tor Jor. 1/2563), 2020[53]) from the Capital Market Supervisory Board.

← 10. For instance, conflicts may arise between social entrepreneurs and investors; pro‑social and for‑profit investors; and social entrepreneurs and consumers/clients/intermediaries (Lim, 2022[36]).

← 11. For example, in Korea, article 433 of the Commercial Act 2020 specifies that the “articles of incorporation shall be amended by a resolution at a general meeting of shareholders”, with article 434 specifying that such a resolution will “be adopted by the affirmative votes of at least two-thirds of the voting rights of the shareholders present at a general meeting of shareholders and of at least one-third of the total number of issued and outstanding shares” (Commercial Act (No. 17362), 2020[12]).

← 12. Meaning that more than half of their total annual revenue must be earned as opposed to contributions or grants (or have a credible plan to work towards this if they are start-ups).