The Digital Supply and Use Tables (SUTs) framework includes recommended templates for the outputs. These templates, presented in this chapter, will allow countries to produce outputs in a consistent manner so that they can be compared across countries. Initial outputs consistent with the Digital SUT framework have already been created by several countries and are presented in this chapter.

OECD Handbook on Compiling Digital Supply and Use Tables

6. Compiling outputs using templates

Abstract

Introduction

This chapter discusses the presentation of the final outputs by combining the previously obtained digital indicators with the rows and columns of the conventional Supply and Use Tables (SUTs). While these indicators have some value by themselves, as discussed in Chapter 1, it is the process of combining them with the existing national accounts estimates contained in the conventional SUTs that provides the opportunity to put the results in perspective. Bringing them together in a consistent framework also ensures cross-country comparability, which creates important value added for the user.

As discussed in Chapter 2, the initial outputs of the Digital SUTs framework are the high priority indicators. In order for these to be presented in a clear and consistent manner, standardised templates have been created. This chapter presents these templates and discusses their compilation. High priority indicators consistent with the templates have already been produced by a number of countries, and examples are shown throughout the chapter.

In line with the earlier chapters of this handbook, the templates are designed to reflect the transaction, product and industry perspectives. This chapter concludes with some general considerations for countries undertaking this work, based on experiences from countries that have already compiled estimates in line with the framework.

The high priority indicators

Originally, the template for the Digital SUTs consisted of a full SUT altered to include the additional industry columns and product rows (OECD, 2019[111]). To distinguish the mode of transaction, it also included the additional transaction rows for every product within the conventional SUTs. While countries can populate an entire Digital SUT if they wish to, the OECD Informal Advisory Group (IAG) on Measuring GDP in a Digitalised Economy felt that this was too ambitious for most countries. Therefore, it has agreed on a set of collection templates reflecting the high priority indicators. These templates will be the focus of discussion in this chapter.

The high priority indicators and the templates presented in this chapter focus on some of the most important outputs from a user perspective (OECD, 2019[112]). For example, while the transactional rows to distinguish the mode of transaction can theoretically be applied to all products, it is not expected that this will be relevant for all countries. Rather, the creation of a set of agreed upon indicators provides a more obtainable goal for countries to aim for in early stages of development while maximising the international comparability of the framework, which implies focusing on specific rows and columns.

The high priority indicators are:

1. Expenditure split by nature of the transaction.

2. Output and/or Intermediate consumption of Digital Intermediation Services (DIS), Cloud Computing Services (CCS) and total information and Communication Technology (ICT) goods and digital services.

3. Digital industries’ output, gross value added (GVA) and its components.

Each of these indicators is explained in more detail in Chapter 2. This part of the handbook focuses on how best to present these outputs in a way that provides the easiest interpretation by users.

Templates for the transaction perspective

Every country that has published estimates consistent with the high priority indicators has published estimates for “total digitally ordered” or “total digitally delivered”. So far, these have been provided from the perspective of the supply table, with countries publishing estimates of output based on the nature of the transaction. However, indicators focusing on the nature of the transaction can be presented in relation to both the supply and the use table. Additionally, the template for providing information on the nature of the transaction from the supply table is presented in two different ways, enabling countries to publish in the best way suited for them.

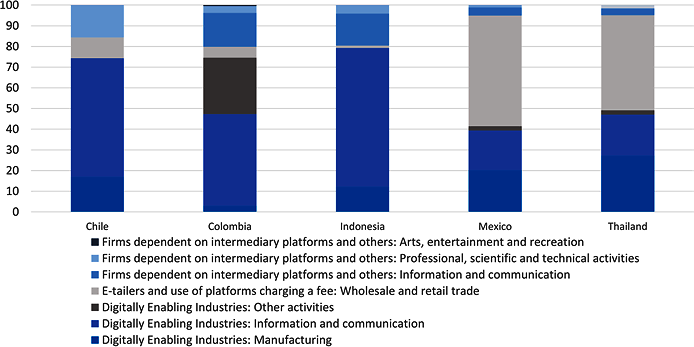

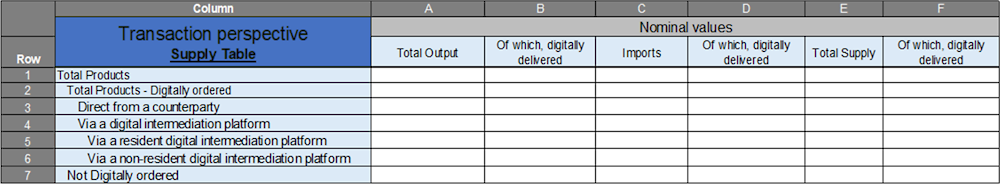

The first set of templates display the nature of the transactions for various aggregates. From the supply side, transaction template 1A (Template T1A, Figure 6.1) covers total output, total imports, and total supply broken down by the different ordering options in the rows and the delivery modes in the columns. Template T1A includes the option for presenting nominal values of the estimate.

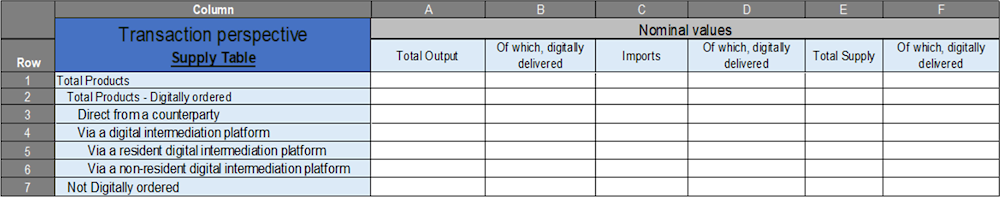

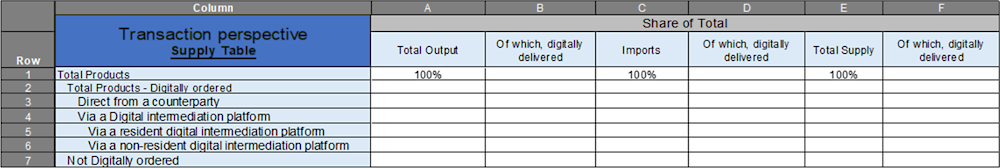

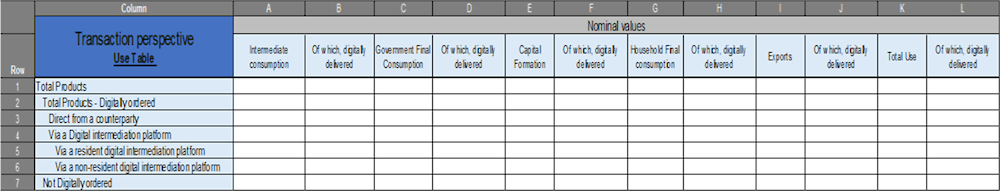

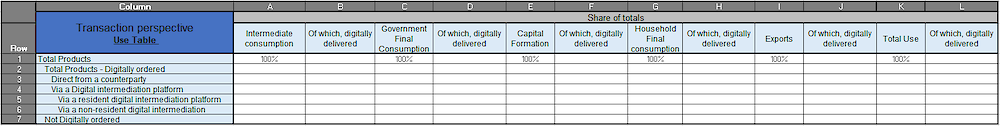

Transaction template 2 (Template T2, Figure 6.2), displays the nature of the transaction from the use perspective. Template T2 is similar to Template T1A in that the aggregates are broken down by row (for digital ordering) and by column (for digital delivery). In Template T2, the aggregates are for intermediate consumption and final demand, which includes government and household final consumption, gross capital formation and total exports.

The specific indicators suggested as high priority in Chapter 2 included: total household final consumption, total imports, and total exports, which are all covered by these templates. These are presented for total products (Row 1). Originally 10 products1 were considered as candidates for the transactional breakdown (OECD, 2020[113]), but their inclusion as high priority indicators was considered too ambitious to be included in the initial version of the Digital SUTs framework.

Countries may still produce estimates for specific products split by the nature of the transaction if they wish. This may include products at the classification level usually used in the conventional SUTs, i.e. divisions of the Central Product Classification (CPC) or Classification of Products by Activity (CPA),2 or at more granular levels. If a country does create transactional estimates for specific products, Row 1 in Templates T1A and T2 should be for the relevant product.

The estimates in Template T1A and Template T2 can also be split by both digital ordering and digital delivery, as well as for the different mechanisms of digital ordering (direct with the counterparty, via platform, etc). Alternatively, it would be possible to report only a split between “digitally ordered” and “not digitally ordered” if there is no additional information on the type of digital ordering.

Figure 6.1 and Figure 6.2 present templates with estimates provided in nominal values. However, these templates (as well as the others shown in this chapter) can also be presented as a proportion (share) of the total taken from the conventional SUTs. These “share of total” templates are shown in Annex 6.A.

Figure 6.1. Template T1A: Transaction perspective – Supply table

Figure 6.2. Template T2: Transaction perspective – Use table

Box 6.1. The benefit of compiling digital transactions for both the supply and use tables

Totals from both tables assist in calculating missing values as residuals

In line with the fundamental principal of SUTs, supply of total products in Template T1A should match use of total products in Template T2.1 While it is easy to ensure these are balanced in the Digital SUTs, as they are both taken direct from the conventional SUTs, theoretically each underlying cell within the total supply column, specifying the mode of transaction, should match the equivalent cell in the total use column. For example, production and/or supply that is the result of digital ordering should have an equivalent amount for that type of transaction within the total use column. Importantly, while total supply should equal total use, the latter amount could be made up from any of the columns that make up final demand and intermediate consumption.

This form of “double entry” accounting is very important and is a benefit of compiling both a supply and use table for the nature of the transaction. If business surveys are able to provide estimates of supply via digital transactions, these can then be used as a form of “control” total on the use side. For example, if the total amount of digitally ordered output and imports is known, this amount can be taken from Template T1A and used to populate cell K2 in Template T2. If use information is available on some but not all of the indicators in the use table, the use of estimates from the supply side allows estimates to be derived for missing items based on residuals. For example, if the digital ordering of household consumption, capital formation, intermediate consumption and exports are known and included in Template T2, the part of government consumption that was digitally ordered can be calculated residually. This is one example of possible residual calculation in the framework, but theoretically it can be used to assist in populating any item for which there is limited or no data, provided that the total is known.

1. These should match as both should be presented in purchaser prices.

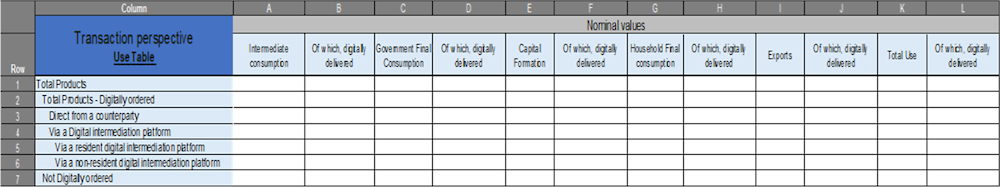

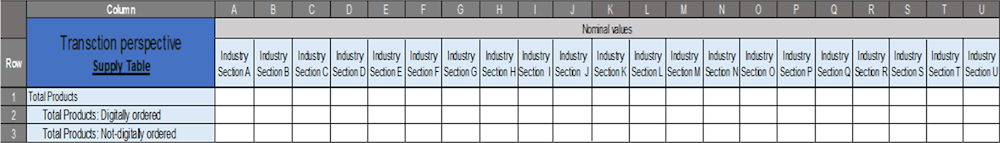

An alternative template for the transaction perspective (Template T1B, Figure 6.3) shows the level of output that was digitally transacted with breakdowns by industry.

Digitally transacted means output that is either digitally ordered and/or digitally delivered for each industry, with output that is both digitally ordered and digitally delivered only included once so that the cells in the column add to the total shown in Row 1. An alternative would be to show digital ordering and digital delivery in separate rows, but this would be inadvisable because the values might add to more than the total in the conventional SUTs (and recorded in Row 1), as the categories are not mutually exclusive.

Template T1B (Figure 6.3) is not consistent with the high priority indicators agreed on by the IAG on Measuring GDP in a Digitalised Economy. However, such a presentation may be chosen due to source data considerations. Most national statistical offices (NSOs) receive information on the level of digital ordering via business surveys. Depending on the exact compilation practices for their SUTs, it may be easier to apply this transactional information at the industry level rather than the product level.

Figure 6.3. Template T1B: Transaction perspective – alternative supply table

Four countries have published estimates for digitally ordered and digitally delivered products: Canada, the Netherlands, Ireland and Sweden. These countries have adopted similar but not identical approaches. They have all presented the level of output (from the supply table). Canada and the Netherlands have presented results at an aggregate level (split by domestic output and imports). The Canadian publication used columns to split the estimates based on whether the product was digitally delivered, allowing for all four options to be covered,3 as recommended in Chapter 3 and in Template T1A (Figure 6.1) above. The resulting matrix is shown in Table 6.1.4

Table 6.1. Supply of digitally ordered and delivered products, Canada, 2019

Million Canadian dollars

|

|

Output, digital industries |

Output, digital industries, digitally delivered |

Total output |

Total output, industries, digitally delivered |

Total imports |

Imports, digitally delivered |

Taxes on products |

Total supply |

Total supply, digitally delivered |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

204,768 |

76,461 |

4,065,386 |

96,580 |

722,624 |

13,236 |

173,179 |

4,961,189 |

115,527 |

|

Digitally ordered |

73,953 |

50,362 |

277,933 |

65,665 |

51,723 |

9,144 |

6,696 |

336,352 |

75,019 |

|

Direct from a counterparty |

59,612 |

49,658 |

218,757 |

64,961 |

19,588 |

8,559 |

1,072 |

239,416 |

73,659 |

|

Via a resident DIP |

1,193 |

704 |

1,193 |

704 |

0 |

0 |

0 |

1,193 |

704 |

|

Via a non-resident DIP |

3,839 |

0 |

3,839 |

0 |

984 |

584 |

70 |

4,893 |

606 |

|

Via a resident retailer or wholesaler |

9,308 |

0 |

54,144 |

0 |

31,150 |

0 |

5,555 |

90,849 |

50 |

|

Not digitally ordered |

130,815 |

26,098 |

3,787,453 |

30,915 |

670,902 |

4,092 |

166,483 |

4,624,837 |

40,508 |

Note: DIP = digital intermediation platform.

Source: (Statistics Canada, 2021[29]).

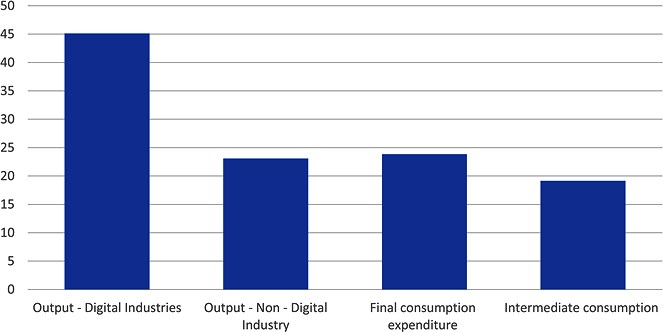

The Netherlands and Sweden have also applied the digitally ordered split to high level aggregates but, unlike Canada, they have applied them to aggregates from both the supply and the use table. From the supply table, the shares of domestic output and of imports that were digitally ordered are separately identified, while from the use table the shares of household consumption, exports and intermediate use that were digitally ordered are published. Estimates for Sweden are shown in Figure 6.4. They do not rely on the matrix suggested in Template T1A (Figure 6.1) Instead, their aggregate estimates are produced by applying digital ordering ratios collected on an industry basis to related products (see Country experiences of producing Digital SUT outputs). However, Sweden does not publish an estimate of the share of digitally ordering at the level of products.

Figure 6.4. Supply and use of products which were digitally ordered, Sweden, 2017

% of total

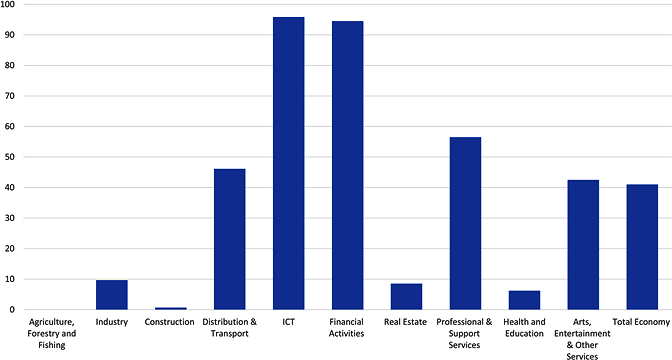

The Central Statistics Office (CSO) Ireland is able to publish estimates relating to the nature of the transaction split by industry. This is consistent with the alternative transactional template (Template T1B, Figure 6.3) presented above. The CSO separated out both “digitally ordered” and “potentially digitally deliverable” as well as combining the two indicators to create the “digitally transacted” indicator, presented on an industry basis (Figure 6.5). While still classifying from a product perspective, based on if the product is digitally deliverable or not (see Chapter 3), the output of these products is assigned to the industry that produces them.

Figure 6.5. Proportion of products transacted digitally, Ireland, 2020

% of total

When presenting from the industry perspective, as the CSO Ireland has done, the percentage of digitally delivered products depends on the composition of the services being produced by each industry as well as the level of detail published. This more aggregated level still allows for the long-term trend towards digital delivery to be easily observed.

At an aggregate level, Ireland has also published estimates below that of digitally ordered, providing estimates of output direct with counterparties (websites) and via digital platforms (Table 6.2).

Table 6.2. Proportion of output by nature of transaction, Ireland, 2020

|

Nature of transaction |

% |

|---|---|

|

Digitally ordered |

21.8 |

|

Digitally ordered direct from counterparty |

15.1 |

|

Digitally ordered via DIPs |

6.7 |

Source: (CSO Ireland, 2022[33]).

Only the Netherlands and Sweden are technically consistent with the high priority indicators listed in Chapter 2 (by showing expenditure rather than production). However, the results for Canada, the Netherlands, Sweden and Ireland all fit with the templates presented above. The differences relate to the data sources available and used, but the digitally ordered concept is the same for all four countries and thus easily comparable (Table 6.3).

Table 6.3. Proportion of output that is digitally ordered, selected countries

|

Canada (%, 2019) |

Netherlands (%, 2018) |

Sweden (%, 2017) |

Ireland (%, 2020) |

|

|---|---|---|---|---|

|

Digitally ordered |

8.3 |

16.1 |

25.2 |

21.8 |

Templates for the product perspective

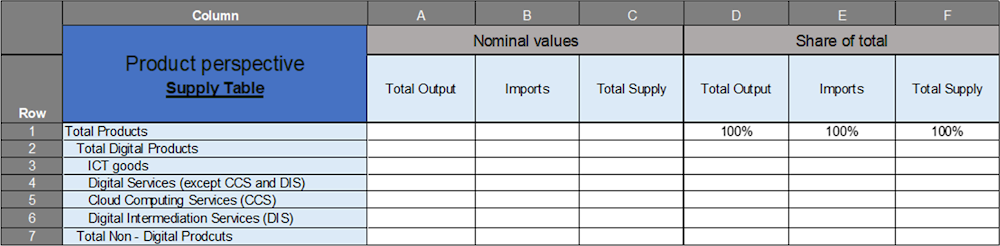

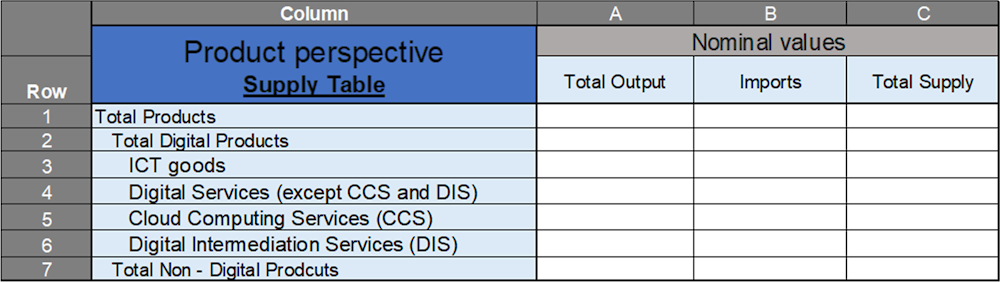

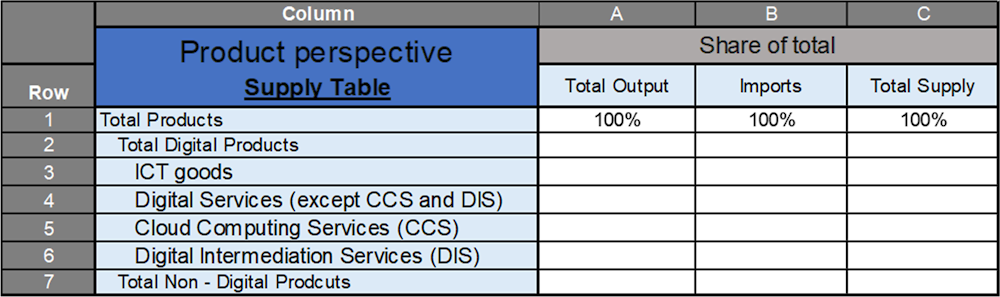

The high priority indicators for products within the Digital SUTs can be presented in relation to either the conventional supply table or the conventional use table. From the supply side, product template 1 (Template P1, Figure 6.6) contains the four product rows: the two aggregates, ICT goods and digital services, along with the two separately identified digital products, CCS and DIS. The columns are split between domestic output and imports, thereby making up total supply of the products, and results are shown both in nominal values and as proportions of total products. The industry split of output of specific products is a lower priority: as the digitally enabling industry will make up a significant portion of production of the first three product classes and digital intermediation platforms (DIPs) charging a fee will produce the vast majority of DIS, there is less analytical value to this split when reallocating estimates from the supply side.

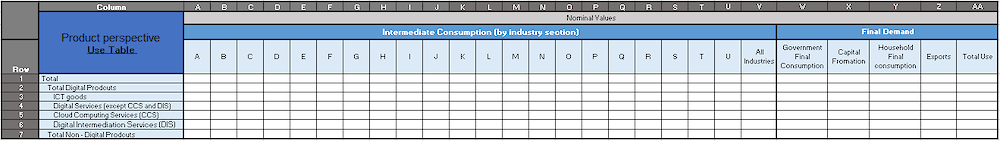

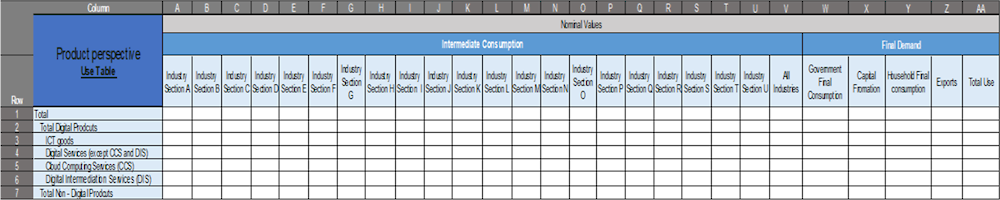

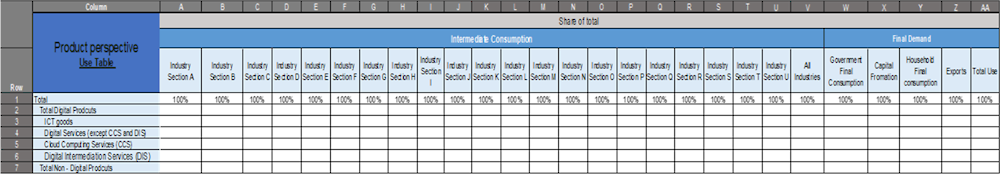

The product perspective can also be applied to the use table, in which the industry dimension is of much more interest because the use table details the products that are being consumed in order to produce the final outputs. It is important to know which industries are consuming more ICT goods and digital services as part of their production. Product template 2 (Template P2, Figure 6.7) from the use table includes intermediate consumption and final demand of the four product rows. The final demand columns include final consumption (by both the household and government sector), gross fixed capital formation (GFCF), and exports. This covers total use of digital products.5

Figure 6.6. Template P1: Product perspective – Supply table

Figure 6.7. Template P2: Product perspective – Use table

The CSO Ireland and Statistics Netherlands have applied the ICT product classification from the CPC Version 2.1, Part 5: Alternative structures (UNSD, 2015[25]) to the product rows in their SUTs, as discussed in Chapter 4. This allowed them to produce an estimate of output associated with digital products. Such a presentation is in line with Template P1.

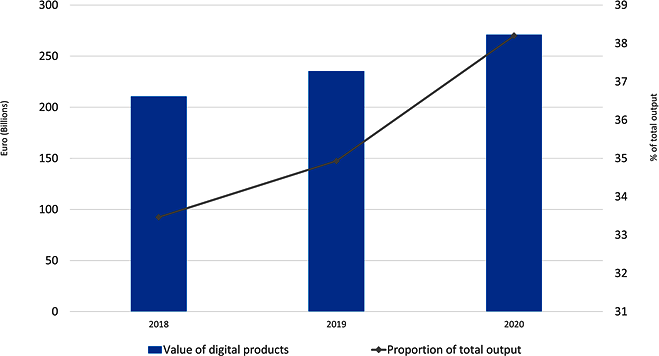

In looking at the estimates published by the CSO Ireland and Statistics Netherlands we can see a slight difference between the countries, while both publish totals that allow for comparison. The CSO has published an aggregate estimate for all digital products - ICT goods and digital services (Figure 6.8) - consistent with the products listed in Chapter 4. This analysis shows that the nominal value of production of digital products grew by 29% between 2018 and 2020 to €271bn, and made up 38% of overall domestic output in 2020. While the CSO has completed only Row 2 of Template P1, it has provided estimates of both absolute values and proportions.

Figure 6.8. Output of ICT goods and digital services, Ireland, 2018-2020

Billion euros (left-hand-side). % of total output (right-hand-side)

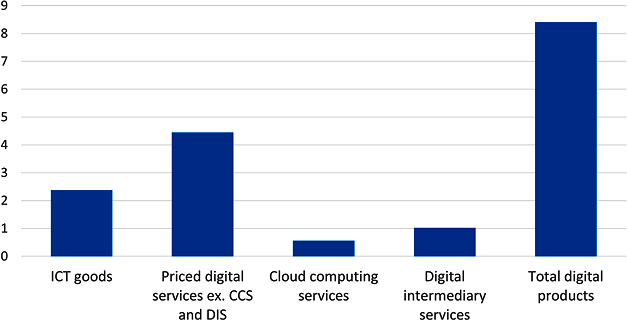

Statistics Netherlands went a step further by separating out ICT goods from priced digital services, as well as separately estimating the level of output associated with CCS and DIS, the two separately identified products in the framework. The results are shown in Figure 6.9.

Figure 6.9. Digital products, proportion of output, Netherlands, 2018

% total output

Statistics Sweden did the same. Their estimates, presented in Table 6.4, correspond to Rows 2-6 of Template P1, with Row 7 calculated as a residual.

Table 6.4. Digital products, proportion of supply, Sweden, 2017

|

|

% of total supply |

|---|---|

|

ICT goods |

1.2 |

|

Priced digital services, except CCS and DIS |

5.6 |

|

Priced CCS |

0.8 |

|

Priced DIS |

0.02 |

|

Total digital products |

7.6 |

Source: (Statistics Sweden, 2023[83]).

Ireland, Sweden and the Netherlands have produced estimates consistent with the high priority indicators. The differences between them are a demonstration of the flexibility in the framework, whereby countries produce more granular estimates depending on the data available to them. Importantly, all of these countries can complete Template P1 and their estimates are easily comparable when presented as a proportion of total output.

To produce these estimates, all three countries used more detailed information taken from existing annual economic surveys. For Ireland, these included the Census of Industrial Production, the Annual Services Inquiry, and the Building and Construction Inquiry (CSO Ireland, 2022[33]). The Netherlands used its Structural Business Statistics survey (Statistics Netherlands, 2021[43]). These surveys usually capture information at detailed levels, allowing countries to aggregate output of digital products based on the CPC classification. Similar surveys are undertaken in most countries so aggregates of output split by product are likely to be achievable.

Even if countries do not compile an estimate of digital products consistent with the ICT product classification in CPC Version 2.1 (Part 5: Alternative structures), countries that produce estimates of the separately identified digital products, DIS and CCS would be able to populate these rows in Template P1. For example, the United States Bureau of Economic Analysis (BEA) has produced estimates of the production of CCS for the United States (see Chapter 4). As such, they could complete Row 5 of Template P1 even if the estimates for the total of digital products is not available. In order to facilitate as many international comparisons as possible, countries are encouraged to provide estimates in the template for the information that they have available. As shown in Table 6.5, this allows for comparisons across countries even when gaps for some indicators exist.

Table 6.5. Digital products, proportion of domestic output

|

|

Netherlands (% of output, 2018) |

Sweden* (% of output, 2017) |

United States (% of output, 2021) |

Ireland (% of output, 2020) |

|---|---|---|---|---|

|

ICT goods |

2.38 |

1.20 |

- |

- |

|

Priced Digital Services (excluding CCS and DIS) |

4.44 |

5.60 |

3.85** |

- |

|

CCS |

0.56 |

0.80 |

0.45 |

- |

|

Priced DIS |

1.02 |

0.02 |

- |

- |

|

Total digital products |

8.41 |

7.60 |

8.30 |

38.20 |

Notes: * proportion is of total supply rather than domestic output. ** Priced DIS and CCS included in percentage. “-“ indicates that information is not available.

The examples of the product perspective that have been discussed so far are from the supply table, that is the production and import of digital products. Template P2 covers an additional product aspect from the use table. It takes the same digital products identified on the supply side and separates them out from the existing product rows on the use table. Such a presentation has the potential to show which industries are increasing their intermediate consumption of digital products, as well as providing insights into the use of digital products in the form of final consumption.

While there have been no publications so far from the use side, examples have been provided by a joint OECD-BEA project (Charara et al., 2021[114]). The Asian Development Bank (ADB)’s work on the digital economy (Asian Development Bank, 2021[115]) also includes examples. The aim of both these pieces of work is to provide evidence of a generally accepted phenomenon that businesses are using more ICT goods and services in response to the increasing level of digitalisation in the economy.

The OECD-BEA project matched the ICT products as classified in the CPC Version 2.1 (Part 5: Alternative structures) and the product classification used within the BEA’s SUTs and the OECD SUT database. Box 6.3 outlines the project in more detail. It shows that when estimates are deflated to reflect the declining price of most digital products over the period from 2007 to 2017, most countries observed some increase in the proportion of digital products used in production when compared with all inputs.

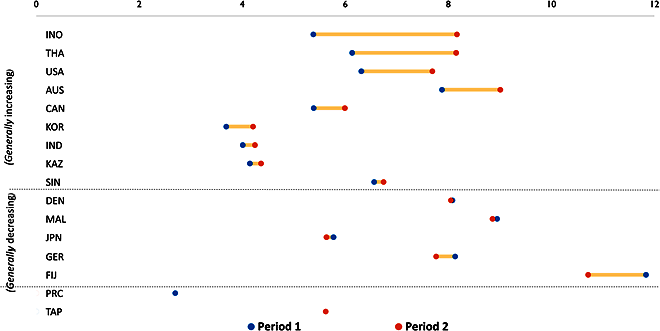

The ADB calculated the share of digital inputs as a proportion of total inputs to production for a number of countries in Asia and elsewhere. They focused on industries that were digitally dependent6 and compared the ratio over two periods. In a majority of the countries selected for the study, these industries increased their share of digital products used in production (Figure 6.10). This kind of analysis could be also done by countries at the industry level in order to calculate which industries within the economy are becoming more digitally intensive.

Figure 6.10. Proportion of digital inputs used in production, selected countries

% of digital inputs in total intermediate inputs

Notes:

AUS = Australia; CAN = Canada; DEN = Denmark; FIJ = Fiji; GER = Germany; IND = India; INO = Indonesia; JPN = Japan; KAZ = Kazakhstan; KOR = Korea; MAL = Malaysia; PRC = China; SIN = Singapore; TAP = Taiwan; THA = Thailand; USA = United States.

Period 1 is AUS, 2010; CAN, 2012; DEN, 2010; FIJ, 2011; GER, 2010; IND, 2010; INO, 2010; JPN, 2011; KAZ, 2001; KOR, 2010; MAL, 2010; SIN, 2000; THA, 2010; USA, 2010.

Period 2 is AUS, 2018; CAN, 2016; DEN, 2016; FIJ, 2015; GER, 2016; IND, 2014; INO, 2014; JPN, 2015; KAZ, 2018; KOR, 2018; MAL, 2015; PRC, 2012; SIN, 2016; TAP, 2016; THA, 2015; USA, 2019.

Source: (Asian Development Bank, 2021[115]).

Box 6.2. The increasing importance of ICT goods and digital services to production

In 2021, the OECD and the BEA undertook a project to produce comparable international estimates that might show the evolving consumption of digital products (Charara et al., 2021[114]). While the Digital SUTs do not show a single numerical estimate of digitalisation’s impact on the production process, they can show, over time, the digital/non-digital make up of products used as intermediate consumption and GFCF. As firms embrace digitalisation they will make greater use of digital products both in the assets they are purchasing and in the type of products that they are consuming as inputs into production.

The high priority indicators identified by the IAG on Measuring GDP in a Digitalised Economy were used as a starting point to determine which estimates of digital products would be compiled. While the high priority indicators suggest compiling estimates of consumption of each of the four different rows that make up digital products (ICT goods, priced digital services, DIS and CCS), for the sake of this project, these four rows were combined into a single aggregated product row that includes all ICT products listed in the CPC Version 2.1 (Part 5: Alternative structures).

The ICT products in the CPC classification are listed at the sub-class level which is more disaggregated than the data available in the OECD SUT database. Products in this database are presented at the CPA division level (there are 88 divisions). Therefore, matching was required between the CPC sub-class level and the CPA division level. In some cases, as an entire CPA division could be used, while in others, the share of the CPA division that comprised digital products had to be estimated.

In order to determine the share that the digital products contributed to the CPA divisions, a template was sent to several NSOs. This template asked for the contribution of certain lower-level product items to the more aggregated CPA categories. From these responses, average percentages were calculated that could then be applied to the conventional SUT data at CPA division level. These shares (proportions) are shown in Table 6.6.

Table 6.6. Proportions of CPA divisions comprising ICT goods and digital services

|

CPA Division |

% of division comprising digital products |

|---|---|

|

C26 Computer, electronic and optical products |

72.7 |

|

C33 Repair and installation services of machinery and equipment |

3.8 |

|

J58 Publishing services |

43.6 |

|

J61 Telecommunications services |

100.0 |

|

J62 Computer programming, consultancy and related services |

100.0 |

|

M71 Architectural and engineering services; technical testing and analysis services |

1.9 |

|

N77 Rental and leasing services |

3.4 |

|

S95 Repair services of computers and personal and household goods |

49.0 |

Source: (Charara et al., 2021[114]). Authors’ calculation based on responses from NSOs.

The proportions could be applied to products within any column in the SUTs. By adding up the amounts in each cell for a column, estimates could be calculated for a range of indicators such as total final use, household consumption, GFCF and intermediate consumption, at the aggregated level or by industry. If countries undertook this kind of work themselves, the estimates could be improved by using country-specific estimates of the percentage of digital products that make up the CPA division.

Due to the differences between OECD economies, the results were shown as proportions. They showed digital products as shares of the previously mentioned indicators, e.g. digital products consumed as intermediate consumption as a proportion of total intermediate consumption.

The proportions were applied to different SUT years for each country, producing a time series of the proportion of digital products feeding into intermediate consumption at both national and industry levels. However, as they were applied at current prices, any change in the proportion reflected both different compositions of products used and changing prices for digital and non-digital products. A proportion might remain broadly stable, even if the business was increasing the volume of ICT goods and services consumed, if the increase in volume was offset by lower prices of the ICT goods and services.

To overcome this issue, prior to the proportion being calculated, the estimates of the numerator (the current price expenditure on digital products) and the denominator (the current price aggregated indicators from the conventional SUTs, i.e. total use, household consumption, intermediate consumption) were reduced or magnified based on the respective price increase or decrease. The price indices chosen were the Implicit Price Deflator (IPD)1 for the information and communication industry (representing the digital component) for the numerator and GDP IPD, representing the overall price change experienced in the economy, for the denominator. If countries did this work themselves, they could apply more precise, improving the conversion into volume estimates.

The digital share of intermediate consumption was estimated for eleven countries, on the basis of data taken from the OECD database. The countries’ shares were applied for selected countries across Europe, North America, Asia, and Oceania. Table 6.7 shows the change in the digital share of intermediate consumption between 2007 and 2017, while Table 6.8 shows digital shares of GFCF.

Table 6.7. Proportion of ICT goods and digital services used in production

|

Intermediate consumption (%) |

|||

|---|---|---|---|

|

Country |

2007 |

2012 |

2017 |

|

Australia |

6.8 |

9.5 |

|

|

Canada |

5.7 |

6.4 |

|

|

Czech Republic |

6.6 |

6.8 |

6.8 |

|

France |

4.4 |

4.3 |

|

|

Germany |

3.9 |

4.5 |

|

|

Italy |

2.9 |

2.7 |

|

|

Korea |

8.6 |

||

|

Netherlands |

3.8 |

4.0 |

|

|

Norway |

7.3 |

7.9 |

|

|

United Kingdom |

11.0 |

11.5 |

12.4 |

|

United States |

8.5 |

9.8 |

12.4 |

Table 6.8. Proportion of capitalised ICT goods and digital services

|

Gross Fixed Capital Formation (%) |

|||

|---|---|---|---|

|

Country |

2007 |

2012 |

2017 |

|

Australia |

|

7.9 |

10.9 |

|

Canada |

|

8.1 |

9.8 |

|

Czech Republic |

9.7 |

12.0 |

14.0 |

|

France |

|

3.8 |

4.6 |

|

Germany |

|

4.1 |

4.8 |

|

Italy |

|

4.6 |

5.3 |

|

Korea |

|

9.4 |

|

|

Netherlands |

|

4.2 |

4.9 |

|

Norway |

|

5.8 |

7.3 |

|

United Kingdom |

16.4 |

20.0 |

18.7 |

|

United States |

20.1 |

27.5 |

28.2 |

1. The IPD represents the change in price of a specific aggregate. It is calculated by dividing the estimate on a nominal basis by a volume (or price adjusted) estimate. The ratio created as a result of this calculation represents the change in price.

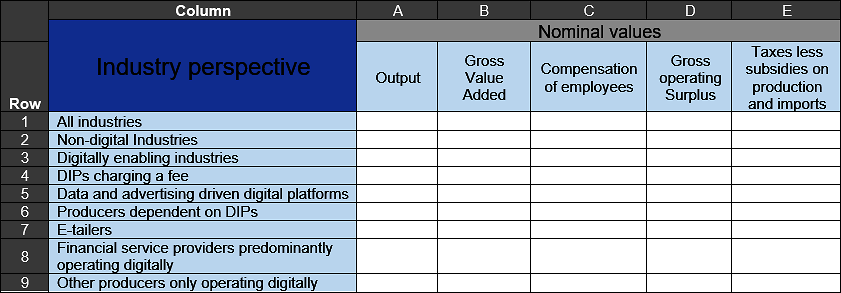

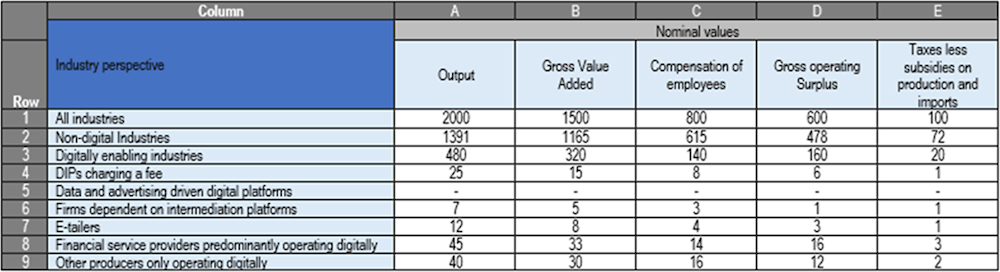

Templates for the industry perspective

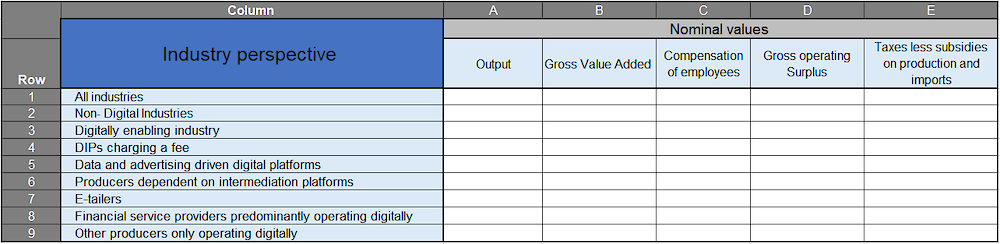

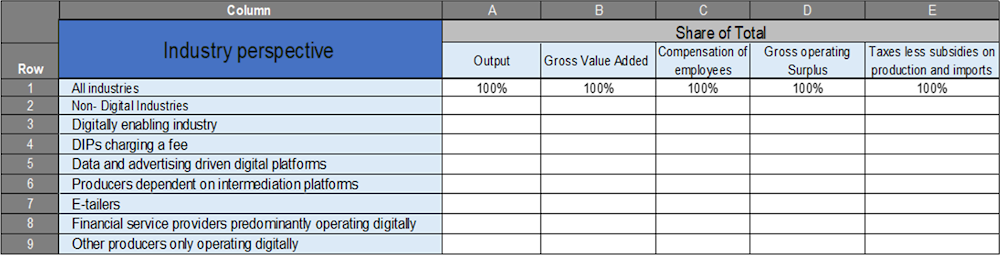

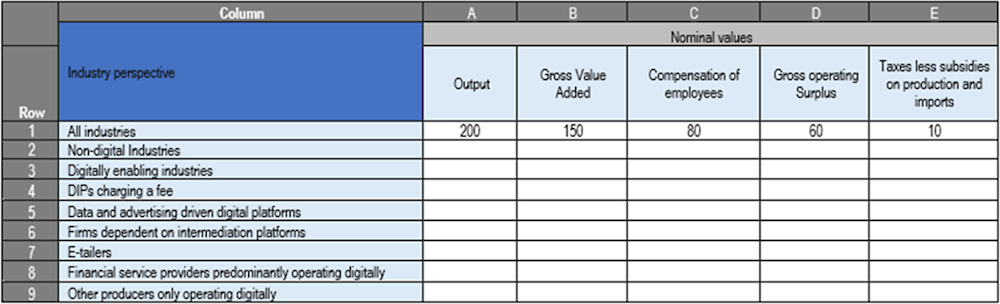

The indicators from the industry perspective are from the use table. They will involve the reallocation of output, GVA and its components (i.e. compensation of employees, gross operating surplus, and taxes less subsidies on production and imports) from the conventional industries to the newly identified digital industries.

Industry template 1 (Template I1, Figure 6.11) contains each of the digital industries matched with cells where estimates of output, GVA and its components can be recorded either as a nominal value or as a share of the total for the economy.7 Countries should aim to populate as much of the Template I1 as possible, ideally the components of GVA as well as the output of these industries. There is analytical value to these additional estimates, as information on the production function (ratio of GVA to output) or other analytical ratios (e.g. operating surplus as a percentage of GVA) can be compared with other conventional industries.

The estimates for the specific industries can be calculated from the bottom up or re-allocated in line with the examples shown in Chapter 5. However, when presented in Template I1, the aggregate for all industries (Row 1 in the template) should reconcile with the estimates for total output and total GVA from the conventional SUT.

Annex 6.A contains a numerical example of how to compile Template I1.

Figure 6.11. Digital SUTs Template I1: Industry perspective – Use table

Several countries have published estimates of the high priority indicators from the industry perspective. There is more consistency regarding how these have been presented than for the nature of transaction and product perspectives. The main variation between countries is whether they have published the estimates as either an absolute value or as a percentage of the aggregate amount, both of which are catered for in the design of Template-I1.

Statistics Canada’s Digital SUTs publication includes a table consistent with Template I1, although it breaks down the digitally enabling industry into four additional types of activities, based on how they are enabling digitisation (Table 6.9). This was possible because the digitally enabling industries map well with the ICT sector in International Standard Industrial Classification (ISIC) Revision 4. Therefore, certain ISIC classes could be assigned to the new digital categories.

Table 6.9. Gross Value Added of digital industries, Canada, 2017-2019

Million Canadian dollars

|

2017 |

2018 |

2019 |

|

|---|---|---|---|

|

Total, all industries |

1,991,534 |

2,079,869 |

2,157,352 |

|

Total digital industries |

103,298 |

111,384 |

117,788 |

|

Information and communications technology |

|||

|

Hardware |

6,536 |

7,012 |

7,243 |

|

Software |

41,891 |

45,726 |

48,013 |

|

Telecommunications |

36,166 |

37,175 |

37,460 |

|

Other Services |

9,912 |

10,669 |

11,511 |

|

Digital intermediation platforms |

1,728 |

2,374 |

3,183 |

|

Data- and advertising-driven digital platforms |

835 |

846 |

979 |

|

Online retailers and wholesalers |

3,748 |

4,248 |

5,187 |

|

Digital-only firms providing finance and insurance services |

2,340 |

2,752 |

3,392 |

|

Other producers only operating digitally |

448 |

582 |

821 |

Source: (Statistics Canada, 2021[29]).

The compilation methods used by Statistics Canada to generate industry estimates were discussed in Chapter 5. An important caveat is the lack of an independent calculation of GVA based on output and intermediate costs of digital industries. Instead, only the output of firms making up each of the digital industries is used to derive the digital industry estimates of GVA, with cost-to-output ratios of existing industries applied to the identified output. This implies that the production function of the units designated as being in a digital industry is assumed the same as that for their non-digital industry counterparts. Statistics Canada acknowledges that this probably means that there is a “smoothing away [of] very divergent dynamics” (Statistics Canada, 2021[102]). A long-term goal of the Digital SUTs is to have separate information on the cost structure of the digital and non-digital entities.

The Netherlands presents estimates of GVA from digital industries in a similar manner (Table 6.10). However, they split e-tailers into e-retailers and e–wholesalers. As was the case for Canada, additional splits are welcome if the data allows for them.

In line with Template I1, Statistics Netherlands has published both the absolute values as well as the shares. They have published both output and GVA, but they have not published the components of GVA due to quality concerns. This is another example of the non-prescriptive nature of the templates, allowing countries to only publish whatever is feasible and relevant.

Table 6.10. Output and Gross Value Added of digital industries, Netherlands, 2018

|

|

Output (million euros) |

GVA (million euros) |

Share of output (%) |

Share of GVA (%) |

|---|---|---|---|---|

|

All industries |

1,514.5 |

692.6 |

100 |

100 |

|

Total digital industries |

137.4 |

55.3 |

9 |

8 |

|

Digitally enabling industries |

95.4 |

36.4 |

69 |

66 |

|

DIPs |

16.3 |

5.4 |

12 |

10 |

|

Firms dependent on DIPs |

1.0 |

0.7 |

1 |

1 |

|

E-tailers (retail) |

3.4 |

1.7 |

2 |

3 |

|

E-tailers (wholesale) |

20.7 |

10.8 |

15 |

20 |

|

Digital-only firms providing finance and insurance services |

0.7 |

0.4 |

0 |

1 |

|

Other producers only operating digitally |

n/a |

n/a |

Source: (Statistics Netherlands, 2021[43]).

Statistics Sweden has also published a table consistent with Template I1 (Table 6.11). The estimates show that the GVA of digital industries in Sweden makes up a slightly larger proportion of total GVA than in the Netherlands.

Table 6.11. Digital industries as a proportion of output and GVA, Sweden, 2017

|

Digital Industry |

% output |

% GVA |

|---|---|---|

|

Digital enabling industries |

6.06 |

5.23 |

|

DIPs charging a fee |

0.04 |

0.05 |

|

Producers dependent on DIPs |

0.06 |

0.06 |

|

E-tailers |

2.52 |

2.88 |

|

Financial service providers predominantly operating digitally |

-- |

-- |

|

Other producers operating only digitally |

1.33 |

0.88 |

|

Total digital industries |

10.01 |

9.10 |

Source: (Statistics Sweden, 2023[83]).

The consistency of the published estimates for digital industries permits comparison across countries (Table 6.12). The industry dimension has proven to be a desirable and obtainable goal for several countries, including those that have not yet published estimates. This may be because it is aligned with GVA and therefore with GDP, which makes it of particular interest to users. Estimates for total digital ordering or delivery or for digital products are presented as a proportion of total output (from the supply table) or as a proportion of final demand (e.g. household consumption or exports). As such, it is harder to relate the estimates to GDP.

Table 6.12. Digital industry in selected countries as proportion of total GVA

|

|

Sweden (% GVA, 2017) |

Netherlands (% GVA, 2018) |

Canada (% GVA, 2019) |

|---|---|---|---|

|

Digital enabling industries |

5.23 |

5.25 |

4.83 |

|

DIPs charging a fee |

0.05 |

0.8 |

0.15 |

|

Data- and advertising-driven digital platforms |

-- |

-- |

0.05 |

|

Producers dependent on DIPs |

0.06 |

0.1 |

-- |

|

E-tailers |

2.88 |

1.8 |

0.24 |

|

Financial service providers predominantly operating digitally |

-- |

0.06 |

0.16 |

|

Other producers operating only digitally |

0.88 |

-- |

0.04 |

|

Total digital industries |

9.10 |

7.9 |

5.46 |

Country experiences of producing Digital SUT outputs

The final section in this chapter discusses some lessons for countries looking to undertake work to produce outputs based on the Digital SUTs. These are based on examining the experiences of countries that have already compiled estimates in line with the framework.

Canada

Statistics Canada published its initial set of Digital SUTs in 2020. In the publication, which covered the years 2017, 2018 and 2019, estimates of GVA for each of the digital industries as well as output and supply split by the nature of the transaction were published. As with subsequent releases by other countries, the estimates were published as “experimental”, subject to revision as more information became available and methods were further refined (Statistics Canada, 2021[102]).

In presentations that accompanied the release, Statistics Canada noted that the Canadian Digital SUTs were not re-compiled from source data with methods that replicate the production of the standard SUTs. Rather, as advocated throughout this handbook, data in the standard tables is disaggregated based on available indicators, i.e. the approach is one of reallocation rather than re-compilation. Information from source data was used to allocate known elements while the remaining data was completed based on simplifying assumptions and residuals.

Beginning with the supply table, columns were mapped to the digital industries while rows were mapped to the identified digital products. The residual estimates that were not mapped to specific digital rows and columns were considered output of non-digital products by non-digital industries. For the majority of products, the output assigned as digitally ordered at basic prices was proportionally split across all relevant use categories (i.e. intermediate consumption, household final consumption, government consumption, gross fixed capital formation and exports) based on existing proportions, and applied at purchaser prices, ensuring the supply and use remained in balance. In other words, proportions of digital ordering from the supply table were used to break up the use table. This approach not only ensures a balance between digitally ordered total demand and digitally ordered supply but also reflects the higher quality of e-commerce sales measures relative to the limited and weaker quality demand-based source data, especially beyond household surveys.

Some additional assumptions were added to arrive at the total amount of digitally ordered total demand and supply once trade estimates were incorporated. For example, digitally delivered exports were used as an additional source of information for digitally ordered exports derived from domestic output based on the simplifying assumption that digitally delivered products are also digitally ordered.

Digitally delivered exports by product that exceeded the value of digitally ordered exports based on the allocation of digitally ordered output from the supply table were added to the value of digitally ordered exports. These values were subsequently allocated to digitally ordered industry outputs on the supply table on a proportional basis to maintain the product balances. Conversely, digitally ordered imports by product were proportionally allocated to use categories, although for practical reasons some categories, such as inventories, were excluded from the allocation pattern.

This mixture of recorded and modelled data allowed Statistics Canada to produce the high priority indicators not just for a single year but for multiple years. As mentioned by Statistics Canada in their publication, the work also provided an important benchmark for understanding the changes caused by the COVID-19 pandemic in 2020.

The Netherlands

For the Netherlands, the production boundary of the Digital SUTs is consistent with the production boundary of the 2008 SNA (Statistics Netherlands, 2021[43]). Therefore, the standard SUTs are used as the starting point for the Digital SUTs, with economic activities that are already included in the regular SUTs used to fill the new rows (digital products) and columns (digital industries). As such, the task of filling the new rows and columns for digital products and industries meant reallocating estimates already present in the standard SUTs. This process starts with the estimation of the amounts to be shifted from a respective cell in the standard SUT to a digital product and/or industry.

An automation system was programmed in R to conduct this reallocation. The automated data processing system takes several different input files depending on whether the reallocation is focusing on the product and industry or on the nature of the transaction:

The first input file contains several columns with splits for each row, indicating whether the row pertains to supply or use, the origin industry, the origin product group, the target industry, the target product group, the value to be re-allocated, and an indicator of the quality of the observation.

The second input file shows whether the row pertains to supply or use, the industry, the product, the fraction digitally ordered, the fraction non-digitally ordered, the fraction ordered through DIPs, the fraction ordered digitally directly from a counterparty, and a quality indicator.

A final input file is used to separate digitally delivered services with a fraction, representing the number of services digitally deliverable, which is applied to columns.

Matching results for digital industries and products based on data sources with the estimates of the standard SUTs has proven challenging. This is because of corrections to data sources, automatic balancing, and the fact that national accounts prioritise the precision of year-on-year growth rates over the precision of absolute values, leading to some additional balancing in the conventional SUTs. These all contribute to differences between the values in the original data sources and the values in the standard SUTs presented in the national accounts.

It is for this reason that Statistics Netherlands decided to use proportions from the data sources rather than calculating the absolute value of digital firms and products from the data sources. The proportions are applied to the values in the standard SUTs in order to calculate the values to be re-allocated to the new columns and rows. This meant that any discrepancies between the data source and the standard SUTs are re-allocated proportionally allowing for a smoother balancing process.

Sweden

Statistics Sweden produced experimental estimates consistent with the Digital SUT framework in 2023 (Statistics Sweden, 2023[83]). They chose 2017 as a reference year based on the availability of data, both of the conventional SUTs and the source data used to reallocate estimates from the existing rows and columns to the new digital industries and products. This source data included the annual Structural Business Statistics survey, the survey on ICT usage in enterprises, as well as the ICT expenditure survey.

The compilation of the estimates was undertaken using a multi-layered Excel spreadsheet. The initial layer was the conventional SUTs, with each additional layer then introducing reclassifications based on transaction, product and industry indicators. While acknowledging that the flexibility this provides was useful for an initial experimental set of estimates, it is suggested that a more automated process is required if compilation is continued on a more regular basis.

Statistics Sweden made several assumptions in order to compile estimates in areas where source data was not comprehensive. An example is the use of digitally ordering information collected on an industry basis and applied to the corresponding products. Statistics Sweden used the correspondence between the statistical classification of economic activities in the European Community (NACE) and the CPA8 at the 2-digit level to present the transaction results on a product basis as per Template T1A rather than on an industry basis as in Template 1B.

There was an additional challenge in regard to the transaction data. This information is collected from a survey with a smaller sample size. When this supply side information was combined with the existing lower-level estimates on the use side, some combinations of product and transaction basis were produced that did not make sense. Statistics Sweden decided to keep them in place as they did not want to prioritise detailed estimates (not published) over statistically sound published aggregates. This is an important consideration for countries when striking a balance between compilation methods and dissemination aspirations.

For the compilation of the industry estimates, Statistics Sweden relied on identifying the specific units that should be classified to each new digital industry and then moving the output, intermediate consumption and value added of these units to the new industry. They note that it was challenging to identify units across a range of established ISIC/NACE classifications.

IMF work with countries

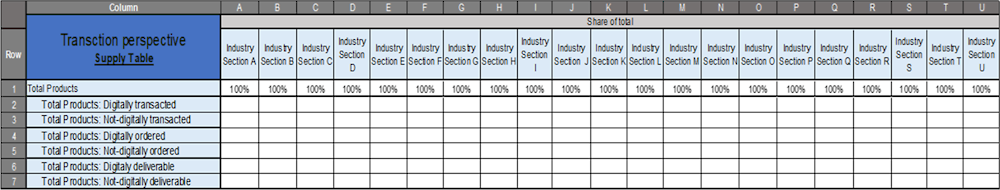

Equally important for the mainstreaming of the framework is the ability for it to be implemented in countries where the statistical infrastructure may not be as advanced. Working with Chile, Colombia, Indonesia, Mexico and Thailand (see Box 6.3), the IMF produced experimental estimates of digital industries based on the concepts and definitions of the Digital SUTs framework, albeit using a different methodology and a sizeable number of assumptions. This allows for relatively straightforward comparisons with other countries that have already released outputs on digital activity.

Figure 6.12 shows the GVA for each of the countries split by the different digital industries. It shows that in a majority of countries the digitally enabling industry (the traditional ICT sector) is by far the largest of the digital industries. In Chile, Colombia, and Indonesia, the digitally enabling industry contributed around three quarters of the overall GVA assigned to the digital industries in 2010-2019, less than the 88% for Canada but higher than the 66% for the Netherlands.

Figure 6.12. Composition of the Digital SUT industries by ISIC sector for participating countries

Average proportion (%) of total GVA of digital industries, 2010-2019

As noted by the IMF, the differences between the countries were more due to the quality of the source data being used than any definitional differences. This may also occur with conventional indicators in the national accounts. It is expected that progress will continue as more countries produce estimates consistent with the Digital SUTs framework and methodologies are shared across countries.

Box 6.3. Experimental estimates of digital indicators in middle-income countries

Digitalisation is occurring all over the world. Often the statistical infrastructure in middle- and low-income countries provides an additional challenge in trying to visualise digitalisation in the economy. Although the ambitious nature of the Digital SUT framework may mean that it is not appropriate for the full framework to be implemented in every country, certain definitions and concepts can still be applied to improve consistency and offer comparability between countries.

The IMF used the Digital SUTs framework as a starting point when it undertook experimental work with the NSOs of Chile, Colombia, Indonesia, Mexico, and the National Economic Social Development Council (NESDC) of Thailand to quantify how and where the increasing use of digital technologies impacts their economies. The aim was to work towards “a set of digital indicators that provide a unique lens on how digitalization is impacting economic activity” (IMF, 2022[116]).

Since the study aimed at generating estimates of GVA, it focused on the industry perspective. The results showed that digital industries (as defined in the study) existed in all of the participating countries, reflecting the changing nature of retail and the increasing use of DIPs.

Rather than identifying the specific firms that were producing a majority of their output in response to digitally ordering, the IMF study took a “top down” approach, estimating the percentage of output of an industry that was digitally ordered. It then applied this ratio to the estimates of output and GVA, creating digital industries based on aggregate GVA rather than on the output of specific firms transacting digitally. Assumptions were also made in relation to the DIPs, where entire classes of certain industries were included if they were considered similar to DIP even though they may not have been exclusively DIPs.

While the methodology relies on some sizeable assumptions, the study is useful for comparing certain industries where the methodology is similar, such as the digital enabling industries and e-tailers. Results for other digital industries can also be provisionally compared with outputs based on the Digital SUT framework, as long as they are accompanied by clear explanations of the methodologies and definitions used. This may provide a starting point while a country’s NSO gathers more source data and creates estimates that are consistent with those of the Digital SUTs.

Conclusion

This chapter has provided more detail on the templates that countries can complete to produce outputs aligned with the Digital SUT framework. It has shown that of the countries that have published outputs already, no two are alike. However, this does not mean the results are not comparable. Rather, additional outputs are often created if data is available or if the NSO believes them to be of particular policy interest. This non-prescriptive nature of the framework, where countries can publish all the data available to them (and not publish results for which they lack data or have quality concerns), helps countries to make progress and publish results, even if they are “experimental”.

One solution that several countries have adopted is applying proportions to the conventional SUTs. This is possible because the conventional SUTs include all the information that the Digital SUTs aim to present, although it is not shown separately. Indicators can be used to produce proportions that are applied to the rows and columns of the conventional SUTs. In this case, the compilation of the Digital SUTs concerns a reallocation rather than a calculation from scratch. This approach not only allows for easier updates in future but can save work in the current compilation by removing the need to rebalance. Such a process is often used with balancing conventional SUTs.

Producing estimates consistent with the framework is often a work-in-progress, with additional outputs published each year as the organisation works through the methodology and new data sources become available. Countries that have already undertaken this work acknowledge that the hardest part of the project is to produce a first set of estimates. Subsequent results are easier to compile. For example, Statistics Netherlands has recently finished the project of adding a subsequent year of data while Statistics Canada is planning to produce another year of Digital SUT outputs using previously compiled indicators when an additional year of conventional SUT data becomes available. Alternatively, countries can update Digital SUT outputs if revised estimates of information used to reallocate the conventional SUTs become available.

Annex 6.A. All templates

Annex Figure 6.A.1. Digital SUT Template T1A: Transaction perspective – supply table: nominal values

Annex Figure 6.A.2. Digital SUT Template T1A: Transaction perspective – supply table: share of total

Note: Columns B, D and F are presented as a proportion of the share recorded in columns A, C and E.

Annex Figure 6.A.3. Digital SUT Template T2: Transaction perspective – use table: nominal values

Annex Figure 6.A.4. Digital SUT Template T2: Transaction perspective – use table: share of total

Note: Columns B, D, F, H, J and K are presented as a proportion of the share recorded in the previous column.

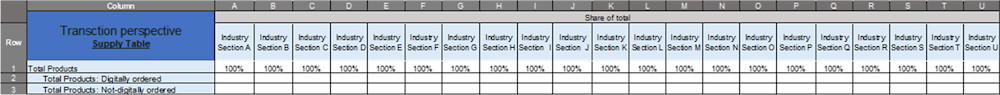

Annex Figure 6.A.5. Digital SUT Template T1B: Transaction perspective – alternative supply table: nominal values

Note: Sections A to U referred to in the column headings reflect ISIC classifications, but can be replaced with the industry classification used for conventional SUTs.

Annex Figure 6.A.6. Digital SUT Template T1B: Transaction perspective – alternative supply table: share of total

Note: Sections A to U referred to in the column headings reflect ISIC classifications, but can be replaced with the industry classification used for conventional SUTs.

Annex Figure 6.A.7. Digital SUT Template P1: Product perspective – supply table: nominal values

Annex Figure 6.A.8. Digital SUT Template P1: Product perspective – supply table: share of total

Annex Figure 6.A.9. Digital SUT Template P2: Product perspective – use table: Nominal values

Note: Please note that the sections A to U referred to in the column headings reflect ISIC classifications but can be replaced with the industry classification used in ones compilation of conventional SUTs.

Annex Figure 6.A.10. Digital SUT Template P2: Product perspective – use table: share of total

Note: Please note that the sections A to U referred to in the column headings reflect ISIC classifications but can be replaced with the industry classification used for conventional SUTs.

Annex Figure 6.A.11. Digital SUT Template I1: Industry perspective – use table: nominal values

Annex Figure 6.A.12. Digital SUT Template I1: Industry perspective – use table: share of total

Annex 6.B. Numerical example of compilation of industry estimates

This annex provides an example of how to compile the high priority indicators from the industry perspective using Template I1. The first step is to transfer estimates of output, GVA, compensation of employees, gross mixed income and operating surplus, and taxes less subsidies on production and imports from the use table of the conventional SUTs (Annex Figure 6.B.1).

Annex Figure 6.B.1. Digital SUT template: Template I1 – Step 1

In this example, estimates for the digital industries come in three groups, with all the estimates derived by identifying the specific units that meet the characteristics of the digital industry. Estimates are then calculated based on these identified units.

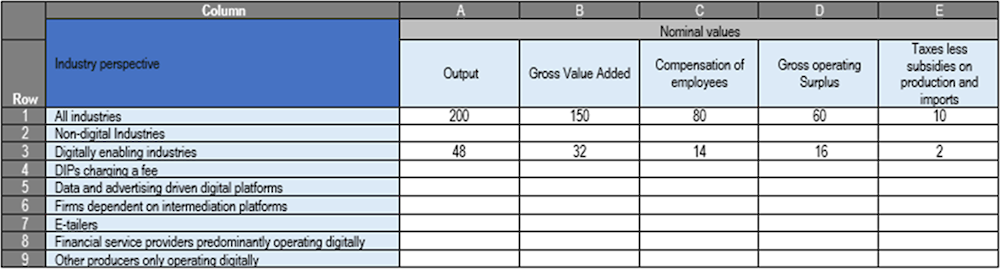

This first group is the digitally enabling industry. As this industry is outlined within the standard industry classifications, the classes, groups and divisions can be separated from the conventional industries and estimates for the five columns can be estimated (Step 2). The example is shown in Annex Figure 6.B.2.

Annex Figure 6.B.2. Digital SUT template: Template I1 – Step 2

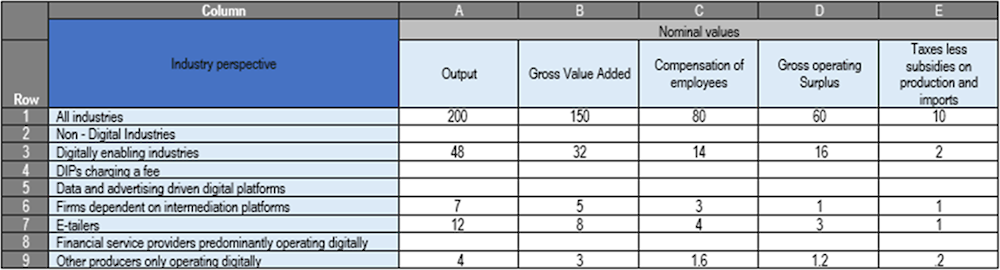

The next group of estimates is based on the e-commerce survey in the country. Such a method was used by Ireland, the Netherlands and Sweden who were able to use this survey to identify those businesses that were getting more than 50% of their sales value from either the company’s website, an Electronic Data Interchange, or DIP.

Based on this survey, businesses that are classified to the retail and wholesale industry division but also receive more than 50% of their orders online are identified as e-tailers. Producers that receive more than 50% of their orders from DIPs are identified as producers dependent on DIPs. These could come from any industry classification except retail or finance, as such firms would be placed in either e-tailers or financial service providers predominantly operating digitally. Finally, the survey is used to identify any producers that are exclusively receiving digital orders (excluding those already classified to e-tailers or firms dependent on DIPs). These units are identified as other producers only operating digitally.

Once units for all three digital industries are classified, estimates from the survey forms can be used to compile the estimates for the five columns in the same manner as the digital enabling industries. In some cases, the information from the e-commerce survey may not be as exhaustive as that from the more comprehensive annual business survey. In these situations, an indicator from the e-commerce survey can be used to split up estimates from existing estimates available. For example, if the e-commerce survey indicates that sales from units that only operate digitally make up 2% of all sales (both digital and non-digital), this ratio may be used to derive estimates for this industry. This third step is undertaken in Annex Figure 6.B.3.

Annex Figure 6.B.3. Digital SUT template: Template I1 – Step 3

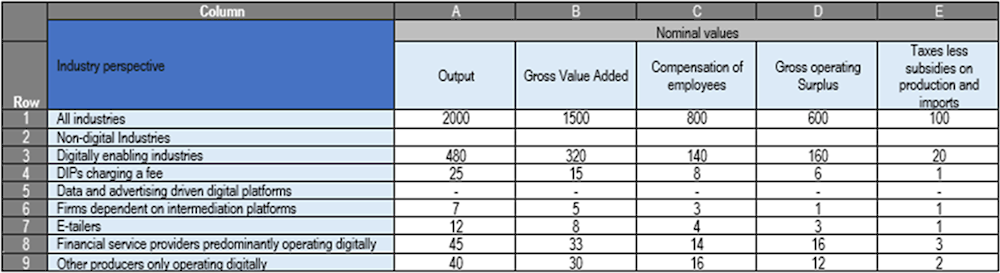

The final group of estimates covers DIPs charging a fee, data and advertising driven digital platforms and financial service providers predominantly operating digitally. These estimates are derived via either a manual or systematic process that identifies the potential units that meet the characteristics of these digital industries. Examples from the United Kingdom, the Netherlands and Canada have been mentioned in the handbook (Chapter 5).

Once the units are identified, compilers can calculate the specific outputs for the five columns (Step 4). If no information is currently available, the annual business survey may need to be modified to collect it, for example by ensuring that the units in these digital industries are covered by the survey. It may become clear that there are no resident units that meet the characteristics of a specific industry. In this example, we illustrate this for data and advertising driven platforms: the industry is left blank in Annex Figure 6.B.4, while estimates are included for the other digital industries.

The fifth and final step is to calculate the non-digital industries residually by taking away each of the digital industries’ amounts from the total taken from the conventional SUTs. This final step is done in Annex Figure 6.B.5.

Annex Figure 6.B.4. Digital SUT template: Template I1 – Step 4

Annex Figure 6.B.5. Digital SUT template: Template I1 – Step 5

Notes

← 1. The products included: Land transport services and transport services via pipelines; Accommodation services; Food and Beverage serving services; Motion picture, video and television programme production services, sound recording and music publishing; Financial and insurance services; Advertising and market research services; Travel agency, tour operator and other reservation services; Education services; Gambling and betting services; and Publishing services.

← 2. The CPA is the European Union’s official classification system for products.

← 3. Digitally ordered – Digitally delivered / Digitally ordered – non-digitally delivered / non-digitally ordered – digitally delivered / non-digitally ordered – non-digitally delivered.

← 4. This table was also shown in Chapter 2 (Table 2.1).

← 5. Inventories are ignored as they are considered to be very minor for ICT goods and digital services.

← 6. The ADB uses forward linkages from the ICT sector to define which industries are digitally dependent. For more information see https://www.adb.org/sites/default/files/publication/722366/capturing-digital-economy-measurement-framework.pdf.

← 7. Figure 6.10 shows the nominal values. The version of Template I1 showing proportions is included in Annex 1.

← 8. Such a practice is reasonable in this case as NACE at the 2 digit classification level matches the second level CPA classification on a 1:1 basis.