This chapter presents the potential role of green bonds in financing Uzbekistan’s green transition, the priority sectors for green bond issuance and barriers that potential issuers face. Non-sovereign issuers, notably subnational governments and corporate entities, face barriers in terms of the country’s existing regulatory requirements and persistent knowledge and expertise gaps, but there is considerable potential for the use of the instrument to finance these issuers’ green projects. Other bond-like instruments, such as green sukuks, an Islamic fixed-income instrument, could prove effective at mobilising domestic demand and offer an alternative financing mechanism if regulatory hurdles to the development of Islamic finance in Uzbekistan are removed. The energy sector, particularly renewable power generation projects, is the sector with the most potential for green bond issuances, but agriculture, transport, housing and water management projects could benefit as well.

Financing Uzbekistan’s Green Transition

5. State of play of green finance in Uzbekistan: Opportunities for and barriers to green bond issuance

Abstract

Box 5.1. Key conclusions and recommendations

Green bonds offer a viable additional source of financing Uzbekistan’s green transition, particularly to support market-ready projects in renewable power generation, but also in other high-impact sectors. Given global trends towards a larger sustainable finance market, greater demand for sustainable financial instruments and mandatory climate risk disclosure among financial institutions in several jurisdictions, Uzbekistan’s issuers could diversify its pool of investors by attracting them to green bonds supporting its national transition objectives.

Uzbekistan should build on its experience with its first two sovereign thematic bonds, drawing on line ministries’ lists of priority infrastructure projects. The government should seek to incorporate emerging good practices internationally in its refinement of its recently adopted domestic green taxonomy, which will help standardise and streamline project selection and evaluation.

The Budget Code currently forbids subnational governments to issue debt instruments. Given the large share of spending carried out at the subnational level, Uzbekistan should consider gradually removing this restriction to allow selected subnational governments with sufficient capacity to finance green projects through green bond issuances.

Uzbekistan’s soon-to-be privatised state-owned banks are increasingly interested in green bonds as a way to improve domestic and international reputation, attract financing from institutional investors with mandates to increase ESG compliant instruments in their portfolios. SanoatQurilishBank (SQB) issued Uzbekistan’s first corporate green bond in August 2023. The government should encourage banks to seek out capacity development opportunities, particularly with peer banks experienced in green bond issuances.

There is currently no regulatory framework for Islamic finance in Uzbekistan, but there are indications that considerable demand for Islamic financial products exists. Green sukuks, a Shariah-compliant bond-like instrument, could be an additional financing tool for the government and corporate entities alike. The government should develop the necessary regulatory framework and capacity to enable issuance of green sukuks.

As outlined in Chapter 3, Uzbekistan needs to mobilise financing from additional sources, especially the private sector, to achieve its climate and development goals. Uzbekistan can use green financial instruments, including green bonds, to finance key components of its green transition while strengthening and deepening its domestic capital market. There is an opportunity to expand the range of potential issuers of green bonds and the types of instruments available on the market and harness them to finance the green transition. Uzbekistan should seek to build on the experience of Uzbekistan’s first three thematic bond issuances, improve the enabling framework to facilitate corporate issuances, remove legislative hurdles for subnational governments and tap into domestic and international demand for green Islamic financial instruments like sukuks.

5.1. Role of and demand for green bonds in Uzbekistan’s green transition

Bonds are a potential solution to one of the major barriers to the financing of some sustainable infrastructure: maturity mismatch. Infrastructure projects, and particularly sustainable infrastructure projects, are characterised by high up-front capital costs and long-dated income streams. Unlike direct financing from banks and corporate entities, bonds can provide longer-term debt capital to finance infrastructure projects or refinance shorter-term loans at potentially more beneficial terms. Although they hardly offer a ‘silver bullet’ solution to the financing gap, bonds can complement other forms of infrastructure financing for long-term capital-intensive projects (OECD, 2017[1]).

Uzbekistan could choose to finance infrastructure projects using conventional (or ‘vanilla’) bonds, which have looser restrictions on the use of proceeds by the emitter. However, green bonds, part of a wider ecosystem of thematic bonds, including green, social and sustainability bonds, have a few distinct advantages for Uzbekistan as it seeks to finance its green transition. Like conventional bonds, thematic bonds are debt instruments issued by governments (sovereign bonds) or banks, other corporate entities or supranational institutions (corporate bonds) that offer regular payments at a fixed interest rate (coupon rate) to debtholders until the bond reaches maturity. They differ from traditional ‘vanilla’ bonds in that, in the case of green, social and sustainability bonds, the use of their proceeds is restricted to green projects, social projects or a mix of green and social projects (for sustainability bonds) (OECD, 2021[2]).

Although these restrictions make the issuance of thematic bond more complicated since the proceeds need to be ringfenced and their use and impact carefully monitored and reported, the assurance they provide about the use of proceeds make them particularly attractive to investors with ESG portfolio requirements. Among investors there is a growing awareness that non-financial sustainability risks could have a significant impact on risk-adjusted returns in the long term, and they therefore seek investments with lower exposure to climate-related and other ESG risks. Several jurisdictions, including Brazil, Canada, the EU, New Zealand, Switzerland, the UK and the USA, have already made climate risk disclosures mandatory for some financial institutions, and other markets, including China, India and Japan, are expected to follow suit (Jonson, 2022[3]). Growing consumer demand has led to a rapid expansion of the global sustainable finance market. Across five major financial markets (Australia and New Zealand, Canada, Europe, Japan and the United States), total sustainable assets increased by 30% between 2016 and the end of 2019 to reach USD 30 trillion. Sustainable funds have expanded their assets under management globally, nearing USD 1 trillion in 2019, with 75% held by institutional investors and 25% by retail investors (OECD, 2020[4]). By offering financial instruments like green bonds, which are designed to guarantee low climate risk exposure and meaningful impact on environmental criteria, Uzbekistan’s government or other potential Uzbekistan-based issuers could tap into an additional source of financing.

Issuers also stand to reap additional benefits from the issuance of green or other thematic bonds. Green bonds can also have a positive impact on the reputation of the issuer and aid in clarifying the entity’s environmental strategy and displaying commitment to environmental sustainability (OECD, 2016[5]). There is also emerging (albeit limited) evidence that thematic bonds can have cost advantages over traditional bonds, notably in sovereign bond issuances in Chile, Egypt, Germany, Indonesia and Thailand. This comparative advantage, known as the green premium or “greenium”, results from lower yields in the secondary market compared to equivalent conventional bonds (OECD, 2021[2]). Recent evidence suggests that emerging market sovereign issuers may benefit from a more robust “greenium” effect than their developed market peers (OECD, 2023[6]).

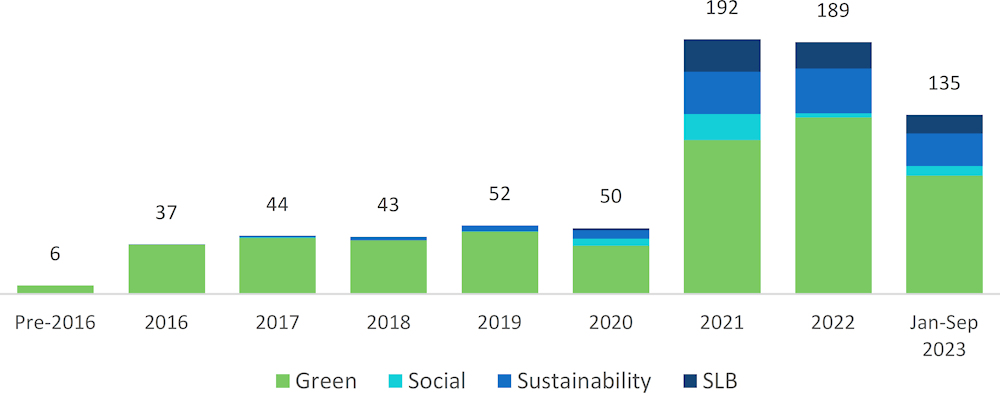

Globally, the sovereign thematic bond market – as well as the market for sustainability-linked bonds – has developed rapidly in recent years, with record issuance of USD 1 151 billion in 2021, over half of which was strictly green (World Bank, 2022[7]). Emerging countries are small but growing players in the market (see Figure 5.1), accounting for about 15% of total issuance volume. Financial (41%) and corporate entities (37%) have issued the bulk of such bonds, while national governments (13%) and subnational governments, government agencies and development banks (8%) account for most of the remainder. Most emerging market bond issuances have been placed on international exchanges (76%) and in hard currency like USD, EUR and JPY (74% of bond issuances and 76% by volume) (World Bank, 2022[7]). A World Bank survey of 32 sovereign issuers of thematic and sustainability-linked bonds revealed that the main motivation behind their choice of a thematic rather than a conventional bond issuance was the desire to diversify their investor base. Other most-cited motivations were to signal commitment to sustainability and raise the funding needed for sustainable investments (World Bank, 2022[7]).

Uzbekistan has identified green bonds as a priority instrument for attracting domestic and international finance for the green transition. As part of a packet of measures adopted to accelerate the country’s transition towards a green economy, Uzbekistan tasked the Ministry of Economy and Finance with designing proposals to attract private capital through green bond issuances for green infrastructure.

In addition to support for potential issuers, the ministry is expected to develop a national green taxonomy and improve the regulatory framework to facilitate green bond issuance (Government of Uzbekistan, 2022[8]). A green taxonomy is a framework that classifies economic activities or financial products based on specific environmental (and sometimes also social and governance) criteria. In October 2023, Uzbekistan adopted a national green taxonomy, which defines 7 categories of green economic activity. Starting on 1 October 2024, the taxonomy’s definitions will be applied on an experimental basis to all green bonds and loans in the country (Government of Uzbekistan, 2023[9]). As experiences of other countries have shown, the development of a functioning green taxonomy is an iterative process of gradual improvements, revisions and expansions. Uzbekistan should seek to draw on emerging good practices from jurisdictions that have already been developed and seek to clearly classify economic activities that align with Uzbekistan’s environmental and development goals. Several jurisdictions, including China, the European Union, Indonesia, Mongolia and Kazakhstan, have adopted such taxonomies, which differ considerably in their coverage, number of categories and underlying methodologies (OECD, 2020[10]). As Uzbekistan continues to refine its taxonomy, it should aim to align with future more ambitious climate objectives taken into account such as, for instance, a net-zero target and long-term low-emission develop strategy. Corporate reporting requirements may need to be strengthened to ensure that information on activities’ sustainability is disclosed and credible.

Figure 5.1. Issuances of sovereign thematic bonds and sustainability-linked bonds in emerging markets have accelerated sharply in recent years

Note: The World Bank classifies some OECD countries (Chile, Colombia, Mexico and Poland) as “emerging markets”. SLB = sustainability-linked bond.

Source: World Bank (2023[11]), “Green, Social, Sustainability, and Sustainability-linked (GSSS) Bonds Market Update October 2023”, https://thedocs.worldbank.org/en/doc/3d313e4819de8d6bcb4238f253874b0f-0340012023/original/GSSS-Quarterly-Newsletter-Issue-No-5.pdf.

5.2. Potential types of green bond issuance

5.2.1. Sovereign bonds

Across emerging markets, both countries eligible for official development assistance (ODA) and those that are not, corporate thematic bond issuances have predominated to date. However, among ODA-eligible countries like Uzbekistan, public sector issuances – mostly sovereign bonds – account for over half of issuances (OECD, 2021[2]). Given the size of governments’ budgets and the role sovereign issuances play in providing benchmarking instruments for local market development, sovereign issuers are well placed to promote the development of a national thematic bond market (OECD, 2021[2]). As such, the fact that initial forays into thematic bond financing in Uzbekistan have been led by the government in the form of sovereign bonds is in line with its peer ODA-eligible countries.

Although Uzbekistan’s first (conventional) sovereign bond issuance dates only from 2019, it has been quick to experiment with sovereign thematic bonds. In November 2020, Uzbekistan offered a two-tranche bond (a so-called “development finance institution (DFI) bond”) consisting of a 10-year USD 555 million tranche and a 3-year UZS 2 trillion tranche. The bond attracted a broad base of investors resulting in an oversubscription ratio of 2.5. A portion of the DFI bond’s proceeds are benefiting several development projects relevant to social Sustainable Development Goals (SDGs), including the construction of schools (SDG 4), health institutions (SDG 3), potable water and sewage pipelines (SDG 6) as well as roads (SDG 9). It also funds social welfare programmes to support women (SDG 5), children and the unemployed (SDGs 1 and 8) (UNDP, 2022[11]).

In July 2021, Uzbekistan issued its first sovereign thematic bond (a so-called “SDG bond”), a sustainability bond aimed at supporting social and climate-related SDGs (SDGs 1-9, 11, 13 and 15). In preparation for the SDG Bond issuance, the government of Uzbekistan developed the SDG Bond Framework with support from the United Nations Development Programme (UNDP). Sustainalytics provided a second-party opinion on the Framework finding it to be in alignment with the Sustainability Bond Guidelines 2021, Green Bond Principles 2021 and Social Bond Principles 2021. Given its alignment with international standards on thematic bonds, the SDG Bond Framework can also be used to issue green bonds, and in October 2023 a second sovereign thematic bond – this time a green bond – was issued (Ministry of Economy and Finance, 2023[12]). Information on this second issuance is still forthcoming, and the remainder of this chapter will instead focus on the first sovereign thematic issuance.

Under the SDG Bond Framework, the ‘procedures for project evaluation and selection’ defines a four-step process whereby key ministries develop a list of potentially financeable socio-economic, environmental and infrastructure projects that are then screened by the Ministry of Economy and Finance’s State Debt Department (and the UNDP acting as an observer and partner evaluator) and reviewed against the Framework’s eligibility criteria and SDGs by the Ministry of Economy and Finance’s Department on Working with International Ratings and Indices and the SDG Coordination Council, headed by the Deputy Prime Minister. OECD consultations with Uzbekistan’s line ministries during a 2022 visit indicated that their input into the project selection process for the 2021 issuance was limited. For future issuances, Uzbekistan’s line ministries, which regularly publish lists of priority infrastructure projects in need of financing in their respective sectors, could add value to the project selection process by feeding their priority projects into the pipelines of high-impact projects to be financed.

In terms of use of proceeds, Uzbekistan’s SDG Coordination Council decided to narrow the focus of the UZS bond’s proceeds predominantly on public transport (54%), health (22%), education (17%) and water (7%), including sustainable water supply and sanitation and flood defence systems. According to the bond’s allocation report, only the proceeds from the UZS-denominated tranche were earmarked for SDG-related expenditure, while the USD-denominated tranche’s proceeds contributed to general budgetary purposes. The 145 projects financed or co-financed by the UZS bond tranche’s proceeds were selected because of their high impact on priority areas for Uzbekistan’s achievement of the SDGs and their bankability (UNDP, 2022[13]).

Like the DFI bond, the SDG bond was structured as a two-tranche bond consisting of a USD 635 million tranche at 3.9% over 10.25 years and a UZS 2.5 trillion (approximately USD 235 million) tranche at 14% over 3 years. Both tranches were oversubscribed at rates of 3.5 for the USD-denominated tranche and 1.5 for the tranche in UZS. The USD tranche attracted investors mostly from the United States (56%), the United Kingdom (19%) and Continental Europe (23%), while only 2% of investors came from Asia, the Middle East and North Africa (2%). For the UZS tranche, the United Kingdom accounted for the largest share of investors(43%), followed by Continental Europe (24%) and the United States (23%). Investors in Asia, the Middle East and North Africa accounted for a larger share of investors for the UZS tranche (10%). Asset managers and funds made up 92% of investors, with insurance and pension funds (4-5%) and banks (3-4%) making up the remainder across both tranches (UNDP, 2022[13]).

5.2.2. Sub-sovereign bonds: subnational governments, public agencies and state-owned enterprises

National governments are not the only public entities that can issue thematic bonds. Globally, sovereign governments issue most thematic bonds in ODA-eligible countries, but subnational governments and public agencies, including state-owned enterprises (SOEs), have the potential to use thematic bonds as an effective tool in the green transition. In developed and non-ODA eligible emerging countries, sub-sovereign bonds make up a larger share of issuances than sovereign bonds (OECD, 2022[14]).

In Uzbekistan, subnational governments must maintain balanced budgets and cannot issue debt, which prevents them from accessing capital markets and using conventional or thematic bonds to finance their needs. Despite this, the City of Tashkent announced plans to issue a USD 500 million bond on the local market after the government granted an exception to the city’s balanced budget rule in 2020. The planned issuance would have financed upgrades to the city’s water and waste management systems as well as broader infrastructure improvements. The plan, however, failed to materialise. In OECD consultations with representatives of the Hokimiyat of the City of Tashkent, officials stated that they were unable to secure the Ministry of Finance as a guarantor for the debt instrument and that further legislative and regulatory changes would be necessary for the Hokimiyat to pursue bond issuances in the future. Given that subnational governments account for 56% of total national spending, sub-sovereign issuances from subnational governments could provide a way for local residents to invest directly in the development of their community.

Kazakhstan, which initially had a similar restriction on subnational debt, gradually extended exceptions to select regional governments with sufficient capacity to manage bond issuances. Starting in 2016, the Budget Code has allowed 14 oblast governments to issue bonds under strict surveillance from the Ministry of Finance regarding debt management and the use of proceeds (OECD, 2016[15]). As of May 2023, three bonds issued by subnational governments are being traded on the Kazakhstan Stock Market. Their cumulative volume accounts for only about 1% of the total government securities market (Kazakhstan Stock Exchange, 2023[16]), but their proceeds have provided a vital additional source of financing to regional governments. Uzbekistan could adopt a similar approach, extending exceptions to the Budget Code for selected subnational governments with sufficient capacity (e.g. City of Tashkent), with the Ministry of Economy and Finance acting as guarantor and supervisor for the process. Provided initial issuances are successful and well managed, Uzbekistan could gradually lift debt restrictions across a wider range of regions and eventually reform its Budget Code to facilitate subnational bond issuances.

Two SOEs, vehicle manufacturer UzAuto Motors and oil and gas industry holding company Uzbekneftegaz, have issued conventional bonds on international markets to date. Unlike subnational governments, Uzbekistan’s SOEs have not faced the same barriers in terms of budget rules and securing guarantees from the state.

Proceeds from the bond issuances were not directed towards activities relevant to the green transition. Given that SOEs account for nearly half of economic output and 80% of public investments in sectors critical to the green economy including renewable energy generation, energy efficiency and water management, thematic bonds could be a viable way to finance the green transformation of high-impact companies while also allowing them to diversify their creditors and lowering their financing costs. In the case of UzAuto Motors, a thematic bond could help the company respond to the government’s push for the increased domestic production of electric vehicles while attracting new investors and developing its international reputation.

Although neither company is listed in Uzbekistan’s plans for privatisation, bond issuances – particularly the issuance of convertible bonds, which bond holders can convert into a predetermined number of shares – can be useful to gradually privatise state-owned enterprises. Such issuances demonstrate the government’s willingness to dispose of its shares, can boost expectations of a company’s share value, bolster corporate governance reform and foster stricter financial discipline. However, since investors choose if and when to convert the bond into shares and poor stock performance can lead to no conversion and slower privatisation, governments tend to prefer more predictable privatisation methods (OECD, 2019[17]).

5.2.3. Corporate bonds

To date, all of Uzbekistan’s corporate bond issuances have been carried out by SOEs (see above) or state-owned banks, namely the National Bank of Uzbekistan, SanoatQurilishBank (SQB) and Ipoteka Bank. The government plans to privatise these latter two in the coming years, although privatisation has been delayed by unstable market conditions.

Given the government’s stated priority to attract domestic and international capital through green bonds, Uzbekistan’s state-owned banks are increasingly interested in organising issuances. In November 2022, the OECD organised a 2-day peer-learning workshop between representatives of SQB, one of Uzbekistan’s largest state-owned banks, and Ameriabank, a leading Armenian bank that has emerged as a pioneer in the adoption of green bonds in the region of Eastern Europe, the Caucasus and Central Asia (EECCA) (see Box 5.2). Many large state-owned banks in Uzbekistan, which account for most of the country’s banking sector, are slated for privatisation in the coming years and are increasingly interested in debt instruments as they will come to rely more on markets than state subsidies. Banks do not face the same legislative and regulatory constraints as other potential issuers such as subnational governments, but instead lack practical expertise in developing and using debt instruments and particularly thematic bonds, which require stronger transparency, monitoring and compliance mechanisms. Peer-learning exercises between banks and especially banks operating in financial ecosystems with similar challenges and levels of development can help develop capacity and identify opportunities to adopt green bonds and other financial instruments.

Box 5.2. Ameriabank’s experience with green bonds and advice to SQB

Ameriabank became the first bank in the region to issue a green bond denominated in EUR in 2020, which was privately issued on the Armenia Securities Exchange with the Development Bank of the Netherlands (FMO) acting as an anchor investor. Ameriabank followed up with a second issuance in 2022, with tranches denominated in both USD and Armenian dram (AMD), the local currency. Given the shared Soviet-era history between the banking systems of Armenia and Uzbekistan, Ameriabank’s experience of transforming from a state-owned bank to a private bank and subsequent adoption of green financial instruments makes the bank’s perspective on challenges faced and lessons learned particularly relevant to SQB.

Ameriabank’s Green Bond Framework, the underlying document that defines eligible green assets and a taxonomy of exclusionary criteria, was adopted in 2020 and determined in a Sustainalytics second-party opinion (SPO) to adhere to the 2018 Green Bond Principles and Green Loan Principles. In the 2022 OECD workshop, Ameriabank representatives emphasised the importance of defining measurable impact targets for defined eligibility criteria, such as quantified greenhouse gas emissions targets. Due to certain green projects lacking sufficient measurement criteria, Ameriabank opted to focus proceeds from its first issuances on renewable energy projects, sustainable buildings, energy and resource efficiency and sustainable transport. In the future, as measurement techniques improve and the bank gains further experience, it aims to include other green categories listed in its Green Bond Framework. Crucially, a credible Green Bond Framework must define criteria for exclusion from receiving green bonds’ proceeds. In Ameriabank’s case, fossil fuel-fired electricity generation (including combined renewable and fossil fuel installations), large (>20 MW) hydroelectricity plants and nuclear power generation facilities are explicitly excluded in the bank’s Green Bond Framework.

Although Ameriabank has benefited from its experience with green bonds, establishing its domestic and international reputation as a trusted sustainable financial institution and expanding its market share to become the country’s largest bank, it cautioned against proceeding hastily with green bond issuances. Ameriabank representatives stressed that banks should seek international guidance and support, prepare a high-quality framework in line with international standards and the bank’s own development strategy and shore up measurement, surveillance, transparency and compliance mechanisms to ensure that the issuance is successful and beneficial. Prior to its first private bond listing, Ameriabank had been working with FMO and other international institutions since 2009 to develop its environmental and social monitoring system. Green bonds come with potential reputational risks if breaches with rules laid out in the Framework are identified, and poorly screened and monitored projects can lead to greenwashing accusations.

Ameriabank representatives recommended that SQB should seek to secure the buy-in of upper and middle management within the bank and ensure that they are properly briefed about the benefits and potential risks of green bonds. While a “greenium” may emerge with later issuances, it should not be used as a selling point, and Ameriabank did not observe a “greenium” effect in its issuances. Instead, banks should pursue green bonds as part of a wider, comprehensive sustainability strategy and to position themselves as a credible actor in sustainable finance.

The developing market for green mortgages in Uzbekistan could offer another opportunity for green bond issuances. These mortgages, primarily provided by Quishloq Qurilish Bank and Ipoteka Bank, offer lower rates for homes designed to reduce water and energy consumption. These banks, as well as the Uzbekistan Mortgage Refinancing Company, could develop green mortgage-backed bonds in the domestic capital market.

5.2.4. Sukuks

Most Uzbek citizens identify as Muslims and approximately 27% of citizens do not have bank accounts citing reasons related to their faith. This indicates that there could be considerable pent-up demand for Islamic financial services and products within the country. Islamic finance differs from traditional finance in that it conforms to Islamic legal tenets such as the prohibition of interest (riba). At present, Uzbekistan lacks a regulatory framework for Islamic finance, and there are significant awareness and knowledge gaps about Islamic finance in the country (UNDP, 2021[18]). In consultations with the OECD in 2022, several key market players, notably the Ministry of Finance, Central Bank and the “Toshkent” Republican Stock Exchange, noted that Islamic finance could be a viable way to attract domestic and foreign investors and develop the domestic capital market.

One Islamic financial instrument of particular interest is the sukuk, a Shariah-compliant fixed-income instrument comparable to a bond. Unlike bonds, sukuks do not pay interest, which is prohibited under Islamic law, but instead offer a comparable stream of payments over a fixed maturity period in the form of profit or rent. To achieve this, broadly speaking, sukuks represent partial ownership of real tangible assets or a contract with an underlying entity, although the ownership and payments cease once the instrument achieves maturity. Sukuks can be structured according to several different contracts, including ijara (lease) sukuks and wakala (principal-agency) sukuks, the two most commonly used structures in green sukuks. The choice of structure depends on factors such as the nature of the underlying assets, tax and regulatory considerations, tradability considerations, the return (fixed or floating), the type of issuer (sovereign or corporate), the targeted investor base and the Sharia approach of the scholars who approve the sukuk issue. In all cases, proceeds from sukuks, like green bonds, cannot be used to finance certain activities. In the case of conventional sukuks, excluded activities include alcohol and pork production; under a green sukuk, additional exclusionary criteria for environmentally harmful activities and eligibility criteria for green products are included (Refinitiv, 2022[19]).

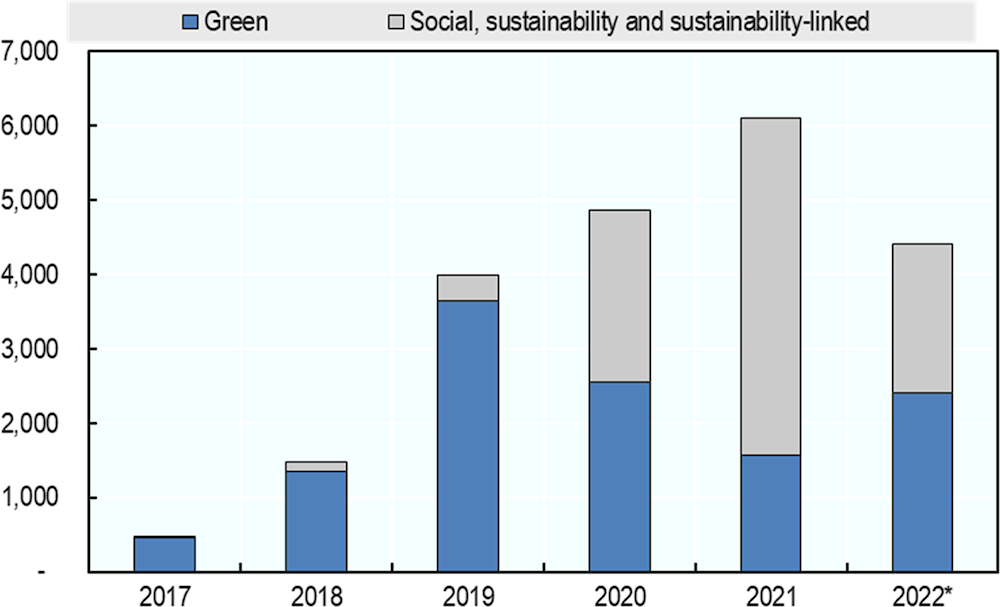

Sukuks, like bonds, can be issued by sovereign or corporate entities, and they can be conventional or thematic, including green, social, sustainability and sustainability-linked sukuks. Following Malaysia’s first issuance in 2017, the market has expanded rapidly (see Figure 5.2). Most issuances have occurred in Indonesia (27%), Malaysia (20%), Saudi Arabia (13%) and the United Arab Emirates (8%), with supranational institutions (24%), notably the Islamic Development Bank, accounting for a large share as well. Central Asian countries have so far been absent from the green sukuk market, although the Development Bank of Kazakhstan issued a conventional sukuk in 2012 and the Astana International Finance Centre has been positioning itself as an Islamic finance hub, offering Islamic financial products and services in Kazakhstan since 2018 and attracting a cross-listing of a sukuk issued by the Qatar International Islamic Bank. Uzbekistan could stand to benefit from the expertise of these countries’ institutions as it seeks to facilitate the adoption of green sukuks (Refinitiv, 2022[19]).

Figure 5.2. The market for green, social, sustainability and sustainability-linked sukuks has expanded more than tenfold since 2017

Note: *2022 covers only the first half of the year.

Source: Refinitiv (2022[19]), Green and sustainability sukuk report 2022, https://www.refinitiv.com/content/dam/marketing/en_us/documents/gated/reports/green-sustainability-sukuk-report-2022.pdf.

International institutions are supporting the government of Uzbekistan in its efforts, expressed in its Programme for Capital Market Development 2021-2023, to create the necessary regulatory and market conditions for the introduction of Islamic finance and green sukuks. The United Nations Development Programme (UNDP) and the Islamic Development Bank have launched a technical assistance project aimed at developing relevant legislative and regulatory framework as well as to elaborate the National Green Sukuk Framework for Uzbekistan. The UNDP, the Ministry of Finance (now the Ministry of Economy and Finance), the Islamic Corporation for the Development of the Private Sector (ICD) and Ansher Capital LLC delivered a webinar in 2022 aimed at raising awareness and interest in Islamic finance instruments and determining priority areas for further work.

5.3. Potential sectors for green bond financing

Thematic bonds, such as green, social and sustainability bonds, and thematic sukuks are potentially useful instruments for financing part of Uzbekistan’s green transition, and certain sectors, due to their high share in Uzbekistan’s greenhouse gas emissions and the market-ready nature of the projects they can offer, are particularly good candidates for early exploration of the instrument’s potential.

The most critical sector is energy, as it has the greatest environmental impact and consequently the largest potential for the implementation of projects related to the transition. The transport, agriculture, housing and water sectors can also be identified as areas with vast potential for promoting a green economy, as a number of green projects have been launched and implemented in the areas of construction and water management.

Energy: In Uzbekistan’s natural gas-dominated energy sector, the renewable energy market growing more attractive to investors thanks in part to government support and incentive programmes. By 2030, Uzbekistan plans to diversity its power generation system, integrating more solar photovoltaic plants (8%) and wind power plants (7%). With maturing renewable markets globally and strengthening mandates for investors to invest in environmental, social and governance (ESG) compliant financial products, Uzbekistan’s public and soon-to-be private institutions could package market-ready renewable electricity projects into attractive debt market instruments. Energy efficiency projects, notably in the country’s housing sector, could also contribute to a bond’s project portfolio. Both types of projects were already included in Uzbekistan’s sovereign SDG bond issuance, demonstrating their viability.

Transport: Uzbekistan’s government has made the domestic production and uptake of electric vehicles a priority for the green development of the transport sector. UzAuto Motors, one of the two SOEs to have issued a bond in Uzbekistan to date, and other vehicle manufacturing companies in Uzbekistan could contribute to the government’s electric vehicle push and diversify their financing sources by issuing green bonds based on projects for development of the sector.

Agriculture: Agriculture employs about a quarter of Uzbekistan’s population, and the sector is important for both domestic food supply and exports. A number of environmental concerns, including water management and biodiversity loss, remain to be addressed, and some aspects of the sector’s green transition could be financed through green bond issuances. Projects to improve water supply, which is currently conducted through an extensive and inefficient grid of dams, canals and pumping stations, and irrigation as well as introduce sustainable methods of farming, pasturing and waste management, could be eligible for inclusion in green bond issuances from the government, banks or relevant corporate entities.

Housing: A nascent market for green mortgages exists in Uzbekistan, whereby banks are beginning to offer lower rates for homes designed to reduce water and energy consumption. Although banks currently face regulatory restrictions against issuing mortgage-backed securities, banks and the Uzbekistan Mortgage Refinancing Company could develop mortgage-backed green bonds in the future.

Water supply and sanitation: Uzbekistan already included a number of water supply and sanitation projects in its first sovereign SDG bond issuance. Similar approaches could be taken for sub-sovereign bond issuances, provided that legislative and regulatory barriers are removed.

References

[9] Government of Uzbekistan (2023), Миллий “яшил” иқтисодиёт таксономиясини тасдиқлаш тўғрисида [On the approval of the National Green Taxonomy], https://static.norma.uz/doc/doc_9/561.pdf.

[8] Government of Uzbekistan (2022), О мерах по повышению эффективности реформ, направленных на переход Республики Узбекистан на «зеленую» экономику до 2023 года [On measures to improve the efficacy of reforms aimed at transitioning the Republic of Uzbekistan to a green economy by 2030], https://lex.uz/ru/docs/6303233 (accessed on 21 June 2023).

[3] Jonson, E. (2022), The Complete Guide to National Climate-Related Disclosures, Carbon Cloud, https://carboncloud.com/2022/09/08/mandatory-climate-disclosures/ (accessed on 28 June 2023).

[16] Kazakhstan Stock Exchange (2023), Обзор рынка государственных ценных бумаг: Май 2023 [Overview of the government securities market: May 2023], Kazakhstan Stock Exchange, https://kase.kz/files/newsletter_gs/ru/Gov_sec_05_ru.pdf (accessed on 28 June 2023).

[12] Ministry of Economy and Finance (2023), The Republic of Uzbekistan for the first time placed “green” international bonds in the national currency, https://www.imv.uz/en/news/category/yangiliklar/post-1621 (accessed on 21 November 2023).

[6] OECD (2023), Green, Social and Sustainability Bonds in Developing Countries: The Case for Increased Donor Co-ordination, https://www.oecd.org/dac/green-social-sustainability-bonds-developing-countries-donor-co-ordination.pdf.

[14] OECD (2022), Green, social, sustainability and sustainability-linked bonds in developing countries: How can donors support public sector issuances?, OECD, Paris, https://www.oecd.org/dac/green-social-sustainability-and-sustainability-linked-bonds.pdf (accessed on 27 June 2023).

[2] OECD (2021), Scaling up Green, Social, Sustainability and Sustainability-linked Bond Issuances in Developing Countries, OECD, Paris, https://one.oecd.org/document/DCD(2021)20/En/pdf (accessed on 27 June 2023).

[10] OECD (2020), Developing Sustainable Finance Definitions and Taxonomies: A Brief for Policy Makers, OECD, Paris, https://www.oecd.org/environment/cc/developing-sustainable-finance-definitions-and-taxonomies-brief-for-policy-makers.pdf (accessed on 28 June 2023).

[4] OECD (2020), OECD Business and Finance Outlook 2020: Sustainable and Resilient Finance, OECD, Paris, https://doi.org/10.1787/eb61fd29-en (accessed on 28 June 2023).

[17] OECD (2019), Corporate Governance: A Policy Maker’s Guide to Privatisation, OECD, Paris, https://doi.org/10.1787/ea4eff68-en (accessed on 27 June 2023).

[1] OECD (2017), Mobilising Bond Markets for a Low-Carbon Transition, OECD, Paris, https://doi.org/10.1787/24090344 (accessed on 28 June 2023).

[5] OECD (2016), Green Bonds: Country Experiences, Barriers and Options, OECD, https://www.oecd.org/environment/cc/Green_Bonds_Country_Experiences_Barriers_and_Options.pdf (accessed on 27 June 2023).

[15] OECD (2016), Subnational Governments Around the World: Structure and Finance, OECD, Paris, http://www.uclg-localfinance.org/sites/default/files/uploaded/Observatory_web.pdf (accessed on 28 June 2023).

[19] Refinitiv (2022), Financing a Sustainable Future: Green and Sustainability Sukuk Report 2022, Refinitiv, https://www.refinitiv.com/content/dam/marketing/en_us/documents/gated/reports/green-sustainability-sukuk-report-2022.pdf (accessed on 27 June 2023).

[11] UNDP (2022), Uzbekistan Development Finance Bond: Impact and Allocation Report, United Nations Development Programme (UNDP), https://www.undp.org/uzbekistan/publications/uzbekistan-development-finance-bond-impact-allocation-report (accessed on 28 June 2023).

[13] UNDP (2022), Uzbekistan’s first SDG Bond Allocation and Impact Report, United Nations Development Programme (UNDP), https://www.undp.org/uzbekistan/publications/uzbekistans-first-sdg-bond-allocation-and-impact-report (accessed on 28 June 2023).

[18] UNDP (2021), Pre-Feasibility Study for Green Sukuk Issuance in the Republic of Uzbekistan, United Nations Development Programme (UNDP), https://www.undp.org/policy-centre/istanbul/publications/pre-feasibility-study-green-sukuk-issuance-republic-uzbekistan (accessed on 27 June 2023).

[20] World Bank (2023), Green, Social, Sustainability, and Sustainability-Linked (GSSS) Bonds Market Update October 2023, https://thedocs.worldbank.org/en/doc/3d313e4819de8d6bcb4238f253874b0f-0340012023/original/GSSS-Quarterly-Newsletter-Issue-No-5.pdf.

[7] World Bank (2022), Sovereign Green, Social and Sustainability Bonds: Unlocking the Potential for Emerging Markets and Developing Economies, World Bank, https://thedocs.worldbank.org/en/doc/4de3839b85c57eb958dd207fad132f8e-0340012022/original/WB-GSS-Bonds-Survey-Report.pdf (accessed on 27 June 2023).