The attractiveness of the Trans-Caspian route is reduced by the presence of cumbersome transit and trade procedures, which add to congestion at border crossing points and result in inconsistent and unpredictable transit and crossing times. In particular, the coexistence of multiple and unharmonised license and permit requirements for each country along the route is exacerbated by deficient border procedure co-operation, reducing network performance, competitiveness, and attractiveness. This chapter thus explores opportunities for harmonising and digitalising transit and border requirements.

Realising the Potential of the Middle Corridor

3. Facilitating trade: harmonisation and digitalisation for traffic development

Abstract

Trade facilitation has progressed for each country along the route, but regional efforts so far remain limited

Stakeholders have identified the need for better trade facilitation and governments have advanced reforms to increase the Corridor’s attractiveness

Stakeholders consulted by the OECD in the scope of this study have emphasised the need to implement trade facilitation reforms to increase the traffic capacity and attractiveness of the Middle Corridor. Respondents to the survey highlighted several actions that could facilitate trade along the route. First, introducing and developing electronic data exchange could accelerate and simplify border procedures. Indeed, digitalisation goes hand in hand with the automation of procedures and the standardisation of customs documents, which could be centralised on a single digital platform. To support such measures, respondents consider it necessary to improve capacities and skills of customs border personnel and harmonisation of freight-related regulatory standards through a common regional legal framework. It is noticeable that private-sector representatives and government agencies offer similar assessments of the main priorities here. These results concur with recent studies highlighting the importance of soft trade measures in improving transit and trade operations in Central Asia and the South Caucasus (OECD-ITF, 2019[1]; ADB, 2023[2]; Wang, 2014[3]). Higher trade costs associated with customs documentation and procedures, such as clearance and inspections, also slow down the international growth of firms, thereby reducing the development of intra-regional trade (López González and Sorescu, 2019[4]).

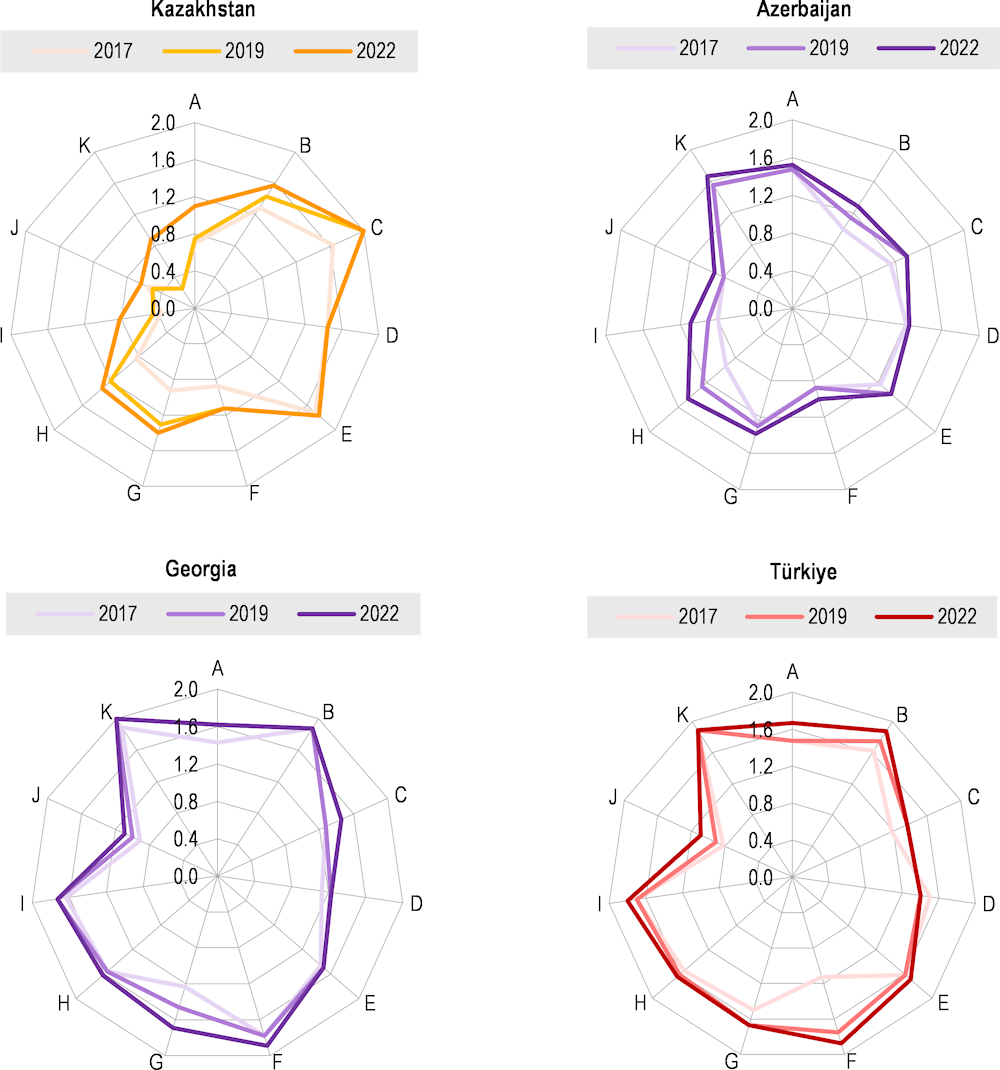

Progress has been observed in each Middle Corridor country, albeit from different starting points. Since 2017, Azerbaijan, Georgia, Kazakhstan, and Türkiye have consistently improved their performance across all areas covered by the OECD Trade Facilitation Indicators (TFIs) (Figure 3.1). Kazakhstan has made the largest relative and absolute improvements in its performance, followed by Azerbaijan, though both performed less well in 2022 than Georgia and Türkiye. Kazakhstan has advanced the most in its governance and impartiality, internal border agency co-operation, streamlining of procedures, and information availability. Azerbaijan has also advanced in streamlining its procedures, internal border agency co-operation, and involving the trade community. Türkiye and Georgia have made strides in the streamlining of documentation and automation of procedures, respectively.

At the national level, countries along the Middle Corridor have advanced trade and customs regulation and digitalisation of border documents and procedures in recent years. Türkiye is one of the most advanced countries in the region in digitalising customs. Kazakhstan, Azerbaijan, and Georgia have been improving the transparency and predictability of trade-related information, streamlining documentation requirements, increasing the use of digital tools, and intensifying internal border agency co-operation. For instance, Kazakhstan has launched several online trade portals and single windows, such as the Single Window for Export-Import Operations, the Kazakhstan Trade Portal, the Trade Facilitation Information Portal, and the Automated System of Customs and Tax Authorities (ASTANA-1) customs border portal, providing firms e-permits, information, references, and documents related to exports (Atameken, 2019[5]). The effects of these reforms have been most visible in the country’s seaports, where cargo transit time has been halved from 12 to six days and is expected to fall to five days by end-2023 (The Astana Times, 2023[6]). Georgia and Azerbaijan have also introduced customs one-stop shops (OSS) to ease customs for businesses and improve inter-agency data exchange through integrated border management measures with agencies responsible for granting transit and trade licenses and permits (Georgia Revenue Service, 2019[7]; World Bank, 2020[8]). Georgia has also transformed its OSS into a customs Single Window, making its customs service one of the most efficient and technologically advanced in the CAREC region (CAREC, 2021[9]). Like Kazakhstan, Georgia has reduced the number of ministries and agencies involved at the border, which previously included the Customs Department (under the Ministry of Finance), the Border Police (under the Ministry of Internal Affairs), the Sanitary and Phytosanitary entity (under the Ministry of Agriculture), and the Transport Administration (under the Ministry of Transport). Now just the Georgia Revenue Services and the Patrol Police are involved (CAREC-ADB, 2022[10]). Türkiye has increased the number of automated customs procedures, reduced the number of required trade documents, improved customs administration and negotiated border co-operation agreements.

Figure 3.1. Evolution of Azerbaijan, Georgia, Kazakhstan, and Türkiye’s performance in the OECD Trade Facilitation Indicators, 2017-2022

Legend: A - Information availability, B - Involvement of the trade community, C - Advance rulings, D - Appeal procedures, E - Fees and charges, F - Documents, G - Automation, H - Procedures, I - Internal border agency co-operation, J - External border agency co-operation, K - Governance and impartiality.

Source: (OECD, 2023[11])

Yet, the persistence of bottlenecks at borders highlights the need for soft measures to improve the route’s competitiveness

Border delays are a major impediment to the Middle Corridor’s development. The 2023 survey and interviews conducted by the OECD have highlighted the prevalence of issues relating to unharmonised cross-border customs procedures and administrative formalities resulting in border point and port congestion, delays that can amount to several days, and increased transit and transport costs. According to the respondents, such difficulties arise at each border along the route: China-Kazakhstan, the Caspian Sea, Azerbaijan-Georgia, and Georgia-Türkiye. Companies frequently spoke of congestion at border crossing points, making crossing times inconsistent and unpredictable. The case of Kazakhstan shows that despite investments in improving average rail transport speed without delays – rising from 40.5 km/h in 2010 to 65.2 km/h in 2020 – longer border-crossing delays were significant enough to slow the overall delivery of goods over this period (CAREC-ADB, 2022[10]). While infrastructure issues have a direct physical effect on traffic (such as the low number of lanes at border crossing points or inefficient multimodality management – see Chapter 4), unharmonised and complex border procedures lead to similar consequences on freight flows. Moreover, freight volumes have continued to grow, so that even improved infrastructure and processes may not be enough to maintain – let alone improve – transit times. At times, trade growth can outstrip investment and reform. Survey respondents underlined the need for simplified and standardised documents and procedures, as well as a streamlining of border regulations for more consistency, to eventually reduce border crossing times and traffic congestion.

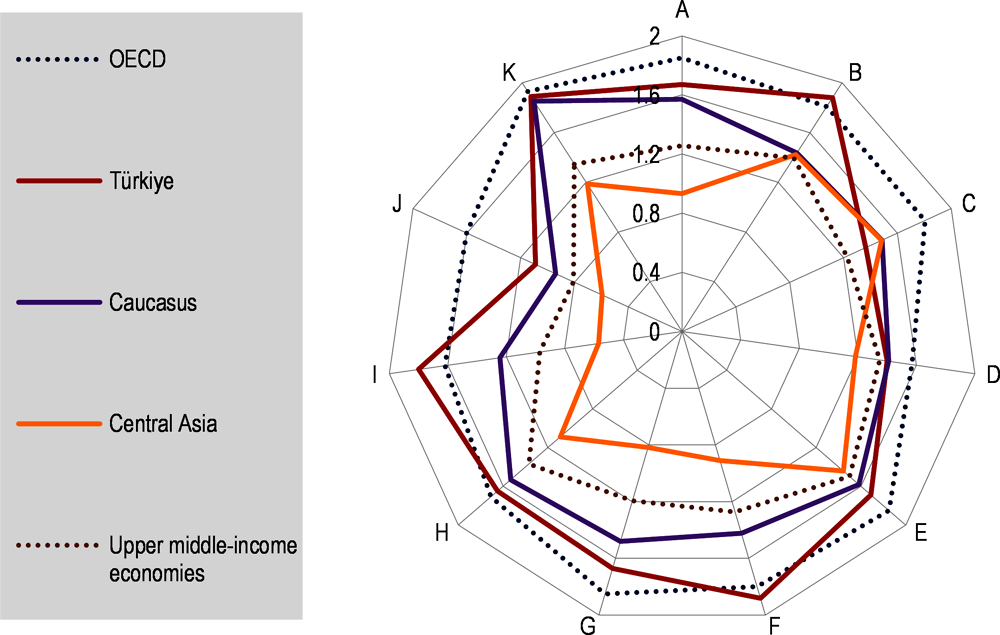

The absence of automation and cross-border agency co-operation contributes to cumbersome procedures and long queues at border points. On average, Central Asia and the South Caucasus still lag Türkiye and the OECD average on internal and external border agency co-operation, harmonisation of documents and procedures, automated border points, information availability, and involvement of the trade community in trade facilitation policy, while border and customs fees exceed OECD average (Figure 3.2). While Central Asia is the least advanced on these matters, even Georgia and Türkiye – the regional leaders – also show higher fees and rates, lower automation rates, and lower cross-border co-operation than the OECD average. The combination of multiple and unharmonised document requirements for each country along the route with deficient border procedure co-operation reduces network performance. The surveys conducted by the OECD which show that the lack of co-operation between national governments on the regulatory framework and limited consultations with the private sector measurably reduce the attractiveness of projects for investors.

Figure 3.2. Performance of Central Asia, the South Caucasus, and Türkiye in the OECD Trade Facilitation Indicators, 2022

Legend: A - Information availability, B - Involvement of the trade community, C - Advance rulings, D - Appeal procedures, E - Fees and charges, F - Documents, G - Automation, H - Procedures, I - Internal border agency co-operation, J - External border agency co-operation, K - Governance and impartiality.

Note: Due to data availability, “Caucasus” is the average for Armenia, Azerbaijan, and Georgia; “Central Asia” is the average for Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan; “OECD” is the average for all 38 OECD member countries.

Source: (OECD, 2023[11]).

Multilateral efforts exist but are scattered

Middle Corridor countries have started engaging in multilateral initiatives on trade facilitation. A Preliminary Data Exchange Agreement for Facilitating Customs Transit Procedures was signed between Azerbaijan, Georgia and Türkiye for the BTK, though implementation is still on-going. (UNECE, 2023[12]). Georgia and Türkiye have signed a data exchange agreement on the joint use of land customs crossing points to accelerate border crossing times, with Azerbaijan and Türkiye having established a preliminary electronic information exchange system, as well. Türkiye and Azerbaijan and Türkiye and Georgia have signed separate simplified customs corridor agreements to facilitate faster customs procedures by enabling data exchange. As mentioned, Azerbaijani Railroads, Georgian Railway, and KTZ have signed an agreement to create a single logistics company to simplify TITR cargo handling and transport processes, among other goals (Prime Minister, 2023[13]).

Nevertheless, no initiative yet covers all Middle Corridor countries, which may lead to gaps and overlaps. Efforts to harmonise and digitalise customs documents and procedures have recently progressed in Central Asia and the South Caucasus. For instance, Armenia signed the Framework Agreement on Facilitating Cross-Border Paperless Trade in the Asia-Pacific Region (CPTA) in 2017, aiming at easing the implementation of digital trade facilitation measures, while Azerbaijan joined in 2018, and Turkmenistan and Tajikistan in 2022 (UNESCAP, 2023[14]). As United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) member countries, Georgia, Kazakhstan and Türkiye are qualified to become parties to the CPTA agreement. In the framework of the Conference on Interaction and Confidence Building Measures in Asia (CICA), co-ordinated by Türkiye, Central Asian countries have signed a regional legal instrument on the interaction of National Committees for Trade Facilitation in April 2023 to expand cross-border information exchange and help the participating states fulfil their WTO Trade Facilitation Agreement requirements – though Armenia and Georgia are not CICA members. Moreover, the Central Asia Regional Economic Co-operation Programme (CAREC) Customs Co-operation Committee (CCC) serves as the regional platform for enhancing customs co-operation. It helped bring about the adoption of the Revised Kyoto Convention in Central Asia, South Asia, and the South Caucasus, though Türkiye is not a member. Additionally, the CAREC members have also collaborated on sanitary and phytosanitary (SPS) matters and agreed to the common use of electronic Phyto certificates (CAREC-ADB, 2022[10]), even though they are yet to be implemented in most countries of the region.

Box 3.1. International organisation trade facilitation projects in Central Asia, the South Caucasus, and Türkiye

International Trade Centre (ITC) Ready4Trade in Central Asia (R4TCA)

The ITC launched the four-year EU-funded R4TCA project in 2020 to help develop intra-regional and international trade by promoting soft measures on trade facilitation, administrative management, trainings, and support to exporting SMEs in Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. It is designed to enhance the transparency of cross-border requirements, remove regulatory and procedural barriers, strengthen businesses capability to comply with trade formalities and standards, or enabling cross-border e-commerce. (International Trade Center, 2022[15])

United Nations Economic Commission for Europe (UNECE)

With 56 members including all Middle Corridor countries, the UNECE has a co-ordination committee dedicated to the Trans-Caspian and Almaty-Istanbul Corridors that convenes regularly to discuss progress on five clusters: (i) evaluating transport infrastructure renewal requirements as well as identifying missing links; (ii) digitalising, harmonising, and standardising transport documents in use on the corridors; (iii) evaluating availability of reliable corridor-wide agreed timetables and tariffs and other issues hampering regular rail freight services; (iv) evaluating the en-route border crossing efficiency identifying, prioritising and implementing border crossing facilitation initiatives; and (v) strengthening the economic viability and resilience of the corridors as well as their environmental performance. (UNECE, 2023[12])

Central Asia Regional Economic Co-operation (CAREC) Programme

Supported by six multilateral institutions, the CAREC programme helps to develop six transport corridors, including one from China through the South Caucasus to Europe, aiming to speed up passage for people and firms across borders and reduce the costs of crossing borders. For trade, it focuses on five priority areas: (i) simplification and harmonisation of customs procedures; (ii) information and communication technology development and data exchange, (iii) risk management and post-entry audit; (iv) joint customs control; and (v) regional transit development. All Central Asian republics and South Caucasus countries are members (CAREC, 2023[16])

Transport Corridor Europe-Caucasus-Asia (TRACECA)

TRACECA is an EU-led intergovernmental programme that aims at developing international transport and trade communication across the Black Sea basin, South Caucasus, and Central Asia. The four Middle Corridor countries and many of their neighbours are part of the programme that aims to develop multimodal transport routes across the region. (TRACECA, 2023[17])

BSEC

The Black Sea Economic Co-operation, regrouping among others Azerbaijan, Georgia and Türkiye1, aims at enhancing trade and economic development between its Member States. Within the workstream promoting regional trade and investment co-operation, the BSEC Working Group on Trade and Economic Development finalised two reports: 1. Regional Trade Facilitation Strategy for the BSEC Region and 2. Framework for BSEC Single Window Co-operation. Some trade facilitation tools were already implemented in the past, such as the BSEC permit. (BSEC, 2023[18])

1. BSEC member countries include Albania, Armenia, Azerbaijan, Bulgaria, Georgia, Greece, Moldova, North Macedonia, Romania, the Russian Federation, Serbia, Türkiye, and Ukraine.

Other organisations have also advocated, and developed pilot programmes for, trade facilitation and customs interoperability. Private firms and state-owned enterprises such as the international association Trans-Caspian International Transport Route (IATITR), have contributed to trade facilitation efforts along the Middle Corridor (Box 3.2).

Box 3.2. the South Caucasus International Association Trans-Caspian International Transport Route

Initially established in 2014 to increase the flow of goods along the TITR, since 2017 the international association Trans-Caspian International Transport Route (IATITR) aims to ensure the competitiveness of the Middle Corridor by developing logistical soft and hard infrastructure, unify transport processes, reduce administrative barriers, and implement an effective tariff policy. It has eight regular members, including the national railway companies of Azerbaijan, Georgia, Kazakhstan, Türkiye, and Ukraine as well as the ports of Aktau and Baku and the Azerbaijan Caspian Shipping Company. There are 11 associate members, including Kazakhstan’s Aktau Marine North Terminal, Kazmortransflot, and Port Kuryk, as well as regional logistics and port partners. These stakeholders frequently meet through working group sessions where they discuss the current state of the route and determine strategies to increase its efficiency.

Source: (TITR, 2023[19]).

Cargo traffic remains subject to multiple and unharmonised regulatory, license, and permit requirements along the Middle Corridor

Unharmonised legal framework conditions, especially for rail and road standards, result in interoperability issues along the route

Multiple legal frameworks regulating freight transit increase the unpredictability of transport times and add to border crossing complexity. Despite recent efforts to increase co-operation and harmonisation between regions and countries along the Middle Corridor, the lack of standardisation of rules and standards governing road and rail transit and transport procedures holds back intraregional trade. From the private sector’s perspective, the differences in transport and customs laws between the countries of the Middle Corridor lead to arbitrary transport documentation and border crossing procedures, slowing down transit time and affecting service reliability (ADB, 2022[20]). OECD interviews indicate that regulatory differences affect both formal procedures and rules for entering and crossing each country, and road and rail vessel and equipment standards, adding to border crossing time and costs for shipments. When asked about national and regional policies that could enable the implementation of trade facilitation measures, various actions were considered to be pivotal, especially regarding the regulatory frameworks for transport modes and customs. Most prevalent among surveyed individual companies was the suggestion that governments deepen regional co-operation through the establishment of supranational transport and trade oversight bodies. These co-ordination platforms could introduce common standards for customs legal frameworks and transport modalities, and to a larger extent improve the regulation of rail, road and shipping sectors and reduce border crossing complexity (see also Chapter 5).

The development of road freight is complicated by the absence of truck requirement standardisation and the existence of a patchwork of rules applying to truck and driver transit (Table 3.1). Surveys and interviews conducted by the OECD further suggest that competing standards for road transport are holding back the development of a competitive freight forwarding market along the Middle Corridor, especially for companies headquartered in Central Asia and the South Caucasus. Interviewees indicate that compliance with weight and dimensional parameters for trucks can be a challenge along the route: while standards exist, they are not yet enforced. Transferring freight between trucks is time-intensive and costly. In Central Asia, parameters are mainly set on a national basis and can conflict with regulations of neighbouring countries. Axle load restrictions are implemented for several months a year to prevent accelerated deterioration of roads, but weight certificates are not always mutually recognised, so trucks must stop at weighing stations in transit countries to attain the required documents. Road transit permits such as TIR cannot waive the need to transfer shipments because they do not obviate the need for vehicle passes. Moreover, protectionist measures to impose cabotage rules and protect local trucking industries from foreign competition are widespread (CAREC-ADB, 2022[10]). Finally, additional national requirements have been reported to cause compliance difficulties and increase shipment costs, including fuel limits for foreign trucks entering Georgia.

Table 3.1. Weight dimensions for goods transport vary significantly across the Middle Corridor

|

Azerbaijan |

Georgia |

Kazakhstan |

Türkiye |

||

|---|---|---|---|---|---|

|

Maximum axle weight |

Per non-drive axle |

10t |

10t |

10t |

10t |

|

Per drive axle |

- |

11.5t |

- |

11.5t |

|

|

Other (tandem/tridem, trailer, semi-trailer, single/dual tyres…) |

23 categories (11-24t) |

- |

24 categories (5-26.5t) |

- |

|

|

Maximum permitted weight |

8 categories (18-38t) |

1 category (44t) |

10 categories (18-48t) |

8 categories (18-44t) |

|

|

Maximum height |

4m |

4m |

4m |

4m |

|

|

Maximum width |

2.55m |

2.55m |

2.55m |

2.55m |

|

|

Maximum length |

Motor vehicle |

12m |

12m |

12m |

13.50m-15m |

|

Articulated vehicle |

20m |

20m |

20m |

18.75m (bus) |

|

Note: m=metre, t =tonne.

Source: OECD analysis based on IRU documentation.

The legal regime for rail cargo carriage creates interoperability issues

Governments along the Middle Corridor have been working to enhance transit facilitation and predictability for rail transport. Cargo carriage is subject to two different legal regimes along the route. In China and Central Asia, rail freight is subject to the SMGS agreement developed by the Organisation for Co-operation of Railways (OSJD), whereas Türkiye and Western Europe apply the CIM Uniform Rules established by the Intergovernmental Organisation for International Carriage by Rail (OTIF). Azerbaijan and Georgia are at the crossroads, accepting both standards, though SMGS reportedly prevails. The lack of a single legal framework puts rail operators at a considerable competitive disadvantage vis-à-vis other transport modes, as a reconsignment of the goods is necessary at the handover point between the CIM and SMGS freight law systems (Box 3.3). This frequently requires consignment notes to be transferred from CIM to SMGS, resulting in additional costs and delays. Moreover, two freight law conventions means that customers face hurdles identifying and enforcing claims in case of cargo losses (UNECE, 2022[21]). Additionally, 35 UNECE members including Azerbaijan, Kazakhstan, and Türkiye, as well as non-UNECE members Mongolia and Pakistan have signed the Joint declaration towards Unified Railway Law (URL) to overcome the two legal frameworks – though Georgia is notably absent (UNECE, 2022[21]).

Acknowledging the coexistence of these regimes as a major bottleneck for rail freight development, governments, in co-operation with the International Rail Transport Committee, established a combined CIM/SMGS consignment note for the countries traversed by the Middle Corridor (Box 3.3). In May 2023, a memorandum was signed between the railway administrations of Azerbaijan, Georgia, Kazakhstan, Türkiye, and Ukraine on piloting of the CIM/SMGS electronic consignment note (UNECE, 2023[12]). While the legal framework exists, though, de facto implementation lags: OECD interviews indicated that the joint note is not systematically used nor recognised in practice, leading to a duplication of procedures.

Yet, different legal requirements complicate rail freight transport between Asia and Europe and create rail-road interoperability issues. The coexistence of two different legal regimes governing carriage of freight featured prominently in interviews conducted by the OECD. Though the consignment notes under both the CIM and SGMS systems contain the same information, their scope of application differs, especially in multimodal transport across maritime routes, creating interoperability issues. For instance, SMGS is only applicable to international railway-ferry traffic where the parties to the Convention “Agreement on International Goods Transport by Rail” (SMGS Agreement) have explicitly declared the waterway sections to be open for such carriage. In contrast, CIM Uniform Rules apply a broader “rail+” approach extended to road transport when international carriage includes carriage by road for national traffic (International Ral Transport Committee and World Transport Organisation, 2016[22]; International Rail Transport Committee, 2023[23]).

The 2022-2027 TITR Roadmap has identified these interoperability issues and includes an action to simplify multimodal border crossing procedures. By 2024, the signatories aim to use the unified CIM/SMGS railway consignment note. They also seek to use SMGS, CIM, or CIM/SMGS railway consignment notes on the Caspian Sea maritime sections using rail ferries. Finally, both notes pose a translation issue, as the SMGS consignment note is issued only in Russian or Chinese, whereas the CIM one is issued in the country of dispatch’s language with a translation into French, German, or English. As a result, businesses surveyed by the OECD report frequent instances of duplication of documents as cargo needs to be registered under both systems.

Box 3.3. Harmonised railway trade and transit systems

A combined CIM/SMGS consignment note

Europe-to-Asia traffic is managed through two distinct legal regimes: (i) the CIM Uniform Rules, administered by the Intergovernmental Organisation for International Carriage by Rail (OTIF)1; and (ii) the SMGS Agreement, also known as the Agreement on International Traffic by Rail, administered by the Organisation for Co-operation between Railways (OSJD)2. Due to the coexistence of the CIM Uniform Rules and the SMGS Agreement, the carriage of freight between China and Europe is subject to different languages and requirements, including two consignment notes. In Türkiye, Western and Central Europe, rail freight transport abides by the CIM rules, while the SMGS law applies for China, Russia, and Central Asia. In Georgia, Azerbaijan, Ukraine, and other Eastern European countries, both frameworks exist.

To facilitate the transit of goods along the Middle Corridor, a common CIM/SMGS consignment note was created in 2006 by a joint International Rail Transport Committee-OSJD initiative to allow legal interoperability. The CIM/SMGS consignment note simplifies and accelerates rail cargo transport by being a CIM consignment note in the CIM area and, simultaneously, a SMGS consignment note in the SMGS area. It contains the necessary standardised information for goods consignment, provides greater legal certainty on the entire carriage process, and authorities recognise it as a customs paper. Such a harmonised document avoids any reconsignment at geographical points of intersection between CIM and SMGS regimes, reducing border crossing times and costs. (CIT, 2013[24]; UNECE, 2019[25])

Unified Railway Law

The Unified Railway Law (URL) has been developed from the CIM and SMGS systems as well as other international conventions for other modes of transport. For the most part, the CIM and SMGS provisions have been included, except for where these two differ (i.e., carrier’s liability) resulting in URL compromises. To simplify and clarify the URL and make it easier to use than the CIMS or SMGS systems, provisions of lesser importance have been excluded (i.e., declarations of value, interest in delivery, cash on delivery, rail-sea traffic and nuclear incidents). The URL has not yet been formally adopted and consequently, has not entered into force.

The contract of carriage is accompanied by a single URL consignment note subject to one legal regime. URL establishes a uniform international legal framework for rail freight transport between the participating states falling otherwise under the CIM or SMGS regimes, including Azerbaijan and Georgia. The URL provisions take priority over their national laws and apply to each single international contract of carriage between those states if the parties to the contract of carriage opt to apply URL to their contract. URL is a voluntary choice for the contracting parties. It will continue to be possible to apply CIM and SMGS systems for carrying goods between Europe and Asia if the parties choose not to apply URL for a specific consignment. In this case, it will once again be necessary to conclude two contracts of carriage, one under CIM and another under SMGS systems, and the consignment needs either two consignment notes or a single CIM/SMGS consignment note. (UNECE, 2019[25]; UNECE, 2022[21])

1. CIM including 51 States, of which 25 are EU Member States, and the EU.

2. 29 States, of which 9 EU Member States from eastern Europe, Russia, China, and most of the Central Asian countries.

Road cargo transport documents and procedures

OECD survey respondents and interviewees have both named the harmonisation of regulatory requirements and permits for road freight transport as a major priority in developing the Middle Corridor. Road traffic is reported to be heavily regulated, with overlapping permits and requirements resulting in high transit costs. Interviewees indicated that in the absence of a regional legal framework for freight forwarding, cargo transport is subject to varying national requirements for truck transit permits and driver transit visas depending on the country of transit. In addition, they reported that prior information on required documents or the duration of their validity is hard to obtain, requiring trucks to carry a vast array of mainly paper documentation and to purchase similar permits in each country of the route. The Georgian “transit card” has been often cited as a case in point, as its price and scope have changed considerably in a short time period: while the transit card used to apply to a truck’s roundtrip through the country, it is now only one-way, while the price has increased from 200 lari (round-trip) to 350 lari per single fare.

The Middle Corridor countries have worked to streamline road border crossing document and procedure requirements, though implementation lags and efforts are fragmented. Kazakhstan, Azerbaijan, Georgia, and Türkiye have all ratified the TIR Convention to simplify and harmonise the administrative formalities of international road transport (Box 3.4). The TIR Convention facilitates cross-border trade using a standard, internationally recognised customs document and transit guarantee (TIR Carnet). China also joined the TIR Carnet transit framework in 2017, increasing the scope of end-to-end transit operations along the Middle Corridor. OECD interviewees reported that the degrees of implementation and scope of acceptance of TIR carnets for shipments vary greatly across the four countries, and even between customs posts within countries. As a result, in most cases each road freight driver needs to fill out, pay for, and carry a national transit permit certifying their cargo within each country. In addition, cargo documentation varies in each country, from a single one-page transit document for the entire cargo load, to multiple documents to be filled out for each single cargo load category. UNECE stated TIR is only operational and used by a part of the contracting countries, and that it does not appear fit for intermodal transport (UNECE, 2021[26]).

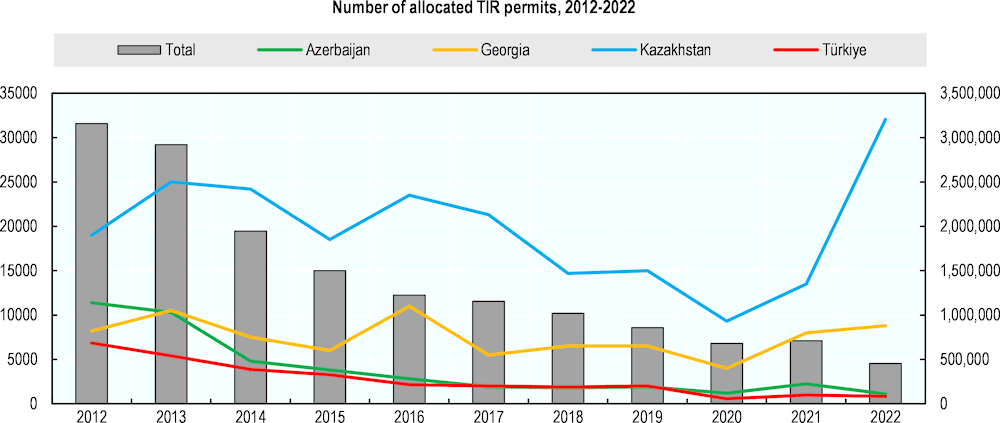

Moreover, the TIR Carnet system does not appear to respond to private sector needs in the region, including harmonisation with EU standards or digital processes (Figure 3.3). UNECE (2021[26]) states that “the TIR Convention is outdated, is not a modern tool adapted to current business requirements but rather an old legal instrument that failed to foresee the future business requirements and need”. Some CAREC countries have recorded a decline in the number of TIR carnets due to the Russian Federal Customs Service’s decision to implement its own transit regime in 2014 and to discontinue paper procedures in 2020 (UNECE, 2021[26]). Since shipments from Central Asia were often headed to Russia, this affected decisions to use TIR. Moreover, the EAEU membership of Kazakhstan and Kyrgyzstan further reduced interest in using TIR in these countries. The UNECE stated that a significant reduction in sales from 2013 onwards was due to a reduction in Russian, Ukrainian, and Turkish permits. It attributed declining sales to the delay in implementing the e-TIR system (see below), as well as increased competition with other customs transit systems (UNECE, 2021[26]). TIR is also perceived to be costly, especially for shorter hauls (CAREC-ADB, 2022[10]).

Figure 3.3. Number of issued TIR Carnets, 2012-2022

Note: In panel a), the number of global and Turkish issued TIR Carnet are plotted on the right axis.

Source: (UNECE, 2022[27])

Other road trade facilitation initiatives exist. Kazakhstan, Azerbaijan, Georgia, and Türkiye have all also ratified the CMR Convention, with the CMR consignment note providing information about shipped goods and the transporting and receiving parties. All four countries also use the European Conference of Ministers of Transport (ECMT) permit, though its uptake throughout Europe is limited. The ATA Carnet, used by Kazakhstan and Türkiye and widespread in Europe, is not used in Georgia or Azerbaijan. Only Georgia and Türkiye use the BSEC permit developed by BSEC PERMIS and BSEC-URTA, though Azerbaijan is a BSEC Member State. Central Asian states are not yet part of the conversation and the number of allocated BSEC permits appears to be below the annual quotas, further limiting its suitability. Similarly, even if Azerbaijan and Kazakhstan are TRACECA Members, TRACECA’s permit is used only by Georgia and Türkiye, and its reach is limited to just 200 permits per country. The 2022-27 TITR Roadmap for Azerbaijan, Kazakhstan, and Türkiye includes an action to encourage the liberalisation of transit permits for goods transported by road, although it lacks details.

Finally, the changing and unpredictable nature of trade and transit requirements not only increases official shipment costs but also leaves room for grey practices, the more so in the absence of integrated digital systems (see below). For instance, international freight transportation between China and Türkiye can fall under the category of “cabotage” (transport of goods within a territory by a transporter from outside the territory) under EAEU rules in certain cases in Central Asia, imposing additional permits requirements. The absence of harmonisation exacerbates border crossing congestion and therefore queuing and shipment times, while imposing multiple and overlapping requirements and costs upon transportation.

Box 3.4. Efforts to harmonise road trade and transit systems

Transports Internationaux Routiers (TIR) Carnet

Concluded in 1975, the multilateral TIR Convention aims to simplify and harmonise international road transport formalities. The United Nations Economic Commission for Europe (UNECE) in partnership with the IRU implements the convention using TIR Carnets. Transport operators holding a TIR Carnet can move goods without replicating border requirements and border checks at intermediate borders. Through mutually agreed customs controls and exchanging shipment data, transport operators using TIR can be exempted from repeated customs guarantees and inspections in each transit country. In 2021, the TIR Convention was adopted by 77 parties, including all Middle Corridor and CAREC countries, representing 33,000 international transport operators and 1 million TIR Carnets per year. (CAREC-ADB, 2022[10]; UNECE, 2021[28])

International Carriage of Goods (CMR) consignment notes

Signed in 1956, the United Nations (UN) Convention on CMR standardises road freight conditions and regulates transport of goods by road contracts or a bill of lading. CMR documents are primarily used for commercial transport contract purposes; they are also often used by law enforcement and customs authorities to check goods and information in cross-border trade. The convention includes Azerbaijan, Georgia, Kazakhstan, and Türkiye as well as EU member states (MS) and other countries (ADB, 2021[29]; ADB, 2022[30])

European Conference of Ministers of Transport (ECMT) permits

Introduced in 1974, ECMT permits allow mutual freight transport access to the markets of 43 mainly European countries, including Azerbaijan, Georgia, Kazakhstan, and Türkiye. Subject to a quota, the ECMT permit is valid for a specific time for an unlimited number of journeys. In 2017, the ECMT permits accounted for 4% of international road freight in Europe. ECMT aims to liberalise road freight transport, rationalise vehicle use to reduce empty running, and harmonise competition. (NI Business Info, 2021[31])

Black Sea Economic Co-operation (BSEC) permits

Implemented in 2014, the BSEC permit is a multilateral permit delivered to transport operators allowing vehicles to transit for goods carriage by road for a single trip. Valid for one calendar year, it does not exempt the carrier from other requirements related to the carriage of exceptional loads. In 2023, BSEC permit’s quota has increased from 20,800 to 40,800 permits year-on-year, representing 5,000 for each Member State except for Armenia (800 permits), though actual uptake is lower. Efforts are made to expand the geographical coverage and to digitalise the process. (BSEC-URTA, 2022[32])

Transport Corridor Europe-Caucasus-Asia (TRACECA) permits

In 2016, Armenia, Georgia, Moldova, Romania, Türkiye and Ukraine joined the Multilateral Permits System TRACECA. Seeking to replace multiple permits among MS, TRACECA permits enable international carriage of goods by road, with 200 permits allocated per MS (TRACECA, 2023[17]).

Temporary Admission (ATA) Carnet

Part of the 1990 World Customs Organisation (WCO) Istanbul Convention, the ATA Carnet is an international customs document that permits duty-free and tax-free temporary import of goods for up to one year and serves as a guarantee to customs duties and taxes. ATA Carnets cut red tape by simplifying and unifying customs border crossing regulations. ATA Carnets are used in the EU, Türkiye, and Kazakhstan but not in Georgia or Azerbaijan (ATA Carnet, 2023[33]).

Countries are still working to address the partial and unharmonised digitalisation of transit and border documents

In 2022-23, cross-border co-operation talks have progressed in relation to harmonisation and digitalisation of documents, but implementation remains a challenge. During the interviews conducted by the OECD, the governments of Azerbaijan, Georgia, and Kazakhstan indicated that they reached an agreement early 2022 on the principle to implement single transit windows for cargo transport by road and rail between their territories. However, the practical implementation of such a system still needs to be carved out. OECD interviews and surveys also seem to indicate that maritime transport so far is not part of regional discussions, although individual countries have started prospecting harmonisation of maritime regulations. For instance, Türkiye’s port Single Window system functions in a similar vein for traders and port authorities as the customs Single Window, while the Container and Port Tracking System enables electronic information exchange for all seaport customs operations. Georgia started developing a maritime Single Window for its Black Sea ports in April 2023, while Azerbaijan and Kazakhstan are working on a joint document to implement a single permit for freight transiting between the ports of Aktau and Alat.

The incomplete nature of transit and border document digitalisation efforts further complicates the unharmonised regulatory landscape and mosaic of overlapping permits and regional associations for businesses and governments alike (Box 3.5). For instance, Kazakhstan implements customs efforts oriented towards the EAEU through its ASTANA-1 project, whereas Georgia’s standardisation efforts focus on the EU (UNCTAD, 2022[34]). As one of the most digitally advanced countries in the region, Türkiye has fully implemented an automated customs system, e-payment system for customs duties, and electronic submission of documents, eliminating the need for paper-based document submissions. Traders can also declare all export declarations and warehouse declarations electronically without any requirement for a paper-based document since 2019 and 2023, respectively (WTO, 2023[35]). Likewise, the Georgian customs service is one of the most efficient in the CAREC region due to recent digitalisation efforts, including the use of big data to manage risks related to customs control and electronic data exchange, and the creation of a Single Window. The Georgia Revenue Service updated the Single Window for taxpayers in 2015 in line with the UN ASYCUDA system. This allowed the paperless processing of most customs operations such as customs declaration, transit declaration, and the introduction of automated risk management (CAREC, 2021[9]). International organisations developed cross border initiatives to address interoperability issues, such as UNCTAD’s ASYCUDA system or UNECE/IRU’s e-TIR system. However, the partial harmonisation results in complex interoperability issues for governments, including the digital interconnection of national customs systems and the ensuing electronic exchange of data along the route. Interviews conducted by the OECD indeed indicated that the coexistence of different e-customs systems across the region, mainly the e-TIR and the UN ASYCUDA systems, prevent easy electronic exchange of data between user countries.

Governments are working to digitalise transit documentation and procedures, though none cover the entire Middle Corridor. Businesses and government agencies interviewed by the OECD highlighted that the partial harmonisation of documents is exacerbated by incomplete digitalisation efforts resulting in a duplication of digital and physical papers and procedures. TIR Carnet sales to Türkiye have dropped by 88% since it joined the New Computerised Transit System (NCTS) in December 2012, indicating the shift of operators’ preferences from TIR to NCTS. Georgia is already using NCTS domestically and plans to expand it in 2024; Azerbaijan, and Moldova are taking steps towards joining NCTS as well. Azerbaijan, Georgia, and Kazakhstan are in the process of implementing the CAREC Advanced Transit System (CATS) which is based on the NCTS. Azerbaijan and Türkiye have also acceded to the digital e-CMR protocol, while Azerbaijan, Georgia, and Kazakhstan have signed an e-TIR letter of intent and the e-TIR main principles (IRU, 2023[36]; UN, 2022[37]). In 2022, Azerbaijan, Georgia, and Uzbekistan connected their national customs systems to the e-TIR international system with the remaining contracting parties along the Middle Corridor expected to follow (UNECE, 2023[38]; UNECE, 2021[28]). At the regional level, the digitalisation of transit documents is prevented by the absence of Kazakhstan in the digitalisation pilot, de facto cutting the road transit connection. Azerbaijan, Kazakhstan, and Türkiye have all conducted e-TIR pilots, but only with Iran or other Central Asian countries rather than among each other. Azerbaijan and Kazakhstan pioneered the Global Transit Document (GTrD) pilot with other Central Asian countries in 2022, though the pilot results are not yet known, and it does not yet cover all Middle Corridor countries (UN, 2022[37]). Türkiye and Uzbekistan trialled the first BSEC e-Permits in their efforts to combine e-CMR and BSEC e-Permit in one project. Though at a trial stage with few permits allocated, the goal is for the e-Permits to work bilaterally between the BSEC countries or in a common network (BSEC-URTA, 2023[39]). Finally, the ECMT digital platform for licence management in place, though the full digitalisation of the quota system is still underway, with paper licenses still being used (ITF, 2021[40]).

Box 3.5. Information customs exchange efforts

New Computerised Transit System (NCTS)

The European New Computerised Transit System (NCTS) allows traders to submit electronic transit declarations online and minimise the number of required documents through the electronic exchange of information along the transport route. NCTS allows actors to monitor in real time/avoid fraud, ensure real-time IT information exchange, and communicate between involved offices (i.e., departure, destination, transit). Launched in 2003, it covers the 27 EU countries, the European Free Trade Association (EFTA) countries, the UK, Türkiye, the Republic of North Macedonia, and Serbia (Irish Tax and Customs, 2023[41]). NCTS deployment to Azerbaijan, Georgia, Moldova, and Ukraine is in progress with technical assistance of the Twinning project provided by the EU. (EU4Digital, 2019[42])

UNCTAD Automated System for Customs Data (ASYCUDA)

ASYCUDA is a customs management system for trade and transport operations. It aims to accelerate customs clearance via computerisation and simplified procedures, to increase customs revenue, and to produce reliable and timely statistics. ASYCUDA TIR is an international transit solution aligned with TIR-EPD/SafeTIR requirements. Within ASYCUDA, the ASTANA-1 integrated system between Kazakhstan and EAEU member states became operational in 2018 to modernise customs clearance procedures and provide a single window. ASYCUDA systems are running or being implemented in 102 countries, including Georgia and Kazakhstan (UNCTAD, 2019[43]; UNCTAD, 2022[44]).

CAREC Advanced Transit System (CATS)

CATS, initially piloted between Azerbaijan, Georgia, and Kazakhstan, aims to create a single harmonised electronic regional transit system that is more cost-effective than TIR and integrated with regional procedures. It streamlines and harmonises transit documentations and promotes the development of a modern, risk-based affordable guarantee mechanism that rewards compliant economic operators. The CATS technical specifications including software to use an alternative digital transit system based on the EU’s NCTS. (CAREC-ADB, 2022[10]; CAREC, 2019[45])

Integration of ports information into national customs systems

In 2020, the three-year OSCE Promoting Green Ports and Connectivity project covering Azerbaijan, Kazakhstan, and Turkmenistan was launched to improve sustainability, security, and connectivity of trade flows in the Caspian Sea region. One of its three workstreams, the Digital Route, is dedicated to connectivity with the aim to improve transport, trade, and border-crossings. The project establishes a common digital data transmission system for cargo transportation between the ports of Baku, Aktau, Kuryk and Turkmenbashi (OSCE, 2021[46]; Port of Baku, 2022[47]).

Insufficient border customs capacity and lacking co-operation among customs agencies along the route lead to congestion when traffic increases

Difficult co-operation between customs along the route lead to repetitive inspections and delays

OECD surveys and interviews indicate that lagging cross-border customs co-operation considerably increases shipment delays. In all four surveyed countries, the private sector cites border point congestion as the single most important bottleneck contributing to the Middle Corridor’s unpredictability in terms of shipment time. This tendency is confirmed in the performance of Central Asian and Caucasus customs in the World Bank’s Logistics Performance Index (LPI) (Figure 3.4). Both regions score below EU average and Türkiye on all indicators related to customs administration as well as the overall score, while progress in the past 15 years has only been modest.

Figure 3.4. Performance of customs administrations in Central Asia, the South Caucasus, and Türkiye

Note: 5 is the maximum score on each indicator. “Central Asia” includes Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan; “Caucasus” includes Armenia, Azerbaijan, and Georgia. For Georgia initial data is 2010, and for Azerbaijan end data is 2014.

Source: (World Bank, 2023[48]).

Businesses interviewed by the OECD point especially to cargo, vehicle, and driver inspection duplication in each transit country. The TIR carnet in theory guarantees the seamless flow of road cargo from the origin to the destination country, with transit customs recognising the results of inspections carried out in the origin country. In practice, though, businesses report controls and inspections at each border crossing point. Beyond cargo inspections, firms also report burdensome controls and inspections of trucks and drivers’ visas, for which standards display a large variability between countries and for which no single permit system so far has been established. Given limited customs capacity along the Middle Corridor (see below), this translates into considerable congestion. Issues are reported to be most acute at the Kazakhstani-Chinese and the Azerbaijani-Georgian borders, where trucks are said to be queuing between two days and a week, if not even longer. Governments are taking measures to address this issue, including the construction of a joint BCP between Azerbaijan and Georgia (Box 3.6).

The absence of generalised electronic exchange of data between the countries of the Middle Corridor further aggravates the problem. Interviewees indicated that freight shipments frequently repeat the same procedures when shipping goods between China and Türkiye due to the duplication of digital and physical border procedures. The issue is reported to be especially acute in Kazakhstan and Georgia. Truck drivers need to carry a large volume of paper documentation with them and undergo lengthy border queuing times and controls that could be avoided if electronic exchange of data were to function properly. Beyond additional time imposed on businesses, and overburdening of customs capacity (see next section), this situation is also reported to favour instances of corruption, leading to increased costs for businesses and revenue losses for customs and government authorities.

Box 3.6. Azerbaijan-Georgia Joint Border Control

Azerbaijan and Georgia are undertaking efforts to handle road traffic. First proposed in 2017, the joint border control at the Tsiteli Khidi or “Red Bridge” border control point (BCP) would be the first in the region. The joint BCP will enable import and export customs controls to be conducted simultaneously within a common area including customs offices of both administrations. It would also contribute to harmonised and mutually recognised customs formalities in Azerbaijan and Georgia. Though not yet launched, the authorities have analysed BCP traffic, assessed existing border crossing procedures, identified problems, and proposed improvement measures. Moreover, the joint BCP architectural concept and procedures have been developed and the two governments have signed a bilateral agreement on the BCP’s implementation. The project’s development still requires reducing customs formalities, harmonising customs control, improving risk management systems, and intensifying co-operation among customs authorities.

Under joint customs control, the authorities are proposing a new BCP at Abreshumis Gza–Ipek Yolu. A shipment crosses only one BCP instead of two (one entry and one exit) at the border, resulting in efficiency gains under joint management. If successful, such an experiment may offer lessons for a more streamlined and efficient border crossing. The Azerbaijan-Georgia joint BCP aims to streamline customs and border procedures, reduce crossing time, and develop new and modernised BCP, road, and logistic infrastructure.

The BCPs in the region chiefly conduct control activities, such as inspections of drivers, goods, and vehicles, and high-level documentary checks lengthening border-crossing times. When entering the BCP, different border authorities conduct checks on the driver and vehicle, usually starting with starting with border security officers before sanitary and phytosanitary measures, immigration, transport controls, and customs. As customs officers are often the final authority to complete the procedure, they can detain the shipment if any unsatisfactory matters arise even if the issue is not customs-related (i.e. vehicle license problem, driver visa error), with border-crossing delays attributed to customs when the reason is beyond customs’ direct responsibility (CAREC-ADB, 2022[10]). In addition to being a lengthy series of actions, such a process complicates improvement in BCP functioning as it may be difficult to determine the root cause of border crossing issues. In contrast, Georgia’s customs service follows the OSS principle, making it one of the most efficient and technologically advanced in the region (CAREC, 2021[9]). In Türkiye, the vehicles are released to a separate inland facility for customs clearance if compliance is, detected to relieve border congestion. However, OECD interviews indicate that this can be an expensive operation with additional risks as trucks to be tracked or accompanied by customs officials to the second location, resulting in the de facto implementation being largely suspended with all operations conducted at the border. As no OSS for imports or exports exist on Türkiye’s land borders, vehicles are required to visit two perrons at the border entrance (police and customs) and another at the exit border, compared to a single OSS for all operations in Georgia.

Border customs lack the capacity needed to handle increased traffic

OECD interviews and surveys indicate that border crossing points in Kazakhstan, Azerbaijan, and Georgia seem to have difficulties in handling increased traffic, especially for roads. From the private sector’s perspective, border crossing times and predictability are key indicators of successful customs policies and attractiveness indicator for a given route – even more than costs. Shippers tend to value consistency in crossing times more than the overall travel time as high transport time variability complicates inventory management (OECD-ITF, 2019[1]). However, firms consulted by the OECD reported that border crossing times in Kazakhstan, Azerbaijan, and Georgia have drastically increased since early 2022 due to increased traffic on the Middle Corridor route. Businesses reported congestion issues to be the most pronounced for the Kazakhstani-Chinese Khorgos as well as the Azerbaijani-Georgian Red Bridge border crossing points despite efforts to renovate and improve BCPs. For rail transport with structurally higher crossing times, interviewees report that border crossing delays are mainly caused by technical issues, such as rail gauge changes and transhipments (see previous section) and wagon unavailability (see Chapter 4), rather than border inspections (OECD-ITF, 2019[1]).

Poor efficiency of customs clearance processes is both a cause and a consequence of delays. Interviewees reported that increased border delays and queues are mainly attributable to the low number of border points and passing lines, the mismatch of border capacity across countries, and the limited capacity of customs officials to perform all required inspections. The combination of an absence of automated or even digitalised customs systems and control facilities with understaffed and at times insufficiently trained customs personnel seems to lie at the centre of the issue. As road cargo inspections are a difficult and time-consuming task, the lack of harmonised transit procedures and the limited availability of infrastructure helping to sort road traffic by level of risk (i.e., green lanes or control facilities) complicates vehicle inspections and transforms into long delays. These results are in line with Kazakhstan, Azerbaijan, and Georgia’s relatively low performance on customs clearance processes in the LPI, for which Kazakhstan’s score even slightly decreased between 2018 and 2022, from 2.66 to 2.60 (World Bank, 2023[48]).

Border crossing times and costs vary significantly across the region (Figure 3.5). Though border crossing costs had decreased for Kazakhstan in 2019 compared to 2011, average costs remain higher than in the South Caucasus (Table 3.2). Azerbaijan has faced increasing costs in recent years – though from a comparatively low base. Interestingly, border crossing time in a given BCP can also face severe annual fluctuations. For instance, border crossing times significantly decreased in Khorgos starting from 2013 on the Kazakhstani side, and 2015 on the Chinese side, following investments in the construction of warehouses and separate vehicle inspection zones to facilitate border crossing (OECD-ITF, 2019[1]).

Figure 3.5. Border crossing costs and times along main border points of the Middle Corridor

Note: *Rail transport. Otherwise specified, data refers to road transport. Data is for 2019 (and not 2020) considering the circumstantial impact of COVID-19 on border processing. Data is missing for the crossing times at Khorgos, the inbound crossing at Dostyk, crossing costs at the Red Bridge in Georgia, crossing costs at Khorgos, inbound crossing costs at Dostyk and outbound crossing costs at Khorgos.

Source: (ADB, 2021[29]).

Table 3.2. Average border-crossing time and costs in Azerbaijan, Georgia, and Kazakhstan

|

Indicator |

Direction |

2011 |

2019 |

2020 |

|

|---|---|---|---|---|---|

|

Azerbaijan |

Time taken to clear a BCP (hours) |

Outbound |

2.1h |

1.9h |

6.3h |

|

Inbound |

13.8h |

3.6h |

10.2h |

||

|

Cost incurred at a BCP (USD) |

Outbound |

$30 |

$34 |

$71 |

|

|

Inbound |

$30 |

$57 |

$97 |

||

|

Georgia |

Time taken to clear a BCP (hours) |

Outbound |

- |

12.9h |

14.2h |

|

Inbound |

- |

2.6h |

4.8h |

||

|

Cost incurred at a BCP (USD) |

Outbound |

- |

$69 |

$45 |

|

|

Inbound |

- |

$49 |

$78 |

||

|

Kazakhstan |

Time taken to clear a BCP (hours) |

Outbound |

6.2h |

7.9h |

8.0h |

|

Inbound |

8.2h |

10.0h |

9.2h |

||

|

Cost incurred at a BCP (USD) |

Outbound |

$155 |

$67 |

$58 |

|

|

Inbound |

$256 |

$139 |

$157 |

Note: “-“ indicates data is not available for that year.

Source: (ADB, 2022[50])

The effects of the pandemic on trade in Central Asia and the South Caucasus have heightened border-crossing costs and times (ADB, 2022[50]). For instance, compared to the previous year, Azerbaijan’s average outbound and inbound times in 2020 increased by 231.6% and 181.3%, respectively; Georgia’s indicators increased by 10.1% and 84.6%. In contrast, Kazakhstan’s times and costs decreased in 2020 – though clearance times in 2019 and 2020 remained higher than in 2011. Moreover, businesses consulted by the OECD indicated that the trend of rising border-crossing costs and times had taken hold or accelerated across the region since Russia’s full-scale invasion of Ukraine in 2022.

Recommendation: develop a regional approach to border and transit documents, and build the capacity of border crossing points

Develop a single regional legal framework regulating all transport modes and ensure standardisation and implementation of requirements

Governments should focus on enhancing uptake and ensuring the practical implementation of the joint CIM/SMGS consignment note. To a large extent, the CIM/SMGS contributes to the objective of unification of legislative frameworks for trade, which significantly reduces transport costs and accelerates trade flows. Though countries are still subject to two legal regimes and thereby incur certain time and financial costs, the joint CIM/SMGS consignment note significantly simplifies cargo operations. In co-operation with the OTIF, OSJD, and UNECE bodies, Azerbaijan, Georgia, Kazakhstan and Türkiye should work towards implementing and developing a uniform CIM/SMGS consignment note application and towards the creation of legal, technical and technological conditions for the application of the electronic uniform CIM/SMGS consignment note (OSJD, 2023[51]). Firms should be free to choose whether they use the joint consignment note or whether they will re-consign goods at the handover point between the CIM and SMGS freight law regimes, but if they choose the former, the participating countries should ensure the relevant regulatory application is respected and applied. The 2023 memorandum on the pilot project should be accompanied by concrete implementation. Though the legal framework exists in Türkiye, it should focus its efforts on the implementation according to OECD interviews with private sector representatives, while Kazakhstan should introduce the joint consignment note too (UNECE, 2023[12]).

Governments should support the stepwise Unified Railway Law (URL) development. The authorities should consider forming an interface law for contract for international carriage of goods by rail between CIM and SMGS, as an opt-in solution. The development of the Agreement on the Contract for International Carriage of Good by Rail between Europe and Asia (CMR) would constitute a first URL Convention, which is more suited than the CIM/SMGS systems for multimodal container transport – a mode that is becoming increasingly important across the Middle Corridor. Without replacing the CIM/SMGS consignment note, this helps fill a gap in the international regulations for international rail freight carriage as neither CIM nor SMGS applies over the entire journey between Europe and Asia (UNECE, 2022[21]). Georgia should join the other Middle Corridor countries and sign the URL declaration. Though the practical use of the URL is subject to its adoption and subsequent entry into force, all countries could consider being more active in the URL discussions and, especially, Azerbaijan and Kazakhstan, which did not participate in the 2022 UNECE discussions nor questionnaire. As two well-established regional legal regimes for international railway traffic exist (OTIF, OSJD), unifying international railway law must be incremental and co-ordinated by both OTIF and OSJD. Moreover, the URL is generally preferred by industry representatives as it addresses their problems of operating in two regulatory regimes, while OTIF adopted an official position to develop the URL (Council of the European Union, 2022[52]).

The Middle Corridor countries should create a transit system in-line with EU standards. A unified transit system is one of the cornerstones of regional integration and can be created through bilateral, multilateral or regional agreements. It facilitates the free flow of goods by eliminating duties and taxes during transit, suspends duties and commercial policy measures, and thereby supports smooth trade flows in a region (WTO, 2012[53]). The EU is expanding its trade and transit policy to broader EU neighbourhood, including the Eastern Partnership countries, and shows a renewed interest in the Middle Corridor’s development. Azerbaijan, Georgia, Kazakhstan, and Türkiye should capitalise on this and work to harmonise their standards with those of the EU, including its Union transit system, which allows for the movement of goods under customs control (Box 3.7). Both Azerbaijan’s and Georgia’s accessions to the Common Transit Convention and implementation of the NCTS have been ongoing since 2018. Both countries should ensure continued collaboration and implement proposed reforms to align their standards with the EU and Türkiye, among other participating countries (UNECE, 2021[26]). Though not an Eastern Partner country, Kazakhstan could pursue the CATS implementation as a suitable and interoperable alternative system. Compared to TIR, the Common Transit Convention involves a more comprehensive guarantee scheme open to all modes of transit with unlimited loading and unloading and a digitalised system through NCTS (UNECE, 2015[54]).

Box 3.7. Common Transit Convention and the Single Administrative Document

The Common Transit Convention established a common transit procedure, while the Single Administrative Document provided for the simplification of formalities. Combined, the simplified rules (i.e., mutually recognised financial guarantees for customs transit, fewer controls) help to cut down on costs for EU and partner country businesses, while facilitating and boosting trade. SAD standardised the import, export and transit declarations and other customs procedures in the European Union (EU). The standardisation was accepted and mainstreamed when the New Computerised Transit System (NCTS) was developed in the 1990s. The first NCTS movements took place in 2000 and the roll out started in 2003. The form standardisation has paved the way for the standardisation of data elements and the EU data model, which itself is based on the global World Customs Organisation (WCO) data model. Contracting parties are the 27 EU member states, the four European Free Trade Association (EFTA) countries, Türkiye, North Macedonia, and Serbia.

Source: Adapted from (European Commission, 2023[55])

Countries can also look at the accession to, and implementation of, other conventions. For instance, the ECMT model bilateral agreement offers provisions that can be accepted by most countries; they do not necessarily need to be best practice. The ECMT is indirectly supported by a progressive multilateral permit and quota system that allows free access to bilateral, transit, and third-country transport market segments for transport operators in other ECMT participating states. It has been successful in developing an efficient European road transport environment and promoting regional convergence (World Bank, 2021[56]). Middle Corridor governments could consider the Convention on International Multimodal Transport or the FIATA Multimodal Bill of Lading, though they should ensure to do so in consultation with partners to avoid unnecessary and unharmonised initiatives.

The relevant authorities should expand the usability of permits and promote their uptake to government and business to reinforce security and trust. Regional integration processes entail the creation of common transit and trade areas, as can be seen in the worldwide TIR, the European Union’s Common Transit Convention and the EAEU’s transit systems. There has been an important decline in the use of the TIR system since 2014 in countries that were the main users of the TIR carnets, including Türkiye, as they switched to the European NCTS system. These developments have impeded regional integration (UNECE, 2021[26]). As TIR is in place, countries should continue its use, but they should look at alternative solutions in parallel. For instance, as Azerbaijan is already a BSEC member, it should consider ramping up efforts to implement the BSEC permit system. Though not a BSEC member, provisions should be considered for Kazakhstan’s inclusion, especially to boost regional trade rather than China-Europe transit through the Middle Corridor, for which the rail regulatory harmonisation my prove a more suitable initiative. With Kazakhstan and Türkiye already ATA Carnet system members, Azerbaijan and Georgia could evaluate their need to join the system. Similarly, Azerbaijan and Kazakhstan can analyse their use cases in joining the TRACECA permit system. In general, governments should promote any permit and their electronic version to build trust and boost trade, though the objective should be to establish single transit document on corridor. This should subsequently be developed to allow for the electronic exchange of data between transit countries on all maritime, rail and road transport operations and the acceptance of pre-submitted transit declarations as a transit document.

Streamlining and rationalisation of permits and documentation are essential if digitalisation is to deliver real benefits. Turning the current mosaic of paper-based permits with deficient operational implementation into a patchwork of digital permits that are insufficiently interconnected along the Middle Corridor should be avoided.

The relevant bodies should develop a minimal agreed standard for truck requirements. Governments can comprehensively review all transport and vehicle standards and build a minimal standard for truck dimensions, axle loads, safety standards for vehicles and drivers, road signs, and navigation rules. The authorities should consider harmonising weight bridge certificates to avoid repeated weight inspections. The Middle Corridor countries can subsequently consider increasing the road quotas for one another and raise the number of road permits (CAREC-ADB, 2022[10]). Moreover, standardised requirements would help reduce the need to tranship from foreign trucks to local ones at country border, as eastern South Asian countries have done (Box 3.8). Finally, though Kazakhstan joined the ITF in 2017, it is not member of ECMT yet, and therefore didn’t respond to the ITF’s questionnaire on road weights and dimensions in 2022. It should consider joining the ECMT to help centralise requirements in a single space together with other ITF members, including Azerbaijan, Georgia, and Türkiye, which already contribute to the survey (ITF-OECD, 2022[57]).

Box 3.8. South Asia’s Motor Vehicles Agreement

In 2015, the Eastern South Asian countries - Bangladesh, Bhutan, India, and Nepal (BBIN) - signed the Motor Vehicles Agreement (MVA) to replace various bilateral and bilateral agreements and facilitate the unrestricted cross-border movement of cargo, passenger, and personal vehicles between BBIN countries. Under MVA, trucks carrying export, import, or transit cargo can move inside the territories of other countries without transhipping to local trucks at border land ports. The MVA is a framework agreement; legal instruments and operating procedures still need to be agreed upon by the countries. Moreover, implementation of the MVA has been delayed as the countries work to clarify some of the provisions that are supposed to be elaborated in protocols, portraying the difficulty in aligning regulations.

Source: (World Bank, 2021[56])

Simplifying and standardising driver visa requirements across countries would address another industry pain point. Azerbaijan, Kazakhstan, and Türkiye are members of the Economic Co-operation Organisation, which has signed an agreement to simplify visa procedures for businesspeople in 1995 and extended this to transit drivers of ECO member states in 2009 (Box 3.9). Though this provides a framework, the need for an introductory letter and an endorsement by the Ministry of Foreign Affairs may pose a significant barrier, while the agreement’s de facto implementation is not clear. The countries could consider a simplified procedure as implemented by the Asia-Pacific Economic Co-operation (Box 3.9).

Box 3.9. Visa simplification initiatives

Economic Co-operation Organisation (ECO)

The 1995 Agreement on Simplification of Visa Procedures for the Businessmen of ECO Countries states that ECO member states will issue entry visas within 72 hours to businesspersons who have an introductory letter from the relevant commercial affairs national authorities and are endorsed by the Ministry of Foreign Affairs. In 2009, this was extended to transit drivers of goods and passengers and other relevant transport crew to include a seven-day transit visa at the border of each member state if the individual has a valid visa for the destination.

Asia-Pacific Economic Co-operation (APEC)

The Asia Pacific Economic Co-operation (APEC) Business Travel Card facilitates short-term business travel within the APEC region by streamlining the entry process into APEC economies. The ‘apply once, information used for multiple purposes’ approach enables applicants to make one application for permission to enter participating economies. Successful applicants receive a five-year card to economies that have granted pre-clearance for short-term business travel of up to 60 or 90 days.

Source: (ECO, 2023[58]; APEC, 2023[59])

Digitalise border and transit documentation and intensify electronic exchange of data

Countries can further operationalise their national Single Window systems and integrate them with all relevant agencies to remove process duplication at borders (ADB, 2022[30]). Ideally, bordering countries would integrate existing systems on either side of the border on a common digital platform along with development of requisite regulatory framework to enable trade, transport, commercial and SPS data to be exchanged electronically among various government agencies and other key stakeholders. For instance, the absence of a single window system on Azerbaijan’s side exacerbated already substantial wait times at the Red Bridge BCP (CAREC, 2023[49]). In general, Georgia’s OSS principle at its BCPs should be replicated in other countries. Türkiye should consider establishing an OSS at the Sarpi-Sarp BCP with Georgia (BSEC-URTA, 2023[60]). Funded by the EU and developed by the International Trade Centre, the Central Asia Ready4Trade program launched the Info Trade Central Asia Gateway – a single point of contact for all national Single Windows within Central Asia that includes guidance and online trainings (ITC, 2023[61]; Info Trade Central Asia, 2023[62]). A similar approach could be taken for the Middle Corridor countries, to stimulate regional trade and transit.

Countries should develop the CAREC Advanced Transit System (CATS), which appears to be a suitable stopgap initiative for all countries of the Middle Corridor that cannot swiftly implement the European New Computerised Transit System (NCTS). Though it is only for CAREC countries, thereby excluding Türkiye, CATS is based on the NCTS, which has been implemented by Türkiye since 2005 and is operational since 2012. CATS can align CAREC transit procedures with other regional transit procedures such as the Common Transit Convention, enhance customs-to-customs information exchange, and advance customs risk assessment of transit movements (ADB, 2019[63]). This makes CATS uniquely positioned within the Middle Corridor countries to provide a harmonised electronic system that uses information customs exchange to facilitate transit. CATS could also provide an alternative to the existing TIR system and could be suited to short hauls within the region at a more cost-effective rate (ADB, 2021[29]). The ADB provides technical and financial assistance in developing CATS, whereas the EU does so for NCTS. By engaging multilateral development banks and local programs like CAREC and TRACECA to help implement best practices the Middle Corridor states countries can build upon existing frameworks and initiatives rather than start anew (ADB, 2021[64]). Kazakhstan’s participation can help expand CATS to other countries in the CAREC region and, especially, Central Asia to help facilitate both intraregional and international trade and transit.

Since TIR remains in use in the Middle Corridor, the countries along the route should develop e-TIR and other digital procedures. The 2022-27 TITR Roadmap indicates countries aim to digitalise the railway transport passing system and apply e-permit systems in international road transport. A starting point could be the pilot interconnection of national customs systems with the e-TIR system, which has been fully implemented by Azerbaijan, Georgia, and Uzbekistan in co-operation with IRU and UNECE (UNECE, 2023[65]). Even if the pilot is not yet a full customs-to-customs digitalised information exchange system, it provides a basis for paperless cargo trade and transit and represents a progress compared to the existing outdated TIR carnets. Countries can consider setting up Middle Corridor-specific e-TIR working groups to ensure its implementation, as is being done already in Central Asia (IRU, 2023[66]). They should also consider developing e-Visas, e-certificates, and e-Permits (i.e., BSEC e-Permits, e-CMR, CATS, etc.), all of which enhance the security, transparency, and flow of goods.

Any multilateral, regional transit system would need an insurance guarantee chain and the recognition of customs authorities to be successful (CAREC-ADB, 2022[10]).CMR provides insurance to road transport operators, so a digitalised version could complement TIR and CATS. As Azerbaijan and Türkiye have already acceded to e-CMR and Kazakhstan’s accession is on-going, Georgia should also start the accession process, as it has already identified e-CMR as a potential next step (Revenue Service, 2023[67]). Moreover, Kazakhstan’s national TIR association KazA could design an e-CMR implementation road map to align the e-CMR convention with the transit regime and liability guarantees mechanism as part of the EAEU (ADB, 2021[29]).

The authorities should provide incentives and raise awareness to enhance the digital uptake of certificates and the submission of documents. For instance, as OECD interviews with Port Aktau indicate that some shippers and firms prefer offline administration, governments could provide fiscal and nonfiscal incentives to encourage digital filing of certificates by the traders to reduce dwelling time for cargo at the trading gateways. Workshops for sensitisation and awareness creation among both traders and customs officials can encourage the online submission of all documents and the advance filing of declarations (ADB, 2022[30]).

Improve information exchange and expand customs capacity through intensified cross-border co-operation