In the short-to-medium term, addressing both trade facilitation needs and infrastructure bottlenecks will require a combination of national initiatives and regional co-operation. The creation of regional oversight bodies could facilitate effective implementation, along with the deepening of regional and international agreements. In the longer term, if these reforms are to contribute to the development of the Middle Corridor into a central regional trade route, there must also be a strong, sustained political commitment to build and integrate regional markets in Central Asia and the South Caucasus and to connect them with Europe and Asia.

Realising the Potential of the Middle Corridor

5. Effective implementation: strategic planning, private sector involvement and regional co-operation

Abstract

Regional dialogue on the Middle Corridor has intensified, but greater co-ordination will be needed to develop it

A regional inter-governmental dialogue on an action plan to develop the route has started to formalise

Azerbaijan, Georgia, Kazakhstan and Türkiye have reinforced their co-operation to develop the Middle Corridor as a credible and attractive trade route. 2022 saw an intensification of political re-engagement between the governments in Central Asia and the South Caucasus, as well as a deepening of their ties with the European Union (EU) in a joint effort to develop the Middle Corridor as an alternative trade route (PMCG, 2023[1]). In March 2022, Kazakhstan, Azerbaijan, and Georgia established the joint venture (JV) Eurasian Joint Alliance to automate logistical services to provide efficient administration of transit operations and facilitate customs and border crossings. Together with Türkiye, they signed a quadrilateral declaration to improve transhipment capacity and encourage global trade integration. In April, the public railway firms of Kazakhstan and Azerbaijan signed a logistics co-operation document, while the following month governments and leading logistics agencies of Azerbaijan, Kazakhstan, Georgia and Türkiye agreed to close co-ordination (Geopolitical Monitor, 2022[2]) the South Caucasus. At the ministerial meeting on Trans-Caspian connectivity in Aktau in November 2022, all four countries signed a Roadmap and Action Plan to enhance the Middle Corridor’s competitiveness, with the aim of increasing its throughput capacity to 10m tons per year by 2025 (see Box 5.1) (Government of Kazakhstan, 2022[3]). This was followed in June 2023 by the signature of a trilateral co-operation protocol to establish an intergovernmental working group on the development of trade along the Middle Corridor between Kazakhstan, Azerbaijan, and Türkiye. The development of new transport routes and logistics projects has also been at the centre of high-level political discussions with China and the EU, as witnessed by the first ever European Union-Central Asia leaders’ summit in October 2022, the May 2023 Xi’an Summit between China and Central Asia, the May 2023 EU-Central Asia Economic Forum, and renewed talks between the EU, Azerbaijan, and Georgia.

Box 5.1. The 2022-27 TITR Roadmap dimensions and implementation

The road map consists of seven pillars of work on which the Governments of Azerbaijan, Georgia, Kazakhstan and Türkiye agreed to focus:

development of commonly prioritised transport and logistics infrastructure;

operational optimisation through the attraction of additional cargo flows;

implementation of a unified tariff policy;

development of a commonly agreed network of logistics centres;

sustainable development of multimodal transportation; and

implementation of a unified digital transport corridor.

The Roadmap delineates each dimension into sub-actions, each with a deadline, completion output, and the responsible parties (i.e., ministries, national companies, railway companies, ports, private firms, and authorities).

Progress has been made in creating a TITR co-ordination body. The Economic Co-operation Organisation (ECO) and the United Nations Economic Commission for Europe (UNECE) convened the First Co-ordination Committee Meeting (CC) on the Trans-Caspian and Almaty-Istanbul Corridors in September 2022, with the second and third meetings taking place in June and July 2023 (ECO, 2022[6]). In addition to government representatives, these meetings included representatives from international organisations, non-governmental organisations, and the private sector – though customs authorities and railways firms are the dominant participants, with rail capacity being the central topic (UNECE, 2023[4]). They are complemented by more frequent discussions, such as on multimodal inland transport routes between Asia and Europe. Kazakhstan has also improved domestic co-ordination: every quarter, a working group with relevant vice ministers, managers and local administrations is chaired by the Ministry of Trade and Integration to report on the five CBC hubs progress, identify issues and decide on solutions and next steps to deblock potential bottlenecks.

Collaboration between Middle Corridor countries is increasing but could be further improved

Examples of transnational infrastructure co-operation in the region exist. For instance, the construction of the Baku–Tbilisi–Kars (BTK) Railway was initially financed by the governments of the three participating countries. Azerbaijan’s State Oil Fund ultimately provided loans to cover Georgia’s section of the track, though all three national railway companies retain ownership (Eurasian Research Institute, 2017[7]). Funded by the two national governments and international financial institutions (IFIs), Georgia’s and Azerbaijan’s East-West Highway has helped reduce travel times significantly and resulted in dozens of new small and medium enterprises (SMEs) being set up along the route, while it also contributed to the development of agriculture and other non-hydrocarbon sectors in Azerbaijan (CAREC, n.d.[8]; World Bank, 2022[9]). Moreover, as indicated in Chapter 1, the two governments are discussing reforms to jointly improve the Red Bridge border crossing facility infrastructure capacity beyond improvements in previous years (World Bank, 2020[10]). Finally, Kazakhstan is developing five cross-border co-operation (CBC) hubs to boost its trade, transport, and transit connectivity with its neighbours, including some bilateral co-operation (Box 5.2). Türkiye has undertaken several bilateral initiatives with countries along the Middle Corridor route, which can lay the foundation for multi-country initiatives. A data exchange agreement was signed between Georgia and Türkiye, within the framework of the Baku-Tbilisi-Kars railway (BTK), on the joint use of land customs crossing points to accelerate border crossing times. Azerbaijan and Türkiye have also established a preliminary electronic information exchange system. Simplified customs corridor agreements exist between Türkiye and Georgia and between Türkiye and Azerbaijan enabling data exchange to facilitate faster customs procedures.

Box 5.2. Kazakhstan: developing cross-border co-operation hubs

Kazakhstan’s National Entrepreneurship Development Project for 2021-2025 seeks to diversify sectors of the economy. It aims to develop a roadmap for the creation and modernisation of five cross-border co-operation hubs delineated in the 2030 Transport and Logistics Potential Development Concept approved in 2022. Under the Ministry for Industry and Infrastructure Development (MIID), Concept 2030 expands Kazakhstan’s existing cross-border co-operation hub (CBC) concept in Khorgos with China to four new ones: the Caspian Knot maritime hub in Aktau, as well as Central Asia, Alatau and Eurasia, bordering Uzbekistan, Kyrgyzstan, and Russia, respectively. Together they seek to foster connectivity with neighbouring countries, with Khorgos and the Caspian Knot aiming to address Middle Corridor bottlenecks:

Khorgos: a joint project between Kazakhstan and China implemented under the previous Nurly Zhol strategies to develop Kazakhstan’s transport infrastructure within China’s Belt and Road Initiative. It serves road, rail, and pipeline traffic and consists of facilities on the Chinese-Kazakh border developed in the last decade, including a Special Economic Zone (SEZ), checkpoints, a railway station and terminal, and an International Centre for Cross-Border Co-Operation (ICBC) Free Trade Zone. The ICBC is a Free Trade Zone that enjoys a special legal and tax regime within its own borders, divided into a Chinese and a Kazakh block. Access and exit to the ICBC are independently regulated by both country’s customs offices. Chinese or Kazakh individuals can remain visa-free on either side for 30 days.

Caspian Knot: seeks to improve internal co-operation with Caspian Sea littoral neighbours and develop trade and logistics infrastructure development. It chiefly focuses on building containerisation capacity for trade and transit of goods in Aktau and Kuryk ports, though parts will also be included in SEZ Port Aktau to stimulate investment.

Source: (Adilet, 2022[11])

Reform efforts also largely remain within the domestic scope

The lack of co-ordinated effort between countries on infrastructure projects does not guarantee continuous traffic flows. Kazakhstan’s Caspian Knot aims to significantly expand the containerisation of trade and transit, though this can only succeed if other Middle Corridor countries boost their own container capacities – especially Azerbaijan. Firms report low transhipment capacity of Azerbaijan’s Alat port due to a lack of dedicated container equipment and terminal, where equipment is intended for bulk operations rather than container operations. As a result, container handling results in additional delays, regardless of Kazakhstan’s efforts to modernise its equipment or Georgia’s containerisation expansion project in Poti. Kazakhstan’s Concept 2030 states that it will develop road infrastructure to Turkmenistan’s western border within the North-South Corridor. Though there is low traffic today, the government forecasts an increase in traffic, but the hard infrastructure links, as well as a border logistics centre on Turkmenistan’s side, would need to be improved for the trade and transit link to be of enhanced practical use (EBRD, 2023[12]; OECD, 2023[13]). The absence of a single co-ordinating body or multilateral mechanism further hinders regional integration, as governments focus on bilateral and trilateral discussions that risk failing to integrate all points of view.

Governments tend to focus on large infrastructure development plans at the national level with only limited regional integration. Georgia has developed its side of the Sarpi-Sarp border control point (BCP), but without corresponding dedicated TIR lanes on the Turkish side, its impact on transit costs and times is limited. Both Azerbaijan and Georgia are developing the Red Bridge BCP, but Azerbaijan’s Single Window development lags that of Georgia, resulting in limited efficiency gains for drivers. While Kazakhstan’s CBC hubs fit into its broader national infrastructure strategy, it risks developing isolated cross-border initiatives ill-suited to Middle Corridor needs. For instance, the Khorgos hub lacks a regional vision beyond limited bilateral co-operation with China, and the Caspian Knot development appears devoid of any other country’s involvement. Azerbaijan and other economic partners are mentioned at times in Kazakhstan’s Concept 2030, there are measures to co-operate or align TITR development plans. The Concept 2030 appears to have been designed without consulting foreign governments or integrating their development strategies with Kazakhstan’s own infrastructure strategies. Similarly, the capacity in million tons of Georgia’s two Black Sea ports is significantly beyond that of Azerbaijan’s Caspian Sea port, while its utilisation rate was just 10% (see Chapter 4), pointing to a mismatch in needs. Containerisation capacity and utilisation are high, but the Poti ATM Terminals’ expansion plans will need to be aligned with forecasts in container traffic and infrastructure development in Azerbaijan and Kazakhstan. Both Azerbaijan and Georgia embarked on rail and road modernisation and expansion around the same time (see Chapter 4), though they have not systematically co-ordinated their approach. Streamlining the existing conventional and single-track Kars-Akhalkalaki rail network into electrified and double-track, as supported by Türkiye, has not been agreed by the Georgian side yet. Türkiye’s public investment plans reflect the ongoing shift to railway investments supporting the Middle Corridor route. However, in some cases, the location and capacity of the logistical centres do not match the expectations of the private sector in terms of efficiency as expressed to OECD.

Trade facilitation strategies are mainly implemented with only a national scope. While international organisations have supported the Central Asian countries in setting up a regional Single Window (see Box 5.3), the gateway was an EU-led initiative and does not cover the remaining Middle Corridor countries. Kazakhstan’s Concept 2030 states that non-physical barriers in international transport communication, including the long and complex cycle of customs administration of the process of multimodal transport of goods in international traffic are a significant barrier, though attention to the Caspian Sea is limited. OECD interviews indicate that though Kazakhstan and other Caspian littoral countries are working on digitalisation of customs information, as well as harmonising and simplifying requirements, most software solutions are developed only with the domestic market in mind. This hampers the exchange of data and reduces the tangible benefits for traders, shippers, and other actors (OECD, 2023[13]). Only part of the signed and ratified agreements is enforced as there is no mechanism for overseeing their implementation. Countries have different standards for the maximum weight and axle loads of heavy goods vehicles and different formal procedures and rules for entering and crossing each border, exacerbating co-operation and harmonisation problems. The situation is further complicated by the substantial border-crossing times (See Chapter 3). (OECD-ITF, 2019[14])

Box 5.3. The Info Trade Central Asia Gateway for Single Windows in Central Asia

Developed by the International Trade Centre (ITC) and funded by the European Union’s (EU) Ready4Trade Central Asia (R4TCA) project, the Info Trade Central Asia Gateway (Central Asia Gateway) aims to provide greater transparency in cross-border trade and remove regulatory and procedural barriers. Launched in 2023, the Central Asia Gateway provides direct access to step-by-step guides on licenses, pre-clearance permits and clearance formalities for most traded goods within, to and from Central Asia. It automatically extracts information from national trade facilitation portals in Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan that present national export, import and transit formalities step-by-step by mode of transport.

From each step, the Central Asia Gateway informs users on where to go, who to meet, what documents to bring, what forms to fill, what cost to pay, what law justifies the step and where to complain in case of problem. ITC also designed free courses which it provides for small and medium-sized enterprises (SMEs) in each participating country to encourage regional and international trade. The courses vary from global trade rules to export procedures, transit routes, quality and compliance standards, and EU market standards. The Central Asia Gateway also links to partner helpdesks (i.e., EU, United States, China, ASEAN) as well as the trade capacity-building and knowledge training websites of each of the five countries, thereby bringing relevant trade information into a single point of contact.

Source: (ITC, 2023[15])

Co-ordination and collaboration in trade facilitation remain a difficult point. All four countries perform worse on external border agency co-operation than any of the other TFI dimensions. Internal agency co-operation is the second poorest performance area in the four countries, though Georgia and Türkiye score well in this area and could likely provide good practices to Azerbaijan and Kazakhstan. Kazakhstan has intensified domestic co-ordination and harmonisation of data requirements and documentary controls among agencies involved in cross-border trade, including increased real-time availability of pertinent data among domestic agencies. Progress is also being achieved in setting the basis for the co-ordination of risk management systems implemented by various agencies, including through shared results of inspections and controls (see Chapter 3). However, according to OECD interviewees, the lack of co-ordination among international organisations, development banks, and development agencies on facilitation initiatives contributes to an uneven and unaligned trade facilitation landscape that already suffers from the absence of a single regulatory authority (OECD, forthcoming[16]).

Figure 5.1. Middle Corridor country trade facilitation indicator performance, 2022

Legend: A - Information availability, B - Involvement of the trade community, C - Advance rulings, D - Appeal procedures, E - Fees and charges, F - Documents, G - Automation, H - Procedures, I - Internal border agency co-operation, J - External border agency co-operation, K - Governance and impartiality.

Note: 2 is the maximum score.

Source: OECD TFIs database, 2022.

At the national level, the lack of an integrated strategy and limited co-ordination between levels of government constrain reform

Co-operation and co-ordination among various authorities, as well as between the public and private sectors at the national level, is still insufficient

Middle Corridor organisation takes place largely through the railroad and port institutions of the constituent economies – as seen by the TITR international association membership. National-level state development of the Middle Corridor is highly dependent on the rail freight development plans of the state-owned railroads and associated port infrastructures (ADB, 2021[17]). For instance, the Ministry of Regional Development and Infrastructure of Georgia appears to be absent in Middle Corridor discussions, despite being responsible for the East-West Highway development. OECD interviews indicate that a new regional working group or committee on connectivity, digitalisation, and border procedure issues in the region is being set up, while the Transport Corridor Europe-Caucasus-Asia and IRU hold sporadic meetings on combining transport modes across the Middle Corridor (IRU, 2023[18]). Such initiatives are a step in the right direction but remain far removed from a holistic institutional framework to address all issues. Moreover, a fragmented landscape of regional initiatives could fail to address the common challenges in making the TITR more competitive.

The absence of a public- or private-sector body supervising all modes of transports is detrimental to multimodality. In Kazakhstan, KTZ Express JSC is the single authorised transport operator that provides unified logistics services for multimodal transport. While this helps facilitate flows and attract cargo traffic, a transnational player is notably absent (OECD, forthcoming[16]). Moreover, the absence of an administrative body in charge of multimodal transport planning in Kazakhstan hampers connectivity, as road and railway agencies often do not work closely together (ITF-OECD, 2019[19]). The national railway company KTZ owns most of Aktau’s port as well as Kuryk’s ferry operations, and its strategies and handling may differ from those of an independent multimodal actor. The rest of Kuryk port is the property of Semurg Invest, and the co-operation between the two port owners is primarily based on exchange of information instead of structural co-operation. Collaboration exists, as interlocutors state that sufficient cargo exists to be handled, though the ports show continued underutilisation and compete for largely similar cargoes (ADB, 2021[20]). The changing geopolitical context could make volumes decline, and competition increase simultaneously. Without minimum volume guarantees or a framework to plan for such eventualities, Caspian Sea port strategies may misalign in the future, especially if they do not intensify domestic and multinational co-ordination among themselves (OECD, 2023[13]). Additionally, Caspian shipping operations are dominated by Azerbaijani firms, which adds a layer of complexity in the collaboration with Kazakh port authorities.

Public-private co-operation also remains at the margins and limits private sector involvement in the planning and financing of the route’s development

Public-private partnership frameworks for infrastructure financing and development exist, yet remain at an early stage of development

Private sector participation in the development and financing of transport infrastructure, essentially in the form of PPPs remains at an early stage in Central Asia and the South Caucasus. Despite being a widespread tool for long-term transport infrastructure financing across OECD countries (Box 5.5), PPP schemes have indeed been either introduced only recently, as in Azerbaijan or Georgia, or rarely used, as in Kazakhstan, to maintain and expand transport infrastructure (Box 5.4). Despite having pioneered PPPs in the region, Kazakhstan has used them only in a limited way for transport infrastructure initiatives. The 2006 Law on Concessions opened the way to private sector participation in the development of the transport sector, whose scope has been later formalised and expanded by the 2015 PPP Law and more recent amendments (UNESCAP, 2018[21]; ITF-OECD, 2019[19]; ADB, 2022[22]). Businesses interviewed by the OECD indicated that though the framework has eased the PPP process, the transport sector represents only 3% of the country’s 1,357 PPP projects (ADB, 2022[22]; KZPPP, 2023[23]). In particular, the government’s current infrastructure development strategy Concept 2030, unlike its predecessors, does not contain precise financial allocations for individual items, nor a list of projects which the private sector could bid. The Concept 2030 however consecrates PPPs as a major tool to develop the infrastructure of seaports and attract private investment to create specialised terminals, while entrusting private investments to finance transport and logistics infrastructure (Adilet, 2022[11]).

Azerbaijan and Georgia have also aimed at increasing private sector participation in infrastructure development by elaborating PPP frameworks. Since 2013, PPPs have been promoted in Georgia as an alternative means of financing infrastructure projects. This has been reemphasised in 2016 and led to the 2018 PPP law which authorises the tool. However, so far only 33 PPP projects seem to have been effectively developed, with the transport sector being the second beneficiary after the energy sector (ADB, 2020[24]; World Bank, 2023[25]). In Azerbaijan, no PPP in the transport sector has been reported so far, largely due to the novelty of the framework, initiated in 2016 and formalised only in December 2022 with the Law on PPP (Public Private Partnership Development Centre, 2022[26]; World Bank, 2023[25]).

After Brazil and China, Türkiye was the third largest recipient of PPI (Private Participation in Infrastructure) investments in 2021, and infrastructure investments have been gaining momentum with larger projects in the pipeline. The first structured legal framework regarding PPPs, specifically Build-Operate-Transfers (BOTs, a project delivery method where the private entity builds the infrastructure and obtains the right to operate it to cover the construction costs) was introduced as early as 1994. However, the major boost to transport infrastructure investments came through 2011 amendments to this law and 2005 amendments to the Transfer of Operating Rights (TOR, a model in which operating rights of existing facilities are transferred from the state to a private entity) provisions with regards to airports. These two changes have contributed significantly to an increasing share of infrastructure PPPs in Türkiye’s investment portfolio. While from 1990-2011 the largest PPP investments were reported in the electricity sector, from 2012-2022 airports took the highest share with significant increases in roads and ports as well. The aggregate PPI in transportation (airports, ports, roads, railways combined) stands at USD 79.3 billion as of 2022 (World Bank, 2023[25]). Türkiye has ambitious transport projects in the pipeline, most notable ones being Canal Istanbul, a constructed sea-level water passage from the Black Sea to the Marmara Sea and the Gebze-Halkali railway over the 3rd Bosporus Bridge (Investment Office, 2023[27])

Box 5.4. Public-private partnership (PPP) frameworks and Traditional Public Investment (TPI) in transport infrastructure in Central Asia, the South Caucasus, and Türkiye

Azerbaijan

Since 2016, PPPs have been regulated by the “Law on the Implementation of Special Financing for Investment Projects in Connection with Construction and Infrastructure Facilities (“Build-Operate-Transfer/BOT Law” ) and the Order on the establishment of conditions of the realisation by investors of investment projects with respect to construction and infrastructure objects with the “BOT” order. A PPP Unit has been established in 2018 that develops and implements PPPs. Nevertheless, beyond the first PPP in 2021, only three PPP projects have been initiated since 2016 (The World Bank, 2022[28]). Azerbaijan’s PPP framework requires a substantial upgrade to comply with internationally recognised standards, which could enhance the development and implementation of more PPPs (EBRD, 2021[29]).

Georgia

The decrees on the “Approval of PPP Policy” and “Approval of Investment Projects Management Guide” were adopted in 2016, setting out the principles organising the institutional and legislative framework of PPPs and the outlines of evaluation, approval and implementation procedures for public investment projects including PPPs, followed by a 2018 “Law on Public-Private Partnership”. Created in 2018, the Public and Private Co-operation Agency – a dedicated government entity – identifies possible PPP projects, ensures their selection and coordinates the development and implementation of the projects. Since 1993, 15 PPP projects have been initiated, including one after the adoption of the new law in 2018 for the Port of Poti marine terminal (The World Bank, 2022[28]).

Kazakhstan

Two main laws regulate PPPs: the 2015 Law “On Public Private Partnership” and the 2006 Law “On Concessions”. Created in 2008, the Center for Development of PPPs is a specialised government entity dedicated to facilitating PPPs. It conducts research to develop recommendations on PPPs, examines PPP projects, evaluates their implementation, and trains specialists. Since 1997, 36 PPP projects were initiated, including 15 after the implementation of the PPP law in 2015 (The World Bank, 2022[28]).

Türkiye

Legislation does not have a single and unified legislative framework for PPPs. Depending on sectors (i.e., infrastructure projects in transportation, energy…) and the PPP model, numerous laws can apply. Since 2018, the Department of PPP of the Presidency of Strategy and Budget has been building PPP capacity, approving projects, and overseeing their implementation. The Ministry of Treasury and Finance is also involved in the facilitation of the PPP program. Since 1990, 222 PPP projects have been initiated (The World Bank, 2022[28]).

Source: (World Bank, 2020[30]).

Table 5.1. Performance of PPP and TPI systems in Central Asia, the South Caucasus, and Türkiye

|

Dimension |

Azerbaijan |

Georgia |

Kazakhstan |

Türkiye |

|---|---|---|---|---|

|

Preparation of PPPs |

30 |

65 |

49 |

37 |

|

Procurement of PPPs |

43 |

74 |

63 |

69 |

|

PPP Contract management |

51 |

79 |

62 |

75 |

|

Infrastructure asset management under TPI |

73 |

61 |

n/a |

46 |

Note: Selected scores (out of 100) from the 2020 World Bank PPP and TPI surveys

Despite improved dialogue at the regional level, the private sector is largely excluded from strategic discussions about the route’s development, at the national level

At the regional level, the private sector has been working towards common standards and addressing recurrent issues along the route. National business associations as well as regional and international organisations covering the different business activities along the Middle Corridor logistics route have been actively mapping infrastructure and trade facilitation bottlenecks and developing dialogue platforms to address them. In particular, the interplay of business representatives and international organisations in the framework of BSEC, IRU, or TRACECA has allowed the elaboration of common transit standards, and the development of pilot projects, in particular about trade facilitation aspects (see Chapter 3). At the regional level, the TITR association has also been instrumental in triggering public-private discussions about the necessary adaptations to raise the route’s attractiveness. The association’s structure, combining membership of major state-owned enterprises as well as other private key players in the rail, road, port, and logistics sectors, has contributed to initiating discussions with governments in Central Asia, the South Caucasus, and Europe, as witnessed in the association’s contribution to the November 2022 TITR Development Roadmap.

However, at the national level, the private sector is consulted only occasionally by governments on infrastructure and trade facilitation issues and policies. Some of the business associations interviewed by the OECD in the countries of the Middle Corridor said they had been consulted by their governments to contribute to national strategies for transport infrastructure development and trade facilitation, providing expert opinions on proposed measures or suggesting additional or alternative ones. In some rare cases, such a dialogue is formalised in the framework of joint action plans, as for instance between the Union of Transport Workers of Kazakhstan and the Ministry of Industry and Infrastructure Development. However, interviews conducted by the OECD suggest that this type of formal arrangement and consultation remains an exception, while most interactions apply to specific laws rather than the development of strategies. Türkiye has a strong private sector with effective lobbying capacity through various sector-specific business NGOs, including those in the transport and logistics sector. These NGOs are consulted on regular basis during the preparation of nation-wide strategic development plans (e.g. so called “Development Plans”) at macro level; while the private sector stakeholders consulted by OECD refer to lack of effective consultation during the preparation and implementation of micro-level infrastructure plans. Consultations for Trade Facilitation, on the other hand, are institutionalised in view of Türkiye’s status as a party to the WTO Trade Facilitation Agreement, which stipulates the establishment of a country-wide coordination committee for trade facilitation encompassing all related public and private stakeholders.

In each country, businesses consulted by the OECD highlighted the lack of an institutionalised public-private dialogue (PPD) on infrastructure development as a major impediment to the route’s development. Beyond the occasional consultation of representatives of the main transport sectors (road, rail, ports) or major business activities on the logistics chain (e.g., freight forwarders), interviewees indicated that PPD remains limited. In particular, interviews indicated an absence of strategic consultations of the private sector by governments when developing the regulatory framework for transport infrastructure expansion or trade facilitation strategies. It appears that Kazakhstan has not systematically consulted non-public stakeholders, while designing the Port Aktau Special Economic Zone (SEZ) or during its operations following the 2003 launch or the planned expansion in 2023. The involvement of private company DP World in Port of Aktau and its intended participation in ownership of SEZ Aktau may have improved operational and governance performance, but with its departure and the absence of other business representatives, such dialogue remains mostly absent (OECD, forthcoming[16]). If such consultations happen, it is mainly in the framework of international sectoral business associations or organisations, such as UIC, IRU or TITR.

Box 5.5. The OECD Principles for Public Governance of Public-Private Partnerships

Overview of the OECD framework for Public-Private Partnerships

Private investment has the potential to supplement public investment to meet investment needs. Investors, particularly long-term ones, expect governments to be competent and reliable partners and to promote a stable business climate for investment. The use of PPPs in OECD countries calls for capacities in government in terms of skills, institutional structures and legal framework to address the complexity of PPPs. Policymakers are encouraged to adopt a robust system of assessing value for money that involves classifying, measuring and contractually allocating risks to the party best able to manage them. Good governance of PPPs requires the alignment of public sector areas such as institutional design, regulation, competition, budgetary transparency, fiscal policy and integrity at all levels of government.

Establishing a clear, predictable and legitimate institutional framework supported by competent and well-resourced authorities is essential for the good governance of PPPs. Regulations affecting the operation of PPPs should be clear, transparent and adaptable to changing conditions.

The selection of PPPs should be grounded in value for money principles and based on a whole government perspective. The decision to choose the delivery mode should be separate from how to procure and finance the project to avoid institutional, procedural or accounting bias, either in favour or against PPPs.

Transparency in the budgetary process is essential to minimise fiscal risks and ensure the integrity of the procurement process. This will help ensure the affordability and sustainability of the overall investment envelope.

Source: (OECD, 2012[31])

Current infrastructure projects therefore remain mainly publicly financed, with limited interest from private investors

Private sector participation in the financing of infrastructure projects remains limited. OECD interviews indicated that the low use of PPPs in the transport sector combined with the prevalence of the state in the rail and road sectors have limited the scope of private sector financing. Port development in Azerbaijan, Georgia, and Kazakhstan seems to be a somewhat notable exception, as despite difficulties, recent construction and expansion projects have attracted some investor interest. Kazakhstan’s Sarzha multimodal marine terminal in Kuryk is being financed by Semurg Invest, a private company owned by a single anonymous individual. However, across both Central Asia and the South Caucasus, public funds, donor financing and concessional loans by major international financial institutions, key among which the EBRD or the ADB, remain the major sources of infrastructure financing while the operation and maintenance of infrastructure assets are mainly covered by public funding (World Bank, 2020[30]; ADB, 2020[24]).

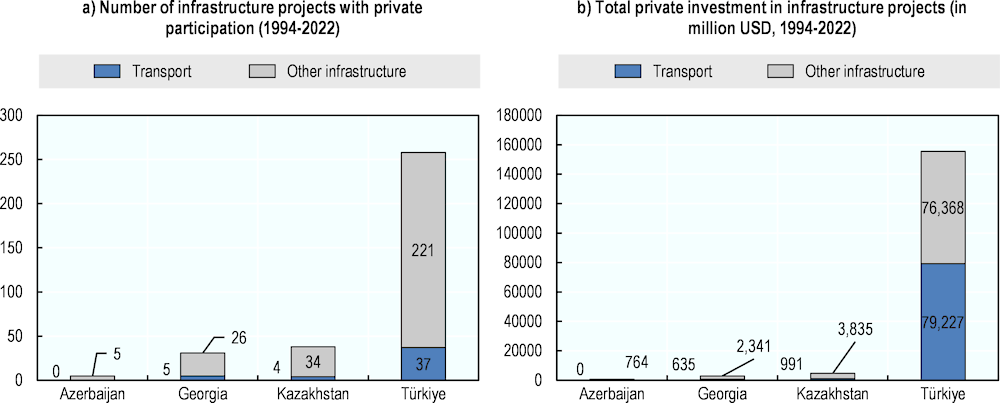

Figure 5.2. Private sector participation in transport and infrastructure projects financing in Central Asia, the South Caucasus and Türkiye

Note: The figure takes into account “active” or “concluded” projects from the PPI database, and not “cancelled” or “distressed” ones.

Source: (The World Bank, 2022[28])

Part of this trend seems to result from limited investor interest in developing segments of the Middle Corridor. OECD surveys and interviews indicated that, despite believing in the potential of the route, the private sector is rather reluctant to commit to projects that could develop some of its segments. Indeed, the uncertainty about future traffic flows is considerably reducing investor interest and willingness to engage in development projects requiring long-term financial engagements (OECD, 2023[13]). The non-fulfilment of the PPP scheme for the development of Georgia’s Anaklia deep seaport in 2020 due to outstanding issues between the project consortium and the government is indicative (CAREC, 2021[32]). However, increased private sector interest in the development of the route since early 2022 could change the situation. Businesses interviewed by the OECD indicated their willingness to engage more closely in the development of the route, addressing key infrastructure bottlenecks, but they also indicated that this would require a change in government practices towards greater consultation of the private sector, use of PPPs, and increased dedicated capacity in relation to both topics.

OECD surveys also indicate that low awareness of PPPs among government officials and the business sector is limiting private sector involvement in infrastructure financing or maintenance. The relative novelty of PPPs in the transport sector especially in Azerbaijan and Georgia, resulted in a low awareness of the tool’s opportunities and benefits among responsible government departments and the private sector and was not yet integrated as a core element of infrastructure planning strategies (ADB, 2020[24]). For instance, while in Türkiye the regulatory framework provides for the inclusion of PPPs in the national budgetary framework and details a specific procedure to ensure the consistency of PPPs with other public investment priorities, such provisions are absent in Azerbaijan, Georgia, and Kazakhstan. In Georgia and Kazakhstan, the regulatory framework only prescribes the need for PPPs to be consistent with all other investment priorities, without establishing a specific procedure to achieve that goal (World Bank, 2020[30]).

More broadly, government bodies responsible for managing infrastructure face major capacity constraints in relation to financial risk analysis, screening, and implementation of infrastructure projects. In particular, risk analyses, ranging from financial to social and environmental aspects, are not yet widespread practices among government agencies when developing infrastructure projects. Capacity constraints also exist in relation to the maintenance and improvement of existing infrastructure assets. For instance, while in Türkiye, Georgia, and Azerbaijan, governments developed routine maintenance and improvement plans for such assets and maintained a related database, no regular surveys of stocks, conditions, and quality of the infrastructure assets were carried out (World Bank, 2020[30]).

Defining a co-ordination framework and building capacity for efficient and transparent planning to enhance regional co-operation

Develop the institutional tools to support a common approach to the development of the Middle Corridor

Set up a formal coordination framework for the Middle Corridor

Partner countries should clarify the Middle Corridor co-operation framework to avoid overlap. Compared to individual country actions, co-operation and common approaches at the Middle Corridor level can leverage mutual expertise in capacity building, research, information and data gathering. Coordination organisations and mechanisms already exist for the Middle Corridor, but there is important overlap in their scope, and competition logics can exist between the different institutions. In certain cases, they cover a bigger region than the four project countries, and in other cases such as the TITR roadmap, they are not formalised. The more formalised the management body will be the more important visibility and enforcement power it will have. This would pave the way for an improved project prioritisation process (EBRD, 2023[12]).

Azerbaijan, Georgia, Kazakhstan and Türkiye should formalise the dialogue between stakeholders involved in the development of the Middle Corridor. Rather than creating from scratch a new management body for the Middle Corridor, governments should formalise the dialogue between the existing international and regional organisations and the relevant administrations in each country. This framework could take the form of regular meetings between representatives of regional organisations and initiatives (TRACECA, CAREC, BSEC, OTS, TITR Association), relevant ministries in each country and National Trade Facilitation Committees. Both high-level ministerial committees and technical committees should be gathered. The participation of private stakeholders in working groups could also be relevant, replicating at the regional scale what is already done in some countries, like in Georgia with quarterly meetings organised with the Business Association of Georgia. Relevant private stakeholders could include business associations, freight forwarders, manufacturers and investment funds. For this framework to be efficient, governments should entrust institutions with clear and consistent mandates, preventing to the extent possible any overlaps in responsibilities both in terms of infrastructure sectors and functions (policymaking, planning and execution). They must also provide entities with ample decision-making powers and allocate sufficient financial resources to ensure their ability to react more promptly to evolving situations (ADB, 2022[33]) (IRU, 2017[34]).

Box 5.6. Regional Trade Facilitation Committees in Africa

There are currently two Regional Trade Facilitation Committees (RTFCs) in operation within Africa. One was established by the Economic Community of Central African States (ECCAS) in 2018. This platform aims to coordinate efforts related to transit facilitation and to implement the World Trade Organization (WTO) Trade Facilitation Agreement. the Economic Community of West African States (ECOWAS) also set up a similar structure in June 2021. The purpose of this initiative is to enhance trade facilitation in the region by fostering co-operation and coordination among ECOWAS National Trade Facilitation Committees (NTFCs). The goal is to achieve a harmonized implementation of trade facilitation reforms at the national, regional, continental, and international levels. A roadmap has also been drafted for the creation of a Regional Trade Facilitation Committee for the Horn of Africa (HoA).

These Regional Trade Facilitation Committees aim is to provide a regional platform for the exchange of expertise, to harmonise the implementation of international trade facilitation reforms and to provide recommendations to the member states regarding the simplification of trade procedures.

Source: (Initiative, 2022[35])

Define and publish a long-term infrastructure development plan

Governments should draft a long-term infrastructure plan in coherence with the priorities established through coordination mechanisms. These types of plans establish long-term time horizons and generally range between 10 and 20 years. The plan should frame the choice of what to build with a cross-sectoral approach to the region’s future, considering synergies and trade-offs. It should have measurable goals and targets to be achieved through the infrastructure investment programme. The document would present a pipeline indicating priority projects, for each one with an explanation of the purposes and objectives and their alignment with the overarching infrastructure strategy. It should also include a timeline illustrating the different project phases and milestones. Planners should publish the long-term plan and ensure transparency of the strategy.

The authorities should monitor and update the plan regularly. They should define specific indicators to monitor and evaluate the implementation of the long-term plan, such as overall traffic and capacity on the route, waiting times at border points, or the carbon footprint of the corridor. The plan should also be as adaptable as possible. Experts should conduct on a regular basis a technical assessment of infrastructure needs and take stock of existing infrastructure. They should keep track of rapidly evolving technologies, environmental or climate change hazards and behavioural changes in society to adapt strategic plans accordingly. From the beginning, the strategic plan should be formulated in a way that is flexible enough to adapt to changing contexts. A formal process should be established to update the long-term infrastructure plan, ensuring this update is undertaken at fixed time intervals.

Box 5.7. Single Trade Corridor Management Authorities in Africa

CMAs established through government-to-government agreements

Most of the Corridor Management Authorities (CMAs) in Africa are set up through governmental co-operation. They usually follow a structure with a council of ministers from the countries’ key ministries, as well as a senior officials committee and sector-level technical committees. The authority is usually administered by a secretariat and relies heavily on support from international cooperating partners. Such CMAs include:

Northern Corridor Transit and Transport Coordination Authority (Burundi, DR Congo, Kenya, Rwanda, Uganda, South Sudan)

Central Corridor Transit Transport Facilitation Authority (Burundi, DR Congo, Rwanda, Tanzania, Uganda)

Dar es Salaam Corridor (Tanzania, Zambia, Malawi)

North-South Corridor (South Africa, Zimbabwe, Botswana, Zambia, DR Congo)

Abidjan Lagos Corridor (Benin, Ghana, Ivory Coast, Nigeria, Togo)

Private sector initiatives

Private-sector Corridor Management Authorities are less common. An example is the Maputo Corridor Logistics Initiative (MCLI). The aim of this corridor is to provide a link between the industrial region of Gauteng in South Africa and the sea, through the port of Maputo, in Mozambique). The MCLI was initiated in 2004 by users of the corridor, infrastructure investors, cargo owners and freight forwarders seeking to improve transport conditions on the corridor. The MCLI was composed of 170 members at its peak and was very successful at conducting infrastructure enhancement, by assisting with the broking of road and port concessions, leading to some of the most successful PPPs on the continent. Yet, the MCLI failed at tackling border crossing improvements, because its private sector nature prevented it from influencing public administrations in the two countries of the corridor.

Source: (UNCTAD, 2022[36])

Ensure sustainability and consensus around the corridor through a transparent and qualitative planning process

Conduct a solid data-supported assessment of infrastructure needs

Countries of the corridor should adopt a methodology to collectively assess current and future infrastructure needs. To avoid an imbalance in capacity on different segments of the corridor, and address efficiently the most pressing bottlenecks, governments should identify infrastructure requirements at a regional scale rather than at the national level. This will require liaising with line ministries and agencies responsible for different infrastructure sectors to take into account complementarities, promote synergies and limit possibilities for overlap. Informing the assessment through a rigorous analysis of evidence and data would help maximise the efficiency of investments and avoid projects ending up as white elephants. To project needs into the future and consider future risks and uncertainties, planners could resort to strategic foresight tools.

Governments should facilitate the access to trade and transport data. Efficient infrastructure planning can rely on quantitative assessment tools, such as the International Transport Forum’s International Freight Model. These models require access to transport and trade data to be refined and adapted to local and regional contexts. Therefore, countries of the corridor should enhance the collection and dissemination of data. Among the possible measures, authorities should define standards for data sharing and establish common platforms. The Middle Corridor’s coordination body could also consider including a “regional observatory for data collection” (ITF-OECD, 2019[19]). Ensuring interoperability between public and private data systems and promoting open data could also benefit the private sector and its involvement in logistic and connectivity challenges.

Box 5.8. The coordination framework of the NAFTA/USMCA corridors

The North American Free Trade Agreement (NAFTA) created a free-trade area between Canada, Mexico and the United States. The combination of a free trade agreement with the development of infrastructure corridors has resulted in the birth of a network of economic corridors. In 2018, NAFTA was succeeded by the United States–Mexico–Canada Agreement (USMCA), sometimes known as “NAFTA 2.0”.

NAFTA resulted in the creation of a Free Trade Commission (now the USMCA Free Trade Commission), bringing together cabinet-level representatives from the United States, Canada and Mexico, as well as NAFTA working groups dedicated to specific subjects with a focus on trade facilitation, investments, subsidies and standards, and a NAFTA secretariat (now the USMCA Secretariat), responsible for the administration of the dispute settlement provisions of the Agreement.

Various stakeholders were involved in the corridor’s development, including national governments, provincial and state governments, local authorities, private companies and regional development associations. The NAFTA/USMCA corridors were shaped by market forces, and there was and is no official coordination body. Yet, interested parties have gathered in various coalitions, such as the North American Supercorridor Coalition (NASCO).

The North American Supercorridor Coalition (NASCO)

NASCO is an association of elected officials and private companies who were concerned with the NAFTA increasing congestion along the I-35 Highway. They decided to act together to improve transport infrastructure and accommodate trade growth on a North-South corridor. NASCO was originally focused on road transport, but expanded its focus on all modes of transport, including rail and sea. NASCO members provide guidance to authorities on multiple subjects, include supply chain integration or workforce. The publication of border action plans is a major outcome of NASCO’s work, with recommendations from local and national officials, and private sector stakeholders, to improve border crossings and international trade between Mexico, the United States and Canada.

Source: (CAREC, 2011[37]) (NASCO, 2023[38])

Finance jointly the investments required for the route’s development

Middle Corridor partners should consider joint investments for the enhancement of the route. Similar to what was done for the Baku-Tbilisi-Kars Railway, where Azerbaijan’s State Oil Fund funded the Georgian section of the project, countries could collectively take part in the financing of projects. This would be especially relevant for the Middle Corridor as the different countries don’t have the same financing abilities, with Azerbaijan and Kazakhstan’s public budget benefitting from revenues related to the extractive sector. Joint investment in infrastructure is a crucial source of funding for the Trans-European Transport Network (TEN-T) and is achieved through the European Investment Bank or the Connecting Europe Facility (CEF) program. Similar schemes could be set up within the Middle Corridor’s coordination body, whether it be through subsidies or a common lending institution.

Ensure transparency and affordability in the planning of the Middle corridor

Governments should involve the private sector to improve the affordability and the fiscal sustainability of investments. When applicable, planners should identify alternative sources of financing, including Public Private Partnerships (PPP). This would mean continuing to enhance the PPP framework in the countries of the corridor. The resort to PPP should not prevent authorities from conducting a solid cost-benefit analysis for projects. The decision to invest in a specific project should be made separately from the decision to procure it through the private sector. Governments should conduct a Value for Money (VfM) assessment for all projects, based the whole life cycle (i.e., design, construction, operation, maintenance, adaptation, and decommissioning). (OECD, 2012[31]; ADB, 2022[22]; Zhao et al., 2022[39]; Watermeyer, 2013[40]).

Planners should involve all institutional and community stakeholders to seek consensus around the Middle Corridor-related projects. At the institutional level, governments should present the long-term infrastructure plans to parliament to ensure political approval over the definition of the strategic vision. Regional co-operation shouldn’t diminish the importance of involving subnational governments in the process of identifying infrastructure needs, making sure to address concerns related to regional disparities and urban-rural gaps. Authorities should also establish a detailed process for public consultation on the strategic vision and subsequent plans. To do so, they should map thoroughly the key stakeholders involved, identifying and addressing participation barriers faced by under-represented and vulnerable populations.

Box 5.9. OECD Framework for the Governance of Infrastructure

The Recommendation was adopted by the OECD Council on 17 July 2020. The OECD Framework for the Governance of Infrastructure to plan and prioritise investments, manage PPPs and procurement, design effective regulatory environments and manage integrity risks. It consists of ten recommendations:

Develop a long-term strategic vision for infrastructure

Guard fiscal sustainability, affordability, and value for money

Ensure efficient and effective procurement of infrastructure projects

Ensure transparent, systematic and effective stakeholder participation

Co-ordinate infrastructure policy across levels of government

Promote a coherent, predictable, and efficient regulatory framework

Implement a whole of government approach to manage threats to integrity

Promote evidence-informed decision making

Make sure the asset performs throughout its life

Strengthen critical infrastructure resilience

References

[33] ADB (2022), Integrated Approach to Trade and Transport Facilitation.

[22] ADB (2022), Public-private partnership monitor Kazakhstan, https://www.adb.org/sites/default/files/publication/850386/public-private-partnership-monitor-kazakhstan.pdf.

[20] ADB (2021), Ports and Logistics Scoping Study in CAREC Countries, https://www.adb.org/sites/default/files/publication/690856/ports-logistics-scoping-study-carec-countries.pdf.

[17] ADB (2021), Unlocking transport connectivity in the Trans-Caspian corridor, https://www.adb.org/sites/default/files/publication/743006/adbi-unlocking-transport-connectivity-092921-web.pdf.

[24] ADB (2020), Public–Private Partnerships in Georgia and Impact Assessment of Infrastructure. Working Paper N°1162, https://www.adb.org/publications/ppp-georgia-impact-assessment-infrastructure.

[11] Adilet (2022), On approval of the Concept of Development of Transport and Logistics Potential of the Republic of Kazakhstan until 2030 (Об утверждении Концепции развития транспортно-логистического потенциала Республики Казахстан до 2030 года), https://adilet.zan.kz/rus/docs/P2200001116#z165 (accessed on 21 April 2023).

[5] Azerbaijan Railways (2023), ITF-Azerbaijan Special Presentation in OECD GRC Istanbul Centre.

[32] CAREC (2021), Railway sector assessment for Georgia, https://www.carecprogram.org/uploads/2020-CAREC-Railway-Assessment_GEO_7th_2021-3-4_WEB.pdf.

[37] CAREC (2011), , https://www.carecprogram.org/uploads/NAFTA-Economic-Corridor-Development.pdf.

[8] CAREC (n.d.), East–West Highway Improvement Project, https://www.carecprogram.org/?feature=east-west-highway-improvement-project.

[12] EBRD (2023), Sustainable transport connections between Europe and Central Asia.

[29] EBRD (2021), “PPP Regime Development in Armenia, Azerbaijan and Georgia: Further regulatory efforts could stimulate private sector participation”, Laws in Transition Journal, https://www.ebrd.com/law-in-transition-2021.

[6] ECO (2022), ECO-UNECE Convene First Coordination Committee Meeting on the Trans-Caspian and Almaty-Istanbul Corridors, https://eco.int/eco-unece-convene-first-coordination-committee-meeting-on-the-trans-caspian-and-almaty-istanbul-corridors/ (accessed on 6 September 2023).

[7] Eurasian Research Institute (2017), Recent Developments in the Baku-Tbilisi-Kars Railway Project, https://www.eurasian-research.org/publication/recent-developments-in-the-baku-tbilisi-kars-railway-project/.

[2] Geopolitical Monitor (2022), The Rise of Trans-Caspian Routes amidst Russia’s Isolation, https://www.geopoliticalmonitor.com/russian-isolation-and-the-trans-caspian-international-transport-route/ (accessed on 3 April 2023).

[3] Government of Kazakhstan (2022), Kazakhstan, Azerbaijan, Georgia and Turkey discussed the development of transport routes through the Caspian Sea, https://www.gov.kz/memleket/entities/mfa/press/news/details/466518?lang=en (accessed on 3 April 2023).

[35] Initiative, H. (2022), Regional Trade Facilitation Roadmap.

[27] Investment Office (2023), Investing in Infrastructure & PPP, https://www.invest.gov.tr/en/library/publications/lists/investpublications/infrastructure-industry.pdf.

[18] IRU (2023), East-west connectivity on agenda for IRU and TRACECA, https://www.iru.org/news-resources/newsroom/east-west-connectivity-agenda-iru-and-traceca (accessed on 6 September 2023).

[34] IRU, W. (2017), Road Freight Transport Services Reform.

[15] ITC (2023), , https://intracen.org/our-work/projects/central-asia-ready4trade-r4tca (accessed on 3 October 2023).

[19] ITF-OECD (2019), “Enhancing Connectivity and Freight in Central Asia”, International Transport Forum Policy Papers No. 71.

[23] KZPPP (2023), Infographics (Инфографика), https://kzppp.kz/en/infographicsen/ (accessed on 3 May 2023).

[38] NASCO (2023), , https://www.nasconetwork.com/.

[13] OECD (2023), OECD Study Visit to Aktau.

[31] OECD (2012), Recommendation of the Council on Principles for Public Governance of Public-Private Partnerships, OECD Publishing.

[16] OECD (forthcoming), Improving Trade Connectivity in Kazakhstan.

[14] OECD-ITF (2019), Enhancing Connectivity and Freight in Central Asia, https://www.itf-oecd.org/sites/default/files/docs/connectivity-freight-central-asia.pdf.

[1] PMCG (2023), Maritime Trade in the Black Sea in the Context of the Russo-Ukrainian War, https://pmcg-i.com/publication/maritime-trade-in-the-black-sea-in-the-context-of-the-russo-ukrainian-war/.

[26] Public Private Partnership Development Centre (2022), https://www.pppdc.gov.az/en/posts/xeberler/dovlet-ozel-terefdasligi-haqqinda-azerbaycan-respublikasinin-qanunu-tesdiq-edildi, https://www.pppdc.gov.az/en/posts/xeberler/dovlet-ozel-terefdasligi-haqqinda-azerbaycan-respublikasinin-qanunu-tesdiq-edildi.

[28] The World Bank (2022), Private Participation in Infrastructure Database, https://ppi.worldbank.org/en/ppidata.

[36] UNCTAD (2022), Transport and Transit Facilitation Systems, Lessons from Regional Transport and Transit Systems in Africa.

[4] UNECE (2023), Progress report on operationalization efforts taking place in the framework of the Economic Commission for Europe/ Economic Cooperation Organization Coordination Committee for the Trans-Caspian and Almaty-TehranIstanbul Corridors, https://unece.org/sites/default/files/2023-07/ECE-TRANS-WP5-2023-01e_0.pdf.

[21] UNESCAP (2018), Public-private partnership in Kazakhstan, https://www.unescap.org/sites/default/files/4-5.%20Presentation_KZ_Guyang_UNESCAP-2.pdf.

[40] Watermeyer, R. (2013), Value for Money in the delivery of public infrastructure, http://ioptions.co.za/sites/default/files/rbwpapers/P7+%20P8%20papers/P7-8.pdf.

[25] World Bank (2023), Private Participation in Infrastructure (PPI).

[9] World Bank (2022), World Bank and Georgia: Supporting Transport Infrastructure, https://www.worldbank.org/en/news/video/2022/09/07/world-bank-and-georgia-supporting-transport-infrastructure (accessed on 9 August 2023).

[30] World Bank (2020), Benchmarking Infrastructure Development, https://bpp.worldbank.org/economy/.

[10] World Bank (2020), Improving Freight Transit and Logistics Performance of the Trans-Caucasus Transit Corridor : Strategy and Action Plan, World Bank Group, http://documents.worldbank.org/curated/en/701831585898113781/Improving-Freight-Transit-and-Logistics-Performance-of-the-Trans-Caucasus-Transit-Corridor-Strategy-and-Action-Plan.

[39] Zhao, J. et al. (2022), “Value for money in transport infrastructure investment: An enhanced model for better procurement decisions”, Transport Policy, Vol. 118, pp. 68-78, https://doi.org/10.1016/j.tranpol.2022.01.021.