Certain risks that consumers face stem from the broader economic context in which they operate. This chapter reports the most significant risks stemming from the operating environment identified by responding jurisdictions. These risks include inflation and rising interest rates, financial scams and frauds, new business models and innovation along with financial market volatility.

Consumer Finance Risk Monitor

2. Risks stemming from the operating environment

Abstract

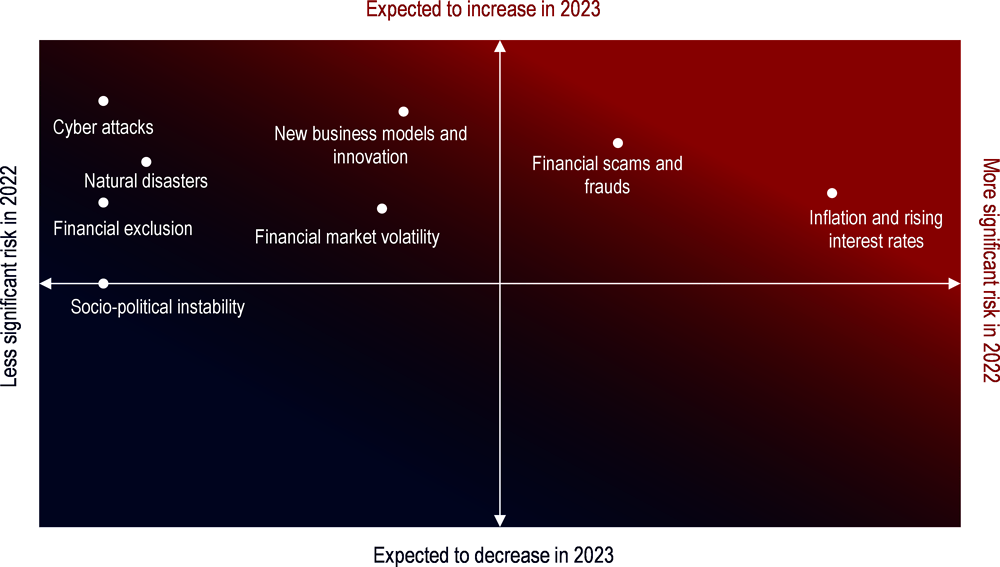

The first category of risks to financial consumers are those stemming from the operating environment. Jurisdictions were asked to select the three most significant risks to financial consumers in their jurisdiction in 2022 and indicate if they anticipated that the significance of each of these three risks would increase, decrease, or remain the same in 2023. Figure 2.1 presents a heatmap of these risks, with the placement of each risk determined by how often jurisdictions selected it among the three most significant risks stemming from the operating environment for 2022 (the x-axis) and whether those jurisdictions expected that the significance of that risk would increase, decrease or stay the same in 2023 (the y-axis). The following key findings emerge from jurisdictions’ responses to these questions:

More than 85% of jurisdictions selected inflation and rising interest rates as one of the three most significant risks to financial consumers.

Nearly 63% of jurisdictions selected financial scams and frauds.

New business models and financial market volatility were slightly less represented among responses, receiving around 40% and 37% of votes, respectively. Nonetheless, as Figure 2.1 demonstrates, of the jurisdictions who chose new business models and innovation as a significant risk in 2022, relatively more of them expected that the risk would increase in 2023.

Cyber attacks and natural disasters were selected by comparatively few jurisdictions, but these jurisdictions mostly expected that the significance of these risks would increase in 2023 (see Box 2.1 for more details on natural disasters).

Figure 2.1. Risks stemming from the operating environment

Note: The x-axis (horizontal) presents responses to questions asking for the top three operating environment risks in 2022. The y-axis (vertical) presents responses to a follow-up question asking whether jurisdictions anticipate the risk would increase, decrease, or stay the same in 2023.

Risks are placed along the x-axis (horizontal) according to how frequently they were selected by respondents (more frequently selected risks are farther to the right). The intersection of the y-axis represents half the number of respondents to the question, i.e., risks to the right of the y‑axis were selected by more than half of respondents. The relative positioning of the risks along the y-axis is determined by calculating an average of responses for how respondents anticipated that the risk would evolve in 2023 (“increase”, “stay the same” or “decrease”).

Source: OECD Consumer Finance Risk Monitor Reporting Template 2023.

2.1. Inflation and rising interest rates

The most frequently selected risk stemming from the operating environment is inflation and rising interest rates. Inflation pressures, rising costs of goods and services, and increases in interest rates all contributed to a cost-of-living crisis with a consequential impact on household finances and on households’ risk of financial hardship. This is further exacerbated in jurisdictions such as Canada, New Zealand and the United States, which are experiencing a tightening housing market and low rental supply.

Jurisdictions noted how these broader economic trends affect the behaviours and financial well-being of consumers. For example, respondents described how inflation and rising interest rates reduced consumer savings, increased the debt-to-income ratio of borrowers, and increased the cost of borrowing, which can decrease access to credit. In Romania, for example, the issuance of mortgages fell by 50% in Q1 2023 compared to Q1 2022.

The impact of interest rate increases is especially notable in jurisdictions where variable-rate loans comprise a large share of outstanding home loans, which varies significantly across regions, ranging from 40% in Luxembourg, to 70% in Spain and 90% in Poland. In contrast, data from the Central Bank of Ireland showed a shift away from variable rate to fixed-rate mortgages; fixed rate mortgages accounted for 93% of the total stock of new mortgages in December 2022. Section 5.2 in Chapter 5 discusses mortgages and home loans in more detail.

Respondents also mentioned how rising interest rates led to increases in insurance premiums due to higher cost of claims and declines in pension fund contributions and—in some cases—the value of assets under management, given the loss of investment market value. Lithuania noted that consumers might also decide to surrender life insurance policies early to access more income to address their financial needs and meet their day-to-day expenses.

In addition to the risks outlined above, inflation and rising interest rates also increase the risk that consumers in vulnerable financial positions will be susceptible to engaging with unsuitable or even fraudulent products as a means of coping with their financial situations.

Most countries and jurisdictions anticipated that the risks driven by inflation and rising interest rates would increase or stay the same in 2023. Certain jurisdictions noted forecasts that prices would continue to increase in their markets, while others cited expectations that inflation would stabilise. In a similar vein, certain jurisdictions predicted that the majority of interest rate increases had already happened, while others warned consumers to be prepared for further rate hikes.

2.2. Financial scams and frauds

Financial scams and frauds were the second most-selected risk in the operating environment, with nearly 63% of jurisdictions ranking this risk among the three most significant. Many jurisdictions are concerned that financial scams and frauds are on the rise, given an increased use of digital finance and online payment platforms, and the search for yield and inflationary pressures that give rise to new risks. Nigeria, Ireland and Romania noted that such scams and frauds are becoming increasingly sophisticated. Given the increased complexity and ubiquity of financial scams and frauds, a thematic chapter is dedicated to discussing jurisdictions’ experiences and approaches in dealing with financial scams and frauds; see Chapter 7 of this report for more details. Most jurisdictions noted that the incidence of financial scams and frauds increased from 2021 to 2022 and they anticipated this would continue in 2023.

2.3. New business models and innovation

Since the COVID-19 pandemic, jurisdictions have witnessed a rise in new business models and innovation. This includes an increase in the use of digital platforms, chatbots, digital assets and other fintech-related innovations. New business models and innovations witnessed in Ontario, Canada, for example, include private and alternative mortgage lending (including ‘equity sharing’ or ‘rent-to-own’ models), do-it-yourself (DIY) investing apps, chatbots, digital platforms, and usage-based insurance. Consumers’ use of Buy Now Pay Later (BNPL) has rapidly expanded in recent years (see Box 5.1 in Chapter 5). In Brazil, supervisory and regulatory authorities noted a rise in banks integrating different activities and establishing partnerships with non-regulated entities.

New business models and innovation in the financial sector can help widen opportunities for financial consumers and help drive financial inclusion. The rapid pace of innovation, however, could also lead to consumer harm. For example, digitalisation has made relatively riskier products more easily accessible to consumers. New digital assets such as crypto-assets have rapidly expanded in recent years, while crypto-asset risk management and governance practices among providers lag behind (see Section 8.1.3 in Chapter 8). In Slovenia, for example, the lack of clarity around crypto-asset ownership rights, custody arrangements and financial representations have created a high degree of confusion for consumers. Further, hacks and outages have resulted in substantial losses for millions of consumers. Respondents were also concerned that the purported lack of a clear regulatory framework governing crypto-assets in some jurisdictions, or crypto-asset activities conducted in non-compliance with applicable domestic regulations in other jurisdictions, would increase the likelihood of fraudulent activity (see Box 5.2 in Chapter 5 for more details on regulating crypto-assets).

Digitalisation and innovation in digital products and services may also make consumers vulnerable to cybersecurity risks and scams and frauds. New business models and innovation, including the use of artificial intelligence, raise concerns regarding data protection, discrimination and bias. Most countries and jurisdictions anticipated that risks stemming from new business models and innovation would increase in 2023.

2.4. Financial market volatility

Financial market volatility was the fourth most-selected risk stemming from the operating environment. Down markets have negative effects for retail investors who are confronted with lower yields on their investments. The search for yield can also make it more likely that retail investors engage with products that do not align well with their risk profile. Austria, Mauritius, and Spain noted that such volatility caused uncertainty among investors. Hong Kong (China) and New Zealand noted that fluctuations in stock markets and bond prices also led to losses or reduced returns in investment funds and pension funds. In Brunei Darussalam, many securities offered in the country are foreign securities products, so volatility in global financial markets affects the trading prices and performance of these securities, and therefore consumers’ preferences for investing in such products. Most countries and jurisdictions anticipated that financial market volatility would increase or stay the same in 2023.

Box 2.1. Natural hazards and climate change

Damages from natural hazards have grown significantly over the past 30 years, due in part to rapid economic development and climate change (OECD/The World Bank, 2019[1]). Jurisdictions reported that the impact of such hazards is dramatically affecting their citizens. Mozambique and Nigeria described how severe floods in their countries had displaced millions of people and caused large amounts of property damage. Peru noted that the Coastal El Niño phenomenon was declared in May 2023, which would bring increasing rainfall in the coastal north and drought in the South Andean region. Various regions in Australia, including South Australia, Victoria, Tasmania, Southeast Queensland, and New South Wales all experienced severe weather and flooding in 2021 and 2022.

Given the increased damage and losses caused by natural hazards, insurance coverage against these risks is increasingly important (OECD, 2021[2]). Natural hazards have a great impact on consumers’ property and on the claims amounts that insurance undertakings must pay to policyholders. One risk to consumers (policyholders) is that insurance products that protect against disaster risks may become unaffordable as such risks become costlier to insure. When disasters occur, as articulated by Slovenia, it can reveal existing problems relating to the lack of clarity in the terms and conditions of insurance policies, particularly in relation to exclusions.

Australia noted a 54% increase in complaints about insurance claim delays from 2021 to 2022, which was partly attributable to disasters putting pressure on the industry.

In Greece, authorities are concerned that a gap in insurance protection for natural hazards could cause detriment to the financial health of consumers, especially as disasters become more commonplace. A post-disaster state relief is provided to consumers with no insurance coverage; however, the compensation is usually less than the actual amount of damage.

In New Zealand, climate change has impacted the affordability of (and potentially access to) financial products. Certain regions in New Zealand have recently experienced severe flooding, which has contributed to damage or loss to property (with associated financial hardship) as well as rising insurance premiums and pay-outs. The government of New Zealand released a severe weather exit strategy and established a task force to make recommendations for the insurability of areas impacted by severe weather events (Robertson, 2023[3]).

In 2022, the Central Bank of Ireland established a cross-sectoral industry forum on climate change with two working groups to address risk management and capacity building (Central Bank of Ireland, 2022[4]). These industry-led groups share examples of best practices and identify areas for further development. In March 2023, the Central Bank released guidance aiming to clarify its expectations on how (re)insurers address climate change risks in their business and to assist them in developing their governance and risk management frameworks to do this (Central Bank of Ireland, 2023[5]).

In 2022, the European Commission launched a Climate Resilience Dialogue, which explores how to address losses incurred from climate-related disasters and aims to identify how the insurance industry can contribute more to climate adaptation (European Commission, 2022[6]).

2.5. Other risks stemming from the operating environment

Relatively fewer jurisdictions selected the remaining risks stemming from the operating environment: socio-political instability, financial exclusion, operational resilience of financial institutions, cyber-attacks and limited financial infrastructure.

Regarding financial exclusion,

Bank of Spain reported that new technologies could mean that people with lower digital capabilities may struggle to engage with credit institutions, especially in the context of bank branch closures.

The United Kingdom noted that significant numbers of branch closures across the banking sector made it more difficult for consumers to access face-to-face services, which can often be crucial for customers in more vulnerable circumstances. The transition to digital services has led to some firms cutting back on traditional service channels, such as contact centres, in favour of online or mobile-based support solutions. Where firms are seeking to cut branches, the FCA has provided guidance to firms to help ensure they have fully considered the impact on their customer base and have established appropriate alternative solutions.

Sweden highlighted a conflict between anti-money laundering regulations and the right to a payment account with basic functionality.

The United States noted that gaps in fair access to financial services may encourage consumers to turn to non-banks, such as payday lenders, crypto-asset platforms and fintechs, which, while generally subject to the same consumer protection regulations, often have less stringent safety and soundness requirements and consumer oversight than banks. They may also be operating in non-compliance with applicable laws and regulations. Furthermore, notable gaps in access to basic financial services continue to exist in many low- and moderate-income communities in the United States. For example, Black and Hispanic households in the United States are around five times more likely to be unbanked than White households. The most cited reason is not having enough money to meet minimum balance requirements.

References

[5] Central Bank of Ireland (2023), Guidance for (Re)Insurance Undertakings on Climate Change Risk, https://www.centralbank.ie/docs/default-source/regulation/industry-market-sectors/insurance-reinsurance/solvency-ii/requirements-and-guidance/guidance-re-insurance-undertakings-on-climate-change-risk.pdf?sfvrsn=a232991d_6 (accessed on 19 September 2023).

[4] Central Bank of Ireland (2022), Central Bank of Ireland hosts inaugural meeting of the Climate Forum and publishes Sustainable Investment Charter, https://www.centralbank.ie/news-media/press-releases/central-bank-of-ireland-hosts-inaugural-meeting-of-the-climate-forum-and-publishes-sustainable-investment-charter-30-june-2022 (accessed on 19 September 2023).

[6] European Commission (2022), Climate Resilience Dialogue, https://climate.ec.europa.eu/eu-action/adaptation-climate-change/climate-resilience-dialogue_en (accessed on 19 September 2023).

[2] OECD (2021), Enhancing Financial Protection Against Catastrophe Risks: The Role of Catastrophe Risk Insurance Programmes, OECD, Paris, http://www.oecd.org/daf/fin/insurance/Enhancing-financial-protection-against-.

[1] OECD/The World Bank (2019), Fiscal Resilience to Natural Disasters: Lessons from Country Experiences, OECD Publishing, Paris, https://doi.org/10.1787/27a4198a-en.

[3] Robertson, G. (2023), Cyclone Taskforce to ensure locally-led recovery, https://www.beehive.govt.nz/release/cyclone-taskforce-ensure-locally-led-recovery (accessed on 19 September 2023).