This chapter analyses key steps businesses can take and the transformations they need to engage to achieve climate neutrality by 2040, across all sectors of the Hamburg economy. It begins by assessing the current progress of Hamburg businesses in implementing net-zero greenhouse gas emission strategies, drawing insights from a survey of selected companies as well as evidence from major companies in Hamburg. This evidence is then compared with international best-practice recommendations. This chapter also assesses specific challenges for SMEs and on the role networks can play to advance SME efforts to decarbonise. Last, this chapter explores how businesses can harness the benefits of low cost renewable energy by adapting to their intermittent nature, as well as urgent action to decarbonise buildings to avoid unnecessary cost.

Reaching Climate Neutrality for the Hamburg Economy by 2040

2. Key cross-sector transformations for the transition to climate neutrality for businesses

Abstract

Businesses, play a critical role to reach net zero emissions by 2050. The transition to climate neutrality brings about material risks for businesses, which translate into financial risks. Climate related risks can be divided into two categories; risks related to the transition to climate neutrality and risks related to the physical impact of climate change (TCFD, 2017[1]). This chapter is only about transition risks. Transition risks include policy actions that constrain emissions, litigation and legal risks, displacement of current technologies requiring fossil fuels, shifts in supply and demand, and reputational risks. In addition to reducing these risks, efforts to mitigate climate change also bring opportunities for businesses. These include resource efficiency and cost savings, development of new products and services, access to new markets, and building resilience along the supply chain.

This chapter assesses key actions businesses need to undertake as well as transformations they need to face to reach climate neutrality by 2040, across all sectors of the economy. It first describes where businesses in Hamburg stand in setting, implementing and disclosing net-zero GHG emissions, drawing on a survey of selected Hamburg businesses as well as on the reporting of Hamburg’s biggest companies. It contrasts this evidence with international best-practice recommendations, including from the high-level UN expert group’s recommendations for non-state actors, presented in Chapter 1.

The transformations to reach climate neutrality will require integrating new knowledge on business practices that are consistent with climate neutrality, for example on the replacement of fossil fuels or on the integration of business models in climate-neutral value chains. This challenge is particularly big for SMEs who have less resources to invest in such knowledge. It is therefore particularly important for SMEs to work together in networks to benefit from the scale economies of such knowledge. They will also facilitate access to new technologies, infrastructure and needed financing that goes with it. The second section is devoted to this issue.

Reaching climate neutrality requires electrification of most energy use and moving electricity generation to renewables. This is especially true in Germany, which has phased out nuclear energy. Most electricity production from renewables will be based on variable renewable energy (VRE). This includes solar and wind power, sources which vary in the amount of energy provided during the day and across the seasons of the year. This requires business to adopt a new approach to energy use, with opportunities for businesses to take advantage of low-cost VRE and to become more resilient to international energy crises. The third section is devoted to this issue.

Saving energy is another central business challenge to succeed the transformations needed to reach climate neutrality. While this is transversal, covering all activities and asset use, economic impacts will be particularly big in buildings, requiring a major boost to activity notably in employment-intensive construction and installation. Actions to decarbonise buildings and reduce energy use in buildings therefore need to be prepared now and accelerated sharply. The final section is devoted to this issue.

Setting, implementing and disclosing net-zero targets

This section focuses on the climate neutrality or net-zero emission targets of businesses, action plans to reach them and on the assessment of emissions and other metrics that is necessary to measure progress with respect to the targets. The first part of this section sets the scene, reviewing the guidelines and recommendations on setting net-zero targets by businesses. The second part describes where Hamburg businesses stand with respect to targets, emission assessments and action plans, according to available data, including from a survey of Hamburg businesses. The third part discusses regulations that will impact businesses’ activities. The last part reviews guidelines for the estimation of Scope 3 emissions, which include emissions in upstream and downstream value chain activities.

To minimize the risks and capture the opportunities in the transitions to climate neutral economies it is essential for businesses to undertake actions to become climate neutral throughout their operations. A survey found that out of 2,000 publicly listed companies, 21% committed to net-zero emissions by 2050 at the latest. The survey also found considerable variation in the quality of business commitments with regards to their scope and implementation plans (OECD, 2021[2]).

There are currently no mandatory requirements for non-state actors to set or report on net-zero GHG emission (or climate neutrality) targets. The UN High-Level Expert Group on Net Zero Emissions Commitments of Non-State Entities offers a roadmap and provides guidance on non-state actors’ net-zero targets (Chapter 1). In addition, the European Commission provides guidelines on the disclosure of climate-related risks to inform internal and external stakeholders (Box 2.1), based on work from the Task Force and Climate Related Risks, instituted by the Financial Stability Board in 2017. The OECD Guidelines for Multinational Enterprises on Responsible Business Conduct also emphasize having science-based targets and strategies to achieve net-zero GHG emissions which allow to quantitatively assess progress. This is in line with the UN High-Level Expert Group and the European Commission guidelines.

Box 2.1. European Commission guidelines on disclosure

1. Business Models

It is important for internal and external stakeholders, notably the board, investors, and customers, to understand the company’s view of how climate change impacts its business model and strategy and how its activities affect the climate, over the short, medium, and long run. For this, companies need to take a longer-term perspective than they normally do for financial reporting. The companies need to describe climate-related risks and opportunities for the company’s business model, strategy and financial planning. The companies should describe how the company’s business model can impact the climate, both positively and negatively. They could also describe the resilience of the company’s business model and strategy, taking into consideration different climate related scenarios over different time horizons.

2. Policies and due diligence processes

Companies need to describe their policies related to climate, including mitigation and adaptation policies. They should describe climate-related targets, notably GHG emission targets, and how their targets relate to national and international targets. They should describe how the company is engaging with its upstream and downstream partners. They need to clarify the board’s oversight of climate related risks and opportunities and describe the management’s role in assessing and managing climate related risks and opportunities.

3. Outcomes

Companies should describe the outcomes of the company’s policy on climate change, including the performance of the company against targets set to manage climate-related risks and opportunities, in particular the development of GHG emissions.

4. Principal risk and management

Companies should describe how they identify, assess, and manage climate related risks over the short, medium, and long term. They should describe the processes for prioritising climate related risks, including any thresholds applied and indicate which risks across the value chains are considered most significant. They need to disclose how scenarios or carbon pricing are used for risk management actions.

5. Key performance indicators

a. Companies need to disclose key performance indicators relevant to their business. Companies need to provide a description of and any changes in the methodologies used to calculate or estimate the indicators. They can consider disclosing the following indicators:

i. GHG emissions → Scope 1, 2 and 3 emissions and GHG absolute emission targets

ii. Energy → total energy consumption and production from renewable and non-renewable sources, renewable energy consumption and/or production target

iii. Physical risks → assets in regions likely to become more exposed to physical climate risks

iv. Products and services → % of turnover (in the reporting year) from products or services associated with activities that meet criteria for contributing to mitigation or adaptation to climate change.

v. Green finance → Climate-related green bond ratios (green bonds outstanding divided by total bonds outstanding) as well as any green debt ratios.

b. In addition to the above-mentioned indicators, companies can also consider the following:

i. Sector-specific indicators relevant to the industry. Use the TCFD’s guidance.

a) TCFD guidelines provide sector-specific guidance for energy, transportation, materials and buildings, and agriculture, food, and forest products

ii. Indicators related to natural capital

iii. Indicators related to human capital and social issues

iv. Indicators related to opportunities (revenues from low-carbon products, revenues from product or services applying to the circular economy model, and R&D expenditures in circular economy production).

Source: European Commission, Guidelines on reporting climate-related information.

The majority of Hamburg businesses still need to set a net-zero target

This subsection draws on a survey of businesses in the Hamburg Chamber of Commerce (HCC), conducted by the HCC, to provide insights on their net-zero GHG emission commitments, their perceptions of related challenges and opportunities, as well as progress in addressing them. It also draws on an evaluation ten biggest companies’ reporting.

The survey was sent to a sample that is broadly representative of the population of Hamburg businesses in the sectors covered by the HCC, although businesses with fewer than 10 employees are underrepresented. The questionnaire was sent to a random sample of 2300 businesses with more than 10 employees and to a random sample of 500 businesses of all size classes. 128 businesses responded to the questionnaire (the number of respondents varies slightly across questions), a response rate of about 4%. This response rate is similar to other business surveys conducted by the HCC. Businesses that are relatively strongly engaged with the climate policy agenda are more likely to respond. This needs to be taken into account when interpreting the survey results reported below.

The sectoral composition of responding businesses corresponds, in broad orders of magnitude, to the sectoral composition of the members in the HCC (Table 2.A.1). Service businesses are somewhat underrepresented, except in logistics, transport as well as in media and ICT. Industrial and construction businesses are slightly overrepresented. However, the size distribution of responding businesses differs strongly from the population of businesses. Businesses with less than 3 employees are heavily underrepresented. All other firm sizes are overrepresented, especially the biggest ones.

As the results below show, unsurprisingly, small firms are much less likely to adopt climate neutrality objectives. Service companies, which are also somewhat underrepresented, also appear to have a smaller propensity to adopt emissions objectives. This also suggests that the share of business with climate targets is overall overestimated. However, larger firms, which are more likely to have climate neutrality targets, also have a bigger weight in Hamburg’s economy and employment.

Low response rates among small businesses suggest they do not have sufficient capacity to invest in needed knowledge. This point is taken up below in the section on business networks for SMEs to build climate-neutral business models.

The questions posed in the survey can be found in the Annex.

Results from the questionnaire

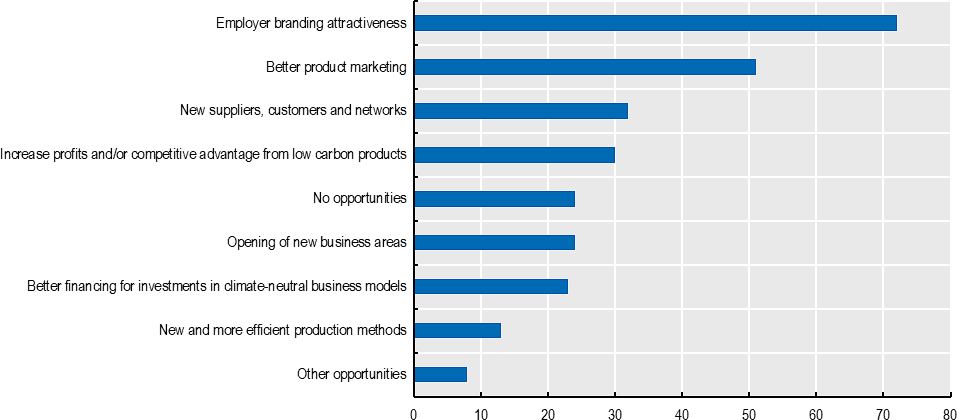

66% of responding businesses report that climate protection is important or very important for them. They see substantial opportunities in reaching climate neutrality. In particular it boosts the employer’s branding attractiveness (Figure 2.1). Indeed, most of the responding businesses see a climate neutrality target as an opportunity to improve their attractiveness as an employer and in product marketing.

Figure 2.1. The biggest perceived opportunity from climate neutrality is employer attractiveness

Answers to the question: What business opportunities do you see for your company in the field of climate neutrality?

Note: Total of responding businesses is 128. Multiple answers were possible.

Source: Survey carried out by HCC (2023).

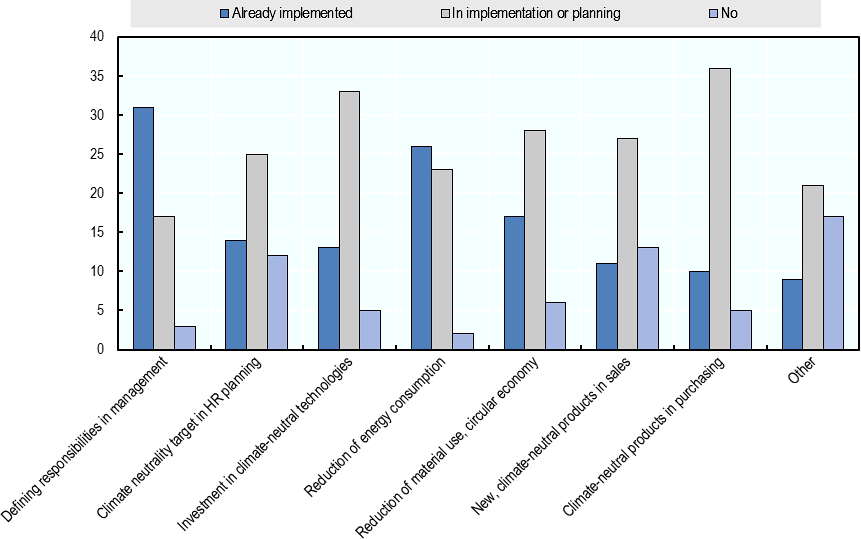

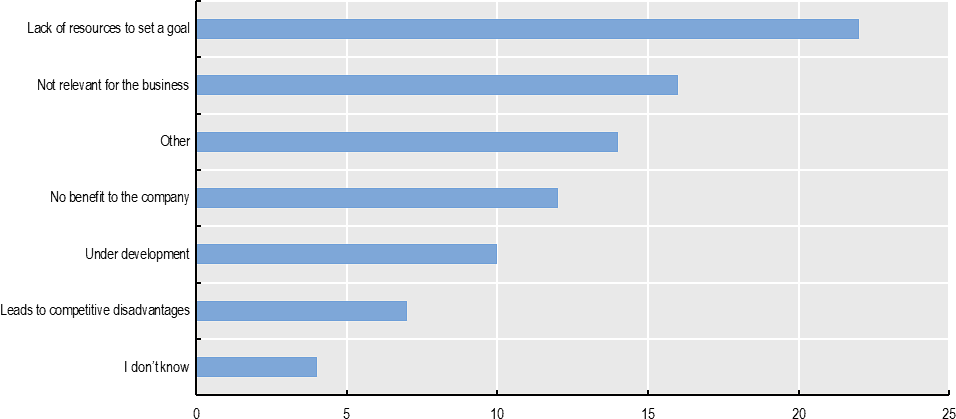

58 responding businesses (48%) have set a net-zero emissions target (Figure 2.A.1). Among these 76% have set targets for 2040 or earlier, in line with the HCC’s climate neutrality target and around 70% have set intermediate targets. Among the responding businesses, lacking resources to do so was the most frequent reason not to have a climate neutrality target (Figure 2.A.2). Most of the businesses with net-zero targets include their Scope 1 and Scope 2 emissions in these targets, but only 45% include Scope 3 emissions. 25 (41%) businesses have reported the net zero target publicly, 19 (31%) have not but are planning to, and 14 have not. Most of the companies have defined responsibilities in management and reduced their energy consumption. However, other measures such as investment in climate neutral technologies, circular economy or climate neutral products in sales or purchasing are still in implementation, or in planning (Figure 2.2). For the phase-out of fossil fuels and the scale-up of renewables a majority of all responding businesses state they have set a target for at least either of the two, although few respondents (around 10%) have a target to exit fossil fuels.

Figure 2.2. Defining management-level responsibilities and reducing energy consumption have been implemented by a majority of respondents

Answers to the question: What measures does your company plan to undertake to achieve climate neutrality?

Note: Total number of responding businesses are those with a climate neutrality target (58). Multiple answers were possible.

Source: Survey carried out by HCC (2023)

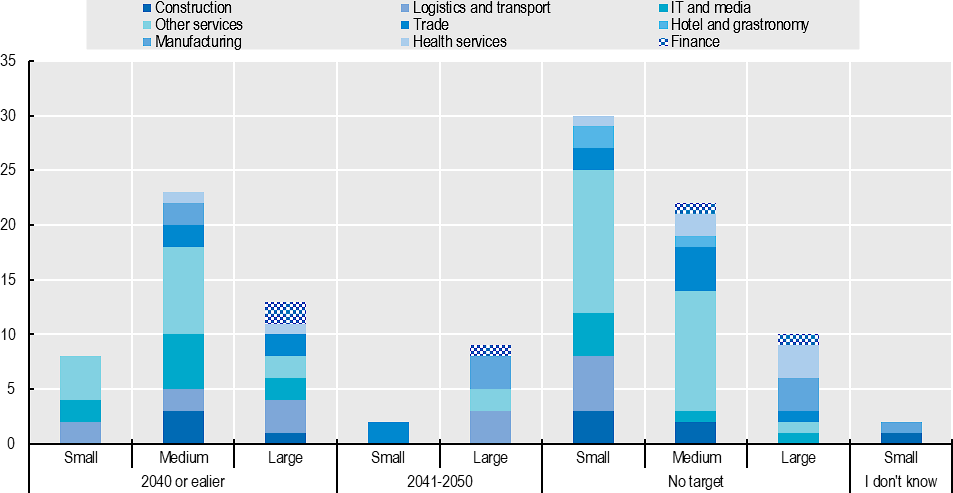

Businesses in information and communication technology as well as in the finance sector appear to be among the most likely to be ambitious, setting net-zero targets of 2040 or earlier, judging by survey responses (Figure 2.3). However, the number of firms responding in each sector is small. The most ambitious companies tend to be medium-sized. The majority of small companies have yet to set a net-zero target.

Figure 2.3. Medium-size, ICT and finance businesses set the most ambitious net-zero targets

Note: Total of responding businesses is 128 and number of responding businesses with a climate neutrality target is 58. The classification of business size is the following: Small for companies with up to 49 employees, medium for companies with 50-249 employees and large for companies with 250 employees or more.

Source: Survey carried out by HCC (2023).

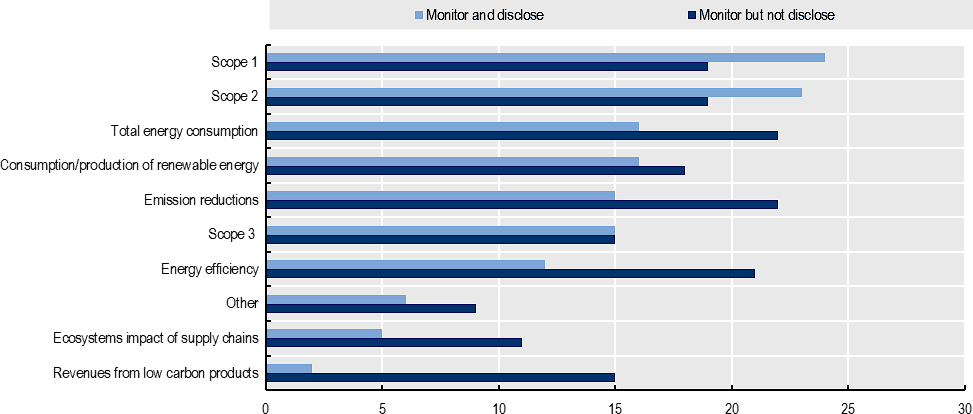

Only 38% of businesses reported that they measure and disclose any relevant indicators. Scope 1 and 2 emissions are the indicators the most monitored and disclosed. Only 30 businesses (23%) monitor Scope 3 emissions, of which one half also disclose them (Figure 2.4). Moreover, most companies don’t monitor energy efficiency, ecosystems impact of supply chains and revenues from low carbon products when these are monitored.

Figure 2.4. Scope 1 and Scope 2 emissions are the most monitored and disclosed key indicators for the transformations to reach climate neutrality

Answers to the question: Which climate indicators does your company monitor?

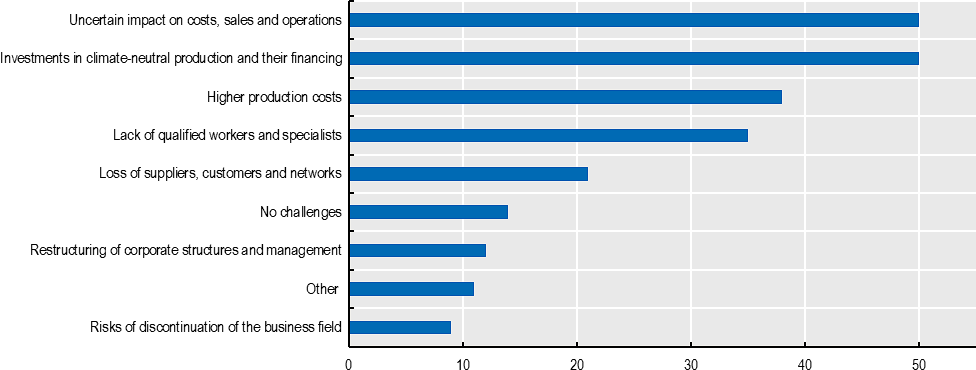

Uncertainty regarding costs, sales, and operations in a climate neutral transition, as well as needed investments in climate-neutral production and their financing are identified the most often as challenges in the transition to climate neutrality. Higher production costs and a lack of qualified workers are also of concern (Figure 2.5).

Figure 2.5. Most Hamburg business perceive uncertain prospects and investment funding as a challenge of the climate neutrality transition

Answers to the question: What business challenges do you see for your company in the field of climate neutrality?

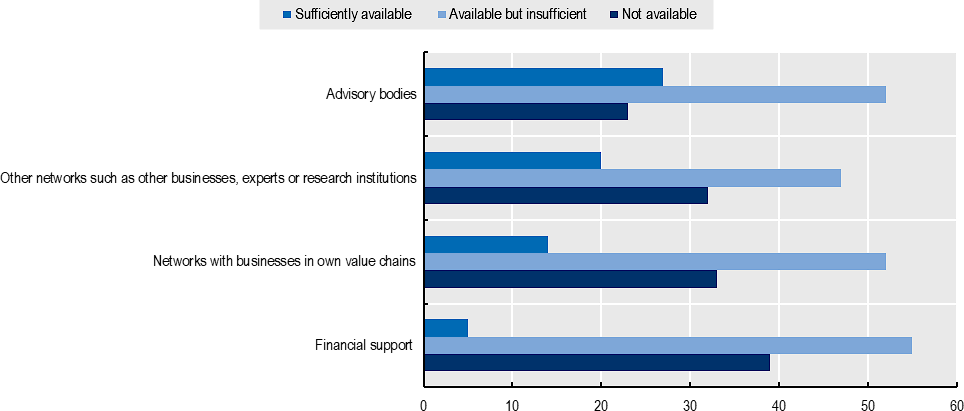

Most businesses lack financial support. By contrast, advisory bodies are available sufficiently. However, all type of support needs to be stepped up to meet the responding businesses’ expectations (Figure 2.6).

Figure 2.6. Most businesses feel that financial support is available but insufficient

Answers to the question: How would you evaluate the availability of the following support services on the way to climate neutrality?

Where do the biggest companies in Hamburg stand?

The biggest 8 companies in Hamburg, according to turnover, have set and disclosed net-zero and intermediate targets (Table 2.1). However, only some include Scope 3 emissions in their net zero and intermediate targets. As argued in chapter 1, Scope 3 emissions are important to assess climate-related risks and opportunities. The companies with net-zero targets for 2050 need to update their ambition to be in line with Germany’s climate neutrality target for 2045 and the 2040 HCC target. The company with the earliest climate neutrality target is Vattenfall GmbH, with a 2040 net-zero target covering Scope 1 and Scope 2 emission. There is a wide range of intermediate targets in terms of what emissions are included, and how emissions are measured. Furthermore, among the biggest 8 companies, climate targets of Aurubis AG, Vattenfall GmbH, Airbus Operations GmbH, and Beiersdorf AG obtained certification for being aligned with the 1.5°C scenario from the Science Based Target initiative (SBTi). The SBTi is an independent organisation that provides climate target advice. The Otto Group and Nordex have adopted a Science Based Target (SBT), which is currently being validated by the Science Based Target initiative (SBTi). The Otto Group intends to follow this target from the 2024 financial year onwards. Five companies are implementing a decarbonisation action plan.

Table 2.1. Net-zero and intermediate targets from the top 8 companies in Hamburg by turnover

|

Company |

Turnover (million €) |

Emissions (tonnes of CO2 eq) |

Net-Zero Target |

Intermediate Targets |

International Offsets |

Action Plans |

|---|---|---|---|---|---|---|

|

Hapag-Lloyd |

22274 |

Scope 1 - 13,390,000 Scope 2 – 9,000 Scope 3 – 2,302,000 |

2045 - Net zero GHG emissions for the fleet |

2030 - reduction of 30% emission intensity compared to 2019 |

Available |

|

|

Aurubis AG |

17064 |

Scope 1 + 2 - 1,605,000 Scope 3 - 6,181,000 |

2050 - Carbon neutrality (latest) |

2030 - reduction of 50% of Scope 1 + Scope 2 emissions from 2018 2030 - 24% reduction of Scope 3 emissions per ton of copper cathodes from 2018 |

In development |

|

|

Otto GmbH & Co KG |

16200 |

2045 – Net zero |

2025 - reduction in 40% GHG emissions compared to 2018 2030 – carbon neutral in all locations, transport and employee mobility |

Offsetting mainly used for the carbon neutral shipment of parcels |

Not available |

|

|

Vattenfall GmbH |

13970 |

Scope 1 – 9,500,000 Scope 2 – 200,000 Scope 3 – 16,100,000 |

2040 – Net zero (Scope 1 + Scope 2) |

2030 – reduction of 77% of Scope 1 + Scope 2 emission intensity compared to 2017 2030 – Reduction of 33% of absolute Scope 3 of sold products compared to 2017 |

Offset of all the business travel emissions through CO2 certificates in the UN’s Clean Development Mechanism system |

Available |

|

Airbus Operations GmbH |

8396 |

Scope 1 + 2 – 857,000 Scope 3 - 505,643,000 |

2050 – Net zero (Scope 1 + Scope 2) and support decarbonization of the industry (Scope 3) |

2030 – reduction in 63% Scope 1 + Scope 2 GHG emissions compared 2015 2030 – reduction in 46% Scope 3 GHG emission intensity generated by commercial aircraft |

Remove 100% of residual emissions by 2030 through offsets |

Available |

|

Beiersdorf AG |

7600 |

Scope 1 – 90,349 Scope 2 – 1,320 Scope 3 - 1,034,279 |

2050 – Net zero (at the latest) |

2025 – 30% absolute reduction in Scope 1,2,3 GHG emissions compared to 2018 2030 – 100% climate neutral production |

Offset flight emissions. Aim to offset remaining GHG emissions. |

In development |

|

ArcelorMittal GmbH |

7400 |

Scope 1 + 2 – 145,800,000 |

2050 – Net zero |

2030 – 35% reduction in Scope 1 + Scope 2 emission intensity in Europe compared to 2018 |

5% of total emissions will be offset by buying high-quality offsets |

Available |

|

Nordex SE |

5694 |

Scope 1 – 27,164 Scope 2 – 501 In production sites as well as main offices Scope 3 - 3,483,000 |

Committed to set net-zero targets in line with the SBTi |

No intermediate targets announced |

Working to identify suitable carbon offset projects to compensate for remaining Scope 1 and Scope 2 emissions by the end of 2023. |

Available |

Note: Scope 3 emissions only relates to Consumer Business.

Companies should prioritise measures to reduce emissions over the purchase of carbon credit to compensate for emissions. Only residual emissions which are unavoidable owing to technological or financial limitations may be compensated. Most of the 8 biggest enterprises in Hamburg are relying on international offsets, although to varying extent. Some companies such as Airbus Operations GmbH and ArcelorMittal GmbH are planning to adopt Carbon Capture Storage (CCS) technology.

Do Hamburg businesses follow the recommendations and guidelines?

Businesses need to scale up their ambition to be aligned with the recommendations from the UN High-Level expert group and the European Commission. Most businesses surveyed have yet to set net-zero targets or publicly announced them. Out of the businesses who have set net-zero targets only a minority include Scope 3 emissions in those targets. In some of Hamburg’s 8 biggest companies’ targets it is not clear which of the Scope 1 and Scope 2 emissions are included. Some of the top ten biggest companies include carbon offsets as means to mitigate residual emissions. Even so, the carbon offsets all seem to be of high quality and in line with the conditions of additionality and permanence sets by the High-level expert group (Chapter 1).

In terms of disclosure, a small number of the surveyed businesses monitors and discloses relevant climate indicators, and even out of the 8 biggest companies, not all disclose emission numbers for all 3 Scopes. Monitoring progress, using these and other metrics, is essential for the businesses to make informed decisions on their path to climate neutrality.

Regulations businesses could expect

Businesses in Hamburg should expect policies at the EU and the German Federal level which will require businesses to strengthen the integration of environmental commitments in the operations and supply chains (OECD, 2021[13]). A few examples of recent policies are the following:

EU Mandatory Due Diligence Rules: Companies will be required to identify, prevent, end or mitigate adverse impacts on human rights and the environment. Once the proposal is adopted by the European Parliament and the Council, Members States will have two years to transpose the requirements into national law. Companies will be required to assess the impact of their business activities on climate change, as well as the impact of their full supply chains on the environment. This includes identifying greenhouse gas emissions, assessing the risks of climate change to their operations, and taking action to mitigate those risks (European Commission, 2022[14]).

German Due Diligence Act: From 2023, companies based in Germany with more than 3,000 employees must ensure that social and environmental standards are observed in their supply chain. Companies must set up processes to identify, assess, prevent, and remedy human rights and environmental risks and impacts in their supply chains and in their own operations. These processes must be published in their annual reports. From 2024, this will apply to companies with more than 1,000 employees (Sedex, 2023[15]).

EU Regulation on Deforestation-free Supply Chains: Once adopted, goods in the EU market must no longer contribute to deforestation and forest degradation globally. All relevant companies will have to conduct strict due diligence of their supply chains that use any products of palm oil, cattle, soy, coffee, cocoa, timber, and rubber, as well as any derived products. Companies will be required to collect precise geographical information on where their commodities are grown and sources. Micro and small enterprises will have a longer adaptation period, but this will apply to all companies (European Commission, 2022[16]).

German Raw Materials Strategy: The strategy aims to ensure long-term security of supply of raw materials needed in industrial production in Germany and ensure socially and environmentally fair supply chains. The strategy focuses on raw materials sourcing, material and resource efficiency, sustainability and transparency and international cooperation. The strategy is in line with European policies and initiatives on raw materials and circular economy (International Energy Agency, 2022[17]).

EU Carbon Border Adjustment Mechanism (CBAM): In October 2023, the CBAM will enter into its transitional phase, initially focusing on the most carbon-intensive’s imported goods, in particular cement, iron, steel, aluminium, fertilisers, as well as electricity and hydrogen. Businesses with these imported goods in their supply chains will have to report embedded GHG emissions (both direct and indirect emissions in the supply chain). From January 2026, importers will need to surrender the corresponding tradable CBAM certificates, for which the price will be calculated depending on the weekly EU ETS price (European Commission, 2022[18]).

The Renewable Energy Directive II defines criteria for sustainable biofuels production. From 2023, this regulation is mandatory for a defined list of stakeholders. If the criteria are not respected, the company couldn’t claim to contribute to reach a specific target, couldn’t receive public subsidies or can have their subsidies frozen.

Assessing scope 3 emissions

To be aware of business model opportunities and risks businesses need to broadly measure their Scope 3 emissions (Box 2.2). Commonly used reporting standards provide some guidance, but challenges remain as reporting approaches are numerous and differ from each other. Businesses need to strike a balance: the accuracy of assessment and reporting on each emission source should depend on the importance for the business model, taking into account feasibility (World Economic Forum, OECD, Business at OECD, 2023[19]). Interoperability of reporting across firms can help improve clarity and reduce cost. The Greenhouse Gas Protocol, a collaboration between the Word Resources Institute and the Carbon Trust, offers technical guidance for calculating Scope 3 emissions in corporate value chains (Greenhouse Gas Protocol, 2013[20]).

Box 2.2. Scope 3 emissions and their categories

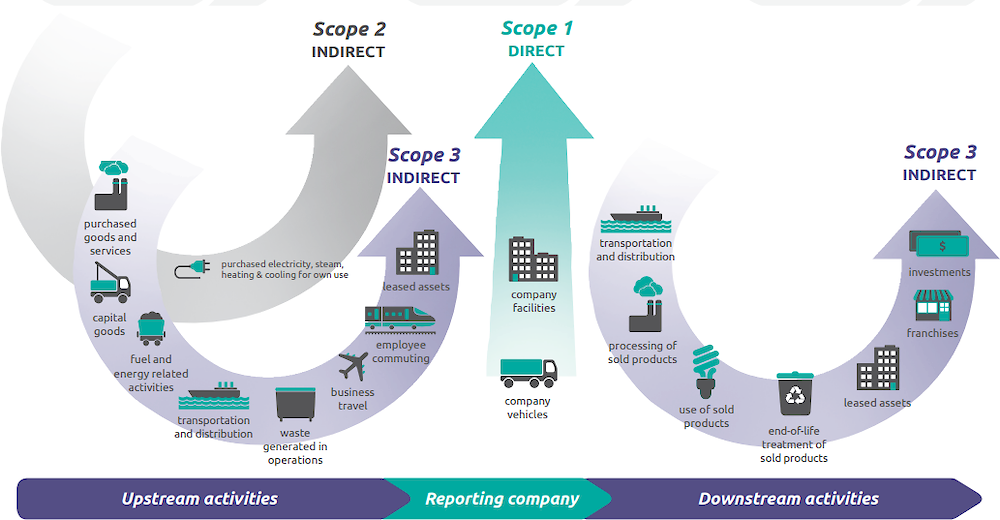

Scope 3 emissions can be divided into upstream and downstream emissions, including 15 different categories (Figure 2.7).

Upstream emissions include all the indirect emissions during the production of a good or service. These include the extraction, production and transport of goods and services purchased by the company, any extraction, production and transport of fuel and energy purchased by the company, any transport and distribution of intermediary products, any waste generated during the operations, emissions from business travel and employee commuting, and any emissions from upstream leased assets.

Downstream emissions occur during the use or disposal of a company’s product, the consumption and end of life period. These include emissions from any transport and distribution of products sold, processing of sold products, use of sold products, end-of-life treatment of sold products, downstream leased assets, franchises, and investments.

Figure 2.7. Scope 3 emissions in corporate supply chains and their 15 categories

The protocol recommends that businesses identify which Scope 3 emissions are a priority to calculate or estimate. Businesses need to start by understanding which emissions are the most relevant according to some suggested criteria:

Emissions with the highest reduction potential

Emissions that pose great risk to the company

Emissions of great importance to key stakeholders

Emissions that are highly relevant in the sector

Emissions that require high level of spending to abate

Emissions of which abatement generate high level of revenue

Once the most relevant Scope 3 emissions are identified, the protocol recommends how to measure or estimate those emissions. The protocol provides calculation and estimation guidance for each of the categories (Figure 2.7). It provides businesses with guidance on which calculation method is best suitable given available company resources. The guide outlines the data needed, the emission factors needed, as well as data collection guidance.

The data businesses can use to calculate Scope 3 emissions are either primary or secondary. Primary data refers to emissions from specific activities within a business’ value chain, including provider-specific energy use, or emissions data provided by suppliers. Secondary data are industry-averages from published databases, government statistics, industry associations, financial and proxy data. For secondary data, companies can use internationally recognized or peer-reviewed databases. The protocol provides secondary data sources that businesses can consider when calculating Scope 3 emissions (Box 2.3).

Box 2.3. Overview of secondary data sources for estimation of Scope 3 emissions

The data sources suggested by the Greenhouse Gas Protocol meet two criteria; they offer direct access to users without need to purchase specific software tools and provide online resources for users to review documentation and additional information. Some of the data sources listed as examples are the following:

The European Aluminium Association (EAA) provides up to date life cycle inventory (LCI) for aluminium production and transformation processes in Europe.

The European Copper Institute (ECI) provides life cycle assessments (LCA) of three types of copper products: tubes, sheets and wires.

The Global LCA Data Access (GLAD) a coalition of datasets providers, provides a global network of LCA databases that connects multiple data sources to support LCA in a way that facilitates sustainability-related decisions.

Greenhouse gases, Regulated Emissions, and Energy use in Transportation (GREET) provides energy and emission impacts of advanced vehicle technologies and new transportation fuels, the fuel cycle from wells to wheels and the vehicle cycle through material recovery and vehicle disposal.

The International Iron and Steel Institute (IISI) supplies LCIs of fourteen steel industry products.

The IPCC Emissions Factor Database is a library of emission factors and other parameters with background documentation and technical references.

LCI calculation tools for Regionalised Waste Treatment allow users to generate LCI datasets for treatment of solid waste.

Scope 3 Evaluator, a global standard in value chain GHG accounting, allows users to estimate emissions for all 15 Scope 3 categories. It helps companies take the first steps in measuring and reporting Scope 3 emissions. Companies can use this information to start identifying areas in which to pursue more accurate inventory and focus their reduction efforts.

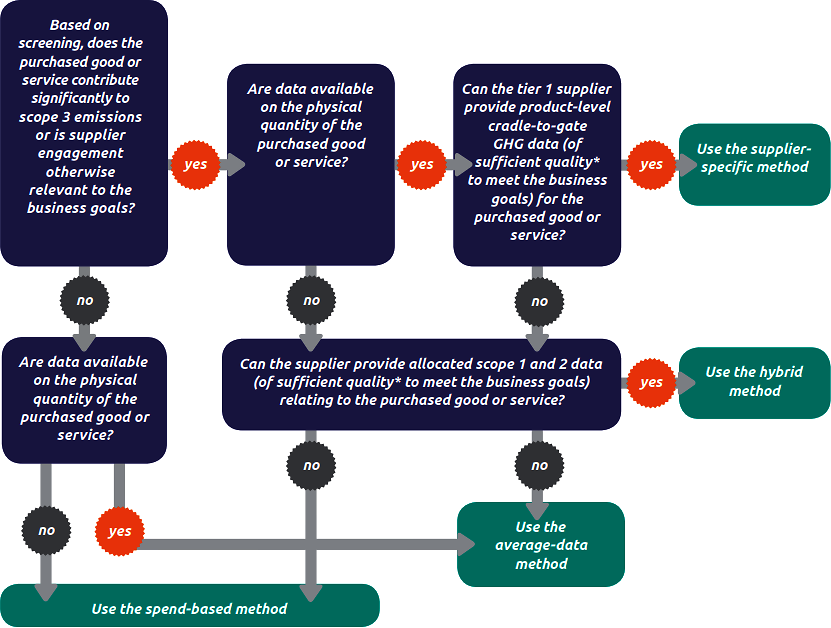

The protocol then provides decision trees for each Scope 3 emission category to help identify the calculation method. Figure 2.8 illustrates the decision tree for emissions arising from purchases of goods and services.

Figure 2.8. Decision tree for selecting a calculation method for emissions from purchased goods and services

The methods for the calculation and estimation of Scope 3 emissions include (Table 2.2):

The supplier-specific method collects product-level cradle-to-gate GHG inventory data from goods and services suppliers.

The hybrid method uses a combination of the supplier-specific method and secondary data to fill the gaps. This includes calculating upstream emissions of goods and services from suppliers’ activity data for the materials, fuel, electricity used, from distance of transportation or waste generation from the production of goods and services.

The average-data method estimates emissions for goods and services by collecting data on mass or other relevant units of goods and services purchased and multiplying by the relevant secondary emission factors.

The spend-based method estimates emissions for goods and services by collecting data on the currency value of goods and services purchased and multiplying it by relevant secondary emissions factors.

Table 2.2. Calculation methods and data requirements for Scope 3 emissions of purchased goods and services

|

Calculation method |

Activity data needed |

Emission factor needed |

|---|---|---|

|

Supplier-specific method |

|

|

|

Hybrid method |

|

Depending what activity data has been collected from the supplier, companies may need to collect:

The secondary emission factors required will also depend on what data is available:

|

|

Average data method |

|

|

|

Spend-based method |

|

|

Standards in reporting of Scope 3 emissions

Once Scope 3 emissions have been estimated, the protocol provides guidelines for reporting them. A business is advised to:

Report Scope 3 emissions separately from Scope 1 and Scope 2 emissions

Report Scope 3 emissions separately for each category

Report in CO2 equivalents

Report the types and sources of data used, and a description of data quality

Report the method used to calculate Scope 3 emissions

Among the 8 biggest companies in Hamburg not all companies that report Scope 3 emissions are reporting the types of data, data quality and the methodology. For example, Hapag-Lloyd was preparing Scope 3 accounts to be available in the second half of 2023 in its sustainability report.

Table 2.3. Top 8 biggest companies and Scope 3 emissions

|

Company |

Report Scope 3 separately from Scope 1 and Scope 2 |

Report categories of Scope 3 emissions separately |

Report in CO2 equivalents |

Report the types, sources of data, and data quality |

Report methodology |

|---|---|---|---|---|---|

|

Hapag-Lloyd |

YES |

YES |

YES |

- |

- |

|

Aurubis AG |

YES |

YES |

YES |

YES |

- |

|

Otto GmbH & Co |

- |

- |

- |

- |

- |

|

Vattenfall GmbH |

YES |

YES |

YES |

YES |

YES |

|

Airbus Operations GmbH |

YES |

YES |

YES |

YES |

YES |

|

Beiersdorf AG |

YES |

YES |

YES |

YES |

YES |

|

ArcelorMittal GmbH |

- |

- |

- |

- |

- |

|

Nordex SE |

YES |

YES |

YES |

YES |

YES |

Key actions

Immediate action:

Businesses need to set a net-zero emissions target, with clear intermediary targets in intervals of, for example 5 years, for at least Scope 1, Scope 2 emissions.

Businesses need to assess Scope 1 and 2 emissions. They should begin assessing Scope 3 emissions as well as related climate risks and opportunities.

Businesses need to prepare an action plan to reach the net zero target by 2040.

The HCC can provide guidance on these steps as well as working groups to facilitate knowledge-sharing and coordination.

Businesses should invest in just transition efforts, for example all businesses with operations in developing countries should demonstrate how their net zero transition plans contribute to the economic development of regions they are operating in.

By 2030

On the basis of Scope 3 emission estimates, business need to work towards reaching climate neutrality in their supply chains following science-based emission reduction scenarios consistent with the Paris Agreement.

Businesses with reporting requirements need to publicly report their GHG emissions and other relevant metrics, such as energy use, and the methods employed. They should disclose net zero targets, intermediate targets and the action plan to meet their net zero target, including actions for reducing Scope 3 emissions in line with the Paris agreement. They need to report on their progress against intermediate targets. Disclosures need to be accurate and reliable. Businesses can also seek independent evaluation of their annual progress reporting and disclosures.

The HCC can create a public platform to monitor progress on these actions, provide guidance, facilitate knowledge-sharing and coordination.

The HCC can provide guidance on all these steps as well as working groups to facilitate knowledge-sharing and coordination.

By 2040

Businesses need to reduce their own Scope 1 and 2 emissions to zero leaving residual positive emissions until 2050 only in a few activities hard to decarbonise. These can be offset with the purchase of carbon credits.

Businesses and the HCC need to find high-quality certified offsets for residual emissions.

The HCC can provide guidance on these steps as well as working groups to facilitate knowledge-sharing and coordination.

Networks for SMEs to build climate-neutral business models

Small and medium sized enterprises (SMEs)1 are key actors to achieve net zero emissions. In OECD countries, SMEs represent at least 50% of greenhouse gas (GHG) emissions and 30-60% of energy use in business sectors (OECD, 2022[22]). Besides, the flexible, risk-taking profile of SMEs makes them essential players in generating and adopting green innovations. Developing clean innovations involves a high level of risk that large companies are often unwilling to take. To illustrate, in the UK, SMEs account for around 90% of clean technology companies (OECD, 2022[22]).

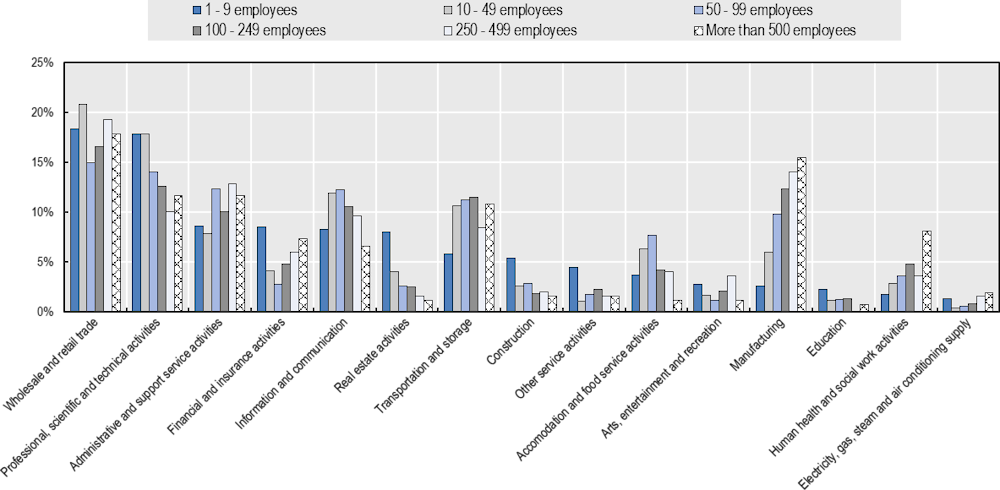

Hamburg's economic landscape includes a large number of SMEs, especially SMEs with fewer than 50 employees. They are particularly numerous in the wholesale and retail trade sector (Figure 2.9). SMEs in this sector are likely to share challenges to make business models consistent with climate neutrality, for example, with respect to assessing and reducing Scope 3 emissions. Some of them may have strong links to the port. SMEs are also heavily involved in transport, real estate activities and construction. Transport includes some of the activities that are most difficult to decarbonise, notably in freight (Chapter 3), while construction firms will make an important contribution to the decarbonisation of buildings. SMEs involved in some professional, scientific, and technical activities can participate in the creation and dissemination of green technologies. This section argues that SMEs may have much to gain from cooperating in networks to address these challenges collectively.

Figure 2.9. SMEs are primarily found within the sectors of trade and business services

Sectoral contributions to the number of businesses in each business size class, in per cent

Note: Sectors representing less than 1% of companies in any category are not taken into account.

Source: Hamburg Statistics Office (2022)

SMEs often lack the resources needed for the transformations to reach climate neutrality. They have more limited access to new technologies, information, and finance, which prevents them from investing in the technologies needed for decarbonisation. In 2021, the UK Chamber of Commerce conducted a survey showing that only 10% of SMEs measure their greenhouse gas emissions, while a Korean survey shows that 31% believe that the main obstacle is a lack of information on the methods to use (OECD, 2022[22]). Given their limited resources, market uncertainty and risk may affect SMEs more, making them more vulnerable. In Korea, 60% of SMEs believe that the net-zero target will reduce their competitiveness. In the Hamburg metropolitan region, SMEs experience more difficulties in innovating and adopting digital technologies than in other regions (OECD, 2019[23]).

Box 2.4. Cluster networks in Hamburg

The approach adopted by the City of Hamburg centers on industrial clusters. As part of Hamburg's "InnovationsAllianz," the city collaborates with stakeholders from diverse sectors, including science, business, politics, institutions, and associations, to identify key activities for cluster development. Each cluster is coordinated through a central management system overseen by local public authorities and is funded through a combination of membership fees and public support. They regularly provide policy recommendations.

Hamburg's strategic clusters, in line with the Smart Specialisation Strategy, cover a range of sectors such as "Life Sciences," "Logistics," "Aviation," "Media & IT," "Renewable Energies," "Creative Industries," "Finance," and "Maritime Industries." Furthermore, a new food cluster is set to be established by the end of 2023, adding another significant sector to Hamburg's economic landscape.

The cluster agencies do not have specific climate neutrality objectives themselves but contribute to the implementation of general or sectoral requirements through their projects. Noteworthy contributors to these efforts include, but are not limited to, agencies such as Renewable Energy Hamburg (EEHH), Hamburg Aviation (HAv), Logistics Initiative Hamburg (LIHH), and Maritime Cluster Northern Germany (MCN).

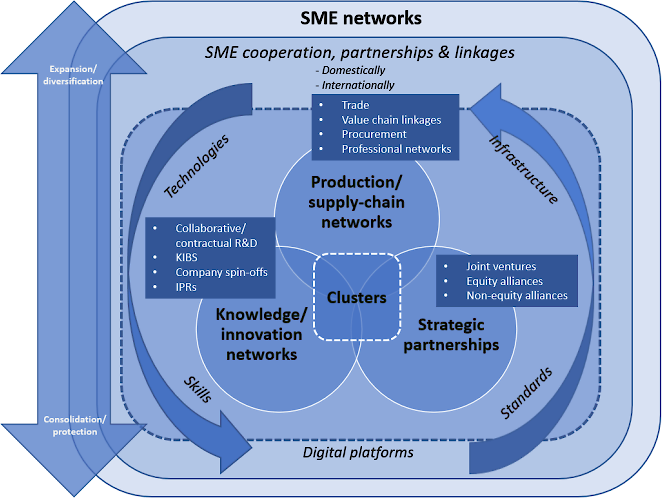

Participating in a network can ease SMEs' transition towards climate neutrality, pooling knowledge and resources. These networks typically fall into four categories: production/supply chain networks, knowledge/innovation networks, and strategic partnerships or clusters (Figure 2.10; (OECD, 2023[24])). Networks offer an efficient avenue for accessing knowledge, allowing to harness economies of scale in the use of such knowledge. Furthermore, network participation can help mitigate uncertainties. Networks can also facilitate access to financial resources. Additionally, SMEs aiming to establish themselves as environmentally responsible enterprises can seek membership in networks that uphold high sustainability standards, to market business models providing climate-neutral solutions. Figure 2.6 suggests that many Hamburg companies consider such networks are not sufficiently available. The HCC should encourage their development. Some cluster initiatives have been developed by the regional government (Box 2.4).

Figure 2.10. Typology of SME networks

Box 2.5. Business networks can meet a range of SME resource needs for the transition to climate neutrality

A network connects businesses with each other, enabling transactions that cannot be intermediated through markets, including knowledge. In the case of SMEs networks, the entities are companies, and the transferable flows can be technologies, data, behaviours, and tacit knowledge (know-how). There are four channels through which flows are transferred:

Supply-chain networks: connect firms’ activities involved in the production of a good or service. Actors (e.g., suppliers, competitors, or multinationals) are connected through trade, investment, professional networks, digital platforms, or networking facilities. They exchange products, services, financial flows, innovations spill over and intangible assets. As part of the net-zero carbon transition, a large company could provide operational and financial support to its SME suppliers to enable them to use greener technologies. For instance, the Apple’s Supplier Clean Energy Program is a program designed to help Apple suppliers decarbonize their production. Through this program, Apple works closely with its suppliers to identify and implement solutions to reduce their energy consumption and carbon footprint.

Knowledge networks: collaborative framework to develop and share knowledge and innovation. The entities involved are innovative SMEs, High Education Institutions (HEI), Public Research Institutions (PRI), government and intermediaries. Those actors share codified and tacit knowledge, R&D, data, skills, technology, financing, and intangibles through contractual or collaborative R&D, consultancy, Knowledge-intensive business services (KIBS), training, labour mobility, patenting and licensing, spin-off, digital platforms, and networking facilities. An example of a knowledge network to accelerate the transition to a carbon-free economy is the EIT Climate-KIC, which is a European Knowledge and Innovation Community (KIC). They bring together several green innovation players, including companies, universities, and public institutions. In addition, the EIT Climate-KIC raises and invests funds, develops educational programs to enhance environmental skills, and has an incubation program.

Strategic partnerships: formal collaboration between two or more entities (e.g., start-ups, multinationals, universities, PRIs) to develop motivation for new products and/or commercialisation. They can also exchange infrastructures through R&D joint ventures, research consortium, join R&D agreements and minority holdings, licensing, or franchising. Yulex Corporation is an example of an SME that has created a strategic partnership with a larger company, Patagonia, to participate in the decarbonisation of the economy. They collaborated in the development and use of plant-based materials for wetsuits instead of synthetic neoprene, which is highly polluting.

Clusters: interconnected entities such as companies, HEIs, research institutes and technology providers, bridging institutions or customers. Cluster can be organized around a geographical area or sectoral proximity. To illustrate, the Sustainable Packaging Cluster in Catalonia, Spain is a cluster program that facilitates connections between SMEs and other players to develop environmentally friendly packaging and support the diffusion of green packaging technologies.

Networks are a key factor in the decarbonization of SMEs

Knowledge and innovation networks are essential for the creation and diffusion of the innovation SMEs need for climate neutral business models. Small companies that cooperate are more innovative than large companies that do not (Figure 2.11). Knowledge and innovation networks can connect public institutions, companies, High Education Institutions (HEI) or Public Research Institutions (PRI) to exchange knowledge, expertise, and new technologies.

Figure 2.11. Innovative firms cooperate more than non-innovative ones

Share of companies that cooperate with other companies or organisations as part of their commercial activities by size class, among non-innovative and innovative companies (2020).

Knowledge networks help SMEs adopt climate-neutral business practices at lower cost. The knowledge required for developing innovation is increasingly specialized and vast, increasing the cost of acquiring it. Joining a network to gain access to this knowledge is a solution for SMEs wishing to innovate while sharing the cost. Knowledge networks enable SMEs to pool data or physical infrastructure, enabling significant economies of scale. More generally, belonging to a network comprising KIBS players gives SMEs access not only to scientific and technological services, but also to legal, accounting and management services, engineering, R&D and IT systems, as well as design and advertising services, among others. These types of services are not at the heart of SME activities, but they are essential to their survival and to the dynamism of the economic fabric.

Networks can facilitate the access to finance in several ways. Many knowledge networks help SMEs to identify and raise private and public funding, some even having their own funds. For instance, EIT Climate KIC raises and invests funds to finance green projects developed by SMEs (Box 2.5). Venture capitalists and business angel investors can be key partners for start-ups thanks to their management and strategic resources, but they are sometimes hard to reach. Participation in network programs offers the opportunity to meet investors. Finally, through strategic partnerships, SMEs can be financed by larger companies.

Access to data at business level are particularly key. Networks can help by providing access to the technology and sources. SMEs need to identify areas for improvement. Measuring electricity consumption, for example, helps to understand electricity requirements.

This knowledge can also be transferred via the supply-chain network, through buyer-supplier or parent-subsidiary relationships or strategic partnerships. Larger firms with more resources could help SMEs to gain information about existing green technologies and best practices, and to implement them, securing net-zero value chains. For instance, in the Aligned Business Framework Program Ford encourages and helps its suppliers to implement energy-efficient technologies.

Through supply chain or strategic partnership networks, SMEs can gain insights into their supply chain operations and how to decarbonize them. Large companies must comply with increasingly stringent environmental regulations. They are also increasingly scrutinized and considered responsible for the entire production chain. As a result, multinationals are paying increasing attention to the environmental performance of the SMEs they deal with. For example, following the adoption of the Corporate Sustainability Reporting Directive (CSRD), several large European companies cancelled contracts with SMEs that had failed to submit sustainability performance reports.

Networks can also serve to set environmental standards and identify members as fulfilling them for marketing purposes. Participating in such networks enables SMEs to gain more information on the environmental standards to be achieved and to identify themselves as complying with those standards, including on emissions reduction. Identification as a “green” business is important for reputation and helps gain visibility with clients, investors, workers and consumers who need access to environmentally high-performing SMEs.

Key actions

Immediate action:

The HCC could identify the extent to which Hamburg SMEs are integrated in networks to help undertake transformations needed to reach climate neutrality.

The HCC could support the creation of networks to help undertake transformations needed to reach climate neutrality, including academics, research institutions, SMEs and large companies to exchange information on technologies and best practices. Networks could provide an online platform and regular meetings/events.

Businesses, with the support of HCC, should initiate the creation of networks on strategic issues identified in this report such as coordinated decarbonization across value chains, cost savings from better renewable energy use (this chapter); infrastructure needs from the electrification of road freight (Chapter 3) or the circular economy (Chapter 4).

Making better use of low-cost renewable energy

This section shows how Hamburg companies can benefit from low-cost electricity produced with variable renewable energies (VRE) by adapting to their intermittent nature. Germany has set an ambitious target of 80% renewable energy sources by 2030 (OECD, 2023[25]), and the IEA forecasts a 50% increase in electricity demand in a net-zero emissions scenario by 2050 (IEA, 2022[26]). Taking advantage of low-cost electricity from renewables when it is abundant will become increasingly important, as renewable electricity use needs to expand rapidly to substitute for fossil fuels.

There is a business case for variable renewable energies (VRE)

VRE have the lowest electricity production costs, even when incorporating battery storage costs (Box 2.6). VRE are expected to play a significant role in Germany, particularly in Northern Germany, which possesses potential to emerge as a leader in renewables with high onshore wind energy production in the Schleswig Holstein region and offshore wind in the North Sea. Collaborative initiatives, such as the Norddeutsches Reallabor (NRL) initiative, have been initiated. The North German Energy Transition initiative, launched between 2016 and 2020, brings together a coalition of 60 public, private, and research stakeholders spanning the two federal states of Hamburg and Schleswig-Holstein. The aim of the initiative is to meet energy demand by providing entirely renewable energy in both states by 2035 (OECD, 2019[23]). However, the existing high-tension power line network is presently insufficient to transport a substantial amount of renewable electricity to Hamburg. This limitation could result in increased electricity prices for the city, even when wind power is abundant. Local photovoltaic (PV) systems, especially solar rooftop panels, emerge as a promising and cost-effective solution for Hamburg, to avoid such bottlenecks. In 2022, Hamburg’s total annual electricity demand stood at 10.4 terawatt-hour (TWh), whereas the estimated potential for PV generation reached 6.37 TWh (Hamburg Klimabeirat, 2023[27]). Currently, solar rooftop adoption in Hamburg is low. Installed capacity of organic photovoltaics in Hamburg stands at 77 megawatt peak (MWp), in contrast to the 190 MWp in Berlin.

Table 2.4. Solar rooftop adoption in Hamburg is lower than in other Länder

Installed capacity of organic photovoltaics (OPV) in selected Länder

|

Länder |

Installed capacity (MWp) |

Installed capacity by inhabitant (kWp/Inhab) |

|---|---|---|

|

Berlin |

190 |

61 |

|

Bremen |

66 |

110 |

|

Hamburg |

77 |

44 |

Notes: MWp stands for megawatt peak and kWp for kilowatt peak. This is a unit of measurement of the potential power of sources such as solar or wind energy, which takes account of variations linked to factors such as the intensity of sunshine or wind speed.

Source: (Hamburg Klimabeirat, 2023[27])

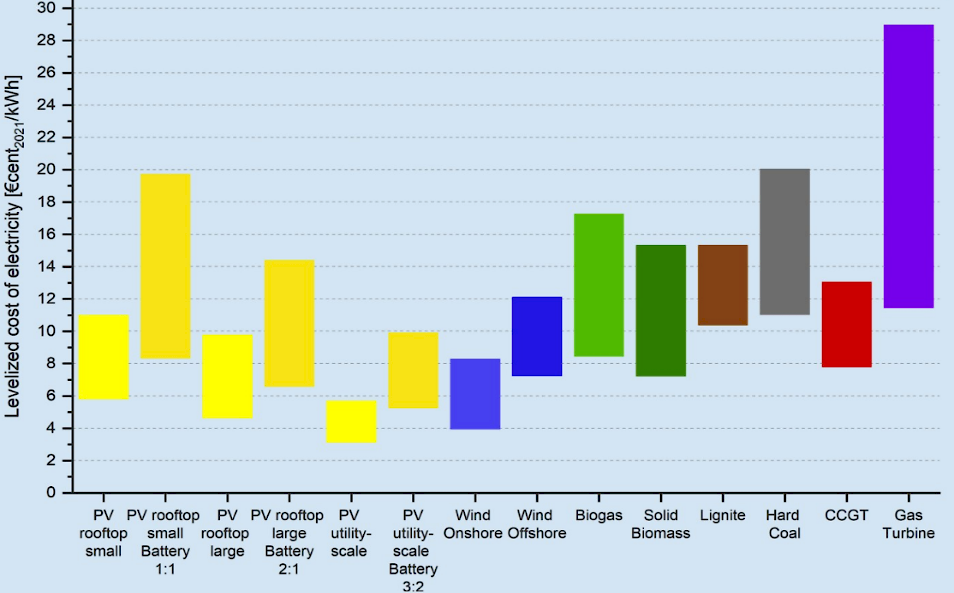

Box 2.6. Electricity from VREs is cheaper than fossil fuel fired electricity

The levelized cost of electricity generation is the lowest for VRE and should continue to fall, widening the gap with fossil fuel-fired electricity (NEA/IEA, 2020[28]). Among VRE, utility-scale solar panels produce the cheapest electricity, although onshore wind turbines remain very competitive. In Germany, photovoltaic (PV) technologies and offshore wind power plants are expected to see the biggest drop in cost (Kost et al., 2021[29]).

Figure 2.12. The cost of electricity generation is the lowest for solar and wind

The levelized cost of electricity of renewable energy technology and conventional power plants in Germany in 2021

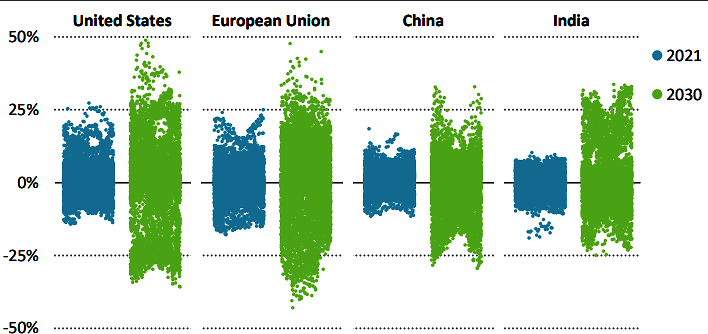

Renewable energy production may not align with current electricity demand patterns. For instance, solar energy generation is highest during the daytime and in the summer, whereas electricity demand typically peaks in the evenings and during the winter months. The International Energy Agency (IEA) anticipates a significant rise in the demand for electricity system flexibility within the European Union by 2030, driven by an increased share of renewables (Figure 2.12).

Figure 2.13. Hour-to-hour flexibility needs rise significantly by 2030 in major markets

Hour-to-hour flexibility needs in the United States, European Union, China and India in 2021 and assuming that all targets announced by government are met on time and in full for 2030

Note: This corresponds to the Annouced Pledges Scenario (APS). Flexibility needs are the needed hour‐to‐hour rate of change in electricity demand (Change in Demand / Time Period) needed to match hourly wind and solar PV production to hourly electricity demand.

Source: (IEA, 2022[26])

Business can make fuller use of low-cost VRE by using sector coupling. Sector coupling refers to the closer integration of energy-using economic activities with VRE electricity production, to make optimal use of available renewable energy when it is the most abundant and therefore available at lowest cost, taking advantage of the needed electrification. For example, electrification of the vehicle fleet can be combined with smart charging infrastructure. Vehicles with large batteries can feed electricity back into the grid (Hossain et al., 2016[30]). Companies with electric vehicles could be rewarded for the electricity they supply in peak periods (Vanholme et al., 2022[31]).To do so, firms must invest in vehicles that are capable to store and release electricity and in bidirectional charging infrastructure. In a transport hub like Hamburg, efficiently managing an electric vehicle fleet can be a particularly valuable tool.

For activities difficult to electrify such as heavy industry or shipping, sector coupling can also involve converting renewable electricity in other storable energy carriers, a concept known as power-to-X technology (Erbach, 2019[32]). For instance, power-to-gas refers to the conversion of the surplus electricity to hydrogen or synthetic gaseous fuels (Gea-Bermúdez et al., 2021[33]), which could be used by Hamburg’s industry, notably steel and chemicals production. Power-to-heat technology refers to the conversion of electricity to heat with, for instance heat-pump.

Sector coupling generates collective benefits. Indeed, it increases capacity utilization in renewable electricity production and improves grid efficiency, thus reducing decarbonization costs from infrastructure development, while speeding up the transition to climate neutrality. For Germany, a sector coupling scenario compared to a fully electric scenario would generate an annual cost saving of €12 bn by 2050 (Van Nuffel et al., 2018[34]), around 15% of annual spending on electricity in recent years. VRE coupled with sector coupling reduces exposure to fuel price volatility and political risk from fossil fuels (Krane and Idel, 2021[35]). Hamburg's role as a transportation hub, coupled with the expected high demand for hydrogen and the as yet undeveloped potential of rooftop solar panels, suggests that sector coupling could result in substantial cost savings for the city.

Individual companies using sector coupling also draw individual benefits (Van Nuffel et al., 2018[34]). First, sector coupling improves energy efficiency. According, to the IEA, charging vehicles during the day when electricity demand is low could decrease charging cost from €0,39 to €0,28 per kWh (IEA, 2023[36]), once prices respond to fluctuations in supply and demand. Additionally, investing in sector coupling creates synergies, as equipment for energy end use can also be used to store and release electricity to save costs. For example, electric vehicles can be used for transport or to store electricity (Box 2.8). With Hamburg hosting numerous firms in the road freight sector, where electrification with battery electric vehicles should be expected to accelerate, sector coupling presents a compelling opportunity. Sector coupling can also raise the benefits to businesses from installing rooftop solar panels, boosting their use of self-generated electricity.

Encouraging sector-coupling through enhanced flexibility in the electricity market

Policy makers should enhance electricity market flexibility to encourage firms to develop sector coupling. Higher granularity of the electricity market helps better reflect the variable supply of VRE over time and across locations and encourages investment in flexibility, including through sector coupling (Kraftnät, 2017[37]). Currently, the wholesale pricing timing (imbalance settlement period) in Germany stands at 15 minutes, but there is potential to further reduce it to align with VRE patterns. Transitioning to a pricing structure in smaller, subnational zones or nodes can enhance the accuracy of price signals, strengthening the efficiency of energy markets, with favourable impacts on competitiveness. Northern Germany, and Hamburg in particular, would be able to put to good value industry and port related activities (Chapter 3) and derive advantages from implementing geographically tailored electricity pricing, which could result in lower prices (IEA, 2022[38]).

Demand response programs can encourage firms to adapt electricity consumption according to wholesale price signals. Policy makers and energy utilities have a role in making these programs available and clear. Incentive based programs reward market participants for adapting to VRE supply patterns through direct payments. Electricity demand can also be managed by utilities directly (Box 2.7). In price-based programs, such as Time of Use programs, prices are higher at peak times (Albadi and El-Saadany, 2008[39]).

Hamburg offers demand response programs in line with national initiatives. These programs include interruptible load programs, auctions, and opportunities for renewable energy producers to engage in direct marketing. These tend to benefit large customers. Demand response aggregators could also assist small and medium-sized consumers in participating collectively. Several initiatives provide real-time data and automated control for electricity consumption. To encourage more demand response, it is crucial to have clear regulations, and information for all participants. One of the main obstacles to developing demand response is the absence of standardized processes and contracts governing settlements between aggregators (consumers) intermediaries and suppliers (ENEFIRST, 2020[40]).

To be able to make their electricity demand more flexible, companies need to invest in digital tools such as demand monitoring and demand response technologies. Digital technologies such as smart meters, energy management systems and automated control systems can be used to closely monitor, control, and forecast energy consumption (IEA, 2022[38]).

Box 2.7. Demand response program types

Incentive Based Programs

IBP programs reward market participants for their adaptation to VRE supply patterns through direct payments.

1. Direct load Control: Utilities could remotely manage and control participant equipment (e.g., air conditioners and water heaters) in response to variations in wholesale electricity prices, reflecting energy supply conditions. In exchange, customers receive a financial incentive.

2. Interruptible/Curtail Programs: Customers receive upfront incentive payments or rate discounts if they agree to reduce their demand to predefined values in periods of high grid stress.

3. Demand Bidding: Customers bid on specific load reductions and if the bid is accepted, the customer must reduce their load by the amount specified in the offer.

4. Emergency DR Programs: Customers are paid incentives for measured demand reductions during emergency conditions.

5. Capacity Market: Customers commit to providing pre-specified demand reductions in case of peak demand in the long term. They are penalized if they fail to respond to calls.

6. Ancillary services market: Customers bid for discounts/payments for offering load reduction on the spot market as an operating reserve. When bids are accepted, participants are paid the spot market price for committing to standby and are paid the spot market energy price if their load curtailments are required.

Price Based Programs

In price-based programs, price signal or tariff are used to change energy demand.

1. Time of Use: The price of electricity per unit of consumption differs according to time of day. Prices are higher at peak times and lower at off-peak times.

2. Critical Peak Pricing / Extreme Day Pricing: In case of contingencies, a higher electricity price is paid in exchange for a lower price on normal days.

3. Real Time Pricing: Customers pay the real time wholesale electricity price.

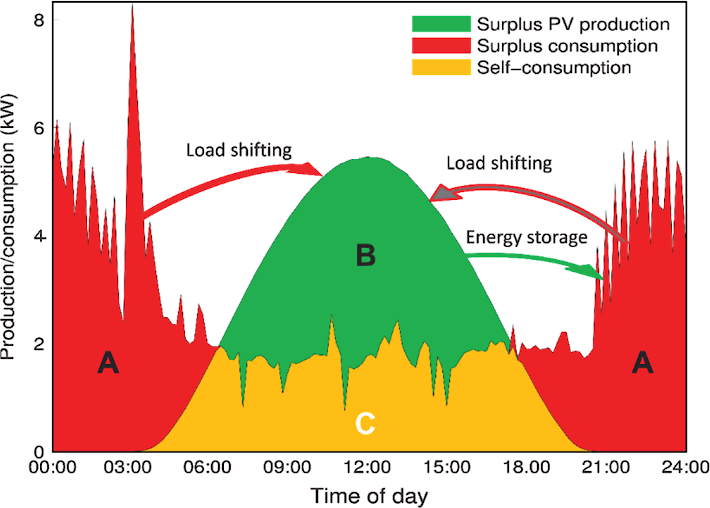

Solar PV rooftop systems can lower energy costs

Solar PV rooftop systems offer a particularly appealing prospect for businesses in Hamburg to generate and consume their own electricity to benefit from low-cost electricity, ultimate contributing to developing a decentralized system based on distributed energy resources (Hargroves et al., 2023[41]). In the absence of granular electricity pricing over time, sector-coupling can offer opportunities for businesses to benefit more from self-production/consumption of VRE, as self-produced electricity tends to be cheaper than electricity purchased from utilities. The production time profile of solar panels, primarily during daylight hours, corresponds well with the electricity consumption patterns of businesses. When the production does not match the demand of electricity, it is possible to couple self-production/consumption with battery or thermal storage (Figure 2.14; (Renewable Energy Agency, 2021[42])). Even in the case of low electricity needs, self-production/consumption with sector coupling is attractive. In 2023 the German government has increased feed-in tariffs for distributed solar PV (IEA, 2022[43]). Finally, it is important to note that Hamburg's photovoltaic potential may not be as high as in other cities, due to the large proportion of less stable logistics buildings.

Figure 2.14. Time profile of self-production/consumption with solar panel (PV) and storage

In Hamburg, several obstacles impede rooftop solar panel installations, with a key challenge being limited access to information regarding technology, regulations, implementation, and cost-saving potentials from rooftop installations, even today. For example, businesses considering rooftop solar panels could collaborate to collectively share the cost of connecting to the grid. Some companies in Hamburg are already working to assist companies to use self-produced VREs (Box 2.8). To enhance companies' awareness and information accessibility, it is key to actively promote and communicate the existence of support institutions that facilitate solar panel installations. These include the chambers of commerce, government-initiated initiatives such as the Hamburger Energielotsen, as well as private organizations like property owners' associations and coalitions like the Solar Offensive, which bring together various stakeholders. The HCC could play a key role in making the business case to its members. Including by pointing out to business models to share investment effort and benefits between building owners and tenants.

Box 2.8. Sager & Deus and Opländer Haustechnik supports businesses to integrate VRE into their energy mix

The Hamburg-based companies Sager & Deus and Opländer Haustechnik have made it their business to replace oil and gas-fired technologies. This includes maximum energy efficiency, the use of renewable energies and environmental technologies, as well as the offer of sanitary technologies that are economically justifiable and ecologically sustainable.

They currently employ 183 people and generate a total annual turnover of around 28 million euros. The companies' main focus is on the transformation of energy systems towards decentralised renewable systems. The goal is to generate renewable, emission-free electricity and heat as close to the consumers as possible. Electricity and heat consumers are becoming prosumers. The objective is to allow more market participants to benefit from value created in this way.

Sager & Deus focuses on renewable and citizen-oriented energy generation systems, serving individual houses, estates and larger commercial properties, as well as on the construction and operation of local collective heat pumps, fuel cells operating with hydrogen as well as combined heat and power plants.

Opländer works with heating, plumbing, ventilation, air conditioning, refrigeration and electric installations. In addition to building these systems, maintenance is an important part of their work. They deploy technologies serving the transition to climate neutrality such as combined heat and power, solar thermal and heat pump technology. The company endeavours to advance climate neutrality, helping to change mindset towards renewable energy and away from fossil fuels, including in craft businesses. It also endeavours to make crafts, which are important to reach climate neutrality, such as in the installation of renewable energy systems, attractive especially for young people. It aims to broaden participation in the environmental transitions, helping to shape a transition shaped more by the society at large and not only by central structures.

Storage can boost flexibility in electricity demand

Electricity storage is one of the most important elements to add the flexibility needed by VRE and sector coupling. Storing electricity is more costly and technically demanding than storing fossil fuels (Erbach, 2019[32]). The most relevant types of energy storage for energy-using companies are electrochemical batteries, hydrogen energy storage, and thermal energy storage (Ould Amrouche et al., 2016[45]) (Münster et al., 2020[46]).

Electrochemical batteries are highly heterogeneous and can be used on a wide range of scales. Batteries are especially well-suited for companies in modestly energy-intensive sectors, that generate their own electricity from solar rooftop systems or participate in demand-response programs. The most widely used types are lithium-ion (Li-ion) batteries, with a market share of 97% in 2017 in Germany. Li-ion batteries are also widely use in electric vehicles.

Battery prices fell by 98% between 1991 and 2018. Even the prices of small-scale residential battery systems fell by 70% in Germany from 2014 to 2020 (International Renewable Energy Agency, 2023[47]). Their prices especially for Li-ion batteries are expected to continue falling for several reasons, such as higher scale production capacity, better materials, or more competitive supply chains (Renewable Energy Agency, 2017[48]). However, environmental footprints of battery production are marked, which may push up prices when these are priced in, making demand response and sector coupling using installations serving also other purposes (heat reservoirs, vehicle batteries) more interesting.

HES converts electricity into hydrogen. This storage technology is of interest to companies requiring long-term energy storage (He et al., 2021[49]). As of now, hydrogen projects are not profitable. However, hydrogen-based energy storage has also become more attractive thanks to the reduced cost of electrolysers (International Renewable Energy Agency, 2023[47]).

As energy is stored in cold or hot fluids, thermal storage can be used with power-to-heat technology to heat or cool buildings (Van Nuffel et al., 2018[34]). In this case, buildings or warehouses are heated when electricity demand is low or supply high, thanks to a smart thermostat. When demand peaks, the building's heating is switched off. This type of storage is particularly suited to companies with high heating/cooling requirements (e.g., supermarkets) and industrial groups. Supermarkets, which need electricity to cool food using refrigeration compressors, are a good illustration of this phenomenon. When electricity is plentiful, cooling compressors can run at full capacity (Van Nuffel et al., 2018[34]).

Cooperation is key to develop sector coupling on a larger scale

Companies located in the same or in nearby buildings can work together to develop infrastructure and benefit from economies of scale. Scale economies can apply to VRE production and storage: bigger shared installations may reduce costs compared to individual use of smaller installations (Kost et al., 2021[29]). Firms can create partnerships to share the up-front cost of solar panels with storage, electric vehicle smart charging systems, or even electrolyser infrastructure. For example, Siemens has collaborated with the Hamburg Port Authority to use surplus electricity generated by wind turbines to produce hydrogen for heavy vehicles and ships.

Companies can engage in collaborative efforts by becoming participants in energy communities. Joining these communities has also enabled businesses to benefit from lower electricity costs, maximising the potential scale economies. These can materialise in shared self-production, including the bigger potential benefit from sector coupling resulting from varying electricity use profiles (e.g., commercial, and residential) of each member in the community. These communities are formed either around shared wind and solar generation setups or by establishing fully self-sustained microgrids. A noteworthy example is the community-oriented Virtual Power Plant in Ghent, which has effectively integrated over 100 PV systems with energy management systems and storage capabilities. Yet, businesses in Hamburg report that energy communities are difficult to make happen. Digital technologies, such as blockchain, have the potential to facilitate the formation of energy communities by guaranteeing secure peer-to-peer (P2P) and peer-to-utility transactions (OECD, 2021[50]).

Finally, coupling sectors requires different types of knowledge. Companies can share their expertise through partnerships. For example, Siemens has created a partnership with Evonik, a chemical company, to develop a technology for converting electricity into hydrogen. E.ON, an energy company, and Audi, a car manufacturer, have collaborated to develop a project combining residential solar photovoltaic systems, energy storage systems and electric vehicles.

Key actions

Immediate action:

The HCC could provide guidance on the profitability of business on-site electricity production, especially solar PV rooftop, as well as on business models to take advantage of production potentials.

Businesses should assess all potentials for own electricity production, especially solar PV rooftop.

Businesses need to assess the potential for making their electricity use more flexible, taking into account investment in equipment they need for energy efficiency and electrification, including heat pumps and electric vehicles.

Businesses can assess scope for cooperating with other economic agents in shared buildings or neighbourhoods in improving flexibility of energy use.

The HCC can argue for market-based solutions for the regulation of electricity markets with increasing renewables shares, notably for granular pricing in space and time, in wholesale and retail markets.

The HCC could conduct an inventory of demand response programmes and advocate the standardisation of processes and the provision of clear information on the regulations and different contracts that may exist.

By 2030

The HCC should monitor solar rooftop electricity production in Hamburg as well as identify any barriers to expansion.

The HCC could complete a review of demand response programmes, making sure they are implemented as much as possible, both at the individual business level, working with utilities, the regional and the national government.

The HCC can provide guidance on all these steps as well as working groups to facilitate knowledge-sharing and coordination.

By 2040

With renewables shares in German electricity production planned to rise to 80%, all businesses should realise their own production and consumption potentials.

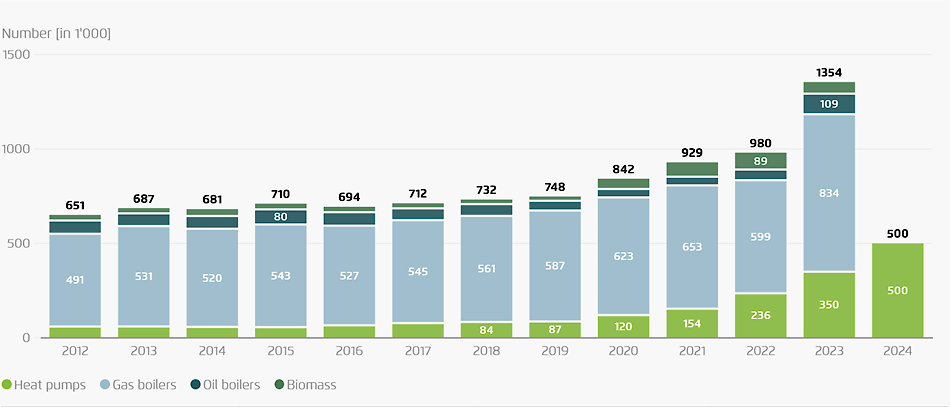

Decarbonising buildings

The buildings sector has a key role to meet energy and climate policy goals, as in 2021 it accounted for around 49% of final energy consumption in Hamburg (26% for private households and 23% for non-industrial commercial buildings), and around 24% of Scope 1 greenhouse gas emissions (equally split between private households and commercial buildings). Private households and non-industrial commercial buildings accounted for 45% of Scope 2 emissions in Hamburg in 2021 (23% and 22% respectively), where most of these emissions are from heating and use of appliances in buildings (Hamburg Statistics Office, 2023[51]). A significant gap exists between ambition and actual emission reductions in the buildings sector: for several years, the sector has exceeded the emissions limits of the German Climate Protection Law.