The fiscal balance is the difference between a government’s revenues and its expenditures. It signals if public accounts are balanced or if there are surpluses or deficits. Recurrent deficits over time can mean the accumulation of public debt and may send worrying signals to consumers and investors about the sustainability of public accounts. These, in turn, may deter consumption or investment decisions. Nonetheless, if debt is kept at a sustainable level, deficits can help to finance necessary public investment, or, in exceptional circumstances such as unexpected external shocks (e.g. pandemics, wars or natural disasters), can contribute to maintaining living conditions and preserving social stability.

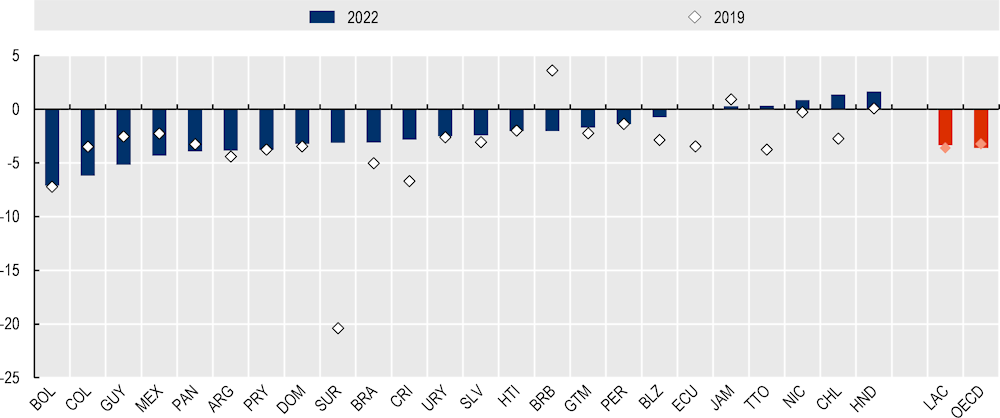

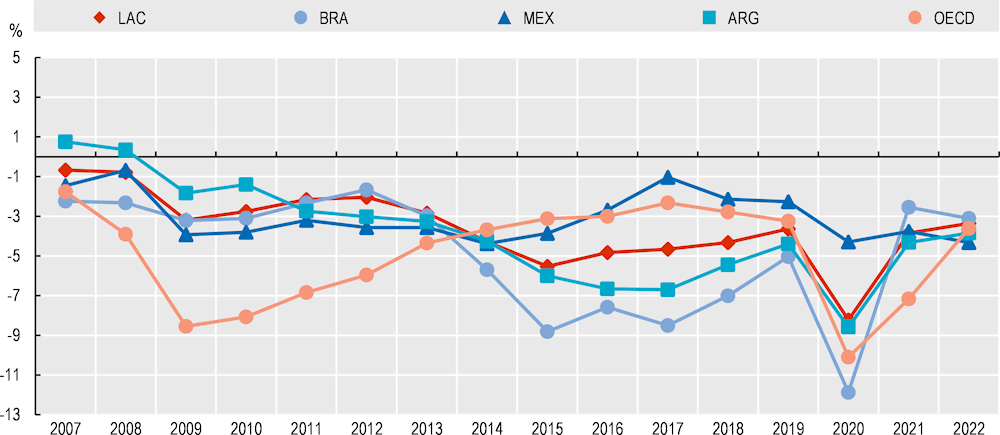

In 2022, the average general government fiscal balance in Latin American and Caribbean (LAC) countries amounted to -3.4% of gross domestic product (GDP). Only 6 out of 24 LAC countries recorded surpluses, the largest of which were in Honduras (1.6%), Chile (1.4%) and Nicaragua (0.8%) (Figure 11.7). Between 2007 and 2022 the evolution of the fiscal balance across LAC countries showed a mixed trend. From 2015 to 2021, Mexico consistently had smaller deficits than the LAC average, while Brazil and Argentina often had substantially larger ones. Differing levels of fiscal deficits can be explained by countries’ differing economic structures, levels of government spending and efficiency, revenue generation capabilities, and external economic influences such as trade relationships and global market fluctuations. The size of the fiscal response to the COVID-19 pandemic also differed, reflecting both policy choices and fiscal capacity. In 2020, when the pandemic started, Brazil recorded the largest deficit (11.9% of GDP) of the three largest LAC economies, compared to the LAC average of 8.2%, and deeper even than the OECD average of 10.1%. Argentina’s fiscal deficit aligned closely to the LAC average, at 8.6%, while Mexico’s deficit was significantly smaller at 4.3% (Figure 11.8).

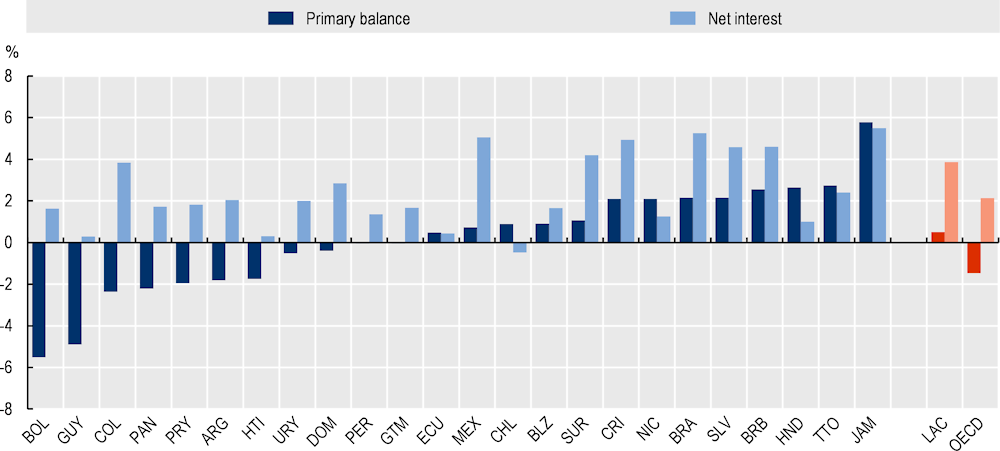

The general government primary balance is the difference between revenues and expenditures excluding net interest payments. It highlights a government’s capacity to meet its financial commitments without taking on additional debt. It is a more accurate indicator of the overall state of public finances in a country than the general fiscal balance. In 2022, the average primary balance in the LAC region was 0.5% of GDP. This indicates that, in general, governments were collecting slightly more money than they were spending. Out of 24 countries, 13 had primary balance surpluses in 2022, with Jamaica (5.8%) having the largest relative to GDP. The remaining 11 countries had primary deficits (Figure 11.9).

Net interest payments for debt servicing are an inflexible part of public budgeting, and countries must always meet them to maintain access to international financial markets and multilateral funds. On average, net interest payments among LAC countries in 2022 amounted to 3.9% of GDP, a higher proportion than among OECD countries (2.1%). The countries with the highest net interest payments relative to GDP were Jamaica (5.5% of GDP), Brazil (5.2%) and Mexico (5.0%). Chile was the only LAC country which had a negative net interest payment (-0.5%), meaning that the country earned more from interest on debt it had issued than interest it had to pay on its loans (Figure 11.9).