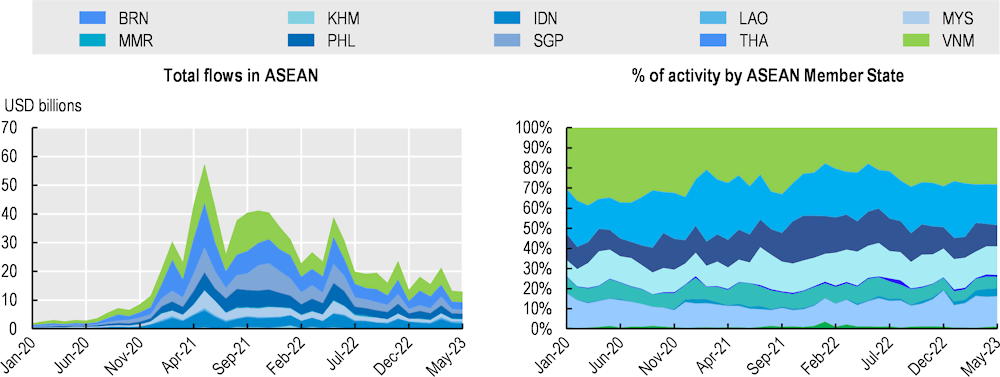

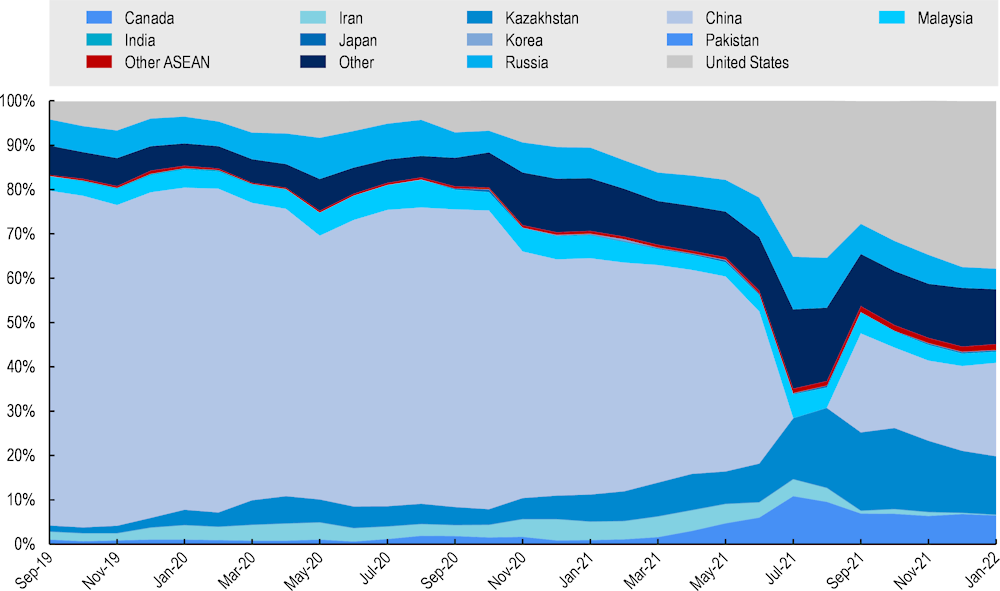

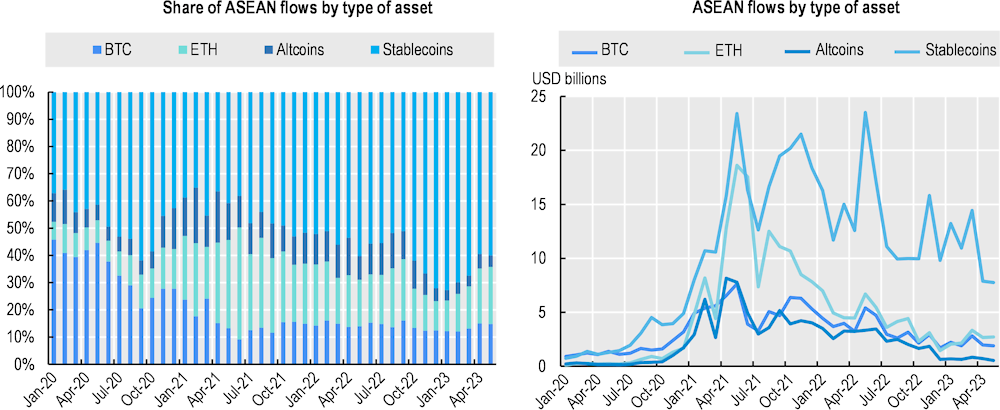

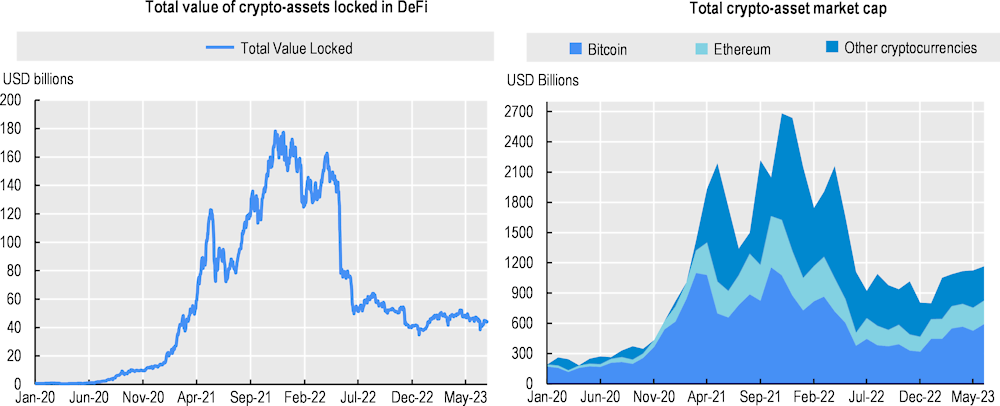

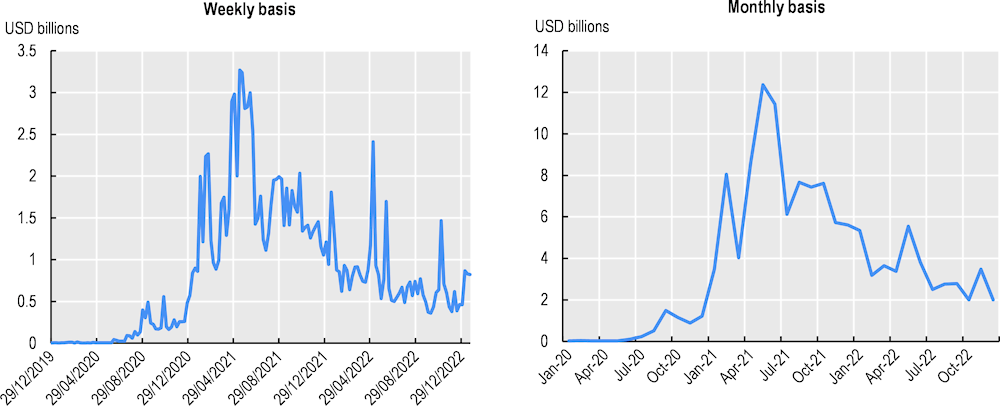

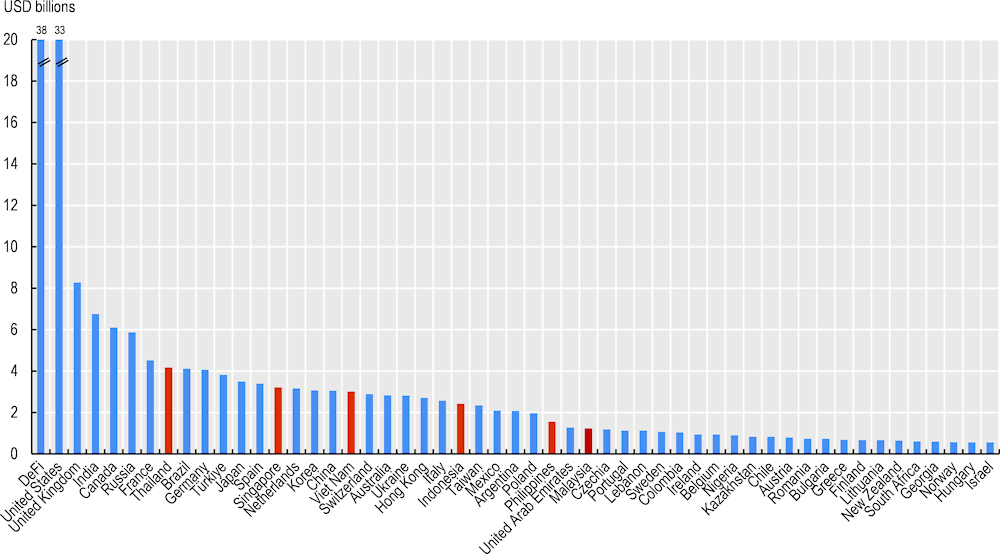

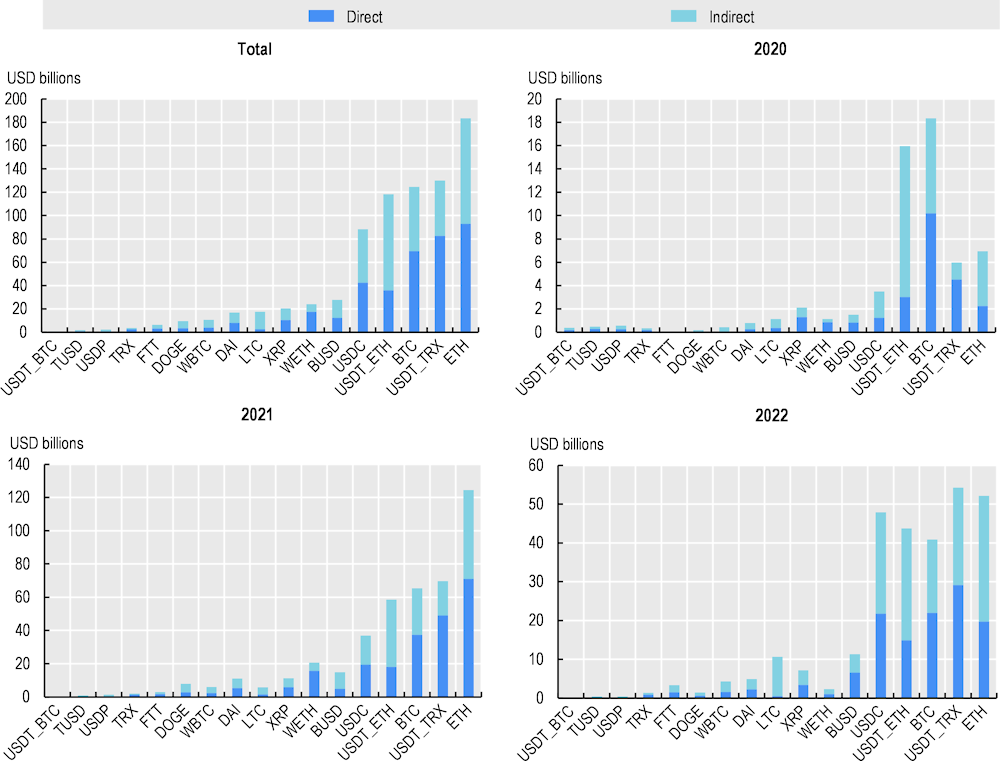

Crypto-asset flows towards ASEAN over the period 2020-22 follow a pattern that tracks to some extent the price evolution of Bitcoin (Figure 1.2). Indicatively, increased activity is recorded around October 2021, when Bitcoin reached a historical high of USD 61 525 (18 October, based on data from Chainalysis). This is not surprising as Bitcoin’s price has been a major driver of overall decentralised finance activity globally. Feedback loops exist between Bitcoin, the price of which has driven much of the activity in the entire crypto-asset market, and the evolution of DeFi measured by the total value of such crypto-assets that is locked into smart contracts of DeFi protocols (OECD, 2022[2]).

Activity in ASEAN peaked in H2 2021, in line with global trends, and started subsiding in early 2022 at the onset of the crypto-asset market downturn (known as ‘crypto winter’) and in line with overall global trends in these markets (OECD, 2022[3]). Interestingly, crypto-asset flows towards ASEAN almost tripled in the aftermath of the Terra UST de-peg on 7 May 2023 (see Box 1.1). A total of USD 17bn of flows to ASEAN were recorded on 8 May 2022, compared to USD 6bn a week before. This could possibly be attributed to withdrawals from Terra-connected Anchor protocol in the wake of the UST de-peg, and to massive withdrawals from among similar DeFi protocols, among other things, by ASEAN-based investors.

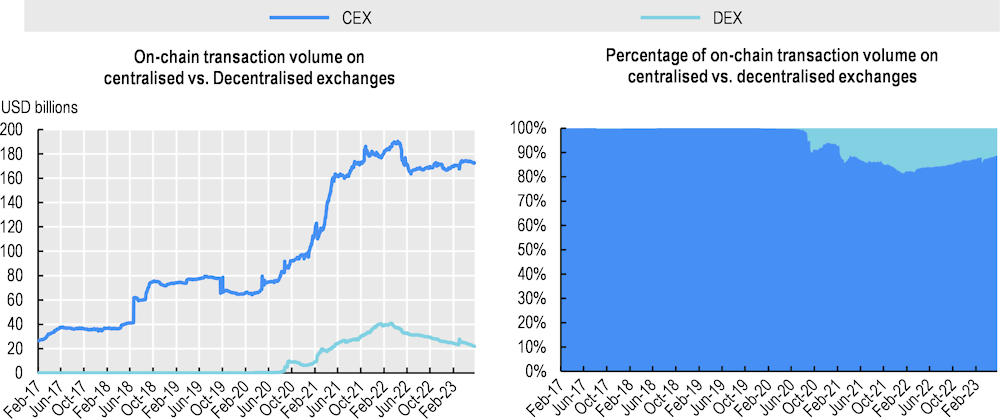

Increased activity of decentralised finance markets in times when crypto-asset valuations are high is an indication of speculative forces driving these markets. Indeed, speculation and the potential for high returns are considered as the main drivers of investor interest and participation in this space (OECD, 2022[4]). There are no fundamental drivers of the surge in crypto-asset prices in what seems to be a market largely driven by speculation, given the very high returns that can be achieved due to the massive volatility of crypto-assets (excluding stablecoins), and the fear of missed returns (so-called fear of missing out or ‘FOMO’). These forces are intensified given the extensive recycling of profits from some crypto-asset activities to others for example from mainstream crypto, such as Bitcoin, to DeFi protocols. The reflexive character of crypto-assets further intensifies these trends of common pattern in levels of activity asset types and regions.