This chapter presents Thailand’s economic context, emissions profile and its climate and energy ambitions and targets. It describes the governance and institutional context of Thailand’s energy policy as well as the structure of its electricity market, renewable energy potential and the main characteristics of its power mix. Finally, the chapter examines the renewable energy finance and investment landscape, focusing on policies and financial incentives on renewable energy as well as on sustainable finance, including analysis of Thailand’s sustainable finance taxonomy. The chapter ends with an overview of the latest trends on renewable energy investments in Thailand.

Clean Energy Finance and Investment Roadmap of Thailand

1. Introduction: key trends and policies for financing renewable energy and energy efficiency in Thailand

Abstract

Thailand’s economic context and clean energy ambitions

Thailand has achieved significant economic and social progress since the 1960s, with fast continuous growth until the 2010s, when Thailand’s growth started to lose momentum compared to other countries in Southeast Asia. The already softer growth momentum was further weakened by the economic downturn from the pandemic (OECD, 2023[1]).

The Thai economy has experienced a later and weaker recovery from the pandemic than other countries in the region. Thailand’s economy was heavily affected by rising energy and food prices, which caused a cost-of-living crisis and a delay in structural reforms (OECD, 2023[1]). After a severe downturn, the recovery picked up rapidly, bolstered by the strong rebound of inbound tourism, and the increase in exports and domestic demand. According to the OECD (2023[1]), as the Thai economy is recovering, Thailand will now need to address several key structural issues, such as the decrease in the economy’s productivity, population ageing, the digital transition, reconfigurations of global value chains and the green transition.

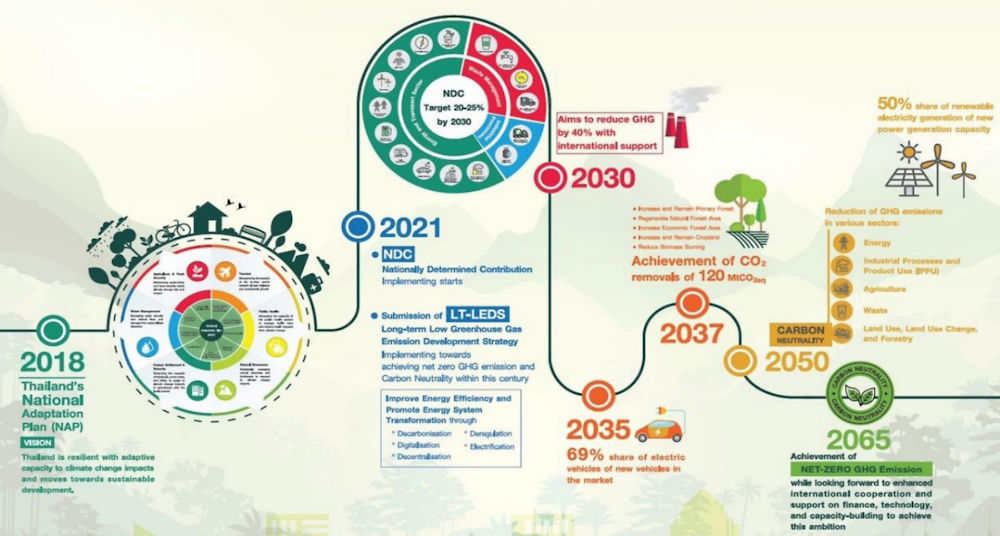

Thailand has increased efforts to decarbonise its economy in recent years. The country submitted its second updated Nationally Determined Contribution (NDC) and its revised long-term low greenhouse gas emissions development strategy (LT-LEDS) in November 2022, committing to reduce its greenhouse gas (GHG) emissions by 30% from the projected business-as-usual (BAU) level by 2030, using 2005 as a baseline year (UNFCCC, 2022[2]; UNFCCC, 2022[3]). The NDC targets emission reductions of up to 40%, subject to adequate and enhanced access to technology development and transfer, financial resources and capacity building support. Furthermore, Thailand committed to meet the long-term goal of carbon neutrality (net-zero CO2) by 2050 and net-zero GHG emission by 2065 (Figure 1.1).

Figure 1.1. Thailand’s long-term GHG emission reduction target

Source: CASE, (2022[4]), Towards a collective vision of Thai energy transition: National long-term scenarios and socioeconomic implications, https://newclimate.org/sites/default/files/2022-11/2022-11-08_th_ltes_-_full_report.pdf.

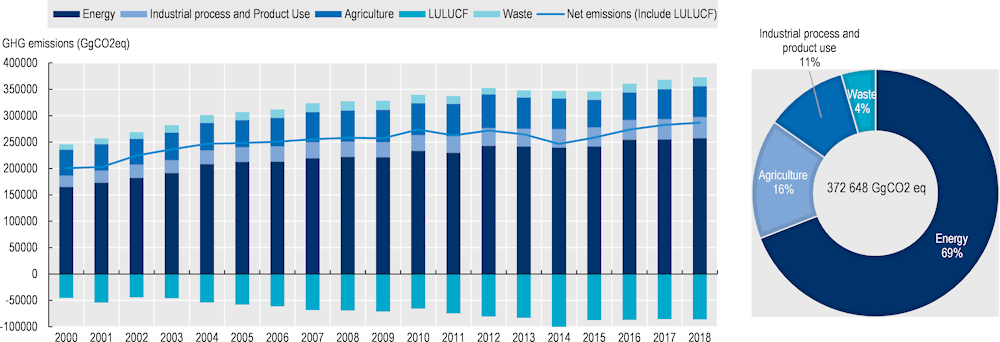

The transformation of Thailand’s energy system will be critical in realising Thailand’s long-term climate goals, as the energy sector accounted for 69% of Thailand’s total GHG emissions of 372 million tonnes (Mt) carbon dioxide-equivalent (CO2-eq) in 2018 (Thailand's Ministry of Natural Resources and Environment, 2022[5]). The remaining 31% was split between agriculture (15.7%), industrial process and product use (IPPU) (10.8%), and the waste sectors (4.5%) (Figure 1.2). Within the energy sector, most total direct GHGs came from fuel combustion (40%), followed by transport (29%), manufacturing industries and construction (20%), other sectors (nearly 7%) and fugitive emissions from fuel (just over 4%).

Figure 1.2. Thailand’s GHG emission profile

Source: Thailand's Ministry of Natural Resources and Environment (2022[5]), Thailand’s Long-term Low Greenhouse Gas Emission Development Strategy, https://unfccc.int/sites/default/files/resource/Thailand%20LT-LEDS%20%28Revised%20Version%29_08Nov2022.pdf.

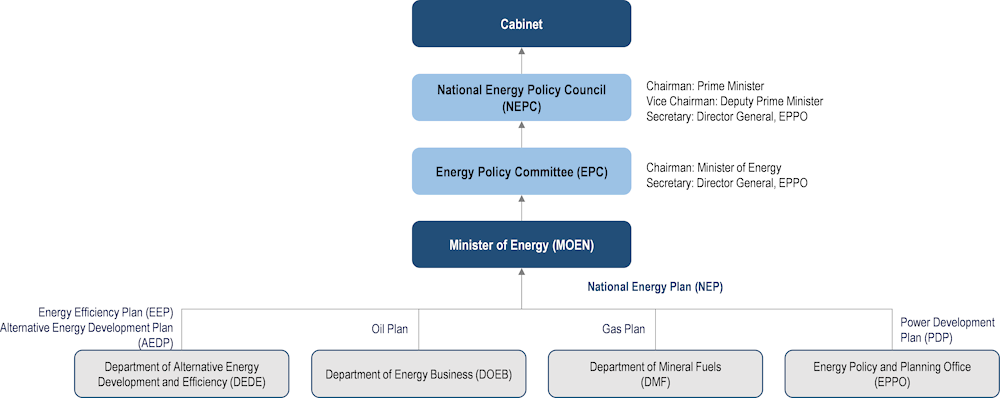

Currently, the Energy Policy and Planning Office (EPPO) of Thailand’s Ministry of Energy (MOE) is in the process of finalising its new National Energy Plan (NEP) with the goal of achieving its long-term climate targets. The forthcoming NEP will integrate five key sub-plans, namely the Power Development Plan (PDP), the Alternative Energy Development Plan (AEDP), the Energy Efficiency Plan (EEP), the Gas Plan and the Oil Plan.

The forthcoming NEP is being revised to align with the revised long-term low greenhouse gas emissions development strategy (LT-LEDS). Thailand’s 2022 revised LT-LEDS also states that to achieve carbon neutrality in 2050, the country aims to phase out oil power plants by 2025, phase down coal power plants by 2040 and phase them out by 2050, while the share of renewable electricity is estimated to reach 68% of total electricity generation in 2040 and 74% in 2050, with the rest being a combination of imports, best-in-class combined cycle natural gas and fossil- and biomass-based power plants equipped with carbon capture, utilisation and storage (CCUS) (UNFCCC, 2022[2]).

This Roadmap was developed based on three latest plans related to renewable energy and energy efficiency. These plans include the Power Development Plan 2018 – Revision (PDP 2018 Rev.1), the Alternative Energy Development Plan 2018 (AEDP 2018) and the draft version for a public hearing of the Energy Efficiency Plan 2022 (draft EEP 2022). The three plans are described in detail in Chapter 2.

Thailand’s acceleration of renewable generation capacity and energy efficiency will contribute to the country’s overall development, not only in terms of economic growth but also social wellbeing and environmental protection. The clean energy transition will not only reduce import dependency on fossil fuels, thereby increasing energy security and mitigating climate change by reducing GHG emissions, but also contribute to socio-economic development, such as by creating new green jobs and environmental sustainability, e.g. by reducing air pollution.

Governance and institutional context of Thailand’s energy policy

The Ministry of Energy (MOE) governs the energy and electricity sector in Thailand and has the main responsibility over renewable energy and energy efficiency policies. Several agencies within the MOEN support this work, including the Department of Alternative Energy Development and Efficiency (DEDE), which designs and implements renewable energy and energy efficiency policymaking and the Energy Policy and Planning office (EPPO), which recommends economy-wide energy policy and planning.

Energy policies and plans are developed under a co-ordination process between several decision‑making bodies. The MOE proposes and drafts policies that are reviewed by the Energy Policy Committee (EPC), the National Energy Policy Council (NEPC) and finally the Cabinet, before finalisation and implementation by the MOEN and its departments (Figure 1.3).

Figure 1.3. Thailand’s national energy policy: decision-making bodies

Source: Authors, based on EPPO (2021[6]), https://www.eppo.go.th/epposite/index.php/th/petroleum/oil/link-doeb/item/17093-nep and Ministry of Energy (2024[7]), https://energy.go.th/th/official-structure.

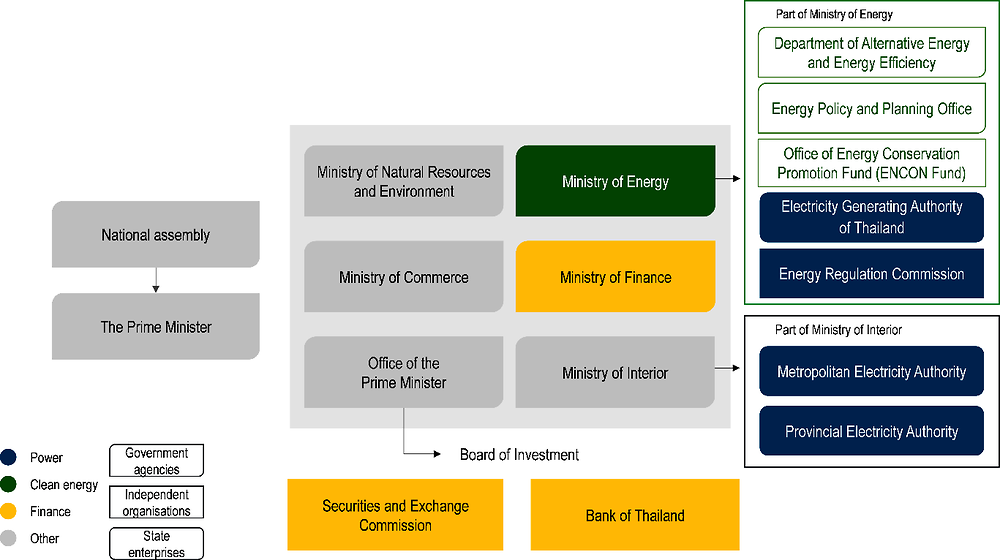

Several other institutions are responsible for areas related to clean energy finance and investment regulations in Thailand (see Figure 1.4 below):

The Electricity Generating Authority of Thailand (EGAT) is a state-owned enterprise under the supervision of the Ministry of Energy and Ministry of Finance.

The Energy Regulatory Commission (ERC) of Thailand is an independent agency whose mission is to regulate energy industry operations, including the electricity industry, the natural gas industry and the energy network.

On the investment side, the Board of Investment (BOI) is a government agency under the Office of the Prime Minister, which promotes inward and outward-bound investments, including for energy‑related sectors.

The Bank of Thailand (BOT) is Thailand’s central bank, which formulates and implements monetary policies, supervises and regulates financial institutions, and manages foreign exchange.

The Securities and Exchange Commission (SEC) aims to ensure an efficient, dynamic and inclusive functioning of Thailand’s capital market.

Figure 1.4. Thailand’s clean energy finance: Institutional context

Source: Authors

Thailand’s electricity market: institutional context and structure

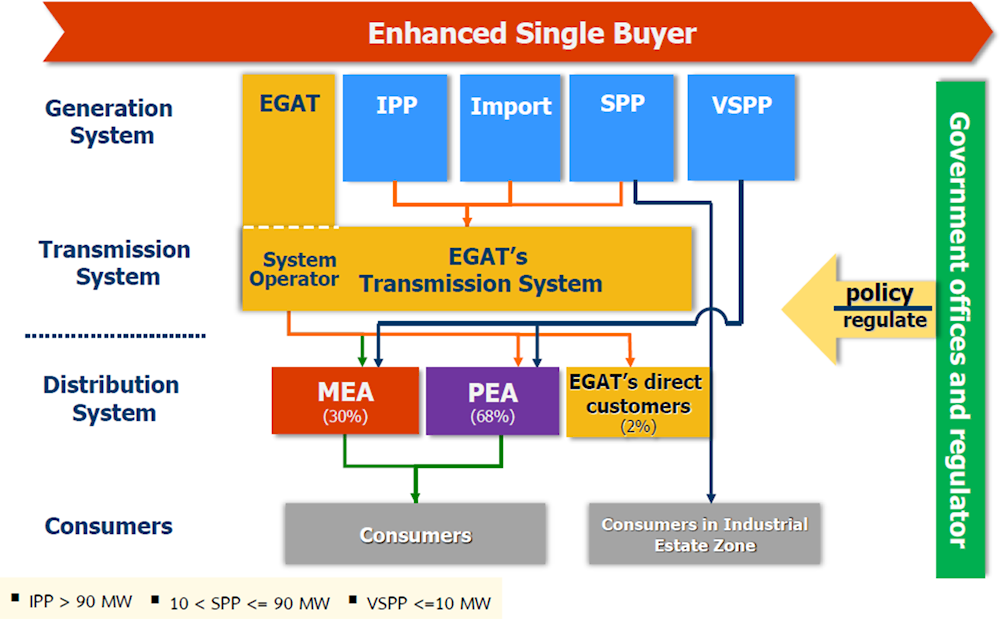

In addition to the Ministry of Energy, the main actors of Thailand’s electricity market include the Energy Regulatory Commission (ERC), the government-owned utility company EGAT (responsible for the transmission grid and 34.5% of total electricity generation), the distribution utility companies, namely the Metropolitan Electricity Authority (MEA) and the Provincial Electricity Authority (PEA), as well as private power producers (see Figure 1.5). The power utility EGAT plans and operates the power system. EGAT sells wholesale electricity to MEA and PEA, as well as to a few industrial clients and utilities in neighbouring countries. The MEA supplies consumers in Bangkok and the metropolitan area, while the PEA supplies the rest of the country (IEA, 2023[8]).

The structure of the power system in Thailand is an enhanced single-buyer system, whereby the vertically integrated state-owned utility EGAT purchases electricity from both its own generation assets and from private power producers. Private power producers can sell electricity to the grid under three power purchase programmes, i.e. (i) Independent Power Producers (IPP), (ii) Small Power Producers (SPP), and (iii) Very Small Power Producers (VSPP). The generation assets are owned by EGAT (30%) and IPPs (33%), SPPs (18%) and VSPPs (8%) (EPPO, 2024[9]). The remaining 16% of installed capacity is sourced from outside the country and is delivered to Thailand through electricity imports. Renewable energy generation capacity is mainly owned by EGAT and VSPPs through the feed-in-tariff and -premium programmes.

The regulations on SPPs and VSPPs were significantly amended in 2007 to be more investor‑friendly and practical, including changes to the criteria for qualifying facility, calculation of the avoided cost and interconnection requirements. The practical regulations, together with the higher tariff granted to SPPs and VSPPs producing electricity from renewable energy, have allowed rapid expansion since 2007. However, the regulated power set-up contributes to a lock-in of fossil fuel technologies and the overall inflexibility of the power system, hindering renewable energy uptake (World Bank Group, 2023[10]).

Figure 1.5. Overview of the electricity market and institutional context in Thailand

Note: IPP > 90 MW; 10 MW < SPP <= 90 MW; VSPP <= 10 MW

Source: EPPO (2017[11]), Public-private partnership in energy sector, https://slidetodoc.com/asean-summit-publicprivate-partnership-public-private-partnership-in/.

Thailand’s power sector

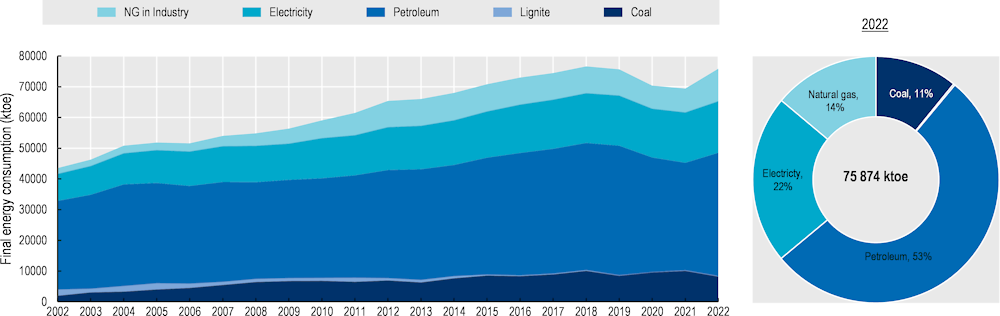

By end of 2022, Thailand's final energy consumption totalled 75 874 thousand tonnes of oil equivalent (ktoe), increasing at an annual rate of 2.8% since 2002. According to EPPO’s data, in 2022 petroleum products accounted for 53% of total energy consumption, while electricity accounts for 22% (EPPO, 2024[12]). Compared to 2021, the final energy consumption increased by 9.3% in 2022, resuming the upward trend after the COVID-19 pandemic. Total final energy consumption has increased for all sources except coal, indicating a growing effort to reduce GHG emissions (Figure 1.6).

Figure 1.6. Thailand’s final energy consumption by fuel type (2002 – 2022)

Source: Authors based on data from EPPO (2024[12]), Energy Overview, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/summery-energy.

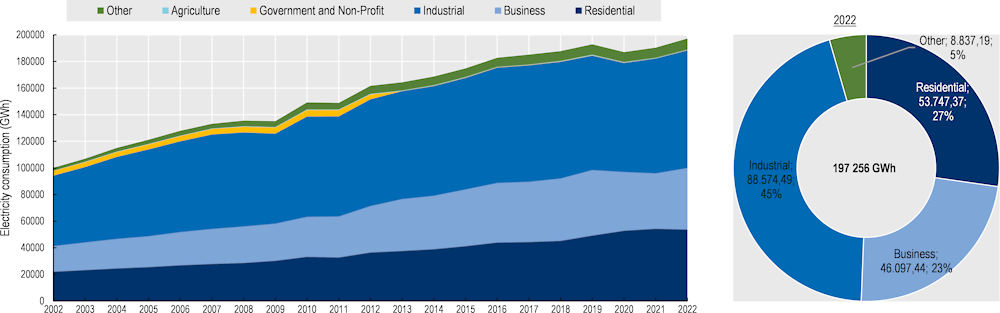

In 2022, electricity accounted for the second-largest share of energy consumption (23%), following petroleum products. As of 2022, the consumption of electricity has reached 197 256 Gigawatt hours (GWh) and has been increasing at an annual rate of over 3% since 2002. The industrial sector consumes the highest share of electricity at 45%, followed by the residential and commercial sectors at 27% and 23% respectively (Figure 1.7). The rise in electricity consumption by the residential sector during 2020-2021 was attributed to remote working practices adopted due to the COVID-19 pandemic.

Figure 1.7. Electricity consumption by sector (2002 – 2022)

Source: Authors based on data from EPPO (2024[13]), Electricity, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/static-electricity?orders[publishUp]=publishUp&issearch=1.

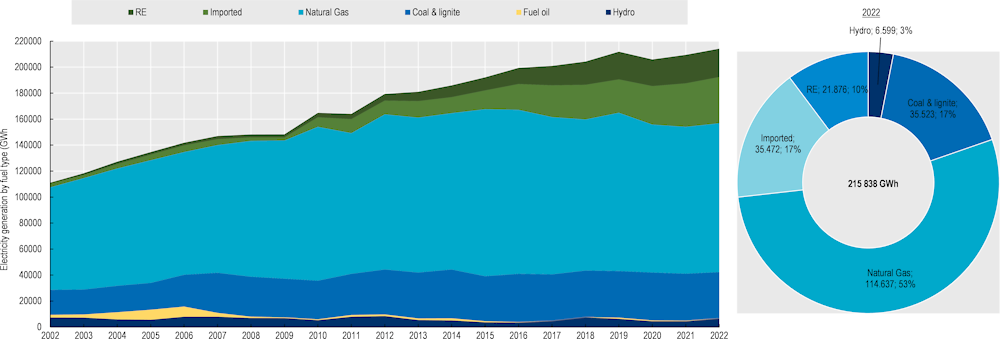

Thailand’s electricity generation primarily relies on natural gas, constituting 53% of total generation in 2022. Coal and lignite accounted for 17%, while imported electricity for 16%. According to data from EPPO, renewable energy sources made up 10% of total generation in 2022, equivalent to 21 876 GWh, marking an 18% annual increase since 2002 (Figure 1.8). Hydro made up 3% of total electricity generation in 2022, at 6 599 GWh. This implies that efforts to increase the share of renewables in electricity generation need to be scaled up significantly to achieve the renewable energy target.

Figure 1.8. Electricity generation by fuel type (2002 – 2022)

Source: Authors based on data from EPPO (2024[13]), Electricity, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/static-electricity?orders[publishUp]=publishUp&issearch=1

Due to a large share of gas in electricity generation, Thailand has a lower CO2 emission intensity compared to other Southeast Asian countries, such as Indonesia and Viet Nam, that mainly rely on coal to generate electricity. Thailand’s average CO2 emission intensity in 2022 stood at 409 grammes CO2 per kilowatt-hour (kWh). This compares with a carbon intensity of 756 g CO2/kWh in Indonesia, where coal represented 61% of its power mix in 2021, while Lao PDR reached a carbon intensity of 309 g CO2/kWh thanks to the higher share of renewable electricity (74% in 2021) (IEA, 2023[8]). At the same time, gas reliance raises security concerns in Thailand, particularly during 2022 when domestic gas production dropped, and imports have been hampered by supply disruptions and high gas prices. This led to extension of the lifetime of some coal assets and resulted in an increase in electricity prices. Gas continues to play an important role in the country as a new gas-fired power plant comprising 4 units of 660 megawatts (MW) capacity is planned to start full operation in Rayong and Chonburi by 2024 (Enerdata, 2023[14]).

Historically, Thailand was a self-sufficient natural gas producer until the 1990s but as demand increased significantly and the production from gas fields in the Gulf of Thailand dropped, share of imports in total consumption has increased. Additionally, Thailand is a net importer of electricity, as it relies on a mix of fossil fuel and hydropower-based electricity from its neighbours, mostly from the Lao People’s Democratic Republic (PDR), but also Cambodia, Malaysia and Myanmar (IEA, 2023[8]).

Thailand is endowed with solar, wind and biomass resource availability. The entire geography of Thailand receives high solar irradiance, especially in the central region of the country. A recent study by the Clean, Affordable and Secure Energy (CASE) for Southeast Asia estimated that Thailand has large solar technical potential, at over 300 GW when considering only high irradiance (>1,850 kWh/m2) which only takes up to less than 2% of total land area (CASE for Southeast Asia, 2022[4]). This provides a good opportunity for utility-scale and grid-connected solar photovoltaic (PV) systems as well as small-scale distributed solar, such as rooftop PV. IEA analysis demonstrated that if 10% of the available estimated rooftop surface was used for distributed solar PV, the capacity hosted would be larger than the system’s peak demand (IEA, 2018[15]). As for wind power, the largest potential exists in the Northeastern region of Thailand, with an average wind speed of 6 metres per second measured at a height of 90 metres (IRENA, 2017[16]). Most of the hydropower plants are in the northwestern regions of Thailand. However, these resources are far from country’s demand locations that are closer to central Thailand (IEA, 2023[8]). Thailand also has biomass power generation potential. Biomass and agricultural residues are available from crops including sugar cane, paddy, cassava, maize and oil palm with variations in seasonal availability. For instance, bagasse, a by-product of the sugar cane industry that can be used for electricity and heat generation is available between December and April (Visvanathan and Chiemchaisri, 2019[17]). Availability of biomass resources is location specific where agricultural activity is present, namely in northern and southern parts of Thailand (DEDE, 2024[18]).

In tropical climates, solar, wind and hydropower supply differs substantially from other climates. For example, during the rainy season, hydropower is more available in Thailand, whereas both wind and solar PV availability generally drops (IEA, 2023[8]). Moreover, hydropower is sometimes restricted by water management to ensure water resource availability for other uses (e.g. irrigation), so hydropower plants do not always produce more hydroelectricity in the wet season than in the summer and winter.

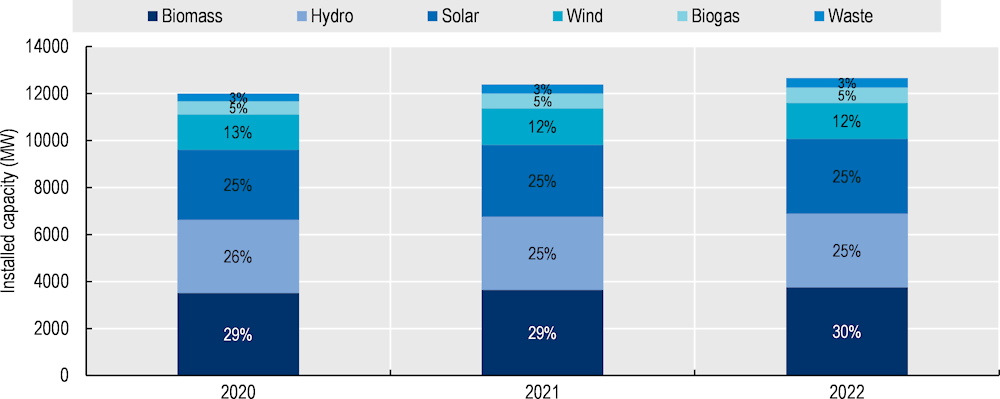

Based on DEDE statistics, the total installed capacity of off-grid and on-grid renewable energy generation in 2022 was 12 666 MW, increasing by slightly over 2% from 2021. The primary sources were biomass (30%), hydro (25%, mainly large projects) and solar (25%), as illustrated in Figure 1.9 below. The renewable mix remained the same over 2020-2022. Regarding solar, most of the grid-connected solar power capacity comes from utility-scale installations of size greater than 1 MW (Tongsopit et al., 2016[19]).

Figure 1.9. Electricity generation by renewable fuel type (2020 – 2022)

Note: Waste includes municipal solid and industrial waste. Hydro includes both large and small hydro power.

Source: Authors based on data from DEDE (2023[20]), Renewable Energy Performance, https://www.dede.go.th/articles?id=450&menu_id=1.

Thailand electricity pricing

Electricity in Thailand benefits from a national uniform tariff policy and cross‑subsidisation for certain types of user groups (Sirasoontorn and Koomsup, 2017[21]). Residential electricity tariffs range between 2.4 and 4.2 Thai Baht (THB) per kWh (0.06 – 0.11 USD/kWh), which need to be added to a monthly service charge of 8.2 to 38.2 THB/month (0.22 – 1.04 USD/month). Low-income households can have access to electricity subsidies if they exceed 150 kWh per month (SIPET, 2024[22]). On average, Thai households pay between 1.1% and 3.7% of their income on electricity, which is relatively low when compared to other ASEAN countries.

Electricity prices in Thailand are based on two components: a base rate and a variable tariff (Ft rate). The former is the fixed costs of generating electricity and the latter is flexible costs taking into account the variability in fuel and other costs and reviewed by the ERC every four months. Increases in fossil fuel prices over the past two years have been reflected onto consumers through a higher Ft rate (The Diplomat, 2023[23]). For instance, in the beginning of 2022, electricity prices increased by 4.6% as a result of the war in Ukraine (ESCAP, 2022[24]) and averaged 4.18 baht (USD 0.12) per kWh throughout 2022 (Kasikorn Research Center, 2022[25]). Long‑term gas import contracts that are on the basis of take or pay from Malaysia and Myanmar alleviate concerns about increase in electricity prices due to the upward trend in fossil fuel prices, coupled with the reduction in subsidised electricity prices. Higher electricity prices would have an impact on competitiveness of businesses and the welfare of the population. Recent analysis estimates that every 1% increase in average electricity prices in Thailand increased the average cost of business by about 0.02% in 2022-2023, when electricity costs for some sectors (e.g. textile and hospitality) represented more than 10% of the total business costs (Kasikorn Research Center, 2022[25]).

Electricity supply and demand profile, and grid infrastructure

Thailand consumed a total of 197 terawatt-hours (TWh) of electricity annually in 2022 (EPPO, 2024[13]). An additional 17 TWh per year was for auxiliary uses in power plants and related to losses in the transmission and distribution grids. Consumption by industry and buildings is roughly on par, as they collectively consumed a total of 182 TWh of electricity.

In Thailand, electricity demand is affected by variations in seasonal changes, which have an impact on industry sectors like food and tobacco as well as in the buildings sector. The summer season experiences a higher electricity load than the wet season due to higher cooling demand (IEA, 2023[8]). There are three peak demands throughout the day where evening peak is higher than the morning and afternoon peaks.

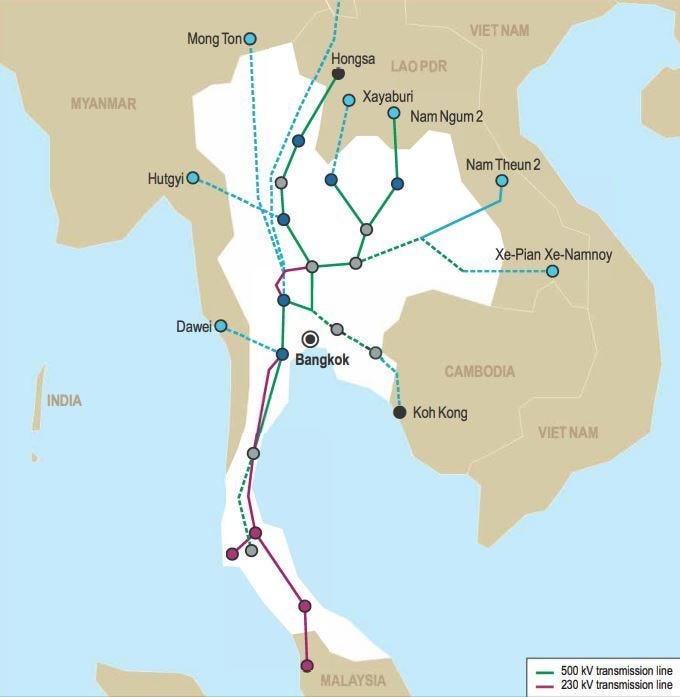

Thailand’s transmission grid that connects multiple supply and demand centres ensures a secure and reliable operation of the power system (OECD/IEA, 2018[26]) (Figure 1.10). So far it has served as a major source of flexibility for the power system, particularly as solar and wind energy penetration has been increasing over the past two decades. Other sources of flexibility have been the natural gas-based power plants and hydropower. Additionally, Thailand shares large transmission interconnections with its neighbours, including Myanmar in the west, the Lao People’s Democratic Republic and Cambodia in the east, and Malaysia in the south. An important asset for Thailand’s power system flexibility is the single 1‑gigawatt (GW) size (4 x 250 MW) pumped hydro storage plant in Lam Takhong. The plant located in northeast Thailand represents a quarter of the country’s total installed hydropower capacity and is the largest plant in the Southeast Asia region.

While Thailand’s power system has latent flexibility and a high reserve margin, as the share of renewable energy increases, higher system flexibility will be required. Results from an IEA study suggest that 15% share of variable renewable energy in the power system can be integrated by 2030 with no additional technical and contractual feasibility measures (IEA, 2021[27]). However, barriers concerning power and fuel procurement often prevent that flexibility from being accessed. IEA analysis also shows that Thailand could pursue a full suite of flexibility options, including energy storage, flexible power plants, investments to enhance the grid infrastructure and demand-side responses. For example, demand-side management programs applied to buildings cooling loads can have a key role to improve the security of the power grid (Mugnini, Polonara and Arteconi, 2021[28]). Moreover, greater flexibility could be achieved by renegotiating or converting contracts to reduce contractual barriers resulting from take-or-pay fuel supply contracts (IEA, 2023[8]). Better management of small-scale and distributed renewable power system can enhance the potential to provide flexibility within the energy system, helping to balance supply and demand and enhance overall reliability and efficiency.

Figure 1.10. An overview of Thailand’s main transmission system

Source: OECD/IEA (2018[26]), Thailand Renewable Grid Integration Assessment, https://iea.blob.core.windows.net/assets/c41cd30d-5f69-4b12-9502-3e7caaca294e/Partner_Country_Series_Thailand_Grid_Renewable_Integration_Assessement.pdf.

Renewable energy finance and investment landscape in Thailand

Policies and incentives promoting renewable energy investment

The Government of Thailand has been a key driver of the country’s renewable energy development. The government’s incentives, such as tax exemptions and higher tariffs for electricity generated from renewable sources, significantly contributed to attracting private sources of financing (domestic and international).

Since 2006, Thailand has put in place a suite of feed-in-tariff (FiT) schemes to boost the development of renewable energy in its electricity sector. The first incentive scheme was called the “adder”, a feed-in premium, whereby for every kWh of electricity produced, the power producer received an adder rate on top of the utility electricity price for 7‑10 years from the Commercial Operation Date (COD) depending on renewable energy type. The adder rates varied depending on the installed capacity of the SPPs or VSPPs and the type of renewable power plant. The scheme was put into effect in 2011 and stopped in 2014 for new projects. With declining costs across various renewable energy technologies, especially for solar installations, in 2015, the government replaced the “adder” with a competitive bidding FiT set as the ceiling price. Thailand’s FiT for solar PV decreased continuously from 11.50 baht/kWh (normal tariff at 3.50 baht/kWh plus the “adder” at 8 baht/kWh) in 2006 to 4.16 baht/kWh in 2016 as a result of the rapid global decline in the price of photovoltaic (PV) systems and changing market conditions (Sagulpongmalee, Therdyothin and Nathakaranakule, 2019[29]). In 2022, Thailand introduced a new quota of 5 GW under the FiT scheme for the period between 2022 and 2030 (Watson Farley & Williams, 2022[30]). This quota is exclusively for ground‑mounted solar, wind power, battery storage and biogas from wastewater and waste. Further details on the FiT programme for small-scale renewables can be found in Chapter 3.

In addition to the FiT scheme, the Board of Investment (BOI) provides investment incentives for renewable energy and energy efficiency projects. These include a wide range of incentives such as up to eight years of corporate income tax exemptions, import duty exemptions for machinery and raw materials used in research and development (R&D), an immigration fast track for foreign workers, and permission to own land (Thailand Board of Investment, 2023[31]).

The incentive measures discussed above contributed to the increase in and acceleration of solar deployment in Thailand and to the decrease in solar PV total installed costs. In Thailand, the solar PV total installed cost in the residential and commercial sectors decreased by almost 67%, from 4 065 USD/kW in 2013 to 1 354 in 2020 (IRENA, 2021[32]).

In 2022, Thailand introduced the concept of the Utility Green Tariff (UGT) scheme to allow power consumers to purchase renewable electricity at a special utility tariff rate. The main objective of the UGT programme is to promote the development of renewable energy power plants while ensuring that the general public is not overburdened. The Energy Regulatory Commission (ERC) has proposed two price structures for the UGT program, one for existing renewable energy power plants from unspecified renewable sources, and the other for new or existing plants from specified sources. These price structures and related criteria were released for public hearing in January 2024.

Sustainable finance initiatives

Thailand’s financial sector and banking system appear sound and mature, with local commercial banks showing high capital adequacy and high liquidity coverage ratios (OECD, 2023[1]). However, private debt remains relatively high, which can weigh on domestic demand especially with the current context of high interest rates. Moreover, current licensing requirements remain burdensome for some businesses to access financing. Easing license requirements and assisting businesses with compliance would ease their access to loans.

Thailand made significant progress on sustainable finance and investment, with a growing local green and sustainable bond market and increasing investor awareness towards climate- and sustainability-related risks and opportunities (ADB, 2022[33]). Outstanding green, social, and sustainability bonds (GSS) in Thailand were worth United States Dollars (USD) 9.5 billion as of 2022, with private issuances leading the way and green bonds being the most common bond type (ESCAP, 2023[34]). Most GSS bonds were issued in Thai baht, showing the maturity of the local currency bond market. However, the GSS bond market in Thailand remains relatively small, compared to the standard local currency bond market (ADB, 2022[35]).

Thailand was one of the first countries in the world to issue a sustainability bond. In 2020, the Government of Thailand issued a 15-year bond to finance a range of green and social projects, which paved the way for a follow-up sovereign issuance, bringing the total amount raised to THB 247 billion (approximately USD 7.1 billion) as of 2022 (Ministry of Finance of Thailand, 2022[36]). Of the first sustainability bond proceeds, only 17% was allocated to green projects (mainly for clean transportation), while the rest was used to support COVID-19 recovery packages. The sustainability bond issuance was based on the Sustainable Financing Framework, which the Government of Thailand developed to issue green, social and sustainability financing instruments (Kingdom of Thailand, 2020[37]).

In 2019, the Thai Sustainable Finance Working Group was established within the “Three Regulators Steering Committee”, composed of representatives of the Bank of Thailand (BOT), the Securities and Exchange Commission (SEC), the Office of Insurance Commission (OIC) and the Ministry of Finance (MOF). The Working Group has the mandate to foster and monitor a culture of sustainable finance within the Thai financial sector. In 2022, the Working Group laid down the key priorities on sustainable finance for Thailand in its document titled “Sustainable Finance Initiatives for Thailand” (Thailand Working Group on Sustainable Finance, 2021[38]), which include:

Developing a practical national sustainable finance taxonomy to promote inward investment flows across Thailand’s financial subsectors from domestic and international investors and support better informed and more efficient decision-making and responses to investment opportunities that contribute to achieving national sustainable development objectives.

Improving the data environment to encourage the flourishing of new products and markets which meet the sustainability criteria of a wider and more diverse range of investors and position Thailand against other sustainable finance centres.

Implementing effective incentives to facilitate and promotes policies and mechanisms that incentivise financial flows towards sustainable development, including fiscal and prudential policies as well as viable non-financial approaches.

Creating demand-led products and services in order to build real underlying demand for sustainable products and services.

Building human capital to improve the quality of day-to-day interactions among relevant stakeholders by enhancing the skills, competences, values, and behaviours of the management and staff of the financial sector.

In recent years, financial authorities in Thailand have developed a wide range of sustainable finance policies, guidelines and codes, in addition to industry guidelines and platforms developed by industry associations. For example:

The Securities and Exchange Commission of Thailand (SEC) developed Sustainability Reporting Guidelines, which are mandatory for publicly listed companies, as well as Green, Social and Sustainability (GSS) Bond Issuance Guidelines, and Guidelines on Management and Disclosure of Climate-related Risk by Asset Managers.

In 2019, the Thai Bankers’ Association (TBA) developed the Sustainable Banking Guidelines for Responsible Lending, which were adopted by all TBA members.

The Stock Exchange of Thailand (SET) also promotes the disclosure of environmental, social and governance (ESG) data of the Thai listed companies, including sustainability assessment results and a list of sustainable stocks.

In 2019, the SEC waived approval and filing fees for GSS bonds issued between May 2019 and May 2025.

The SEC also launched the Investment Governance Code, which contains guidance reflecting internationally accepted standards for responsible investment.

In addition, the SEC and the Thai Bond Market Association collaborated to design and launch the Sustainable Information Platform to serve as an information centre for GSS bonds.

Moreover, in 2022, the SEC issued regulations for the disclosure standards of the Sustainable and Responsible Investing Fund to widen access for retail investors.

In 2023, The Association of Southeast Asian Nations (ASEAN) stock exchanges, including Thailand’s, agreed on a common set of ESG metrics to encourage the disclosure of consistent ESG information across the region.

In the insurance space, the Office of the Insurance Commission (OIC) is also promoting good ESG practices among insurance companies.

In addition, in 2023, the BOT issued a policy statement on “Internalizing Environmental and Climate Change Aspects into Financial Institution Business”. The policy statement contains expectations for financial institutions to systematically assess the environmental impact both in terms of opportunities and risks in the decision-making process and operations, governance, strategy, risk management as well as disclosure. The BOT requested financial institutions to apply this policy statement in accordance with their organisational structure and size, as well as the materiality of environmental risks on their business (Bank of Thailand, 2023[39]).

Most notably, in 2023, the Thailand Taxonomy Board, composed of representatives of the BOT and the SEC, developed the first phase of a transition taxonomy to classify economic activities and facilitate the development of green, transition and sustainable finance products (Thailand Taxonomy Board, 2023[40]). The Thai taxonomy is designed to cover six environmental objectives: climate change mitigation; climate change adaptation; sustainable use and protection of marine and water resources; protection and restoration of biodiversity and ecosystems; pollution prevention and control; and resource resilience and transition to a circular economy. The first version of the Thai Taxonomy developed screening criteria and thresholds only for the climate change mitigation objective, as a start, and it incorporates the principles of Do No Significant Harm (DNSH) to the other five objectives, i.e. activities that are in line with mitigation thresholds shall comply with generic DNSH requirements to ensure no damage to the other environmental objectives. Any activity eligible for the Thai taxonomy also needs to ensure that it does not generate a negative social impact and observes minimum social safeguards, based on a list of local and international policies and principles.

The Thai taxonomy employs a traffic light system that distinguishes between green, amber (transitional) and red activities depending on their contribution to mitigation objectives. As part of the first phase, the Thai taxonomy established green, amber and red quantitative thresholds to classify activities in the energy and transportation sectors. All thresholds are subject to review every three to five years in accordance with new data and technological development. The second phase of the Thai taxonomy – currently under development – will cover manufacturing, agriculture, real estate, construction and waste (Thailand Taxonomy Board, 2023[41]).

The green threshold of energy activities in the Thailand Taxonomy has been established as 100 grams of carbon dioxide equivalent per kilowatt-hour of electricity generated (gCO2e/kWh) until 2040 and will decline to 50 gCO2e/kWh afterwards. This threshold is in line with international good practice, such as the Climate Bonds Initiative (CBI) and European Union (EU) taxonomies. The amber threshold is applicable to “transitional” activities, i.e. those that have not yet achieved net-zero emissions but are on a credible decarbonisation pathway. The amber threshold is applicable only to existing activities (e.g. retrofits of existing assets), whereas new activities are supposed to adopt purely green technologies. 2040 is established as a sunset date for the amber threshold. After this date, all activities need to achieve the green threshold. The sunset date may be subject to change based on new technological and scientific developments. The amber thresholds are based on Thailand’s NDC pathways and the Long-Term Low Greenhouse Gas Emission Development Strategy. Table 1.1 below summarises the main thresholds for energy activities under the first phase of the Thai taxonomy, but it is worth noting that the taxonomy includes additional quantitative and qualitative thresholds for every energy activity.

Table 1.1. Summary thresholds for energy sector activities according to the Thai taxonomy (gCO2e/kWh)

|

|

2022-2025 |

2026-2030 |

2031-2035 |

2036-2040 |

2041-2045 |

2046-2050 |

|---|---|---|---|---|---|---|

|

Green Activities |

100 |

100 |

100 |

100 |

50 |

|

|

Amber Activities |

381 |

225 |

191 |

148 |

N/A |

N/A |

|

Red Activities |

>381g |

>225g |

>191g |

>148g |

>50g |

>50g |

Note: After 2040, the sunset date, the amber classification is no longer available (amber activities will have reached the green threshold by then).

Source: Thailand Taxonomy Board (2023[40]), Thailand Taxonomy Phase I, https://www.bot.or.th/content/dam/bot/financial-innovation/sustainable-finance/green/Thailand_Taxonomy_Phase1_Jun2023_EN.pdf.

Renewable energy activities (solar, wind, marine energy generation) all classify as green, whereas hydropower, geothermal, bioenergy generation, energy production from natural gas and renewable non‑fossil gaseous and liquid fuels (including hydrogen), and co-generation of heating and cooling using renewables can be classified as either green, amber or red, depending on their mitigation performance. Energy efficiency measures are covered under these energy sector criteria by means of establishing thresholds using emission intensity (gCO2 per unit of production). In order to achieve a certain threshold, an energy activity must reduce its emission intensity, including by implementing measures to improve efficiency as an option.

The Thai Taxonomy is closely aligned with the ASEAN Taxonomy for Sustainable Finance (ASEAN taxonomy), which is a guide designed to promote the development of sustainable finance taxonomies across ASEAN member states (ASEAN Taxonomy Board, 2023[42]). The ASEAN taxonomy allows for both a principle-based assessment and a threshold-based classification of activities with different “tiers” (i.e. levels of performance), to accommodate for differences in levels of development and starting points of ASEAN countries. The ASEAN taxonomy sets technical screening criteria for some priority sectors (electricity, gas, steam and air conditioning (AC) supply). Criteria for other sectors will be developed in subsequent versions of the Taxonomy. Overall, for the energy sector, the green thresholds of the Thai taxonomy are broadly aligned with the ASEAN taxonomy, whereas amber thresholds under the Thai taxonomy are more ambitious than the ASEAN taxonomy.

Feedback from the stakeholder consultation workshops conducted for this report also revealed that while the financial sector has grown accustomed to energy efficiency financing and Thailand's taxonomy has emerged as a significant driver for financial institutions to support green activities, undertaking technical assessments of taxonomy alignment remains complex.

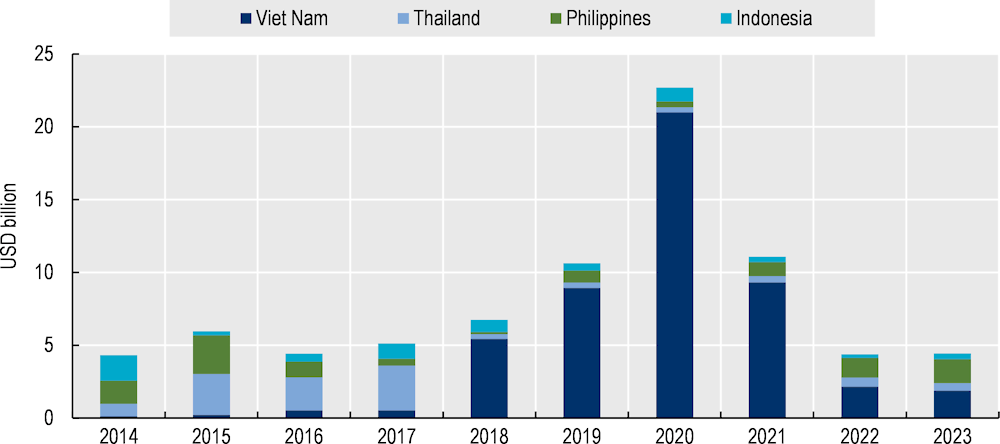

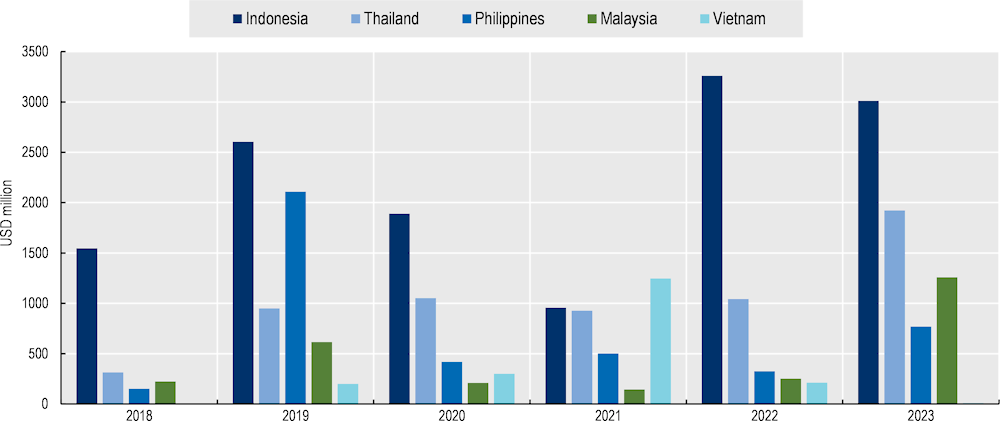

Estimated trends on finance and investment for renewable energy in Thailand

Despite increases in renewable energy investments in Thailand from 2013 until 2017, outstanding policy unpredictability and overcapacity issues might have hindered renewables investments in Thailand until today (IRENA and CPI, 2023[43]). According to data from BloombergNEF (BNEF), Thailand attracted over USD 11 billion of renewable energy investment from 2014 to 2023. In terms of cumulative volume, when compared to other Southeast Asian countries, renewable energy investment in Thailand over the 2014-2023 period are approximately on par to those in the Philippines. Renewable energy investments in Thailand saw a peak in 2017, when they reached over USD 3 billion, and declined since then (Figure 1.11). According to IRENA and the Climate Policy Initiative (CPI), this is partially explained by the overcapacity in the system where the installed capacity exceeded demand by 40%. Additionally, policy uncertainty might have hindered renewable energy investment by the private sector (2023[43]).

Figure 1.11. Renewable energy investments in selected Southeast Asian countries (2014-2023)

Note: This data includes new investments only.

Source: Authors, based on data on renewable energy investment data from BloombergNEF (BNEF).

Domestic public finance for renewable energy and energy efficiency

The main sources of domestic public finance for clean energy in Thailand include (Frankfurt School - UNEP Collaborating Centre for Climate & Sustainable Energy Finance, 2012[44]; Parliamentary Budget Office, 2022[45]):

National budget: The Thai government has allocated resources for the development of renewable energy in Thailand from its national budget. The budget for renewable energy development is primarily allocated to the Ministry of Energy and, in 2022, it stood at THB 2.7 billion (USD 77.5 million) whereas THB 1.1 billion (USD 32.6 million) was devoted to promoting competitiveness through the promotion of renewable energy (RE), energy efficiency (EE), enhanced energy security and regulating energy prices.

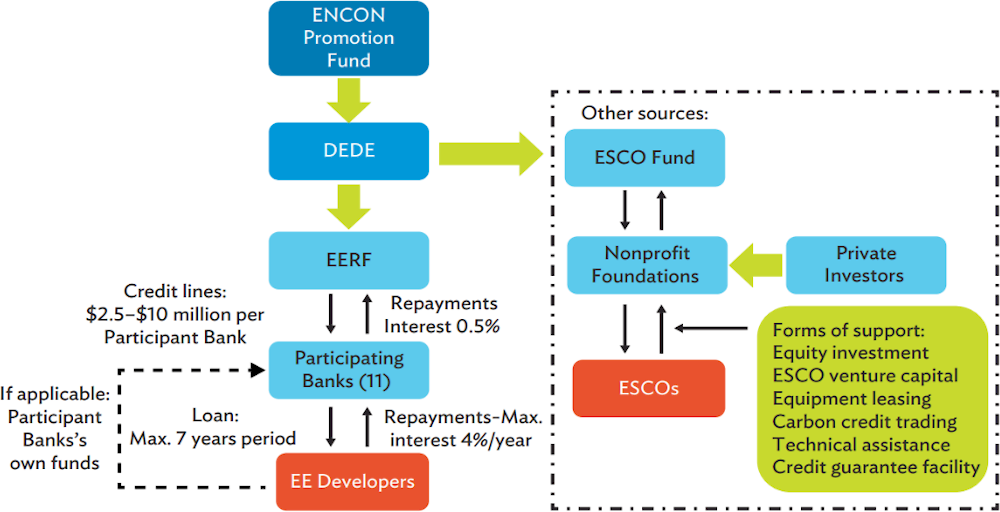

Energy Conservation Promotion Fund (ENCON Fund): Established under Thailand's Energy Conservation and Promotion Act, this fund has been the Thai government's key financial mechanism for supporting renewable energy and energy efficiency development. A budget of THB 3 billion (USD 99 million) from the ENCON Fund was allocated for the promotion of renewable energy and energy efficiency during 2022 – 2024 to encourage both public and private investments. Various financial instruments including grants, low-cost project debt, and project-level equity have been applied. The ENCON Fund is also the main funding source for the direct subsidies programme for clean energy. The ENCON Fund is split into two main funds (see Figure 1.12):

The Energy Efficiency Revolving Fund (EERF): The EERF was initiated in 2003 to provide companies access to low-interest loans for renewable energy and energy efficiency projects, through nine rounds of implementation, running from 2003 until 2019. The EERF provided a low-cost source of funding (0% - 0.5% interest rate) to private Thai banks, who could then on-lend these funds to companies at a lower-than-market interest rate—not higher than 4% (Asia Clean Energy Partners, 2022[46]). The EERF targeted owners of private buildings and factories interested in installing energy efficiency technologies. The EERF disbursed USD 235 million from 2003 to 2012 and mobilised USD 284 million in debt financing from 13 local banks, which resulted in 294 projects mainly involving the replacement of chillers and the installation of biogas facilities (Asian Development Bank, 2022[47]). Funding was eligible for medium size projects with an installed capacity at least 1 MW.

The ESCO Revolving Fund was established to encourage private investments in viable renewable energy and energy efficiency projects, including through ESCOs (Energy For Environment Foundation, 2011[48]). The fund was implemented during 2008 – 2019 during which a total of THB 1 500 million (USD 46 million) was allocated to two fund managers, i.e. the Energy for Environment Foundation (EforE) and the Energy Conservation Foundation, Thailand (ECFT). During the first two phases, the fund amounting THB 550 million (USD 17 million) was allocated to EforE who financed 63 renewable energy and energy efficiency projects. The ESCO Fund included six financing mechanisms: equity; venture capital; equipment leasing; partial credit guarantees; carbon credit trading; and technical assistance. Venture capital investments are conducted through a sub-fund, the ESCO Venture Capital Fund.

Power Development Fund, established in 2010, aims to enhance the livelihood and quality of life of communities nearby power plants as well as to support the development of Thailand's power sector by providing financing for renewable power projects. In 2022, a budget of THB 341 million (approximately USD 10 million) was allocated to promote RE.

Figure 1.12. Structure of the Energy Conservation Promotion Fund (ENCON Fund)

Source: ADB (2022[47]), Financing Clean Energy in Developing Asia—Volume 2, https://dx.doi.org/10.22617/TCS220368-2.

The ENCON Fund has been a major source of subsidies for energy efficiency projects in Thailand. The ENCON Fund’s Direct Subsidy Scheme offers grant contributions of 20%, 30% or 40% of the total energy efficiency equipment costs, with the minimum and maximum funding amounts in 2018 being THB 30 000 (USD 928) and THB 1.5 million (USD 46 729), respectively (ACE and GIZ, 2019[49]). The ENCON Fund also has performance-based grants, i.e. financial support determined by the financial savings resulting from energy efficiency measures. This included notably the demand side management (DSM) bidding programme, which provided subsidies based on actual energy savings through a bidding mechanism, whereby proposals with lower-weighted subsidy rates were subsidised first. The ENCON Fund’s grant arm also provided tax incentives offering a total of 25% VAT tax exemptions of the purchasing cost of energy-efficient equipment/machinery, until 2018 (ACE and GIZ, 2019[49]).

International development finance for renewable energy

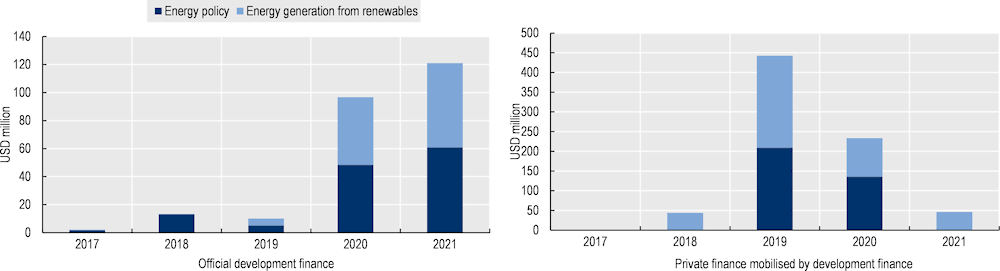

International development finance has been instrumental to mobilise renewable energy investments in Thailand. Official development finance1 for energy generation from renewables and mitigation-related energy policy in Thailand is on an upward trend since 2019 and reached a peak of over USD 121 million in 2021 (Figure 1.13). Private finance mobilised by official development finance for the same sectors has been declining since 2019 and stood at USD 46 million in 2021.

A wide range of bilateral and multilateral development finance providers are active in Thailand. Japan, Germany, the United States, Denmark and Canada are among the most active bilateral development finance providers for renewable energy in the country, and the Asian Development Bank (ADB), the International Bank for Reconstruction and Development (IBRD) and the Global Environment Facility (GEF) are the key multilateral providers.

Figure 1.13. Development finance and private finance mobilised for renewable energy in Thailand

Note: Official development finance data presented include both Official Development Assistance (ODA) and Other Official Flows (OOF), provided by both bilateral and multilateral providers. OOF include: grants to developing countries for representational or essentially commercial purposes; official bilateral transactions intended to promote development, but having a grant element of less than 25%; and official bilateral transactions, whatever their grant element, that are primarily export-facilitating in purpose (OECD, 2024[50]). Source: OECD (2024[51]), Creditor Reporting System (CRS) database, OECD Data Explorer • Mobilised private finance for development.

Private financing for green infrastructure and sustainable energy

Private financing plays a crucial role in the development of renewable energy projects in Thailand, as government funding alone is not sufficient to meet the country's renewable energy targets. Private financing for renewable energy in Thailand takes several forms, including:

Project financing: This involves raising capital for a specific renewable energy project. The financing is typically structured on a non-recourse or limited recourse basis, whereby the lender can claim only the project’s assets with no further claim against the borrower's other assets in the event of default (non-recourse) or can have limited claims beyond the project’s assets under specific conditions (limited recourse).

Corporate financing: This involves raising capital for a renewable energy company, which can use the funds to develop multiple projects with activities reflected on the sponsor’s balance sheet. Unlike project finance, which is confined to specific projects, corporate finance deals with broader financial strategies of an entire organisation.

Crowdfunding: This involves raising small amounts of money from a large number of people through an online platform. Crowdfunding is a relatively new form of financing for renewable energy projects in Thailand.

Typical private financial instruments used for clean energy in Thailand include:

Green bonds: they are any type of bond instrument where the proceeds or an equivalent amount will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible green projects (ICMA, 2021[52]). Unlike plain vanilla bonds, the proceeds from green bonds are exclusively used to finance or refinance projects with clear environmental benefits. In Thailand, green bonds are becoming an increasingly popular way to finance renewable energy projects.

Green loans: they are any type of loan instruments and/or contingent facilities (such as bonding lines, guarantee lines or letters of credit) made available exclusively to finance, re-finance or guarantee, in whole or in part, new and/or existing green projects (LMA, 2023[53]).

The standards used to issue a green bond or extend a green loan in Thailand include the Green Bond Principles issued by the International Capital Market Association (ICMA), the ASEAN Green Bond Standards issued by the ASEAN Capital Markets Forum and the Green Loan Principles issued by the Loan Market Association (LMA) in 2020 (Thailand Working Group on Sustainable Finance, 2021[38]). Thailand’s taxonomy can be used to identify eligible projects that can be financed through green bonds or loans (further details on the Thai taxonomy are elaborated later in this chapter) (Thailand Taxonomy Board, 2023[41]).

Thai commercial banks are increasingly setting ambitious targets to promote green financing and sustainability strategies. Bank of Ayudhya, Government Savings Bank and Kasikornbank are signatories of the Principles for Responsible Investment (UNEP FI, 2024[54]). Among Thailand’s largest and most active financial institutions in clean energy include the following list and Table 1.2 below provides an overview of the main loan programmes for renewable energy and energy efficiency in Thailand:

Kasikornbank (KBank) is considered one of the green financing leaders in Thailand, with dedicated units working on renewable energy and energy efficiency projects. KBank is committed to a net-zero target for its operations by 20302 and to a goal of allocating at least THB 100‑200 billion (USD 3-6 billion) in sustainable financing and investment by 2030 (KBank, 2022[55]). To achieve its sustainability goals, KBank offers several loan schemes for renewable energy and energy efficiency projects, such as solar energy, lighting solutions and energy savings, with favourable interest rates.

Siam Commercial Bank (SCB) has commitments to sustainability targets under three pillars – sustainable finance, creating social impact, and a better environmental future. Its sustainable finance targets related to clean energy include: (i) funding and raising THB 53 000 million (USD 1523 million) to support the Sustainable Development Goals (SDGs); (ii) developing at least 100 Environmental, Social, and Governance (ESG) financial products; and (iii) integrating ESG considerations as part of credit and advisory policies and processes (Siam Commercial Bank, 2021[56]).

Bangkok Bank (BBL) has sustainable finance-related targets, such as providing eco-friendly loans and integrating EGS issues into its policies and credit approval processes. The Bank already offers a range of sustainable finance products, such as green loans (especially for RE), sustainability‑linked loans, sustainable bonds and sustainable mutual funds (Bangkok Bank, 2022[57]).

Several commercial banks in other countries in the region are also active in financing and supporting clean energy projects in Thailand. One example is the Singaporean bank UOB, which in 2021 launched a financing platform to drive the development and adoption of energy efficiency projects for buildings in Singapore, Malaysia, Thailand and Indonesia (Box 1.1 below).

Table 1.2. Overview of loan programmes for clean energy offered by Thai banks

|

Bank |

Loan programme |

Objective |

Eligibility criteria |

|---|---|---|---|

|

Kasikorn Bank (KBank) |

K-Energy Saving Guarantee Program |

Implementing energy-saving solutions, guaranteed and provided by Energy Service Companies (ESCOs). |

- Energy cost (fuel and electricity) > THB 500 000 (USD 14 368) per month. - Services provided by certified ESCO. |

|

K–Energy Saving Guarantee Program (Solar Rooftop) |

Installing solar rooftop PV. |

- Having owned and conducted businesses for at least three years. - Aiming to reduce the cost of electricity or sell solar electricity back to the grid. - Guaranteed energy savings. |

|

|

K-Energy Saving Loan under the Revolving fund for energy conservation |

Supporting projects with energy savings, with DEDE support. |

- Projects certified by DEDE and in line with the Energy Promotion Act - Maximum loan term of 7 years. |

|

|

Top-Up Loan for Energy Saving (Lighting Solution) |

Implementing energy-efficient lighting solutions, guaranteed and provided by ESCOs. |

- Entrepreneurs who use more than 12 hours of electrical lighting per day. - Projects that aim to manage energy efficiency with guaranteed energy savings or a warranty. - The supplier that conducts the project must be an ESCO, approved by the bank. - The project and customer must follow the bank's requirements. |

|

|

Siam Commercial Bank (SCB) |

SME Go Green |

Promoting energy savings and other green businesses. |

- Having operated businesses for more than four years. - Annual business sales between THB 75-500 million (USD 2 – 14 million). |

|

Green Forward |

Promoting energy efficiency, pollution control and green/sustainable businesses. |

- Having operated businesses for more than three years. - Annual business sales of no more than THB 75 million (USD 2 million). |

|

|

Bangkok Bank (BBL) |

Bualuang Green Loan |

To support MSMEs in investing in environmentally friendly solutions. |

Debt-to-equity ratio no more than 3. |

|

Krungthai Bank (KTB) |

Environmental Credits (loans) |

Supporting MSMEs to invest in waste treatment systems. |

- Equipment replacement in air/waste/wastewater control system, up to THB 50 million (USD 1.5 million). - Fermentation plant installation (to produce fertilizer), up to 20 tonnes per day. - Wastewater management system, up to 100 m per day. |

|

Loans for solar rooftop systems |

Supporting solar rooftop investments. |

N/A |

|

|

Bank of Ayudhya (Krungsri) |

Solar Roof Lending Program |

Supporting entrepreneurs wishing to install a solar roof. |

N/A |

|

Exim Bank |

Solar Orchestra by BIZ Transformation Loan |

Supporting solar rooftop investment. |

- Having businesses operated more than eight years with net positive profits for over two years. - Only for industries that are related to export activities. |

|

EXIM Kill Bill by Biz Transformation |

Supporting entrepreneurs’ replacement of chillers and use of energy saving equipment, with minimum interest rate of 2.00% per annum and a maximum loan tenor up to 7 years. |

N/A |

|

|

SME Development Bank |

Bio-Circular-Green Economy (BCG) Loan |

Supporting BCG businesses. |

Having operated businesses more than three years. |

|

Government Savings Bank (GSB) |

GSB for BCG economy |

Supporting BCG businesses, such as biodiesel, reusing, recycling, solar rooftop, etc. |

Only for BCG businesses. |

Source: Authors

Box 1.1. U-Energy: An integrated financing platform to drive energy efficiency in Thailand

Building owners, energy service companies and homeowners are expected to reduce an average of 20% in energy consumption by tapping UOB’s green financing for energy efficiency projects.

In 2022, UOB Thailand launched U-Energy, the first integrated financing platform in Asia, to drive the development and adoption of energy efficiency projects for commercial and residential buildings in the country. With U-Energy, the Bank will help businesses and homeowners save on electricity bills, cut carbon emissions and achieve their sustainability goals.

At launch, the U-Energy platform will have eight energy service companies that customers can tap for energy efficiency projects. These U-Energy partners can support common energy efficiency projects such as improving chiller and air conditioning efficiency, installing solar panels on rooftops, switching to Light Emitting Diode (LED) lights, optimising energy and power management systems and changing the building facade to reflect direct sunlight to reduce heat absorption, as well as replacing elevators with energy-regeneration technology. On average, it is expected that ESCOs on the U-Energy platform will help customers cut down energy consumption by an average of 20%.

The platform offers green finance products with favourable and flexible terms and conditions. Commercial and industrial building owners can opt for a direct purchase of the energy-efficient equipment or system with UOB Thailand’s green financing. Under this scheme, building owners may obtain a loan of up to THB 250 million (USD 7 million) with a maximum seven-year loan facility, subject to optimal equipment and system sizing by the U-Energy partners. To enable greater speed to market, loan applications from building owners who are existing UOB Thailand customers will be put on a fast-track approval process. Alternatively, building owners can take up the “energy-as-a-service” model where UOB will provide green loans to U-Energy partners at no upfront cost to building owners.

For homeowners, UOB Thailand offers a zero per cent interest instalment plan of up to 36 months when UOB credit cards are used as the mode of payment for their energy efficiency retrofitting projects.

Source: UOB (2022[58]), UOB Thailand launches U-Energy, Asia’s first integrated financing platform to drive energy efficiency, https://www.uob.co.th/investor-en/news/press-news/2022/news-23Mar2022.page.

Several institutions in Thailand have successfully issued green bonds to finance green infrastructure investment, particularly for transport and clean energy. As shown in Figure 1.14 below, green bond issuance in Thailand has been on an upward trend since 2018. Thailand is one of the countries with the highest volume of green bond issuance in Southeast Asia, following Singapore and Indonesia. According to data from Climate Bonds Initiative (CBI), a total of 80 green bonds worth USD 6.2 billion was issued from 2018 to 2023 in Thailand, with the vast majority (85%) being issued in local currency (THB) and the rest in United States dollars or euros, showing high liquidity of the local currency green bond market in Thailand. In 2023, green bond issuances in Thailand were worth USD 1.9 billion. According to data from the Thai Bond Market Association, green bonds in Thailand were mainly issued in the form of long-term corporate bonds (Thai Bond Market Association, 2023[59]). Clean energy and transport accounted for most of the green bond proceeds’ allocation (Asian Development Bank, 2022[60]).

Figure 1.14. Green bond issuances in selected Southeast Asian countries (2018-2023)

Source: Authors, based on data provided by the Climate Bonds Initiative (CBI).

References

[49] ACE and GIZ (2019), Energy Efficiency Financing Guideline in Thailand, https://agep.aseanenergy.org/wp-content/uploads/2019/05/EEF-Guideline-in-Thailand.pdf.

[35] ADB (2022), Green Bond Market Survey for Thailand, https://www.adb.org/sites/default/files/publication/801601/green-bond-market-survey-thailand.pdf.

[33] ADB (2022), Promoting Local Currency Sustainable Finance in ASEAN+3, https://www.climatebonds.net/files/reports/asean3_report.pdf.

[42] ASEAN Taxonomy Board (2023), ASEAN Taxonomy for Sustainable Finance, https://www.bot.or.th/content/dam/bot/financial-innovation/sustainable-finance/green/ASEAN-Taxonomy_ver2_202306.pdf.

[46] Asia Clean Energy Partners (2022), Thai Financial Institutions Open A New Era for Energy Efficiency Financing in Thailand, https://www.asiacleanenergypartners.com/post/thai-financial-institutions-open-a-new-era-for-energy-efficiency-financing-in-thailand.

[47] Asian Development Bank (2022), Financing Clean Energy in Developing Asia—Volume 2, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/tcs220368-2.

[60] Asian Development Bank (2022), Green Infrastructure Investment Opportunities:, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/TCS210495-2.

[57] Bangkok Bank (2022), Sustainability Report 2022, https://www.bangkokbank.com/-/media/files/investor-relations/sustainability-report/2022/sr2022_en.pdf.

[39] Bank of Thailand (2023), Policy Statement of the Bank of Thailand Re: Internalizing Environmental and Climate Change Aspects into Financial Institution Business, https://www.bot.or.th/content/dam/bot/fipcs/documents/FPG/2566/EngPDF/25660028.pdf.

[4] CASE for Southeast Asia (2022), Towards a collective vision of Thai energy transition: National long-term scenarios and socioeconomic implications, Clean, Affordable and Secure Energy (CASE) for Southeast Asia, https://newclimate.org/sites/default/files/2022-11/2022-11-08_th_ltes_-_full_report.pdf.

[18] DEDE (2024), Biomass Database Potential in Thailand, https://weben.dede.go.th/webmax/content/biomass-database-potential-thailand.

[20] DEDE (2023), Performance on Alternative Energy Policy, https://www.dede.go.th/articles?id=450&menu_id=1.

[14] Enerdata (2023), Mitsubishi commissions the 2nd turbine of a 2.65 GW CCGT project in Thailand, https://www.enerdata.net/publications/daily-energy-news/mitsubishi-commissions-2nd-turbine-265-gw-ccgt-project-thailand.html.

[48] Energy For Environment Foundation (2011), ESCO Revolving Fund, http://www.efe.or.th/escofund.php?task=&sessid=&lang=en.

[13] EPPO (2024), Electricity, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/static-electricity?orders[publishUp]=publishUp&issearch=1.

[9] EPPO (2024), Electricity by EPPO, https://public.tableau.com/app/profile/epposite/viz/5__16516658875330/sheet0.

[12] EPPO (2024), Energy overview, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/summery-energy.

[6] EPPO (2021), National Energy Plan, https://www.eppo.go.th/epposite/index.php/th/petroleum/oil/link-doeb/item/17093-nep.

[11] EPPO (2017), Public - Private Partnership in Energy Sector, https://slidetodoc.com/asean-summit-publicprivate-partnership-public-private-partnership-in/.

[34] ESCAP (2023), Sustainable Finance: Bridging the Gap in Asia and the Pacific, https://www.unescap.org/kp/2023/sustainable-finance-bridging-gap-asia-and-pacific.

[24] ESCAP (2022), The role of power system connectivity in times of high energy prices, https://www.unescap.org/blog/role-power-system-connectivity-times-high-energy-prices.

[44] Frankfurt School - UNEP Collaborating Centre for Climate & Sustainable Energy Finance (2012), Case Study: The Energy Efficiency Revolving Fund, https://unfccc.int/files/cooperation_and_support/financial_mechanism/standing_committee/application/pdf/fs-unep_thai_eerf_final_2012.pdf.

[52] ICMA (2021), Green Bond Principles, https://www.icmagroup.org/assets/documents/Sustainable-finance/2022-updates/Green-Bond-Principles-June-2022-060623.pdf.

[8] IEA (2023), Thailand’s Clean Electricity Transition, https://iea.blob.core.windows.net/assets/dd5b10b2-b655-4c7d-8c09-d3d7efe6bd50/ThailandsCleanElectricityTransition.pdf.

[27] IEA (2021), Thailand Power System Flexibility Study, https://iea.blob.core.windows.net/assets/19f9554b-f40c-46ff-b7f5-78f1456057a9/ThailandPowerSystemFlexibilityStudy.pdf.

[15] IEA (2018), Thailand Renewable Grid Integration Assessment, https://iea.blob.core.windows.net/assets/c41cd30d-5f69-4b12-9502-3e7caaca294e/Partner_Country_Series_Thailand_Grid_Renewable_Integration_Assessement.pdf.

[32] IRENA (2021), Renewable Power Generation Costs in 2020, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Jun/IRENA_Power_Generation_Costs_2020.pdf?rev=c9e8dfcd1b2048e2b4d30fef671a5b84.

[16] IRENA (2017), Renewable Energy Outlook Thailand, https://www.irena.org/-/media/files/irena/agency/publication/2017/nov/irena_outlook_thailand_2017.pdf.

[43] IRENA and CPI (2023), Global landscape of renewable energy finance, 2023, International Renewable Energy Agency (IRENA), https://www.irena.org/Publications/2023/Feb/Global-landscape-of-renewable-energy-finance-2023.

[25] Kasikorn Research Center (2022), Electricity price remains on the rise…Businesses are pressed to adapt to rising costs, https://www.kasikornresearch.com/en/analysis/k-social-media/Pages/Energy-Charge-FB-05-10-22.aspx.

[55] KBank (2022), Sustainability Report 2022, https://www.kasikornbank.com/en/sustainable-development/SDAnnualReports/Y2022_SD_EN.pdf.

[37] Kingdom of Thailand (2020), Sustainable Financing Framework, https://www.pdmo.go.th/pdmomedia/documents/2020/Jul/KOT%20Sustainable%20Financing%20Framework.pdf.

[53] LMA (2023), Green Loan Principles, https://www.lma.eu.com/application/files/8916/9755/2443/Green_Loan_Principles_23_February_2023.pdf.

[7] Ministry of Energy (2024), Government structure, https://energy.go.th/th/official-structure.

[36] Ministry of Finance of Thailand (2022), Sustainability Bond Annual Report 2022, https://www.pdmo.go.th/pdmomedia/documents/2023/Jan/Cover%20Sus%20bond%20annual%20report-edited.pdf.

[28] Mugnini, A., F. Polonara and A. Arteconi (2021), “Energy flexibility curves to characterize the residential space cooling sector: The role of cooling technology and emission system”, Energy and Buildings, Vol. 253, p. 111335, https://doi.org/10.1016/j.enbuild.2021.111335.

[51] OECD (2024), Mobilised private finance for development, https://data-explorer.oecd.org/vis?fs[0]=Topic%2C1%7CDevelopment%23DEV%23%7COfficial%20Development%20Assistance%20%28ODA%29%23DEV_ODA%23&pg=0&fc=Topic&bp=true&snb=11&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_MOB%40DF_MOBILISATION&df[ag]=OECD.DCD.FSD&df[vs]=.

[50] OECD (2024), Other official flows (OOF), https://data.oecd.org/drf/other-official-flows-oof.htm#:~:text=OOF%20include%3A%20grants%20to%20developing,are%20primarily%20export%2Dfacilitating%20in.

[1] OECD (2023), OECD Economic Surveys: Thailand 2023, OECD Publishing, Paris, https://doi.org/10.1787/4815cb4b-en.

[26] OECD/IEA (2018), Thailand Renewable Grid Integration Assessment, https://iea.blob.core.windows.net/assets/c41cd30d-5f69-4b12-9502-3e7caaca294e/Partner_Country_Series_Thailand_Grid_Renewable_Integration_Assessement.pdf.

[45] Parliamentary Budget Office (2022), Budget analysis report. Fiscal year 2022, https://www.parliament.go.th/ewtadmin/ewt/parbudget/download/article/article_20210813152628.pdf.

[29] Sagulpongmalee, K., A. Therdyothin and A. Nathakaranakule (2019), “Analysis of feed-in tariff models for photovoltaic systems in Thailand: An evidence-based approach”, Journal of Renewable and Sustainable Energy, Vol. 11/4, https://doi.org/10.1063/1.5091054.

[56] Siam Commercial Bank (2021), Sustainability targets [2021 - 2023], https://www.scb.co.th/content/dam/scb/about-us/sustainability/documents/2021/x-3-year-sustainability-target-en.pdf.

[22] SIPET (2024), Thailand Power Sector Snapshot, https://www.sipet.org/Power-Sector-Snapshot-thailand.aspx#:~:text=Tariffs%20and%20Affordability,-Residential%20electricity%20tariffs&text=Low%2Dincome%20households%20can%20make,of%20their%20income%20on%20electricity.

[21] Sirasoontorn, P. and P. Koomsup (2017), Energy Transition in Thailand: Challenges and Opportunities, https://library.fes.de/pdf-files/bueros/thailand/13888.pdf.

[59] Thai Bond Market Association (2023), Green, Social, Sustainability Bond & Sustainability-linked Bond (ESG Bond), https://www.thaibma.or.th/EN/BondInfo/ESG.aspx.

[31] Thailand Board of Investment (2023), Investment Promotion Guide 2023, https://www.boi.go.th/upload/content/BOI_A_Guide_EN.pdf.

[41] Thailand Taxonomy Board (2023), Thailand Taxonomy A Reference Tool for Sustainable Economy, https://www.bot.or.th/en/financial-innovation/sustainable-finance/green/Thailand-Taxonomy.html.

[40] Thailand Taxonomy Board (2023), Thailand Taxonomy Phase 1, https://www.bot.or.th/content/dam/bot/financial-innovation/sustainable-finance/green/Thailand_Taxonomy_Phase1_Jun2023_EN.pdf.

[38] Thailand Working Group on Sustainable Finance (2021), Sustainable Finance Initiatives for Thailand, https://www.bot.or.th/en/news-and-media/news/news-20210818.html.

[5] Thailand’s Ministry of Natural Resources and Environment (2022), Thailand’s Long-Term Low Greenhouse Gas Emission Development Strategy, https://unfccc.int/sites/default/files/resource/Thailand%20LT-LEDS%20%28Revised%20Version%29_08Nov2022.pdf.

[23] The Diplomat (2023), Who Pays and Who Profits From High Energy Prices in Thailand?, https://thediplomat.com/2023/06/who-pays-and-who-profits-from-high-energy-prices-in-thailand/.

[19] Tongsopit, S. et al. (2016), “Business models and financing options for a rapid scale-up of rooftop solar power systems in Thailand”, Energy Policy, Vol. 95, pp. 447-457, https://doi.org/10.1016/j.enpol.2016.01.023.

[54] UNEP FI (2024), Our Members, https://www.unepfi.org/members/.

[3] UNFCCC (2022), Thailand’s 2nd Updated Nationally Determined Contribution, https://unfccc.int/sites/default/files/NDC/2022-11/Thailand%202nd%20Updated%20NDC.pdf.

[2] UNFCCC (2022), THAILAND’S LONG-TERM LOW GREENHOUSE GAS EMISSION DEVELOPMENT STRATEGY (REVISED VERSION), https://unfccc.int/sites/default/files/resource/Thailand%20LT-LEDS%20%28Revised%20Version%29_08Nov2022.pdf.

[58] UOB (2022), UOB Thailand launches U-Energy, Asia’s first integrated financing platform to drive energy efficiency, https://www.uob.co.th/investor-en/news/press-news/2022/news-23Mar2022.page.

[17] Visvanathan, C. and C. Chiemchaisri (2019), Management of Agricultural Wastes and Residues in Thailand: Wastes to Energy Approach, https://faculty.ait.ac.th/visu/wp-content/uploads/sites/7/2019/01/Agri-waste2energy-Thai.pdf.

[30] Watson Farley & Williams (2022), THAILAND’S 5 GW RENEWABLE PPA FIT SCHEME: 2022-203, https://www.wfw.com/articles/thailands-5-gw-renewable-ppa-fit-scheme-2022-2030/.

[10] World Bank Group (2023), Thailand Economic Monitor: Thailand’s Pathway to Carbon Neutrality: The Role of Carbon Pricing, https://documents1.worldbank.org/curated/en/099121223123018912/pdf/P5010090ef52cc09d0b46c0af1a43820def.pdf?cid=eap_fb_thailand_en_ext.