This chapter presents estimates of the finance and investment needed to implement and reach Thailand’s clean energy plans. The estimates result from modelling work of the Thai consultancy, The Creagy, which supported the OECD with the research and analysis conducted for this Roadmap. The chapter starts with an overview of Thailand’s latest renewable energy and energy efficiency plans as well as its energy outlook to 2037. The chapter then provides an overview of the estimates of the financing needs for both renewable energy and energy efficiency. The chapter also shows estimates of the local share and the supply chain distribution of the required investments in solar PV as well as in high-efficiency cooling systems. The chapter concludes with a summary of the estimated economic impact resulting from the implementation of the current clean energy plans, in terms of value added and job creation.

Clean Energy Finance and Investment Roadmap of Thailand

2. Estimated finance and investment needs to reach Thailand’s clean energy plans

Abstract

This chapter provides estimates of finance and investment needs to meet the goals of Thailand’s National Energy Plan, as well as the economic benefits of the clean energy transition in terms of green job creation. These models can be updated to reflect the targets of the forthcoming National Energy Plan and a training to achieve this has been delivered to the Department of Alternative Energy Development and Efficiency (DEDE) of the Ministry of Energy of Thailand in 2023. The models have been developed by the Thai consultancy firm The Creagy.1 Further details on the methodology applied for the modelling work can be found in Annex C.

Thailand’s latest clean energy plans

The Ministry of Energy of Thailand has taken steps to develop a comprehensive National Energy Plan that will integrate five key energy sub-plans, including:

the Power Development Plan (PDP)

the Alternative Energy Development Plan (AEDP)

the Energy Efficiency Plan (EEP)

Natural Gas Management Plan (Gas Plan)

Fuel Management Plan (Oil Plan).

The section below outlines the existing drafts available for the PDP, the AEDP and the EEP, which are currently being revised.

Power Development Plan (PDP) 2018-2037 (Revision 1), or PDP 2018 (Rev.1)

The Power Development Plan 2018-2037 (Revision 1) or PDP 2018 (Rev. 1) aims to enhance energy security and improve energy efficiency in Thailand (EPPO, 2020[1]). The plan focuses on three key areas:

energy security − to meet the increasing demand for power and fuel diversification, aligned with the National Economic and Social Development Plan

economy − to maintain a proper cost of power generation ensuring long-term economic competitiveness

environment − to reduce the carbon dioxide footprint of power generation and emphasise renewable energy sources.

The PDP aims for a 36% share of renewable power generation by 2037. According to the plan, a total contracted capacity of 77 211 megawatts (MW) is expected by 2037, out of which 18 696 MW (24%) will come from the contracted capacity of new renewable energy power plants.

Thailand’s Alternative Energy Development Plan 2018-2037 (AEDP 2018)

The overall goal of Thailand’s current Alternative Energy Development Plan 2018-2037 (AEDP 2018) is to increase the share of renewable energy of total final energy consumption, to 30% by 2037. In 2037, total renewable energy would be consumed across three sectors, namely heating (26 901 thousand tonnes of oil equivalent (ktoe)), power (7 298 ktoe) and biofuels (4 085 ktoe). The share of renewable energy in total final energy consumption as of December 2022 was about 14% (11 524 ktoe), which is significantly below the target.

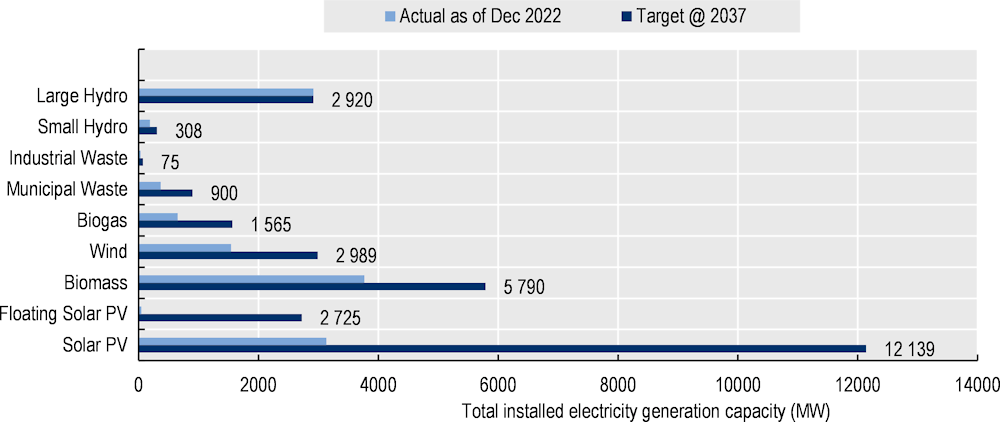

Realising the AEDP 2018 could reduce dependency on gas imports and put the energy sector on a path aligned with Thailand’s long-term climate ambitions. The AEDP aims for an expansion in renewable energy capacity in electricity generation from 12 666 MW in 2022 to a total of 29 411 MW (including large hydro) in 2037 that would represent 23% of the total electricity demand (DEDE, 2023[2]; EPPO, 2020[1]). Solar photovoltaic (PV) would represent by far the largest generation capacity (14.9 GW), followed by biomass (5.8 GW), hydro (3.2 GW) and wind (3 GW) (Figure 2.1).

Figure 2.1. Total installed electricity generation capacity development according to the AEDP 2018

Source: DEDE (2023[2]), Performance on Alternative Energy Policy, https://www.dede.go.th/articles?id=450&menu_id=1.

Thailand’s draft Energy Efficiency Plan (EEP 2022)

The draft version of the Energy Efficiency Plan (EEP 2022) is Thailand’s latest plan on energy efficiency released for a public hearing by DEDE, aiming to reduce energy intensity2 by 36% by 2037 (with 2010 as the base year) or to reduce final energy consumption (FEC) by 52 318 ktoe (DEDE, 2023[3]). From 2010 until 2021, the amount of accumulated energy savings was 16 821 ktoe; therefore, approximately 35 497 ktoe reduction of FEC (68%) is targeted under this Plan until 2037.

All sectors are planned to contribute to these savings, with savings in electricity and heat demand split as 8 761 ktoe (25% of the total) and 26 736 ktoe (75%), respectively. The transportation and industrial sectors are two key economic sectors accounting for high shares of the energy efficiency target (48% and 35%, respectively), while the commercial, residential, and agricultural sectors account for 10%, 5%, and 2%, respectively (Table 2.1 below).

Table 2.1. Energy savings contribution of different sectors towards the target under EEP 2022

|

Sector |

Total (ktoe) |

Share of total energy consumption |

|---|---|---|

|

Industrial |

12 432 |

35% |

|

Commercial |

3 542 |

10% |

|

Residential |

1 774 |

5% |

|

Agriculture |

710 |

2% |

|

Transportation |

17 039 |

48% |

|

Total |

35 497 |

Source: DEDE (2023[3]), Thailand’s Economy Update, https://www.apec.org/docs/default-source/Satellite/EGEEC/Files/60/Economy_Updates_-_Thailand.pdf.

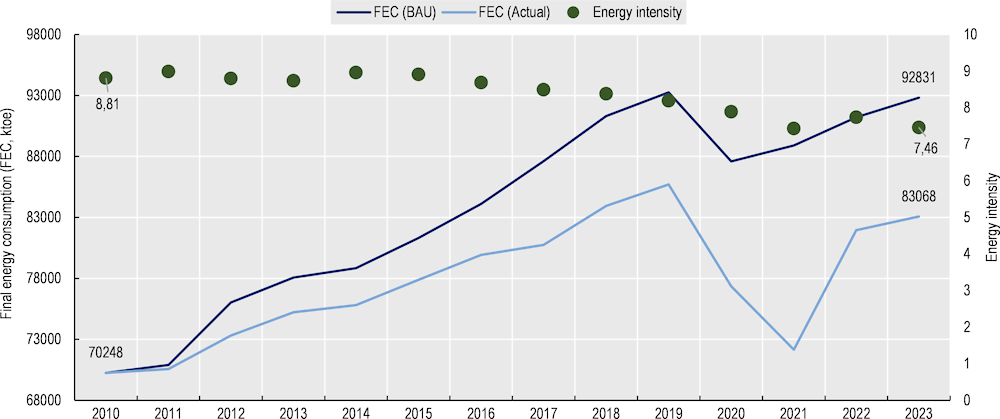

In 2023, Thailand’s final energy consumption stood at 83 068 ktoe. This was 9 763 ktoe less than the projection according to the Business-as-Usual (BAU) model (92 831 ktoe). The energy intensity in 2023 was 7.46 ktoe/billion Thai Baht (THB) or 15% decrease from the base year (2010) (see Figure 2.2).

Figure 2.2. Energy efficiency trends in Thailand (2010-2022)

Source: Authors, based on data from EPPO and DEDE (2023[4]), Performance on Energy Efficiency Policy, https://www.dede.go.th/uploads/GDP_EI_4_2566_edit_5a8f948e8c.pdf?updated_at=2024-04-04T03:32:13.061Z.

To realise the energy efficiency targets, Thailand’s EEP 2022 lays out three strategic measures (compulsory, voluntary, and complementary). Compulsory measures include energy management standards, energy codes (industrial, buildings, residential), energy efficiency resource standards, demand responses and excise taxes (eco-sticker). Voluntary measures include equipment standards and labelling, financial support (grants and subsidies, soft loans, tax incentives and credit guarantees) and innovations (smart building and big data). Complementary measures include human resources development, energy managers, energy auditors, technologies, public relation/awareness, research and development.

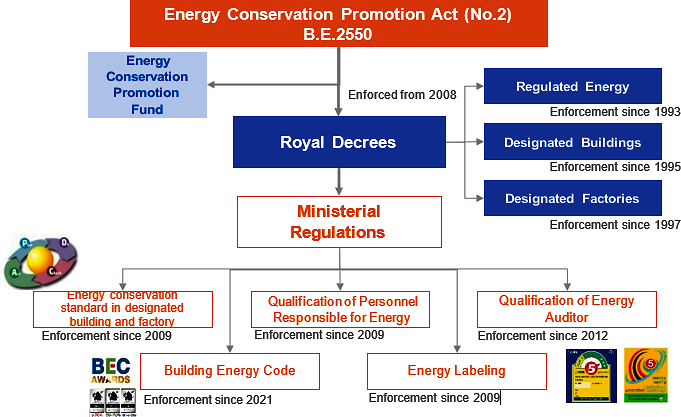

The Energy Conservation Promotion Act (ENCON Act) is another key instrument establishing the legal framework for promoting energy conservation in Thailand (see Figure 2.3). This Act introduced several regulations to support the implementation of energy conservation measures in various sectors. The act establishes an Energy Conservation Promotion Fund (ENCON Fund) to support research and development of energy-efficient technologies, as well as to provide financial assistance for energy conservation projects. The act requires large energy-consuming industries and buildings to develop and implement energy conservation plans, including measures such as energy audits, energy-efficient design, and installation of energy-saving equipment. Additionally, the act mandates the labelling of energy-efficient appliances to promote consumer awareness and encourage the purchase of energy-efficient products.

Figure 2.3. Laws and regulations on energy efficiency in Thailand

Source: Authors based on (DEDE, 2018[5]), Building Energy Code, Ministry of Energy of Thailand, https://seforallateccj.org/wpdata/wp-content/uploads/ecap17-thailand.pdf.

Estimating finance and investment needed to meet Thailand’s clean energy plans as well as their economic impacts

Thailand is facing the challenges of sustaining economic growth while simultaneously addressing environmental concerns and energy security. Within the development of this Roadmap, the Thai consulting firm The Creagy ran three models to estimate the financing and investment needs to achieve Thailand’s current renewable energy and energy efficiency targets. The data and projections presented in this section were drawn from official sources such as the PDP 2018 (Rev.1), the AEDP 2018 and the draft version of EEP 2022, and are based on the energy and power system models developed by the Energy Research Institute, Agora Energiewende, and NewClimate Institute, as part of the Clean, Affordable and Secure Energy for Southeast Asia (CASE) programme (CASE for Southeast Asia, 2022[6]). Further details on the energy targets and projections the models are based on are shown in Annex C.

The models run for this Roadmap aimed to estimate the following elements:

the investment and financing needs required for implementing the AEDP 2018 and the draft EEP 2022, the level of financial assistance needed by public and private financing sources, as well as the distribution of investment costs across the supply chain for the selected renewable energy and energy efficiency technologies.

the economic impact, including employment and value added, that would be generated from the implementation of the AEDP 2018 and the draft EEP 2022.

The main findings are presented below and the full methodology used for the three models can be found in Annex C.

Estimated finance and investment needs for the implementation of the Alternative Energy Development Plan 2018-2037 (AEDP 2018)

The goal of the AEDP 2018 is to increase the contractual capability of renewable energy power generation to 29 411 MW by 2037. Out of this, along with the retired capacity of 1 554 MW during 2022 - 2037, approximately 18.6 GW will be required from newly installed systems between 2022 and 2037. The modelling work conducted for this Roadmap estimated the finance and investment needed to reach the goals of the AEDP 2018. Key findings from the model are:

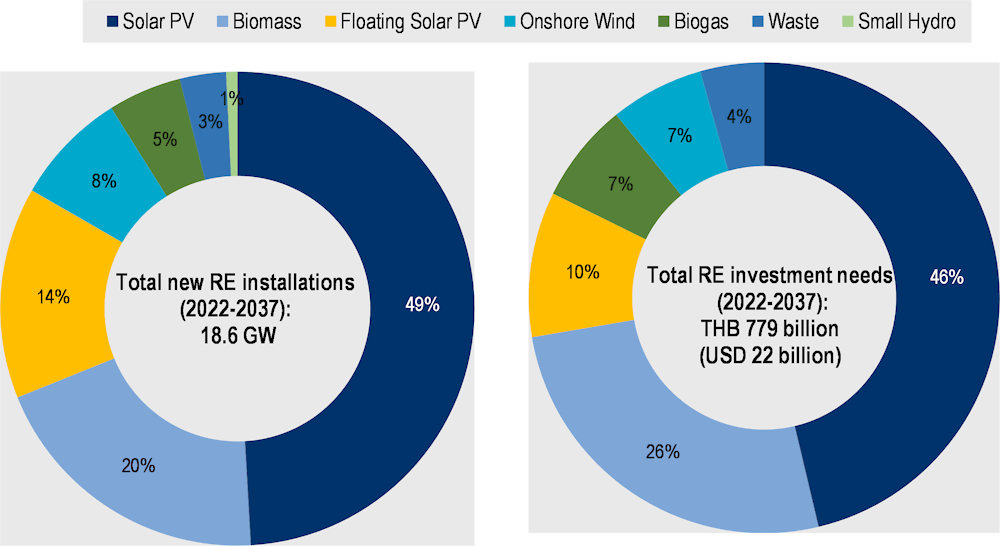

The total investment in new renewable power required between 2022 and 2037 will amount to approximately THB 779 billion (USD 22 billion). Investment in solar PV, including solar PV rooftop, utility-scale solar and floating solar PV contributes to 56% of the new installations (Figure 2.4 below).

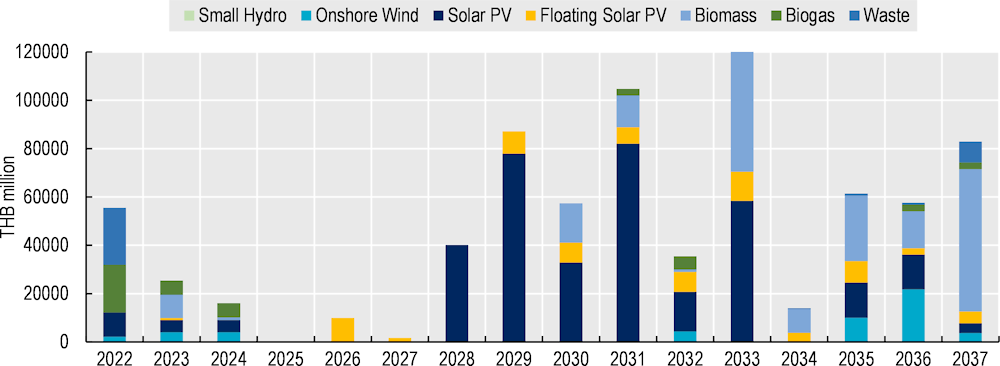

The investment needs for new renewable power between 2022 and 2037 vary each year, with the lowest amounting THB 370 thousand (USD 11 thousand) in 2025 and the highest amounting THB 130 billion (USD 4 billion) in 2033 (Figure 2.5).

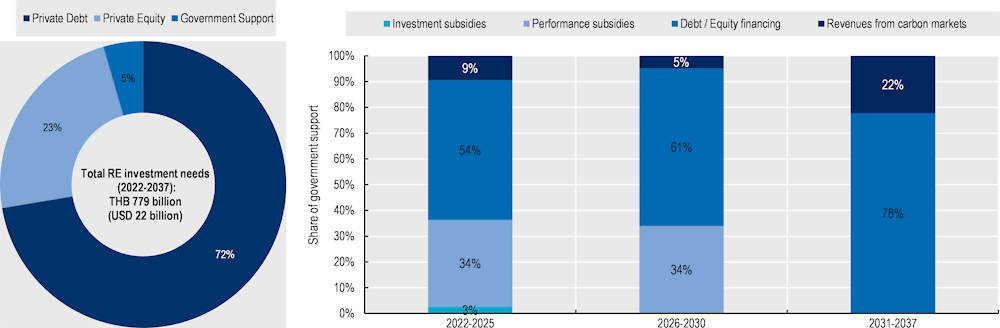

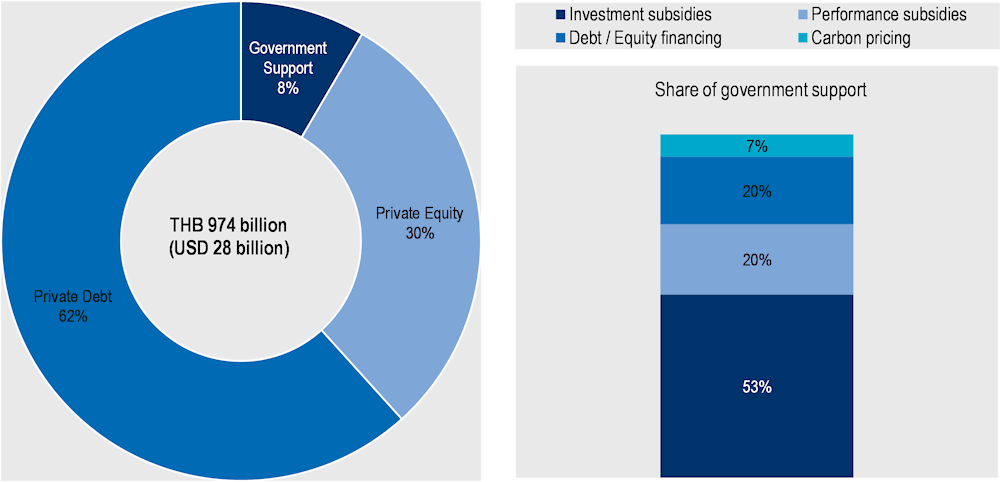

To finance the installation of new renewable power, a combination of government support, private equity and private debt is needed. The share of government support, private equity and private debt are 4%, 23%, and 72%, respectively. To implement the AEDP 2018, government support of THB 35 billion (USD 1 billion) is needed. The support is likely to be provided mainly through five financial instruments, namely grants, investment and performance subsidies, debt and equity financing, and carbon credits, as shown in Figure 2.6.

The modelling also provided an estimation of the local share of investment for solar PV. Key findings are presented in Box 2.1 below.

Figure 2.4. New renewable energy installations in the power sector and estimates of related investment needs (2022 – 2037)

Figure 2.5. Estimates of annual investment needs for new renewable energy installations in the power sector (2022-2037)

Figure 2.6. Estimates of needed government support, private equity and private debt for investment in new renewable energy installations in the power sector (as per the AEDP 2018)

Box 2.1. Estimated local share of solar PV investment

Under the AEDP plan, an additional analysis has been made for solar PV to assess the distribution of the investment across its supply chain. The supply chain of solar PV consists of two main groups: (i) equipment suppliers and (ii) project developers responsible for engineering, procurement, and construction work. In 2019, Ambition to Action conducted a study that examined the component-level costs and the local share for Solar PV. It was found that for every THB 100 (USD 2.9) of investment, THB 34 would be allocated for PV modules, THB 17 for balance of system (BOS) and grid connection, while the rest is split among inverter, racking, installation and developer costs, and fee and contingencies. Each of these components will have a local share of 10%, 10%, 47%, 32%, 63%, 76%, and 89%, respectively. When considering the total investment size of solar PV within the AEDP plan, it was found that about THB 111 billion (USD 3 billion) represents the domestic portion, while the remaining THB 249 billion (USD 7 billion) would be international, mainly due to the imported solar PV panels, inverters, BOS and grid connection components (Table 2.2).

Table 2.2. Estimated local share of solar PV investments

|

|

PV Module |

Inverter |

Racking |

BOS & Grid Connection |

Installation |

Developer |

Fees & Contingencies |

Total |

|---|---|---|---|---|---|---|---|---|

|

Share |

34% |

6% |

9% |

17% |

12% |

12% |

9% |

100% |

|

Local content |

10% |

10% |

47% |

32% |

63% |

76% |

89% |

- |

|

Investment (THB million) |

122 576 |

22 352 |

33 168 |

62 009 |

43 983 |

43 983 |

32 447 |

360 517 |

|

Local investment |

12 258 |

2 235 |

15 589 |

19 843 |

27 709 |

33 427 |

28 877 |

111 061 |

|

Investment gap |

110 318 |

20 117 |

17 579 |

42 166 |

16 274 |

10 556 |

3 569 |

249 456 |

Source: Authors

Estimated finance and investment needs for the implementation of the draft Energy Efficiency Plan (EEP 2022)

The goal of the draft EEP 2022 is to reduce the energy intensity (EI) by 36% by 2037, compared to the base year of 2010. To achieve this goal, it is estimated that around 35 497 ktoe of energy from five sectors, including industrial, commercial, residential, agricultural and transportation sectors, needs to be saved from the business as usual (BAU) scenario. However, the modelling work conducted as part of this Roadmap focused on energy efficiency in industrial, commercial, residential, and agricultural sectors. The energy saving target of these four sectors amount to 18 458 ktoe.

Key findings from the model are:

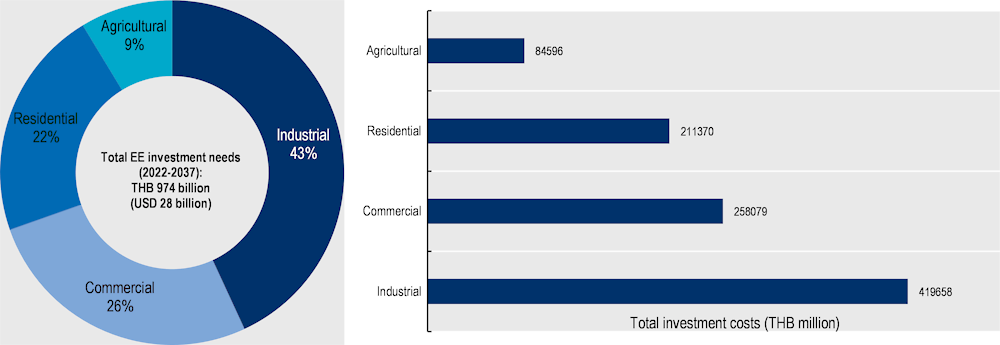

The total energy efficiency investment required in the four economic sectors between 2022 and 2037 will amount to THB 974 billion (USD 28 billion). The industrial sector needs the largest investment of THB 420 billion (USD 12 billion), or 43% of the total energy efficiency investment (Figure 2.7).

The extent of government support, private equity and private debt for energy efficiency investment in the four economic sectors during 2022 – 2037 are 9%, 30%, and 61%, respectively. To implement the draft EEP 2022, government support of THB 92 billion (USD 3 billion) is needed. The support could be provided through five financial instruments as shown in Figure 2.8 below. Box 2.2 below provides an overview of estimates of local investment needed for high-efficiency cooling systems.

Figure 2.7. Estimates of total energy efficiency investment needs in four economic sectors, as per the draft EEP 2022 (2022 – 2037)

Figure 2.8. Estimates of needed government support, private equity and private debt for energy efficiency investment, as per the draft EEP 2022 (2022 – 2037)

Box 2.2. Estimated local share of investment in high-efficiency cooling systems

Under the EEP plan, an additional analysis has been made for high efficiency cooling systems to determine how the investment will distribute across the supply chain. The supply chain for cooling systems is composed of four main groups: (i) raw materials; (ii) manufacturing; (iii) assembling; and (iv) engineering. In 2019, a study was conducted by the King Mongkut’s University of Technology Thonburi to assess the local share of the cooling system across the supply chain. The study found that for every THB 100 (USD 2.9) of investment, the allocation would be as follows: raw materials (THB 42, or United States Dollars (USD) 1.2), manufacturing (THB 23 or USD 0.6), assembling (THB 15, or USD 0.4) and engineering (THB 20 or USD 0.6). Each of these components has a local share of 0%, 43%, 100%, and 100%, respectively (Table 2.3 below). Assuming that high-efficiency cooling systems contribute to 20% of the total energy efficiency investment in the commercial sector (Brown, Soni and Li, 2020[7]), the total estimated investment for high-efficiency cooling systems under the draft EEP amounts to THB 51 616 million (USD 1 483 million). As shown in Table 2.3, about THB 23 billion (USD 664 million) represents the domestic portion of the needed investment while THB 28 billion (USD 818 million) represents the foreign portion, primarily due to raw material imports.

Table 2.3. Estimated local share of investment in high-efficiency cooling systems

|

|

Raw materials |

Manufacturing |

Assembling |

Engineering |

Total |

|---|---|---|---|---|---|

|

Share |

42% |

23% |

15% |

20% |

100% |

|

Local content |

0% |

43% |

100% |

100% |

- |

|

Investment (THB million) |

21 808 |

11 743 |

7 742 |

10 323 |

51 616 |

|

Local investment |

0 |

5 049 |

7 742 |

10 323 |

23 115 |

|

Investment gap |

21 808 |

6 693 |

0 |

0 |

28 501 |

Notes: * Derived from (Kotanan, Lorterapong and Patoomnakul, 2019[8]).

** Assuming that high-efficiency cooling investment accounts for 20% of total investment in the commercial sector as per the study on Distribution of bills of goods for three energy efficiency sectors (Brown, Soni and Li, 2020[7]).

Source: Authors

Estimated economic impact of the implementation of the AEDP 2018 and the draft EEP 2022

The purpose of this analysis was to estimate the economic impact, in terms of employment and value added, resulting from the implementation of the AEDP 2018 and the draft EEP 2022. The total jobs generated from the implementation of the AEDP 2018 can be estimated from the sum of manufacturing, construction and installation, and operation and maintenance jobs. The full methodology can be found in Annex C.

The estimated impacts of the implementation of the AEDP 2018 include:

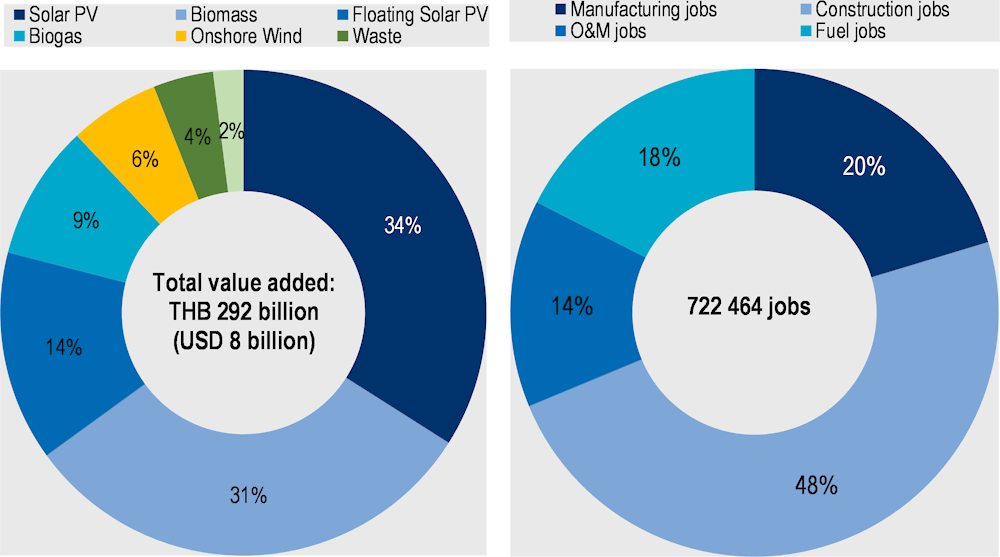

Total investment of renewable energy during 2022-2037 amounting to THB 779 billion (USD 22 billion) is expected to create value added of THB 292 billion on average (USD 8 billion) or about 37.5% of the total investment (Figure 2.9).

This investment is expected to create 722 thousand jobs on average during the same period, which translates to an average of 45 thousand jobs per year or 2.4 jobs per MW (Figure 2.9).

Figure 2.9. Estimated value added and employment created as a result of the implementation of the AEDP 2018

Value added created from AEDP 2018 on the left-hand side chart and employment created from AEDP 2018 on the right-hand side chart.

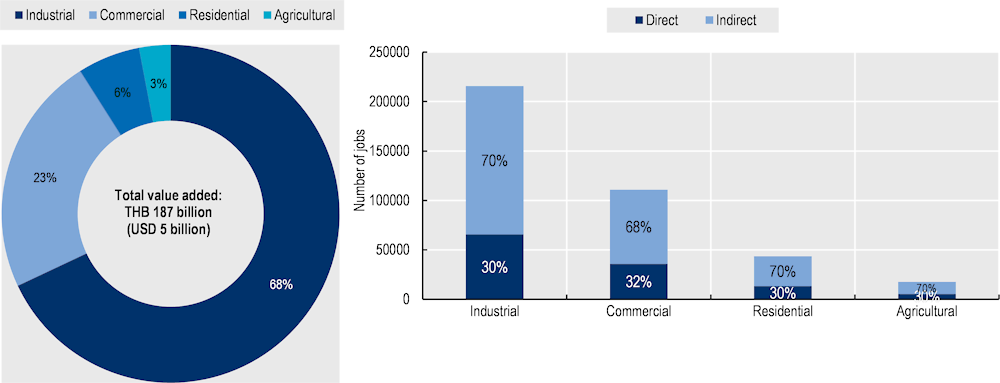

The estimated economic impacts of the implementation of the draft EEP are:

Total investment of energy efficiency during 2022-2037 amounting to THB 974 billion (USD 28 billion) is expected to create value added of THB 187 billion (USD 5 billion) or about 19% (Figure 2.10).

This investment is expected to create 387 thousand jobs during the same period, out of which on average 119 thousand (31%) are direct jobs and 268 thousand (69%) are indirect jobs (Figure 2.10).

Figure 2.10. Estimated value added and employment created as a result of the implementation of the draft EEP 2022

References

[7] Brown, M., A. Soni and Y. Li (2020), “Estimating employment from energy-efficiency investments”, MethodsX, Vol. 7, p. 100955, https://doi.org/10.1016/j.mex.2020.100955.

[6] CASE for Southeast Asia (2022), Towards a collective vision of Thai energy transition: National long-term scenarios and socioeconomic implications, Clean, Affordable and Secure Energy (CASE) for Southeast Asia, https://newclimate.org/sites/default/files/2022-11/2022-11-08_th_ltes_-_full_report.pdf.

[2] DEDE (2023), Performance on Alternative Energy Policy, https://www.dede.go.th/articles?id=450&menu_id=1.

[4] DEDE (2023), Performance on Energy Efficiency Policy, https://www.dede.go.th/uploads/GDP_EI_4_2566_edit_5a8f948e8c.pdf?updated_at=2024-04-04T03:32:13.061Z.

[3] DEDE (2023), Thailand’s Economy Update, https://www.apec.org/docs/default-source/Satellite/EGEEC/Files/60/Economy_Updates_-_Thailand.pdf.

[5] DEDE (2018), Building Energy Code (BEC), https://seforallateccj.org/wpdata/wp-content/uploads/ecap17-thailand.pdf.

[10] EPPO (2024), Electricity, https://www.eppo.go.th/epposite/index.php/th/energy-information/static-energy/static-electricity?orders[publishUp]=publishUp&issearch=1.

[1] EPPO (2020), Power Development Plan (PDP) 2018 Revision 1, https://www.eppo.go.th/images/Infromation_service/public_relations/PDP2018/PDP2018Rev1.pdf.

[8] Kotanan, A., P. Lorterapong and J. Patoomnakul (2019), Value chain and development of the Thai air conditioning industry, https://www.thailog.org/wp-content/uploads/2019/01/54-68.pdf.

[9] Office of Natural Resources and Environmental Policy and Planning (2022), Infographic regarding COP26, https://www.onep.go.th/infographic-%e0%b8%97%e0%b8%b5%e0%b9%88%e0%b8%99%e0%b9%88%e0%b8%b2%e0%b8%aa%e0%b8%99%e0%b9%83%e0%b8%88%e0%b9%80%e0%b8%81%e0%b8%b5%e0%b9%88%e0%b8%a2%e0%b8%a7%e0%b8%81%e0%b8%b1%e0%b8%9a-cop26/.

Notes

← 1. In the past, the same model has been applied as part of the following studies: (i) Financing Thailand’s Climate Actions in NDC and NAP under GIZ’s Thai-German Climate Programme (2020), (ii) Ambition to Action’s Domestic Expenditure and Employment Impacts of Power Sector Development in Thailand (A2A, 2019), and (iii) Affordable and Secure Energy for Southeast Asia (CASE) on Towards a collective vision of Thai energy transition: National long-term scenarios and socioeconomic implications (2022).

← 2. In the EEP 2022, energy intensity is measured as final energy consumption divided by GDP (ktoe/billion baht).