In 2021, the share of corporate tax revenues in total tax revenues was 16.0% on average across the 123 jurisdictions for which corporate tax revenues are available in the database, and the share of these revenues as a percentage of gross domestic product (GDP) was 3.2% on average.

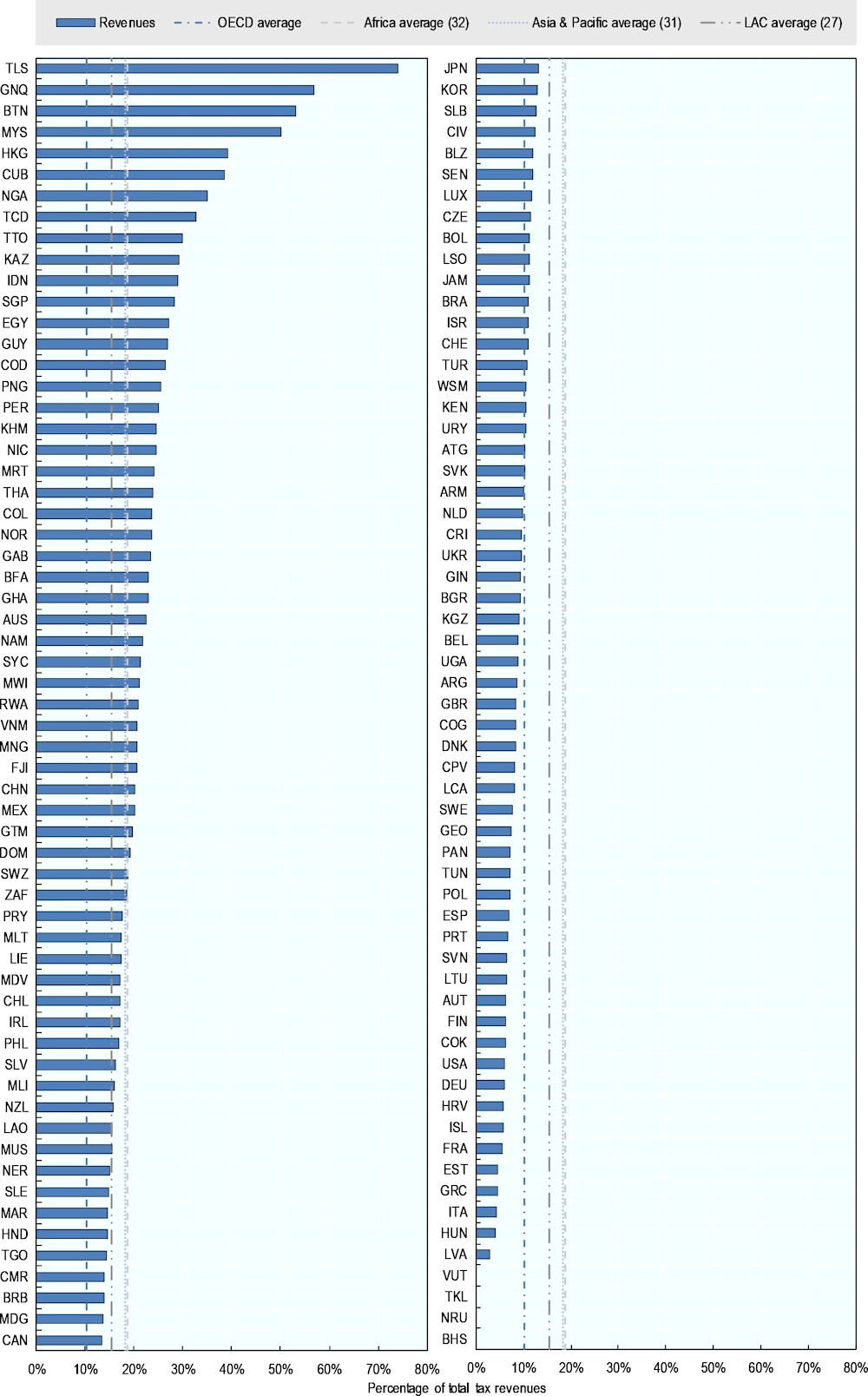

The size of corporate tax revenues relative to total tax revenues and relative to GDP varies by groupings of jurisdictions. In 2021, corporate tax revenues were a larger share of total tax revenues on average in Africa (18.7% in the 32 jurisdictions), Asia and Pacific (18.2% in the 31 jurisdictions) and Latin American and The Caribbean (LAC) (15.4% in the 27 jurisdictions) than the OECD (10.2%). In general, middle and low-income countries are more strongly reliant on corporate income tax as a share of total taxation.

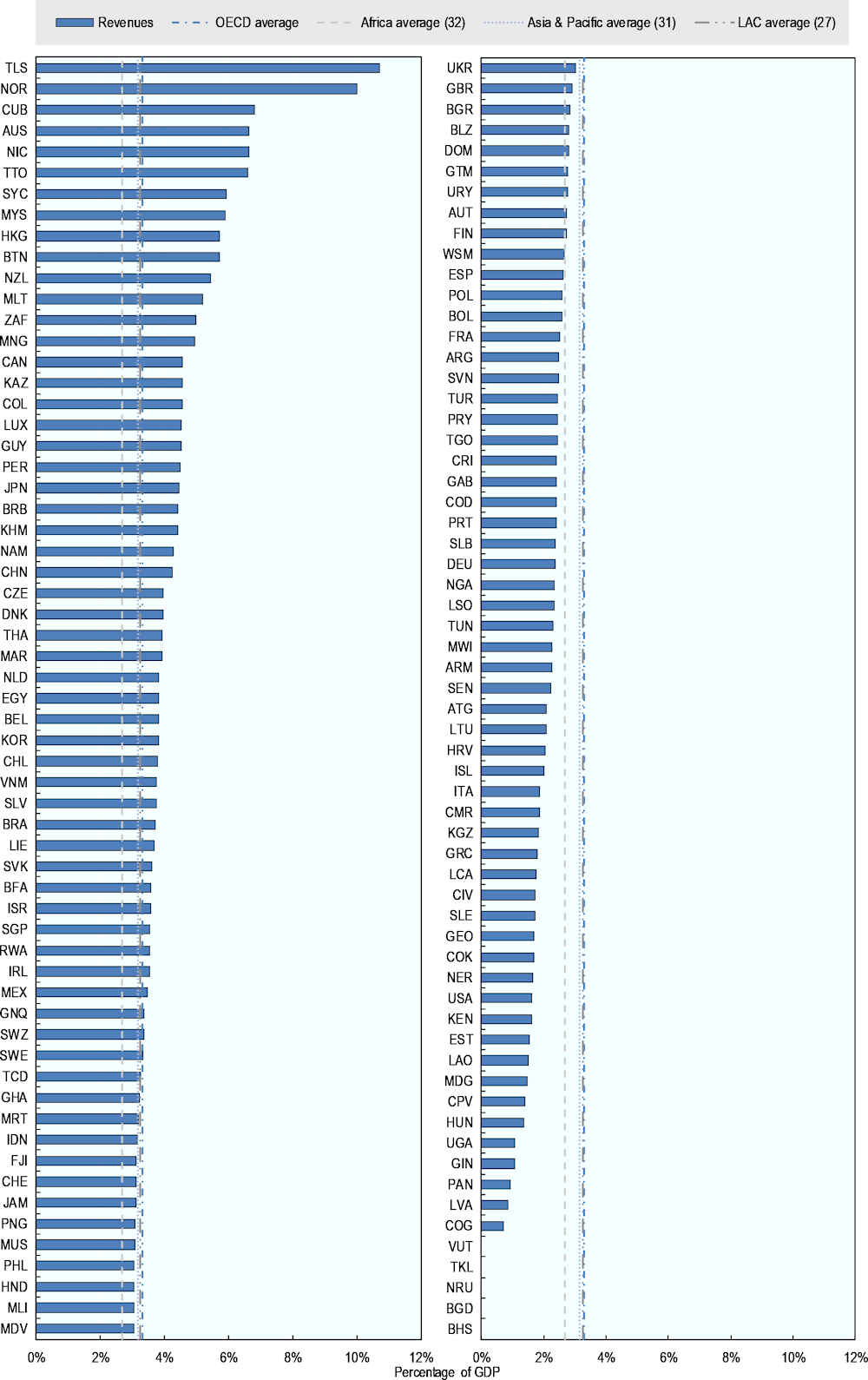

However, there is less variation between groupings in terms of corporate tax revenues as a share of GDP. The average of corporate tax revenues as a share of GDP was the largest in the OECD and LAC (27 jurisdictions) (3.3% respectively), followed by Asia and Pacific (3.2%) and Africa (2.7%).

In seventeen jurisdictions – Bhutan, Chad, Cuba, Democratic Republic Of The Congo, Egypt, Equatorial Guinea, Guyana, Hong Kong (China), Indonesia, Kazakhstan, Malaysia, Nigeria, Papua New Guinea, Peru, Singapore, Timor-Leste and Trinidad And Tobago – corporate tax revenues made up more than a quarter of total tax revenues in 2021.

Corporate Tax Statistics 2024

1. Corporate tax revenues

Key insights

Data on corporate income tax (CIT) revenues can be used for comparison across jurisdictions and to track trends over time. The data in the Corporate Tax Statistics database is drawn from the OECD’s Global Revenue Statistics Database and allows for the comparison between individual jurisdictions as well as between average corporate tax revenues across OECD, LAC, African, and Asian and Pacific jurisdictions.1

The Corporate Tax Statistics database contains four corporate tax revenue indicators:

the level of CIT revenues in national currency;

the level of CIT tax revenues in USD;

CIT revenues as a percentage of total tax revenue;

CIT revenues as a percentage of GDP.

The data are from the OECD’s Global Revenue Statistics Database, which presents detailed, internationally comparable data on tax revenues. The classification of taxes and methodology is described in detail in the OECD’s Revenue Statistics Interpretative Guide.

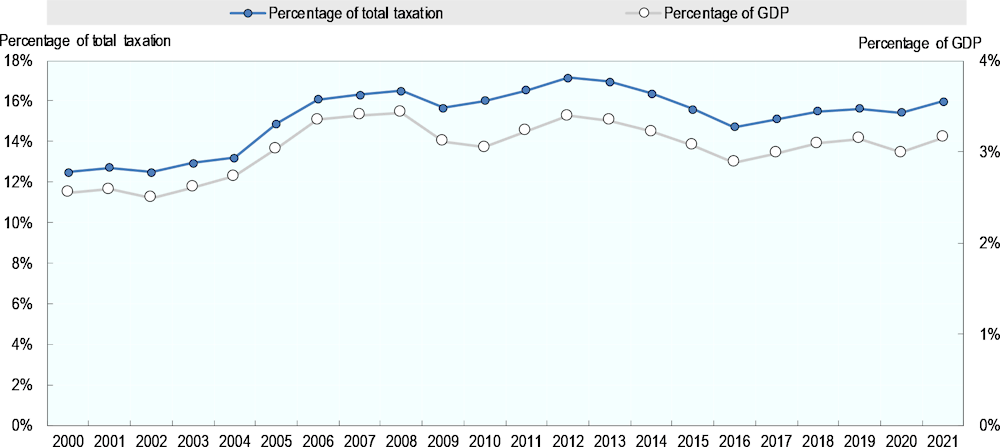

Trends in corporate tax revenues

Data from the OECD’s Corporate Tax Statistics database show that there was an increase in both the average of CIT revenues as a share of total tax revenues and as a share of GDP between 2000 and 2021 across the 123 jurisdictions for which data are available.2 Average CIT revenues as a share of total tax revenues increased from 12.5% in 2000 to 16.0% in 2021, and average CIT revenues as a percentage of GDP increased from 2.6% in 2000 to 3.2% in 2021.

Between 2000 and 2021, the trend for both indicators is very similar (Figure 1.1). When measured both as a percentage of total tax revenues and as a percentage of GDP, corporate tax revenues reached their peak in 2008 and then dipped in 2009 and 2010, reflecting the impact of the global financial and economic crisis. While average CIT revenues recovered after 2010, the unweighted average across all 123 jurisdictions for which data are available declined in 2014, 2015 and 2016. The unweighted average recovered slightly in 2017, 2018 and 2019 as a result of increases across a wide range of jurisdictions. This was followed by a slight decline in 2020 in both indicators, however in 2021, average CIT revenues as a share of total tax revenues and as a share of GDP both increased and approach levels similar to the peak in 2008.

Figure 1.1. Average corporate tax revenues as a percentage of total tax and as a percentage of GDP

The averages mask considerable differences across jurisdictions (Figure 1.2). In Bhutan, Chad, Cuba, Democratic Republic Of The Congo, Egypt, Equatorial Guinea, Guyana, Hong Kong (China), Indonesia, Kazakhstan, Malaysia, Nigeria, Papua New Guinea, Peru, Singapore, Timor-Leste and Trinidad And Tobago, CIT revenue accounted for more than 25% of total tax revenue. In Bhutan, Equatorial Guinea, Malaysia and Timor-Leste, it accounted for more than 40%. In contrast, some jurisdictions – such as the Bahamas, Estonia, Greece, Hungary, Italy, Latvia, Nauru, Tokelau and Vanuatu3 – raised less than 5% of total tax revenue from the CIT. In most jurisdictions, the difference in the level of corporate taxes as a share of total tax revenues reflects differences in the levels of other taxes raised.

The average revenue share of corporate tax in 2021 also varied across the OECD and the regional groupings (LAC, Asia and Pacific and Africa). In 2021, the OECD average was the lowest, at 10.2%, followed by the LAC average (15.4% in 27 jurisdictions), the Asia and Pacific average (18.2% in 31 jurisdictions) and the Africa average (18.7% in 32 jurisdictions).

Some of the variation in the share of CIT in total tax revenues results from differences in statutory corporate tax rates, which also vary considerably across jurisdictions. In addition, this variation can be explained by institutional and jurisdiction-specific factors, including:

the degree to which firms in a jurisdiction are incorporated;

the breadth of the CIT base;

the current stage of the economic cycle and the degree of cyclicality of the corporate tax system (for example, from the generosity of loss offset provisions);

the extent of reliance on other types of taxation, such as taxes on personal income and on consumption;

the extent of reliance on tax revenues from the exploitation of natural resources;

other instruments that postpone the taxation of earned profits.

Generally, differences in corporate tax revenues as a share of total tax revenues should not be interpreted as being related to base erosion and profit shifting (BEPS) behaviour, since many other factors are likely to be more significant, although profit shifting may have some effects at the margin.

Corporate tax revenues as a share of GDP

Corporate tax revenues as a percentage of GDP also vary across jurisdictions. In 2021, the ratio of corporate tax revenues to GDP were between 2% and 5% for a majority of the 123 jurisdictions covered (Figure 1.3). For 12 jurisdictions, corporate tax revenues accounted for more than 5% of GDP. In contrast, they were less than 2% of GDP in 27 jurisdictions. In 2021, the OECD and LAC, and Asia and Pacific averages were similar, at 3.3%, 3.3%, and 3.2% of GDP respectively, whereas the Africa average was lower (2.7%).

The reasons for the variation across jurisdictions in corporate tax revenues as a percentage of GDP are similar to those that explain why the corporate tax revenue share of total tax revenue differs, such as differences in statutory corporate tax rates and differences in the degree to which firms in a given jurisdiction are incorporated. In addition, the total level of taxation as a share of GDP plays a role. For example, for the 32 African jurisdictions, the relatively high average revenue share of CIT compared to the relatively low average of CIT as a percentage of GDP reflects the low amount of total tax raised as a percentage of GDP (average of 15.6%). Total tax revenue as a percentage of GDP is somewhat higher for the 27 LAC jurisdictions (average of 21.7%), the 31 Asian and Pacific jurisdictions (average of 19.8%) and significantly higher for the OECD jurisdictions (average of 34.2%). Across the jurisdictions in the database, low tax-to-GDP ratios may reflect policy choices as well as challenges associated with domestic resource mobilisation (e.g., administrative capacity and levels of compliance). The fact that CIT-to-GDP ratios are similar across countries with varying levels of economic development suggests that variation in total tax-to-GDP ratios is driven more strongly by other tax categories (e.g. PIT, SSCs) than by CIT.

Figure 1.2. Corporate tax revenues as a percentage of total tax revenues, 2021

Figure 1.3. Corporate tax revenues as a percentage of GDP, 2021

Notes

← 1. The Global Revenue Statistics Database covers 127 jurisdictions as of June 2024. Data on CIT revenues is available for 123 of these jurisdictions. In addition to the OECD, the Global Revenue Statistics Database also contains data on 31 Asian and Pacific jurisdictions, 27 Latin America and Caribbean jurisdictions, and 32 African jurisdictions, and averages for the LAC, African, and Asian and Pacific regions.

← 2. The latest tax revenue data available across all jurisdictions in the database are for 2021, although there are 2022 data available for some jurisdictions in the Global Revenue Statistics database.

← 3. The Bahamas, Nauru, Tokelau and Vanuatu do not levy a corporate income tax.