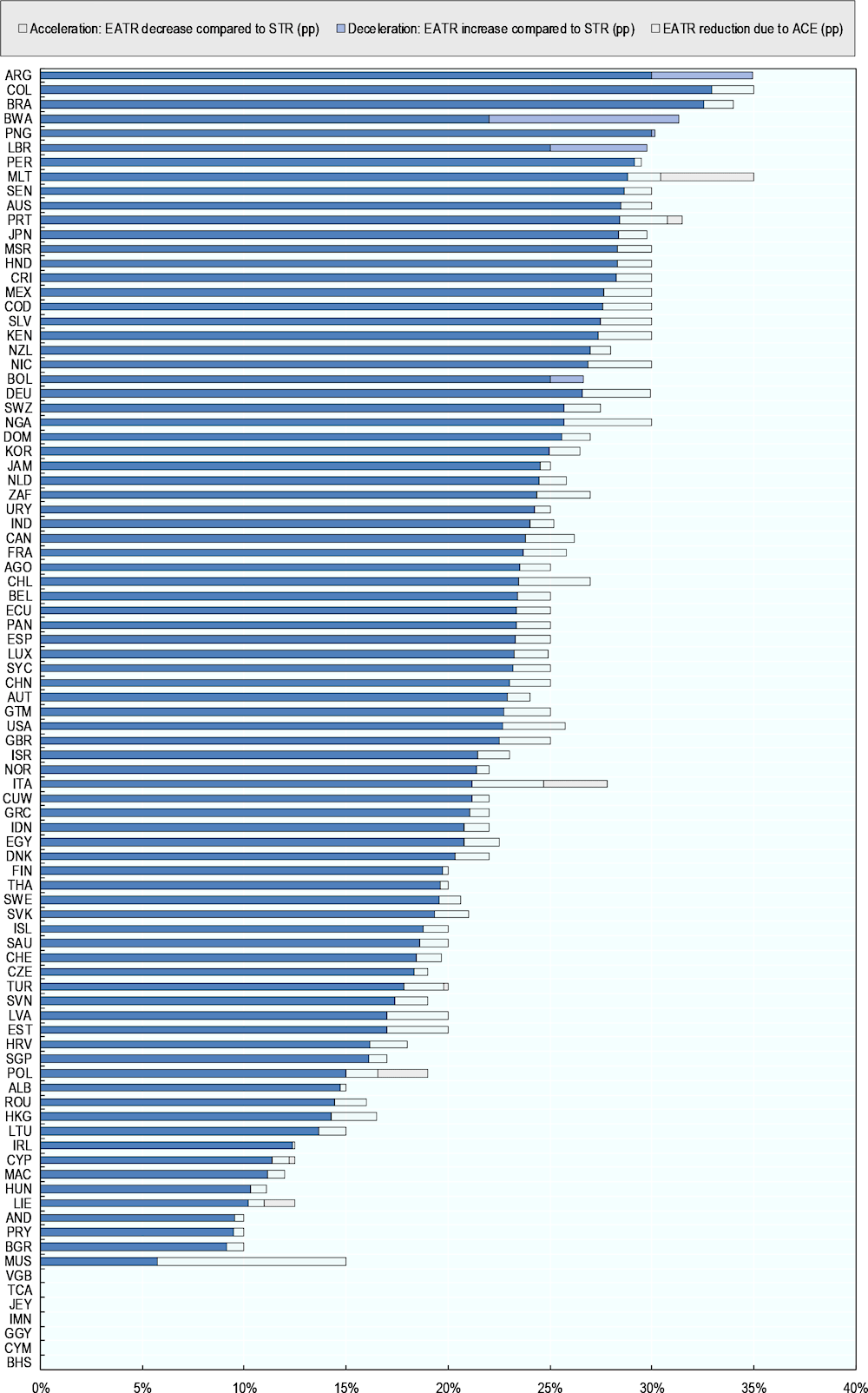

Of the 90 jurisdictions covered for 2023, 79 provide accelerated depreciation, which results in Effective Average Tax Rate (EATRs) on investments in these jurisdictions below their statutory tax rate (STRs). Among those jurisdictions, the average reduction of the STR was 1.9 p.p.; in 2023, the largest reductions were observed in Mauritius (9.3 p.p.), Italy (6.6 p.p.), Malta, (6.2 p.p.), Nigeria (4.3 p.p.), Poland (4.0 p.p.), and Chile (3.6 p.p.). In contrast, fiscal depreciation was decelerated in five jurisdictions, leading to EATRs above the statutory tax rate. Among those jurisdictions, the average difference between the EATR and the STR was 4.2 p.p.; the largest differences between EATRs and STRs were observed in Botswana (9.3 p.p.), Argentina (4.9 p.p.) and Liberia (4.7 p.p.).

Among all 90 jurisdictions, eight jurisdictions had an allowance for corporate equity (ACE): Belgium, Cyprus, Italy, Liechtenstein, Malta, Poland, Portugal and Türkiye. Including this provision in their tax code has led to an additional reduction in their EATRs of between 0.3 to 4.5 p.p.

The average EATR across jurisdictions (20.2%) is 1.0 p.p. lower than the average STR (21.2%). The median EATR is 2.8 p.p. lower (22.2%) than the median STR (25.0%). While more than half of the jurisdictions covered have EATRs between 15% and 28%, several Latin American and The Caribbean (LAC) jurisdictions have EATRs at the higher end of the range due to the decelerating effect of their tax depreciation rules for acquired software (e.g., Colombia and Brazil).

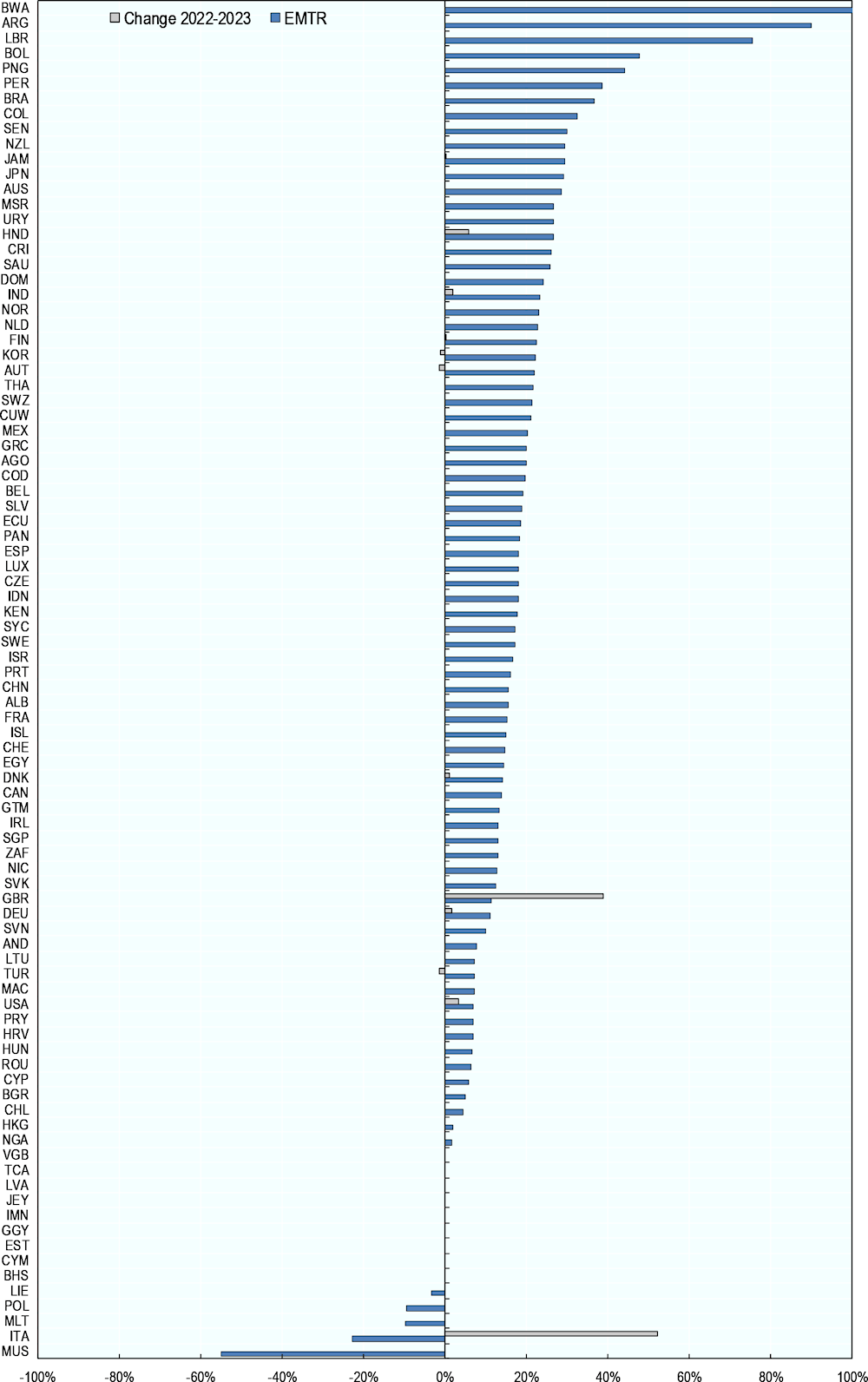

Effective marginal tax rates (EMTRs) are among the lowest in jurisdictions with an allowance for corporate equity, i.e., Cyprus, Italy, Liechtenstein, Malta, Poland, Portugal and Türkiye.

Nine jurisdictions have decreased the generosity of their tax depreciation rules, resulting in an increase in their EMTRs in 2023 compared to 2022; the largest increase was observed in Italy (52 p.p.).

Three jurisdictions have increased the generosity of their tax depreciation rules, leading to lower EMTRs in 2023 than in 2022; this group includes Austria (1.3 p.p.), Korea (1.2 p.p.) and Türkiye (1.0 p.p.).

Disaggregating the results to the asset level shows that fiscal acceleration is strongest for investments in buildings and tangible assets. The average EATR across jurisdictions is 18.9% for buildings and 19.3% for tangible assets, lower than the average composite EATR (19.6%), which also includes acquired software and inventories. For the tangible asset category, which covers air, railroad and water transport vehicles, road transport vehicles, computer hardware, industrial machinery and equipment, most of this effect is driven by more generous tax depreciation rules for air, railroad and water transport vehicles, as well as for industrial machinery.

Over recent years, EATRs have remained relatively stable on average, with modest declines at the top and bottom of the distribution across countries. Average EATRs were 20.9% in 2019 and 20.2% in 2023, while median EATRs were 22.9% in 2019 and 22.7% in 2023. This may reflect the stabilisation of STRs discussed in Chapter 2, which are a key component of the EATRs.

By contrast, the EMTRs have declined over the previous five years, with the average EATR being 19.6% in 2019 and 16.6% in 2023. The stability of EATRs combined with declines in EMTRs suggests a narrowing of tax bases in the sample, notably through an increase in the generosity of depreciation provisions. Examining the asset breakdown shows these trends have been driven by increased generosity of depreciation of tangible and intangible assets, as opposed to buildings and inventories.

Corporate Tax Statistics 2024

4. Corporate effective tax rates

Key insights

Variations in the definition of corporate tax bases across jurisdictions can have a significant impact on the tax liability associated with a given investment. For instance, corporate tax systems differ across jurisdictions with regard to several important features, such as fiscal depreciation rules as well as other tax provisions. To capture the effects of these provisions on corporate tax bases and tax liabilities, it is necessary to go beyond a comparison of statutory corporate income tax (CIT) rates.

The Corporate Tax Statistics dataset presents “forward-looking” ETRs, which are synthetic tax policy indicators calculated using information about specific tax policy rules. Unlike “backward-looking” ETRs, they do not incorporate any information about firms’ actual tax payments. As described in more detail in Box 4.1, the ETRs reported in Corporate Tax Statistics focus on the effects of fiscal depreciation and several related provisions (e.g., allowances for corporate equity, half-year conventions, inventory valuation methods). While this includes fiscal depreciation rules for certain kinds of intangible property, namely acquired software, the effects of expenditure-based R&D tax incentives and intellectual property (IP) regimes are not accounted for in the baseline data discussed in this chapter. However, the following chapter presents forward-looking ETRs capturing the effects of R&D tax incentives on R&D investments.

The Corporate Tax Statistics database contains four forward-looking tax policy indicators reflecting tax rules as of 1 July for the years 2017-23:

the effective average tax rate (EATR);

the effective marginal tax rate (EMTR);

the cost of capital;

the net present value of capital allowances as a share of the initial investment.

All four tax policy indicators are calculated by applying jurisdiction-specific tax rules to a prospective, hypothetical investment project. Calculations are undertaken separately for investments in different asset types and sources of financing (i.e., debt and equity). Composite tax policy indicators are computed by weighting over assets and sources of finance. More disaggregated results are also reported in the Corporate Tax Statistics database. This chapter discusses only results for two indicators: the EMTR and the EATR.

The tax policy indicators are calculated for two different macroeconomic scenarios. Unless noted, the results reported in this publication refer to composite effective tax rates based on the macroeconomic scenario with 3% real interest rate and 1% inflation.

Forward-looking corporate effective tax rates in 2023

Two complementary forward-looking ETRs are typically used for tax policy analysis, capturing incentives at different margins of investment decision making:

EATRs reflect the average tax contribution a firm makes on an investment project earning above-zero economic profits. This indicator is used to analyse discrete investment decisions between two or more alternative projects (along the extensive margin).

EMTRs measure the extent to which taxation increases the pre-tax rate of return required by investors to break even. This indicator is used to analyse how taxes affect the incentive to expand existing investments given a fixed location (along the intensive margin).

Effective average tax rates

Figure 4.1 shows the composite EATR for the full database. In most jurisdictions, EATRs diverge from the statutory CIT rate; if fiscal depreciation is generous compared to true economic depreciation or if there are other significant base narrowing provisions, the EATR (and also the EMTR) will be lower than the statutory tax rate, i.e., tax depreciation is accelerated. On the other hand, if tax depreciation does not cover the full effects of true economic depreciation, it is decelerated, implying that the tax base will be larger and effective taxation higher.

To allow comparison with the statutory tax rate, the share of the EATR (in p.p.) that is due to a deceleration of the tax base is shaded in light blue in Figure 4.1; reductions of the STR due to acceleration are transparent. In addition, the reduction in the EATR due to an ACE is indicated as a dotted area.

Comparing the patterns of tax depreciation across jurisdictions shows that most jurisdictions provide some degree of acceleration, as indicated by the transparent bars. The most significant effects being observed in jurisdictions with an ACE, such as Italy, Malta, Poland, Portugal and Türkiye among others, as well as in jurisdictions with larger accelerated depreciation provisions, such as Canada, South Africa, the United Kingdom and the United States. While fewer jurisdictions have decelerating tax depreciation rules, the effect of deceleration can become large in jurisdictions where acquired software is non-depreciable (Botswana) or depreciable at a very low rate (e.g., in Argentina and to a lesser extent also in Mexico, Papua New Guinea and Peru).

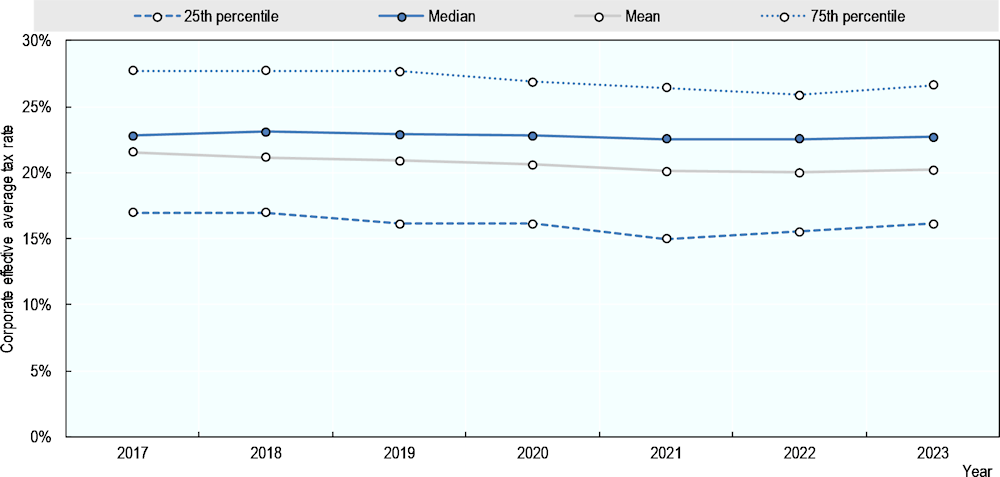

Between 2017 and 2023, average EATRs have tended to decline modestly. Looking at the development of the composite EATR from 2017 and 2023, the unweighted average composite EATR has declined modestly over this period (1.4 p.p.), from 21.6% in 2017 to 20.2% in 2023. The average STR has declined somewhat less over the same time period (1.0 p.p.), from 22.2% in 2017 to 21.2% in 2023, implying that changes to the corporate tax base have also contributed to the reduction in EATRs as well as reductions in the headline rates.

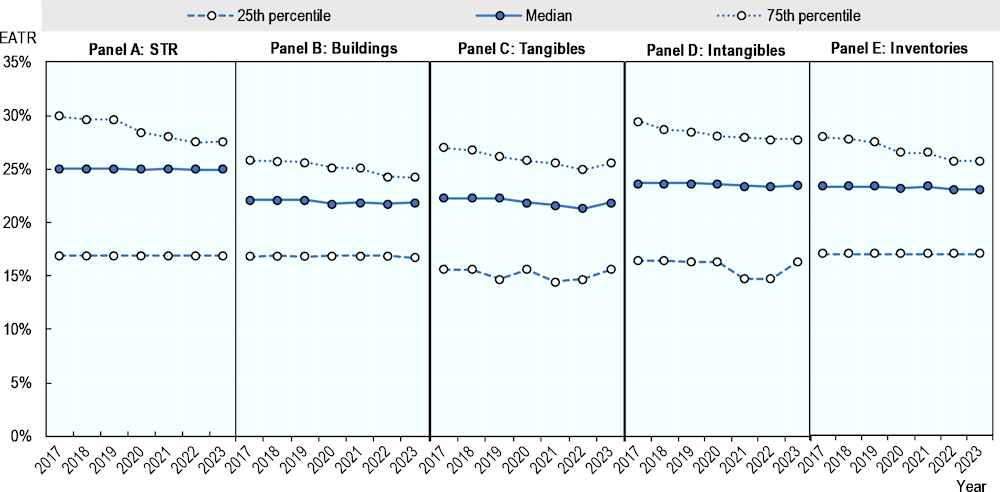

The distribution of EATRs has shifted slightly downwards between 2017 and 2023. Figure 4.2 shows the evolution of different points of the EATR distribution over time. The median represents the EATR of the jurisdiction that lies in the middle of the distribution, 50% of jurisdictions would have EATRs above this value. The 25th percentile represents the EATR where 25% of the jurisdictions would be below this value, and the 75th represents the EATR where 75% of the jurisdictions would be below this value. The median EATR has remained largely steady over the period, with a rate of 22.8% in 2017 and 22.7% in 2023, while the top and bottom of the distribution have dropped from 27.7% and 17.0% in 2017 to 26.6% and 16.2% in 2023.

Changes to the distribution of the EATR can be attributed to the decline over time in statutory CIT rates and to various base reforms. The largest changes in the distribution of EATRs are concentrated in 2021. In 2021 the median EATR dropped to 22.5%, from 22.8% in 2020 (a decline of 0.3 p.p.). During this year, several countries implemented significant changes in their CIT systems which can explain the observed downward trend. Some of these related to reductions in statutory CIT rates or the introduction of base narrowing. From 2021 to 2023 EATRs have remained largely steady with a value of 20.0% in 2022, and 20.2% in 2023.

Figure 4.1. Effective average tax rates, 2023

Note: The values of EATRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. Additional parameters are outlined in the Effective Tax Rate (ETR) explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf. Note additional details on the modelling of ETRs for Poland and Saudi Arabia.

Poland: The value of ACE in Poland is capped at PLN 250 000 per tax year. The presence of caps or limitations on the use of ACEs are not captured on the ETR modelling. For taxpayers for which the cap is binding, the impact on ETRs of the ACE would be lower.

Saudi Arabia: The Kingdom of Saudi Arabia imposes a corporate income tax rate of 20% on a non-Saudi’s’ share of a resident company or a non-resident’s income from a permanent establishment in Saudi Arabia or income of a company operating in the natural gas sector. A higher corporate income tax rate is imposed as well on companies operating in the oil sector (i.e., 50% or higher). The Kingdom of Saudi Arabia also levies the Zakat on companies, which is an example of a tax on both income and equity. The Zakat is levied at 2.5% on a Saudi’s share of a resident company (also applies to citizens of Gulf Cooperation Council countries with an established business in the Kingdom of Saudi Arabia), but since it is imposed on income and equity, it yields a higher rate in effective terms. The Saudi government considers the corporate Zakat as an equivalent to corporate income tax, levied on a different basis. It is also considered a covered tax for the purposes of the GloBE rules in the Pillar 2 Blueprint Report (OECD, 2020). For the calculation of the forward-looking ETRs, three different groups of taxpayers are considered: (i) foreign companies as well as domestic and foreign companies in the natural gas sector taxed at 20%, (ii) domestic and foreign companies in the hydrocarbon sector taxed at 50%, (iii) other domestic companies taxed through Zakat at 2.5%. The results for these three groups of taxpayers are weighted using the respective turnover shares as weights, i.e., 18.17% for group (i), 28.72% for group (ii) and 53.11% for group (iii). The composite EATR corresponds to the combination of the unshaded and shaded blue components of each bar.

Source: Corporate Tax Statistics Effective Tax Rates

Box 4.1. Key concepts and methodology

Forward-looking effective tax rates (ETRs) are calculated on the basis of a prospective, hypothetical investment project. The OECD methodology has been described in detail in the OECD Taxation Working Paper No. 38 (Hanappi, 2018[1]), building on the theoretical model developed by Devereux and Griffith (1998[2]; 2003[3]). The methodology builds on the following key concepts:

Economic profits are defined as the difference between total revenue and total economic costs, including explicit costs involved in the production of goods and services as well as opportunity costs such as, for example, revenue foregone by using company-owned buildings or self-employment resources. It is calculated as the net present value (NPV) over all cash flows associated with the investment project.

The user cost of capital is defined as the pre-tax rate of return on capital required to generate zero post-tax economic profits. In contrast, the real interest rate is the return on capital earned in the alternative case, for example, if the investment would not be undertaken and the funds would remain in a bank account.

The tax-exclusive effective marginal tax rate measures the extent to which taxation increases the user cost of capital; it corresponds to the case of a marginal project that delivers just enough profit to break even but no economic profit over and above this threshold. The tax exclusive EMTR uses the real interest rate as the denominator to avoid misspecification at negative values of the cost of capital. Which may arise e.g., due to tax incentives. The tax inclusive EMTR instead uses the cost of capital in the denominator.

The effective average tax rate reflects the average tax contribution a firm makes on an investment project earning above-zero economic profits. It is defined as the difference in pre-tax and post-tax economic profits relative to the NPV of pre-tax income net of real economic depreciation.

Real economic depreciation is a measure of the decrease in the productive value of an asset over time; depreciation patterns of a given asset type can be estimated using asset prices in resale markets. The OECD methodology uses economic depreciation estimates from the US Bureau of Economic Analysis (BEA, 2003[4]).

Jurisdiction-specific tax codes typically provide capital allowances to reflect the decrease in asset value over time in the calculation of taxable profits. If capital allowances match the decay of the asset’s value resulting from it being used in production, then fiscal depreciation equals economic depreciation.

If capital allowances are more generous relative to economic depreciation, fiscal depreciation is accelerated; where capital allowances are less generous, fiscal depreciation is referred to as decelerated. The NPV of capital allowances, measured as percentage of the initial investment, accounts for timing effects on the value of capital allowances, thus providing comparable information on the generosity of fiscal depreciation across assets and jurisdictions.

The cost of capital, EMTR, EATR as well as the NPV of capital allowances are all available for 90 jurisdictions in the Corporate Tax Statistics online database.

Box 4.2. Asset categories and tax provisions covered

The calculations build on a comprehensive coverage of jurisdiction-specific tax rules pertaining to four asset categories.

1. Buildings including non-residential structure such as, e.g., manufacturing plants, large engineering structures, office or commercial buildings

2. Tangible assets including five specific asset groups: road transport vehicles; air, rail or water transport vehicles; computer hardware; equipment and industrial machinery

3. Inventories including, e.g., goods or raw materials in stock

4. Acquired software such as computer programmes or applications that a company acquires for commercial purposes

For this edition of Corporate Tax Statistics, the data collection process for the tangible asset category has been disaggregated to further improve the cross-country comparability of the ETR data series. Since tangible assets are a particularly broad asset category, collecting disaggregated information on asset-specific tax rules ensures that the variation across specific assets is better captured within this category.

The following corporate tax provisions are covered:

combined central and sub-central CIT rates;

asset-specific fiscal depreciation rules, including first-year allowances, half-year or mid-month conventions;

general tax incentives only if available for a broad group of investments undertaken by large domestic or multinational firms;

inventory valuation methods including first-in-first-out last-in-first-out and average cost methods;

allowances for corporate equity.

The composite ETRs reported in this publication are constructed in three steps. First, ETRs are calculated separately for each jurisdiction, asset category and source of finance (debt and equity); within the tangible asset category, ETRs are first calculated separately for each of the five disaggregated assets and then combined through an unweighted average. While the debt-finance case accounts for interest deductibility, jurisdiction-specific limitations to interest deductibility have not been covered in this edition. Second, an unweighted average over the asset categories is taken, separately for both sources of finance. Third, the composite ETRs are obtained as a weighted average between equity- and debt-financed investments, applying a weight of 65% equity and 35% debt finance.

Box 4.3. Macroeconomic scenarios

The two main macroeconomic parameters used in the models, inflation and interest rates, interact with the effects of the tax system in various ways and can have significant effects on ETRs.

The Corporate Tax Statistics database contains ETR results for two different macroeconomic scenarios. In the first scenario, interest and inflation rates are held constant; the second scenario uses jurisdiction-specific macroeconomic parameters. While the former approach addresses the question of how differences in tax systems compare across jurisdictions holding other factors constant, the latter approach gives some indications about the effects of varying macroeconomic conditions on investment incentives as captured by the ETRs.

The results published in this publication build exclusively on the macroeconomic scenario with constant 3% interest and 1% inflation rates, however, results from the other macroeconomic scenario are available in the online database.

Figure 4.2. Changing distribution of corporate effective average tax rates, 2017-2023

Note: The values of EATRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf.

Effective marginal tax rates

Figure 4.3 shows the ranking based on the composite EMTR. As highlighted above, the EMTR measures the effects of taxation on the pre-tax rate of return required by investors to break even. While the effects of tax depreciation and macroeconomic parameters work in the same direction as in the case of the EATR, their impacts on the EMTR will generally be stronger because marginal projects do not earn economic profits (see Box 4.1). As a consequence, jurisdictions with relatively high statutory CIT rates and relatively generous capital allowances, notably Italy the United Kingdom and the United States, rank lower than in Figure 4.1. On the other hand, jurisdictions with less generous fiscal depreciation rules, including Argentina, Japan, New Zealand, Papua New Guinea and Peru (as well as Botswana, Liberia, and Czechia), are ranked higher based on the EMTR, as shown in Figure 4.3.

Figure 4.3. Effective marginal tax rate, 2023

Note: The values of EMTRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. The EMTR is computed using the tax exclusive definition (Box 4.1). Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://oe.cd/5hb.

Where investment projects are financed by debt, it is also possible for the EMTR to be negative, which means that the tax system, notably through interest deductibility, reduces the pre-tax rate of return required to break even and thus enables projects that would otherwise not have been economically viable. Figure 4.3 shows that the composite EMTR, based on a weighted average between equity- and debt-financed projects, is negative in 5 out of 90 jurisdictions; this result is due to the combination of debt finance with comparatively generous tax depreciation rules. For jurisdictions with an ACE, the composite EMTR will generally be lower because of the notional interest deduction available for equity-financed projects.

Comparing EMTRs in 2023 with the previous year shows that changes in the corporate tax provisions covered in the calculations had significant effects on EMTRs in several countries. On the one hand, 9 jurisdictions have decreased the generosity of their tax depreciation rules, resulting in an increase in the EMTRs in 2023 compared to 2022; this group includes the United Kingdom (38 p.p.) among others. On the other hand, three jurisdictions have increased the generosity of their tax depreciation rules, leading to lower EMTRs in 2023 than in 2022; this group includes Austria, Türkiye (both 1.3 p.p.), and Korea (1.2 p.p.).

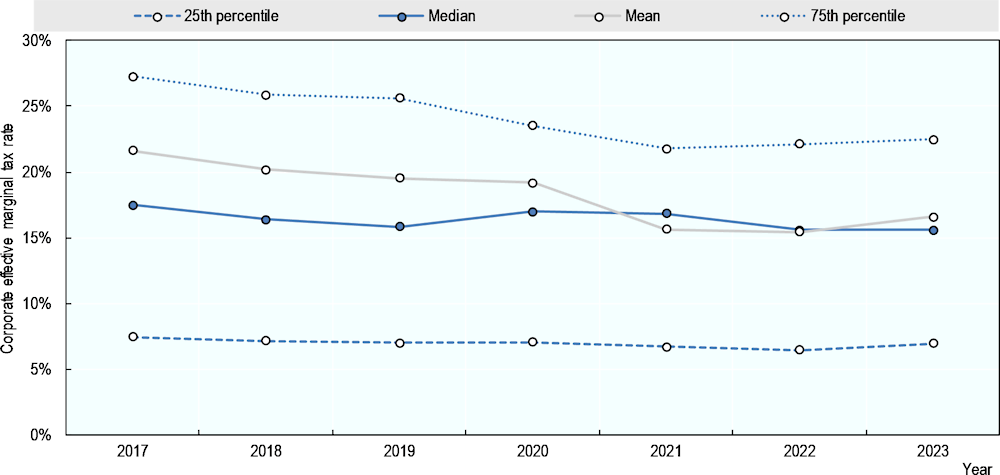

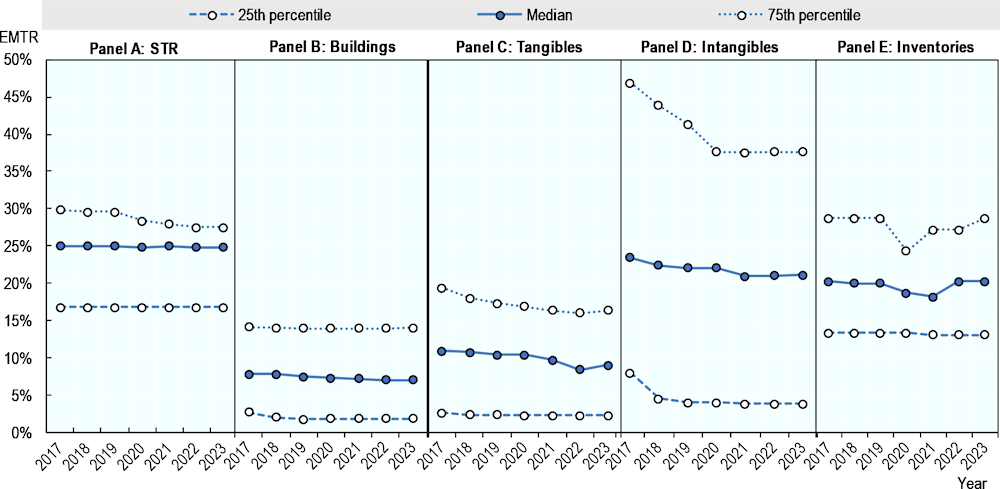

Figure 4.4. Changing distribution of corporate effective marginal tax rates, 2017-2023

Note: The values of EMTRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. The EMTR is computed using the tax exclusive definition (Box 4.1). Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf.

The distribution of EMTRs saw a general downward trend between 2017-2023 throughout the distribution. The median EMTR has dropped from 17.5% in 2017 to 15.6% in 2023, while at the top and bottom of the distribution the 75th and 25th percentile dropped from 27.3% and 7.5% respectively in 2017 to 22.5% and 6.9% in 2023. The average EMTRs have fallen from 21.6% in 2017 to 16.6% in 2023, although there was an increase from 15.4% in 2022. This latter increase is mainly due to increases in the EMTR for Italy and the United Kingdom.

Effective tax rates by asset categories

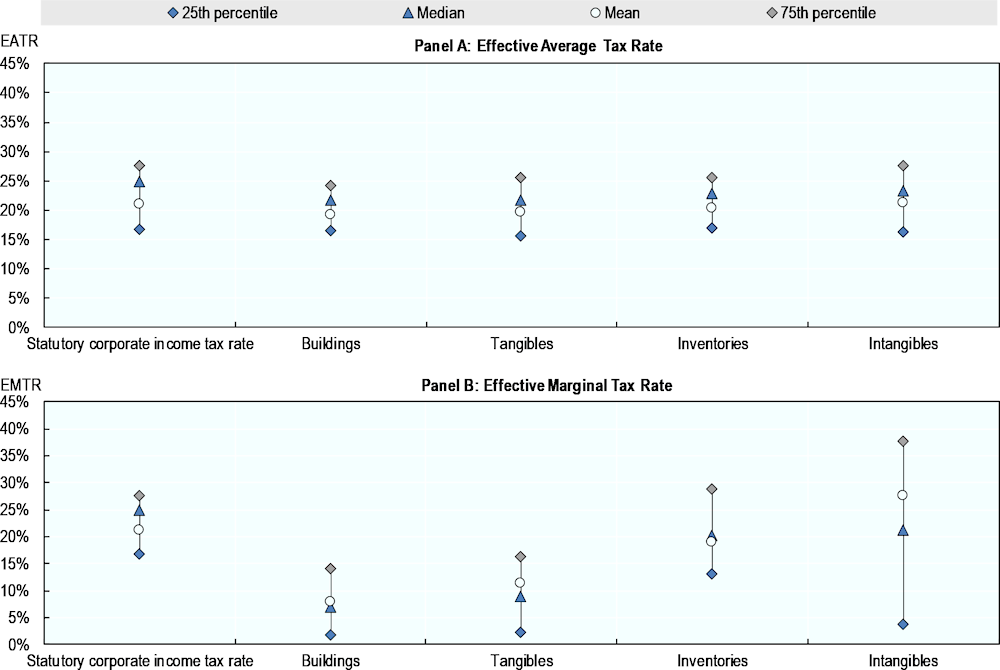

The composite ETRs can be further disaggregated by asset categories; jurisdiction-level EATRs and EMTRs by asset categories are available in the online Corporate Tax Statistics database. Figure 4.5 summarises these data on ETRs by asset category. The upper panel provides more information on the distribution of asset specific EATRs, comparing them to the distribution of statutory CIT rates. The first vertical line depicts information on the statutory CIT rates; it shows that the mean (i.e., the circle in the middle of the first vertical line) and the median (the light blue triangle) are around 21.2% and 25% respectively, while the 50% of jurisdictions in the middle of the distribution have statutory CIT rates between 16.9% and 27.6%.

The other four vertical lines in the upper panel of Figure 4.5 illustrate the distribution of EATRs across jurisdictions for each of the four asset categories: buildings, tangible assets, inventories and acquired software. Since there is more variation in economic and tax-related characteristics across tangible assets, this category summarises information on investments in several specific tangible assets, i.e., air, railroad and water transport vehicles, road transport vehicles, computer hardware, industrial machinery and equipment (see Box 4.2).

Figure 4.5. EATR and EMTR: Variation across jurisdictions and assets, 2023

Note: The values of EMTRs and EATRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. The EMTR is computed using the tax exclusive definition (Box 4.1). Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf.

Comparing the four broader asset categories with the statutory CIT rate shows that the distribution of EATRs is more condensed for investments in buildings, with the middle 50% of the country distribution ranging between 16.6% and 24.2%. For investments in tangible assets, the middle 50% of jurisdictions have EATRs between around 15.6% and 25.5%. However, the mean EATR (19.7%) on investments in tangible assets is around 2.1 p.p. lower than the median (21.8%), indicating that some jurisdictions have much lower EATRs on this type of investment. For investments in the other two asset categories, the distributions are similar to the statutory tax rate.

The lower panel illustrates the EMTR distribution for each of the four broader asset categories. The following insights emerge from this graph.

Investments in buildings and tangible assets benefit more often from accelerated tax depreciation than other investments; as a result, the EMTRs are generally lower.

Investments in buildings have EMTRs ranging between 1.8% and 14.0% in half of the covered jurisdictions.

Investments in inventories often benefit from lower EMTRs, compared to the statutory tax rate, although to a lesser extent than the first two asset categories.

The tax treatment of investments in acquired software is subject to more variation across jurisdictions, which is reflected in the vertical line that stretches out more than the others, ranging from around 3.9% to around 37.7%.

Figure 4.6. Changing distribution of EATRs by assets, 2017-2023

Note: The values of the EATRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf.

When comparing Figure 4.2 to Figure 4.6, it appears that the downward trend in EATRs between 2017 and 2023 did not occur consistently throughout all asset groups and their respective distributions. While the composite EATR shows an overall decline in the 25th percentile between 2017 and 2023, the 25th percentile of the EATRs for buildings and inventories (Panels B and E) remained relatively stable during those years. During the same period the 25th percentile for tangibles and intangibles were more volatile in comparison. Between 2017 and 2023, the 75th percentile of the EATR distribution has decreased consistently for inventories and intangibles while 2023 has seen an increase in the 75th percentile for tangibles. By contrast, between 2020 and 2021 the drop in EATRs for intangibles was stronger in jurisdictions at the lower end of the distribution. With the exception of the 25th percentiles for tangibles and intangibles the evolution of the values for each group follow that of the STR closely.

Comparing median EMTRs over time, tangible assets and buildings face significantly lower EMTRs than the other asset categories. Figure 4.7 shows the distribution of the EMTRs disaggregated by asset types and over time. The dispersion of EMTRs is particularly marked for acquired intangibles (Panel D). This reflects important differences in the fiscal depreciation provisions applicable to acquired software between jurisdictions. Several jurisdictions in the database offer very stringent depreciation rules for acquired software. In some cases, it is non depreciable, which drives the EMTR of this asset category above the STR. Notably, the dispersion of EMTRs for tangible assets has tended to decrease over time, notably for countries at the top of the distribution.

Figure 4.7. Changing distribution of EMTRs by assets, 2017-2023

Note: The values of EMTRs are calculated assuming a fixed inflation rate at 1% and fixed real interest rate at 3% and setting the pre-tax rate of return from investments at 20%. The EMTR is computed using the tax exclusive definition (Box 4.1). Additional parameters are outlined in the ETR explanatory annex accompanying Corporate Tax Statistics. https://www.oecd.org/tax/tax-policy/explanatory-annex-corporate-effective-tax-rates.pdf.

When comparing the distribution of disaggregated EMTRs with that of EATRs, the former - as depicted by Figure 4.7 - exhibits more heterogeneity both within and between asset categories. The figure shows that during the years of coverage, the EMTR applicable to investments in buildings and tangible assets as well as the EMTR applicable to inventories are consistently lower than the STR. The median EMTR for buildings and tangible assets is lower than 10% throughout the period 2017-2023 while the median STR remains around 25%. This contrast reflects that baseline CIT systems tend to provide generous fiscal depreciation for these asset types, thereby significantly reducing the cost of capital (a key element in the derivation of the EMTR) and reducing the effective tax burden on investments at the intensive margin.

Changes in the distribution of EMTR by asset type highlight the effects of certain tax reforms. Whereas Figure 4.4 shows a large drop in the average EMTR between 2020 and 2021, the equivalent disaggregated figure informs that this drop was neither consistent between asset groups nor within the respective distributions of asset groups. Panel C shows that an important part of the drop was driven by the relief in tax burden for marginal investments in tangible assets – particularly for jurisdictions at the top end of the distribution such as Italy and the United Kingdom where the EMTR for tangible assets dropped by 5.0 and 4.2 p.p., respectively. During those two years, the 75th and 25th percentiles as well as the median for EMTRs applicable to buildings remained about constant. By contrast, the median values for intangibles and inventories both decreased during the same period.

References

[4] BEA (2003), Fixed Assets and Consumer Durable Goods in the United States, 1925-97 | U.S. Bureau of Economic Analysis (BEA), https://www.bea.gov/node/24441 (accessed on 18 February 2023).

[3] Devereux, M. and R. Griffith (2003), “Evaluating tax policy for location decisions”, International Tax and Public Finance, Vol. 10/2, pp. 107-126, https://doi.org/10.1023/A:1023364421914.

[2] Devereux, M. and R. Griffith (1998), “The taxation of discrete investment choices”, https://www.econstor.eu/handle/10419/90851 (accessed on 18 February 2023).

[1] Hanappi, T. (2018), “Corporate Effective Tax Rates: Model Description and Results from 36 OECD and Non-OECD Countries”, OECD Taxation Working Papers, No. 38, OECD Publishing, Paris, https://doi.org/10.1787/a07f9958-en.