This chapter describes market developments and medium-term projections for world meat markets for the period 2024-33. Projections cover consumption, production, trade and prices for beef and veal, pig meat, poultry, and sheep meat. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world meat markets over the next decade.

OECD-FAO Agricultural Outlook 2024-2033

6. Meat

Copy link to 6. MeatAbstract

6.1. Projection highlights

Copy link to 6.1. Projection highlightsGlobal meat demand will slow

Over the medium term, the global average grams of daily meat protein consumed per capita is expected to increase by 3% or an additional 0.5 kg rwe (edible retail weight equivalent)/year by 2033, half the increase of the previous decade. The recent decrease in feed costs and reduction in general inflation in many parts of the world have not completely offset other higher production expenses, which will underpin retail meat prices, and restrain demand growth. In addition, reduced population growth and re-shaping demographics will diminish growth in aggregate meat demand. Global meat consumption is anticipated to rise 12% by 2033 relative to the Outlook 2021-23 base period.

The COVID-19 pandemic and economic downturn have significantly affected living costs, influencing consumer behaviors regarding meat consumption. Behaviour changes include include reduced dining out, increased home cooking due to remote work, and a trend towards more affordable proteins, elevating price as a key decision factor along with health or environmental concerns. Consumers have adjusted to higher meat prices and reduced purchasing power by shifting toward cheaper meats and meat cuts and a shift of out-of-home food expenditure towards the fast-food industry. However, following the general assumptions of the Outlook for modest growth with reduced inflation, and considering the emphasis on valuing healthy living, climate awareness, and lifestyle driven food choices, individuals with higher income will increasingly pay more for premium less processed meat options. This trend reflects a growing preference for quality over quantity in their dietary selections.

Advances in productivity, largely due to improved genetics and farm management, are expected to enhance breeding rates and animal slaughter weights, helping to ensure that supply keeps pace with demand (Figure 6.1). This balance will be maintained even as the industry navigates through challenges, such as the need for investment in production modernization, labour shortages, regulatory compliance, and environmental sustainability in the context of adverse weather and animal disease threats. These productivity advances, whether intensive or extensive production regimes, will play an increasingly critical role in planning and managing meat production, ensuring sustainability and limiting the environmental impact of livestock farming.

The Outlook anticipates a worldwide growth in livestock populations to be close to 2 billion cattle, 1 billion pigs, 32 billion poultry, and nearly 3 billion sheep. Consequently, the meat industry's greenhouse gas (GHG) emissions are predicted to rise 6% by 2033. This rise in emissions is smaller than the 12% growth in meat production, attributed to an increased proportion of poultry in the meat production mix and advances in productivity that allow for more meat to be produced per animal, with a decreasing amount of GHG emissions per unit of meat produced.

The economic growth of key meat markets remains relatively weak, and while the People’s Republic of China (hereafter “China”) will remain the biggest single market for meat, the pace of its economic recovery is uncertain. China's role in the global meat market remains crucial in the global meat economy, as its market share of trade, while declining from its recent high, will still represent 16% by 2033. There are growing signs the country will gradually become less dependent on non-ruminant meat imports. The reduction in China's pork imports since 2020 has contributed to decreased production among three of the four major exporters (the United States, the European Union, and Canada) starting in 2021, while Brazil has seen output growth due largely to real exchange rate depreciation, which has rendered its sector more competitive in the last decade. A less dramatic but similar decline in China’s imports of poultry can also be observed.

This trade shift due to China is also causing global meat exports to return to the lower levels observed in 2019, mainly reflecting the significant impact on global pork market dynamics in particular, but also on the global meat sector's Outlook. Global meat trade is set to expand over the medium term, driven by rising demand linked to per-capita income growth in Asian countries and population-driven increases in Sub-Saharan Africa. The pace at which trade will increase will be moderate compared to the previous decade, with the proportion of globally traded meat output projected to rise back to the “African Swine Fever” induced high of 2021 toward the end of the projection period.

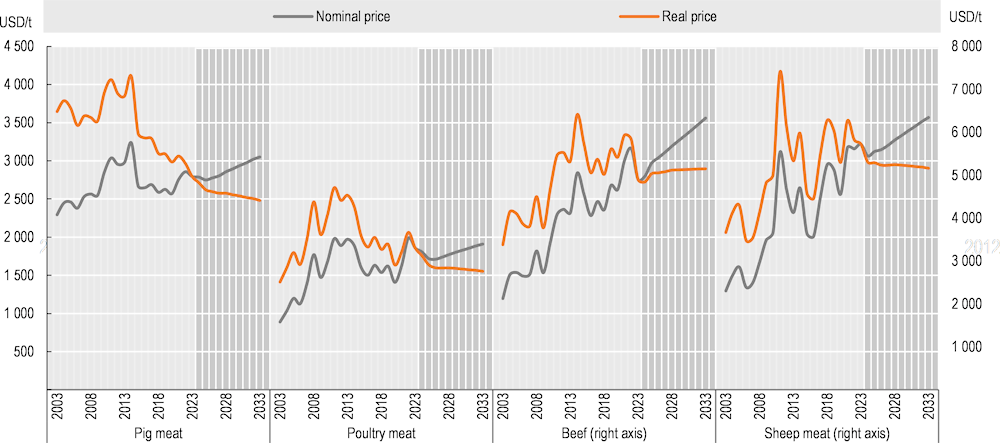

Meat prices started to decline in 2023 from historically high nominal levels. In real terms, the Outlook projects real prices of all meats to gradually return to their long-term downward trend levels influenced by reduced demand growth, lower real feed costs, and continuous improvements in productivity, particularly in genetics.

Animal disease outbreaks pose significant uncertainties for the meat sector, with economic impacts from such incidents often disrupting markets and requiring years for resolution. This underscores the importance of collaborative biosecurity efforts to ensure the sector's sustainability, particularly in the face of risks to exports and imports. The meat industry's environmental impact, notably its substantial resource consumption and GHG emissions, will be shaped by global demand trends, productivity improvements, and environmental policy implementation. Demographic changes, health awareness, and environmental concerns may gradually decrease meat consumption. In addition, the industry should aim to provide high-quality protein while pursuing sustainability, aligning with the United Nations Sustainable Development Goals through enhanced animal welfare, worker well-being, reduced packaging, and minimizing food loss and waste. Finally, the current disruptions in key maritime passages notably the Suez Canal, Panama Canal, and the Black Sea represent a complex challenge for trade. These disruptions, caused by geopolitical tensions, natural events, and logistical hurdles, have an impact on animal protein feed availability and global meat supply chains. They lead to increased transportation costs, delays, and supply chain inefficiencies, directly affecting the cost and availability of meat products.

6.2. Current market trends

Copy link to 6.2. Current market trendsGlobal Meat Supply Sluggish Amidst Persistent High Production Costs

In 2023, global meat production rose to an estimated 354 Mt, a modest 0.7% increase from the previous year. In Asia, especially China, the pig meat sector changed as small-scale farmers leaving the industry liquidated their herds due to low profitability and tighter production regulations. In South America, production growth is due to increased competitiveness with depreciated exchange rates, while Oceania has benefited from an expanded supply of slaughter-ready animals. These gains are partially offset by lower production in Europe due to the higher cost of complying with stricter environmental legislation, reduced returns due to high inflation, animal diseases, and a declining herd population. Africa has faced adverse weather conditions and conflicts that disrupt livestock operations. Northern America is grappling with output declines responding to reduced returns for producers due to high production costs, including interest expenses.

Global meat trade fell to 39 Mt in 2023, 3% lower than the previous year. Imports are under pressure in Africa and Europe, limited by sluggish economic growth, high inflation, and currency depreciation affecting consumer purchases. Nevertheless, Asia and Oceania, import demand is rising modestly, driven by increased food services sales. For export, the United States and Australia have increased shipments due to their disease-free status and competitive prices. Global meat prices declined in 2023 after their nominal historical peak in 2022, mainly due to increased export availability from leading exporting regions and a slowdown in import demand by key meat-importing countries.

6.3. Market projections

Copy link to 6.3. Market projections6.3.1. Consumption

Middle-income countries driving global increases in meat demand

Global poultry, pig meat, beef, and sheep meat consumption is projected to grow 16%, 8%, 11%, and 16%, respectively, by 2033. Per capita, meat consumption will rise by 2% by 2033, just 0.5 kg/year/person on an edible retail weight equivalent basis (hereafter “rwe”), reaching 28.6 kg/year/person rwe. This is only one-third of the growth rate in the previous decade. Consumption in most high-income countries (which represent 32% of total meat consumption for 16% of the population in 2023) will continue to stagnate, changing in composition based on the type and quality of the meat consumed1. Due to their lower base intake and more rapid increases in population and incomes, 79% of growth will be generated from middle-income countries. On a country basis, the growth in the volume of meat consumption, aside from China and India because of their vast population, is expected to be greatest in Viet Nam, the United States, and Brazil. Globally, there is a growing trend among consumers to become increasingly sensitive to animal welfare, environmental and health concerns. In some instances, shifts in preferences may lead to shrinking per capita meat consumption, as in the case of the European Union, for which the Outlook foresees an ongoing substitution of beef, pig meat, and sheep meat by poultry meat.

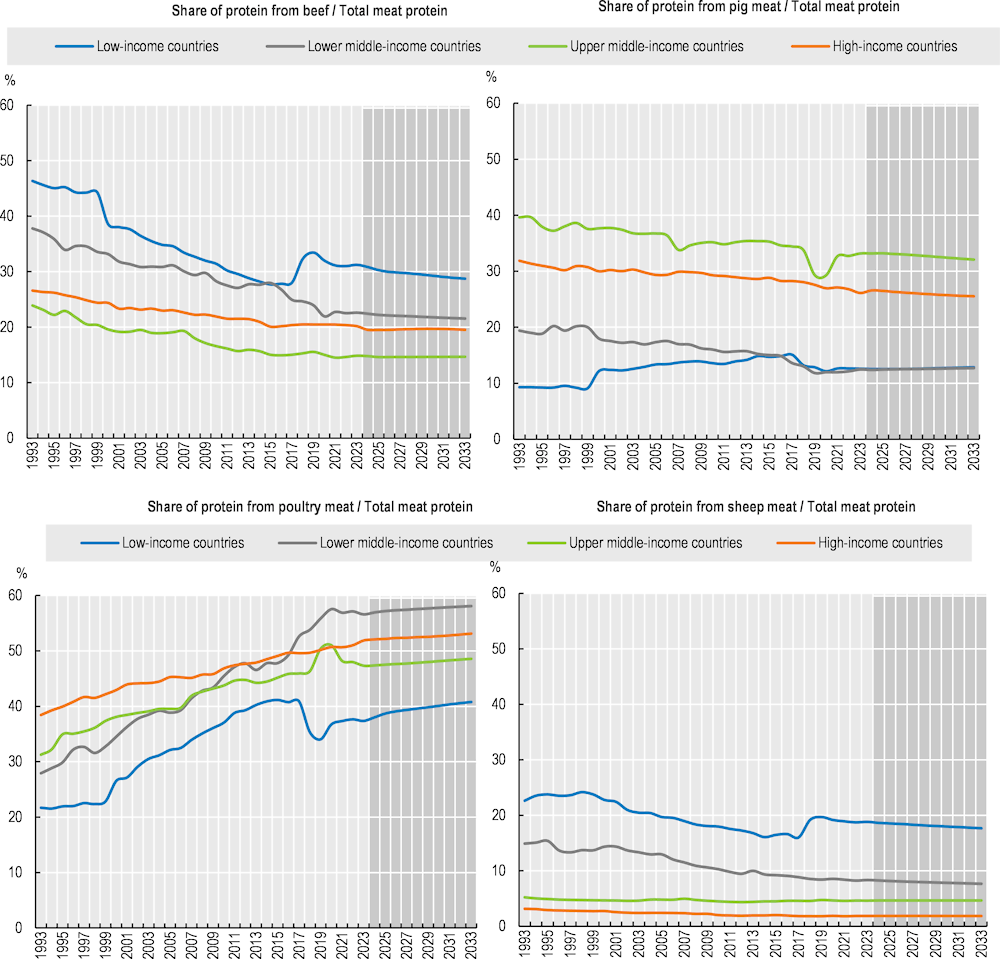

Global poultry consumption is projected to reach 160 Mt rtc, accounting for half of the additional meat consumed. The increase in poultry consumption in the last decade was driven by rising consumption in Asia, particularly in China, India, Indonesia and Viet Nam. These trends will continue, but consumption is projected to grow rapidly in other regions, including Brazil, Mexico, the European Union, and the United States. The global increase in protein from poultry consumption as a share of total protein from meat has been the main feature of the growth in meat consumption for decades, this trend is expected to continue (Figure 6.2). Poultry meat will account for 43% of the protein consumed from all meat sources in 2033, followed by pig, bovine and sheep meat. This is due to several factors and chief among them is price as poultry is by far the lowest priced meat. In addition, poultry contains a healthier combination of protein and fat than other meats. Environmental considerations also contribute to the shift towards poultry meat, as the production of red meat is more resource-intensive and leads to high greenhouse gas emissions. Poultry is therefore more attractive to sustainability/environment conscious consumers.

Figure 6.2. Share of proteins in total meat consumption

Copy link to Figure 6.2. Share of proteins in total meat consumption

Note: Per capita consumption. The 38 individual countries and 11 regional aggregates in the baseline are classified into four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global pig meat consumption is projected to grow in all regions, except in Europe, where consumption is already high, and health, environmental and societal concerns significantly impact consumer choice. However, pig meat will remain the most widely consumed meat in the European region. Pig meat will be the second largest contributor to the total growth in meat consumption and is projected to reach 131 Mt cwe by 2033. However, a decline of 2% will be recorded over the projection period in global per capita terms rwe. In Latin American countries per capita consumption is projected to increase by 1.3 kg/year rwe, due to favourable relative pig meat/beef prices. Elsewhere, per capita demand is anticipated to grow less or remain stagnant.

Global beef consumption is projected to reach 81 Mt cwe over the next decade, roughly in line with population growth, remaining stable at around 6 kg per capita rwe. Most regions are projected to reduce their beef intake, apart from the Asia-Pacific region, where per capita beef consumption is projected to increase by 0.5 kg/year rwe. This is partly due to a growing middle class which has increased demand for meat, including beef. China, India and Pakistan, the world’s second, fifth, and sixth largest beef (including carabeef) meat consumers, although relatively low in per capita terms are projected to see further increases in their per capita consumption by 2033. In contrast, Latin America, North America and Oceania, which historically have strongly preferred beef, are expected to see the most significant decrease in per capita consumption as beef prices move higher than those of substitutes. There are also growing concerns about the environmental impact of beef production, which is perceived as a significant contributor to greenhouse gas emissions.

While sheep meat consumption is a relatively small part of the global meat market, it remains an essential source of protein for many consumers in the Middle East and North Africa, where pig meat is not a substitute. While some change is occurring in global dietary patterns, the contribution of sheep meat to total protein from meat is projected to remain stable (Figure 6.2). It is often a traditional (cultural) food choice, although beef and poultry are more widely available and cheaper than sheep meat.

6.3.2. Production

Productivity growth is key to containing higher costs

High costs of production, increasingly stringent regulatory frameworks and various disease outbreaks have posed significant challenges for meat producers worldwide in recent years. While high feed costs have abated, rising operating and labour costs make it more difficult for meat producers and processors/retailers, especially at the beginning of the Outlook period, as inflation of input prices and interest rates also remain high. Environmental and animal health regulations are multiplying everywhere, with associated costs of compliance. In this setting, sector participants must strive for higher productivity in order to remain competitive. The Outlook anticipates that higher productivity will result from improved breeding and operational management practices and higher slaughter weights. Figure 6.1 elaborates on how these gains will evolve over the Outlook. Greater feed efficiency, with less feed required per kg of meat production as reported in Table 6.1,2 is also projected to continue at trend rates.

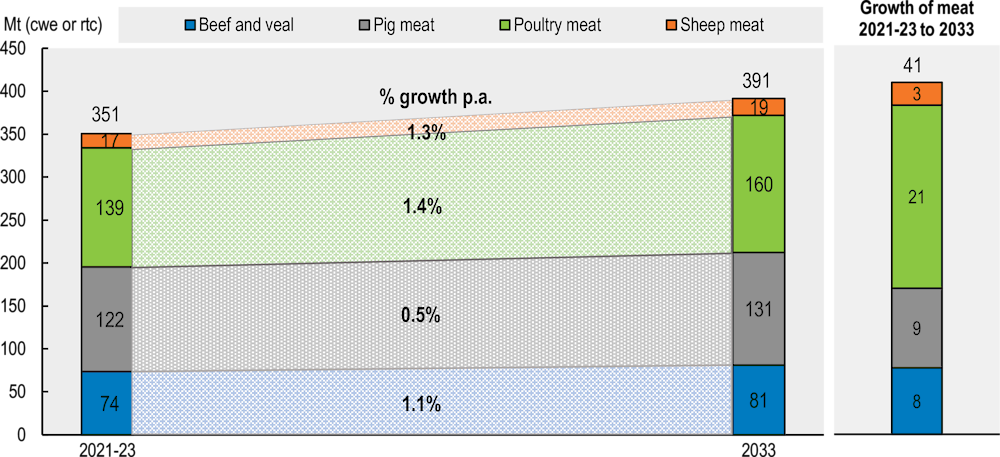

World meat production is projected to rise 12% or 41 Mt cwe to an estimated 388 Mt cwe by 2033. Most of the growth in meat production will occur in Asia, globally led by a 19 Mt increase in poultry production (Figure 6.3). In China, the rebound in pig meat production following its past ASF outbreak will offset the projected decline in European pig output, where factors such as societal criticism, ASF outbreaks, stricter environmental laws and animal welfare regulations will impact markets. Meat supplies from Latin America will continue to increase production share, underpinned by more favourable competitive conditions.

Poultry will increase its dominance within the meat complex, accounting for half of the additional meat produced in the next decade. Driven by domestic demand, poultry production will expand most rapidly in developing countries. Rising demand for animal protein, including eggs for the bakery and confectionery sectors, is underpinning growth. Poultry has advantages over other meats in terms of production cycle, higher feed conversion ratio with lower costs, and proximity to fast-growing urban markets.

Several factors will constrain the growth of the poultry sector. The rising density of poultry production increases the risks of disease (e.g. HPAI), which, while improved detection and treatment make them more easily contained, also raises costs for the industry. Poultry production also faces environmental and health challenges, particularly regarding antibiotic use and animal welfare concerns.

Table 6.1. Trends in non-ruminant Feed Conversion Ratios in selected countries

Copy link to Table 6.1. Trends in non-ruminant Feed Conversion Ratios in selected countries|

Country |

Commodity |

Average 2021/2023 |

2014-2023 |

2024-2033 |

|---|---|---|---|---|

|

kg of feed / kg of meat live weight |

%/yr |

%/yr |

||

|

Argentina |

Poultry |

1.77 |

-0.13 |

-0.06 |

|

Pork |

3.62 |

-0.27 |

-0.17 |

|

|

Australia |

Poultry |

1.76 |

-0.15 |

-0.06 |

|

Pork |

3.60 |

-0.29 |

-0.14 |

|

|

Brazil |

Poultry |

1.73 |

-0.16 |

-0.05 |

|

Pork |

3.44 |

-0.35 |

-0.15 |

|

|

Canada |

Poultry |

1.73 |

-0.16 |

-0.05 |

|

Pork |

3.44 |

-0.35 |

-0.15 |

|

|

China |

Poultry |

1.24 |

0.71 |

0.46 |

|

Pork |

3.01 |

3.85 |

0.53 |

|

|

European Union |

Poultry |

1.77 |

-0.14 |

0.06 |

|

Pork |

3.53 |

-0.34 |

-0.14 |

|

|

India |

Poultry |

2.15 |

-0.01 |

-0.04 |

|

Pork |

4.48 |

-0.01 |

-0.04 |

|

|

South Africa |

Poultry |

2.1 |

0.03 |

-0.04 |

|

Pork |

4.38 |

0.03 |

-0.04 |

|

|

Thailand |

Poultry |

2.13 |

-0.03 |

-0.12 |

|

Pork |

4.43 |

-0.03 |

-0.12 |

|

|

United States |

Poultry |

1.73 |

-0.16 |

-0.05 |

|

Pork |

3.44 |

-0.35 |

-0.15 |

|

|

Viet Nam |

Poultry |

2.15 |

-0.02 |

-0.06 |

|

Pork |

4.47 |

-0.02 |

-0.06 |

Note: Trend growth rates are computed from trend regression over the period indicated.

Source: OECD/FAO (2024), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database).

Figure 6.3. Growth of meat production by meat type, 2033 vs. 2021-23

Copy link to Figure 6.3. Growth of meat production by meat type, 2033 vs. 2021-23

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Recovery from ASF in Asian countries is assumed to occur during the first half of the Outlook projection, so global pig meat production is projected to increase by 0.5% p.a. during the next decade. Most of the increase will occur in the Asian ASF-affected regions, where conversion from largely small-scale backyard holdings to large-scale commercial enterprises with higher biosecurity standards is taking place.

Beef production will rise over the medium term with higher animal carcass weights, improved animal genetics and improved farm management. The output will reach 81 Mt cwe by the end of the Outlook period (Figure 6.3). The main contributor to this expansion in global beef supply is China’s growth following technological improvements. India will also be one of the main contributors to the production expansion as efforts have been made to improve the infrastructure for the meat industry, including export-oriented integrated meat processing plants, as Indian buffalo meat has a huge demand in the international market. While the United States and Brazil's beef herd continue their destocking phase at the start of the Outlook, Australia's increasing slaughter capacity and profitability will trigger higher beef production over the Outlook period.

Global sheep production is anticipated to reach 19 Mt cwe by 2033 due to flock rebuilding and increased lambing rates in response to higher prices, particularly in China, which will contribute 16% of additional production. Production in the European Union is projected to increase marginally from the current level despite the continued decline in the EU countries that entered into the European Union before 2004 in spite of production-coupled income support and favourable producer prices in the main sheep-producing Member States. New Zealand’s pledge to reduce GHG emissions is expected to constrain flock size as productive sheep land is converted into plantations for carbon credits.

The livestock sector will face rising concerns about its environmental footprint. GHG emissions from livestock are projected to rise by 6% by 2033. This increase is lower than that of meat production due to the shifts towards poultry production, national low-carbon emission initiatives, and increased productivity, which yields higher meat output from a given stock of animals. The strongest growth in meat-related greenhouse gas emissions will be in Africa, where they will be over 15% higher in 2033 than in the base period. Emissions in Europe and Oceania from meat production are expected to decline by 6% and 1%, respectively (Figure 6.4).

The Outlook implications for GHG emissions from meat production are broadly consistent with those of the IPCC. Looking beyond the medium term into the longer term, demographic trends and consumer preferences are anticipated to translate into a rise from 6.2 Gt CO2eq in 2015 to 9.1 Gt CO2eq by 2050 with no intervention in terms of GHG reduction assuming no change in the emission per unit of output and no efficiency improvement along the production chain (Box 6.1).

Box 6.1. Pathways towards lower emissions: A global assessment of the greenhouse gas emissions and mitigation options from livestock agrifood systems

Copy link to Box 6.1. Pathways towards lower emissions: A global assessment of the greenhouse gas emissions and mitigation options from livestock agrifood systemsA new FAO report presents a detailed analysis of greenhouse gas (GHG) emissions from livestock systems and explores various mitigation options. Utilising the Global Livestock Environmental Assessment Model (GLEAM), it quantifies emissions related to livestock, including direct emissions from enteric fermentation and manure management, and indirect emissions from the production of feed and other inputs. The report finds that in 2015, livestock systems contributed approximately 6.2 gigatonnes of CO2-equivalent emissions, accounting for around 12% of all anthropogenic GHG emissions. Cattle farming is the largest source of emissions, responsible for 62% of the sector's output. The report also highlights significant variations in emission intensity across different countries, species, and production systems, influenced by factors such as breeds, management practices, and environmental conditions. While there is no one-size-fits-all solution to lowering emissions from livestock, it stresses the importance of adopting sustainable practices to reduce emissions and mitigate the environmental impact of livestock systems by enhancing animal health, breeding practices, feed quality, and other targeted GHG mitigation measures such as rumen manipulation and feed additives. These measures can reduce emissions while meeting the 20% increase in livestock product demand mostly anticipated to originate from the Americas and Asia by 2050.

Source: FAO (2023), Pathways towards lower emissions – A global assessment of the greenhouse gas emissions and mitigation options from livestock agrifood systems. Rome https://doi.org/10.4060/cc9029en.

Measures to reduce food loss and waste (FLW) in the sector may also lower the need for production and, hence, reduce the sector’s resource footprint. Global attention has been drawn to the issue of food loss and waste in the food value chain which is discussed extensively in Chapter 1 and was described relative to the livestock sector in last year’s OECD-FAO Agricultural Outlook 2023-20323, Box 6.2 noted that estimates of food loss and waste differ depending on the methodology used. Current estimates used in the Aglink-Cosimo model assume that 20% of production (69 Mt) in cwe in the meat sector is assumed to be lost or wasted and estimates that household consumption accounts for 55% of total food waste, followed by distribution (25%) and post-slaughter losses (20%).4

Some benefits can be achieved by promoting a circular bioeconomy along livestock supply chains. Likely improvements also include better farm management education, adequate cold chain facilities, technological innovations like active packaging and Radio-Frequency Identification for longer shelf life, improved organisational strategies in distribution, such as a stock rotation strategy that ensures older stock (first in) is sold or used before newer stock (first out), and consumer education on food handling, planning and storage to mitigate waste effectively. Highlighting the importance of targeted interventions at each stage to mitigate food loss and waste in the meat sector may lead to improved policy approaches.

6.3.3. Trade

Meat exports will return to 2021 high by the end of the Outlook

Meat trade was at historically high levels in 2020-2021, largely due to high import demand by China during its ASF outbreak, when it accounted for almost one-quarter of global imports. With the recovery of China's meat sector, China’s self-reliance policy will underpin its production of pork as well as poultry, which has been affected by Avian Influenza. Given the importance of China’s trade, global meat trade will continue to decline in the initial year of the Outlook. Nevertheless, with underlying growth in African markets, trade will return to their level of 40 Mt cwe last seen in 2021. (Figure 6.5).

North and South America are expected to account for more than half (56%) of global meat exports by 2033, a share that will remain stable over the Outlook period. The share of the two major exporters, Brazil and the United States, each representing 20%, will also remain stable over the projection period.

Argentina, Australia, Brazil, and Thailand are expected to record the most significant increase in global meat exports, benefiting from favourable exchange rates and feed availability. India’s meat exports decline are particularly notable as they consist of lower-priced buffalo meat, fulfilling consumers’ demand for low-cost meat in developing countries.

The European Union’s global meat export share will continue its decline, which started in 2021 to reach 15% in 2033. The most significant growth in import demand originates from Africa, which will account for 73% of additional imports of all meat types. While Chinese meat imports remain high in the early part of the projection period, a gradual decline is projected as poultry and pig meat production recovers from the disease outbreak. In terms of composition, poultry will account for 72% of the additional meat imports, bringing its share of total meat imports to 41% by 2033.

Australia and New Zealand will continue to lead global sheep meat markets. Australia is expected to increase lamb exports (of higher value) to high-end restaurants at the expense of mutton, while in New Zealand, exports will slowly decline as land use shifts from sheep farming. The rising middle-class consumer in the Middle East is the source of higher import demand.

6.3.4. Prices

Real prices of meat are expected to remain well below their 2013-2014 peaks

The Outlook projects that meat prices over the medium term, after recent years of high prices, are expected to decline gradually following the decrease in feed costs and general inflation, in both nominal and real terms at the start of the Outlook period. As incomes rise, consumer spending on meat, especially poultry, is likely to rebound. The Outlook projects real prices of meats to gradually return to their long-term trend levels influenced by lower real feed costs and continuous improvements in productivity, but reduced demand growth for red meat is expected to keep prices low. Meat prices in real terms are projected to be 7% to 19% lower than their 2021-2023 averages (Figure 6.6).

Figure 6.6. World reference prices for meat -rising in nominal, but falling in real terms

Copy link to Figure 6.6. World reference prices for meat -rising in nominal, but falling in real terms

Note: Real prices are nominal world prices deflated by the US GDP deflator (2023=1). United States: Meat of Swine (Fresh, Chilled or Frozen) export unit value USD/t, Brazil: Meat and Edible Offal of Poultry (Fresh, Chilled or Frozen), export unit value USD/t, Beef (Australia), cow forequarters, 85% chemical lean, c.i.f. US imported USD/t, New Zealand: Lamb 17.5kg, USD/t cwe.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

6.4. Risks and uncertainties

Copy link to 6.4. Risks and uncertaintiesBiosecurity stands as a crucial concern for the meat industry

The meat sector faces several uncertainties in meeting the increasing demand for meat products while addressing concerns about animal disease, weather and environmental sustainability, consumer preferences, animal welfare, public health and trade policies.

Disease outbreaks are a continuous threat to markets. They have a variety of socio-economic costs, depending on the country and situation, including the loss of export markets, reduced imports from affected countries, or decreased consumer purchases due to health concerns. While these costs can be high globally, they can be mitigated by supplies from alternative disease-free markets or by following World Organization for Animal Health (WOAH) protocols that localise disease impacts on trade.5

Seasonal conditions and climate change will have negative but uncertain impacts on the Outlook. First, they will potentially reduce the availability of feed, water, and other resources critical to livestock production. Secondly, increased adoption of policies to address climate change may increase costs of production and adherence to regulations. Third, the growing shift in consumer preferences toward more environmentally conscious purchases may result in reduced demand for traditional meat products which could have significant implications for the meat industry.

Consumer increasingly prefer healthier food options.6 It has already been noted that consumer preferences have shifted in favour of poultry meat as a high-protein/low-animal-fat meat. Concerns have also been raised about the health effects of consumption of red7 versus white meat. Furthermore, public health concerns over antibiotic resistance are increasing, and there are pressures to reduce the use of antibiotics in animal agriculture.

Finally, international trade plays a vital role in the meat sector, and changes in trade policies—tariffs and trade bans—can also significantly impact national and global markets. After several decades of more liberal trade, recent tendencies toward more protectionism will reduce trade and generally lower trade prices.

Notes

Copy link to Notes← 1. In the United States, for example. Kuck, G. and G. Schnitkey. "An Overview of Meat Consumption in the United States." farmdoc daily (11):76, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, 12 May 2021.

← 2. More detailed analysis is reported in the OECD/FAO (2022), OECD-FAO Agricultural Outlook 2022-2031, OECD Publishing, Paris, https://doi.org/10.1787/f1b0b29c-en. Box 6.1“Productivity change in the meat sector”.

← 3. OECD/FAO (2023), OECD-FAO Agricultural Outlook 2023-2032, OECD Publishing, Paris, https://doi.org/10.1787/08801ab7-en.

← 4. Average 2021-2023, with significant regional variations and disparities among food groups.

← 5. Currently, a country affected by ASF is not obliged to completely stop its exports if it takes the measures recommended by the WOAH.

← 6. “Affordability, freshness, taste and nutritional value figure among consumers’ top priorities when making food purchases in the nine surveyed countries (Chapter 5)”. OECD (2023), How Green is Household Behaviour?: Sustainable Choices in a Time of Interlocking Crises, OECD Studies on Environmental Policy and Household Behaviour, OECD Publishing, Paris, https://doi.org/10.1787/2bbbb663-en.

← 7. Health effects of red and processed meat: WHO https://www.who.int/news-room/questions-and-answers/item/cancer-carcinogenicity-of-the-consumption-of-red-meat-and-processed-meat.