This chapter describes market developments and medium-term projections for world cotton markets for the period 2024-33. Projections cover consumption, production, trade and prices developments for cotton. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world cotton markets over the next decade

OECD-FAO Agricultural Outlook 2024-2033

10. Cotton

Copy link to 10. CottonAbstract

10.1. Projection highlights

Copy link to 10.1. Projection highlightsOver the next ten years, global consumption of raw cotton, also known as lint, is projected to increase by an annual rate of 1.7%, on account of population growth and increasing incomes in middle- and low-income countries. Demand in the textiles and apparels sectors, as well as competition from substitutes, will remain key elements influencing raw cotton consumption. Asian countries, notably Bangladesh and Viet Nam, are projected to experience the fastest growth in cotton consumption over the next decade. Due to competitive labour and production costs, a further expansion in the milling capacity of Viet Nam, Bangladesh and India is expected over the next decade. Nevertheless, China is expected to remain the largest cotton processing country in 2033, followed by India.

In the coming decade, global lint cotton production is expected to increase by 1.3% p.a., reaching 29 Mt by 2033. This growth is primarily expected to be supported by improved yields, estimated at 1.1% p.a., with a smaller contribution from the expansion of harvested areas at 0.2% p.a. The anticipated increase in yields is set to be spurred by advancements in genetics, enhanced agricultural practices, the adoption of new technologies, and the implementation of digitalization to support precision agriculture.

Cotton production is expected to be supported marginally by area expansion in Brazil and in the United States. Conversely, a decline in area is expected in China, while production is projected to remain relatively stable due to higher yields. Nevertheless, China, is expected to retain its position as the world’s largest cotton producer, alongside India. Together, these two countries are projected to account for almost half of the global production by the end of the Outlook period.

Over the next ten years, global trade of lint is expected to increase by 2.1% p.a., reaching 12.4 Mt by 2033. This growth is expected to be driven by strong demand from countries with expanding textile industries such as Bangladesh and Viet Nam, which heavily rely on imports due to insufficient domestic production capacity. In addition, the stagnant growth rate of production in China is expected to spur imports over the next decade. The growing gap will be filled mainly by top producing countries, such as Brazil and United States, which will export an increasing share of their production. Overall, the global cotton market structure is expected to remain relatively stable in the next decade, with the United States and Brazil set to persist as the largest exporters of raw cotton in 2033.

Prices will continue to be influenced by competition from synthetic fibres along with changes in consumers preferences. International cotton prices in real terms are foreseen to trend slightly downward in the medium term.

The demand for cotton is closely tied to global economic conditions, affecting demand for textile products, while competition from synthetic fibres and the increasing trend for fast and athleisure fashion also affect demand for cotton. However, consumers’ concerns about the environment and the growing demand for sustainable and organic cotton are expected to boost demand for cotton (Figure 10.1), although this may be partly offset by the impact of circular economy business models, particularly recycling and second-hand. On the supply side, the main source of uncertainty is yield risk, due to extreme weather events, unsustainable water usage and pest infestations. Finally, policy measures affecting the production and consumption of cotton (e.g. Product Environmental Footprint (PEF) and the Strategy for Sustainable circular textiles in the European Union), trade developments and geopolitical tensions, as it was with the enforcement in June 2022 in the United States of the Uyghur Forced Labor Prevention Act (UFLPA),1 can also have important implications for the world cotton market.

10.2. Current market trends

Copy link to 10.2. Current market trendsThe slowdown in the global economy is seen affecting global cotton consumption in 2023/24

Global cotton production in the 2023/24 (August/July) season is expected to be slightly lower that the previous season. The decline is largely attributed to expectations of reduced outputs in key producing countries, China and India, due to lower plantings and crop yields, affected by unfavourable weather conditions. A sharp decline in production is also forecast in the United States, where prolonged dry weather conditions are anticipated to curb yields. By contrast, cotton production is expected to increase in Brazil, with the country currently forecast to overtake the United States as the third world’s largest cotton producer. A strong rebound is anticipated in Pakistan and also in West African countries after the drop in 2022/23 mainly caused by a significant Jassids infestation.

Global cotton consumption in 2023/24 is forecast only slightly above its level in 2022/23 season, which was the lowest in ten years. The slowdown in the global economy is seen to affect global demand for cotton-related products. The year-on-year increase is mainly driven by forecasts of higher cotton use in Pakistan, Türkiye, and Viet Nam. By contrast, in the world’s largest cotton-spinning countries, mill use is projected at the 2022/23 level in China, while in India, a relatively small decrease is anticipated.

International cotton prices have generally declined since the start of the season in August 2023, pressured downwards by concerns over weak global demand for textiles and clothing, due to the slowdown in global growth. In 2023, cotton prices averaged 27% below their multi-year high levels in 2022, affecting planting decisions in key producing countries, including in India and the United States.

World trade of raw cotton is foreseen to increase by around 10% compared to the previous season. On the supply side, exports from Brazil are expected to rebound significantly in line with the bumper crop expected and to more than offset a decline in the United States, the worlds’ larger exporter. A rebound in exports is also forecast from West African countries. On the demand side, the forecast of higher purchases by China, mainly based on an expected decline in domestic production, along with increased imports from Bangladesh and Viet Nam are foreseen to drive the overall increase in global imports in the current season.

10.3. Market projections

Copy link to 10.3. Market projections10.3.1. Consumption

Viet Nam to take the lead in annual growth of mill use, but China projected to retain its position as the world’s largest cotton processing country

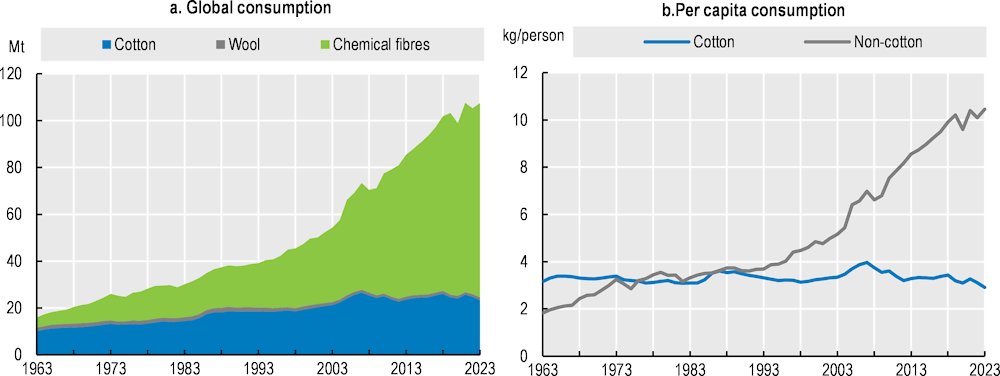

Cotton consumption refers to the use of cotton fibres by mills to transform it into yarn. Cotton mill-use depends largely on two major factors: global textile demand and competition from synthetic fibres. Over the past decades, global demand for textiles fibres has sharply increased, driven mainly by population and income growth, particularly in low- and middle-income countries. This expanding demand has been largely supplied by chemical fibres (Figure 10.2, Panel a). The diverse advantages of synthetics compared to cotton including durability, wrinkle resistance, moisture-wicking, and/or competitive prices have boosted textile manufacture industry to favour synthetic over cotton fibres. As a result, global consumption of natural fibres peaked in 2007 at 26.5 Mt and shrank to around 24.4 Mt in 2021-23.

From the early 1990’s, non-cotton fibres have gained solid ground in the textile industry. In 2023, the end-use market-share reached 78.2% for chemical fibres and only 21.8% for cotton. Likewise, per capita consumption of non-cotton fibres has strongly outpaced per capita consumption of cotton fibres and continues to strongly increase. In contrast, per capita consumption of cotton has remained stagnant over time and trended downwards in recent years (Figure 10.2, Panel b).

Figure 10.2. Historical trends in consumption of textile fibres

Copy link to Figure 10.2. Historical trends in consumption of textile fibresThe prospects for global cotton use relies mainly on its evolution in developing and emerging economies. Demand from these regions with lower absolute levels of consumption but higher income responsiveness is projected to exert upward pressure on global demand for cotton as the incomes and population of these countries are projected to increase. Global mill use is projected to grow by around 1.7% p.a. over the next decade.

The geographical distribution of demand for cotton fibres depends on the location of spinning mills, where natural and synthetic fibres are transformed into yarn. Traditionally, the spun yarn industry has been established predominantly in Asian countries, where conditions such as lower labour costs are favourable for the industry. China has been the world’s leading cotton consumer since 1960.

Higher labour costs and more stringent labour and environmental regulations led to a gradual decrease in China’s cotton mill consumption since 2010. This decline was further exacerbated by the abolishment of the support price system in 2014. This provoked a move to other Asian countries, notably Viet Nam and Bangladesh. Mill consumption has regained some lost ground in China since 2016, in part because domestic cotton prices have become more competitive when compared to polyester, which appears to have suffered a setback due to government measures to combat industrial pollution. Furthermore, significant government investments and incentives directed towards the textile industry, coupled with large availabilities of domestically-produced cotton, are poised to boost spinning mill use over the next decade.

In India, the growing textile industry coupled with competitive labour costs, and government support to the sector are expected to result in continuous growth in cotton mill use. Cotton plays an important role in the Indian economy as the country's textile industry is predominantly cotton based while absorbing around 90% of the cotton produced domestically. The textile industry, however, faces several challenges, including technological obsolescence, high input costs, and poor access to credit. The government has implemented heavy investments in increased spinning capacity and has launched several schemes over the past few years aimed at promoting the textile industry, fostering innovation, and improving the livelihood of the people involved.

The phase-out in 2005 of the Multi-Fibre Arrangement, which imposed fixed bilateral quotas on developing country imports into Europe and the United States, was initially expected to favour Chinese textile producers over smaller Asian countries. However, countries such as Bangladesh and Viet Nam experienced strong growth of their textile industry based on an abundant labour force, low production costs, and government support measures. In the case of Viet Nam, this was partly driven by its accession to the World Trade Organization in 2007 and by foreign direct investment (FDI), notably by Chinese entrepreneurs. In addition, Free Trade Agreements (FTAs) including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Viet Nam Free Trade Agreement (EVFTA) have also facilitated greater market access to Vietnamese textile exports. Similarly, foreign investments and FTAs have boosted the textile industry in Bangladesh, contributing to its emergence as a major player in the global textile market. The escalation of the United States-China trade dispute has spurred additional mill use in Bangladesh and Viet Nam. The expansion of textiles industries in Viet Nam, Bangladesh, and other central Asia economies, is foreseen to keep boosting mill consumption growth over the coming decade. Viet Nam will take the lead in annual growth of mill use at 3.3% p.a. In Bangladesh, growing demand for yarn and fabric from the domestic garment and textile industries is prompting investments in spinning capacity and cotton fibres consumption is expected to rise 3.3% p.a. This growth has not only consolidated their positions as key players in the global textile market but also significantly contributed to their overall economic development. Nevertheless, China is expected to remain the largest cotton processing country in 2033, followed by India, with consumption projected to grow 0.9% and 1.5% p.a. respectively over the next decade.

10.3.2. Production

Production to grow as a result of improved yields while higher compliance with sustainable standards is also anticipated.

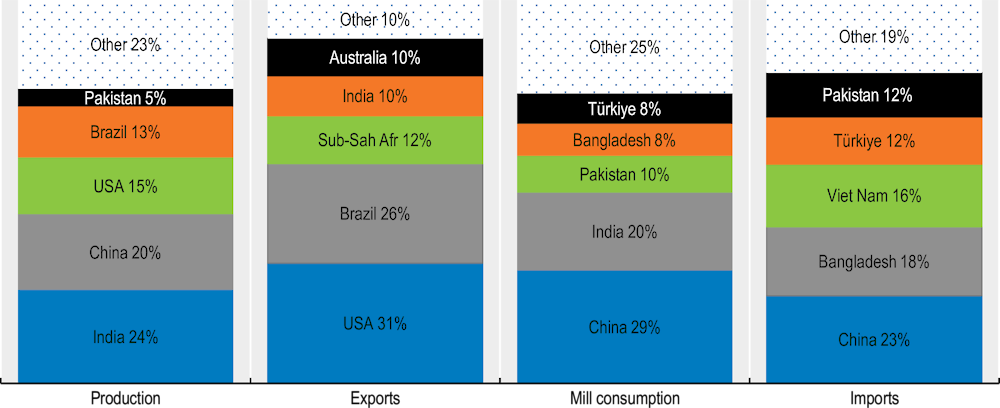

Cotton is grown in subtropical and seasonally dry tropical areas in both the northern and southern hemispheres, although most of the world’s production takes place north of the equator. The leading producing countries are India, China, the United States, Brazil, and Pakistan. Jointly, these countries are expected to account for around 77% of global output in 2033 (Figure 10.4).

Figure 10.4. Global players in cotton markets in 2033

Copy link to Figure 10.4. Global players in cotton markets in 2033

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

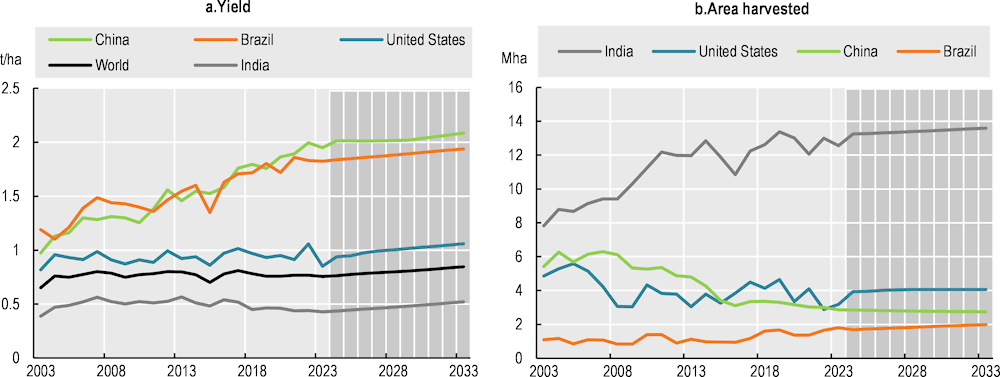

Global production of cotton is expected to grow steadily and reach 29 Mt by 2033, 17% higher than in the base period (Figure 10.5). The foreseen increase will mostly come from growth in the main cotton producers: India will account for about 38% of the global increase, followed by the United States (27%), and Brazil (21%). Overall, gains in cotton production are predominantly driven by higher yields, and to a lesser extent, on expansion in area harvested.

Average global yields are projected to increase by 11% compared to the base period. Factors such as improvements in genetics, better agricultural practices, and digitalization supporting precision agriculture will significantly contribute to enhance productivity and sustainability. Over the past two decades, global average yields have been stagnant, suggesting static or decreasing yields in some of the major producers due to various factors including climatic constraints, limited uptake of efficient agricultural practices, unfavourable conditions for the application of new technology and high input costs. The yield gap between main producers in 2023 is projected to remain constant over the Outlook period. By 2033, yields in China and Brazil are projected to double the world average, while in India, the largest cotton producer, yields are expected to remain below it. (Figure 10.6, Panel a). Cotton area is projected to expand by 6% compared to the base period, with the highest growth occurring in Brazil (23% compared to the base period), where the prospect of growing exports encourages producers to invest in increasing the planted area.

Production in India is estimated to grow by around 2.3% p.a. over the next decade, mainly on account of yield improvements rather than area expansion, since cotton already competes for acreage with other crops, such as soybeans and pulses. Raw cotton productivity has remained stagnant in recent years and is among the lowest globally. Cotton is traditionally grown on small farms, which limits the adoption of intensive farming technologies. Furthermore, farmers in India allocate more row space between plants to accommodate the passage of a bullock and cultivator for weed control purposes, which hinders yields. This reduced plant density is partially compensated for by multiple manual pickings, rather than machine harvesting. To tackle this issue, researchers are developing production schemes with higher plant populations, aiming to improve yields. However, growing demand from the domestic apparel industry continues to spur investments in the sector and various federal and state government agencies and research institutions are engaged in cotton varietal development, seed distribution, crop surveillance and integrated pest management activities. Based on that, the Outlook assumes a growth in yields that are projected to grow by 2% p.a. over the next decade. Nonetheless, climate change, with most cotton grown under rain-fed conditions, may undermine the yield growth potential.

Figure 10.6. Cotton yields and area harvested in major producing countries

Copy link to Figure 10.6. Cotton yields and area harvested in major producing countries

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Chinese cotton is currently produced with the highest global yield (1.90 t/ha average in 2021-23), which are more than double of the world’s average. Over the past two decades, the cotton area in China has been declining, mostly due to changing government policies. Nevertheless, this trend seems to have slowed down since 2016. It is expected that the cotton area will decrease by 0.4% p.a. during the Outlook period, against a near 3% decline in the past decade, while cotton production is expected to remain stable thanks to improvements in yields, mainly as a result of the increasing rates of mechanization, investments in irrigation and improved agricultural practices in general.

In Brazil, cotton is grown in part as a second crop in rotation with soybeans or maize. Recently, output has strongly grown in the main cultivation areas such as Mato Grosso, where 70% of Brazilian cotton is currently harvested. Cotton output is foreseen to increase by 2.4% p.a. Production gains are mostly coming from higher yields and the use of genetically engineered (GE) seeds and fertilisers. Recent investments in cotton-growing capacity and the acquisition of new equipment (planters, pickers, and ginning capacity) are expected to boost production in the coming years. Due to strong competition with other crops, mainly soybeans, the planted area depends widely on the profitability of cotton compared to other commodities.

Sustainability issues play an important role and will impact cotton markets in the medium term. In a context of growing concerns over the effects of climate change and socio-environmental considerations, new initiatives have been introduced to promote sustainability along the supply chain. In the season 2021/22, the market share of cotton covered by programs recognised by the 2025 Sustainable Cotton Challenge2 reached 27% of global cotton production (Figure 10.1). Among the existing standards, Better Cotton, a not-for-profit organisation, dominates globally, at around 21% of all cotton in the season 2021/22. Alternative strategies promote better agricultural practices to mitigate climate change and provides guidance to textile brands and retailers to source their cotton inputs from recognised and certified sustainable producers. It is expected that demand for more sustainable cotton continues to rise, driven by commitments from brands and awareness among young populations. Therefore, growing trends towards consumption of more sustainable cotton products will likely boost cotton production in countries such as Brazil, where around 78% of total cotton output already complies with the sustainable standards. In India and Pakistan, cotton programs accounted for 21% and 68% of total cotton production in 2021/22, respectively. It is expected that the Sub-Saharan region will also benefit from higher compliance with sustainable standards, with programmes such as Cotton Made in Africa (CMIA) currently accounting for 10% of global sustainable output.

10.3.3. Trade

Viet Nam and Bangladesh driving trade growth over the next decade

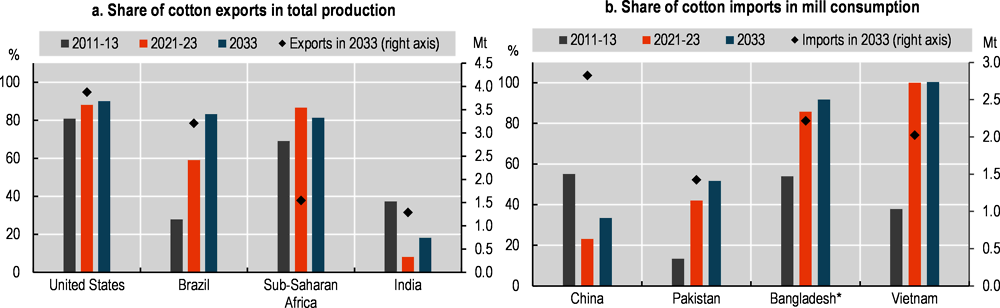

World cotton trade is projected to expand steadily over the next decade by 2.1% p.a. and reach 12.4 Mt in 2033. The increase reflects the substantial growth in mill use in Asian countries, particularly Viet Nam and Bangladesh, which source virtually all their cotton from imports to support their growing domestic textiles sector. Moreover, the stagnant production growth rate in China is anticipated to drive an increase in lint imports over the next decade to fulfil the demand of local mills and replenish state reserves. By 2033, raw cotton imports are projected to increase by 0.7% p.a., reaching 2.8 Mt (Figure 10.7, Panel b), which remains well below the over 3% growth projected in Viet Nam and Bangladesh.

The United States will remain the world’s largest exporter throughout the Outlook period. Exports from the United States have stabilised in recent years, recovering from the lows in 2015. It is projected that its share of world trade will reach 31% in 2033 (around 3.9 Mt). Despite the major changes in the Chinese textile industry, the United States remains its main trade partner.

Brazilian exports are expected to grow strongly over the next decade, consolidating the country’s position as the second largest exporter by 2033, with Sub-Saharan Africa as a whole following behind (Figure 10.7, Panel a). In Sub- Saharan Africa, cotton is an essential export crop, accounting for around 16% of global exports.

Figure 10.7. Trade as a percentage of cotton production and mill consumption

Copy link to Figure 10.7. Trade as a percentage of cotton production and mill consumption

Note: * Includes mill consumption and imports from other countries such as Cambodia, Myanmar, Bhutan and Nepal.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Sub-Saharan African exports are projected to continue growing at around 0.7% p.a. in the coming decade, with South and Southeast Asia being the major export destinations. However, the textile and apparel industry is expanding in countries such as Ethiopia, where the textile and clothing sector primarily relies on cotton, supported by FDI flows and government investments. In the long run, the increase in mill use may affect the net export status of Sub-Saharan Africa.

10.3.4. Prices

International cotton prices to decline in real terms over the medium-term

International cotton prices in real terms are foreseen to trend slightly downward in the medium term (Figure 10.8). Prices will continue to be influenced by competition from man-made fibres along with changes in consumers preferences.

From the early 1970s, when polyester became price-competitive, cotton prices tended to follow polyester prices. For example, cotton prices were only 6% above polyester staple fibre prices between 1972 and 2009. Since 2010, however, cotton prices have been on average around 70% above the polyester price, in nominal terms. It is assumed that the relative price competitiveness between these two types of fibre will not change drastically over the projection period.

10.4. Risks and uncertainties

Copy link to 10.4. Risks and uncertaintiesRegulatory shifts and innovation as key challenges shaping the cotton sector

Key drivers of per capita textile demand in emerging economies, notably economic expansion and urbanisation, will continue to exert substantial influence on cotton fibre demand. Additional demand trends affecting projections encompass the growing adoption of recycling in the textile sector. Notably, recycled cotton, which had an estimated production of 0.3 Mt in 2022 compared to 25 Mt of newly produced cotton, is expected to experience significant growth in the coming years.3 Moreover, increased competition from synthetic fibres and evolving consumer preferences towards athleisure apparel present significant hurdles to cotton demand. However, the adoption of sustainability norms offers potential stimulation to cotton demand amid mounting environmental concerns.

Changes in climate factors, water availability, and pest infestations remain significant risks to cotton production, necessitating innovative pest management strategies, optimization of water use, and climate-resilient agricultural practices. Precision agriculture technologies, such as soil moisture sensors and drip irrigation systems, are increasingly adopted to optimise water usage in cotton fields, while improving cotton yields. Initiatives such as China's extensive irrigation programs demonstrate efforts to mitigate water scarcity's impact on cotton cultivation, essential for ensuring sustainability and resilience in cotton farming.

Further factors such as harvest losses and supply chain disruptions, such as transportation bottlenecks or trade restrictions, can also negatively affect cotton production and hinder market availability.

Regulatory frameworks promoting sustainability, traceability, and labelling standards are reshaping the global cotton landscape, reflecting a growing consumer preference for eco-friendly products. Policies such as the Product Environmental Footprint (PEF) and the Strategy for Sustainable Circular Textiles in the European Union exemplify initiatives driving this shift. Additionally, policy measures that affect consumption, such as the decision by several East African countries to discourage second-hand clothing imports to boost local textile industries, have the potential to bolster cotton consumption and encourage value addition within Africa. However, it is important in this regard to ensure that the adoption of these standards benefits smallholder cotton growers by improving their livelihoods.

The transition towards a circular economy, characterised by recycling and the growing second-hand market, presents both challenges and opportunities for the cotton industry. While recycling initiatives hold promise for resource efficiency, they may disrupt traditional supply chains and alter demand patterns for raw cotton. Furthermore, issues associated with social, economic, and environmental sustainability, such as the Strategy for Sustainable Circular Textiles in the European Union, are gaining prominence among consumers, industry stakeholders, and policymakers globally. External factors, including the US-China dispute and the Uyghur Forced Labor Prevention Act4, further complicate matters, resulting in disruptions along the supply chain.

Notes

Copy link to Notes← 1. The Uyghur Forced Labour Prevention Act forbids the import of goods produced in China’s Xianjiang region. The importer must clearly prove that the merchandise coming from this region was not produced with forced labour.

← 4. The Uyghur Forced Labour Prevention Act forbids the import of goods produced in China’s Xianjiang region. The importer must clearly prove that the merchandise coming from this region was not produced with forced labour.