This chapter analyses Albania’s current circular economy policy landscape and initiatives, focusing on key economic features and environmental implications stemming from energy production, emissions, material use and waste management. By pinpointing gaps in both policy and practice and integrating additional analyses, the chapter provides valuable insights for prioritising areas in future circular economy policy documents to drive Albania’s transition to a circular and carbon-neutral economy.

A Roadmap towards Circular Economy of Albania

2. State-of-play of the circular economy in Albania

Abstract

Albania’s key economic features and their relevance to the circular economy

Albania has made significant economic progress over the past three decades, moving from a low-income economy to an upper middle-income European Union (EU) candidate state, with gross domestic product (GDP) per capita PPP (constant 2017 international $) rising from 3 265 in 1992 to 15 492 in 2022 (World Bank, 2024[1]). In 2021, 1.25 million people were employed in Albania (44.8% women and 55.2% men), representing 60.9% of the labour force, on an increasing trend since 2014. Albania’s economy has grown at moderate rates for most of the last decade, averaging 2.7% between 2012 and 2022 (World Bank, 2023[2]). Since 2020, economic growth has been impacted by external shocks, the first of which was the COVID pandemic. The subsequent energy crisis and inflation, induced by the war in Ukraine, have dampened its economic recovery (Box 2.1).

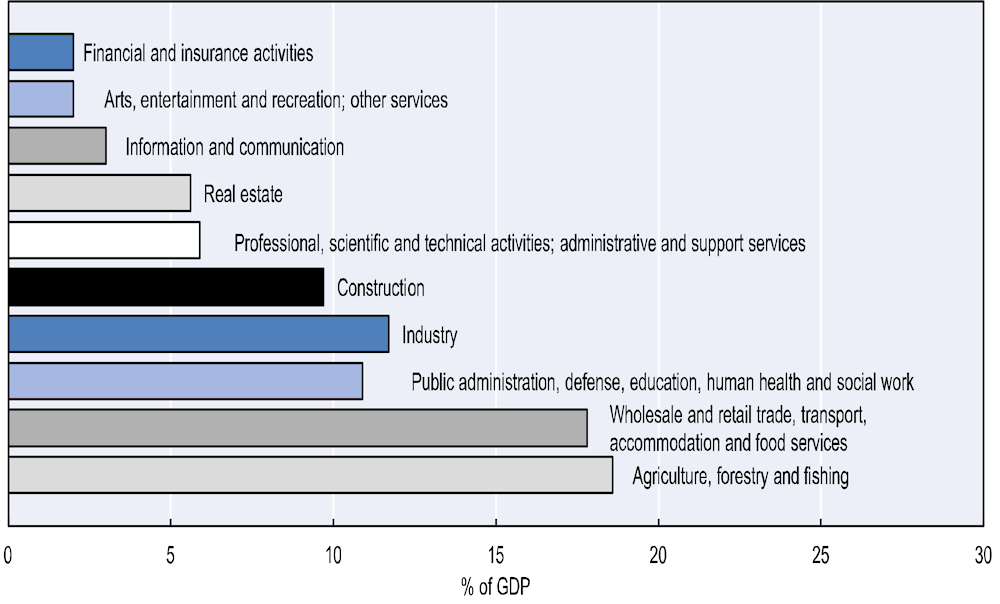

The breakdown of value added by economic activity shows that the economy is particularly reliant on agriculture, forestry and fishing, followed by trade, transport, and accommodation and food services, largely due to its sizable tourism sector (Figure 2.2).

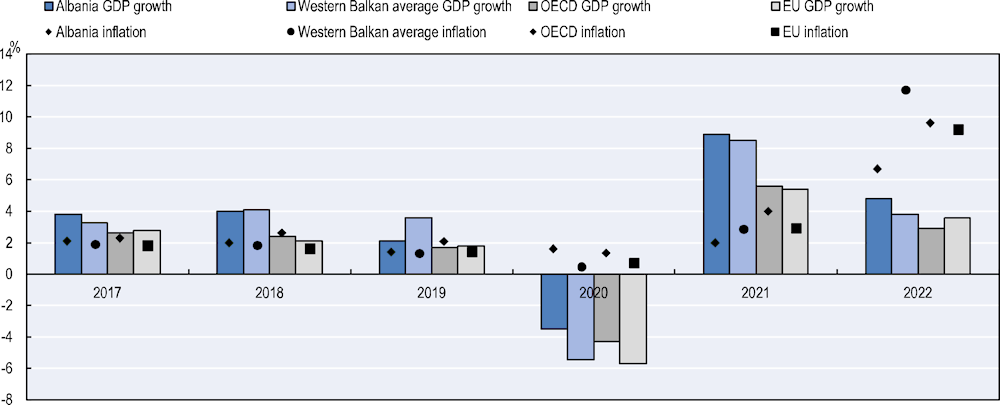

Box 2.1. Impact of recent crises on Albania’s economic growth

The earthquake that hit Albania in 2019 coupled with the start of the COVID-19 pandemic in 2020 had a strong impact on Albania’s gross domestic product (GDP) (Figure 2.1).

Fast and determined responses from the government and the central bank managed to soften the negative impacts of the pandemic and helped maintain the macroeconomic and financial sector stability.

Albania rebounded with an 8.9% GDP growth in 2021, thanks to increases in both domestic and foreign demand.

Nevertheless, inflation rose to an annual average of 7% in 2022, induced by the Russian Federation’s ongoing war in Ukraine, leading to the central bank normalising its very loose monetary policy. The economic recovery decelerated but GDP growth was still robust at an estimated 4.8% in 2022, driven by private investment and consumption.

Figure 2.2. Value added by economic activity in Albania, 2022

Notes: Industry includes energy, mining and manufacturing. The total of percentage of gross domestic product (GDP) of all NACE activities does not equal 100%. Data are based on estimations. GDP measurement includes gross value added plus taxes, minus subsidies on products.

Source: Eurostat (2023[6]).

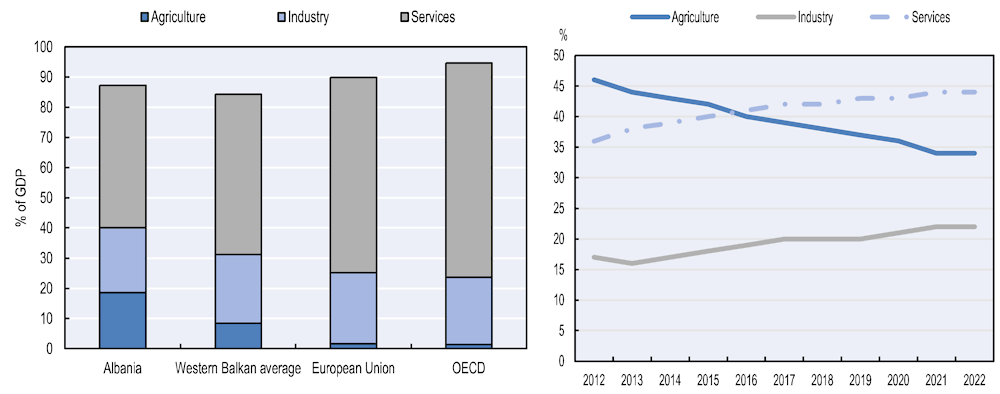

Service sector

Services represented 47.2% of GDP and 44% of employment in 2022 (Figure 2.3), holding the highest sectoral share in the GDP and employment of Albania.

Figure 2.3. Value added by grouped activity, 2022, and employment by economic activity in Albania, 2012-2022

Notes: Industry includes construction, energy, mining and manufacturing. The value-added shares presented in the World Development Indicators for agriculture, industry and services may not add up to 100% due to financial intermediary services indirectly measured and net indirect taxes. 2022 data are based on estimations for some of the Western Balkan economies. Full OECD country data are only available until 2021.

Tourism

With tourism representing 17.4% of GDP and 20% of employment in 2021, Albania is highly dependent on tourism exports (AIDA, 2022[10]). Average annual tourist arrivals increased by 13% between 2009 and 2019, and arrivals in the first 10 months of 2022 grew by approximately 17% compared to 2019 – ranking Albania as the highest performing destination in Europe and second in the world,1 with this increase continuing in 2023 (UNWTO, 2023[11]; EIU, 2022[12]). Nevertheless, the sector’s growth is undermined by high seasonality, concentration in coastal areas, poor infrastructure and the lack of a qualified workforce. The value added per tourist is still relatively low because Albania tends to mostly attract short-stay tourists with low spending power, due to the undiversified tourism value chain and a limited range of offered activities (OECD, 2021[13]). On a per-arrival basis, international tourism receipts in Albania are lower than close-by and neighbouring destinations, such as Croatia and Greece (UNWTO, n.d.[14]), and far below the EU average (tourists spent an average of EUR 51 per night in Albania (UNDP, 2022[15]) compared to EUR 87 in the European Union in 2022 (Eurostat, 2023[16])). Moreover, the recent increase in tourism and related investments have caused environmental pressures on coastal areas (OECD, 2021[13]). While tourism has been severely impacted by recent economic shocks, recovery offers unique opportunities to redesign the sector in a sustainable and resilient way in line with a circular economy model, intentionally regenerative of natural, human and social capital, operating within the local destinations’ sustainable boundaries (Einarsson and Sorin, 2020[17]).

Industry sector

The industrial sector, including construction and covering energy, mining and manufacturing, remains important for the Albanian economy, representing around one-fifth of GDP (21.4% in 2022), albeit a 5 percentage point decrease over the last ten years. It also accounts for 22% of employment (Figure 2.3). While industry is the most resource-intensive and waste-producing economic sector, it shows tremendous potential for innovation, as the markets for new clean products and services keep growing. Nevertheless, upgrading and diversifying the industry sector in Albania is hindered by low levels of innovation and technology adoption, and thus not boosted by local technical know-how (OECD, 2021[13]).

Textile and footwear

Textile and footwear is an industry of great importance to the Albanian economy, representing 32% of value added in manufacturing in 2021 and 27.8% of total exports in 2022 (World Bank, 2021[18]; INSTAT, 2023[19]). There are more than 1 000 active companies working in the textile and footwear manufacturing sector in Albania, employing mainly women (95%), represented by the Proeksport Albania Association. The industry has a long history in the economy and until the transformations of the early 1990s, used to oversee the entire chain of production, from the production of raw materials to the final products. Nowadays, factories no longer produce raw materials but clothing with imported material, which is then exported. While textile and footwear companies are still mostly responsible for the time-intensive cutting and packaging of products (a so-called cut-make-trim model), in recent years, manufacturing companies have improved their processes and invested in new machinery to offer a full-package service for foreign customers, including the capacity to design products (Invest in Albania, n.d.[20]; ILO and UNIDO, 2023[21]). Digitalisation of the sector is also underway. Projects funded by international development co-operation partners financially and technically support the integration of computer-aided design and computer-aided manufacture tools in design and manufacturing processes.2

Nevertheless, production processes for textiles and footwear remain characterised by low recycling, low reuse and underutilisation of fabric, leading to considerable amounts of generated waste. The textile industry is considered to be one of the most polluting and waste-generating sectors globally, contributing to 10% of total carbon emissions worldwide, surpassing aviation and marine shipping (European Commission, 2020[22]). Furthermore, it accounts for 20% of global freshwater pollution and is associated with high rates of landfilling and burning. Its associated carbon dioxide (CO2) emissions are projected to increase by more than 60% by 2030; “a new textile economy” based on a circular model will, therefore, be key in reaching climate-neutral targets (Design4Circle, 2021[23]). Because Albania’s textile companies are not involved in raw material production of fabrics or end-of-life management of clothes or footwear, the circular potential lies in sustainable production processes (manufacturing, treating and dyeing) and waste reduction in cutting and packaging techniques. Moreover, as more and more local enterprises are abandoning the cut-make-trim model and moving towards the full production cycle, moving to a sustainable design of garments could be a key element to restructuring the sector and supporting the transition to a circular model, as around 80% of a product’s environmental impact is locked in at the design stage (Design4Circle, 2021[23]; ILO and UNIDO, 2023[21]). Additionally, textile co-labels, for which guidelines have been developed in Albania, could increase demand for green and circular business practices, while also being useful for small and medium-sized enterprises (SMEs) when dealing with business licensing and administrative requirements (OECD, 2021[24]).

Construction

The construction sector’s value added has increased in the past decade, accounting for 9.7% of GDP in 2022 (see Figure 2.2). The growth of the sector in recent years was spurred by significant infrastructure and residential development, such as the Reconstruction Programme3 initiated after the earthquake in 2019, increasing investments in real estate from non-residents and in the tourism sector, as well as major infrastructure projects, including the Trans-Adriatic Pipeline.4 Additionally, there proves to be long-term growth potential in the construction of renewable energy infrastructure and improvements to transmission lines and the distribution grid.5 The increased value added of the sector was one of the main contributors to the rapid economic recovery from the COVID-19 pandemic. The sector is expected to further expand, evidenced by the increasing number of construction permits issued in recent years6 (INSTAT, 2023[25]).

Construction materials and metals is construction’s leading sub-sector, representing 21.6% of total exports in Albania in 2022, with aluminium, iron, steel and cement being the most exported products (INSTAT, 2023[19]; World Bank, 2023[26]). Albania’s main export destinations are EU countries, with the majority of products exported to Italy.

These industries are, nevertheless, energy- and carbon-intensive, lack modern technology, and the production of secondary materials from material waste is almost non-existent (Ministry of Infrastructure and Energy, 2016[27]). Overall, untapped potential remains in the production of sustainable construction materials, in particular through more resource-efficient mining operations and the use of industrial waste and reuse of construction materials. Moreover, transitioning to circular production processes of construction products might be beneficial in light of the EU Carbon Border Adjustment Mechanism.7

Mining and quarrying

Mining and quarrying accounted for 2.2% of GDP in 2021 (INSTAT, 2023[28]) and for 11.4% of total exports in 2022 (INSTAT, 2023[29]) and has a long-standing history in the economy (National Agency of Natural Resources, 2022[30]). Albania is rich in different mineral resources. Those mined and treated in its territory include mainly chrome, copper, iron-nickel and coal. As of February 2023, there were 554 active mining permits (Ministry of Infrastructure and Energy, 2023[31]) and over 100 business entities involved in mining and quarrying activities, employing 0.46% of the workforce (excluding processing), 64% of it in the chromium subsector (Extractive Industries Transparency Initiative, 2020[32]).

In 1994, the Law on Mining opened the mining sector up to private investments. Processing levels in Albania, however, remain relatively low, and metal ores are mainly exported as raw material with low added value for further processing in the destination countries (National Agency of Natural Resources, 2022[33]). To tackle these issues, the sector is increasingly seeking to attract strategic and substantial investments in the processing of metal ores. In addition, the government recently introduced a tax exemption for domestically processed minerals to redirect investment into processing and counter unsustainable material consumption in the mining sector (Gjonaj, 2020[34]). Yet, insufficient clean-up and remediation of mining sites remain evident. Coupled with unsustainable extraction methods, mining activities pose a potentially serious risk to environmental and human health through the release of hazardous chemicals and air, water and soil pollution and contamination (UNECE, 2018[35]). Enhancing circularity during the mining operations stage and recovering essential raw materials from extractive waste in ongoing mining operations and historical mining waste sites could ensure the sustainability of critical raw materials and safeguard the environment from hazardous and toxic elements.

Agriculture

Agriculture’s value added in Albania has been stagnating at around 20% over the past decade (18.6% of GDP in 2022) and is still the highest in the Western Balkans (where it stood at 9% on average in 2022) and remains well above the EU and OECD averages (1.7% and 1.4%, respectively, in 2022) (Figure 2.3) (OECD, 2021[13]). Despite a decline of 12 percentage points in the last decade, agriculture still represented 34% of employment in 2022 (Figure 2.3), with most jobs being low-skilled and low-wage, mainly due to the prevalence of subsistence farming (Ministry of Agriculture and Rural Development, 2022[36]; Invest in Albania, 2023[37]).

A share of 40.5% of Albanian land is used for agriculture, but the sector is dominated by a large number of very small and fragmented farms (the average farm size is around 1.2 hectares, or one-tenth the size of the EU27 average) (European Commission, 2023[38]; World Bank, 2023[26]). This has a significant impact on the sector’s competitiveness and productivity, which is among the lowest in Europe (Ministry of Agriculture and Rural Development, 2022[36]). In addition to land fragmentation, inadequate irrigation (only 19.6% of land was irrigated and only 57% of the rural population had access to water services in 2021) and transport infrastructure, as well as limited access to finance, hinder the development of a competitive, export-oriented agriculture and agribusiness sector (World Bank, 2022[39]). Agricultural exports, while increasing, remain relatively low and are dominated by the fruit and vegetable sector (which represents more than one-third of agriculture exports) (Ministry of Tourism and Environment, 2019[40]; OECD, 2021[13]). The European Union remains Albania’s most important partner for both the export and import of agri-food commodities (63% of total agri-food exports and 62% of imports during 2022), whereas the Western Balkan region is destination to 26.4% of the agri-food exports and origin of 12.3% of agri-food imports (INSTAT, 2023[41]). In 2022, agri-food exports from Albania to the Western Balkans and the European Union reached a record high of EUR 473 million, an 18.5 % increase compared to the previous year (Ministry of Agriculture and Rural Development, 2023[42]).

Despite favorable climatic conditions and ongoing efforts to standardise regulations, a high percentage of agricultural farms in Albania do not meet national and EU standards. This is mainly due to limited financial resources for facility and technology improvements and a lack of knowledge about these standards. However, there are vast opportunities to enhance the competitiveness of Albania’s agricultural products in regional markets (Ministry of Agriculture and Rural Development, 2022[36]). The main agricultural products produced in Albania in 2022 were vegetables (1.3 million tonnes), followed by cereals (0.69 million tonnes). Vegetable production in greenhouses represented 22.9% of total vegetable production in 2022, where tomato production represents 51.6% of total production (INSTAT, 2023[43]). Moreover, olive cultivation has increased over the last 15 years (157 000 tonnes in 2022, up by 43% from 2021), in part due to heavy state subsidies, which made Albania the leading olive oil producer in the Western Balkans, though its current production still represents only 0.6% of total EU production (INSTAT, 2023[43]; OECD, 2021[13]). Despite having taken steps, there is a need to improve olive farming technology; support technology renovation for a significant part of processing plants; increase investments in olive oil storing, bottling, labelling and packaging capacity; and ensure olive waste treatment according to the standards (Ministry of Agriculture and Rural Development, 2022[36]). About half of farmers are engaged in livestock production (mainly cattle, sheep and goats), and while dairy output has increased significantly, there is considerable scope to expand dairy exports further (World Bank, 2022[39]; INSTAT, 2023[43]).

A circular transition could foster growth in the sector by ensuring sustainable agricultural production, an increase of the use of food surplus, technological progress and an efficient use of resources in order to prevent further depletion and over-exploitation of natural resources (OECD, 2019[44]). By adopting circular economy principles, the sector could improve water, energy and waste management while protecting biodiversity and enabling the sustainable development of local communities, thus contributing to other sectors’ goals, such as tourism.

SME sector

SMEs constituted 99.8% of all enterprises and 81.6% of employment in 2021, slightly higher shares than in the European Union (98.9% of all enterprises and 67% of employment) (INSTAT, 2023[45]; OECD, 2022[46]; Eurostat, 2020[47]). Services represent the main economic activities for more than 85% of SMEs in Albania, with the largest share of SMEs working in the trade sector (39.2%), followed by accommodation and restaurants (16.4%), mainly due to the growing importance of the tourism sector. Moreover, around 13% of SMEs work in the industry sector (mainly construction, manufacturing, and mining and quarrying)8 (INSTAT, 2023[45]).

While climate change mitigation policies have historically focused on large emitters, SMEs, on aggregate, have a significant environmental footprint (small firms account for 50% of greenhouse [GHG] emissions in the world (ICT, 2021[48]) and 63% in the European Union (European Commission, 2022[49])). It is, hence, essential that Albania considers them in its environmental policy making. On the one hand, SMEs, like any other economic agent, face the effects of environmental degradation, which can pose specific challenges for their survival and growth. On the other hand, and more importantly, the large share of SMEs in Albania can be a source of innovation and solutions to develop the technologies needed to address environmental challenges and achieve circular objectives, both due to SMEs’ flexibility in adopting circular business models (“green performers”) and their contribution in developing new products, technologies and approaches that address environmental issues (“green innovators”) (OECD, 2021[50]). However, only 20% of Albanian businesses believe that their business models allow for a shift towards a circular economy, with added costs and the lack of government subsidies being the most significant impediments in this regard (RCC, 2023[51]).

Environmental trends and recent developments relevant to the circular economy

Energy use and emissions trends

As a Non-Annex-I signatory to the United Nations Framework Convention on Climate Change and its Paris Agreement and a party to the Kyoto Protocol, Albania has committed to an 11.5% reduction of CO2 emissions compared to the baseline for the period 2016-30, based on a business-as-usual scenario. Moreover, in line with the European Union’s ambition to become climate-neutral by 2050, Albania has also committed to achieving carbon neutrality by 2050 by endorsing the Green Agenda for the Western Balkans.

CO2 emissions account for around two-thirds of Albania’s total GHG emissions. An inventory of other pollutants (SO2, CH4, N2O, hydrofluorocarbons) is available as part of Albania’s Fourth Communication to the United Nations Framework Convention on Climate Change for the period 2009-19 (including emissions estimates from energy; industrial processes and product use; agriculture; land use, land-use change and forestry; and waste) (Ministry of Tourism and Environment, 2022[52]).

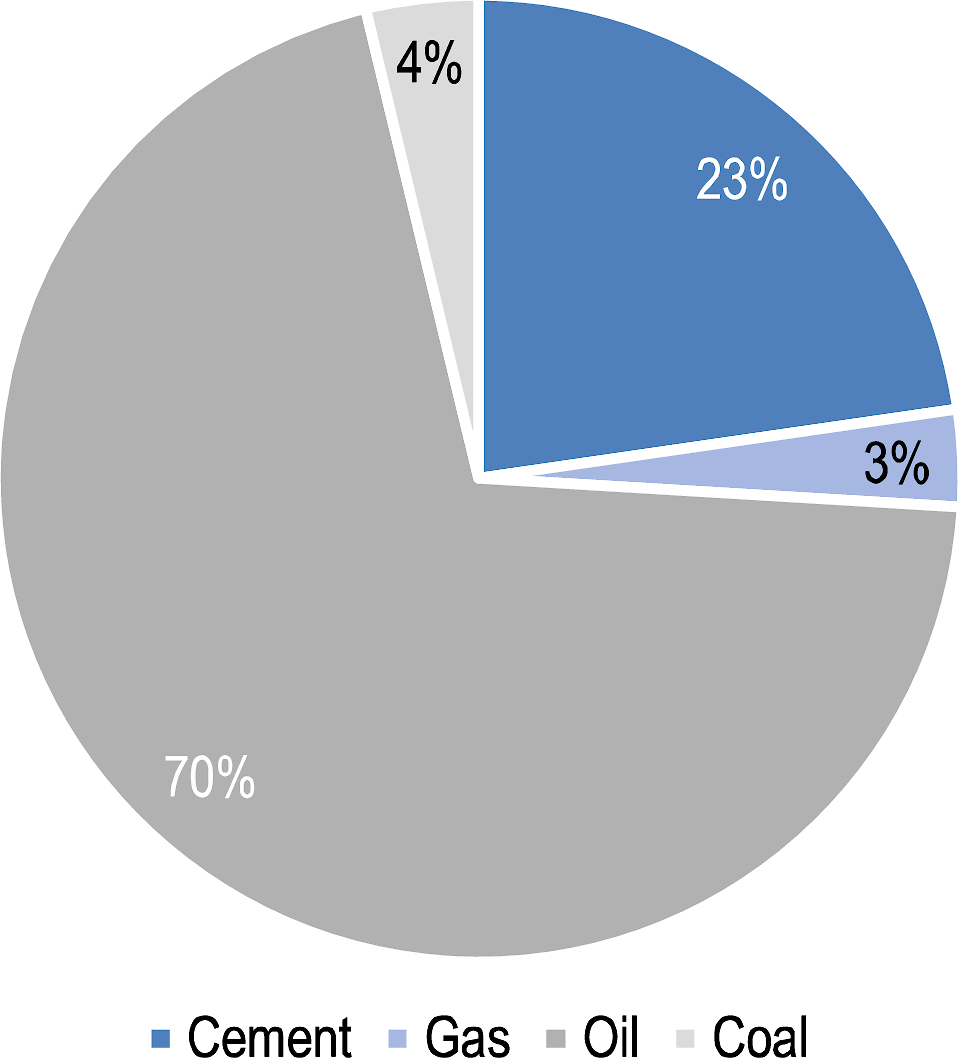

In 2022, Albania had the lowest GHG emissions per capita (2.71 tonnes of CO2 equivalent per capita) in the Western Balkan region and compared to the EU and OECD averages (8.1 and 9.9 tonnes CO2 equivalent per capita, respectively) (Crippa et al., 2023[53]). However, when looking at the trend over the past two decades, while the OECD and European Union have made significant progress in reducing their emissions per capita, they almost tripled up to 2017 (3.17 tonnes of CO2 equivalent per capita) in Albania, but have since been slowly decreasing (JRC/IEA, 2023[54]; Eurostat, 2023[55]). Likewise, a different picture emerges when considering the carbon intensity of national income. Although significantly lower than its regional peers, Albania produced approximately 0.175 tonnes of CO2 equivalent/1 000 USD/GDP per 2017 PPP, placing it at a similar level to the European Union (0.186 tonnes of CO2 equivalent/1 000 USD/GDP) in 2022 (JRC/IEA, 2023[54]). Oil and oil products are the largest source of CO2 emissions in Albania, representing 70% of total emissions (Figure 2.4). Transport, and in particular road transport, is the sector with the greatest oil demand and the one that emits the most CO2 in Albania, accounting for over a third of total emissions (35% in 2022) (JRC/IEA, 2023[54]). Albania is the exception in the region and compared to the European Union in this regard, where transport only accounts for 20.5% and 27.5% of total emissions on average, respectively.

Figure 2.4. CO2 emissions by source in Albania, 2021

% of total CO2 emissions

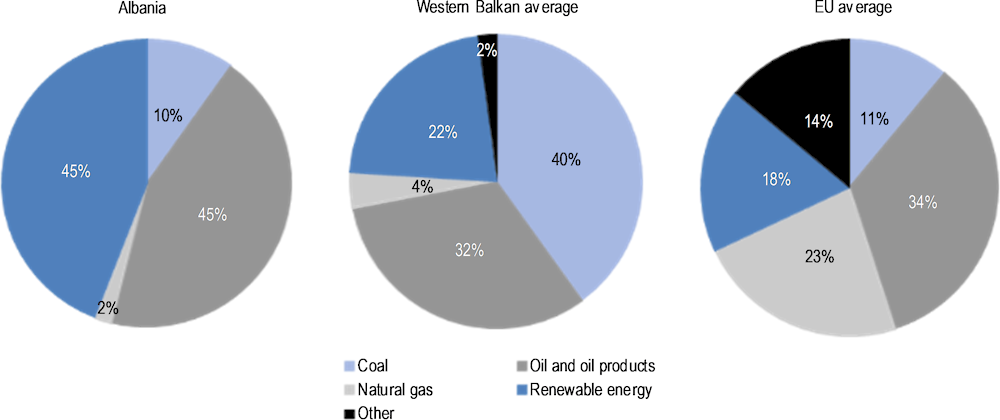

While Western Balkan economies are, on average, over-reliant on coal (Figure 2.5), it accounts for a much smaller share in Albania (10%) and contributes to a minor share of total CO2 emissions, due to higher reliance on oil and renewables (Figure 2.4). Natural gas also plays a smaller role for the primary energy consumption mix (2%) than in the European Union (23%). This share is expected to increase as Albania recently connected to an international natural gas pipeline via the Trans-Adriatic Pipeline (OECD, 2021[13]).

Figure 2.5. Energy mix in Albania, the Western Balkans and the European Union, 2021

% of total energy

Notes: Western Balkans average refers to Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia. Nuclear heat accounts for 12.8% of the European Union’s energy mix. The major types of renewable energy sources are biomass (wood and wood waste, municipal solid waste, landfill gas and biogas, biofuels), hydropower, geothermal, wind and solar. Totals may not add up to a 100% due to net imported or exported electricity.

Source: Eurostat (2023[57]).

With Albania being one of the few economies in the region producing crude oil, almost half of its energy supply is covered by oil and oil products – the highest share in the Western Balkans. However, the crude oil that is produced is mostly exported to be refined abroad (Altax, 2019[58]).

Renewable energy accounts for a significant share of Albania’s energy mix – approximately 45%, a higher share than its regional peers, 73% of which is derived from hydro generation (Eurostat, 2023[57]). Albania is, however, almost entirely dependent on hydropower for its electricity supply. This gives it an advantage in decarbonising its electricity sector but also makes it highly vulnerable to the changing climate; important annual fluctuations due to hydrological changes mean that Albania has to import electricity most years9 (Eurostat, 2022[59]). In recent years, Albania has been increasing the share of other renewable energy sources in line with its energy commitments, particularly through renewable energy auctions (solar and wind).10

Moreover, Albania had higher energy intensity of GDP than the European Union in 2020 (196 and 117 kilogrammes of oil equivalent per EUR 1 000 respectively), making its industries more vulnerable to rising energy prices. High energy intensity is largely a consequence of both the low-cost electricity supply based on hydro and the slow rollout of investments in energy efficiency (Eurostat, 2023[60]). However, over the past decade, energy intensity in Albania has shown a decreasing trend, steadily converging with levels observed in the European Union.

The long-term sustainability of the energy sector in Albania will be dependent on improving water resource management for continued reliance on hydropower, diversifying the energy mix through other renewable sources and curbing demand growth through energy efficiency measures. Introducing circular economy strategies into hydropower generation could ensure its sustainability, as hydropower plants and dams can create greater value, such as contributing to cleaning rivers with equipped trash racks and cleaning machines or improving water management services with water-tracking devices for better climate forecasts. If environmental protection is ensured for hydro generation investments,11 designing durable and easily disassembled and recycled hydropower plants (their lifetime can exceed 100 years) can be significant to long-term low-carbon electricity. When it comes to investments in other renewable sources (solar and wind), obtaining the materials they require – in particular lithium, cobalt and rare earths – exclusively via mining presents sustainability and energy security12 challenges (Pennington, 2022[61]). Renewable material recycling and the use of secondary low-carbon materials will, therefore, be vital to support the clean energy transition.

Materials use

Albania is endowed with considerable natural resources, including water, arable lands (of which 24% is used for agriculture), natural gas reserves, oil (220 million barrels), coal (575 million tonnes of proven coal reserves), metallic mineral deposits (gold, chromium, copper, iron-nickel), rock (travertine, limestone, dolomite), and a wide variety of freshwater and saltwater fish (Environment Go, 2022[62]; National Agency of Natural Resources, 2022[33]).

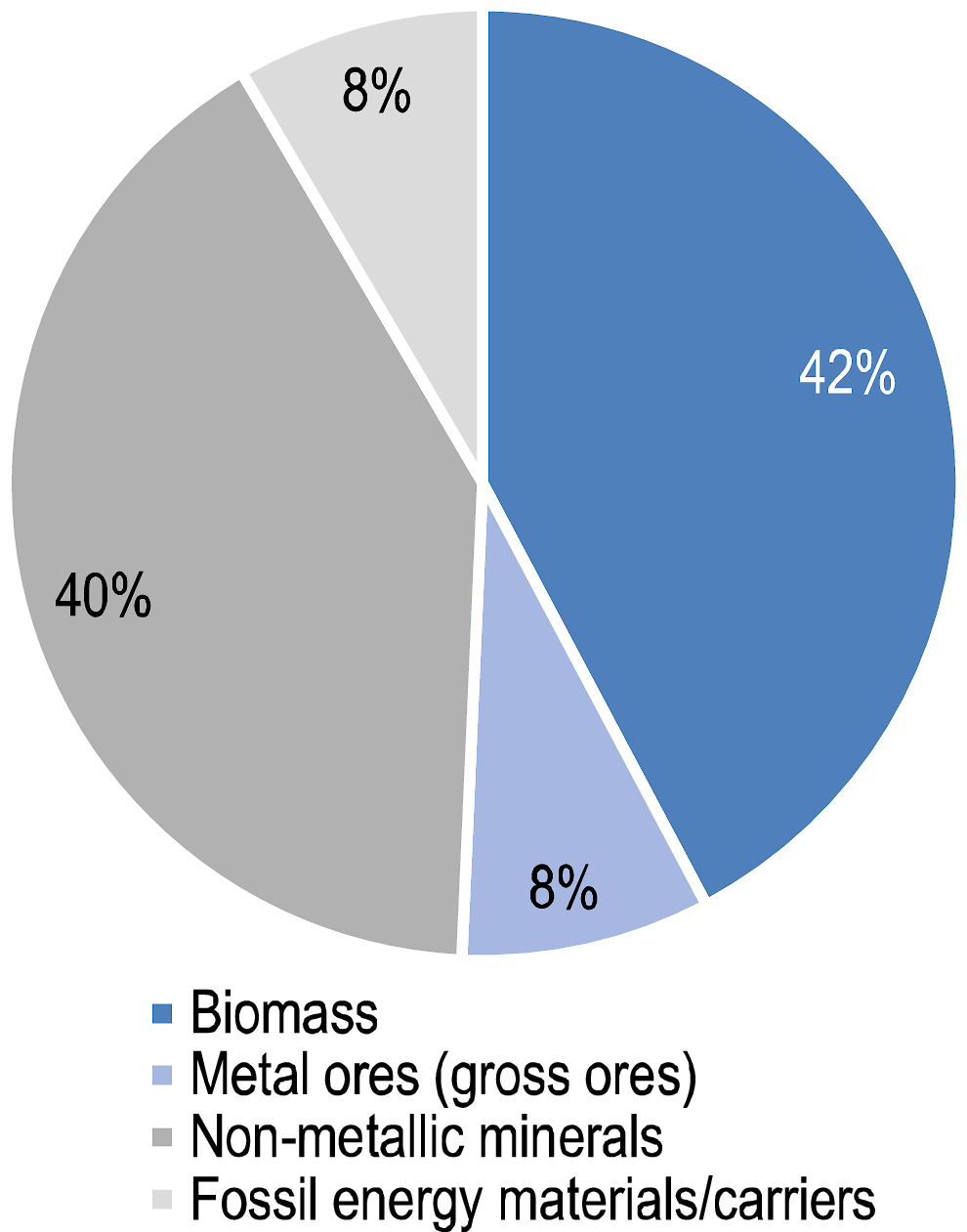

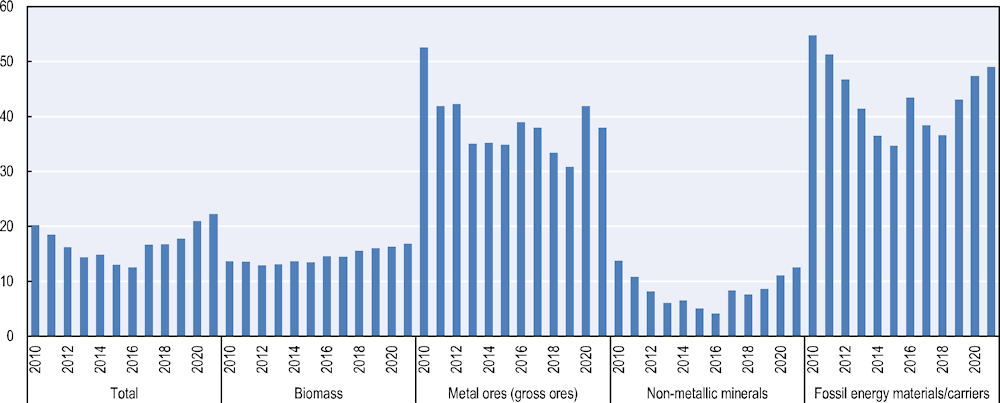

Domestic material consumption (DMC), or the total amount of materials extracted and used from the environment, taking into account the physical trade balance, stood at 7.2 tonnes per capita in 2021, below the EU and OECD averages, which amounted to 14.1 tonnes per capita (in 2021) and 17.5 tonnes per capita (in 2019), respectively. Albania’s DMC is dominated by biomass (wood, food), followed by non-metallic minerals (industrial and construction minerals), which combined account for 82% of the total. Fossil energy materials and carriers and metal ores amounted to 8% each (Figure 2.6).

Biomass’ share in Albania’s DMC (42%) is much higher than in the European Union, where it only accounts for about a quarter of total DMC (Eurostat, 2022[63]), due to the high contribution of agriculture to Albania’s GDP and the use of firewood for various heating applications (IRENA, 2021[64]). The circular transition of biomass and the development of a circular bioeconomy could be significant in meeting climate targets and protecting the environment, through better policies guiding more resource-efficient and sustainable primary production and waste management (composting and anaerobic digestion) and supporting the use of residues and wastes in agricultural practices. Moreover, bio-waste conversion to energy could support Albania’s climate targets by reducing its reliance on fossil energy materials.

Additionally, the production of non-metallic minerals, relatively low-value bulk commodities which are essential for Albania’s construction sector, is resource- and energy-intensive, due to the several steps necessary for their transformation (such as grinding, heating, mixing, cutting, shaping and honing) (OECD, 2019[65]). Resource efficiency efforts in all non-metallic materials’ life cycles will be important to reduce emissions and minimise the environmental impacts.

Figure 2.6. Structure of domestic material consumption in Albania, 2021

% of total

Between 2017 and 2021, Albania witnessed changes in its DMC. The DMC of non-metallic minerals decreased by approximately 20%, while biomass consumption remained stable. In contrast, there was a noteworthy 22% increase in the consumption of fossil energy materials and nearly a doubling in the consumption of metal ores (INSTAT, 2023[66]). These shifts have led to a slight restructuring of Albania’s DMC, with the proportion of metal ores doubling during this period and that of non-metallic minerals decreasing by more than 5 percentage points. In addition to the increasing consumption of fossil energy materials and metal ores, their import dependencies have remained the most significant (Figure 2.7). A transition to a circular economy could positively contribute to decreasing these dependencies, in particular since metal ores can be recycled indefinitely without losing quality or purity, particularly iron, steel and aluminium – metals which are the most extracted in Albania (INSTAT, 2022[67]).

Figure 2.7. Import dependency in Albania, 2010-2021

Notes: Import dependency is the ratio of imports over direct material inputs (DMI). DMI is calculated as the sum of domestic extraction of natural resources and imports of materials.

Source: INSTAT (2023[66]).

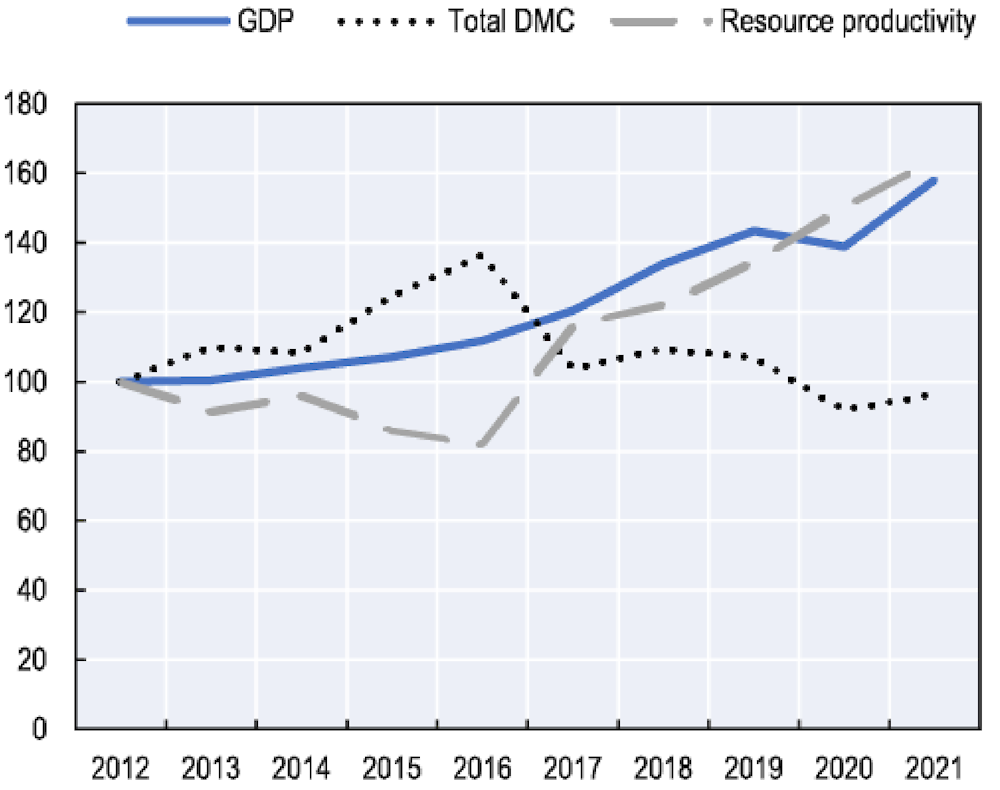

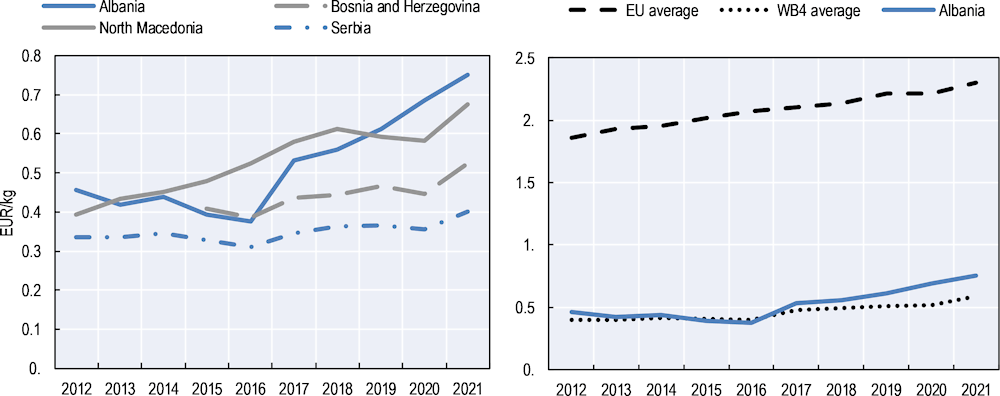

With Albania’s DMC per capita on a slight decreasing trend since 2016 (when it was 9.9 tonnes per capita), resource productivity has been on a constant increase, reaching an all-time high in Albania in 2021 at 0.75 EUR/kg, marking a sharp increase starting in 2016 (Figure 2.8). While resource productivity is low and still falls short of the EU average (2.1 EUR/kg), these recent trends can be interpreted as a first sign of relative decoupling of economic growth and consumption of natural resources, which could be further accelerated with the transition to a circular economy. Overall, further efforts are needed to increase resource efficiency and productivity at all stages of the material life cycle (extraction, transport, manufacturing, consumption, recovery and disposal) and throughout supply chains. A transition to a circular economy, through repair, reuse and recycle, would reduce material extraction levels, ensure the sustainable flow of resources and offer possibilities to reduce dependencies (OECD, 2021[68]).

Figure 2.8. Resource productivity, 2012-2021

Notes: EU: European Union. WB4: Western Balkans 4: Albania, Bosnia and Herzegovina, North Macedonia, and Serbia; DMC: domestic material consumption. Resource productivity presents the gross domestic product (GDP) divided by DMC. DMC measures the total amount of materials directly used by an economy. No data are available for Bosnia and Herzegovina (before 2014), Kosovo, or Montenegro.

Source: INSTAT (2023[66]); Eurostat (2022[63]; 2022[69]).

Figure 2.9. GDP and domestic material consumption in Albania, 2012-2021

Index 2012=100

Waste-related trends

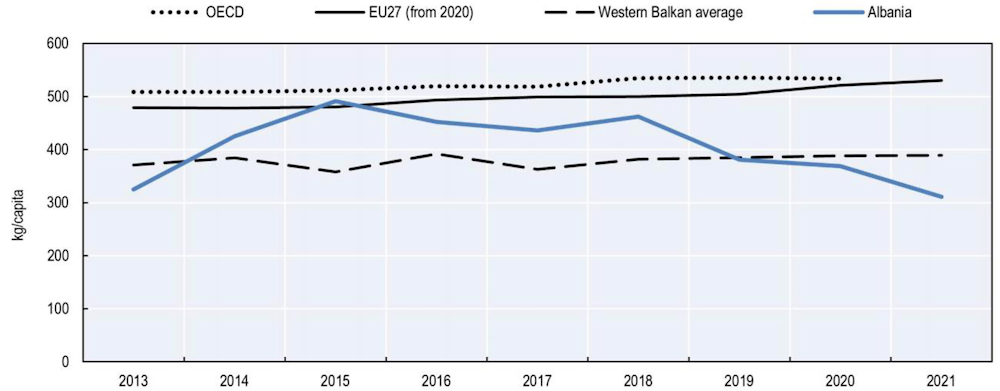

Albania’s level of municipal waste generation is in the midfield compared to its neighbouring economies, with a slight decreasing trend over recent years (Figure 2.10). Municipal waste dropped from 1.4 million tonnes in 2015 (corresponding to 491 kg/capita) to 0.9 million tonnes in 2021 (corresponding to 311 kg/capita) (Eurostat, 2021[70]). However, this decrease is attributed to the improvement in waste reporting over years13 and thus cannot point to a reducing trend per se (EEA, 2021[71]). Nevertheless, the data are still not considered of high quality as there are no exact statistics for waste generation; data and reports are instead based on municipalities’ and recycling companies’ estimations, except for the few municipalities that take their waste to a sanitary landfill or incinerator equipped with weighing devices (EEA, 2021[71]). There are some ongoing efforts to improve waste statistics. Between 2020 and 2022, the Ministry of Tourism and Environment conducted a waste data collection and weighting exercise in all 61 municipalities (National Environmental Agency, 2022[72]) with the aim of increasing awareness of waste quantities and reducing discrepancies between estimated and weighted waste. The waste data obtained through this weighing exercise in Albania for 2022 indicate a notable amount of waste per municipality and a substantial per capita waste generation. However, given that data for all municipalities were only collected for one year and technical structures vary considerably at the local level, they significantly differ from the administrative data. Data are expected to converge more closely in the future if these practices are continued and professionalised.

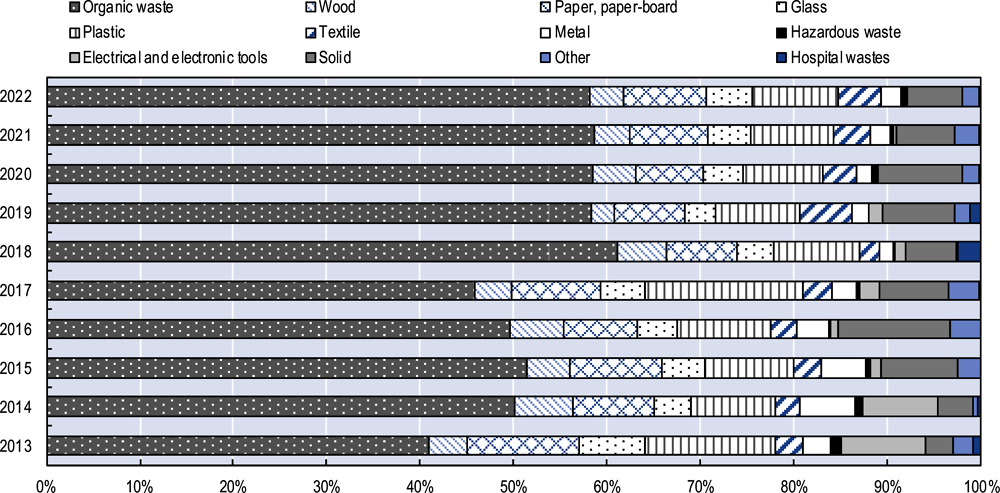

Figure 2.10. Municipal waste generation, 2013-2021

In 2022, 58.1% of municipal waste produced in Albania was organic,14 followed by 9.2% of plastic and 8.9% of paper waste (Figure 2.11) (EEA, 2022[74]). When it comes to plastic waste, although Albania is not the largest contributor to plastic pollution in the Adriatic-Ionian basin, its plastic leakage into these natural waters, at 20 kg per person, lies in the higher range among the economies concerned (World Bank, 2020[75]). Another critical point to consider is the fact that a high share of waste, including plastics, is being discharged untreated into the Mediterranean basin from Albania, due to the high proportion of mismanaged waste (73% of total generated waste) (Dalberg Advisors, WWF Mediterranean Marine Initiative, 2019[76]), with litter from fishing and shipping in the Adriatic Sea further adding to the problem of land-based pollution (European Commission, 2020[77]).

Figure 2.11. Waste by compound in Albania, 2013-2022

Around 89% of the population was served by waste collection services in Albania in 2022, mainly in urban areas (INSTAT, 2022[79]), well short of the EU average of 98% (Eurostat, 2023[80]). Waste collection and treatment services are funded through waste management fees paid by households and private companies, but current amounts remain low and insufficient to ensure proper collection equipment (containers and trucks) (Ministry of Tourism and Environment, 2020[81]). While waste management fees have increased in certain municipalities,15 leading to an improved waste service, the most vulnerable social groups have not received any kind of special treatment in terms of fees.

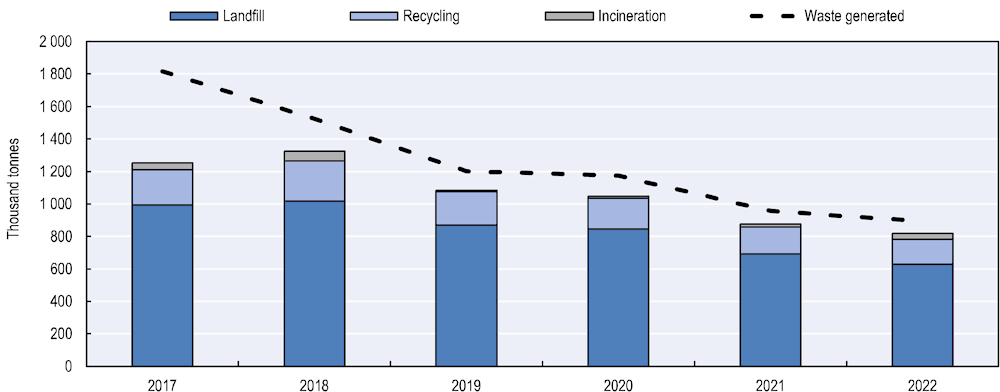

Municipal waste management remains a challenge in Albania. Municipal waste separation at source and relevant infrastructure is almost non-existent, despite a legal obligation.16 The main method of managing municipal waste was disposal to landfill in 2022 (over 70%), significantly above the share in the European Union (23%) (Figure 2.12) (Eurostat, 2021[70]). A few pilot projects are, nevertheless, underway to introduce separate collection in some Albanian cities (in particular for paper and cardboard, aluminium, plastics, and bio-waste)17. Moreover, the government reported that three composting plants have recently been established (Cerrik, Roskovec and Belsh) and three material recovery facilities (Saranda, Himara and Prrenjas) are operating across Albania, with ten additional plants to be opened in the next four years.

Although higher than in other regional economies, recycling rates of municipal waste in Albania are low (17% in 2022) compared to the EU average (49% in 2021) (Figure 2.12) (Eurostat, 2021[70]). Five recycling plants are operational in the Bushat, Korca and Vlora landfills, and plans are ongoing for the plants to be established at the remaining landfills. While collection for recycling is conducted at sanitary landfills and at the incinerator plant in Elbasan by staff employed to do so, the majority of recyclable waste is still collected by informal waste pickers from dumpsites and bins and sold to the recycling industry18 (OECD, 2021[13]). The following processes then take place:

paper and cardboard are sorted in small quantities at the three paper mills (Tirana, Fier and Durres)

glass bottles are sterilised and reused by beverage companies

the majority of aluminium cans are exported to neighbouring economies and a small share is directed to a private Albanian smelter

steel and scrap are sent to the Elbasan metallurgical plant (EEA, 2021[71]).

Figure 2.12. Municipal waste generation and treatment in Albania, 2017-2022

There are more than 30 private recycling companies in Albania (part of the Association of Recyclers of Albania) in charge of these processes. The industry’s investment market value is estimated to reach around EUR 230 million. These companies’ combined processing capacity is about 500 000 tonnes/year, which is more than enough to process all recyclable waste generated in the economy.19 Nevertheless, due to the lack of raw material, the companies have reported to be working at around 25% of their production capacity, recycling around 10% of the total municipal waste generated (Ministry of Tourism and Environment, 2020[81]).

Moreover, the first incineration plant in Albania started operating in 2019 in Elbasan, which treated around 2% of municipal waste for energy purposes in 2021 (incineration data prior to 2019 are related to illegal burning of waste at landfills) (EEA, 2021[71]). The construction of two additional waste incinerators in Fier and Tirana, as part of the government’s plans to replace the estimated 199 large uncontrolled dumpsites and various small sites still in operation by 2028,20 have not yet been completed. Nevertheless, recent investments in waste incineration plants should not come at the expense of Albania’s recycling industry and should not diverge the country from aligning with the EU acquis waste hierarchy principle, recycling targets and a circular model21 (European Commission, 2022[84]). In addition to the new incinerator plants, a new sanitary landfill is in the planning stage in Vlora and ten illegal landfills are in the process of being approved for remediation to be used while sanitary landfills are constructed (EEA, 2021[71]).

Few data are available on the quantity and management of industrial waste. Key industrial waste generators in Albania include the oil industry, cement production, and steel and mining (EEA, 2018[85]). Mining waste is estimated to amount to more than 45 million tonnes22 (Thanas, Bode and Mati, 2022[86]) and in 2022, around 12% of total waste managed by municipalities came from industrial production (INSTAT, 2023[78]). Industrial waste is also largely disposed in waste landfills or unmanaged. These sites pose a serious threat to the environment, as industrial waste products have particularly dangerous properties, causing pollution in water, soil and crops.

Treating waste according to the waste hierarchy, through higher recovery and recycling rates of municipal and industrial waste, will be vital to aligning with EU waste legislation, including its recycling and landfill reduction targets. The large amounts of organic waste (see Figure 2.11) generated by municipal and agricultural waste could be further turned into compost and used as a resource for organic soil fertilisers or as a source of biomass to generate biofuels, thus reducing the cost of purchasing new raw materials or products. Mining waste could potentially be used as a commodity and provide solutions to limited metal supplies, such as to backfill mining voids; as a construction material for restoring old mining sites; and as aggregates in embankment, road, pavement, foundation and building construction (EIT Raw Materials, 2021[87]). The cement industry, with its high-temperature kilns, may also have the capacity to utilise certain waste materials, such as used oils, tyres and plastic waste, as alternative sources of energy or raw materials. Moreover, in addition to the ban on certain types of single-use plastic bags introduced in 2022, circular solutions are necessary to further reduce plastic pollution, generated by its untenable use and disposal of (single-use) plastic products, as it comes with several risks for the Albanian tourism sector, ecosystems and human health.

Existing policy landscape and initiatives relevant to the circular economy in Albania

Although no specific policy framework targets the circular economy, the concept is gaining momentum in Albania. Some activities have been undertaken to promote a circular transition in the economy, primarily by international partners, civil society and academia, but they remain rather uncoordinated and ad hoc.

Overview of the Albanian circular economy policy landscape

In Albania, the Ministry of Tourism and Environment – in particular the newly established Directorate for Circular Economy – the Ministry of Finance and Economy, the Ministry of Infrastructure and Energy, and the National Agency of Environment are the most relevant institutions for the conception and implementation of circular economy policies. The Albanian Investment Development Agency can also play an important role in promoting circular business models, considering its expanding role as a government business support services provider. Moreover, the Institute of Statistics is instrumental in providing essential data and insights that support informed decision making on the circular economy transition.

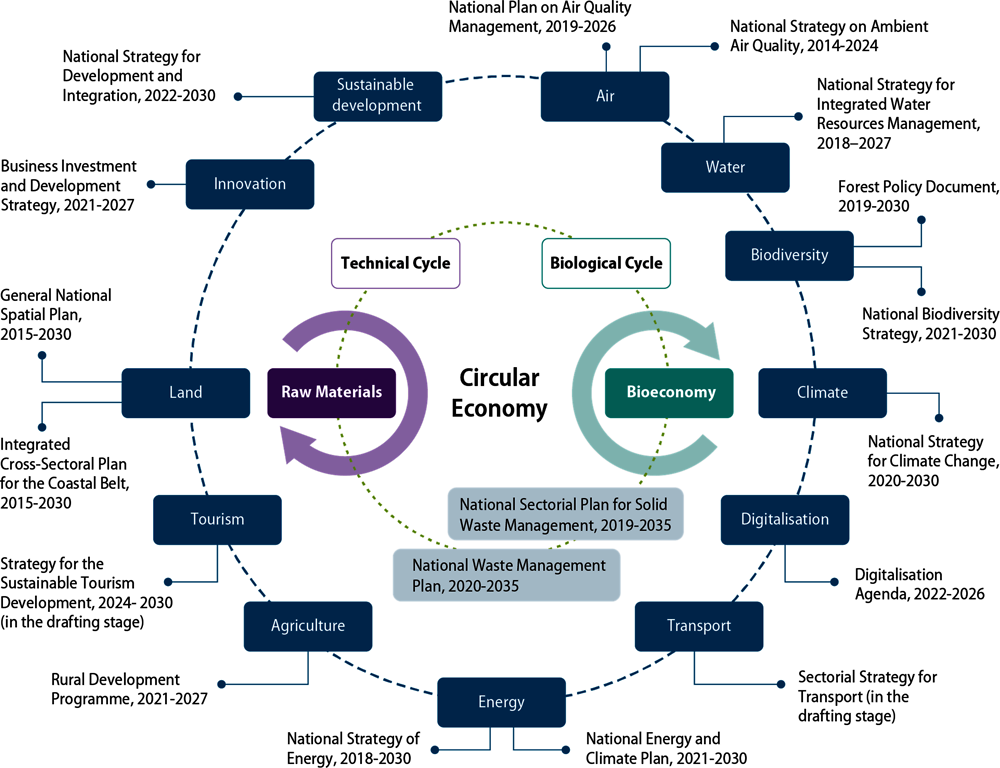

The current legal and policy frameworks, including national regulations, strategic documents and action plans, do not provide a solid basis for the circular economy transition. Nevertheless, strategies across a number of thematic areas are considered to be relevant in the circular economy context (Figure 2.13).

Albania lacks an umbrella policy framework on environmental protection, although a comprehensive National Strategy for Climate Change was adopted in 2019, which includes a priority on waste management and reduction. Stemming from Figure 2.13, Table 2.1 outlines policy documents (regional and national) that are relevant to the circular economy, classified into “core” and “directly related”. Documents identified as “core’’ directly reference the circular economy.

Figure 2.13. Overview of the Albanian policy landscape relevant to the circular economy

Notes: This policy analysis covered policy documents currently in place and identified across a number of thematic areas considered to be relevant for the transition to a circular economy. This thematic scope includes both technical and biological cycles in the circular economy, as well as policy frameworks enabling this transition. The examples of relevant policies in the circular economy context are not exhaustive.

Table 2.1. List of overarching policy documents relevant to the circular economy in Albania

|

Topic area |

Title |

Time frame |

Qualitative goals relevant to the circular economy |

Quantitative targets |

|

|---|---|---|---|---|---|

|

Core policy documents |

|||||

|

Overarching Green Agenda |

2020-30 |

For the circular economy specifically:

|

|

||

|

Waste |

2020-35 |

|

Targets for 2035:

Targets for 2035 for specific waste streams:

|

||

|

Climate |

2020-30 |

|

|

||

|

Directly related documents |

|||||

|

Sustainable development |

2022-30 |

|

|

||

|

Climate and energy |

2021-30 |

|

|

||

|

Private sector |

2021-27 |

|

None directly related to the transition to a circular economy |

||

|

Tourism |

2019-23 |

|

|

||

Waste management

Waste management in Albania is covered in the amended Laws on Environmental Protection and on Integrated Waste Management, both adopted in 2011. Several decisions of the Council of Ministers cover specific waste streams (both municipal and industrial) and specify the competencies of central and local governments. While the Law on Integrated Waste Management envisaged the transposition of EU waste legislation, it pre-dates the revisions of the EU Waste Framework Directive adopted in 2018.

Promisingly, after being delayed since 2020, Albania amended its waste management law to ban the use of certain categories of plastic bags23 in March 2022 and has partially aligned with the EU Directive on single-use plastics. Further alignment with this directive is needed, by banning other single-use plastic items (European Commission, 2022[84]). A task force was established following the adoption of the amendment to ensure enforcement of the ban.

To ensure alignment with the Waste Framework Directive, the Albanian government is in the process of further revising its legislative framework, through acts transposing the European List of Wastes into Albanian legislation. Regarding the producer responsibility organisations, the new Law on Extended Producer Responsibility (EPR), which aims to establish the schemes24 for the collection and recycling of special waste streams, such as packaging waste, waste from electronic and electrical equipment, and waste from batteries and accumulators, has been drafted25 and is expected to be adopted in the second quarter of 2024. The draft EPR Law foresees the product tax coming into effect in January 2025, with 30% of all income generated going into a Special Fund for Circular Economy.

The draft EPR Law largely covers aspects of the OECD EPR Guidance (see Chapter 4) (OECD, 2016[88]). Outlined rules pertain to the creation and functioning of producer responsibility organisations, spanning their authorisation process as well as the registry of data related to products under EPR, producers or the producer responsibility organisation itself. They also clearly define the responsible institutions (national and local government) as well as co-ordination among them for the implementation of the law, alongside the obligations (e.g. reporting) and sanctions against non-compliance of registered producers or producer responsibility organisations. In the case of Albania, the National Environmental Agency will be responsible for the inspection and monitoring of EPR schemes.

Two main strategic documents have been adopted covering waste, in 2019 and 2020, respectively: the National Plan for Integrated Waste Management (NPIWM) (2020-2035), which covers both municipal and industrial waste, and the National Sectorial Plan for Solid Waste Management (2019-2035).

The NPIWM (2020-2035) was developed based on the results of the previous NPIWM (2011-2019), whose ambitious measures and targets were largely not implemented or achieved (e.g. increase the amount of waste collected by local authorities that is recycled or mixed to 55% by 2020, starting from a very low base and with underdeveloped separation-at-source infrastructure) mostly due to the overall lack of staff and financial resources to ensure greater enforcement (OECD, 2021[13]).

The NPIWM envisages a gradual transition from a linear to a circular economy by encouraging waste diversion from landfills to waste reuse and recycling through improved waste separation at source. Its main objectives are to:

Improve waste management by meeting the main targets and legal requirements. This includes establishing efficient systems for measuring and reporting municipal waste, drafting local municipal plans, improving the collection and treatment of waste based on the waste hierarchy, closing non-compliant landfills, and implementing EPR schemes.

Improve and harmonise the legal framework for waste management. This includes clarifying institutional roles and responsibilities for central and local governments and developing guidelines for municipalities.

Mobilise sustainable financing of waste management, including infrastructure. Municipalities will be tasked to determine their budgetary needs for the complete cycle of waste management and related fees.

Improve human resources and citizens’ awareness of and participation in waste management. Expertise on green public procurement will be supported. Awareness-raising campaigns and educational courses promoting waste reduction and sustainable consumption will be organised.

The current NPIWM specifies more realistic targets, set over three periods, with goals for 2025, 2030 and 203526 (see Table 2.1) with defined institutions responsible for their implementation. Monitoring and evaluation are set to be conducted annually, and data collection is to be improved to measure performance against the targets.

To reach these objectives, a number of activities are ongoing (EEA, 2021[71]):

Preparation of local waste management plans for some municipalities.

Improvement of the infrastructure in some municipalities (bins, vehicles) and pilot projects on separate collection.

Improvement of the waste data management system by providing verified data on municipal waste and the potential for GHG reductions with support from international development co-operation partners. A weighting exercise has been conducted in all municipalities as part of the project.

The National Environmental Agency is implementing a nationwide campaign to raise the awareness of the general public and educate local institutions with regard to waste management services (the ban of single-use plastic items is one of the topics discussed). The campaign has been realised in all 61 municipalities. Municipalities also organise the “Let’s do it” public awareness campaigns promoting responsible environmental behaviour and waste reduction, reuse and recycling.

Start of the rehabilitation and closure of some existing dumpsites.

Start of feasibility studies for two waste management zones, which would be the base units for integrated waste management planning: Fier and Elbasan. These zones are to include at least one centre for the recovery of recyclable and compostable materials, an incinerator with energy recovery, or a sanitary landfill.

Establishment of three composting facilities and three material recovery facilities.

The National Sectorial Plan for Solid Waste Management is a detailed investment plan for local and regional solid waste management infrastructure (waste collection and transport, reduction and recycling of waste, treatment, and disposal facilities) for the period 2019-35.

Climate action

Albania strengthened its climate action policy framework with the adoption of the National Climate Change Strategy and corresponding national mitigation and adaptation plans in 2019. The main objectives of the strategy are relevant to a circular economy transition and include:

Reducing GHG emissions, mainly from the transport sector and energy production.

Promoting renewable energy, in particular solar, wind and hydropower.

Enhancing energy efficiency, in particular in buildings and transportation. This includes promoting energy-efficient technologies and encouraging less energy consumption.

Improving waste management by reducing waste generation and increasing recycling.

Strengthening Albania’s resilience to the impacts of climate change, namely floods, droughts and extreme weather events. This includes improving infrastructure, enhancing early warning systems and promoting agriculture practices.

Albania submitted its revised Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change in 2021. The NDCs acknowledge that climate change is a cross-cutting issue for all sectors in Albania, and that several policies and strategies have or are being developed to address it. The NDCs are complemented by an Action Plan, which builds on the National Climate Change Strategy, through the integration of its priority actions, and by aligning implementation mechanisms and timelines.

Moreover, Albania is one of the two economies in the Western Balkans (along with North Macedonia) that has adopted its National Energy and Climate Plan in 2021, as mandated by the Energy Community. Nevertheless, crucial improvements are necessary to ensure the plan is successfully leading the economy towards achieving 2030 climate targets. In particular, the plan lacks ambition in reducing GHG emissions and many of the envisaged policies lack an operationalisation plan with concrete funding sources and timelines (Climate Action Network Europe, 2022[89]).

Industry

The Country Programme for Inclusive and Sustainable Industrial Development in Albania was developed as a comprehensive programmatic framework to achieve inclusive and sustainable industrial development for the period 2020-24. It includes around 20 project proposals in 3 priority areas: 1) industrial competitiveness and market access; 2) productive employment and entrepreneurship development; and 3) sustainable energy for productive uses and environmental management (UNIDO, 2020[90]). The identified components are aligned with the Sustainable Development Goals (SDGs) and some programmes are planned to boost the circular economy. For instance, one of the projects strives to transform the market for using organic waste from olive oil production and other industries for energy generation. The programme also envisages the development of eco-industrial parks; however, this measure had not been implemented at the time of writing (De Oliveira Pereira, 2019[91]).

A Zero Draft Roadmap on Sustainability and Resource Use in the Textiles, Clothing, Leather, and Footwear industries of Albania was launched in October 2022 within the framework of the Business Partnerships and Solutions for SDGs, a project funded and implemented by international co-operation partners. The overall objective of the roadmap is to improve the sustainability of the textiles, clothing, leather and footwear sector in Albania with evidence on its environmental, social and economic impacts and to work with a wide range of stakeholders across the supply chain to support the transition to formality and fill existing sector gaps regarding waste collection, separation, recycling, energy efficiency and water treatment (ILO and UNIDO, 2023[21]).

The Non-Food Industry Strategy (2016-2025), active between 2016 and 2019, prioritised enhancing competitiveness in sectors dealing with raw materials, mineral resources and waste. While not explicitly centered on circularity, the strategy focused on optimising natural resource use and integrating secondary raw materials into production processes to alleviate environmental impact. The strategy planned to apply best available techniques for modernised production in areas like metal ore, non-metallic minerals processing and waste management, aiming to reduce energy use and promote recycled materials to minimise environmental harm. Another key aspect of the strategy was the revival of historic industrial sites in various locations like Elbasan, Fier, Lac, Rubik, Shkoder and Burrel to attract both local and foreign investments. The goal was to enhance the non-food industry’s impact on Albania’s GDP, exports and employment rates. The strategy also proposed initiatives for the remediation of contaminated industrial sites and the construction of infrastructure for managing industrial waste, particularly hazardous waste.

Private sector

The legal and policy framework targeting private sector and industrial development has recently been strengthened to improve the business environment; with circular economy policies being increasingly recognised in some strategic documents.

The newly adopted Law on Support and Development of Start-ups (2022) and its related measures aim to support the innovation ecosystem, are expected to facilitate peer-to-peer learning and the development of products and services that contribute to a green and circular economy.

The new Business Investment and Development Strategy (2021-2027) has a specific focus on the circular transition, as part of the “green and digital transformation” pillar. In particular, it encourages companies to increasingly make changes in their supply chains as a response to opportunities that more sustainable and circular products and services could bring. A stronger push for eco-innovation in the post-COVID economic recovery is envisaged through awareness-raising and capacity-building activities as well as improved access to green finance, such as through the provision of grants for eco-innovative start-ups, government credit guarantee schemes for green projects, the development of a network of business angels and regulation of crowd funding. Trainings and educational programmes are planned to upscale skills development in this regard. For instance, the Albanian Development Guarantee Foundation has a “green window” to support SMEs and investments in the agriculture sector that aim to reduce energy consumption or CO2 emissions by at least 20%. As of December 2022, the foundation had guaranteed 42 green loans for a total of EUR 3 million.

Albania has also made some progress in developing a Smart Specialisation Strategy, with the establishment of an Inter-Ministerial Committee overseeing its drafting and implementation. A national team on smart specialisation was also created as a technical-level structure, comprised of experts and representatives from various institutions and organisations (S3 Platform, 2024[92]). A roadmap has been completed, and the Entrepreneurial Discovery Process, in line with the European Commission’s Joint Research Centre methodology, started in 2022. Following the development of quantitative and qualitative mapping of Albania’s economic, innovative, scientific and technological potential, preliminary priorities have been identified. Circular economy considerations could be highly relevant to some of the key preliminary priorities, encompassing sectors such as agriculture, forestry, and fishing; manufacturing; energy; as well as accommodation and supporting service activities. The circular economy could be included as a horizontal objective. This would imply promoting the circular economy as a cross-cutting priority across all sectors and areas of focus outlined in the strategy. By systematically incorporating all aspects of economic development, innovation and policy making to foster a more sustainable and resilient economy, Albania could maximise resource use while minimising environmental impact and generating long-term socio-economic benefits.

Moreover, recognition of green best practices through eco-labelling, which can encourage the production, marketing and use of products with a reduced impact on the environment, is legislated in Albania (Regulation on the Approval of the Procedure and Criteria for Granting an Eco-label, Its Use and Validity; as well as the composition and functioning of the Commission for the Issue of Eco-label). Nevertheless, while the legislation requests the Ministry of Tourism and Environment to adopt guidelines on the criteria for granting eco-labels for each product or product group, only one guideline on textiles has been developed to date. A certification body responsible for delivering eco-labels is yet to be established in Albania.

Public procurement

The public procurement market in Albania represented 10.7% of the country’s GDP in 2021, having more than doubled from a share of 4.8% in 2019, mainly driven by post-earthquake reconstruction projects and economic contraction caused by the COVID-19 pandemic (European Commission, 2022[93]). Given the major role the public sector plays in driving the demand for products and services, it is a powerful tool for the circular transition in Albania.

The Public Procurement Law (2020) mandates contracting authorities to adhere to environmental, social and labour legislation. It also allows the consideration of climate impacts in the awarding criteria (OECD, 2022[46]). The Public Procurement Agency published a Green Procurement Roadmap and general methodology in 2023. While Albania introduced its National Public Procurement Strategy 2020-2023 in 2020, no specific advancements in green procurement legislation have been made. The legal framework for public procurement should be enhanced to integrate circularity-related sustainability concerns, like resource efficiency, waste reduction and eco-friendly product development, into public procurement processes. By considering these factors in awarding contracts, the law would encourage the purchase of goods and services that promote circular practices, contributing to a more sustainable and circular economy in Albania. The revision status of the National Public Procurement Strategy 2020-2023 is currently unknown.

Tourism

The National Strategy for Sustainable Tourism Development (2019-2023) was the first tourism strategy adopted after ministries in charge of tourism and environment joined forces to form the Ministry of Tourism and Environment in 2017. The strategy outlines the government’s objectives for the tourism sector, in particular promoting sustainable tourism, improving infrastructure and services, and creating a favourable business environment for tourism operators. Although the strategy does not specifically cover the circular economy, it includes a range of measures to develop sustainable tourism practices that minimise negative impacts on the environment and preserve Albania’s natural and cultural assets.

The Ministry of Tourism and Environment is in the process of drafting the new tourism strategy for the period 2024-30, which will focus on high-end and eco-tourism. The planned objective of the strategy going forward will not be to attract more tourists, but to diversify the tourism offer and attract tourists for longer stays and all year round to reduce pressures on coastal areas and develop better services. Some of the touristic destinations planned to be promoted include mountains, forests and the coastline, with a focus on cultural heritage, gastronomy, hiking and rafting. The strategy plans to develop a long-term, resilient, sustainable tourism industry, respectful of destinations’ natural and social ecosystems, and include circular economy aspects.

Overview of circular economy initiatives and main non-governmental stakeholders in Albania

A number of stakeholders have been involved in different circular economy-related activities and initiatives in Albania. They focus on different aspects relevant for the circular economy – primarily, though, on waste management and awareness-raising activities. However, their work remains uncoordinated, and synergies remain to be created between them. Figure 2.14 provides an overview of the main non-governmental circular economy stakeholders in Albania.

Figure 2.14. Overview of the main non-governmental circular economy stakeholders in Albania

Note: The list in non-exhaustive.

The community of international development co-operation partners is conducting several projects relevant for the circular economy in Albania, providing financial and technical support to the government in different areas. Albania’s main partners and international development co-operation partners include the European Union, the Swiss Agency for Development and Cooperation, Kreditanstalt für Wiederaufbau (KfW), Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), the French Development Agency, the World Bank and United Nations agencies (see Annex C for an overview of non-governmental stakeholders). The majority of projects undertaken by the international community aim at strengthening municipal and industrial waste management (enhanced infrastructure, waste prevention activities, introduction of waste recycling programmes) (see Annex B). While some initiatives include grants and subsidies, buy-in from the private sector remains limited and phase-out processes often lack.

Non-governmental organisations in Albania have been active in promoting and raising awareness on environment- and ecology-related concepts and practices, with some undertaking projects directly focusing on the transition to a circular economy. Some non-governmental organisations have conducted research on the circular economy in Albania (Build Green Group, Environmental & Territorial Management Institute, Urban Research Institute), raised awareness on circular economy concepts (Centre for Competitiveness Skills, Co-PLAN Institute for Habitat Development, Environmental Centre for Development Education and Networking), developed platforms to connect circular economy businesses (Circular Economy Club Tirana, Build Green Group), and implemented projects on circular waste management (Institute for Environmental Policy, Milieukontakt) (see Annex C). Nevertheless, their initiatives remain uncoordinated and are rarely led by a strategic government approach towards the circular transition.

Academia and research institutes have also been at the forefront of conducting analyses and developing solutions to increase the uptake of circular economy practices. Several universities in Albania (such as the University of Tirana, the Agricultural University of Tirana, the Polytechnic University of Tirana and Polis University) offer courses introducing circular economy concepts (see Annex C). Nevertheless, while the Ministry of Tourism and Environment is undertaking measures to include environment and recycling aspects in school curricula, no concrete initiatives have been taken to develop an overarching circular economy educational programme at the university level.

Private sector organisations, including chambers of commerce, export associations and sector-specific unions, are essential for reaching a wide range of businesses, in particular SMEs. Through awareness-raising activities, conferences and networking events, private sector organisations are increasingly influencing Albanian companies to develop or transition to circular business models (see Annex C).

Several companies in Albania have circular business models, promoting different ways of producing and consuming goods and services. The main circular businesses in Albania focus on the reuse of agricultural surplus and by-products, sustainable packaging options, and recycled waste (particularly from vehicles or electronics) (see Annex C). While their contribution is required to transition to a more resource-efficient and circular economy, government measures have rarely supported them financially or technically. Moreover, as the vast majority of businesses are still not familiar with circular concepts, it remains difficult to map all the actors concerned.

References

[10] AIDA (2022), “Tourism”, https://aida.gov.al/en/business-in-albania/sectors/tourism.

[95] Albanian Government (2020), Karavasta Photovoltaic Park, biggest investment in solar power in Balkans, https://www.kryeministria.al/en/newsroom/parku-fotovoltaik-i-karavastase-investimi-me-i-madh-ne-ballkan-per-energjine-diellore/.

[58] Altax (2019), “Oil industry in figures in Albania”, https://altax.al/en/1-oil-industry-in-figures-in-albania-2019.

[89] Climate Action Network Europe (2022), “Two years after Sofia: Limited progress of national climate and energy plans in the Western Balkans, new report by CAN Europe warns”, press release, https://caneurope.org/wb-necp-report-2022.

[53] Crippa, M. et al. (2023), CO2 Emissions of All World Countries, Publications Office of the European Union, Luxembourg, https://edgar.jrc.ec.europa.eu/booklet/GHG_emissions_of_all_world_countries_booklet_2023report.pdf.

[76] Dalberg Advisors, WWF Mediterranean Marine Initiative (2019), Stop the Flood of Plastic: How Mediterranean Countries Can Save Their Sea, World Wide Fund for Nature, https://www.wwf.fr/sites/default/files/doc-2019-06/20190607_Rapport_Stoppons_le_torrent_de_plastique_WWF-min.pdf.

[91] De Oliveira Pereira, D. (2019), “Bioenergy that is good for business”, https://www.unido.org/stories/bioenergy-good-business (accessed on 11 January 2023).

[23] Design4Circle (2021), Circular Economy in the Textile and Footwear Industry: Skills and Competences for a Sector Renewal, Design4Circle, https://design4circle.eu/wp-content/uploads/2021/04/CIRCULAR%20ECONOMY_IN_THE_TEXTILE_AND_FOOTWEAR_INDUSTRY_SKILLS_COMPETENCIES_FOR_SECTORAL_RENEWAL.pdf.

[74] EEA (2022), “Waste recycling in Europe”, https://www.eea.europa.eu/ims/waste-recycling-in-europe.

[71] EEA (2021), Municipal Waste Management in Western Balkan Countries: Albania, European Environment Agency, Copenhagen, https://www.eea.europa.eu/themes/waste/waste-management/municipal-waste-management-country/albania-municipal-waste-factsheet-2021/#:~:text=Albania%20has%20a%20new%20national,the%20treatment%20of%20residual%20MSW.

[85] EEA (2018), Municipal Waste Management: Albania – Country Fact Sheet, European Environment Agency, Copenhagen, https://www.eea.europa.eu/themes/waste/waste-management/municipal-waste-management-country-profiles/albania-municipal-waste-factsheet-2018.

[17] Einarsson, S. and F. Sorin (2020), Circular Economy in Travel and Tourism: A Conceptual Framework for a Sustainable, Resilent and Future Proof Industry Transition, CE360 Alliance, https://circulareconomy.europa.eu/platform/sites/default/files/circular-economy-in-travel-and-tourism.pdf.

[87] EIT Raw Materials (2021), Roadmap of Actions for the Exploitation of RM Sector in the ESEE Region, EIT Raw Materials, https://reseerve.eu/upload/content/446/d6-4-final_executive-summary_web.pdf.

[12] EIU (2022), What to Watch in the Western Balkans in 2023, Economist Intelligence Unit, London, https://viewpoint.eiu.com/analysis/article/422592625.

[62] Environment Go (2022), “Top natural rescources in Albania”, https://environmentgo.com/10-top-natural-resources-in-albania.

[38] European Commission (2023), “Agriculture in the enlargement countries”, https://agriculture.ec.europa.eu/international/international-cooperation/enlargement/candidates_en (accessed on 31 October 2023).

[84] European Commission (2022), 2022 Communication on EU Enlargement Policy: Albania Progress Report, European Commission, Brussels, https://neighbourhood-enlargement.ec.europa.eu/system/files/2022-10/Albania%20Report%202022.pdf.

[93] European Commission (2022), Albania 2022 Report, European Commission, Brussels, https://neighbourhood-enlargement.ec.europa.eu/system/files/2022-10/Albania%20Report%202022.pdf.

[49] European Commission (2022), Annual Report on European SMEs 2021/2022, European Commission, Brussels, https://ec.europa.eu/docsroom/documents/50654/attachments/1/translations/en/renditions/native#:~:text=However%2C%20due%20to%20their%20large,greenhouse%20gas%20emissions%20by%20enterprises.

[3] European Commission (2022), EU Candidate Countries’ & Potential Candidates’ Economic Quarterly (CCEQ) – Western Balkans and Türkiye. 3rd Quarter 2022, European Commission, Brussels, https://doi.org/10.2765/418856.

[77] European Commission (2020), Green Agenda for the Western Balkans, European Commission, Brussels, https://neighbourhood-enlargement.ec.europa.eu/system/files/2020-10/green_agenda_for_the_western_balkans_en.pdf.

[22] European Commission (2020), “The impact of textile production and waste on the environment (infographics)”, https://www.europarl.europa.eu/news/en/headlines/society/20201208STO93327/the-impact-of-textile-production-and-waste-on-the-environment-infographics (accessed on 4 December 2023).

[55] Eurostat (2023), “Energy statistics”, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Energy_statistics_-_an_overview (accessed on 2 November 2023).

[57] Eurostat (2023), “Energy statistics: An overview”, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Energy_statistics_-_an_overview.

[60] Eurostat (2023), “Enlargement countries – energy statistics”, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Enlargement_countries_-_energy_statistics#Energy_trade (accessed on 6 November 2023).

[16] Eurostat (2023), “Expenditure by duration, purpose, main destination of the trip and expenditure category”, https://ec.europa.eu/eurostat/databrowser/view/tour_dem_extot/default/table?lang=en (accessed on 10 January 2024).

[6] Eurostat (2023), “Gross value added and income by A*10 industry breakdowns”, https://ec.europa.eu/eurostat/databrowser/view/nama_10_a10__custom_8247007/default/table (accessed on 6 December 2023).

[80] Eurostat (2023), “Treatment of waste by waste category, hazardousness and waste management”, https://ec.europa.eu/eurostat/databrowser/view/env_wastrt/default/table?lang=en (accessed on 25 November 2023).

[59] Eurostat (2022), “EU energy mix and import dependency (archive)”, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_energy_mix_and_import_dependency#Energy_mix_and_import_dependency.

[69] Eurostat (2022), “GDP, current prices”, https://ec.europa.eu/eurostat/databrowser/view/nama_10_gdp/default/table?lang=en (accessed on 25 November 2023).

[63] Eurostat (2022), “Material flow accounts and resource productivity”, https://ec.europa.eu/eurostat/databrowser/view/env_ac_rp/default/table?lang=en.

[70] Eurostat (2021), “Municipal waste statistics”, https://ec.europa.eu/eurostat/databrowser/view/env_wasmun/default/table?lang=en (accessed on 6 December 2023).

[47] Eurostat (2020), “Small and medium-sized enterprises: An overview”, https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20200514-1 (accessed on 1 December 2023).

[32] Extractive Industries Transparency Initiative (2020), Extractive Industries Transparency Initiative Albania: Report for the Years 2017 and 2018, Deloitte Audit Albania, Tirana, https://eiti.org/sites/default/files/attachments/eiti-draft-report-2017-2018.pdf.

[34] Gjonaj, A. (2020), “The mining rent is zeroed: The aim is to curb the export of low-value raw ore”, Albanian Telegraphic Agency, https://ata.gov.al/2020/11/07/zerohet-renta-minerare-synohet-frenimi-i-eksportimit-te-mineralit-bruto-te-paperpunuar-me-vlere-te-ulet.

[48] ICT (2021), SME Competitiveness Outlook 2021: Empowering the Green Recovery, International Trade Centre, Geneva, https://www.intracen.org/publications/smeco2021/ITCSMECO2021.

[21] ILO and UNIDO (2023), SDG Principles and Positive Practices Adopted by the Textile, Clothing, Leather, and Footwear Sector in Albania, International Labour Organization, Geneva, https://www.ilo.org/wcmsp5/groups/public/---europe/---ro-geneva/---sro-budapest/documents/publication/wcms_869582.pdf.

[43] INSTAT (2023), Agriculture Statistics 2022, Institute of Statistics, Tirana, https://www.instat.gov.al/media/11772/agriculture-statistics-2022.pdf.

[25] INSTAT (2023), “Construction figures”, https://www.instat.gov.al/en/themes/industry-trade-and-services/construction (accessed on 10 January 2024).

[9] INSTAT (2023), Employment in Albania, https://www.instat.gov.al/en/statistical-literacy/employment-in-albania (accessed on 6 December 2023).

[28] INSTAT (2023), Indicators by economic activities by economic activity, type and year, http://databaza.instat.gov.al/pxweb/en/DST/START__NA__NAY__NAYPA/NAYPA2/table/tableViewLayout1 (accessed on 6 December 2023).

[19] INSTAT (2023), “International trade in goods”, http://databaza.instat.gov.al/pxweb/en/DST/START__FT__FTE/NewFTE005/table/tableViewLayout1 (accessed on 10 January 2024).

[78] INSTAT (2023), “Managed waste origin by type and year”, http://databaza.instat.gov.al/pxweb/en/DST/START__EN__MU/MU11/table/tableViewLayout1 (accessed on 25 November 2023).

[66] INSTAT (2023), Material Flow Accounts, Institute of Statistics, Tirana, https://www.instat.gov.al/media/11487/material-flow-accounts-2021.pdf.

[45] INSTAT (2023), Statistics on Small and Medium Enterprises, 2021, Institute of Statistics, Tirana, https://www.instat.gov.al/media/11356/results-on-sme-2021.pdf.

[82] INSTAT (2023), “Total generated waste by type and year”, http://databaza.instat.gov.al/pxweb/en/DST/START__EN__MU/MU04 (accessed on 2 November 2023).

[83] INSTAT (2023), “Urban waste in tonnes by urban waste treatment, type and year”, http://databaza.instat.gov.al/pxweb/en/DST/START__EN__MU/MU05 (accessed on 2 November 2023).

[41] INSTAT (2023), “Value by country, group of commodities, import/export, type and year”, http://databaza.instat.gov.al/pxweb/en/DST/START__FT__FTY/NewFTY007/table/tableViewLayout1 (accessed on 7 November 2023).

[29] INSTAT (2023), “Value by gruppro, economic activity, import/export, type and year”, http://databaza.instat.gov.al/pxweb/en/DST/START__FT__FTE/NewFTE005/table/tableViewLayout1 (accessed on 25 November 2023).

[67] INSTAT (2022), Albania Institute of Statistics, http://databaza.instat.gov.al/pxweb/en/DST/?rxid=ab6a42a1-79b5-4ddd-aea6-829a85e396e1.

[79] INSTAT (2022), Urban Solid Waste, 2022, Institute of Statistics, Tirana, https://www.instat.gov.al/media/12579/urban-solid-waste-2022.pdf.

[37] Invest in Albania (2023), “Invest in agriculture in Albania”, web page, https://invest-in-albania.org/industries/agriculture.

[20] Invest in Albania (n.d.), “Cloth manufacturing – The textile industry in Albania”, web page, https://invest-in-albania.org/industries/clothing-manufacturing (accessed on 6 February 2023).

[64] IRENA (2021), Renewables Readiness Assessment – Albania, International Renewable Energy Agency, Abu Dhabi, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/March/IRENA_RRA_Albania_2021.pdf.

[54] JRC/IEA (2023), Country Fact Sheet Albania, EDGAR – Emissions Database for Global Atmospheric Research, https://edgar.jrc.ec.europa.eu/country_profile/ALB (accessed on 2 November 2023).

[94] KESH (2023), “Skavica Project”, web page, https://www.kesh.al/en/skavica-project.

[42] Ministry of Agriculture and Rural Development (2023), “Record value of 55.1 billion lek agricultural exports in 2022”, https://bujqesia.gov.al/vlere-rekord-prej-5-1-mld-leke-eksporte-bujqesore-ne-vitin-2022 (accessed on 31 October 2023).

[36] Ministry of Agriculture and Rural Development (2022), Rural Development Programme of the Republic of Albania, Ministry of Agriculture and Rural Development, Tirana, https://bujqesia.gov.al/wp-content/uploads/2022/09/Programi-IPARD-III_2021-2027_English.pdf.