Junghun Kim

Fiscal Policy Institute

Bricks, Taxes and Spending

4. The Korean national property tax: History, controversies and future directions

Abstract

Korea’s National Property Tax (NPT), characterised by its redistributive nature, is unique in the OECD. Originating from a history of progressive property taxation in the 1970s, the NPT was introduced in 2005 to refine the progressive local property tax system, by absorbing its upper brackets at a higher level of government. While aiming explicitly at redistribution, it has been controversial. This paper argues that given Korea’s weak capital gains tax on housing, a progressive property tax, like the NPT, is sensible, a position echoed by recent OECD studies. However, challenges arise due to its use for housing price stabilisation and its limited role as a wealth tax. Maintaining the NPT at a moderate level is recommended.

The opinions expressed and arguments employed herein are those of the author and do not necessarily reflect the official views of the OECD, its Member countries, or the KIPF.

4.1. Introduction

In the majority of OECD countries, recurrent taxes on immovable property are typically levied by local governments. As discussed in Bird (1993[1]), IMF (2009[2]), and OECD (2022[3]), these taxes have several desirable characteristics of local taxes: immobility of the tax base, visibility (accountability), stability, buoyancy and adherence to the principle of benefit taxation. As a result, they have become a major revenue source for local governments. Yet, as discussed in OECD (2022[3]), there is generally significant scope to enhance the design and efficacy of these taxes. First of all, taxes on immovable property are among the most economically efficient forms of taxation (OECD, 2022, pp. 79-80[3]). This implies that significant efficiency gains can be achieved through improvements in their design. Furthermore, progressive property tax rates can improve the equity of recurrent taxes on immovable property. In this context, OECD (2022, pp. 87-88[3]) emphasises that effective redistribution is best achieved at higher levels of government to ensure equitable treatment of residents regardless of their residence.

Against this backdrop, Korea’s property tax system is an interesting case because both the central and local governments collect property taxes—a practice unique among OECD countries. The nation has maintained the tradition of progressive property taxation since the introduction of a highly progressive local property tax in 1973, establishing it as a norm for nearly half a century. This approach has been driven by a prolonged and significant appreciation in land and housing values. Given that the wealth disparity in Korea predominantly stems from differences in these values, progressive property taxation has long been supported by the public.

Despite its longstanding presence, progressive property taxation in Korea is by no means a well-established tax system. In particular, it is vulnerable to volatility stemming from shifts in politics. Although always a topic of contention, debates concerning the merits and drawbacks of the progressive property tax intensified with the introduction of the highly progressive national property tax, known as CRET, in 2005. This chapter delves into the historical evolution of progressive property taxation in Korea and offers a critical reassessment of the pros and cons of CRET as discussed in the existing literature.

4.2. Property tax characteristics in OECD countries

4.2.1. Taxes on property

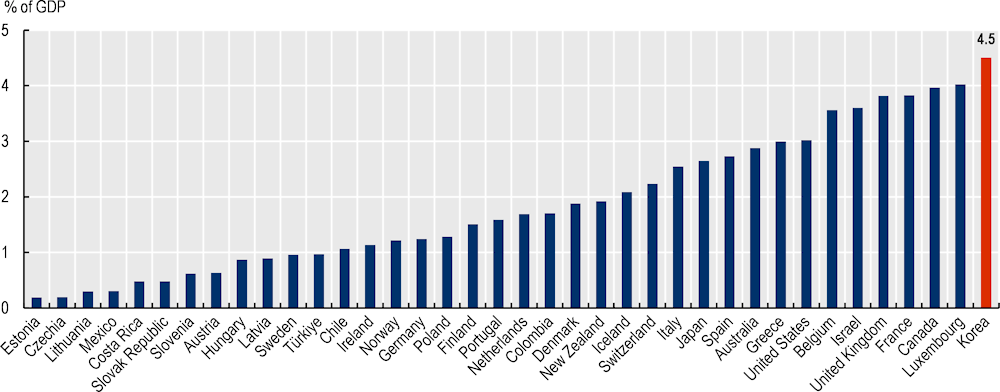

In OECD countries, revenues from all types of property taxes—including recurrent taxes on immovable property, net wealth taxes, estate taxes, inheritance and gift taxes, as well as taxes on financial and capital transactions—average 1.9% of GDP. This percentage varies among countries, ranging from above 4% in some to below 0.5% in others (Figure 4.1). Countries with high levels of property tax revenues include the United Kingdom, France, Canada, Luxembourg and Korea, with Korea collecting property taxes amounting to 4.5% of its GDP. Conversely, countries like Estonia, the Czech Republic, Lithuania, Mexico and Costa Rica collect revenues from property taxes that are below 0.5% of GDP.

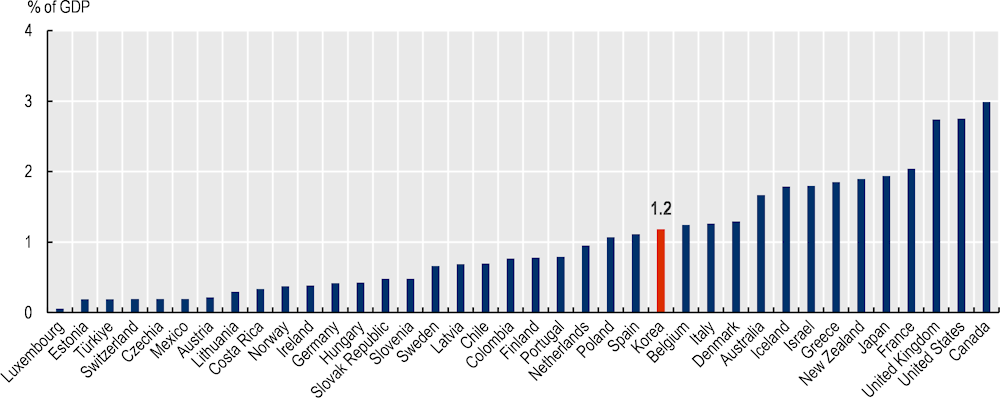

The revenue from recurrent taxes on immovable property ranges from more than 2.5% of GDP in the United Kingdom, the United States, and Canada to less than 0.5% in Luxembourg, Estonia, Türkiye, the Czech Republic, and Switzerland (Figure 4.2). In Korea, this revenue item constitutes around 1.2% of GDP, indicating that the country's revenue from property transaction taxes (taxes on financial and capital transactions) is significantly higher than that from recurrent taxes on immovable property.

Figure 4.1. Revenue from property taxes in OECD countries, 2021

4.2.2. Recurrent taxes on property

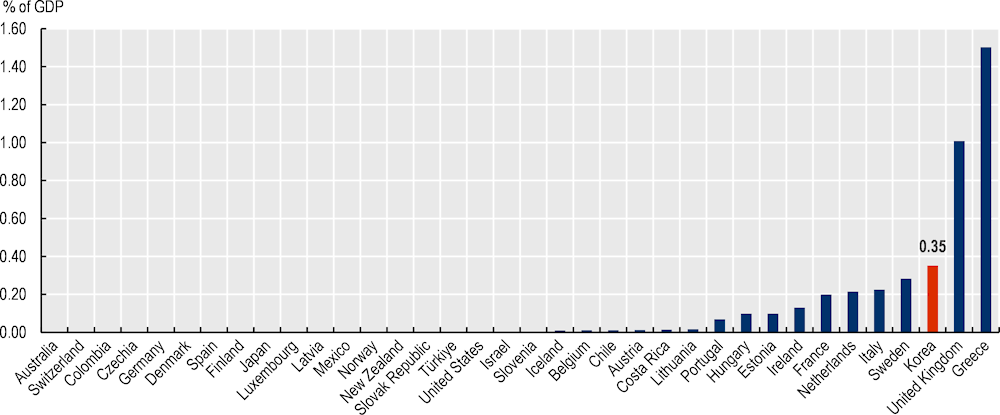

Recurrent taxes on immovable property are typically levied by local governments. However, in several OECD countries—including Korea, the United Kingdom, Greece, France, Sweden, Italy, the Netherlands, and Ireland—the central government imposes a national property tax (Figure 4.3). Among these countries, Korea is unique as it is the only OECD country where the central government collects a redistributive property tax.1 In countries such as Italy, Ireland, and Estonia, the central government sets the rates for local property taxes—Municipal Real Estate Tax (IMU),2 Local Property Tax,3 and Land Tax,4 respectively—and then allocates the revenue from these taxes to local governments. According to the OECD Revenue Statistics (OECD, 2022, pp. 345-346[4]), these taxes are classified as central government taxes since their rates are determined by the central government.5

Figure 4.2. Revenue from immovable property taxes in OECD countries, 2021

Similarly, in the Netherlands, where local tax revenue as a share of total tax revenue is very low at around 5%, local taxes are governed by respective laws,6 resulting in a portion of local property tax revenue being reported as central government revenue. In Sweden, property tax on real estate was historically levied at both the local and state level. However, following the tax reform of 1991, the property tax became exclusively a national tax. The state real estate tax on owner-occupied houses and apartment buildings was abolished in 2008. Currently, the real estate tax is applied to commercial premises and industrial properties, with tax rates of 1.0% and 0.5%, respectively.7 Figure 4.3 shows that the size of property tax revenue collected by the central government in the United Kingdom is relatively high. However, the UK's figure in Figure 4.3 represents the central government's revenue from business rates on shops, offices, pubs, etc., not property tax on residential properties. In the case of France, the number in Figure 4.3 shows the central government's revenue from the residence tax (tax d'habitation), which is being phased out through 2023.

Contrary to these countries where the central government determines local property tax rates which are flat, the central government in Greece adopted a progressive property tax structure. Greece's property tax, known as ENFIA, consists of a standard component (main ENFIA) and an additional component with progressive tax rates (applied on property values over EUR 400 000).8 As discussed in Andriopoulou et al. (2020[5]), the role of the property tax became more prominent after the Greek government debt crisis. It should be noted, however, that the size of Greece's national property tax revenue shown in Figure 4.3, which is the highest among the OECD countries, represents the combined revenue from both the main ENFIA and the surcharge ENFIA. Andriopoulou et al. (2020[5]) argue that the burden of ENFIA is regressive when measured as a share of disposable income, implying that the progressive structure of property taxes—including the surcharge ENFIA—is not effectively redistributive in Greece.

In sum, national property taxes in most OECD countries are fundamentally similar to local property taxes, as they typically levy a flat tax rate on property values, and any progressive tax rate structures that exist are not particularly effective. However, the property tax system in Korea, and in particular the national property tax known as the Comprehensive Real Estate Tax (CRET), is notably different. Historically, during the 1970s, Korea's local property tax—which has been, and continues to be, controlled by the central government—was made highly progressive. This shift was due to the perception of relatively expensive owner-occupied housing as a luxury good. However, this led to strong tax resistance, as even minor increases in the tax base resulted in significant increases in the tax burden. By the mid-2000s, it was widely recognized that a highly progressive local property tax was both counterproductive and burdensome for local governments to manage. Consequently, in 2005, the property tax system in Korea was restructured into two components: a mildly progressive local property tax and a highly progressive national property tax, known as the CRET.

Figure 4.3. Revenue from national property taxes in OECD countries, 2021

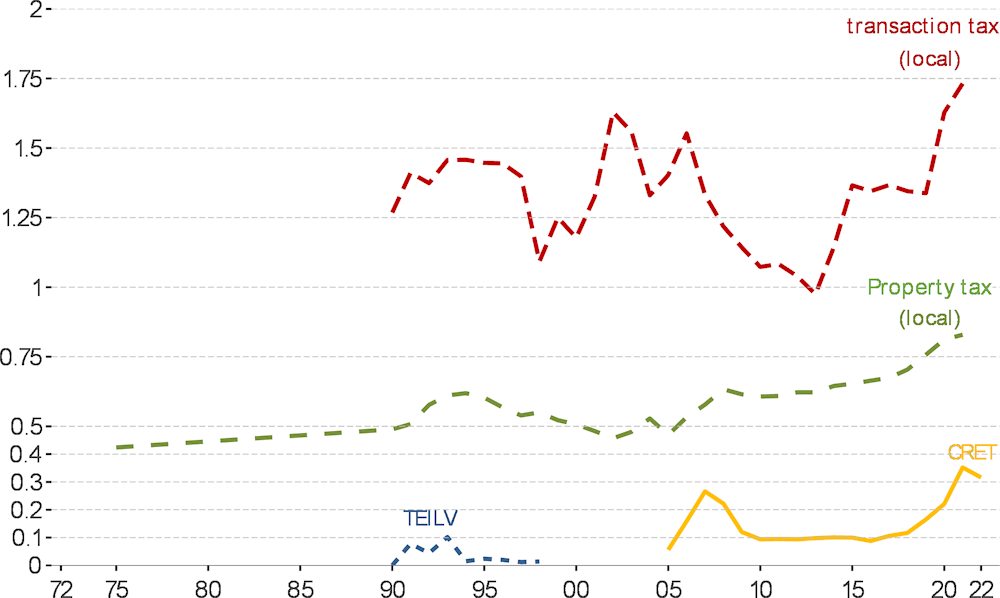

4.2.3. Trends in the growth of housing prices and property tax revenues

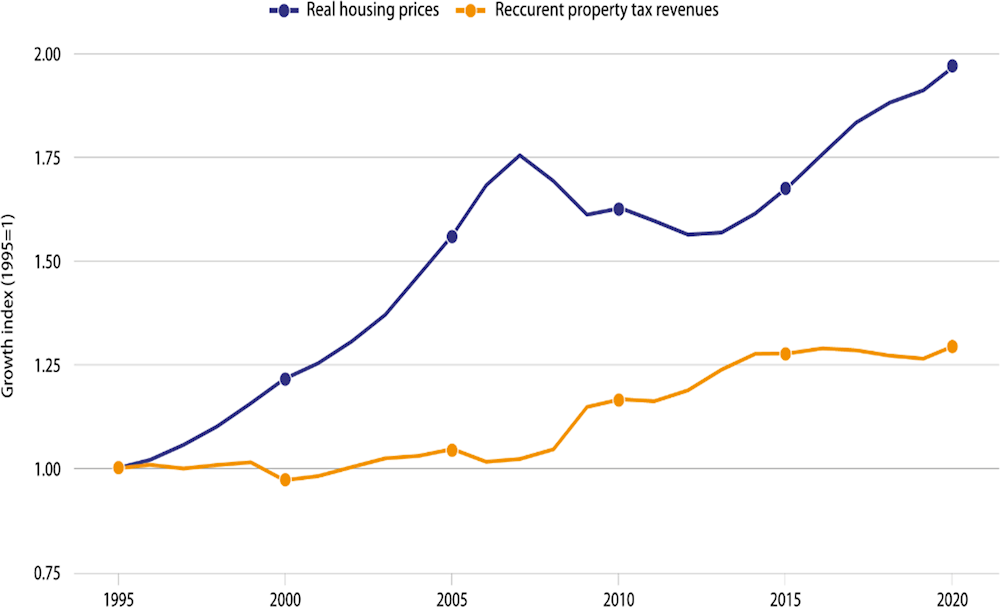

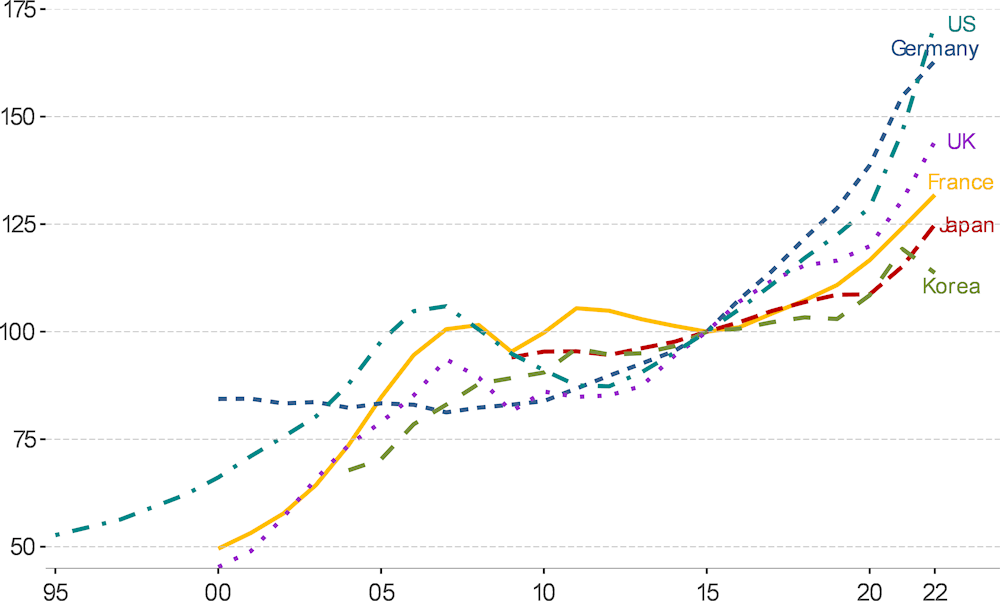

The average growth in real house prices has considerably outpaced the average growth in real property tax revenues in OECD countries. As seen in Figure 4.4, the average housing price in 15 OECD countries nearly doubled in real terms between 1995 and 2020. On the other hand, revenue from taxes on immovable property increased by only about 25% in real terms during the same period in these countries.

Figure 4.4. Growth trend of real housing prices and property tax revenue

Mean growth in real housing prices and revenues from recurrent taxes on immovable property in 15 OECD countries

To examine the trend of housing prices in OECD countries in more detail, Figure 4.5 presents the housing price indexes of six selected countries (the United States, the United Kingdom, France, Germany, Japan, and Korea). The figure shows that housing prices more than doubled in all countries except Japan, and rose particularly steeply during the COVID-19 period. Between 2000 and 2020, housing prices increased by factors of 2.35, 2.64, 1.64, and 1.95 in France, the United Kingdom, Germany, and the United States, respectively. In the case of Korea, housing prices increased by a factor of 1.60 between 2004 and 2020. Japan was the exception, experiencing only modest increases in housing prices.

It is worth noting that housing prices are highly sensitive to interest rates, as discussed by Dieckelmann et al. (2023[6]) and Duca and Murphy (2021[7]), among others. During the COVID-19 period (2020-2022), central banks in OECD countries implemented expansionary monetary policies to avoid an economic recession, resulting in historically low interest rates worldwide. Consequently, housing prices experienced a sharp increase between 2020 and 2022 in these countries, as observed in Figure 4.5.

Figure 4.5. Housing price developments in 6 OECD countries

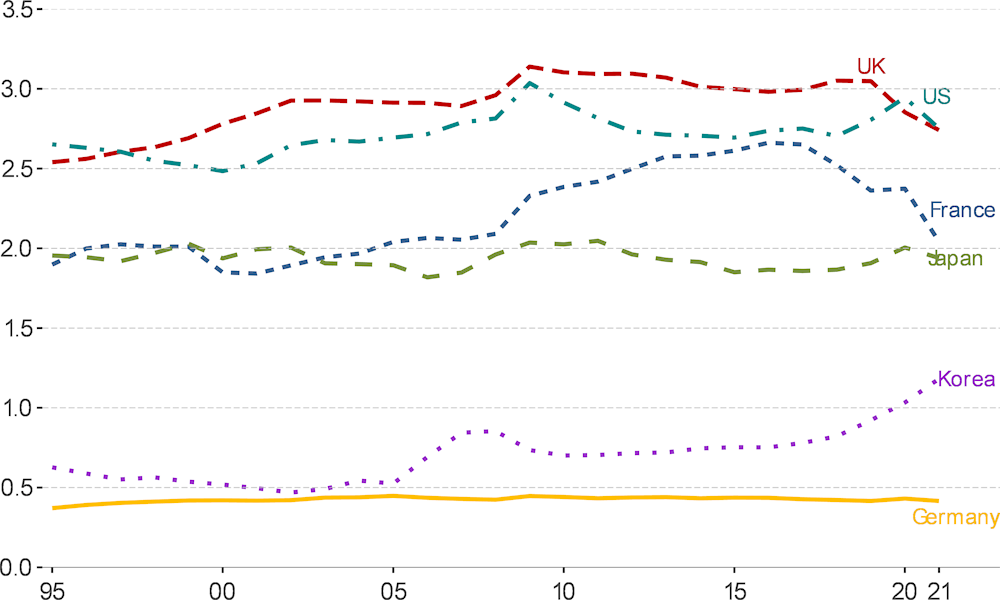

In contrast to the rapidly rising housing prices, property tax revenue as a share of GDP has remained relatively stable in all six countries over the past two decades (Figure 4.6). Property tax revenues in the United States and the United Kingdom have consistently ranged between 2.5% and 3.1% of GDP from 1995 to 2021, with a noticeable decline in the past two years. In France, property tax revenues hovered around 2% of GDP between 1995 and 2010, then increased to a peak of 2.7% in 2016 before rapidly declining back to 2% in 2021. Germany and Japan have maintained remarkably stable property tax revenues at around 0.4% and 2% of GDP, respectively, over the past two decades. In contrast, property tax revenues in Korea have shown a slightly increasing trend, noticeably after the introduction of CRET in 2005 and the efforts of the government before 2022 to boost CRET revenue. This has led to an approximate 0.2 percentage point increase in property tax revenues as a share of GDP over the past four years. However, the new government elected in May 2022 has pledged to reduce the CRET to the 2017 level. Consequently, Korea's property tax revenue, currently slightly above 1% of GDP, is expected to decrease to less than 1% in the coming years. Overall, property tax revenues in OECD countries, including the six countries examined above, have remained relatively stable, contrasting with the long-term trend of rapidly increasing housing prices.

4.3. Historical development of redistributive property taxation in Korea

4.3.1. Introduction of progressive property taxes in 1973

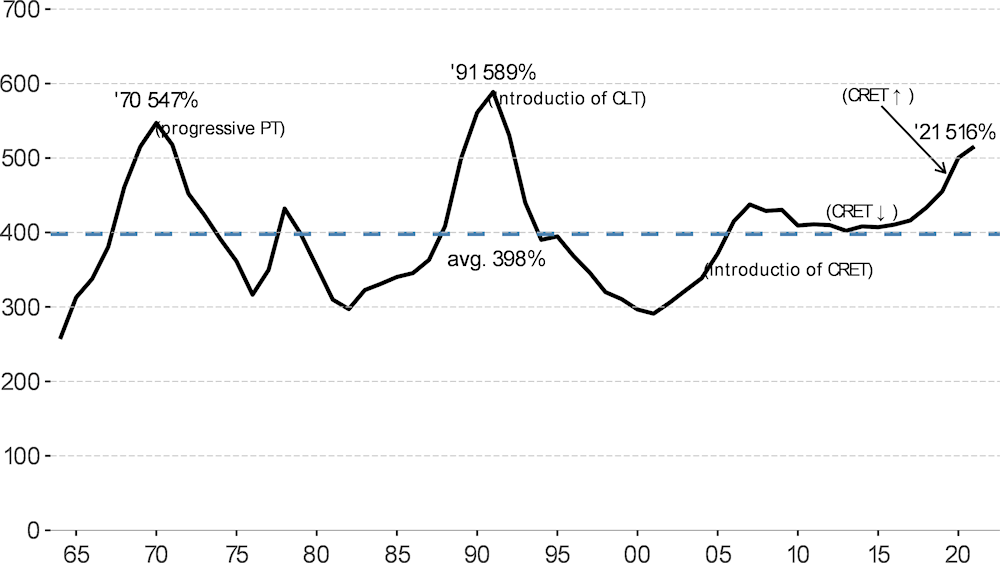

Property taxes on immovable properties (land and structures) were first introduced in Korea in 1962, with a flat tax rate of 0.2% applied to assessed land values. The tax on structures was initially a unit tax based on valuation indices, but an ad valorem rate of 0.3% was applied to the assessed value of structures starting in 1966. The 1960s marked the onset of rapid economic growth in Korea, which was accompanied by a significant increase in property values. Notably, the rate of property value appreciation outpaced the growth rate of the South Korean economy during this period. As shown in Figure 4.7, the share of land value relative to GDP surged from 256% in 1964 to 547% in 1970. The rapid increase in property values during the 1960s generated political demand for measures to curb land and housing speculation. Consequently, progressive tax brackets were introduced for property taxation of housing in 1973, as illustrated in Table 4.1. In the initial year of progressive property taxation, four progressive tax brackets (0.3%, 0.4%, 0.5%, and 0.6%) were applied to structures. Once the progressivity of property taxes was established, it was significantly strengthened. In 1975, the starting point of tax bases for structures was reduced and tax brackets were sub-divided, making the degree of progressivity steeper. Simultaneously, three significantly higher rates of 1%, 3%, and 5% were added. The tax rate on land also changed from a flat rate of 0.2% to highly progressive rates with five tax brackets (0.3%, 0.5%, 1%, 3%, and 5%). Following this, whenever the land price appreciation outpaced the growth rate of the economy (GDP), there was political demand for increased progressivity to curb land and housing speculation.

Figure 4.6. The trend of property tax revenues as a share of GDP in 6 countries

Figure 4.7. Land value in Korea as a per cent of GDP

Note: Land value before 1995 is based on Cho, et al. (2015[8]).

Source: Bank of Korea (GDP and National Balance Sheet after 1995).

Table 4.1. Property tax rates in 1973 and 1975

|

Structure |

Land |

||||||

|---|---|---|---|---|---|---|---|

|

1973 |

1973 |

1975 |

-1975 |

1975 |

|||

|

Assessed value (KRWM) |

Rates (%) |

Assessed value (KRWM) |

Rates (%) |

Rates |

Assessed area (3.3㎡) |

Rates (%) |

|

|

0-20 |

0.3 |

0.3 |

0-5 |

0.3 |

0.2 |

0-100 |

0.3 |

|

20-30 |

0.4 |

5-10 |

0.5 |

100-200 |

0.5 |

||

|

30-50 |

0.5 |

10-20 |

1.0 |

200-300 |

1.0 |

||

|

50- |

0.6 |

20-30 |

3.0 |

300-500 |

3.0 |

||

|

30- |

5.0 |

500- |

5.0 |

||||

Note: The basic unit of floor space used in Korea is 3.3 square meters, which is called 'pyeong'

Source: Korean Local Tax Law, versions of 1973 and 1975.

4.3.2. Introduction of the Comprehensive Land Tax (CLT) in 1990

After a significant economic slump in the early 1980s, the Korean economy began to experience strong economic growth in the latter half of the decade, which was again accompanied by a rapid increase in land prices. To curb land and housing speculation, an additional property tax bracket of 7% was added in 1987. However, as illustrated in Figure 4.7, the increase in land value was only beginning in 1987. The ratio of land value to GDP reached its peak in 1991, surging to 589%.

In response to the historically strong land speculation in the late 1980s, a highly progressive land tax was introduced in 1990, which consisted of nine tax brackets (0.2%, 0.3%, 0.5%, 0.7%, 1.0%, 1.5%, 2%, 3%, 5%).9 At first glance, the progressivity of this nine-bracket system might not appear significantly stronger than its predecessor, given that it dropped the highest previous rate of 7% and added a new lowest rate of 0.2%. However, the land tax reform of 1990 changed the tax base from the value of land in a single local government to the combined value of land across all local governments owned by a single person. Under the previous land tax system, individuals who owned multiple parcels of land in different local governments paid land taxes in each jurisdiction, usually at relatively low rates. Under the new land tax system, the tax base for such individuals became the combined value of all land they owned. This subjected them to higher land tax brackets and, given the highly progressive land tax rates, resulted in a significant tax burden for those who owned a large amount of land across multiple jurisdictions. The new land tax was thus called the Comprehensive Land Tax (CLT). Although the CLT was based on the combined value of land across all local governments, it continued to be classified as a local tax. Therefore, CLT was collected by the central government in the first stage, and then its revenue was allocated to the relevant local governments based on an allocation formula.

4.3.3. Introduction of the Comprehensive Real Estate Tax (CRET) in 2005

The third land value surge occurred in the first half of the 2000s. As depicted in Figure 4.7, the magnitude of the land value increase during this third wave was less significant compared to the previous two waves. However, two aspects of taxes on land and structures became controversial during this wave. First, the assessed value of properties was substantially lower than their market value. According to Kim (2004, p. 6[9]), despite highly progressive tax rates—0.2% to 7% for the land tax and 0.3% to 5% for the tax on structures—the average effective tax rate of CLT (tax revenue/total land value) was only 0.16%, and the corresponding rate (tax revenue/total value of structures) for the tax on structures was 0.09% in 2004 (Table 4.2). Second, the practice of assessing land and structures separately led to unrealistically low figures, especially for high-rise apartments, which comprised about 58% of housing in the Seoul Metropolitan region in 2005.10 This was due to the relatively small land area associated with individual units in high-rise buildings, which meant that the land value of apartment buildings was not fully subject to taxation. Furthermore, the assessed value of structures in older apartments in well-developed areas such as the Seoul metropolitan area was very low due to the high depreciation rates applied in the assessment process, despite significantly higher housing prices in these areas compared to other regions. Given that nearly half of Korea's population resides in the Seoul region, the substantial discrepancy between assessed housing value and market value in the Seoul metropolitan area became a politically contentious issue. In response to the political demand for a more equitable property tax system, the progressive government introduced a newly designed national property tax named the Comprehensive Real Estate Tax (CRET) in 2005.

Table 4.2. Effective tax rates on land and structures in 2004

|

Total |

Persons |

Corporations |

||||||

|---|---|---|---|---|---|---|---|---|

|

Tax base Land |

Tax revenue |

Effective rate |

Tax base Land |

Tax revenue |

Effective Rate |

Tax base Land |

Tax revenue |

Effective rate |

|

1,059 |

16,511 |

0.16% |

835 |

8,906 |

0.11% |

224 |

7,605 |

0.34% |

|

Total |

Persons |

Corporations |

||||||

|

Tax base Structures |

Tax revenue |

Effective rate |

Tax base Structures |

Tax revenue |

Effective rate |

Tax base Structures |

Tax revenue |

Effective rate |

|

994 |

8,619 |

0.09% |

744 |

6,985 |

0.09% |

250 |

1,634 |

0.07% |

Source: Kim (2004[9]).

The creation of a redistributive national property tax (CRET), which remains a unique case among OECD countries, warrants further discussion. One of the justifications for introducing a national property tax is outlined by Kim (2004[9]). First, he argues that the existing property tax system in 2004 was already highly progressive, with nine progressive tax brackets for land and five for structures. Such a highly progressive property tax system was rare in the OECD, where most countries employed a single flat property tax rate. In other words, the property tax system in Korea had been uniquely progressive since the early 1970s, making it politically and practically difficult to abruptly abolish this highly progressive system. On the other hand, under the principles of fiscal federalism (see, e.g., Musgrave (1959[10])), the central government should bear the responsibility for redistribution, and thus it was considered desirable for the central government to levy a property tax with highly progressive brackets. Therefore, according to Kim (2004[9]), the creation of CRET would allow local governments to implement milder progressive property tax rates, aligning the tax with the benefit principle of local taxation. Additionally, it could be expected that local property tax rates would converge toward a flat rate over time as the central government takes on the role of implementing a redistributive property tax.

Second, the highly progressive nature of local property taxes posed a significant obstacle to increasing property tax revenue. Taxpayers were likely to strongly resist a substantial increase in the tax burden if tax base revaluation were pursued under highly progressive tax rates. As a result, local governments were often reluctant to exercise fiscal sovereignty by effectively mobilising revenue from property taxes. This was seen as a major obstacle to the development of local autonomy, especially since property taxes were considered the most important and suitable source of revenue for local governments compared to other taxes such as VAT and corporate income tax.

Third, though the progressive property tax system had a long history, making abrupt abolition difficult, there were considerations regarding the feasibility of introducing a flat-rate property tax system. However, transitioning from a highly progressive system to a single-rate system poses challenges due to the potential for excessive progressivity or regressivity. A pragmatic approach to address this issue was selecting a moderate tax rate within the existing brackets for land and structures, striking a balance between extremely low and high rates. For instance, a 1% rate could be a suitable candidate for both the land tax and the tax on structures (Table 4.3). However, as noted by Kim (2004[9]), approximately 75% of land taxpayers fell into the first tax bracket with a 0.2% rate in 2004. Approximately 17% of land taxpayers were in the second bracket (0.3% rate), while the remaining 8% were in the third bracket (0.5% rate) or higher (ranging from 0.7% to 5%). This suggested that even with a flat tax rate of 0.3%, about 75% of taxpayers would face a 50% increase in their tax burden under the new system. Consequently, the only viable option to prevent widespread tax resistance while adopting a flat-rate land tax would be to use a 0.2% rate. This, however, would essentially abolish the progressive land tax system that had been in place for nearly four decades. Such an option would likely face strong political opposition, particularly from the majority (75%) of taxpayers who, as a low-income group, supported the progressive land tax system. The same line of reasoning can explain why there was no realistically viable option for a single-rate tax on structures (Table 4.4).

Table 4.3. Distribution of taxpayers and revenue of CLT in 2004

|

Tax brackets (KRWM) |

Tax rates |

Persons |

Tax base |

Tax revenue |

Effective rate (%) |

|||

|---|---|---|---|---|---|---|---|---|

|

Number |

Share (%) |

(KRWB) |

Share (%) |

(KRW100M) |

Share (%) |

|||

|

-20 |

0.2 |

8,569,271 |

79.43 |

58,800 |

33.01 |

1,180 |

15.59 |

0.07 |

|

20-50 |

0.3 |

1,611,343 |

14.94 |

49,700 |

27.9 |

1,166 |

15.41 |

0.08 |

|

50-100 |

0.5 |

436,249 |

4.04 |

29,300 |

16.45 |

942 |

12.45 |

0.12 |

|

100-300 |

0.7 |

150,035 |

1.39 |

22,800 |

12.8 |

1,119 |

14.79 |

0.18 |

|

300-500 |

1.0 |

13,243 |

0.12 |

4,960 |

2.78 |

335 |

4.42 |

0.24 |

|

500-1,000 |

1.5 |

5,743 |

0.05 |

3,840 |

2.16 |

363 |

4.8 |

0.34 |

|

1,000-3,000 |

2.0 |

1,972 |

0.02 |

3,090 |

1.73 |

446 |

5.89 |

0.52 |

|

3,000-5,000 |

3.0 |

297 |

0 |

1,150 |

0.65 |

229 |

3.03 |

0.72 |

|

5,000- |

5.0 |

333 |

0 |

4,510 |

2.53 |

1,787 |

23.62 |

1.44 |

Source: Kim (2004[9]).

Table 4.4. Distribution of taxpayers and revenue of tax on structures in 2004

|

Tax brackets (KRW10,000) |

Tax rates |

Share of taxpayers |

Share of tax bases |

Share of tax revenue |

|---|---|---|---|---|

|

B ≤ 1,200 |

0.3 |

84.2 |

33.7 |

22.8 |

|

1,200 <B≤ 1,600 |

0.5 |

9.00 |

15.3 |

11.0 |

|

1,600 <B≤ 2,200 |

1.0 |

4.00 |

25.2 |

24.6 |

|

2,200 <B≤ 3,000 |

3.0 |

1.98 |

7.4 |

11.0 |

|

3,000 <B≤ 4,000 |

5.0 |

0.55 |

7.0 |

12.0 |

|

4,000 <B |

7.0 |

0.06 |

11.3 |

18.6 |

Source: Kim (2004[9]).

Given that 75% of land taxpayers fell into the first bracket of the land tax and 92% into the first two brackets, one might expect that a substantial portion of land tax revenue would come from these taxpayers. However, as Table 4.3 shows, only about 25% of the total land tax was paid by this group. Therefore, abolishing the progressive land tax would have not only faced strong political resistance but also resulted in a significant loss of tax revenue.

Regarding the tax on structures (Table 4.4), 84% of taxable structures fell into the first tax bracket with a rate of 0.3%, while 9% fell into the second tax bracket with a rate of 0.5%. This means that 93% of taxpayers for structures were in the first two brackets. However, this group accounted for only around 34% of the total revenue from the tax on structures. Similar to the land tax, abolishing the progressive tax on structures would have entailed a considerable loss of tax revenue.

4.3.4. Controversies and evolution of CRET since 2005

The main theoretical reasons for the establishment of CRET, as discussed in Kim (2004[9]), are summarised as follows. First, the separation of highly progressive property taxes into a local property tax and a national property tax allows the central government to assume the role of redistribution. Concurrently, local governments can exercise their fiscal autonomy through moderately progressive local property tax rates. Second, the establishment of a national property tax enables the central government to manage a redistributive property tax from an optimal taxation perspective,11 which seeks to balance the equity and efficiency of the redistributive property tax. In addition, given that local governments now have moderately progressive property tax rates, these rates may converge to a flat rate over time. However, in practice, the actual operation of CRET has been significantly influenced by political considerations and certain ambiguities in the wording of the Law on CRET. Article 1 of the law postulates that CRET has three objectives: (i) equity of taxation; (ii) property price stabilisation; and (iii) equitable development of local fiscal systems.

On the surface, the objectives of CRET may seem reasonable, albeit ambitious. In reality, however, the first objective, equity of taxation, is interpreted in practice to imply that CRET functions as a wealth tax, placing a 'heavy tax burden on the owners of highly expensive housing'. However, 'heavy' and 'highly expensive' are not clearly defined in the Law on CRET, as it is not explicitly intended to serve as a wealth tax in the traditional sense. Notably, the tax base of CRET is the gross housing value, which includes mortgage debt, thereby deviating from the standard definition of a wealth tax.12

The second objective, property price stabilisation, is more contentious. There is an extensive literature supporting the positive effect of a property tax on housing price stabilisation. For instance, the IMF (Poghosyan, 2016[11]) and the Irish Central Bank (2022[12]) present findings that support this assertion. Additionally, a report by the European Systemic Risk Board (2020[13]) corroborates these findings. This evidence suggests that CRET, as a form of property tax, could potentially stabilise housing prices. However, given CRET's narrow scope (targeting 1.8% of total homeowners in 2012, and 6.2% in 2021 when CRET reached its peak), and its emphasis on taxing the owners of multiple houses (single homeowners accounted for only 27% of CRET revenue from housing in 2021), the impact on macroeconomic housing price stabilisation is likely negligible. The extent to which CRET affects housing price stabilisation merits further discussion and will be addressed in the next section.

The third objective, equitable development of local fiscal systems, entails that CRET revenue, primarily collected in the Seoul Metropolitan region, is redistributed to local governments outside this area. This aspect of CRET is notable, as it serves as a redistribution mechanism not just among individuals, but also across local governments. It is worth noting that in Korea, the total resource pool for intergovernmental equalisation transfers, of which nearly 90% is allocated to local governments outside the Seoul Metropolitan region, is fixed at 19.24% of national tax revenue. This makes the utilisation of CRET revenue for intergovernmental redistribution not a new concept in Korea. However, the allocation of 100% of CRET revenue for this purpose implies that the third objective is being pursued actively. This objective has been met with relatively fewer controversies and criticisms compared to the other two objectives.

Given these controversies, CRET revenue as a share of GDP has fluctuated significantly depending on the political leanings of the government in power. Between 2003 and 2008 (first period), and again between 2017 and 2022 (second period), progressive governments were in power. During these periods, CRET revenue increased to nearly 0.3% of GDP in the first period and to approximately 0.4% in the second period. Conversely, during the tenure of the conservative government between 2008 and 2016, CRET revenue remained around 0.1% of GDP. The conservative government established in 2022 pledged to reduce CRET revenue back to the 2017 level.

Separately, it is important to consider the economic context. Periods of housing booms since 2000 coincided with the tenure of progressive governments, as illustrated in Figure 4.7. This suggests that the increase in CRET revenue in the late 2000s and late 2010s was influenced more by housing booms rather than by political decisions alone. Considering that the rapid and significant increase in the property tax burden, particularly through CRET, during the late 2010s is reported to have contributed to the defeat of the progressive political party in the last presidential election, and given that strong housing booms are less likely to occur due to the ageing population and low fertility rate in Korea, the peak in CRET revenue in 2021 seems unlikely to be surpassed in the foreseeable future.

4.4. Discussions of the criticisms of the Comprehensive Real Estate Tax

In the previous section, the rationale for creating a national redistributive property tax (CRET) was explored based on historical and practical reasons as presented by Kim (2004[9]), among others. However, since its inception, CRET has been the subject of debates, with arguments both for and against it. As the future improvement of CRET hinges on reconciling these divergent perspectives, the opposing views on CRET are carefully discussed below. According to (OECD, 2008, pp. 80-82[14]), which summarises many criticisms of CRET, criticisms of CRET can be divided into five categories: whether CRET contributes to (i) promoting economic growth; (ii) ensuring adequate revenue; (iii) contributing to housing price stabilisation; (iv) addressing income inequality; and (v) improving the local tax system.

4.4.1. Promotion of economic growth

Regarding the promotion of economic growth, (OECD, 2008[14]) views the reform of property taxation (including both recurrent and transaction taxes) as an opportunity to encourage the efficient use of land. It particularly emphasises that enhancing annual property taxation on immobile properties reduces the burden of more distortionary taxes, such as transaction taxes, which tend to decrease property transactions and, consequently, the efficient use of land by increasing the cost of property transactions. As supporting evidence, (OECD, 2008, p. 80[14]) cites the low level of property transactions during the late 2000s as possible evidence of the negative effect of the capital gains tax increase in 2006-07. Additionally, it is worth noting that revenue from the property transaction tax relative to GDP is the highest in Korea among OECD countries (Figure 4.1). The stark contrast between the large amount of property taxes related to transactions (property transaction tax and capital gains tax) and the moderate amount of recurrent property tax revenue has led to a longstanding policy slogan in Korea calling for a "lower burden of transaction taxes and higher revenue from annual property taxes".

The argument for a "lower burden of transaction taxes and higher revenue from annual property taxes" has a sound theoretical basis, as the former can reduce transactions inefficiently, while the latter does not incur any distortionary effect, particularly in the case of land taxes, given that land supply is essentially fixed. However, from a practical standpoint, it is important to note that transaction taxes typically encounter a significantly lower degree of tax resistance compared to annual property taxes. This is because transaction taxes capitalise on the property purchasers' ability to pay—as the tax burden is proportional to the amount spent on properties—whereas annual property taxes are levied irrespective of taxpayers' income flow. Unsurprisingly, politicians and bureaucrats in Korea, both at the central and local levels, tend to favour transaction taxes over annual property taxes as a revenue source.

Given that revenue from property transaction taxes is the highest in Korea among OECD countries, it can be presumed that the burden of property transactions is also the highest in Korea, potentially leading to inefficiently low levels of property transactions. However, it should be noted that the extent to which transaction taxes induce distortionary effects on property use hinges on the elasticity of property transactions with respect to transaction taxes, not the absolute size of the revenue from transaction taxes.

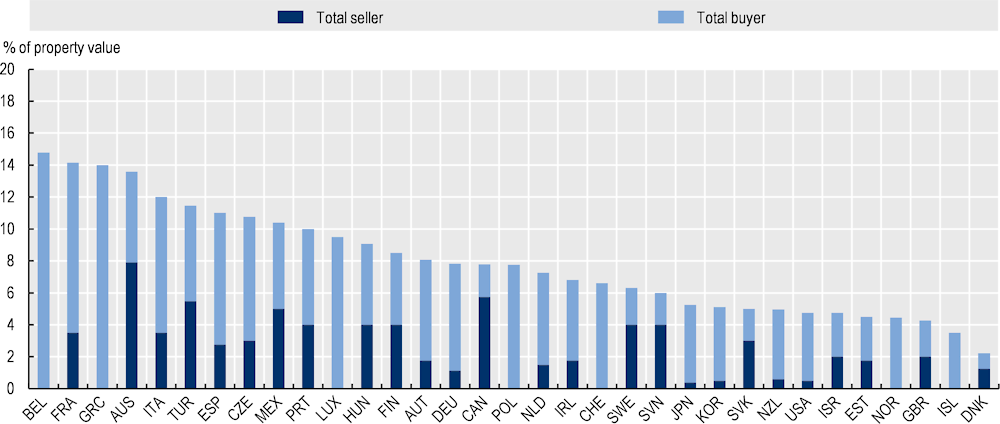

In this regard, the size of property transaction costs in OECD countries as a percentage of property value shown in Figure 4.8 provides important information. As discussed in OECD (2011[15]), these transaction costs include notary fees, registration fees, real estate agent fees, transfer taxes (stamp duties and acquisition taxes, etc.), and legal fees paid by both buyers and sellers. Contrary to expectations, Figure 4.8 reveals that property transaction costs in Korea, which stand at around 5% of property value, are relatively low compared with other OECD countries. In 10 OECD countries including Belgium, France, Greece, Australia, Italy, and Spain, transaction costs exceed 10% of the property value. Moreover, transaction costs in Finland, Austria, Germany, Canada, the Netherlands, Sweden, and Japan are all higher than those in Korea.

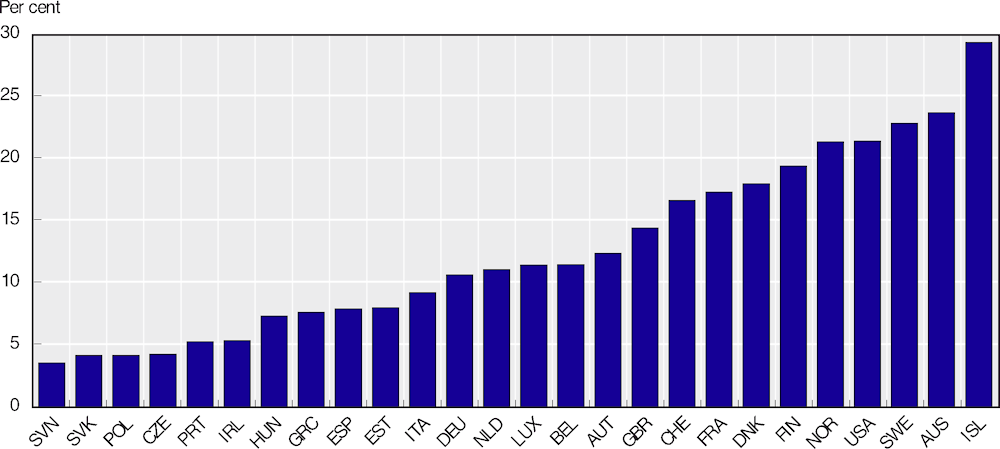

Figure 4.8. Housing transaction costs for buyer and seller (2009)

Another important metric related to property transactions is residential mobility, defined as the percentage of households that have changed residence within the last two years (housing mobility index). Figure 4.9 shows that among 25 OECD countries, Israel has the highest residential mobility at approximately 30%.13 The index is between 20% and 25% in Austria, Sweden, the United States, and Norway. In countries such as Finland, Denmark, France, the United Kingdom, and Germany, the index ranges from 10% to 20%, while in countries like Italy and Spain, where household mobility is very low, the indices are below 10%. Although the mobility index for Korea is not included in Figure 4.9, it is available from the Korea Housing Survey published by the Ministry of Construction and Transport. Notably, as shown in Table 4.5, Korea’s housing mobility index has consistently exceeded 35% over the past two decades, which is the highest in the OECD.

As Figure 4.1 illustrates, in conjunction with Figure 4.8 and Figure 4.9 and Table 4.5, property transactions and the revenue from property transaction taxes in Korea have several distinctive features. First, as demonstrated in Figure 4.8, the cost of property transactions, as a percentage of property value in Korea, is relatively low when compared to many OECD countries. Second, the frequency of property transactions in Korea is among the highest among OECD countries. Third, the interplay of these two factors results in Korea having the highest revenue from property transaction taxes as a percentage of GDP. Applying a moderate level of taxation to a high volume of property transactions generates significant revenue. Consequently, if there are any distortionary effects from property transaction taxes in Korea, they appear to be relatively mild.

Given this context, the argument for a "lower burden of transaction taxes and higher revenue from annual property taxes," as discussed by the OECD (2008[14]), does not directly counter the case for strengthening the annual property tax in Korea because the data suggests that the distortionary effects of transaction taxes are relatively mild. Although this argument is often cited in opposition to CRET due to the lack of corresponding reductions in the burden of property transaction taxes, the fact that the distortionary effect of property transaction taxes is mild suggests that it is not a strong point against enhancing the annual property tax system in Korea.

Figure 4.9. Residential mobility in OECD countries

Percentage of households that changed residence within the last 2 years

Table 4.5. Residential mobility in Korea

Percentage of households that changed residence within the last 2 years

|

Area |

2006 |

2010 |

2014 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|---|---|---|---|

|

Whole country |

37.5 |

35.2 |

36.6 |

36.9 |

35.9 |

36.4 |

36.4 |

37.2 |

37.2 |

|

Seoul metropolitan area |

44.4 |

40.1 |

40.3 |

40.9 |

40 |

40.6 |

40.3 |

41.9 |

41 |

|

Major cities |

34.5 |

33.9 |

35.1 |

37.1 |

35.2 |

35.5 |

35.5 |

36.1 |

37.5 |

|

Provinces |

29.4 |

28.8 |

32 |

30.8 |

30.3 |

30.6 |

30.9 |

30.5 |

31 |

Source: Ministry of Land, Infrastructure and Transport, 2021 Housing Survey.

4.4.2. Adequacy of property tax revenue

The second argument that the OECD (2008[14]) presents against CRET is its focus on imposing a significant tax burden on a small group of taxpayers. This approach yields a relatively small amount of revenue as a share of GDP (around 0.2~0.3%, as illustrated in Figure 4.10). The OECD contends that a higher effective rate could be achieved by progressively increasing the overall holding tax, with the following argument: "as with the highly progressive rate structure of local property taxes in the past, the CRET makes it difficult to raise the average tax on holding property from its relatively low level... The introduction of the CRET in 2005 continues to limit the scope for local authorities to raise the local property tax."

While the OECD's criticism regarding CRET's narrow target and steep progressivity is valid, the claim that CRET limits the capacity of local authorities to increase local property tax overlooks a key feature of CRET: the division of the formerly highly progressive property taxes into a local property tax with moderate progressivity and a national property tax (CRET) with high progressivity. As Kim (2004[9]) points out, the theoretical intention behind CRET was to assign the central government the role of progressive taxation, allowing local governments the fiscal autonomy to expand their own property taxes by implementing a moderately progressive, though not flat, local property tax. While the trend of local property tax revenue alone does not directly support the argument put forward by Kim (2004[9]), Figure 4.10 shows that the revenue from local property tax as a share of GDP, which had hovered at around 0.5% for more than two decades, steadily increased to 0.83% in 2021. This trend suggests the property tax revenue-raising effect of moderating local property tax progressivity in 2005. Contrary to the OECD's criticism, the introduction of the CRET in 2005 did expand the scope for local authorities to increase their local property tax revenue.

Figure 4.10. Long-term trends in property tax revenues in Korea as a per cent of GDP

4.4.3. Housing price stabilisation

The third argument against CRET, as presented in OECD (2008[14]), is that CRET was primarily aimed at controlling short-term fluctuations in housing prices, whereas property taxes should ideally be based on long-term efficiency considerations and government revenue needs. The OECD contends that "given that housing prices are influenced by numerous factors, including macroeconomic conditions and regulations, utilizing tax policy to affect house prices in the short term is likely to be ineffective and leads to a sub-optimal tax policy." This criticism of CRET has proven highly pertinent, especially in recent times. The previous government aggressively employed CRET to curb housing price increases, largely propelled by extensive quantitative easing that began in 2009 and intensified during the COVID-19 pandemic. Additionally, CRET was perceived as a tool for tapping into significant, albeit unrealised, housing capital gains during this period. Speculative housing purchases, a common occurrence during housing booms in Korea, further spurred this approach, leading to demands for more progressive land and housing taxes since the 1970s. However, it is important to note that at the macroeconomic level, the increase in housing prices in Korea over the past two decades has been relatively subdued compared to other OECD countries. As illustrated in Figure 4.5, the housing price index since 2015 (including the COVID-19 period) was lower in Korea compared with the United States, the United Kingdom, Germany, and Japan. In fact, over the past two decades, Korea's index was the lowest among these countries, except for Japan.

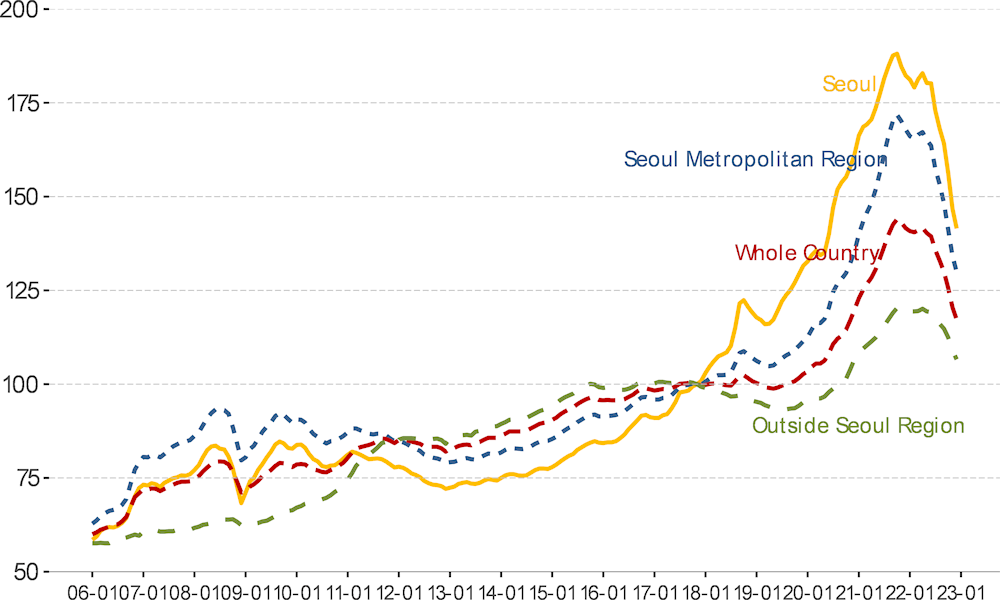

Given the relatively mild housing price appreciation in Korea during the past two decades, it is puzzling why the former progressive government supported a further strengthening of the progressivity of CRET, despite controversies regarding its role in stabilising housing prices. The answer to this question can be found in more detailed information on housing price trends. Figure 4.10 illustrates the rates of apartment price increases in four regions—namely, the whole country, Seoul, the Seoul Metropolitan area, and areas outside the Seoul Metropolitan area—between 2006 and 2022. The rates of housing price increases starkly contrast with those in Figure 4.5, which shows a mere 13% increase in housing prices between 2017 and 2021. Unlike the trends for all types of residences shown in Figure 4.5, apartment prices—which comprise over 60% of housing and are the most popular type of residence in Korea—skyrocketed in the past five years. The peak of apartment price increase in Seoul between 2017 and 2022 was around 180%. For other areas such as the Seoul Metropolitan area, the whole country, and areas outside the Seoul Metropolitan area, the peak rates were approximately 170%, 140%, and 120%, respectively. Considering that housing prices in Seoul nearly doubled in just five years, it is unsurprising that the former progressive government adopted policies that employed a range of measures to curb housing price appreciation.

To bolster CRET during the recent housing boom, the tax base was expanded to encompass more households, particularly in the Seoul region, who became subject to CRET due to sharp increases in housing prices. Additionally, the assessed values of properties were adjusted to better reflect the surging market values, thereby widening the tax base. However, this adjustment in assessed values relative to market prices contributed to a marked increase in the tax burden for both CRET and local property taxes, sparking significant tax resistance in the Seoul metropolitan area. Considering that 50% of the country’s population resides in the Seoul region, the mounting tax burden from steeply progressive property taxes unsurprisingly became a major political issue during the 2022 presidential election. The government elected in 2022 has pledged to bring the CRET tax burden down to the level of 2017. Although it remains uncertain whether CRET revenue will drop to 0.1% of GDP (the proportion in 2017), the recent downward trend in property values in Korea indicates that 2021 might have been the peak year of CRET revenue for the foreseeable future.

Regarding the objective of housing price stabilisation through CRET, it is essential to distinguish between the macroeconomic housing price stabilisation and the taxation of capital gains accruing to expensive apartments in the Seoul Metropolitan area, which is CRET’s primary target. Furthermore, CRET's design inherently focuses not just on expensive houses, but also on the number of houses owned by individuals. Table 4.6 presents the revenue from CRET on housing in 2021, categorised by the number of houses owned by taxpayers. Of the 931 384 taxpayers subject to CRET on housing, approximately 46% owned a single house. However, this group contributed only 26.6% of the total revenue from CRET on housing, indicating that around 73% of CRET on housing was paid by owners of multiple homes. This suggests that a key motivation for strengthening CRET during the housing boom was to impose a heavier tax burden on multiple homeowners, thereby encouraging them to sell properties and retain only a single home. This strategy seemingly increases the supply of houses. However, it also inadvertently increases the demand for more expensive homes as, from a CRET tax burden perspective, it is more favourable to own a one-million-dollar house than two half-million-dollar houses. Additionally, in many OECD countries, the main residence is exempt from capital gains tax (OECD, 2022, p. 137[17]). While Korea does have a cap on capital gains tax exemption for the main residence, the incentive to own an expensive primary home remains significant, similar to other OECD countries. In conclusion, CRET’s narrow targeting and its role in increasing demand for expensive primary residences limit its effectiveness in curbing the housing price boom (Figure 4.11).

Table 4.6. Revenue from CRET on housing, categorised by number of houses (2021)

|

Number of houses |

Number of taxpayers |

Share of taxpayers (%) |

Tax base (KRWM) |

Amount of CRET (KRWM) |

Share of CRET (%) |

|---|---|---|---|---|---|

|

Total |

931 484 |

100 |

364 850 372 |

5 610 142 |

100 |

|

1 |

426 686 |

45.8 |

160 181 400 |

1 490 118 |

26.6 |

|

2 |

288 106 |

30.9 |

106 241 909 |

1 753 361 |

31.3 |

|

3 |

70 697 |

7.6 |

26 800 746 |

513 565 |

9.2 |

|

4 |

36 848 |

4.0 |

14 013 682 |

277 964 |

5.0 |

|

5 |

23 236 |

2.5 |

8 938 907 |

179 415 |

3.2 |

|

6-10 |

47 471 |

5.1 |

20 037 590 |

415 590 |

7.4 |

|

11- |

38 440 |

4.1 |

28 636 139 |

980 129 |

17.5 |

Source: National Tax Service, Statistical Yearbook of National Tax, 2022.

Figure 4.11. Evolution of apartment price indices in four major areas

Source: Korean Statistical Information Services (KOSIS, https://kosis.kr/). Korea Real Estate Board.

4.4.4. Redistributive role of property taxation

The fourth argument against CRET presented in OECD (2008[14]) contends that housing property taxes, as local government revenue sources, should adhere to the benefit principle. This principle posits that local taxes ought to reflect the use of local public services rather than the taxpayer's ability to pay. With respect to CRET, OECD (2008[14]) asserts that "relying on real estate taxes for redistribution is inappropriate as it does not include other forms of wealth. While housing ownership in Korea does increase with income, the relationship between household income and housing wealth is not strong, thus reducing the effectiveness of the property tax in reducing income inequality."

The first part of the OECD’s argument concerning the benefit principle of local taxes does not directly pertain to CRET, as CRET is a central government tax. Nonetheless, questioning whether CRET contributes to reducing income inequality is a pertinent issue. First and foremost, the magnitude of CRET revenue, which hovers around 0.2~0.3% of GDP, is almost negligible compared to the personal income tax. The latter is a major fiscal instrument for redistribution and constitutes a significantly larger portion of approximately 6% of GDP. Furthermore, in contrast to a wealth tax that encompasses various types of financial assets, CRET does not adequately embody the principle of horizontal equity.

However, this line of argument overlooks the long history of redistributive property taxation in Korea, as emphasised throughout this chapter. In essence, the criticism concerning the redistributive nature of CRET could equally be levelled at all progressive property taxes that have been in place since the 1970s, and as such, may not be seen as a unique criticism of CRET. For instance, the Comprehensive Land Tax (CLT) introduced in 1990 was met with similar debates and contentions before it was replaced by CRET in 2005. However, it is important to highlight that there is a clear legal distinction between CLT and CRET. The Local Tax Law indicated that the purpose of CLT was to ensure that the tax burden on land was proportional to the extent of land ownership and aligned with progressive tax brackets (i.e., higher tax rates for larger land holdings). On the other hand, the Law on CRET explicitly states that one of its objectives is to enhance the equity of the tax burden. Therefore, the debate regarding whether CRET is a more effective tool than a comprehensive wealth tax, and whether there is a strong correlation between household income and housing wealth, represents a valid and important consideration.

In this regard, it is worth noting that a recent study on housing taxation by the OECD (2022[17]) supports the redistributive role of housing taxation. In particular, OECD (2022, p. 87[17]) explains the desirability of redistributive housing taxation as follows: "progressive property tax rates apply in a minority of OECD countries and may enhance vertical equity, as taxpayers with higher-value properties face proportionately higher tax liabilities. The effectiveness of progressive tax rates in increasing the overall progressivity of the tax system will depend on the distribution of housing along the income and wealth distributions; it will be enhanced in countries where housing wealth is concentrated at the top." OECD (2022[17]) further notes that "an alternative to progressive property tax rates on individual properties consists in levying progressive taxes on taxpayers’ total net housing wealth (e.g., Korea and France both levy national-level progressive taxes on overall real estate wealth above a certain threshold)."

Moreover, according to OECD (2022[17]), housing wealth represents approximately 75% of total household wealth on average in OECD countries. Furthermore, the report highlights that in Korea, it takes an average income earner more than 16 years to buy a 100m2 house, second only to New Zealand at 18 years. Given Korea's lengthy history of progressive property taxation and the high ratio of housing prices to income, CRET can be seen as a second-best solution to addressing housing wealth inequality.

However, an important caveat is that housing wealth should ideally be measured in terms of net value, which is the gross housing value minus the housing mortgage. Since CRET is calculated based on gross housing value, it has clear limitations if the objective is to strengthen it as a wealth tax.

4.4.5. Role of property taxation in the context of fiscal decentralisation

The fifth argument against CRET, presented in OECD (2008[14]), contends that CRET limits the role of local property taxes, which have many desirable characteristics as a local tax, such as visibility and accountability, by making both central and local governments co-occupy property tax bases. OECD (2008[14]) further notes that "in most OECD countries, property tax is a purely local tax, reflecting its advantages as a source of finance for local governments. However, the use of a national property tax in Korea limits the scope for using local property taxes and increasing the autonomy of local governments.”

As has been repeatedly emphasised, this argument overlooks the fact that highly progressive local property taxes have been prevalent in Korea since the 1970s, a unique feature among OECD countries. The highly progressive nature of local property taxes meant that local governments did not have any incentive to exercise their taxing power on properties even before 2005. Consequently, the introduction of CRET in 2005 did not curtail any existing local fiscal autonomy, as local governments were not exercising this autonomy. On the contrary, the proportion of local property tax revenue to GDP has steadily risen from 0.5% in 2005 to 0.83% in 2021. Importantly, this increase did not result from local governments exerting their taxing power - a power which is, in practice, unused for any local tax items in Korea.14 Instead, it reflected the steady growth of local property tax bases due to the rising market value of properties. However, as depicted in Figure 4.7, the ratio of land value to GDP significantly increased during the late 1960s, early 1970s, late 1980s, early 2000s, and late 2010s. Meanwhile, as demonstrated in Figure 4.10, the local property tax revenue in relation to GDP experienced a noticeable surge only in the late 2010s. Thus, it is argued in this chapter that the separation of formerly highly progressive local property taxes into a moderately progressive local property tax and a highly progressive national property tax (CRET) helped alleviate political resistance from local residents facing increasing assessed property values. In other words, the steady increase in local property tax revenue since 2005 is the result of a gradual tax burden increase that was made possible by the separation of a highly progressive property tax system before 2005 into a mildly progressive local property tax and CRET.

4.5. Conclusion and future directions

In understanding the Comprehensive Real Estate Tax (CRET) in Korea, which serves a redistributive role, it is crucial to acknowledge the long-standing history of progressive property taxation in Korea, spanning more than five decades. However, critiques of CRET, such as that by OECD (2008[14]) and others, fail to adequately address this history. In essence, many of the criticisms levied against CRET by OECD (2008[14]) and others could also have been applied when the highly progressive property tax system was introduced in 1973, or upon the introduction of the Comprehensive Land Tax (CLT) in 1990. Notably, the introduction of CLT in 1990 was even more radical than that of CRET in 2005, as CLT marked the first implementation of a nationwide land tax applying highly progressive tax rates to the aggregate land value across all local governments. Therefore, from a theoretical standpoint, what distinguished CRET, established in 2005, was not its progressivity but rather the fact that the central government assumed the responsibility for managing a progressive property tax, in contrast to its passive role in relation to CLT.

Thus, the pros and cons of CRET can be viewed from the perspective of second-best versus first-best arguments. If one believes that the introduction of a single-rate property tax in Korea is feasible in the short term, as was implied by the discussions in OECD (2008[14]), a national property tax may not be desirable or necessary. However, if the long history of progressive property taxation in Korea is considered a constraint, an important theoretical question arises: Should a progressive property tax be the responsibility of local governments (as was the case with CLT) or the central government (as is the case with CRET)? As discussed by OECD (2022[17]), a national redistributive property tax is generally more desirable than a local property tax for reasons articulated by, among others, Musgrave (1959[10]).

It should also be considered whether a highly progressive property tax system should be maintained in the long run with the objective of functioning as a form of wealth tax, as is currently the case with CRET. There are compelling reasons why redistributive property taxes are popular in Korea, where housing wealth constitutes about 75% of total household wealth, and the housing price relative to income is among the highest in the OECD. However, CRET is levied on gross property value, which includes housing mortgages, not on net property value. The net value of properties subject to CRET can still be overall very high with relatively few exceptions, but a transition from gross value to net value would involve a significant administrative burden. In addition, CRET has a clear limitation in its attempt to capture unrealised housing capital gains during housing booms since such unrealised housing capital gains might disappear when a housing boom ends, as recently experienced in many countries including Korea. Thus, the volatility of housing wealth clearly implies the inherent limitations of CRET when aiming to function as a wealth tax.

Considering its pros and cons, there are several reasons why CRET should be maintained at a moderate level. First, there is a clear limit to the redistributive effect of CRET; even if its tax revenue exceeds its peak level from 2021 (0.38% of GDP), it is still far below the size of the personal income tax, which is the primary fiscal tool for redistribution. Second, as suggested by OECD (2008) and Kim (2004[9]), if the tax burden of CRET is gradually reduced over time, local governments would progressively find room to boost revenue from local property taxes, as demonstrated in Figure 4.10. In other words, as long as the burden of CRET is maintained at a moderate level of 0.2%-0.3% of GDP, and the size of local property tax revenue continues to increase, the primary purpose of creating CRET in 2005, which is to mitigate the progressivity of local property tax, is achieved.

References

[5] Andriopoulou, E. et al. (2020), “The distributional impact of recurrent immovable property taxation in Greece”, Public Sector Economics, Vol. 44/4, pp. 505-528.

[1] Bird, R. (1993), “Threading the fiscal labyrinth: Some issues in fiscal decentralization”, National Tax Journal, Vol. 46/2, pp. 207-227.

[16] Caldera Sánchez, A. and D. Andrews (2011), “Residential Mobility and Public Policy in OECD Countries”, OECD Journal: Economic Studies, https://doi.org/10.1787/eco_studies-2011-5kg0vswqt240.

[8] Cho, Taehyung, et al. (2015), “Estimation of Long-Term Time Series of Land Values in Korea”, BOKDP No. 2015-06, Bank of Korea.

[6] Dieckelmann, D. et al. (2023), “House prices and ultra-low interest rates: exploring the non-linear nexus”, Working Paper Series, No. 2789, European Central Bank.

[7] Duca, J. and A. Murphy (2021), “Why House Prices Surged as the COVID-19 Pandemic Took Hold”, Federal Reserve Bank of Dallas, December 28, https://www.dallasfed.org/research/economics/2021/1228.

[13] European Systemic Risk Board (2020), A Review of Macroprudential Policy in the EU in 2019.

[20] Georgopoulos, K. (2022), The new Law 4916/2022.

[2] IMF (2009), “Macro Policy Lessons for a Sound Design of Fiscal Decentralization”, Policy Papers, No. 2009-050.

[18] Jonckheereere, D. et al. (2019), “Open versus Closed Competence to Tax: A Comparative Legal Study of Municipal Taxes in Belgium and the Netherlands”, Intertax, Vol. 47/5, pp. 468-489.

[9] Kim, J. (2004), Property Tax Reform Agenda, Korea Institute of Public Finance [Public Hearing Document].

[10] Musgrave, R. (1959), The theory of public finance: a study in public economy, McGraw-Hill, New York.

[12] O’Brien, D. et al. (2022), Recurrent property taxes and house price risks. Irish Central Bank.

[17] OECD (2022), Housing Taxation in OECD Countries, OECD Tax Policy Studies, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/03dfe007-en.

[3] OECD (2022), Housing Taxation in OECD Countries - Highlights, Figure 9. p. 14.

[4] OECD (2022), Revenue Statistics 2022: The Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/8a691b03-en.

[21] OECD (2021), “Tax Autonomy Indicators: Explanatory Annex”, OECD Fiscal Decentralisation Database, OECD, Paris, https://www.oecd.org/tax/federalism/fiscal-decentralisation-database/explanatory-annex-tax-autonomy-indicators.pdf.

[15] OECD (2011), “Housing and the Economy: Policies for Renovation”, in Economic Policy Reforms 2011: Going for Growth, OECD Publishing, Paris, https://doi.org/10.1787/growth-2011-46-en.

[14] OECD (2008), OECD Economic Surveys: Korea 2008, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-kor-2008-en.

[11] Poghosyan, T. (2016), “Can Property Taxes Reduce House Price Volatility? Evidence from U.S. Regions”, IMF Working Paper, No. WP/16/216, IMF.

[22] Scheuer, F. and J. Slemrod (2021), “Taxing Our Wealth”, Journal of Economic Perspectives, Vol. 35/1, pp. 207-230, https://doi.org/10.1257/jep.35.1.207.

[19] Stenkula, M. (2015), “Taxation of Real Estate in Sweden (1862–2013)”, in Henrekson, M. (ed.), Swedish Taxation, Palgrave Macmillan, New York.

Notes

← 1. The property tax rates in Greece have a progressive structure. However, as discussed in Andriopoulou et al. (2020[5]), the property tax burden, when measured as a share of disposable income, exhibits a regressive pattern.

← 2. The ordinary rate set by law for properties other than the main house is 0.76% and municipalities can increase or decrease it up to 0.3 percentage points (see OECD, (2021, p. 17[21])).

← 3. The Local Property Tax in Ireland is governed by the Finance (Local Property Tax) Act 2012 and the Finance (Local Property Tax) (Amendment) Act 2021, as stated in the Irish Statute Book. As most local taxes are governed by laws in Ireland, the share of local tax revenue in the total tax revenue in Ireland was 1.3% in 2021.

← 4. The land tax in Estonia is imposed under the Land Tax Act, as stated on the Estonian Tax and Customs Board homepage. Similarly to Ireland, local tax revenue occupies only 0.9% of total tax revenue.

← 5. The definition of local tax is explained in the appendix section of (2022[3]). In the appendix section A.12, the attribution criteria are stated as follows: "A tax is attributed to the government unit that a) exercises the authority to impose the tax and b) has final discretion to set and vary the rate of the tax." When two levels of government independently determine the rates of a tax, § 106 of the OECD criteria of attribution states that "the tax revenues are attributed to each government according to its respective share of the proceeds."

← 6. See de Jonckheereere et al. (2019[18]).

← 7. See Stenkula (2015[19]) for detailed historical developments of the property tax system in Sweden.

← 8. For more detail, see Kyriakides Georgopoulos (2022[20]) and Andriopoulou et al. (2020[5]).

← 9. Another type of stringent tax on landholding, known as the Tax on Excessively Increased Land Value (TEILV), was introduced in 1990. The TEILV was levied by the central government on parcels of land that were left unused, typically held for speculative purposes. However, this tax was controversial and was ultimately abolished in 1998.

← 10. It has grown to 66% in 2021 (Statistic Korea, Population and Housing Census).

← 11. This view is in line with a recent OECD publication: OECD (2022, p. 15[3]) identifies a number of options for governments to reforming housing taxes, based on an assessment of their efficiency, equity, and revenue effects. One of the suggested options is “to consider capping the capital gains tax exemption on the sale of main residences to ensure that the highest-value gains are taxed, which would enhance progressivity and mitigate upward pressure on house prices, while still exempting capital gains on the main residence for most households.”

← 12. Scheuer and Slemrod (2021, p. 209[22]) define a wealth tax as follows: “In principle, the base of a wealth tax is net worth—the value of assets minus debts”.

← 13. Residential mobility is defined as percent of households that changed residence within the last two years.

← 14. This is because the nationwide standard tax rates for all local taxes are first determined by Parliament, which then leaves room for local governments to exercise additional taxing power, usually within a range of 50% above or below the standard tax rates. Given that the objective of raising local tax revenues is already achieved by the act of Parliament, local governments have historically not exercised their authority to impose additional tax burdens on residents.