Andrew Reschovsky

University of Wisconsin-Madison, USA

Bricks, Taxes and Spending

5. Do property taxes in the United States contribute to housing inequities?

Abstract

This chapter aims to assess the contribution of the local property tax in the United States to housing affordability and housing equity. Although property taxes contribute to the annual costs of homeownership, to the extent that property taxes are capitalised into lower housing prices, they may make it easier for families to become homeowners. The impact of public policies on the distribution of property tax burdens is analysed by tracing the role of property tax administration and assessment procedures, tax reliefs and tax limitations on the burdens faced by low-income households. The study suggests that a high-quality property tax administration that eliminates or minimises any bias towards regressivity in property tax assessment, combined with a robust system of property tax reliefs that targets those facing high property tax burdens (relative to their incomes) will help reduce property taxes for households facing high housing cost burdens.

The opinions expressed and arguments employed herein are those of the author and do not necessarily reflect the official views of the OECD, its Member countries, or the KIPF. The author is Professor Emeritus of Public Affairs and Applied Economics, University of Wisconsin-Madison, United States. He thanks the workshop participants, Sean Dougherty, Peter Hoeller, Stephen Malpezzi, Semida Munteanu, Sarah Perret and Joan Youngman for advice and for comments on an earlier draft.

5.1. Introduction

As in most countries, housing inequities in the United States take many forms. Homeownership varies dramatically by race and ethnicity. In the third quarter of 2022, the homeownership rate for White households was 74.6%, for Black households, 46.3%, and for Hispanic households, 48.7% (U.S. Census Bureau, 2022[1]). For many homeowners and renters in the United States. the most salient issue is the cost of housing. Over time the difficulty of finding affordable housing has risen (HUD USER, 2017[2]). The problem is particularly severe for households with low income and for many racial and ethnic minorities.

This paper will consider whether the property tax, a primary source of local government finance in the United States, exacerbates housing affordability. The next section provides an overview of housing affordability in the United States and in other OECD countries. Section 3 addresses the relationship between the property tax and housing affordability, Section 4 discusses the role of property taxation in financing local governments in the United States and Section 5 focuses on the burden of the property tax on homeowners. The next four sections analyse the impact of administration of the property tax, property tax reliefs, property tax limitations imposed by state governments, as well as income tax policies on housing equity and affordability. The final section summarizes the findings and suggests several policy recommendations.

5.2. Housing affordability

As emphasised by Malpezzi (2017[3]), housing affordability is difficult to define and measure. Most measures of affordability consider monthly or annual housing costs relative to household income. This ratio is generally referred to as a housing cost burden. Setting a threshold for housing affordability is somewhat arbitrary and the thresholds have changed over time. In the United States, the federal Department of Housing and Urban Development (HUD) considers housing to be unaffordable, if the cost burden is over 30%. If housing costs are greater than 50% of income, HUD classifies a household as facing a severe cost burden. The housing affordability measure used by the OECD is the Housing Cost Overburden Rate. It calculates the percentage of households with mortgage payments or rental payments that exceed 40% of their income. These calculations are done separately for households in different income quintiles.

In measuring cost burdens, decisions must be made about what costs to include. While the OECD’s measure includes mortgage or rental payments, the American Housing Survey conducted by the U.S. Census Bureau, includes in its measure of homeowners’ monthly total housing costs spending on mortgages, property taxes, homeowner association or condominium fees, utility payments, property insurance and routine maintenance. For renters, in addition to rent, housing costs include utilities and property insurance. Income measures also differ. Disposable (after-taxes and transfers) income is used in the housing cost burden calculations made for many OECD countries. Housing burden calculations made by the U.S. Census Bureau are based on self-reported (before tax) household income. As pointed out by Malpezzi (2017[3]) and Gabriel and Painter (2020[4]), standard measures of housing affordability may understate the economic and social costs associated with the access to housing. In order to avoid homelessness, households may be forced to make housing decisions that are detrimental to themselves and more broadly to society. To find an affordable housing unit, households may have to choose locations with low-quality public schools, close to environmentally toxic sites, or at great distance from their jobs. These personal trade-offs not only affect individuals and their families but are likely to create negative externalities for their communities and their country.

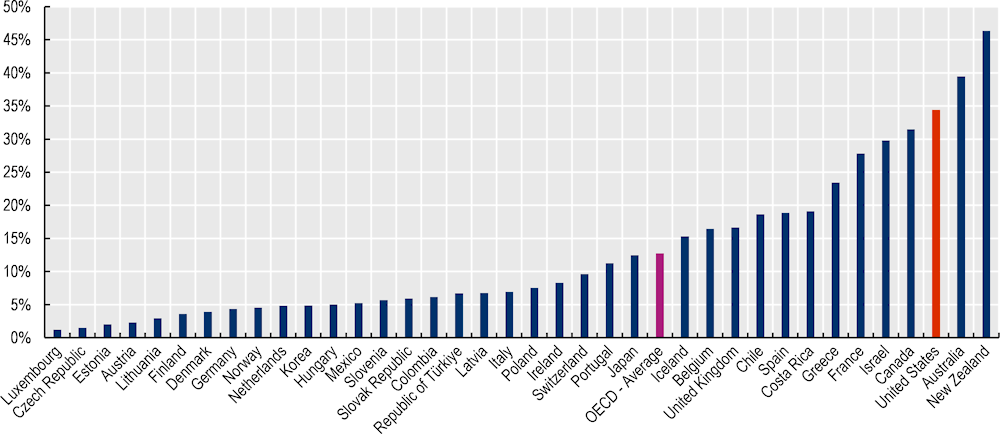

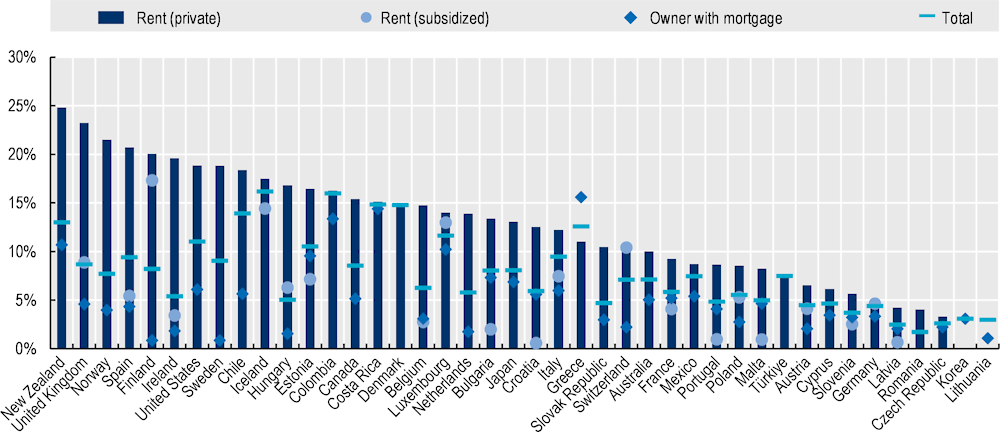

Figure 5.1 reports data from the OECD’s Affordable Housing Database (OECD, 2022[5]). It displays the OECD’s Housing Cost Overburden Rate for 42 countries. The US rate for renters is the seventh highest. At 6.1%, the US overburden rate for homeowners with mortgages is above the average rate of 5.1%. When the OECD calculates the housing cost overburden rate for households in the lowest quintile of the income distributions, not only are all burdens much higher, but of the countries included in Figure 5.1, only Colombia, Costa Rica and Chile have higher total (owners and renters) overburden rates.

Figure 5.1. Housing cost overburden rate for homeowners and tenants

% of population spending more than 40% of disposable income on mortgages or rent by tenure, 2020 or latest year

Note: In Chile, Colombia, Mexico, Korea and the United States gross income instead of disposable income is used due to data limitations. No data available on subsidised rent in Australia, Canada, Chile, Mexico and the United States. In the Netherlands, Denmark, New Zealand and Sweden tenants at subsidised rate are included in the private market rent category due to data limitations. No data on mortgage repayments available for Denmark, Iceland and Türkiye. Results are only shown if a category is composed of at least 100 observations.

Source: OECD (2022[5]).

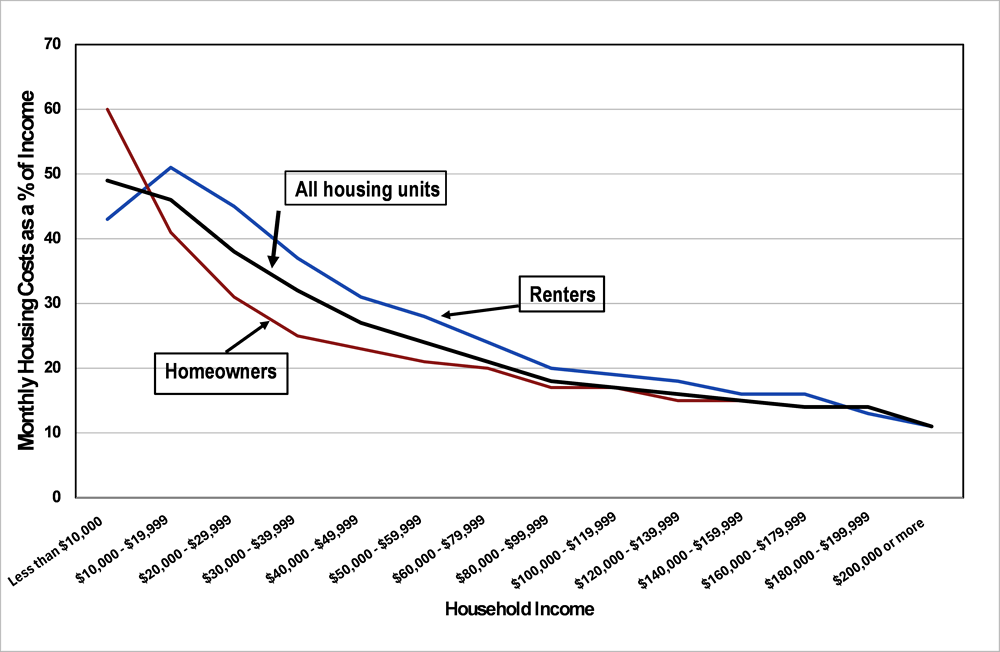

The Annual Housing Survey conducted every other year by the US Census Bureau and the Department of Housing and Urban Development collects data on a broader measure of housing costs than just mortgage and rent payments. The survey addresses housing cost affordability by calculating monthly housing costs as a percentage of household income for all owner and renter households. Using data from this survey, Figure 5.2 displays the median housing cost burden by household income class separately for homeowners, renters and for all households. The data show clearly that median housing cost burdens are highest for low-income households. Except for households with income below $10 000, median housing cost burdens for renters are higher than cost burdens for homeowners with similar incomes.

Figure 5.2. Median monthly housing costs as a percentage of income by tenure, 2021

Note: Excludes households with no cash rent, with housing costs greater than income, and with zero or negative income.

Source: U.S. Census Bureau (2022[6]).

The magnitude of the housing affordability problem depends in part on the housing cost burden threshold one uses to define housing affordability. As in Figure 5.2, the data in Table 5.1 use the American Housing Survey’s comprehensive measure of monthly housing costs that includes property taxes (for homeowners), property insurance and all utilities. The table displays the percentage of owner and renter households that face housing cost burdens above two different thresholds: 30%, referred to as moderate housing cost burdens, and 50%, referred to as severe burdens.

The data in Table 5.1 show that over a third of homeowners and half of renters with incomes below $50 000 face moderate housing cost burdens. Over 10% of these households face severe housing cost burdens. Even though over two-thirds of households are homeowners, because housing affordability is a greater problem for renters, more renters than homeowners face high housing cost burdens.

Table 5.1. Housing affordability in the United States by household income and housing tenure, 2021

Percentage of homeowners and renters facing moderate and severe housing cost burdens

|

Household Income |

Number of Homeowners |

Per cent with Housing Costs as a % of Income above |

Number of Renters |

Per cent with Housing Costs as a % of Income above |

||

|---|---|---|---|---|---|---|

|

30% |

50% |

30% |

50% |

|||

|

Less than $10,000 |

761 000 |

95.3% |

65.7% |

1 187 000 |

76.5% |

42.8% |

|

$10,000 to $19,999 |

3 890 000 |

71.9% |

37.5% |

4 085 000 |

81.0% |

51.7% |

|

$20,000 to $29,999 |

5 248 000 |

52.5% |

22.4% |

4 628 000 |

82.7% |

40.7% |

|

$30,000 to $39,999 |

5 361 000 |

40.1% |

14.4% |

4 616 000 |

72.5% |

23.1% |

|

$40,000 to $49,999 |

5 631 000 |

34.5% |

10.6% |

4 230 000 |

55.5% |

12.5% |

|

$50,000 to $59,999 |

5 232 000 |

28.2% |

6.5% |

3 392 000 |

45.3% |

6.8% |

|

$60,000 to $79,999 |

10 290 000 |

22.6% |

4.4% |

5 462 000 |

29.7% |

4.0% |

|

$80,000 to $99,999 |

8 460 000 |

15.8% |

2.0% |

3 305 000 |

17.1% |

1.8% |

|

$100,000 to $119,999 |

7 464 000 |

11.9% |

1.3% |

2 039 000 |

10.9% |

0.0% |

|

$120,000 to $139,999 |

5 559 000 |

7.2% |

0.0% |

1 378 000 |

2.4% |

0.0% |

|

$140,000 to $159,999 |

4 613 000 |

6.8% |

0.0% |

816 000 |

0.0% |

0.0% |

|

$160,000 to $179,999 |

3 003 000 |

4.1% |

0.0% |

471 000 |

0.0% |

0.0% |

|

$180,000 to $199,999 |

2 161 000 |

2.7% |

0.0% |

363 000 |

0.0% |

0.0% |

|

$200,000 or more |

8 895 000 |

1.2% |

0.0% |

1 317 000 |

0.0% |

0.0% |

|

Total |

77 077 000 |

23.0% |

7.5% |

37 715 000 |

47.5% |

17.7% |

Note: A moderate housing cost burden is defined as monthly housing costs that are over 30% of household income. A severe housing cost burden exists when monthly housing costs are more than 50% of household income.

Source: U.S. Census Bureau (2022[6]).

5.3. The property tax and housing affordability

Property tax payments are an integral part of the costs of homeownership. By raising the annual cost of homeownership, the property tax can contribute to or exacerbate problems of housing affordability. However, the link between property taxation and the cost of homeownership is complex and not without controversy.

With the exception of some mobile homes, the purchase of a housing unit is inexorably linked to a specific location. Every location has a set of attributes. These include amenities such as access to parks, good schools, shopping, nodes of employment, and possible dis-amenities such as the condition of neighbouring houses, high crime rates and air pollution. It is widely accepted that locational attributes are capitalised into property values, either increasing housing values (amenities) or decreasing housing values (dis-amenities). Among the attributes of any location are a set of goods and services provided by local governments and a set of taxes and fees used to finance these local government public services. In the United States, the property tax is the primary local source of local government revenues.

Starting with Wallace Oates (1969[7]), there is a large empirical literature directed at measuring the capitalisation of both local government public services and local property taxes. This literature generally finds that property taxes are either partially or completely capitalised into lower property values, while public services are generally capitalised into higher property values. The net impact varies across studies and across locations reflecting differences in the demand and supply elasticity of housing and differences (often unmeasurable) in the quality of local public services.1

While in some locations, the positive capitalisation of local public services may completely offset the negative capitalisation effect of property taxes, in other locations the negative capitalisation of taxes may exceed any positive capitalisation of public services. This is especially likely to occur where local governments provide low-quality public services.2 As pointed out by Slack and Tassonyi (2022[8]), while high taxes will increase annual housing costs, the net negative capitalisation of local public services and taxation will lower housing prices and hence increase affordability.

Additional complications arise in tracing the link between property taxation and housing affordability for residential tenants. Depending on the elasticity of supply and demand for rental housing, as much as 100% of property tax liabilities could be shifted from landowners to tenants in the form of higher rents. England (2016[9]) provides a comprehensive review of the theoretical and empirical literature on the incidence of property taxes on rental housing. The results of the relatively small empirical literature are mixed, with several studies finding substantial shifting to tenants. In a paper that addresses many of the empirical shortcomings of previous research, Carroll and Yinger (1994[10]) finds that landlords in the Boston metropolitan area are able to shift only about 15% of property tax increases to their tenants. Recent research by Schwegman and Yinger (2020[11]) found that only 16% of property tax increases in three large cities in New York State were shifted to tenants. Bauer et al. (2020[12]) in a study of rent shifting in German municipalities found considerable tax shifting to tenants in urban communities, but no tax shifting in rural communities.

Given the high rent-income ratios faced by many tenants, especially those with low income, property taxation will probably exacerbate housing affordability as long as there is some shifting of property taxes to rents. However, given the lack of comprehensive data on tax shifting, quantifying the impact of property taxation on renter housing burdens is not possible.

The focus of the rest of the paper will be on the impacts of the property tax on housing affordability for homeowners.3 To the extent that the property tax increases the monthly housing costs associated with homeownership, property taxes, especially those levied on individuals with relatively low incomes, may influence housing tenure choices by making it more difficult for individuals to become first-time homeowners.4

5.4. The role of the property tax in funding local governments in the United States

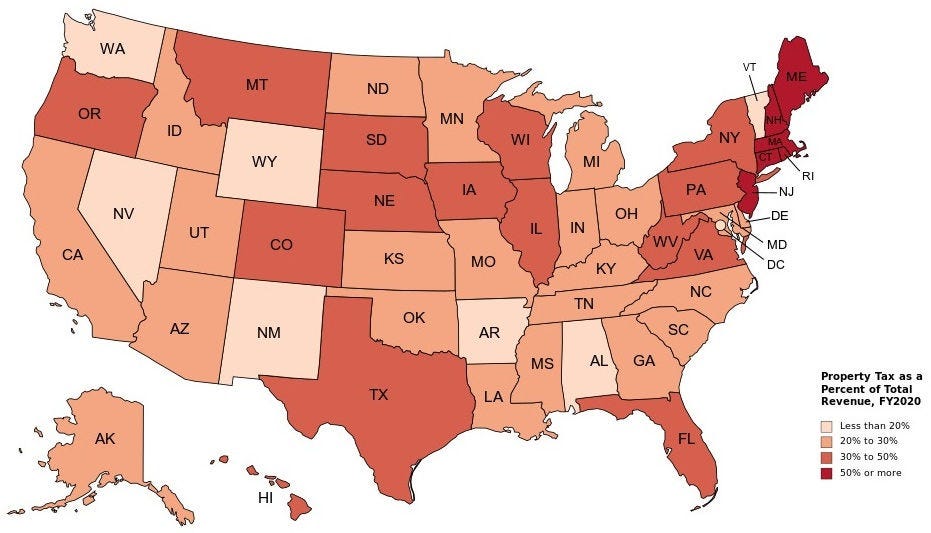

In the United States, the property tax levied by local governments plays a much more important role in the financing of local public services than in most OECD countries. In 2020, the property tax accounted for nearly half of the own-source revenue of local governments and 34.4% of their total revenue (OECD/UCLG, 2022[13]). As illustrated in Figure 5.3, this percentage was nearly three times the average property tax share among 37 OECD countries. Only in Australia and New Zealand did property taxes account for a larger share of local government revenue.

The role of the property tax varies substantially across states, with the property tax as a share of own-source revenue ranging from 19.7% in Alabama to 88.4% in Connecticut (U.S. Census Bureau, 2022[14]). As the share of local governments’ total revenue from intergovernmental transfers (especially from state governments) also varies substantially across states, the importance of the property tax in the total revenue of local governments ranges from 11.8% in Arkansas to 61.5% in New Hampshire. Figure 5.4 shows that the heaviest reliance on property taxation is found in the New England states and in New Jersey.

Figure 5.3. Local government property tax revenue as a percentage of local government revenue in OECD countries, 2020

Figure 5.4. Property tax revenue as a percentage of total local government revenue by state, FY2020

Table 5.2 provides an overview of the role of the property tax in local government finance in the United States. There are four types of local governments. Municipal governments are contained within larger counties. In some parts of the country, especially in the South, county governments provide a broad range of public services including education, while in New England, counties have very few functions. Independent school districts have their own governing bodies, which impose and collect property taxes. Some states rely in whole or part on dependent school districts, which are part of county or municipal governments and rely on revenues from their parent governments. Special districts are governments created for a specific purpose such as fire protection, hospitals, water and sewage, public transportation, including airports and parks and recreation.

The data in Table 5.2 show that of the over $500 billion in local government property tax revenue collected in 2017, the largest share went to independent school districts. School districts rely on property taxes for over 80% of their own-source revenue and after accounting for intergovernmental transfers, for 37% of their total revenues. While property taxes are a relatively minor source of revenue for special districts, which rely heavily on user fees, property taxes contribute 43% of the revenue of county governments.

In general, local governments have considerable autonomy in setting property tax rates. However, state governments often play an important role in authorising and financing property tax relief measures, in restricting or limiting changes in the assessed values of property and in property tax levies (OECD, 2022[15]). Although the determination of the value of properties subject to taxation is almost always a local government function, state government regulations and legislation generally define the parameters of property tax assessment systems and in some states, state governments play an active role in maintaining assessment quality. As a result, there are large variations in property tax systems across states. This implies that the relationship between housing affordability and the property tax differs by state.

Table 5.2. The financing of local government by type of government, 2017

Millions of US dollars

|

Type of Government |

Counties |

Municipal (incl. Townships) |

Independent School Districts |

Special Districts |

All Local Governments |

|---|---|---|---|---|---|

|

Number of governments |

3 031 |

35 748 |

12 754 |

38 542 |

90 074 |

|

General revenue |

$420 590 |

$562 916 |

$573 699 |

$193 128 |

$1 750 334 |

|

Per cent of general revenue from transfers |

33.8% |

23.4% |

55.2% |

34.0% |

37.5% |

|

General revenue from own sources |

$278 586 |

$431 402 |

$256 992 |

$127 387 |

$1 094 367 |

|

Property tax revenue |

$119 452 |

$155 440 |

$212 074 |

$21 770 |

$508 736 |

|

Share of total property tax revenue |

23.5% |

30.6% |

41.7% |

4.3% |

100.0% |

|

Share of own-source revenue |

42.9% |

36.0% |

82.5% |

17.1% |

46.5% |

|

Share of general revenue |

28.4% |

27.6% |

37.0% |

11.3% |

29.1% |

Source: U.S. Census Bureau (U.S. Census Bureau, 2022[16]).

5.5. Property tax burdens on homeowners

For homeowners, real estate taxes constitute about one-fifth (19.1%) of total monthly housing costs.5 Although slightly higher for income under $30 000, the property tax share of total housing costs varies very little over the entire income distribution. Housing costs are dominated by monthly mortgage payments. Thus, households without mortgages generally have much lower monthly housing costs and property taxes tend to be a larger share of total monthly costs. There is also substantial geographic variation in not only housing costs but in housing costs as a percentage of income. For example, in New York City, where housing prices are high, median total monthly housing costs for owner-occupied housing are $1 837 and equal to 22% of median household income (compared to a national average of 16%). In New York, median real estate taxes comprise 25.6% of median housing costs. By comparison, in Memphis, Tennessee, median housing costs are only $926, which is equal to 17% of median income, and property taxes make up only 15.1% of total housing costs (U.S. Census Bureau, 2022a).

Although policymakers generally consider the local property tax to be regressive, economists’ view on the incidence of the property tax is hardly settled. Two well-known experts on the property tax recently concluded: “Despite a series of books and papers stretching over a period of nearly 50 years, there is nothing approaching a consensus on this issue” (Oates and Fischel, 2016[17]).

Some scholars argue that the property tax is a benefits tax with property taxes being payments for the receipt of local public services, and hence questions of property tax incidence are largely irrelevant. Alternatively, the so-called capital view takes a general equilibrium approach and assumes that housing capital is mobile, and that in response to an increase in property taxes, it will move into non-housing uses, thereby reducing the rate of return on all capital. As the ownership of capital is concentrated at the top end of the income distribution, the property tax under the capital view is likely to be progressive.

In discussing property tax incidence, economists often abstract from a number of important institutional features of the tax such as different property tax assessment practices in different jurisdictions, the variation in tax rates across jurisdictions, the impact of a wide set of state government tax relief measures, and state government-imposed limitations on rates, assessments and tax levies.

In considering the incidence of the property tax levied on homeowners, proponents of the capital view generally recognise that differences from the national average tax rate create excise tax effects which are borne by the owners of individual properties. In addition, for the majority of homeowners, their total net worth consists primarily of their home equity, suggesting that homeowners bear most of the burden of the property tax levied on their homes.

Calculating property tax burdens on homeowners requires that one compares their property tax liability to their ability to pay. The empirical issue is how best to measure a family’s ability to pay. As both income and consumption vary over most people's lives, the correct way to assess incidence of a tax is from a lifetime perspective. The basis for this argument, which has its origins in Friedman's permanent income theory of consumption (Friedman, 1957[18]) and the companion life-cycle model of saving (Ando and Modigliani, 1963[19]), is that if most people with low incomes are only temporarily poor, and if housing consumption decisions tend to be made on the basis of lifetime income, then calculating tax burdens based on data from a single year will yield tax burdens for low-income people that are substantially higher than burdens calculated on the basis of lifetime or permanent income. As a result, tax incidence calculations are biased towards regressivity.

Although this “annual income bias” in the calculation of tax burdens has long been recognised (Poterba, 1989[20]), the absence of large-scale longitudinal datasets that include data both on household income and property tax payments, means that most property tax burden calculations are made using data for a single year. One exception is Boldt, Caruth and Reschovsky (2010[21]) who used eight years of income and property tax data from Wisconsin state income tax returns to calculate average property tax burdens. By using average household income over an eight-year period, they argue that they have eliminated most of the impact of transitory income. Their income measure includes income from both taxable and non-taxable sources and an estimate of the imputed rent from homeownership. As expected, the property tax is regressive when tax burdens are calculated using a single year of data. The property tax remains regressive when 8-year average burdens are calculated, but the regressive pattern is reduced.6

Given data limitations, the property tax burden calculations presented in this paper are all based on annual property tax and income data. These data show that the property tax levied on homeowners is regressive, with the highest burdens falling on homeowners with low annual income. Based on 2019 U.S. Census Bureau data, nearly two-thirds of homeowners face annual property tax burdens of less than 4% of their income (Langley and Youngman, 2021[22]). However, 14% of homeowners face burdens of between 4% and 6% and 21% burdens above 6%. Most homeowners facing the highest property tax burdens have relatively low incomes.

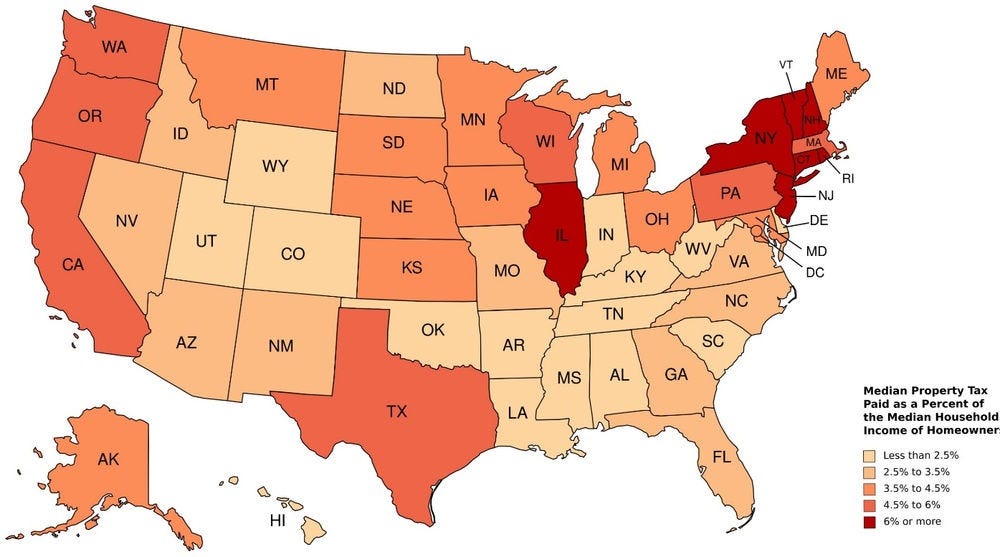

Property tax burdens measured as the median property tax paid by homeowners divided by the median household income of homeowners, vary substantially by state. Figure 5.5 shows the regional concentration of both low tax burden and high tax burden states. Low tax burden states are concentrated in the South and Central portion of the country, while with the exception of Illinois, high tax burden states are found in the Northeast. Median burdens are also high in the Pacific coast states as well as in Texas, a state without a state income tax.

Figure 5.5. Homeowner property tax burdens by state

5.6. Property tax administration

Local governments in the United States use a market value-based system of property taxation. This means that the value of properties for tax purposes (generally known as the assessed value) is regularly updated to reflect changes in the market value of properties. Although sometimes subject to limitations and restrictions imposed by state governments, local governments have considerable freedom to determine the size and the composition of their budgets. Based on estimates of how much revenue they are likely to receive from federal and state government transfers and from user fees, licenses and other non-property tax sources, local government officials calculate the amount of money they need to raise from the property tax in order to fund their spending priorities.

Using the latest assessed values of their property tax base, local officials determine the property tax rate necessary to raise their desired property tax levy.7 As shown in equation 1, the property tax paid by household j in city i (Tij) equals the tax rate in i (ti) on the assessed value of j’s property (Aij).8 The property tax revenue in i is the sum over j of all Tijs.

(1) Tij = ti Aij

To compare tax rates across communities, it is necessary to calculate an effective tax rate (teij). It is defined as the tax paid by a property owner relative to its true market value. As shown in equation 2, the effective tax rate is calculated by multiplying the nominal tax rate by an assessment ratio, which is defined as the average ratio in city i of the assessed value to sales price of recently-sold properties (Mij). From equation 1, we know that the nominal tax rate is defined as the ratio of taxes paid relative to assessed value.

(2) = x

Especially in urban areas, where problems of housing affordability tend to be most severe, property tax assessed values for residential properties are usually based on various automated valuation models (AVMs). These models use statistical techniques, such as hedonic regressions, based on data from recent arms-length housing sales, to produce estimates of market values for housing units that have not been sold.

In a well administered property tax system, there will be very little variation in assessment ratios across properties.9 In fact, the quality of property tax assessments varies substantially across states. A major reason why assessment ratios differ across properties is infrequent reassessments. According to a recent survey of assessment cycles, 10 states require annual reassessments of property, 14 states require reassessments every 2 to 4 years, 15 states every 5 or more years, while 10 states have no fixed reassessment schedules (Dornfest et al., 2019[23]). The frequency of assessment is important because changes over time in property values vary within jurisdictions, especially in cities. If properties are not reassessed frequently, those properties whose market values grow at below-average rates will face higher assessment ratios than properties whose market values grow at above-average rates. To the extent that the market prices of more expensive houses tend to grow at a faster rate than the market value of less expensive houses, overtime, without reassessment, the average assessment ratios for low-valued houses will exceed the average assessment ratio for high-valued houses. The result, as can be seen in equation 2, is that although all houses face the same nominal tax rate, the effective rate of property taxation on low-value houses will be higher than the effective rate on high value houses.

There is a relatively small literature that has investigated the extent to which higher-priced properties tend to have lower assessment ratios than lower-priced properties. Most of these studies have found a regressive pattern of assessments.10 While older studies focused on assessments within a single jurisdiction, several recent studies use administrative records of the assessed values and sale prices of millions of housing units throughout the country. Christopher Berry (2021[24]) used a national sample of 26 million housing sales occurring between 2007 and 2020. He calculated sales ratios for each transaction by dividing the assessed value of each property on January 1st of the sales year by the sales price. He then used regression analysis to determine whether the sales ratios declined as sales prices increased. His results show a substantial amount of assessment regressivity with on average sales ratios within any given jurisdiction being twice as high in the bottom sales price decile than in the top decile.11

Using the same national data as Berry but a somewhat different methodological approach, Amornsiripanitch (2022[25]) provides further evidence that inexpensive houses are over-assessed relative to expensive houses. Although some of the measured assessment regressivity is attributable to measurement error in sale prices, he argues that 60% of the remaining regressivity can be explained by a flawed methodology used by assessors and 40% by infrequent reassessments. In a recent paper, Avenancio-León and Howard (2022[26]) find that after controlling for assessment regressivity, Black and Hispanic households face assessment ratios that are substantially higher than assessment ratios on homes of white households. They attribute these racial gaps to the fact that assessments fail to capture many within and across neighbourhood characteristics that are reflected in market values.

Even if there were no biases in the assessment process, some states require different assessment ratios for different types of property. In some states commercial and industrial property is subject to a higher assessment ratio than residential property. In Connecticut and several other states, residential apartment buildings, generally defined as having four or more apartments, are assessed at a higher fraction of market value than single-family homes (Lincoln Institute of Land Policy/George Washington Institute of Public Policy, 2022[27]). As a result, a higher effective tax rate is applied to rental apartment buildings than to single family housing, regardless of whether it is owner-occupied or rented. In Massachusetts, where all types of property are assessed at 100% of market value, local governments are given the option of applying higher tax rates to commercial-industrial property than to residential property. The application of different assessment ratios or tax rates to different types of property is referred to as classification.

The rules that define property tax assessment and administrative procedures, and the quality of the assessment process vary tremendously across states. The evidence to date suggests that even in states with high-quality property tax assessments, low-value properties may be assessed at a higher proportion of their true market value than high-value properties. The result is that the owners of relatively low-value properties may face higher effective tax rates than owners of properties with higher market value. To the extent that household income is correlated with the value of owner-occupied housing, the administration of the property tax may result in higher housing costs for low-income households. Although the impacts of property tax administration on problems of housing affordability are difficult to quantify, it is likely that in some states, property tax administration adversely affects the ability of low and moderate-income households to become homeowners.

5.7. Property tax relief

The property tax system in every state includes a set of policies designed to reduce property taxes on selected taxpayers. In many cases property tax relief measures are designed to reduce property tax regressivity by targeting relief to individuals facing high property tax burdens. If properly designed these relief measures have the potential to reduce housing-related costs for taxpayers struggling to afford housing. In this section, I describe the most commonly used types of property tax relief. Their effectiveness in reducing property tax regressivity depends on how each policy is designed, which taxpayers are eligible to receive property tax relief, and whether the funding of property tax relief comes from the state government or from individual local governments. Information in this section of the paper comes primarily from detailed descriptions of homeowner property tax relief measures in all 50 states and the District of Columbia compiled by the Lincoln Institute of Land Policy and George Washington Institute of Public Policy (2019[28]).

5.7.1. Property tax exemptions and credits

The most common property tax relief measure is a fixed dollar exemption, often referred to as a homestead exemption because eligibility is almost always restricted to homeowners on their primary residence. This type of property tax relief exempts a fixed dollar amount of homeowners’ assessed value from property taxation. With a state-funded homestead exemption, a taxpayers’ property tax liability is determined by equation 3, where E is the legislatively-determined exemption amount.

(3) Tij = ti (Aij – E)

As E is the same for all eligible homeowners, the exemption will result in a larger percentage reduction in property taxes for homeowners with low-valued homes as compared to homeowners with more valuable homes. This progressive pattern reduces the regressivity of homeowner property tax burdens. The tax savings from a fixed dollar exemption depend both on the size of the exemption and the local government tax rate. In some states, exemptions apply to all local government property tax payments, while some other states apply exemptions only to property taxes levied by independent school districts.

Although used less frequently, a few states provide homeowners with a percentage exemption, which as shown in equation 4, exempts from taxation a fixed percentage (γ) of each homeowner’s assessed value. Percentage exemptions provide a larger dollar exemption to owners of more valuable houses and thus have no impact on regressivity.12

(4) Tij = ti (Aij – γAij)

Using the Lincoln Institute of Land Policy’s Significant Features of the Property Tax database, Adam Langley (2015[29]) determined that 25 states and the District of Columbia offer property tax exemptions or credits to all homeowners, with 11 of these states providing higher benefits for “seniors”. In nearly all states, seniors are defined as homeowners age 65 or older.13 In seven states homeowner property tax exemptions and credits are only available for seniors.14 In the remaining 18 states, homeowners are not eligible for property tax relief from exemptions or credits.15

In a number of states, local governments are reimbursed by their state government for the reduced property tax revenue associated with the issuance of exemptions and credits. In some states, the financing of property tax relief is shared by the state and local governments, while in other states, the entire cost of the exemptions and credits is borne by local governments. Local government self-funding implies a shifting of tax burdens from those eligible for property tax relief to those taxpayers who are not eligible. In most cases, this implies higher taxes on commercial-industrial property and on most multi-unit residential property. To the extent that taxes are shifted to tenants, local government funding of homeowner property tax relief results in tax burden shifting from homeowners to tenants.

It is important to emphasize that the generosity of tax relief programmes varies tremendously across states. For example, among states with fixed dollar exemptions, the exempted property values range from $4 850 in Iowa to $75 000 in Louisiana. Using detailed information from the Significant Features of the Property Tax database on characteristics of state property tax relief programmes, Adam Langley (2015[29]) estimated the property tax savings from each tax relief programme operating in each state in 2012. His estimates were made by combining details of property tax relief programmes with data on individual household characteristics from the U.S. Census Bureau’s American Community Survey (ACS). This survey of over 6.5 million households includes data on household characteristics such as age, income, marital status, disabilities, veteran status, home value and property tax payments, which are required to determine eligibility for and benefits from various property tax relief programmes.

Langley’s results demonstrate the wide variation of the impact of property tax relief policies across states. Among the 25 states and the District of Columbia that provide a property tax exemption or credit to all homeowners on their principal residence, the tax saving of the median homeowner was less than 10% in 11 states and over 40% in five states.16 Figure 5.6 illustrates for each state the total tax saving from all property tax exemptions or credits programmes as a percentage of property tax revenue in that state. In only eight states, total tax relief exceeds 10% of property tax revenue. For the nation as a whole, total tax savings from tax reliefs equal 3.6% of tax revenue. Given that in most states the exemption levels are not indexed for inflation, it is likely that since 2012 the tax savings from property tax relief measures have declined as a percentage of property tax revenues.

Figure 5.6. Total tax savings from property tax exemptions and credits as a percentage of total property tax revenue by State, 2012

5.7.2. Property tax circuit breakers

Unemployed individuals or those unable to work because of a medical crisis and elderly taxpayers with low income but houses that have greatly appreciated in value over time may face economic hardship due to high property tax burdens. Starting in the 1960s a few states developed policies designed to target property tax relief to taxpayers whose property taxes are particularly high relative to their income. Drawing on the analogy to an overcharged electrical circuit, some states developed circuit breakers, which are tax credits designed to partially offset high property tax burdens. In most states, the credits are issued as refundable state income tax credits or as property tax credits mailed directly to taxpayers.

As illustrated in equation 5, a circuit breaker credit to taxpayer j can be defined as a share, α, of the taxpayer’s property tax liability, Tij, in excess of a threshold percentage, β, of the taxpayer’s income, Yj.

(5) CBij = α(Tij – βYj) if Tij > βYj and zero otherwise.

In a state that defined α equal to one and β equal to 5%, the circuit breaker credit would effectively place a 5% ceiling on the property tax burden. It would also mean that as long as the taxpayer’s income remained unchanged, the taxpayer would be completely shielded from any future property tax increases. Facing a tax-price of zero, recipients of circuit breakers in community i may support higher spending, effectively shifting the financing of that spending to other taxpayers.

To discourage excess spending and to reduce the costs of circuit breaker programmes most states give α a value of less than one, thereby requiring that taxpayers pay a portion of their property tax bill that is in excess of the threshold percentage of their income.17 Furthermore, every state with a circuit breaker restricts eligibility by setting a maximum income for eligibility. These income ceilings range from $10 000 in Oregon to $113 150 (for a married couple) in Minnesota. In addition, many circuit breaker programmes specify a maximum circuit breaker payment. Langley and Youngman (2021[22]) report that in 2018 of the 26 states with circuit breaker programmes, the largest number set their maximum benefit between $1 000 and $1 500.

In about half the states with circuit breaker programmes, renters are also eligible. As tenants do not directly pay property taxes, state legislatures must determine a percentage of individuals’ gross rent constituting property taxes and apply this percentage to all rent payments. In 2018, these legislatively-determined percentages ranged from 6% in New Mexico to 25% in Massachusetts and Wisconsin. Although every state which provides circuit breakers to tenants uses a single rent constituting property tax percentage for all eligible tenants, empirical estimates of this percentage indicate large intra-state variations. Allen et al. (2007[30]) estimated that 22% of rent in Milwaukee constituted property taxes, while that percentage was only 13 per cent in Madison, the state’s second largest city. A statewide study conducted by the Minnesota Department of Revenue (2018[31]) determined that the rent constituting property taxes percentage was 16.1% in Minneapolis, 15.5% in St. Paul but only 12.9% in the rest of the state.

In principle, circuit breakers are a powerful tool for reducing property tax payment for those taxpayers facing the highest property tax burdens. As most taxpayers facing the highest burden also have low incomes, circuit breakers can reduce the regressivity of the property tax and increase housing affordability for low-income households. In practice, circuit breakers fail to live up to their potential. Only half the states have circuit breaker programmes, and among those states, circuit breakers are restricted to elderly taxpayers in 14 states (Lincoln Institute of Land Policy/George Washington Institute of Public Policy, 2019[28]).

A few states have robust circuit breaker programmes. For example, in New Jersey all non-elderly homeowners with incomes below $75 000 and elderly homeowners with income below $150 000 are eligible for circuit breakers. Maximum benefits are relatively high, with the maximum for elderly homeowners set at $10 000. New Jersey, however, is not typical. Because many states have low-income ceilings, relatively few taxpayers facing high property tax burdens are eligible for circuit breakers, and among those who are eligible, programme parameters, including low ceilings on benefits, limit the effectiveness of circuit breakers in reducing high property tax burdens.

The state of Wisconsin provides an example of a weak circuit breaker programme (officially called the Homestead Tax Credit). Credits are equal to 80% of the difference between a taxpayer’s property tax and 8.75% of the taxpayer’s income above $8 060 (Spika, 2021[32]). All residents over the age of 18 are eligible. For tenants, property tax payments are assumed to be 25% of rent.18 Circuit breaker credits are limited in a couple ways. First, using a broad definition of income, households’ annual income may not exceed $24 680. Second, the maximum property tax that can be used in calculating the credit is $1 460. This implies that the largest possible credit, payable to households with incomes below $8 060, is $1 168 (80% of $1,460).

Because these maximum income and benefit programme parameters have remained unchanged since 2010, it is not surprising that the number of circuit breaker claimants fell by 47% between 2010 and 2019. In 2019, only 5.4% of Wisconsin households benefited from the state’s circuit breaker, with the average credit equal to $493.19

Another reason for the limited effectiveness of circuit breakers in reducing high property tax burdens among low-income households is the administrative complexity involved in applying for circuit breaker credits. To receive a credit, taxpayers must understand complex instructions and complete lengthy forms that require that they provide a substantial amount of information. Although detailed data are not available, it is likely that some eligible households who are most in need of property tax relief are not receiving circuit breaker credits because they are unaware of the programme or because of the administrative complexities involved in applying for the credits.

5.8. Property tax limitations

Nearly every state places limits on property taxation. Although these limits are usually enacted as a means of providing property tax relief, they are generally not targeted to individuals, but rather constrain the fiscal behaviour of local governments. Based on information from the Lincoln Institute’s Significant Features of the Property Tax database, Langley and Youngman (2021[22]) determined that 37 states imposed property tax levy limits on their local governments, 36 states imposed rate limits, and 18 states imposed assessment limits.20 Although in some states these limits have been embedded in state constitutions, most limits are imposed by statutes, either enacted by state legislatures or by voter-approved referenda.

The primary objective of property tax levy and rate limits is to reduce local government property tax revenues. Unless local governments can shift to alternative sources of revenue, these limits will have the effect of reducing local government spending. Supporters of these tax limitations frequently argue that reducing spending will force local governments to reduce waste and hence, tax limitations will have no adverse impact on public services. However, research has quite consistently shown that property tax limits placed on school districts, which rely heavily on local revenue from the property tax, have resulted in both reduced spending per pupil and reduced academic performance by students (Downes and Figlio, 2015[33]).

The impact of property tax levy or rate limits on housing inequities is far from clear. To the extent that these limitations result in reductions in both property tax revenue and public spending, they are unlikely to have a significant impact on property values. In jurisdictions where property values are rising, and presumably where housing affordability may be a growing problem, property tax levy limits will mandate that local governments lower their property tax rates. Tax rate reductions have similar impacts on property owners of both low-value and high-value properties. As a result, percentage reductions in housing-related costs are likely to be similar for both low-income and high-income households.21

Assessment caps place a limit on annual increases in the assessed values of properties. For example, California’s Proposition 13, a 1978 voter-approved ballot initiative, restricted the annual growth of assessed values to the lesser of 2% or the rate of inflation, with market-value reassessment only occurring upon the sale of the property. In New York City, the annual increase in the assessed value of most houses is limited to 6% and to no more than 20% over a five-year period.

The assessment ratio will decline for any homeowner whose house value is appreciating at a rate greater than the assessment cap. As can be seen in equation 2, this will result in a decline in their effective property tax rate relative to homeowners whose houses are appreciating at rates below the assessment cap. In California, where Proposition 13 also limited the property tax rate to 1%, the assessment cap has resulted in large horizontal inequities in effective property tax rates depending solely on homeowners’ tenure in their house. The property tax bills on two identical and adjacent houses may well vary by a factor of ten or more if one homeowner has lived in their house for decades and the other has just purchased their house.

Aside from the horizontal inequities caused by assessment caps, they can have adverse, and presumably unintended, impacts on housing affordability. In states, such as California, where houses are reassessed to market value only upon sale, current owners have an incentive to remain in their house. Wasi and White (2005[34]) provide estimates of the magnitude of the “lock-in” effect created by Proposition 13. By extending the average length of housing tenure, the assessment cap reduces the supply of houses available for sale and exacerbates housing affordability. It reduces the mobility of the elderly, who have owned their homes for decades and are eager to downsize, and worsens housing affordability, especially for parents looking for larger houses for their families.

When high-value houses appreciate at faster rates than lower-value houses, as is often the case in American central cities, assessment caps are likely to increase property tax regressivity by shifting property tax burdens from the owners of high-value properties (benefiting from the assessment cap) to owners and renters of lower-valued properties unaffected by the assessment cap. This tax burden shifting occurs because to maintain public service levels, local governments must raise property tax rates in response to the reduced size of their tax base due to the assessment caps. As a result of this tax shifting, property taxes are likely to rise for those city residents most likely to be coping with severe problems of housing affordability.22

5.9. The impact of income tax policies on housing costs

While property taxes have the closest direct connection to housing costs, it is important to emphasise that federal and state income tax policies also have a large impact on housing costs. As in many OECD countries, owner-occupied housing relative to rental housing is strongly favoured by income tax policies (OECD, 2022[35]). As in nearly all countries, in the United States the imputed rent on owner-occupied housing is excluded from income subject to taxation. In addition, homeowners who itemise deductions on their federal income tax returns can deduct their mortgage interest payments from their gross income.

For several reasons, the tax savings from mortgage interest deductions have always been skewed towards high income homeowners. The share of taxpayers itemising deductions (rather than taking a standard deduction) rises with income, the tax savings from any deduction is greater for those taxpayers facing higher marginal tax rates, and high-income taxpayers tend to own more expensive houses. An analysis conducted by the Congressional Research Service (Keightley, 2020[36]) found that in 2018, 63.9% of the tax savings from the mortgage interest deduction went to tax filers with income over $200 000, while only 3.4% of the benefits went to taxpayers with income less than $75 000.

The passage of the Tax Cuts and Jobs Act (TCJA) in 2017 resulted in a sharp reduction in the number of taxpayers who itemised deductions.23 In 2017, 30.6% of taxpayers itemised their deductions. As a result of the passage of the TCJA, the percentage of itemisers fell to 11.4% in 2018 and 9.5% by 2020. Between 2017 and 2020, the number of taxpayers taking the mortgage interest deduction fell from 33.7 million to 12.3 million, a decline of 63.6% (Internal Revenue Service, 2022[37]).

Prior to the passage of TCJA, homeowners who itemised deductions were able to deduct property tax payments. The TCJA capped the total deduction of all state and local taxes at $10 000. As a result, the number of tax filers deducting property taxes fell from 39.1 million in 2017 to 13.6 million in 2020, a reduction of 65.4%. Finally, homeowners can exclude from income subject to taxation up to $250 000 ($500 000 for a married couple) in capital gains from selling their home. Subject to some limitations, this tax benefit can be taken several times.

5.10. Conclusions

Many American households, both homeowners and renters, struggle to meet their monthly housing-related expenses. In addition to mortgage or rent payments, households bear the cost of utilities, property insurance, and for homeowners, property taxes, routine maintenance, and in some cases, condominium or homeowner association fees. Based on data from the American Housing Survey, nearly 21 million households (27.1% of all homeowners) had an income below $50 000. Of these households, fully half reported housing costs equal to 30% of more of their incomes. For 22% of these households, housing costs exceeded 50% of their income.

A goal of this paper is to assess the contribution of the property tax to housing affordability and housing equity. The potential capitalisation of both property taxes and local public services into housing values makes it difficult to assess the impact of the property tax on housing affordability. Although property taxes contribute to the annual costs of homeownership, to the extent that property taxes are capitalised into lower housing prices, they may actually make it easier for families to become homeowners.

Housing is unique because housing consumption is always bundled with the receipt of public services. In the United States local governments provide an especially wide array of public services, including primary and secondary education. Although local property taxes play a central role in financing these services, it is important to emphasise that other potential sources of local government revenue, such as local sales or income taxes, would, by lowering disposable income or raising the costs of non-housing expenditures, worsen housing affordability.

In the United States, the property tax is primarily a local government tax with individual state governments playing an important role in mandating how the tax is administered, in authorising property tax relief measures, and in imposing various limitations on local government policies with respect to the property tax. As a result, the potential impact of the property tax on housing costs varies dramatically across states. On average, however, property taxes make up a little under one fifth of total monthly housing costs.

Housing cost burdens decline as income rises. This reflects in part that property tax burdens decline across the income distribution. The paper describes the impact of public policy on the distribution of property tax burdens by tracing the role of property tax administration and assessment procedures, tax reliefs, and tax limitations on the burdens faced by households, especially by those with relatively low income.

The contribution of the property tax to housing inequities also depends on how the property tax operates in different locations. High-quality property tax administration that eliminates or minimises any bias towards regressivity in property tax assessment, combined with a robust system of property tax reliefs that targets those facing high property tax burdens (relative to their incomes) will help reduce property taxes for households facing high housing cost burdens.

Local government services are particularly important for individuals and families with a low and moderate income, who lack the resources to obtain private sector substitutes, such as private schools for their children and gym memberships in lieu of public recreation facilities. The question of whether property taxes contribute to housing inequities focuses on two issues. First, what is the appropriate role of the property tax in funding local public services? Assuming the assignment of functions among levels of governments remains basically unchanged, then the question is whether state and federal governments should play a more important role in financing local government public services, in particular public education.

A shift to more state funding of local government services will likely improve the economic well-being of low- and moderate-income households if state government funding comes primarily from progressive income taxes. The answer is less clear in states that rely heavily on consumption taxes. Also of great importance is the way in which state funding is distributed to local governments. Funding formulas that allocate more state aid to jurisdictions with high housing cost burdens and with high property tax rates are likely to reduce the contribution of property taxes to housing costs.

References

[30] Allen, D. et al. (2007), “The School Property Tax and Homestead Credits: Accuracy, Equity, and Contribution to Overall Fiscal Relief”, Wisconsin Department of Revenue, Report prepared for the Wisconsin Department of Revenue, Madison, WI: Robert M. La Follette School of Public Affairs, May 4.

[25] Amornsiripanitch, N. (2022), “Why Are Residential Property Tax Rates Regressive?”, Working paper (Federal Reserve Bank of Philadelphia), Federal Reserve Bank of Philadelphia, https://doi.org/10.21799/frbp.wp.2022.02.

[19] Ando, A. and F. Modigliani (1963), “The ‘Life Cycle’ Hypothesis of Saving: Aggregate Implications and Tests”, American Economic Review, Vol. 53, pp. 55-84.

[26] Avenancio-León, C. and T. Howard (2022), “The Assessment Gap: Racial Inequalities in Property Taxation”, The Quarterly Journal of Economics, Vol. 137/3, pp. 1383-1434, https://doi.org/10.1093/qje/qjac009.

[12] Bauer, T. et al. (2020), “Local Property Taxation and the Rental Housing Market”, RWI – Leibniz Institute for Economic Research Universtät Duisburg Essen.

[24] Berry, C. (2021), “Reassessing the Property Tax”, SSRN Electronic Journal, https://doi.org/10.2139/ssrn.3800536.

[21] Boldt, R., B. Caruth and A. Reschovsky (2010), “An Empirical Investigation of the Incidence of the Property Tax on Owner-Occupied Housing”, Paper prepared for delivery at the 103rd Annual Conference on Taxation, National Tax Association, Chicago, IL, November 18-20, 2010.

[10] Carroll, R. and J. Yinger (1994), “Is the Property Tax a Benefit Tax? The Case of Rental Housing”, National Tax Journal, Vol. 47/2, pp. 295-316, https://doi.org/10.1086/ntj41789069.

[43] Chernick, H. and A. Reschovsky (2023), Measuring the Fiscal Health of U.S. Cities, IMFG Papers on Municipal Finance and Governance, No. 63, Institute on Municipal Finance & Governance, University of Toronto, https://hdl.handle.net/1807/126243.

[44] Chernick, H. and A. Reschovsky (1997), “Who Pays the Gasoline Tax?”, National Tax Journal, Vol. 50/2, pp. 233-259, https://doi.org/10.1086/ntj41789255.

[23] Dornfest, A. et al. (2019), “State and Provincial Property Tax Policies and Administrative Practices (PTAPP): 2017 Findings and Report”, Journal of Property Tax Assessment & Administration, Vol. 16/1, pp. 43–130.

[33] Downes, T. and D. Figlio (2015), “Tax and Expenditure Limits, School Finance and School Quality”, in Handbook of Research in Education Finance and Policy, Second Edition, edited by Helen F. Ladd and Margaret E. Goertz, Routledge, New York, https://doi.org/10.4324/9780203961063.ch21.

[40] Dye, R. and D. McMillen (2007), “The Algebra of Tax Burden Shifts from Assessment Limitations”, Lincoln Institute of Land Policy Working Paper WP07RD1, https://www.lincolninst.edu/publications/working-papers/algebra-tax-burden-shifts-assessment-limitations.

[9] England, R. (2016), “Tax Incidence and Rental Housing: A Survey and Critique of Research”, National Tax Journal, Vol. 69/2, pp. 435-460, https://doi.org/10.17310/ntj.2016.2.07.

[18] Friedman, M. (1957), A Theory of the Consumption Function, National Bureau of Economic Research, Princeton University Press.

[4] Gabriel, S. and G. Painter (2020), “Why affordability matters”, Regional Science and Urban Economics, Vol. 80, p. 103378, https://doi.org/10.1016/j.regsciurbeco.2018.07.001.

[2] HUD USER (2017), “Defining Housing Affordability”, PD&R Edge; an Online Magazine, August 14, https://www.huduser.gov/portal/pdredge/pdr-edge-featd-article-081417.html.

[37] Internal Revenue Service (2022), “Returns with Itemized Deductions: Sources of Income, Adjustments, Itemized Deductions by Type, Exemptions, and Tax Items”, Statistics on Income, Table 2.1, Publication 1304, November, https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns-complete-report-publication-1304-basic-tables-part-2.

[36] Keightley, M. (2020), “An Economic Analysis of the Mortgage Interest Deduction”, Congressional Research Service Report R46429, Washington, DC, June 25, https://crsreports.congress.gov/product/pdf/R/R46429.

[29] Langley, A. (2015), “How Do States Spell Relief? A National Study of Homestead Exemptions & Property Tax Credits”, Land Lines Magazine, Lincoln Institute of Land Policy, April 24-31, https://www.lincolninst.edu/publications/articles/how-do-states-spell-relief.

[22] Langley, A. and J. Youngman (2021), Property Tax Relief for Homeowners, Policy Focus Report, Lincoln Institute of Land Policy, Cambridge, MA, https://www.lincolninst.edu/publications/policy-focus-reports/property-tax-relief-homeowners.

[41] Lincoln Institute of Land Policy (2014), Significant Features of the Property Tax, Tax Savings from Property Tax Exemptions and Credits in 2012, https://www.lincolninst.edu/research-data/data-toolkits/significant-features-property-tax/access-property-tax-database/residential-property-tax-relief-programs.

[27] Lincoln Institute of Land Policy/George Washington Institute of Public Policy (2022), Significant Features of the Property Tax, Property Tax Classification, 2020, https://www.lincolninst.edu/research-data/data-toolkits/significant-features-property-tax/access-property-tax-database/property-tax-classification.

[28] Lincoln Institute of Land Policy/George Washington Institute of Public Policy (2019), Significant Features of the Property Tax, Residential Property Tax Relief Programs: Summary Tables on Exemptions and Credits and on Circuit Breakers in 2018, https://www.lincolninst.edu/research-data/data-toolkits/significant-features-property-tax/access-property-tax-database/residential-property-tax-relief-programs.

[3] Malpezzi, S. (2017), “Is the American Dream Affordable? A First Look at Housing ‘Affordability”, in New Jersey and the United States, Rutgers Center for Real Estate, https://realestate.business.rutgers.edu/news/american-dream-affordable.

[39] McMillen, D. and R. Singh (2022), “Measures of Vertical Inequality in Assessments”, Lincoln Institute of Land Policy, https://www.lincolninst.edu/publications/working-papers/measures-vertical-inequality-in-assessments.

[31] Minnesota Department of Revenue (2018), “Estimate of the Percentage of Rent that Constitutes Property Taxes in Minnesota: Based on Rent and Property Taxes Paid in 2016”, Report to the Legislature, March 1, https://www.revenue.state.mn.us/sites/default/files/2018-12/Rent%20Constituting%20Property%20Taxes%202018%20%28Feb%2027%29.pdf.

[7] Oates, W. (1969), “The Effects of Property Taxes and Local Public Spending on Property Values: An Empirical Study of Tax Capitalization and the Tiebout Hypothesis”, Journal of Political Economy, Vol. 77/6, pp. 957-971, https://doi.org/10.1086/259584.

[17] Oates, W. and W. Fischel (2016), “Are local property taxes regressive, progressive, or what?”, National Tax Journal, Vol. 69/2, pp. 415-433, https://doi.org/10.1086/ntj44014529.

[5] OECD (2022), “Figure HC1.2.3, Panel B: Housing Costs Over Income”, OECD Affordable Housing Database, https://www.oecd.org/housing/data/affordable-housing-database/housing-conditions.htm.

[35] OECD (2022), Housing Taxation in OECD Countries, OECD Tax Policy Studies, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/03dfe007-en.

[15] OECD (2022), “Twenty years of tax autonomy across levels of government: Measurement and applications”, in Fiscal Federalism 2022: Making Decentralisation Work, OECD Publishing, Paris, https://doi.org/10.1787/599c856a-en.

[13] OECD/UCLG (2022), The OECD/UCLG World Observatory on Subnational Government Finance and Investment, Database, https://www.sng-wofi.org.

[20] Poterba, J. (1989), “Lifetime Incidence and the Distributional Burden of Excise Taxes”, American Economic Review, Vol. 79/2, pp. 325-330.

[42] Rakow, R. (2022), “Comparative Measures of Property Tax Equity in Suffolk County, Massachusetts”, Lincoln Institute of Land Policy Working Paper WP22RR1, August, https://www.lincolninst.edu/publications/working-papers/comparative-measures-property-tax-equity-in-suffolk-county-massachusetts.

[11] Schwegman, D. and J. Yinger (2020), “The Shifting of the Property Tax on Urban Renters: Evidence from New York State’s Homestead Tax Option”, Center for Economic Studies, Working Papers 20-43, Center for Economic Studies, U.S. Census Bureau, https://www.census.gov/library/working-papers/2020/adrm/CES-WP-20-43.html.

[8] Slack, E. and A. Tassonyi (2022), “Unaffordable Housing: Is Property Tax the Villain?”, Perspectives on Tax Law & Policy, Vol. 3/3, pp. 13-15.

[32] Spika, D. (2021), “Homestead Tax Credit”, Informational Paper, No. 13, Wisconsin Legislative Fiscal Bureau, https://docs.legis.wisconsin.gov/misc/lfb/informational_papers/january_2021/0013_homestead_tax_credit_informational_paper_13.pdf.

[16] U.S. Census Bureau (2022), “2017 State & Local Government Finance Historical Datasets and Tables”, 2017 Census of Governments Finance. Table 2: Local Government Finances by Type of Government and State: 2017, revised June 2022, https://www.census.gov/data/datasets/2017/econ/local/public-use-datasets.html.

[45] U.S. Census Bureau (2022), “2021 5-Year American Community Survey, Median Real Estate Taxes Paid (Table B25103) and Median Household Income and Median Monthly Housing Costs (Table S2503)”.

[6] U.S. Census Bureau (2022), American Housing Survey, Table: 2021 National-Housing Costs - All Occupied Housing Units, Owners, and Renters, https://www.census.gov/programs-surveys/ahs/data/interactive/ahstablecreator.html?s_areas=00000&s_year=2021&s_tablename=TABLE10&s_bygroup1=7&s_bygroup2=1&s_filtergroup1=1&s_filtergroup2=1.

[14] U.S. Census Bureau (2022), Annual Surveys of State and Local Government Finances, 2020, Table 1. State and Local Government Finance by Level of Government and by State: 2020, https://www.census.gov/data/datasets/2020/econ/local/public-use-datasets.html.

[1] U.S. Census Bureau (2022), Current Population Survey, Table 16, Homeownership Rates by Race and Ethnicity, https://www.census.gov/housing/hvs/data/histtabs.html.

[34] Wasi, N. and M. White (2005), “Property Tax Limitations and Mobility: Lock-in Effect of California’s Proposition 13”, Brookings-Wharton Papers on Urban Affairs, Vol. 2005/1, pp. 59-97, https://doi.org/10.1353/urb.2006.0013.

[38] Wigger, C. (2022), “Persistence and Variation in the Capitalization of Neighborhood Schools in Housing Markets”, Unpublished paper, Elon University.

Notes

← 1. In a recent paper using a boundary discontinuity research design, Wigger (2022[38]) provides evidence, consistent with previous research, that public school quality, measured by academic test results, is capitalised into higher housing prices.

← 2. Low-quality public services may result from government inefficiencies or because of the weak fiscal health of local governments. See Chernick and Reschovsky (2023[43]) for estimates of the fiscal health of 148 large American central cities.

← 3. While many states take no account of the possible burden of the property tax on tenants, I will discuss tax policies in several states that provide property tax relief to tenants.

← 4. In its 2022 report, the National Association of Realtors (2022) reported that first-time homeowners made up the smallest share of home purchases in the 41 years they have been tracking this information.

← 5. This percentage is calculated as the median monthly real estate tax as a share of the median monthly total housing costs. Data are from the 2021 American Housing Survey.

← 6. In a study of the incidence of the gasoline tax, Chernick and Reschovsky (1997[44]) address the annual income bias inherent in the calculation of consumption taxes by using average incomes over a period of 11-years as a proxy for lifetime income. They find that while regressivity is reduced, the incidence of the gas tax remains regressive.

← 7. Property tax rates are usually defined in mills. A mill is one-tenth of one per cent.

← 8. Some states allow a “classified” property tax system, where different types of property within a jurisdiction can be taxed at different tax rates. In most classified systems, commercial and industrial property is taxed at higher rates than residential property.

← 9. In most states, the standard for good assessment practice is based on an assessment ratio equal to one. However, in some jurisdictions assessed values are set equal to a fraction of market values. For example, in Chicago assessed values are defined as 10 per cent of market value and in Detroit at 50 per cent of market value. In these jurisdictions, higher nominal tax rates compensate for fractional assessments.

← 10. McMillen and Singh (2022[39]) explain why several frequently used measures of the vertical incidence of assessments are biased towards regressivity. To address this issue, they propose three approaches, each of which focuses on the entire distribution of assessments rather than using a single measure to characterizes the entire assessment process.

← 11. Rakow (2022[42]) re-examines Berry’s assessment regressivity results for Suffolk County, Massachusetts. Using data from the Massachusetts Department of Revenue, he finds evidence of the regressivity of assessment ratios, but to a lesser extent than Berry. Berry’s Suffolk County analysis also calculates effective tax rates by property value decile and reports that effective tax rates are regressive over the bottom few deciles. Rakow’s calculation of effective tax rates, which includes the impact of generous homestead exemptions, finds that the pattern of effective tax rates is progressive across market value deciles.

← 12. In Ohio, homeowners are eligible for a percentage credit on their property tax bills. Like a percentage exemption, the credit has no impact on the progressivity of the property tax. Homeowners in Illinois and Wisconsin can receive a state income tax credit on a fixed percentage (5 per cent in Illinois and 12 per cent in Wisconsin) of the property taxes they pay on their principal residence. The maximum credit in both states is fixed at $300 and the credit is non-refundable. As a result, low-income homeowners are unlikely to benefit, or fully benefit, from the credit.

← 13. In some states, only seniors with income below a threshold level are eligible for property tax exemptions.

← 14. Many states also provide property tax relief to specific categories of homeowners such as disabled veterans.

← 15. Three of the states without state-wide property tax relief programmes do however provide local governments with the option of operating their own property tax exemption or credit programmes. No state government funds are used to finance these local option property tax relief programmes.

← 16. Langley’s detailed estimates of tax savings from property tax relief measures can be found at Lincoln Institute of Land Policy (Lincoln Institute of Land Policy, 2014[41]).

← 17. Some states use a “sliding scale” with the value of α declining as taxpayer income rises. Circuit breaker formulas in other states include multiple income thresholds with the value of β higher for higher income households.

← 18. Rent constituting property taxes are equal to 20% of rent when utilities (heat and electricity) are included in the rent.

← 19. According to data from the 2021 5-Year American Community Survey, the median homeowner in Wisconsin paid $3 690 in annual property taxes (U.S. Census Bureau, 2022[45]).

← 20. A local government’s property tax levy is the amount of property tax revenue it intends to raise. Actual property tax revenue may be smaller than the tax levy if the jurisdiction is unable to collect the entire levy.

← 21. If local government services provide larger benefits to low-income households, property tax limits that lead to cuts in public spending may have a larger negative impact on those households.

← 22. Dye and McMillen (Dye and McMillen, 2007[40]) develop a model that identifies the conditions under which an assessment limit will result in property tax increases even for property owners whose assessed values grow at rates above the assessment limits.

← 23. By nearly doubling the standard deduction and capping the amount of state and local taxes that could be deducted, many taxpayers no longer benefited from itemising their deductions.