Governments face budgetary constraints that limit their capacity to invest in long-term resilience and ensure adequate funding to respond to climate-related losses and damages through budgetary tools. The materialisation of fiscal risks from climate change can require rapid and significant adjustments to the level and composition of government revenues and expenditures. This chapter discusses the range of tools that governments can use to manage disaster-related costs, including budgetary instruments, such as budget reallocations and contingency and reserve funds, public guarantees for catastrophe risk insurance programmes as well as financial instruments such as debt financing and risk transfer. The chapter also discusses the role of risk prevention investments to reduce risk exposure. The chapter discusses the adequacy of each tool in different national contexts and for climate risks of varying frequency and severity.

Building Financial Resilience to Climate Impacts

4. Public budgetary and financial instrument options

Abstract

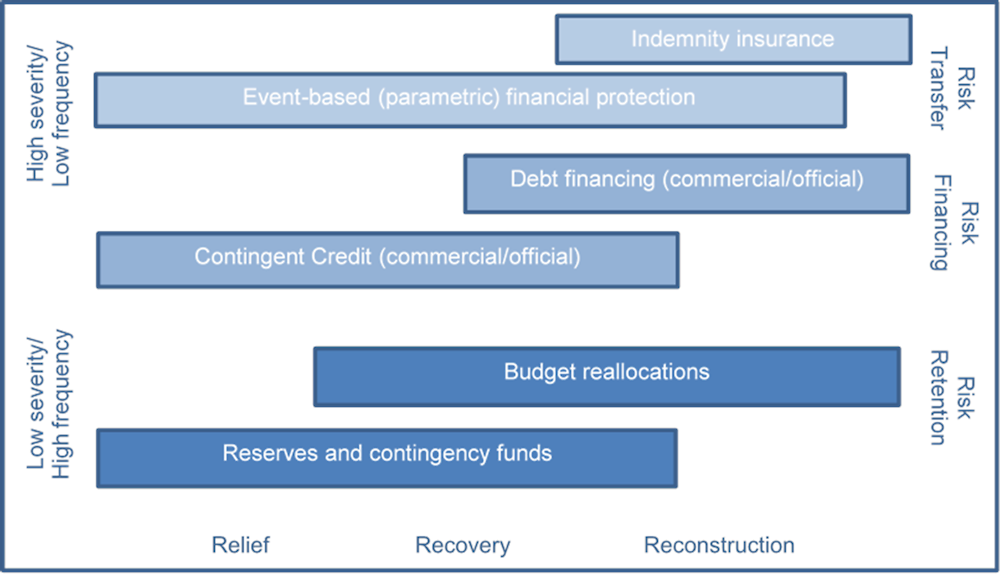

The materialisation of fiscal risks from climate change can require rapid and significant adjustments to the level and composition of government revenues and expenditures. Governments have a range of budgetary and financial tools for managing such disaster costs. The type of hazard and the magnitude of disruptions to economic activity (amongst other factors, as discussed below) determine a government’s optimal post-disaster response. As shown in Figure 4.1, frequent events that cause minor economic disruptions are generally best absorbed using budgetary tools. Lower frequency, higher intensity (or severity) events might best be managed through the use of debt financing and risk transfer. However, not all countries are equivalent in terms of fiscal capacity, to mobilise their budget, use debt financing and access risk financing and risk transfer markets. Different countries will choose different solutions based on the conditions they face. Developing countries – and particularly lower income countries – face different challenges in terms of fiscal capacity and access to capital markets which impacts their ability to fund spending needs through fiscal frameworks and debt financing.

Figure 4.1. Funding approaches to cover contingent liabilities from disasters

Source: OECD

The extent to which governments can leverage these tools depends on rigidities in the budget as well as competing economic, social and political objectives. Considering these pressures, this section reviews the public financial management practices that governments can use to respond to climate-related shocks.

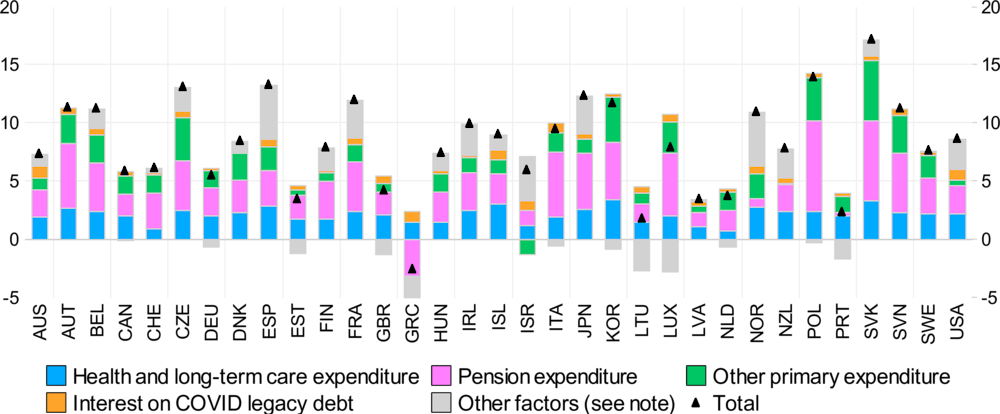

4.1. Long-term fiscal pressures on climate risk management

Countries in different income groups face different fiscal pressures. OECD countries face long-term pressures on public expenditures that are mostly due to their demographic structures. The OECD projects health and long-term care expenditures as well as pension expenditures to respectively increase by an average of 2.1 and 3 percentage points of GDP by 2060 (Figure 4.2). More broadly, public expenditures are expected to increase by about 8% of GDP on average across OECD countries. The demographic structures in lower income countries is however much different. By 2060, the medium-fertility scenario of the United Nations finds that the percentage of the total population above 60 years old will be 34% in high-income countries but only 19% in lower-middle-income countries and 10% in low-income countries (United Nations, 2019[1]).

Figure 4.2. Change in fiscal pressure between 2021 and 2060, % points of potential GDP

Note: The chart shows how the ratio of structural primary revenue to GDP must evolve between 2021 and 2060 to keep the gross debt-to-GDP ratio stable near its current value over the projection period (which also implies a stable net debt-to-GDP ratio given the assumption that government financial assets remain stable as a share of GDP). The underlying projected growth rates, interest rates, etc., are from the baseline long-term scenario presented in section 2. Expenditure on temporary support programmes related to the COVID-19 pandemic is assumed to taper off quickly. The necessary change in structural primary revenue is decomposed into specific spending categories. The component ‘Interest on COVID legacy debt” approximates the permanent increase in interest payments due to the COVID-related increase in public debt between 2019 and 2022. The component ‘Other factors’ captures anything that affects debt dynamics other than the explicit expenditure components (it mostly reflects the correction of any disequilibrium between the initial structural primary balance and the one that would stabilise the debt ratio). This projection excludes climate change adaptation as a source of expenditure pressure.

A common budget constraint that countries of all income groups face is debt vulnerability, that is the knock-on effect that additional expenditures generated by climate hazards and extreme weather events would have on public finances, including in terms of additional debt (see section 4.4.2 below). Across OECD countries, general government debt increased from 52% of GDP in 2007 to 94.3% in 2020 (OECD, 2021[3]). The average net government debt without ageing costs of OECD countries is projected to reach about 145% of GDP by 2060 (Guillemette and Turner, 2021[2]). Lower income countries have experienced a parallel trend. The share of Least Developed Countries (LDCs) and Low-Income Countries (LICs) considered to be at high risk of debt distress or in debt distress by the IMF/World Bank Debt Sustainability Framework has increased from 30% in 2015 to 60% in 2022 (Inter-agency Task Force on Financing for Development, 2022[4]). Yet, little of this was due to the pandemic, as the fiscal response of countries in these income levels was limited. In Middle Income Countries (MICs) and Small Island Developing Countries (SIDS), however, the pandemic strongly contributed to an increase in debt levels. In the coming years, the United Nations expects developing countries’ debt to remain high, supported by high financing needs and the ongoing impact of the pandemic on growth and incomes. Once the recovery from the COVID-19 crisis is well entrenched, fiscal consolidation pressures to reduce debt vulnerability are likely to hamper preventive investments and the use of contingency funds to manage climate risks in both higher and lower income countries. High debt levels not only limit the incentives of countries to make use of these instruments, they can, in some cases, limit the ability of countries to finance short-term recovery and relief. Narrow fiscal space already limited the financing of COVID-19 response measures in a number of middle and low-income countries.

The constraint on fiscal policy imposed by high debt levels is in fact more significant for lower income countries. While the public finances of OECD countries are also exposed to climate risks (Rawdanowicz et al., 2021[5]), LDCs, SIDS are disproportionately exposed to climate change due to their geographic locations and physical features, combined with more limited fiscal capacity (IPCC, 2018[6]; IPCC, 2019[7]). Such high exposure, combined with little fiscal space, makes lower income countries particularly vulnerable to climate hazards.

4.2. Budgetary tools to respond to climate hazards

4.2.1. Reserve and contingency funds

Contingency reserves and reserve funds are budget provisions or dedicated funding pools set aside to address unforeseen expenses. A contingency reserve is a provision within the annual budget that usually rolls over to the next year when not used whereas dedicated reserve funds, including climate or natural disaster funds, are funding pools that accumulate over time. Both of these tools can serve as fiscal buffers to mitigate climate-related risks. When a disaster strikes, governments can swiftly mobilise these reserves and provisions to finance their responses to climate catastrophes and extreme weather events (Radu, 2021[8]). Because they tend to be smaller, contingency reserves are best suited for high-frequency and low-severity disasters such as localised climatic shocks (e.g. floods and droughts) and to cover immediate relief needs (see Figure 4.1). On the other hand, dedicated reserve funds are most appropriate for climate-related hazards that are relatively less frequent and relatively more severe (though still less severe and more frequent than hazards that may be best addressed with debt financing and/or insurance) and to fund longer-term recovery and reconstruction expenses.

In the European Union, for example, most member states have set aside funds for climate-related contingencies. These buffers help countries absorb climate shocks while also supporting their fiscal targets and sustainability by reducing the need for additional borrowing. Governments can hedge their position by relying on a mix of contingency reserves and budgetary reallocations. When disaster costs exceed a country’s reserve and contingency funds, budget reallocations can be used to cover residual expenses. At the same time, making the necessary fiscal savings to finance contingency reserves can discourage governments from overspending in periods of economic growth. Robust fiscal responsibility frameworks that promote these countercyclical savings are therefore particularly important in countries most exposed to climate hazards and extreme weather events (World Bank, 2019[9]).

Although climate disasters and extreme weather events are set to increase in frequency and magnitude, forecasting their precise macroeconomic impacts is uniquely difficult and influenced by a range of factors such as hazard type, affected location and risk management practices in place (as outlined in Chapter 3). As a result, determining the size of reserve and contingency funds can be challenging. Investing too little is costly when a major disaster strikes while investing too much comes at the cost of other expenditure priorities. Considering these trade-offs, governments should try to estimate the annualised relief and recovery costs of climate disasters and other contingencies (Phaup and Kirschner, 2010[10]). These estimates can be calculated from past spending data on disaster relief and recovery or through probabilistic modelling. However, further investments are necessary to implement probabilistic modelling at scale. Reserve funds can then be credited with an appropriation equal to this estimate. Lithuania, for example, has four contingency reserves that amount to around 0.5 percent of total expenditure as of 2017. In Malta, contingency reserves account for 0.1-0.5 percent of GDP and are invested in short-term liquid assets until they are needed (OECD, 2021[11]). Low income and lower middle income countries may have less capacity to set aside funds as contingency reserves or reserve funds given limited revenue generation and significant (and unmet) spending demands to support economic and social development.

Table 4.1. Reserve funds in selected countries

|

Country |

Name |

Contingencies covered |

Details |

|---|---|---|---|

|

Belgium |

National Calamity Fund and National Agricultural Fund |

Storm, earthquake, flood, public sewage overflow, landslides, ground subsidence |

Purpose: providing assistance to public establishments and individuals. Drawdown procedure: prior to any disbursement, there must be a declaration of natural calamity made by the Director of Calamities based on scientific opinion. Approval from the Ministry of the Interior and the Council of Ministers is also required. |

|

Austria |

Austria Catastrophes Fund |

Flood, avalanche, earthquake, landslide, hurricane, hail |

Purpose: assuring the provision of adequate aid to injured persons and the reconstruction of damaged infrastructure. Disaster damage to private property is usually compensated by the states (bundeslander), for up to 20-30% of the loss suffered, and their compensation expenses are 60% reimbursable by the Fund. Damage to public infrastructure in the states or other local jurisdictions is financed up to 50% by the Fund. The Fund covers protective measures and provides financial assistance to victims of disasters (individuals, enterprises). It also contributes to the funding of equipment for disaster relief by the fire brigades. In the event of a disaster, additional funds can also be mobilized by the government for the compensation of losses. |

|

China |

Central Natural Disaster Livelihood Subsidy Fund |

Drought, flood, typhoon, hail, freezing temperatures, snow, earthquake, rock avalanche, landslide, mudslide |

Purpose: ensuring that affected populations can retain a basic living standard after a natural disaster. Size: the fund has an annual budget of CNY 13 billion. |

|

Colombia |

National Fund for Disaster Risk Management (FNGRD) |

Natural disasters, national calamities |

Purpose: funding disaster response costs at the national-level and supporting funding needs at the subnational level Departments have established subnational funds Fondos (Departamentales para la Gestión del Riesgo de Desastres) to support investment and funding needs within the jurisdiction of the department or other subnational authority. The establishment of reserve funds at departmental level is a legislative requirement with the allocation of funds linked to estimates of fiscal risks. |

|

India |

National Disaster Response Fund and State Disaster Response Fund (SDRF) |

Natural calamities, cyclone, drought, earthquake, fire, flood, tsunami, hailstorm, landslide, avalanche, cloud burst, frost, cold wave, pest attack |

Purpose: supporting affected individuals to meet immediate basic needs and regain livelihood. Financial assistance is provided on a case-by-case basis. Drawdown procedure: In order for the funds to be activated the natural calamity must be deemed severe. Currently there are no legislatively entrenched criteria or threshold for a natural calamity to be deemed as severe - the government of India has discretion to categories an event in this way. Funding: the SDRF is the responsibility of the Ministry of Home Affairs with the government of India contributing 75% of the funding for the states in the general category and 90% of the funding for the states in the special category |

|

New Zealand |

National Government Financial Support (CDEM Expense) Local Authority Protection Programme disaster fund |

Earthquake, storm, flood, cyclone, tornado, volcanic eruption, tsunami, other disasters of a catastrophic nature |

Purpose: providing funding to local governments to assist them with critical infrastructure and uninsurable essential services disrupted by a disaster. Local governments have established a Local Authority Protection Programme disaster fund (LAPP) which is a cash accumulation mutual pool operating since 1993 to help local authority members pay their share of infrastructure replacement costs for water, sewage and other generally uninsurable essential services if damaged by natural disaster. The LAPP is to cover a local authority’s 40% share above the threshold set by central government for recovery assistance. |

|

Norway |

National Scheme for Natural Damage Assistance |

Flood, landslide, storm and tempest, earthquake, volcanic eruption, inundation Excluded: lightening, frost and drought |

Purpose: providing assistance to affected populations for damages that cannot be insured through the insurance markets (e.g. damages to roads and bridges or agricultural land or forests). Compensation is capped at a maximum of 85% of total damages with a deductible of NOK 10 000 to be applied on the resulting sum. |

|

The Philippines |

National Disaster Risk Reduction and Management Fund |

Natural disasters, national calamities |

Purpose: funding immediate post-disaster needs. Funding: An annual allocation to the fund is set in the national budget; its size is based on recommendations from the National Disaster Risk Reduction and Management Council (NDRRMC) and subject to the approval of the President. Of the total allocation, 70% is mandated for disaster risk reduction and prevention while the remaining 30% are set aside in a Quick Response Fund available for relief, response, and recovery programmes. Size: PHP 20 billion were allocated to the fund in 2022. |

|

Turkey |

Disaster Reserve Fund |

Natural disaster, earthquake, flood, tornado, hurricane |

The Disaster and Emergency Management Presidency (AFAD) is authorized to allocate the disaster response and recovery budget to the related institutions and the local government in the scope of their needs. In addition to the AFAD budget, the Ministry of Finance has a Disaster Reserve Fund which can be used for the disasters during the period of recovery. |

|

United States |

Capital Fund |

Extraordinary events, earthquake, flood, tornado, hurricane |

Purpose: providing assistance to help rebuild public housing where existing insurance is exhausted or not available. The Capital Fund assists government departments and housing authorities to pay for reconstruction of public housing when insurance has been exhausted and there is no other federal assistance. The Capital Fund is for presidentially declared disasters and non-presidentially declared disasters for damages arising from extraordinary events. |

|

European Union |

EU Solidarity Fund |

Major natural disasters |

Purpose: providing assistance to EU member states facing large-scale disasters causing more than 3 billion EUR in damages or over 0.6% of gross national income in the affected country. Size: the Fund’s annual budget is EUR 500 million. The maximum amount available for extraordinary regional disasters is limited to 7.5% of the Fund’s annual budget. Drawdown procedure: the approval of the European Parliament and Council of the European Union are required prior to the release of the full grants. Advanced payments of up to 10% of the anticipated support package are available to eligible countries. |

Source: Adapted from (OECD, 2015[12]), (European Commission, 2019[13])

Note: as discussed below, reserve funds can also be used to fund risk reduction.

The conditions for the disbursement of these reserves vary across countries – some reserve funds target contingencies in general while others have explicit criteria tying them to natural disasters in particular. In Malta, drawdowns from the contingency reserve can be made with the approval of the House of Representatives in case of “urgent, temporary and unforeseen circumstances”. Disbursements from reserves that target more specific contingencies are generally underpinned by a legal provision or an official declaration of emergency by the government. In Belgium, for example, the Director of Calamities must make an official declaration of calamity based on scientific opinion prior to any disbursements from the National Agricultural Fund and the National Calamity Fund. Subsequent approvals by the Ministry of the Interior and the Council of Ministers are required and then followed by a Royal Decree signed by the monarch and published in the Belgian Official Gazette (OECD, 2015[12]).

The timely deployment of funds is essential to tackle the immediate challenges posed by climate disasters and extreme weather events. There is a need for proper operational preparedness, that is systems and processes to allow pre-arranged funding to flow to the targeted beneficiaries. The lack of such systems often results in delayed response (rather than the lack of funding) At the same time, fast-tracking the disbursement of reserves may create opportunities for the mismanagement of funds by compromising oversight mechanisms and routine audit exercises. To prevent the misallocation of emergency funds, countries can implement additional safeguards. For example, automatic triggers can allow for the rapid disbursements of contingency funds when certain measurable conditions are met (e.g. strong wind gusts, extreme temperatures, heavy rainfall…). Contingency reserves can also target specific expenses such as social security and health insurance rather than general disaster-related costs. However, earmarking disaster relief to specific expenses can also create fiscal rigidities. These constraints may be particularly challenging in the case of climate disasters as they can have unpredictable consequences on economic activity.

Ex ante budgetary tools (contingency reserves and reserve funds) act as fiscal buffers that provide quick liquidity to cover immediate post-disaster financing needs. Reserve funds can also help governments cover the longer-term costs of recovery and reconstruction efforts. They can help support economic growth by accelerating the implementation of rehabilitation projects in the aftermath of climate disasters. From 1999 to 2021, Mexico’s FONDEN provided additional funds to states and local agencies that incurred disaster costs beyond their financial capacity. Research estimates that municipalities with access to FONDEN assistance grew 2-4 percent more than those without in the year following a natural disaster (de Janvry, del Valle and Sadoulet, 2016[14]).

Natural disaster funds are not without limitations. Setting aside part of the budget for an uncertain future creates an opportunity cost as the resources could be allocated elsewhere. When other spending needs are not met, these funds become politically costly. In addition, the rapid use of these funds in case of an emergency can expose governments to some critics, especially when oversight controls are relaxed. The opportunity cost in setting aside substantial funds for responding to climate-related events will be higher in low and lower middle income countries with significant other unmet spending demands.

4.2.2. Budgetary reallocations

In case of an emergency, appropriations set in the budget can be reallocated across programmes, budget lines and ministries, or even across local governments. Budgetary reallocations allow governments with some degree of budgetary flexibility to provide swift funding where it is most needed. They are the first line of response to high-frequency, low-intensity hazards such as localised weather events that cause moderate damage (e.g. localised floods, droughts, wildfires, excessive rain and heat…). Reallocations of resources allow a government to reshuffle expenditures within the bounds of its approved budget, therefore limiting the shock on fiscal targets. In the OECD, around 75 percent of countries allow for the re-allocation of funds across budget lines without parliamentary pre-approval (OECD and World Bank, 2019[15]). Slovenia, for example, has budgetary provisions in place to allow for the reallocation of funds in case of a natural disaster. In contrast, Finland is an example where no such flexibility exists, even if the country has a large stockpile of special public physical reserves which can be mobilised in case of an emergency. The budgetary framework for emergencies only allows for the reallocations of appropriations within the spending limits set over the medium term in a supplementary budget.

Research suggests that most countries have at least some room for manoeuvre in their budget (Hochrainer-Stigler et al., 2014[16]). According to estimates and government officials, diversions from the budget are usually limited to 10 percent of revenues (Ibid.). Still, countries can face tight budgetary conditions that make any shift from the budget impossible, especially in post-disaster contexts or during an economic crisis. Evidence suggest that budget reallocations are not an option for 15 percent of all countries because of fiscal capacity constraints (Ibid). In developing countries, the reallocations of budgeted funds might be impossible given tight government financial constraints.

Depending on the size of the climate hazards to be absorbed, budget reallocations can be costly as they put other objectives at risk. Shifting resources from one spending priority to another can cause disruptions in the provision of public goods and services that play a critical role in supporting long-term economic growth and that also provide safety nets for affected households and businesses. In developing countries, the reallocations of budgeted funds can derail long-term economic and social investments and undermine development strategies. Rigidities in the budget can also make reallocations of resources challenging. For example, there is little room to manoeuvre in a budget dominated by mandatory spending on pensions, civil service wages and debt servicing. As a result, governments may be forced to cut discretionary spending and delay capital investments.

4.2.3. Catastrophe risk insurance programmes and public guarantees

Broader availability of affordable insurance coverage for losses and damages faced by households and businesses (as well as subnational governments) should reduce government expenditure needs. While there are a number of policy, regulatory and supervisory approaches that can enhance the availability of affordable insurance (as outlined in section 5.1.2), governments can also use balance sheet measures to address some of the challenges to the availability of affordable insurance.

In many countries, catastrophe risk insurance programmes have been established to broaden the availability of affordable insurance coverage for households (and often businesses) against climate-related risks. These programmes provide direct insurance, co-insurance, reinsurance – and often a government backstop – for climate-related risks (Table 4.2 provides selected examples of government-backed programmes1 for climate-related perils).

Table 4.2. Catastrophe risk insurance programmes for climate risks: selected examples

|

Programme |

Climate-related perils |

Type of insurance coverage |

Public sector involvement |

|---|---|---|---|

|

Algeria (Compagnie Centrale de Réassurance) |

Flood, storm and tempest, landslide |

Reinsurance |

CCR is a government entity backed by an unlimited government guarantee |

|

Australia (Cyclone reinsurance pool) (under development) |

Cyclone (wind and flood) |

Reinsurance |

Administered by ARPC, a government enterprise that benefits from a government guarantee for excess cyclone losses1 |

|

France (CATNAT) |

Flood, landslide, mudslide, avalanche, subsidence and high winds |

Reinsurance |

CCR, the reinsurance provider that administers CATNAT, is a government entity backed by an unlimited government guarantee |

|

Iceland (Natural Catastrophe Insurance of Iceland (NTI)) |

Landslides, avalanches, river, costal and glacial flood |

Direct insurance |

NTI is a government entity backed by an unlimited government guarantee (although overall indemnity limits apply per event) |

|

Romania (Pool-ul de Asigurare împotriva Dezastrelor Naturale (PAID)) |

Flood, landslide |

Co-insurance/ reinsurance |

PAID may borrow funds from the Ministry of Public Finance if claims exceed the company’s financial resources |

|

Spain (Consorcio de Compensación de Seguros (CCS)) |

Flood, windstorm |

Direct insurance |

CCS is a government entity backed by an unlimited government guarantee (although self-financed with its own capital and reserves) |

|

United States (National Flood Insurance Program) |

Flood |

Direct insurance |

NFIP is administered by the Federal Emergency Management Agency (a government agency) The NFIP collects premiums and has the authority to borrow from the US Treasury. NFIP has transferred part of its risk to private reinsurance companies and capital market investors |

1. The guarantee is annually reinstated at AUD 10 billion and would be called upon in the event that funds from the pool are insufficient to meet claims costs. Each year, the guarantee resets to AUD 10 billion if it was called on in the previous year. However, in the event that a single year has an event or events exceeding the AUD 10 billion of the guarantee, the Government must fund any shortfall to ensure that the pool meets all its obligations. This means an event or event of greater than AUD 10 billion would still be covered by the guarantee.

In France, the state provides government-guaranteed reinsurance for a number of climate-related hazards (e.g. floods, severe storms and landslides) and other natural hazards (e.g. volcanic activity and earthquakes) for both public and private assets. The French CATNAT programme is funded by a mandatory insurance premium applied to all property insurance policies, fixed by the state at a uniform rate for all policies covering properties and motor vehicles. In case of a major disaster requiring insurance payouts beyond 90 percent of the special reserve and annual defined equalisation reserves, the government is required to step in (OECD and World Bank, 2019[15]). By bearing the residual costs of extraordinary climate disasters and extreme weather events, the government can prevent illiquidity while ensuring the provision of affordable insurance coverage. The mandatory nature of the insurance offer helps to ensure broad coverage and avoid adverse selection.

In Australia, the government has implemented a government-backed reinsurance pool for cyclone and related flood damage. The pool will promote resilience by promoting access to more affordable insurance (through the provision of lower cost government-backed reinsurance) for households, strata owners, and small businesses in areas prone to cyclones. Reinsurance premiums provide discounts for properties that have undertaken cyclone damage mitigation measures. This reinsurance pool is operated by the Australian Reinsurance Pool Corporation (ARPC) and is backed by an annually reinstated AUD 10 billion government guarantee. The guarantee ensures that the ARPC will be able to pay any liabilities in the case of a major cyclone event causing significant damage or in a year marked by multiple cyclones. The Australian government has designed the reinsurance pool to be cost-neutral over time, based on estimations of the cost and frequency of cyclone events. The government will also collect data on cyclone and flood related costs to inform natural disaster risk management policy.

Government-backing for these programmes as a contingent credit or guarantee provider creates potential fiscal risks should a programme not have sufficient financial capacity to meet its claims obligations. However, most of the programmes operate at a relatively high-level of financial resilience. The amount of premiums collected and reinsurance/retrocession protection acquired by many of the programmes has been significantly greater than insured losses from the largest events (since 1990) and only a few programmes have received loans or payments from governments.2

4.3. Risk prevention investments to reduce risk exposure to climate change

Governments can promote investments in climate change adaptation ex ante to reduce social and economic exposure to future losses and damages. This focus on ex ante risk prevention generally relies on a mix of different types of interventions. Risk prevention efforts may involve costly structural investments in physical public infrastructure to make it more resilient to climate change and extreme weather events. Other public sector interventions, known as non-structural measures, involve policies and regulations to reduce exposure and encourage private investment in climate-change adaptation (e.g. zoning regulations that outlaw construction in high-risk areas, building codes, etc.).

Returns on both structural and non-structural investments are generally high and can reduce losses from hazards. For example, 17 out of 20 responding countries to an OECD survey on flood risk financing asserted that structural investments in physical infrastructure contributed to a reduction in flood risks (OECD, 2017[18]). Calculations by a private reinsurance company indicate that EUR 2.2 billion investments in flood protection infrastructure since a storm surge hit the city of Hamburg in 1962 and caused losses of EUR 1.6 billion have protected the city from four coastal floods of similar magnitude and prevented EUR 17.5 billion of losses (Munich Re, 2012[19]). There is also some evidence that investments in resilience can support higher sovereign credit ratings and reduce borrowing costs (see subsection below on Risk financing: commercial lending markets in section 4.4.1).

Despite the benefits noted above, there is strong evidence that the share of expenditures to respond to disasters is still overwhelmingly higher than ex ante spending for risk reduction (OECD and World Bank, 2019[15]). Despite the financial benefits of undertaking investments to reduce climate-related risks, governments have few political incentives to do so. For voters, the material gains of such investments are much smaller than recovery and relief measures. In addition, a tight fiscal environment makes it more difficult to make structural investments in physical infrastructure. They directly add to budget deficits while their financial benefits are difficult to communicate as climate hazards are by nature unpredictable.

To minimise ex-ante spending for risk reduction, governments can further exploit their regular spending channels and notably public procurement expenditures which account for almost a third of annual total government expenditures across OECD countries (OECD, 2021[20]). Several countries are looking at mainstreaming climate change considerations into their purchasing decisions. For example, in the United States, the Federal Acquisition Regulations (FAR) Council has proposed changes to the Regulations to minimise the risk of climate change in Federal procurement through disclosure of GHG emissions reduction targets for suppliers or incentives for environmental innovation. This is a direct response to the Executive Order 14030 on Climate-Related Financial Risk (White House, 2021[21]). Other countries are implementing life-cycle costing techniques to inform decision-making when procuring goods, services and public works. These techniques allow for the accounting of direct and indirect costs in addition to the upfront price of purchasing which contributes to selecting products that display greater resilience to environmental externalities.

4.3.1. Funding for risk reduction and prevention

Countries can mobilise a number of policy and funding tools to promote investment aimed at reducing climate-related risks. Costa Rica, Mexico, Peru and Chile have, for example mainstreamed climate change and natural hazard considerations into public investment management systems. Mexico incorporated standardised sustainability criteria into cost-benefit analyses of public investment projects (Delgado, Eguino and Pereira, 2021[22]).

Responsibilities for managing and investing in risk prevention measures vary across countries. In Japan, responsibilities for disaster risk reduction and mitigation are shared across government levels. In Australia and New Zealand, local governments have primary responsibility for implementing structural and non-structural prevention measures. Some national governments have also established financial incentives for subnational governments to invest in risk reduction measures. This is the case in Austria, for example, where the central government provides co-financing up to 40% for physical risk reduction investments (OECD, 2017[18]). Such policies exist to reduce moral hazard and the expectation of subnational governments that central governments will bear the full costs of disasters.

Accumulated funds in reserve funds can provide a source of funding for risk reduction investments. Governments may also fund investments in hard infrastructure or general risk prevention projects through reserve funds. In Mexico, the FONDEN fund, which was a disaster management fund, had a sub-fund, FOPREDEN, devoted to ex ante risk prevention expenditures (OECD, 2013[23]). Both France (Fonds de Prévention des Risques Naturels Majeurs or Barnier Fund) and Austria (Katastrophenfond) have reserve funds that can be used to finance rehabilitation projects from climate hazards as well as invest in ex ante risk prevention projects.

Catastrophe risk insurance programmes in some countries also provide a source of funding for risk reduction investment. For example, in Switzerland, public insurers for real estate allocate approximately CHF 80 million annually to fund and subsidise loss mitigation efforts (both before and after a loss) in order to increase the resilience of buildings against natural perils (AECA, 2019[24]). In France, a portion of the surcharge applied to each policy for natural catastrophe risk (12%) is transferred into the Barnier Fund to finance risk reduction and prevention measures. The fund was initially established to support the acquisition of high-risk properties damaged by a catastrophe event although the scope of its activities (as well as the share of the premium surcharge allocated to the fund) has increased over time to include other types of investments in risk reduction (Cazaux, Meur-Férec and Peinturier, 2019[25]). In 2021, the fund was integrated into the national budget with an expanded allocation to invest in risk reduction (OECD, 2021[26]).

In some countries, catastrophe risk insurance programmes have been designed to incentivise investment in risk reduction. For example, in the United States, the insurance coverage provided to households and businesses through the publicly-backed National Flood Insurance Program is only available in communities that implement specific floodplain management measures (Kousky, 2018[27]). In France, households and businesses face higher deductibles on their insured losses in cases where the property has suffered repetitive losses and if the municipality has not implemented a risk reduction plan.

Governments can also access debt financing to fund investments in risk reduction/ adaptation (where there is capacity to issue new debt). Government bonds that are issued with the aim of achieving environmental or social objectives can be issued as thematic bonds which may have some benefits in terms of cost of funding (see Box 4.1). Green bonds are a form of fixed income security where the borrowed funds are to be used to achieve positive environmental impacts, including for climate change adaptation (such as efforts to improve infrastructure resilience as well for information support systems, such as climate observation and early warning systems) (ICMA, 2021[28]). Social bonds are a form of fixed income security where the borrowed funds are to be used to achieve positive social impacts, including access to services, housing, food security and social advancement for target groups (including those that are vulnerable as a result of natural disasters) (ICMA, 2021[29]). As of March 2022, at least 30 sovereign issuers (from developed and developing economies) have issued ESG-labelled bonds - raising approximately USD 240 billion in financing. Green bonds accounted for approximately four-fifths of the volume of issuances (OECD, 2022[30]).

Box 4.1. Increasing investor appetite for green and other thematic bonds

There is some evidence of increasing demand for investments such as thematic bonds that meet Environmental, Social, and Governance (ESG) objectives, driven partly by voluntary initiatives related to climate risk disclosures (Klusak et al., 2021[31]) – although the definition of what constitutes an ESG asset varies across countries and over time. According to one estimate, ESG-based assets could reach USD 53 trillion by 2025, equivalent to approximately one third of all assets under management (Sidley Austin LLP, 2022[32]). Thematic bonds issued by a government have the same level of credit risk as other bonds issued by that government (Imrana Hussain, 2022[33]). While some green and/or social bonds have been priced fairly consistently with other government issuances of similar tenor (e.g. Thailand’s issuance of a sustainability bond in August 2020), others appear to have benefited from lower pricing due to significant demand (e.g. Egypt’s green bond and Mexico’s Sustainable Development Goal bond, both issued in 2020 as well as Indonesia’s green sukuks issued in 2018 and 2019) (Imrana Hussain, 2022[33]). However, better pricing for ESG-related bonds may be due to significant demand for such assets that exceeds current supply. As a result, the pricing advantage may decline over time if the sovereign issuers increase the issuance of ESG-related bonds (although sovereign issuers that demonstrate sustainability in their policies might still benefit from a lower cost of borrowing) (OECD, 2022[30]).

Proceeds from a number of green bonds have been used to finance climate change adaptation. In 2017, Fiji issued a green bond to fund the rehabilitation of schools and other structures that had been impacted by cyclones and to invest in improved drainage and coastal protection (Qadir and Creed, 2021[34]). In 2019, the Netherlands issued a green bond to fund sustainable water management, including investments in flood risk reduction (Qadir and Creed, 2021[34]). In Norway, a local government funding agency (Kommunalbanken) issued a green bond to fund climate mitigation as well as adaptation measures such as improving infrastructure resilience to flood risks (Qadir and Pillay, 2021[35]). According to one estimate, approximately 16.4% of green bonds have been issued to finance some activities related to climate adaptation and resilience (Qadir and Pillay, 2021[35]).

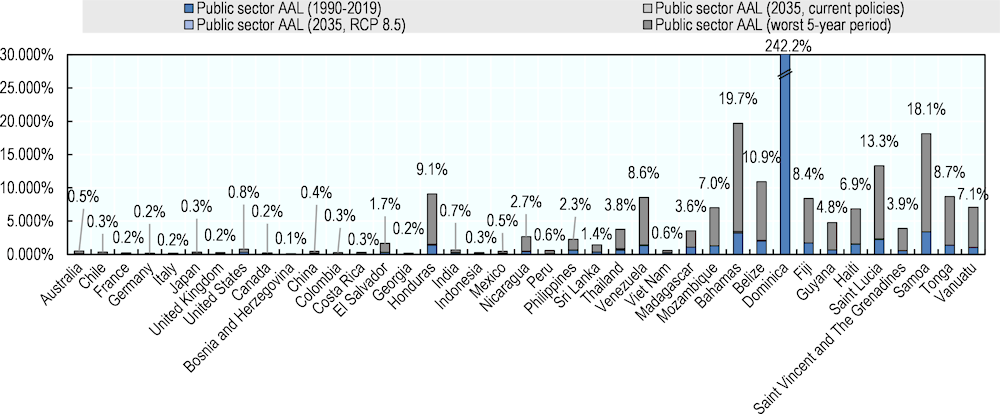

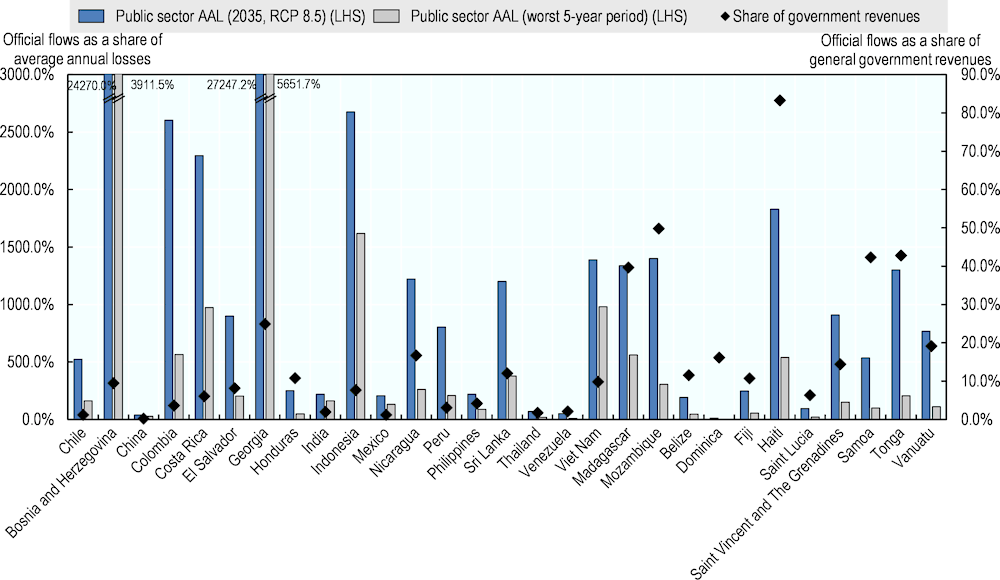

4.4. Financial instrument options

For some climate-related catastrophes, and particularly major events, budgetary tools such as reserve funds may not provide sufficient funding to meet post-event government expenditure needs. Not all countries enjoy sufficient fiscal space. For many governments (particularly in lower-income countries), the potential public sector share of losses from climate-related catastrophes are equivalent to a significant share of general government revenues which would make it extremely challenging to fund recovery and reconstruction spending needs through current revenues (see Figure 4.3).

Figure 4.3. Potential climate losses and damages as a share of general government revenues

Note: General government revenues are for 2019. Public sector AAL (1990-2019) is calculated as 35% of the average losses per year between 1990 and 2019. Public sector AAL (2035, current policies) incorporates the estimated increase in flood and tropical cyclone losses in Climate Impact Explorer “NGFS current policies” scenario. Public sector AAL (2035, current RCP 8.5) incorporates the estimated increase in flood and tropical cyclone losses in Climate Impact Explorer “RCP 8.5” scenario. Public sector AAL (worst 5-year period) refers to 35% of average annual losses for 1990-1994 (Costa Rica, Haiti, Samoa, United Kingdom), 1995-1999 (France, Honduras, Venezuela), 2000-2004 (Belize, Germany, Italy, Madagascar), 2005-2009 (Dominica, Guyana, Nicaragua), 2010-2014 (Australia, Bosnia and Herzegovina, Canada, China, Colombia, El Salvador, Georgia, Indonesia, Mexico, Philippines, Saint Lucia, Saint Vincent and the Grenadines, Thailand), 2015-2019 (Bahamas, Chile, Fiji, India, Japan, Mozambique, Peru, Sri Lanka, Tonga, United States, Vanuatu, Viet Nam).

Source: OECD calculations based on catastrophe economic loss data from (Swiss Re sigma, 2020[36]), estimates of future economic losses from Climate Impact Explorer (Climate Analytics et al., n.d.[37]) and data on general government revenues from (IMF, 2021[38]).

Governments can borrow to meet budgetary needs, either through pre-arranged (ex ante) contingent credit arrangements (available to developing countries from official sources) or ex post borrowing from banks, capital markets or official lenders. They can also enter into various types of risk transfer arrangements in order to access the funding needed for post-event recovery and reconstruction, either through arrangements to meet general spending needs or to provide indemnification for damages and losses incurred to specific public assets. This section will provide an overview of risk financing and risk transfer tools, their use in different countries as well as the relative advantages and limitations of different risk financing and risk transfer options.

4.4.1. Funding public budgetary needs through risk (debt) financing

Governments (national and subnational) regularly access commercial lending and capital markets to meet a variety of funding needs, including funding needs related to recovery and reconstruction in the aftermath of a climate-related catastrophe.

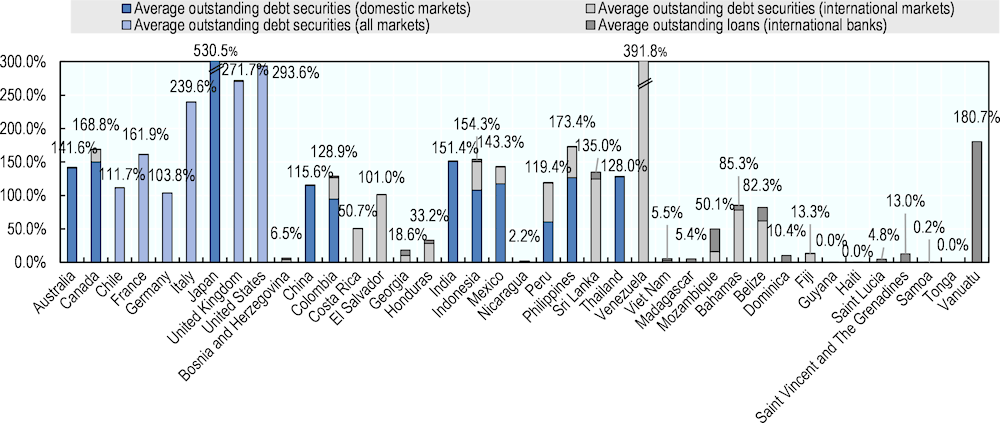

Risk financing: commercial lending markets

In general, national and subnational governments have access to funds for general government funding needs through loans extended by domestic and international commercial banks and bills and bonds issued in capital markets – although access to credit varies significantly across countries. Some governments (particularly in low-income countries) depend more on commercial bank lending (as well as access to loans and grants from official sources) for government borrowing while others (particularly high-income countries) tend to fund government borrowing needs almost exclusively by issuing bills and bonds in either domestic or international capital markets (or both) (see Figure 4.4). Developing countries (particularly low-income countries) tend to rely more heavily on international capital markets and external creditors due to the limited development of local capital markets and the limited availability of domestic savings (An and Park, 2019[39]).

Figure 4.4. Outstanding loans and debt securities as a share of public revenues (selected countries)

Note: Outstanding loan and debt securities is calculated as the average outstanding at year-end between 2016 and 2020. Public revenues are for 2019.

Source: OECD calculations based on general government revenue data from (IMF, 2021[38]) and data on loans and debt securities outstanding from (BIS, 2022[40]), (BIS, 2022[41]).

Governments can access commercial bank loans and issue debt (i.e. debt financing) to fund the spending needs that arise as a result of climate-related catastrophes although the availability and cost of debt financing varies across countries. In lower-income countries, domestic debt financing capacity is more limited while international debt financing may be difficult to access in the aftermath of a major catastrophe (Hochrainer-Stigler et al., 2014[16]). Only a few larger middle-income countries (as well as a number of developed countries) have access to significant financing from domestic debt markets (e.g. China, Colombia, India, Indonesia, Peru, Thailand) – most smaller middle-income countries, low-income countries and small island developing states only have access to international bond markets (or no access at all). International bond markets often require issuance in international currencies such as USD or EUR which leads to foreign exchange risk for issuing countries and which ultimately must be paid using available foreign exchange reserves and earnings.

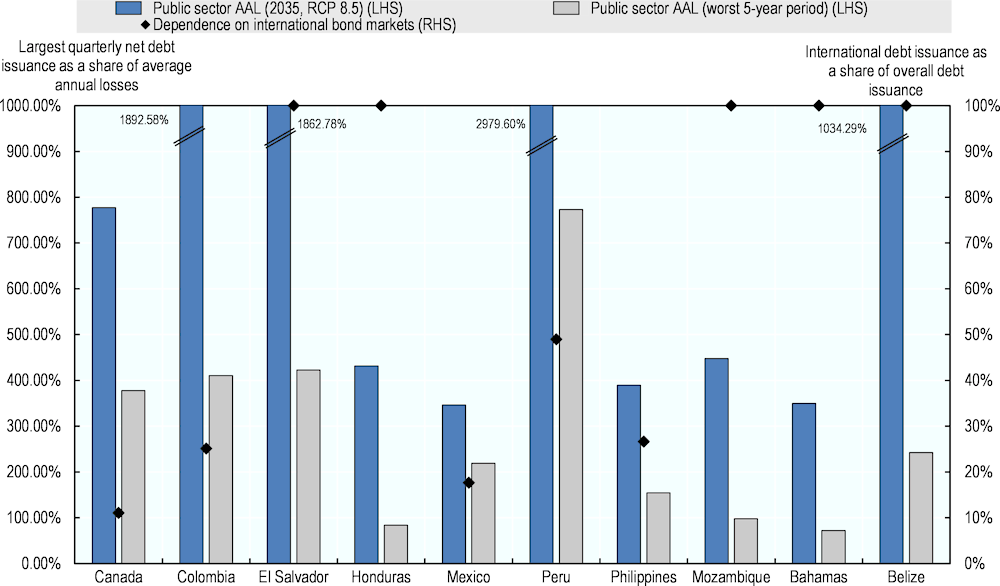

Figure 4.5 provides an illustration of the potential international borrowing capacity of governments in selected countries (measured as the largest quarterly net debt security issuance in international markets between 2016 and 2020) relative to potential climate-related catastrophe losses. For most developed countries and many upper middle-income countries, past international bond market issuance has demonstrated market capacity that is well above any potential financing needs for the public sector share of losses and damages. However, in some middle- and lower- income countries and small island developing states, past borrowing through international debt issuance is not significantly higher than potential future or significant past climate losses – which could be particularly challenging for countries whose debt issuance is dependent on international markets. The figure below should be considered illustrative as the level of recent net debt issuance in international markets is not necessarily a perfect indicator of potential market appetite as investors may be willing to provide significantly more debt financing than has been accessed in the recent past.

Figure 4.5. Illustrative international borrowing capacity relative to potential climate losses and damages

Note: Public sector AALs (average annual losses) are calculated as 35% of overall losses. Public sector AAL (2035, RCP 8.5) incorporates the estimated increase in flood and tropical cyclone losses in Climate Impact Explorer “RCP 8.5” scenario. Public sector AAL (worst 5-year period) refers to (35% of) average annual losses for 1990-1994 (Costa Rica, Haiti, Samoa, United Kingdom), 1995-1999 (France, Honduras, Venezuela), 2000-2004 (Belize, Germany, Italy, Madagascar), 2005-2009 (Dominica, Guyana, Nicaragua), 2010-2014 (Australia, Bosnia and Herzegovina, Canada, China, Colombia, El Salvador, Georgia, Indonesia, Mexico, Philippines, Saint Lucia, Saint Vincent and the Grenadines, Thailand), 2015-2019 (Bahamas, Chile, Fiji, India, Japan, Mozambique, Peru, Sri Lanka, Tonga, United States, Vanuatu, Viet Nam).

Source: OECD calculations based on quarterly data on net debt securities issuance in international markets from (BIS, 2022[40]), estimates of future economic losses due to floods and tropical cyclones from Climate Impact Explorer (Climate Analytics et al., n.d.[37])Source: OECD calculations based on quarterly data on net debt securities issuance in international markets from (BIS, 2022[40]), estimates of future economic losses due to floods and tropical cyclones from Climate Impact Explorer (Climate Analytics et al., n.d.[37]) and data on catastrophe losses from (Swiss Re sigma, 2020[36]). (Climate Analytics et al., n.d.[37]) and data on catastrophe losses from (Swiss Re sigma, 2020[36]).

The cost of debt financing also varies significantly across countries. Credit ratings are the main factor in determining the interest rate of debt securities issued by sovereign borrowers (i.e. the cost of debt financing through bond issuance) and are a major factor in determining interest rates on loans extended by commercial banks3 (i.e. the cost of debt financing through commercial bank loans). The damages and losses that result from a climate-related catastrophe can lead to a deterioration in public finances, and the current account, which has a direct impact on the capacity of governments to repay creditors (or external creditors in the case of a deteriorating current account balance) (An and Park, 2019[39]). One analysis of the impact of natural disasters on credit ratings (based on past events) found that a large event with damages equivalent to 10% or more of GDP led to ratings downgrade of approximately 0.5 notches across the sample with more significant impacts in the case of meteorological and climatological catastrophes (such as floods, storms and droughts) and in developing countries relative to developed countries (An and Park, 2019[39]).4

In addition, the increasing integration of climate and other Environmental, Social and Governance (ESG) factors into credit ratings and credit pricing decisions5 could potentially increase the future cost of debt financing for countries (particularly lower-income countries) that are vulnerable to climate risks. For example, an analysis by one major credit agency found that the “credit impact scores” of ESG factors, which provide a measure of the impact of ESG factors on credit ratings, were very highly or highly negative in just over 60% of the 107 emerging market sovereigns included in the analysis, driven in many cases6 by climate-related physical risks (Moody’s, 2021[42]). Similarly, an IMF analysis for the period 1995 to 2017 found that a measure of climate vulnerability in developing countries had a significant negative impact on credit ratings and that a measure of climate resilience had a significant positive impact (Cevik and Tovar Jalles, 2020[43]).7

There is some evidence that investors are already demanding higher yields from sovereign issuers in developing countries that are particularly vulnerable to climate change physical risks, even where that risk is not yet reflected in credit ratings (Semet, Roncalli and Stagnol, 2021[44]).8 Similarly, the increasing use of climate stress testing in banking supervision could impact the risk-weighting of banks’ loan assets and lead to higher debt financing costs for sovereigns in countries that face higher climate vulnerability9 (with the possibility that banks are already rating climate vulnerable sovereigns higher even if capital requirements have not been calibrated to do so).

As the impacts of climate change materialise (particularly under high-emissions/low-mitigation scenarios), the impact on credit ratings and the cost of debt financing could become much more significant. One analysis that applied climate modelling to credit rating methodologies to estimate future rating impacts found that climate change could lead to ratings downgrades of approximately 1.02 notches for 63 sovereign issuers as soon as 2030 (under the RCP 8.5 climate scenario), increasing to downgrades of approximately 2.48 notches for 80 sovereign issuers by 2100 (Klusak et al., 2021[31]). An analysis of the potential impact of future hurricane risk on credit spreads and access to debt markets in seven Caribbean countries found that credit spreads could increase by 95 basis points on average and access to credit could decline, although with significant variation across the sample of countries (Mallucci, 2022[45]).

Borrowing by the government, particularly in domestic credit markets, could also crowd-out the availability of financing for other segments of society affected by climate-related catastrophes. For example, there is some evidence that, particularly in countries that implement capital controls, lending to those affected by natural disasters reduces credit availability in unaffected regions (Ivanov, Macchiavelli and Santos, 2022[46]). This suggests that domestic credit supply is limited and could result in unmet demands if external financing is limited by capital controls or reductions in the appetite of external lenders for credit risks in countries affected by major catastrophes.

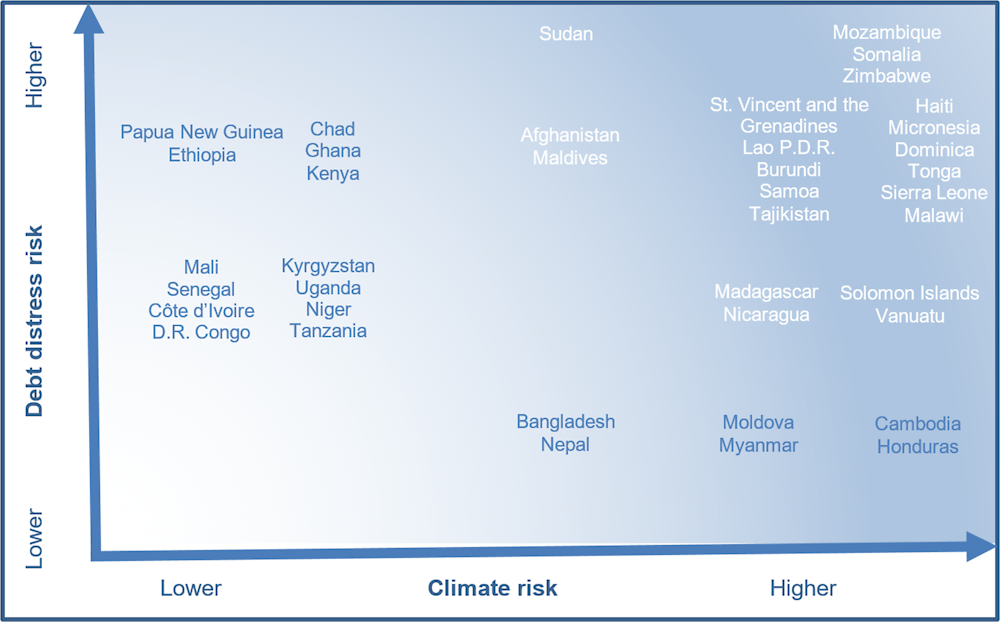

For some developing countries, the ability to fund spending needs resulting from climate-related catastrophes through debt financing may be limited by debt sustainability constraints. The IMF and World Bank have developed a joint debt sustainability framework for low-income countries to assess the sustainability of external and total debt (the IMF has also developed a debt sustainability framework for market access countries). The aim of these analyses is to ensure that countries are able to balance their debt financing needs with their ability to repay. A number of low-income countries that are highly exposed to climate-related catastrophe risk face moderate to high risk of external debt and/or total debt distress, which limits their ability to borrow new funds to meet spending needs related to climate-related catastrophes (see Figure 4.6).

Figure 4.6. Debt distress and climate risk: Low-income countries

Note: The indicators for climate risk are based on average annual climate-related losses for the worst 5-year period since 1990 as a share of GDP (countries with average annual losses above 0.5% of 2019 GDP for that period are considered to have high climate risk).

Source: OECD calculations based on data on GDP from (IMF, 2021[38]). Data on catastrophe losses is from (Swiss Re sigma, 2020[36]). Data on debt distress is from (World Bank, 2021[47]) Data on debt distress is from (World Bank, 2021[47])

To address some of these challenges, some countries have negotiated conditions that allow for reduced or delayed repayments of interest and/or principal due in the event of a large-scale catastrophe which would provide additional resources to fund post-event spending needs and reduce the need for additional debt financing. Often referred to as a “natural disaster clause” or “hurricane clause”, this approach to payment deferral was first inserted into bonds issued by Grenada as part of a debt restructuring in 2015 and has since been included in sovereign bonds issued by Barbados in 2018 and 2019 (Ho and Fontana, 2021[48]). In Grenada, the bonds included a clause that would defer a semi-annual payment of principal and interest in the event that the country is affected by a tropical cyclone that causes USD 15 million to USD 30 million in losses and two semi-annual payments in the event of a tropical cyclone causing more than USD 30 million in losses (Ho and Fontana, 2021[48]). In Barbados, the bonds included a clause to allow deferral of principal and interest payments in the event of a tropical cyclone, earthquake or excess rainfall event resulting in losses of more than USD 5 million (Ho and Fontana, 2021[48]). For both countries, the payment deferrals were linked to the triggering of parametric insurance policies provided by CCRIF (a regional risk pool for countries in the Caribbean and Central America, see below) which provides an independent assessment of when the conditions for deferral are met (Ho and Fontana, 2021[48]). The clause would reportedly allow Barbados to defer USD 700 million in repayments in the case of a triggering event (Ho and Fontana, 2021[48]), providing substantial resources to fund recovery and reconstruction. Based on this experience, the International Capital Markets Association has developed a model “hurricane-linked extendible feature” clause that sovereign debt issuers can incorporate into new loan agreements and bill and bonds securities (Ho and Fontana, 2021[48]). Some bilateral official creditors (e.g. Germany’s KfW) have begun piloting shock-resilient loans that include clauses that allow for redemptions or payment deferrals should a climate-related catastrophe occur (OECD, 2021[49]).

More recently, Belize has incorporated a “catastrophe wrapper” into the issuance of a “blue bond” (a type of sovereign debt that incorporates use of proceeds conditions related to healthy oceans and blue economies). The catastrophe wrapper provides debt relief in the event that the country is affected by a hurricane of a given magnitude (Willis Towers Watson, 2021[50]). Similar to a natural disaster or hurricane clause, the catastrophe wrapper will provide Belize with resources to fund recovery and reconstruction in the event of a major hurricane – although by eliminating (rather than deferring) the repayment of principal and/or interest on the outstanding blue bonds. An analysis of the impact of hurricane risk and sovereign borrowing in seven Caribbean countries found that the inclusion of disaster clauses that provide a payment suspension (as in the case of Barbados and Grenada) or debt reduction (as would be provided by the catastrophe wrapper in Belize) can reduce sovereign default frequency and increase access to credit, particularly in the case of clauses that lead to debt reduction (Mallucci, 2022[45]).

Risk financing: official financing

Governments (national or subnational) in developing countries can also access official financing (or development financing) through multilateral development banks and bilateral donors, in the form of different financial instruments, such as grants or loans. Official financing plays a significant role in ensuring the availability of funding for recovery and reconstruction in countries with more limited access to commercial lending markets, whether as a result of climate risks or other factors. In low-income countries, the average annual level of official financing (funds dedicated to a variety of development objectives) from international providers of development cooperation (2015-2019) is equivalent to approximately 16% of general government revenues (2019) and to multiples of the potential level of climate-related losses and damages although with large variations across countries. In small island developing states, the official financing accounts for a similar (slightly higher) share of general government revenues although a lower share of potential climate-related losses and damages (see Figure 4.7).

Figure 4.7. Official financing as a share or general government revenues and potential climate losses and damages

Note: Public sector AALs (average annual losses) are calculated as 35% of overall losses. Public sector AAL (2035, RCP 8.5) incorporates the estimated increase in flood and tropical cyclone losses in Climate Impact Explorer “RCP 8.5” scenario. Public sector AAL (worst 5-year period) refers to (35% of) average annual losses for 1990-1994 (Costa Rica, Haiti, Samoa, United Kingdom), 1995-1999 (France, Honduras, Venezuela), 2000-2004 (Belize, Germany, Italy, Madagascar), 2005-2009 (Dominica, Guyana, Nicaragua), 2010-2014 (Australia, Bosnia and Herzegovina, Canada, China, Colombia, El Salvador, Georgia, Indonesia, Mexico, Philippines, Saint Lucia, Saint Vincent and the Grenadines, Thailand), 2015-2019 (Bahamas, Chile, Fiji, India, Japan, Mozambique, Peru, Sri Lanka, Tonga, United States, Vanuatu, Viet Nam).

Source: Data on general government revenues is from (IMF, 2021[38]). Data on catastrophe losses is from (Swiss Re sigma, 2020[36]) and estimates of future economic losses due to floods and tropical cyclones from Climate Impact Explorer (Climate Analytics et al., n.d.[37]) . Data on official financing is from the OECD database on Geographical Distribution of Financial Flows (OECD, 2022[51]).

However, access to official (or development) financing for climate-related needs can be volatile, slow and/or impacted by political, procedural and financial considerations in the donor country. One examination of international financial flows to nine countries in the 18 months following a crisis found that: (i) these flows provided only a small portion of the funding needs identified through post-disaster needs assessments (15%); (ii) funding commitments were slow to confirm (only 41% of response funding had been committed within the first 6 months) and disbursements were delayed (only 64% of committed funds had been disbursed within 18 months); and (iii) the amount of funding provided rapidly was significantly higher for rapid-onset events relative to slow-onset crises such as droughts and varied significantly across recipient countries (Crossley et al., 2021[52]).

To address some of the risks related the volatility and speed of official financing, a number of catastrophe-prone countries have arranged ex ante access to contingent credit through multilateral development banks and other official lenders that is triggered based on the occurrence of an eligible event, usually linked simply to the declaration of a disaster (see Table 4.3). Given that the credit is pre-arranged and that the trigger is usually based solely on a government declaration, this financing can be accessed relatively quickly (World Bank, 2022[53]) and is not subject to any re-assessment of credit risk as a result of the occurrence of an event. The cost of financing is also relatively low given the official nature of the creditors.

Table 4.3. Contingent credit arrangements (official creditors)

|

Official creditor |

Credit available |

Climate perils covered (indicative)1 |

|

|---|---|---|---|

|

Argentina |

Inter-American Development Bank |

USD 300 million |

Flood |

|

Bahamas |

Inter-American Development Bank |

USD 100 million |

Windstorm |

|

Barbados |

Inter-American Development Bank |

USD 80 million |

Windstorm |

|

Belize |

Inter-American Development Bank |

USD 10 million |

Windstorm |

|

Colombia |

World Bank |

USD 300 million |

Windstorm, Flood, Wildfire, Drought |

|

Cook Islands |

Asian Development Bank |

USD 20.1 million |

Windstorm, Flood, Drought |

|

Dominican Republic |

Inter-American Development Bank |

USD 300 million |

Windstorm |

|

Ecuador |

Inter-American Development Bank |

USD 300 million |

Flood |

|

El Salvador |

Inter-American Development Bank |

USD 400 million |

Windstorm |

|

Fiji |

World Bank |

USD 13.9 million |

Windstorm, Flood, Drought, Wildfire |

|

Grenada |

World Bank |

USD 20 million |

Windstorm, Flood, Wildfire |

|

Guatemala |

Inter-American Development Bank |

USD 400 million |

Windstorm, Drought |

|

Honduras |

Inter-American Development Bank |

USD 300 million |

Windstorm |

|

Indonesia |

Asian Development Bank |

USD 500 million |

Windstorm, Flood, Drought |

|

Jamaica |

Inter-American Development Bank |

USD 285 million |

Windstorm |

|

Kiribati |

Asian Development Bank |

USD 8 million |

Windstorm, Flood, Drought |

|

Marshall Islands |

Asian Development Bank |

USD 6 million |

Windstorm, Flood, Drought |

|

Mexico |

World Bank |

USD 485 million |

Windstorm |

|

Micronesia |

Asian Development Bank |

USD 6 million |

Windstorm, Flood, Drought |

|

Nepal |

World Bank |

USD 36 million |

Flood, Landslide |

|

Nicaragua |

Inter-American Development Bank |

USD 186 million |

Windstorm |

|

Palau |

Asian Development Bank |

USD 20 million (3 years) |

Windstorm, Flood, Drought |

|

Panama |

Inter-American Development Bank |

USD 100 million |

Flood |

|

Paraguay |

Inter-American Development Bank |

USD 150 million |

Flood, Wildfire |

|

Philippines |

Asian Development Bank |

USD 500 million |

Windstorm, Flood, Drought |

|

Philippines |

World Bank |

USD 500 million (3 years) |

Windstorm, Flood, Landslide |

|

Saint Vincent and the Grenadines |

World Bank |

USD 70 million |

Windstorm, Flood, Wildfire |

|

Samoa |

Asian Development Bank |

USD 10 million |

Windstorm, Flood, Drought |

|

Solomon Islands |

Asian Development Bank |

USD 5 million |

Windstorm, Flood, Drought |

|

Suriname |

Inter-American Development Bank |

USD 30 million |

Flood |

|

Tonga |

Asian Development Bank |

USD 10 million |

Windstorm, Flood, Drought |

|

Tuvalu |

Asian Development Bank |

USD 4 million |

Windstorm, Flood, Drought |

|

Uruguay |

Inter-American Development Bank |

USD 100 million |

|

|

Vanuatu |

Asian Development Bank |

USD 5 million |

Windstorm, Flood, Drought |

1. The list of climate perils covered is based on reporting to InsuResilience although some (if not all) of the contingent credit arrangements could be available for other types of peril as well as disbursement often only requires a declaration of a state of emergency by the national government,

Source: (InsuResilience, 2022[17])

Contingent credit arrangements offered through multilateral development banks often require borrowers to implement specific measures to improve disaster risk management or disaster risk financing before being provided access to the credit facility. Official lenders will often provide technical assistance and support to borrowers to implement those measures. For example, the World Bank’s Cat Deferred Drawdown (Cat DDO) policy loans have provided access to capacity development to both national and subnational governments for strengthening disaster risk management policies, such as for the development of disaster risk financing strategies and the use of hazard and risk data to inform risk reduction (World Bank, 2022[53]).

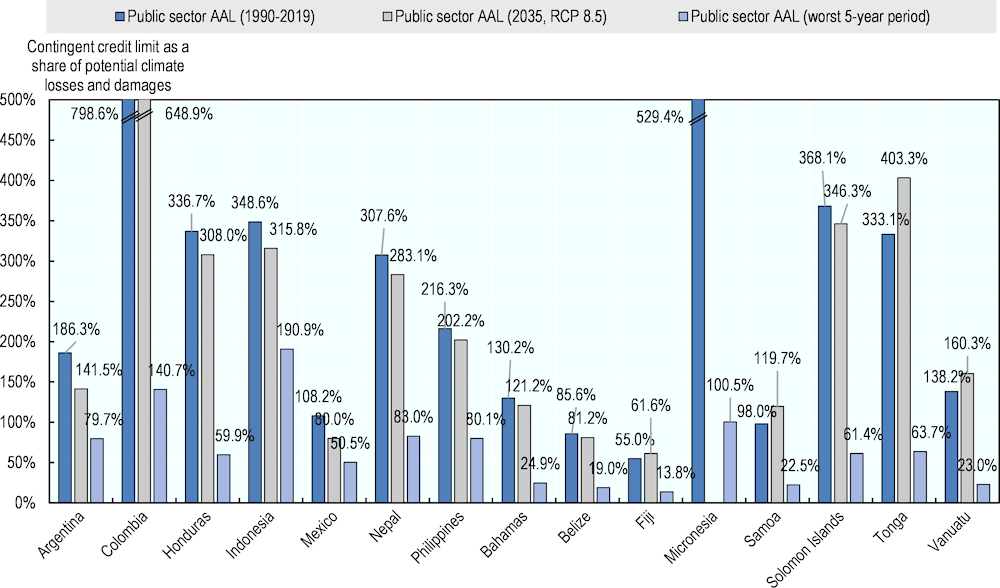

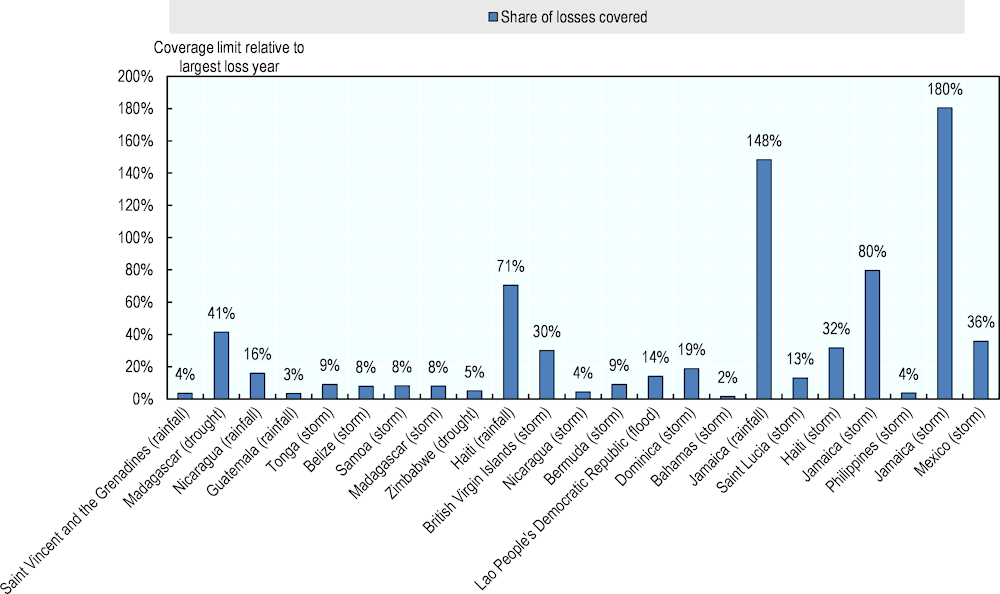

The amount of funding available through contingent credit can be substantial. For example, the World Bank’s programme can provide up to USD 500 million (or 0.25% of GDP, whichever is lower) to IBRD-eligible borrowers and up to USD 250 million (or 0.5% of GDP, whichever is lower) for IDA-eligible countries (World Bank Treasury, 2021[54]), (World Bank Treasury, 2018[55]). The Asian Development Bank has provided access to USD 500 million in contingent credit to Indonesia and the Philippines while the Inter-American Development Bank has provided access to USD 400 million in El Salvador and Guatemala. For many of the countries that have put in place such arrangements, available credit exceeds past average annual losses from climate-related catastrophes and a significant share of potential annual losses based on the highest annual losses for a five-year period since 1990 – although the amounts arranged relative to past losses appear to be slightly lower in small island developing states (see Figure 4.8). However, this does not mean that the amount of credit would be sufficient to cover the potential losses of an extreme event (i.e. larger than has occurred in recent years). There are also a number of countries that face high levels of exposure to climate risks and limited access to debt financing that are not covered by any official creditor contingent credit arrangement.

Figure 4.8. Available contingent credit relative to potential public share of climate losses and damages

Note: Public sector AALs (average annual losses) are calculated as 35% of overall losses. Public sector AAL (2035, RCP 8.5) incorporates the estimated increase in flood and tropical cyclone losses in Climate Impact Explorer “RCP 8.5” scenario. Public sector AAL (worst 5-year period) refers to (35% of) average annual losses for 1990-1994 (Samoa), 1995-1999 (Honduras), 2000-2004 (Belize), 2010-2014 (Colombia, Indonesia, Mexico, Philippines, Solomon Islands), 2015-2019 (Argentina, Bahamas, Fiji, Nepal, Tonga, Vanuatu). In the case of Dominican Republic, Ecuador, El Salvador, Guatemala, Jamaica, Nicaragua, Panama, Paraguay and Saint Vincent and the Grenadines, Uruguay (not shown), available credit is significantly larger than past climate losses and damages (both measures).

Source: Information on contingent credit arrangement is from (InsuResilience, 2022[17]) . Data on catastrophe losses is from (Swiss Re sigma, 2020[36])and estimates of future economic losses due to floods and tropical cyclones are from Climate Impact Explorer (Climate Analytics et al., n.d.[37]).

Providers of development cooperation should take debt sustainability issues into account when establishing lending arrangements, including contingent credit facilities. Official development assistance reforms in 2016 explicitly linked loan policy to IMF and World Bank requirements related to debt sustainability (OECD, 2021[49]).

4.4.2. Funding public budgetary needs through risk transfer

Governments (national or subnational) can transfer some of the risks related to climate-related catastrophe financing needs to insurance/reinsurance markets and capital markets (through insurance-linked securities and other financial products). The risk transfer could be structured to provide either an indemnity-based payment to cover losses incurred to a specific building/infrastructure asset or pool of public assets or as an event-based (parametric-based) payment to meet general government spending needs.

Risk transfer for general public budgetary needs

Governments (national or subnational) can acquire insurance coverage or other forms of financial protection (such as catastrophe bonds) with payments made based on the occurrence of an event that meets specific pre-determined parameters (i.e. a parametric trigger). This type of financial protection can provide a source of funds to meet a general increase in spending needs in the aftermath of a climate-related catastrophe. A number of countries have acquired this form of financial protection, either through regional risk pooling arrangements (in most cases) or the issuance of catastrophe bonds (see Table 4.4).

Table 4.4. Risk transfer for general spending needs: country examples

|

Type of instrument |

Type of trigger |

Climate perils covered |

Beneficiary (or issuer) |

|

|---|---|---|---|---|

|

Anguilla |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Antigua and Barbuda |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Bahamas |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Barbados |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Belize |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Bermuda |

Insurance (CCRIF) |

Parametric |

Windstorm |

National government |

|

British Virgin Islands |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Cayman Islands |

Insurance (CCRIF) |

Parametric |

Windstorm |

National government |

|

Colombia |

Insurance |

Parametric |

Flood, landslide |

Municipal government (Medellin) |

|

Cook Islands |

Insurance (PCRAFI) |

Parametric |

Windstorm |

National governments |

|

Cote d’Ivoire |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Dominica |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Gambia |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Grenada |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Guatemala |

Insurance (CCRIF-CA) |

Parametric |

Extreme rainfall |

National government |

|

Haiti |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

India |

Insurance |

Parametric |

State government (Nagaland) |

|

|

Jamaica |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Jamaica |

Catastrophe bond |

Parametric |

Windstorm |

National government |

|

Lao People's Democratic Republic |

Insurance (SEADRIF) |

Parametric |

Flood |

National government |

|

Madagascar |

Insurance (ARC) |

Parametric |

Drought, windstorm |

National governments (to be distributed to agricultural sector) |

|

Malawi |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Mali |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Mauritania |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Mexico |

Catastrophe bond |

Parametric |

Windstorm |

National government (FONDEN) |

|

Montserrat |

Insurance (CCRIF) |

Parametric |

Windstorm |

National government |

|

Nicaragua |

Insurance (CCRIF-CA) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Niger |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Panama |

Insurance (CCRIF-CA) |

Parametric |

Extreme rainfall |

National government |

|

Philippines (2019-2021) |

Catastrophe bond |

Parametric |

Windstorm (67%) |

National government |

|

Philippines |

Insurance |

Parametric |

Windstorm |

Municipal governments |

|

Saint Kitts and Nevis |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Saint Lucia |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Saint Vincent and the Grenadines |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Samoa |

Insurance (PCRAFI) |

Parametric |

Windstorm |

National government |

|

Senegal |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Sint Maarten |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Sudan |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Togo |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Tonga |

Insurance (PCRAFI) |

Parametric |

Windstorm |

National government |

|

Trinidad and Tobago |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Turks and Caicos Islands |

Insurance (CCRIF) |

Parametric |

Windstorm, Extreme rainfall |

National government |

|

Zambia |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |

|

Zimbabwe |

Insurance (ARC) |

Parametric |

Drought |

National governments (to be distributed to agricultural sector) |