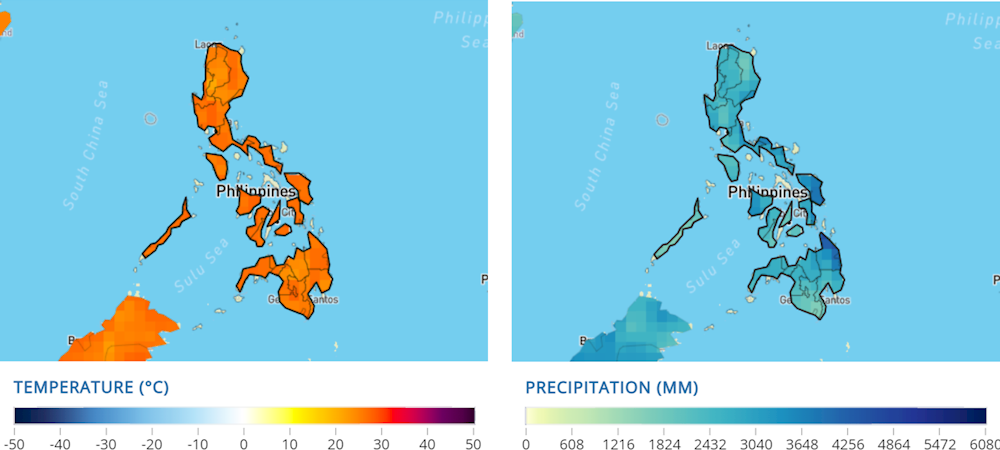

This section aims to provide a short overview of the past and future hazards based on the IPCC Sixth Assessment report (Shaw et al., 2022[1]). It discusses the observed hazards, the projections for the future, and concludes with a discussion of exposures and vulnerabilities. The Philippines comprises approximately 7,000 islands, most of which can be characterised as mountainous terrain bordered by narrow coastal plains. Figure A A.1 shows the historical averages of temperature and precipitation (1990-2020). Average temperatures are generally high at 25°C with little variation across the country or throughout the year. Average annual rainfall is approximately 2400 mm, but with significant variation both across the country and the year. Climatological variations in the Philippines are significantly influenced by El Niño Southern Oscillation (ENSO), with El Niño causing droughts and La Niña causing rainfall leading to floods (OECD, 2020[1]).

Building Financial Resilience to Climate Impacts

Annex A. Philippines

Philippines' exposure and vulnerability to climate hazards and climate change

Figure A A.1. Observed climatology of mean temperature and precipitation of the Philippines

Past and current hazards

Due to its geographical location and topography, the Philippines is exposed to different types of extreme weather events, such as typhoons, floods, landslides and droughts (as well as to other types of hazards such as earthquakes and volcanic eruptions). Its narrow coastal plains are particularly vulnerable to rising sea levels, erosion, droughts, monsoon rains and changes in sea surface temperatures. Climate change and heightened climate disaster risks also affect the lives and livelihoods of populations whose economic activity is dependent on nature (e.g. agriculture, fishing, tourism, etc.). From 2000 to 2019, the Philippines reported 304 weather-related disasters which affected a total of 149 million people over several years1, making the Philippines the fourth most disaster-affected country in the world (UNDRR, 2020[3]).

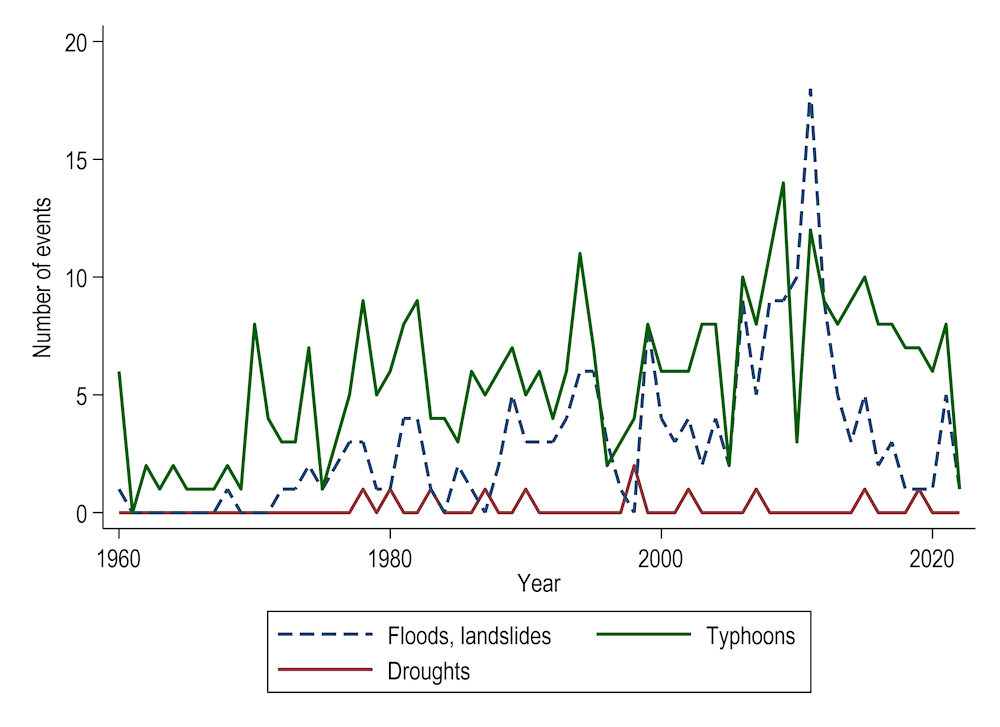

On average, 20 tropical cyclones per year enter the Philippine Area of Responsibility (PAR), with about 8 or 9 of them crossing the Philippines (PAGASA, 2022[4]). Since 2009, the Philippines has experienced a number of highly destructive extreme weather events with Typhoons Ondoy, Pepeng, Sendong, and Pablo leading to over 3,000 deaths, affecting more than 10 million people and causing economic losses and damages amounting to approximately USD 5.7 billion (OECD, 2020[1]). In addition, the 2013 Super Typhoon Yolanda (Haiyan) is recorded as one of the most intense and deadly tropical typhoons. It caused more than 6 300 deaths, and economic costs of about PHP 95 billion or about USD 2.3 billion (using 2013 exchange rates) (NDRRMC, 2013[5]). Figure A A.2 shows the frequency of floods and landslides, droughts and typhoons from 1960 to 2022 July, based on EM-DAT data (CRED/UC Louvain, 2022[6]). The frequency of typhoons has increased over the period, but the trend is not as apparent as the upward trend for floods and landslides. This coincides with the most recent scientific evidence. The frequency of typhoons has not changed since 1950, but the frequency of extreme typhoons2 (with wind speeds over 150 km per hour) has increased (Shaw et al., 2022[7]). In addition, there has been a northward shift in typhoon tracks (PAGASA, 2021[8]).

Figure A A.2. Frequency of floods and landslides has increased in the Philippines

Note: The graph illustrates the frequency of extreme events in the Philippines between 1960 and 2022. Note that the 2022 data is incomplete, it is only covered until July. A drawback of EM-DAT is only disasters which cause 10 or more deaths, or affect 100 or more people, or lead to declaration of a state of emergency, or there is a call for international assistance, are recorded, which biases the data against certain events.

Source: (CRED/UC Louvain, 2022[6]).

Projected hazards

The already observed increase in the strength of typhoons and their northward shift are projected to exacerbate as climate change progresses, according to regional projections.3 The expected damages for a 1-in-100 year tropical cyclone are projected to increase by 10%, as storms with this frequency become more severe, under the most likely scenarios by 2060 (Climate Analytics, 2022[9]). Rising temperatures will also likely lead to more floods, landslides and stronger typhoons in the region, even though the effect on rainfall is not clear (Shaw et al., 2022[7]). In some parts of the country, the intensity and frequency of rainfall events are increasing, whereas in others, decreasing (OECD, 2020[1]). The annual damages from river flooding are expected to rise by about 40% by 2060, according to central projections, though with considerable uncertainty (Climate Analytics, 2022[9]). Projections also show that the frequency of droughts will increase (Shaw et al., 2022[7]). This will have consequences for the agricultural sector and will impact the poor through increased food prices. In other parts of Asia, droughts have already led to changing agricultural practices.

Exposure and vulnerability

The Philippines is considered to be a climate hotspot where strong hazards, large exposure and high concentration of vulnerable people coincide. In such hotspots, the impacts of global climate also have profound social implications, threatening human health and well-being, destabilising assets, stressing coping capacities and response infrastructures, and substantially increasing the number of socially, economically and psychologically vulnerable individuals and communities (Shaw et al., 2022[7]).

Around half of the economic activity of the Philippines is nature-dependent (WEF, 2020[10]; GOV.PH, 2022[11]). Thus, biodiversity and ecosystem services play a crucial role in socioeconomic development, but also cultural and spiritual fulfilment of the population (IPBES, 2018[12]). The coastal ecosystems provide services related to food production by fisheries, carbon sequestration, coastal protection and tourism (Shaw et al., 2022[7]). In addition, around a third of employment is accounted for by agriculture, a sector which is vulnerable to climate change (ABI and CIAT & WFP, 2022[13]). Thus, climate change has significant and widespread effects on water supply, food production, human health, well-being and availability of land and ecosystems (Shaw et al., 2022[7]).

Rapid urbanisation and the proliferation of informal settlements have increased vulnerabilities, especially among poor households migrating from rural areas (OECD, 2020[1]). Unregulated urban expansion has intensified flood risk and is expected to continue to do so in the future (Shaw et al., 2022[7]). For example, in its second national communication to the UNFCCC, the Philippines notes that while the rise in flood risk can, in part, be explained by increased rainfall variability, it is also caused by sewers and waterways clogged by waste trapping the water (GOV.PH, 2014[14]; OECD, 2020[1]). Other anthropogenic factors, including deforestation and land use change, also exacerbate flood risk (Shaw et al., 2022[7]; OECD, 2020[1]).

Climate change also threatens long-run growth as poor households are constrained in their ability to receive nutrition, schooling and healthcare for their children (Shaw et al., 2022[7]). At higher warming, key infrastructure such as power lines, transport by roads, railways, and infrastructure such as airports and harbours are more exposed to climate-induced extreme events, especially in coastal cities (Shaw et al., 2022[7]).

Low-income households are disproportionately affected by extreme events (Shaw et al., 2022[7]). Climate change, when combined with factors such as unmanaged development, has adverse impacts on ecosystems and the role of these systems for many rural populations as sources of income and livelihood, as noted above (Hallegatte et al., 2015[15]; OECD, 2020[1]). In addition, lower income households often reside in areas more exposed to the risks of climate change, in some cases because these areas are more readily available. Complemented by heightened vulnerabilities to climate impacts, poorer households also have relatively fewer resources at their disposal for responding to these impacts. As a result, many residents that live just above the poverty line cycle in and out of poverty (OECD, 2020[1]). The concentration of population growth in less developed regions means that an increasing number of people with the least ability to adapt to climate change will be at increased risk (Shaw et al., 2022[7]).

Identify, assess and report on climate-related risks and their financial implications for government

Identifying and assessing climate-related risks, financial vulnerabilities, and financial implications for government

The Philippines Catastrophe Risk Model was developed in 2014 to provide probabilistic estimates of total losses from typhoons and earthquakes, on an annual long-term average basis (World Bank, 2021[16]). Assessments are based on a database of asset exposure and historical loss as well as a geo-referenced catalogue of national government assets (World Bank, 2021[16]). The model is used to assess the government’s potential losses and inform the design of risk transfer instruments to adequately finance disaster and climate risks (see below). Estimates are reported in a Fiscal Risks Statement published annually by the Department of Budget and Management (DBM). The model shows that, on average, the Philippines is expected to incur PHP 177 billion (USD 3.5 billion) per year in losses to public and private sector assets due to typhoons and earthquakes. The country has a 10% annual probability of experiencing losses exceeding PHP 377.8 billion and a 1% annual probability of experiencing losses exceeding PHP 1.73 trillion (World Bank, 2021[16]) Of the PHP 177 billion average annual loss, 96% relates to private assets and 4% to public assets. Within the 4% of average annual losses to public assets (PHP 8 billion or USD 158.4 million), 75% can be attributed to typhoons and 25% to earthquakes (World Bank, 2021[16]).

Risk and vulnerability assessments are also key tools for informing planning processes to identify and prioritise investments (OECD, 2020[1]). The Climate and Disaster Risk Assessment (CDRA), which is conducted by local governments, as per the Supplemental Guidelines on Mainstreaming Climate and Disaster Risks in Comprehensive Land Use Plan (CLUP), aims at:

identifying different hazards and hazard-prone areas;

evaluating the likelihood of occurrence and severity of consequence of different hazards;

understanding exposure for different critical areas (e.g. population, infrastructure, natural resources); and

recommending appropriate measures for climate change adaptation and disaster risk reduction (GOV.PH, 2017[17]).

While the CDRA is implemented at the local level, the assessments aid the National Government in designing risk transfer instruments, such as through the PH Catastrophe Risk Model. An ongoing challenge which has lead to confusion in implementation and generated possible inefficiencies is that different national institutions (e.g., National Economic and Development Authority (NEDA), Climate Change Commission (CCC), National Disaster Risk Reduction and Management Council (NDRRMC), Department of the Interior and Local Government (DILG)) promote slightly different versions of the CDRA, with different definitions and methodologies. This inconsistency is partly due to the desire of national agencies to make the process less resource intensive and ensure that lower income (and thus lower capacity) Local Government Units (LGUs) are not excluded from the risk assessment process due to requirements they cannot meet. However, there remain some challenges in conducting CDRA at the local government level. These capacity gaps hinder subsequent policy planning and implementation processes, including efforts to access disaster risk management (DRM) funds. More importantly, the variations in the different methodologies reflect the specificities of the policy planning processes they serve (OECD, 2020[1]).

LGUs also play a central role in disaster risk prevention and management in the Philippines. The implementation of the Mandanas-Garcia4 ruling in 2020 is seen as strengthening the capacity of LGUs which will help limit disaster-related damages, enhance emergency response time and facilitate reconstruction and recovery.

Reporting climate-related fiscal risks to promote transparency in public financial management

The Philippines’s Development Budget Coordination Committee provides an overview of the country’s exposure to fiscal risks from contingent liabilities (including natural disasters) in its annual Fiscal Risk Statement published by the Department for Budget Management. For example, according to the 2022 statement, the Philippines is expected to incur USD 3.6 billion per year in total losses to public and private assets due to typhoons and earthquakes on a long-term average basis (Department of Budget and Management, 2022[18])Losses and damages could be even higher without adequate policies for adaptation and risk mitigation in place. However, while fiscal risks statements provide information on past events and probabilistic estimates of total losses and damages, information on public financial exposure is more limited and is only available based on historical losses rather than probabilistic modelling.5

Mitigate financial losses from climate-related risks and their implications for governments

Promoting, investing and financing risk prevention, risk reduction and adaptation to reduce exposure and vulnerability

Reliable data and information on hazards, exposure and vulnerabilities are necessary to inform disaster risk reduction (DRR) activities and policies. This information should be made available and communicated effectively to policy makers and stakeholders. Recent efforts by the government demonstrate its willingness to address the need to centralise and facilitate access to climate and disaster-related information. For example, GeoRisk Philippines is a multi-agency initiative that aims at building the country’s resilience to climate hazards by providing a central source of information for hazard and risk assessment (see Box A A.1).

Box A A.1. GeoRisk Philippines – An initiative to centralise climate and disaster-related information

GeoRiskPH is a multi-agency initiative that aims to become the central source of information for hazard and risk assessment in the Philippines. By bringing multiple agencies together, the initiative plans to address mapping inaccuracies, gaps, overlaps and duplication of efforts due to the absence of mapping standards, protocols and codes.

The initiative was led by the Philippine Institute of Volcanology and Seismology (PHIVOLCS), funded by the Department of Science and Technology (DOST) and monitored by the Philippine Council for Industry, Energy, and Emerging Technology Research and Development (PCIEERD) from 2018 to 2020. In 2021, the initiative was institutionalised in DOST-PHIVOLCS. Today, 10 government agencies have agreed to contribute their data to the GeoRiskPH platform.

As of 2022, GeoRiskPH provides a set of tools to share and collect information on hazards, exposure, and risk. For example, HazardHunterPH is a web and mobile application that allows users to quickly generate hazard assessment reports for a selected location.

Note: Given that the initiative is still recent, it is too early to evaluate its impact.

Source: (GeoRisk Philippines, 2022[19])

With the same goal of providing stakeholders with timely climate information, early warnings systems (EWS) with clear, colour-coded instructions to take action are now in place for all major hazards. For example, PAGASA issued yellow ‘take action’ weather warnings to alert people to the risk of flooding in advance of three typhoon-related events in 2014 in Manila (Met Office, 2017[19]). Before EWS, general weather forecasts would provide a warning of heavy rains but would not assess the risk of flooding, leaving forecasts up for individual interpretations.

Funding for risk prevention and reduction is well-integrated in the budget structure of local governments (UNDRR, 2019[20]). The DRRM Act of 2010 mandates LGUs to set-up a Local Disaster Risk Reduction and Management Fund (LDRRMF). Under the legislation, this fund should be financed by a minimum of 5% of LGUs’ estimated revenue from regular sources. 70% of the Fund’s resources are to be dedicated to risk prevention, reduction and preparedness. This includes both structural (e.g. construction of flood barriers) and non-structural measures (e.g. building codes and land-use planning). The remaining 30% are allocated to the Quick Response Fund (QRF) for funding emergency response.

Despite the existence of such good practice budgeting mechanisms for risk reduction, several constraints make it difficult for these funds to make an impact (OECD, 2020[21]):

The country’s fiscal decentralisation system does not recognise the differentiated exposure of LGUs to climate change. Given that the LGUs more exposed to climate change are the ones with the least resources, vulnerability reduction efforts are effectively limited.

Even when the funds’ resources are spent, LGUs have little technical capacity to assess effective risk reduction measures which diverts existing financing towards short-term measures (e.g. relief equipment). Greater efforts can also be made in terms of non-structural measures. There is low enforcement of building codes and standards as communities continue to construct buildings in high-risk areas and informal settlements to reduce construction costs (COA.GOV.PH, 2014[22]).

Protecting households and businesses through insurance

The Philippines has a well-developed regulatory framework for insurance companies. Capital requirements have been increased in recent years to ensure that insurance companies have sufficient funds to meet their obligations to policyholders (OECD, 2020[23]). The Insurance Commission (IC) has established minimum pricing for flood and typhoon (as well as earthquake) coverage to ensure that insurers are collecting sufficient premium although a highly competitive market has led some insurers to set premiums at (or even below) the minimum requirements (OECD, 2020[23]). Commercial catastrophe models are available for many of the main climate-related perils although use of these models has been limited (OECD, 2020[23]). A national reinsurance company has been established and ensures the availability of reinsurance coverage for domestic insurance companies although a system of preferences creates some limitations on the ability of insurers to leverage international property catastrophe reinsurance markets (OECD, 2020[23]).

The Philippines has a relatively low-level of non-life insurance penetration (although similar to other middle income economies in the region). Non-life insurance premiums were equivalent to 0.23% of GDP in 2020 (Insurance Commission, 2021[24]), relative to 4.9% of GDP in OECD countries and 0.4% in Indonesia (OECD, 2022[25]). Insurance coverage for floods and typhoons is available as an optional add-on to commercial and residential fire insurance policies and is often only acquired by commercial policyholders and higher-income households (OECD, 2020[23]). Some mortgage lenders have requirements for adequate insurance coverage that includes flood and typhoon risks although this requirement is not consistently (and continuously) enforced (OECD, 2020[23]). A stand-alone (low insured limit) coverage for typhoon risks is also available to commercial and residential policyholders (OECD, 2020[23]). For events with available data (2000-2019), approximately 4.5% of flood losses were insured and 9.4% of typhoon losses.6

Increasing the level of household and commercial insurance coverage for disaster and climate risks has been identified as a key element of the Philippines’ Disaster Risk Financing and Insurance (DRFI) Strategy (Alvarez, 2019[26]). In the Philippines, a working group has been established involving the Insurance Commission, Philippine Insurance and Reinsurance Association and NatRe (national reinsurer) to develop a Philippines Catastrophe Insurance Facility (PCIF) for typhoon, flood and earthquake risks. The facility would pool these risks among insurers with the aim of broadening insurance coverage and supporting financial resilience (Philippine Insurers and Reinsurers Association (PIRA) and German Development Cooperation - Regulatory Framework Promotion of Pro-poor Insurance Markets in Asia (GIZ RFPI Asia), 2020[27]). The Insurance Commission (IC), issued a regulation to establish the PCIF in April 2021 (Insurance Commission, 2021[28]). In July 2022, the IC issued a regulation revising minimum rates for catastrophe risk insurance which will support the operation of the PCIF (Insurance Commission, 2022[29]).

The Philippines has a highly-developed microinsurance sector facilitated by a tailored regulatory framework (ADB, 2017[30]). The Philippines has the highest level of microinsurance outreach (share of population covered) in the world although the vast majority of coverage is provided for life and health (including credit life) with only a few providers offering coverage for climate risks to property (Kong and Gopalakrishna, 2020[31]).

Ensuring clarity in public financial assistance arrangements for households and businesses to mitigate future financial losses

A key element of the Philippines’ DRFI Strategy is a strong link between social protection and disaster risk financing (Alvarez, 2019[26]) which involves integrating a disaster-related income support into the national conditional cash transfer programme. The Department of Budget and Management (DBM) also provides financial assistance to individuals residing in cities and municipalities affected by destructive natural disasters such as typhoons. For example, in the aftermath of Typhoon Odette in 2021, the DBM released PHP 4.85 billion to LGUs in impacted communities to provide financial assistance of up to PHP 1 000 per individual and PHP 5 000 per household. The DMB also issued complementary guidance for LGUs on the delivery of financial assistance to those affected (DMB, 2021[32]). However, there is still a need to strengthen the link between disaster risk financing and social protection by establishing a post-disaster emergency income support programme which integrates a post-disaster component in the national conditional cash transfer programme (OECD, 2020[21]).

Aligning incentives across levels of government

With the support of international donors, the country is currently transferring the primary responsibility for disaster risk reduction and climate change management from the central government to Local Government Units (LGUs).

The national government’s People’s Survival Fund (PSF) was created by virtue of the Republic Act (R.A.) No.10174 (Amending R.A. No. 9729 or the Climate Change Act of 2009). It is an annual fund intended for LGUs and accredited local/community organisations to implement climate change adaptation projects that will better equip vulnerable communities to deal with the impacts of climate change. It supplements the annual appropriations allocated by relevant government agencies and LGUs for climate change-related programmes and projects.

The fund has an annual allocation of PHP 1 billion in the national budget with the aim of financing adaptation programmes and projects that are directly supportive of the objectives enumerated in the Local Climate Change Action Plans (LCCAP) of LGUs and communities.

The fund is managed and administered by the PSF Board headed by the Secretary of the Department of Finance (DOF). The PSF Board shortlists and approves proposals submitted by LGUs, NGOs and CSOs. However, proponents have reportedly faced difficulties in obtaining funding approval, resulting in a low utilisation of the fund.

To address these challenges, the PSF has a sub-financing window called the Project Development Grant (PDG) with an allocation of PHP 60 million or 6% of the annual PHP 1 billion PSF budget. It aims to help project proponents, mainly LGUs, in preparing PSF funding proposals based on concept notes that have been approved by the PSF Board and have the potential for community-level climate change adaptation.

In parallel, funds from the National Disaster Risk Reduction and Management Fund (NDRRMF) may be used for disaster risk mitigation, prevention, and preparedness activities, including the training of personnel as well as the procurement of equipment and capital expenditures. The funds can also be used for relief and reconstruction efforts, including pre-disaster activities or to replenish the Quick Response Fund when its balance has reached 50 percent.

Capacity constraints are also visible in the access to the NDRRMF (CFE-DM, 2021[33]; OECD, 2020[21]). LGUs that have exhausted their internal resources can access the NDRRMF for additional funding. However, the process of accessing such funds is intricate and lengthy which limits the approval of requests.

For many years now, the country has also considered the use of additional incentives for DRR investments at the subnational level (UNDRR, 2019[20]). Such incentives would take the form of concessional loans from the central government. This has, however, not yet been operationalised.

Budget Tracking

Collaboration between DBM, the Climate Change Commission (CCC) and Department of the Interior and Local Government (DILG) has resulted in an initiative on Climate Change Expenditure Tagging (CCET). The initiative came into effect at the national and local government levels in 2015. The purpose of CCET is to track, monitor and report climate change programmes, activities, and projects. The typology used for tracking expenditure follows that of the National Climate Change Action Plan (NCAPP), which includes long-term investments in adaptation and mitigation activities. By analysing the results of programs, activities, and projects related to climate-change, CCET supports the government in its effective implementation of the NCCAP strategy across seven priorities: food security, water sufficiency, ecosystem and environmental stability, human security, climate-smart industries and services, sustainable energy, and knowledge and capacity development. From 2019 to 2021, the country’s adaptation expenditures increased to PHP 80.27 million while mitigation expenditures accrued to PHP 2.23 million. This contributed to a PHP 82.5 million increase (41% increase) to total climate change expenditures from 2018 to 2022.

The process of identifying, reporting, and tagging expenditure related to climate-change also enhances transparency. The data generated from CCET is reported in the National Integrated Climate Change Database and Information Exchange System (NICCDIES), the Philippine’s integrated climate information portal launched in 2018.

The local implementation of CCET requires continuous capacity building and knowledge sharing across government levels. This collaboration has contributed to the institutionalisation of climate adaptation and mitigation into the planning and budgeting processes of both national and local government by mandating considerations related to building resilience to climate change.

Prepare integrated multipronged government financial strategies

Assessing budgetary capacities to fund relief, recovery, and reconstruction, including through budget reallocation

National Disaster Fund

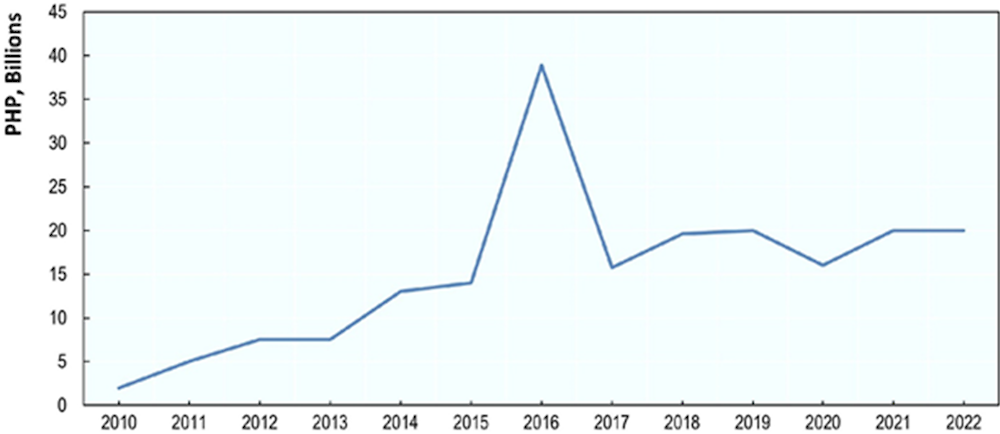

Financial reserves and contingency mechanisms are in place to support effective response and recovery when required. The Philippine Disaster Risk Reduction and Management Act established the above-noted National Disaster Risk Reduction and Management Fund (NDRRMF) in 2010 to finance both early investments in risk prevention as well as more immediate post-disaster needs. An annual allocation to the fund is set in the national budget; its size is based on recommendations from the National Disaster Risk Reduction and Management Council (NDRRMC) and subject to the approval of the President. Of the total allocation, 70% is mandated for DRR and prevention while the remaining 30% are set aside in a QRF available for relief, response, and recovery programmes. The overall allocation to the fund has increased steadily since its inception in 2010 (see Figure A A.3). This increase is due to both an increase in political focus on disaster risk management as well as increasing expenses from damages caused by more frequent and intense weather and climate events. Prior to the DRRM Act of 2010, the Calamity Fund served as the main source of funds for disaster risk management. Allocations to the NDRRM fund are made in addition to regular budget allocations to government line agencies with mandates, projects and activities that contribute to building resilience to climate impacts. These agencies include the Department of Public Works and Highways, the Department of Agriculture, the National Irrigation Agency, the Department of Transportation, the Department of Energy, and the Department of Labour and Employment.

Figure A A.3. Budget allocation to the Philippines’ National Disaster Risk Reduction and Management Fund, 2010-2022

Note: the major budget increase observed in 2016 (178%) follows the devastating impact of typhoon Yolanda in late 2013. Of the PHP 38.9 billion allocated to the fund in 2016, PHP 18.9 billion (nearly 50% of the total) was allocated to the Comprehensive Rehabilitation and Recovery Plan (CRRP) for areas devastated by typhoon Yolanda.

Source: (GOVPH, 2022[34]), (GOVPH, 2017[35])

In theory, part of the 70% allocation of the NDRRM Fund towards prevention can be used for climate adaptation projects (OECD, 2020[1]). In practice, however, there can be limited funding for prevention and adaptation. A 2017 review of how the fund was disbursed over the past decade found that it is mainly used for relief, recovery and reconstruction, due to the high and immediate financing needs in these areas (OECD, 2020[1]). In some years, the amount in the NDRRM Fund has been inadequate to meet post-disaster financing needs, much less risk reduction efforts (Villacin, 2017[36]). In addition, disaster prevention activities should be included in the regular budgets of agencies rather than charged to the NDRRMF, as they can be determined in planning exercises and programmed by agencies.

Local disaster funds

The Local Disaster Risk Reduction and Management Fund (LDRRMF) is the primary instrument for LGUs. The DRRM Act of 2010 requires that LGUs set aside no less than 5% of estimated annual revenues from regular sources to their LDRRMF (OECD, 2020[1]). Those contributions are allocated as follows:

Quick Response Fund (QRF) - 30% of the annual LDRRMF allocated for post-disaster financial liquidity. Resources from the QRF are available upon the declaration of a state of calamity at a local (city or higher) or national level by a relevant body.

Disaster Mitigation Fund - 70% of the annual LDRRMF allocated for use in disaster prevention, mitigation, preparedness, response, rehabilitation and recovery projects identified in a city’s local disaster risk reduction and management plan and integrated into its annual investment programme.7

Special Trust Fund (STF) - unexpended balances of the LDRRMF at the end of a budget year accrue to a special trust fund for use within 5 years for the sole purpose of disaster risk reduction and management activities (NDCC, 2010[37]).

Budget reallocations

In the Philippines, one third of post-disaster expenditure is financed through ex ante arrangements (e.g. national disaster funds and contingency reserves). The remaining two thirds of post-disaster expenditure is mainly financed through regular budget allocations and reallocations (World Bank, 2020[38]). This heavy reliance on budget reallocations can be explained by their relative speed compared to the delays and bottlenecks experienced in the disbursements of pre-arranged funding sources for disasters (Ibid.). When a disaster strikes, the government can reallocate spending from other sectors relatively quickly to finance its disaster response.

The redistribution of budgeted resources across priorities can compromise allocative efficiency and place a disproportionate burden on national governments even though local governments also have a dedicated budget for disasters (Ibid.). In the aftermath of Typhoon Yolanda, the Department of Social Welfare and Development reallocated PHP 489.5 million in budgeted funds to purchase supplies for relief operations. These funds were replaced upon receipt of the DBM Special Allotment Release Order (SARO) from the NDRRM fund. Similarly, the Department of Health reallocated PHP 254.8 million in budgeted FY2013 appropriations to emergency purchases.

The effectiveness of the NDRRM fund is reportedly a concern as it routinely experiences bottlenecks in the approval, release and transfer of funds to implementing agencies (World Bank, 2020[38]). While the indicative timeline for the Office of Civil Defence is 15 to 30 working days and 60 working days for Local Government Units, the reported delay for the provision of NDRRM funds can exceed one year (Ibid.). These delays hinder the fund’s capacity to cover the immediate spending needs that follow a disaster – the very purpose for which it was established. According to the World Bank, these delays are likely to be related to the capacity to manage a large number of requests requiring the processing and approval of different agencies (World Bank, 2020[38]).

Assessing debt market borrowing capacities

Risk financing – and particularly contingent credit facilities – also make an important contribution to funding government spending needs. The Philippines issues debt in both domestic and international markets (international debt issuance represents 27% of total debt issuance). Funding the entire estimated average annual loss (as estimated by the Government of the Philippines) with debt funding would require approximately 2.7% of the average international and domestic debt outstanding between 2016 and 2020 (for all perils, including earthquakes). As of 2020, the Philippines’ national government outstanding debt was equivalent to 62.1% of GDP (of which 42.6% is domestic debt and 19.5% is external debt) (Bureau of the Treasury, 2022[39]).

Optimising financial tools under budgetary and financing constraints, within an overall framework of disaster risk management and risk reduction

Contingent credit

Contingent credit arrangements play a prominent role in the Philippines’ DRFI Strategy. These arrangements provide the government with immediate liquidity when a disaster strikes. Automatic triggers can further facilitate the disbursement of these funds when a pre-set condition is met (e.g., a Presidential Declaration of a State of Calamity or public health emergency).

The Philippines has entered into four contingent credit arrangements under the World Bank’s Development Policy Loan with a Catastrophe Deferred Drawdown Option (Cat DDO) programme since 2011. The most recent arrangement was approved in 2021 and provides up to USD 500 million in loans (renewable for 15 years) to address shocks related to natural disasters and health emergencies (World Bank, 2022[40]).

The ADB’s Disaster Resilience Improvement Program (DRIP) is a USD 500 million loan executed by the Department of Finance. This program is part of the national government’s contingent financing strategy and can be disbursed quickly following a health-related emergency or other nature-induced disaster. The DRIP came into effect in October 2020, with a three-year implementation period. It was fully disbursed as of April 23, 2021.

JICA’s Post Disaster Stand-By Loan Phase 2 (PDSL2) provides JPY 50 billion in quick budget support to build resilience to climate and health related disasters. The loan agreement for PDSL2 was signed in September 2020. It was fully disbursed as of August 20, 2021.

The three facilities, if drawn down in full, would provide approximately USD 1.4 billion in funding, equivalent to approximately 39% of the Government of the Philippines’ estimate of annual loss from all perils.

Official financing

Official development financing and cooperation for climate change adaptation and DRR play an important role in the Philippines. Bilateral and multilateral development partners provide technical assistance, policy support, financial aid, and in-kind disaster relief.

When a major climate disaster overwhelms both local and national governments, targeted assistance can help fill the gaps in capacities and resources. The Philippines may accept specific offers of assistance through the Philippines International Humanitarian Assistance Cluster (PIHAC), its main institutional framework for the mobilisation and coordination of international assistance. The framework also institutionalises a one-stop-shop facility to facilitate the entry of international humanitarian personnel, equipment, and in-kind support (PIHARC).

Disaster management partners can also provide policy support to pilot new initiatives and instruments. For example, the World Bank suggested revisions to the National Building code to include measures for DRR such as the incorporation of wind load related to typhoons. Other examples of policy support include a pilot for the Philippine City Disaster Insurance Pool (PCDIP)8.

A review of adaptation-related commitments by bilateral providers and other multilateral providers reported into the OECD Creditor Reporting System show considerable variation over the period, ranging from a high of USD 586 million in 2014 to a low of USD 82 million in 2016 (OECD, 2020[1]). In general, the majority of commitments include a significant focus on adaptation. This can in part be explained by the fact that, over the period 2013-2017, nearly half of commitments targeted three broader sectors: (1) general environmental protection, (2) water supply and sanitation and (3) government and civil society. An examination of the adaptation-related commitments shows that only a small share, ranging between 1% and 11%, target the three DRM-linked sub-sectors. Again, this can be linked to the predominant focus on broader sectors that do not necessarily facilitate a focus on DRM. An exception is 2014, when Japan, ADB and the World Bank committed post-disaster stand-by loans following Typhoon Yolanda in November 2013 (OECD, 2020[1]).

Insurance

Insurance and other financial protection mechanisms, both indemnity and event-based, are also an important element of the Philippines’ DRFI Strategy. This includes indemnity-based insurance of public assets to fund reconstruction as well as various risk transfer mechanisms to provide early funding for government spending needs.

The Government Service Insurance System (GSIS) is a government entity mandated to: (i) provide various types of insurance coverage to government employees; and (ii) since 1951, administer a General Insurance Fund that provides property insurance coverage to all government-owned assets, including for disaster and climate risks. All government organisations, at national and subnational level, are legally required to acquire insurance coverage from GSIS although there is some evidence that many assets remain uninsured (or underinsured) (World Bank, 2021[16]), (OECD, 2020[1]). Since 2017, the Bureau of the Treasury (BTr) has been developing a National Asset Registry System (NARS) with the aim of improving (public) asset management. By 2020, the NARS included data on schools and hospitals, roads and bridges, irrigation facilities, social welfare centres, communications towers and power plants (Department of Finance, 2021[41]). The government plans to transfer some of the disaster-related risk to strategically important public assets to international reinsurance markets through a National Indemnity Insurance Program (NIIP) (Department of Budget and Management, 2021[42]), although the programme’s planned launch has been delayed due to challenges in the insurance procurement process (de Vera, 2022[43]).

The Philippines has implemented financial protection mechanisms to provide funding based on the occurrence of an event, including a pilot parametric insurance programme (2017-2019), a catastrophe bond (issued in 2019) and is currently finalising the implementation of a Philippines City level Parametric Liquidity Program (CPLP).

In 2017-2018 and 2018-2019, through the Government (BTr), a parametric insurance coverage against typhoons and earthquakes was acquired to provide quick funding for the national government and affected local governments. The policy provided USD 206.4 million in coverage in 2018 and USD 406.7 million in coverage in 2019 (based on additional interest from the international insurance sector) and was designed to trigger based on a modelled loss (either partially or in full).9 The funds were to be allocated equally between the national government and affected local governments although most of the funds for qualifying events were distributed to the national government (World Bank, 2021[16]). The policy was issued to the BTr by GSIS and 100% reinsured by the World Bank which transferred (retroceded) 100% of the risk to international reinsurance markets. The parametric (modelled loss) approach allowed for payment to be made to GSIS (cedant) within 3 weeks and to the policyholders and beneficiaries (national and local governments) within 30 days from the occurrence of the event (World Bank, 2021[16]). In 2019, the insurance coverage was triggered on two occasions and made payouts of PHP 1.34 billion (approximately USD 26.8 million) (Department of Budget and Management, 2021[42]).

While the parametric insurance coverage was not extended beyond the pilot phase, elements of its design were applied in the issuance of a 3-year catastrophe bond in 2019 covering typhoon (USD 150 million in coverage) and earthquake (USD 75 million in coverage) risk. Similar to the parametric insurance policy, the catastrophe bond pays out based on a modelled loss trigger. The catastrophe bond was issued by the World Bank with premiums (coupon rate10 on bonds) paid by - and benefits accruing to - the national government (World Bank, 2019[44]). Some of the proceeds of any catastrophe bond payouts will be provided to subnational governments (local government units) impacted by such events.

The Department of Finance is also working with the Asian Development Bank on the design of a Philippine City Disaster Insurance Pool (PCDIP), currently called the CPLP, that would provide quick funding to support response and recovery at municipal level (ADB, 2018[45]). The initial proposal would provide coverage for earthquakes and typhoons with a potential future expansion to also include flood risk. The coverage would be provided by GSIS through a special purpose vehicle that who would then seek reinsurance coverage for the pool of city risks from domestic and international reinsurance markets. Participating cities would be able to acquire coverage for different return periods, from 1-in-10 years to 1-in-100 years (ADB, 2018[45]). The national government is currently finalising the technical and operational elements of the proposal.

References

[13] ABI and CIAT & WFP (2022), Philippine Climate Change and Food Security Analysis.

[45] ADB (2018), PCDIP: Philippine City Disaster Insurance Pool, Asian Development Bank, https://www.adb.org/sites/default/files/publication/479966/philippine-city-disaster-insurance-pool-summary.pdf.

[30] ADB (2017), Assessment of Microinsurance as Emerging Microfinance Service for the Poor: The Case of the Philippines, Asian Development Bank, Manila, Philippines, https://doi.org/10.22617/RPT178653-2.

[26] Alvarez, P. (2019), The Philippines Disaster Risk Financing Strategy, https://mefin.org/files/DOF%20Disaster%20Risk%20Financing%20Initiative.%20TWG%20P&R%2020%20May%202019.pdf.

[73] Arias, C. (2021), Estrategia Nacional de Protección Financiera del Riesgo de Desastres, Epidemias y Pandemias, Ministerio de Hacienda y Crédito Público.

[64] BBC (2014), Colombia drought triggers clashes in La Guajira province, https://www.bbc.com/news/world-latin-america-28754687 (accessed on 2 July 2022).

[39] Bureau of the Treasury (2022), National Government Debt Indicators (1986-2022), Bureau of the Treasury.

[50] Cardona, O. et al. (2020), Entregable 3: Informe con los resultados de la propuesta de medidas de adaptación y su efecto en reducción del riesgo – Fase 1, INGENIAR Risk Intelligence Ltda.

[67] Castellanos, E. et al. (2022), Central and South America, Cambridge University Press.

[33] CFE-DM (2021), 2021 Philippines Disaster Management Reference Handbook, https://reliefweb.int/report/philippines/2021-philippines-disaster-management-reference-handbook.

[9] Climate Analytics (2022), Climate Impact Explorer, https://climate-impact-explorer.climateanalytics.org/ (accessed on 1 August 2022).

[22] COA.GOV.PH (2014), Assessment of Disaster Risk Reduction and Management (DRRM) at the Local Level, https://www.coa.gov.ph/phocadownloadpap/userupload/DRRM/Assessment_of_DRRM_at_the_Local_Level.pdf.

[6] CRED/UC Louvain (2022), EM-DAT, https://www.emdat.be/ (accessed on 15 July 2022).

[75] Cruz, R. (2017), 2017 Philippine Climate Change Assessment: Working Group 2 Impacts, Vulnerabilities and Adaptation.

[43] de Vera, B. (2022), “Gov’t eyes insurance for P1.9T public assets”, Philippine Daily Inquirer, https://business.inquirer.net/341501/govt-eyes-insurance-for-p1-9t-public-assets (accessed on 2 August 2022).

[18] Department of Budget and Management (2022), Fiscal Risks Statement, https://www.dbm.gov.ph/wp-content/uploads/DBCC_MATTERS/FiscalRiskStatement/Fiscal[1]Risks-Statement-2022-for-Circulation.pdf.

[42] Department of Budget and Management (2021), Fiscal Risks Statement, https://www.treasury.gov.ph/wp-content/uploads/2020/12/Fiscal-Risks-Statement-2021-for-Circulation.pdf.

[70] Department of Energy (2018), Developing a Disaster Risk Finance and Insurance Strategy for the Philippines, https://www.doe.gov.ph/sites/default/files/pdf/announcements/a_plenary_04_developing_disaster_risk_finance.pdf?withshield=1.

[41] Department of Finance (2021), BTr inventories P1.3-T non-financial Gov’t assets in 2020, Department of Finance, https://www.dof.gov.ph/btr-inventories-p1-3-t-non-financial-govt-assets-in-2020/ (accessed on 2 August 2022).

[69] Department of Finance (2019), The Philippines Disaster Risk Financing Strategy, https://mefin.org/files/DOF%20Disaster%20Risk%20Financing%20Initiative.%20TWG%20P&R%2020%20May%202019.pdf.

[32] DMB (2021), LGUs Receive Additional P4.85 Billion for Typhoon Odette, Department of Budget and Management, https://www.dbm.gov.ph/index.php/secretary-s-corner/press-releases/list-of-press-releases/2043-lgus-receive-additional-p4-85-billion-for-typhoon-odette (accessed on 27 October 2022).

[76] DOST-PAGASA (2022), DOST-PAGASA MODIFIES TROPICAL CYCLONE WIND SIGNAL (TCWS) SYSTEM, https://www.pagasa.dost.gov.ph/press-release/108.

[56] FINAGRO (2017), Seguro Agrícola Catastrófico en Colombia: Estudio de Factibilidad, FINAGRO.

[68] French Development Agency (2022), Disaster Risk Reduction: New Support for Localities in the Philippines, https://www.afd.fr/en/actualites/disaster-risk-reduction-new-support-localities-philippines.

[19] GeoRisk Philippines (2022), GeoRisk Philippines.

[11] GOV.PH (2022), Gross Domestic Product, by Industry, https://psa.gov.ph/grdp/tables/2022 (accessed on 17 July 2022).

[74] GOV.PH (2018), DBM Secretary discusses climate and infrastructure financing on second day of World Bank Annual Meetings, https://www.dbm.gov.ph/index.php/secretary-s-corner/press-releases/list-of-press-releases/853-dbm-secretary-discusses-climate-and-infrastructure-financing-on-second-day-of-world-bank-annual-meetings.

[17] GOV.PH (2017), Enhanced LGU Guidebook on the Formulation of Local Climate Change Action Plan, https://lga.gov.ph/.

[14] GOV.PH (2014), Second National Communication to the United Nations Framework Convention, https://unfccc.int/sites/default/files/resource/phlnc2.pdf.

[55] Government of Colombia (2022), Colombia’s response to the Questionnaire for the review of the OECD Recommendation on Disaster Risk Financing Strategies.

[48] Government of Colombia (2022), Report from Colombia on implementation of the OECD Recommendation on Disaster Risk Financing Strategies (submission to the OECD Insurance and Private Pensions Committee).

[59] Governor’s Office of Huila, Ministry of Finance and Public Credit and World Bank (2021), Disaster Risk Management Financial Protection Strategy for the department of Huila, Government of Huila.

[34] GOVPH (2022), Status of National Disaster Risk Reduction and Management Fund, https://www.dbm.gov.ph/index.php/programs-projects/status-of-national-disaster-risk-reduction-and-management-fund (accessed on 18 July 2022).

[35] GOVPH (2017), Policy Brief: Examining the Philippines’ Disaster Risk Reduction and Management System, https://senate.gov.ph/publications/SEPO/PB_Examining%20PH%20DRRM%20System_05June2017.pdf.

[15] Hallegatte, S. et al. (2015), Shock Waves: Managing the Impacts of Climate Change on Poverty, Washington, DC: World Bank, https://doi.org/10.1596/978-1-4648-0673-5.

[29] Insurance Commission (2022), Guidelines on the Adoption of the Revised Schedule of Minimum Catastrophe Rates.

[24] Insurance Commission (2021), Key Statistical Data: 2016-2020, Insurance Commission, https://www.insurance.gov.ph/summary-from-2016-2020/.

[28] Insurance Commission (2021), Strict Implementation Of Sustainable Catastrophe Insurance Premium Rates And Establishment Of The Philippine Catastrophe Insurance Facility (PCIF).

[12] IPBES (2018), Summary for policymakers of the regional assessment report on biodiversity and ecosystem services fro Asia and the Pacific of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services.

[61] IPCC (2021), Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge University Press.

[31] Kong, D. and I. Gopalakrishna (2020), Philippines: Highly developed microinsurance market; 90% respondents rate microinsurance as very important, https://www.asiainsurancereview.com/Milliman/MillimanArticle/aid/25/-a-href-articleLink-class-subcat-sapn-class-red-Philippines-sapn-Highly-developed-microinsurance-market-90-respondents-rate-microinsurance-as-very-important-a- (accessed on 1 August 2022).

[62] L’Hereux, M. (2014), What is the El Niño–Southern Oscillation (ENSO) in a nutshell?, https://www.climate.gov/news-features/blogs/enso/what-el-ni%C3%B1o%E2%80%93southern-oscillation-enso-nutshell (accessed on 22 June 2022).

[77] Met Office (2017), Improving resilience to severe weather and climate change in the Philippines.

[78] Met Office (2017), Improving resilience to severe weather and climate change in the Philippines, https://www.metoffice.gov.uk/binaries/content/assets/metofficegovuk/pdf/business/international/17_0015-pagasa_case_study_final.pdf.

[57] Ministerio de Hacienda y Crédito Público (2021), Estrategia Nacional de Protección Financiera de Riesgo de Desastres, Epidemias y Pandemias.

[51] Ministry of Finance and Public Credit (2011), Contingent Liabilities: The Colombia Experience, Ministry of Finance and Public Credit.

[60] Nagy, G. et al. (2019), “Climate vulnerability, impacts and adaptation in Central and South America coastal areas”, Regional Studies in Marine Science, Vol. 29, p. 100683, https://doi.org/10.1016/j.rsma.2019.100683.

[37] NDCC (2010), Implementing Rules and Regulations of Republic Act No. 10121, https://ndrrmc.gov.ph/attachments/article/95/Implementing_Rules_and_Regulartion_RA_10121.pdf.

[5] NDRRMC (2013), Final Report re Effects of Typhoon “YOLANDA” (HAIYAN), https://ndrrmc.gov.ph/attachments/article/1329/FINAL_REPORT_re_Effects_of_Typhoon_YOLANDA_(HAIYAN)_06-09NOV2013.pdf.

[25] OECD (2022), OECD Insurance Statistics (database).

[79] OECD (2021), Managing Climate Risks, Facing up to Losses and Damages, OECD Publishing, Paris, https://doi.org/10.1787/55ea1cc9-en.

[1] OECD (2020), “Approaches in the Philippines to increased coherence in climate change adaptation and disaster risk reduction”, in Common Ground Between the Paris Agreement and the Sendai Framework : Climate Change Adaptation and Disaster Risk Reduction, OECD Publishing, Paris, https://doi.org/10.1787/4ec0f8bc-en.

[21] OECD (2020), Approaches in the Philippines to increased coherence in climate change adaptation and disaster risk reduction, OECD Publishing, https://doi.org/10.1787/4ec0f8bc-en.

[23] OECD (2020), Leveraging the Role of Property Catastrophe Reinsurance Markets: The Case of India, Indonesia, Myanmar, and the Philippines, OECD, https://www.oecd.org/finance/insurance/leveraging-the-role-of-property-catastrophe-reinsurance-markets.htm (accessed on 15 July 2021).

[52] OECD (2017), OECD Insurance Statistics (database), http://stats.oecd.org/Index.aspx?DatasetCode=INSIND (accessed on 26 March 2018).

[54] OECD/The World Bank (2019), Fiscal Resilience to Natural Disasters: Lessons from Country Experiences, OECD Publishing, Paris, https://doi.org/10.1787/27a4198a-en.

[58] Office of the Governor of Putumayo, Ministry of Finance and Public Credit and World Bank (2021), Financial Protection Strategy for the Management of Disaster Risks in the Putumayo Department.

[4] PAGASA (2022), Tropical Cyclone Information.

[8] PAGASA (2021), Annual Tropical Cyclone Tracks, https://www.pagasa.dost.gov.ph/information/annual-cyclone-track.

[27] Philippine Insurers and Reinsurers Association (PIRA) and German Development Cooperation - Regulatory Framework Promotion of Pro-poor Insurance Markets in Asia (GIZ RFPI Asia) (2020), Climate and Disaster Risk Insurance-related Country Experience: Philippine Catastrophe Insurance Facility (PCIF), The Mutual Exchange Forum on Inclusive Insurance (MEFIN) Network, https://www.mefin.org/docs/CDRI-Philippine-Catastrophe-Insurance-Facility-Factsheet-2020.pdf.

[66] Ranasinghe, R. et al. (2021), Climate Change Information for Regional Impact and for Risk Assessment, Cambridge University Press.

[65] Senviratne, S. et al. (2021), Weather and Climate Extreme Events in a Changing Climate, Cambridge Unversity Press.

[7] Shaw, R. et al. (2022), Asia, Cambridge University Press.

[53] Swiss Re sigma (2020), Natural catastrophes and man-made disasters: 1990-2019 (dataset), Swiss Re.

[3] UNDRR (2020), The human cost of disasters: an overview of the last 20 years (2000-2019).

[20] UNDRR (2019), Disaster Risk Reduction in the Philippines, Status Report, https://www.unisdr.org/files/68265_682308philippinesdrmstatusreport.pdf.

[49] Unidad Nacional para la Gestión del Riesgo de Desastres (2018), Atlas de Riesgo de Colombia: revelando los desastres latentes, Government of Colombia.

[36] Villacin, T. (2017), “A review of Philippine government disaster financing for recovery and reconstruction”, PIDS Discussion Paper Series, Vol. 2017/21, http://hdl.handle.net/10419/173598.

[10] WEF (2020), Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy.

[71] World Bank (2022), Current Climate: Colombia, https://climateknowledgeportal.worldbank.org/country/colombia/climate-data-historical (accessed on 15 July 2022).

[2] World Bank (2022), Current Climate: Philippines, https://climateknowledgeportal.worldbank.org/country/philippines/climate-data-historical (accessed on 20 July 2022).

[40] World Bank (2022), Strengthening the Philippines’ Post-disaster Financial Resilience through Support at the National and Local Levels, World Bank, https://www.worldbank.org/en/news/feature/2022/04/05/strengthening-the-philippines-post-disaster-financial-resilience-drmhubtokyo (accessed on 1 August 2022).

[63] World Bank (2021), Climate Risk Profile: Colombia.

[16] World Bank (2021), Lessons Learned: The Philippines Parametric Catastrophe Risk Insurance Program Pilot (Evaluation Report), World Bank, https://openknowledge.worldbank.org/handle/10986/36013.

[38] World Bank (2020), Public Expenditure Review : Disaster Response and Rehabilitation in the Philippines.

[46] World Bank (2019), Super-sized Catastrophe Bond for Earthquake Risk in Latin America, World Bank.

[44] World Bank (2019), World Bank Catastrophe Bond Transaction Insures the Republic of Philippines against Natural Disaster-related Losses Up to US$225 million, World Bank, https://www.worldbank.org/en/news/press-release/2019/11/25/world-bank-catastrophe-bond-transaction-insures-the-republic-of-philippines-against-natural-disaster-related-losses-up-to-usd225-million (accessed on 2 August 2022).

[47] World Bank (2012), Thai Flood 2011 : Rapid Assessment for Resilient Recovery and Reconstruction Planning, World Bank.

[72] World Bank & ADB (2021), Climate Risk Profile: Philippines.

Notes

← 1. The total number of affected people (149 million) is higher than the population of the Philippines (approximately 112 million) because the number of affected people is counted per year (i.e. people can be counted multiple times if they are affected by multiple disasters across different years).

← 2. Based on the modified Tropical Cyclone Wind Signal (TCWS) system of the PAGASA-DOST, typhoon (TY) is a tropical cyclone with maximum wind speed of 118 to 184 kph and super typhoon (STY) is a tropical cyclone with maximum wind speed exceeding 185 kph (DOST-PAGASA, 2022[76]).

Floods and landslides have become more frequent, as is shown by Figure A A.2 (note that the 2022 data ends in July, which likely explains the drop of the last data point). These are driven, at least partially, by stronger typhoons and extreme precipitation events which have become more frequent (Shaw et al., 2022[1]). Stronger typhoons also lead to more severe landslides (World Bank & ADB, 2021[9]). For example, the average annual loss associated with flooding in the Philippines is around USD 625 million (World Bank & ADB, 2021[9]). There is no discernible trend for droughts in Figure A A.2. Frequency of floods and landslides has increased in the Philippines.

← 3. While the current and past observations of hazards are made for the Philippines specifically, the uncertainties associated with climate projections are not country-specific (see Chapter 2 of (OECD, 2021[79])), but are made for wider regions, in the case of Philippines to South-East Asia.

← 4. The Supreme Court (SC) ruled that the just share of LGUs from the national taxes is not limited to “national internal revenue taxes” collected by the Bureau of Internal Revenue (BIR) but includes collections (customs duties) by the Bureau of Customs (BOC).

← 5. For example, the National Disaster Risk Reduction and Management Council Operations Center (NDRRMC OC) has been collecting data on damages to properties by type (i.e., agriculture, infrastructure, private) caused by tropical cyclones since 2011.

← 6. OECD calculations based on data provided by (Swiss Re sigma, 2020[53]).

← 7. Source: https://dilg.gov.ph/PDF_File/issuances/joint_circulars/DILG-Joint_Circulars-2013417-26053e1cc9.pdf.

← 8. Formerly known as the PCDIP, the USD2.5 million Technical Assistance grant will be funded from the ADB Regional Technical Assistance (RETA) 9766: Southeast Asia Public Management, Financial Sector, and Trade Policy Facility

← 9. A modelled loss trigger is designed to make payments based on the whether the actual parameters of the event exceed specific thresholds as defined in a designated catastrophe model. The most common threshold is a modelled loss level (i.e. where a model is used to estimate losses based on the parameters of the event and payouts are made if the loss exceeds a specific threshold). In this policy, payouts were made based on the estimated annual probability of occurrence of an event with the parameters of the actual event – providing a partial payout for events with a probability of occurrence of between 3.3% and 10% and a full payout for events with a probability of occurrence below 3.3% (World Bank, 2021[16]).

← 10. The coupon rate was set as the 3-month LIBOR rate plus a funding margin (-0.12%) and risk margin (+5.65% in the case of tropical cyclones) (World Bank, 2019[44]).