This chapter provides some key economic indicators and analysis of Romanian non‑financial companies’ demographics, capital structure, investment and performance. Although some data pre‑date the COVID‑19 crisis, they still provide useful insights for understanding the underlying structural challenges faced by the corporate sector and the Romanian economy. The chapter also provides an overview of the initial impact of the COVID‑19 crisis on the corporate sector and summarises the government relief programmes to the corporate sector.

Capital Market Review of Romania

3. The Romanian corporate sector

Abstract

Romania had a period of strong economic growth in the five years up to 2019, which helped improve living standards and reduce unemployment. However, it has had twin fiscal and current account deficits for the past two decades, and investment growth has lagged general economic growth. Further, competitiveness is held back by shortcomings such as a lack of skills, poor innovation and uncertainty with respect to the regulatory environment. At the same time, the financial system is heavily bank dependent, in particular on foreign‑owned banks, while capital markets play a very limited role in providing financing to the non‑financial corporate sector.

3.1. Overview of the economy

Economic growth in Romania was on average 4.7% per year between 2015 and 2019, leading to lower unemployment and improved per capita income levels converging towards those of advanced European economies (Table 3.1). However, due to the impact of the COVID‑19 pandemic, GDP contracted 3.9% in 2020.

Table 3.1. Key economic indicators for Romania

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Real GDP growth (%) |

(3.9) |

1.9 |

2.0 |

3.8 |

3.6 |

3.0 |

4.7 |

7.3 |

4.5 |

4.1 |

(3.9) |

|

Real GDP per capita (EUR, thousands) |

12.8 |

13.3 |

14.0 |

14.3 |

14.8 |

15.5 |

16.9 |

18.7 |

19.9 |

21.6 |

21.4 |

|

Unemployment rate (%) |

7.0 |

7.2 |

6.8 |

7.1 |

6.8 |

6.8 |

5.9 |

4.9 |

4.2 |

3.9 |

5.0 |

|

Headline inflation (%) |

6.1 |

5.8 |

3.3 |

4.0 |

1.1 |

(0.6) |

(1.6) |

1.3 |

4.6 |

3.8 |

2.8 |

|

Labour productivity growth (%) |

(2.0) |

3.9 |

2.7 |

4.7 |

3.4 |

5.6 |

4.6 |

6.0 |

4.1 |

3.9 |

(2.3) |

|

Fiscal balance (% of GDP) |

(6.9) |

(5.4) |

(3.7) |

(2.1) |

(1.2) |

(0.6) |

(2.6) |

(2.6) |

(2.9) |

(4.4) |

(9.4) |

|

Primary fiscal balance (% of GDP) |

(5.6) |

(4.0) |

(2.3) |

(0.7) |

0.2 |

0.7 |

(1.4) |

(1.6) |

(2.0) |

(3.5) |

(7.9) |

|

Gross government debt to GDP (%) |

29.6 |

34.0 |

37.1 |

37.6 |

39.2 |

37.8 |

37.4 |

35.1 |

34.7 |

35.3 |

47.4 |

|

Current account balance (% of GDP) |

(5.2) |

(5.0) |

(4.9) |

(0.9) |

(0.2) |

(0.5) |

(1.4) |

(2.7) |

(4.3) |

(4.6) |

(3.8) |

|

Investment (GFCF, percentage of GDP) |

26.1 |

27.2 |

27.5 |

24.7 |

24.4 |

24.8 |

22.9 |

22.4 |

21.1 |

23.6 |

. |

|

Non‑performing loans to total lending (%) |

11.9 |

14.3 |

18.2 |

21.9 |

20.7 |

13.4 |

9.7 |

6.6 |

5.0 |

4.3 |

3.9 |

Note: Real GDP per capita is measured in purchasing power standards (PPS).

Source: Romanian National Institute of Statistics, OECD Economic Outlook 110, OECD Productivity Statistics, Eurostat, World Bank.

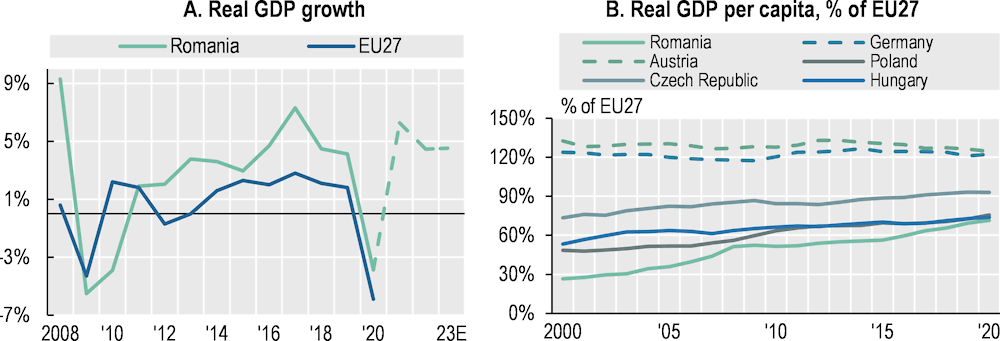

Even including the global crises of 2008 and 2020, which had significant impacts on Romanian economic growth, the economy has been expanding by an average of 3.7% annually in real terms since 2000, far above the EU average (Figure 3.1, Panel A). The economy grew at 6.1% per annum from 2000 to 2008, followed by a protracted downturn after the 2008 crisis and the subsequent European sovereign debt crisis. It was only in recent years that it began to pick up again, reaching 7.3% in 2017. Prior to the pandemic, this growth appeared set to continue into 2020, as real GDP in Q1 2020 was 2.4% higher than the same quarter in 2019.

However, as an effect of the pandemic induced crisis, Romania’s real GDP growth for 2020 was ‑3.9%. 2021 has surpassed growth expectations and showed strong signs of recovery, as the first three‑quarters of 2021 saw a GDP growth of 7.2%.

While Romania’s per capita real GDP is still low compared with more advanced European countries and in the lower range of CEE peers, the growth in recent years has led to a convergence towards general EU levels (Figure 3.1, Panel B).

Figure 3.1. GDP growth in Romania and selected European countries

Note: Figures provided in dashed lines in Panel A for 2021, 2022 and 2023 are forecasts from (OECD, 2021[1]).

Source: Romanian National Institute of Statistics, OECD Economic Outlook 110, Eurostat.

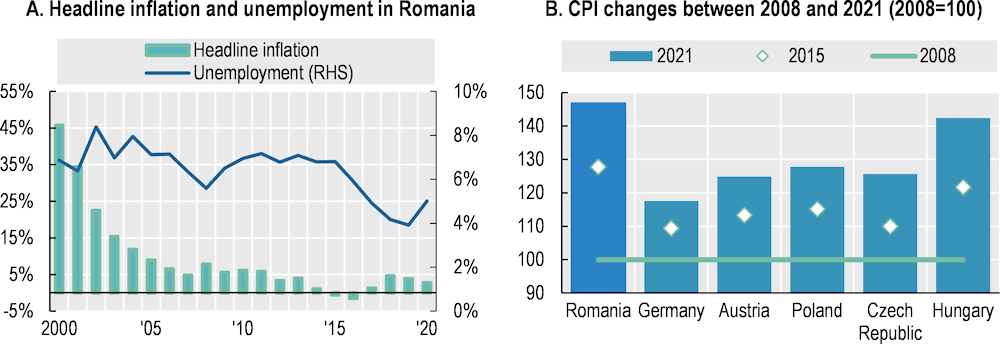

After remaining persistently high at around 7% between 2000 and 2015, the Romanian unemployment rate began to decrease gradually in 2016, falling to a record low of 3.9% in 2019. However, this is partly an effect of a sustained decrease in the labour force following a reduction in the working age population coupled with outward migration of skilled labour (EC, 2019[1]; EC, 2020[2]). The current structure of the labour force is seen as leading to challenges in the recruitment process and driving the wage growth in the country (EC, 2019[1]). Further, as a result of the COVID‑19 crisis, unemployment has increased markedly, reaching 5.0% in 2020 (Figure 3.2, Panel A).

Figure 3.2. Inflation and unemployment

Source: Romanian National Institute of Statistics and OECD Economic Outlook 110 for Panel A; Eurostat for Panel B.

Simultaneously, price inflation in Romania has fallen from high levels in the early 2000s to more subdued levels since the 2008 financial crisis, in line with the more general European pattern of pervasive low inflation (Figure 3.2, Panel A). Still, in 2021 price inflation in Romania was one of the highest among EU countries (Eurostat, 2022[3]). Indeed, between 2008 and 2021 consumer prices saw a cumulative increase of almost 50%, the highest among peer countries (Figure 3.2, Panel B). Despite a period of deflation in 2015 and 2016, in recent years there are signs that inflation has begun to increase again, driven by hikes in food and energy prices as well as internal factors (EC, 2019[1]).

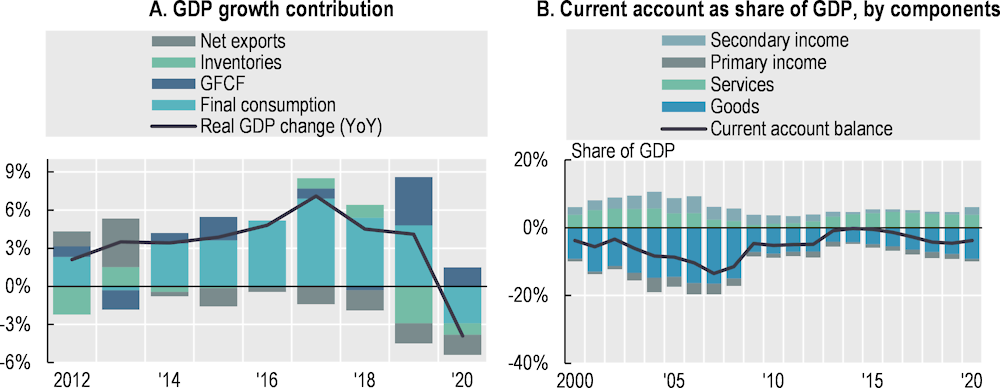

GDP growth in Romania over the past decade was driven by consumption. Of the cumulative real GDP growth contribution between 2012 and 2020, 96% was made up by consumption, with gross fixed capital formation (investment) representing only 24% (inventories and net exports contributed ‑10% each). This consumption‑led growth model has not only led to pressure on the current and fiscal accounts but is also hampering Romania’s sustainable economic convergence towards general EU living standards (EC, 2019[1]; EC, 2020[2]). The sustainability of such a growth model is fragile if consumption is financed with debt or driven by a wealth effect resulting from a rise in real house prices, for example. In both cases, future spending may be constrained as a result of deleveraging or a reversal in housing prices (Kharroubi and Kohlscheen, 2017[4]).

The consumption dependent growth is also reflected in the long standing Romanian current account deficit, which is driven primarily by large goods imports, coupled with relatively low export growth (Figure 3.3,Panel B). The net export contribution to GDP growth has been negative in every year since 2014 (Figure 3.3, Panel A). These developments have contributed to the diminishing competitiveness of Romanian corporations in domestic and foreign markets (IMF, 2019[5]). Specifically, the average annual current account deficit since 2000 has been over 5%, with a corresponding goods deficit of almost 10%. This has been slightly offset by an average services export surplus of around 3.6% and an average secondary income surplus of 2.5%.

Figure 3.3. GDP growth contribution and current account composition in Romania

Source: Romanian National Institute of Statistics for Panel A; Eurostat for Panel B.

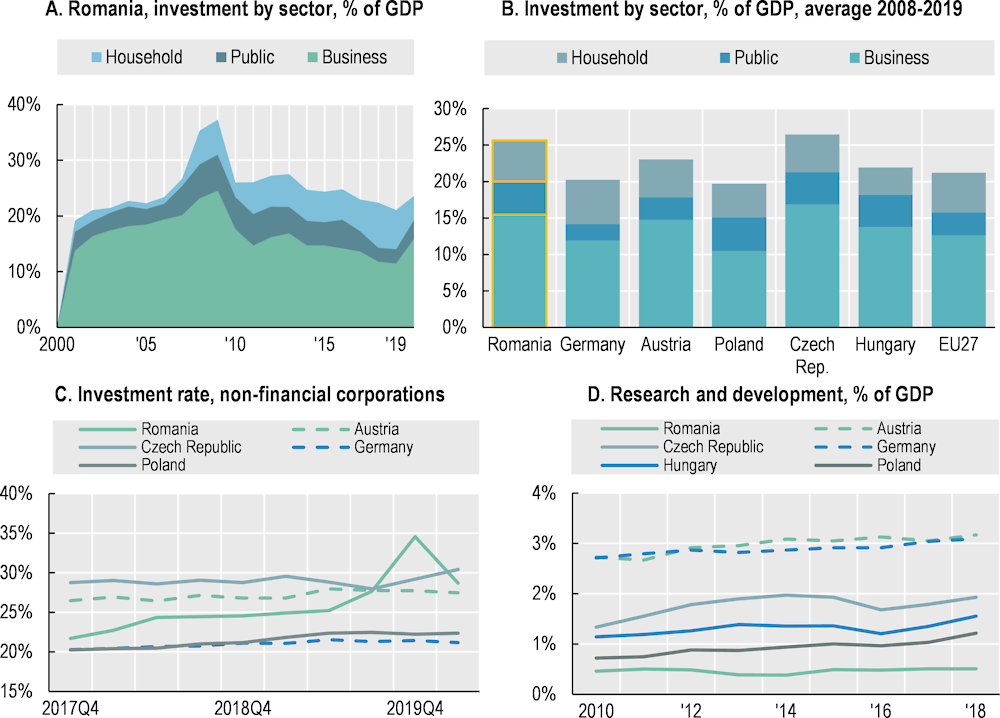

Investment in Romania has been declining since the 2008 financial crisis (Figure 3.4, Panel A). Still, compared to regional peers the headline figures remain favourable, with a split between business, public and household investment similar to that of the EU average (Figure 3.4, Panel B). Non‑financial corporate investment has been improving since 2017, both in terms of shares of gross value added and when compared to peer countries. However, it should be noted that the investment rate only reflects fixed investment and as such is typically higher for less advanced economies that have a smaller capital stock to begin with (Figure 3.4, Panel C). Finally, compared to other EU economies, non‑financial corporate investment in Romania appears to be concentrated in a much smaller number of firms, as the country has one of the lowest shares of domestic companies investing (Pal et al., 2019[6]).

Figure 3.4. Investment trends in Romania and selected European countries

Note: In Panel B gross fixed capital formation consists of resident producers’ acquisitions, less disposals of fixed assets plus certain additions to the value of non‑produced assets realised by productive activity, such as improvements to land. In Panel C the gross investment rate is defined as gross fixed capital formation divided by gross value added. Data for Hungary are unavailable in Panel C. Research and development in Panel D covers basic and applied research as well as experimental development.

Source: Eurostat.

To compare the level of intangible investment across economies, research and development (R&D) expenditure is a relevant indicator. Romania shows by far the lowest level of R&D as a share of GDP among its peers at around 0.5% annually since 2010. This is less than a quarter of the EU average and around one‑seventh of Germany and Austria’s levels (Figure 3.4, Panel D). Lack of R&D investment may hamper future technological progress, productivity increases and innovation in the economy. It is important to note that in order to support such intangible, relatively riskier investments, some form of market-based financing is often required, which is why underinvestment in intangibles is also a reflection of the state of capital markets.

Moreover, financial soundness is low in the Romanian corporate sector, which has the highest share of companies with negative equity in Europe (see Section 3.6). Together with the closely related phenomenon of higher financing costs, this represents an important factor hindering companies’ access to external financing, thereby limiting their investment capacity (EIB, 2019[7]) In addition, according to a survey on companies’ views on investment obstacles by the European Investment Bank the level of uncertainty in the economy as well as challenging business and labour market regulations are pointed out as key issues for Romanian firms (EIB, 2019[7]).

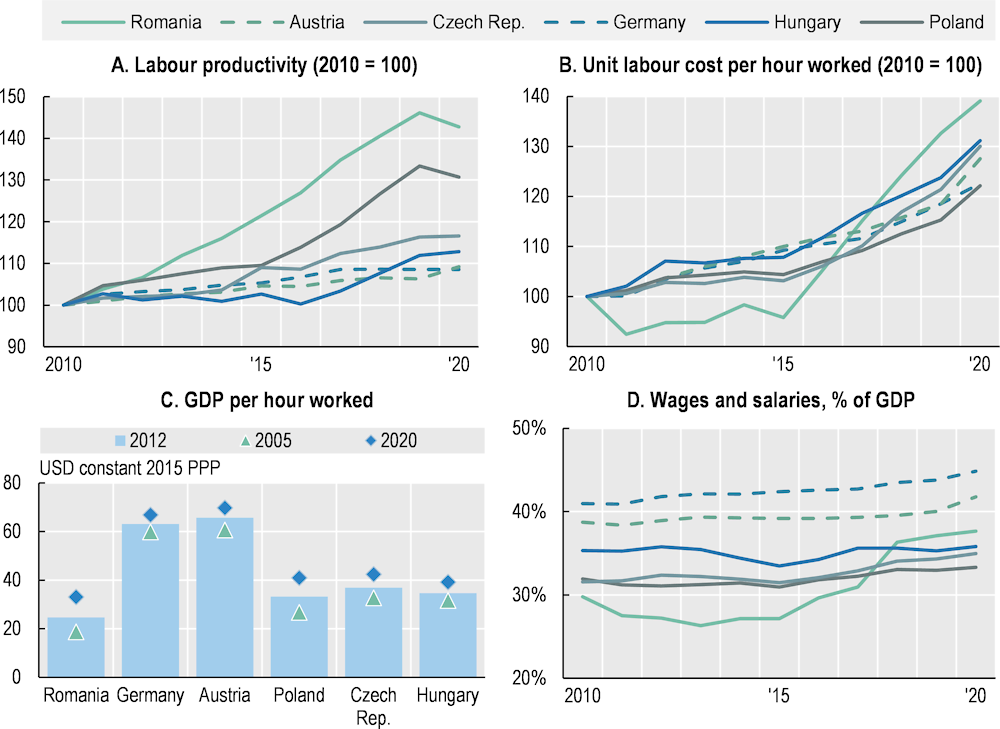

Labour productivity growth (measured as GDP per hour worked) in Romania was strong in the past decade, far outpacing regional peers and more advanced European economies (Figure 3.5, Panel A). It should be noted, however, that at the start of the analysed period, labour productivity was significantly lower than that of peer countries (for example, in 2010, USD 23 was produced for every hour worked in Romania, compared to USD 36 in the Czech Republic and USD 61 in Germany). As a result, and despite the growth, it remains low in dollar terms both in a CEE and in a broader European context (Figure 3.5, Panel C). In addition, wages have outgrown productivity in recent years, notably since 2015. The increase in unemployment after the 2008 crisis and the subsequent Euro crisis led to a year on year decrease in Romanian unit labour costs in 2009, 2011 and 2015. However, between 2015 and 2020 unit labour costs increased by 45%, far exceeding the increase in labour productivity of 18% (Figure 3.5, Panels A and B).

Still, while due attention should be paid to the relation between wage and productivity growth over the longer-term, it should be noted that the wage share of GDP has historically been low in Romania (Figure 3.5, Panel D). Since labour productivity/wage comparisons do not account for the initial relation between wages and productivity, cross country comparisons should be contextualised with the wage share of GDP. Wages and salaries as a share of GDP have been rising since the second half of 2015, as a result of increments in public sector wages, minimum wage increases and a tightening labour market. In spite of this, wages in Romania are still low relative to much of the rest of the EU and they are expected to continue growing. One factor to bear in mind is that wage growth in excess of productivity gains could lead to losses in competitiveness. Boosting productivity enhancing investments is therefore key for the Romanian economy.

Figure 3.5. Labour productivity and wage share in Romania and selected European countries

Source: OECD Productivity Statistics, OECD Stat Database.

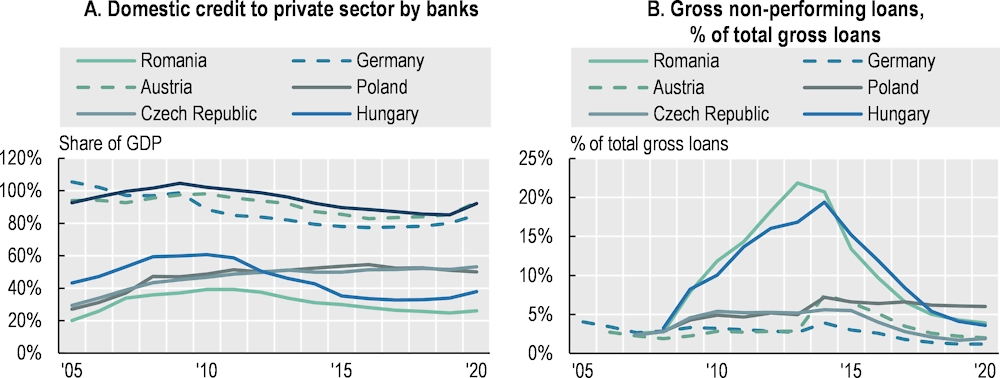

Further, domestic bank credit to the private sector as a share of GDP stood at 26% in Romania at the end of 2020, the lowest among peer countries, and the share has been decreasing since 2011 (Figure 3.6, Panel A). The non‑bank financial system is even smaller and does not fill this financing gap. While the banking financial system represented 57% of GDP in Q3 2021, the non‑bank financial system represented less than 14% (ASF, 2021[8]). Moreover, Romanian non‑financial companies rely heavily on non‑resident financial institutions for loan financing, which is a cause for concern in terms of financial stability. At the end of 2019, loans from non‑resident financial institutions were 1.2 times higher than loans from resident financial institutions (BNR, 2020[9]). Rather than bank loans or capital markets, Romanian companies’ main sources of external financing are overdrafts and credit lines. Together with the lack of bank financing to the corporate sector, the underdevelopment of the capital market is likely to negatively impact economic growth (EC, 2020[2]). Both the bank and non‑bank financial sectors are instead heavily exposed to Romanian Government securities, raising risks of excessive interdependence between banks and the state (World Bank and IMF, 2018[10]; ASF, 2020[11]) As of November 2021, government bonds made up 61% of assets both for mandatory pension funds and optional pension funds (ASF, 2021[8]).

Figure 3.6. Banking sector loan trends in Romania and selected European countries

Note: For Panel B data from 2014 onwards comes from Eurostat (except for the Czech Republic, 2014‑15). Prior years use World Bank data.

Source: Eurostat, World Bank.

Despite low levels of credit to the private sector, Romania had the highest share of non‑performing loans (NPLs) among peer countries after the 2008 financial crisis and the subsequent Euro crisis (Figure 3.6, Panel B). In 2014, it had the fifth-highest share in the European Union (Eurostat, 2022[12]). Since then, the National Bank of Romania (BNR) has pursued a number of initiatives in order to reduce pressure on banks’ balance sheets with respect to NPLs, including more prudent provisioning, disposal of NPLs and annual bank by bank supervisory targets for NPL reductions (World Bank and IMF, 2018[10]). In addition to the significant decrease in the NPL ratio between 2015 and 2020 (more than 9 percentage points), at the end of 2019, the non‑performing loan coverage ratio in Romania exceeded 60% which is far above the EU average of 44.6% (BNR, 2020[9]). Despite the COVID‑19 crisis, the NPL ratio continued to fall in 2020, reaching 3.9%, while the coverage ratio increased to 63.3% (BNR, 2021[13]). According to the National Bank of Romania, the probability of default estimated for non‑financial corporations during September 2021 – September 2022 will further decline to an average of 2.7% (BNR, 2021[14]). In addition, the Romanian economy has a significant level of overdue payments, amounting to 9% of GDP at the end of 2018 (BNR, 2020[9]).

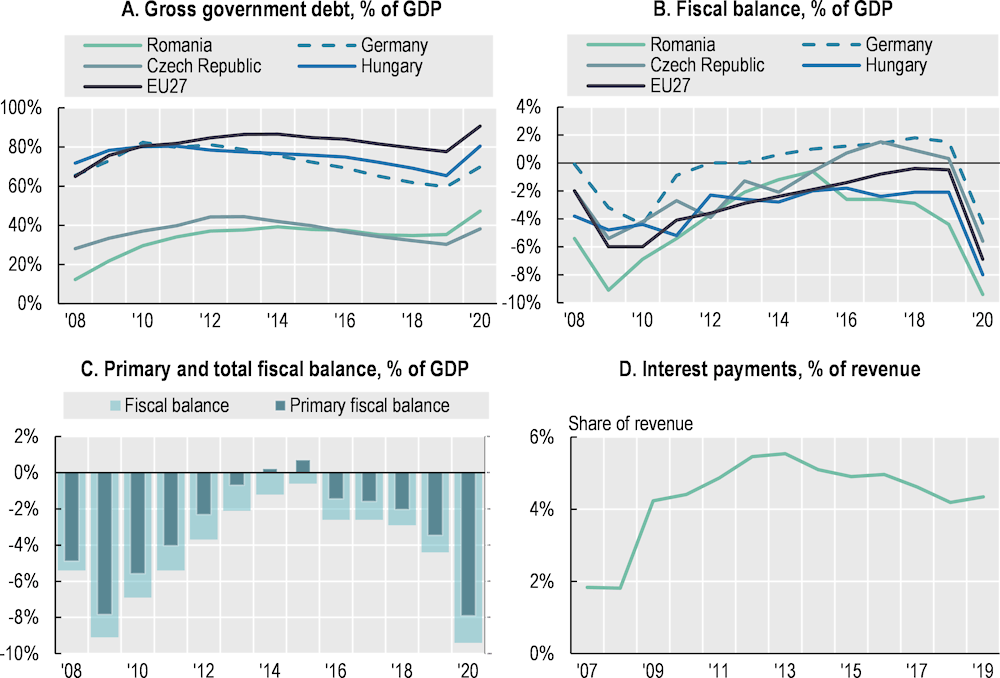

In spite of sustained fiscal deficits over the past decade and the additional pressure from the COVID‑19 crisis, Romanian sovereign indebtedness remains well below the threshold stipulated in the Stability and Growth Pact (S&G) of the European Union,1 and modest compared with many other European countries (ECB, 2020[15]). Still, gross government debt almost tripled as a share of GDP between 2008 and 2019 (from 12% to 35%), and further rose to 47.4% in 2020 and reached 48.9% in 2021 (RMF, 2022[16]). The fiscal deficit has remained larger than the 3% laid out in the S&G Pact for many years (Figure 3.7, Panel B). Moreover, according to the European Commission, the debt‑to‑GDP ratio is projected to exceed 90% by 2030, mainly driven by a projected significant increase in pension spending (EC, 2020[2]).

Figure 3.7. Fiscal balance and gross public debt

Source: Eurostat, OECD Economic Outlook 108, World Bank.

It should be noted that the primary and total fiscal balances differ markedly in Romania (Figure 3.7, Panel C). While the average fiscal deficit over the 2008‑20 period was over 4% of GDP, the primary deficit was around 3%, meaning interest payments make up a significant part of the Romanian deficit. Indeed, interest payments as a share of total revenue has increased substantially since 2008, even as interest rates have fallen to historical lows in Romania (BNR, 2021[17]) and around the world (Figure 3.7, Panel D). This was a joint effect of falling government revenue in 2009 and a sharp increase in borrowing from 12% of GDP in 2008 to 22% in 2009 (Eurostat, 2022[18]). For this reason, it should also be noted that even if debt levels are modest, there is lower “tolerance” for debt in emerging economies compared to advanced economies. Therefore, the sustainable level of sovereign borrowing for Romania is likely to be lower than in advanced economies.

3.2. Business demographics

In 2021, small and medium enterprises (SMEs) accounted for 99.8% of all firms in the non‑financial business sector in the European Union, employing 65.2% of the total workforce (EC, 2021[19]). Similarly, in Romania, SMEs made up 99.7% of total non‑financial corporations at the end of 2019 (Table 3.2). Although the share of SMEs is very similar across peer countries, the composition of subcategories within SMEs varies considerably. For instance, the share of micro firms in the Czech Republic, Hungary and Poland averages 95%, whereas in Germany and Austria micro firms account for only around 85% and small firms for over 10%. Romania stands in the middle with micro firms (1 to 9 employees) representing 89.5%, small firms (10 to 49 employees) 8.6%, and medium sized firms (50 to 249 employees) 1.6%. Large firms (over 250 employees) represent 0.3% of all Romanian non‑financial companies. Notably, the share of large non‑financial companies is larger than in the Czech Republic, Hungary or Poland, but lower than in Austria and Germany, where large firms constitute 0.4% and 0.5% of all firms, respectively.

The distribution of Romanian companies remained quite stable between 2010 and 2019, with the share of micro firms growing from 88.9% in 2010 to 89.5% in 2019. The total number of non‑financial firms grew from 440 000 in 2010 to over 500 000 in 2018, a 16% increase. This increase exceeds those in Austria, the Czech Republic and Hungary but is smaller than those in Germany and Poland, which saw their total number of non‑financial firms increase by 25% and 37% respectively from 2010 to 2019.

Table 3.2. Company distribution by firm size

|

2010 |

2019 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Micro |

Small |

Medium |

Large |

No. of firms |

Micro |

Small |

Medium |

Large |

No. of firms |

|

|

Romania |

88.9% |

9.0% |

1.7% |

0.3% |

443 736 |

89.5% |

8.6% |

1.5% |

0.3% |

512 762 |

|

Austria |

87.4% |

10.7% |

1.6% |

0.3% |

300 252 |

87.2% |

10.8% |

1.6% |

0.4% |

329 680 |

|

Czech Republic |

95.7% |

3.4% |

0.7% |

0.1% |

968 539 |

96.0% |

3.1% |

0.7% |

0.2% |

1 050 650 |

|

Germany |

82.2% |

14.8% |

2.6% |

0.5% |

2 063 310 |

83.2% |

14.2% |

2.2% |

0.5% |

2 580 300 |

|

Hungary |

94.6% |

4.5% |

0.7% |

0.1% |

547 724 |

94.7% |

4.5% |

0.7% |

0.1% |

639 635 |

|

Poland |

95.3% |

3.4% |

1.1% |

0.2% |

1 460 288 |

94.8% |

4.3% |

0.7% |

0.2% |

2 002 550 |

Note: In accordance with the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 4, the total corresponds to the Business economy, except financial and insurance activities.

Source: OECD SDBS Structural Business Statistics.

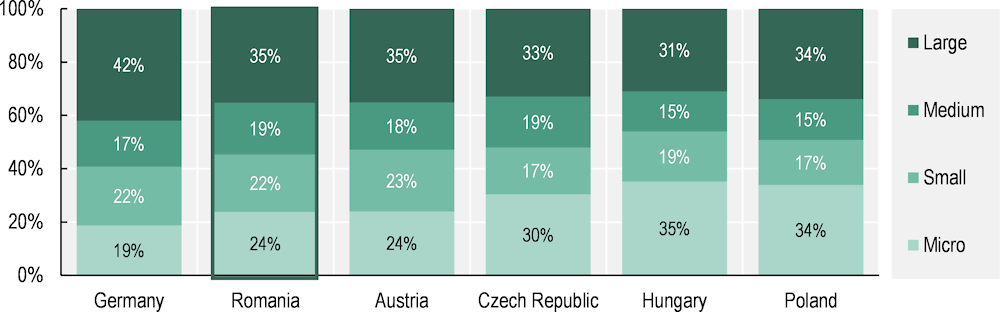

In Romania, the non‑financial business sector employs 21% of the total population (4.1 million workers) compared to 33% on average in Austria, the Czech Republic and Hungary. In Poland and Germany, the shares are 26% (10 million employees) and 38% (31 million employees) of the total population, respectively. SMEs in Romania account for 65% of total employment, similar to its peer countries with the exception of Germany, where SMEs represent 58% of total employment (Figure 3.8). Moreover, while in terms of the number of firms, large firms account for the smallest portion of non‑financial companies in all the selected countries, they employ the largest share of workers. In Romania, 35% of the labour force is employed by large firms.

Figure 3.8. Employment distribution by firm size in 2019

Note: The figure corresponds to the sector “Business economy, except financial and insurance activities” according to the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 4.

Source: OECD SDBS Structural Business Statistics.

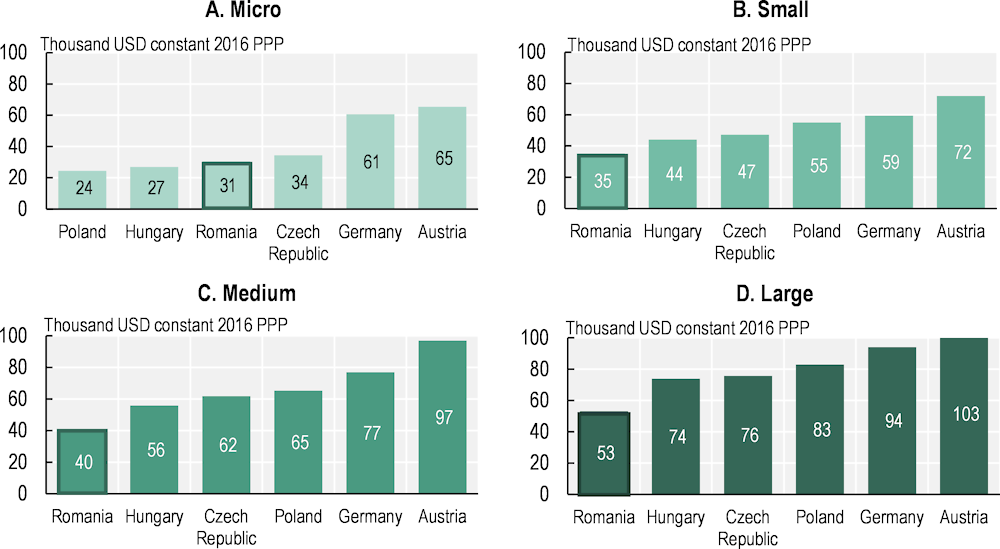

In general, labour productivity levels tend to be higher for large firms than for smaller ones. For instance, in Romania, labour productivity of micro firms is USD 31 thousand (2016 PPP) per person employed, and USD 53 thousand for large firms (Figure 3.9). German and Austrian firms are the most productive among peer countries, with over USD 60 thousand per person employed across firm size categories. In particular, large German and Austrian firms generate USD 94 thousand and USD 103 thousand respectively per person employed annually. In contrast, Romanian companies rank the lowest in terms of labour productivity when compared to their peers, with the exception of micro firms, where Romanian firms are more productive than Polish and Hungarian firms.

Figure 3.9. Labour productivity by firm size in 2016

Note: The figures correspond to the sector “Business economy, except financial and insurance activities” according to the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 4. The numbers are form 2016 due to the lack of updated information for Germany and Hungary.

Source: OECD SDBS Structural Business Statistics.

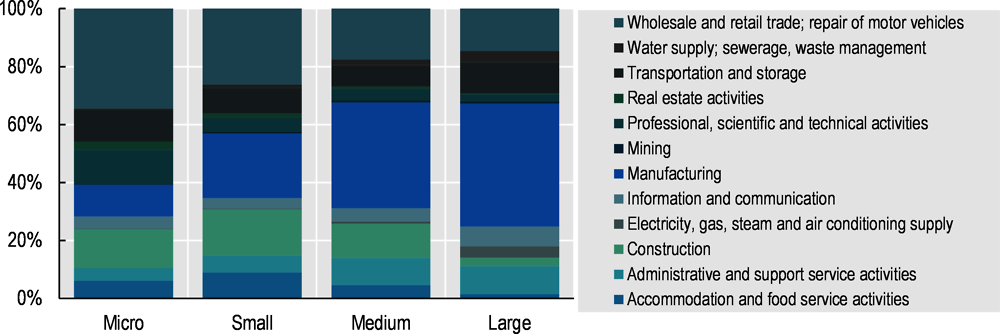

In terms of employment distribution across industries, manufacturing companies dominate and employ 31% of the Romanian workforce (Figure 3.10). Moreover, the share of employment in the manufacturing industry increases with company size, representing 11% of the employment in micro firms, 22% in small firms, 38% in medium firms and 43% in large firms. Wholesale and retail trade companies rank second in total employment in Romania with a share of 22%. This industry represents on average 35% of employment in micro and small companies, 17% in medium firms and 14% in large firms. The transportation and storage industry ranks third representing 10% of total employment, followed by the construction industry, which is important among SMEs.

Figure 3.10. Employment distribution in Romania by company size and industry in 2019

Note: In accordance with the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 4, the total corresponds to the Business economy, except financial and insurance activities.

Source: OECD SDBS Structural Business Statistics.

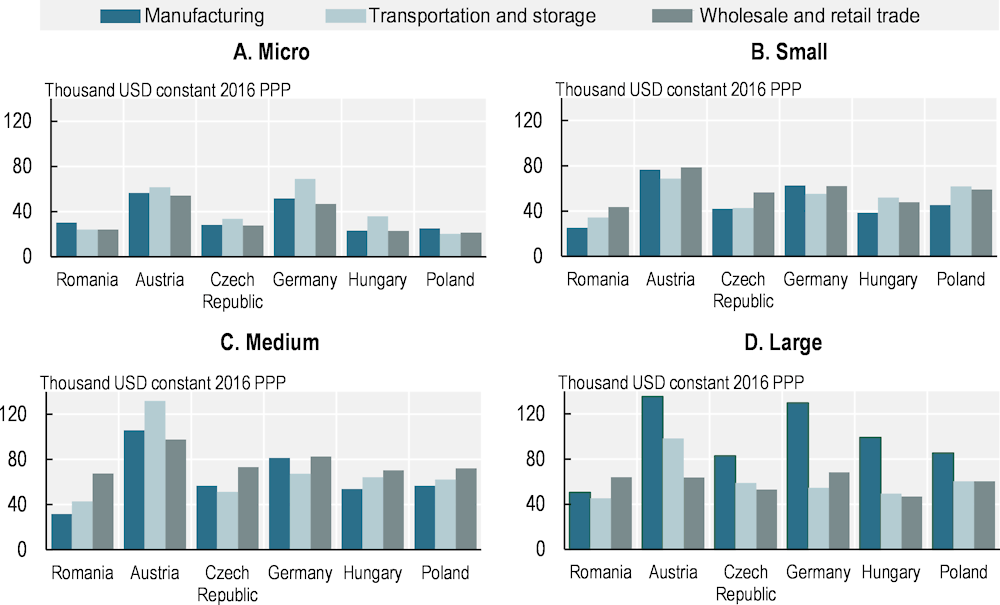

Manufacturing, wholesale and retail trade, and transportation and storage account for a significant share of employment in Romania. A detailed analysis of labour productivity for these three industries is shown by firm size in Figure 3.11. Austrian manufacturing large firms have the highest level of productivity with USD 135 thousand (2016 PPP) per person employed against only USD 50 thousand (2016 PPP) for large Romanian companies in the same industry (Figure 3.11, Panel D). Among micro firms, Romanian manufacturing firms have a labour productivity of USD 30 thousand, greater than firms in the Czech Republic, Hungary or Poland. In the rest of the firm category sizes – small, medium and large – wholesale and retail trade companies in Romania appear to be the most productive ones when compared to the other two industries. Notably, large Romanian wholesale and trade firms rank second with USD 64 thousand per person employed just behind German wholesale and trade large firms.

Figure 3.11. Labour productivity by firm size for selected industries in 2016

Note: Sectors classification is in accordance with the International Standard Industrial Classification of All Economic Activities (ISIC) Rev. 4.

Source: OECD SDBS Structural Business Statistics.

3.3. Company categories in Romania

This section describes how companies are classified and grouped for the analysis in the following sections of this part the report. Using financial and ownership information from the ORBIS database, Sections 3.4 to 3.6 present an analysis of the business dynamics in Romania, including comparisons with selected European peer countries. The analysis is limited to non‑financial companies with more than ten employees. The rationale for choosing a size threshold of ten employees is twofold: first, data coverage typically increases with firm size which means that the coverage for smaller firms is less reliable, hampering comparability. Second, the focus of this report is market‑based financing and micro firms are generally unlikely to tap capital markets.

The OECD‑ORBIS Corporate Finance dataset includes financial and ownership information for non‑financial companies between 2005 and 2018. To evaluate the representativeness of the data against the official statistics, Table 3.3 compares the coverage of the OECD ORBIS Corporate Finance dataset with the Eurostat business statistics. The OECD‑ORBIS dataset generally has similar coverage as Eurostat for small firms and a higher coverage for medium and large firms. Moreover, the distribution of firms across different size groups is also similar for both datasets. For Romania, the total coverage is almost identical in both datasets.

Large companies are defined as having 250 or more employees, medium sized companies as having between 50 and 249 employees, and small companies as having less than 50 employees. When employment figures are unavailable, companies are classified based on their asset size. The asset size thresholds used are: above EUR 20 million for large firms, between EUR 4 million and EUR 20 million for medium firms, and less than EUR 4 million (but larger than EUR 350 000) for small firms.

Table 3.3. Comparison of the OECD‑ORBIS Corporate Finance dataset and the Eurostat universe

|

Large |

Share of total |

Medium |

Share of total |

Small |

Share of total |

|

|---|---|---|---|---|---|---|

|

Romania – Eurostat |

1 662 |

3% |

7 955 |

15% |

43 643 |

82% |

|

Romania – ORBIS |

1 693 |

3% |

7 918 |

15% |

44 424 |

82% |

|

Czech Rep. – Eurostat |

1 654 |

4% |

7 057 |

17% |

32 763 |

79% |

|

Czech Rep. – ORBIS |

1 372 |

6% |

4 869 |

20% |

17 551 |

74% |

|

Germany – Eurostat |

12 139 |

3% |

61 634 |

14% |

375 504 |

84% |

|

Germany – ORBIS |

9 804 |

4% |

47 335 |

20% |

175 057 |

75% |

|

Hungary – Eurostat |

941 |

3% |

4 515 |

13% |

28 033 |

84% |

|

Hungary – ORBIS |

1 208 |

3% |

5 838 |

15% |

32 909 |

82% |

|

Poland – Eurostat |

3 364 |

3% |

15 474 |

15% |

82 709 |

81% |

|

Poland – ORBIS |

3 819 |

6% |

14 548 |

23% |

45 139 |

71% |

Note: All data are as of end‑2018, with the exception of Germany, for which 2017 data are used due to limited availability in 2018 from both ORBIS and Eurostat.

Source: OECD‑ORBIS Corporate Finance dataset and Eurostat; see Annex for details.

One potential weakness of analysing the investment and financing structure of the business sector in an economy is treating the whole non‑financial corporate sector as one entity without taking into account differences with respect to key characteristics, such as size, listing status and industry. From a corporate finance perspective, it may also be important to know if a company is part of a larger company group. To overcome these shortcomings, non‑financial companies in Romania and peer countries are divided into four categories:

Category 1: Listed companies

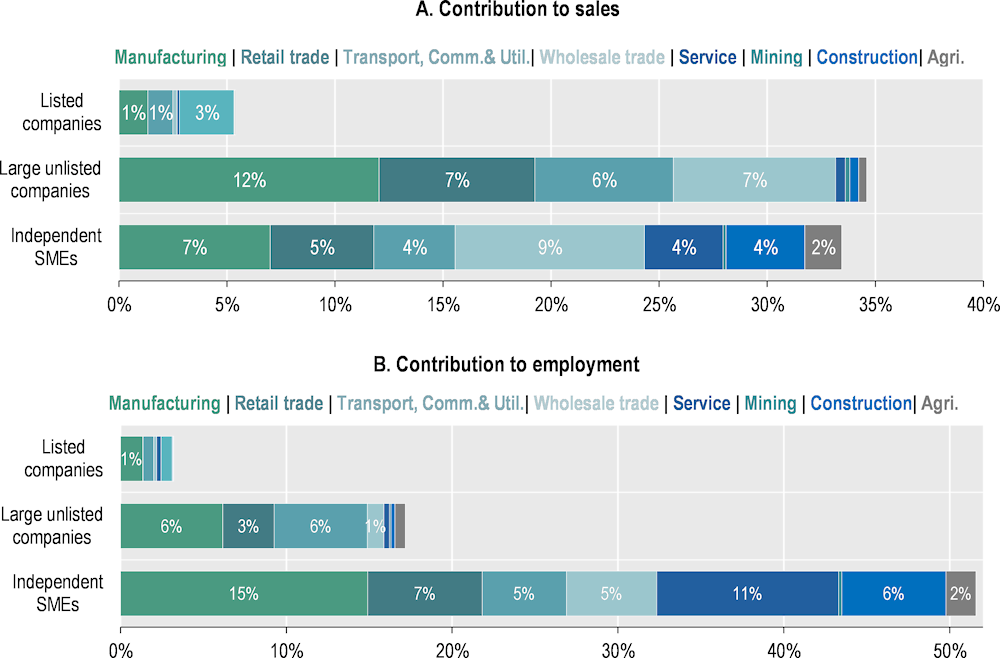

This category includes, on average, 287 non‑financial listed corporations per year with median assets of around EUR 8.3 million. Since being listed on a stock exchange requires the adoption of certain transparency and disclosure standards as well as other corporate governance practices, listing status may have a strong impact on a corporation’s financing conditions. A listed company typically passes a certain threshold in terms of its formal and institutional structure, which may make outside investors more willing to provide funds and which facilitates access to a wider range of financing options, including private equity as well as public and private debt markets. This category includes corporations that were listed on multilateral trading facilities (MTFs). Companies that were listed on the discontinued (since 2015) alternative equity market Rasdaq were excluded. As presented in Figure 3.12, in 2018 listed companies accounted for 3% of employment in the economy and generated 5% of aggregate sales.

Category 2: Large unlisted companies

This category includes, on average, 216 non‑financial corporations with assets larger than EUR 89 million (USD 100 million) in 2019 real terms. Their median asset size was EUR 166 million in 2018, which is significantly larger than that of listed companies. This is mainly a result of the inclusion of smaller MTF listed companies in the listed company category.2 Compared with publicly listed companies, less information is available for large unlisted companies, reducing their available financing options or potentially resulting in less favourable financing conditions. However, companies in this category can generally be classified as professionally managed, formal companies. In 2018, large unlisted companies represented around 35% of total sales and 15% of employment in the economy.

Category 3: Small and mid‑sized companies that are part of a group

This category includes all small and mid‑sized enterprises controlled by a listed (Category 1) or a large unlisted corporation (Category 2). SMEs based in Romania but controlled by a non‑Romanian company are also included in this category. Category 3 contains, on average, 1964 companies per year with median assets of EUR 4.5 million. Since the financial results of SMEs that are part of a group are consolidated into a parent company, unconsolidated accounts are used in the analysis to identify their own structure. In general, the information available for SMEs is relatively limited, but being part of a group can help them access financing on better conditions compared with independent SMEs. By creating an internal capital market, an economic group can also improve the available financing options for group companies.

Category 4: Independent small and mid‑sized companies

The last category includes all SMEs identified to be controlled by individuals and those with no available ownership information. For this category, only unconsolidated accounts are available. The group of Independent SMEs is the largest in terms of number of companies (an average of 40 540 companies per year), but the smallest in terms of size (median assets of around EUR 0.39 million). The information available for these companies is limited and unlike SMEs that are part of a group, Independent SMEs do not benefit from the financing advantages related to a group structure. As of end‑2018, independent SMEs made up more than half of the total employment in the economy, but only 33% of total sales.

Table 3.4 below shows the distribution of these four categories of non‑financial companies in Romania with respect to their number and their median assets.

Table 3.4. Company categories of the non‑financial business sector in Romania.

|

Category 1: Listed companies |

Category 2: Large unlisted companies |

Category 3: SMEs part of a group |

Category 4: Independent SMEs |

|||||

|---|---|---|---|---|---|---|---|---|

|

No. of companies |

Median assets (EUR K) |

No. of companies |

Median assets (EUR K) |

No. of companies |

Median assets (EUR K) |

No. of companies |

Median assets (EUR K) |

|

|

2005 |

325 |

5 113 |

104 |

207 801 |

1 546 |

3 024 |

32 745 |

271 |

|

2006 |

320 |

6 213 |

142 |

181 782 |

1 587 |

3 842 |

35 923 |

338 |

|

2007 |

318 |

8 087 |

191 |

172 845 |

1 696 |

4 399 |

39 303 |

383 |

|

2008 |

315 |

8 157 |

208 |

171 499 |

1 832 |

4 419 |

39 909 |

399 |

|

2009 |

305 |

8 181 |

206 |

163 619 |

1 820 |

4 402 |

35 188 |

419 |

|

2010 |

296 |

8 641 |

221 |

171 535 |

1 876 |

4 524 |

34 945 |

430 |

|

2011 |

288 |

8 640 |

221 |

172 637 |

2 032 |

4 663 |

38 951 |

394 |

|

2012 |

294 |

8 729 |

219 |

190 497 |

2 083 |

4 572 |

41 116 |

382 |

|

2013 |

288 |

8 945 |

213 |

173 276 |

2 084 |

4 587 |

42 341 |

370 |

|

2014 |

281 |

8 538 |

226 |

168 614 |

2 162 |

4 761 |

43 193 |

385 |

|

2015 |

270 |

8 804 |

256 |

157 895 |

2 268 |

4 723 |

44 952 |

395 |

|

2016 |

245 |

8 747 |

266 |

151 430 |

2 167 |

4 939 |

46 262 |

397 |

|

2017 |

246 |

8 883 |

268 |

158 618 |

2 239 |

5 094 |

46 225 |

411 |

|

2018 |

232 |

9 905 |

279 |

165 573 |

2 098 |

5 538 |

46 509 |

445 |

|

Avg. |

287 |

8 256 |

216 |

171 973 |

1 964 |

4 535 |

40 540 |

387 |

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

Figure 3.12. Company categories’ contribution to sales and employment by industry in 2018

Note: For each category, sales and employment numbers are presented as shares of economy totals. Calculations for the total economy take into account the group structure of companies and avoid considering companies that are already consolidated in the accounts of domestic non‑financial parent companies. The figure does not show the category SMEs part of a group as these companies are accounted for in the financial statements of their parent company. The categories in this figure are subsamples of the economy constructed for characterisation and comparison purposes and do not consider parent companies with less than EUR 89 (USD 100) million in assets. As a result, they do not add up to 100%.

Source: OECD‑ORBIS Corporate Finance dataset, see Annex for details.

3.4. Non-financial company performance and profitability

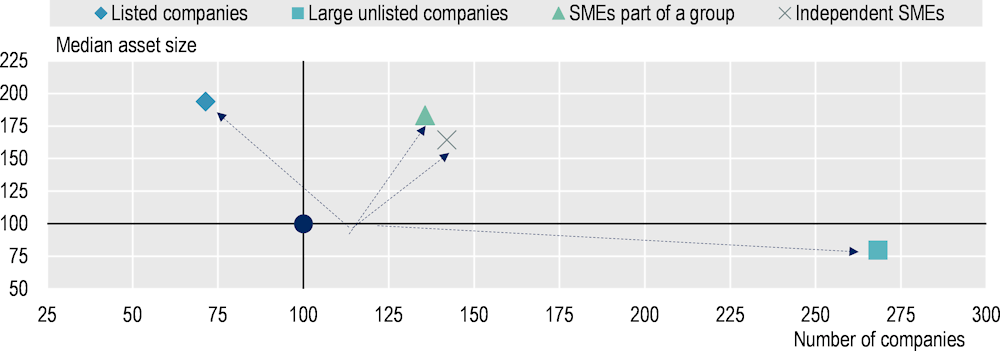

In Romania, the number of companies in all four categories has grown since 2005, except for the number of listed companies, which is now significantly lower than it was in 2005. In parallel, the median asset size of listed companies has increased substantially, resulting in fewer but larger listed companies. Asset size has also increased for SMEs that are part of a group and independent SMEs, while it has decreased somewhat among large unlisted companies. Figure 3.13 illustrates the evolution in the number of companies and median asset size for each category between 2005 and 2018, where 2005 is indexed to a baseline value of 100.

Figure 3.13. Growth in the number of companies and median asset size, 2005‑18 (2005 = 100)

Note: Median assets are inflation adjusted per 2019, thus the change in median assets size reflects real change.

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

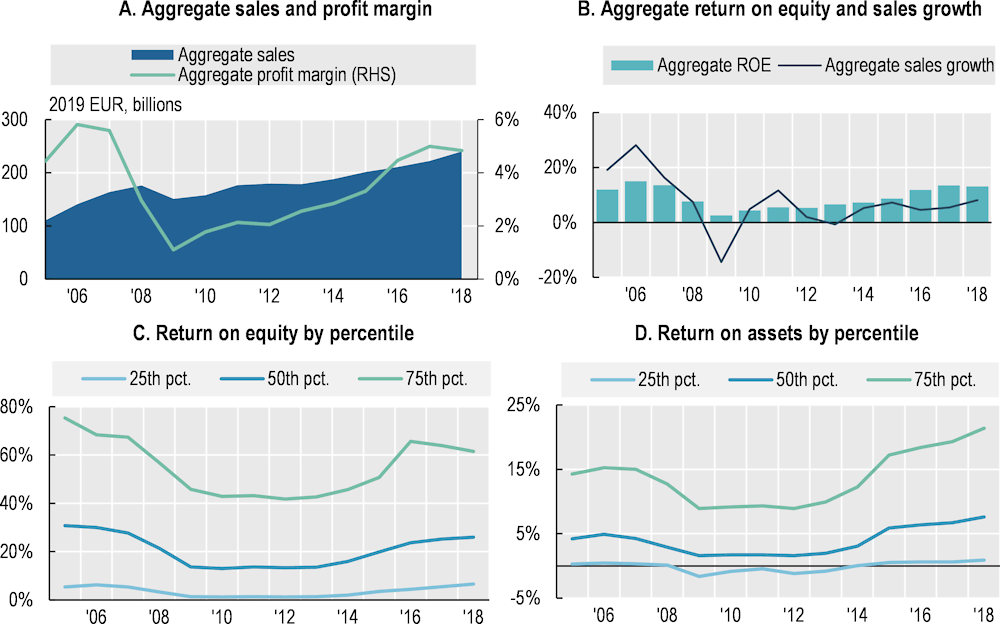

The corporate sector in Romania was severely hit by the 2008 financial crisis. Sales dropped by 14% in 2009, profit margins fell from 3% to 1% and aggregate ROE from 8% to 3% (Figure 3.14, Panels A and B). This decline is observed for both high and low performing firms in terms of return on equity (ROE) and return on assets (ROA) (Figure 3.14, Panels C and D). After remaining at lower levels for a number of years, the aggregate profitability ratios started to pick up gradually in 2013. While sales growth has remained subdued compared to pre‑2008 levels, the aggregate profit margin reached pre‑crisis levels in 2018. It should be noted that there is a marked difference in performance between the top and bottom groups of non‑financial corporations in Romania, as illustrated in Panels C and D below. While the differences between the 75th and the 25th percentiles in terms of both ROE and ROA were actually decreasing during the period between 2005 and 2012, the gap has been widening again since 2013.

Figure 3.14. Profitability and sales of Romanian non‑financial companies

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

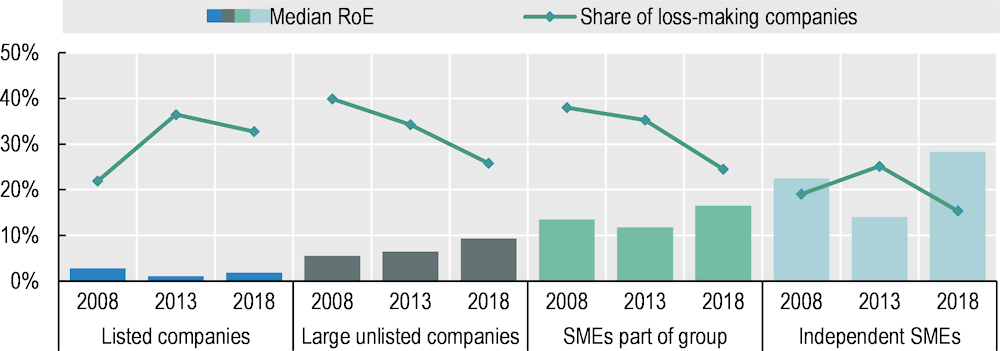

Financial performance, measured as ROE and the share of loss making companies,3 differs significantly across company categories (Figure 3.15). Generally, the lower the share of loss making companies, the higher the median ROE. Independent SMEs exhibit by far the highest median ROE and the lowest share of loss making companies, while the reverse is true for listed companies.

Figure 3.15. Median ROE and share of loss‑making companies by category

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

In 2018 the mining industry had the highest share of loss making companies in Romania, followed by the transport, communication and utility industry (Figure 3.16). The mining industry is also the only one that had a larger share of loss making companies in 2018 than it did in 2008. Wholesale trade had the lowest share in 2018 with 12% of all the companies in the industry. A general observation is that the share of loss making companies has declined for all industries since 2013, although to varying degrees.

Figure 3.16. Share of loss‑making companies by industry

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

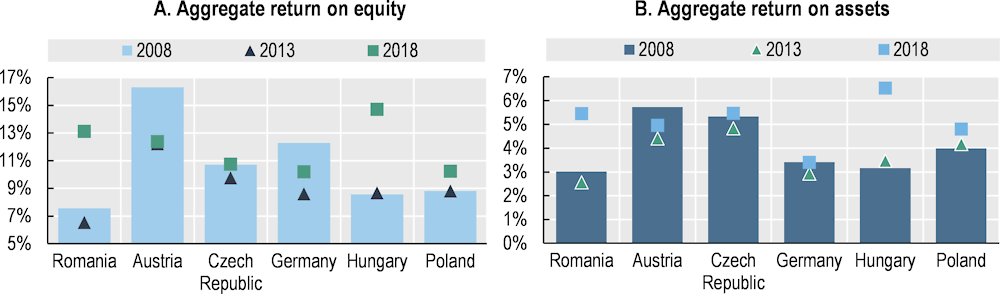

A comparison with peer countries reveals that Romanian non‑financial companies’ profitability ranked second highest in terms of return on equity and close third in terms of return on assets in 2018 (Figure 3.17). This is a significant improvement from both 2008 and 2013, when Romania ranked last for both metrics.

Figure 3.17. Profitability of non‑financial companies for Romania and selected European countries

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

3.5. Leverage levels

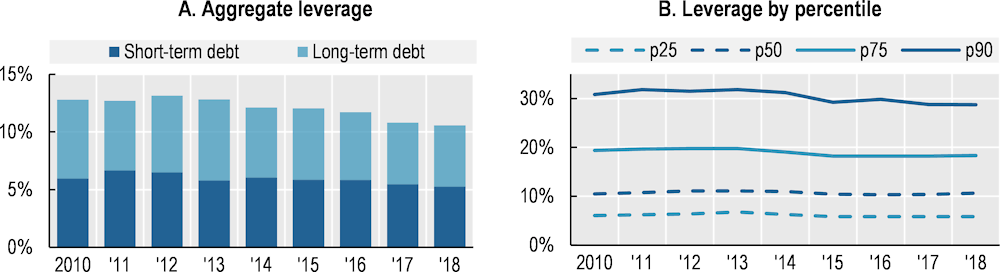

Romanian non‑financial companies have seen a slight decrease in leverage ratios (financial debt over total assets) over the past decade, which is mainly a result of the decline in long-term debt from 7% in 2010 to 5% in 2018. This drop can be primarily attributed to highly leveraged companies lowering their indebtedness. Specifically, companies in the 90th percentiles saw a 2 percentage point decline in 2015.

Figure 3.18. Leverage of Romanian non‑financial companies

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

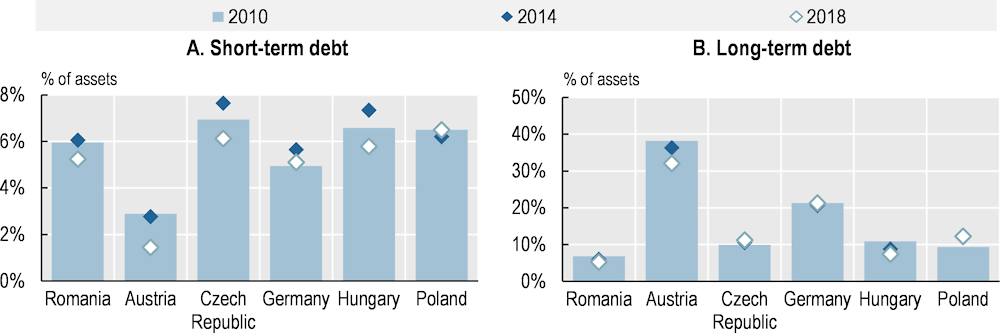

A comparison with peer countries shows that the Romanian corporate sector has a relatively low level of indebtedness, particularly with regards to long-term debt (Figure 3.19, Panel B). This is consistent with the fact that the bank credit stock to the corporate sector in Romania has remained one of the lowest in the region at around 26% of GDP (see Figure 3.6, Panel A). Notably, Romanian corporations have since 2005 always been the ones with the lowest level of long-term debt. The opposite is true for Austrian and German firms, which have lower levels of short-term debt, as they instead rely mainly on long-term debt. High reliance on short-term debt can expose companies to economic downturns and is not considered appropriate for financing strategic productivity enhancing investments.

Figure 3.19. Debt of non‑financial companies in Romania and selected European countries

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

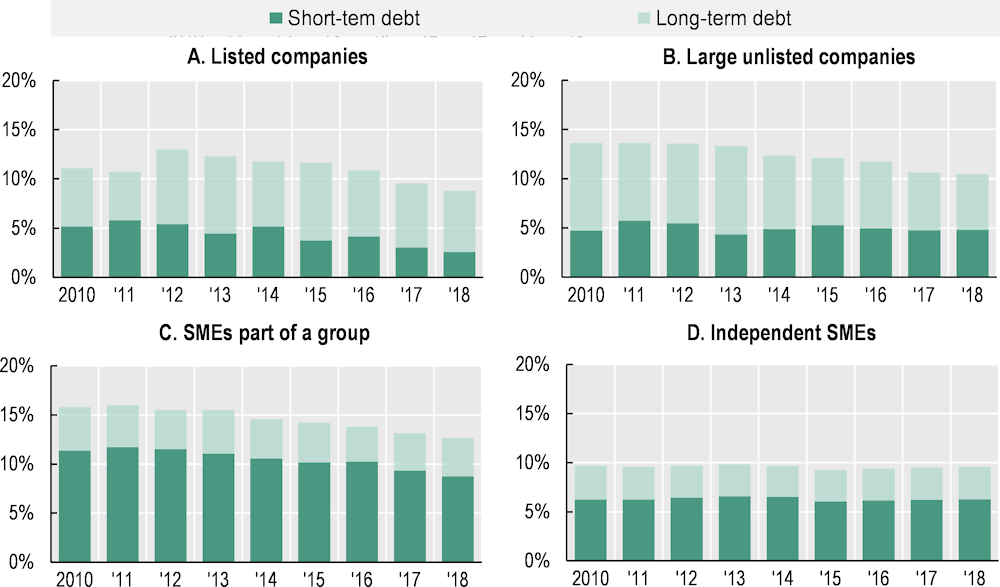

Among the four categories of non‑financial companies in Romania, independent SMEs are the ones with the lowest leverage levels, remaining at around 10% throughout the period (Figure 3.20, Panel D). SMEs that are part of a group have the highest aggregate leverage levels, with short-term debt almost 5 percentage points higher than independent SMEs (Figure 3.20, Panel C).

Figure 3.20. Aggregate leverage levels by company categories in Romania

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

Listed companies, which typically have higher levels of capitalisation, are much less dependent on debt financing. As Panel A of Figure 3.20 shows, in 2012 listed companies increased their average debt level rather sharply from 11% to 13%, which may be a result of companies raising funds to cope with the crisis. Since then, leverage in listed companies saw a stable decrease from 13% in 2012 to 9% in 2018. The same trend can be observed in large unlisted companies, where average leverage decreased from 14% in 2012 to 10% in 2018 (Figure 3.20, Panel B). It is also important to point out that these two groups of companies have a higher ratio of long-term debt to total debt compared to SMEs.

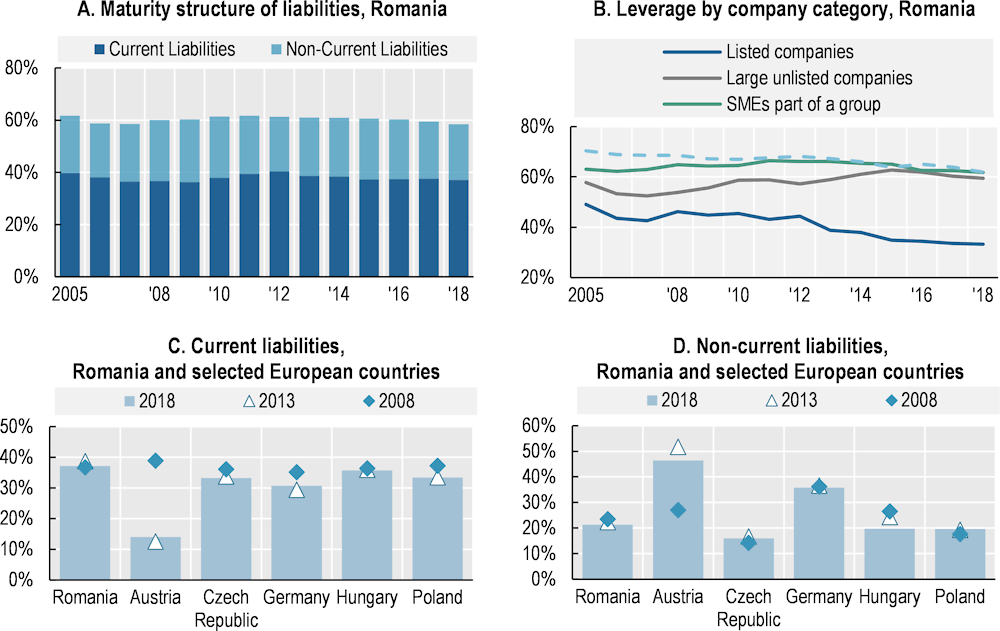

Only a small share of the total number of companies in Romania reported that they had any financial debt on their balance sheets. Therefore, in order to improve the comparability of the analysis, Figure 3.21 shows an alternative leverage measure which also includes non‑financial liabilities (e.g. trade payables). Total liabilities over total assets was around 60% throughout the period for Romanian companies, with current liabilities accounting for almost two‑thirds of the total liabilities (Figure 3.21, Panel A). However, there is heterogeneity across company categories and over time. The alternative leverage ratio for listed companies was significantly lower compared with the other three categories at 49% in 2005 and 33% in 2018. While the leverage level for the independent SMEs category was the lowest when only financial debt is considered, it is the highest when total liabilities are taken into account. However, they also saw a decline in leverage from 70% in 2005 to 62% in 2018 (Figure 3.21, Panel B). The two other groups, large unlisted companies and SMEs part of a group, had relatively stable levels of liabilities as a share of total assets over the period.

Companies in the CEE region are typically more heavily reliant on short-term liabilities in their financing structure than European peers. In 2018, the average share of current liabilities to total liabilities for Romania, the Czech Republic, Hungary and Poland was 65%, compared to 23% in Austria and 46% in Germany (Figure 3.21, Panels C and D).

Figure 3.21. Leverage measured as total liabilities as a share of total assets

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

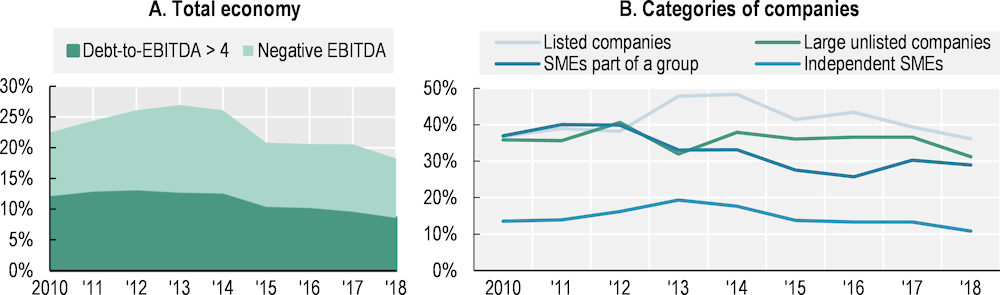

One important indicator to measure a company’s ability to service its debt is the debt‑to‑EBITDA ratio, which shows the indebtedness level against the operational profit generating capacity of the company. This measure provides a proxy for debt sustainability: a higher value reflects a lower debt service capacity. It is typically considered that a ratio over four puts a company in a higher risk category (Standard & Poor’s Global, 2013[20]). Panel A of Figure 3.22 shows that the share of Romanian firms with a high debt‑to‑EBITDA ratio (>4) increased significantly after the 2008 crisis and during the European sovereign debt crisis, as profitability decreased. As the economy has recovered gradually in recent years and indebtedness has decreased, the share of firms with high debt‑to‑EBITDA ratios has since dropped significantly.4 In 2018, around 9% of companies in Romania had a debt‑to‑EBITDA ratio over four, which is significantly lower than in Poland (17%) and the Czech Republic (14%).

Among the different categories of companies, listed companies have the largest share of companies in the higher risk category at around 40%, while the independent SMEs category has the smallest portion (Figure 3.22, Panel B). Large unlisted companies and SMEs that are part of a group reached 40% in 2012 during the crisis, after which the portion of companies with high debt‑to‑EBITDA ratios declined gradually, reaching around 29% in 2018.

Figure 3.22. Share of firms with high debt‑to‑EBITDA ratio

Note: In Panel A, companies that reported both financial debt and negative EBITDA are included in the high‑leverage companies to reflect their incapacity to generate operational profit to be used towards repaying debt.

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

An issue of great importance with respect to corporate leverage is the structure of the debt, in particular the currency composition. Non‑financial companies in Romania are heavily dependent on non‑resident creditors and foreign currency debt, which has financial stability implications. Foreign direct investment in the form of loans and direct loans from non‑resident financial institutions make up more than half of all non‑financial corporate debt in Romania. At the end of 2019, foreign financing was 1.2 times higher than financing from resident financial institutions. More importantly, loans from non‑resident entities make up 72% of total foreign currency debt (BNR, 2020[9]). This reliance on foreign creditors and currencies carries potential financial stability risks, including spill overs from macroeconomic fluctuations in the currency issuing country, especially to the extent that there is a mismatch between the debtor companies’ revenues (local currency) and their debt service (foreign currency). Overall, the debt composition of Romanian non‑financial corporations add to the already strong rationale for developing domestic capital markets.

3.6. Capitalisation and equity capital misallocation

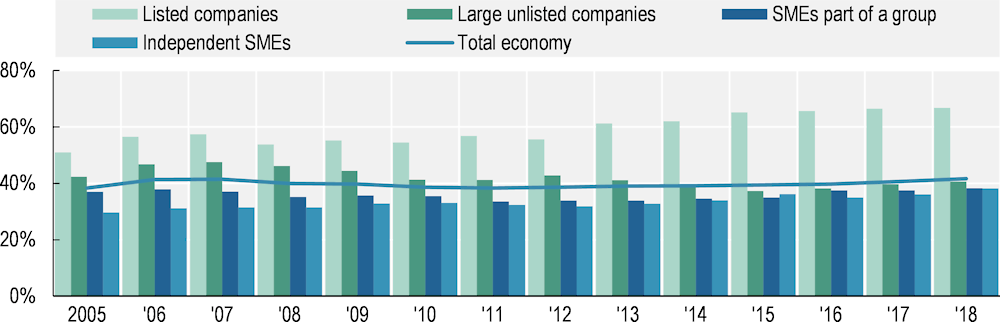

During the 2008 financial crisis, Romanian non‑financial companies saw a sharp drop in their capitalisation levels (total shareholders’ equity as a share of total assets). The aggregate equity capital as a share of total assets declined by 3 percentage points, from 41% in 2007 to 38% in 2011 (Figure 3.23). Listed companies have had the highest capitalisation level since 2008, and following the initial drop in capitalisation they also managed to increase their equity capital significantly from 56% in 2012 to 67% in 2018. Large unlisted companies, however, saw a continued decrease in capitalisation over the same period. SMEs that are part of a group experienced a decline from 37% to 34% from 2007 to 2011. After remaining at this level for a number of years, their equity levels began to improve, reaching 38% in 2018. The capitalisation level of independent SMEs has risen modestly since 2005.

Figure 3.23. Capitalisation levels for different categories of Romanian companies

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

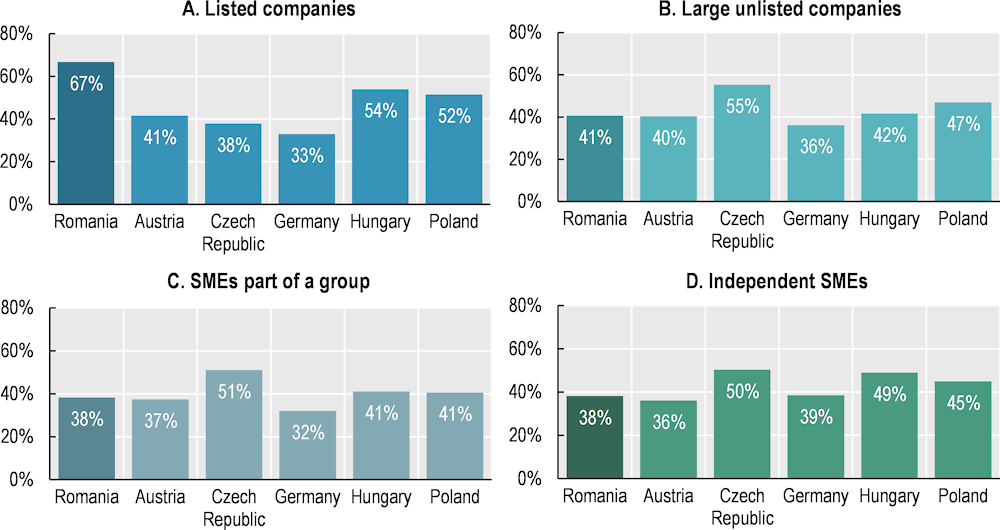

A comparison between Romania and peer countries shows that Romanian listed companies have a much higher aggregate capitalisation level (Figure 3.24, Panel A). This generally holds across the distribution of capitalisation (i.e. both for high and low capitalisation companies) and over time. However, large unlisted companies have a lower level of capitalisation (41%) compared with countries such as the Czech Republic (55%) and Poland (47%) (Figure 3.24, Panel B). In addition, both groups of SMEs have relatively low capitalisation levels compared to regional peers (Figure 3.24, Panels C and D).

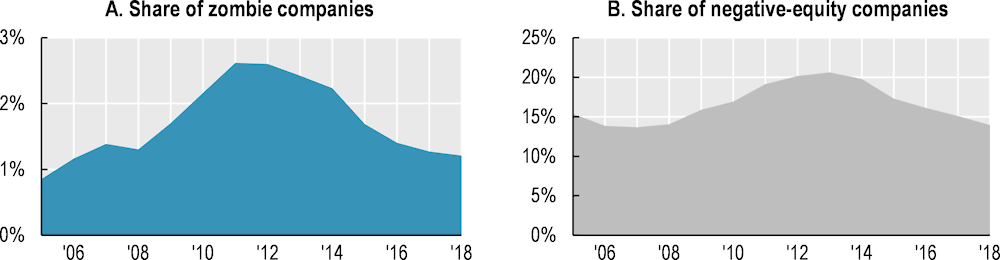

In recent years, there has been an increasing concern worldwide about companies that do not even generate enough profits to service their debt, so called zombie companies. In addition, some companies have suffered an erosion of their equity capital over time as a result of continued low profitability and are currently in a situation where they have negative equity. While zombie companies are defined as those that are incapable of covering their interest payments with operating income, negative equity firms are those firms for which liabilities exceed assets.5 These two groups of companies are still alive either due to the protection of creditors or because they are related to a more solvent economic group or parent company. Having a large share of zombie and negative equity companies can pose a threat to the resilience of the corporate sector as a whole (Banerjee and Hofmann, 2018[21]). Importantly, it may not only be detrimental to the individual company but to the economy as a whole, since zombie companies are locking in resources that could be allocated to more productive activities. Continued support for zombie companies distorts market functioning and hinders economic recovery and reallocation (Scope, 2019[22]).

Figure 3.24. Company capitalisation for Romania and selected European countries in 2018

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

In Romania, the share of zombie firms is relatively small. This is to some extent driven by the fact that smaller companies have low levels of financial debt. In 2015, out of 460 000 enterprises active in the country, less than 28% fell within banks’ minimum financial criteria (World Bank and IMF, 2018[10]). Panel A of Figure 3.25 shows that the share of zombie firms increased significantly in the build up and aftermath of the 2008 crisis, after which it began decreasing in 2012. Romanian companies have also experienced an increase in firms with negative equity. The share of firms with negative equity peaked in 2014 at 20% of all companies and then declined to 14% in 2018 (Figure 3.25, Panel B).

Figure 3.25. Share of zombie and negative‑equity companies in Romania

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

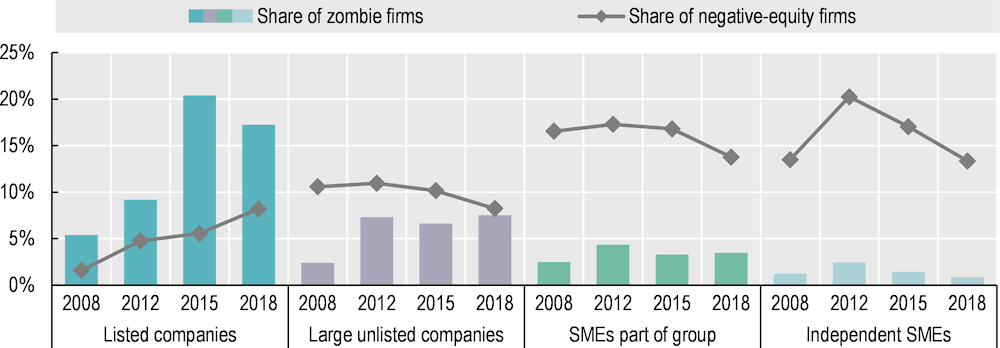

The share of zombie and negative equity companies differs considerably between different groups of companies. Importantly, the portion of listed zombie companies more than tripled between 2008 and 2018 (Figure 3.26). Similar to listed companies, large unlisted companies also saw a significant increase in zombie companies in the aftermath of the 2008 financial crisis and during the European sovereign debt crisis, reaching 7% in 2012; a level at which it remained in 2018. Both groups of SMEs, particularly independent SMEs, have rather low share of zombie firms. However, they have the highest ratio of negative equity companies. Independent SMEs saw an important increase in negative equity companies from 13% in 2008 to 20% in 2012.

Figure 3.26. Share of zombie and negative‑equity companies across different groups

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

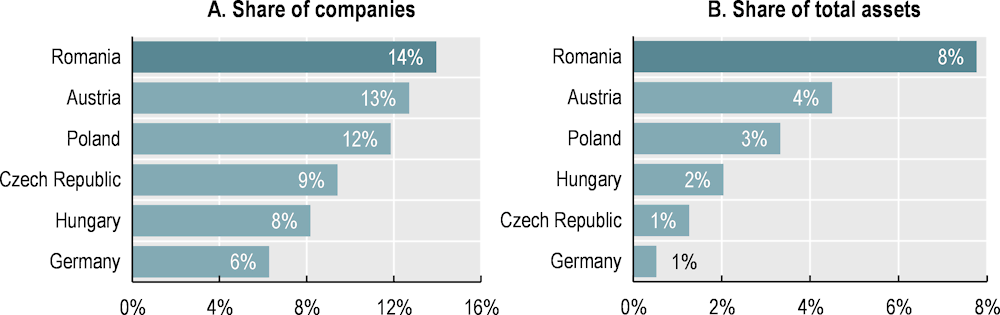

Both zombie and negative equity firms can reduce the efficiency of capital allocation in the economy as capital locked up in such firms could potentially be used by more productive companies. Despite having a modest share of zombie firms, Romania was the country with the highest ratio of negative equity firms in 2018 among peer countries (Figure 3.27). The share of companies and assets associated with negative equity companies are 14% and 8% respectively, which is higher than in peer countries. According to the National Bank of Romania, by the end of 2019, the capital needs of non‑financial companies with negative equity amounted to 16.8% of Romanian GDP. Moreover, negative equity companies accounted for 67% of overdue payments in the economy and around 35% of non‑performing loans from local credit institutions. The NPL ratio of those firms was 20% at the end of 2019 (BNR, 2020[9]).

Figure 3.27. Companies with negative equity in Romania and selected European countries in 2018

Source: OECD‑ORBIS Corporate Finance dataset; see Annex for details.

3.7. The impact of COVID‑19 on the corporate sector

The COVID‑19 pandemic is having an unprecedented impact on economies around the world. Measures such as social distancing, travel restrictions and prohibitions to engage in social activities implemented to contain the transmission of the virus led to a widespread shutdown of businesses during the initial and subsequent waves of the pandemic. As a result, the world economy has seen a record slowdown in activity. The OECD expects a 3.4% contraction in global GDP in 2020 (OECD, 2021[23]). The sharp drop in sales experienced by the corporate sector has also caused acute liquidity pressures and growing insolvency concerns in many economies and industries. The estimated decline in profits is sizeable, amounting to on average between 40% and 50% of normal time profits according to OECD research. In such a scenario, around 7‑9% of otherwise viable European companies could become distressed and around one‑third of the companies may not be able to cover their interest expenses (Demmou et al., 2021[24]). It is forecasted that as the crisis evolves, some existing businesses will recover after a temporary downturn while others will be phased out. Importantly, this shock came at a time when there was already widespread concerns about the high levels of debt in the corporate sector and the declining quality of the outstanding stock of debt around the world.

In the third quarter of 2020, global activity recovered in some sectors as a result of significant measures taken by governments and central banks. Government interventions have played an important role in helping firms address the liquidity shortfall (Demmou et al., 2021[25]). However, some service activities remain limited due to physical distancing. The collapse in employment observed at the start of the pandemic has partially reversed, but a large number of people still remain unemployed. Most firms have survived, but are in many cases financially weak. Vaccination programmes, health policies and government financial support are expected to lift global GDP by 5.6% in 2021 (OECD, 2021[23]).

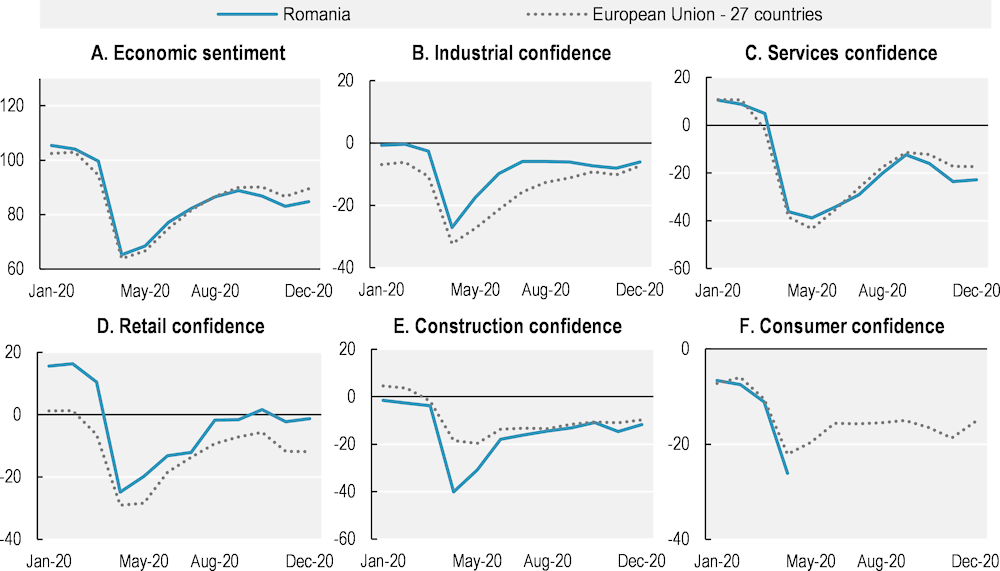

Figure 3.28. Economic sentiment and confidence across industries in Romania and EU‑27

Note: The Economic Sentiment Indicator is scaled to a long-term mean of 100 and a standard deviation of 10. Values above 100 indicate above‑average economic sentiment and vice versa. The confidence indicators are published as the difference between positive and negative answers (in percentage points of total answers).

Source: European Commission ‑ DG ECFIN.

As in all other countries, the uncertainty about the future developments of the COVID‑19 pandemic has significantly weakened expectations about economic growth and business sector confidence in Romania. The economic sentiment indicator in Romania saw a sharp decline during the initial phase of the pandemic, much in line with the EU 27 (Figure 3.28, Panel A). After May 2020, expectations started to pick up. Still, uncertainties kept expectations lower than at the beginning of 2020 and the economic sentiment in Romania was lower than the average EU 27 by the end of 2020. The confidence indicator across industries reached its lowest level in April 2020. Confidence loss was particularly strong in the Services and Construction industries. Similar to economic sentiment, confidence levels have not yet recovered, and perceptions at the industry level remain overall pessimistic. Confidence in the retail industry has recovered faster in Romania than in the EU 27 overall (Figure 3.28, Panel D).

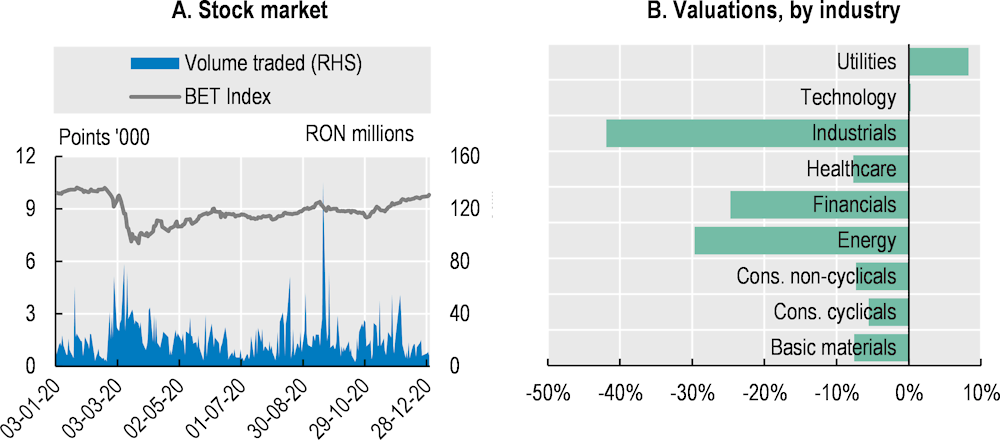

The listed corporate sector in Romania has also suffered a large contraction in valuations while volatility in financial markets has increased. As a result of the pandemic, current and forecasted corporate revenues have declined significantly. The local index of the Bucharest Stock Exchange experienced a sharp contraction of 30% from the end of 2019 to its lowest index value in March 2020. By the end of 2020 the domestic index had almost recovered its value compared to the start of the year, recovering more quickly than the stock market indices in Hungary and the Czech Republic (Figure 3.29, Panel A). The contraction in stock market valuations varied across industries. For example, industrials companies had seen a 42% contraction by October 2020, followed by energy companies and the financial sector, which fell by 30% and 25%, respectively. Technology companies in Romania did not experience any change in their valuations, whereas utilities companies showed an 8% increase (Figure 3.29, Panel B).

Figure 3.29. Financial market indicators in Romania

Note: Panel B compares stock market values between end‑October and the beginning of 2020.

Source: Thomson Reuters Eikon, Bucharest Stock Exchange, BNR.

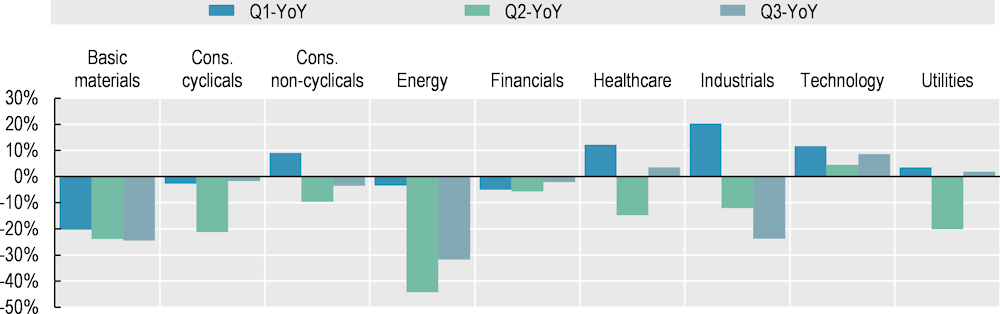

In the first quarter of 2020, among the listed companies on the Bucharest Stock Exchange, five industries saw an increase in total sales compared to the same quarter in 2019 (Figure 3.30). However, in the second quarter all industries experienced a drop in reported sales compared to the second quarter of 2019, with the exception of technology companies. Energy, basic materials and industrials saw sharp falls in total sales in the third quarter of 2020. At the same time, health care, technology and utilities companies experienced higher sales.

Figure 3.30. Quarterly sales YoY changes 2019‑20

Source: Thomson Reuters Datastream.

3.8. Government relief programmes to the corporate sector

In response to the COVID‑19 pandemic, the Romanian Government has implemented a range of measures to support households, jobs and businesses. The authorities have also implemented measures to support specific industries affected by the pandemic.

To help companies maintain their workforce, the government started partially covering the wages of the self‑employed and partially subsidising the wages of workers with reduced working hours at the beginning of the pandemic. Subsidies were allocated to workers returning to work. Later, the government established a job retention scheme (with a compensation for employees at 75% of their gross salary), a 3‑months wage subsidy for the resumption of activity, and an allowance for the self‑employed. Subsidies were also provided for hiring jobseekers aged over 50 or below 30, and to Romanian citizens returning to the country. These measures amounted to RON 8.0 billion in 2020 and RON 1.9 billion in 2021 (OECD, 2022[26]).

To alleviate the liquidity needs of corporations, the government has introduced a deferral of utilities payments for SMEs. Other measures include faster reimbursement of VAT, suspending foreclosures on overdue debtors, discounts on corporate income taxes, postponement of the property tax, and exempting hospitality companies from the industry specific tax. In addition, the government has issued legislation that requires banks to defer loan repayments for households and businesses affected by the crisis by up to nine months (in place until March 2021). In October 2020, a EUR 103 million Romanian guarantee scheme was established to support the trade credit insurance market with a view to secure the continuity of the trade credit insurance to all companies, to avoid the need for buyers of goods or services to pay in advance, therefore reducing their immediate liquidity needs. In November 2020, another EUR 216 million scheme was introduced to support SME liquidity through guarantees of the factoring products. The scheme applies only to factoring products with recourse against the seller. The support was offered in the form of direct grants. The government also introduced the possibility to cancel interest and penalties on outstanding corporate tax liabilities (in place until January 2022) and to reschedule corporate tax liabilities for 12 months (in place until September 2021) (OECD, 2022[26]).

To help companies access financing, in 2020 the government enabled a state aid scheme under the Temporary Framework developed by the European Commission to support the economy in the context of the coronavirus outbreak. The aid was provided in the form of state guarantees for loans (the guarantee ceiling in 2020 was RON 20 billion) and direct grants to cover interest and some related fees. The aim of the scheme is to help businesses cover their immediate working capital or investment needs, thus ensuring the continuation of their activities. By the end of September 2021, the total amount of guarantees issued amounted to RON 19.09 billion. A guarantee scheme of about RON 1.5 billion (0.15% of GDP) was also adopted to support the procurement of work equipment by SMEs. In July 2020, the EC approved an additional RON 4 billion (approximately EUR 800 million) Romanian scheme to support companies affected by the coronavirus outbreak. The scheme offered subsidised loans and state guarantees on loans to SMEs with a turnover over RON 20 million (approximately EUR 4 million) in 2019 and to large companies. The scheme is managed by the development bank arm of Export Import Bank of Romania (“EximBank”), acting on behalf of the Romanian state. In August, another EUR 935 million was made available to support SMEs active in specific sectors and certain large companies related to the eligible SMEs. The help was provided in the form of direct grants for working capital and productive investments and was co-financed by the European Regional Development Fund. Grants to microenterprises, SMEs and firms in the tourism, accommodation and food sectors were also introduced in 2021.

To help the airline industry, a EUR 1 million scheme was established to support airlines resuming or starting flights to and from Oradea airport in Romania. The aid was in the form of direct grants and was accessible to all interested airlines, with a limit of EUR 800 000 per company. An additional EUR 1.7 million scheme was approved to support airlines resuming or starting flights to and from Sibiu airport in Romania. In addition, in August 2020, the EC approved a Romanian direct grant of approximately EUR 1 million (RON 4.8 million) to compensate the Timișoara Airport for the high operating losses incurred in the context of the coronavirus outbreak. In November, another EUR 4.4 million was assigned to compensate regional airport operators for the damage suffered due to the COVID‑19 pandemic. The scheme was targeted at operators of Romanian airports with an annual traffic turnover of between 200 000 to 3 million passengers, which are to be compensated with direct grants for net losses incurred between 16 March and 30 June 2020. Two airline companies have also received direct aid. In October 2020, a loan guarantee of EUR 62 million was granted to the Romanian airline Blue Air, and in December the Romanian state owned airline TAROM, received a loan guarantee of EUR 19.3 million.

To help companies active in the pig and poultry breeding sectors, as well as wine producers, two schemes with a total budget of EUR 47.4 million were established in September 2020. The support will be provided in the form of direct grants. The aim of the schemes is to help companies address their liquidity needs and continue their operations in order to ultimately secure food and feed materials for the food industry and to maintain jobs. For each of the sectors, the schemes are expected to benefit over 1 000 companies. On November 2020, the EC authorised a EUR 12.4 million scheme to support wine producers. The support is offered in the form of direct grants and is also expected to benefit over 1 000 producers (IMF, 2021[27]).

In addition to the above‑mentioned measures, on April 2020 the Romanian Financial Supervisory Authority (ASF) increased the threshold for private pension funds to invest in government securities. In particular, private pension funds were allowed to invest up to 70% of the total value of the fund’s assets in government securities issued by the Romanian state or by other EU countries. In addition, in March 2020, the ASF lowered the notification threshold for net short positions in relation to shares traded on the regulated market to 0.1% of the issuer’s share capital (Schonherr, 2020[28]). The ASF has also established a 25% discount on all tariffs, taxes, quotas and contributions collected from regulated entities during the state of emergency (ASF, 2020[29]).

References

[8] ASF (2021), “Monthly Market Report - November 2021”, https://asfromania.ro/uploads/articole/attachments/61c31f9317d66913613028.PDF.

[29] ASF (2020), “Annual Report 2019”, https://asfromania.ro/files/Rapoarte/Raport_anual_ASF_2019_22062020.pdf.

[11] ASF (2020), “Report on the Non Bank Financial Markets Stability, 1/2020”, https://asfromania.ro/uploads/articole/attachments/6076bfbea439e497380894.pdf.

[21] Banerjee, R. and B. Hofmann (2018), “The rise of zombie firms: causes and consequences”, BIS Quarterly Review, September, https://www.bis.org/publ/qtrpdf/r_qt1809g.htm.

[13] BNR (2021), “Annual report 2020”, http://www.bnr.ro/Regular-publications-2504.aspx.

[14] BNR (2021), “Financial Stability Report - December 2021”, https://www.bnr.ro/DocumentInformation.aspx?idDocument=39452&idInfoClass=19968.

[17] BNR (2021), “Statistics report – BNR’s interest rate”, https://www.bnr.ro/Statistics-report-1124.aspx.

[9] BNR (2020), “Annual report 2019”, http://www.bnr.ro/Regular-publications-2504.aspx.

[24] Demmou, L. et al. (2021), “Insolvency and debt overhang following the COVID 19 outbreak: Assessment of risks and policy responses”, OECD Economics Department Working Papers No. 1651, OECD Publishing, Paris, https://doi.org/10.1787/747a8226-en.

[25] Demmou, L. et al. (2021), “Liquidity shortfalls during the Covid 19 outbreak: assessment and policy responses”, OECD Economics Department Working Papers No. 1647, OECD Publishing, Paris, https://doi.org/10.1787/581dba7f-en.

[19] EC (2021), “2021 SME Country Fact Sheet”, https://ec.europa.eu/docsroom/documents/46060.

[2] EC (2020), “European Semester Country Report Romania 2020”, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020SC0522&from=EN.

[1] EC (2019), “European Semester Country Report Romania 2019”, https://ec.europa.eu/info/sites/default/files/file_import/2019-european-semester-country-report-romania_en.pdf.

[15] ECB (2020), “Convergence Report”, June 2020, http://www.ecb.europa.eu/pub/pdf/conrep/ecb.cr202006~9fefc8d4c0.en.pdf.

[7] EIB (2019), “Investment: What hold Romanian firms back?”, Economics-Working Papers, Vol. 08, http://www.eib.org/attachments/efs/economics_working_paper_2019_08_en.pdf.

[18] Eurostat (2022), “Government revenue, expenditure and main aggregates”, https://ec.europa.eu/eurostat/databrowser/view/GOV_10A_MAIN/default/table.

[12] Eurostat (2022), “Gross non-performing loans, domestic and foreign entities - % of gross loans”, https://ec.europa.eu/eurostat/web/products-datasets/-/tipsbd10.

[3] Eurostat (2022), “HIPC – inflation rate, Annual average rate of change (%)”, http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=tec00118&lang=en.

[27] IMF (2021), IMF Policy Responses to COVID 19, https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19.

[5] IMF (2019), “Staff Report for the 2019 Article IV Consultation for Republic of Romania”, https://www.imf.org/en/Publications/CR/Issues/2019/08/30/Romania%202019%20Article%20IV%20Consultation%20Press%20Release%20Staff%20Report%20Staff%20Supplement%20and%2048634.

[4] Kharroubi, E. and E. Kohlscheen (2017), “Consumption led expansions”, BIS Quarterly Review, Vol. March 2017, https://www.researchgate.net/publication/327111739_Consumption-led_expansions.

[26] OECD (2022), OECD Economic Surveys Romania, OECD Publishing, Paris, https://doi.org/10.1787/e2174606-en.

[23] OECD (2021), OECD Economic Outlook, Interim Report September 2021, OECD Publishing, Paris, https://doi.org/10.1787/490d4832-en.

[6] Pal, R. et al. (2019), “Investment: What holds Romanian firms back?”, EIB Working Papers, European Investment Bank (EIB), https://doi.org/10.2867/011088.

[16] RMF (2022), “Government debt according to EU methodology 2015 – February 2022”, https://mfinante.gov.ro/static/10/Mfp/buletin/executii/EvdatorieguvconformUEenglezafebruarie_2022.pdf.

[28] Schonherr (2020), “CEE Legislation Tracker”, http://www.schoenherr.eu/content/cee-legislation-tracker-romania/.

[22] Scope (2019), “Fallen angels and zombies: Potential risks in a downturn”, Scope Ratings, http://www.scoperatings.com/ScopeRatingsApi/api/downloadstudy?id=66341d72-618e-4b0a-8e11-c13adb595523.

[20] Standard & Poor’s Global (2013), “Corporate Methodology”, November 2013, http://www.spratings.com/scenario-builder-portlet/pdfs/CorporateMethodology.pdf.

[10] World Bank and IMF (2018), “Financial Sector Assessment – Romania”, Vol. July 2018, http://www.imf.org/en/Publications/CR/Issues/2018/06/08/Romania-Financial-Sector-Assessment-Program-45961.

Notes

← 1. The Stability & Growth Pact limits the debt to GDP ratio to 60% and fiscal deficits to 3% annually.

← 2. Around 75% of listed companies in the sample are listed on the AeRO Market, which is the MTS Market run by Bucharest Stock Exchange.

← 3. The share of firms with negative net income in the total number of firms.

← 4. Note that debt here refers to financial debt, not total liabilities.

← 5. More specifically, in the following analysis zombie companies are defined as companies that are more than nine-years old and which have had interest payments in excess of EBIT during at least the last three years.