This chapter provides an overview of private equity trends in Romania and offers a comparison with selected peer European countries. It presents a detailed analysis of the three main stages of private equity activity: fundraising, investment and divestment. The analysis addresses, among other things, issues relevant to the geographical and institutional source of fundraising, the industry distribution of investments and divestment forms.

Capital Market Review of Romania

6. The Romanian private equity market

Abstract

Private capital markets have grown significantly in recent years. By the end of June 2019, total assets in private capital markets reached USD 6.5 trillion globally. In private capital markets, private equity (PE) is by far the largest asset class. Its global net asset value has increased eight fold since 2000 and assets under management (AUM) of PE funds reached USD 3.9 trillion by the end of June 2019 (McKinsey, 2020[1]). Private equity and venture capital serve as an alternative source of financing for non‑financial corporations especially for start‑up firms, private medium‑sized firms, firms in financial distress and public firms seeking buyout financing.

6.1. Overview of private equity activity in Romania

There are three main stages in the private equity investment process. The initial stage is fundraising where general partners of the private equity firms raise funds from investors, including institutional investors and high net worth individuals. In the second stage of the process, funds are invested in companies at different stages of their lifecycle. Private equity funds generally have a defined investment horizon within which they are expected to exit their investments. Divestment, the third stage of the process, occurs when private equity firms sell their stake in investee companies. There are a number of options for PE funds to divest their holdings, including initial public offerings and sales to other private equity firms.

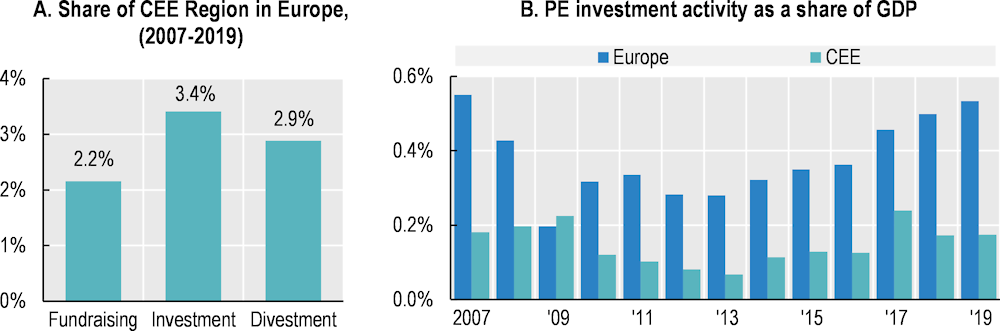

During the 2007‑19 period, EUR 20 billion was raised by private equity firms in the Central and Eastern Europe (CEE) region. This amount represented only 2.2% of the total private equity capital raised in Europe (Figure 6.1, Panel A). In the CEE region,1 PE investment and divestment activity is slightly higher than the fundraising activity as a share in European investment and divestment volumes. CEE private equity firms invested EUR 28 billion and divested EUR 13 billion between 2007 and 2019. This represented 3.4% and 2.9% of the total European investment and divestment activity, respectively (Figure 6.1, Panel A).

Another comparison with Europe reveals that PE activity in the CEE region is also far below European levels. PE activity measured as the volume of PE investment to GDP represented 0.53% of European GDP in 2019, and only 0.17% in CEE. In every year between 2007 and 2019, except 2009, PE investment activity in CEE has been less than a half of PE investment activity in Europe (Figure 6.1, Panel B). A similar trend can be seen for the CEE PE fundraising and divestment activity. The volume of funds raised in Europe in 2019 was 0.62% of European GDP, while the corresponding share was very modest for the CEE region at only 0.08% of the CEE GDP. PE divestment as a share of GDP represented 0.18% of European GDP in 2019, while for the CEE region, the corresponding share was 0.06%.

Figure 6.1. Private equity activity in CEE region and Europe

Source: Invest Europe / EDC.

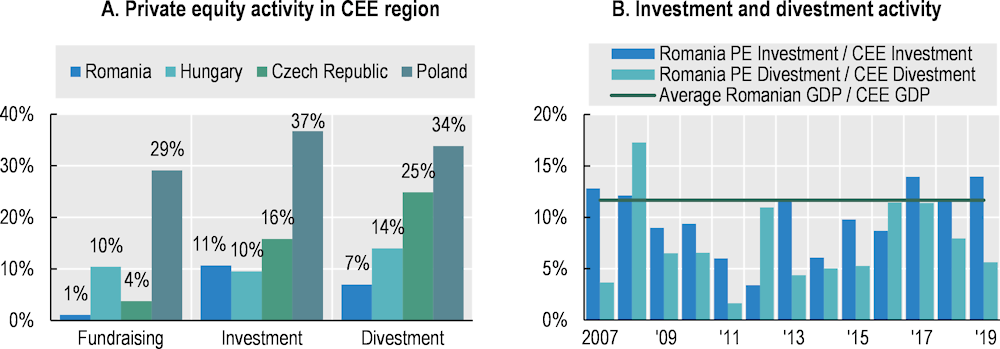

The private equity market in Romania is still in a development phase. Between 2007 and 2019 private equity firms in Romania raised EUR 222 million. This represented only 1% of the total amount of private equity capital raised in the CEE region and was well below Romania’s average annual share in CEE GDP for the same period (11.7%). In fact, during this period, fundraising activity in Romania was concentrated in only six years. Yet, during the last three years, PE firms were able to raise an annual average of EUR 31 million. Poland and Hungary ranked first and second in the CEE fundraising activity and together accounted for almost 40% of all the funds raised in the region.

Compared to fundraising, Romania’s share in PE investment in the CEE region volume was significantly higher. Between 2007 and 2019, PE investment in Romania was, on average, EUR 226 million per year. This means that Romania’s investments are equivalent to 11% of the regional total and close to its share in CEE GDP (Figure 6.2, Panel A). PE investment activity in Romania has increased since 2012 (Figure 6.2, Panel B). Romanian divestments between 2007 and 2019 amounted to EUR 909 million, representing 7% of divestment in CEE countries. Poland and the Czech Republic ranked first and second, respectively, in PE investment and divestment in the CEE region. Together their activity represented 53% of PE investment and 59% of PE divestment of the regional total.

Figure 6.2. Private equity activity in Romania as share in CEE region, 2007‑19

Note: In Panel A, CEE region includes EUR 8 billon of funds raised of which the target country information not specified.

Source: Invest Europe / EDC.

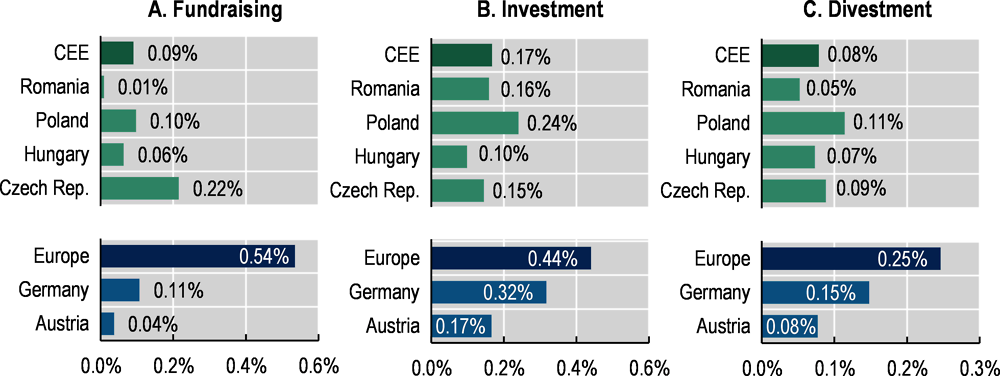

Compared to the selected peer countries, Romania has lagged behind in PE activity over the last five years, particularly in fundraising and divestment (Figure 6.3). In the Czech Republic and Poland, PE fundraising between 2015 and 2019 represented on average 0.22% and 0.10% of their respective GDP, while the corresponding figure for Romania was only 0.01%. Moreover, PE divestments over the same period accounted for only 0.05% of Romania’s GDP, which is also below the CEE average of 0.08%. The exception is PE investment to GDP, for which Romania, with 0.16%, is almost at the same level as the CEE average of 0.17% of GDP.

Figure 6.3. Private equity activity in Romania and selected European countries, percentage of GDP

Note: The shares represent the five‑year average between 2015 and 2019, in Panel A, CEE region includes EUR 8 billon fundraising of which the target country information not specified.

Source: Invest Europe / EDC.

6.2. Fundraising, investment and divestment trends

PE fundraising activity in Romania is modest compared to CEE regional volumes. Romanian private equity firms mostly rely on foreign investors when raising funds. Between 2007 and 2019, 69% of the committed capital in Romania was raised from other European investors (Figure 6.4, Panel B). This is almost twice as high as the total CEE non‑domestic share of 34%. Moreover, a modest amount of the Romanian funds have been raised from investors outside of Europe, while for the CEE region as a whole, around 14% of funds were raised from non‑European investors (Figure 6.4, Panel C).

In Poland, 45% of the funds were raised from other European countries and 22% from non‑European countries. However, other CEE countries rely heavily on their domestic market for raising funds, notably in Hungary where 77% of total funds raised come from domestic investors (Figure 6.4, Panel A). Generally, CEE countries depend heavily on the domestic market and on other European markets which together account for 66% of the total funds raised, while for Europe the corresponding share is 50%.

Figure 6.4. PE fundraising by origin of investors in Romania and selected European countries, 2007‑19

Note: The analysis only includes funds raised where the origin of the investor is specified.

Source: Invest Europe / EDC.

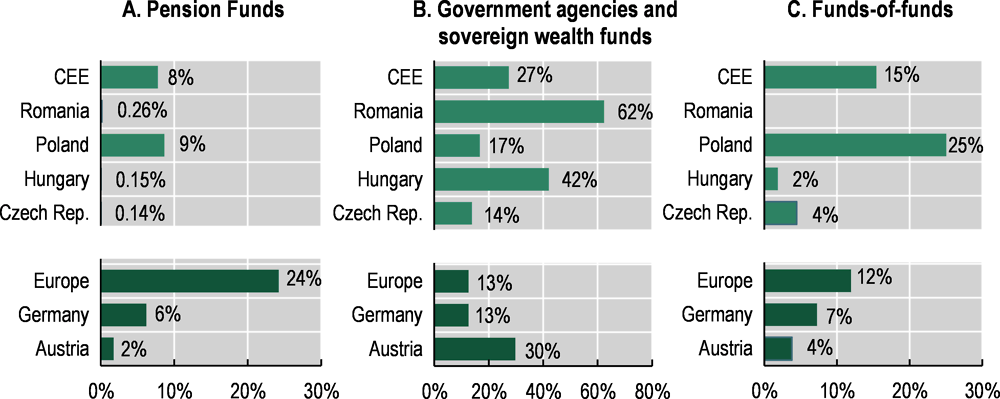

During the 2007‑19 period, pension funds were the largest investors providing 24% of the total funds raised in Europe (Figure 6.5, Panel A). For the CEE region, however, pension funds provided only 8% of total funds raised, while government agencies and sovereign wealth funds was the single largest source of funds, contributing 27% of total funds raised. This situation is even more accentuated in Romania where government agencies2 account for 62% of all funds raised between 2007 and 2019. (Figure 6.5, Panel B). This is to a large extent the result of increased PE activity by government agencies in Eastern Europe, including Romania, to offset investment outflows in the wake of the 2008 global financial crisis and the 2012 Euro crisis (Mihai, 2015[2]). Additionally, in Romania individual investors and banks represent 10% and 5% of the funds raised, respectively. Importantly, funds‑of‑funds, which otherwise play a significant role in PE fundraising especially in Europe, were not active in the Romanian PE market.

Figure 6.5. PE fundraising by type of investors in Romania and selected European countries, 2007‑19

Note: CEE region includes EUR 8 billon fundraising of which the target country information not specified, as a result, the specific country level data of the capital providers for that amount is not available.

Source: Invest Europe / EDC.

Private equity firms mainly specialise in buyouts, venture capital and growth investment. The AUM of the three account for 54%, 25% and 18% of the total PE AUM, respectively as of June 2019 (McKinsey, 2020[1]). The buyout segment of private equity markets provides funds for the acquisition of more mature companies to improve their operations, thereby enhancing the efficiency and increasing the valuation of the company. Generally, the buyout segment of PE investment focuses on under performing companies, with the investment aiming to foster corporate restructuring and enhance productivity (OECD, 2007[3]). Venture capital investors typically focus on early stage firms, for example companies in technology intensive industries, which may have difficulties raising funds from the banking sector or the primary financial markets. An efficient venture capital market contributes to economic growth, employment creation and long-term competitiveness by enabling access to financing for high growth firms (ECB, 2005[4]). The growth segment of PE refers to the investment in relatively mature companies that require capital for their growth objectives.

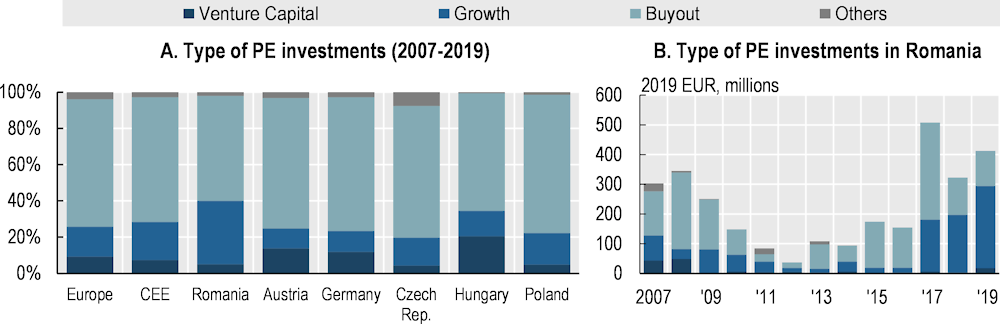

As discussed before, investment activity in Romania, unlike fundraising, shows a level of activity closer to its contribution to GDP in the CEE region. Among different types of PE investments, buyout transactions dominate investment volumes across countries and regions. Buyout transactions typically involve high levels of debt financing, with the aim of acquiring a controlling share of the company to facilitate the restructuring process. In both Europe and the CEE region, buyout deals accounted for almost 70% of the total PE investment value between 2007 and 2019. A cross‑country comparison shows that the share of buyout deals in investments (58%) is relatively low in Romania (Figure 6.6, Panel A).

Growth investments accounted for 35% of total PE investments in Romania between 2007 and 2019 (Figure 6.6, Panel A). This investment type represents the highest share of total PE investment compared to peer countries. It was mainly driven by the increase in growth investments during the last three years when the share of growth investment increased from 35% in 2017 to almost 70% of total PE investment in 2019 (Figure 6.6, Panel B). It is also worth mentioning that the share of venture capital stood at 5% of the total investment over the whole period, a modest level compared to 20% in Hungary and 14% in Austria.

Among different reasons for the low level of venture capital activity in Romania, the total R&D intensity measured as the gross R&D expenditure to GDP has been found to be closely linked to early stages of venture capital activity in Romania (Diaconu, 2012[5]). Enterprises create a demand for venture capital for their innovative projects, therefore creating activity in the venture capital market. However, Romania shows by far the lowest level of R&D measured as a share of GDP among its peers (see Chapter 3, Figure 3.4), which could partly explain the low level of venture capital activity in the country.

Figure 6.6. PE investment in Romania and selected European countries

Source: Invest Europe / EDC.

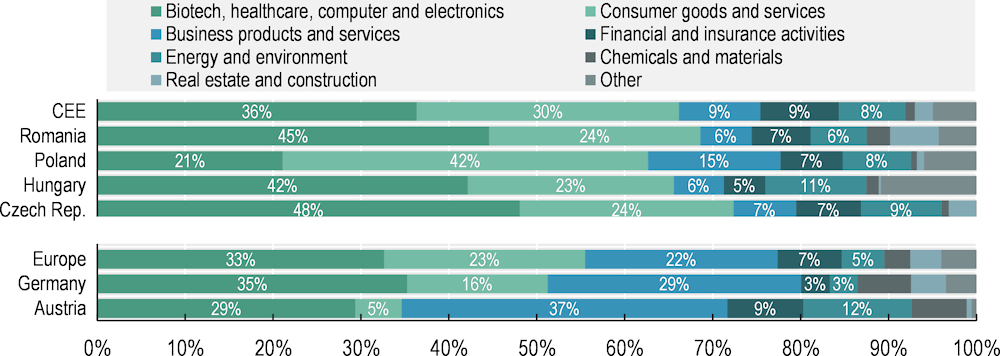

During the 2007‑19 period, most PE investments in Europe and in the CEE region were concentrated in three industries: technology including biotech, health care, computers and electronics; consumer goods and services; and business products and services. These three industries accounted for more than 75% of total PE investments in Europe as well as in the CEE region, with Europe at large being more focused on the business products and services industry compared to the CEE region (Figure 6.7). In Romania, the largest industry is technology, which attracted 45% of total PE investments over the 2007‑19 period.

Figure 6.7. PE investment by industry in Romania and selected European countries, 2007‑19

Source: Invest Europe / EDC.

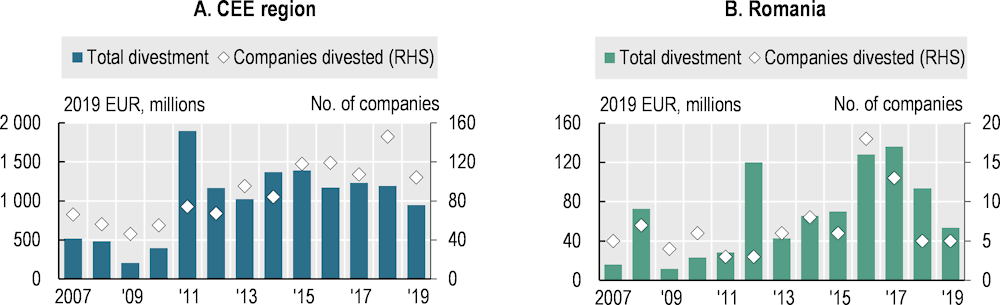

The final stage of private equity investment is divestment, where private equity funds exit their investments at the end of the fund’s lifecycle. There are several forms of divestments including sale through public offerings, sale to other private equity firms or financial institutions, buyback by managers or owners, repayment of preference shares/loans and write‑offs.

Divestment activity in the CEE region has decreased since 2015 (Figure 6.8, Panel A). In 2019, total divestments in the CEE region amounted to EUR 946 million, a decline of 21% compared to 2018. This decrease is in line with broader European divestment trends, where the total divestment amount decreased by 16% between 2018 and 2019. Divestment by companies from the CEE region in 2019 accounted for 3% of total European divestments. In 2019, Romania recorded its lowest level of divestment since 2013 at EUR 53 million, corresponding to only five companies (Figure 6.8, Panel B). This placed divestment volumes in Romania fourth in the CEE region after Serbia, Poland and the Czech Republic.

Figure 6.8. PE divestment volume in CEE Region and Romania

Source: Invest Europe / EDC.

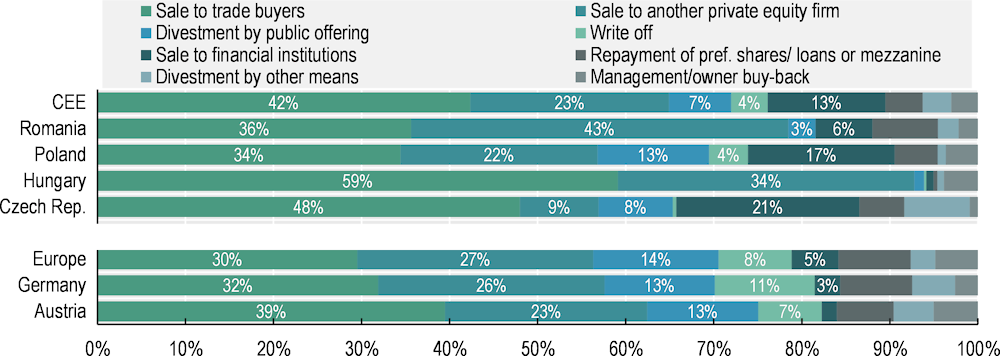

Among the different forms of divestment, the sale to another private equity firm and trade buyers are the most common forms accounting for 57% and 65% of the total aggregate divestment value for Europe and the CEE region, respectively (Figure 6.9). In Romania, these two forms of exits account for 79% of all divestments. In particular, exit through the sale to another private equity firm makes up more than 40% of the total exit value. Importantly, while the divestment through a public offering represents 14% and 7% of the total exit value for Europe and the CEE region, respectively, it represents only 3% in Romania.

Figure 6.9. PE divestment by exit forms in Romania and selected European countries, 2007‑19

Source: Invest Europe / EDC.

References

[5] Diaconu, M. (2012), “Characteristics and drivers of venture capital investment activity in Romania”, Theoretical and Applied Economics, Vol. XIX/7(572), pp. 111-132.

[4] ECB (2005), The Development of Private Equity and Venture Capital in Europe, ECB Monthly Bulletin, October 2005, http://www.ecb.europa.eu/pub/pdf/other/mb200510_focus02.en.pdf.

[1] McKinsey (2020), A new decade for private markets, McKinsey Global Private Markets Review 2020, February 2020, http://www.mckinsey.com/.

[2] Mihai, P. (2015), “What drives private equity investment in Romania”, Studia Universitatis “Vasile Goldis” Arad. Economics Series, ISSN 1584 2339, pp. 25 – 42.

[3] OECD (2007), “The Private Equity Boom: Causes and Policy Issues”, http://www.oecd.org/finance/financial-markets/40973739.pdf.

Notes

← 1. CEE countries include: Bosnia Herzegovina, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Latvia, Macedonia, Moldova, Montenegro, Poland, Romania, the Slovak Republic, Slovenia, Serbia, Ukraine.

← 2. Government agencies refer to the amounts raised by two funds “Balkan Accession Fund” and “Emerging Europe Accession Fund” managed by the private equity firm Access Capital Partners SA. The Balkan Accession Fund targets investment in Bulgaria, Romania and other south east European countries and the lead investors of the fund are Black Sea Trade and Development Bank (BSTDB), the German Investment and Development Society (DEG), EBRD and the Netherlands Development Finance Company (FMO).The Emerging Europe Accession Fund targets companies based in South Eastern Europe and fund’s lead investors are BSTDB, DEG, EBRD and European Investment Fund (EIF).