This chapter focuses on the capacities of the centre of government (CoG) to contribute to budget strategy and collaborate with the Ministry of Economy on the settings, priorities and allocations for the federal budget. It considers how the CoG can ensure that the government’s medium-term and long-term plans align with the federal budgetary framework and how the budget can support the government’s key national policies in a coherent manner.

Centre of Government Review of Brazil

3. Budgeting in the centre of government in Brazil

Abstract

Introduction

The budgetary environment is challenging in Brazil. The COVID-19 pandemic has seen Brazil’s budgetary position deteriorate with increases in the budget deficit, public debt and demand for scarce public resources. These challenges will remain in the medium term and it will likely take time for the economy to recover from the pandemic (OECD, 2020[1]).

At the same time, the design of the federal budgetary system in Brazil faces challenges relating to the co‑ordination, prioritisation and allocation of budgetary resources. The CoG in Brazil has asked the OECD for advice on ways in which the centre can strengthen its capacities in these.

The CoG performs a pivotal role in budgeting in Brazil because of the federal nature of the government, its role in bringing legislation to Congress and its responsibility for strategic planning across the government. The government of Brazil has examined the management of its federal budget on many occasions. It has already taken action on some matters, such as the introduction of a fiscal rule to manage the growth in federal expenditure over time and the formation of the Budget Execution Board (JEO) as an advisory body to the president. The board’s membership comprises the Minister of Economy and the Head of the Civil Cabinet of the Presidency of the Republic (Casa Civil).

This chapter considers the institutional arrangements that govern budgeting in Brazil at the CoG and looks at how the budget process is conducted from that perspective. The material in the following sections helps to identify five issues that can impact the CoG’s ability to budget soundly and five areas for reform to improve the management of budgetary outcomes. These areas are:

Fiscal sustainability and the management of legislated expenditure.

Budget predictability from in-year amendments.

The relationship between budgeting and planning to support prioritisation.

Capital investment and the management of fiscal risks.

Incentives to scrutinise baseline expenditure.

The OECD has looked at the capacities that the CoG can bring to the budget process and the information the centre requires in order to make informed decisions to help ensure the federal budget pursues governmental priorities and has an approach that focuses on results, value for money and accountability. The recommendations propose managerial solutions to improve co-ordination across government, as well as new materials that are not currently available to inform budget decisions and strengthen the budgetary framework.

The OECD’s analysis is based on the Recommendation of the Council on Budgetary Governance (OECD, 2015[2]) and draws on comparative information from across OECD countries. This chapter does not consider the structure of government, nor does it give a view on fiscal priorities. Rather, it focuses on the effectiveness of decision-making processes in the budget with respect to the responsibilities of the CoG.

Institutional arrangements are unique to Brazil

Budgeting at the federal government of Brazil is characterised by obligations that are established in the national constitution for each branch of government and the government ministries and entities within the executive. This section looks at these arrangements for the aspects that are relevant to the CoG in budgeting.

Budgetary arrangements are embedded in the national constitution

In Brazil, the federal government’s obligations to prepare and execute a budget are expressed in the 1988 national constitution and its amendments. Article 165 provides for a multi-year plan, budget directives and an annual budget (Constitute, 2021[3]). The multi-year plan is to list the objectives and targets of the federal public government for current expenditure, capital expenditures and other expenses. The information is to be presented on a federal and regional basis. Budget directives lay out the targets and priorities of the government. The directives support budget transparency by requiring a budget implementation report to be published within 30 days of each 2-month period. The report, entitled The Bimonthly Report on the Evaluation of Primary Revenues and Expenditures, is mandated under the Fiscal Responsibility Law. The annual budget shows the allocation of funding to governmental agencies, capital investment and social security expenditures and funds. Reflecting the federal character of Brazil, the budget also shows the regional distribution of revenue, expenditure, subsidies, exemptions and lending.

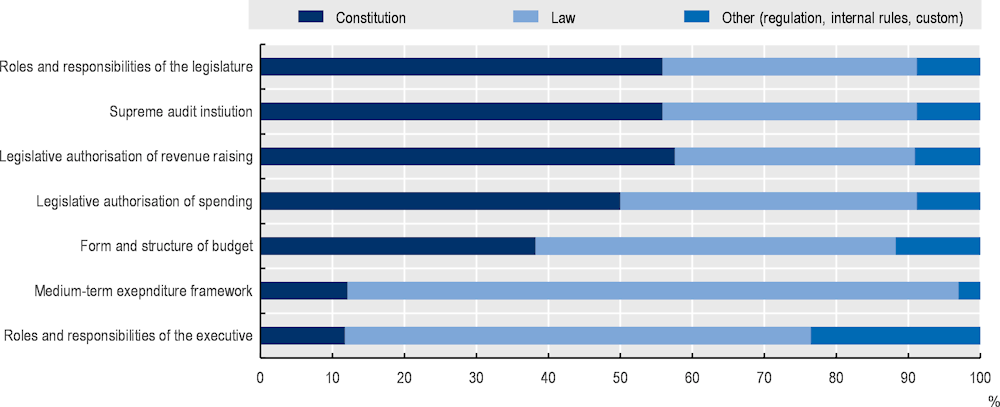

The Constitution of Brazil defines the roles and responsibilities of legislature, executive, and budgetary oversight institutions. It includes requirements for fiscal rules, the rights and obligations of regions and the requirements to audit financial statements. National constitutions in many OECD countries also contain articles relating to budgets (Figure 3.1. ). Many of the provisions are comparable to those contained within the constitution of Brazil, for example:

Multi-annual budget plans: Only 10% of OECD countries define the requirements for medium-term strategic plans in constitutions. The majority of OECD countries use statutes such as budget laws or administrative procedures.

Budget scope: Constitutional clauses stating that all government revenues and expenditures must be included in the budget are frequent, for example in Germany, Greece and Spain. Some countries such as Spain require the disclosure of tax expenditures. Other countries refer to the social security budget, for example, Portugal. Some OECD countries also define whether government business enterprises are to be included in the financial statements of government.

Budget structure: The structure of the budget and basis for votes (line item, programme, by ministry, etc.) is set out usually in special or ordinary legislation. An exception can be found in Portugal where the constitution mandates that the budget shall be structured by programmes (Article 105).

Figure 3.1. Legal basis of budgetary practices in OECD member countries

Note: The figure presents the proportions of countries surveyed that provided responses (34 countries for most categories).

Source: OECD (2019[4]), Budgeting and Public Expenditures in OECD Countries in 2019, https://doi.org/10.1787/9789264307957-en.

The legislature has extensive powers on budget legislation

Congress is responsible for approving the government’s proposed federal budget. Congress exercises an active role in the determination and approval of the federal budget and frequently proposes amendments.

A range of proposals has been put forward at different times to limit Congress’ ability to re-estimate revenue and to place restrictions on the amendments that congressional representatives can introduce. Some proposals have tried to strengthen the committee stage of Congress’ scrutiny of the executive’s budget proposal, for example by merging the technical units of the Chamber and Senate to pool the resources available to Congress (Tollini, 2009[5]). However, these have gained little traction and illustrate the limitations of importing budgetary institutions from other jurisdictions without adapting them to Brazil’s existing arrangements.

Budgetary responsibilities are shared across institutions in the executive

Within the executive, the CoG comprises several organisations that are located inside and outside of the institutions of the presidency. As explained in Chapter 1, the CoG performs four core functions: strategic planning, co-ordination, communication and monitoring. These functions include responsibilities for the co‑ordination of policy across government and with Congress.

Organisations within the presidency, such as the General Secretariat (Secretaria Geral, SG) and the Civil House (Casa Civil) hold responsibilities for developing strategic plans, sector priorities and goals.1 In the case of the SG, the planning function is for the internal management of the presidency and the modernisation of the state where the scope of responsibility is to define goals and priorities. These responsibilities are relevant to the preparation of the federal budget and are assigned largely to special secretariats and related bodies within each organisation. The allocation of responsibilities has encouraged specialisation and the development of expertise; however, the responsibilities have changed over successive presidential terms with functions being added or transferred. The changes have resulted in duplications in some areas: for instance, the Special Secretariat for Strategic Affairs (SAE) is responsible for formulating national planning strategies in terms of sector priorities and goals. Similarly, Casa Civil contributes to the process of developing the government’s strategy, sector priorities and goals. It has responsibilities for the presidency’s relationship with Congress, as does the Secretariat of Government (SEGOV). SEGOV assists the president of the republic in political and social co‑ordination, especially in the relationship with Congress. There are some distinctions but the commonality of the functions illustrates a need for co-ordination across the four ministry-level organisations within the presidency on strategic planning and prioritisation for budgetary purposes.

Outside of the presidency, the Ministry of Economy (Ministério da Economia) also has responsibility for strategic planning in relation to the budget. The ministry is responsible for budgeting, public finance, economic forecasting and monitoring public expenditures, amongst other things. In the case of the organisations within the presidency and the Ministry of Economy, the responsibilities are established in legislation. Casa Civil also has special bodies with responsibilities for budgeting (public finance), economic policy and public management. Again, the functional responsibilities identify a degree of overlap and the need for co-ordination.

Planning and budgetary functions in government should occur in a co-ordinated manner to maximise the value from each function. A budget helps inform whether plans are achievable and a plan helps guide a budget so that it can contribute to the government’s priorities over time. In Brazil, the federal government has well-established planning and budgetary functions. The 2003 OECD review of budgeting in Brazil observed that budgeting and planning occur in parallel and largely disconnected ways (Blöndal, Goretti and Kristensen, 2003[6]). However, since then the government has taken actions to strengthen the institutional arrangements, for instance by establishing a JEO that is composed of senior representatives from within this the presidency and the Ministry of Economy.

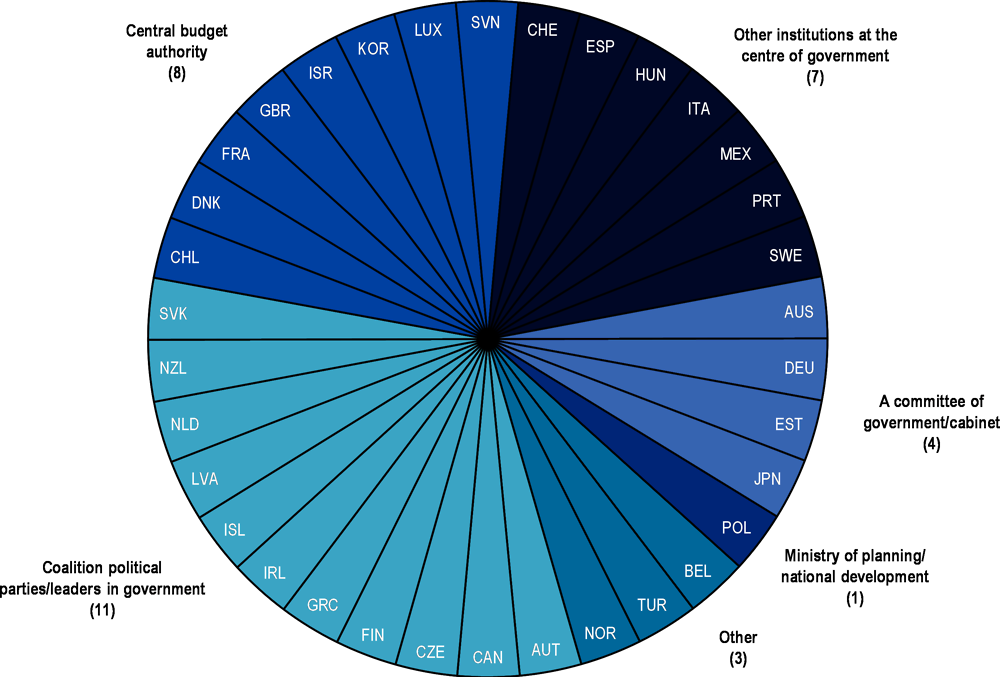

In some OECD countries, institutional responsibilities for planning and budgeting are shared across more than one organisation and with the CoG. The shared responsibility is to help ensure that the medium-term aspects of budgeting align with a government’s medium-term and strategic priorities. Figure 3.2 shows that in 65% of OECD countries, the responsibility for strategic planning for the purposes of budgeting resides in entities that are closest to the leadership of the country. In this regard, the shared responsibilities for planning and aspects of the federal budget in Brazil are not unique.

Figure 3.2. Institutions responsible for strategic planning for budgetary purposes in OECD countries

Source: OECD (2019[4]), Budgeting and Public Expenditures in OECD Countries in 2019, https://doi.org/10.1787/9789264307957-en.

In Brazil, the CoG is responsible for strategic planning initiatives and for medium-term planning, both of which are discussed in Chapter 2. Casa Civil, in conjunction with other areas of the presidency, identifies and defines whole-of-government strategic priorities and design long-term strategic plans. These capacities are not well connected to the formulation of the annual budget, despite the fact that Casa Civil has a role in monitoring the implementation of the budget.

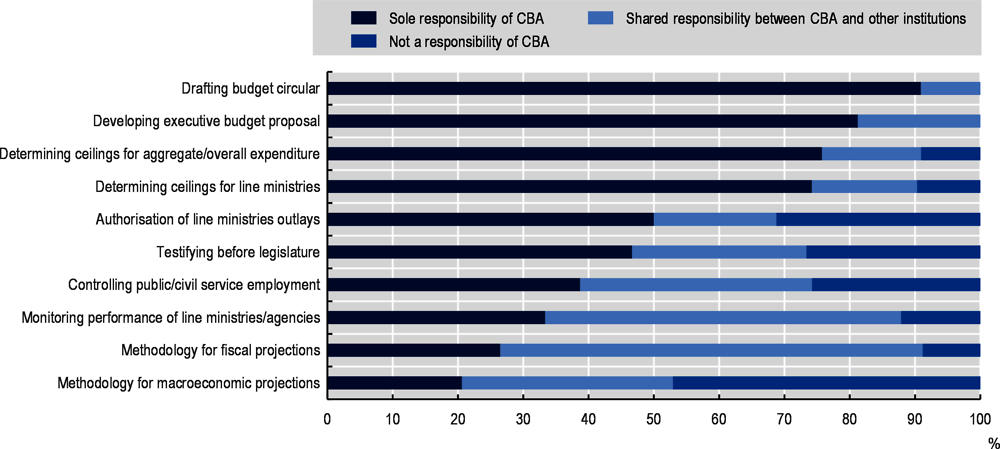

The central budget authority is responsible for leading the budget process. In the majority (86%) of OECD countries, the central budget authority is located in the Ministry of Finance or its equivalent (OECD, 2019[4]). In Latin America, the proportion of central budget authorities located in a ministry of finance is a similar percentage (84%) (OECD, 2020[7]). In the case of four OECD countries (Australia, Canada, Ireland and the United States [US]), the responsibilities are allocated across more than one government agency for the budgeting of expenditure and revenue. In fact, shared responsibilities exist across a range of budgetary functions, not just strategic planning (Figure 3.3) in OECD countries. In Brazil, responsibilities for strategic planning in relation to the budget are shared across Casa Civil and the Special Secretariat within the CoG as well as with the units in the Ministry of Economy responsible for budgeting, public finance, economic forecasting and monitoring public spending. Challenges with this arrangement include co‑ordination across organisations and processes to prioritise strategic planning initiatives for budgeting purposes, and more broadly to align coherently the federal budget with Brazil’s planning instruments (notably the Pluriannual Plan or PPA).

Figure 3.3. Responsibilities of central budget authorities in OECD countries

Note: CBA: Central budget authority.

Source: OECD (2019[4]), Budgeting and Public Expenditures in OECD Countries in 2019, https://doi.org/10.1787/9789264307957-en.

The judiciary performs an active role in the legality of federal budgets

In Brazil, the role of the judiciary provides a safeguard on the use of public funds after the budget is approved by Congress to ensure the use of funds remains consistent with the country’s existing laws. The judiciary may review the federal budget where an area of budget expenditure is inconsistent or contravenes existing legislation. The judiciary can also rule on the use of presidential decrees to shift money from one purpose to another during a given year. As such, the judiciary’s remit goes beyond ruling on procurement processes to undertake initiatives that were proposed in the budget.

From a CoG perspective, the judicial remit on budgeting means that Casa Civil remains ready to defend the budget from legal challenges even after the budget has been approved by Congress. This responsibility is shared with the Ministry of Economy.

The government has continued to strengthen its public finance architecture

Over two-thirds of OECD countries now have independent fiscal institutions (independent parliamentary budget offices or fiscal councils, Instituiçãos Fiscal Independente, IFIs). Brazil joined their ranks in 2016 with the establishment of its Instituição Fiscal Independente in the Senate to monitor fiscal policy, provide independent economic analysis and more generally strengthen budget transparency. The IFI, modelled in part on the United Kingdom Office for Budget Responsibility, was established through primary legislation and is led by a three-member board chosen by the Senate (Federal Senate, 2016[8]). As such, the Brazilian model has the collective leadership typical of a fiscal council but is embedded in the legislative branch. In addition to the board, it also has a Technical Advisory Council (modelled in part on the advisory panels of the Congressional Budget Office in the United States).

The Brazilian IFI is mandated to: i) publish estimates of economic parameters and variables that are relevant to the construction of fiscal and budgetary scenarios; ii) analyse adherence of tax and budgetary indicators to legally defined goals; iii) measure the impact of relevant tax events, especially those arising from decisions of the Powers of the Republic, including the costs of monetary, credit and foreign exchange policies; and iv) project the evolution of fiscal variables that are determinant to the long-term equilibrium of the public sector. Resolution 42/2016 requires the Brazilian IFI to present its projections and fiscal analyses to the Economic Affairs Committee on a biannual basis (Federal Senate, 2019[9]).

The IFI is relevant to Casa Civil as the CoG has responsibility for the government’s interactions with Congress. The IFI provides budget analysis to Congress to help the Congress in its budgetary role. In doing so, the IFI has added to the specialisation and separation of budgetary roles between the CoG, the Ministry of Economy and Congress. In the five-year period since its establishment, the IFI has become a reliable voice on budgetary and fiscal policy; its analysis may also be useful to Casa Civil as it manages relations with Congress.

The CoG performs essential roles in budgeting

This section considers the budget documents and the budget process as the tools available to the government to manage the federal budget effectively across the organisations within the CoG.

Budget documents are prescribed in detail in legislation

In Brazil, budgetary documents (Box 3.1) are prepared by the Ministry of Economy in accordance with the national constitution and the 2000 Fiscal Responsibility Law (Lei de Responsabilidade Fiscal). The law has helped Brazil manage its budget responsibility by requiring comprehensive coverage of the public sector in the federal budget, including budget transactions with states and municipalities. However, the law has been diluted over time: for instance, in 2009, the primary surplus target was reduced. The Fiscal Responsibility Law’s objectives around transparency have also been undermined by off-budget transactions, such as public-private partnerships and financial support to local banks.

Box 3.1. Budget documents in the federal government of Brazil

The budget is expressed in three core documents that become law once each is approved by Congress:

Pluriannual plan (Plano Plurianual da União, PPA): The PPA contains macroeconomic forecasts and fiscal objectives for a four-year period, which the government prepares within its first year of taking office and submits to Congress for approval. The four-year period of the plan means that the final year extends into the first year of the next governmental term, for the purpose of providing continuity across electoral cycles.

Budget directives (Lei de Diretrizes Orçamentárias, LDO): The directives set targets and priorities for the federal government for the coming budget year. The targets and priorities are established each year in the context of a two-year time horizon – the present year and the next year. The purpose of the directives is to provide guidance to the executive on the preparation of the annual budget.

Annual budget (Lei Orçamentária Annual, LOA): The annual budget proposal is to be consistent with the PPA and LDO. If there were no change to the economic and operating environment, or the political demands facing the government, the sum of four annual plans should broadly equate to the PPA. However, such abstractions are not the reality.

Within the budget documents that are submitted to Congress, the information on programmes and sub‑programmes is highly detailed. An implication from the detail is that budget flexibility is limited and changes to the composition of costs must be submitted to Congress for approval. As such, Congress becomes involved in the definition of programmes and programmatic details and may focus less on performance and results.

The PPA provides a medium-term perspective of the government’s budgetary intentions. The period of the PPA and the timing of its preparation conveys the notion of continuity between two governmental terms. The directives provide goals, priorities and parameters for the annual budget; however, it stops short of being a fiscal strategy. The three budgetary documents should create an inter-related system of planning, guidance and budget allocation. However, the clean design is more complex in reality. As discussed in Box 3.1, the PPA remains unchanged largely during the four-year period and becomes increasingly detached from the realities facing the executive in each successive year of its term. However, there is a legal provision for an annual revision to the PPA, which is intended for budgetary adjustments to programmes and goals (Government of Brazil, 2020[10]).

Separate from the four-year plan, the CoG prepares strategic plans. The strategic plans are not approved by Congress but identify a long-term vision and high-level policy direction for Brazil. The distinction between the strategic plans and the four-year PPA illustrates the attention Brazil gives to planning. However, in a budgetary context, the separation of responsibilities from planning within the presidency and budgeting in the Ministry of Economy creates co-ordination challenges for the flow of information across government in Brazil, as shown in Chapter 1.

The budget process is well developed

Table 3.1. characterises the five phases of the budgetary process. In the majority of OECD countries, the CoG is involved in the budget strategy phase of the budget process and in the budget approval phase when the executive’s budget proposal is submitted to the legislature. In each instance, the CoG’s involvement is conducted with the central budget authority.

Table 3.1. Five phases of the budgetary process

|

Budget phase |

Description |

|---|---|

|

Budget strategy |

The objectives, priorities and high-level settings that are to guide the formulation of the executive’s budget proposal. |

|

Budget formulation |

The executive’s preparation of its proposed budget. |

|

Budget approval |

The legislature’s approval of the proposed budget, with or without modification. |

|

Budget execution |

The implementation of the approved budget. |

|

Budget review |

The independent review of the completed budget, including the financial statements of government. |

In Brazil, the centre has a powerful influence in the co-ordination of government and the budget because of Casa Civil’s responsibilities for progressing legislative proposals. Casa Civil capacities in the ex ante evaluation of legislative proposals and the co-ordination of relations with Congress can support the passage of budget legislation in a manner that is not replicated by other ministries of government.

Budget strategy requires a co-ordinated approach with the CoG

The co-ordination between a CoG and a central budget authority on budget strategy helps ensure that a government’s priorities are part of the budget strategy.

In Brazil, the budget process is well established in its component phases. However, in 2017, the International Monetary Fund noted that the budget documents do not provide a clear picture of fiscal strategy or the policy measures to help achieve the government’s objectives on fiscal policy (IMF, 2017[11]). Since then, the Ministry of Economy through the National Treasury Secretariat has strengthened its preparation of a fiscal risk annex in the budget documents (Decree No. 9.679/2019). In addition, the secretariat prepares medium- and long-term scenarios and sets fiscal policy guidelines on fiscal planning and the identification of fiscal risks. This process involves monitoring and evaluations to improve the federal government’s budgetary and financial process. These developments help take Brazil closer to operating fully a medium-term expenditure framework that informs budget strategy and decisions.

Budget formulation is pre-determined largely by existing legislation

In Brazil, the federal budget is prepared by the Ministry of Economy on a cash basis and focuses on incremental expenditure while abiding by constitutional and other legislative (mandatory) requirements on the allocation of expenditure. Approximately 94% of the budget is determined by the allocations that are set in legislation. In this regard, the majority of the budget is completed before the budget process begins, as only 6% of the incremental expenditure is available to be allocated to the government’s priorities. The legislated allocation of expenditures does not have regard for innovation, quality or the volume of services that may be required.

The legislated expenditure creates challenges for fiscal sustainability as the government is not able to change the cost structure of the budget to respond to changes in economic and social circumstances. In addition, the legislated expenditure makes it challenging to scrutinise the existing expenditure to identify activities that are ineffective and inefficient. As a result, the government faces two options:

Seek a legislative amendment to the expenditure.

Use presidential decrees during the year to reallocate certain expenditures.

The circa 6% that is available for the government’s policy priorities, includes public investment priorities. With such a small proportion of available funds for allocation in a federal budget, the competition for funding is high and should flow through to well-developed capacities for prioritisation. However, this does not always appear to be the case. There is scope for the Ministry of Economy, in conjunction with Casa Civil, to strengthen the assessment and prioritisation of current expenditure to support the selection of budget initiatives in the context of scarce resources. One area where prioritisation has improved during the formulation of the budget has been capital expenditure where the government has identified specific projects to complete.

Budget approval processes in the legislature are complex and unpredictable

In Brazil, there are effectively four budgets and each can differ from the other.

The planned budget, as expressed in the government’s PPA.

The budget proposal that the executive submits to Congress for approval.

The approved budget that contains Congress’ amendments.

The executed budget that is adjusted with presidential decrees and is subject to the cash available.

Despite guidelines that permit updates to the PPA, authorities noted that the PPA can become dated over a four-year period (see Chapter 2 on planning). The budget proposal that the executive submits to Congress is subject to amendment and the approved budget is not achievable to the extent that revenue is overestimated. The process of re-estimating revenue and proposing new expenditure can help to reveal the expenditure pressures that exist across the country and identify the extent to which there is a political consensus on those pressures. However, increases in revenue over and above the forecasts submitted to Congress by the government create the challenge of how to undertake expenditure if the revenue does not materialise. As such, the predictability of the budget is a challenge, as the government has to manage new expenditures based on the cash available, which can mean that new initiatives can take longer than planned to implement.

An expenditure rule has strengthened the government’s budget framework

Fiscal rules commit a government to how it determines the overall size of the budget. It is an important means of communicating the government’s budget strategy, in particular the way a government is proposing to manage fiscal sustainability challenges over time.

In Brazil, in December 2016, Congress approved a constitutional amendment (Amendment 195, Teto dos Gastos) to place a ceiling on federal expenditure for a 20-year period to 2036. The amendment limits the growth in expenditure in any one year to no more than the rate of inflation of the previous year. The purpose of the rule is to keep expenditure constant in real terms over time. The expenditure rule applies to the executive, judiciary and legislative branches of the federal government. If a branch of government does not stay within the expenditure ceiling, in the subsequent year, it is prevented from increasing salaries, hiring staff or commencing procurement tenders until expenses return to within the ceiling. Assuming that economic growth continues at a higher rate than inflation, the level of debt as a percentage of gross domestic product (GDP) is to decrease over the 20-year period and improve fiscal sustainability. Initial signs are that the expenditure rule is providing an effective means of controlling aggregate expenditure and supports market confidence, but at the same time adds to the pressures of prioritising budget proposals.

A CoG performs an important role in times of crisis where the president leads the response to a natural disaster or health emergency. In 2020, during the outbreak of COVID-19, Congress ratified a constitutional amendment to allow for the separation of COVID-19 related expenses from the federal government’s ordinary budget. The amendment suspended Brazil’s golden rule on budgeting to enable the government to raise debt to help manage the health crisis (Box 3.2). The amendment illustrated the CoG’s involvement in budgetary matters as a result of COVID-19. A Special Secretariat for COVID-19 has created committees to help state and municipal governments to access federal resources. Ordinarily, the golden rule would mean the government’s borrowing cannot exceed capital expenditure.

Box 3.2. Budgetary responses to COVID-19 in Brazil

In 2020, Congress declared a state of emergency and granted an exemption from the 2020 budget target. It approved additional public expenditure of around 8.5% of GDP for social protection, health and other areas of spending, including:

Additional health resources included in transfers to state and municipal governments.

The Brazilian Development Bank announced new credit lines for companies.

For small- and medium-sized enterprises, an emergency credit line was opened to cover two months of wages for employees.

For formal workers and their employers, a new short-term work scheme from unemployment insurance.

For informal workers and the unemployed, a temporary new benefit, provided that they earn less than half a minimum wage and are not covered by other social benefits, except Bolsa Família.

Withdrawals from individual unemployment insurance accounts have been made possible.

Source: OECD (n.d.[12]), Country Policy Tracker, OECD, Paris, https://www.oecd.org/coronavirus/country-policy-tracker/.

Five issues on budgeting at the CoG

This section focuses on five issues that can affect budgeting at the CoG in Brazil, based on the previous sections.

Increases in federal expenditure create challenges for fiscal sustainability

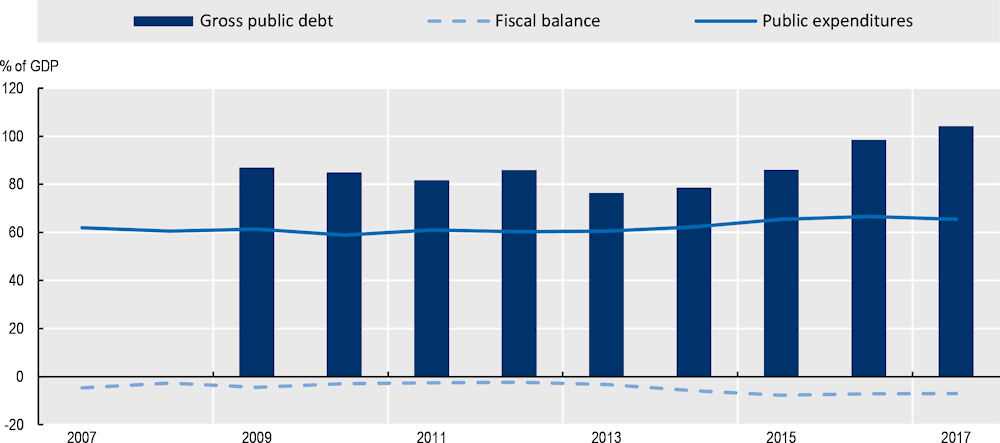

Brazil faces challenges to fiscal sustainability from increases in fiscal deficits, the size of the government and gross public debt. Figure 3.4 shows trends in the performance of these metrics for the general government, which is defined as the federal government, state, municipal governments and social payment expenditures.

Figure 3.4. Trend in budgetary performance in Brazil

Note: The graph refers to general government fiscal balance, general government gross debt and general government expenditures.

Source: OECD (n.d.[13]), OECD National Accounts Statistics (database), https://doi.org/10.1787/na-data-en.

Even before COVID-19, the level of gross public debt in Brazil was high for an emerging market economy in relative terms. Debt simulations by the OECD indicate that the trajectory of debt will continue to increase in the coming years, although the exact path depends on the government’s reform agenda (OECD, 2020[1]). The expenditure rule has strengthened the budgetary framework in Brazil and has set a path to improve fiscal sustainability. The general government’s primary fiscal balance had improved since the introduction of the expenditure rule and prior to the budgetary responses to the COVID-19 pandemic.

In Brazil, the Secretariat of Government has responsibilities for the government’s interactions with Congress, for example:

Legislated expenditure can damage fiscal sustainability in Brazil: Expenditure that is fixed in legislation can remove the incentive to improve the cost base and to adapt to changing circumstances. As an illustration, the national constitution specifies that 25% of municipal tax revenues be allocated to education. However, variations in the distribution of wealth between states limit the ability of the federal government to use the education budget to address lower levels of educational attainment in some states relative to others (World Bank, 2017[14]).

Existing budgetary settings are considered unsustainable: The state pension is an example of budget expenditure that is monitored by the government constantly but, up to the time of this review, has increased each year. Pension reform in Brazil is not new, nor are the issues that underpin the reform. The pivotal contribution by the CoG to the fiscal sustainability of the federal budget is to advance legislative reform to improve the affordability of existing policies. Leadership by the CoG is fundamental as there cab be a lack of incentive to advance reform in the public sector (Box 3.3). On this, the Secretariat of Government (International and Inter-institutional Relations (SRI), and Parliamentary Affairs) is involved in reviewing budgetary settings.

Box 3.3. The reform of state pensions in Brazil

The salary gap between public and private sector workers in Brazil is significant, which flows through to pensions where benefits are calculated as a proportion of salary. The majority of public servants are in the wealthiest quintile of the population. The country’s population is ageing and the age-dependency ratio is increasing.

In 2018, the shortfall from pension payments relative to contributions in the main pension schemes for the public sector and private sector employees contributed to a sizeable unfunded liability. The liability is likely to increase in magnitude over the next decade. In February 2019, the government submitted a pension reform proposal to Congress. Reforms increased the retirement age for men and women and introduced a minimum contribution period to the schemes before recipients can receive payments.

Source: OECD (2020[15]), “Civil service pension reform in developing countries: Experiences and lessons”, https://doi.org/10.1787/f872f328-en.

Medium-term expenditure frameworks support budget predictability

The absence of a medium-term expenditure framework in the budget reduces the predictability of the budget beyond a 12-month period (World Bank, 2017[14]). While Brazil does not have a fully developed multi-year perspective in budgeting, the government has undertaken reforms to strengthen aspects of its medium-term perspective in budgeting, Article 9 of Budget Guidance Law 2021 (No. 14.116/2020), for instance, establishes multi-year investment projects for high-value capital expenditure projects (greater than BRL 50 million). In addition, the PPA 2020-2023 (Law No. 13.971/2019) refers to priority investments. However, areas remain where the government could build on its reforms to date as the PPA is not binding on the budget and is limited to the federal government; it does not determine medium-term budget planning for states and municipalities.

The absence of a full medium-term expenditure framework is in contrast to the majority of OECD countries (OECD, 2019[4]). Two examples are Sweden and the United States:

Sweden: As a result of an economic crisis, the Swedish government implemented a top-down budgeting system to move from a single year focus to a budget with a medium-term perspective with strong fiscal control on aggregate expenditure (Box 3.4).

United States: The federal budget contains a multi-year perspective. The budget is for one year and budget documents include revenue and expenditure estimates for the next four years, which in total provide a five-year view of the potential impacts of government policies in fiscal terms. Multi-year appropriations apply to public investment.

Budgets focus on federal expenditure for a single year. Within a single budget year, there are three ways in which the government can amend the budget after it has been approved by Congress:

Creditos orcamentarios suplementares, which is a presidential decree to reallocate expenditure within the limits set by the annual budget.

Creditos orcamentarios especiais, which is for new expenditure that was not within the annual budget and requires congressional approval.

Creditos orcamentarios extraordinarios, which is for urgent expenditures, such as natural disasters, where congressional approval is required after the fact and is subject to certain requirements, such as executive approval on a provisional basis until congressional approval is obtained.

The impact on the predictability of the budget can also apply when Congress grants prior authorisation to implementing a decree, as the timing and extent of the government’s response to the authorisation have yet to be determined. Although budget laws in OECD countries permit reallocations, these occur with conditions or restrictions. For instance, in Australia, reallocations can occur only within one performance area and in Germany, the reallocation is to be pre-approved by parliament (OECD, 2019[4]).

Box 3.4. Medium-term and top-down budgeting in Sweden

In the 1990s, Sweden experienced an economic crisis. Inflation was around 10%, which created economic imbalances in the form of an overvalued fixed exchange rate and rapidly increasing prices for real and financial assets. GDP fell three years in a row from 1991-93 and general government debt as a percentage of GDP nearly doubled over the course of a few years, to reach 75% in 1994.

The government budget process was weak by international comparison: bottom-up, demand-driven and with a strong one-year focus. Coming into the 1990s, a reformed budget process was necessary to gain control of the growth of expenditure. The reformed budget process uses a top-down and medium-term framework, with an aggregate expenditure ceiling that is approved by parliament for three years and a structural target for general government finances. The crisis stimulated several other reforms, including in the public pension system. The establishment of an independent fiscal institution, Sweden’s Fiscal Policy Council, complemented and reinforced these reforms.

In order to strengthen prioritisation in the political system, the expenditure ceiling refers to all central governmental expenditure. This includes all legally based entitlement systems, such as pensions and unemployment benefits. Only interest payments were left outside the ceiling. In Sweden, a budgeting margin allows for limited fluctuations within the fixed ceiling but, apart from the margin, higher expenditures must be financed by cutting other spending.

Based on the experiences in an unstable economic environment, the government updates continuously its baseline macroeconomic forecasts and projections of government finances. Improved forecasting allows the government to detect expenditures that could threaten the ceiling. The sooner a possible deviation is detected, the greater the possibilities for the political system to take action. As of 2021, the Swedish government still produces five-year forecasts every year.

Source: Ministry of Finance, Sweden; Blöndal, J. (2001[16]), “Budgeting in Sweden”, https://doi.org/10.1787/budget-v1-art4-en.

Effective capital investment and fiscal risk management support budget outcomes

In Brazil, the federal budget gives a special priority to capital investment within the funds that are available to support economic and productivity growth. Casa Civil has particular regard for capital investment to see that the president’s flagship investments are implemented. Flagship investments can include such things as infrastructure, defence equipment and modernising technologies. However, capital investment by the federal government faces challenges as investments that have been approved by Congress in the budget can still face delays in advancing to implementation. The challenge is notable because the rate of capital investment expenditure by the federal government in Brazil is low relative to the average rate by OECD countries (Figure 3.5). Recent developments, including a constitutional amendment (102/2019) to provide in the Budget Directives Law for the proportion of resources that are to be allocated to public investment in the annual budget, provide some optimism for improved results in the coming years.

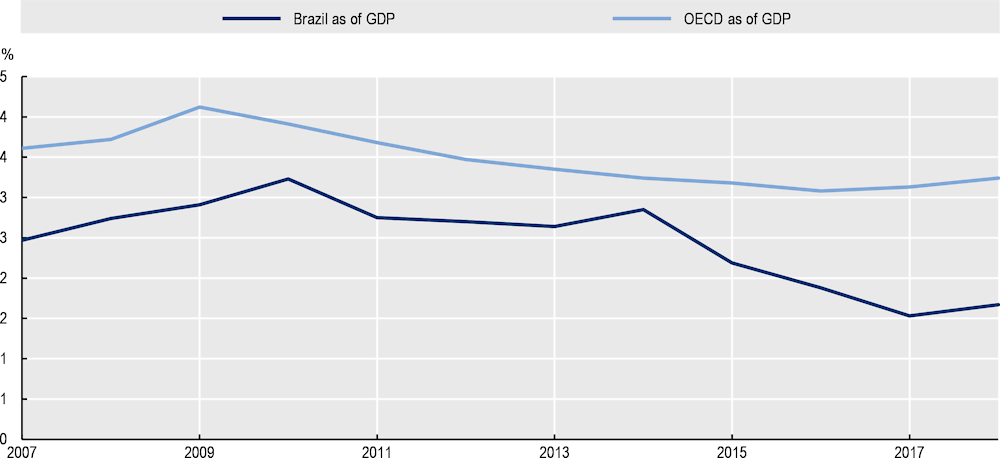

Figure 3.5. Public investment in Brazil

Note: The graph refers to the share of total government expenditures.

Source: OECD (n.d.[13]), OECD National Accounts Statistics (database), https://doi.org/10.1787/na-data-en.

Other improvements include the information that is available to the Ministry of Economy and Casa Civil when making decisions on prospective capital investment proposals, for instance the use of timely and comprehensive information on fiscal risks. The National Treasury Secretariat prepares medium- and long-term scenarios of public finances, which inform the identification of fiscal risks. Fiscal risk assessments are part of the Budget Guidelines Law and are updated periodically.

A fiscal risk management framework and reporting regime are available to the JEO. Prior to board meetings, agenda items are analysed by the Federal Budget Secretariat, to ensure analytical advice is available to the board. However, the fiscal risk reports do not identify potential budgetary impacts or responses should a risk eventuate. In addition, the fiscal risk framework does not require line ministries to have a fiscal risk management framework in order to help ensure risk mitigation measures can be managed by ministries.

By way of a comparative practice, in Australia, fiscal risk reports help to articulate the extent of risks, specific concentrations of risk and the risk treatments that are in place (Box 3.5).

Box 3.5. Fiscal risk management in Australia

As a federal country, Australia has an established track record of managing fiscal risks. In 1998, Australia adopted the Charter of Budget Honesty Act, which requires the government to prepare a statement of the risks, quantified where feasible, that may have a material effect on the fiscal outlook. The government’s fiscal risk management framework has two objectives:

Identify the full range of factors that may influence the actual budget outcome in future years.

Manage and mitigate, where possible, these risks in accordance with the principle of sound financial management.

To give effect to the framework, the government operates a Risk Potential Assessment Tool to help government entities assess risks by guiding them on how to consider such things as whether a new initiative is a strategic priority of the government and the risks associated with the initiative. Entities are to provide the information from the tool to the department of finance. A risk statement is included in the budget documents and is available publicly. The budget documents also contain an analysis of the fiscal risks that are associated with uncertainties in the economic outlook.

Source: Moretti, D. (forthcoming[17]), “Managing fiscal risks: Lessons from case studies of selected OECD countries”, Journal on Budgeting.

Budgeting and planning are interdependent functions

A budget helps determine the extent to which a plan is realistic and a plan helps prioritise the allocation of resources so the plan can be achieved. A plan that is disconnected from the budget sets out a vision without the practical means to achieve it. In Brazil, the contribution by the planning secretariat at the CoG is largely a one-in-four-year event when preparing the PPA and there are other long-term plans that are disconnected from budgetary processes. The four-year PPA stands in isolation from the government’s other planning activities, principally those developed by the CoG. In this regard, planning and budgeting functions in the federal government of Brazil face a “Stockdale paradox” in that planning for the future should not be disconnected from the facts of the present reality (Collins, 2001[18]). The value from budgetary processes would be increased by bringing governmental plans into the budgeting process and establishing a budget constraint to planning to help ensure it is achievable over time.

Although the relationship between budgeting and planning contains an inherent logic, it can be difficult to implement in a government where the functions are not co‑ordinated closely. It should not be necessary to have a structural solution such as a single organisation to have a co-ordinated approach. As discussed in Chapter 1, a co-ordinated approach highlights the importance of well-defined governance arrangements that articulate the functional responsibilities and expertise of each organisation, the flow of information that is to occur and the decisions and outputs that are to result from the co-ordination.

In Brazil, federal budgeting is technical and prescriptive. The technical aspects are due to the fine degree of detail in the format of the budget. Expenditure is categorised by organisation, function, programme, project, activity, input, region and other criteria. According to the Budget Technical Manual, there are 13 expense categories (Government of Brazil, 2021[19]). The level of detail allows for control over expenses but provides less flexibility for changes in circumstances. Project planning and implementation is hampered, as the detail prevents budget reallocations that meet operational needs.

The CoG has a role in lifting sights above the detailed requirements to identify the initiatives that matter most across government. Two country examples where such processes operate from the CoG are:

United Kingdom: The CoG (cabinet office) focuses principally on strategy, prioritisation and accountability in relation to the budget (Box 3.6).

United States: In 2020, there were 90 priorities, approximately 3-4 for each federal department and the CoG used centrally co-ordinated processes and routines to help drive progress.

In both instances, the priorities of the government inform the design of the budget and the initiatives that are funded.

Box 3.6. Budget-related functions in the CoG in the United Kingdom

The CoG in the United Kingdom is principally the Prime Minister’s Office and the Cabinet Office. Many of the functions performed by the HM Treasury are also relevant to the CoG. On budgeting, the Treasury focuses on budget strategy, prioritisation and accountability. These functions are also of key interest to the Prime Minister’s Office and the Cabinet Office. Budget strategy includes the prime minister’s involvement in the early stages of the budget process. Prioritisation is largely on the flagship initiatives that help define the government’s policy agenda, and the accountability functions can refer to transparency, delivery and guidance on standards and methodologies.

The emphasis applied to budget strategy, prioritisation and accountability can vary depending on the priorities of the prime minister of the day and the needs of the government. As an example, in 2002, the then prime minister, Tony Blair, established a delivery unit to strengthen the CoG’s accountability role by monitoring the progress of the government’s flagship priorities. Subsequent prime ministers have changed the focus of the unit. The enduring aspects of each function were the ones that were complementary and not duplicative of the functions performed by other ministries.

Scrutinising baseline expenditure helps the government achieve its priorities

Applying scrutiny to the existing allocation of government expenditure has political and administrative dimensions. Changing the composition or delivery of public services may require political leadership to explain the change and may result in changes to a minister’s portfolio. At the same time, the operational knowledge of the services rests with government ministries and entities. Budgeting effectively requires a sound knowledge of the performance of the expenditure that has already been committed to ensuring that it offers value for money and is allocated to the areas that require it the most.

In many countries, Brazil amongst them, a budget comprises new expenditure that adds to the base of existing expenditure. However, the existing expenditure is not static as the composition of public services changes over time, based on changes to the demand for services and new ways of delivering services. This means that the composition of existing expenditure can change while still producing the same services.

In Brazil, the legislated allocation of expenditure can be a barrier to improving the effectiveness and efficiency of expenditure. The monitoring functions of line ministries perform a crucial role in providing assurance on the efficacy of existing expenditure. However, the monitoring does not reveal in a systemic manner the areas where changes to the composition of expenditure may be warranted. An evaluation of the effectiveness of the monitoring functions and a spending review framework (Box 3.7) that is compatible with the budgetary institutions of Brazil are two areas where the government could initiate reforms to improve budgetary processes.

Box 3.7. Spending reviews help to assess the effectiveness of existing expenditure

Spending reviews provide an assessment of the public expenditures that have already been appropriated to ministries and agencies and provide political leaders with recommendations on ways to improve the effectiveness and efficiency of that expenditure. At its core, a spending review is concerned with identifying funding options that government ministers can select to advance governmental priorities and increase the value for money from public spending.

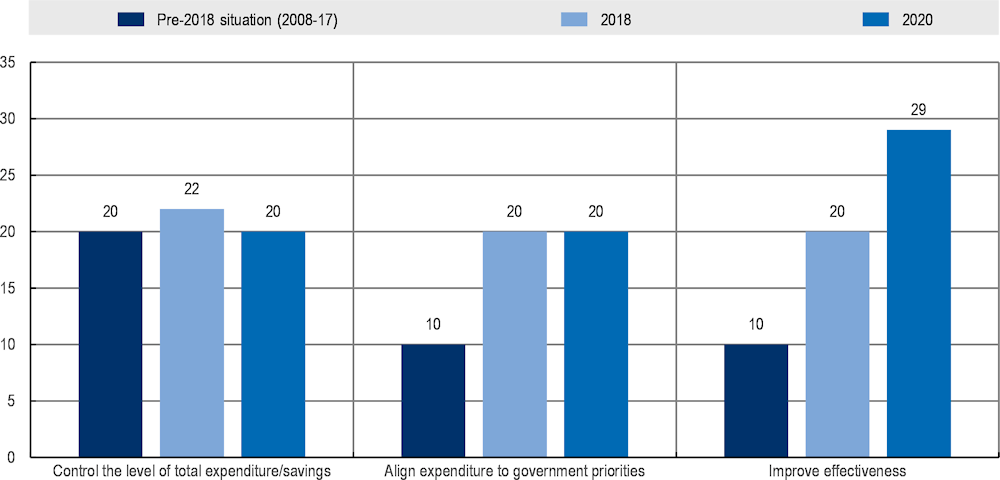

The OECD’s research shows that, since 2008, the majority of OECD countries have adopted spending reviews. The objectives of spending reviews have increasingly been to improve the effectiveness of spending (Figure 3.6).

Figure 3.6. Objectives of spending reviews in OECD countries (by number of countries)

Source: OECD (forthcoming[20]), Best Practices for Spending Reviews in OECD Countries, OECD Publishing, Paris.

Case study on business environment reform in Brazil

One of the federal government’s cross-cutting goals refers to the transformation of the business environment to simplify the setup and operation of businesses and to attract investment while improving the country’s position in international business environment rankings. From a federal budget perspective, the allocation of resources to transform the business environment is modest. Progress towards this cross-cutting goal is largely from non-financial initiatives and the prioritisation and promotion of existing activities.

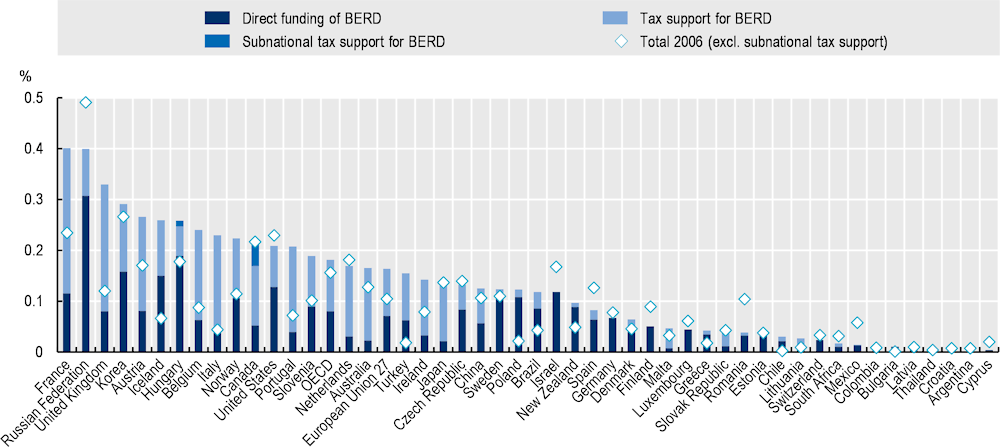

Federal expenditure on business transformation does not link directly to budgetary governance or the government’s public financial management. At the time of this review, Brazil did not provide data to the OECD on the Classifications of the Functions of Government (COFOG) for the purposes of classifying expenditures on governmental activities. However, proxy measures are available: Figure 3.7 shows direct funding and tax support by the Brazilian government for business research and innovation (referred to as BERD), which has more than doubled in the period from 2006 to 2018. The figure also shows that the mix of direct funding and tax support can vary greatly between countries. Brazil is approximately in the middle of the distribution across countries but, at 0.12% of GDP, is below the OECD average of 0.18%.

Figure 3.7. Direct government funding and government tax support for business R&D, 2006 and 2018

Source: OECD (2021[21]), OECD Science, Technology and Innovation Outlook 2021: Times of Crisis and Opportunity, https://doi.org/10.1787/75f79015-en.

From a budgetary perspective, legislated spending requirements, including the indexation of expenditure, limit the federal government’s ability to increase expenditure on business transformation to a greater extent than has been possible in the period shown in Figure 3.7. Instead, a more accessible avenue to the government in the short term is the role that can be played by competition-friendly regulation to support such things as business transformation, as noted in the OECD Economic Outlook (OECD, 2021[22]).

Consistent with this review, the 2021 OECD Economic Outlook (OECD, 2021[22]) also notes that strengthening the medium-term fiscal framework contributes to boosting market confidence and private investment, which in turn can support business transformation.

Recommendations

The federal government of Brazil has a well-articulated legislative framework for budgeting. At the same time, Brazil is experiencing a deterioration in its aggregate budget measures from increases in public debt, the size of government and the budget deficit. Although budgetary measures to contain the spread of COVID-19 provide a current and prominent reason for some of the deterioration, systemic factors relating to the operation of the budgetary framework are a more fundamental cause.

The federal government has taken action to strengthen the budgetary arrangements by adopting a fiscal rule to contain the growth in expenditure. Brazil has also established an independent fiscal institution. The CoG and the Ministry of Economy have taken measures to improve co-ordination by establishing a Budget Execution Board that is composed of representatives from the CoG and the Ministry of Economy.

In this report, the OECD found that the involvement of the CoG in aspects of the federal budget process is well placed, notably in the strategic phase of the budget. The involvement is consistent with the majority of OECD countries. The OECD found that targeted reforms in the five areas below could build on the reforms the federal government has already adopted. The five areas refer to OECD Budgetary Governance Principles 2, 8 and 9, as shown in the annex.

Recommendations

Consider greater use of legislative reform to update and improve legislated public expenditures in order to support fiscal sustainability and other governmental objectives in the budget process.

The CoG has a specialist role in the formulation of the federal budget because, through the presidency, it can advance policy initiatives that require legislative reform.

Continue to strengthen the medium-term expenditure framework to improve the predictability of the federal budget by ensuring the framework applies to all federal revenues and expenditures and supports the operation of the fiscal expenditure rule.

Strengthening the coverage and application of the medium-term expenditure framework is relevant to the information available to the Budget Execution Board (JEO) at the CoG.

Broaden the application of the fiscal risk management framework and reporting regime to include potential budgetary impacts should a fiscal risk eventuate, and ensure line ministries implement fiscal risk management policies that align to the framework in the Ministry of Economy.

Ensure that the JEO brings the outputs of the planning function in the CoG into the strategy phase of the budget process.

In Brazil, the CoG has a well-developed planning framework; however many aspects of it are disconnected from the budget process. The government should make further efforts to ensure that there is co-ordination between planning and budgeting processes.

Design and implement a spending review framework to assess the performance of existing expenditure relative to the policy objectives of that expenditure.

This framework should be developed by the Ministry of Economy.

The CoG should have a role in conducting spending reviews to ensure that federal expenditure is aligned to government priorities and to identify the legislative implications of any prospective change to the existing allocation of expenditure.

References

[16] Blöndal, J. (2001), “Budgeting in Sweden”, OECD Journal on Budgeting, Vol. 1/1, https://doi.org/10.1787/budget-v1-art4-en.

[6] Blöndal, J., C. Goretti and J. Kristensen (2003), “Budgeting in Brazil”, OECD Journal on Budgeting, http://www.oecd.org/gov/budgeting/40139608.pdf.

[18] Collins, J. (2001), Good to Great, Harper Collins Publishers.

[3] Constitute (2021), Brazil’s Constitution of 1988 with Amendments through to 2017, Constitution of Brazil, http://www.constituteproject.org/countries/Americas/Brazil?lang=en.

[9] Federal Senate (2019), Approval of Works by the Independent Fiscal Institution, https://www12.senado.leg.br/ifi/arquivos-atas/2019/termo-de-aprovacao-dos-trabalhos-produzidos-pela-instituicao-fiscal-independente-2013-ifi-do-senado-federal-em-2019.

[8] Federal Senate (2016), Resolution of the Federal Senate No. 42, https://legis.senado.leg.br/norma/582564/publicacao/17707278.

[19] Government of Brazil (2021), Budget Technical Manual, https://www1.siop.planejamento.gov.br/mto/lib/exe/fetch.php/mto2021:mto2021-versao14.pdf.

[10] Government of Brazil (2020), Review Guide of the PPA: Sectoral Bodies, http://www.gov.br/economia/pt-br/assuntos/planejamento-e-orcamento/plano-plurianual-ppa/arquivos/guia-revisao-ppa-20-23-exercicio-2021.pdf.

[11] IMF (2017), Fiscal Transparency Evaluation of Brazil, International Monetary Fund, http://www.imf.org/en/Publications/CR/Issues/2017/05/03/Brazil-Fiscal-Transparency-Evaluation-44874.

[17] Moretti, D. (forthcoming), “Managing fiscal risks: Lessons from case studies of selected OECD countries”, Journal on Budgeting.

[22] OECD (2021), OECD Economic Outlook, Volume 2021 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/66c5ac2c-en.

[21] OECD (2021), OECD Science, Technology and Innovation Outlook 2021: Times of Crisis and Opportunity, OECD Publishing, Paris, https://doi.org/10.1787/75f79015-en.

[15] OECD (2020), “Civil service pension reform in developing countries: Experiences and lessons”, OECD Development Policy Papers, No. 33, OECD Publishing, Paris, https://doi.org/10.1787/f872f328-en.

[7] OECD (2020), Government at a Glance: Latin America and the Caribbean 2020, OECD Publishing, Paris, https://doi.org/10.1787/13130fbb-en.

[1] OECD (2020), OECD Economic Surveys: Brazil 2020, OECD Publishing, Paris, https://doi.org/10.1787/250240ad-en.

[4] OECD (2019), Budgeting and Public Expenditures in OECD Countries in 2019, OECD Publishing, Paris, https://doi.org/10.1787/9789264307957-en.

[2] OECD (2015), Recommendation of the Council on Budgetary Governance, OECD, Paris, http://www.oecd.org/gov/budgeting/Recommendation-of-the-Council-on-Budgetary-Governance.pdf.

[20] OECD (forthcoming), Best Practices for Spending Reviews in OECD Countries, OECD Publishing, Paris.

[12] OECD (n.d.), Country Policy Tracker, OECD, Paris, https://www.oecd.org/coronavirus/country-policy-tracker/.

[13] OECD (n.d.), OECD National Accounts Statistics (database), OECD, Paris, https://doi.org/10.1787/na-data-en.

[5] Tollini, H. (2009), “Reforming the budget formulation process in the Brazilian Congress”, OECD Journal on Budgeting, Vol. 2009/1.

[14] World Bank (2017), A Fair Adjustment: Efficiency and Equity in Public Spending in Brazil, Public Expenditure Review of Brazil, World Bank, Washington, DC, https://www.worldbank.org/en/country/brazil/publication/brazil-expenditure-review-report.

Annex 3.A. OECD Recommendations of the Council on Budgetary Governance

The OECD Recommendation of the Council on Budgetary Governance (2015[2]) contains ten principles. The principles were used to inform the analysis in this chapter and its conclusions.

1. Manage budgets within clear, credible and predictable limits for fiscal policy.

2. Closely align budgets with the medium-term strategic priorities of government.

3. Design the capital budgeting framework in order to meet national development needs in a cost-effective and coherent manner.

4. Ensure that budget documents and data are open, transparent and accessible.

5. Provide for an inclusive, participative and realistic debate on budgetary choices.

6. Present a comprehensive, accurate and reliable account of the public finances.

7. Actively plan, manage and monitor budget execution.

8. Ensure that performance, evaluation and value for money are integral to the budget process.

9. Identify, assess and manage prudently longer-term sustainability and other fiscal risks.

10. Promote the integrity and quality of budgetary forecasts, fiscal plans and budgetary implementation through rigorous quality assurance including independent audit.

Note

← 1. Decree No. 9/982, 20 August 2019, Annex 1.