This chapter examines investment promotion and facilitation policies in place in Indonesia. It analyses the use of targeted incentives and financing for energy efficiency and renewable energy development, and provides insights into good practices in other countries. It highlights key measures implemented by the government to improve the business environment for clean energy projects, as well as areas of untapped opportunity to attract further investment. It also examines the role that public procurement of energy efficiency services and corporate sourcing of renewables can play to jump-start market-based instruments and foreign investment in clean energy projects. The chapter identifies remaining challenges and proposes recommendations to address them.

Clean Energy Finance and Investment Policy Review of Indonesia

5. Investment promotion and facilitation

Abstract

The Government of Indonesia has introduced multiple regulatory changes and policy measures in recent years to encourage clean energy development (see Chapter 3). It has also taken a number of reforms targeting investment facilitation, such as the creation and on-going development of its Online Single Submission (OSS) business licensing system, which is working to improve transparency, streamline licencing and ease the business development process. These measures, alongside targeted incentives such as the import duty exemptions for renewable energy machinery passed by the Ministry of Finance (MoF) in 2010 and the use of tax holidays or tax allowances for certain projects, are helping to stimulate growth in renewable energy and energy efficiency investments in Indonesia.

At the heart of overall investment promotion and facilitation is the Indonesian Investment Co-ordinating Board (Badan Koordinasi Penanaman Modal, or BKPM). Notably, its role includes co-ordinating across the various ministries and related entities that influence investment policies and their implementation (OECD, 2020[1]). In more recent years, its focus has been to simplify licensing, facilitate investment projects and improve conditions to attract investments, though this can be a challenging task, given the number of actors involved (see Chapter 2).

While progress in co-ordinating, facilitating and promoting investment is encouraging, the current level of investment in clean energy is still not sufficient to meet Indonesia’s ambitious targets by 2025 and beyond. In practice, procedures and requirements can still be rather complex, for instance requiring obtaining licences and permits from line ministries and regional administrations beyond what is processed in the OSS. New regulations stemming from the recent Omnibus Law are working to harmonise and ease the business process further, and subsequent implementing regulations should help to operationalise those ambitions. For example, a new version of the OSS that integrates via a single portal business and risk‑based assessment licensing (taking into account health, safety, environmental security and resource risks, as per Government Regulation No. 5 of 2021) is expected to be launched in June of 2021.

Ensuring these policy measures create an enabling environment that promotes and facilitates investment (while equally ensuring compliance with environmental impact assessment requirements) will therefore be critical to scale-up clean energy deployment in Indonesia. Encouraging and rewarding early adopters, diminishing obstacles for investors and incentivising innovative solutions and market-based services will also be critical to promote and facilitate the required scale-up in clean energy investment.

Assessment and recommendations

Indonesia should continue to see through its fossil fuel subsidy reform

Progress made since 2014 is commendable, though ensuring cost-reflective market pricing for all energy products is critical to meeting Indonesia’s clean energy targets. Phasing-out remaining fossil fuel subsidies will not only create a more level playing field for clean energy projects but also will signal to investors the government’s steadfast commitment to clean energy development. The reform can also be targeted in a way that achieves longer lasting impact for poor households, for instance by sensibly redirecting financial support to energy efficiency and renewable energy solutions, rather than to annual price subsidies.

Time to 2025 ambitions is short, but near-term measures can get projects off the ground

Indonesia can promote and facilitate clean energy development by focusing or expanding its use of cost‑based tax incentives and accelerated depreciation rules. It can also develop more targeted support for clean energy projects, for instance using the Perseroan Terbatas Sarana Multi Infrastruktur (PT SMI) fund to provide a de-risking or credit enhancement mechanism to lower collateral requirements for renewable energy project developers or by designing specific procedures within the Indonesia Infrastructure Guarantee Fund (IIGF) risk guarantee for energy efficiency projects. These incentives and support mechanisms can help address market barriers and encourage uptake of clean energy solutions and services. Complementing those measures with longer-term policy signals, such as progressive ratcheting up of energy performance requirements, will help create a pipeline of clean energy projects to 2025 and beyond.

Lack of incentives give limited reason to adopt current voluntary standards

Complementing regulatory measures with grants or financial incentives can create a “carrot and stick” approach – encouraging adoption of efficient products to then drive out least-efficient ones – that has been successful in other countries such as Denmark, Japan and Australia. Current lack of tax credits or other financial incentives in Indonesia limits uptake of energy efficiency, especially given most current standards are voluntary. Incentives will encourage adoption of voluntary regulations such as national non-residential building codes, creating momentum and confidence in the market that can then be used to transition to mandatory requirements and to expand regulations to other sectors, such as residential buildings. Market‑based instruments, such as the tradable energy savings (white) certificates used in Europe, can also encourage adoption of energy efficiency solutions and best practices.

Channelling finance and investment to energy efficiency requires more targeted support

Government support and incentives to date have not sufficiently targeted energy efficiency development, which continues to lag behind. In particular, low capacity in the market to propose “bankable” projects creates a critical barrier to finance and investment. To improve this situation, Indonesia can provide more targeted support to stakeholders involved in preparing energy efficiency projects, such as the informational guide by the Sustainable Energy Authority of Ireland1 for public and private actors preparing energy performance contracting. Additional support can include measures to enable energy service companies (ESCOs), such as continued training on investment grade energy audits and development of certification of third-party monitoring and evaluation. These measures will help to ensure a standardised investment environment without need for investors to treat financing on a case-by-case basis.

Demonstrating support of clean energy projects is critical to create market confidence

Support through financing products like the Kredit Usaha Rakyat (People’s Business Credit), which provides a guarantee scheme and subsidised interest rates for small businesses, can help overcome barriers such as high collateral requirements, making it easier for businesses to establish or expand their offerings. Government efforts should focus on expanding financial support for clean energy development, with immediate focus on enabling successful projects that address perceived risks and that encourage market replication. The government can help jump-start the market through initiatives such as pilot ESCO projects with state-owned enterprises (e.g. by extending the current IIGF scope beyond public-private partnership [PPP] models). It can also focus on deploying clean energy solutions in specific clusters, for example, by partnering with energy-intensive industries to facilitate renewable energy procurement. Efforts to demonstrate successful applications will increase market confidence and create more attractive conditions for clean energy finance and investment.

Support should aim to diminish obstacles to renewable energy finance and investment

Effort is needed to address obstacles preventing growth in the renewable electricity market in Indonesia. One such example is the present framework for wheeling of power, which makes corporate sourcing of off‑site renewable electricity generation both complex and challenging. The current system to determine feed-in tariffs for net metering likewise does not provide transparency in the calculation of cost and can put renewables at a disadvantage, compared to other generation assets. Perceived risks, such as lack of transparency in power purchase agreement (PPA) prices as well as uncertainties around government force majeure (GFM) and natural force majeure (NFM), also create uncertainty for investors and can lead to high costs of capital for clean energy projects. Addressing these types of barriers requires establishing transparent rules and processes (e.g. for power wheeling) that will complement on-going support for renewable energy business development, ensuring there is on the one hand ample demand for renewable energy projects and on the other hand a fair and competitive market offering those solutions.

Indonesia has shown it can be innovative in enabling renewable energy investment

One such example is the recently announced project between the state electricity company, Perusahaan Listrik Negara (PLN), and the Abu Dhabi-based renewables firm, Masdar, to develop a 145 megawatt (MW) floating solar photovoltaic (PV) plant in the Java-Bali system (Harsono, 2020[2]). The project will be a hybrid system, located on a reservoir behind a hydroelectric power plant, designed using smart controllers to ensure the hydroelectric power can balance the variable production of the solar PV, thus making the installation more flexible, reliable and cost-effective with capacity to add additional renewable assets in the future. The project also highlights a potential synergistic opportunity to address the challenging issue of land access for renewable energy development. Efforts to enable similar bankable solutions, including recent developments by PLN to apply renewable energy certificates (RECs), will make Indonesia a more attractive destination for clean energy finance and investments.

Long-term effort should focus on creating conditions for a flexible and dynamic market

This will require co-ordinated oversight and planning, building upon success and addressing enduring challenges to ensure the overall facilitation and compatibility of clean energy investments (e.g. grid and generating assets). Medium- to long-term efforts should focus on enabling innovative finance and market‑based mechanisms such as energy savings performance contracting, open and tradeable energy attribution certificates, and energy-as-a-service models. These can all enable large-scale engagement of private capital for clean energy projects, so long as Indonesia addresses gaps and weaknesses impeding market development (e.g. ensuring a transparent, straightforward process for licensing and permitting of renewable energy projects). Enabling uptake of market-based mechanisms may also require government support to enable their operability, for example by providing risk guarantees or insurance products until the market is sufficiently familiar and comfortable with those financial instruments.

Box 5.1. Main policy recommendations on investment promotion and facilitation

Review with PLN current operational regulations for power wheeling in comparison to international best practises for grid access in order to develop a more transparent process that fits the specific Indonesian context and that encourages greater corporate sourcing of renewable electricity, especially from businesses looking to procure off-site renewable generation.

Mandate public institutions and local authorities to identify energy savings opportunities to help jump-start the current energy efficiency market, while equally enabling public actors to engage in procurement of those solutions and services. This could include relaxing rules on multi-year contracts or identifying suitable accounting practices that allow public authorities to engage in those energy efficiency investments.

Identify levers such as risk guarantee mechanisms that help clean energy projects and investors to overcome risks to finance, and address shortcomings in existing funds such as the IIGF to provide more targeted support to clean energy projects. This can include working with partners to create a dedicated clean energy fund or a risk-sharing facility such as the one support by the Small Industry Development Bank of India to help lower the cost of capital and mobilise investments for energy efficiency and renewable energy.

Improve the clean energy investment environment by speeding up decision making and facilitating market-based solutions. Building on recent OSS efforts, work to provide simple and straightforward access to rules and guidelines to facilitate project developer and investor engagement, while also prioritising co-ordination across governance institutions involved in clean energy projects.

Clarify intentions on the short, medium and long-term expectations for energy regulations, subsidies, tax regimes and other targeted incentives, for instance by enshrining these objectives in the anticipated presidential regulation on renewable energy. Also ensure policies are transparent to enable project developers, financial institutions and investors considering or engaged in clean energy development to make informed decisions and risk assessments, as these currently hinder wide-spread renewable energy and energy efficiency deployment.

Consider aligning feed-in tariff calculations with international net-metering practices, ensuring that grid tariff structure is not an unfair barrier to deploy renewable energy. Also consider expanding current incentives for renewable electricity development, such as the tax holiday for large-scale clean energy investments, to facilitate and encourage investment at a smaller scale.

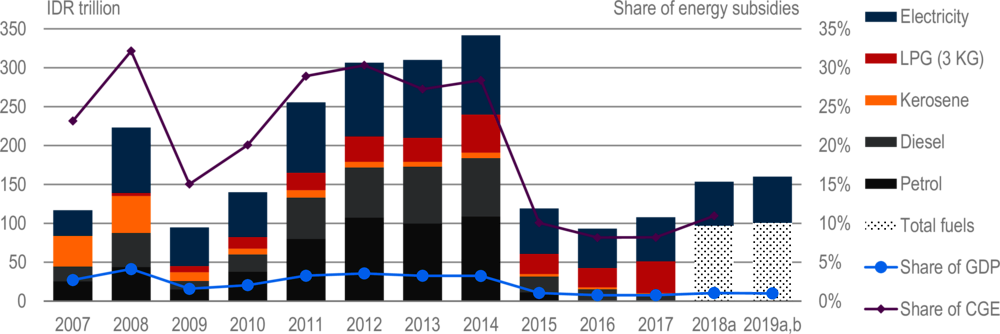

Energy subsidy reform and carbon pricing

Energy subsidies, including both fossil fuel and electricity price subsidies, have constituted a large share of government expenditure in Indonesia, representing as much as 4% of gross domestic product (GDP) since 2005 (Figure 5.1). This share is not certain, though, as Indonesia did not have a comprehensive inventory taking stock of the subsidies and their associated costs.

Nevertheless, the question of reform was inevitable, given the sizeable fiscal burden of the subsidies (OECD, 2019[3]), and the government consequently kicked off major reforms in 2014, for instance linking domestic transport fuel prices to international prices and applying more targeted electricity subsidies. The result was a rapid cut in expenditures, saving an estimated USD 9 billion, or 8% of state revenues, in 2015 alone (IEA, 2017[4]).

Figure 5.1. Government expenditure on energy consumption subsidies, 2007-19

Note: LPG = liquefied petroleum gas; CGE = central government expenditure; a) detailed breakdown for fuel subsides not available;

b) data refer to planned budget.

Source: (OECD, 2019[3]) Green Growth Policy Review of Indonesia 2019; MoF (2019), Indonesia’s Effort to Phase out and Rationalise its Fossil-fuel Subsidies: A Report on the G20 Peer-review of Inefficient Fossil-fuel Subsidies that Encourage Wasteful Consumption in Indonesia.

By 2016, 12 consumer classes of electricity subsidies had been phased out, targeting removal from higher‑income households and supporting instead the two lowest consumption classes of 450 volt-ampere (VA) and 900 VA customers. The initial effect of the electricity subsidy reform, in addition to cutting annual government subsidy spending by around USD 5.6 billion (IEA, 2017[4]), was around 7% lower overall household electricity consumption (Burke and Kurniawati, 2018[5]). Further reforms were planned to phase out subsidies for 900 VA customers, but the government announced intentions to keep those electricity prices constant until at least 2019 due to fears of social unrest (OECD, 2019[3]). There were also plans to adjust the tariff for 450 VA customers that are not listed in the poor and vulnerable household database, but those reforms have not yet occurred (Afut Syafril and Sri Haryati, 2020[6]; Massita Ayu, 2020[7]).

The government has also been working to improve the subsidy mechanisms for LPG, which is estimated to have cost the government around USD 664 million in fiscal support to the coal industry in 2015 (Bridle et al., 2018[8]). Just like electricity subsidy reforms, LPG reforms will target support only to poor and vulnerable households, although to date the price subsidy has remained in place.

Broadly speaking, fossil fuels still benefit from a number of fiscal incentives such as tax incentives to the mining and processing industries. Fossil-fuel production is also supported through the domestic market obligations (DMOs), which require oil, natural gas and coal producers to sell part of their output (generally between 15% and 25%) to the domestic market at heavily discounted prices (OECD, 2019[3]). Coal-fired electricity generators can also benefit from support such as preferential loans, loan guarantees and subsidised credit, and in 2020, the government announced its plans to move forward with coal downstream industry development, which could increase spending on coal support (Arinaldo et al., 2021[9]).

In terms of monitoring, fossil fuel subsidies are now scrutinised on a monthly basis, accounting for fuels consumed and the respective subsidy amounts. This helps to ensure subsidies remain within the agreed quota, and the tally is used to design subsidy policy and possible reforms for the next budget year. It is important to note that the quota, budget and subsidy policy are all subject to parliament agreement.

While Indonesia has made great progress in reducing its fossil-fuel and electricity price subsidies since the mid-2000s, not all price reforms have been implemented as announced, and the continued use of these subsidies (including indirect support such as industry tax incentives and DMOs) are holding back Indonesia’s transition to a sustainable energy system (OECD, 2019[3]). A clear, transparent strategy on the government’s intentions and commitment to follow through with energy subsidy reform will thus send important signals to market, helping to encourage energy efficiency and renewable energy investment.

The government is also considering the implementation of a carbon price on fossil fuels, after several years of discussions for it. A green paper published by MoF in 2009 identified policy options that would help reach the country’s climate change commitments, including the introduction of carbon pricing alongside gradual removal of energy subsidies (Keuangan, 2009[10]). The paper proposed applying an initial carbon tax on fossil-fuel combustion for electricity generation and large industrial installations as of 2014, although no legislation was introduced to impose the tax. Nonetheless, Presidential Regulation No. 77 of 2018 did provide a legal framework for carbon trading, and the government studied potential carbon pricing mechanisms, including a cap-and-trade system for the power sector, the pulp and paper industry and the cement sector (OECD, 2019[3]).

Several discussions and studies, with support from international co-operation such as the Partnership for Market Readiness (PMR) programme2, have also looked to enhance market readiness for a carbon market in Indonesia and to initiate domestic links to other carbon markets. There also were inter-ministerial discussions throughout 2020 on the topic of carbon pricing, and a presidential regulation may be announced in 2021.

In March of 2021, the Ministry of Energy and Mineral Resources (MEMR) announced that it would begin an initial trial of a carbon trading scheme for the electricity sector (Meilanova, 2021[11]). Around 80 coal‑fired power plants will participate in the first year of the trial, including 19 plants with more than 400 MW of electricity generation capacity and another 51 plants with between 100 MW and 400 MW capacity. To monitor participants, MEMR Directorate General of Electricity created a monitoring tool called APPLE (Aplikasi Pelaporan dan Perhitungan Emisi, or the Emission Reporting and Calculation App). Participants exceeding the emissions cap will be able to: substitute fuel (e.g. using biodiesel co-firing); convert generation capacity to renewable electricity; or replace old technology to make the power plant more efficient. Further details for the trial are in preparation.

MEMR Minister Arifin Tasrif also launched a new category for Greenhouse Gas Emissions Reduction and Trading at the 2021 Subroto Award for Energy Efficiency (Riana, 2021[12]). The new award aims to reward power plants participating in the carbon trading trial and those that have succeeded in reducing their emission levels. The trial and awards are intended to serve as a learning tool for the development of a broader emissions trading scheme expected under the presidential regulation on carbon pricing.

Targeted incentives and funds for energy efficiency investment

Tax incentives are one of the commonly used tools to attract investment for development. In Indonesia, these incentives to support investment in the country are among the most generous in the region (OECD, 2020[1]). Unfortunately, they are not specific to energy efficiency development.

In principle, tax holidays given for investment in certain sub-sectors of industry could be used for energy efficiency investments, but these are not noted explicitly as eligible expenses. In the same way, a luxury goods value-added tax (VAT) policy can consider, in theory, energy efficiency as one of the bases for determining tax rates (e.g. VAT of luxury vehicles may vary depending on emissions and the efficient use of fuel), but again this is not specific to energy efficiency.

Other incentives, such as some local tax benefits for green building construction, are available in a few cities but are rather limited in size and scope (APEC, 2017[13]). For instance, Bandung’s energy performance requirements for small buildings include incentives via reduced land and property taxes for buildings meeting two and three star ratings (Pahnael, Soekiman and Wimala, 2020[14]). Otherwise, there are no specific financial incentives (e.g. dedicated lines of credit, concessional financing or project finance) used to encourage energy efficiency in Indonesia, thus further contributing to a limited project pipeline.

Lack of incentives compounds other challenges affecting energy efficiency investment

Progress in developing and implementing new energy efficiency regulations, such as the planned minimum energy performance standards for 10 new appliance and equipment categories, is encouraging, as is improved compliance with regulations in recent years (see Chapter 3). Improved monitoring, verification and enforcement of energy efficiency policy will help to increase uptake and compliance, but lack of incentives (e.g. rebate schemes, tax reductions and VAT exemptions) fails to encourage early adopters and market awareness for energy efficiency solutions.

Incentives can play a critical role in creating a “carrot and stick” approach for energy efficiency that has been successful in many countries. For example, the Italian government created an incentive programme in 2010 offering 50 percent tax deduction for replacement of household appliances such as refrigerators, washers, dryers, ovens and freezers with more efficient new units. Mexico similarly provided government‑funded subsidies to consumers to cover a portion of the purchase of new, energy-efficient refrigerators and air conditioners. Other examples, such as the “Carbon Cashbag” programme in Korea, which created credits for energy-efficient and low-carbon products that could then be used for things like discounts on public transportation, have been used to incentivise energy efficiency uptake (de la Rue du Can et al., 2014[15]), while more innovative approaches include examples such as the on-wage financing scheme launched by Ghana to improve the accessibility and affordability of energy-efficient appliances in line with the countries new energy efficiency standards and labelling regulations (U4E, 2020[16]).

Lack of incentives (e.g. reduced property taxes or enhanced capital allowances) similarly fail to encourage businesses, facility owners and asset managers to seek out energy efficiency, though they often are aware of its value. Programmes such as Germany’s tax relief for energy-efficient refurbishment of buildings can help encourage asset owners and property managers to engage in energy saving activities (IEA-UNEP, 2019[17]). At the same time, awareness and incentives may not suffice to overcome additional barriers such as inadequate human resource capacity (e.g. to carry out investment grade energy audits), and so capacity building efforts may also be needed to enable “bankable” energy efficiency opportunities (see Chapter 7).

Mainstream financial institutions also commonly lack familiarity of the notions and (financial) benefits of energy efficiency measures, which can also include not knowing how to structure financial products for those investments, and they do not necessarily have real incentive to seek out energy efficiency projects. In fact, even when institutions are familiar, credit regulations (established to protect against risky lending practices) do not incentivise them to finance those projects. Thus, while banks may currently be the main funders of energy efficiency projects in Indonesia, this generally is through corporate finance to existing customers and usually requires collateral that covers 80-120% of the project cost (APEC, 2017[13]).

In response, the government of Indonesia has supported a number of activities to try and improve this situation, for example by creating its Partnership Program on Energy Conservation, which supports energy efficiency uptake by providing government-funded energy audits for buildings and industry. Through this programme, 28 investment grade energy audits have been carried out since 2014 to profile energy efficiency opportunities and investment needs. In the finance sector, Otoritas Jasa Keuangan, Indonesia’s financial services regulator, has also made significant efforts supported by MEMR to raise awareness raising and do capacity building, for instance designing guidelines for energy efficiency projects and running training modules to improve knowledge on energy efficiency technologies for local banks.

The government has also announced intentions to introduce a number of measures supporting energy efficiency investment as part of its update of the 2009 Regulation on Energy Conservation, which is expected in 2021. Those measures include: further details on the ESCO business model; support to improve investment grade energy audits as well as measurement and verification protocols; fiscal and non-fiscal incentives for energy efficiency development; mandatory energy management requirements for certain large energy users and providers; improved capacity building programmes; and other efforts to de-risk energy efficiency projects.

In addition to these measures, the government can further incentivise energy efficiency investment through existing initiatives, notably by explicitly targeting energy efficiency development to address barriers to the development of energy efficiency projects under those schemes. For instance, existing guarantees under the IIGF and the project development facility from PT SMI already acknowledge energy efficiency as an eligible project type, but have seldom been used for energy efficiency (as it has traditionally been achieved through conventional procurement). This is due, in part, to a PPP framework whose due diligence requirements can make public procurement of energy efficiency services and solutions complex and costly (see Chapter 3), thus making it challenging to access those guarantees, which were designed to have an element of public ownership. Addressing these barriers, for instance through standardised PPP documentation to help facilitate the public procurement process, can help to unlock those risk guarantees and other financial support mechanisms for energy efficiency development.

The government could also consider establishing a dedicated energy efficiency fund that could support long-term concessional finance and/or a risk-sharing facility to address barriers like lack of collateral for ESCOs and facility owners looking to finance energy efficiency investments. For example, this could be through the SDG Indonesia One Blended Finance Platform managed by PT SMI, working with potential financiers like the Green Climate Fund or the Asian Development Bank. The fund could be used as a line of credit with financial partners using a list of eligible projects and/or technologies, which would concurrently help build awareness and confidence in those solutions in the market, as it has in other countries like India (Box 5.2). The fund equally could be built around a “lending plus” approach, providing non-financial support (e.g. technical assistance or support in preparing contractual structures) where needed. This may be especially helpful in kick-starting the nascent energy efficiency market in Indonesia.

Box 5.2. India’s partial risk sharing support is enabling growth in energy efficiency services

Like Indonesia, India has substantial untapped potential for energy efficiency developments that have been hindered by market barriers impeding access to finance, such as perceived risk by commercial banks. To help mobilise capital for investment in energy efficiency initiatives, the Government of India and the World Bank via the Global Environment Facility launched a USD 43 million grant and guarantee agreement in 2015 to support the Partial Risk Sharing Facility (PRSF) managed by the Small Industries Development Bank of India (SIDBI). This builds upon SIDBI’s experience in supporting energy efficiency finance and investments through various forms of financial support (e.g. lines of credit, micro-loans, guarantees and a “credit plus” approach providing both finance and technical advisory services).

The PRSF programme has the objective to transform India’s energy efficiency market by promoting and enabling increased investment in energy efficiency projects, notably through ESCOs and energy service performance contracting. In particular, the programme aims to overcome gaps from complex contractual structures, lack of collateral or tangible assets, and limited market experience with ESCOs.

To address these barriers, the programme has supported loans guaranteed by various participating financial institutions using partial credit guarantees to cover a share of the default risk (up to 75%) faced when extending loans to eligible energy efficiency projects. A technical assistance component also provides capacity building activities and other operational support to prepare projects for finance.

As of 2020, the programme had applied around USD 14 million in guarantees for total project investment of nearly USD 50 million (Bharti, 2020[18]). These projects are helping to demonstrate the viability of ESCOs and energy savings performance contracts in India, for example to deliver energy efficiency measures for street lighting, school, hospitals, utility facilities and industry. Indonesia could look to create a similar facility or support mechanism, which would help create confidence in the energy savings model and support increased flows of finance to the currently limited and nascent ESCO market.

Public procurement for energy efficiency investments can propel market demand

Presently, use of public procurement for energy efficiency investments in Indonesia is limited. Financial support by the government, essentially for PPPs, has mostly been for large-scale infrastructure projects, although the government is currently preparing some strategies to encourage the implementation of smaller scale projects under the PPP scheme. In addition, local authorities and public entities cannot easily engage in contractual arrangements that are longer than one year, due to budgetary regulations, thus limiting local energy efficiency procurement, for instance through energy savings performance contracts (see Chapter 3).

Nevertheless, a few examples of public procurement of energy efficiency exist. This includes a public procurement project for public street lighting that is currently being implemented across Indonesia. The programme will fund the replacement of 12 437 halogen street lights by light-emitting diode (LED) lamps in 93 cities and regencies, including use of 5 005 solar-powered LED street lights (MEMR, 2020[19]). It is financed by annual state budgets and implemented through procurement that is managed by the government’s procurement agency, Lembaga Kebijakan Pengadaan Barang/Jasa Pemerintah.

A similar project for public street lighting using a PPP model exists in Surakarta (see Chapter 4). The programme is not fully implemented, but it illustrates the potential for public engagement to accelerate energy efficiency deployment in Indonesia, similar to successful PPPs and other public procurement programmes in other countries. For example, in India, the publicly-owned Energy Efficiency Services Limited super ESCO used bulk procurement to deliver energy-efficient LEDs to market at less than USD 1, which is 80% lower than the previous market price, thanks to bulk purchase of around 330 million LEDs (IEA, 2018[20]). In the United States, the federal government, which represents a considerable purchasing power, has procurement rules that require the purchase of high efficiency ENERGY STAR equipment (IEA, 2019[21]).

Indonesia’s government can similarly create business opportunities for energy efficiency services and technology providers by creating momentum in the market. For instance, the government could mandate state-owned facilities such as schools and hospitals to engage in a transparent and standardised process for procurement of energy-efficient products (e.g. retrofitting with LEDs and high-efficiency air conditioning equipment) or energy efficiency services (e.g. through ESCO models). These projects would not only help achieve energy conservation (and related financial savings) for public entities, but also would help the market to recognise how monetised energy savings can be used to finance energy efficiency projects, which is particularly important for project finance development in Indonesia.

Market-based instruments can help to promote energy efficiency investment

Market-based instruments such as energy saving obligations for industry or utilities, white certificate (or energy saving certificate) programmes, and energy efficiency auction mechanisms are not currently in use in Indonesia. These instruments can be an effective tool to drive investment in energy efficiency measures, helping to creating a market-based (e.g. tradable) approach to achieve energy savings through a market-based, cost-effective approach that has been used in other countries (IEA, 2017[22]).

For example, in China, the State Grid Corporation created ESCOs in all 26 provinces within its service territory in response to the country’s 2010 energy obligation programme, while the Southern Grid Company likewise established a single ESCO at the corporate level, covering all four provinces within its service territory. These ESCOs implemented energy efficiency projects, delivered specialised energy and consultancy services, and helped organise workshops and seminars to engage costumers in energy efficiency programmes. Between 2012 and 2016, the two grid companies exceeded their cumulative electricity savings target (around 55 gigawatt-hours of electricity reductions) by over 13 gigawatt-hours in additional savings (IEA, 2018[23]).

While no market-based instruments exist currently in Indonesia, the government has been working alongside the World Bank and United Nations Development Programme since 2013 through the PMR programme. There were delays in the original implementation schedule, but the programme has been working with stakeholders from the power and industry sectors since late 2017 to consider carbon pricing issues and prepare Indonesia’s capacity and readiness to implement market-based instruments such as energy efficiency certificates and cap and trade programmes.

As the government prepares its update of the 2009 Regulation on Energy Conservation, including announced mandatory energy management requirements for certain large energy users and providers, it could consider developing incentives and market-based instruments (e.g. tradable energy savings certificates) to support development of energy efficiency projects in Indonesia. This would help address barriers to energy efficiency development such as facility owners’ unwillingness to finance energy efficiency projects. The combination of energy performance obligations with use of market-based instruments would also encourage large energy users to take up “low-hanging fruits” in the immediate term, while a programmed ratcheting-up of energy savings requirements over time would push them to identify cost-effective energy efficiency solutions for the future.

Promotion of an energy services market can unlock energy efficiency development

The energy services market in Indonesia is fairly limited. There is a small number of ESCOs operating in the country (MEMR, 2019[24]), and they tend to be small engineering firms providing services to industry or businesses, for instance to identify energy savings opportunities (APEC, 2017[13]). Most of these ESCOs have very limited capital and access to corporate finance due to lack of collateral, which consequently limits their potential to grow.

Growth of the energy services market is limited further by low market familiarity with the ESCO model and poorly perceived credibility, for instance because of inadequate human resource capacity to prepare proper investment grade energy audits and third-party verification. These limitations are due, in part, to the lack of regulatory conditions (e.g. standardised energy savings performance contracts) targeted at the development of an energy services market in Indonesia, as MEMR revoked its regulation aimed at regulating and promoting an ESCO market (see Chapter 3).

Good practice in other countries shows that regulatory frameworks are central in addressing legally robust energy services contracting. For example, Dubai’s Regulatory and Supervisory Bureau for Electricity and Water launched a regulatory framework for ESCOs in 2014 that provided an official system to approve ESCOs, while also establishing standardised methods of measuring and documenting energy savings and equally providing standards for energy performance contracts as well as a clear and transparent mechanism for settling disputes (Construction Week, 2014[25]) In other countries, accounting rules (e.g. for ring-fencing of savings) and other policies such as restrictions for public debt and deficit have needed to be amended in order to eliminate regulatory barriers to engagement in energy performance contracting.

As noted previously, regulations on public financing in Indonesia do not allow local government institutions to enter into multi-year contracting. Officially, Presidential Regulation No. 38 of 2015 on PPPs does allow certain forms of multi-year contracts, but it does not specifically mention ESCOs. ESCOs can participate in PPP projects through an available payment fee structure3, but specific details are left to line ministries to regulate in sectoral regulations (e.g. leaving MEMR to regulate technical provisions for PPPs in the energy sector). The sector regulations in turn need to be in line with the general regulation on PPP development under Bappenas Regulation No. 02/2020. Overall, this policy environment limits development of the nascent market for ESCO services in Indonesia, where globally most robust ESCO markets generally exist only where there is considerable public sector use of the energy services business model (e.g. for public buildings or street lighting using paid-from-savings contracting).

Indonesia’s government can help create demand for an ESCO market through a number of measures, including addressing current limitations for public sector engagement in energy savings performance contracting, which has helped to drive ESCO market development in other countries. It can also work to provide legal and regulatory guidance and energy performance contracting (e.g. on baseline calculations, measuring of energy savings, and resolution of disputes) to support businesses in engaging with ESCOs, for instance as the government lowers the energy intensity threshold for industry and requires stricter energy management by those companies.

The government can also build upon its awareness and capacity building efforts, such as the trainings carried out with the Asian Development Bank on investment grade energy audits and energy saving verifier certification. It likewise could provide standard contracting documents and guidelines for public sector engagement with ESCOs, such as those used in Australia. Inspiration can also be taken from innovative programmes in other countries, such as the ColdHubs cooling as a service model in Nigeria (Box 5.3), where support by Indonesia’s government for development of similar energy service models can enable replication in the market.

The government could also provide targeted financial support to address the creditworthiness of ESCOs in the country. For instance, IIGF can provide credit guarantees for a contracting agency (e.g. a state‑owned enterprise). To date, ESCOs have received very limited support from IIGF and PT SMI. Yet, given ESCO difficulties to access debt financing in Indonesia, support from those funds (e.g. through risk guarantees) would help address known financing barriers like high required levels of collateral (e.g. 120% of the loan value) and high interest rates.

Box 5.3. The ColdHubs model is helping to scale up energy-efficient cooling solutions in Nigeria

Innovative financing using cooling as a service (CaaS) models1 have gained traction in recent years, helping implement energy efficiency measures without businesses having to use directly upfront capital. One such example is ColdHubs2, a social enterprise in Nigeria that designs, installs, commissions and operates energy-efficient walk-in cold rooms using 100% solar power for farm clusters.

Notably, ColdHubs provides a pay-as-you-go model for small-scale farmers, providing them with a shared cold storage facility to keep their produce and other perishable items fresh. Farmers pay roughly USD 50 cents per day to store food in a 20 kilogram crate, where the “hub” is operated by a local female operator, who collects the fees and builds relationships with local farming clusters. There is no contract, making the model simple and accessible, while also providing much needed cold storage to reduce risk of food spoilage and support the livelihood of local farmers.

By 2019, ColdHubs were operating 24 facilities serving over 3 500 farmers and helping to save around 24 000 tonnes of food from spoilage (Cool Coalition, 2020[26]). Similar CaaS projects have been launched recently in other countries, such as the cooling systems for octopus fishing activities in Kilwa, Tanzania3. Indonesia could support development of comparable CaaS financing models that can help facilitate deployment of energy-efficient and low-carbon cooling technologies, particularly across Indonesia’s many islands that have similar cold storage needs (e.g. for fisheries and farming).

1. For more information on CaaS, see https://www.caas-initiative.org/.

2. For more information, see www.coldhubs.com/.

Targeted incentives and enabling environment for renewable electricity

Indonesia has applied a combination of incentives and pricing schemes to encourage development of renewable electricity over the last decade. For example, MoF implemented a tax holiday on clean energy investments under which new power plants that generate clean energy with a minimum investment value of IDR 100 billion (around USD 7 million) are eligible for a tax holiday. This can range from 5-20 years in corporate income tax exemption, where the length is determined by the investment value. Additional incentives have been added under the Omnibus Law and subsequent Presidential Regulation No. 10/2020 on Investment Business Activities, which came into force in March of 2021 (Table 5.1). Import duty and VAT exemptions are also available for certain components for renewable energy power generation.

Table 5.1. Power sector tax incentives under Presidential Regulation No. 10 of 2021

|

Tax holiday |

Mini tax holiday |

Tax allowance |

|

|---|---|---|---|

|

Reference regulations |

MoF Regulation 130/PMK.010.2020 and BKPM Regulation No. 07/2020 |

Government Regulation No. 78/2019; MoF Regulation No. 96/PMK.010/2020 |

|

|

Eligible business activity |

New and renewable energy power plants |

Micro power plants; mini power plants with investment value below IDR 100 billion (around USD 7 million) |

|

|

Tax Benefit |

Corporate income tax exemption Minimum CAPEX: IDR 500 billion (around USD 35 million) between 5 and 20 years (depending on CAPEX size) |

50% corporate income tax discount CAPEX: IDR 100 billion to less than IDR 500 billion (USD 7 to 35 million) for 5 years |

Net income / earning before tax reduction by 30% of CAPEX, in instalment over 6 years at 5% per annum |

|

Additional benefits |

50% corporate income tax discount for following 2 years |

25% corporate income tax discount for following 2 years |

Accelerated depreciation / amortisation |

|

Withholding tax for dividend, lowered to 10% (or based on tax treaty) |

|||

|

Losses carried forward for 5-10 years |

|||

Note: CAPEX = capital expenditure.

Source: OECD communication (April 2021) with BKPM on Implementing Regulations of Law 11/2020 on the Clean Energy Sector

Renewable electricity procurement practices need to sufficiently encourage investment

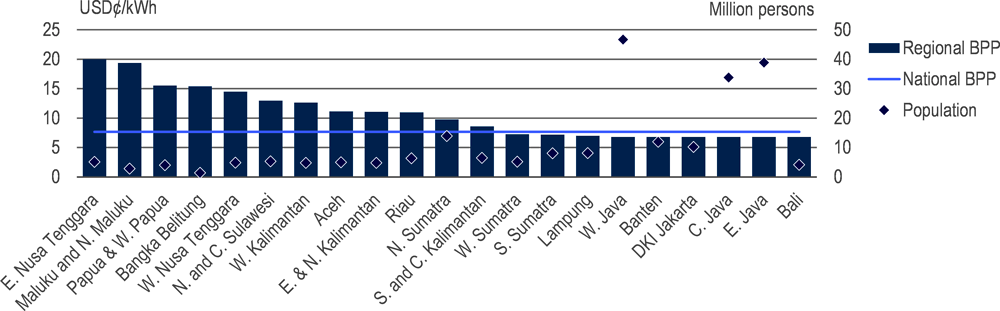

The government has also applied several different methods of remunerating renewable energy over the past decade, including the previous feed-in-tariff (FiT) scheme and the latest system of remuneration governed by MEMR Regulation No. 50/2017 and the more recent MEMR Regulation No. 04/2020 (see Chapter 3). The measures have aimed to encourage renewable electricity deployment, though these have not always provided real incentives to project developers. In particular, the 2017 changes introduced the controversial tariff scheme using the average cost of electricity production (Biaya Pokok Penyediaan, or BPP) which has proven to deter certain renewable energy investments. While the BPP calculation was designed in principle to enable renewable energy to enter into the electricity system and contribute to lower average prices of electricity generation, in most parts of the country the regulation effectively establishes price ceilings that can be too low for renewable electricity projects to compete with fossil fuels (Figure 5.2).

The lack of transparency in the value of exported renewable electricity in Indonesia is also seen by renewable electricity proponents as a barrier to investment, effectively creating a shadow price regulatory framework that can deter project developers. Other electricity market regulations, such as the current room for negotiation between independent power producers (IPPs) and PLN, similarly do not give strong incentive to invest in renewable energy projects. Lack of a standard PPA allows an unfair playing field across investors, and current, complex PPA negotiations can act as a barrier for new developers establishing themselves in the country. These barriers may limit Indonesia’s ability to mobilise competitive investment in renewable energy, unlike best practice in other countries that has supported investor engagement (Box 5.4).

PPA risk allocation changes introduced in MEMR Regulation No. 10/2018 is another point of contention. Political risk is always a consideration in the early development phase of clean energy projects. However, in low-risk countries, policy changes do not impact existing agreements, meaning there is no retroactive application of new rules or policies. This guarantee around changes in policy is a critical factor in the assessment of the economic viability of projects (e.g. eventual changes to tariffs), where signalling changes well in advance gives projects time to prepare (and does not affect those that are far into the development process).

Figure 5.2. Renewable energy projects may be uncompetitive in the most populated areas

Note: kWh = kilowatt-hour; E = East; N = North, W = West; C = Central; S = South; exchange rate assumption: IDR 13 307 per USD; many provinces have several electricity grids with different average generation costs, where for reasons of simplification this figure presents average costs in the province or region as a whole.

Source: Adapted from (OECD, 2019[3]) Green Growth Policy Review of Indonesia 2019; MEMR (2018), Ministerial Decree No. 1772 K/20/MEM/2018; BPS (2018), "Population Projection by Province, 2010-2035", Statistics Indonesia (database).

Box 5.4. Transparent electricity procurement in Mexico led to record-breaking price reductions

Mexico launched an energy reform in 2013, opening up the power sector to participation by the private sector and introducing competitive electricity markets for capacity and clean certificates. In 2015, the Ministry of Energy published rules for long-term energy auctions to support renewable electricity development, where the auctions and resulting PPAs were designed to help generators avoid risks of volatile prices, thus benefitting from stable revenues to finance their investments (Rio, 2019[27]).

Mexico ran three successful auctions for renewable energy in 2015, 2016 and 2017. They were run by the unbundled system operator CENACE, which allowed the incumbent state-owned enterprise to compete on a level playing field with other investors. The auctions resulted in progressive price reductions, which were record-setting at the time (BNEF, 2016[28]), and helped to attract several international investors.

One of the main features of the auctions was that pricing featured a locational component, which would increase or decrease the value of the bid, depending on system friendliness. This had the effect that even if some prices were more expensive, projects would still be selected over other less expensive ones if they had more value for the system (e.g. because the project was located in a place of power scarcity). The effect was that the overall system cost was lowered, where the price resulting from the first auction was USD 47.8 per megawatt-hour (MWh), while the price was reduced to USD 33.5 per MWh in the second auction and then USD 20.6 per MWh in the third.

Another important feature was an evaluation between each round of the auctions’ design. This allowed for progressive improvement of the auction system to ensure as many competitive bids as possible. In addition, the three auctions were planned ahead of time, so that developers could see a clear pipeline of projects, which allowed them to assess the business case of developing projects in Mexico.

In total, the three auctions resulted in USD 9 billion of investment, coming from eight different countries. The auctions had more than 50 bidding participants, thus ensuring competition resulting in the record‑breaking prices. This approach exemplifies the important role procurement design plays in facilitating competitive and attractive conditions for investment in renewable electricity development.

In general, policy stability and foreseeable certainty, including no retroactive implications, for policy changes are key features of low perceived risk. This stability is also important to bring down the cost of capital for investment in renewable energy. While in theory MEMR Regulation No. 10/2018 accounted for issues created with the previous regulations on GFM, leaving risk-allocation to a case-by-case negotiation can increase both the perceived and real risk of investment for developers. Typically, a PPA is not negotiated without substantial effort, and thus monetary commitment has already been made by the developer in preparing the PPA. The 2018 revision in regulation thus means project developers have to carry force majeure uncertainty while already spending money preparing the project. This may deter developers from considering electricity projects, and likely decreases the perceived bankability of projects.

Extending PPAs in the case of NFM events is also not international best practise. Normally, compensation payment is given to asset owners when prolonged disruptions happen. This gives grid companies an incentive to be as efficient as possible in repairing any outages, both in terms of limiting the timing of the outages but also prioritising repairs based on system efficiency. In so far as disruptions are compensated by PLN, the only risk for investors is the credit worthiness of PLN. However, if the rules are unclear on when compensation is paid, or if risk of prolonged outages are allocated to asset owners, then these provisions will negatively affect PPA bankability and increase the overall cost of capital for renewable investments.

In short, while policy changes in recent years have aimed to simplify the regulatory environment for renewable electricity development, they may in fact create a disincentive for project developers and investors. Transparent rules and processes (e.g. through standardised PPAs) can help to diminish these obstacles, but to be successful, market conditions need to address the bankability of renewable energy projects by addressing risks and remuneration in a consistent and fair manner.

Licensing of renewable electricity projects can be improved to facilitate development

Beyond PPAs and related risk and remuneration concerns, the licensing process for renewable electricity projects in Indonesia is, in theory, relatively straightforward. Before an entity can operate an electricity generation asset, an electricity business licence (Izin Usaha Penyediaan Tenaga Listrik, or IUPTL) must be obtained. The IUTPL allows the entity to supply electricity for public use and is valid for 30 years and extendable. It also can allow the entity to supply electricity for own use with a capacity of more than 200 kilovolts, valid for 10 years and extendable.

Given the expected lifetime of a renewable asset, the process of obtaining a licence for 30 years would not normally create a barrier. However, the 10-year lifetime of a self-supply licence may be a bit low for some businesses. If the expected process for extension is perceived as easy and more or less guaranteed, this should not be a major concern.

Indonesia has taken positive steps in recent years to simplifying the licensing process through its OSS system, which has helped with development of clean energy projects (e.g. with monitoring of the approval process for Analisis Manajemen Dampak Lingkungan, or AMDAL, environmental impact assessments). Applying for an IUPTL in Indonesia has also been facilitated through submission of applications in the OSS system. OSS likewise facilitates newly established businesses to obtain a single business number (Nomor Induk Berusaha, or NIB), as required by Government Regulation No. 24 of 2018.

Feedback from investors is that licensing processes can still be relatively complex, especially for elements that are not presently covered by the OSS system. Additional measures can further improve or streamline project development. For instance, the process of obtaining an Izin Mendirikan Bangunan, or IMB, construction permit can be time consuming and costly (e.g. for wind farms). Land issues also need to be tackled more effectively, and there is general consciousness of the importance of addressing this, for instance through the One Map policy that is expected to play an important role in overcoming handicaps to land acquisition (see Chapter 4). Additional measures, such as the forthcoming single portal for risk‑based assessment and business licensing under a new online OSS architecture, should help to facilitate some of these challenges. It is equally important that streamlining of licensing procedures do not weaken environmental and social safeguards.

To address these types of administrative barriers to licensing, other countries have made so called “one-stop shops” for permitting and licensing. These one-stop shops often include multiple filing procedures for development projects, such as environmental impact assessments, land permits, business permits and other context specific requirements, through a centralised portal. In this way, investors have a single point of contact in order to obtain needed licences and permits for investing in renewable assets, thus easing the process significantly. This is a key enabling factor in lowering the cost of capital for renewable investments and thus should be considered as a possible solution to build upon positive changes in the OSS system.

Corporate sourcing of renewable electricity remains an untapped opportunity

Around 70 companies in Indonesia have pledged to commit to renewable energy under initiatives like the global RE-100 campaign4. While this is encouraging, it is not sufficient to achieve Indonesia’s renewable energy targets by 2025, including deployment of 45 gigawatts (GW) of renewable energy capacity by then. Private investments, including international capital flows, are critical to meet the estimated USD 95‑100 billion of needed investments by 2025 (and more than USD 525 billion to 2050)5. Yet, there are a number of barriers to encourage and enable corporate sourcing of renewables in Indonesia.

Currently, it is possible for industry and businesses to self-generate electricity in Indonesia. Assets that generate electricity for their own use (rather than for sale to PLN) are known as private power utilities (PPUs, sometimes referred to as captive power plants). As regulated in the Electricity Law of 2009, PPUs are allowed to generate for on-site consumption, including use by tenants of an industrial estate. This can include direct sale of power to end customers, but to do so, PPUs bigger than 200 kilovolts must hold an operating licence and get approval from the relevant minister, governor or mayor. They must also be granted an IUTPL as well as an electricity business area (Wilayah Usaha) licence.

MEMR Regulation No. 1/2017 (see Chapter 3) also allows PPUs to establish a back-up connection to PLN’s grid, but getting that connection can come at a high cost. The requirements include:

a connection charge: based on existing laws and ministerial regulations

a capacity charge: calculated as total power generated x 40 hours x electricity tariff

an energy charge: applied for electricity consumed when PPUs operate in parallel systems, either as a normal charge or as emergency energy charges, which applies in emergency situation that results in PPUs requiring electricity supplied by PLN.

Off-site power generation is also allowed via MEMR Regulation No. 01/2015, which addresses co‑operation on the utilisation of power grid (for transmission or distribution). However, off-site generation needs to be transmitted through the PLN grid via a power wheeling agreement, and there currently is no implementing regulation nor technical guidelines on power wheeling to establish the cost of grid connection and the terms for grid use. As a result, power wheeling is uncommon, and where it could be used, the process could be improved (e.g. considering a tripartite agreement with PLN to allow corporate buyers to find a suitable model).

Net-metering is also available (e.g. for rooftop solar photovoltaic), but power exported to the grid is settled at 65% of the BPP. While the number of rooftop customers grew from 351 in 2018 to more than 2000 in June 2020, this pricing structure (accounting for facility services with respect to reliability and power quality) has been seen by some investors as making it uneconomical to invest in self-generation. The grid fee for IPPs can also detract from corporate investment. In fact, the low export tariff has motivated some self-generators to go off-grid and invest in electricity storage solutions instead. Forthcoming changes to MEMR regulation under the recent Omnibus Law are expected to raise the export calculation from 65% to 75%, and to 90% for consumers with battery capacity. However, these tariff rules are still not in line with net-metering schemes globally (see Chapter 3).

Recently, PLN looked at how to increase private investment in renewable electricity capacity. One such effort includes a new PLN Service Product that it developed with the Clean Energy Investment Accelerator to provide a tracking system for RECs for customers looking to procure clean electricity. The RECs can be bundled with the purchase of electricity or they can be bought as a separate product (unbundled). RECS are valued as 1 MWh of power and it can be sold within a year of their production. This means that RECs will expire after a year, and they follow international standards using the APX, Inc. Tradable Instrument for Global Renewables registry for tracking the certificates.

PLN’s RECs are currently priced at IDR 35 000 (around USD 2.50) and are available to both PLN and non-PLN consumers. If this promising initiative continues towards internationally accepted practice, PLN’s RECs market can help attract industries that value green energy to Indonesia, which in turn can incentivise the government to create more ambitious targets for renewable energy.

Further developments for a successful RECs market can include provisions allowing renewable energy producers to get certificates from their production and to sell them in equal competition with the certificates from PLN. In the current PLN structure, it is currently unclear if IPPs can get their energy certified for RECs that can be sold to or through the PLN system. This would be a prerequisite for the new system to attract investment in renewable energy development, as not all investors will want to go through PLN. An open RECs system would also be aligned with international best practise.

While progress on RECs is promising, Indonesia’s options and incentives for corporate buyers are still not where they could be compared to other countries. Off-grid captive and on-site captive connected renewables may work well for some companies, but for companies without nearby access to renewable energy, there are limitations. Even for those that are able to do captive production, it is still challenging to meet 100% of their electricity needs, given constraints in total production capacity locally – generally only around 10-15% of electricity needs. RECs are important to companies, but so are robust PPAs and availability of other procurement mechanisms, such as green tariffs. These options are not really available in Indonesia and are limiting broad sources of electricity supply for customers looking to meet renewable energy targets.

A “carrot and stick” approach can also help in engaging corporate sourcing of renewables. This has worked well in other countries, such as Australia, where the renewable energy target scheme with financial incentives (e.g. solar subsidies) and industry obligations helped bring spot prices down for renewable electricity generation certificates and led to 3.5 GW of new renewable generation capacity in 2020, supported by corporate PPAs (Kay, 2020[29]).

Incentives for investments in renewable integration and grid infrastructure can improve

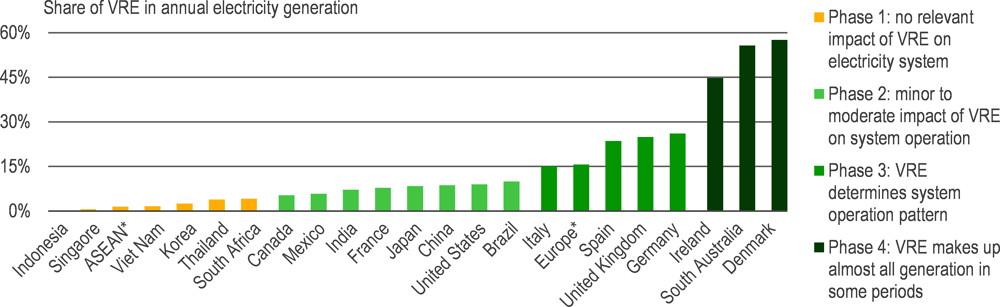

The integration of variable renewable energy in Indonesia’s electricity mix is rather low. The share of renewables in electricity generation capacity in 2019 was 9.15% (IEA, 2020[30]). Of the installed renewable capacity, wind and solar made up 150 MW and 140 MW, respectively. With this relatively low amount of variable renewables in the system, there should be little to no system impact due to the variable production of those assets6 (Figure 5.3). For example, the Java-Bali system has a system peak demand of around 25 000 MW. Even if all the 2019 variable renewable electricity capacity installed in Indonesia was located in Java-Bali, it would still only represent 1.2% of total peak load.

Figure 5.3. Level of renewable energy integration across selected countries in 2019

Notes: VRE = variable renewable energy; ASEAN = Association of Southeast Asian Nations; * indicates average across countries.

Source: Adapted from (IEA, 2020[31]), Power systems in transition: Challenges and opportunities ahead for electricity security.

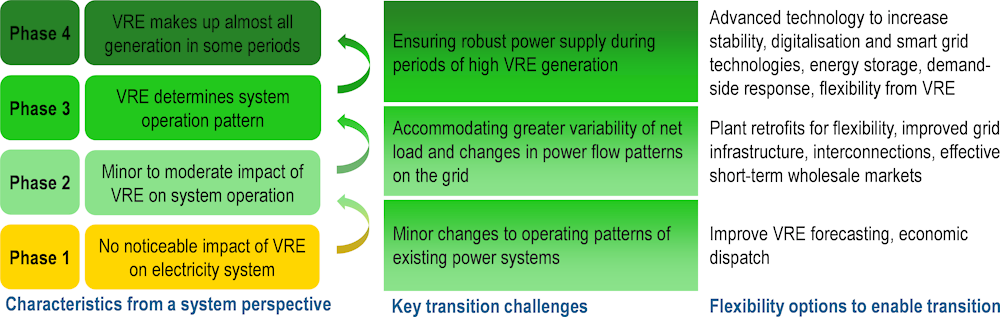

The International Energy Agency (IEA) developed a framework to highlight the different challenges of system integration, depending on the phase of transition in a country. Lower phase challenges typically can be addressed by minor changes to operation practises and by using some economic incentives (Figure 5.4). The IEA assesses that Indonesia is still in Phase 1, where there is no measurable impact on the existing power system (though regions within countries can differ from the country average). While Indonesia may be in Phase 1, it is important that the country nonetheless prepare for coming phases, especially given Indonesia’s ambitious renewable targets, where suitable policy frameworks and market incentives can ensure phase transitions happen smoothly.

Figure 5.4. Renewable integration transition challenges and enabling options, by phase

Currently, there are no incentives to ensure system friendly deployment of renewables in Indonesia, and operational practises are geared overall towards a system composed mainly of dispatchable baseload generation. The planning process in Indonesia has historically catered to this baseload generation, which means that there is no approach developed to ensure grid investments are made in line with development of renewable sources. One such example can be seen in PLN’s 2019-28 electricity supply business plan (RUPTL): the target of 23% renewable integration is not complemented by the planned 10% drop in investment for power transmission.

Grids are imperative to the successful integration of variable renewable energy sources, and the planned scale-back in grid investments in the RUPTL is concerning. It is not uncommon to see solar projects halted due to grid constraints, especially outside the main grid of Java-Bali (Hamdi, 2019[33]). Closer links between grid and renewable energy expansion would thus be beneficial to mobilise investments in renewables.

An integrated planning approach is needed to alleviate potential issues with grid constraints. This includes considering electricity demand, generation and grid planning in a holistic approach to ensure responsive feedback is enabled across all elements of Indonesia’s electricity ecosystem. In particular, such planning would ensure necessary grid investments are made ahead of renewables deployment, given those developments generally take longer than typical renewable energy asset deployment. For example, green corridors in India and the United States are being developed with grids capable of accommodating high shares of variable renewable energy (Box 5.5).

Future renewable projects under the expected large-scale auctions will be designed by PLN, which means that renewable energy investments can be integrated into the wider electricity system. With the right planning procedures, this can ensure the entire electricity system benefits from those investments. Development also can be planned in a way that helps to avoid costly interruptions for renewable energy generation and the electricity system.

Box 5.5. Green corridors in India are preparing for renewable electricity capacity additions

India has some states that are very rich in renewables potential, where large-scale solar and wind projects can be deployed at low costs. However, that renewable energy will need to be transmitted from resource-rich areas and distributed across the country to electricity load centres. In order to do this effectively, India has introduced the concept of green corridors for transmission projects, which will develop inter- and intra-state transmission lines to utilise resource-rich areas effectually and increase renewable electricity generation for the whole country. In addition, a Renewable Energy Management Centre will be established and advanced forecasting will also be implemented.

The green corridor project illustrates the importance of aligning transmission planning with renewable energy development, helping to avoid potentially “stranded” assets due to grid connection or capacity issues. With well-planned and well-designed grids, the pipeline of renewable energy projects will not be halted due to grid constraints, helping to create an attractive environment for project development and investment. Once built, well-developed grids also make renewable energy integration easier from a system operations perspective.

From an Indonesian perspective, grid development within and between islands is important to utilise and integrate renewable energy efficiently and effectively. System planning, including grid development, will increase investor confidence and ultimately lower the cost of capital for renewable energy investment.

Source: (IEA, 2020[34])

References

[6] Afut Syafril, N. and Sri Haryati (2020), Government extends electricity-relief scheme until September 2020, Antara News, https://en.antaranews.com/news/151590/government-extends-electricity-relief-scheme-until-september-2020 (accessed on 18 December 2020).

[13] APEC (2017), Energy Efficiency Finance in Indonesia Current State Barriers and Potential Next Steps, https://apec.org/Publications/2017/10/Energy-Efficiency-Finance-in-Indonesia-Current-State-Barriers-and-Potential-Next-Steps (accessed on 8 April 2020).

[9] Arinaldo, D. et al. (2021), Indonesia Energy Transition Outlook (IETO) 2021, Institute for Essential Services Reform, Jakarta, https://iesr.or.id/en/pustaka/indonesia-energy-transition-outlook-ieto-2021 (accessed on 4 March 2021).

[18] Bharti, P. (2020), SIDBI Green Climate & Sustainable Development Initiatives, Small Industries Development Bank of India, Paris, https://www.slideshare.net/OECD_ENV/pawan-kumar-bharti-sidbi-green-climate-sustainable-development-initiatives-239052077 (accessed on 18 December 2020).

[28] BNEF (2016), “Mexico’s second power auction results: Record low prices in Latin America”, Bloomberg New Energy Finance, https://data.bloomberglp.com/bnef/sites/14/2017/01/BNEF_MexicosSecondPower_SFCT_FNL_B.pdf (accessed on 17 December 2020).

[8] Bridle, R. et al. (2018), Missing the 23 Per Cent Target: Roadblocks to the development of renewable energy in Indonesia, Global Subsidies Initiative, International Institute for Sustainable Development (IISD), https://www.iisd.org/sites/default/files/publications/roadblocks-indonesia-renewable-energy.pdf (accessed on 15 December 2020).

[5] Burke, P. and S. Kurniawati (2018), “Electricity subsidy reform in Indonesia: Demand-side effects on electricity use”, Energy Policy, Vol. 116, pp. 410-421, http://dx.doi.org/10.1016/j.enpol.2018.02.018.

[25] Construction Week (2014), Regulatory framework for ESCOs launched in Dubai, https://www.constructionweekonline.com/article-26310-regulatory-framework-for-escos-launched-in-dubai (accessed on 9 February 2021).

[26] Cool Coalition (2020), Meet The Global Cooling as a Service Prize Winner: ColdHubs, United Nations Environment Programme, Kigali Cooling Efficiency Programme, https://coolcoalition.org/meet-the-global-caas-prize-winner-coldhubs/ (accessed on 18 December 2020).

[15] de la Rue du Can, S. et al. (2014), “Design of incentive programs for accelerating penetration of energy-efficient appliances”, Energy Policy, Vol. 72, http://dx.doi.org/10.1016/j.enpol.2014.04.035.

[33] Hamdi, E. (2019), Indonesia’s Solar Policies: designed to fail?, Institute for Energy Economics and Financial Analysis (IIEFA), Cleveland, https://ieefa.org/wp-content/uploads/2019/02/Indonesias-Solar-Policies_February-2019.pdf (accessed on 16 December 2020).

[2] Harsono, N. (2020), “UAE’s Masdar to support development of Indonesia’s largest solar power plant”, The Jakarta Post, https://www.thejakartapost.com/news/2020/01/08/uaes-masdar-to-support-development-of-indonesias-largest-solar-power-plant.html (accessed on 16 December 2020).

[34] IEA (2020), India 2020 Energy Policy Review, OECD Publishing, Paris, https://dx.doi.org/10.1787/9faa9816-en.

[30] IEA (2020), Power investment trends in indonesia, International Energy Agency.

[31] IEA (2020), Power systems in transition: Challenges and opportunities ahead for electricity security, OECD Publishing, Paris, https://dx.doi.org/10.1787/4ad57c0e-en.

[21] IEA (2019), Perspectives for the Clean Energy Transition: The Critical Role of Buildings, International Energy Acency, Paris, https://webstore.iea.org/perspectives-for-the-clean-energy-transition (accessed on 16 December 2020).

[23] IEA (2018), Energy Efficiency 2018: Analysis and outlooks to 2040, International Energy Agency, Paris, https://dx.doi.org/10.1787/9789264024304-en.

[20] IEA (2018), Perspectives for the Energy Transition: The Role of Energy Efficiency, International Energy Agency, Paris, https://webstore.iea.org/perspectives-for-the-energy-transition-the-role-of-energy-efficiency (accessed on 18 December 2020).

[32] IEA (2018), Renewables 2018: Analysis and Forecasts to 2023, International Energy Agency, Paris, https://dx.doi.org/10.1787/re_mar-2018-en.

[4] IEA (2017), Energy Efficiency 2017, International Energy Agency, Paris, https://dx.doi.org/10.1787/9789264284234-en.

[22] IEA (2017), Insights brief: energy utility obligations and auctions, International Energy Agency, Paris, https://www.iea.org/reports/insights-brief-energy-utility-obligations-and-auctions (accessed on 18 December 2020).

[17] IEA-UNEP (2019), 2019 Global Status Report for Buildings and Construction: Towards a zero-emissions, efficient and resilient buildings and construction sector, International Energy Agency, United Nations Environment Programme, Paris, https://www.iea.org/reports/global-status-report-for-buildings-and-construction-2019 (accessed on 18 December 2020).

[29] Kay, I. (2020), Attracting Private Investment for Renewable Energy, Australian Renewable Energy Agency (ARENA), https://www.slideshare.net/OECD_ENV/ppt-ian-kay-attracting-private-investment-for-renewable-energy (accessed on 16 December 2020).

[10] Keuangan, I. (ed.) (2009), Economic and fiscal policy strategies for climate change mitigation in Indonesia : Ministry of Finance green paper, Ministry of Finance, Republic of Indonesia : Australia Indonesia Partnership.

[7] Massita Ayu, C. (2020), Good News is a Bad News: Indonesia’s Electricity Subsidy - The Purnomo Yusgiantoro Center, The Purnomo Yusgiantoro Center, https://www.purnomoyusgiantorocenter.org/good-news-is-a-bad-news-indonesias-electricity-subsidy/ (accessed on 18 December 2020).

[11] Meilanova, D. (2021), “ESDM Trials Carbon Trading in Steam Power Plants”, Bisnis.com, p. 1, https://ekonomi.bisnis.com/read/20210318/44/1369262/esdm-uji-coba-perdagangan-karbon-di-pembangkit-listrik-tenaga-uap (accessed on 8 April 2021).

[19] MEMR (2020), Data & Information of Energy Conservation 2019, 3rd Edition, Directorate of Energy Conservation, Ministry of Energy and Mineral Resources, http://www.ebtke.esdm.go.id (accessed on 15 December 2020).

[24] MEMR (2019), Data & Information of Energy Conservation 2018, 2nd Edition, Directorate of Energy Conservation, Ministry of Energy and Mineral Resources, https://drive.esdm.go.id//wl/?id=cwFohj0AaWgwIWQMNr5Yu68d8ptxTg4o (accessed on 15 December 2020).

[1] OECD (2020), OECD Investment Policy Reviews: Indonesia 2020, OECD Investment Policy Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/b56512da-en.

[3] OECD (2019), OECD Green Growth Policy Review of Indonesia 2019, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/1eee39bc-en.

[14] Pahnael, J., A. Soekiman and M. Wimala (2020), “Penerapan Kebijakan Insentif Green Building di Kota Bandung (Implementation of Green Building Incentive Policies in Bandung City)”, Jurnal Infrastruktur, Vol. 6/1, pp. 1-13, http://dx.doi.org/10.35814/infrastruktur.v6i1.1315.

[12] Riana (2021), “Arifin Launched Subroto Award for Energy Efficiency 2021”, Pontas, p. 2, https://pontas.id/2021/03/18/arifin-launching-penghargaan-subroto-bidang-efisiensi-energi-2021/ (accessed on 8 April 2021).

[27] Rio, P. (2019), Auctions for the support of renewable energy in Mexico, AURES II, European Commission, http://aures2project.eu/wp-content/uploads/2019/12/AURES_II_case_study_Mexico.pdf (accessed on 17 December 2020).

[16] U4E (2020), ECOFRIDGES Green On-wage Financial Mechanism Launched in Ghana by the Energy Commission, United for Efficiency (U4E), United Nations Environment Programme, https://united4efficiency.org/ecofridges-green-on-wage-financial-mechanism-launched-in-ghana-by-the-energy-commission-unep-and-base-to-make-environmentally-friendly-cooling-products-more-affordable/ (accessed on 16 December 2020).

Notes

← 1. For more information, see https://www.seai.ie/business-and-public-sector/business-grants-and-supports/energy-contracting/.

← 2. For more information, see https://www.id.undp.org/content/indonesia/en/home/projects/Partnership-for-Market-Readiness.html.

← 3. For more information, see http://kpbu.djppr.kemenkeu.go.id/pembayaran-ketersediaan-layanan/ (in Bahasa).