This chapter discusses disability programmes offered at the national and subnational level, including contributory and non-contributory benefits managed and funded by the national authorities and a range of (health and social) services and other in-kind benefits provided by the regions and the municipalities. It concludes that the system is complex and difficult to navigate but also generally quite adequate for people who manage to access all supports they may be eligible for. However, many people fail do access support and many of them might still be very vulnerable. The chapter also finds a significant North-South divide, characterised by a strong reliance on nationally funded benefits in the South of the country, which lacks the capacity to provide stronger disability services. It concludes that reform is needed to improve the performance of the system, to address the large cross-territorial differences, and to achieve a shift away from the provision of benefits towards support for employment and self-sufficiency.

Disability, Work and Inclusion in Italy

3. Social protection for people with disability in Italy

Abstract

Italy’s national system of disability supports has changed little in the past two decades although services provided at the regional and local level are in the flux. A key concern, also demonstrated in this chapter, are considerable differences across Italy’s regions in the provision and take‑up of benefits and services. The 2021 Enabling Act is also addressing social protection issues. However, while the law is quite precise on the forthcoming reform of the assessment of disability, including the requirement for a single national body to manage the assessment of disability status, a review of the system of social protection in its complexity and organic nature was beyond the scope of the Enabling Act. However, it should be noted that the regulatory choice to link the identification of support for the person with disability to the elaboration and implementation of the personalised and participatory life project – the qualifying orientation of the implementing decree dedicated to the multidimensional assessment of disability – lays the basis for a significant change in the social protection process.

3.1. The national disability benefit system

At the national level, disability benefits are provided through a contributory system and a non-contributory system (civil invalidity), both managed by the National Institute of Social Security (INPS). Such a distinction is common in many OECD countries, but the Italian disability system is complex and fragmented. System complexity has its roots in the multitude of distinctions within disability programmes themselves. Within the contributory system, parallel systems coexist by regime (dependent employees, self-employed, “putative self-employed”, and different categories of employees) and within those regimes. Different occupations have different benefit systems, with differences in generosity but otherwise similar characteristics. Within the civil invalidity system, special parallel systems coexist for deaf and blind people, despite them at the same time also being eligible for the general non-contributory system. Table 3.1 summarises the different income replacement benefits for people with disability in Italy, focusing only on the general regime within the contributory system. The subsequent sections provide some detail on the characteristics of the contributory and non-contributory systems to shed some light on the multitude of benefits provided by the disability system, highlighting differences and overlaps between programmes.

Table 3.1. Multiple national disability benefits coexist for people with disability in Italy

Characteristics of income replacement benefits for persons with disability in Italy at the national level

|

|

CIVIL INVALIDITY (NON-CONTRIBUTORY) SYSTEM |

CONTRIBUTORY SYSTEM |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Disability pension (full and partial) |

Attendance allowance |

Disability pension for the blind (full and partial) |

Disability pension for the deaf |

Contributory disability pension (full and partial) |

|||||

|

Name of benefit |

Pensione di inabilità per invalidi civili (full pension) Assegno mensile di assistenza per invalidi civili (partial pension) |

Indennità di accompagnamento |

Pensione per i ciechi assoluti (full pension) Pensione per i ciechi parziali ventesimisti (partial pension) |

Pensione non reversibile per sordi |

Pensione di invalidità previdenziale ordinaria (Full pension) Assegno ordinario di invalidità (Partial pension) |

||||

|

Regulatory law |

Law 118 (March 1971) |

Law 18 (February 1980) |

Law 382 (May 1970) |

Law 381 (May 1970) |

Law 222 (June 1984) |

||||

|

Type |

Non-contributory, permanent |

Non-contributory, non-permanent |

Non-contributory, permanent, non-reversible |

Non-contributory, permanent |

Contributory, non-permanent |

||||

|

Responsible organisation(s) |

INPS |

INPS |

INPS |

INPS |

INPS |

||||

|

Eligibility |

|||||||||

|

Age |

18 to 67 |

No age limit |

18 and over |

18 to 67 |

18 to 67 |

||||

|

Disability assessment |

Civil invalidity or civil invalidity for the deaf (if partial) |

Civil invalidity + impossibility to walk or conduct activities of daily living |

Civil invalidity for the blind |

Civil invalidity for the deaf |

Work-capacity assessment |

||||

|

Degree of disability |

100% (Full) 74%‑99% (Partial) |

100% |

100% (Full) 80% (Partial) |

100% |

100% (Full) 66%‑99% (Partial) |

||||

|

Minimum contributory period |

None |

None |

None |

None |

3 of last 5 years |

||||

|

Means-testing income threshold |

EUR 17 271 per year (Full pension, in 2022) EUR 5 015 per year (Partial pension, in 2022) |

None |

EUR 17 271 per year (in 2022) |

EUR 17 271 per year (in 2022) |

None |

||||

|

Generosity |

|||||||||

|

Replacement rate or (average) monthly payment |

EUR 292 per month (for 13 months, in 2022) |

EUR 531 per month (in 2022) |

EUR 310.17 or 292 per month for full and partial, or full in non-residential (for 13 months, in 2022) |

EUR 292 per month (for 13 months, in 2022) |

EUR 753.83 average monthly payment |

||||

|

Increased generosity |

Increase for social reasons |

N/A |

Increase for social reasons |

Increase for social reasons |

Increase for social reasons |

||||

|

Benefit base |

N/A |

N/A |

N/A |

N/A |

Average earnings in last 5 years (if more than 15 years of contributions) or variable period between the last 5 and 10 years (if less than 15 years) |

||||

|

Minimum and maximum benefits |

N/A |

N/A |

N/A |

N/A |

Partial pension minimum EUR 6 816.48 per year if household income below EUR 12 170.72 for a single household and EUR 18 256.07 for a coupled household No maximum |

||||

|

Duration of benefits |

Transition to social benefit at age 67 |

No maximum |

No maximum |

Transition to social benefit at age 67 |

Transition to old-age pension at 67 |

||||

|

Compatibility with other income sources |

|||||||||

|

Labour earnings |

Compatible |

Compatible |

Not compatible |

Not compatible |

Not compatible |

||||

|

Other INPS income replacement programmes |

Attendance allowance Contributory benefits |

All INPS pensions and allowances |

Attendance allowance Contributory benefits |

Attendance allowance Contributory benefits |

Attendance allowance Non-contributory pensions |

||||

|

INPS in-kind programmes |

Handicap |

Handicap |

Handicap |

Handicap |

Handicap |

||||

|

Regional benefits and services |

Yes |

Some |

Yes |

Yes |

Yes |

||||

Source: Mutual Information System on Social Protection (MISSOC), www.missoc.org/missoc-database/, Istituto Nazionale della Previdenza Sociale (INPS) and discussions with country experts.

3.1.1. The contributory disability pension system

Workers with at least five years of social security contributions (three of which in the past five years) are eligible for pensions from the contributory system, which provides a disability pension that mirrors old-age pensions. Disability pensions can be full pensions, granted to workers with a full (= 100%) and permanent incapacity for any work, or partial pensions, granted to workers with an incapacity of at least two‑thirds. Disability pensions are calculated using the old-age pension formula, but with a substantial difference for full disability pensions: like the regulations in most OECD countries, the calculation of a full disability pension includes a contributory bonus (bonus contributivo), which assumes a full contributory career until age 60. Partial disability pensions can be complemented with labour earnings, contrary to full disability pensions, but payments will be reduced accordingly.

Because of the contributory bonus, at any given wage and age, a full disability pension will be as high as a corresponding old-age pension (except for people working beyond age 60), making the system relatively adequate for those qualifying for a full benefit. In 2022, the average payment for a full contributory disability pension was EUR 1 074 a month, about 85% of the average old-age pension (which was EUR 1 285 per month in 2022) (INPS, 2022[1]). This difference reflects wage differentials between people with and without disability and the shorter insurance records of people with disability, in line with international evidence (OECD, 2022[2]). However, most recipients receive only a partial contributory disability pension with an average monthly payment of EUR 701 in 2022. The average payment across all full and partial benefits from the contributory system averaged at EUR 753 in 2022.

Contributory disability pensions are automatically transformed into old-age pensions upon reaching the statutory retirement age (age 67 in 2022), whereby years of receipt of a disability pension are counted as contributory years for the calculation of the person’s old-age pension. The interaction between disability and old-age pensions creates some financial incentive for early retirement through the contributory disability benefit system but data to assess the actual extent of spill-over are not available.

3.1.2. The civil invalidity disability system

Civil invalidity pensions

The non-contributory disability benefit system provides a means-tested flat-rate pension to people with a civil invalidity certification. Just like the contributory system, also the non-contributory system provides two separated payments depending on whether someone qualifies with full civil invalidity (loss of 100% of work incapacity, pensione di invalidità) or partial invalidity (loss of three‑quarters of work capacity or more, assegno di invalidità). The non-contributory system provides parallel benefits for people with disability qualifying through blindness and deafness for which also a special assessment is required (see Table 3.1 for a summary of all income‑replacement benefits).

One particularity of the Italian system compared to systems in other OECD countries is that the flat-rate payment for both benefits is the same, amounting to EUR 292 per month in 2022, with a temporary increase in 2020 in response to the COVID‑19 pandemic (INPS, n.d.[3]). In most OECD countries, payments for a partial non-contributory benefit (where they exist) would be lower than for a full benefit, reflecting the remaining ability for gainful employment capacity. A second particularity in Italy is that the earnings threshold is lower for those with partial civil invalidity than for those with full civil invalidity, making the system quite work-incompatible. To qualify for a full disability benefit, a person must have a yearly personal income below EUR 17 271, excluding the pension itself and any other disability-related payments (such as occupational pensions, or the attendance allowance described below). Instead, to qualify for a partial disability benefit, the yearly personal income should be below EUR 5 015. Thus, the system imposes stronger limitations (and poorer incentives) to work on people receiving partial disability payments, who in fact should be more able to complement their disability payments with income from work.

Attendance allowance

An additional element to the civil invalidity system is the attendance allowance, an additional or top-up payment granted to people with a certification of full civil invalidity and the incapacity to walk or conduct activities of daily living independently. Attendance allowance effectively is a long-term care benefit linked to the non-contributory system through the assessment of civil invalidity; it is not means-tested and provides a flat-rate payment of EUR 520 per month. As a benefit for long-term care, attendance allowance is not discussed in detail in this report but Box 3.1 provides additional information on the levels of take up and spending for this payment. Effectively, attendance allowance is the most frequent benefit granted from the non-contributory system (68% of all benefits in 2022) and also responsible for three‑quarters of total public expenditure on non-contributory disability payments.

In-kind benefits

In addition to these financial benefits, the non-contributory system also includes a large set of in-kind benefits that are available to people with a civil invalidity certification, even if they do not qualify for one of the (contributory or non-contributory) disability pensions. In-kind benefits include money to purchase medical aids, such as prostheses and hearing aids, exemptions to healthcare co-payments, and free public transportation. But it also includes a judicial amnesty of up to three years of prison years, and a priority in choosing the seat of the public institution for those winning a public competition. Due to the lack of data on in-kind benefits provided by INPS, these are not covered in the following.

3.1.3. Descriptive statistics

Civil invalidity claims are key to the disability pension system in Italy

More than twice as many working-age people claim pensions from the non-contributory civil invalidity system as from the contributory system. In 2022, close to 2.2% of the working age population were claiming a civil invalidity pension (partial or full), a share that has increased since 2018 (Figure 3.1, Panel A) while only about 1% were receiving a contributory disability pension. While most contributory claims are for a partial benefit, claims from the civil invalidity system are in most cases for a full benefit: 53% claim a full non-contributory benefit, 37% claim a partial benefit, and the remaining 10% of non-contributory claims are for full or partial pensions for the blind and pensions for the deaf. Incidentally, payment levels are identical for all non-contributory payments (see Table 3.1).

With less than 4%, the total share of people receiving a disability benefit in Italy is low in an international comparison. In particular, the share of people claiming contributory disability benefit is very low compared to other OECD countries with a comparable contributory disability pension system, like Austria or Canada (OECD, 2022[2]). It appears that the contribution requirements – five years of contributions of which three in the past five years – are too demanding for people to qualify for a contributory payment. This also explains why more people are claiming non-contributory payments which, at EUR 298 per months, are low and much lower than the average contributory disability pension, a difference that has widened over time.

Comparisons between the contributory and the non-contributory benefit system also must keep differences in the underlying disability assessment in mind. As explained in Chapter 2, eligibility for the contributory disability system requires a permanent loss in the capacity to work, evaluated on a case‑by-case basis by INPS doctors. Instead, eligibility to the non-contributory system relies on the certification of civil invalidity which, with a strong medical orientation, de facto associates a degree of disability to every health condition. As the correspondence tables used in this process have not been updated since 1992, over time these two ways of assessing disability may have become more and more different.

Box 3.1. The role of attendance allowance in the Italian disability system

Attendance allowance is granted to people with civil invalidity at 100% who require personal support to walk and conduct activities of daily living, although it is not earmarked to spending on personal support.

A rough multiplication of the number of recipients in 2022 by their average payment indicates that EUR 1 billion was spent on attendance allowance in 2022, an amount 2.5 times higher than the total spending on civil invalidity pensions.

Almost 20% of the recipients receive attendance allowance only (all others receive it together with a disability benefit), which is a proxy of those for whom the means-test is binding. Those in working age receiving attendance allowance, but not receiving a pension, are likely not eligible for a pension because they have an income above the means-test. This can both be because they earn above the earnings threshold, or because their wealth is above the eligibility requirements. Either way, INPS data for 2022 suggest that almost 20% of people are in this situation and receive an average monthly payment of EUR 500.

There are three types of benefits within attendance allowance, in addition to a benefit for minors: the general attendance allowance, an allowance for the blind, and an allowance for the deaf. This mirrors the disability pension system, with the difference that the qualifying condition is the same in this case (impossibility to walk and conduct activities of daily living). Most importantly, a blind or deaf person with full civil invalidity can qualify for both their special benefit and the general one and, in case of co-morbidities, cumulate multiple attendance allowances. De facto, however, 97% of all people receiving attendance allowance, receive the general allowance.

Receipt of attendance allowance has a strong age gradient. Table 3.2 shows that, except for people under age 18, receipt increases with age and is very high for those over age 70: at that age, 13% receive an attendance allowance. This strong age gradient, together with the lack of means-testing and earmarking, makes attendance allowance take‑up dependent on the ageing of the Italian population. With current demographic trends, spending on attendance allowance is projected to increase by 42% until 2065 (Ministero dell'Economia e delle Finanze, 2022[4]).

Table 3.2. Receipt of non-contributory attendance allowances is strongly related to age

|

|

Recipients of attendance allowance as a share of the respective population (%) |

|---|---|

|

Under 18 |

3.1 |

|

18‑19 |

0.9 |

|

20‑59 |

1.0 |

|

60‑64 |

1.9 |

|

65‑69 |

2.5 |

|

70 and older |

13.6 |

|

Total |

22.7 |

Source: OECD calculations using pension data from Istituto Nazionale della Previdenza Sociale (INPS) (www.inps.it/osservatoristatistici/6/37/o/378) and population data from Istituto Nazionale di Statistica (ISTAT) (http://dati.istat.it/Index.aspx?DataSetCode=DCIS_POPRES1#)

Regional differences uncover large financial incentives to claim disability benefits

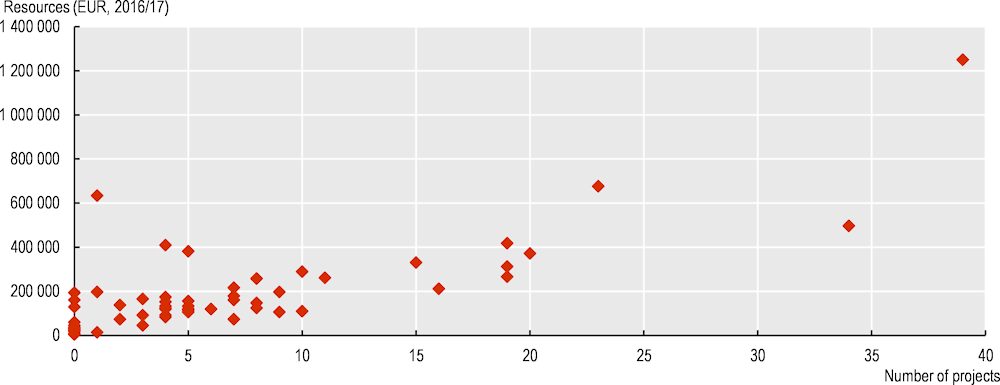

Regional differences in the take‑up of disability benefits are large: while the national average stands at 3.5% of the working-age population, including both contributory and non-contributory benefits, some regions face a beneficiary rate of over 7% and others manage to keep the rate at around 2% (Figure 3.1, Panel A). Differences follow a North-South pattern: the Southern regions of Italy (like Calabria, Apulia, and Campania) and the Islands (Sardinia and Sicily) have a higher take‑up rate than the Northern regions (such as Veneto and Lombardy). The proportions of the pensions coming from the contributory and the non-contributory system also vary across the territory, but to a lesser extent. On average, contributory pensions represent 28% of all disability pensions granted to people of working age. This share is substantially lower in the Islands and Campania, and much higher in Emilia-Romagna and Umbria.

Figure 3.1, Panel B also shows that territorial differences are likely to remain or even widen, as new disability benefit claims are highest in regions with already high beneficiary rates.

Figure 3.1. Regional differences in the take‑up of disability benefits are very large

Note: The beneficiary rate is calculated as the number of contributory and non-contributory disability pensions and attendance allowance payments as a share of the working-age population. The inflow rate is calculated as new claims of contributory and non-contributory disability pensions and attendance allowance payments per 100 000 of the working-age population.

Source: OECD calculations using population data from the Istituto Nazionale di Statistica (ISTAT) (http://dati.istat.it/Index.aspx?DataSetCode=DCIS_POPRES1#) and beneficiary and inflow data prepared by Istituto Nazionale della Previdenza Sociale (INPS) for the OECD.

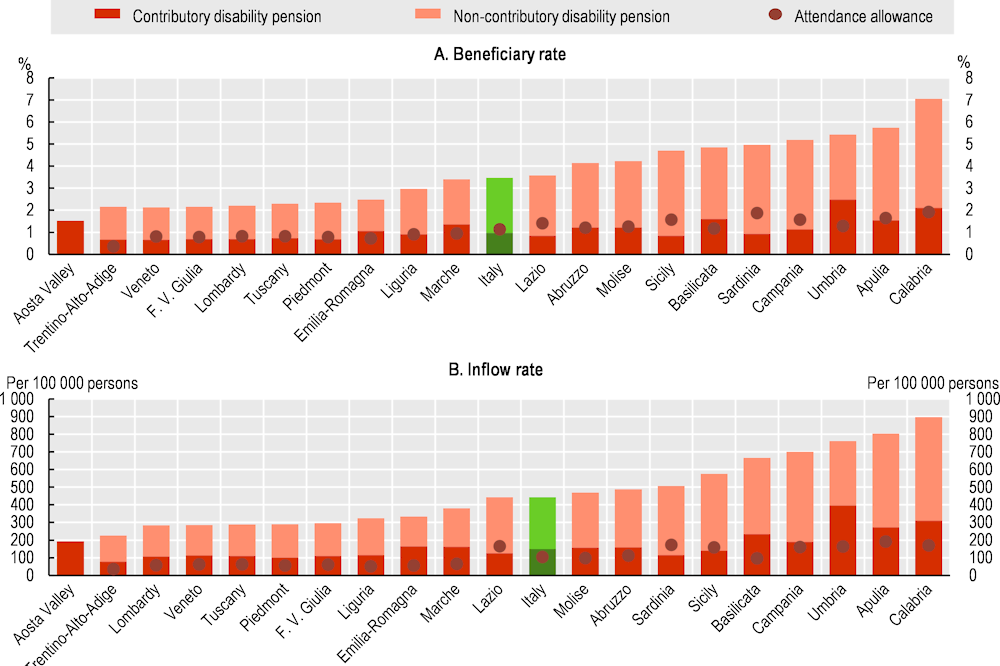

Financial incentives to claim the non-contributory disability pension play a large role in explaining regional differences. The level of payments of non-contributory pensions is the same for all regions, despite large differences in labour earnings, household income and costs of living. Because labour earnings are so much lower in Southern regions and the Islands than in Northern regions, the value of a non-contributory disability pension varies a lot across the territory. Figure 3.2 shows that differences in the value of these benefits (i.e. the average disability pension payment over average gross labour earnings) have a considerable explanatory power for the benefit take‑up rate (R2=0.8): in regions where the average pension is high relative to labour earnings, far more people claim non-contributory disability pensions.

Figure 3.2. Financial incentives to claim the non-contributory disability pension play a critical role

Note: The replacement rate is constructed as the average non-contributory pension payment in 2020 (about EUR 300) over the average taxable gross labour earnings in each region. The take‑up rate is calculated as the number of pensioners over the number of residents in the working age bracket. Results are not driven by a single region: removal of each region individually does not change the results.

Source: OECD calculations using population data from the Istituto Nazionale di Statistica (ISTAT) (http://dati.istat.it/Index.aspx?DataSetCode=DCIS_POPRES1#) data prepared by the Istituto Nazionale della Previdenza Sociale (INPS) for the OECD, and Ministry of Economy tax records (www1.finanze.gov.it/finanze/analisi_stat/public/index.php?opendata=yes).

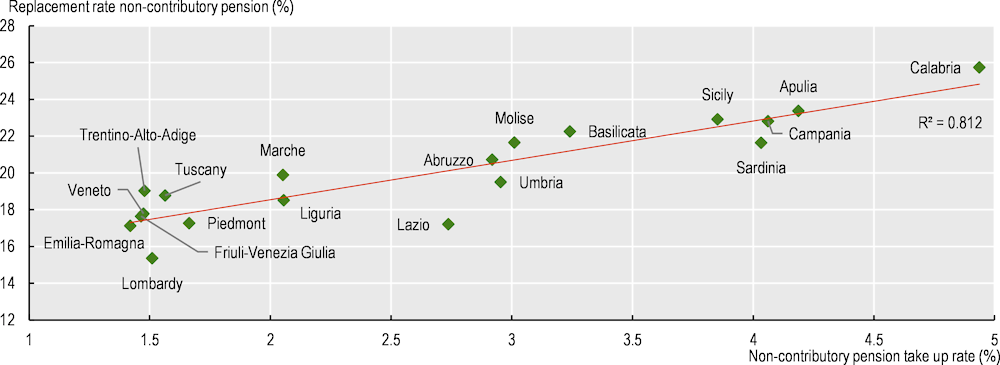

Strong financial incentives to claim disability benefits could create moral hazard if application to disability benefits is more lenient in regions where generosity is highest. However, data suggest that civil invalidity commissions are not more lenient in areas where financial incentives to claim benefits are highest.

Figure 3.3 shows that the acceptance rates of benefit claims (calculated as accepted claims over benefit applications in the period 2010‑21 to account for years-long backlogs in processing claims) vary substantially across regions. However, the relationship between the replacement rate and the acceptance rate to civil invalidity is not very clear (correlation of 0.14).

Leniency could instead come from the eligibility conditions for non-contributory disability benefit payments, i.e. the means test. Since means-tested income is linked to the regional level of wages, it is to be expected that in regions where average wages are lower, it is more common to have an income below the means test. Thus, even if the acceptance to civil invalidity is equally lenient or strict across the territory, a higher share of those with a civil invalidity status will be eligible for a pension in poorer regions because of the means test.

This is an issue for means-tested benefit programmes in several OECD countries but the large North‑South divide in Italy in economic development is a particular challenge. The regional differences in labour market conditions raise a broader question on benefit levels and means-testing criteria, which are both set at the national level. Poverty alleviation in a centralised manner promotes regional redistribution but identical benefit levels in regions with very different earnings, will create differential disincentives to work. Large differences across Italy’s region in the share of people looking for a civil invalidity assessment, discussed in Chapter 2, seem to be the result of such differences. At the same time, using the same means test in regions with very different living standards could, and empirically does, promote benefit dependency.

Figure 3.3. The acceptance rate into civil invalidity is not strongly correlated to system generosity

Source: OECD calculations using data prepared by the Istituto Nazionale della Previdenza Sociale (INPS) for the OECD.

3.2. Employment integration measures

Effective labour inclusion measures and activation requirements for people with partial work capacity are particularly important under such circumstances, to address weak and unequal work incentives. In Italy, labour inclusion of people with disability is regulated under Law 68/99 (Collocamento Mirato) and corresponding services are provided by the Public Employment Service (PES) and the provinces, mostly in relation to the system of employment quotas, and more recently also including hiring subsidies.

People with disability with a partial civil invalidity certification or a certification of occupational incapacity can register in provincial employment lists, and the PES will facilitate the matching with jobs or employers who are looking to fulfil their employment quota. Technically, they can facilitate matching by providing career guidance to workers with disability and helping them define an employment project. At the same time, they can support employers in understanding their obligations in hiring people with disability and analysing the tasks available in the different jobs. The PES will support successfully matched workers and their employers in onboarding the job and monitoring their progress.

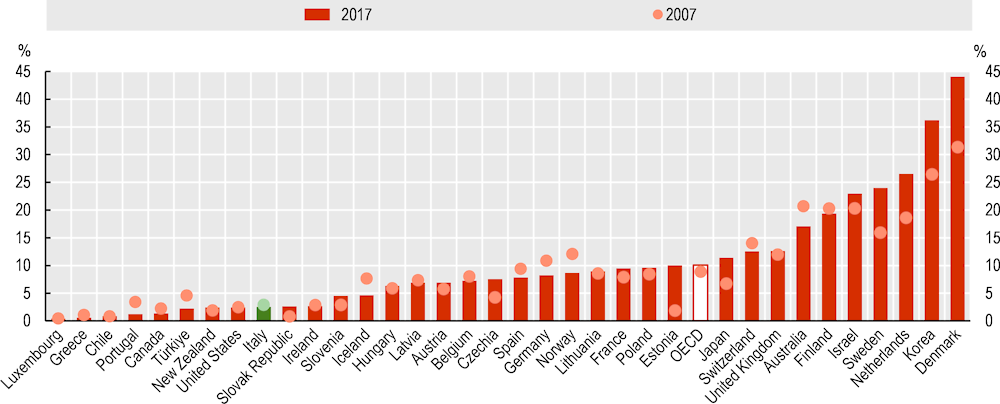

However, Italy is among the OECD countries which are spending only very little on active labour market measures for the inclusion of people with disability. Figure 3.4 shows that in 2017, in Italy only 2.5% of total spending on disability programmes was used for active measures (and, thus, 97.5% for payment of benefits), a share well below the OECD average of 10%. There is also no evidence that Italy’s spending on employment measures has increased over the last decade.

Figure 3.4. Italy spends very little on employment integration measures for people with disability

Note: OECD is an unweighted average of the countries shown. Incapacity benefits include: disability pensions, occupational injury pensions,

sickness allowances, rehabilitation services, other cash and in-kind benefits related to disability and all disability-related programmes offered by

the public employment service (PES).

Source: OECD (2022[2]), Disability, Work and Inclusion: Mainstreaming in All Policies and Practices, https://doi.org/10.1787/1eaa5e9c-en, Figure 4.9.

Since registration with the PES is voluntary, few people with disability enlist to be supported in their job search (Table 3.3). Data suggest that in 2018, less than 65 000 people with disability registered with the PES under Law 68/99 to find employment through the employment quota. This is a low number compared to the 645 000 applications to civil invalidity in 2018, implying that only one in ten people granted a civil invalidity status opted to register with the PES. The number of people who find employment with the help of the PES is very low, as only 6% of those in the employment list in 2018 were hired in that same year. Most of these people were hired on temporary contracts (58%), which often do not get renewed, causing a substantial number of people transitioning out of employment soon again. The second major cause for transitioning out of employment are resignations, again highlighting the lack of obligations for workers in this process, followed by dismissals due to an objective valid reason.

Table 3.3. Few of the eligible people with disability register with the public employment service

Take up, hiring rate and type of contracts granted through the employment quota, 2018

|

Metric |

Value |

|---|---|

|

Public Employment Service Registrations under Law 68/99 |

65 000 |

|

Share of registrations |

10% of max number of registrations |

|

Hired from Employment List |

6% of registered |

|

Type of Contracts Granted |

58% Temporary |

Source: Ministry of Labour and Social Policy (2021[5]), Camera dei deputati relazione sullo stato di attuazione della legge recante norme per il diritto al lavoro dei disabili.

Some more information is available on the compliance of employers with the disability employment quota. A substantial share of employers does not comply with the employment quota (Table 3.4). From the employer side, disability quotas in Italy are binding for firms with 15 or more employers: firms with 15 to 35 employees should employ one person with a certified disability, two persons for firms with 36 to 50 employees, and 7% of the firm employees for firms with more than 50 employees. The quota for firms above 50 employees is large compared to other countries using quotas, such as Germany and France (both using a quota of 6% of the workforce) or Korea (using a quota of 2%). This is possibly one of the reasons why quota fulfilment was only 71% in 2018 (Ministry of Labour and Social Policy, 2021[5]). At the firm level, data show that 44% of firms do not fulfil their quota, particularly large private firms, among which 60% do not meet the 7% quota. This finding is also reflected in territorial differences: in Northern regions, where firms are larger, quota fulfilment is lower than in Southern regions. It is important to note that while sanctions for not fulfilling the quota are also comparatively severe in theory, amounting to EUR 150 per working day per unfilled vacancy, the number of sanctions imposed is small (one sanction for every ten firms not fulfilling the quota), contributing to the limited compliance with the quota.

Table 3.4. A large share of employers does not comply with the employment quotas

Quota fulfilment by firms, 2018

|

Metric |

Value (%) |

|---|---|

|

Disability quota fulfillment |

71 |

|

Firms not fulfilling quota |

44 |

|

Large private firms not meeting quota |

60 |

|

Share of sanctions for non-compliance |

10 |

Source: Ministry of Labour and Social Policy (2021[5]), Camera dei deputati relazione sullo stato di attuazione della legge recante norme per il diritto al lavoro dei disabili.

Temporary hiring subsidies seem to have increased the hiring of workers with disability, but numbers remain small. Since 2015, firms hiring workers with disability can have access to temporary hiring subsidies covering up to 70% of the gross wage. Firms hiring workers with psychological disabilities receive a larger subsidy, both in terms of the minimum degree of disability of the worker to quality for the subsidy (45% for mental health, compared to 67% for physical health), the duration of the subsidy (60 months compared to 36 months), and its generosity (70% of the gross wage regardless of the degree of disability, compared to 35% for those with physical disability with a degree of disability under 79%). In 2016 and 2017, about 3 000 workers with disability were hired through a hiring subsidy, almost reaching a maximum usage of the resources allocated to the subsidy, and resulting in a budget-driven drop to only 800 workers in 2018 (Ministry of Labour and Social Policy, 2021[5]). Despite the additional incentives for hiring workers with psychological disability, only one‑quarter of the hired workers belong to this category. Table 3.5 shows that 74.5% of the workers hired in 2016 were still employed in 2018, a figure that is expected to decrease as subsidies reach their limit, but also a figure that remains encouraging compared to the effectiveness of other employment incentives across OECD countries (OECD, 2022[2]). The fixed budget for hiring subsidies, EUR 20 billion per year, however, implies that the outreach of this policy can only be limited, much like the regional measures discussed above.

Table 3.5. Temporary hiring subsidies seem to have boosted the hiring of workers with disability

|

Metric |

Value |

|---|---|

|

Workers hired (2016 and 2017) |

3 000 |

|

Workers hired (2018) |

800 |

|

Still employed (2018 from 2016 hires) |

74.5% |

|

Total annual cost |

EUR 20 billion |

Source: Ministry of Labour and Social Policy (2021[5]), Camera dei deputati relazione sullo stato di attuazione della legge recante norme per il diritto al lavoro dei disabili.

The data presented in this section are old and given that the importance of active employment measures for people with disability in the policy debate has increased, it is likely that the spending and take up are higher now. However, the lack of recent data is symptomatic of a more general issue of lacking evidence in Italy. Each regional PES is responsible for monitoring the take up and outcomes of employment integration measures, but in many regions this exercise is not adequately conducted, or data are not publicly available. Given this lack of cohesive data, it is difficult to measure the take up of employment integration measures, let alone its effectiveness. For labour inclusion measures less regulated than the employment quota, such as training or reasonable accommodation of workplaces, there is even less data.

3.3. Meeting the needs of people with disability by regional and local supports

Regional and local authorities play a crucial role in Italy in supporting the functioning and capability of people with disability by providing a range of in-kind benefits. Regional in-kind benefits fall under two main areas: health services and social assistance/social services.

Regions directly provide most health services for people with disability through Health Agencies (Aziende Sanitarie). As described in Chapter 2, these services are initiated by a multidimensional assessment and an individual plan, and include medical, infirmary and rehabilitative services at home (domiciliare) or semi-residential and residential structures (semi-residenziale, residenziale). The same types of services are also granted to people with mental health problems and pathological addictions (DPCM 12.01.2017).

Municipalities provide social services, aimed at guaranteeing support to individuals and families with social needs of various kind, including needs related to care and social inclusion of people with disability (Law 328/2000). Specifically, the latter include a multidimensional assessment and an individual plan, residential and semi-residential assistance, homecare and at-school assistance, educative support at home and at school, socio-labour services (e.g. work experiences and SIL – Servizio Inserimento Lavorativo), and social transport.

The division between health and social services does not correspond to the realities of the needs of people with disability. Often, their needs are complex and include several of these areas. Several interventions from the health and social realm can, and often will, concur, consistent with the aim of a multidimensional and tailored set of interventions for the specific needs of people with disability. This requires, or would require, a substantial level of co‑ordination, especially as there is no single point of entry that assesses the needs and activates the delivery of services (again, see Chapter 2).

3.3.1. Residential and homecare services

Residential services and homecare can be provided both by Health Agencies and by municipalities. The main difference between the services offered by the two entities is that residential and homecare services under Health Agencies have the objective to meet medical needs, while those under municipalities have a social inclusion objective. However, many residential, semi-residential and homecare services cater a mix of medical and social inclusion needs.

Spending on residential and homecare services for people with disability represents almost 1% of GDP (Table 3.6). Health Agencies alone spent 0.92% of GDP in 2019 on homecare and residential (and semi-residential) services, capturing most health spending on people with disability, excluding staff costs and other expenses that are difficult to attribute. For reference, total healthcare spending was 8.5% of GDP in 2019, implying that spending for people with disability, including those with mental health issues and lack of autonomy, represent 11% of the total spending on healthcare (OECD, 2023[6]).

Spending on services for people with disability by municipalities was 0.11% of GDP in 2018, out of a total 0.42% of GDP spending by municipalities (ISTAT, 2022[7]). Homecare and residential services represent 45% of the municipal spending, indicating that also from the social inclusion side, a large part of resources go to providing residential, semi-residential and homecare services.

Spending on residential services remains high, despite efforts to promote the de‑institutionalisation of people with disability. In line with the UN Convention on the Rights for People with Disability, Italy is supporting the de‑institutionalisation of people with disability by increasing homecare financing. Three funding initiatives implemented in the last decades aim at promoting the transition from residential to homecare services: the Non-Self-Sufficiency fund (FNA), established by L. 296/2006; the “Fund for the assistance of people with severe disability without family support (“After Us” Fund), established by Law 112/2016; and the Family Caregivers fund (DM 26.07.2016; L. 205/2017 art. 254) with the aim to promote legislative intervention toward caregivers support. While this increase in specific funding is visible in terms of the much larger coverage of homecare compared to residential services (see Chapter 4), the cost of residential services per user is much higher, resulting in a greater overall spending.

Table 3.6. Spending on residential and homecare services represents almost 1% of GDP

Spending on homecare and residential services for people with disability by actor, as a share of GDP (%), 2019

|

Homecare |

Residential |

Total |

|

|---|---|---|---|

|

Health Agencies |

0.28 |

0.64 |

0.92 |

|

Municipalities |

0.02 |

0.03 |

0.05 |

Source: OECD calculations using BDAP – Ragioneria Generale dello Stato, Modello di rilevazione dei Livelli di Assistenza, https://bdap-opendata.rgs.mef.gov.it/content/2019-modello-di-rilevazione‑dei-livelli-di-assistenza-degli-enti-del-ssn (2019), Istat Spesa Sociale dei Comuni www.istat.it/it/archivio/7566, and OECD GDP data https://data.oecd.org/gdp/gross-domestic-product-gdp.htm (accessed October 2023).

Many residential structures are a jointure between municipalities and Health Agencies, offering medical and inclusion services. However, municipalities can also offer non-medical inclusion residences. Taking the example of Campania, residential solutions can range from autonomous apartment-sharing (Gruppo Appartamento) to more structured cohabitation situations (Comunità Alloggio), to proper residential structures where some minimum health services are also ensured (Comunità Tutelare per Persone non-autosufficienti). For semi-residential structures, the offer can vary even more, depending on municipal initiatives. For instance, the municipality of Cagliari in Sardinia sets up centres to promote creativity, where people with disability are helped socialising and improving their mental well-being through theatre workshops, animation and body expression, or painting.

Homecare services are also provided by both health authorities and municipalities. Health authorities will finance infirmary, rehabilitative, medical, and psychological support services at home or outpatient. Municipalities’ homecare services include homecare intervention assistance (servizio assistenza domiciliare) for the support of social integration (e.g. educational support, transports) and basic care for independent living (hygiene, meals, mobilisation, caregivers support, etc.). Homecare services can be granted either directly or through the reimbursement of family costs (e.g. assegno/voucher di cura).

While residential and homecare services are a regional and local competence, the national government regulates its provision by setting minimum levels of service provision (= minimum standards). Since 2001, the Ministry of Health sets standards for Health Agencies (Livelli Essenziali di Assistenza, LEA) which, for people with disability, mostly relate to the minimum numbers of beds in residential and semi-residential structures. Most recently, the 2022 budget law (law n. 234/2021) sets minimum standards also for social services (Livelli Essenziali Delle Prestazioni Sociali, LEP), aiming to close large regional disparities in the provision of social services, including residential and homecare services for people with disability.

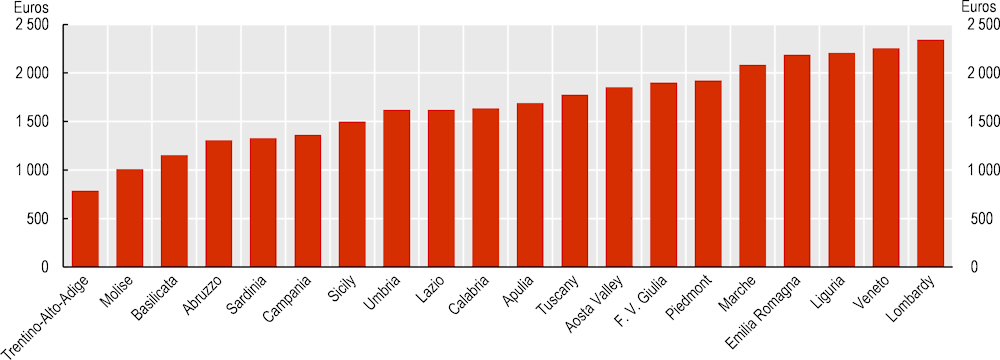

Despite substantial efforts to harmonise minimum levels of service, regional differences in service provision continue to be large, again following a strong North-South divide. Figure 3.5 illustrates this for the case of spending on health services for people with disability: spending ranges from EUR 1 011 per person in Molise to EUR 2 343 per person in Lombardy. Similar data for spending on social services are unavailable but as these services are provided locally, differences across the country are likely to be even larger.

Figure 3.5. Regional differences in service provision are large, following a North-South divide

Source: OECD calculations using BDAP – Ragioneria Generale dello Stato, Modello di rilevazione dei Livelli di Assistenza, https://bdap-opendata.rgs.mef.gov.it/content/2019-modello-di-rilevazione‑dei-livelli-di-assistenza-degli-enti-del-ssn (2019) and Istituto Nazionale di Statistica (ISTAT) population data.

It should be noted that available data do not allow measuring the number of service users. Moreover, the data presented in Figure 3.5 are a lower bound for total spending on health services, particularly for those regions with substantial autonomy in the management of their healthcare system, as they capture only healthcare spending falling under the monitoring process to the national government. This is very relevant for instance for the Autonomous Province of Trento, where some spending is not reported in this figure, explaining the low per capita spending for this region.

3.3.2. Social services

Social services include employment and social inclusion initiatives tailored for people with disability, typically administered by municipalities. Social services include the support by social workers to orient people with disability on the services and in-kind benefits available, on multidimensional assessments, and on the administrative costs of individual plans. They also include means-tested economic supports, for instance contributions for housing contributions to residential and semi-residential fees (integrazioni rette), vouchers for care services (e.g. assegno di cura), specific contributions supporting people with disability in the work or training stages (indennità di partecipazione), and cost sharing or fee reductions for relational, cultural and recreational services. The largest spending however goes to employment and social integration services, described in more detail in the following.

Employment integration

Most regions roll out programmes like the “Servizio Inserimento Lavorativo” (SIL). Targeted at people with disability registered under L.68/1999, these programmes aim to enhance social and vocational skills of individuals looking for work and can serve as preliminary steps or alternatives to traditional employment. The interventions range from inclusive training internships to employment grants.

Other employment programmes include local grassroots initiatives, many of which are financed by the European Commission (through ESF funds), such as the INCLUDIS project in Sardinia, which aims to provide work experience to people with disability. Funding for this project was close to EUR 6 million for 1 223 people with disability, or close to EUR 5 000 per person. Of those 1 223 participants, 719 ended up in an internship in one of the private co‑operatives partnering with municipalities for the purpose of this project. There is no information on how many ended up in employment.

Social inclusion

Social inclusion services are designed to facilitate daily living at home and within the broader community. Examples are socio‑educational services often delivered via individual tutorship, family mediation, projects to promote independent living, co-housing assistance, mobility and transportation provisions, and caregiver support. It is also noteworthy that individuals with disability receive priority for social housing allocations (L.104/92). The overarching goal across these initiatives is promoting the highest degree of independent living. The establishment of the Support Administrator role (L.6/2004) stands out as a significant move towards bolstering autonomy and self-determination for people with disability.

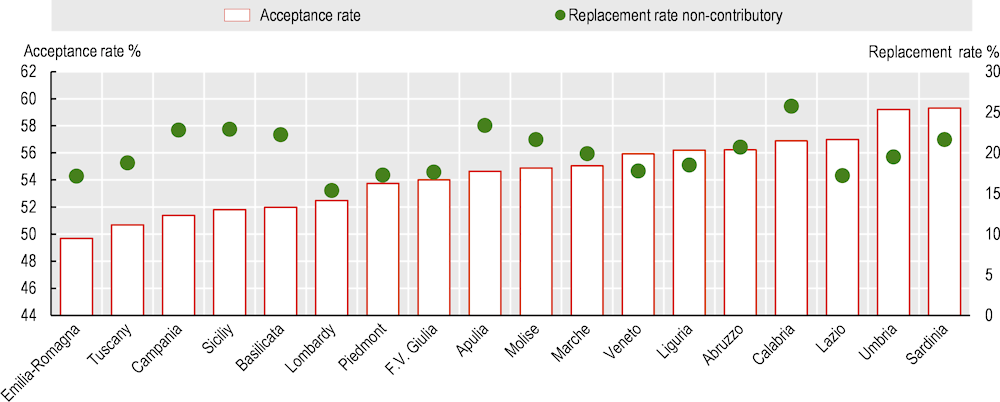

The largest social inclusion programmes are the “Dopo di noi” project (Law 112/16) and the “Independent Life Project”. Both projects are available in most regions since they are financed by national-level funds. The two programmes have a similar goal, in that they provide support (financial and in-kind) to people with disability of working age with a handicap certification to support their independent living. The two projects are funded by separate funds, and thus require parallel bookkeeping, a clear duplication of work for local authorities and a barrier for users in deciding which programme to use. Beyond duplication, and despite being a national priority, data show the limited reach of these projects, at an extraordinary cost.

By way of example, in Sardinia (2020), out of 41 000 individual plans, just 58 people benefitted from an Independent Life Project (for a financing of EUR 1.3 million, or EUR 22 413 per person). For Campania, data suggest that in 2016‑17, 394 people benefitted from the “Dopo di noi” project. Figure 3.6 plots the take‑up of Dopo di noi in every single municipality (and consortium) in Campania against the total resources assigned for this project. The average cost per user is EUR 28 274, a magnitude comparable to the Independent Life Project in Sardinia. The large variation in resources used for this project, despite the small number of users in many municipalities, is astounding. This highlights the clash between specific earmarked funds provided by the national government without assuring the necessary capacity at the local level, to implement the programmes equally and effectively.

Figure 3.6. Independent living projects: High costs per user at the expense of a limited reach

The next chapter builds on this description of disability supports available in Italy and takes a broader system perspective to assess the effectiveness and performance of social protection for people with disability. It raises the importance of looking beyond disability systems only to assess the adequacy and coverage of social protection for people with disability; highlights how disability assessment may contribute to system inefficiencies; and looks deeper into geographical inequalities of the social protection system.

References

[1] INPS (2022), Osservatorio sulle pensioni erogate dall’INPS, https://www.inps.it/osservatoristatistici/6/37/o/378 (accessed on 3 October 2022).

[3] INPS (n.d.), Incremento delle prestazioni di invalidità civile (invalidi civili totali, ciechi civili, sordi e titolari di pensione di inabilità previdenziale), 2020, https://www.inps.it/news/incremento-delle-prestazioni-di-invalidita-civile-invalidi-civili-totali-ciechi-civili-sordi-e-titolari-di-pensione-di-inabilita-previdenziale (accessed on 19 November 2022).

[7] ISTAT (2022), La Spesa dei Comuni per I Servizi Sociali (The Expenditure of Municipalities on Social Services), https://www.istat.it/it/archivio/253929.

[4] Ministero dell’Economia e delle Finanze (2022), Le Tendenze di Medio-Lungo Periodo del Sistema Pensionistico d Socio-Sanitario.

[5] Ministry of Labour and Social Policy (2021), Camera dei deputati relazione sullo stato di attuazione della legge recante norme per il diritto al lavoro dei disabili.

[6] OECD (2023), OECD Health Statistics 2023, https://oe.cd/ds/health-statistics.

[2] OECD (2022), Disability, Work and Inclusion: Mainstreaming in All Policies and Practices, OECD Publishing, Paris, https://doi.org/10.1787/1eaa5e9c-en.