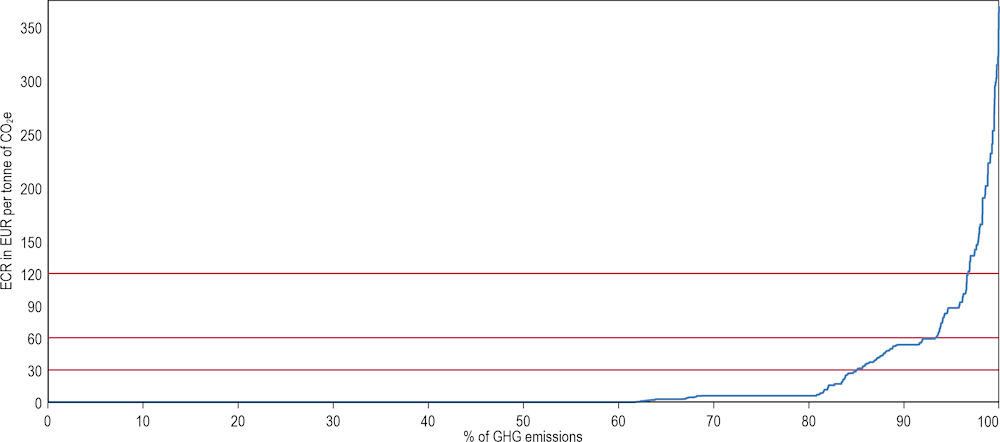

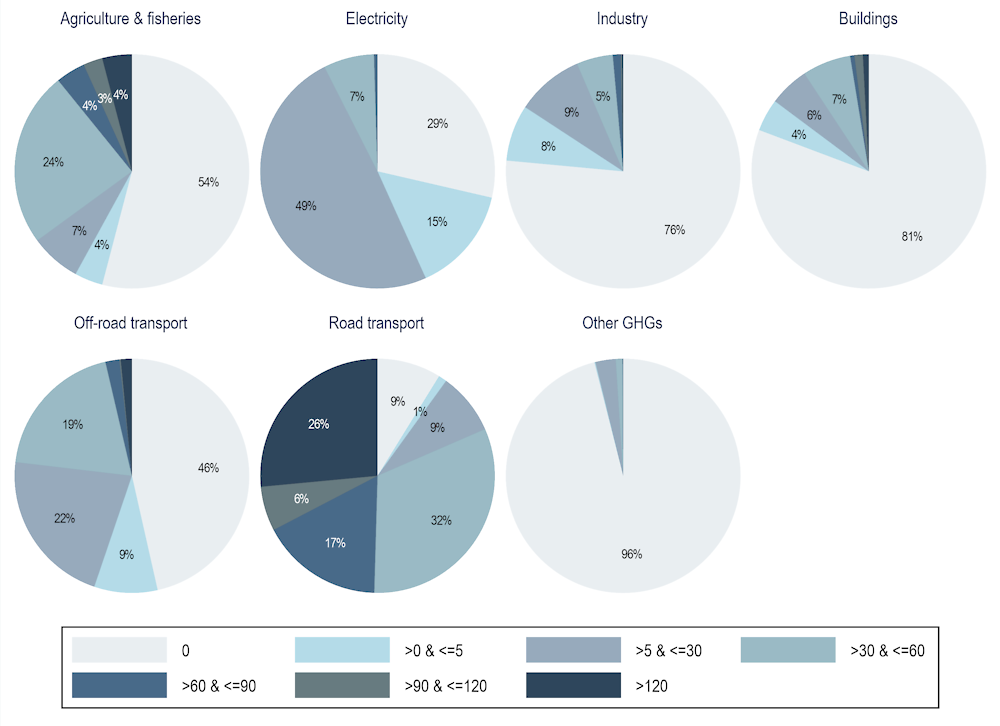

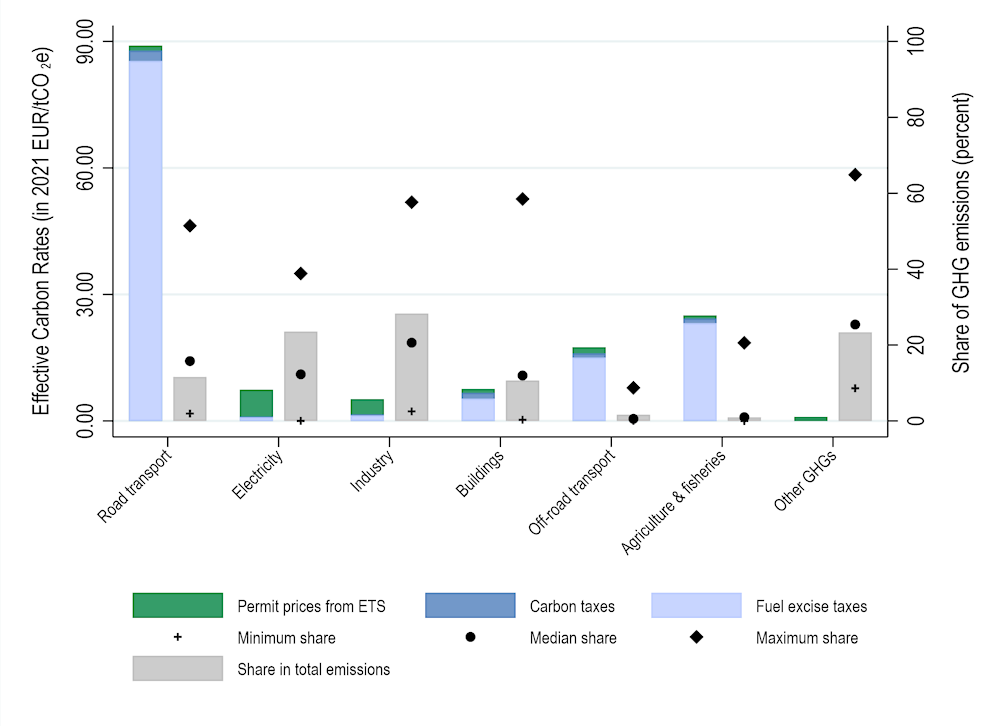

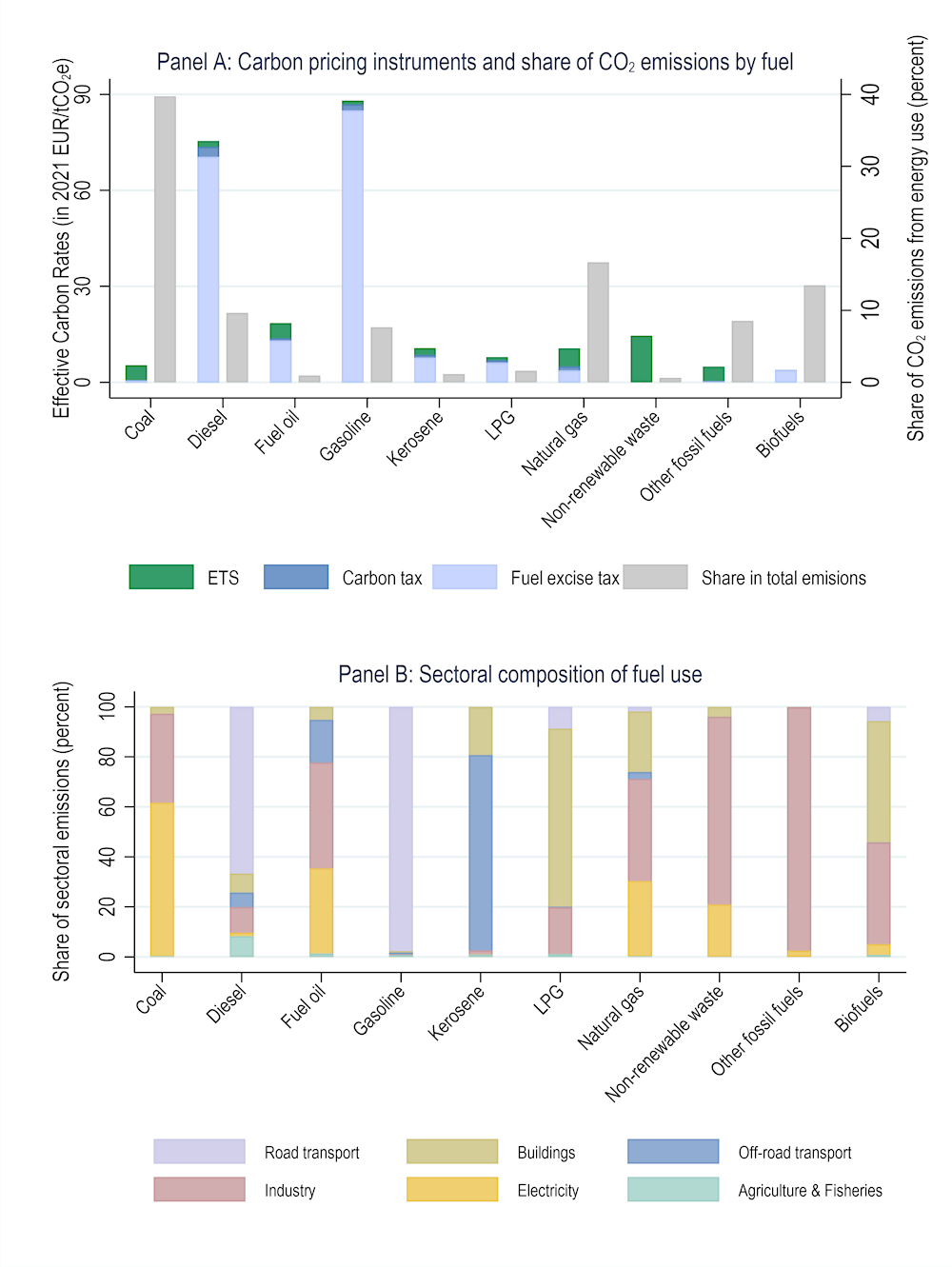

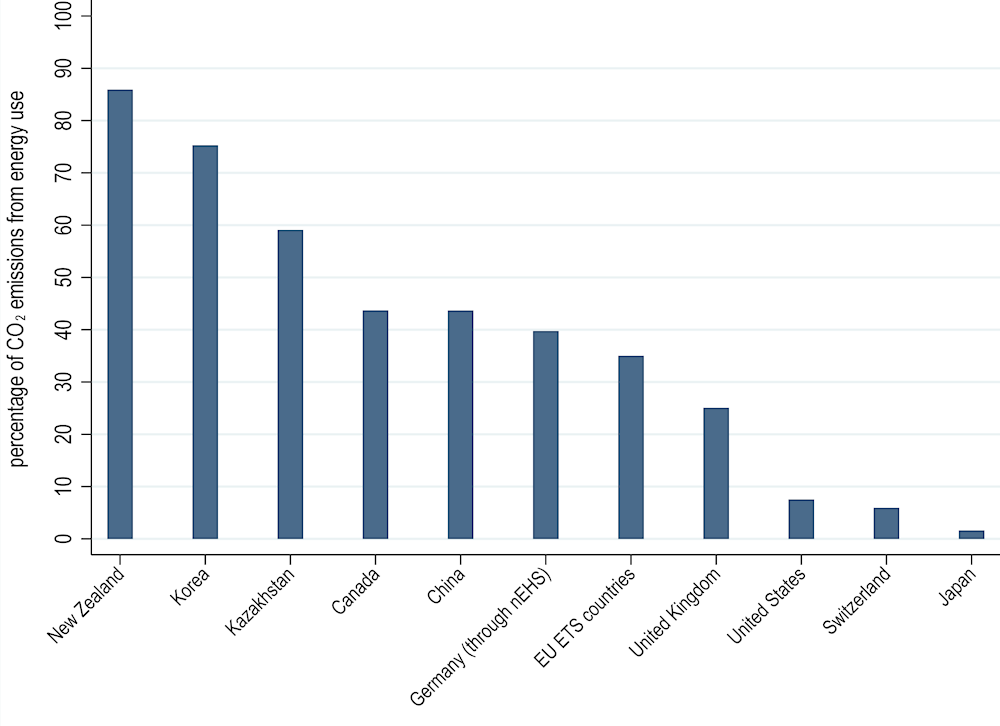

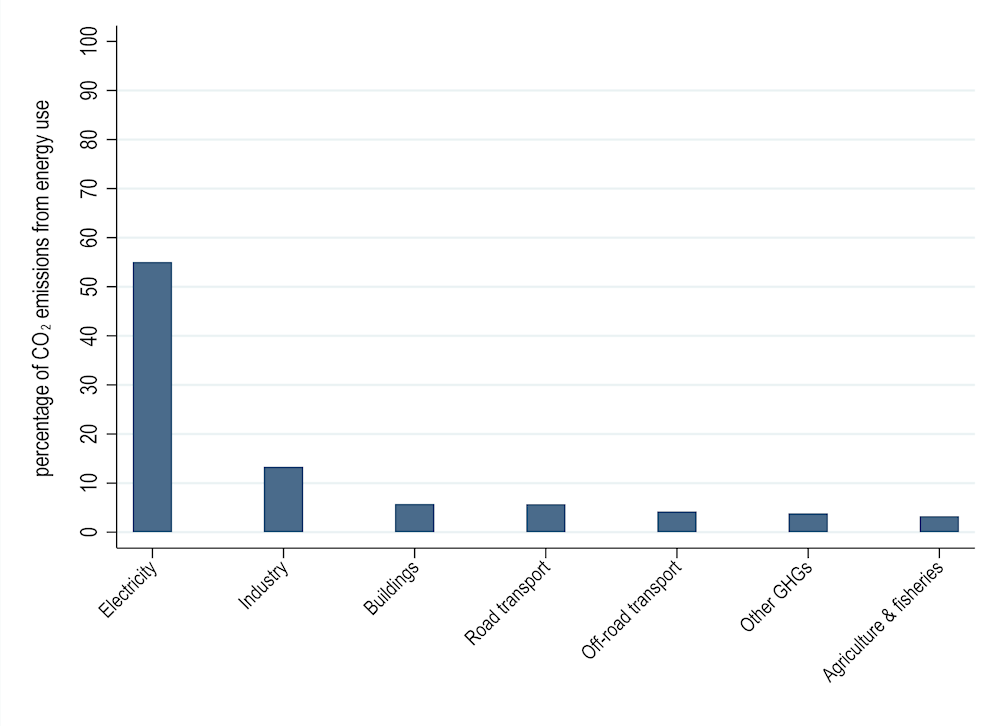

This Annex presents Effective Carbon Rates (ECRs) results from Chapter 2 , as well as ETS country and sectoral coverage (see Chapter 3) when accounting for CO2 emissions from biofuel combustion. These emissions represent a non-negligeable share of CO2 emissions from energy use (about 13.5%, see Figure A A.4, Panel A). CO2 emissions from biofuel combustion face low price coverage and levels. Accordingly, when accounting for CO2 emissions from biofuel combustion, 38% of total GHG emissions are priced (Figure A A.1). Coverage decreases in all six sectors responsible for CO2 emissions from energy use, and mostly so in the buildings sector, where the share of emissions facing no carbon price goes from 64% when excluding these emissions, to 81% when including them (Figure A A.2). When accounting for emissions from biofuels, the shares of buildings in total GHG emissions goes up from 6.3% to 10.7%. ECRs in this sector are much lower, as fuel excise taxes often exempt or present lower rates on biofuels (biofuels face the second lowest average ECR after coal, see Figure A A.4, Panel A), especially when used for residential and commercial purposes. ECRs in the industry sector are lower as well, since prices in that sector most stem from emissions trading systems (ETS), which generally do not apply to CO2 emissions from biofuel combustion (except for the German nEHS, which covers biofuels which do not follow certain sustainability criteria) (Figure A A.3). This also explains why ETS coverage is lower in all countries and sectors when accounting for CO2 emissions from biofuel combustion (Figure A A.5, Figure A A.6). This is especially the case for the buildings and industry sector, which is where biofuels are most used (Figure A A.4, Panel B).

Effective Carbon Rates 2023

Pricing Greenhouse Gas Emissions through Taxes and Emissions Trading

OECD Series on Carbon Pricing and Energy Taxation