[20] Aghion, P. et al. (2016), “Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry”, Journal of Political Economy, Vol. 124/1, pp. 1-51, https://doi.org/10.1086/684581.

[12] Andersson, J. (2019), “Carbon Taxes and CO2 Emissions: Sweden as a Case Study”, American Economic Journal: Economic Policy, Vol. 11/4, pp. 1-30, https://doi.org/10.1257/pol.20170144.

[34] Baudry, G. et al. (2017), “The challenge of measuring biofuel sustainability: A stakeholder-driven approach applied to the French case”, Renewable and Sustainable Energy Reviews, Vol. 69, pp. 933-947, https://doi.org/10.1016/j.rser.2016.11.022.

[21] Calel, R. and A. Dechezleprêtre (2016), “Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market”, Review of Economics and Statistics, Vol. 98/1, pp. 173-191, https://doi.org/10.1162/rest_a_00470.

[50] CCC (2020), The Sixth Carbon Budget - Methodology Report.

[49] CCC (2020), The Sixth Carbon Budget - The UK’s path to Net Zero.

[25] Climate Watch (2022), https://www.climatewatchdata.org.

[22] D’Arcangelo, F. et al. (2023), “Corporate cost of debt in the low-carbon transition: The effect of climate policies on firm financing and investment through the banking channel”, OECD Economics Department Working Papers, No. 1761, OECD Publishing, Paris, https://doi.org/10.1787/35a3fbb7-en.

[15] D’Arcangelo, F. et al. (2022), “Estimating the CO2 emission and revenue effects of carbon pricing: New evidence from a large cross-country dataset”, OECD Economics Department Working Papers, No. 1732, OECD Publishing, Paris, https://doi.org/10.1787/39aa16d4-en.

[5] Dechezleprêtre, A. et al. (2022), “Fighting climate change: International attitudes toward climate policies”, OECD Economics Department Working Papers, No. 1714, OECD Publishing, Paris, https://doi.org/10.1787/3406f29a-en.

[13] Dechezleprêtre, A., D. Nachtigall and F. Venmans (2018), “The joint impact of the European Union emissions trading system on carbon emissions and economic performance”, OECD Economics Department Working Papers, No. 1515, OECD Publishing, Paris, https://doi.org/10.1787/4819b016-en.

[6] Dimanchev, E. and C. Knittel (2023), “Designing climate policy mixes: Analytical and energy system modeling approaches”, Energy Economics, Vol. 122, p. 106697, https://doi.org/10.1016/j.eneco.2023.106697.

[11] Dussaux, D. (2020), “The joint effects of energy prices and carbon taxes on environmental and economic performance: Evidence from the French manufacturing sector”, OECD Environment Working Papers, No. 154, OECD Publishing, Paris, https://doi.org/10.1787/b84b1b7d-en.

[44] European Commission (2018), “A Clean Planet for all - A European strategic long-term vision for a prosperous, modern, competitive and climate neutral economy”, COM(2018) 773 final, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773.

[51] European Investment Bank Group (2020), “Climate Bank Roadmap. 2021-2025”, https://www.eib.org/attachments/thematic/eib_group_climate_bank_roadmap_en.pdf.

[16] Fetet, S. and M. Postic (2021), Global carbon accounts in 2021, https://www.i4ce.org/download/global-carbon-account-in-2021/.

[10] Green, J. (2021), “Does carbon pricing reduce emissions? A review of ex-post analyses”, Environmental Research Letters, Vol. 16/4, https://doi.org/10.1088/1748-9326/abdae9.

[19] Hicks, J. (1963), The Theory of Wages, Palgrave Macmillan UK, London, https://doi.org/10.1007/978-1-349-00189-7.

[23] ICAP (2023), Documentation Allowance Price Explorer, https://icapcarbonaction.com/en/documentation-allowance-price-explorer (accessed on 30 May 2023).

[39] ICAP (2023), “Emissions Trading Worldwide: Status Report 2023”, Berlin: International Carbon Action Partnership, https://icapcarbonaction.com/system/files/document/ICAP%20Emissions%20Trading%20Worldwide%202023%20Status%20Report_0.pdf.

[17] ICAP (2023), “Emissions Trading Worldwide: Status Report 2023.”, Berlin: International Carbon Action Partnership..

[30] IEA (2023), “Extended world energy balances”, IEA World Energy Statistics and Balances (database), https://doi.org/10.1787/data-00513-en (accessed on 28 March 2023).

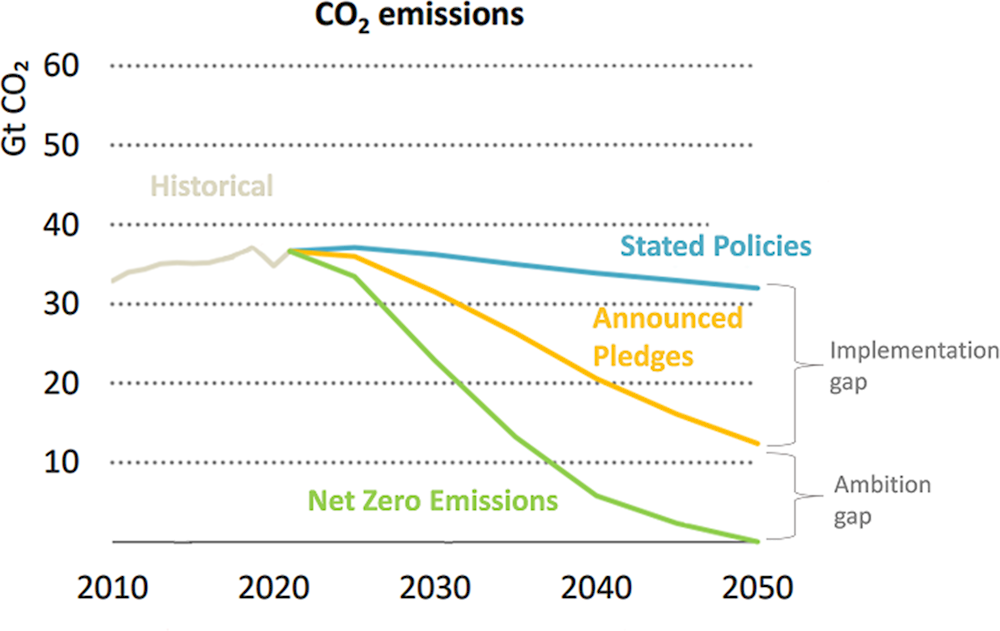

[3] IEA (2022), “World Energy Outlook 2022”, IEA, Paris, License: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A), https://www.iea.org/reports/world-energy-outlook-2022.

[47] IEA (2021), Net Zero by 2050 - A Roadmap for the Global Energy Sector.

[24] IEA (2020), Extended world energy balances (database), http://www.iea.org/statistics/topics/energybalances.

[26] IEA (2020), “World Energy Balances - 2020 Edition - Database documentation”, https://www.iea.org/subscribe-to-data-services/world-energy-balances-and-statistics.

[1] IPCC (2023), “Synthesis Report of the IPCC Sixth Assessment Report (AR6)”, https://report.ipcc.ch/ar6syr/pdf/IPCC_AR6_SYR_LongerReport.pdf.

[46] IPCC (2018), Global Warming of 1.5°C.

[33] Jeswani, H., A. Chilvers and A. Azapagic (2020), “Environmental sustainability of biofuels: a review”, Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences, Vol. 476/2243, https://doi.org/10.1098/rspa.2020.0351.

[43] Kaufman, N. et al. (2020), “A near-term to net zero alternative to the social cost of carbon for setting carbon prices”, Nature Climate Change, Vol. 10/11, pp. 1010-1014, https://doi.org/10.1038/s41558-020-0880-3.

[36] Kooten, G., C. Binkley and G. Delcourt (1995), “Effect of Carbon Taxes and Subsidies on Optimal Forest Rotation Age and Supply of Carbon Services”, American Journal of Agricultural Economics, Vol. 77/2, pp. 365-374, https://doi.org/10.2307/1243546.

[40] La Hoz Theuer, S. et al. (2023), “Offset Use Across Emissions Trading Systems”, Berlin: ICAP.

[9] Leroutier, M. (2022), “Carbon Pricing and Power Sector Decarbonisation: Evidence from the UK”, Journal of Environmental Economics and Management, Vol. 111, https://doi.org/10.1016/j.jeem.2021.102580.

[2] Net Zero Tracker (2023), Data Explorer, https://zerotracker.net/.

[38] OECD (2023), Air pollution effects (indicator), https://doi.org/10.1787/573e3faf-en (accessed on 4 May 2023).

[4] OECD (2023), Net Zero+: Climate and Economic Resilience in a Changing World, OECD Publishing, Paris, https://doi.org/10.1787/da477dda-en.

[41] OECD (2023), Reform Options for Lithuanian Climate Neutrality by 2050, OECD Publishing, Paris, https://doi.org/10.1787/0d570e99-en.

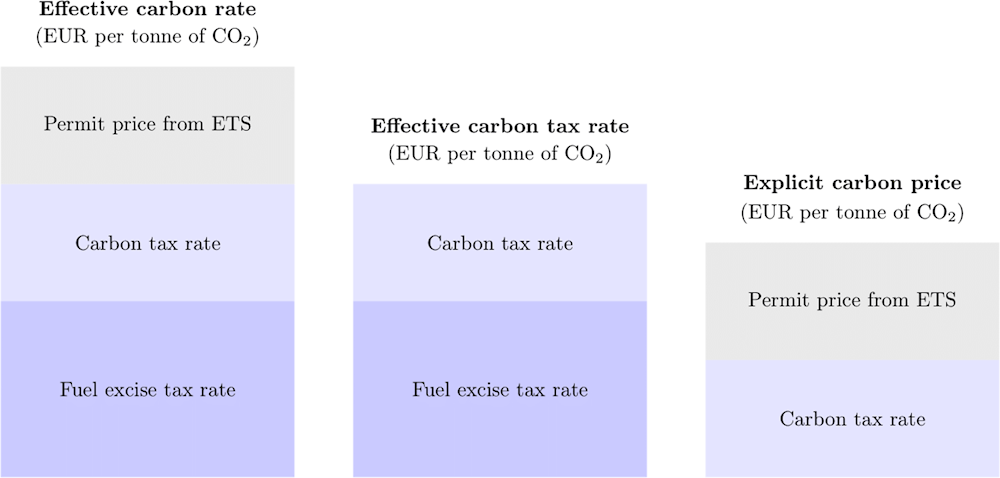

[28] OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

[42] OECD (2021), Effective Carbon Rates 2021: Pricing Carbon Emissions through Taxes and Emissions Trading, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/0e8e24f5-en.

[35] OECD (2021), OECD Environmental Performance Reviews: Finland 2021, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/d73547b7-en.

[37] OECD (2020), Environment at a Glance 2020, OECD Publishing, Paris, https://doi.org/10.1787/4ea7d35f-en.

[32] OECD (2019), Taxing Energy Use 2019: Using Taxes for Climate Action, OECD Publishing, Paris, https://doi.org/10.1787/058ca239-en.

[31] OECD (2018), Effective Carbon Rates 2018: Pricing Carbon Emissions Through Taxes and Emissions Trading, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/9789264305304-en.

[27] OECD (2016), Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/9789264260115-en.

[29] OECD (2015), Taxing Energy Use 2015: OECD and Selected Partner Economies, OECD Publishing, Paris, https://doi.org/10.1787/9789264232334-en.

[18] OECD (n.d.), OECD Taxation Working Papers, OECD Publishing, Paris, https://doi.org/10.1787/22235558.

[48] Quinet, A. (2019), La valeur de l’action pour le climat - Une valeur tutélaire du carbone pour évaluer les investissements et les politiques publiques.

[14] Sen, S. and H. Vollebergh (2018), “The effectiveness of taxing the carbon content of energy consumption”, Journal of Environmental Economics and Management, Vol. 92, pp. 74-99.

[45] Stern, N. et al. (2022), “A Social Cost of Carbon consistent with a net-zero climate goal”, Roosevelt Institute, https://rooseveltinstitute.org/wp-content/uploads/2022/01/RI_Social-Cost-of-Carbon_202201-1.pdf.

[8] Van Dender, K. and A. Raj (2022), “Progressing carbon pricing - a Sisyphean task?”, Gestion & Finances Publiques 7, pp. 43-57, https://doi.org/10.3166/gfp.2022.ns.010.

[7] van der Ploeg, F. and A. Venables (2022), Radical climate policies, University of Oxford, https://ora.ox.ac.uk/objects/uuid:75d49b40-396d-454d-a07f-59b452de6e51.