This chapter describes the economic and fiscal policies adopted during the crisis, particularly those aimed at supporting business. It compares the measures adopted in Luxembourg with those of other OECD Member countries. The chapter offers a detailed analysis of the use of the various measures by the size, sector and pre-crisis financial health of the beneficiary companies. It also includes the results of an impact assessment analysing how the support received by businesses affected their performance. Finally, this chapter makes recommendations for improving the targeting, implementation and impact of emergency economic and fiscal policies.

Evaluation of Luxembourg's COVID-19 Response

6. Emergency economic and fiscal measures in Luxembourg

Abstract

Key findings

Fiscal measures were in line with those adopted by comparable OECD member countries

Of the EUR 3.57 billion that Luxembourg allocated to deal with the COVID-19 crisis over two years, EUR 2.85 billion went to companies and households (including EUR 200 million in the form of State‑guaranteed loans). This amounts to 3.8% of the country’s GDP (2021) and is similar to spending levels in other European countries. Notably, Luxembourg opted to prioritise employment support measures, and this enabled it to maintain a relatively high level of employment, especially in the early stages of the crisis.

Economic policies met the needs of most economic sectors

Business support measures include a variety of programmes. In Luxembourg, these measures have been able to meet the needs of most economic sectors. The most popular measures with companies are short-time work, repayable advances, support for uncovered fixed costs, recovery support and State-guaranteed loans. However, short-time work did not apply to the self-employed, who received a dedicated support measure in the form of a lump-sum two weeks after the first lump-sum support for companies.

Support for business was granted quickly and easily, despite some initial hesitation

The first measures were put in place during the early weeks of the crisis, after the State of Emergency Act was passed on 24 March 2020. Relatively flexible fiscal procedures, together with regular reporting of fiscal information to parliament, allowed the government to commit and disburse the necessary funds quickly.

The public authorities in Luxembourg have been responsive and have been able to cope with a large influx of requests for support from companies, working with employers’ associations and making effective use of IT tools. This agility allowed companies to obtain assistance quickly – a decisive factor in safeguarding their liquidity.

The support measures covered the economic sectors hardest hit by the crisis

Subsidies primarily targeted those companies that were hardest hit by the crisis. The top four deciles of hardest-hit companies in terms of reduced turnover in 2020 have received 57% of the total amount of subsidies, which is in line with the objective of supporting those sectors most exposed to the crisis.

The measures have largely focused on companies that were previously in good health and suffered during the crisis

Overall, the support measures have benefitted to a greater extent those companies whose financial health was neither very good nor very bad. In contrast, smaller total amounts have benefitted those companies in poor or excellent financial health. This finding is consistent across all of the support measures analysed and regardless of the financial health indicator employed. The finding suggests that the support has primarily helped companies that were doing relatively well before the crisis but needed assistance to survive the crisis.

The support measures seem to have protected the financial position of companies in the sectors hardest hit by the crisis

The amounts of assistance and employment support have been broadly sufficient to protect the financial position of most companies, as measured by profits, liquidity and solvency. Bankruptcy rates in the hotel, restaurant and café sector (HORECA), one of the hardest hit by the crisis, are decreasing, which confirms that the support put in place for this sector has been somewhat effective. The sectors hardest hit by the crisis will, however, require increased monitoring as some, such as HORECA, are facing structural changes due to the development of remote working and videoconferencing.

6.1. Introduction

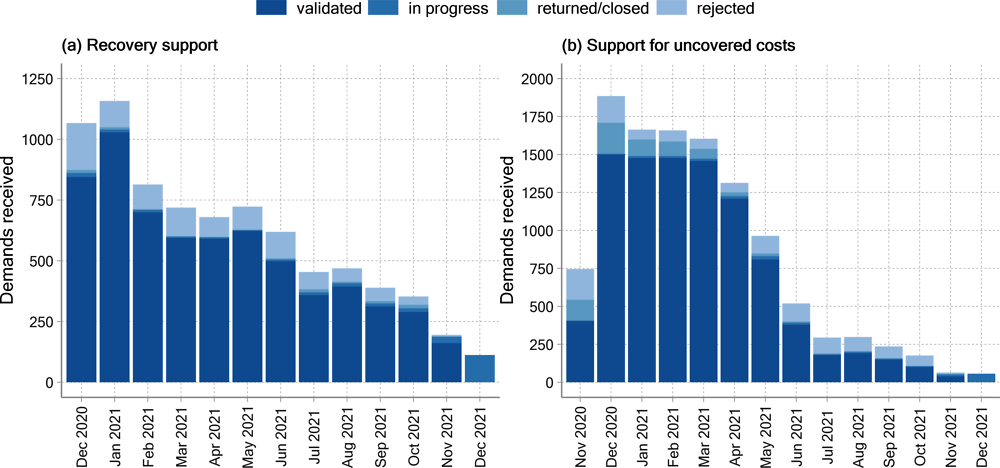

Faced with the health crisis, the fiscal response of OECD Member countries was swift, massive and multifaceted. In Luxembourg, the comprehensive business support package was similar to those deployed by many OECD Member countries. It included a variety of measures aimed at providing a response tailored to each company’s situation. These measures can be grouped into four main categories: i) tax deferrals; ii) measures to maintain employment; iii) direct support; and iv) State loans and guarantees. For each of these four categories, Figure 6.1 sets out the measures covered in this chapter. The measures analysed were selected based on their relative share of disbursements within Luxembourg’s emergency plan.

To address the economic impact of the health crisis, stabilisation and recovery plans have been put in place to support and accelerate the ongoing recovery and future growth. The recovery package will not be considered in detail in this chapter because it would be premature to conduct an impact assessment on a set of measures that are still being implemented.

Figure 6.1. Luxembourg’s measures to support businesses during the COVID-19 crisis

Source: Prepared by the authors.

An analysis of discretionary measures to tackle COVID-19 shows that the support policies adopted in Luxembourg have been commensurate with the needs of most economic sectors. The self-employed received less support at the start of the crisis; however, specific support measures were put in place during the crisis. Assistance was granted swiftly, a critical success factor in supporting companies that may run out of cash very quickly. Given the scale and speed of the intervention, the potential risk was of a windfall effect enabling companies to receive support when they did not need it. The OECD’s analysis suggests that this has not been the case: the companies hardest hit by the crisis are those that have received the most support. The analysis demonstrates that it is important to continue to monitor the financial health of businesses to ensure that future interventions can be appropriately targeted. It also seems necessary to continue to digitalise administrative procedures. The digitalisation effort has proved its value during the crisis and can help create a resilient business climate.

The rest of the chapter is structured as follows: it first assesses the overall package implemented by Luxembourg by comparing it with those adopted in other OECD member countries. It then looks at the implementation of the support measures, analysing the procedures for applying for and granting assistance, as well as the budgetary procedures used to disburse the necessary funds. The chapter then goes on to address the issue of targeting by analysing the use of support measures. It also presents the results of a microsimulation that offers some elements that will help evaluate the impact of the measures on business performance.

6.2. The features of the business support measures in Luxembourg and the main expenditure items

In Luxembourg, the first business support measures were put in place very quickly to accompany the strict lockdown implemented on 18 March 2020. Most of the measures followed the Communication from the European Commission on 19 March 2020 introducing changes to the State aid regulations (see Box 6.1). The objective of Luxembourg and most of the countries in the region was to protect domestic industry for a future recovery and to limit the social impact of the business shock. In Luxembourg, short‑time work was the key measure in terms of the amount of total expenditure. In this respect, the choices made by Luxembourg are in line with those made by other open economies such as Ireland and Belgium. Liquidity measures, such as State loans and guarantees, have been less important in Luxembourg, limiting the risk of long-term corporate debt as the crisis ends.

Box 6.1. The European Union’s Temporary Framework

Faced with the exceptional circumstances caused by the pandemic, the European Union issued a communication on 19 March 2020 introducing a temporary change to the rules on business support.

Article 107 of the Treaty on the Functioning of the European Union regulates the granting of aid to protect competition within the single market. Paragraph 2 of Article 107 already allowed Member States to introduce a generalised short-time work programme, to suspend taxes paid by businesses and to subsidise businesses directly affected by the pandemic (for example in the aviation, tourism or trade sectors) under the provision on aid to make good the damage caused by natural disasters or exceptional circumstances. Paragraph 3 allows for economic support to be expanded in the event of a “serious disturbance in the economy of a Member State.”

The nature and scale of the COVID-19 pandemic enabled Member States to activate paragraph 3 of Article 107. However, given the magnitude of the situation, the Commission prepared a special legal basis for all Member States. This Temporary Framework made it possible to supplement and regulate the opportunities available while taking into account common competition issues. It authorised the introduction of State-guaranteed loans and public loans at favourable interest rates, which were to be capped at EUR 800 000 per company. Recipient companies had to be experiencing difficulties due to the pandemic.

Implementation of these measures by the Member States was, however, subject to prior approval by the European Commission, which was granted swiftly. The Commission approved the introduction of a repayable advance programme in Luxembourg on 24 March.

This regulation, which was amended six times, remained in force until 30 June 2022. The 27 Member States introduced a total of around EUR 3 200 billion in support within this framework.

Source: Communication from the European Commission: Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak (2020/C 91 I/01), https://eur-lex.europa.eu/legal-content/en/TXT/PDF/?uri=CELEX:52020XC0320(03)&from=EN; the State Aid Temporary Framework, https://competition-policy.ec.europa.eu/state-aid/coronavirus/temporary-framework_en.

6.2.1. Business support measures were put in place at the beginning of the pandemic

As in many other European countries, the adjustment in the labour market in Luxembourg took the form of a reduction in the average working time per employee. The aim was to limit the rise in unemployment by reducing working hours through short-time work. This involved a large-scale programme in which public funding has played the most significant role in supporting businesses. In addition to the “force majeure/COVID-19” short-time work programme, which was implemented in March 2020, the employment measures included COVID-19-related family leave. This enabled employees and the self-employed to care for their loved ones following the closure of schools, childcare facilities and care homes for people with disabilities and the elderly.

At the same time, from late March 2020, the Government implemented several waves of direct, non-repayable support. This was initially aimed at businesses with fewer than ten employees (microenterprises). Self-employed people, who were also eligible for this assistance, were specifically targeted from April 2020 onwards. Companies with fewer than 20 employees received a second lump-sum payment in April 2020, and self-employed people in May 2020. From June 2020, recovery support provided all small businesses in the tourism, events, HORECA, culture and entertainment sectors, as well as the self-employed, with a monthly grant of EUR 1 250 per employee in work and EUR 250 per employee on furlough. Businesses were eligible if they experienced a reduction in turnover of more than 25% compared to the same month in 2019.1 The recovery support measures were adjusted after March 2022 as part of a gradual reduction, and came to an end in June 2022. In November 2020, the government also introduced support for “uncovered fixed costs”. This direct, monthly, non-repayable support targeted the sectors hardest hit by the COVID-19 crisis: tourism, events, HORECA, culture and entertainment. It was intended to cover a portion of the monthly expenditure not covered by businesses’ revenues. Businesses were eligible if they had experienced a reduction in turnover of at least 40% compared to the same month in 2019. Recovery support and support for uncovered fixed costs were extended until June 2022. Other specific forms of financial support for the tourism (including vouchers for overnight stays), physical retail, culture, sport and agriculture sectors were introduced in the same period.

Companies experiencing liquidity issues resulting from the pandemic were also able to request the waiver of advance payments for direct taxes (corporate income tax and municipal business tax) for the first two quarters of 2020. For businesses operating in the HORECA sector, this option was extended to the third and fourth quarters of 2020. The government also helped companies affected by the COVID-19 crisis by accelerating the reimbursement of some tax claims (indirect taxes), in particular VAT credit balances of less than EUR 10 000. Unpaid VAT credit balances of less than EUR 10 000 were automatically refunded during the week of 16 March 2020. Penalties for late submission of VAT and other returns were waived.

In addition to non-repayable assistance, the Government also awarded capital grants to businesses, in the form of repayable advances, and guarantees to facilitate access to bank financing (Box 6.2).

Box 6.2. The main support measures taken by Luxembourg in response to the crisis

i) Tax and social security contributions waivers and deferrals

Waiver of tax advance payments and deferral of payment due date (18 March 2020): waiver of quarterly advance payments of community income tax and municipal business tax for the first two quarters of 2020 (until the second quarter of 2021 for the HORECA sector). The measure also allowed for payments of these two taxes and the wealth tax to be deferred for four months. Businesses and self-employed people who were struggling due to the pandemic were eligible.

Tax leniency (18 March 2020): reimbursement of unpaid VAT credit balances below EUR 10 000; abolition of penalties for late VAT and subscription tax reporting for companies experiencing difficulties due to the pandemic.

Other measures (1 April 2020): suspension of the calculation of interest on arrears for late payment of social security contributions; tax deduction for landlords who waived part of the rent owed by tenants during 2020 to encourage rent reductions (capped at EUR 15 000). Businesses and self-employed people who were struggling due to the pandemic were eligible.

ii) Employment support

Short-time work for “force majeure/COVID-19” (18 March to 24 June 2020): reinforcement and simplification of the pre-existing short-time work scheme allowing the payment of an advance to businesses who applied for it; beneficiaries committed not to laying off employees and had to be directly or indirectly affected by the health measures. The advance covered 80% of the wages paid to employees and apprentices, as well as workers on fixed-term contracts and temporary workers (27 March). This was increased to 100% for employees paid at the social minimum wage.

Structural short-time work scheme during the economic recovery period (1 July 2020 to 30 June 2022): a new simplified scheme for businesses affected by the health crisis. Conditions for receipt of support were more favourable to the HORECA, tourism and events sectors, which were deemed vulnerable (no limit on the number of eligible employees and ability to lay off employees). The conditions became progressively stricter. The scheme was suspended in July 2021 before being reactivated for vulnerable sectors in February 2022 until the end of June. Businesses that were required to close were covered by a temporary scheme which placed no limits on the number of eligible employees.

iii) Direct support

Lump-sum payments to microenterprises and small businesses (25 March to 24 June 2020): one-off payment for microenterprises (fewer than ten employees) and small businesses (fewer than 20 employees). The 25 March grant was EUR 5 000, and was paid to microenterprises and the self-employed who had to close their businesses due to the sanitary restrictions. On 24 April, the government introduced further payments of EUR 5 000 for microenterprises and EUR 12 500 for small businesses that had either closed or lost at least 50% of their turnover.

Lump-sum payments for the self-employed (8 April 2020 to 24 June 2020/29 January 2021 to 15 May 2021): scheme renewed three times. The first payment was EUR 2 500 and could not be combined with the 25 March 2020 payment. The second payment (6 May 2020) was EUR 3 000, EUR 3 500 or EUR 4 000 depending on revenues. Both payments were available until 24 June 2020 to the self-employed experiencing temporary financial hardship due to the pandemic. The third payment, in January 2021, was identical to the second one.

Recovery and Solidarity Fund/Recovery support (24 July 2020 to 30 June 2022): direct, monthly, non-repayable assistance for businesses in vulnerable sectors (tourism, events, HORECA, culture and entertainment) that experienced a reduction in turnover of at least 25% and did not lay off more than 25% of their employees. The amount of support granted was calculated by multiplying the number of employees and self-employed people working for the business by EUR 1 250 (EUR 250 for employees on short-time work). Businesses were eligible for support for the month of June 2020. The amount of support then gradually decreased. This support could not be combined with support for uncovered fixed costs, but it could be claimed alongside repayable advances and State guarantees.

Support for uncovered fixed costs (21 December 2020 to 30 June 2022): direct, monthly, non‑repayable assistance for businesses in vulnerable sectors (tourism, events, HORECA, culture and entertainment) that experienced a reduction in turnover of at least 40%. The support covered a portion of the monthly expenses not covered by business revenue. The eligible amount was calculated as the difference between 75% of expenditure and 100% of revenue. The State covered 70% of this amount (or as much as 90% for companies with fewer than 50 employees). Businesses were eligible for support for the month of November 2020.

iv) State loans and guarantees

Repayable advances (3 April 2020 to 31 December 2021): a State loan scheme for businesses and the self-employed experiencing difficulties due to the pandemic. The amount covered 50% of costs, including staff costs (capped at EUR 5 355) and rent (capped at EUR 10 000 per month per group). The interest rate was 0.5%. Repayment was to begin 12 months after the first advance payment. This support could be combined with the short-time work scheme and other support granted by the Ministry of Economy.

State guarantee scheme (21 April 2020 to 30 December 2021): a State guarantee scheme facilitating bank lending to businesses and self-employed people experiencing difficulties due to the pandemic. The State guaranteed 85% of the nominal amount of bank loans. The loan amount could cover up to 25% of a business’s turnover in 2019. Interest rates varied from 0.25% to 2% depending on the size of the business and the maturity of the loan. Businesses were obliged to first make use of other financing tools (Société Nationale de Crédit et d'Investissement (SNCI), a public-law banking institution in Luxembourg; the European Investment Bank (EIB); Office du Ducroire, Luxembourg’s export credit agency).

Special Anti-Crisis Financing (26 March 2020 to 31 December 2021): co-financing scheme operated by SNCI (60%) and banks (40%) for businesses experiencing difficulties due to the pandemic. The amount of financing ranged from EUR 12 500 to EUR 10 million. The maximum duration of the Special Anti-Crisis Financing was five years and repayments were to begin no later than two years after the funds were released.

Note: the names of the schemes are accompanied by their start and end dates.

Source: Government of the Grand Duchy of Luxembourg; prepared by the authors.

Analysis of the emergency measures implemented in Luxembourg and in six OECD Member countries (Belgium, France, Germany, Ireland, the Netherlands and Switzerland) confirms that the country took action as quickly as its neighbours (see Table 6.1). Other countries introduced or adapted pre-existing regular income replacement schemes for self-employed people. Luxembourg opted instead to adapt the legal framework for short-time work (which did not previously cover compensation for the self‑employed). In addition to repayable advances, the government introduced a non-repayable lump‑sum payment of EUR 2 500 for the self-employed on 8 April to partially offset the effects of the crisis. This payment came in addition to a first lump-sum payment granted to microenterprises, which benefitted also some self-employed people.

Table 6.1. Like its neighbours, Luxembourg was quick to support domestic businesses

List of schemes implemented in Luxembourg and in six OECD member countries in March and April 2020 (excluding tax waivers and deferrals)

|

Country (date of lockdown) |

Short-time work |

Income replacement for the self-employed |

COVID-19 parental leave |

State-guaranteed loan |

Loan |

Lump-sum payment for businesses |

Lump-sum payment for the self-employed |

|---|---|---|---|---|---|---|---|

|

Luxembourg (16 March 2020) |

|||||||

|

Name |

Chômage partiel (Short‑time work) |

N/A |

Congé (Leave) |

Garantie étatique (State guarantee) |

Avances rembour. (Repayable advances) |

Aide micro. (Microenterprise support) |

Aide indép. (Self-employed support) |

|

Date |

18 March |

N/A |

14 March |

21 April |

3 April |

25 March |

8 April |

|

Eligible |

Businesses |

N/A |

Businesses + self-employed |

Businesses + self‑employed |

Businesses + self‑employed |

Businesses + self‑employed |

Self-employed |

|

Switzerland (16 March 2020) |

|||||||

|

Name |

Réduction horaire de travail (RHT – Reduced working hours) |

Allocations pour pertes de gains (APG – Loss of earnings allowances) |

Cautionnements solidaires COVID (COVID guarantees) |

N/A |

N/A |

N/A |

|

|

Date |

20 March |

20 March |

25 March |

N/A |

N/A |

N/A |

|

|

Eligible |

Businesses + self‑employed |

Businesses + self‑employed |

Businesses + self‑employed |

N/A |

N/A |

N/A |

|

|

Netherlands (15 March 2020) |

|||||||

|

Name |

Noodmaatregel Overbrugging Werkgelegenheid (NOW) (Temporary emergency measure for employment) |

Tijdelijke Overbruggingsregeling Zelfstandige Ondernemers (TOZO) (Temporary support measure for the self-employed) |

N/A |

Garantie Ondernemingsfinanciering Corona (GO-C) & Borgstelling MKB Kredieten (BMKB) (COVID corporate financing guarantee & SME loans guarantee) |

N/A |

Tegemoetkoming Ondernemers Getroffen Sectoren COVID-19 (TOGS) (Support for business in COVID-affected sectors) |

|

|

Date |

6 April |

22 April |

N/A |

17 March |

N/A |

31 March |

|

|

Eligible |

Businesses |

Self-employed |

N/A |

Businesses + self‑employed |

N/A |

Businesses + self‑employed |

|

|

Germany (16 March 2020) |

|||||||

|

Name |

Kurzarbeitergeld (Short-time work) |

Grundsicherung für Solo-Selbstständige (Dedicated support for the Self-Employed) |

N/A |

Wirtschaftsstabilisierungsfond & KfW loans (Fund for Economic Stabilisation & KfW loans) |

N/A |

Soforthilfen (emergency support) |

|

|

Date |

14 March |

28 March |

N/A |

23 March |

N/A |

30 March |

|

|

Eligible |

Businesses |

Self-employed |

N/A |

Businesses + self‑employed |

N/A |

Businesses + self‑employed |

|

|

Ireland (15 March 2020) |

|||||||

|

Name |

Temporary Wage Subsidy Scheme (TWSS) |

Pandemic Unemployment Payment (PUP) |

Illness Benefit COVID-19 |

COVID Credit Guarantee Scheme (CCGS) |

MFI business loan/Working capital loan |

N/A |

N/A |

|

Date |

26 March |

13 March |

4 April |

1 April |

13 March/1 April |

N/A |

N/A |

|

Eligible |

Businesses |

Businesses + self‑employed |

Businesses + self‑employed |

Businesses |

Businesses + self‑employed |

N/A |

N/A |

|

Belgium (14 March 2020) |

|||||||

|

Name |

Chômage temporaire (Temporary layoff) |

Droit passerelle indépendants (Transitional benefit for self-employed people) |

N/A |

Régime de garantie fédérale (Federal guarantee scheme) |

N/A |

Primes régionales (Regional allowances) |

|

|

Date |

13 March |

24 March |

N/A |

1 April |

N/A |

15 and 27 March (Flanders and Wallonia) |

|

|

Eligible |

Businesses |

Businesses + self‑employed |

N/A |

Businesses + self‑employed |

N/A |

Businesses + self‑employed |

|

|

France (17 March 2020) |

|||||||

|

Name |

Activité partielle (AP – Short-time working) |

Congés pour garde d’enfant (Childcare leave) |

Prêt Garanti par l’État (PGE – State-guaranteed loan) |

Prêts bonifiés et Avances rembour. (Subsidised loans and repayable advances) |

Fonds de solidarité (Solidarity Fund) |

Aide du CPSTI aux indép. (Social protection for self-employed people) |

|

|

Date |

23 March |

16 March |

25 March |

26 April |

1 April |

10 April |

|

|

Eligible |

Businesses + self‑employed |

Businesses + self‑employed |

Businesses + self‑employed |

Businesses |

Businesses + self‑employed |

Self-employed |

|

Note: Cells marked N/A denote that a similar scheme of the same scale was not identified in the country concerned before 1 May 2020. In the vast majority of cases, the date corresponds to the date on which the scheme took effect or the date of publication of the legislation. Where these dates are not available, the date given is the most likely date based on government communications and available information on the subject. Where “businesses” and/or “self-employed” are marked as eligible, this does not mean that all businesses and/or all self-employed people were eligible for the scheme in question. Date of lockdown = date on which the HORECA sector was closed.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional governments of Belgium; EU PolicyWatch (Eurofound); prepared by the authors.

6.2.2. Fiscal measures focused on supporting employment

The measures adopted in Luxembourg with the largest budgetary impact were:

short-time work, with a total of EUR 1 208 million granted;

family leave, amounting to EUR 288 million in 2020 and 2021;

the Recovery and Solidarity Fund, with a total of EUR 271 million granted (EUR 110 million for recovery support and EUR 161 million for support for uncovered fixed costs);

the State guarantee scheme, with a total of EUR 194 million guaranteed for loans taken out in 2020 and 2021;

repayable advances granted to businesses amounting to a total of EUR 180 million.

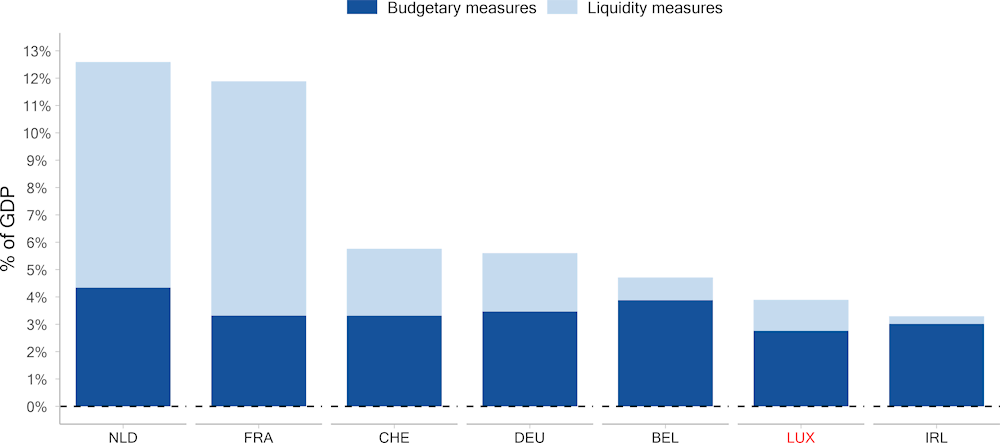

To better assess the relative importance of the measures implemented in Luxembourg, the budgetary effort has been compared with the efforts of other OECD Member countries (Belgium, France, Germany, Ireland, the Netherlands and Switzerland) along the four main types of business support measures: i) tax and social security contribution waivers and deferrals; ii) short-time work and leave; iii) direct support; and iv) State loans and guarantees.

Business support measures

Estimating the total value of emergency schemes in OECD Member countries, as well as the breakdown of expenditure across different areas, is a difficult task. Measures are not categorised the same way in different countries. The availability and frequency of data updates also varies. Nevertheless, this exercise is useful because it enables a better assessment of the choices made in a given country compared with the efforts of other OECD Member countries.

Overall, a degree of heterogeneity can be seen in the relative scale of national schemes.1 In 2020‑21, of the EUR 3 570 billion allocated to tackle the COVID-19 crisis, Luxembourg allocated EUR 2 850 billion in support to businesses and households. This represents 3.9% of its annual GDP in 2021. It is an effort comparable to that of Belgium, which devoted 4.7% of GDP, and Ireland, which devoted 3.3% of GDP. These economies were relatively less affected by the crisis and were therefore able to bounce back more quickly. In other countries, the effort was greater: it amounted to 12.6% of GDP in the Netherlands, 11.9% in France and 5.6% in Germany.

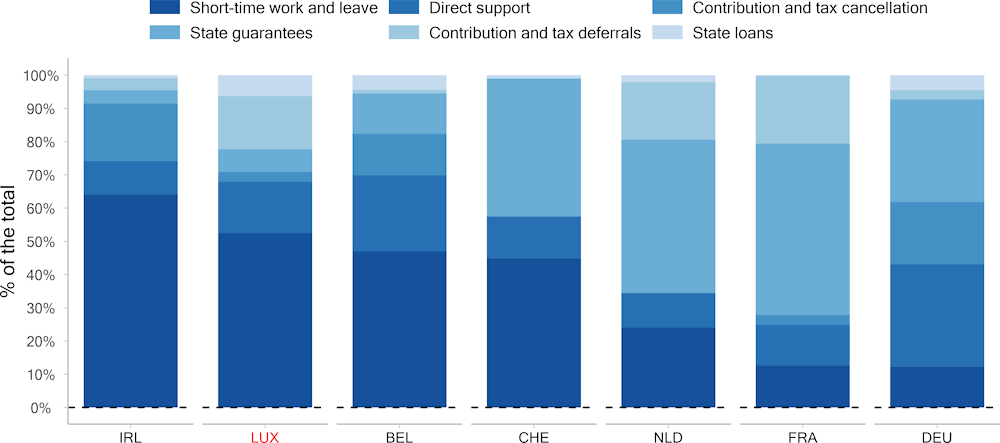

Support measures have been divided into two categories: i) fiscal measures (short-time work and leave, direct support and tax and social security contribution waivers); and ii) liquidity and guarantee measures (State guarantees, tax and social security deferrals and State loans). This categorisation enables a distinction to be made between expenditure with an immediate and definitive effect on public finances, and temporary disbursements and guarantees that are expected to have only a limited impact on public finances in future years. In general, all of the countries considered in the analysis relied mainly on immediate fiscal measures, with the exception of the Netherlands and France, which favoured liquidity and guarantee measures within their overall packages.

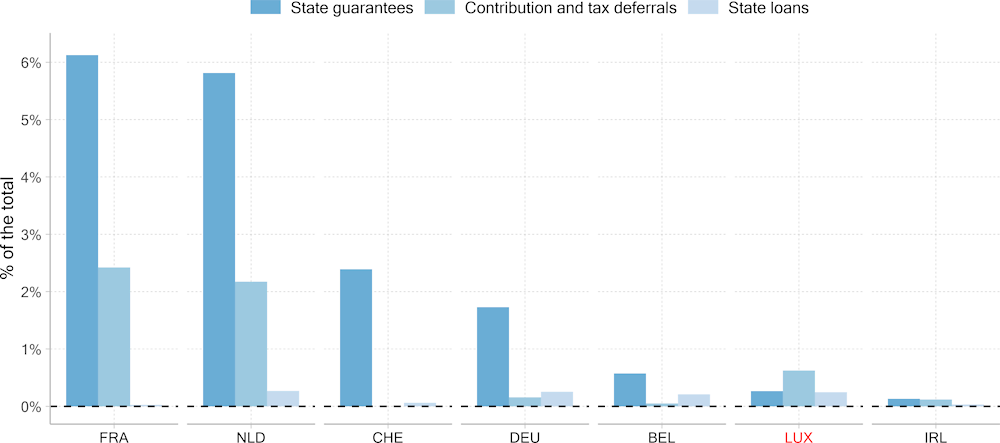

Across the board, the main fiscal measures are comparable, ranging from 3.0% (Ireland) to 4.3% (Netherlands) of GDP. In terms of liquidity and guarantee measures, France, with measures worth around 8.6% of GDP, and the Netherlands, with measures worth 8.3% of GDP, stand out, followed by Switzerland (2.3%), Germany (2.1%), Luxembourg (1.1%), Belgium (0.8%) and Ireland (0.3%) (see Figure 6.2).

Figure 6.2. Luxembourg’s budgetary effort is in line with that of other OECD member countries

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for direct support, short-time working and leave have been disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

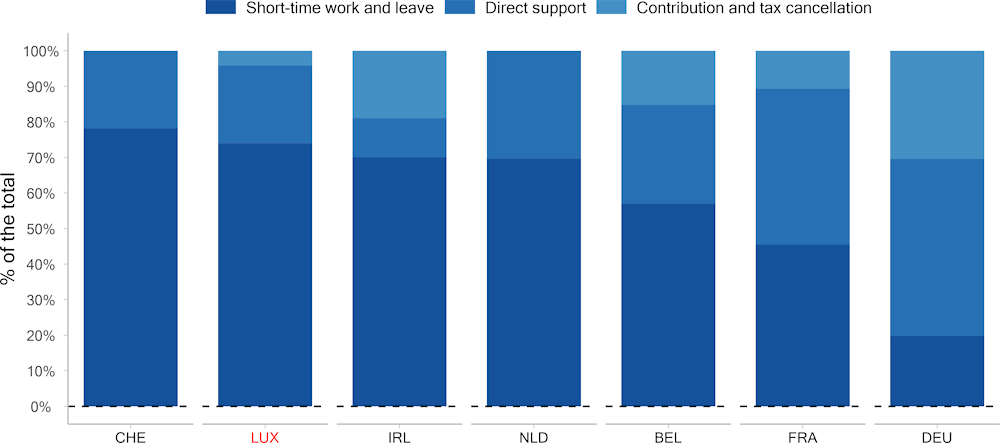

A comparative analysis of emergency measures shows that Luxembourg (along with Ireland, Belgium and Switzerland) stands out for the predominant focus on employment support measures, mainly in the form of short-time work (see Figure 6.3). Luxembourg’s decision to focus on maintaining employment from the early phases of the crisis seems appropriate given the country’s heavy reliance on cross-border workers and its need to retain as much of this workforce as possible. This decision may also have facilitated the economic recovery following the rebound in demand in the second half of 2020 (OECD, 2021[1]; IMF, 2021[2]).

Figure 6.3. In Luxembourg, measures focused primarily on supporting employment

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for direct support, short-time working and leave have been disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

Budgetary disbursements

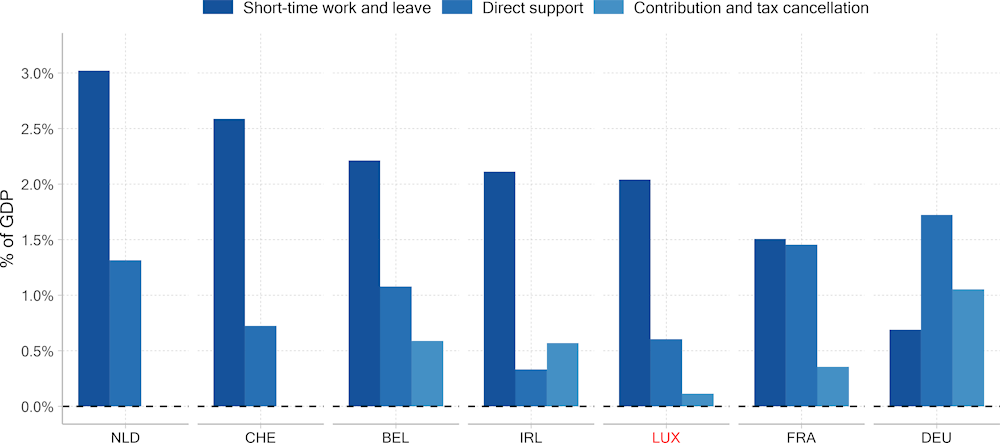

In all the countries considered in this comparative analysis, public financing of short-time work has played a significant role in the schemes supporting businesses. In Luxembourg, short-time work accounted for 60% of the funds spent to support businesses, or 1.6% of GDP. The coverage rate of this scheme is among the highest, at 80% of gross wages, rising to 100% for wages at the level of the Social Minimum Wage. In Ireland, short-time work accounted for 70% of spending to support businesses, or 2.1% of GDP. In contrast, in Germany, which has one of the lowest replacement rates (60% of the benchmark net hourly wage), short-time work accounted for only 20% of spending to support businesses, or 0.7% of GDP (see Figure 6.4 and Figure 6.5).

Direct support includes subsidies or similar granted to companies and self-employed people. These measures represent recurring and important budgetary support mechanisms for businesses. They made up the largest share of support in Germany and France, accounting for 50% of spending allocated to help businesses in Germany (1.7% of GDP) and 44% in France (1.4% of GDP). In Luxembourg, this kind of support accounted for a smaller share of spending (16%, or 0.6% of GDP), as the employment component covered the initial shock of the crisis. However, as the second part of this chapter will show, more direct support was used in 2021 (see Figure 6.5).

In Luxembourg, tax deferrals accounted for approximately the same amount of spending as direct support (with the difference that deferrals represent temporary expenditure for the State). These measures include the waiver of quarterly tax advances, the deferral of tax due dates, the deferral of social security contributions and the refund of VAT credit balances.

Figure 6.4. Public financing of short-time work played a significant role within the budgetary measures

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for direct support, short-time work and leave refer to actual disbursements.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional Governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

Figure 6.5. The extent of budgetary spending is similar to that in the countries studied

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for direct support, short-time working and leave have been disbursed.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional Governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

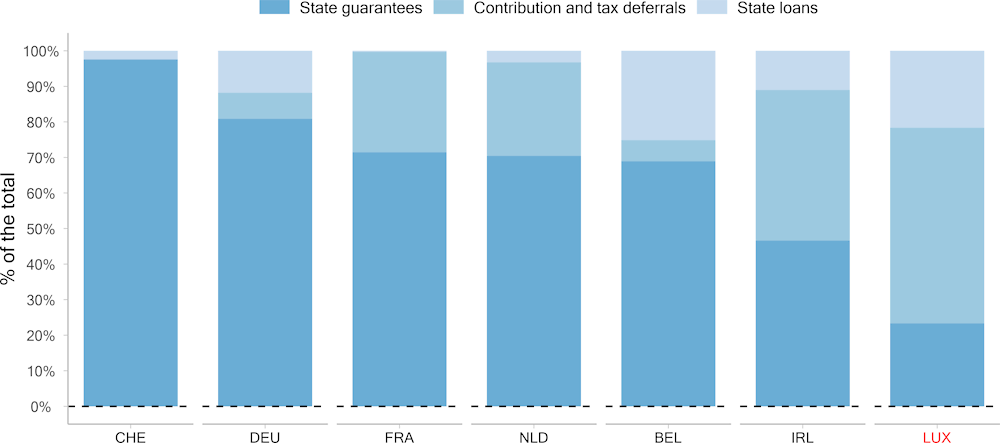

Provision of liquidity and guarantees

With respect to liquidity and guarantee measures, State-guaranteed loans were the most widely used measure in most of the countries surveyed. In Luxembourg, however, such loans accounted for just 23% of total liquidity spending, or 0.3% of GDP. This type of measure accounted for almost all of the liquidity and guarantee provision in Switzerland, representing 2.3% of GDP. It accounted for more than 60% of spending in all countries surveyed, except for Luxembourg and Ireland (see Figure 6.6 and Figure 6.7).

While these measures have been widely used in all of the countries studied, the implementation mechanisms differed. Most countries, like Luxembourg, have guaranteed loans for a maximum of six years. Some countries have allowed a ten-year period in special circumstances (for example, small businesses experiencing serious cash flow problems in France). The interest rate varies according to the duration of the loan. In Luxembourg, it is 0.25% for a one-year maturity, 0.5% for three years and 1% for six years (see Figure 6.6).

Finally, most countries have put in place tax deferrals for businesses. This type of measure accounts for 60% of the liquidity and guarantee provision in Luxembourg, compared with 42% in Ireland. Deferrals can take the form of deferring direct tax payments (as in the Netherlands, Germany and Ireland), deferring social security contributions for businesses and self-employed people, or deferring VAT payments (as in Belgium) (see Figure 6.6).

Figure 6.6. State-guaranteed loans were the most widely used liquidity measure in most of the countries surveyed

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for tax deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional Governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

Figure 6.7. Luxembourg was among the countries that spent the least on liquidity measures in GDP terms

Note: The amounts indicated are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from the survey of the countries selected for this chapter. The amounts given for tax deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg, State Accounts of the Swiss Confederation; Ministry of Finance of the Netherlands; Federal Government of Germany; Government of Ireland; Federal and Regional Governments of Belgium; EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

6.3. Implementation of the business support measures in Luxembourg

In Luxembourg, support through advances for short-time work and ex-post controls helped provide a rapid response to businesses’ demand and needs, maintain people in employment, while limiting public expenditure. The digital tool used to process direct support for businesses also made it possible to respond quickly to applications and to grant assistance within a relatively short time. Speed of delivery has been recognised as a key factor in protecting the liquidity of businesses (Schivardi, 2020[3]). The fiscal procedures were flexible enough to allocate the necessary funds quickly, while keeping parliament informed.

6.3.1. Luxembourg deployed its short-time work programme quickly, relying on an established consultation framework

In consultation with social partners, the Government introduced the “force majeure/COVID‑19” short-time work programme on 18 March 2020. Unlike the system already in place, this special programme was based on advances paid to businesses in order to support them quickly. The existence of the Economic Committee (Comité de conjoncture) and its consultative framework for approving short-time work measures (see Box 6.3) facilitated consultation with social partners and a rapid response to applications from businesses.

Box 6.3. Luxembourg’s Economic Committee

The Economic Committee (Comité de conjoncture) is a government advisory body, whose main task is to maintain employment by taking measures to prevent layoffs resulting from cyclical causes. Part of the committee’s remit involves issuing opinions on the various types of applications for short-time work arrangements and on requests for early retirement to support restructuring.

The members of the Economic Committee represent employee and employer organisations, as well as various ministries and government agencies. The Minister of Economy convenes the Economic Committee, which may be chaired by the Minister of Economy, the Minister of Labour and Employment, or the Minister of Finance, individually or jointly. The committee comprises representatives from the following institutions and organisations:

National Institute for Statistics and Economic Studies (STATEC)

Ministry of Economy

Ministry of Labour, Employment and the Social and Solidarity Economy

Inspectorate of Finance

National Employment Agency (ADEM)

Inspectorate of Labour and Mines

Federation of Luxembourg Industrialists and Entrepreneurs (FEDIL)

Federation of Craftspeople (Fédération des artisans)

Independent Trade Union Confederation of Luxembourg (OGB-L)

Luxembourg Confederation of Christian Trade Unions (LCGB)

Luxembourg Confederation of Commerce (CLC)

Luxembourg Central Bank (BCL).

Source: Government of Luxembourg, Economic Committee, https://cdc.gouvernement.lu/fr.html (accessed 15 June 2022).

Once a business’s application was accepted by the Economic Committee, the National Employment Agency (ADEM)2 paid the special advance. This meant that businesses were able to make use of this advance within ten days of the ADEM receiving their application. An ex-post accounting process made it possible to verify that the advances paid matched the actual short-time hours declared via the businesses’ accounts. A total of 20 000 applications were audited. The differences between the amounts actually owed to businesses and the advances received by them have been accounted for in benefit payments for subsequent financial years.

The use of this advance payment system with ex-post verification seems to have been particularly effective in responding very quickly to business needs while reducing the risk of wasteful use of resources. Similar systems were also implemented in other OECD member countries (OECD, 2022[4]). In Luxembourg, the risk of fraud seems to have been relatively contained: in 2021, the Ministry of Labour reported just six cases of fraud, either because the beneficiary business had gone bankrupt or because the beneficiary business received the advances while keeping the employees at work (Chamber of Deputies, 2021[5]; Jacquemot, 2021[6]).

6.3.2. Implementation of direct support took longer, requiring the establishment of a legal framework and specific processing methods

Direct support took longer to be implemented than short-time work due to the lack of a pre‑existing legal framework. The first lump-sum payment of EUR 5 000 to microenterprises on 25 March 2020 benefited only those businesses closed due to government decisions. This excluded about 6 000 businesses. Some of these businesses were not considered to be microenterprises as they fell below the qualifying thresholds. Others were affected by the sanitary restrictions, but they were not obliged to close. The Ministry of Economy’s Directorate for Small and Medium-Sized Enterprises (DGCM) decided to open up the subsequent programmes also to these companies.

At the beginning of the crisis, business support was not always appropriately targeted. Repayable advances and short-time work targeted sectors defined by the Statistical Classification of Economic Activities in the European Community (NACE), which is an economic activity classification system based on the business’s principal activity code (APE code). However, this classification appeared to be unsuitable for allocating support. By using this classification to determine which businesses should receive support, the public authorities excluded businesses that were highly dependant on a NACE sector directly affected by the crisis, even though they did not belong to it. This was particularly the case for business working on the organisation of events (sound engineers, communication managers, online corporate event organisers, and so on), which are not classified as belonging to the events sector and did not therefore receive any support. Yet the decline in activity in the sector probably had a similar impact on them. There was also the risk of excluding businesses whose APE code had not been updated but had in fact an activity affected by the crisis. The DGCM subsequently sought to avoid these pitfalls by asking businesses to describe the main activity in their applications for support. This approach helped improving targeting. The ministry’s teams then had to analyse these activity descriptions on a case-by-case basis.

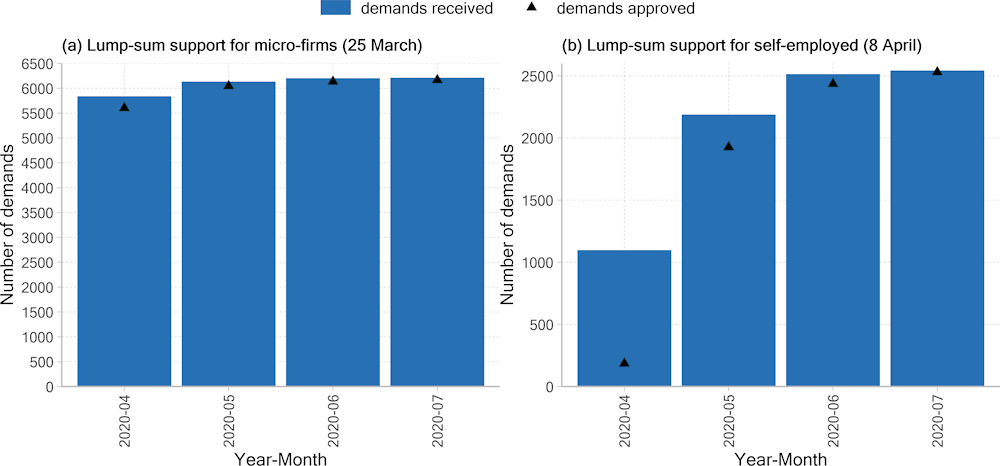

Some self-employed people (around one in six) benefited from the first lump-sum payment of EUR 5 000 and were eligible for the repayable advances introduced on 3 April 2020. The second support package introduced by the DGCM on 8 April specifically targeted the self-employed, whether or not they had been required by the authorities to cease their activity. This allowed some self-employed people to receive EUR 2 500 directly into their bank accounts, which to some extent mitigated their ineligibility for short-time work. However, most self-employed people did not receive this support until May or even June 2020 (Figure 6.8). For the first time, all applications for this support to the self-employed were submitted entirely in digital format, thus requiring some time for the ministry’s teams to adapt to the digital tool. As a result, the DGCM was only able to start processing applications from 16 April. It is also possible that some eligible self‑employed people were not immediately aware of this support. The fact that the number of applications was higher for the second and third lump-sum payments for the self-employed is consistent with this possibility. Some self-employed people may also have thought that they were ineligible for the first payment of EUR 5 000 (because they were not required by the authorities to cease their activity).

Figure 6.8. Implementation of the first lump-sum payment for the self-employed took longer

Note: Only those applications for support which went on to be approved are shown. Detailed information on rejected applications is not available for these programmes. The rejection rate reported by the DGCM for the first lump-sum payment targeting microenterprises is 56%.

Source: DGCM, Ministry of Economy.

The analysis shows that providing support to the self-employed proved more difficult. This seems to be partly due to their special status, which excluded them from short-time work. In addition, short-time work benefited from an existing consultative framework with social partners, namely the Economic Committee. This was not the case for the implementation of direct support, including for the self‑employed, for which consultation and dialogue took place in a more informal way. To remedy this situation, Luxembourg should, in the future, assess the needs of the self-employed, take their specific needs into account and consider strengthening recurrent support that is provided in the early stages of a crisis. It would also be important to establish a more formal framework for dialogue, including with representatives of the self-employed, when putting in place measures aimed at supporting business, in order to better target direct assistance and monitor the implementation of the measures.

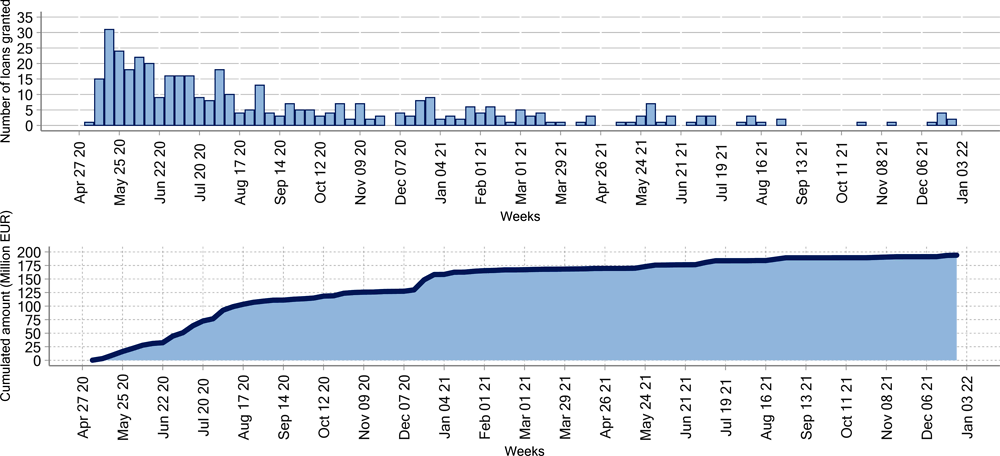

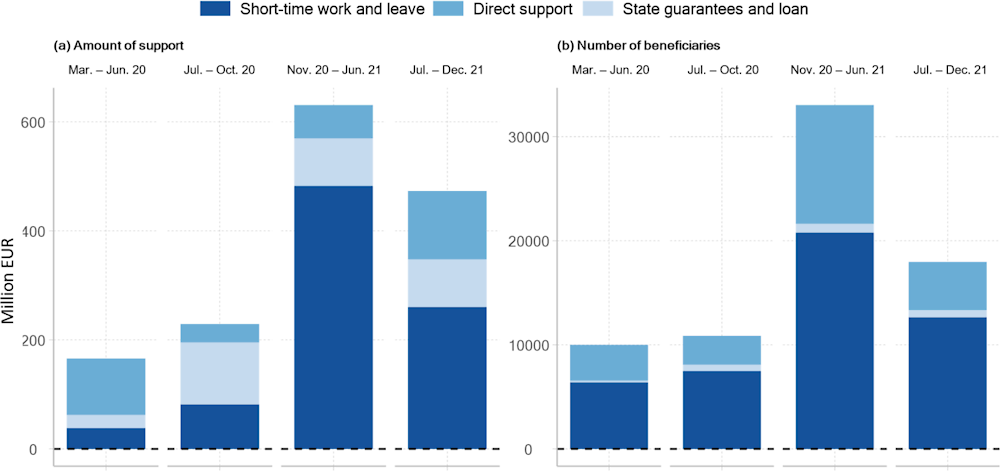

6.3.3. Luxembourg adapted the support measures and how they were allocated as the pandemic evolved

The change in the number of businesses accessing support reflects the different waves of infection and the associated sanitary restrictions. The first wave corresponded to a very high use of support measures for a three-month period, followed by a lower level of use from July to October 2020 and then a slight upward trend from November 2020 to June 2021 (see Figure 6.9, Panel b). There were significant differences in the amounts spent during the first and second waves. These differences can be explained both by the changing number of beneficiary businesses and by the redefinition of some measures, in particular the Recovery and Solidarity Fund, which was stepped up in the second phase of the pandemic, responding to the need to revive the economy as the crisis was ending. The Recovery and Solidarity Fund also focused on those businesses that were hardest hit by the COVID-19 pandemic.

For short-time work, the funds paid out amounted to EUR 482 million for the first wave, and just EUR 81.5 million in the subsequent wave, before rising again in the third wave to EUR 280 million (see Figure 6.9, Panel a). A total of 33 032 businesses received these funds in the first wave, and 10 868 in the second wave. This decrease was primarily due to the difference in the intensity of the shock experienced by business during the first and second lockdown waves (see Figure 6.9, Panel b). According to STATEC data, following a 7.3% decline in activity in the second quarter of 2020, at the height of the crisis, Luxembourg was able to return to pre-crisis activity levels in the third quarter of 2020.

Conversely, the funds allocated to direct support almost doubled between the first and third periods, rising from EUR 60.9 million to EUR 125 million. This increase was not due to more beneficiary businesses (the number actually fell), but to a greater diversity of direct business support and an increased concentration of support for the hardest-hit sectors.

Figure 6.9. Support evolved in line with the evolution of the pandemic

Note: The first period covers the state of emergency in Luxembourg. The second period corresponds to an intermediate period during which the epidemic slowed. Starting in November 2020, the country faced a series of waves until June 2021. The fourth period corresponds to the end of 2021.

Source: STATEC – Central Balance Sheet Office, and the DGCM, Ministry of Economy (Luxembourg); prepared by the authors.

6.3.4. Digitalisation improved the management of demands for support

Digitalisation played a very important role in implementing direct support to business. The DGCM provided back-office management for processing applications using a software package known as MMAET. This software was operational less than a week after the first support measure was launched (25 March 2020) and its development was accelerated during the crisis.

The DGCM quickly went “all digital” for processing support applications. From the launch of the lump-sum payment for the self-employed (8 April 2020), applicants were required to use the professional area on the MyGuichet.lu website.3 This caused an initial delay in implementation, as applications could not be processed before 16 April. However, this approach delivered significant time savings for businesses and gains in effectiveness for the government.

In parallel, the MMAET software has been continuously improved since the beginning of the crisis, providing information about the number of applications submitted and the status of applications (in process, in payment, rejected, etc.). These figures are available in real time.

To respond to the many requests for information, a hotline and a dedicated e-mail address were set up. The DGCM updated a frequently asked questions (FAQ) document listing eligible and ineligible types of activity. This FAQ was updated and sent to employers’ associations daily. An e-mail address dedicated to the support for uncovered fixed costs and recovery support programmes was created. A hotline was provided by staff at the House of Entrepreneurship, a dedicated point of contact for entrepreneurship launched in 2016 by the Chamber of Commerce and the Ministry of Economy (House of Entrepreneurship, n.d.[7]). Getting the House of Entrepreneurship involved in responding to questions and providing more information about support measures not only offered answers which better met the needs of entrepreneurs but also allowed the DGCM to focus on processing applications.

Finally, the DGCM put in place a verification process to check the information supplied by businesses and avoid the risk of fraud. An internal audit was also carried out using sample checks.

Analysis of indicators relating to the applications received highlights the positive impact of these initiatives on application processing. For the initial EUR 5 000 support payment for microenterprises, of 14 145 applications, only 6 220 enterprises were approved (see Table 6.2). This large discrepancy is due to non-compliance with the eligibility criteria, mainly because of a misunderstanding of the criteria relating to the size of the business. The number of full-time equivalent employees used to determine eligibility was that of the group and not of the individual organisation or business. The rejection rate improved significantly following the second support payment of EUR 12 500, with 8 022 of 8 944 applications being accepted. In total, business support payments amounted to about EUR 76 million.

Table 6.2. Lump-sum payments targeting the most vulnerable companies

|

|

Initial support payment of EUR 5 000 for microenterprises |

Additional payment of EUR 5 000 for microenterprises |

Payment of EUR 12 500 for small businesses |

Total (in EUR million) |

|---|---|---|---|---|

|

Period covered |

25 March to 25 June 2020 |

28 April to 25 June 2020 |

||

|

Number of beneficiaries |

6 220 |

7 329 |

693 |

14 242 |

|

Amounts disbursed |

31 517 500 |

36 547 500 |

8 415 000 |

76.5 |

|

Rejection rate |

56% |

10% |

38% |

|

Note: Businesses were able to apply just once for each support payment. A business could therefore receive the initial payment of EUR 5 000 when it was introduced, and the additional EUR 5 000 one month later. This explains why there were not 14 242 different businesses that received the support payments. The figures for the amounts disbursed provided by the Ministry of Economy differ slightly from the amounts obtained by multiplying the number of beneficiaries by the amount of support.

Source: DGCM, Ministry of Economy (Luxembourg) on 27 January 2022.

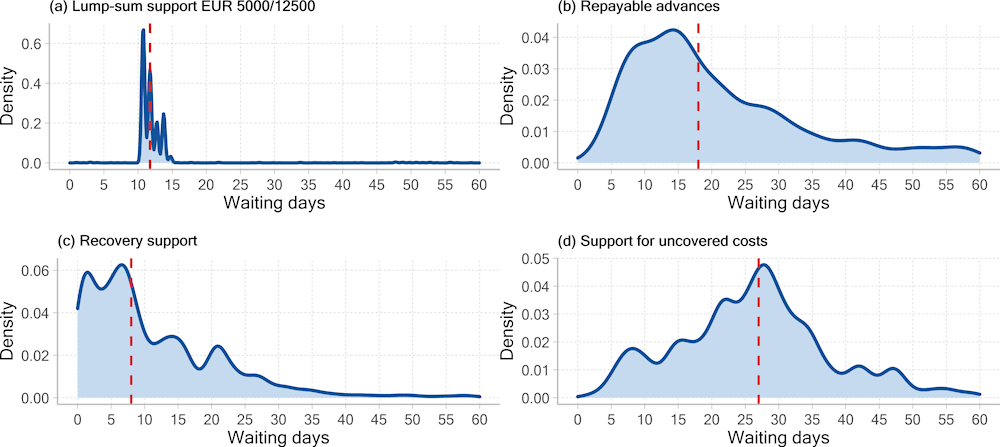

On average, companies waited 15 days to receive the second lump-sum payment of EUR 5 000 and EUR 12 500. To receive the amount requested, businesses had to wait an average of 15 days for recovery support and 30 days for support for uncovered fixed costs. Under the repayable advance programme, the average time taken to receive the support was 29 days (see Figure 6.10).

Figure 6.10. Businesses waited an average of between 15 and 30 days to receive direct support

Note: The date on which payments were received has been estimated from the date on which the Ministry of Economy decided to award the payment and start the payment procedure, and from the last date on which the status of the application was changed. For the lump-sum payments of EUR 5 000 to EUR 12 500, the mean time was 15 days and the median time was 12 days (the first quartile – 11 days and the third quartile – 13 days). For recovery support, the mean time was 15 days and the median time was 8 days (the first quartile – 4 days and the third quartile – 19 days). For support for uncovered fixed costs, the mean time was 30 days and the median time was 27 days (the first quartile – 20 days and the third quartile – 34 days). For repayable advances, the mean time was 29 days and the median time was 18 days (the first quartile – 12 days and the third quartile – 32 days).

Source: DGCM, Ministry of Economy.

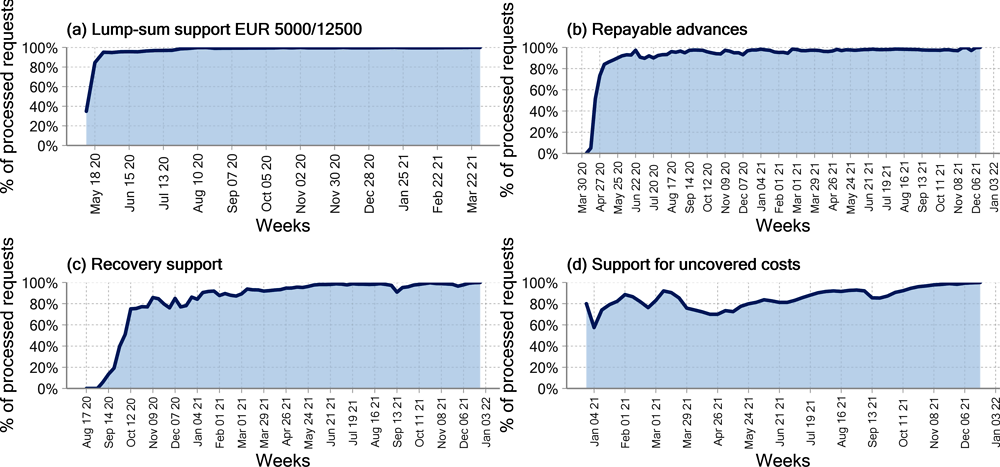

Over time, an increasing proportion of the applications received were approved. As regards lump‑sum payments and repayable advances, two weeks after their introduction, almost all applications were being processed within seven days (see Figure 6.11). Support for uncovered fixed costs had the largest mean (and median) delay between application and receipt of payment. It is also the programme for which the DGCM took the longest time to deal with all applications. This is partly due to the number of steps required to validate an application and grant such a large amount of support (support under this measure was capped at EUR 300 000). In addition, businesses were required to send a number of documents and other items to receive the support. This resulted in a significant number of incomplete applications.

Figure 6.11. There were continuous improvements in application processing times

Note: The proportion of approved applications = applications received since the support measure was introduced that have received a favourable decision divided by applications received since the support measure was introduced. The figures only cover approved applications since data on rejected applications are not available. An increase in the Figure means that the administration is processing enough applications in one week to be able to deal with applications not processed in previous weeks.

Interpretation: At the end of the week of 12 October 2020, fewer than 80% of applications for recovery support received since this measure was introduced had been processed by the administration. The remaining applications were not processed at that time.

Source: DGCM, Ministry of Economy.

The improvement in processing times is also the result of the decrease in the number of applications received as the crisis eased (see Figure 6.12).

Figure 6.12. Applications for support gradually fell between December 2020 and December 2021

Crisis management has demonstrated the advantages of simplifying and digitalising administrative procedures so that support can be awarded quickly, protecting business liquidity and jobs. This process should continue.

Recommendation: the Ministry of Economy and the DGCM should conduct an in-depth analysis of the administrative procedures for businesses, especially small and medium-sized businesses, and seek to simplify and digitalise them. This process can build on the tools put in place during the crisis.

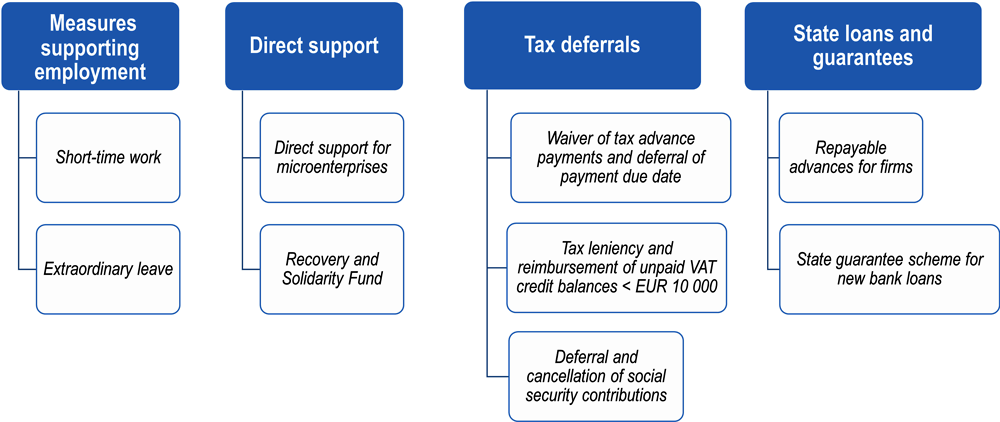

6.3.5. Guaranteed loans have been widely used by businesses

Luxembourgish businesses affected by the pandemic took advantage of the guaranteed loan programme, as soon as it was implemented. In the first three months of the programme’s implementation, 222 loans were granted, totalling EUR 95.6 million. As of 31 December 2021, the State Treasury had identified a total of 415 loans granted, totalling EUR 194 million. The amount guaranteed by the State is equivalent to some EUR 164.9 million (85% of the nominal amount of the loans). As the recovery progressed, the number of applications gradually declined, holding steady at relatively low levels during the first three quarters of 2021, underlining the resilience of Luxembourg’s economy to the pandemic (see Figure 6.13).

Figure 6.13. Applications for State guarantees declined as the economy recovered

The State Treasury manages the day-to-day registry of guaranteed loans, including the approval and rejection of applications submitted by banks. The arrangements and practical implementation are formalised in an agreement signed between the State and the banks participating in the guaranteed loan programme (BCEE, BIL, Banque de Luxembourg, Banque Raiffeisen, BGL BNP Paribas, ING, Bank of China, Banque BCP).

In Luxembourg, beneficiary businesses have six years to repay the loans, as is the case in most countries (Anderson J., 2020[8]). As of 30 June 2022, less than 7% of loans were in default. Of these, only 28 loans were classified as "in default" for a total amount of EUR 12 781 800. It should be noted that “a loan in default" does not necessarily mean that bankruptcy proceedings have been initiated and that the State may have to cover all or part of funds loaned. So far, no State guarantee has been activated (Government of Luxembourg, 2022[9]).

6.3.6. Flexible fiscal procedures enabled a quick and appropriate response

Given the scale of the economic measures implemented in Luxembourg, the Government had to ensure that there was sufficient liquidity to disburse the funds quickly, and that it also had the authority to do so. A mechanism for proper monitoring of the commitment and disbursement of funds was also required.

The State Treasury

To this end, from the beginning of the health crisis, Luxembourg ensured that it had sufficient liquidity to be able to disburse the sums linked to the exceptional measures adopted, and to absorb the drop in revenue associated with the crisis (for example, income tax and VAT revenue fell).

During the first two months of the crisis, Luxembourg was able to benefit from surplus liquidity thanks to a EUR 1.7 billion loan taken out in November 2019 to repay a loan maturing in May 2020. This situation gave the State Treasury valuable time amid great uncertainty and increased volatility on the markets due to the rise in international financing rates. This period of uncertainty did not last long in Europe, thanks to the intervention of the European Central Bank (ECB), which introduced the pandemic emergency purchase programme on 18 March 2020. The act passed on 18 April 2020 also allowed the Government to borrow an additional EUR 2.5 billion on 28 April 2020. All these circumstances meant that Luxembourg did not experience any liquidity problems.

In addition to having the money available to fund the measures, the Government also needed the authority to commit and disburse the funds. In principle, the funds that a Government can use are limited to the amount specified in the budget passed by Parliament. Any increase in these funds therefore requires Parliament to make changes to the budget. There is, however, one important exception to this rule in Luxembourg: items may be given an "open-ended" limit in exceptional cases. For these funds, the Minister of the Budget may grant an overrun at the request of the authorising minister. Each year, the budget contains several items that have open-ended limits for each ministry, with the aim of adding some flexibility to the annual budget in case of force majeure or an unforeseen economic downturn. In the case of the COVID-19 crisis, this exception allowed the Government of Luxembourg to commit and disburse the majority of the necessary funds in this flexible way, without having to go through Parliament. More than 80% of the additional COVID-related spending in 2020 was related to items with open-ended limits that were already included in the original 2020 budget (that Parliament passed in late 2019).

Nevertheless, new budget items still had to be adopted for some measures. An act on 24 July 2020 thus created a Recovery and Solidarity Fund for businesses, and another on 15 December 2020 established a legal basis for introducing a new open-ended item to fund COVID-19-associated health insurance expenditure. Most of the crisis-related expenditure already had a legal basis in the initial budget, however, and this facilitated a quick Government response. Unlike France or Germany, for example, Luxembourg did not have to introduce an amended budget act in Parliament.

The role of Parliament

This flexibility was accompanied by frequent communication between the Minister of Finance and Parliament. The Minister of Finance provided regular updates on changes in the State’s financial position at joint meetings of the Chamber of Deputies Finance and Budget Committee and Budget Oversight Committee. At these meetings, the Minister reported on the amounts disbursed in response to the COVID-19 pandemic. However, the information was limited to amounts. No details were provided on how the funds were allocated by measure or by type of beneficiary. For 2022, on the other hand, the Ministry of Finance took note of the recommendation issued by the Court of Auditors and produced a document featuring detailed information for each measure introduced in 2020. This document is currently in the process of being published. This process of discussion and providing information should continue. In the future, the Government of Luxembourg should continue such regular exchanges with the Chamber of Deputies on the beneficiaries, targeting and impact of the measures put in place, even in crisis situations.

Monitoring of spending

Monitoring by the Ministry of Finance and the Inspectorate of Finance focused on the fiscal and financial aspects to ensure continuity of the fiscal system and sufficient liquidity. Since Luxembourg has not (yet) introduced performance budgeting, the fiscal authorities were not able to monitor the efficiency or effectiveness of the measures adopted. While such an analysis was not necessarily a priority in the acute phase of the crisis, a budgetary perspective that included performance data would have been useful in the context of a long crisis to determine whether certain measures should have been extended or better targeted. A performance-based approach could also have provided additional information to Parliament, thereby enhancing transparency. In general, performance budgeting would help improve the budget process in Luxembourg. The approach used by France can serve as an example in this area: annual performance reports attached to the 2020 budget accounts with objectives and performance indicators.

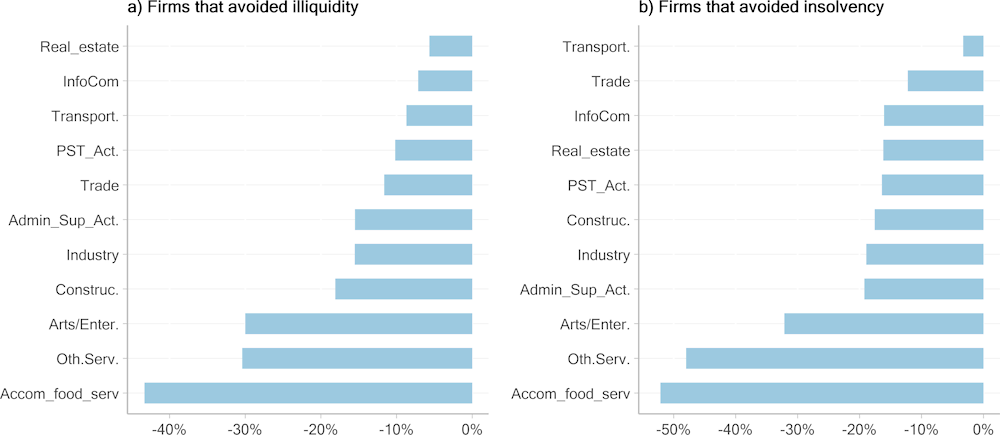

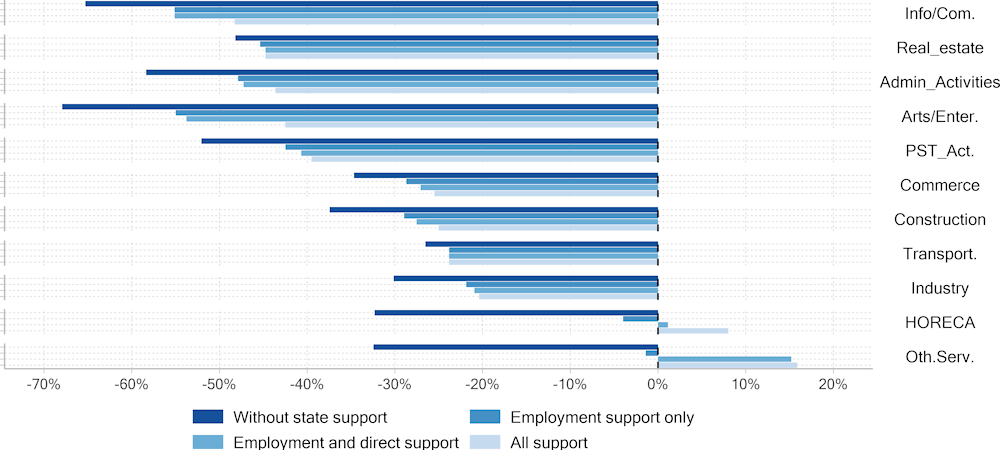

6.4. Targeting and impact of support measures in Luxembourg

Cross-analysis of data on the financial position of businesses in Luxembourg and data on support to business demonstrates that the support measures in Luxembourg met the needs of most businesses (see Box 6.4). The businesses hit hardest by the crisis received the most support. Conversely, measures addressed to all businesses might have benefited businesses that could have weathered the crisis without the need for support, creating a windfall effect. A broad support package would have also heightened the risk of protecting businesses that would have gone bankrupt without the crisis. The available data suggest that this did not happen in Luxembourg. Public support benefited businesses that were in good shape in 2019 and were particularly hard hit by the crisis. The analysis of the impact of the support on businesses’ performance also shows that the financial position of most businesses has been protected.

Box 6.4. Description of the data used in this study

The analysis of support’s take-up and impact on business performance is based on a database that includes the following data:

STATEC – Central Balance Sheet Office (Centrale des Bilans)

The Central Balance Sheet Office holds information on the annual accounts of businesses in Luxembourg (commercial companies, sole traders with an annual turnover of more than EUR 100 000, Luxembourg branches of foreign companies and economic interest groups). The Central Balance Sheet Office covers 66% of the 37 000 businesses in the country (2016), as some businesses are not legally required to file their annual accounts (financial companies, public institutions, self-employed professionals and non-profit associations). Most of the businesses included in the dataset are small businesses (98%).

Microdata on government support (Ministry of Economy, DGCM, Ministry of Finance, General Inspectorate of Social Security)

The DGCM supplied data on the beneficiaries of the main COVID-19 support measures for which it was responsible (lump-sum payments for businesses and self-employed people, repayable advances, recovery support, support for uncovered fixed costs, support for retail businesses and social minimum wage support). Beneficiary businesses are accounted for every time that they received support under the same programme.

The Ministry of Finance has made available data relating to the beneficiaries of the State guarantee programme. The General Inspectorate of Social Security shared data on beneficiaries of the short-time work scheme and extraordinary family leave for COVID-19 via STATEC.

Consolidated database

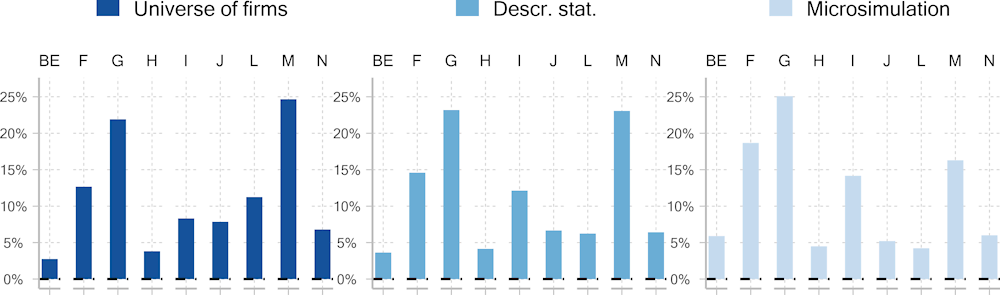

The consolidated database built by combining the data listed above excludes financial activities (NACE section K), public administration, education, human health and social work (sections O, P and Q), as well as the activities of households as employers and extra-territorial activities (sections T and U). The data were linked using the business registration number and reference year. The data track businesses from 2016 to 2021, although not all data are available every year. After cleaning, the consolidated database covered 21 247 businesses in 2020, representing 63% of businesses in Luxembourg operating in the sectors of interest (excluding arts and entertainment and excluding other services due to the lack of public data). The data used for the microsimulation covered only 12%. Nevertheless, the samples are relatively representative at the sectoral level (see Figure 6.14). In addition, businesses with fewer than 50 employees accounted for 97% of the consolidated database (in 2020).

Figure 6.14. Distribution of sectors in the samples studied compared to the distribution of all businesses in Luxembourg

Note: BE=Industry, F=Construction, G=Trade, H=Transportation and warehousing, I=HORECA, J=Information and communication, L=Real estate, M=Specialised, scientific and technical activities, N=administrative and support service activities. Sections R (arts and entertainment) and S (other services) have been excluded here due to a lack of information but are included in the consolidated database. To compare the samples (descriptive statistics and microsimulation) with the universe of firms, the distribution of economic sectors in Luxembourg has been recalculated based only on these sectors (such that the sum of these shares is equal to 100%). The distribution of sectors in Luxembourg is based on 2019 data, which are the most recent available data. The distribution of sectors in our samples corresponds to the year 2020.

Source: STATEC – LuStat and Central Balance Sheet Office, prepared by the authors.

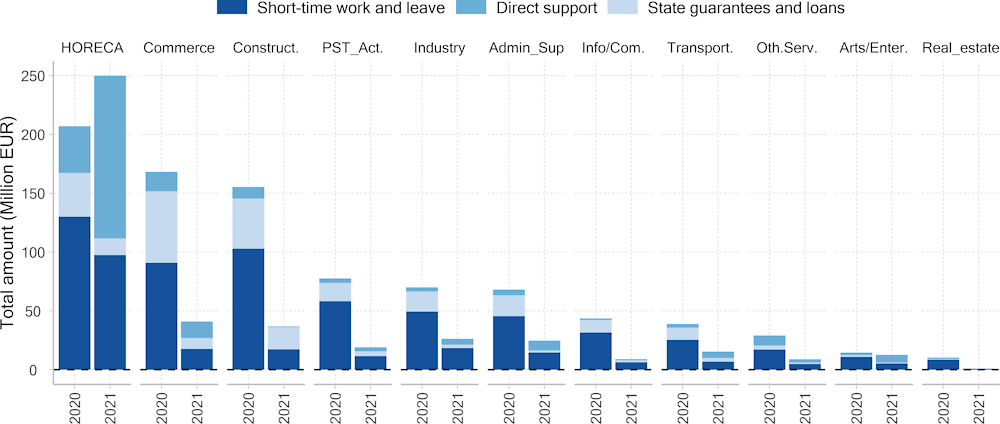

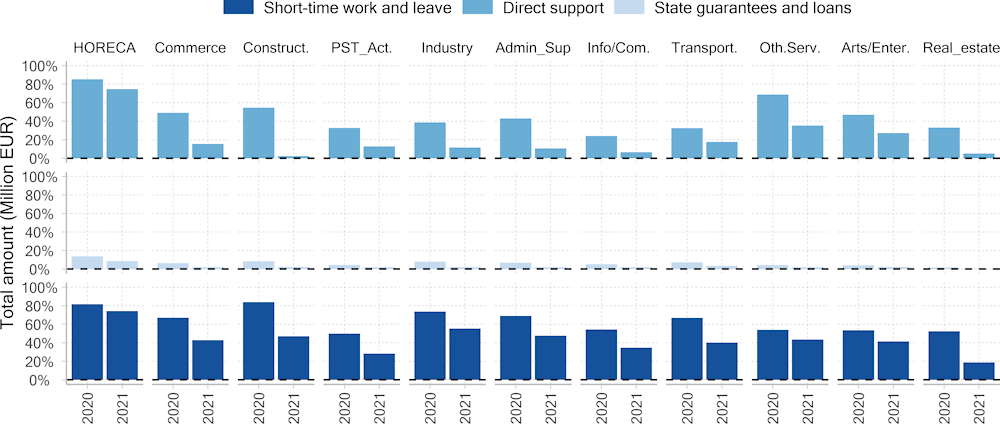

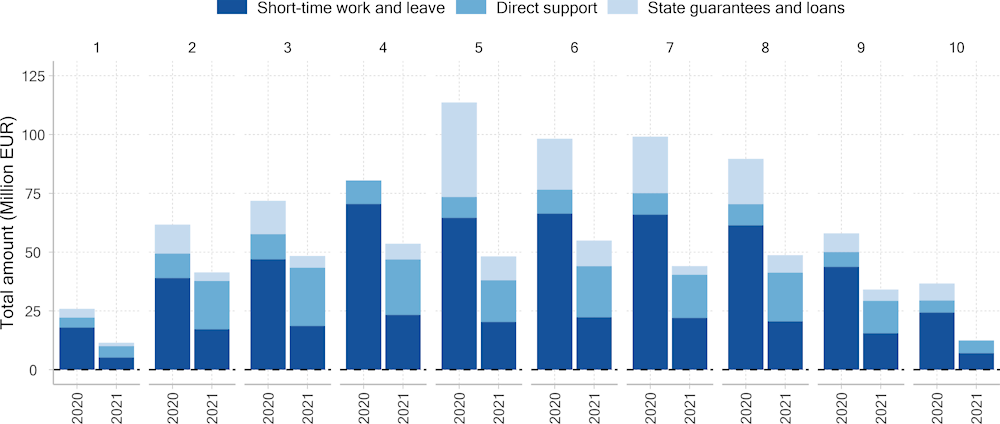

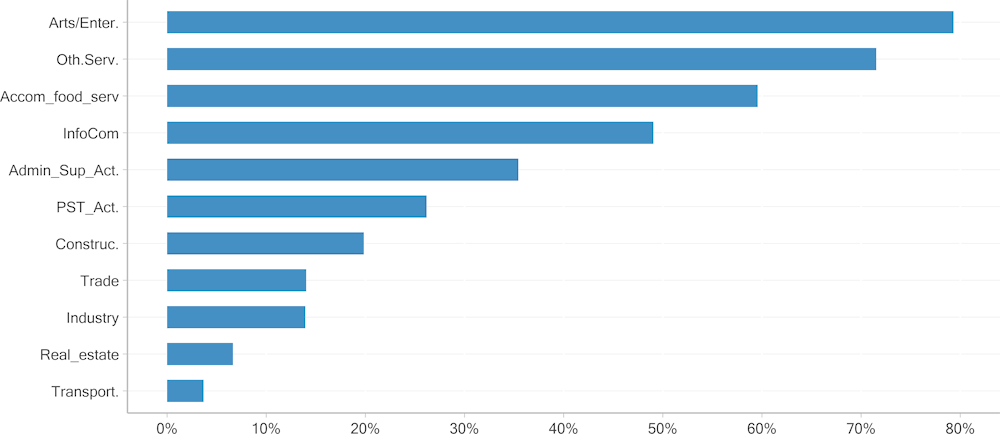

6.4.1. State support targeted the hardest hit sectors and businesses

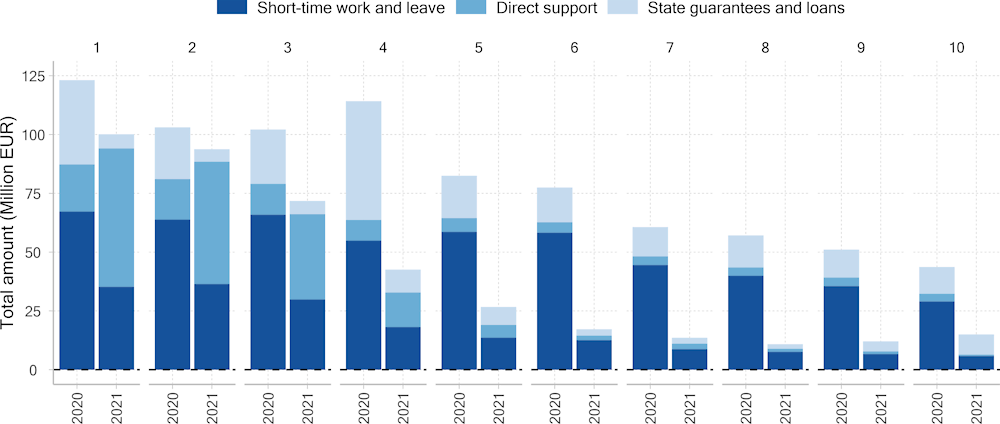

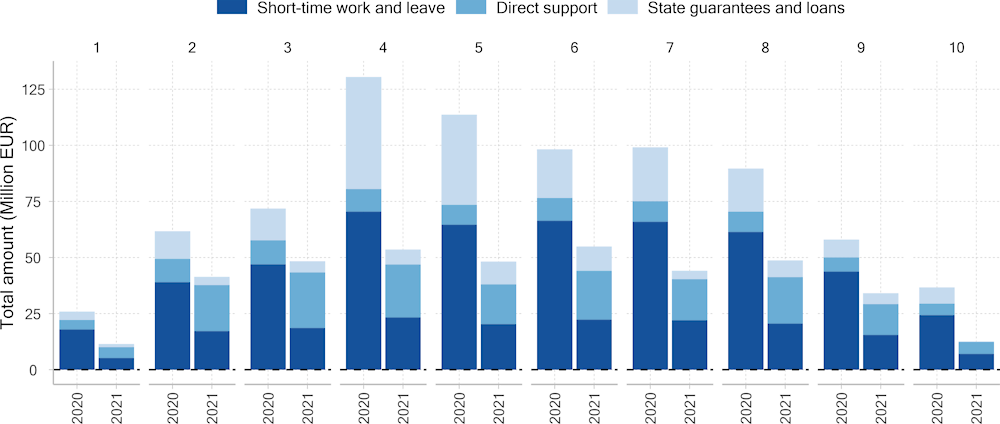

The crisis affected almost all sectors of the economy (excluding the financial sector) and the sample data used in this study confirm that they all received support in 2020, i.e. at the peak of the crisis (see Figure 6.15 and Figure 6.16). The variation in the amounts disbursed in 2021 by sector reflects the evolution of the crisis. Aggregate amounts increased in 2021 for the HORECA sector and remained virtually stable for arts and entertainment (see Figure 6.15). This is due to the sectoral conditions for granting short-time work and the main direct support measures in 2021, as these sectors were considered the "vulnerable" sectors. While the amounts allocated to these two sectors did not decrease in 2021, the number of beneficiary businesses did (see Figure 6.16). The measures thus increasingly targeted vulnerable sectors on the one hand, and the hardest hit businesses within these sectors on the other.

In 2020, employment support measures, direct support and loans mainly benefited three service sectors, which together accounted for 57% of employment support, 70% of direct support and 64% of total loans: accommodation and food services (EUR 130 million in short-time work and leave, EUR 39 million in direct support and EUR 37 million in loans), construction (EUR 102 million, EUR 42 million and EUR 10 million), and trade (EUR 91 million, EUR 61 million and EUR 17 million).

After the sanitary restrictions were relaxed in 2021, the use of these measures became more targeted; the accommodation and food services sector accounted for 48% of short-time work and leave payments and 75% of direct support payments. The trade, construction, and HORECA sectors accounted for 64% of newly allocated State-guaranteed loan funds in 2020, rising to 73% in 2021 (see Figure 6.15 and Figure 6.16).

Figure 6.15. Support targeted the hardest hit sectors

Source: STATEC – Central Balance Sheet Office and DGCM, Ministry of Economy; prepared by the authors.

Figure 6.16. In 2021, direct support favoured businesses in the HORECA, other services and arts and entertainment sectors

Note: For each type of support, the Figure shows the proportion of all businesses in the sector that benefited from at least one form of support on at least one occasion. A single company may be included in all three categories at the same time.

Source: STATEC – Central Balance Sheet Office and DGCM, Ministry of Economy; prepared by the authors.

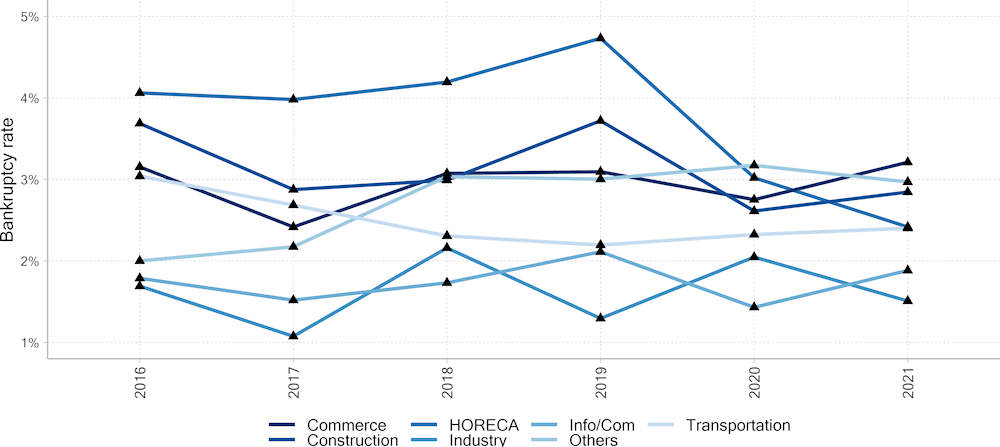

The impact of the pandemic and the support measures is reflected in the bankruptcy rate for each sector. Figure 6.17 shows the trend in bankruptcies since 2016, based on aggregated public data from STATEC. In 2020, the bankruptcy rate decreased in three sectors (out of seven available). However, HORECA is the only sector in which the bankruptcy rate fell for two consecutive years. This seems to confirm that this sector, which was particularly affected by the pandemic, was particularly targeted by the support measures.

Figure 6.17. In Luxembourg, bankruptcy rates are in line with historical figures, except in the HORECA sector

Note: Bankruptcy rate = number of bankruptcies divided by the number of businesses in the previous year. Bankruptcy is a state in which a legal entity has ceased payments and can no longer obtain credit from banks, suppliers or creditors. The entity may continue to exist following the conclusion of bankruptcy proceedings, but ceases to exist permanently in the event of dissolution or liquidation. Other = Financial and insurance activities + Real estate activities + Specialised, scientific and technical activities + Administrative and support service activities.

Source: STATEC; prepared by the authors.

The aim of the measures, as regulated by the European Union, was to target businesses that were healthy before the crisis but suffered a sharp decline in activity in 2020. According to the data collected, the businesses hardest hit by the COVID-19 crisis benefited more from the support measures. This suggests that the support was relatively well targeted. Regardless of the measure concerned, the rate of use increased with the scale of impact on the activity. This relationship becomes even clearer in 2021 (see Figure 6.18).

The first four deciles of hardest-hit businesses in terms of reduced turnover in 2020 received 54% of the total support paid out over the period considered. This is in line with the objective of supporting the sectors most exposed to the crisis, and was reinforced in 2021, when the top two deciles received 48% of the total funds allocated (see Figure 6.18).

The data indicates a threshold effect for direct support, some of which was awarded on condition of a reduction in turnover of at least 25% compared to the same month of the previous year.4 Between the third and fourth decile, the total amount of direct support disbursed decreases more than the reduction in turnover. Adjustments to support measures on the basis of a progressive reduction in turnover could have avoided this effect. This approach would have helped businesses that were less affected because they adapted better than others. To remedy this situation, all new direct support measures could include a subsidy proportionate to the reduction in turnover to help target businesses more precisely.

Figure 6.18. Support measures targeted the hardest-hit businesses

Note: Businesses have been split into ten equally sized categories based on their rate of growth in turnover between 2019 and 2020. The deciles that separate businesses into these ten categories are: -48%, -31%, -22%, -14%, -7%, -1%, 6%, 15% and 37%.

Source: STATEC – Central Balance Sheet Office, and data from the DGCM, Ministry of Economy (Luxembourg); prepared by the authors.

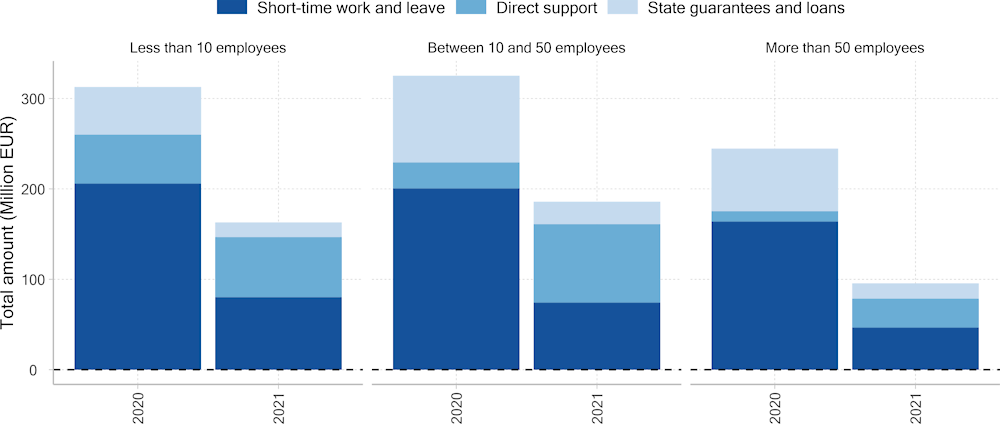

In two years, businesses with fewer than 50 employees received 74% of the total amount granted under all support measures (see Figure 6.19). Nevertheless, different beneficiary profiles can be distinguished according to the measures examined. With respect to employment support, the amount of support was divided equally across businesses. Conversely, more than half of direct support went to microenterprises (fewer than ten employees) in 2020. These smaller firms were generally harder hit during the crisis in OECD Member countries (OECD, 2020[10]). The Government of Luxembourg introduced several lump-sum payments specifically for very small businesses, which explains this concentration in 2020. In contrast, direct support was no longer so focused on microenterprises the following year (36%). In 2021, recovery support and support for uncovered fixed costs, which were not conditional on business size, accounted for most of the direct support.

Figure 6.19. Businesses with fewer than 50 employees received more support

Source: STATEC – Central Balance Sheet Office, and data from the DGCM, Ministry of Economy (Luxembourg); prepared by the authors.

6.4.2. State support targeted healthy companies that needed support during the crisis