Labour market and social policies in Luxembourg were relatively well prepared going into the COVID-19 pandemic. As employees fell ill, reduced their working hours or lost their earnings, paid sick-leave, family leave, job retention schemes and unemployment benefits kicked-in. Existing schemes were extended and reinforced, while new measures were adopted to respond to emergent needs. The tight labour market coming out of the crisis has aided a strong recovery, and many of those deeply affected have since recovered their livelihoods. Nevertheless, there remains scope for fine-tuning policies to ensure, if such a crisis happens again, support reaches everyone who needs it, and no one is left to fall through the cracks. This chapter examines the main labour market and social impacts of the COVID-19 crisis in Luxembourg, and presents a first review of the measures taken by Luxembourg authorities to support the jobs and livelihoods of those affected.

Evaluation of Luxembourg's COVID-19 Response

7. Luxembourg’s labour market and social policy response to the COVID‑19 crisis

Abstract

Key findings

Luxembourg’s labour market was heavily affected by the crisis. Unemployment rates rose by 1.8 percentage points while the number of hours worked fell 10 percent on the previous year. Yet the recovery has been swift and strong. Employment rates now exceed their pre-crisis levels and inactivity rates have fallen to levels not seen since prior to the financial crisis. The concentrated sectoral nature of the crisis, however, left some groups acutely exposed.

Containing the COVID-19 pandemic called for unprecedented restrictions on social and economic activity. While necessary, these restrictions caused widespread disruption to people’s lives, jobs, and incomes. Luxembourg was, in many ways, well prepared for the shock, with jobs shielded by existing paid sick leave and job retention schemes, an exceptional family leave, and generous unemployment insurance and social assistance systems in place to protect livelihoods. These measures, rapidly extended to adapt to the demands of the crisis, have helped to minimise job losses and sustain the incomes of many.

Notwithstanding this, they did not reach all those whose livelihoods were affected. Accelerated access to job retention support dampened the impact of the labour market shock, and at the peak of the crisis close to 2 in 5 of all dependent employees were supported by the scheme. Yet self-employed workers were not covered by the scheme, and many are likely to have faced financial distress. Other workers – such as young people, and those on temporary contracts – while in principle protected by the scheme appear, de facto, to have had more difficulty in accessing support. This is because channelling support through employers, renders targeting dependent on employer incentives. These incentives are shaped by hiring and firing costs which are themselves are dependent on tenure, and contract type. Those with short work histories and precarious contracts may, therefore, struggle to access support. Alongside this, young workers and those on temporary contracts, with their shorter or patchier employment histories, will also have been less likely to meet the minimum employment criteria to qualify for unemployment benefits, and below-25 year-olds do not have direct access to Luxembourg’s main social assistance benefit.

Luxembourg introduced new and generous measures to support parents and caregivers who were no longer able to rely on the school and care facilities that enabled them to go to work. This family leave was an essential, and innovative, element of Luxembourg’s emergency response to the crisis. The policy enabled parents to retain jobs and income while ensuring their children were taken care of. During the confinement in spring 2020, close to 40% of eligible parents benefited from this policy, and it is likely to have played an important role in avoiding the swell in the gender gap in employment rates seen in a number of OECD countries. However, the gender imbalance in the take-up of such policies may have pernicious long-run consequences if women suffer from extended absences from the labour market. Paid sick leave, which replaced 100% of earnings, was key to protecting workers and ensuring those who were sick with COVID-19 stayed isolated. However, in a similar crisis it would be important to ensure all workers had access to paid sick leave.

With its comprehensive and generous systems for the protection of employment and livelihoods, Luxembourg was well placed to support its population through the COVID-19 pandemic. The policies introduced, and the extensions agreed, were timely and responsive to the needs emerging from the pandemic. However, this support was not available and accessible to all workers – the young, those with interrupted employment histories and the self-employed were among the most vulnerable. These workers, concentrated in the most heavily impacted sectors, were often less able to access the support provided by chômage partiel, income support and even sick leave. These gaps in Luxembourg’s comprehensive safety net should be addressed in a future pandemic.

7.1. Introduction

In the early months of 2020, the outbreak of COVID-19 caused a profound disruption, both to lives and to livelihoods across the OECD. Indeed, containing the COVID-19 pandemic called for unprecedented restrictions on social and economic activity. In Luxembourg, the Grand Duc declared a state of crisis on 18 March 2020 and endorsed a full lockdown, requiring the closure of all non-essential shops and schools, and imposing severe restrictions on mobility.1 As employees fell ill, reduced their working hours or lost their earnings, paid sick-leave, family leave, job retention schemes and unemployment benefits kicked in to protect their jobs and incomes. Existing schemes were extended and reinforced, and new measures were adopted to bridge the gaps. This chapter examines the main labour market and social impacts of the COVID-19 crisis in Luxembourg, and presents a first review of the measures taken by Luxembourg authorities to support the jobs and livelihoods of those affected by the COVID-19 pandemic.

The policies introduced in Luxembourg in response to the pandemic were timely and largely responsive to emergent needs. The tight labour market coming out of the crisis has aided a strong recovery, and many of those deeply affected have since been pulled back to work. Nevertheless, there remains some scope for fine tuning to ensure that, if such a crisis happens again, support reaches everyone who needs it, and no one is left to fall through the cracks.

This chapter begins with an analysis of the impact of the pandemic on Luxembourg’s labour market and social outcomes. It examines the impact of the crisis on job loss and hours worked and analyses how the impact fell with particular force upon certain groups of Luxembourg’s workers and their families. The analysis draws primarily on two data sources: for cross-country analysis the chapter makes use of the European Labour Force Survey (EU-LFS) which is highly standardised across countries but comes with certain drawbacks. Notably, the EU-LFS has a limited sample size and no coverage of cross-border workers. For more detailed analysis of labour market patterns of more specific groups, and for evidence on take-up and coverage of support policies, this chapter therefore uses more detailed microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS), which capture the entire population and include cross-border workers.

Following the analysis of labour market trends, the chapter then turns to the primary policies adopted to cushion this impact; protecting jobs through Job Retention Schemes (JRS), exceptional family leave, and paid sick leave, and protecting income through unemployment benefits, social assistance, and targeted support to vulnerable groups.

7.2. The impact of the COVID-19 crisis on labour market and social outcomes in Luxembourg

7.2.1. Luxembourg’s labour market was heavily affected by the crisis, but has made a strong recovery since

The COVID-19 pandemic had a profound impact on labour markets across the OECD and, by the second quarter of 2020, unemployment rates hit levels nearly 3.5 percentage points above those seen prior to the pandemic (see (OECD, 2020[1]) and (OECD, 2021[2])). While Luxembourg was no exception to this trend and saw unemployment rates rise by 1.8 percentage points in the space of just three months, the impact was relatively modest compared to the OECD average. The muted impact in Luxembourg – and in many other European countries employing such schemes – was, to a large extent, due to the heavy use of Job Retention Schemes (JRS) – in Luxembourg, chômage partiel. Such job retention programmes seek to minimise job losses, and enable a quick resumption of economic activity, by funding a significant share of lost wages for employees who work reduced hours – or not all – on a temporary basis.2

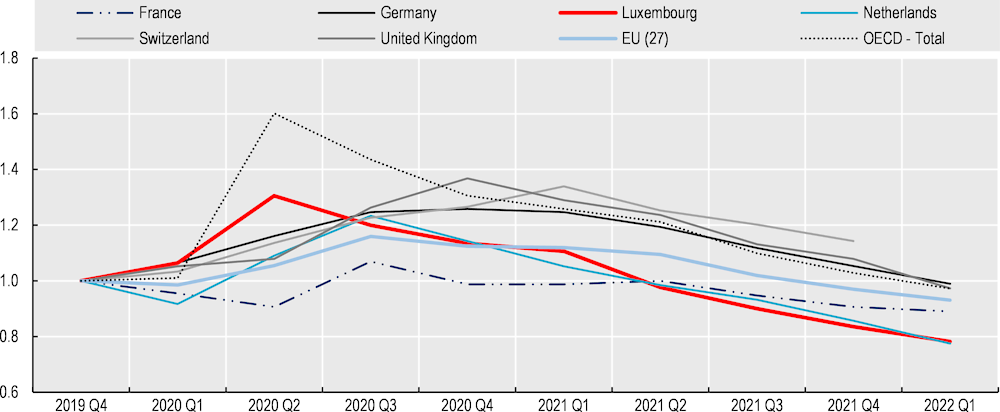

Two years into the pandemic economic activity has made a strong recovery and unemployment rates in many OECD countries are close to – or even below – their pre-crisis levels (Figure 7.1). In Luxembourg, where unemployment was a little higher than in some peer countries before the crisis3, the unemployment rate has continued to fall since May 2020 and is now substantially (1.2pp) below its pre-crisis level. These levels have not been seen since prior to the global financial crisis.

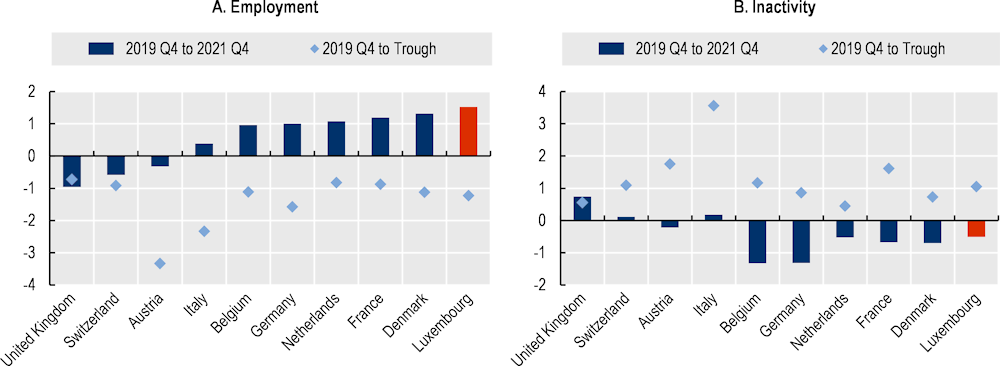

Figure 7.1. The unemployment rate in Luxembourg has come down to below its pre-crisis level

However, unemployment rates do not paint a complete picture of the labour market impact of the crisis. Alongside the unemployed, many people – both inside and outside the labour force – would have liked to work more. During the COVID-19 lockdowns, many of those who lost their jobs were unable to search for work because their sector was effectively closed for business. Furthermore, the widespread school and care facility closures brought unforeseen care duties for many workers – often mothers – making paid work difficult. Though they left employment, these workers were not formally counted as unemployed. Instead, they were included in the inactive population because they were neither available nor actively searching for work. Indeed, at the peak of the first wave in Luxembourg, during the first quarter of 2020, employment rates fell to under 67%, 1.23 percentage points short of their pre-pandemic levels, while inactivity rates peaked at 29% – 1.1 percentage points above its pre-crisis level (Figure 7.2). This increase in inactivity, was substantial compared to other OECD countries. For example, Germany saw an increase of just 0.9 pp and the Netherlands just 0.5pp. Nevertheless, it was less pronounced than in a number of neighbouring countries such as France (1.6pp), or elsewhere such as Austria (1.8pp) and Italy (3.6pp). Furthermore, employment, and to a lesser extent inactivity, have since made a strong recovery.

Figure 7.2. The employment rate is higher, and inactivity lower, than they were before the crisis

Note: Countries are sorted by the change in employment rates since before the crisis in ascending order.

Source: OECD Short-term Labour Market Statistics (2022) https://stats.oecd.org/.

7.2.2. Many workers in Luxembourg started teleworking during the crisis

Increasing unemployment and inactivity during the early months of the pandemic were largely driven by job loss among those workers requiring physical proximity to undertake their work. In Luxembourg, however, the dominance of high-skilled services that do not require such physical proximity meant that many workers were able to transition to telework. This sectoral concentration, no doubt, played an important role in dampening the extent of job loss in Luxembourg. Close to three in every four jobs in Luxembourg can be done remotely (OECD, 2021[2]).

Among all OECD countries, Luxembourg has by far the lowest share of workers working in occupations put at risk by mandated closures (Basso et al., 2020[3]).4 Indeed, the proportion of employees working remotely saw an unprecedented leap following the outbreak of the crisis, reaching an historic peak of 52% in the second quarter of 2020. This was more than double the pre-crises figure (STATEC, 2022[4])5 and significantly higher than the 39% average across the OECD (OECD, 2020[1]). The rise in telework was particularly pronounced in the financial and insurance sector and in extraterritorial organisations (i.e. international organisations and diplomatic services), and concentrated among qualified white-collar workers (STATEC, 2021[5]). Those who could not telework had to reduce their working hours, yet the shock was short‑lived in Luxembourg

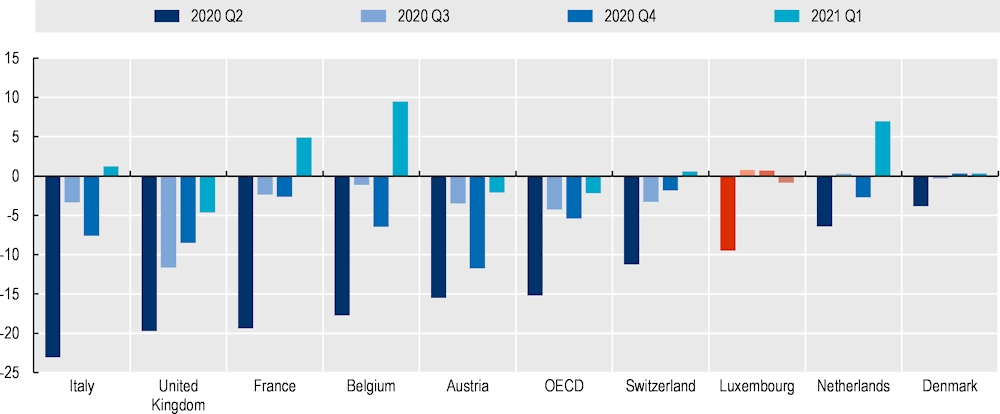

Many of those who were unable to work from home had to reduce their working hours, due to the widespread recourse of employers to the chômage partiel scheme. In just one month, the number of employees receiving support under chômage partiel increased from just 820 in February 2020 to 103 438 in March 2020. The construction sector accounted for the largest share, at over 31% in March 2020. As a result, changing hours worked gives a more complete picture of the labour market impact of the crisis, capturing not only unemployment and wider joblessness but also the impact on people working less than they normally would. Hours worked in Luxembourg fell by 10% during the first quarter of the crisis, relative to the previous year, a much more muted impact compared to countries such as Italy (-23%), the United Kingdom (-20%), France (‑19.4%) as well as the OECD average (-15%). Furthermore, the loss in hours worked was quick to recover, with hours exceeding pre-crisis levels already in the third quarter of 2020 (Figure 7.3).

Figure 7.3. Total hours worked in Luxembourg declined by less and recovered more quickly than in many peer OECD countries

Notes: EULFS hours data not available for Germany during this period.

Source: OECD calculations based on the European Labour Force Survey.

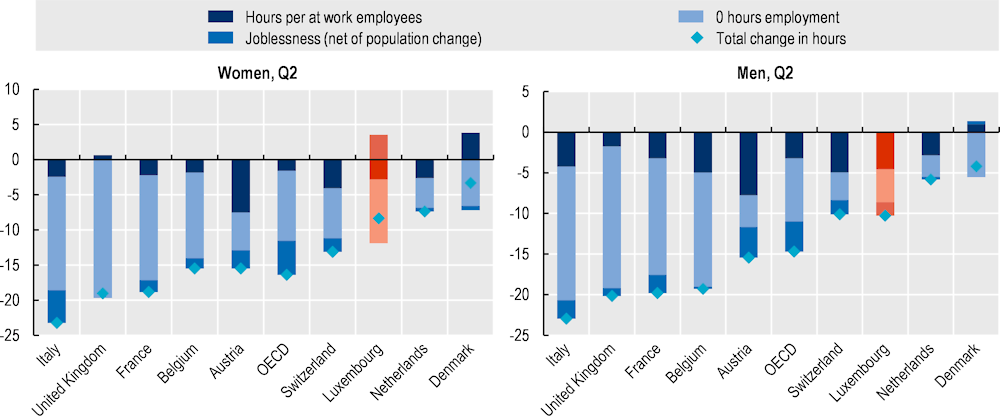

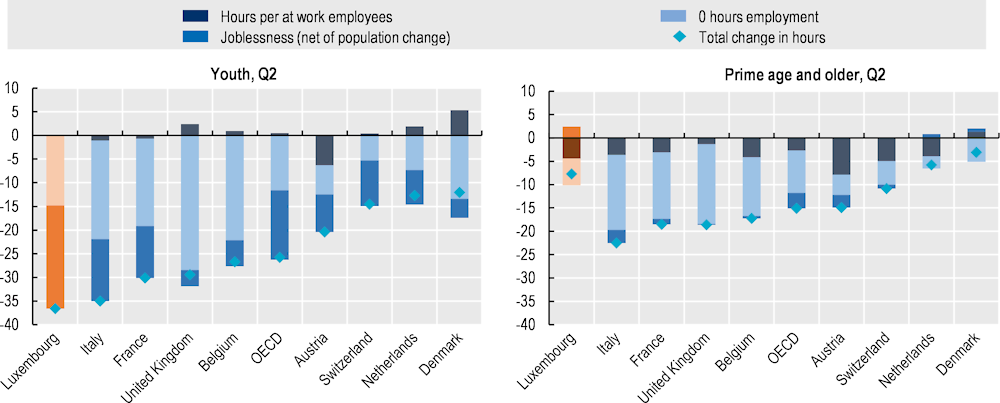

Unlike in most other OECD countries, the aggregate fall in hours worked in Luxembourg was largely accounted for by workers who remained in their jobs, working reduced or even zero hours. This can be seen by breaking down the source of the reduction in aggregate hours as resulting from job losses (i.e. the extensive margin) or reduced working hours among workers who remain employed (i.e. the intensive margin). In fact, net joblessness in Luxembourg – net of population change – appears to have declined incrementally during this period. These results stand in stark contrast to those in the majority of OECD countries – even those who, like Luxembourg, relied heavily on JRS. The heavy reliance on job retention support is likely to have supported the rapid recovery in hours worked seen in quarters 3 and 4 of 2020 as the health crisis dissipated and workers were able to return to their jobs.

As unemployment rates have declined, a growing share of those who remain unemployed are now the long-term unemployed. In March 2022, those out of work for 12 months or more accounted for 48.7% of all jobseekers, compared to 43.1% in February 2020, though the number of long-term unemployed people has been declining since the beginning of 2021 in absolute terms. The long-term unemployed require particular attention and support, and, in the context of a tight labour market and an ageing population, they should be considered as a resource on the Luxembourg labour market.

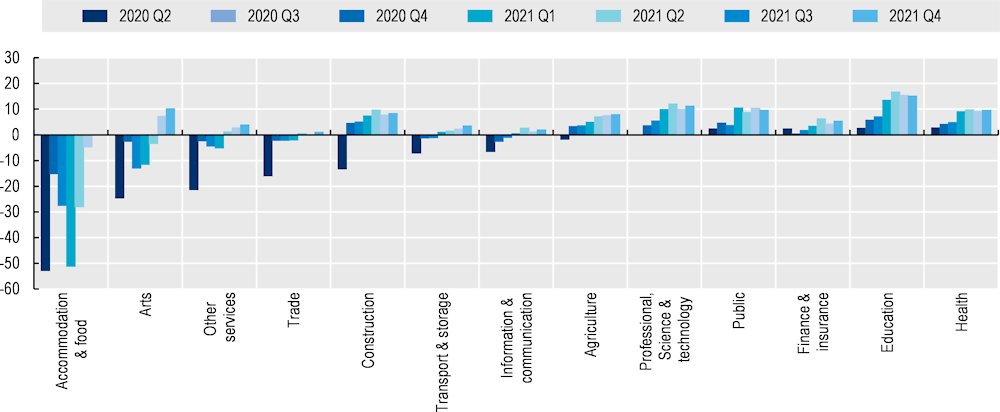

While the initial shock of the COVID-19 crisis was felt across large swathes of the Luxembourg economy, some sectors were particularly hard hit, and have been slow to recover. Accommodation and food services, as well as the arts sector, were initially most severely impacted, with the number of hours worked plummeting in the second quarter of 2020 by 53% and 25%, respectively (Figure 7.4). Wholesale and retail trade, as well as construction, also experienced large declines in total hours worked, at -16% and ‑14%, respectively. At that time, expectations that closures would be short-lived prompted widespread use of Luxembourg’s chômage partiel. The result was a strong rebound in most sectors in the third quarter of 2020 as theatres and cinemas reopened, trade recommenced, and many of those on chômage partiel indeed returned to work. However, some of these sectors, such as hospitality and the arts, took a second hit during the second wave of the pandemic in the third quarter of 2020 as a result of new, more targeted, limitations on work, culture and social interactions. Meanwhile, other sectors saw hours worked rise to levels even higher than those seen prior to the crisis.

Figure 7.4. The impact on hours worked in the arts and hospitality was profound and sustained

Note: Hours are not defined for the self-employed.

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

7.2.3. The concentrated sectoral impact of the crisis in Luxembourg, and nature of support, left some groups acutely exposed

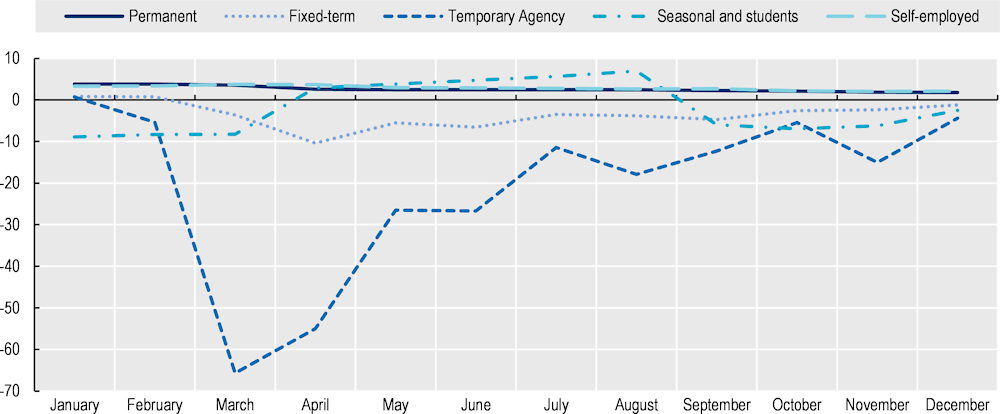

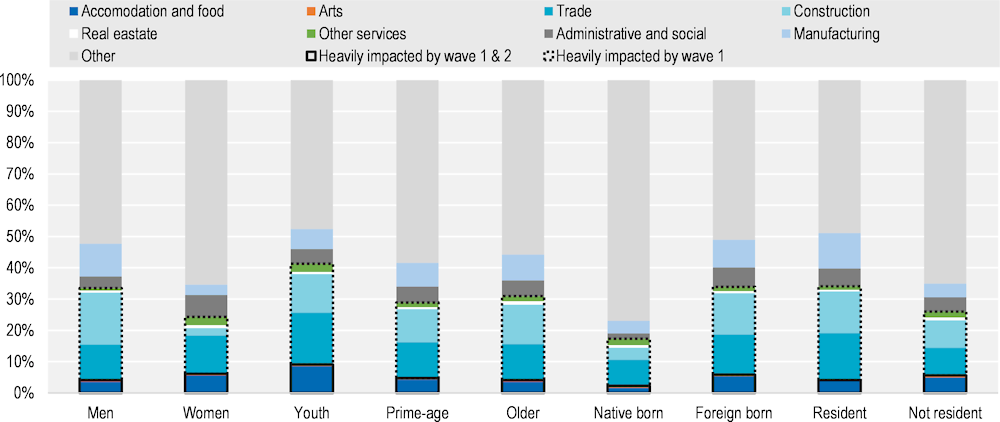

The impact of the crisis differed substantially across groups of workers depending, to a large degree, on their sector of employment and the types of jobs they held. Workers in heavily impacted sectors and in jobs deemed “non-essential” that required physical proximity and therefore could not be carried out from home saw their work disappear, while those in precarious work and on unstable contracts found themselves to be less protected by the deep employment support that was provided by chômage partiel (Figure 7.5). The pandemic exacerbated labour market inequalities to the extent that more disadvantaged socio‑economic groups – the low paid, those with a low education, and young people – are over‑represented in these sectors and jobs (Figure 7.6).6

Figure 7.5. Temporary workers saw a big drop in employment

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

Figure 7.6. Sectoral concentration of socio-demographic groups in Luxembourg prior to the crisis

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

7.2.4. Women experienced compounding burdens from the crisis, but in Luxembourg employment rates have more than recovered and have improved relative to men’s

The COVID-19 crisis, through its peculiar nature as a public-health crisis, has had a gendered impact on labour market and social outcomes, and brought specific challenges for women (OECD, forthcoming[6]). Women were at the forefront of the fight against the COVID-19 virus being over‑represented in many health and long-term care professions. At home, women often faced increased care burdens for children and elderly or frail relatives when formal care services were closed or disrupted, which compounded with the often much greater share of unpaid work they were doing already. Indeed, in a survey carried out during the first pandemic wave (LISER, 2021[7]), the self-reported hours spent on childcare were 60% higher for mothers than for fathers before the lockdown (32 vs. 20 hours per week), and also a slightly larger share of the additional care burden during the lockdown fell on mothers (7 vs 6 hours per week). In the same survey, women were also slightly more likely to report worse-than-usual psychological well-being. And victims of domestic violence – in most cases women – were more exposed to their abusers during lockdowns and faced increased risks of violence (see below for measures put in place to address this).

By contrast, women’s employment outcomes developed relatively positively over the crisis, and particularly so in Luxembourg (OECD, 2021[2]). By the fourth quarter of 2021, female employment rates in Luxembourg were 2.5 percentage points higher than they had been before the crisis, in the fourth quarter for 2019. The gender gap in employment rates had narrowed by 2 percentage points. This reflects employment growth among women notably in the health and education sector as well as in high-paid services, and it puts Luxembourg among the OECD countries with the most positive employment trends for women since the start of the crisis. While women in Luxembourg also experienced a lesser decline in unemployment rates over the crisis than men (-0.6% vs. -1.2% between Q4 2019 and Q4 2021), this is a consequence of a growing share of women entering the labour force, with some of them initially being unemployed before finding a job.

One possible reason may be Luxembourg’s generous exceptional family leave, which enabled people caring for small children or frail adults to temporarily take time away from the labour market while care facilities were closed. This meant that, while elevated calls to provide care at home led many women, and particularly mothers, to stop working or reduce their working hours, in Luxembourg these additional calls did not require them to leave the labour market entirely. Indeed, a decomposition of hours lost during the first year of the crisis illustrates that, women were able to keep a foothold in the labour market (Figure 7.7), and thus to increase their hours rapidly as schools reopened and economic activity renewed.

Figure 7.7. Women were able to keep a foot in the labour market and did not experience largescale job loss

Note: Cross-border workers are not captured in the EULFS data.

Source: OECD calculations based on the European Labour Force Survey.

7.2.5. Youth employment remains subdued, and inactivity has risen in Luxembourg

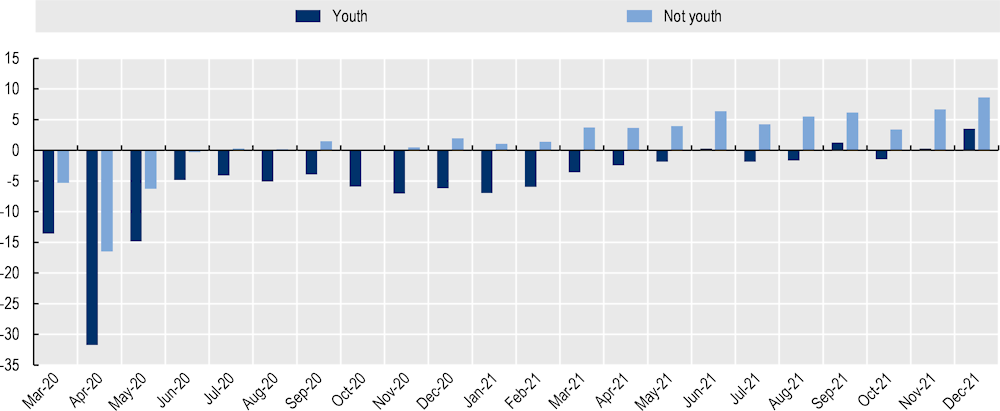

In Luxembourg, as elsewhere in the OECD, younger workers were more concentrated in sectors heavily impacted by the crisis. Over 40% of young workers were employed in sectors that suffered a heavy loss in hours during the early months of the pandemic – in accommodation and food services, in arts, in transport and storage, in agriculture, construction and trade (Figure 7.6). This is ten percentage points higher than among prime-aged and older workers. The evolution of hours worked throughout the pandemic waves shows the relevance of sectoral concentration. During the first wave, in early 2020, hours worked by young workers fell more sharply than those of older workers. During the second wave, young people – who were more likely to work in accommodation and food services – again saw their hours tumble (Figure 7.8).

Figure 7.8. Young workers bore the brunt of the impact of the crisis

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

More broadly, beyond the sectoral nature of the COVID-19 crisis, it is well-established that youth labour market outcomes tend to be more sensitive to economic cycles. Youth tend to be more concentrated on temporary contracts (in Luxembourg 22% of young workers aged 15-24 are on temporary, fixed-term, contracts compared to just 2% of those between 25 and 54). Furthermore, having typically been hired more recently, young people tend to have fewer firm-specific skills and less experience, such that firing and re-hiring costs are more limited. As the last in, they are often the first out. This also implies that firms’ incentives to maintain employment contracts with the support of chômage partiel are more limited for young workers than for those with a longer tenure. This is shown by the trend in hours worked: during the second quarter of 2020 the hours worked by younger workers not only fell faster, by close to 37% year on year, as compared to just over 7% among prime-aged workers. This drop was also driven largely by moves into joblessness as opposed to reduced hours in employment (Figure 7.9).

Figure 7.9. Losses in aggregate hours were much higher for young workers, and they reflect to a much greater share employment losses

Note: Cross-border workers (frontaliers) are not captured in the European Labour Force Survey data.

Source: OECD calculations based on the European Labour Force Survey.

These trends have increased an – already large – gap in employment rates between young and prime‑aged workers in Luxembourg, by 1.4 and 4 percentage points during both the first and second waves of the COVID-19 pandemic (not shown).

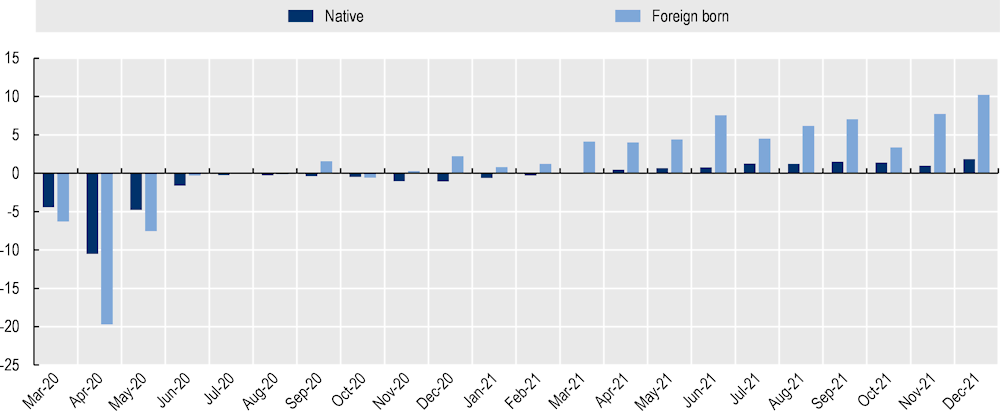

7.2.6. Foreign born workers felt a deep impact of the pandemic in Luxembourg but a strong recovery has been driven by increasing employment in high-skilled services, health and construction

Luxembourg has the highest share of migrants in the population of all OECD countries.7 Over 40% of Luxembourg’s population were born abroad and these foreign-born individuals are highly educated, with over half holding a tertiary degree. In addition to this large resident foreign-born population, Luxembourg also hosts a large number of cross-border workers. Indeed, according to the IGSS, close to 200 000 cross border workers came to work in Luxembourg from another country (with 50% originating in France). As a result, the Luxembourg labour market is heavily dependent on its foreign-born population, with only 27% of the jobs occupied by the native born. This dependence is particularly marked in certain sectors such as health – with 1 in 10 cross-border workers employed in health and social work activities.

While the hours worked by cross-border workers has followed a similar pattern to that of the resident population of Luxembourg, the initial impact of COVID-19 on the working hours of foreign-born workers was profound. Hours worked by foreign-born workers fell by nearly double that of the native-born population, which reflects partly that many native-born workers are employed in the public sector. Yet the recovery was fast for Luxembourg’s foreign born and by June 2020 hours worked had recovered their pre-pandemic levels (Figure 7.10). This recovery was likely driven by strong growth in the number of foreign-born working in professional, scientific and technical activities, as well as health and construction. These sectors account for the largest share of foreign-born workers, 12.3%, 8.3%, and 13.1%, respectively. Employment of the foreign-born in trade, which also accounts for a large share of Luxembourg’s foreign-born workers, 12.7%, however, has remained subdued. Indeed, the selective departure of those foreign-born workers who lost their job has also, no doubt, contributed to the strong recovery.

Figure 7.10. The foreign-born saw a deeper initial impact but have made a strong recovery

Note: Note: hours are not defined for self-employed. Hours are corrected for calendar effects.

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

7.2.7. Household incomes have been relatively protected from the crisis in Luxembourg

While the labour market impact of the crisis could be measured in a timely manner, through monthly labour force surveys, much less is known still about how the crisis has affected household incomes. In most OECD countries, data on the level and distribution of household incomes are collected through household surveys – in Luxembourg this is through the European Union Statistics on Incomes and Living Conditions (EU‑SILC) – which are typically published with a delay of about two years. For this reason, survey-based data on trends in disposable household incomes in Luxembourg were not yet available at the time of writing. However, the Luxembourg national statistical office (STATEC) and the IGSS, have jointly simulated income data for the year 2020. These data allow for a first tentative assessment of the income trends in Luxembourg during the initial crisis year.8

These simulated data suggest that the COVID-19 crisis has not had a major impact on the level and distribution of disposable household incomes in Luxembourg in 2020 (STATEC, 2021[5]). According to these simulations, the median disposable household income in Luxembourg, i.e. the income after taxes and social transfers of the household that is exactly in the middle of the income distribution, rose slightly in nominal terms between 2019 and 2020, by about 2.6%. Income inequality, as captured through different inequality measures, including the Gini Index, stayed constant or slightly declined. Also, the poverty rate remained nearly unchanged, at 17.2% (17.4% in 2019).9 These trends are in line with a survey carried out by the Luxembourg Institute of Socio-Economic Research (LISER) towards the end of the first pandemic wave, in late May to early July 2020, which had only few respondents reporting acute financial difficulties: 9% indicated finding it very or quite difficult to manage financially, 11% to have had difficulties paying bills and 7% to have had difficulties paying rent or mortgage (LISER, 2021[7]). The Eurofound’s Living, Working and COVID-19 survey found that the share of people reporting having difficulties making ends meet in Luxembourg was the second lowest across all 27 EU countries (Ahrendt et al., 2021[8]).

The stability in household incomes, inequality and poverty is notable given the depth of the economic crisis and can be considered testament of the success of Luxembourg’s policy response to the crisis. In particular, it certainly reflects the effectiveness of the chômage partiel, the exceptional family leave, and, to a lesser degree, unemployment benefits in protecting the incomes of workers who were forced to reduce their hours worked or were affected by job loss. Meanwhile, the incomes of many other population groups, such as workers who continued working in their workplace and those who teleworked, pensioners or the unemployed, were not directly affected by the crisis. The finding of stable household incomes and constant or declining inequality in Luxembourg is consistent with findings for other EU countries with available data, such as France, Germany, Italy and Spain (Clark, D’Ambrosio and Lepinteur, 2021[9]; Braband et al., 2022[10]). It is, however, much too early for an assessment of how household incomes may have developed after 2020 when many of the crisis emergency measures had been rolled back.

7.3. Policies to protect jobs and incomes in Luxembourg during the COVID-19 crisis

Luxembourg authorities responded to the COVID-19 crisis with timely and wide-ranging measures to preserve people’s jobs, incomes and livelihoods. This included extensions of existing schemes, in particular in the areas of job retention support, paid sick leave, unemployment benefits, and minimum‑income benefits, as well as the introduction of new measures, notably exceptional family leave and targeted support for certain vulnerable groups. These policies appear, overall, to have been highly effective at securing employment and cushioning income losses. However, there remains scope for some learning and fine tuning to ensure that, if such a crisis happens again, support is provided in an even more targeted way and reaches everyone one in need.

7.3.1. Luxembourg extended its existing job retention scheme and provided accelerated access

Across the OECD, the restrictions imposed by COVID-19 containment measures were accompanied by support to help businesses retain their workforce. In particular, the sharp decline in activity led nearly all OECD countries to introduce, or expand on existing, Job Retention Schemes (JRS). In mid-March 2020, Luxembourg supplemented its existing JRS scheme with a newly adopted crisis scheme: Mesures pour le chômage partiel pendant la période de relance économique. The crisis scheme provided accelerated access to support and, alongside workers on permanent contracts, widened access to include temporary workers and those working for temporary work agencies. Self-employed workers, however, remained, de facto, excluded from JRS support. These measures remained in place for vulnerable sectors until 30 June 2022. However, between July 2020 and January 2021, access to the accelerated support was restricted to companies in the tourism and events sector and from January 2021 to March 2021, layoff rules tightened for companies outside vulnerable sectors (defined as those with mandated closures).

The support extended under chômage partiel provides workers with a subsidy to cover 80% of their wages for these lost hours. Workers at the minimum wage receive 100% of their salaries while the subsidy is capped at 2.5 times the minimum wage. The proportion of wages covered by the scheme is increased from 80% to 90% for workers undertaking training while on JRS. However, households receiving support under chômage partiel were ineligible to apply for the more generous support offered under the exceptional family leave in the event of school closures.

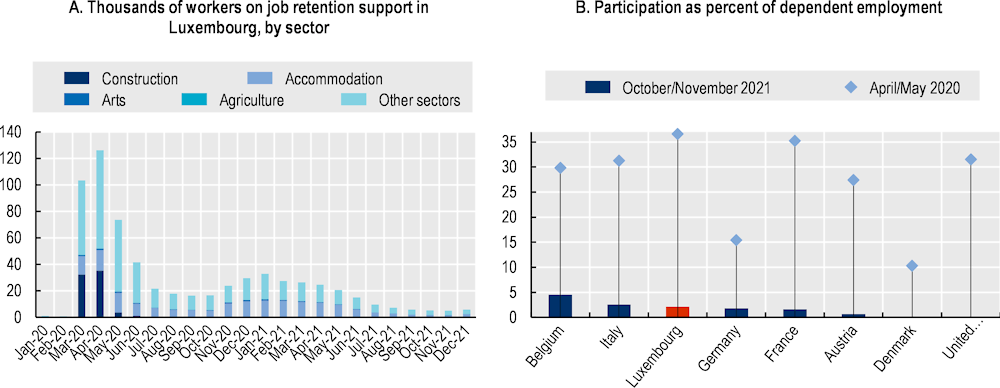

By supporting firms in retaining their employees, Luxembourg’s chômage partiel, went a long way towards smoothing the impact of the pandemic on jobs. In just one month, the number of workers receiving support under the chômage partiel scheme increased from just 820 in February to over 100 000 in March 2020, spiking at over 120 000 in April. At the peak of the pandemic, close to 2 in 5 of all dependent employees accessed support under the scheme, putting it among the most far-reaching JRS in the OECD. In these early months of the pandemic workers in the construction sector received the lion’s share of support (Figure 7.11). The numbers fell rapidly thereafter, as economic activity picked up and workers in many sectors returned to work, but they remained relatively high in the accommodation and food services, until support was formally restricted to these sectors in July 2020.

Figure 7.11. At the peak of the crisis many workers were supported by chômage partiel

Widespread use of JRS, across the OECD, has largely shifted the burden of the cost of hours not worked from employers and employees to governments. In Luxembourg, workers at the average wage who are asked to work reduced hours recoup approximately 80% of their gross wage. This is comparable to what Luxembourg’s generous unemployment insurance system pays during the initial months of an unemployment spell. Elsewhere in Europe, support provided for those on JRS often exceeds unemployment support by a substantial degree (e.g. Switzerland (10pp), France (13pp), Norway (21pp) and Austria (25pp)), but unemployment benefit support is also less generous.

Workers earning the minimum wage receive the entirety of their salary when on chômage partiel, while the subsidy is capped at 250% of minimum wage. In Luxembourg the government bears just over 70% of wage costs, marginally higher than the average government contribution across OECD countries utilising similar schemes of 68% of the labour costs for low-wage workers and 61% at the average wage (OECD, 2021[2]).

7.3.2. In Luxembourg, financial incentives to encourage training while on chômage partiel had limited impact

Job retention schemes are primarily designed to offer stability – both to the workers and to the economy and labour market more widely – by smoothing the impact of ephemeral disruptions. The risk of such programmes, however, is that they can delay necessary restructuring, maintaining workers in jobs that are no longer economically viable. To ensure that workers are prepared for the eventuality that their job, and their skills, are no longer demanded in a post-crisis labour market, some OECD countries encouraged training of JRS participants by offering financial incentives (OECD, 2021[2]).

In Luxembourg, workers who undertook training while on chômage partiel saw their wage subsidy increased from 80% to 90% of wages.10 However, workers on the minimum wage already received 100% of their salary and thus faced no incentive to train. In addition, others saw their incentives limited if the cap on the subsidy (at 250% of the minimum wage), was binding. For these workers the payment could not rise further and the incentive for training had little impact. Indeed, in 2020 only 537 workers accessed the 90% wage subsidy, and in 2021 this figure dropped to just 29.

The lack of incentives for training among those for whom the subsidy cap was binding, de facto had the effect of targeting training towards those with lower wages; this can be an effective strategy if lower wage workers are likely to be those who may struggle the most in moving to a different job if their employer does not resume operations. However, the lack of incentives facing those at the minimum wage, could be problematic. These are the workers who would most benefit from training and upskilling. Luxembourg should consider increasing the subsidy for those workers at the minimum wage, even if this takes the subsidy beyond 100%. Alongside this, given that those on JRS support for extended periods are those most likely to become unemployed at the end of the support, an alternative targeting mechanism would be to incentivise training only for those who have claimed JRS for an extended period. Luxembourg could consider an additional training incentive for those who have been on JRS for an extended period.

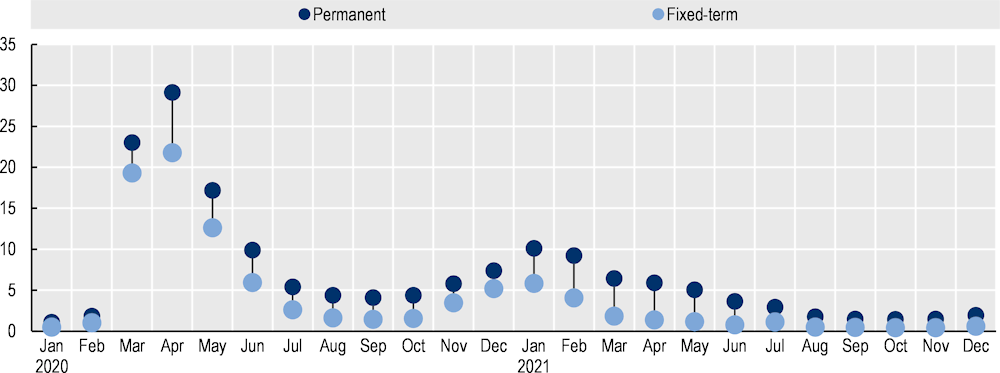

7.3.3. Temporary workers and the self-employed were under-protected

Despite the large number of beneficiaries, Luxembourg’s chômage partiel scheme left some coverage gaps. Despite formal eligibility, fewer temporary, fixed-term contract workers accessed job retention support (Figure 7.12). In principle, widening access to include temporary workers, as Luxembourg did, should reduce the risk that JRS reinforce labour market duality. However, in practice, employers have weak incentives to bear the costs of using job retention support for temporary workers, and even less to renew their contracts. Indeed, throughout the COVID-19 crisis, workers on a permanent contract were more likely than those on a temporary contract to receive support through chômage partiel. Furthermore, the disparity in access expanded during the latter half of both the first and second waves, suggesting that, indeed, the contracts of those on JRS were not renewed when they expired.

Figure 7.12. Permanent workers were more able to access chômage partiel than those on a fixed‑term contract

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

Self-employed workers were excluded from the Luxembourg JRS, and many self‑employed workers will therefore have struggled to cover recurring expenses such as housing costs, which are difficult to bring down in the short term – particularly during lockdown (OECD, 2020[11]). While some self-employed may have been able to cushion a drop in income by eating into their savings, requiring the self-employed to run down their savings is problematic when business closures are part of a government-mandated health measure. It can also be inefficient if it requires self-employed workers to sell their productive assets. From mid-April 2020 the Ministry of the Economy introduced a number of ad hoc measures to support self‑employed workers. However, this support came late and eligibility was, initially, limited to those with income below 2.5 times the minimum wage and employing fewer than ten employees. Until May 2020, when further support was introduced, no support was provided for those self-employed with moderate earnings, whose primary income source nevertheless, fell suddenly away, and who were unable to meet ongoing expenses.

Perhaps most importantly, the ad hoc nature of support provided little predictability for the self-employed to enable them to plan their finances through the turbulent COVID-19 pandemic. Alongside the economic consequences of this insecurity, the lack of ongoing and predictable support is likely to have had toll on the mental health of those unsure of the level of protection they would receive. In response the needs of the self-employed that were revealed during the pandemic a number of OECD countries introduced temporary, but recurrent, measures to support their incomes (Box 7.1).

Box 7.1. Support for self-employed workers in OECD countries

Across the OECD, even in countries with well-developed social protection systems, many self‑employed workers who suddenly lost their income struggled to make ends meet.

Several countries introduced recurrent cash transfers for self-employed workers in the early phase of the crisis. Often, these transfers were dependent either on previous earnings, or on losses due to the crisis:

In the United Kingdom, for example, the self-employed received a taxable grant of up to 80% of their previous earnings over the previous three years. The support, capped at GBP 2 500 a month, was available for self-employed with average annual profits of less than GBP 50 000.

In Austria, self-employed workers received a benefit replacing 80% of their net income loss, up to a limit of EUR 2 000 a month. Newly self-employed workers who only started their business in 2020 and therefore could not prove their income with a tax declaration received a flat rate payment of EUR 500 per month.

In the United States, where the Department of Labor estimates that the self-employed account for 16 million workers, with an additional 1.5 million gig workers, the Federal Government’s relief package extended the coverage of unemployment support to cover these workers.

In Ireland, self-employed workers who lost all of their income received the COVID-19 Pandemic Unemployment Payment, a flat-rate payment of EUR 350 a week paid for the duration of the crisis. Those with only partial losses did not receive income support, however.

Germany rolled out a federal “Corona Supplement” for self-employed workers with up to ten employees, providing lump-sum cash support of up to EUR 15 000 depending on the number of employees and costs that the self-employed / small firms were unable to cover because of the COVID-19 crisis. This support covered only operating costs of the business such as rent, wages of employees not covered by short-time work schemes; for their own living costs, self‑employed workers had to rely on the means-tested minimum-income benefit (Unemployment Benefit II), eligibility to which was temporarily relaxed – see (OECD, 2020[11]). The city of Berlin provided an additional top-up of EUR 5 000 Euros for small firms; however, this programme had to be suspended within days as earmarked funds (EUR 1.3 billion) were depleted following a large number of claims.

Most of these earnings-replacement programmes were designed to deliver support quickly. But determining previous earnings is complex without a structure in place to do so –especially for the self‑employed, whose earnings fluctuate. Therefore, some workers may still have fallen through the cracks, particularly those with short work histories and those who have taken career breaks for parental leave. A “pay now, assess later” approach to payments – see (OECD, 2020[11]) – ensures that those in need receive payments quickly, while the exact policy design is ironed out at a later date. Requiring self-certification of current need, as in the German “Corona Supplement” scheme can also speed up payments. In Austria, the first “immediate hardship fund” for self-employed workers required claimants to self-certify their need for assistance and preserve documentation, with random checks to be carried out at a later date.

Source: OECD (2020[11]), “Supporting livelihoods during the COVID-19 crisis: Closing the gaps in safety nets”, OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/17cbb92d-en

7.3.4. A tight labour market and restrictions on JRS have led to a sharp decline in the take-up of support in Luxembourg

To ensure that support offered under JRS did not become an obstacle to the recovery, by locking workers in unviable jobs, from July 2020 accelerated access to chômage partiel has been restricted to so-called vulnerable sectors and those limiting layoffs. These restrictions were further tightened in January 2021. Alongside the strong labour market recovery, this has no doubt played a role in the sharp decline in take-up of support which fell to just over 2% by October 2021.

As the pandemic progressed, countries across the OECD increased the targeting of JRS. Some, like Luxembourg, targeted support to those activities or areas that remained subject to restrictions while others linked restrictions to the decline in business activity of firms (OECD, 2022[12]). While the former approach was relatively straightforward during mandatory closures, defining ‘vulnerable sectors’ became less clear cut as restrictions eased. In Luxembourg, the sectors defined as vulnerable were designated in consultation with social partners. However, this sectoral approach may have proven somewhat blunt, as businesses operating outside vulnerable sectors but potentially directly dependent on them (such as restaurant cleaners) were no longer eligible for accelerated access to support. A number of OECD countries have increased co-financing obligations, requiring firms to cover a larger part of the costs of hours not worked. This can be an alternative – or complementary – approach to increasing the targeting of support.

By alleviating labour costs for firms, Luxembourg’s chômage partiel, significantly reduced the number of jobs at risk of termination and, no doubt, went an important distance towards cushioning the employment impact of the pandemic and mandatory business closures. Going forward, it would be important for the Luxembourg government to ensure that no workers – irrespective of employment history and contract type – are left to fall through the cracks. This also includes ensuring that firms’ incentives, including the avoidance of hiring and firing costs, and the effects these incentives have on the de facto targeting of support, are anticipated and assuaged.

7.3.5. Luxembourg provided generous extraordinary family leave benefits to workers with unforeseen care duties

As in the majority of OECD countries, Luxembourg authorities mandated the closure of schools, childcare facilities and care support structures, to contain the spread of COVID-19, following the outbreak of the pandemic in March 2020. All elementary schools and childcare facilities were fully closed between 16 March and 24 May 2020, and then progressively opened with restrictions between 25 May and 15 July 2020. The closure of formal care facilities brought a significant increase in households’ care burdens across the OECD, with much of this increased unpaid work falling on women.11

Luxembourg responded rapidly to the unanticipated increase in home care needs following the outbreak of the pandemic by introducing two types of exceptional family:

a special leave for family reasons (congé pour raisons familiales extraordinaire), aimed at helping parents of young children to cope with (i) emergency school and childcare facility closures, and (ii) isolation or quarantine of children with COVID-19;

and a leave for family support (congé pour soutien familial), aimed at helping workers to look after a disabled adult or an elderly person who could not attend their usual support structures.

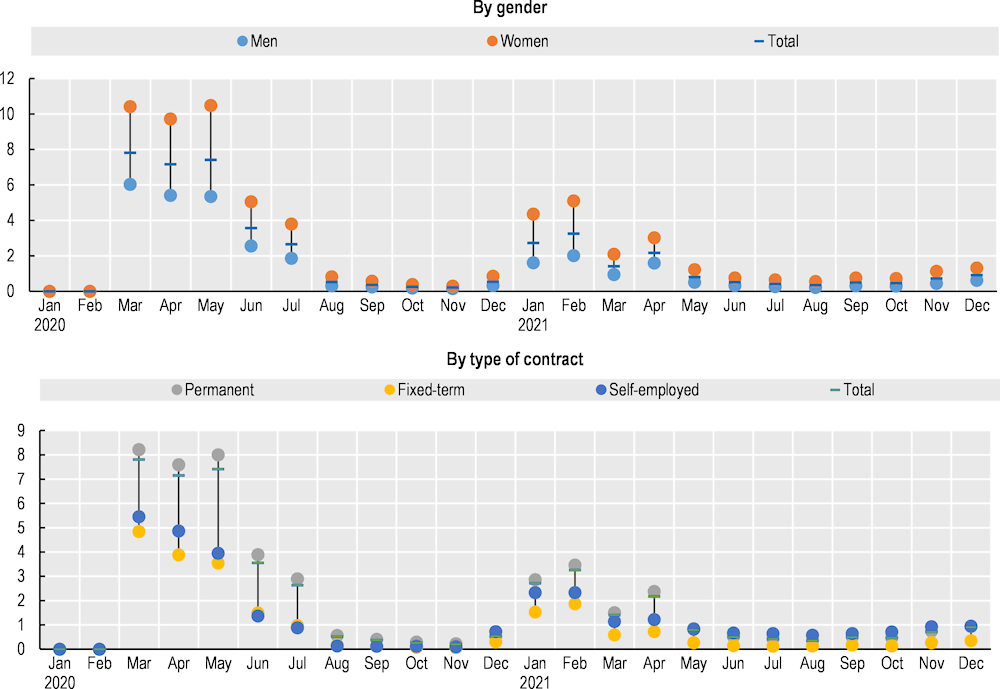

Both employees and the self-employed were eligible for the scheme, but those with a household member in chômage partiel were ineligible. For the self-employed, coverage of the period up to the end of the month of the first 77 days of leave was subject to a voluntary affiliation to the Mutualité des employeurs. Together with the chômage partiel, the congé pour raisons familiales extraordinaire was an essential element Luxembourg’s emergency response to the crisis, allowing parents to keep their jobs and income while ensuring that their children were taken care of. During the confinement in spring 2020 close to 40% of eligible parents benefited from this policy (Zhelyazkova, Berger and Valentova, 2020[13]). Meanwhile, the take-up of the congé pour soutien familial was low – only 60 people accessed this support over the entire period during which it was available. This may reflect lower demand for this type of support, with possibly only a small number of workers hosting an elderly or disabled person in their own home after the closure of a care facility. At the peak of the crisis, between March and May 2020, when schools and childcare facilities were fully closed, 7% of Luxembourg workers benefited from either of the two types of exceptional family leave, on average (Figure 7.13). Take-up remained relatively high in June and July 2020 when schools were open with restrictions (close to 3%), and rose again in January and February 2021 when schools were again only partially open (3%).

7.3.6. The generous family leave likely contributed to a quick recovery of female employment

More working women than working men took up exceptional family leave during the COVID-19 crisis (Figure 7.13). At the peak of the crisis, when schools and childcare facilities were fully closed, close to 10% of working women took up this leave, compared to an average of only 5% of working men. This reflects that a larger share of the increased domestic and care work brought by the crisis fell on women.

The implications of a higher incidence of exceptional family leave among women for gender equality are ex ante ambiguous. On the one hand, the paid leave formally recognised the value of what is typically unpaid work, allowing parents – and in many cases women – to do this work at full earnings without having to resign from their jobs. This likely contributed to the faster recovery of female relative to male labour force participation and employment after the crisis in Luxembourg, helping women to bounce back more quickly than if they had exited the labour market to take care of their children. On the other hand, it possibly accentuated the traditional pattern of women being more involved than men in domestic and childcare, hence potentially undermining gender equality by supporting their absence from the workplace (physical or virtual), with possible longer-term negative consequences for career progression. Indeed, there may be costs associated with this absence in terms of loss of visibility, human capital accumulation, and project assignment, which, if born disproportionately by women, may accentuate existing gender related inequities.

Figure 7.13. Take-up of exceptional family leave was higher among working women and for workers on permanent contracts

Note: Employment figures include people on short-time work.

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

7.3.7. Take-up of exceptional family leave was lower for workers in non-standard employment in Luxembourg

A higher share of workers with standard, permanent, contracts took up exceptional family leave compared to workers with fixed-term contracts and the self-employed (Figure 7.13). For the self-employed, the lower take-up reflects that coverage of the first 77 days of family leave is dependent on a voluntary affiliation to the Mutualité des employeurs, which only 40% of the self-employed have. This lower coverage was identified by the Luxembourg authorities as a potential challenge during the crisis, and there have been reflections among the Luxembourg authorities on whether to extend mandatory affiliation to the Mutualité des employeurs for the self-employed. Recently the government conducted awareness campaigns to inform the self-employed about the risks of non-affiliation and motivate them to affiliate. Irrespective of this, in the context of a global pandemic, there may have been a rationale of covering self-employed workers irrespective of their affiliation. After all, the need for exceptional leave largely resulted from government‑mandated closures of schools and childcare facilities.

For fixed-term workers, the lower coverage likely reflects the fact that some of these workers considered it necessary to continue working in order to increase the likelihood of having their contract renewed.

7.3.8. Some workers in Luxembourg faced a trade-off between special leave for family reasons and JRS

The interaction between family leave and JRS may in some cases have led to inequities. Family leave was more generous than JRS, with a replacement rate of 100% instead of 80%. This made it more beneficial for parents with children younger than 13 years old to request family leave. However, the timing of the support meant that such a choice was not always possible. Where registration for JRS preceded a need for family leave the parent received support under JRS and could not apply for family leave. As a consequence, some workers who were already on JRS may not have been able to access the more generous family leave, even if their personal circumstances would justify it. This may have created discrepancies between the use of family leave by workers on JRS support and other workers, who could access the leave without restrictions. Although both JRS and family leave allowed workers to stay at home without working to take care of their children and older relatives in need, the difference in replacement rates was not negligible, implying an advantage for those who could request family leave. To minimise the probability of these unbalances occurring in future crises, Luxembourg authorities could consider the possibility of switching between JRS and family leave, allowing workers to retract from JRS temporarily to benefit from family leave. Alternatively, a top-up of 20% could be given to workers on JRS support who would need to benefit from family leave, to compensate from the difference in the replacement rates of the two schemes.

7.3.9. Paid sick leave was key to protecting quarantined and sick workers in Luxembourg

As in most OECD countries, paid sick leave played a crucial role in protecting Luxembourg workers’ health, jobs and incomes during the COVID-19 crisis. First, it helped contain the spread of the virus, by allowing workers infected with COVID-19 or in quarantine to stay home rather than continue going to work. Second, it helped to preserve the jobs of workers who were sick or in quarantine, by keeping employment relationships intact, reducing pressure on the unemployment benefits and JRS. Third, it supported workers’ income by ensuring an uninterrupted continuation in income for those either affected by the virus or asked to self-isolate.

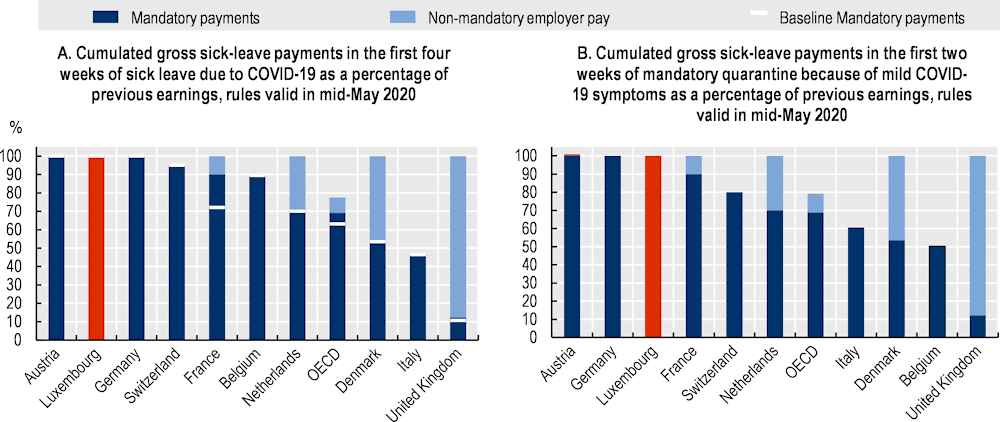

Luxembourg took special measures to prolong entitlement periods, excluding days of sick leave taken between 16 March and 24 June from the calculation of the duration limit. It also supported employers with the costs of paid sick leave associated to COVID-19, covering the costs from the first day between 1 April and 30 June 2020, and increasing the reimbursement rate from 80% to 100% for cases of COVID-19 isolation and quarantine from 1 July onwards. These measures ensured an adequate coverage and generosity of sickness benefits. Indeed, Luxembourg was one of the few OECD countries with a replacement rate of 100% during the first four weeks of paid leave for people who fell sick with COVID-19 and during the first two weeks of mandatory quarantine because of mild COVID-19 symptoms (Figure 7.14).

Figure 7.14. Paid sick leave replaced 100% of earnings for workers who were sick with COVID-19 or in quarantine

Note: The results refer to an eligible full-time private-sector employee who is married with no kids, age 40, earning an average wage and working with the same employer for one year who cannot work from home. “Mandatory paid sick leave” refers to mandatory payments paid to individuals by employers (sick pay) and mandatory payments by the government, either directly paid to individuals or indirectly by subsidising employers (sickness benefits). “Non-mandatory employer sick pay” includes employer sick pay commonly agreed via collective agreements or other arrangements; these payments are included for those countries where the majority of employees would receive such payments. Countries emphasised with a dashed fill are those where employees are entitled to a benefit other than a dedicated sickness benefit.

Source: (OECD, 2020[14])“Paid sick leave to protect income, health and jobs through the COVID-19 crisis”.

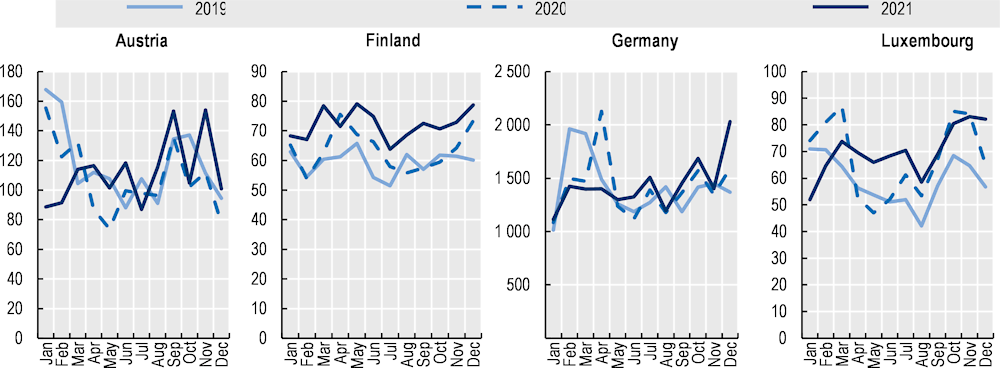

Take-up of paid sick leave in Luxembourg varied over the course of the pandemic, reflecting the evolution of the spread of COVID-19, the intensity of restrictions to mobility and economic activity, and the interaction with other policy interventions (Figure 7.15). It increased at the onset of the pandemic, in March 2020, when the number of COVID-19 cases surged, and then went down between April and June 2020 (below the comparable pre-crisis levels), following the rapid shift to teleworking in many occupations and the extensive use of JRS. Workers became less exposed to the virus, and if they were, may have continued teleworking or remained under JRS support rather than taking paid sick leave. Take-up continued to exhibit variations until the end of 2021, although to a minor extent. This is in line with trends observed in other OECD countries, such as Austria, Finland and Germany. Notwithstanding the variation during the COVID-19 crisis, take-up rates did not significantly increase relative to the pre-crisis status quo, which reflected the massive utilisation of JRS and the high share of workers who teleworked. More generally, the evolution of take-up reflects two opposing trends: a rise due to contagion from COVID-19 and a decrease because of a lesser prevalence of non-COVID-19-related sicknesses as a result of the containment measures. Therefore, the increase in take-up strictly due to the COVID-19 pandemic may have been more substantial than what is possible to observe in the data, which does not include disaggregation by sickness type.

Figure 7.15. Take-up of paid sick leave varied over the course of the pandemic

Note: Monthly averages for Finland and Luxembourg, numbers at the beginning of the month for Germany and at the end of the month for Austria. The data for Finland exclude recipients of employer-provided sick pay, i.e. the first nine respectively ten days of sick leave.

Source: OECD (2022) Employment Outlook 2022 based on national administrative data for Austria, Finland and Germany, and administrative data provided by the Inspection Générale de la Sécurité Sociale (IGSS) for Luxembourg.

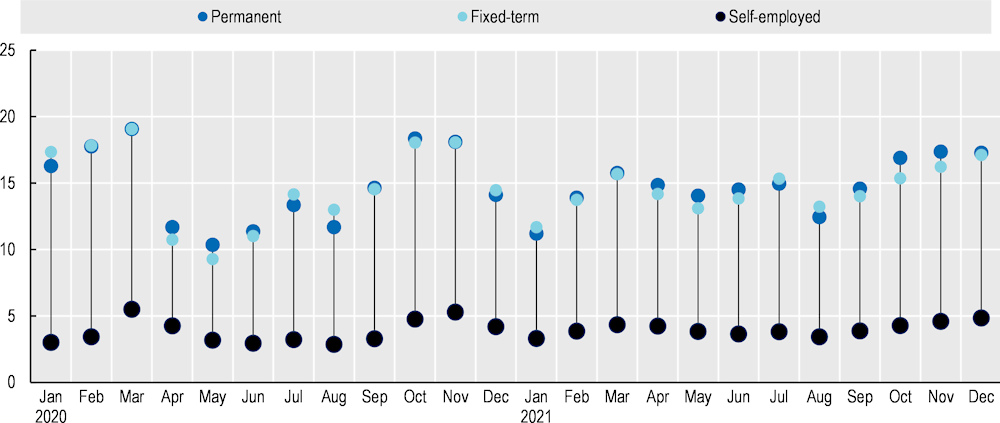

7.3.10. But, in Luxembourg as in other OECD countries, the self-employed were less well covered by paid sick leave than dependent employees

Despite high overall take-up of paid sick leave, there was a significant gap between the self-employed and workers in dependent employment (Figure 7.16). Across the whole crisis period, the take-up of paid sick leave was systematically lower for the self-employed, with an average difference of ten percentage points relative to dependent employees. As for family leave, this reflects that for the self-employed coverage depends on a voluntary affiliation to the Mutualité des employeurs. While some self-employed have private insurance cover, a pandemic may – as for the extraordinary family leave – be considered extraordinary enough to justify a temporary extension of insurance to non-affiliated workers. Given the importance of containing the spread of the virus, providing access to paid sick leave to non-covered self‑employed workers would also have provided additional incentives to stay home if sick or in quarantine.

Figure 7.16. Take-up of paid sick leave was much lower for the self-employed

Note: Employment figures include people on short-time work.

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

7.3.11. In Luxembourg, unemployment benefits were easily accessible and comparatively generous pre-crisis and provided important income support

Income support for workers affected by job and earnings losses was another important pillar of governments’ efforts to cushion the effects of the crisis on workers and households. Despite the rapid expansion of the JRS, the unemployment rate in Luxembourg rose by 1.8 percentage points from the first to the second quarter of 2020. Finding new employment was difficult during the lockdown and the period of uncertainty that followed, including for jobseekers that had already been without work prior to the pandemic. Unemployment benefits (UB) and other out‑of‑work income support therefore played a vital role in protecting workers and families’ livelihoods during these periods.

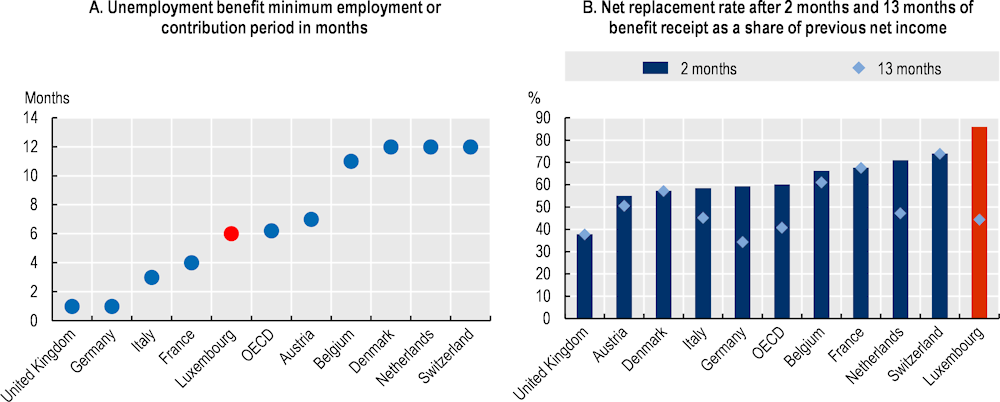

Workers affected by job and earnings loss had relatively good access to UB during the crisis, and benefits were comparatively generous at least in the early phase of an unemployment spell. To be entitled to UB, jobseekers in Luxembourg generally needed to have been employed for at least six out of the 12 months preceding unemployment (Figure 7.17, left panel). This corresponds to the average required contribution or employment period across OECD countries in 2021.12 Meanwhile, in Germany and the United Kingdom, non-contributory unemployment assistance programmes (the Arbeitslosengeld II and Universal Credit) provide support to jobseekers from the first month of unemployment. Self-employed workers in Luxembourg in principle have the same rights to UB as dependent workers under the condition that they previously declared their taxable income and that they give up their business license. This is rather an exception: in most OECD countries, self-employed workers have only partial access to UB (e.g. in Belgium and France), unemployment insurance is voluntary (e.g. in Austria and Germany) or they have no access at all (e.g. in the Netherlands and Italy) (OECD, forthcoming[6]). Young people who are looking for work after having completed training can also be eligible to UB in Luxembourg under certain conditions.

Figure 7.17. Unemployment benefits are relatively accessible and replace a large share of earnings in the initial months of the benefit spell in Luxembourg

Note: Both panels include unemployment insurance and assistance benefits. Panel B: net replacement rates are for a jobseeker with previous earnings at 100% of the national average wage assuming a 36‑month contribution record. They include receipt of social assistance and housing benefits. OECD gives the average over 34 countries (Panel A) and 29 countries (Panel B). Both panels represent the situation on 1 January.

Source: OECD TaxBEN Model (version 2.4.0) http://oe.cd/TaxBEN.

UB payments are comparatively high in Luxembourg, at least in the beginning of the unemployment spell. For a jobseeker with the required six-month employment record and previous earnings at 100% of the national average wage, unemployment benefits in the second month of unemployment replace about 86% of previous net earnings (the so-called net replacement rate, NRR; Figure 7.17, right panel). This compares to an NRR of 60% across OECD countries on average. However, the benefit amount rapidly declines for many jobseekers after the third month of unemployment, and most jobseekers exhaust their entitlements within a year. In the 13th month of unemployment, a jobseeker with the same employment and earnings history only touches social assistance and housing benefits in Luxembourg, which account to 44% of previous net earnings. This is still a little above the OECD average (NRR of 41%), but much less than in Switzerland (74%), France (68%) and Belgium (61%).

7.3.12. Luxembourg extended the duration of unemployment benefits in the initial crisis phase

Most OECD countries extended unemployment benefit entitlements in the initial phase of the COVID-19 crisis, extending benefit entitlements along one or several of three dimensions (OECD, forthcoming[6]): half of all countries improved access by reducing or waiving minimum contribution periods, covering groups of workers who had previously not been entitled, or even introducing new unemployment assistance benefits; more than one in three countries extended benefit durations by lengthening durations outright or automatically extending entitlements that expired during the peak of the crisis; a dozen countries raised benefit amounts by introducing temporary lump-sum top‑ups, raising replacement rates, lifting benefit floors or ceilings, or suspending progressive reductions in benefit amounts for recipients with longer unemployment spells. These measures aimed at covering groups of workers who had previously not been entitled and accounted for the fact that jobseekers had only poor chances of finding new work at a time when large parts of the economy were effectively at a stand-still.

Also Luxembourg extended the maximum UB duration for the duration of the state of crisis, by three months in spring 2020. This particularly benefited workers who were already unemployed at the onset of the crisis and whose entitlements would otherwise have expired during the state of crisis or shortly after. It also made sure that workers with rather short work histories who lost their jobs during the crisis would keep their entitlements until the end of 2020. Luxembourg did not again extend UB durations in the later phases of the pandemic, which reflects the generally favourable labour market developments in the second half of 2020 and through 2021 (see Figure 7.1).

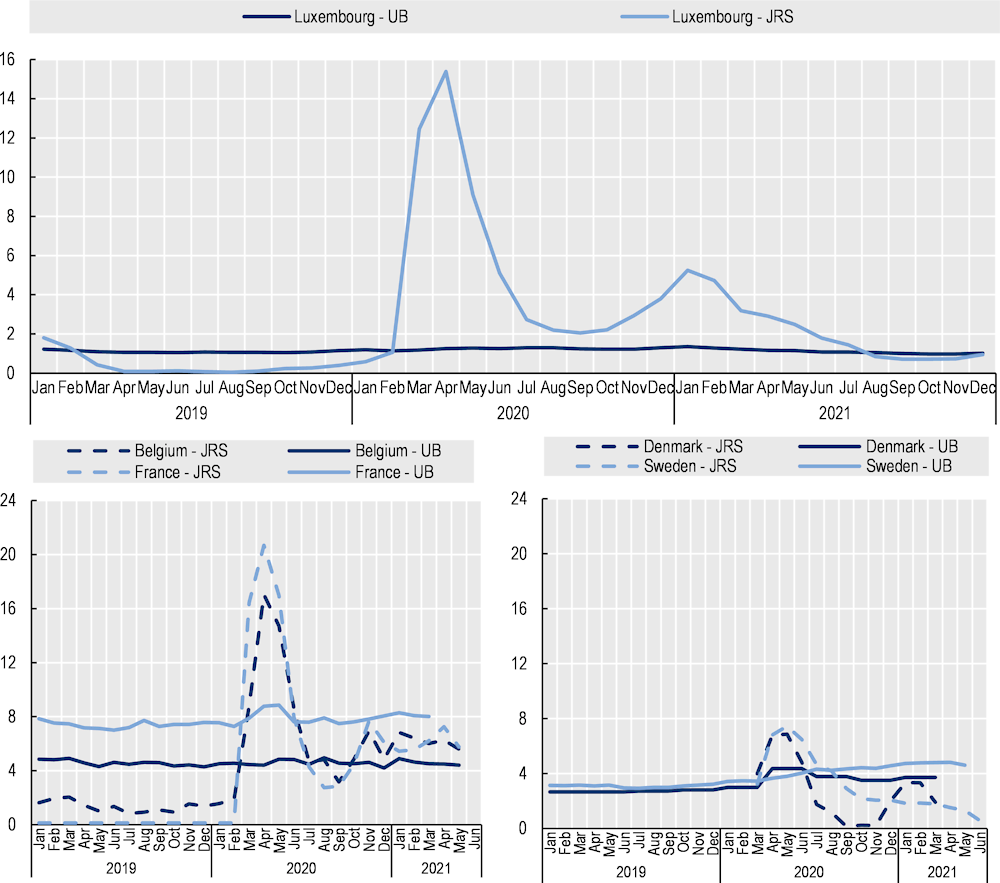

7.3.13. Unemployment benefit receipt rates remained low, as the chômage partiel absorbed most of the labour market shock

Despite the massive repercussions of the COVID-19 pandemic on the Luxembourg economy and labour market, rates of UB receipt remained low as the chômage partiel secured workers’ jobs and so took pressure off the UB system. While Luxembourg experienced a 20% rise in the absolute number of monthly UB recipients relative to the pre-crisis year 2019, benefit receipt as a share of the working‑age population remained at a little above 1% throughout the crisis (Figure 7.18). At the peak of the crisis, in April 2020, 1.3% of the Luxembourg working-age population received UB, a number dwarfed by the 15.4% of people on chômage partiel. This is in line with trends observed in some other countries where comprehensive JRS absorbed most of the labour market shock, such as Belgium, Denmark, France and Sweden.

Figure 7.18. The share of unemployment benefits recipients remained low during the crisis

Note: For Denmark, JRS numbers refer to two schemes, the pre-existing sharing scheme and the wage compensation introduced in March 2020; complete JRS figures are missing before March 2020; monthly figures for both UB and JRS were interpolated from quarterly time series.

Source: Top panel: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS). Bottom panels: OECD Employment Outlook 2022 based on the OECD Social Benefit Recipients – High Frequency database (SOCR-HF), https://www.oecd.org/fr/social/soc/recipients-socr-hf.htm

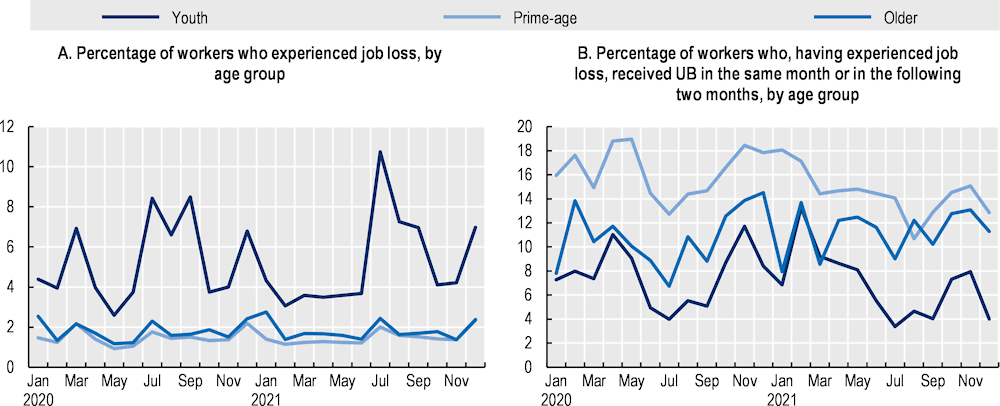

7.3.14. Workers with patchy employment records, in particular the young, may have faced gaps in unemployment benefit coverage

While JRS and UB, in combination with the exceptional family leave, provided strong income protection for most workers who were forced to suspend their work or cut hours during the pandemic, certain groups may have gone uncovered. This may be part of the reason for why UB receipt rates remained largely flat even when unemployment rates increased in March 2020.

In particular, workers with short or patchy employment records were less well covered against the risk of income losses during the crisis. This typically concerns young people, who often have shorter and less stable employment careers, as well as workers on temporary contracts. Both groups were also particularly affected by the reduction in hours and employment losses in the initial phase of the crisis (see Figure 7.5 and Figure 7.8), and a greater share of them likely did not meet the six-month minimum employment requirement to qualify for UB. Indeed, young people were both the age group most affected by job loss and the group least likely to receive UB in case of job loss (Figure 7.19). In a few countries, including Germany and the United Kingdom, UB are available from the first month of unemployment, which improves access for jobseekers with short or patchy work histories. A number of other OECD countries took measures to improve access to UB for those workers during the crisis, by reducing or entirely waiving minimum-contribution requirements (e.g. Finland, Israel, Norway, Spain and Sweden), extending the qualification period for the employment requirement (France, Switzerland) or even introducing new unemployment assistance schemes (Canada, Lithuania, Korea) (OECD, 2020[1]; forthcoming[6]).

Figure 7.19. Young workers were disproportionately affected by job loss and less often covered by unemployment benefits

Note: Youth corresponds to 15-24 year-olds, prime-age to 25-54, and older to 55-64.

Source: OECD calculations based on microdata provided by the Inspection Générale de la Sécurité Sociale (IGSS).

Some groups of self-employed workers may also have faced greater difficulties in accessing income support. Self-employed workers with shorter work history do not qualify. Furthermore, they were not eligible for JRS and, while in principle, they had equal access to UB, self-employed workers needed to have declared their incomes for a minimum of two years prior to suspending operations to qualify. In return, they were entitled to at least one year of benefit receipt.13 Some Nordic countries waived the requirement for self‑employed workers to renounce their business licence to receive income support during the crisis. This could have been considered by the Luxembourg authorities, given the exceptional nature of the crisis. Luxembourg provided targeted ad-hoc support to self-employed workers at different points during the crisis, but such ad-hoc payments are less predictable, and usually less generous, than the support provided through standard social protection systems.

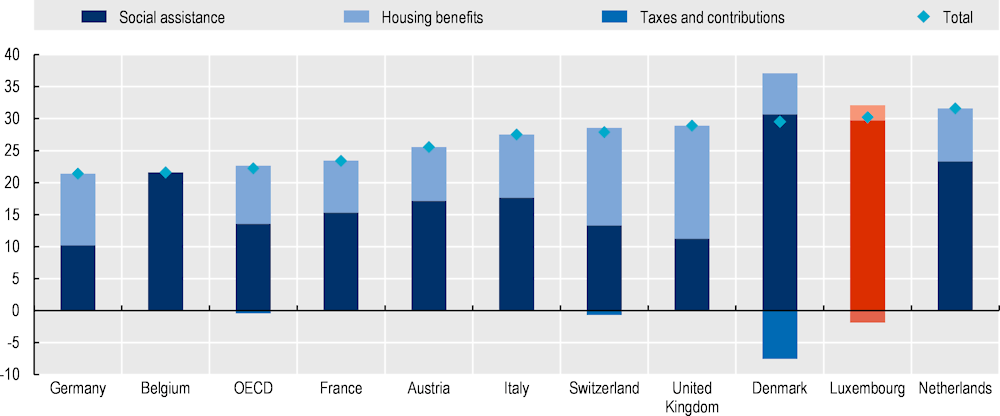

7.3.15. Luxembourg also strengthened income assistance to low‑income households

Income assistance played an important role across OECD countries in supporting the livelihoods of low-income household affected by the crisis, particularly those that did not have access to earnings-related support through JRS or UB. Luxembourg provides such income assistance through two social assistance (SA) benefits, the social inclusion income (REVenu d’Inclusion Sociale, REVIS) and the cost-of-living allowance (allocation de vie chère), as well as a housing benefit (subvention de loyer). For a 40-year-old single person with no other sources of income, the net payments from REVIS and the housing benefit accounted for about 30% of the national average wage in 2021, somewhat more than in many European countries (22% across the OECD on average; Figure 7.20). The REVIS accounts for the bulk of these payments.

Figure 7.20. Income assistance benefits are somewhat higher in Luxembourg than in peer countries

Note: OECD gives the average over 29 countries. Social assistance only includes REVIS, as the cost-of-living allowance is not simulated.

Source: OECD TaxBEN Model (version 2.4.0) http://oe.cd/TaxBEN.

Luxembourg strengthened income support to low-income households during the crisis by expanding its housing benefits (subvention de loyer) and doubling the payment of the annual cost-of-living benefit (allocation de vie chère). While no adjustments were made to the REVIS these measures were an effective way of quickly channelling additional support to a large number of financially vulnerable households without requiring them to apply for new benefits and go through lengthy bureaucratic procedures. Indeed, the majority of recipients of SA benefits in Luxembourg receive the cost‑of‑living allowance, with a small share only receiving the REVIS (an average of 4.2% of households receives some form of SA, with 0.3% receiving only the REVIS, 2.7% receiving only the cost-of-living allowance and 1.2% receiving both). However, since the cost-of-living allowance is paid annually, and the time lag between the application and the receipt of the benefit is variable, it will not necessarily have reached households at the time of greatest need.

7.3.16. Benefit receipt rose little, and some vulnerable groups may have been left behind

Meanwhile, receipt rates of SA increased only little. The share of people in households that received either the REVIS or the cost-of-living allowance rose on average from 4.2% per month in 2019 to 4.5% in 2020 and declined again to 4.2% in 2021. All of this (small) increase reflects the growing number of recipients of the cost‑of-living allowance. While SA plays a vital role in supporting the living standards of the most vulnerable households, these numbers suggest that it was of lesser importance in supporting the incomes of workers and households affected by the crisis more broadly. Again, this is consistent with patterns observed in a number of other European countries, where rates of SA receipt have remained relatively flat over the crisis. This certainly reflects the effectiveness of earnings-related benefits, such as the JRS and UB, in protecting workers’ incomes. It also explains what appear to have been stable poverty rates in Luxembourg in 2020.

However, the lack of reactiveness of SA receipt rates to the crisis may to some extent also indicate that some vulnerable groups did not have access. This certainly applies to young people between 18 and 25 years, who generally do not qualify for REVIS. Young workers with patchy employment histories may therefore have been left without support, as they could access neither UB nor SA. As shown previously, young workers experienced high job separation rates during the crisis. Relaxing the age condition to access REVIS, at least temporarily, could have been a way to account for this rise in joblessness among the young. Alternatively, Luxembourg authorities could have considered providing an exceptional, temporary, targeted support for these workers. University students who relied on a part-time job to fund their studies may also have required additional attention as they were not eligible to the cost-of-living allowance and therefore did not benefit from the increase in support. These students are entitled to grants to partly cover their cost of living and education fees, whose duration was extended during the crisis. Nevertheless, additional income support would have seemed appropriate. France, for example, provided a one-off emergency aid worth up to EUR 500 for students in sudden financial difficulty due to the crisis (OECD, 2021[15]). The gaps in income support for students revealed by the crisis sparked discussions on how to improve income protection – the New Zealand government already acted by increased social benefits for young people.

7.3.17. Luxembourg introduced targeted support to non-standard workers, in particular the self-employed and workers in the arts, entertainment and recreation sector

In addition to the expansions of JRS, UB and SA programmes, Luxembourg implemented targeted support measures for non-standard workers, who were not well covered by standard job and income protection mechanisms. These included self-employed workers, and in particular those in the arts, entertainment and recreation sector.14

For the self-employed, Luxembourg introduced in April 2020 three types of lump-sum emergency allowances to support workers who experienced financial difficulties directly linked to the COVID-19 crisis. These one-off allowances provided rapid relief, but only for a short time, and some professions, including in health and financial and insurance activities, were excluded. A more targeted way of providing such support could have been to make it conditional on proof that workers’ activity had been severely impacted by the crisis. A number of countries also introduced recurrent emergency support payments for self-employed workers during the crisis (see Box 7.1).

Luxembourg also carried out a wide range of measures targeted specifically at workers in arts, entertainment and recreation, a sector heavily affected by the crisis (see Figure 7.4) in which many people work on non-standard contracts. These measures supported three main groups of workers: First, artists who before the crisis were able to live out of their projects, without relying on the statut d’intermittent.15 The impact of the crisis for these artists was substantial, as they were left without any source of revenues. The authorities provided several exceptional support measures, though a challenge has reportedly been that some of these workers were hesitant to take-up such type of support. Second, artists who prior to the crisis had the status of statut d’intermittent. For these workers, the authorities reduced the number of working hours necessary to access the scheme and to increase the amounts. Third, teachers in private dance schools, music schools, yoga studios, and other art-related establishments, and technical workers. Many of these workers had troubles accessing chômage partiel because they did not have an employee status even when they mostly worked for a single employer and with little flexibility in hours. They also did not qualify for the exceptional lump-sum allowances provided to the self-employed. The Ministry also introduced support measures for this group of workers, to ensure that they were not left unprotected.

7.3.18. In Luxembourg, support was rolled-out to minimise the increase in domestic violence

In many OECD countries, the onset of the COVID-19 crisis brought an increase in officially reported incidents of domestic violence, of calls to helplines, and of visits to websites offering support and assistance (OECD, 2021[16]). The confinement measures imposed by the majority of OECD governments obliged families to live in close contact for several months. This increased the risk of conflict and violent behaviour, and concomitantly, the need to protect victims of domestic violence.