Thailand is located in the centre of mainland Southeast Asia, with income levels in the middle of the regional group. Its level of human development, including income, life expectancy and education, is very high. Thailand shares these features with Malaysia alongside similar proportions of urban and rural population, so the two countries are analysed as a cluster represented by Thailand. The chapter outlines the geographic, economic and social conditions for broadband connectivity in Thailand. It proceeds by examining the performance and structure of the market and reviewing Thailand’s communication policy and regulatory framework, including broadband strategies and plans. It then reviews competition, investment and innovation in broadband markets; broadband deployment and digital divides; the resilience, reliability, security and capacity of networks; and the country’s assessment of broadband markets. It offers recommendations to improve in these areas, which could be relevant for the other countries forming this cluster.

Extending Broadband Connectivity in Southeast Asia

5. Extending broadband connectivity in Thailand

Abstract

Policy recommendations

1. Further strengthen the transparency of the selection process of high-level NBTC officials and avoid undue delays in future selection processes.

2. Consider revisiting NBTC's regulation governing mergers in the communication sector.

3. Carefully monitor the implementation of merger conditions in the recent merger of True and dtac in the mobile market.

4. Clarify any remaining uncertainty between the respective remit of NBTC and TCCT regarding competition in the communication sector.

5. Consider facilitating wholesale networks, especially in underserved areas, and monitoring wholesale prices.

6. Eliminate foreign direct investment restrictions.

7. Reduce barriers to broadband deployment through simplified procedures for obtaining permits, access to public infrastructure and rights of way.

8. Incentivise communication network operators to co-operate in network development activities.

9. Promote coordination of civil works and passive infrastructure sharing between networks to deploy high-capacity backbone and backhaul networks.

10. Consider leveraging Internet and international connectivity infrastructure.

11. Promote and invest in the improvement of digital skills.

12. Leverage synergies between programmes to promote the provision and adoption of connectivity services.

13. Publish open, verifiable, granular and reliable subscription, coverage and quality-of-service data.

14. Promote measures to improve the geographical diversification of communication infrastructures.

15. Support and promote smart and sustainable networks and devices and encourage communication network operators to periodically report on their environmental impacts and initiatives.

16. Regularly assess the state of connectivity, and availability, performance and adoption of connectivity services and infrastructure deployment.

Note: NBTC = National Broadcasting and Telecommunications Commission; TCCT = Trade Competition Commission of Thailand. These tailored recommendations build on the OECD Council's Recommendation on Broadband Connectivity (OECD, 2021[1]), which sets out overarching principles for expanding connectivity and improving the quality of broadband networks. The number of recommendations is not an appropriate basis for comparison as they depend on several factors, including the depth of contributions and feedback received from national stakeholders. In addition, recommendations do not necessarily carry the same weight or importance.

5.1. Geographic, economic and social conditions for broadband connectivity

Thailand is located in the centre of mainland Southeast Asia and has five distinct regions: the mountains in the north and west, the Khorat Plateau in the northeast; the Chao Phraya River basin in the centre; the maritime corner of the central region in the southeast; and the long, slender peninsular portion in the southwest (Britannica, 2022[2]).

Thailand had a population of 71.7 million as of 2022 (UN DESA, 2022[3]), concentrated mainly in the large metropolitan area of Bangkok, which has 15 million inhabitants (2015) (European Commission, Joint Research Centre, 2015[4]), more than 20% of the country's population. Other urban centres of considerable size are Chiang Mai and Phitsanulok in the mountainous northwest; Phuket and Hat Yai on the peninsula's coast; Chonburi, Pattaya and Nakhon Pathom in the Chao Phraya River basin; and Khon Kaen, Nakhon Ratchasima, and Udon Thani in the northeast.

Due to its geography, Thailand is exposed to climate extremes. The Chao Phraya delta is particularly vulnerable to flooding, with agriculture and tourism at most risk. Over 9 million Thais already live at risk of flooding, either permanent or annual, and this number is projected to rise to 19 million by 2050 (ASEAN, 2021, p. 117[5]). In terms of economic impacts, Thailand's economic composition makes it especially vulnerable to physical infrastructure damage (ASEAN, 2021[5]).

Thailand is the representative country of the cluster comprising Thailand and Malaysia, as outlined in Chapter 1. These countries share many commonalities, especially on several macroeconomic metrics that influence a country’s level of broadband deployment. Thailand had a gross domestic product (GDP) per capita of USD PPP 21 153 in 2022, ranking fourth among SEA countries (IMF, 2023[6]). Malaysia ranked third in GDP per capita, just above Thailand, at USD PPP 34 392 in 2022 (IMF, 2023[6]). However, Malaysia’s population in 2022 was 33.9 million, around half of Thailand’s (UN DESA, 2022[7]).

Thailand and Malaysia have similar geographic breakdowns between urban and rural areas. Around 96% of the land mass in both countries was classified as “rural”1, with the remaining area classified as urban (“urban cluster”2 or “urban centre”3) (European Commission, Joint Research Centre, 2015[4]). However, the population was more concentrated in urban areas in Malaysia than in Thailand (Table 5.1). In terms of human development, the United Nations Development Programme (UNDP) classifies Thailand and Malaysia as having a “very high” human development, along with Brunei Darussalam and Singapore in the region (UNDP, 2022[8]). The level of human development considers indicators across longevity, education and income (Table 5.1).

Table 5.1. Human development (2021) and degree of urbanisation (2015), Thailand and Malaysia

|

Life expectancy (years, 2021) |

Expected years of schooling (children, 2021) |

Mean years of schooling (adults, 2021) |

Gross domestic product per capita (current prices, PPP, 2022) |

Population living in urban centres (%, 2015) |

Population living in urban clusters (%, 2015) |

Population living in rural areas (%, 2015) |

|

|---|---|---|---|---|---|---|---|

|

Thailand |

78.7 (2) |

15.9 (2) |

8.7 (5) |

21 153 (4) |

30.7 |

28.1 |

41.2 |

|

Malaysia |

74.9 (3) |

13.3 (5) |

10.6 (2) |

34 392 (3) |

51.3 |

29.1 |

19.6 |

|

OECD Average |

80.0 |

17.1 |

12.3 |

53 957 |

48.8 (2022 data) |

28.11 (2022 data) |

23.11 (2022 data) |

Note: The numbers in parentheses refer to the simple ranking (i.e. no weighting) of SEA countries for each indicator. The OECD average for human development indicators is a simple average across OECD member countries. The urbanisation indicators for SEA countries refer to the population percentage in urban centres, urban clusters and rural areas, respectively. For the OECD, figures are given for the rate of the population living in predominantly urban, intermediate, and rural regions, respectively.

Source: [Human development indicators] UNDP (2022[8]), Human Development Report 2021/2022: Uncertain Times, Unsettled Lives: Shaping our Future in a Transforming World, www.undp.org/egypt/publications/human-development-report-2021-22-uncertain-times-unsettled-lives-shaping-our-future-transforming-world. [GDP per capita, SEA countries] IMF (2023[6]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 28 June 2023). [GDP per capita, OECD] OECD (2023[9]), Gross domestic product (GDP) (indicator), https://doi.org/10.1787/dc2f7aec-en (accessed on 30 June 2023). [Urbanisation indicators for SEA] European Commission, Joint Research Centre (2015[4]), Global Human Settlement Layer (GHSL), https://ghsl.jrc.ec.europa.eu/CFS.php. [urbanisation indicators for OECD] OECD (2023[10]), OECD.Stat (database),”Regions and cities: Regional statistics: Regional demography: Demographic indicators by rural/urban typology, Country level: OECD: share of national population by typology”, https://stats.oecd.org/ (accessed on 28 August 2023).

Given the similarities in geographical and economic conditions for broadband deployment in Thailand and Malaysia, the recommendations for Thailand may also apply to a certain extent to Malaysia. Nevertheless, the subsequent sections will focus on the situation in Thailand for further analysis.

5.2. Market landscape

5.2.1. Market performance

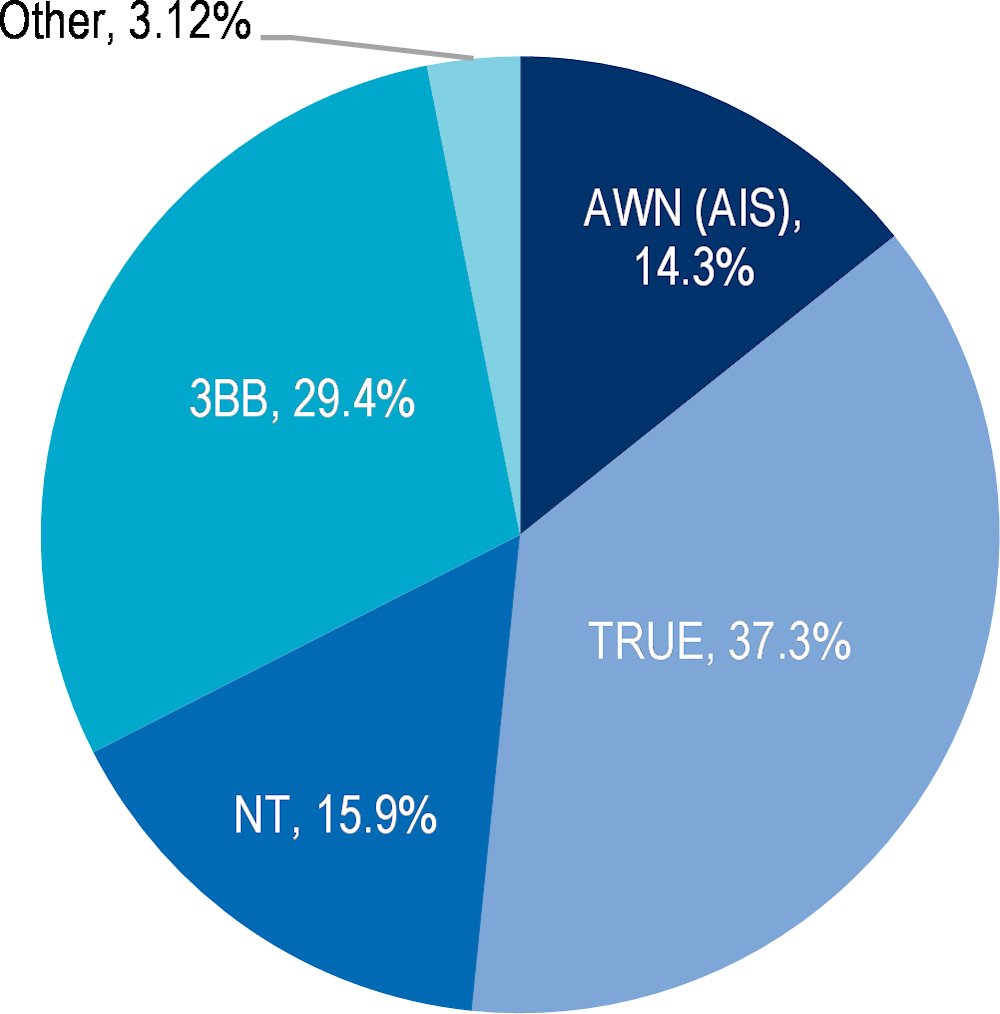

Thailand’s broadband markets have made great strides over the past decade to increase network coverage and total number of broadband subscriptions, as well as deploy high-quality mobile and fixed technologies. Network coverage of fixed and mobile networks increased, with fixed networks reaching over half of all households in 2021 (based on government data). Mobile networks reached 98% population coverage for 3G and 4G by 2015 and 2016, respectively, and 85% for 5G by 2022 (GSMA Intelligence, 2023[11]). The total number of broadband subscriptions reached 100.6 million in 2022 with mobile broadband accounting for 87% (ITU, 2023[12]). Mobile connectivity has kept pace with successive technology upgrades, accelerating between 2012 and 2014, coinciding with deployment of 4G. In 2021, with deployment of 5G, connectivity grew by 27% in a single year (Figure 5.1) (ITU, 2023[12]). Fixed subscriptions have shown slow, but consistent, growth from 2010-22, with year-on-year growth rates ranging between 5-20% and an average year-on-year growth rate of 12% (ITU, 2023[12]). In terms of penetration, the number of mobile subscriptions reached 121.8 subscriptions per 100 inhabitants in 2022, above the regional average (103.7 subscriptions) (ITU, 2023[12]).

Figure 5.1. Broadband subscriptions, 2010-22

Note: Fixed broadband subscriptions refer to fixed subscriptions to high-speed access to the public Internet (TCP/IP connection) at downstream speeds equal to, or greater than, 256 kbit/s. This includes cable modem, DSL, fibre-to-the-home/building, other fixed (wired)-broadband subscriptions, satellite broadband and terrestrial fixed wireless broadband. It includes fixed WiMAX and any other fixed wireless technologies. This total is measured irrespective of the method of payment. It excludes subscriptions with access to data communications (including the Internet) via mobile-cellular networks. It includes both residential subscriptions and subscriptions for organisations. Mobile broadband subscriptions (active mobile-broadband subscriptions in ITU Database) refer to the sum of active handset-based and computer-based (USB/dongles) mobile-broadband subscriptions that allow access to the Internet. It covers actual subscribers, not potential subscribers, even though the latter may have broadband-enabled handsets. Subscriptions must include a recurring subscription fee or pass a usage requirement if in the prepayment modality – users must have accessed the Internet in the last three months (ITU, 2020[13]).

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

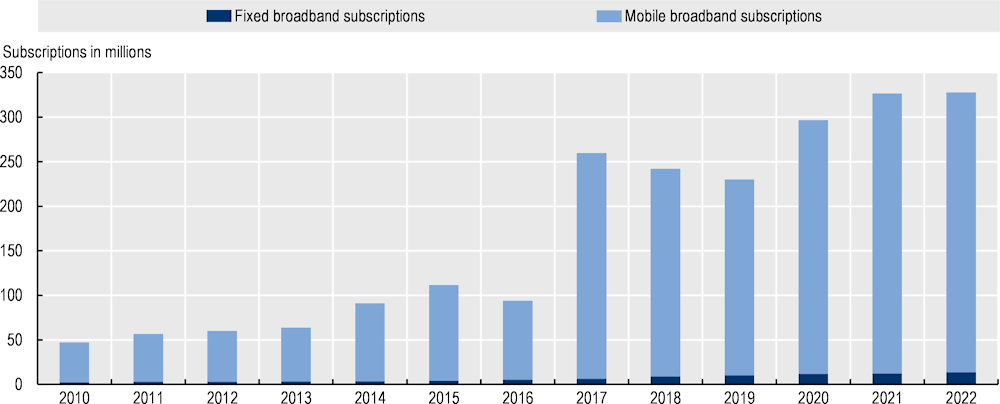

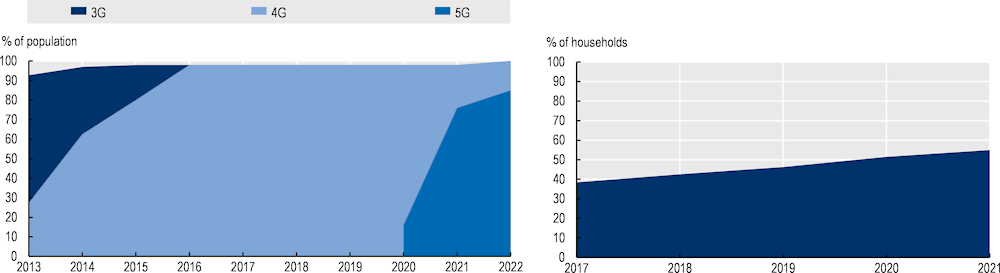

4G was the most common mobile broadband technology in Thailand in 2022 with 70% of mobile connections, followed by 3G with 17% and 5G with 13% (Figure 5.2) (GSMA Intelligence, 2023[11]). 3G connections have shown a steady decline since 2016, coinciding with the rise in 4G connections (GSMA Intelligence, 2023[11]). While 4G remains the most prevalent technology as of 2022, 4G connections decreased slightly from 2021 to 2022 (from 72% to 70%). This occurred simultaneously as 5G connections increased (from 4% to 13%) over the same period (GSMA Intelligence, 2023[11]). This suggests 5G connections will likely gain ground compared to 4G, especially considering the high 5G population coverage of 85% in 2022 (GSMA Intelligence, 2023[11]).

Figure 5.2. Percentage of mobile connections per technology, 2013-22

Source: GSMA Intelligence (2023[11]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

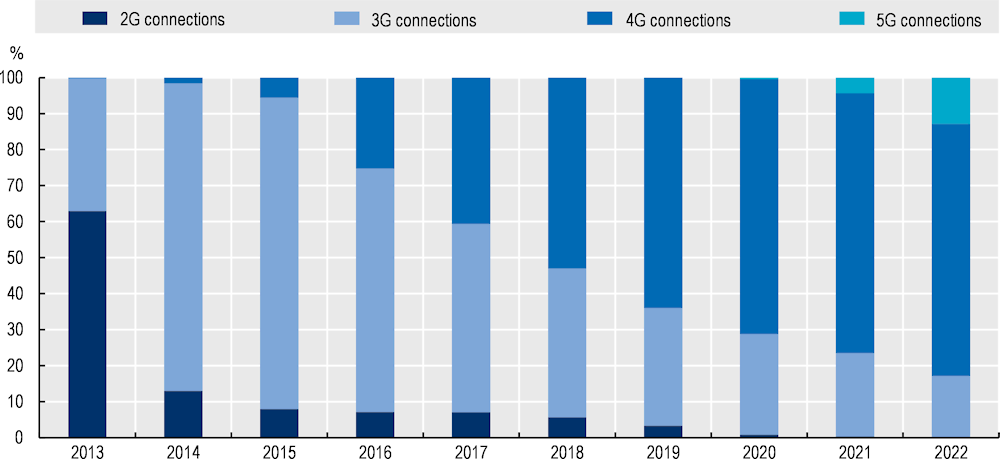

Fixed networks have also proven to be dynamic in recent years. Fibre-to-the-Home (FTTH), which overtook digital subscriber line (DSL) in 2018, represented the most widespread broadband fixed technology in 2021 with an impressive 82% of fixed subscriptions (Figure 5.3) (ITU, 2023[12]). Much of the fibre in the country has been deployed over aerial fibres. This is true in major metropolitan areas like Bangkok, as well as in suburban and rural areas. While this installation mode is often quicker and cheaper than laying fibre underground, aerial fibre is more exposed to the elements and adverse weather. As a result, aerial fibre might prove to be less resilient.

Figure 5.3. Fixed broadband subscriptions by technology, 2010-21

Note: ‘Cable’ data for 2021 and 'Other' data for 2020 and 2021 are estimates.

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

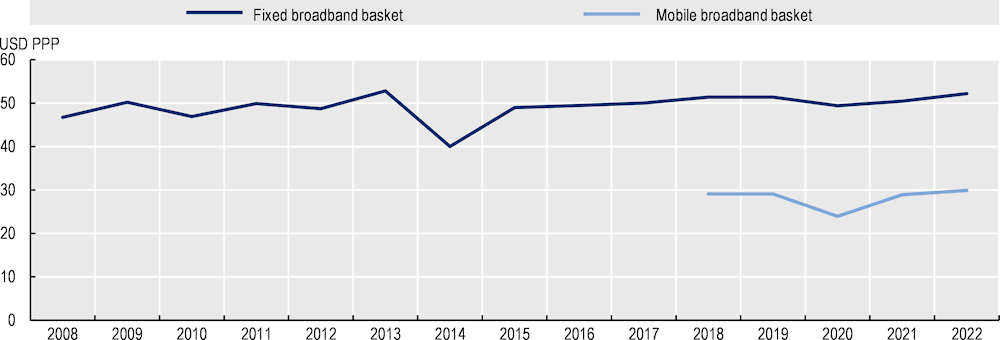

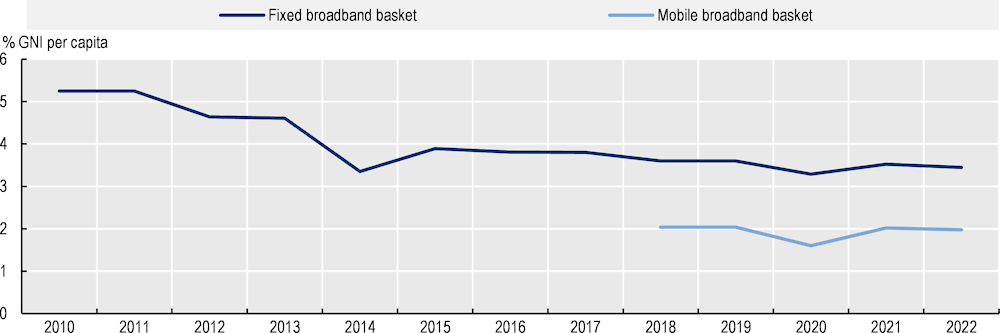

As mobile and fixed coverage and subscriptions have increased, prices for entry-level services for each have remained largely stable (Figure 5.4). In 2022, the price of entry-level fixed services (5 GB) was USD PPP 52.2, which was almost equal to the regional average of USD PPP 51.6 (ITU, 2023[12]). On the mobile side, the price for entry-level mobile services (70 min + 20 SMS + 500 MB) in 2022 was USD PPP 29.9, the highest price in the region and well above the regional average of USD PPP 15.5 (ITU, 2023[12]). However, in light of gross national income (GNI) per capita, Thailand’s mobile and fixed prices for entry-level services rank more affordable than those of some regional peers. Mobile prices were 2.0% of GNI per capita in 2022, slightly above the regional average (1.6%). In addition, fixed prices represented 3.4% GNI per capita, roughly half of the regional average (6.2% of GNI per capita), as discussed further below (Figure 5.13) (ITU, 2023[12]).

Figure 5.4. Prices for entry-level fixed and mobile communication services, USD PPP, 2008-22

Note: The fixed broadband basket refers to the price of a monthly subscription to an entry-level fixed-broadband plan. For comparability reasons, the fixed-broadband basket is based on a monthly data usage of a minimum of 1 GB from 2008 to 2017, and 5 GB from 2018 to 2022. For plans that limit the monthly amount of data transferred by including data volume caps below 1GB or 5 GB, the cost for the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s. The mobile broadband basket is based on a monthly data usage of a minimum of 500 MB of data, 70 voice minutes, and 20 SMSs. For plans that limit the monthly amount of data transferred by including data volume caps below 500 MB (low-consumption), the cost of the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s, relying on 3G technologies or above. The data-and-voice price basket is chosen without regard to the plan’s modality, while at the same time, early termination fees for post-paid plans with annual or longer commitment periods are also taken into consideration (ITU, 2020[14]). Mobile basket prices are not available from 2008 to 2017.

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

5.2.2. Market structure

Thailand underwent a significant period of privatisation and liberalisation in the early 2000s to reform its communication market. Prior to the reforms, the state-owned enterprises Telecommunication Organization of Thailand (TOT) dominated domestic telephony services, while the Communication Authority of Thailand (CAT) dominated international telephony, postal and other non-voice services.

Since the late 1980s, TOT and CAT also performed certain roles normally undertaken by a regulatory body. For instance, they both issued licences (“build-transfer-operate concessions”) to private operators for various services (Jittrapanun and Mesher, 2004[15]). These licences allowed private operators to enter the Thai market and could be seen as a first step towards liberalisation.

In 2000, the government aimed to privatise TOT and CAT. However, due to political uncertainty, they were established as “private” companies with the government owning all shares (Wisuttisak and Rahman, 2020[16]). This situation continues, with the Ministry of Finance owning all shares of the TOT-CAT merged entity, National Telecom (NT), making it a fully state-owned enterprise. The merger of the two state-owned entities had long been under discussion. TOT-CAT finally merged in 2021 to become NT, with the aim of improving efficiency and better competing against other market players (Inside Telecom, 2021[17]).

These efforts were supported by the establishment of an independent regulatory agency, the National Telecommunications Commission (NTC). The NTC was replaced by the National Broadcasting and Telecommunications Commission (NBTC) in 2010 under the Act on the Organization to Assign Radio frequency and to Regulate the Broadcasting and Telecommunications Services B.E. 2553 and its amendments (hereafter the “NBTC Act”) (Government of Thailand, 2010[18]; Government of Thailand, 2021[19]).

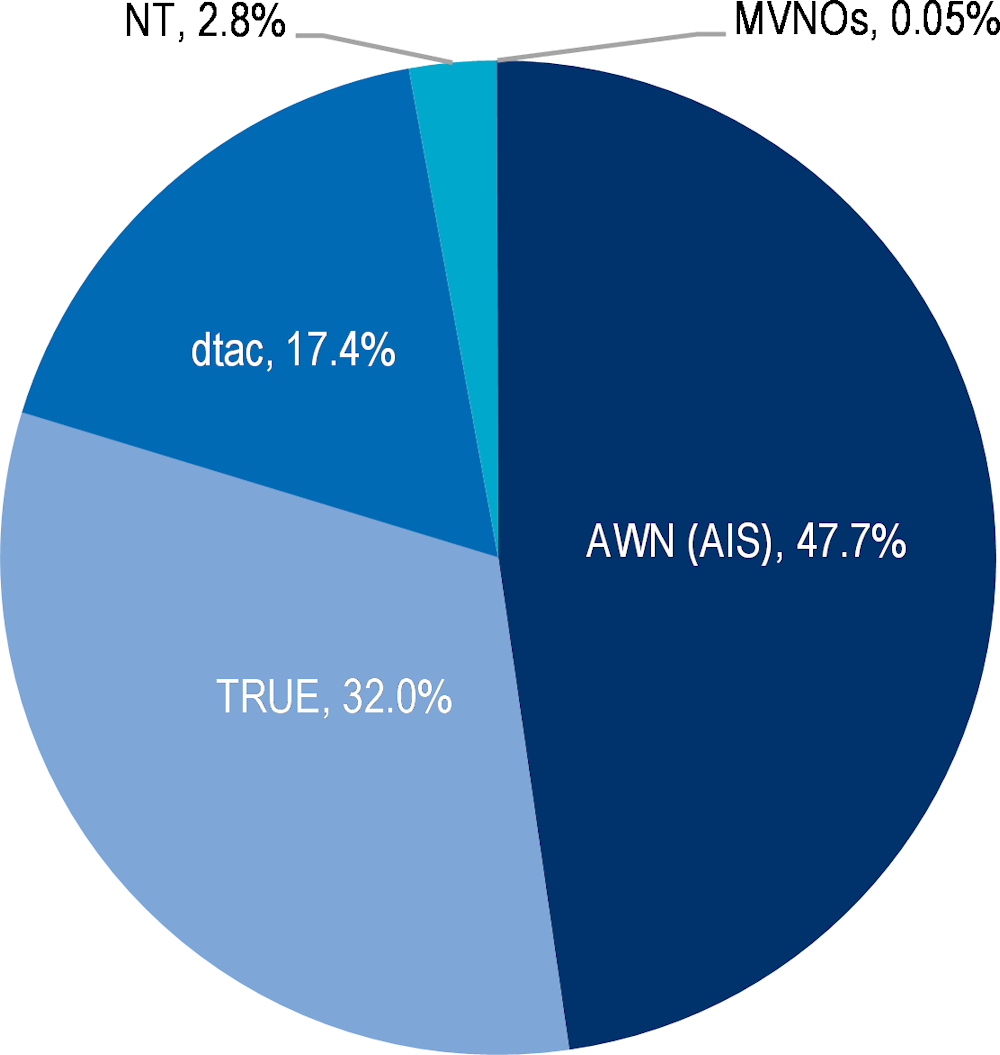

While the incumbent operator has not been privatised, the pace of liberalisation has picked up, with several private operators offering services. The mobile market has four main operators: Advanced Wireless Network Company Ltd. (AWN), a subsidiary of Advanced Info Service Public Ltd. Co. (AIS), True Internet Corporation Co., Ltd. (True), Total Access Communication Public Company Ltd. (dtac, part of the Telenor Group), and NT. Mobile virtual network operators (MVNOs) also offer services.

The mobile market is more concentrated than the fixed market. As of Q4 2021, AIS was the leader with almost half of the market share (47.7%) based on mobile subscribers, based on data from national authorities. It is followed by True with 32.0%, dtac with 17.4% and NT with 2.8% (Figure 5.5). MVNOs represent a small proportion of mobile subscribers, with only 0.05% of the total. Three of the four main players in the fixed market also provide mobile services: AWN (AIS), True and NT.

Figure 5.5. Mobile market shares based on mobile subscribers, Q4 2021

Note: “Mobile subscribers” refer to the total number of mobile subscribers in Thailand with plans using data, voice or both.

Source: OECD elaboration based on data from Thai authorities.

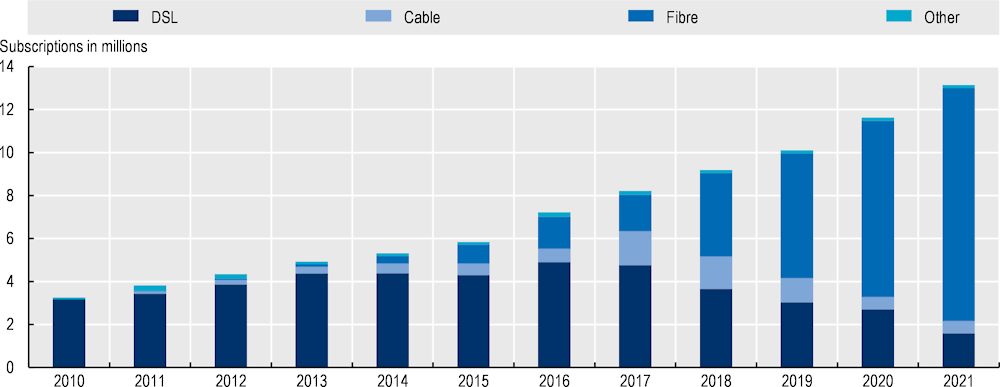

In the fixed market, there are four main players: AWN (AIS); True; Triple T Internet Co. (3BB), a subsidiary of Jasmine International; and NT. According to information from national authorities, True is the leader in the fixed market with 37.3% market share in terms of fixed broadband subscribers, followed closely by 3BB with 29.4%, NT (15.9%) and AWN (AIS) (14.3%) in Q4 2021 (Figure 5.6). Smaller operators make up the remaining 3.12% of the market. NT, AWN (AIS) and True also provide wholesale services.

Figure 5.6. Fixed market shares based on fixed broadband subscribers, Q4 2021

As Figure 5.5 and Figure 5.6 show, competitors have assumed leading positions in the market from the national incumbent, NT. This is in part a testament to the impact of liberalisation on both the fixed and mobile markets. It also suggests equal treatment of new private players compared to the incumbent under Thai law.

However, the above market shares only provide a snapshot as of the end of 2021, which is the most recent data provided by national authorities. As such, they do not reflect recent market developments. In the mobile market, the merger of True and dtac was completed in March 2023 (Telenor Asia, 2023[20]). In the fixed market, AWN (AIS) indicated interest in the potential acquisition of two Jasmine International subsidiaries: 3BB and Jasmine Broadband Internet Infrastructure in 2022 (KPMG, 2022[21]).

Thailand’s framework to assess mergers and acquisitions has been put to the test during the merger proceedings of True and dtac, which began in 2021. According to local news outlets, NBTC itself seems to have been uncertain about its own authority in the matter, convening specific subcommittees on the issue. This included whether it could approve or deny the merger, upon which it sought judgement from the Office of the Council of State (The Reporter Asia, 2022[22]). The Council of State reportedly upheld NBTC’s 2018 regulation and the notify-only regime it establishes (The Nation Thailand, 2022[23]).

In October 2022, NBTC officially acknowledged the merger plan between True and dtac. This allowed the merger to proceed according to the plans presented. However, NBTC stipulated certain conditions involving requirements on prices, and provision of network services to support MVNOs, quality of service, coverage and innovation (NBTC, 2022[24]).

The decision was met with criticism from customer groups that argued the merger would harm competition. The Thailand Consumers Council (TCC) petitioned the Central Administrative Court in November 2022 to revoke NBTC’s decision and to order an emergency investigation and temporary halt to merger proceedings until the court’s verdict (TCC, 2022[25]). The Court dismissed the TCC’s petition (Central Administrative Court, 2023[26]).

In March 2023, dtac announced the merger’s completion (Telenor Asia, 2023[20]). Taking the market shares from end-2021 as an indication of possible outcomes following the merger, the market could evolve into essentially a duopoly, with AWN (AIS) controlling 47.72% of the market share and the merged entity becoming the market leader with 49.4%.

In addition, if the merged entity maintains and combines the individual spectrum holdings prior to the merger, it will change distribution of spectrum in the market. Before the proceeding, AWN (AIS) held 1 420 MHz across all bands; True held 990 MHz, NT had 540 MHz; and dtac had 270 MHz, according to national authorities. After dtac and True’s merger, they would hold 1 260 MHz, just behind AWN (AIS); NT would trail with 540 MHz.

Another acquisition is being discussed in the fixed market. In July 2022, AWN (AIS) announced plans to acquire 99.87% interest in 3BB and a 19% interest in Jasmine Broadband Internet Infrastructure Fund (KPMG, 2022[21]). However, the deal for these two Jasmine International subsidiaries is still pending NBTC’s regulatory review. Given AWN (AIS)’s dominance in the mobile market but weaker position in the fixed market, it may be motivated to increase its fixed footprint through the merger. This would allow it to offer better bundled offers, as well as to expand its backhaul network.

Should the acquisition occur, AWN (AIS) and the acquired 3BB would have the largest market share based on 2021 fixed broadband subscribers at around 43.66%. It would edge out True (with its market share of 37.3%), as well as NT (15.9%). If both deals go through, the merged entity of True and dtac and AWN (AIS), with its acquisition of 3BB, would be the top two providers with substantial market shares in both fixed and mobile markets.

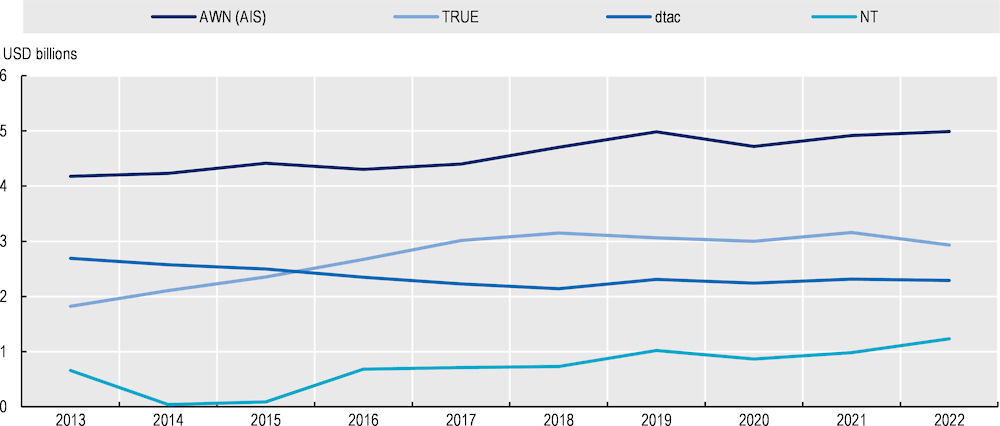

Revenues and investment offer another way to understand the market, although data are only available for mobile markets in Thailand. In the mobile market, total revenues increased by 22% from 2013-22 in nominal terms, from USD 9.38 billion in 2013 to USD 11.45 billion in 2022 (GSMA Intelligence, 2023[11]). These market revenues placed Thailand first in the region in 2022 in nominal terms, almost tied with Indonesia (USD 11.40 billion) (GSMA Intelligence, 2023[11]).

Perhaps unsurprisingly given its market share, market leader AWN (AIS) has consistently had the highest revenues of all players since 2013, reaching USD 4.99 billion in 2022 (nominal terms) (GSMA Intelligence, 2023[11]). In 2022, True had the next highest revenue with USD 2.93 billion. Dtac and NT followed at USD 2.29 billion and USD 1.23 billion, respectively (GSMA Intelligence, 2023[11]) (Figure 5.7). This order follows the ranking by market shares (Figure 5.5).

Figure 5.7. Mobile revenues by operator, 2013-22

Source: GSMA Intelligence (2023[11]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

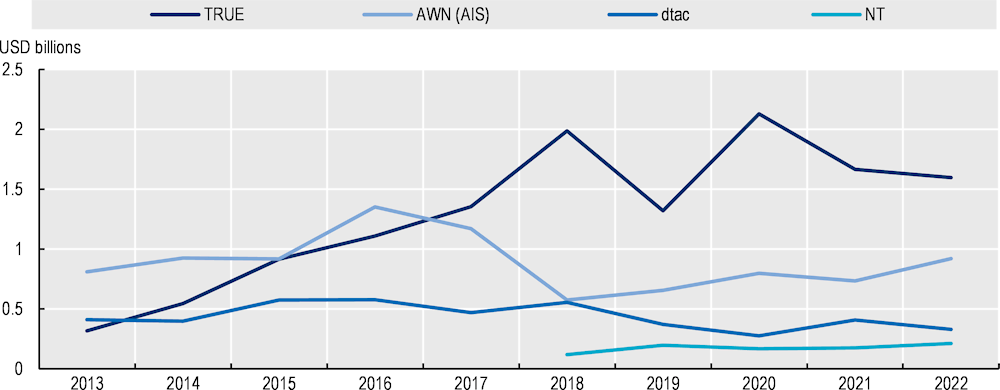

Comparing operators’ revenues in the mobile market to the total spent on capital expenditures (Capex) tells a different story. Capex is a typical measure to track investment by operators on longer-term assets, such as to extend their network footprint. True stands out among its peers with a much more aggressive investment strategy. In 2022, True invested USD 1.60 billion in nominal terms, almost double the amount invested by AWN (AIS) (USD 919 million), and more than four times that of dtac (USD 329 million) and NT (USD 212 million) (GSMA Intelligence, 2023[11]) (Figure 5.8). True’s level of Capex in 2022 accounted for 54% of its revenues, whereas AWN(AIS) and NT had a capex-to-revenue ratio of 18% and 17%, respectively. Meanwhile, dtac’s capex represented 14% of its revenue (GSMA Intelligence, 2023[11]).

Overall, total investment in mobile markets grew rapidly over 2013-22. In 2022, investment reached USD 3.06 billion (nominal terms), fuelled by True’s investments that make up just over half of the total (GSMA Intelligence, 2023[11]). This puts Thailand at the top of Southeast Asian (SEA) rankings in terms of mobile Capex investment in 2022, closely followed by Indonesia (GSMA Intelligence, 2023[11]).

Figure 5.8. Investment in mobile networks (total Capex) by operator, 2013-22

Source: GSMA Intelligence (2023[11]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

5.3. Communication policy and regulatory framework

5.3.1. Institutional framework

The main bodies covering the communication sector in Thailand are the Ministry of Digital Economy and Society (MDES) and NBTC. MDES develops policies for the digital economy and society, including for communication infrastructure. Under MDES, the Office of the National Digital Economy and Society Commission (ONDE) is the primary policy-making unit. It supports and co‑ordinates with the National Committee on Economy and Society, a body with representatives from various ministries and chaired by the Prime Minister. The committee develops national plans and policies to promote digital transformation of the Thai economy and society (Government of Thailand, 2017[27]).

NBTC is an independent regulatory agency with remit over the communication and broadcasting sector in Thailand. As previously noted, NBTC was established through the NBTC Act (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]). NBTC is charged with managing, assigning and licensing spectrum resources, setting technical standards and specifications, licensing and regulating broadcasting and communication services, and promoting competition in the market, among other duties (Government of Thailand, 2010[18]). Further, NBTC can establish rules under the scope of its duties, as well as monitor the provision of communication and broadcasting services (Government of Thailand, 2010[18]).

MDES and NBTC co-operate to develop policies to advance the communication services in Thailand. MDES develops the overarching digital policy across various sectors, including the communication sector, which is set forth in the Digital Economy and Society Development Plan (2018-2037). NBTC defines sector-specific plans, such as those related to spectrum management, broadcasting and the Telecommunications Master Plan No. 2 (2019-2023), which aligns with the Digital Economy and Society Development Plan. NBTC must consult on these sector-specific plans with MDES and relevant government bodies, as well as the public and operators, and consider comments received (Section 49) (Government of Thailand, 2010[18]).

Aside from roles and responsibilities of MDES and NBTC within Thailand’s institutional framework, the level of NBTC’s independence should be considered. Section 60 of the Thai Constitution defines the de jure independence of NBTC (Government of Thailand, 2017[28]). NBTC can determine its own budget and revenues (Sections 57 and 65), only receiving government funds if its other sources cannot cover expenditures (Government of Thailand, 2010[18]). The NBTC Act and its amendments establish NBTC, its structure, functions and responsibilities, as well as the appointment process of NBTC Commissioner (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]).

The selection process for NBTC’s Commissioners begins with a selection committee that defines the required skills and experience of candidates. Subsequently, the Senate announces a public application process that lasts at least 30 days. The selection committee consists of representatives from the constitutional court, the Supreme Court, the Supreme Administrative Court, the National Anti-Corruption Commission, the State Audit Commission, the Ombudsman and the Bank of Thailand (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]). After reviewing the candidate pool, the committee sends the names of candidates meeting the defined requirements to the Senate. The Senate must approve with at least half of the total number of existing members (Section 16), after which it sends the names of approved candidates to the Prime Minister, who then forwards the list to the King for royal appointment (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]). Overall, the legislation requires a degree of transparency, as the Senate must publicly announce and accept applications for the Commissioner posts.

While the government is involved in the appointment of NBTC Commissioners to a degree (i.e. through Senate approval and royal appointment), the selection committee is made up of representatives from judiciary bodies, independent organs, and the Bank of Thailand, which may help to decrease the risk of political influence. Similarly, in many OECD countries, a governmental or ministerial body appoints the leadership of communication regulators (OECD, 2021[29]). Nevertheless, measures to promote transparency, such as an independent selection panel to nominate and appoint leaders based on merit, can help insulate the process from any undue influence (OECD, 2021[29]). In Mexico, for example, the selection process of the communication regulator, the Federal Institute of Telecommunications (IFT), is based on “a qualification procedure carried out by an Evaluating Committee, based on the federal executive’s proposal, with the Senate’s subsequent ratification” (OECD, 2017[30]).

While the process in Thailand is rather transparent, NBTC was delayed in finalising the appointment process of its Commissioners. Five commissioners received Senate approval in December 2021 and began their terms in April 2022 (Bangkok Post, 2023[31]; Bangkok Post, 2021[32]). The Senate approved the sixth in August 2022, whose term began in October 2022 (Bangkok Post, 2023[31]; Bangkok Post, 2022[33]). The seventh post (the Commissioner acting for the area of telecommunication) received Senate approval in February 2023 and is listed as being in office on NBTC’s website as of June 2023 (Bangkok Post, 2023[31]; NBTC, 2023[34]).

Some of the delay may have stemmed from legislative changes. The NBTC Act was amended in 2021, after the selection process had already begun. The 2021 amendment, which focuses on articles related to selection of Commissioners, were put forward to address “practical problems” in recruitment (Government of Thailand, 2021[19]). It modifies the required characteristics of selection committee members and specifies aspects of the recruitment and selection procedures (Government of Thailand, 2021[19]). Previously, one Commissioner each needed experience in engineering, law and economics, respectively. With the new amendment, two of the seven Commissioners can have experience that “will benefit the performance of NBTC’s duties” (Government of Thailand, 2021[19]). Moreover, under prior rules, one Commissioner could have experience in either support for promotion of rights and liberties or consumer protection. Under the new rules, one Commissioner is required to have experience in each of these fields (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]).

In summary, under the amended rules, Commissioners should have qualifications and expertise in the following fields: one for broadcasting, one for television, one for telecommunication, one for consumer protection, one for the promotion of rights and liberties, and two other disciplines that support NBTC’s duties (Government of Thailand, 2021[19]). The current Commissioners chosen to fill the last two roles have expertise in economics and law (NBTC, 2023[34]).

Overall, the final Board largely seems to have relevant experience. However, passing the amendment during the selection process undoubtedly delayed the appointment of the Commissioners, and should not be a precedent. In future, care should be taken to fill the Commissioner positions without undue delays.

Once appointed, Commissioners hold office for a non-renewable term of six years. However, they only vacate their office once the incoming Commissioners have been appointed (Government of Thailand, 2021[19]; Government of Thailand, 2010[18]).4 The Commissioners vote among themselves to nominate the Chairperson, who with the consent of the NBTC shall appoint and remove the NBTC Secretary-General (Government of Thailand, 2010[18]). The latter has a term of five years, which may be extended but “shall not hold office for more than two consecutive terms” [unofficial translation] (Government of Thailand, 2010[18]). The delay to appoint the seven NBTC Commissioners also resulted in delays to appoint the NBTC Secretary-General.

Recommendation

1. Further strengthen the transparency of the selection process of high-level NBTC officials and avoid undue delays in future selection processes. While NBTC is an independent regulator, the government is involved in the appointment of NBTC Commissioners, which may be an opportunity for political influence. The government could consider adopting further measures to insulate the process from political influence, such as by adopting measures to increase transparency, such as an independent selection panel. Future selection processes should aim to appoint Commissioners without undue delays, including to avoid changing relevant regulation during an ongoing process. In addition, promoting transparency in the appointment process to name the NBTC Secretary-General by the NBTC Commissioners may help instil trust and confidence.

5.3.2. Regulatory framework

Several laws govern the communication sector, namely the Telecommunications Business Act, B.E. 2544 (2001), the NBTC Act and the Radiocommunications Act, B.E. 2498 (1955), as amended. Under this governing legislation (Telecommunications Business Act and NBTC Act), NBTC may issue additional regulations (“notifications”) on specific issues under its remit. The Telecommunications Business Act defines the licensing framework to provide telecommunication and broadcasting services in the country and sets forth three licence types (Government of Thailand, 2001[35]):

Type One: for operators without their own network infrastructure that aim to provide services considered appropriate to promote liberalisation.

Type Two: for operators with or without their own network infrastructure that aim to provide non-public services (e.g. to a limited group of people) or to provide services unlikely to significantly impact competition.

Type Three: for operators with their own network infrastructure that aim to provide public services (e.g. to a wide group of people) or to provide services that may significantly impact competition or require consumer protection.

Interested parties must apply to NBTC and receive approval to provide service in the country. Licensees owning a network must allow other licensees to connect to their network and conform to technical standards for their network equipment and devices as relevant (Government of Thailand, 2001[35]). Section 55 of the Telecommunications Business Act also authorises NBTC to set maximum fee thresholds for specific services being offered by licensees (Government of Thailand, 2001[35]). Licensees are furthermore required to charge the same rate for the same or similar categories of services to consumers (Government of Thailand, 2001[35]). The Act also authorises NBTC to manage a fund to promote universal service and require relevant licensees to contribute to and support its operations. In addition, it requires NBTC to approve contracts undertaken by a licensee and a communication service user (Government of Thailand, 2001[35]). Among these, the NBTC Act determines NBTC is responsible for licensing spectrum and establishing a frequency allocation plan. According to the above framework, NBTC is also responsible for licensing and assigning numbering resources.

The Radiocommunication Act, B.E. 2498 (1955) establishes the regulatory framework governing equipment and requires a licence to manufacture, own, use, import, export, trade or install any piece of radiocommunication equipment (Government of Thailand, 2015[36]). It also includes measures aimed at reducing harmful interference or the obstruction of radiocommunications.

5.3.3. Broadband strategies and plans

Promoting the digital economy seems to be a priority at the highest levels of the Thai government. For example, the National Committee on Economy and Society, established in 2017, is chaired by the Prime Minister. Together with ONDE under MDES, the committee aims to promote digital transformation. The Digital Economy and Society Development Plan (2018-37) is key to promote this transformation, which is led by MDES (MDES, 2019[37]). The first strategy (of six) aims to “build country-wide high-capacity digital infrastructure, ensuring accessibility, availability and affordability” (MDES, 2019[37]; MDES, 2018[38]).

Figure 5.9. Key actions and goals under Strategy 1 of the Digital Economy and Society Development Plan (2018-37)

Source: OECD elaboration based on MDES (2018[38]), Thailand Digital Economy and Society Development Plan, pg. 19, www.onde.go.th/assets/portals//files/Digital_Thailand_pocket_book_EN.pdf.

In addition, the NBTC Act tasks NBTC to create a five-year plan to define and structure its operations, a part of which corresponds to the Digital Economy and Society Development Plan. The Telecommunications Master Plan No. 2 (2019-23), published in January 2019, is the most recent plan (NBTC, 2019[39]). There are six strategies in the Master Plan covering: promoting competition; licensing and regulation of telecommunication and radio communication; effective management of spectrum and numbering resources; Universal Service and closing digital and skills divides; consumer protection; and supporting digital transformation (NBTC, 2019[40]). It has several comprehensive strategic goals that correspond to many of the tenets of the OECD Recommendation on Broadband Connectivity (hereafter, “OECD Broadband Recommendation”) (OECD, 2021[1]). Areas of overlap include on measures to foster competition, investment and innovation; streamline licensing procedures; support efficient spectrum management; safeguard consumer rights; and close digital divides.

In conjunction, ONDE drafted the Action Plan for Broadband Infrastructure Phase 1 (2022-27) (ONDE, 2021[41]) as a roadmap to develop efficient, nationwide connectivity infrastructure. The plan sets out several goals, including to build fixed Internet with nationwide coverage with speeds of at least 100 Mbps; transition from analogue to digital systems, especially in television; increase data flows to and from Thailand; and support investment of data centres (ONDE, 2021[41]).

5.4. Competition, investment and innovation in broadband markets

5.4.1. Competition

The market structure of the fixed and mobile broadband networks in Thailand sheds light on the level of competition in the respective markets, allowing for an assessment of market concentration. As noted above, the mobile market has four main players: AWN (AIS) with 47.7% market share based on mobile broadband subscribers, followed by True (32.0%), dtac (17.4%) and NT (2.8%), as of Q4 2021, according to national authorities (Figure 5.5). MVNOs also operate in the country but only account for a small share of the market.

With four main players, including one that holds about half the market, the Herfindahl-Hirschman Index (HHI) based on these market shares is 3 612. This may indicate a moderately concentrated market, which some scales classify as those with HHIs between 1 500 and 2 500 (US DoJ, 2010[42]). However, this HHI and, consequently, the level of market concentration is likely to increase following the 2023 merger of True and dtac, the second and third largest players in the mobile market.

The fixed side also has four main players, but market shares by fixed broadband subscribers are more evenly distributed. True holds a 37.3% market share, followed by 3BB (29.4%), NT (15.9%) and AWN (AIS) (14.3%) as of Q4 2021, according to national authorities (Figure 5.6). Other providers account for 3.12% of total subscribers. Based on these market shares, the HHI for the fixed market is 2 724, considerably lower than the one for the mobile market. However, this HHI may also shift if AWN (AIS)’s proposed acquisitions proceed.

In light of these market structures and changes to the landscape (e.g. True-dtac merger and AWN (AIS)’s potential acquisition), Thailand’s competitive regulatory framework is especially important. Upholding competition in the communication and broadcasting sectors is a key mandate of NBTC, as set out in the NBTC Act. The legislation empowers the regulator to prescribe further measures to prevent anti-competitive behaviour (Government of Thailand, 2010[18]). In addition, Section 21 of the Telecommunications Business Act gives NBTC the right to prescribe measures to prevent licensees from undertaking monopolistic practices that limit market competition. It also requires licensees to allow other licensees to connect to their networks (Government of Thailand, 2001[35]).

NBTC issued the Notification on “Criteria and Procedures for Identifying Operators with Significant Market Power (SMP) in Telecommunications Business B.E. 2557 (2014)” to determine market players with SMP for relevant markets defined by NBTC (NBTC, 2014[43]). These include markets that are highly concentrated according to the HHI, have persistently high barriers to entry or have low levels of competition (NBTC, 2014[43]). Where relevant markets have low levels of competition, NBTC may consider designating players with more than 40% market share as having SMP. It could do the same for players with between 25-40% market share in light of other factors that may impact dominance in a certain market (NBTC, 2014[43]). NBTC prepares a report analysing the level of competition in the relevant markets and defines a list of SMP operators in each relevant market. This is a basis for setting out measures on operators with SMP, in line with the competitive conditions of the market (NBTC, 2014[43]).

SMP operators, as well as Type Two or Three licensees designated by NBTC, must provide local loop unbundling on non-discriminatory and fair terms, according to NBTC’s wholesale access regulation (NBTC, 2010[44]). Most recently, Decision No. 26/2564 defined SMP operators, including for mobile call termination and wholesale broadband access (NBTC, 2021[45]). For mobile call termination, AWN (AIS), True, dtac and NT were all listed as having SMP (NBTC, 2021[45]). For wholesale broadband access, NT, 3BB and True were classified as having SMP (NBTC, 2021[45]). SMP operators must comply with certain measures, such as applying fees based on costs (long-run incremental cost), offering wholesale access, reporting to NBTC and applying accounting separation (NBTC, 2021[45]).

Decision No. 26/2564 does not consider either the mobile or fixed retail markets to be relevant markets for consideration. This is somewhat surprising for the mobile retail market, given the 48% market share of AWN (AIS). Such an assessment may be even more warranted following the 2023 merger of True-dtac.

Given their immediate and sometimes significant impact on competition in the communication market in which the operators provide service, mergers and acquisitions are often closely monitored and regulated. The NBTC “Notification on measure to regulate mergers in the telecommunications business, 2018” (hereafter referred to as the 2018 merger regulation) sets forth the regulatory framework to assess mergers and acquisitions (NBTC, 2018[46]). Whereas previous legislation gave NBTC the right to approve or reject requests for mergers or acquisitions, the 2018 merger regulation changed this to a notify-only regime. Notification to NBTC of mergers exceeding financial thresholds must include, among other aspects, a competition analysis by an independent consultant (NBTC, 2018[46]). If this analysis finds the proposed merger results in an HHI of above 2 500, a change of more than 100, additional barriers to enter the market and the number of critical infrastructure being owned by the merged entity increases significantly, NBTC can consider specific conditions on the merger (NBTC, 2018[46]). However, NBTC cannot reject the merger or acquisition outright. The 2018 notify-only regime has caused a great deal of uncertainty, prolonged the period of consideration for the True-dtac merger and sparked legal contests regarding NBTC’s authority in the case.

In OECD countries, regulators closely scrutinise mergers in the communication sector before deciding whether they can go ahead. In many cases, regulators introduce merger conditions, such as those in Italy in 2016 (Hutchinson/WIND/JV) and the United States in 2020 (T-Mobile/Sprint) (OECD, 2021[47]).

Under the 2018 merger regulation, NBTC can prescribe conditions on mergers that are likely to increase the level of market concentration. Given market characteristics before the True-dtac merger, it seems likely the merger will increase market concentration. The sum of True and dtac’s pre-merger shares would result in a 49% market share and would increase the HHI to 4 726, up from the pre-merger HHI of 3 612. With True-dtac’s combined market share of 49%, competing with AWN (AIS)’s 48%, the market would become essentially a duopoly, assuming the pre-merger market shares of the two combine. These circumstances meet the 2018 merger regulation’s thresholds for NBTC to specify conditions, for example, the post-merger HHI is above the threshold of 2 500 and increases by more than 100) (NBTC, 2018[46]).

Indeed, NBTC did introduce merger conditions on several topics, including prices, provision of network services to support MVNOs, quality of service, coverage and innovation (NBTC, 2022[24]). Notwithstanding these conditions, given the potential impact of mergers on competition, the move to a notify-only regime where mergers are no longer subject to regulatory approval is concerning. It raises the question of whether NBTC can fulfil its mandate to uphold competition in the market.

The recent merger proceedings of dtac and True have forced NBTC to consider its role under this regulatory regime. Therefore, some of the legal ambiguity that arose during the merger will be clearer for future proceedings. This sectoral regulation (2018 merger regulation), which specifies NBTC’s mandate over mergers, takes precedence over the general competition authority in Thailand – the Trade Competition Commission of Thailand (TCCT). TCCT’s remit does not extend to competition issues within the remit of sectoral regulators, as defined by their governing laws (Government of Thailand, 2017[48]).

However, NBTC has only issued regulation on certain competition issues (e.g. mergers, SMP definition). It is unclear which body would have responsibility for other competition issues involving actors in the communication market. The role and mandate of NBTC should be clearly defined and delineated from TCCT in cases where no specific regulation has been issued by NBTC on other competition aspects.

Consistency in the application of the regulatory framework is also important. For example, different approaches and interpretations may have been used to evaluate the merger between True and dtac and between TOT and CAT. In the True-dtac case, NBTC convened committees and held several meetings to discuss the merger and its own jurisdiction in the matter. This does not seem to be the same process for the TOT-CAT merger. Some interpretation also seems required to apply the current legal framework. If different approaches apply under some cases, clear criteria should be set forth in the regulation to establish under what conditions.

Recommendations

2. Consider revisiting NBTC’s regulation governing mergers in the communication sector. In the medium term, it is highly recommended to revisit NBTC’s “Notification on measures to regulate mergers in the telecommunications business” from 2018, which changed the mergers and acquisitions regulation to a notification-only regime. NBTC can no longer approve or reject requests for mergers and acquisitions, which lowers its power to judicate in such cases. It also risks increased market concentration, with potential detrimental effects on consumer welfare, investment and innovation. In addition, the regulatory framework governing mergers should be applied consistently for all mergers and acquisitions in the communication market, or clearly defined in the regulation when different approaches may apply.

3. Carefully monitor the implementation of merger conditions in the recent merger of True and dtac in the mobile market. It is imperative that NBTC closely monitor competition in the mobile market and ensure the implementation of merger conditions as stipulated. Where NBTC finds the mobile market to be a relevant market for competition assessment, which is likely given the high market shares of both AWN (AIS) and the merged entity following the proceedings, the regulator could consider SMP classifications and/or ex ante remedies, according to the assessment.

4. Clarify any remaining uncertainty between the respective remit of NBTC and TCCT regarding competition in the communication sector. NBTC has only issued notifications on certain competition issues (e.g. mergers, SMP definition). Uncertainty remains on the mandates of NBTC and TCCT on other competition issues upon which the NBTC has not issued a specific regulation. Thus, NBTC’s role and mandate should be clearly defined and delineated from TCCT to clarify ambiguity in the respective remits of the two bodies.

5.4.2. Investment

Thailand’s regulatory framework aims to ease infrastructure investment in communication networks, mainly by allowing infrastructure sharing and promoting open access. With prior NBTC approval, mobile network operators may share infrastructure such as towers/masts, base stations, cables, antennas and radio node controllers or base station controllers (Government of Thailand, 2019[49]). Currently, Thai operators share passive infrastructure and assets according to national authorities, even though active infrastructure sharing of certain radio access network (RAN) and core network elements are permitted. Thailand also promotes an open access model in the Net Pracharat project (discussed in the “Digital divides” section below). The project allows licensed operators to use the networks constructed under the project to provide last mile Internet services to users in underserved areas. Such open access models can help optimise communication resources and avoid duplication of investments, particularly in areas that are not financially viable.

Another way network operators may seek to optimise resources while still fostering connectivity is by contracting wholesale services, especially in underserved areas. A well-functioning wholesale market can provide another option for network operators to access backhaul and backbone capacity to supplement their own networks in such areas. In Thailand, wholesale access regulation exists, and some operators are offering wholesale services. However, competing operators report reluctance to contract these services due to price and quality. Thailand could consider two actions to encourage the wholesale market. First, it could facilitate the deployment of wholesale networks, especially in underserved areas where it may be difficult for operators to recoup investments. Second, NBTC could monitor prices for wholesale services nationwide, (not only in underserved areas) and consider measures if it finds prices are not set at fair levels. This would be especially relevant for operators classified as having SMP in the wholesale market in question.

Thailand’s legal framework sets some restrictions on foreign direct investment (FDI). Section 8 of the Telecommunications Business Act prohibits a foreigner under the Foreign Business Act (including where the majority of shareholders are non-Thai) from applying to obtain either Type Two or Three licences (Government of Thailand, 2001[35]; Government of Thailand, 1999[50]). Type One licences apply to operators offering services without owning their own network; Type Two licences are namely for operators that offer services to a specific group of customers (with or without their own network); while Type Three licences target operators that own their network and offer services to the general public (Government of Thailand, 2001[35]). This essentially caps foreign ownership or investment at 49% of capital shares for Type Two or Three licensees. In addition, NBTC issued further regulation prohibiting “foreign dominance” (NBTC, 2022[51]).

Nevertheless, several of the main players in both the fixed and mobile markets have foreign investors, although their ownership is limited to less than half. For example, dtac (prior to the merger) was part of the Telenor Group (Telenor, 2023[52]). AWN’s parent company, AIS, has a mix of shareholders, with the two largest being Intouch Holdings Plc (holding 40% of total shares) and Singtel Strategic Investments (holding 23%), both of which include foreign shareholders (AIS, 2022[53]). True (prior to the merger) also had China Mobile International Holdings Ltd. owning 18% of shares as of September 2022 (True, 2022[54]). Removing foreign ownership restrictions may help further increase foreign investment, especially as foreign players have already shown interest in Thailand’s communication markets.

In addition to the FDI regulation, several fees apply to operators. According to Thai authorities, all operators providing commercial communication services must pay an annual business licence fee based on annual revenues. This ranges from 0.125% of annual revenues for licensees with revenues of up to THB 100 million (USD 2.86 million) to 1.5% for operators with annual revenues of more than THB 50 billion (USD 1.43 billion) (NBTC, 2017[55]).5 Licence application processing fees also apply, which are quite nominal.

Spectrum fees apply as well. These are: 1) spectrum usage fees, for all operators or business entities using licensed spectrum; and 2) auction fees, where spectrum is auctioned (e.g. for mobile spectrum bands). Auction fees vary by auction, depending on spectrum band, demand and the amount of spectrum being sought. Numbering fees also apply. For instance, numbers for mobile service cost THB 1.50 (USD 0.04)/number/month (NBTC, 2020[56]).6 Finally, licensees must contribute 2.5% of net income from communication services (e.g. gross income minus certain costs deductions) as a universal service contribution (NBTC, 2017[57]).

These fees factor into business decisions related to investment, as they pose an overhead cost to operate in the country. Several other aspects may influence an operator’s propensity to invest. These include the company’s business and investment strategy and future goals (including merger plans); the financial health of the business; the level of competition in the market; and the regulatory framework governing investment in the country, including for FDI.

Nevertheless, the fees operators may pay may increase operators’ expenses and impact investment decisions. While the total level of fees that apply per operator varies, three out of four of the main mobile operators reported 2021 revenues above USD 1.43 billion (AIS [AWN], True, dtac; see Figure 5.7) (GSMA Intelligence, 2023[11]). This would likely place them in the highest licence fee category of 1.5%. When combined with the Universal Service Obligation of 2.5%, their fees represent at least 4% of revenues from communication services. This does not include spectrum or numbering fees, which would also apply to these mobile operators.

Consequently, high fees could impact operators’ ability to make long-term investments. This is especially true on the mobile side, which have additional payments such as spectrum auction fees to obtain mobile spectrum, along with the spectrum usage fee.

On the mobile side, the current level of fees seems manageable as operators are investing in their networks (Figure 5.8). Indeed, Thailand is the regional leader in terms of total mobile Capex. These investments are likely supporting the expansion of high quality networks in the country, as evidenced by Thailand’s impressive 5G mobile coverage (85% of the population in 2022) (GSMA Intelligence, 2023[11]). However, Thailand’s median mobile performance in July 2023 places it in the middle of SEA countries. It has a 40.6 Mbps median download speed and 13.5 Mbps median upload speed (Ookla, 2023[58]).7 Compared to its regional peers, these mobile speeds could imply more investment is still needed to improve mobile performance.

On the fixed side, operators seem to be heavily investing in fibre, as indicated by the high proportion of fibre of overall fixed subscriptions and its high median fixed download speeds (Figure 5.3). On speed metrics, Thailand is a clear leader, ranking second in the region behind Singapore. It is also fifth globally in terms of median fixed download speeds (211.3 Mbps download and 180.2 Mbps upload in July 2023) (Ookla, 2023[58]).

Current indications suggest that Thai operators are investing to expand and improve their networks. Nevertheless, Thailand should monitor the effect of fees on investment decisions moving forward to ensure operators have the financial capacity to invest over the long-term.

Recommendations

5. Consider facilitating wholesale networks, especially in underserved areas, and monitoring wholesale prices. In underserved areas, Thai authorities could facilitate the deployment of wholesale access networks to provide operators with another option to access backhaul and backbone capacity in such areas. In addition, NBTC could monitor prices for wholesale services, in general, to determine whether they are considered too high, especially for operators designated as having SMP in the relevant wholesale market.

6. Eliminate foreign direct investment restrictions. Eliminating FDI restrictions would help new players enter the market, spur competition and encourage further foreign investment. It would also increase the availability of latest technologies and acquisition of technical and specialised knowledge in the Thai market.

5.4.3. Innovation

Thailand has policies and regulations to promote innovation. For instance, the NBTC Telecommunications Master Plan No. 2 (2019-23) sets a goal to promote innovative research and development in equipment and technology through the Broadcasting and Telecommunications Research and Development (BTFP) Fund. The BTFP Fund supports various projects in the telecommunication and broadcasting sectors. Recent telecommunication projects include support for research and development of equipment to inspect communication cables (2018) and a project to leverage the Internet of Things and communication systems to develop telehealth services amid social distancing restrictions (2020) (BTFP, n.d.[59]).

Several other policies emphasise next-generation communication networks, especially 5G. To promote the provision of 5G, NBTC issued the “Notification Re: Criteria for Permitting Frequency Use for Innovation Development and Testing in a Sandbox Area (Sandbox Notification)” in 2019. The Sandbox Notification allows participants to use certain frequencies and conduct frequency testing within the sandbox to develop and test equipment, networks or systems for pre-commercialisation purposes (NBTC, 2019[60]). Before, telecommunication operators could only receive a licence from NBTC for frequency testing. With this notification, a governmental entity or a juristic person registered under Thai law can apply for a sandbox licence to use frequency within the sandbox area (NBTC, 2019[60]).

ONDE has also developed an Action Plan for Promoting the Adoption of 5G Technology in Thailand, Phase 1. This plan aims to define the framework to support widespread adoption of 5G technology in various sectors and promote co‑operation between the public and private sectors. Under this plan, Thailand introduced the "Thailand 5G Alliance" to drive 5G as the country’s key digital infrastructure. To that end, it will promote applications of 5G technology through business potential and commercial readiness.

In addition to these policies, Thailand supported deployment of next-generation networks by auctioning the spectrum needed to support 5G. NBTC auctioned three bands in 2020 – the 700 MHz, 2.6 GHz and 26 GHz bands – to support deployment of 5G networks. These 5G networks can, in turn, support innovative new use cases by providing higher speeds, lower latencies and improved capacity.

Thailand promptly set up the right enabling environment to promote 5G network deployment. This has included the 5G regulatory sandbox for operators to test frequency bands, policies to promote 5G applications and adoption, and assignment of sufficient spectrum in a variety of bands (low, medium and high). Indeed, Thailand was one of the first SEA countries to auction 5G spectrum. These actions seem to have paid off, considering Thailand’s early 5G rollout and its extensive 5G population coverage. By 2022, 5G networks covered 85% of the population, with 5G connections representing close to 13% of total mobile connections (GSMA Intelligence, 2023[11]).

5.5. Broadband deployment and digital divides

5.5.1. Broadband deployment

Over 2010-21, broadband deployment in Thailand sped up for both fixed and mobile broadband networks. In terms of mobile broadband networks, 3G and 4G networks have expanded rapidly in recent years, reaching virtually the entire population (98%) in 2015 and 2016, respectively (GSMA Intelligence, 2023[11]). Impressively, 5G network coverage by population reached 85% by 2022, just two years after operators began deploying in 2020 (GSMA Intelligence, 2023[11]). This increase in coverage has gone hand in hand with the aggressive investment strategy pursued by the dominant operator, True, over the last few years. However, the rollout of mobile networks would benefit from more investment by other competitors. They could be encouraged by a relaxation of restrictions on FDI and facilitation of mergers, subject to the relevant caveats (see section ‘Competition, investment and innovation in broadband markets’).

Figure 5.10. Broadband networks coverage

Note: The number of households covered by a fixed network is also referred to as cabled households or homes passed by a fixed wired network. The number of households covered by a fixed wired network, cabled households or homes passed denotes the availability of but not necessarily the subscription to or usage of fixed network services. Households should be classified as covered, cabled or passed if the network provider already provisions or could provision a connection to the fixed network within a short period of time (i.e., a few days) and without an extraordinary commitment of resources. An extraordinary commitment of resources involves any of the following: installing or extending cable from local switching centre, a DSLAM, CMTS, OLT, fibre node, optical splitter, FTTC cabinet, HFC node, building a duct, installing poles, leasing a line (ITU, 2020[13]).

Source: [Mobile broadband coverage] GSMA Intelligence (2023[11]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023). [Fixed broadband coverage] Data provided by national authorities, ONDE, Thailand.

For fixed networks, the increase in coverage in recent years is notable. According to the ONDE (MDES), the number of households covered by a fixed broadband network in Thailand increased by 43% between 2017-21, reaching 54.9% of households (Figure 5.10). Further progress is needed to cover more households. The massive FTTH rollout between 2018 and 2021 is also noteworthy, resulting in good performance of fixed broadband services in Thailand, second only to Singapore in the region (see next section). This rollout has been mainly through aerial cables using existing electricity poles, although the government plans to consolidate this cabling in rural areas and move it underground in urban areas.

Operators report the burden of obtaining permits for network construction as a main barrier to network deployment. The process often includes different agencies across different jurisdictions (e.g. NBTC, the Metropolitan Electricity Authority, Provincial Electricity Authority). Dealing with several agencies is cumbersome and time-consuming, and often delays approvals. In some cases, operators reported lack of clarity regarding which authority has priority to give the permits. Removing such barriers can have a positive impact on network deployment in Thailand, particularly on the deployment of backhaul networks and national plans for fibre consolidation and undergrounding.

Moving up from the access networks to the backbone/long-haul transmission networks, Thailand has a terrestrial fibre network of 33 868 km (2020) connecting major urban centres through the five regions (ITU, 2023[61]).8 However, only 19% of Thailand's population is within 10 km of a transmission node (2020) (ITU, 2023[61]), well below the SEA average (43%) (ITU, 2023[61]). This means that long distance backhaul networks will need to be built to connect broadband access networks and reach end-users. This can be a barrier to extending coverage in areas of low commercial interest, such as sparsely populated areas.

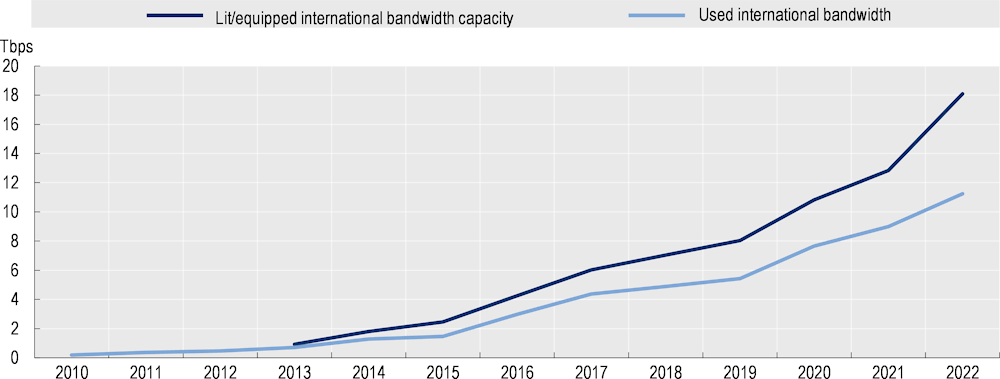

The equipped international bandwidth capacity in Thailand has been growing since 2013.9 This growth coincides with the rollout of 4G networks, which anticipated increased demand that reached 11 terabits per second (Tbps) in 2022 (ITU, 2023[12]). As expected, used bandwidth followed the same trend, albeit at a slower pace, reaching 62% of equipped capacity in 2022 (ITU, 2023[12]) (Figure 5.11). Thailand ranks fourth in the region for equipped capacity (18 Tbps), after Singapore (220 Tbps), Malaysia (93 Tbps), Indonesia (47 Tbps), and Viet Nam (24 Tbps) (ITU, 2023[12]).

Figure 5.11. International bandwidth, 2010-22

Note: Lit/equipped international bandwidth capacity refers to the total lit capacity of international links, namely fibre-optic cables, international radio links and satellite uplinks to orbital satellites in the end of the reference year (expressed in Mbit/s). If the traffic is asymmetric (i.e., different incoming and outgoing traffic), then the highest value out of the two should be provided. Average usage of all international links, including optical fibre cables, radio links and traffic processed by satellite ground stations and teleports to orbital satellites (expressed in Mbit/s). The average is calculated over the twelve-month period of the reference year. If the traffic is asymmetric (i.e. different incoming and outgoing traffic), then the highest value out of the two should be provided. All international links used by all types of operators, namely fixed, mobile and satellite operators should be taken into account. The combined average usage of all international links can be reported as the sum of the average usage of each link (ITU, 2020[13]).

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

Thailand has 13 submarine cable landing stations to implement this international connectivity. Eleven of these cable landings connect the country to extra-regional cable systems. This includes some of the world's largest submarine cables, such as SeaMeWe-3 and 4, Asia-America Gateway (AAG), FLAG Europe-Asia (FEA) and Asia Africa Europe-1 (AAE-1) (TeleGeography, 2023[62]).

Among other SEA countries, Thailand and Indonesia rank fourth in extra-regional cable connections behind Singapore (28), Philippines (17) and Malaysia (15) (TeleGeography, 2023[62]). Thailand is also connected to two regional SEA cable systems: the Thailand-Indonesia-Singapore Cable (TIS) and the Malaysia-Cambodia-Thailand Cable (MCT) (TeleGeography, 2023[62]).

Taking all cables together, Thailand is connected to virtually all regions of the world. These connections are mostly through Singapore but also include direct connections to Asia and Europe (through Asia Africa Europe-1 cable system) (Table 5.3). At the SEA level, Thailand is connected to all other countries through submarine cable systems (except the landlocked Lao PDR) with 13 connections to Viet Nam; 10 to Singapore; 9 to Malaysia; 4 to the Philippines; 2 each to Brunei Darussalam, Cambodia, Myanmar; and Indonesia (Table 5.2).

Moreover, according to the ITU Broadband Map (ITU, 2023[61]), Thailand has international terrestrial connectivity to its neighbouring countries (Myanmar, Lao PDR, Cambodia). In addition to terrestrial fibre networks of several operators, it connects through the Greater Mekong Subregional Information Superhighway (GMS IS). The GMS IS provides international terrestrial fibre connectivity to link Cambodia, the People’s Republic of China (Yunnan Province), Lao PDR, Myanmar, Thailand and Viet Nam (ADP, 2005[63]).

Its international connectivity infrastructure, both undersea cable and terrestrial, and the relatively large number of Internet Exchange Points (IXPs), positions Thailand as a gateway to the Internet for other less connected countries. For example, it could be a main or backup route to the Singapore or Hong Kong, China, hubs. It is also in a good position to host content and other services (CDN and cloud services nodes).

Table 5.2. Thailand's connections with other SEA countries via submarine cables

|

Cable System |

Brunei Darussalam |

Cambodia |

Indonesia |

Malaysia |

Myanmar |

Philippines |

Singapore |

Viet Nam |

|---|---|---|---|---|---|---|---|---|

|

Asia Africa Europe-1 (AAE-1) |

x |

x |

x |

x |

||||

|

Asia Direct Cable (ADC) |

x |

x |

x |

|||||

|

Asia Pacific Gateway (APG) |

x |

x |

x |

|||||

|

Asia-America Gateway (AAG) Cable System |

x |

x |

x |

x |

x |

|||

|

FLAG Europe-Asia (FEA) |

x |

x |

||||||

|

India Asia Xpress (IAX) |

x |

x |

x |

|||||

|

Malaysia-Cambodia-Thailand (MCT) Cable |

x |

x |

x |

|||||

|

SEA-H2X |

x |

x |

x |

x |

||||

|

SeaMeWe-3 |

x |

x |

x |

x |

x |

x |

x |

|

|

SeaMeWe-4 |

x |

x |

x |

|||||

|

Singapore India Gateway (SING) Cable |

x |

x |

||||||

|

Southeast Asia-Japan Cable 2 (SJC2) |

x |

x |

||||||

|

Thailand-Indonesia-Singapore (TIS) |

x |

x |

x |

Source: OECD elaboration from TeleGeography (2023[62]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

Table 5.3. Thailand's connections with other regions via submarine cables

|

Cable System |

Northern Africa |

Sub-Saharan Africa |

North America |

Eastern Asia |

Southern Asia |

Western Asia |

Northern Europe |

Southern Europe |

Western Europe |

Australia and New Zealand |

Micronesia |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Asia Africa Europe-1 (AAE-1) |

x |

x |

x |

x |

x |

x |

|||||

|

Asia Direct Cable (ADC) |

x |

||||||||||

|

Asia Pacific Gateway (APG) |

x |

||||||||||

|

Asia-America Gateway (AAG) Cable System |

x |

x |

x |

||||||||

|

FLAG Europe-Asia (FEA) |

x |

x |

x |

x |

x |

x |

x |

||||

|

India Asia Xpress (IAX) |

x |

||||||||||

|

SEA-H2X |

x |

||||||||||

|

SeaMeWe-3 |

x |

x |

x |

x |

x |

x |

x |

x |

x |

||

|

SeaMeWe-4 |

x |

x |

x |

x |

x |

||||||

|

Singapore India Gateway (SING) Cable |

x |

x |

|||||||||

|

Southeast Asia-Japan Cable 2 (SJC2) |

x |

Source: OECD elaboration from TeleGeography (2023[62]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

Thailand has 7 IXPs (2023) (PCH, 2023[64]), the second highest number after Indonesia. All are located in the Bangkok area except for the BKNIX Chiang Mai IXP in Chiang Mai, in the north-west of the country (Table 5.4). This infrastructure appears to perform well in handling the growing Internet traffic in Thailand. Quality indicators such as median fixed broadband latency (5 ms) were among the best in the region, only surpassed by Singapore and Brunei Darussalam (4 ms) in July 2023 (Ookla, 2023[58]).10

Table 5.4. Internet exchange points, 2023

|

Name |

City |

|---|---|

|

Bangkok Neutral Internet Exchange |

Bangkok |

|

BKNIX Chiang Mai |

Chiang Mai |

|

BBIX Thailand |

Bangkok |

|

JasTel Internet Exchange |

Nonthaburi |

|

Thai-IX Bangkok by CS Loxinfo |

Bangkok |

|

Thailand IX |

Bangkok and Nonthaburi |

|

True International Gateway NIX |

Bangkok |

Source: PCH (2023[64]), Internet Exchange Directory, www.pch.net/ixp/dir (accessed 5 December 2023).

5.5.2. Digital divides

Despite the overall positive development of broadband penetration, there are significant divides when considering other factors, such as geography, age and gender. In 2021, 82% of individuals in rural areas used the Internet compared to 90% in urban areas (ITU, 2023[12]). In that same year, only 24% of those aged 75 and over use the Internet compared to 85% or more for other age groups (ITU, 2023[12]). With respect to gender, however, the differences are much less pronounced. There is a two percentage point gap favouring men, which has remained virtually unchanged over the last 20 years (ITU, 2023[12]).

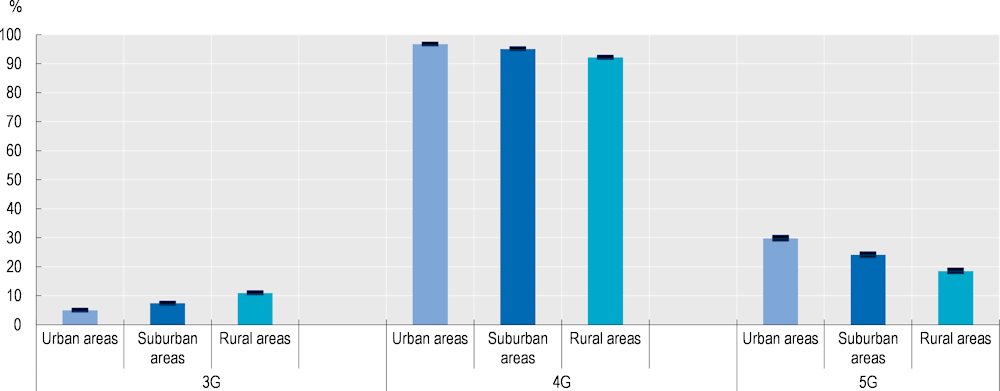

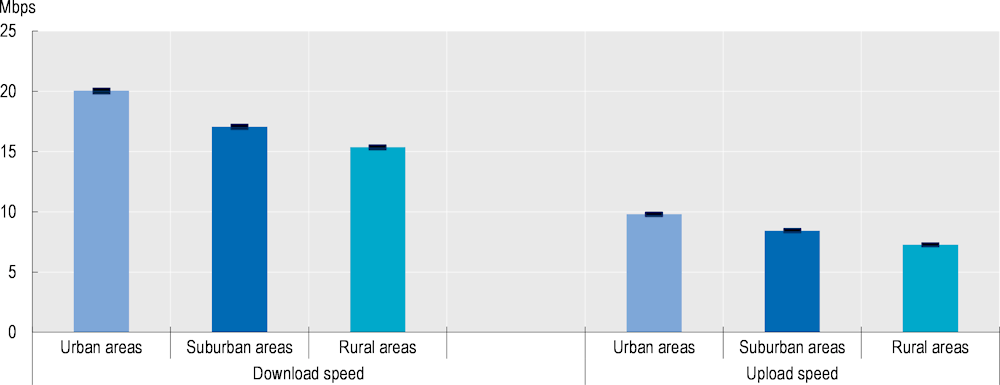

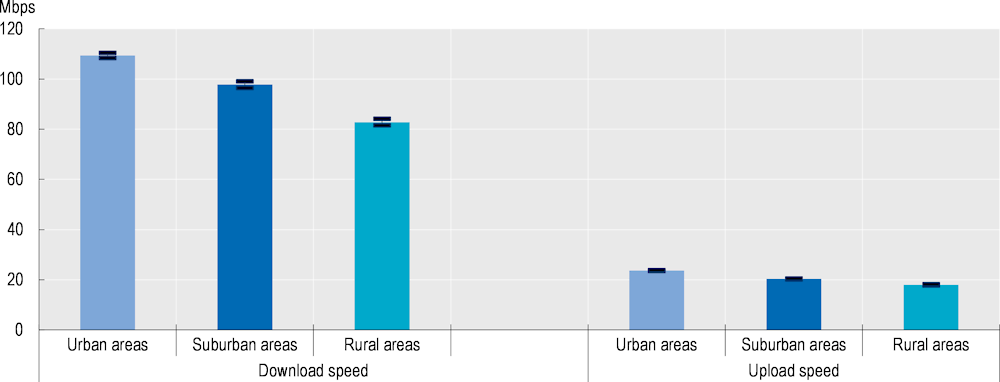

There are several reasons behind these divides. Looking further at the supply-side reasons, mobile broadband mobile network availability, understood as the proportion of time users have a 3G, 4G and 5G connection (Opensignal, 2023[65]), shows high values and little difference between urban, suburban and rural areas. According to Opensignal the availability of 4G networks in rural areas was 92.1%, 4.6 percentage points lower than in urban areas (96.7%) (December 2022 – February 2023) (Figure 5.12) (Opensignal, 2023[66]).11 Despite the high level of mobile network availability, the lower quality of mobile broadband services in rural areas may contribute to the geographical divide connections (Figure 5.14, Figure 5.15).

There appears to be a gap in fixed broadband coverage. While there is no disaggregated data by geography, Thai authorities recognise that lack of access to broadband networks in sparsely populated areas is a main barrier preventing take-up by residential users and small and medium-sized enterprises (SMEs) in these areas. In addition, initiatives such as Net Pracharat to extend fixed networks to rural areas (backhaul and Wi-Fi access points) seem to confirm that fixed broadband coverage can pose a problem in such parts of the country.

Figure 5.12. Network availability, percentage of time (3G, 4G, 5G), December 2022 – February 2023

Notes:

1. Data was collected by Opensignal from its users over 90 days (1 December 2022–28 February 2023).

2. 3G availability shows the proportion of time that all Opensignal users had a 3G connection. 4G availability shows the proportion of time Opensignal users with a 4G device and a 4G subscription – but have never connected to 5G – had a 4G connection. 5G availability shows the proportion of time Opensignal users with a 5G device and a 5G subscription had an active 5G connection (Opensignal, 2023[65]).

3. Confidence intervals (as represented by error bars) provide information on the margins of error or the precision in the metric calculations. They represent the range in which the true value is likely to be, considering the entire range of data measurements.