Data have become a key asset for increasing productivity and innovation capacity, and enabling SMEs to scale up. Yet SMEs are less aware of the potential and need for them to implement better data governance. This chapter aims to understand how governments create the incentives and conditions for improving SME data governance. It first presents the rationale and scope for policy intervention, and proposes an analytical framework for mapping relevant national policies and institutions in this area. Based on cross-country analysis of 487 policies and 209 institutions across the OECD, the report provides an overview of the policy mixes governments have put in place to enhance SME access to, protection and exploitation of data, as well as on the institutional and governance arrangements behind.

Financing Growth and Turning Data into Business

3. Turning data into business

Abstract

In Brief

Policies in support of SME data governance aim to help SMEs turn data into economic value to scale up business activities and grow. With data emerging as a key driver of firm performance, and potentially enabling a broader deployment of more sustainable, energy- and resource-efficient business models, there is a need to better understand the extent to which and how governments act for improving SME data governance.

A number of barriers, notably uneven access to data, technology and skills limit opportunities for SMEs in increasingly data-driven economies, frequently paired with a lack of financing options and demanding regulatory requirements (e.g. related to personal data protection). Outdated data infrastructures, data silos, as well as management practices or cultures that are not conducive to digital innovation and change, represent additional challenges inherited from analogue business models.

Based on a cross-country mapping of national data governance policies and institutions, this chapter aims to identify emerging practices in the field and the considerations given to SMEs and potential scalers. At this pilot stage of the project, the objective is to develop an initial overview of the policies governments have put in place to improve SME access to data, as well as their protection and exploitation, that can help policymakers understand how data policies are shaping across countries and thereby offer them more informed policy options.

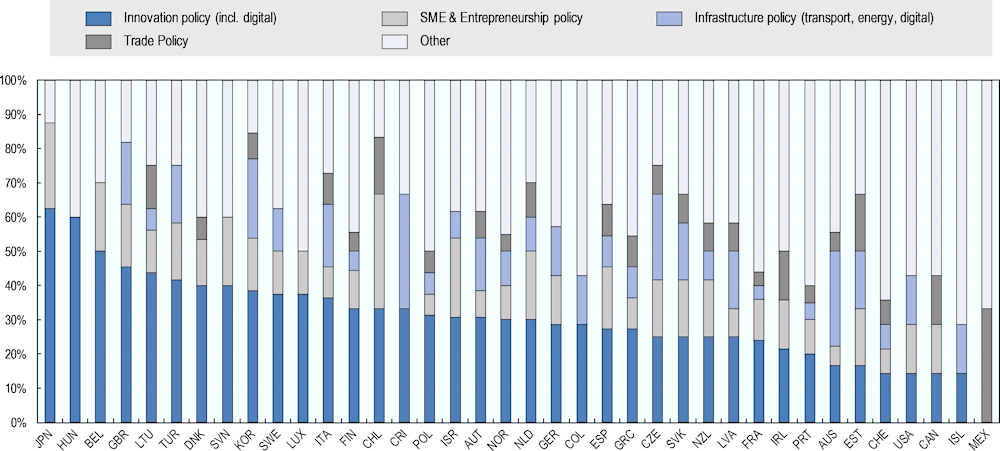

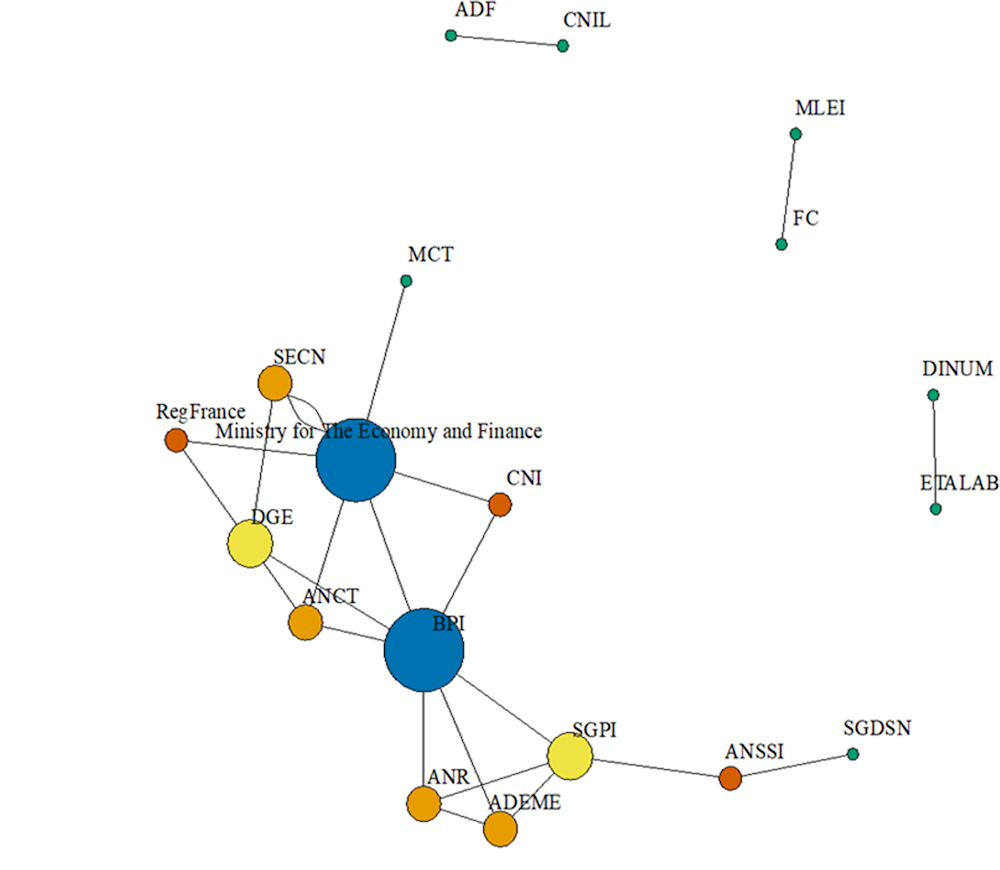

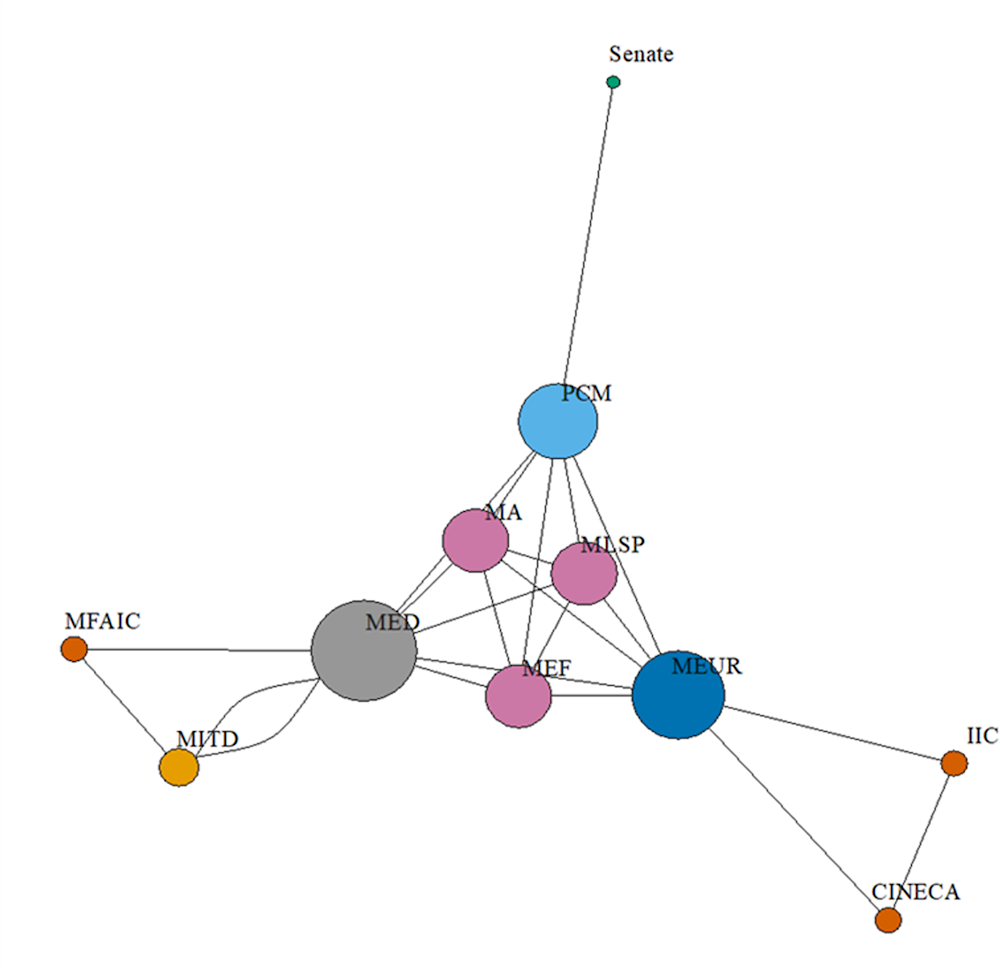

SME data governance policies are cross-cutting by nature, with a diverse set of institutional and governance arrangements in place. Out of 209 institutions mapped across the OECD area, different types and models of institutions are in charge of policy design and implementation. Policy coordination takes place through national strategies on cybersecurity, digitalisation or innovation etc. These horizontal instruments represent the most prevalent instrument in national policy mixes, suggesting that data governance remains an emerging field where public efforts still focus on broader governance considerations. Data policy institutions also cover a broad range of mandates, beyond SME and entrepreneurship policy, which calls for greater attention to mainstreaming SME&E considerations into data policymaking.

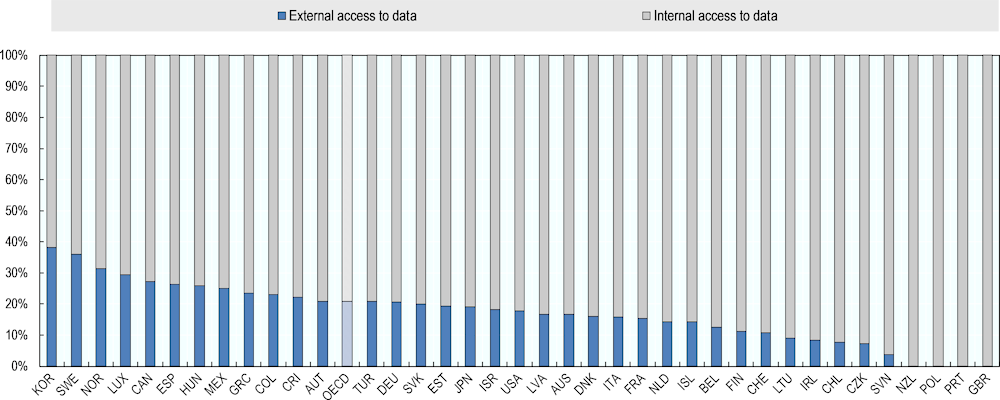

In their policy mix, countries are currently placing a strong focus on strengthening SME internal capacity to use data. Out of the 487 mapped policies, the vast majority of initiatives (72%) seek to raise SMEs’ internal capacity to effectively exploit and protect their data. Notably, close to two thirds of policy initiatives (64%) seek to promote data culture and skills among SMEs, suggesting that data governance issues are addressed from an awareness and training entry point. Less focus is given to enabling SME access to external data, with only 28% of mapped policies oriented toward improving data sharing or the deployment of data related infrastructure.

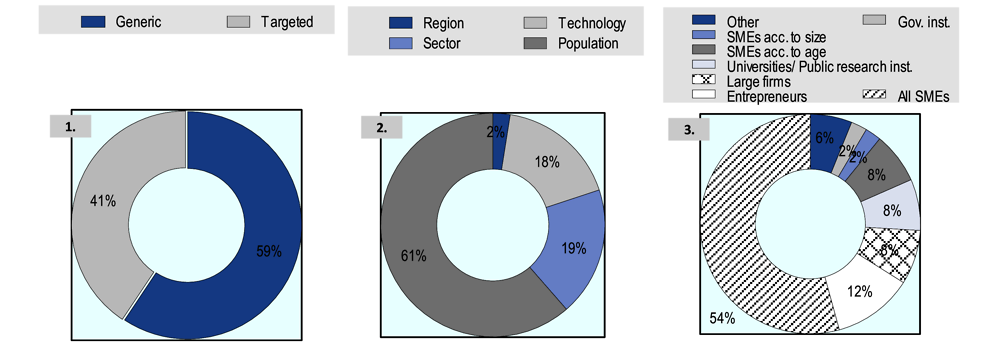

Countries typically combine generic data policies with more targeted measures that aim to tackle specific barriers that SMEs or certain segments of the SME population face. Across the OECD area, data governance policies targeted at populations, sectors and/ or regions represent 41% of the mapped initiatives. The majority of those aims at SMEs as a whole (54%), and less often at specific subgroups (22%), such as start-ups or entrepreneurs. Overall, however, less than one third (29%) of all policies mapped in this area are SME-targeted, and even fewer are specifically dedicated to data issues, which rather tend to be weaved into broader SME digitalisation initiatives.

Future research could help shed further light on how data can support greater SME sustainability as well as their ability to apply IPR mechanisms in this context.

Infographic 3.1. Key aspects of SME data governance

Note: Word cloud based on the description of the relevant 487 national policy initiatives mapped in this area. Descriptions and more detailed information are available in the OECD Data Lake on SMEs and Entrepreneurship.

Source: Authors’ own elaboration.

Introduction

Small and medium-sized enterprises (SMEs) that scale up achieve greater business performance. A change in scale signals the capacity of the firm to create new competitive advantages, or increase productivity, resource efficiency or profits (See Chapter 1).

For long, policy makers have paid close attention to scalers for their significant contribution to job creation, or their potential to drive innovation, especially in technology-intensive sectors or frontier areas (OECD, 2021[1]). For instance, while scalers only represent 13%-15% of SMEs in Finland, Italy, Portugal, the Slovak Republic and Spain, they contributed 47% to 69% of all new jobs by non-micro firms between 2015 and 2017. However, most of these scalers are mature firms operating in low-tech sectors (see Chapter 1), with about three-quarters of employment scalers having been established at least six years before the beginning of their high-growth phase (OECD, 2021[1]).

This diversity in scalers’ profiles and trajectories has increased concerns that policy makers may look for potential scalers in the wrong (or only in a limited number of) places and support them with the wrong instruments. So far, most of governments’ efforts in support of scaling up have focused on start-ups and enterprises enabling disruptive innovation, giving by default stronger emphasis on policies that influence market entry (such as taxation, competition or regulation), or policies that affect early business growth and technology development (such as R&D tax incentives, university spin-offs, or equity capital etc.) (OECD, 2016[2]).

New results from the measurement work of this pilot project call for a rethinking of scale up policies, starting with a better understanding of what the SME scaling up drivers are, the potential failures that require policy intervention and the form(s) of action governments could implement (see Chapter 1 for a more detailed discussion). Based on literature review and early evidence from the microdata work of this pilot project, there are a number of internal factors that can drive SME scale up: 1) innovation; 2) Investments in financial, human and knowledge-based capital, and 3) market and network expansion, including abroad. These drivers can operate in isolation or in combination. In this context, scaling appears to be a strategic choice and most often a firm-driven process, with the associated transformation(s) often beginning before actual scaling materialises (OECD, 2021[1]).

More specifically, scalers tend to invest more in dedicated IT resources, as evidenced by a systematically higher share of IT employees in these firms, across all sectors, and at all stages of their transformation (before, during and after the scaling-up phase) (see Chapter 1). This suggests a higher digital intensity of future scalers which require above-average ICT handling capacity. In this context, the volume of data these firms access or generate is likely to increase, implying in turn a need to raise internal capacity for data management and for addressing a possibly greater exposure to digital security risks (OECD, 2021[3]).

Better access and use of data, and data-related technologies and skills, could help SMEs raise capacity to operate in a sustainable way at a higher scale of performance. There are multiple data types, with multiple data applications possible across sectors, or within the firm across business functions (see Box 3.1). These applications are poised to give tremendous opportunities to smaller businesses to pull on scale up levers, e.g. by achieving greater cost or resource efficiency, specialising or differentiating products, innovating with new data-enabled or data-enhanced business models, increasing own-financing capacity, or expanding markets and networks including abroad (see Chapter 1).

Box 3.1. What is data? What is data governance?

‘Data’ refers to recorded information in structured or unstructured formats, including text, images, sound and video. Data can be in any format, including analogue formats like paper, or emerging quantum forms like qubits, but the rise of digital technologies has enabled the growth and policy relevance of digital data, namely information stored by a computer in binary format. Almost every aspect of the digital environment, including a website or a banner advertisement, is data. Data in digital formats are characterised by their ability to be processed and analysed by digital technologies (OECD forthcoming, 2022[4]). For the purposes of this chapter, data is meant to refer to digital data, unless this is otherwise made clear.

Data can be categorised as personal, public, or proprietary data (OECD, 2021[5]). Personal data, for instance, typically requires more restrictive access regimes than non-personal or certain public sector data. With regard to the latter, most OECD countries today have adopted “open by default” approaches, thus paving the way for more mature open government data policies. This approach reflects the notion of “public data as a public good”, which in turn should be delivered with a purpose, proactively, with a focus on re-use, and in line with user needs and its potential contribution to value co-creation. At the same time, it should be governed by the right policies in terms of data protection, privacy, transparency, ethics and digital rights (Rivera Perez, Emilsson and Ubaldi, 2020[6]).

On the other hand, industrial data is in most cases proprietary data and therefore access and sharing tends to be more restrictive compared to public sector data, which in many cases can be shared through open data portals. Some data types may also overlap or lead to conflicts of interest among different stakeholder groups (OECD, 2019[7]). Such concerns are compounded when dealing with cross-border data flows, where data moves beyond the reach of domestic regulatory bodies and thus becomes subject to differing regulations depending on the type and location of the data.

While the term data governance is often primarily associated with the public governance of data, the concept is increasingly also being applied to the private sector, including at firm level, thus recognising the different models of how businesses access, use and share data – see for example (Petzold et al., 2020[8]) (Begg and Caira, 2017[9]) (Linck, 2021[10]) (European Commission, 2020[11]). Against this backdrop, data governance can be thought of as a system of rules, policies, and processes that ensures data quality, reliability, compliance and security and provides a framework for data collection and use – across various types of organisations. Its concept thus covers key aspects such as data access and sharing, data quality and curation, data control and ownership, data protection and privacy, data interoperability and standards, trans-border data flows and investments in data-related infrastructures, skills and competences. These are closely tied to the data value cycle and its phases, from datafication (i.e. process by which subjects, objects, and practices are transformed into digital data), data collection and data curation to data processing via data analytics, including artificial intelligence (AI) algorithms, to knowledge creation and data-driven decision making (OECD, 2019[7]).

In this context, the OECD Recommendation on Enhancing Access to and Sharing of Data represents the first internationally agreed upon set of principles and policy guidance on how governments can develop data governance frameworks that maximise the cross-sectoral benefits of access to and sharing of all types of data while protecting the rights of individuals and organisations (OECD, 2021[5]).

Note: The concepts of digitisation and digitalisation have distinct meanings. Digitisation means to convert analogue information into a digital format, i.e. encoding of data and documents so that computers can store, process, and transmit such information. Unlike digitisation, digitalisation doesn’t have a single, clear definition, but it typically refers to converting (business) processes over to use digital technologies, instead of analogue or offline systems, such as paper or whiteboards (OECD, 2019[12])

Improving SME data governance has thus emerged as a potentially critical condition for scaling up, and a central point of policy attention in support of job creation and the deployment of more sustainable and resilient business models. The cross-country analysis presented in this chapter seeks to provide an overview of how SME data governance policies shape across OECD countries, and will feed relevant policy lessons into a broader body of work on the subject (see Box 3.2).

Box 3.2. Going Digital III: Data Governance for Growth and Well-being

The OECD Horizontal Project on Data Governance for Growth and Well-being represents the third phase of the OECD Going Digital project and aims to provide policy guidance on how governments, businesses and citizens can benefit from data, address related challenges, and foster a holistic and coherent approach to data governance, across policy trade-offs and between policy regimes. It brings together contributions from different OECD policy communities to account for the multidisciplinary nature of the topic.

More specifically, the Horizontal Project is articulated across four core modules:

1. Data stewardship, access, sharing and control

2. Fostering cross-border data flows while preserving trust

3. Data shaping markets and firms

4. Measurement of data and data flows

Importantly, the project has also contributed to proposing a definition of the data governance concept, which has been lacking thus far, whereby “‘Data governance’ refers to a range of arrangements, including technical, policy, regulatory or institutional provisions, that affect data and its creation, collection, storage, use, protection, access, sharing and deletion, including across policy domains and organisational and national borders. Efforts to govern data can take many forms and often seek to maximise the benefits from data, while addressing related risks and challenges, including to rights and interests.”

The analytical framework of the present work, while narrower in scope, has been aligned with the concepts developed as part of the Horizontal Project and seeks to reflect the dimensions laid out in the above definition. On that basis, it will provide a substantive contribution to the third module around Data Shaping Firms and Markets. This module will explore trends in data use by firms, technical aspects relevant for policy makers, as well as policy implications for helping firms prosper in data-intensive/driven markets. In particular, the module will look at the emerging opportunities for SMEs and entrepreneurs, the obstacles they face in accessing, using and managing data to enhance their businesses, as well as at measures that governments can implement to remove or lower those barriers and improve SME data governance.

This chapter starts by introducing data governance as an emerging policy field that is critical to SME scale up and presents the rationale for policy intervention by discussing key opportunities and barriers for SMEs in this area. It then proposes an analytical framework for mapping relevant national policies and institutions in this area. Based on cross-country analysis of 487 policies and 209 institutions across the OECD, the chapter then provides an overview of the character and intensity of public efforts to improve SME access to, protection and exploitation of data, as well as on the institutional and governance arrangements for implementing national policy mixes.

Businesses are increasingly leveraging data, with broad scope for driving SME scale up

Businesses have long been using data, but in recent years both the scale of data usage and their central importance for many business models have grown exponentially, as reflected by increasing data traffic around the world and the global use of data centres (OECD, 2021[13]).

Progress has been driven by the deployment of key technologies that improved the conditions for storage, processing and use of data (see Box 3.3). Combined together, the Internet of Things (IoT), big data analytics and cloud computing have increased firms’ capacity for prototyping, decision making and automation (OECD, 2017[15]) (OECD, 2021[3]).

Box 3.3. Potential benefits of the adoption of fourth industrial revolution technologies

Fourth industrial revolution technologies have recently risen to the top of the SME policy agendas of OECD countries. The adoption of these technologies have the potential to drive SME scale up and reap the benefits of the data economy.

The Internet of Things (IoT) supports machine-to-machine communication and enables the generation of an unprecedented volume of data through the hyper-connectivity of devices, sensors and systems.

Artificial intelligence (AI) leverages machine learning and new algorithms for data exploration and data analytics. AI allows for the processing of large amounts of data to recognise patterns and infer specific sets of rules, enabling greater automation and predictive capacity.

Cloud computing allows storing and processing more data, especially at a more affordable cost as upfront investment in hardware or maintenance costs are reduced. Cloud computing allows access to “software as a service” (e.g. for storage, servers, databases, and software) and to leapfrog to new technologies along a pay-as-you-go model that better suit the needs of smaller actors. These set of cloud services, tools or applications enable SMEs to improve their data management and integration capacity, and represent a first step toward a more efficient organisation of data flows within the firm. In addition, some technologies, specialised software and hardware, enhance business capacity for data protection and security.

Block chain (and distributed ledger technologies) for instance are typically secure decentralised database technology that enable transparent transfer of data without intermediation. A widespread use of block chain applications can ensure the protection of sensitive data, while enhancing accountability and trust among parties.

Big Data analytics permits SMEs to improving their decision-making, forecasting and allowing for better consumer segmentation and targeting,

3D printing or additive manufacturing might increase SMEs manufacturing capabilities, allowing them to increase their competitiveness and product offering.

Quantum computing have the potential to increase computing capacities and address problems that are intractable on any classical computer. In particular, it is expected to foster R&D and innovation in different sectors such as agriculture, drug development, and manufacturing, among others.

As a result, data are increasingly generated across business operations, e.g. production and delivery (process data), and compiled at various stages of business transactions (user, consumer and supplier data) (OECD, 2019[18]). The growing variety of data types and applications across business models and industries suggests that data governance will play a key role in corporate strategies and policies, and may ultimately also prove pivotal in driving business scale up.

Process data for instance can improve stock management, logistics and maintenance, and business reactivity to just-in-time production requirements. They also increase the scope of efficiency gains including in terms of energy and resource consumption, or waste generation. Data can help reduce operation costs along the internal value chain of the firm and generate productivity gains, without need for the firm to create additional mass.

User, consumer and supplier data, on the other hand, are crucial for developing market knowledge, improving customisation and shaping new products and business models. Data can help scale up capacity for product differentiation and market segmentation, as it enables businesses to gain insights on their customer base (“Know Your Customer”). Data also offer opportunities for achieving greater regional and global reach through network effects, or by reducing information asymmetry on markets.

In addition, better access to external data, including for example open government data, can allow entrepreneurs to develop innovative commercial or social goods and services, as well as create new business opportunities for data intermediaries, including data brokers, mobile apps and personal information management systems (OECD, 2019[7]). A recent study finds a significant and positive relationship between open government data and levels of entrepreneurship, especially in countries with high institutional quality. At the same, publishing government data alone does not seem to be sufficient to boost innovative entrepreneurship, rather governments need to focus on a broader set of policy initiatives that promote good governance, including rules related to contractual relationships and market exchanges between data publishers and users (Huber et al., 2022[19]).

As a result, data is emerging as a strategic asset for an increasing number of SMEs. In the OECD, they already represent the majority of businesses in sectors that process large volumes of data, such as professional, scientific and technical services, or sectors where data analytics and machine learning are poised to have a tremendous impact in the near future, e.g. retail, transport and logistics, travel, automotive and assembly and consumer packaged goods (OECD, 2019[18]) (OECD, 2021[3]). Table 3.1 illustrates how different data-driven applications may benefit SMEs in their operations and help them scale up through efficiency gains, enhanced innovation capacity, greater potential for diversification, differentiation and specialisation (typically, major levers on SME competitiveness) or network expansion, etc.

Table 3.1. Examples of data applications in SME-dominated sectors and business models

|

Data applications |

Sectors of application |

Applications across business functions (all sectors) |

Expected impact on business operations |

Potential benefits for SME performance and scale up capacity |

|---|---|---|---|---|

|

Customer profiling |

Retail trade; food and accommodation services, ICT services, transports etc. |

Marketing, sales, product development |

Capture a wide range of behavioural data about customers/users: e.g. identify behavioural shopping patterns such as purchasing similarities between customers to predict their preferences toward new items. Track customer movement in store and provide high volume of information at low cost (in-store behaviour analysis for store layout) Greater use of customer data in product conception and early development. Optimise assortment for micro-segments of customers |

Mass customisation and product differentiation; improved sales and marketing opportunities; Higher sales revenues by exposing customers to new or customised products. |

|

Design and conception |

All sectors, e.g. construction |

R&D, product development |

Generative designs: Generate a wide assortment of design solutions that meet the given design requirements |

Product differentiation and cost efficiency in design |

|

Pricing strategies |

All sectors, e.g. retail trade |

Marketing, sales, finance/budget |

Evaluate sources of sales lift and plan future promotions; together with greater anticipatory capacity of input cost fluctuations. |

Higher profits through more optimal pricing strategies |

|

Consumption analytics |

All sectors, e.g. construction, manufacturing |

Procurement, production and distribution |

Yield-energy Throughput (YET) analytics: maximize yield/ throughput of individual assets by optimising working parameters. Fuel consumption analytics: optimize energy consumptions. Building energy management systems (BEMS): Monitor the energy consumption of buildings Improved input price and forecasting accuracy; Resource optimization and waste reduction by design |

Higher productivity through cost efficiency. Raising profiles (e.g. ESG) for investors |

|

Predictive maintenance |

Manufacturing; transport services, construction |

Production, logistics and distribution |

Reduced machine downtime. Automation of safety control processes. Improved supply operations. Optimize building operations and maintenance. |

Higher productivity through cost and time efficiency and increased production output. |

|

Quality Management |

Manufacturing |

Production |

Cut down on test times and reduce the number of tests required to assure desired quality. Replacement of manual inspections. |

Higher productivity through cost efficiency and improved product quality |

|

Network and system management |

Transports, manufacturing, automotive industry, tourism, retail and wholesale trade; construction |

Logistics; supply chain management, production |

Analyse network traffic in real-time, including e.g. geospatial distribution of demand or congestion risks. Real-time monitoring of the mobility system (smart traffic systems) and improved real-time fleet management Inventory optimization: enhanced real time inventory tracking and stock management and greater capacity for just-in-time production /delivery. Adaptive, real-time control and increased coordination over an ever-expanding array of building activities. Dynamically define optimal setup point (e.g. sales mix, value allocation, procurement mix) to maximize profit per hour. Enhanced integration of operational systems, from manufacturing to end-to-end value chain. |

Cost efficiency (e.g. maintenance, insurance, fuel etc.), new business models (e.g. taxis, trucks and delivery services, with implications for the automotive industry and the chains of part suppliers), |

Note: Based on (OECD, 2021[3]) and (OECD, 2019[18]).

Source: Authors’ own elaboration.

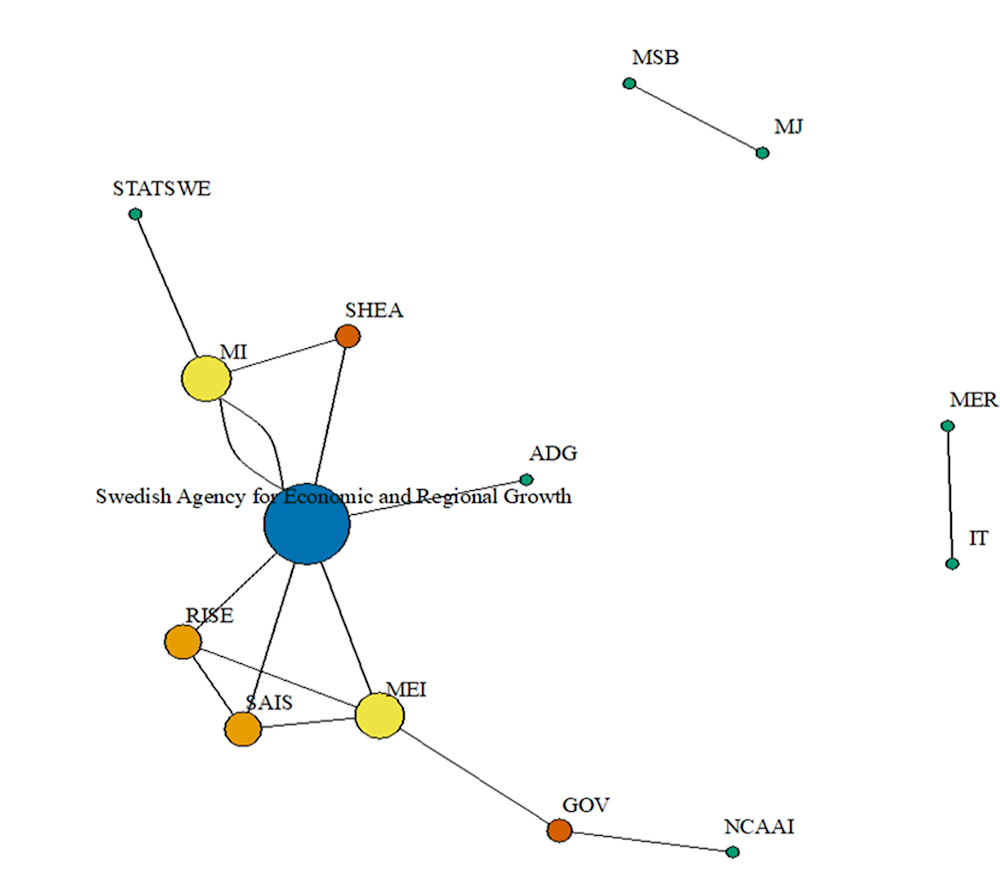

There are however varying degrees of capitalisation on data across business sectors, which will likely impact the degree to which specific SMEs can leverage data as a strategic asset. In 2019, for example, the Swedish government commissioned its Agency for Economic and Regional Growth to map the enabling conditions for SMEs to use data as a strategic resource and to identify particular sectors that hold most promise or face most challenges. The study identifies the Transportation and Storage sector as strategic for investment, with the sub-industry Road transport of goods as particularly relevant given the prevalence of SMEs in this sector, where access to real-time data sets has enabled new business models for transport activities. On the other hand, the study argues that the low digital maturity of the hospitality and construction industries, for example, made SMEs in these sectors less conducive to data-enabled business models (Tillväxtverket, 2020[20]). Such findings suggest that not all industries would benefit equally from targeted investments or policies related to data.

Data create economic value by enhancing business operations, and sometimes even enable the creation of new business models…

A growing body of literature offers empirical insights on the relationship between the adoption and use of data and firms’ performance. For instance, (DeStefano, Kneller and Timmis, 2020[21]) find that small firms in the UK that adopted cloud technologies were more likely to experience growth in both employment and revenue. Similarly, (Tang, Huang and Wang, 2018[22]) explored the adoption of IoT solutions at firm level and found that, controlling for industry, IoT adopters tend to display on average better financial performance (including return on assets, asset turnover and profit margins) than non-adopters. Lastly, (Müller, Fay and vom Brocke, 2018[23]) found that the adoption of big data related assets1 was associated with an average improvement in firm productivity of 3%-7%.

In the manufacturing sector, more specifically, a recent study by McKinsey found that predictive maintenance, system/ supply chain dynamic optimisation and Yield-energy Throughput (YET) analytics2 can deliver EBITDA (earnings before interest, taxes, depreciation, and amortization) margin improvements of as much as 4-10% for firms. By using these advanced data analytics, companies can determine the circumstances that tend to cause a machine to break and monitor input parameters so they can intervene before breakage happens—or be ready to replace it when it does—thus minimising downtime. Predictive maintenance typically reduces machine downtime by 30-50% and increases machine life by 20-40% (Dilda et al., 2017[24]).

While some firms lag behind, the digital age has facilitated the rise of firms at the cutting end of the technological frontier, whose current business models would not exist without the access to and use of data. Unlike firms whose operations are simply enhanced by data, some data-enabled firms rely on their ability to generate, collect and analyse data (Nguyen and Paczos, 2020[25]). Put differently, the more data-enabled a firm is, the more data represents a critical input into its productive activities, and data or data-related tools may be among the most valuable assets it controls. Based on this broad distinction, four categories of data-related business models emerge (Table 3.2).

Table 3.2. Typologies of data-driven business models and SME examples

|

Data-enabled |

Data-enhanced |

||||

|---|---|---|---|---|---|

|

Selling or licensing raw or aggregated data |

Developing and selling new data-related products |

Using data to improve existing products |

Using data to improve production processes |

||

|

SME examples |

Verified (NZL) offers background data for screening purposes. Data Stream (USA) collects, analyses and sells customer and business databases. Databroker (UK) sells data for direct mail, telemarketing, and email marketing campaigns. |

Flowbase (EST) using AI turns cameras into actionable, real-time data. Altilia (ITA) provides a platform that uses AI for data collecting and data analysis. Taptap (ESP), a Data Marketplace which helps users find, buy and sell data online. |

Darwin AI (CAN) generates high-performing design for products based on parameters using machine learning. INBA (SVN) a Real Estate marketplace that uses block chain to make transactions instantaneous. Deep Instinct (ISR) applies deep learning to cybersecurity. |

Zelros (FRA), an AI and Machine Learning technology firm, helping insurance companies increase sales efficiency. Worldsensing (ESP) a provider of data loggers and sensors to monitor the safety of mines. Daisee (AUS) offers automated quality management of customer interaction using AI voice analytics technologies. |

|

Note: Data-enabled firms include businesses that have been created by the use - or new use - of data and that would not exist without those, (e.g. communication and technology firms, digital platforms) Data- enhanced firms include businesses whose primary function is not data-based, but whose efficiency may significantly improve, or whose business model may significantly change through the use of data (e.g. firms operating in the utilities, transportation, finance, or health sector).

Source: Authors’ own elaboration, based on (Nguyen and Paczos, 2020[25]).

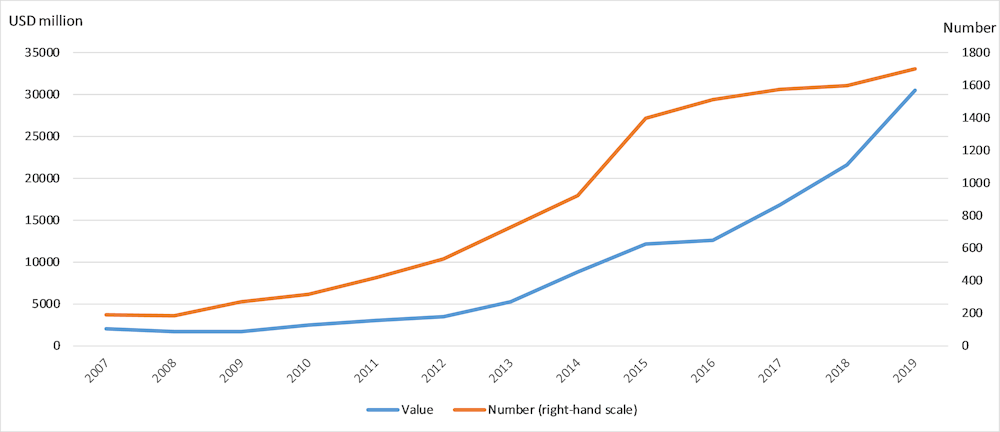

As a result, markets increasingly value firms that can make use of the growing volumes of data they generate, which is notably reflected in the exponential growth that private equity investments in big data firms have experienced recent years. Data from Preqin Pro, a platform providing access to private capital and hedge fund data worldwide, suggests that venture capital (VC) investments in “big data” firms, which reflect the investors’ evaluation of the long-term value of the data assets owned by these firms, grew significantly over 2007-19, both in terms of the number of deals (9-fold increase, from 190 to 1702) and in terms of their value (15-fold increase, from USD 1.98 billion to USD 30.5 billion) (Figure 3.1).

Figure 3.1. VC deals in big data firms worldwide have grown exponentially

Note: The definition of “big data” firms includes firms providing solutions for large volumes of data, through data gathering, storing or analysis, but excludes firms producing hardware, software or services that underpin the provision of big data services.

Source: OECD, based on Preqin Pro, www.pro.preqin.com (last accessed in February 2021). DSTI/CDEP/MADE(2021)3

...and data will play a key role in helping SMEs scale up through more sustainable business models

Improved data governance can also create new opportunities for SMEs to grow and respond to growing environmental pressures, as well as the need for more responsible business conduct (RBC).

Efficiency gains can be achieved through energy and resource savings. Process data combined with an optimised use of data-intensive technologies, for example, enable consumption analytics and predictive maintenance (Table 3.1), which will help reduce wastage, and support the introduction of more environmentally-friendly practices in production process (Ortega-Gras et al., 2021[26]). This way, SMEs can identify operations at low energy consumption level, and implement strategies in order to modify their energy consumption practices curtailing carbon emissions. The deployment of smart grids and the Internet of Things (IoT) – a range of smart objects, sensors, devices and software that connect and exchange data - could also support data collection and transfer. For instance, Woodsense – a Danish SME – has created a product called “moisture meter”, which automatically monitors the moisture in timber structures through IoT sensors as a way to improve energy efficiency of building maintenance.3

In particular, the circular economy creates room for SMEs to scale up, because a circular approach - as opposed to the traditional linear one - raises business capacity to reduce costs, improve resource price predictability and increase resilience to supply disruptions. The circular economy carries a transformational and high profit potential for a broad range of industries, where SMEs are in the majority (Ellen MacArthur Foundation, 2015[27]). ‘Share’ models can help cut costs and improve performance in distributive trades (i.e. wholesale and retail trade) or accommodation and food services; ‘virtualise’ models in administrative and support services, legal and accounting and head-office consulting, as well as in a range of knowledge-intensive services; ‘loop’ models in construction, transportation and storage. The building sector, for example, could halve construction costs with industrial and modular processes.

In addition, SMEs embracing circular - and more broadly green - models could expand networks and benefit from access to emerging markets and obtain greater visibility to a customer base (OECD, 2019[18]). According to survey data, accessing new markets, together with saving material costs and creating competitive advantages, are indeed among the main reasons for European SMEs to take action towards more circular practices (Rizos et al., 2016[28]). SMEs can operate in circular and green supply chains in local markets that may be unattractive or impenetrable for large global firms, including in emerging economies and low-income countries. The circular economy also encourages a shift in business strategies towards more customer-focused design thinking for which smaller firms may have a comparative advantage due to their greater reactivity, local footprint, and proximity to end markets (OECD, 2019[18]).

To enable circular and green business models, SMEs need data. Information and data on the property of products and materials are required either as a way to create new products or for extending the lifetime of existing goods (Dubey et al., 2019[29]). With IoT devices compiling data across the value chain, firms that participate in the circular economy can obtain consistent and accurate insights on the conditions and functioning of assets (Suciu (Vodă) et al., 2021[30]). Without access to relevant data, however, SMEs will face barriers to repairing, refurbishing or upgrading goods and the development and creation of secondary markets will remain limited (Stahel, 2016[31]). To date, siloed data, lack of data interoperability and data standards remain indeed common barriers faced by actors of the circular economy (Nordic Innovation, 2021[32]).

Data is also instrumental to access sustainable finance or obtain eco-certification, a sesame to green markets and green public procurement. In recent years, markets, customers and investors have shown an increased interest in aligning decisions with environmental or personal values. As a consequence, more and more brokerage firms and mutual fund companies have started offering exchange-traded funds (ETFs) and other financial products that follow environmental, social, and governance (ESG) criteria (see Box 3.4) (Boffo and Patalano, 2020[33]). These criteria have become an increasingly popular way for investors to evaluate companies in which they might want to invest in, leading in turn to a soaring in the number of ESG indices, spurred by the growth in ESG-related data and benchmarks (Kuzmanovic and Koreen, 2022[34]). Eco-labels and green certifications also require business process data to estimate carbon footprint or environmental impact (Zhao, Guo and Chan, 2020[35]), and the increasing demand for sustainable products and services is likely to steer the development of green-certifications and further consumer demand for environmentally friendly goods (OECD, 2018[36]).

Box 3.4. Environmental, social, and governance (ESG) performance

Environmental, social, and governance (ESG) performance criteria are a set of standards for a company’s operations that investors may use to screen potential investments and that can also drive consumers’ preferences. Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

More specifically, the three dimensions typically take into consideration the following elements:

Environmental criteria may include a company’s energy use, waste, pollution, natural resource conservation, and treatment of animals. The criteria can also be used in evaluating any environmental risks a company might face and how the company is managing those risks.

Social criteria look at the company’s business relationships, e.g. whether its suppliers hold the same values the company, possible donation of its (part of its) profits to the local community volunteer work by employees, or the company’s working conditions and their regard for its employees’ health and safety.

Governance criteria usually require that a company uses accurate and transparent accounting methods and that stockholders are allowed to vote on important issues. They may also want assurances that companies avoid conflicts of interest in their choice of board members, do not use political contributions to obtain unduly favourable treatment and, of course, do not engage in illegal practices.

The growing investor interest in ESG criteria reflects the view that environmental, social and corporate governance issues - including risks and opportunities - can affect the long-term performance of issuers and should therefore be given appropriate consideration in investment decisions.

Source: Based on (OECD, 2020[37]) and on (Boffo and Patalano, 2020[33])

Accessing sustainable finance requires that SMEs are able to effectively respond to reporting requirements and leverage internal data (both financial and non-financial). ESG ratings rely mainly on self-reported data or proxy data that is often not verified or audited. The current quality of these data is likely to reflect the capacities of companies to adequately measure and report on their environmental performance and greening actions. This reporting burden likely disadvantages SMEs, because in many countries they are either not required to report on their non-financial performance – or simply have limited capacities to collect, measure and report on the relevant indicators (Kuzmanovic and Koreen, 2022[34]). A case in point is the 2020 EU Taxonomy Regulation4 which aims to create an EU-wide classification system for sustainable activities, but whose reporting requirements currently do not include SMEs, for which disclosure of relevant data remains voluntary. Recent research suggests indeed that there is an ESG scoring bias in favour of large-cap companies, and ESG ratings are positively correlated with the resources that companies devote to reporting, with larger companies that can dedicate more resources displaying higher scores (Boffo and Patalano, 2020[33]). In turn, higher ESG ratings can help advance capabilities in producing relevant data and metrics that conform to the needs of rating firms and a plethora of investors.

Business incentives to meet reporting requirements are likely to grow further, including among SMEs, with standardisation of ESG criteria. While there are many different solutions for ESG reporting for large and listed companies, dedicated solutions for SMEs are still scarce and the few existing ones can be found mostly in the emerging fintech ecosystem that deals with data collection for reporting purposes (Möslinger, Fazio and Eulaerts, 2022[38]). At the same time, regulators are increasingly standardising the definitions, data and methodologies with a view to limiting the scope for “greenwashing” in ESG (i.e. artificial elevation of environmental scores that provide a misleading picture of a company’s environmental performance). This, along with the development of sector/ industry specific metrics, should help overcome existing market inefficiencies and unlock useful ESG information from smaller companies by helping them prioritise their data collection efforts and develop core metrics that are most decision-relevant to equity and debt investors (Kuzmanovic and Koreen, 2022[34]).

A number of barriers continue to prevent SMEs’ access to and use of data for scaling up their business

A number of barriers, notably uneven access to data, technology and skills limit opportunities for SMEs in increasingly data-driven economies, frequently paired with a lack of financing options and burdensome regulatory requirements (e.g. related to personal data protection) (Bianchini and Michalkova, 2019[39]). A recent study examining how the EU General Data Protection Regulation (GDPR) can affect firm performance across 61 countries and 34 industries found that enhanced data protection reduces the financial performance of companies targeting European consumers. Importantly, the negative impact on profits among small technology companies was almost double the average effect across the full sample, suggesting that the compliance costs brought about by this regulation affect SMEs disproportionately (Chen, Frey and Presidente, 2022[40]). Outdated data infrastructures, data silos, as well as management practices or cultures that are not conducive to digital innovation and change, represent additional challenges inherited from analogue business models.

Taken together, these barriers largely reflect the key drivers of SME performance related to their business environment and access to strategic resources, as conceptualised in the OECD SME and Entrepreneurship Outlook (OECD, 2019[18]). A recent study demonstrates a widespread awareness of the benefits related to the use of digital platforms among EU SMEs operating across many sectors and exhibiting various levels of R&D intensity. It also points to a number of persisting challenges related in particular to scaling up activities, which is often hampered due to limited access to assets, resources, and markets. In this context, firms located in peripheral regions seem to face increased difficulties in finding complementary resources (De Marco et al., 2019[41])

In addition, the perspective of lower-income countries has so far largely been absent, even though they are likely to face increased barriers in terms of developing adequate legal and regulatory frameworks, and deploying the required broadband infrastructure. It is estimated that less than 20% of low- and middle-income countries have modern data infrastructure such as colocation data centers and direct access to cloud computing facilities, thus further limiting SME potential for accessing, creating and using data (World Bank, 2021[42]).

Overall, SME readiness to harness the value of data is strongly determined by their adoption level of digital technologies - and here, they tend to lag behind large firms, with adoption gaps typically larger the more advanced the technology is (OECD, 2021[3]). Even though digital technology adoption tends to spur further digital adoption, with cloud computing as prime example of a tool that can help SMEs leapfrog to more advanced technologies, effectively exploiting data generated within a business and implementing data-driven decision making typically requires significant complementary investments on the side of the firm. Such investments may include the purchase of hardware/ software to increase data storage and computing capacity, implementation of data-driven processes (management, supply chain), or the creation of a data analytics division, for which the required resources may not be proportional to the size of the firm (Brynjolfsson and McElheran, 2016[43]). At the same time, the fast evolving nature of data technologies, and extremely short technology cycles, may imply frequent investments into new tools, as well as high depreciation rates on the equipment needed, which may in turn act as a disincentive for SMEs and micro firms to invest. As a result, large enterprises are often better placed to absorb the necessary demands that data governance places on firms’ resources (Begg and Caira, 2017[9]).

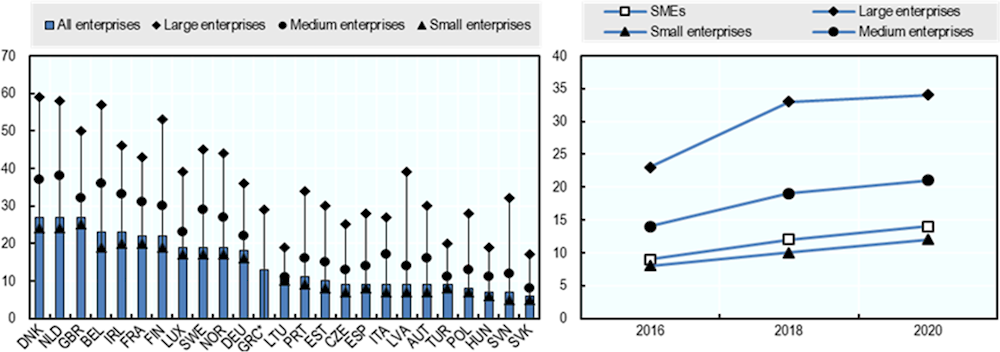

Recent data on EU firms show that the share of large firms performing big data analysis in 2020 was 2.4 times higher than that of SMEs, suggesting that SMEs have not yet fully capitalized on data as a strategic asset, albeit with considerable differences across firm size (Eurostat, 2021[44]). Although SMEs continue to lag behind large enterprises, medium-sized firms (50-249 employees) are in fact on average 75% more likely to perform big data analysis compared to small firms (10-49) (Figure 3.2).

Figure 3.2. Large firms are more advanced users of big data analysis than small firms

Note: Disaggregated data for small and medium enterprises for Greece is missing (left chart). EU average by firm size category (right chart).

Source: Eurostat (2021), database, http://ec.europa.eu/eurostat/data/database?node_code=isoc_eb_bd (accessed September 2021).

Gaps in adoption are broadly similar for cloud computing and IoT, with 38% of small firms using cloud technologies and 16% making use of IoT devices, compared to 72% and 38% of large firms, respectively. They are however more pronounced across more advanced technologies like AI and 3D printing, where the adoption rate among large EU firms in 2021 was four to five times higher compared to the EU average of small enterprises using this technology. More specifically, 28% of large firms used AI, compared to only 6% of small firms, and 17% of large firms had adopted 3D solutions, compared to only 4% of small firms (Eurostat, 2021[44]).

An increased volume of data SMEs may access or generate are making them also more vulnerable to digital security incidents. Such developments have been amplified by the COVID-19 crisis, where many SMEs in a rush to move operations online, left themselves exposed to new digital risks. Despite recent increases in the frequency and costs associated with cyberattacks, available evidence suggest that SMEs are less likely to undertake digital risk assessments or have insurance against ICT incidents. They are also less likely to be aware of digital security obligations and to implement security tests or regular backups (OECD, 2020[16]) (OECD, 2021[3]). The most common factors for the low uptake of digital security solutions are often the associated costs (Hiscox Ltd, 2019[45]), as well as a common misconception of being too small to be targeted (Abbott et al., 2015[46]). As a result, the implementation gap with regard to digital security practices between European SMEs and large firms was around 30% in 2020 (Eurostat, 2021[44]).

Taken together, existing barriers to data governance may result in SMEs failing to manage, protect and value data to the same extent as other tangible assets that underpin their success, or in the same way large firms could do, thus foregoing the potential to improve business performance through the adoption of data intensive technologies.

What is more, the timing of technology adoption is crucial as early adopters of innovation tend to reap the largest benefits, while latecomers usually receive lower or even no benefits (OECD, 2021[3]). Therefore, SMEs’ overall lag in the digital transition is also an obstacle in generating and accessing more data, which may further widen the gap with more digitally-advanced firms, who are already reaping the opportunities of the data economy (OECD, 2019[18]).

From skills gaps…

One of the main barriers to data governance is SMEs’ lack of skills to adopt and effectively integrate relevant digital technologies in business processes, in particular as the adoption gap vis-à-vis large firms tends to increase the more advanced, i.e. data-driven, the technology. This includes notably a lack of capacity and networks to identify and access talent, higher job turnover, often due to less attractive remuneration and working conditions, resulting in higher relative costs in finding and retaining talent, as well as lower levels of management skills to anticipate needs. In addition, training requirements also typically imply elevated levels of time off the job and reskilling of SME staff, including the bearing of associated expenses. In this context, the financial costs of tailored training and development opportunities are relatively higher for SMEs, which constrains their capacity and willingness to invest in skills development (OECD, 2021[3]).

At the same time, there is a difference between digital literacy and advanced digital skills. While the adoption of advanced technologies can benefit all SMEs, including those operating in traditional sectors, not all SMEs need to develop or acquire the skills to code and produce software in-house. However, they do need to invest in internal capabilities so as to have an understanding of what advanced digital technologies (e.g. Block chain, Artificial Intelligence, Internet of things) could do for their business and how they could leverage them, even if they are provided by third parties. At the same time, the importance of early steps in the digital journey should not be overlooked, such as the benefits that small businesses may accrue by effectively using accessible digital tools that require basic skills, such as social media or launching a website. Acquisition and usage of basic digital technologies are the first steps toward more advanced digital adoption, which nonetheless demand strategic decisions for integrating the technology with the business model and process (OECD, 2021[47]).

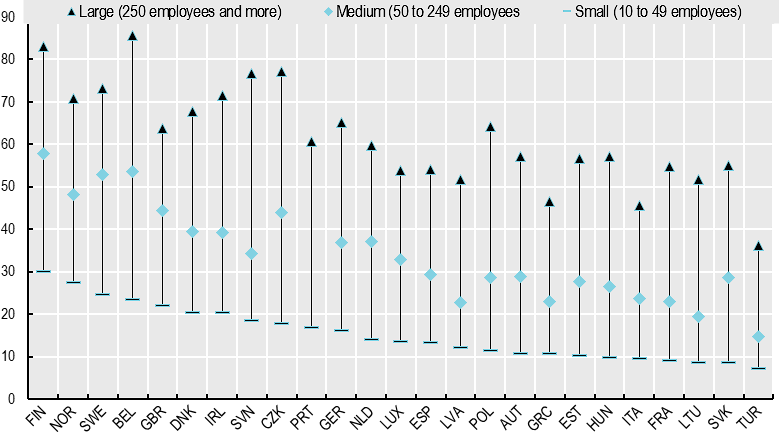

Against this backdrop, the development of digital skills should be diffused across employees and managers and not be limited to ICT specialists. The share of firms offering ICT trainings to their employees, for example, seems to be positively correlated to the share of firms using social media across OECD countries, with a higher effect the smaller the size of the firm. Yet, across the OECD area, there is still a pronounced gap between large and smaller firms in terms of ICT training provided to non-ICT professionals (see Figure 3.3).

Figure 3.3. Smaller firms offer less ICT training to employees

Note: Data for the UK and for small and medium-sized businesses in Greece refer to 2019.

Source: OECD ICT Access and Usage by Business database (accessed September 2021).

With regard to data governance in particular, while there is no common definition (or exhaustive list) of the skills that are typically required in data-related professions, there is a general convergence on key elements that are recurrent across online job postings in the field. Overall, it is estimated that by 2030, an estimated 90% of jobs will require some level of data skills in order to access the opportunities of the global digital economy (ICTworks, 2022[48]). Typically, data analysts are required to have a well-developed toolbox of technical skills, combined with a number of soft skills (see Box 3.5 for an overview).

Box 3.5. What are data skills, as per job postings?

At its core, data analysis implies translating a business question or need and into a data question – and then transform and analyse data to answer that question. In this context, having a foundation of advanced statistical and mathematical skills, including an in-depth understanding of statistical concepts like linear regression, classification and resampling methods, is usually key. With econometrics, on the other hand, analysts apply statistical and mathematical data models to the field of economics to help forecast future trends based on historical data – often a key requirement for jobs in the financial sector.

Against this backdrop, data professionals require specific skills to thrive in their field. While their qualifications are primarily tech-centric, they also need a number of soft skills.

Technical skills

Data Visualisation makes (complex) trends and patterns in data easier to understand, including for audiences that may lack advanced analytical training. It typically requires the use of visualisation software, like Tableau, which allows data professionals to transform analysis into charts, graphs, maps, and other visual representations like dashboards, data models or business intelligence reports.

Data cleaning and preparation is one of the most critical steps toward gaining meaningful insights from data, accounting for around 80% of data professionals’ work. Commonly, a data analyst will need to retrieve data from one or more sources and prepare the data so it is ready for numerical and categorical analysis. Data cleaning also involves handling missing and inconsistent data that may affect analysis.

Data management refers to the practices of collecting, organising, and storing data in a way that is efficient, secure, and cost effective. While some organisations will have roles dedicated to data management – e.g. data architects and engineers, database administrators, and information security analysts - data analysts often manage data in some capacity and thus usually require a broad understanding of how databases work, both in physical and cloud environments.

Structured Query Language (SQL) is the standard language used to communicate with databases. It allows data professionals to update, organise, and query data stored in relational databases, as well as modify data structures. On the other hand, NoSQL systems do not organise their data sets along relational lines, but based on a variety of alternative (non-relational) frameworks, which follow flexible hierarchies instead of tabular relations – thus requiring a broader set of skills/ languages (e.g. MongoDB).

Statistical programming languages enable data professionals to clean, analyse, and visualise large data sets more efficiently. In this context, Python is a high-level, general-purpose programming language, which was ranked the top programming language in the 2019 IEEE Spectrum survey5. Python’s applicability to AI development is particularly important, making it a key tool in an increasingly AI-concerned professional landscape. Another pervasive and well-used language in data analytics is R, which often appeals to businesses thanks to its ability of handling complex or large quantities of data. In addition, businesses interested in big data and machine-learning models have begun turning to MATLAB, an advanced programming language that supports algorithm implementation, matrix manipulations, and data plotting, allowing analysts to cut down on the time they spend pre-processing data and facilitating quick data cleaning, organisation, and visualisation.

Machine Learning, a branch of artificial intelligence (AI), has become one of the most important developments in data science. This skill focuses on building algorithms designed to find patterns in big data sets, improving their accuracy over time. The more data a machine-learning algorithm processes, the “smarter” it becomes, allowing for more accurate predictions. While data analysts are not systematically expected to have a mastery of machine learning, these skills can give them a competitive advantage.

Microsoft Excel is used by an estimated 750 million people worldwide and the term “Excel skills” frequently appears under the qualifications section for jobs posted on hiring services. While there is now significantly more advanced technology data analysts have at their disposal, Excel is well-used among businesses and many of its automated features, such as Visual Basic for Applications (VBA), Microsoft’s programming language for Excel, can save analysts a lot of time on frequently-performed, repetitive tasks such as accounting, payroll, or project management.

Soft skills

In addition, there are non-industry-specific skills that data analysts require to succeed. While their specific scope will inevitably depend on the roles and responsibilities of the person a business is seeking to recruit, as well as on the sector it operates in, they typically include transversal soft skills like communication, critical thinking and problem solving. As data becomes increasingly essential to decision-making across industries, analysts are expected to translate complex technical information into something simple enough for their audience to understand and effectively communicate their findings – both vis-à-vis clients and business partners, as well as internally to their colleagues. In addition, they are often tasked with conducting experiments, testing hypotheses and making inferences from the data within their reach, requiring them to think critically and creatively about solving problems and applying human judgment to business challenges. Finally, a strong domain knowledge and business acumen will also be essential for making an impact on an organisation. This implies understanding things that are specific to the particular industry and company one is working for – which might require understanding the nuances of e-commerce, if it is a business with an online store, but which might equally imply understanding mechanical systems and how they work, in the case of an engineering company.

This is also reflected in a recent OECD study analysing the skills sets (“skills bundles”) demanded in artificial intelligence (AI)-related online job postings, based on Burning Glass Technologies’ data for the United States and the United Kingdom over the 2012-19 period. The paper finds that with regard to skill bundles related to programming, management of big data and data analysis, skills related to the open source programming software Python and to machine learning represent “must-haves” for working with AI. Employers additionally value specialised skills related to data mining, cluster analysis, natural language processing and robotics. Beyond the technical dimension, network analysis relating AI skills to general skills highlights the growing role of socio-emotional skills, including notably communication skills, problem solving and creativity, while for managers in the AI field, presentation skills, planning, budgeting and business development are also important (Sameki, Squicciarini and Cammeraati, 2021[53]).

…to a lower capacity in leveraging intellectual property rights (IPRs)

Data assets increasingly form the majority of firms’ value. Recent OECD analysis seeking to provide an estimate on the value of data suggests that production of data assets covers nearly 40% of intangible investment (ranging from data stores with raw records of data over structured databases ready to be exploited to advanced data intelligence, which reflects the further integration of data with advanced analytic tools). While there is no one-to-one correspondence between components of intangibles and different data asset components (sometimes also referred to as data stack or data value chain), intangible investment is likely to include most forms of data intelligence, which tends to represent the most valuable stage of the value chain and can take on many forms, including e.g. data tools/ apps and databases, but also related scientific/ engineering design, marketing, or business strategy (Corrado et al., 2022 forthcoming[54]) (Corrado et al., 2022 forthcoming[55]).

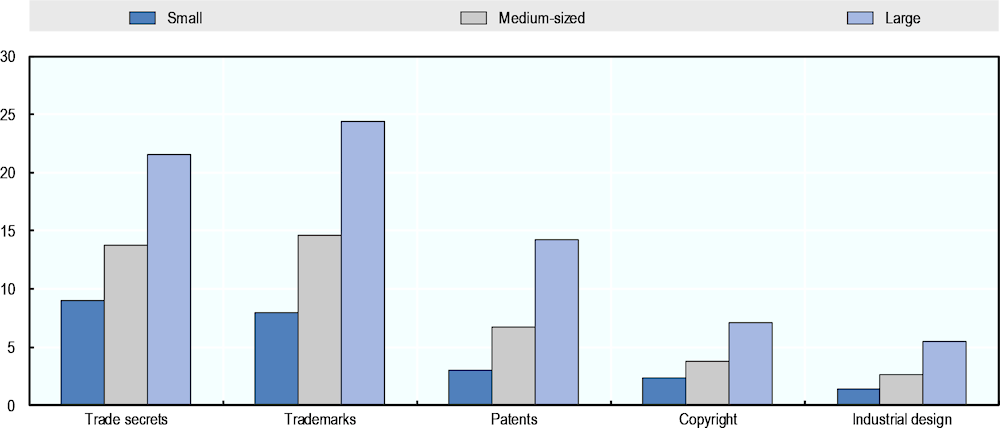

To protect their data and/ or related data-enabled products and activities enterprises can resort to intellectual property rights (IPRs). As data is a non-rival good by nature, i.e. multiple agents can use them at the same time, IPRs can provide innovators with a temporal monopoly in this context (Ilie, 2014[56]). Among the formal IPRs such as patents, trade secrets, trademarks, copyrights and industrial designs, some can be particularly suitable for businesses to appropriate the value of their data and secure a return on their investments in intangible assets (including data software and external data) (EUIPO, 2020[57]). Recent evidence on European SMEs documents the benefits of IPRs for high-growth firms. In particular, SMEs with prior IPR activities are more likely to grow than other SMEs, and SMEs that use bundles of trademarks, patents and designs instead of a single category of IPR, are even more likely to achieve high growth (EUIPO, 2020[57]). Similarly, recent data suggest that trademarks are the basic building block of effective IP bundles. Business surveys provide further evidence on the effect of IPRs on SMEs scaling up (EUIPO, 2019[58]). After registering their IP rights, 54 % of SME owners claim to have seen a positive impact, through an increase in reputation (52 %), turnover (39 %) and ability to access new markets (37 %).

However, SMEs face some challenges in applying IPRs that might hinder them from scaling up operations through data. In particular, while there is a large range of IPR mechanisms that could be used, they do not apply to data and data repositories to the same extent, thus raising the level of complexity SMEs may have to deal with. For instance, datasets are protected by copyright, with different levels of protection in the EU and in the United States. Algorithms and other methods for data processing and analysis, on the other hand, can usually not be protected through copyright, but through trade secrets6 (Maggiolino, 2019[59]) (IusMentis, 2005[60]). Unlike patents, trade secrets are protected by law on confidential information, e.g. confidentiality agreements or non-disclosure or covenant-not-compete clauses (OECD, 2019[18]).

Historically, SMEs have faced various barriers in using and applying intellectual property, with latest innovation surveys showing significant gaps among size classes of firms in using IPRs. While trade secrets remain the most popular IP solution for SMEs, only 9% of small enterprises were using trade secrets as compared to 13.7% of medium-sized enterprises and 21.5% of large ones in 2018 (Eurostat, 2021[61]). Similarly, there were on average three times more large firms applying for trademarks and copyright than small enterprises, and gaps are even more pronounced in the area of patents and industrial design, where the share of large firms leveraging these mechanisms is roughly four times higher than those of small firms (Figure 3.4).

Figure 3.4. SMEs are less prepared to protect their data through IPRs

Note: Country average on EU countries for which data are available

Source: Eurostat (2022), Community Innovation Survey, https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=inn_cis11_ipr&lang=en.

Among the common barriers faced by SMEs in using and exploiting intellectual property are the lack of awareness, lack of legal skills as well as the high cost of application and enforcement procedures (Agostini, Filippini and Nosella, 2016[62]) (Sukarmijan and Sapong, 2014[63]). In particular, SMEs report the length and complexity of related procedures, or the risk of potential litigation and difficulties enforcing IPRs as the main reasons for not taking any measure, with only 17% of surveyed firms having a dedicated unit in place to monitor their IPR infringement in 2019 (EUIPO, 2019[58]).

Finally, the protection of data and databases through IPRs may limit the availability of external data SMEs can use, or increase the costs for accessing these data, especially for smaller scale businesses, and in fine limit the potential for effective data sharing. In addition, while trade secrecy and IPRs do not offer the same level of protection to the same sorts of assets and are complementary by nature, trade secret law is more difficult to enforce than a patent, and is set within national legal frameworks that apply to a certain jurisdiction, limiting transnational data transfers (OECD, 2019[18]).

Mapping SME data policy and institutions: analytical framework, sources and methods

With data emerging as a key driver of firm performance, and possibly a major barrier for business scale-up, there is a need to ensure more even data access and use for smaller firms, and to better understand the extent to which governments account for these issues in their national policies.

What is at stake goes beyond the employment benefits SME scaling up can bring, as a broader transformation capacity within the SME population could also drive the broader deployment of more sustainable, responsible and greener business models. If SMEs cannot achieve their full potential through better data governance, there may be a broader loss of opportunity to create the collective capacity that is required to reduce greenhouse gas emissions and address the urgent challenge of environmental degradation – at least in certain contexts or industries (see Chapter 1).

SME data governance has emerged as a multidimensional challenge reflecting the diverse set of internal- and external-to-the-firm barriers, and calling for a holistic approach in policy making – both in terms of institutional set up, as well as in terms of the policy mix. Yet, policymakers and regulators continue to face difficulties in defining a common ground and language for discussions, co-operation and coordination in this area, as they naturally tend to focus on aspects that are relevant to their policy domains (OECD, 2022 forthcoming[14]).

This section presents the analytical framework, sources and methodology used to identify emerging practices in this new policy field and inform policymakers on existing policy options with regard to how they can help SMEs better use data, build a data culture and improve data governance within the firm (OECD, 2021[13]).

This provides the bases of an international policy mapping of policies and institutions across the 38 OECD member countries in relevant areas. The mapping exercise aims to identify to which extent national policy initiatives pursue (one or several) specific data governance objectives, identify the key institutions involved at the national (and where possible and relevant at subnational and international level) and diverse set of policy instruments they mobilise (see Chapter 1 for operational definitions),

Main strategic objectives pursued

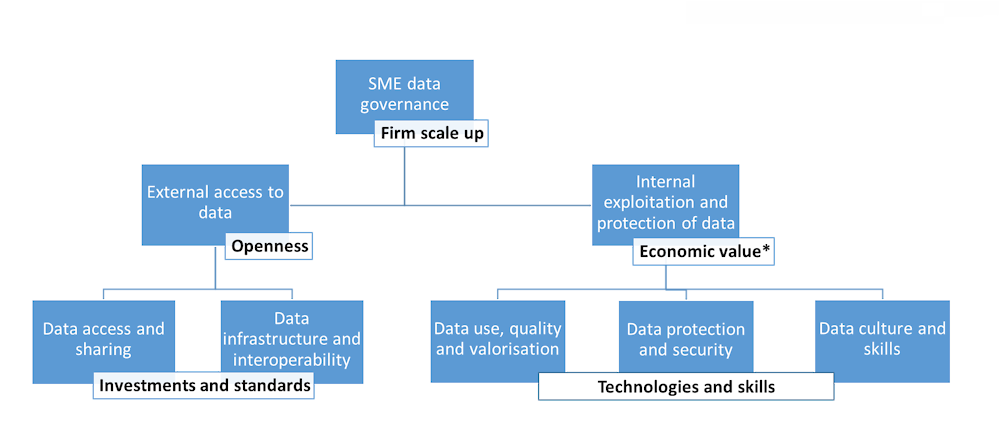

Policies in support of SME data governance aim to help SMEs turn data into economic value and capitalise on internal and external data to scale up capacity and grow business. Adopting the right cultural, policy, institutional, and technical environment could enable firms of all sizes and sectors to control, manage, share, protect and extract value from their data – and address relevant barriers in this context. In line with the OECD Going Digital Horizontal Project on Data Governance (see Box 3.2), the strategic objectives of SME data policy are depicted in Figure 3.5.

Figure 3.5. Strategic objectives of policies to promote SME data governance

Note: Generating economic value is to be understood in a broad sense, including not only growth in turnover or profit. It can notably also include increased innovation capacity, a firm’s ability to improve its environmental performance and its transition to a more sustainable business model, or improved capacity to comply with responsible business conduct (RBC) requirements or broader environmental, social and governance (ESG) criteria (see Chapter 1 for further discussion).

Source: Author’s own elaboration.

Policy intervention for improving SME data governance falls into two categories according to the strategic objectives it pursues. First, SME data policy can aim to improving SME access to external data, which is largely shaped by the degree of openness the policy environment allows for (but also the willingness of business partners to share data). Second, SME data policy can aim to incentivise and enable better exploitation and protection of data within the firm, both approaches aiming ultimately to greater business, economic, environmental or social value for the firm.

On that basis, five distinct data policy (sub-)objectives emerge, whose realisation mostly depends on an interplay between (infrastructure) investments and standards, on the one hand, and the availability of necessary assets, including technology and skills, within the firm, on the other hand.

Policies aiming to improve SME access to external data

Data access and sharing: increase SMEs’ overall access to data as an economic asset, including both open-source data, but also data from business partners and other relevant bodies via relevant sharing mechanisms.

Data infrastructure and interoperability: create the necessary (physical) infrastructure and conditions to allow for effective sharing of data via common standards, platforms or networks that bring together SMEs with other relevant players from their ecosystem (large firms, academia, etc.)

Policies aiming to strengthen SME exploitation and protection of data within the firm

Data use, quality and valorisation: enable SMEs to optimise the use of their data (whether internally generated or accessed externally) to create value for their business through relevant digital technologies and practices (e.g. data analytics).

Data protection and security: ensure that SMEs have the relevant safeguarding mechanisms (e.g. technologies, processes, as well as awareness and behavioural capacities) in place that allow them to protect their data in the same way as they (ideally) protect other business assets – both from external attacks/ infringements as well as from internal misuse.

Data culture and skills: strengthen awareness about the importance of data governance issues among SMEs and foster the development of relevant (digital) skills and skills strategies at firm level.

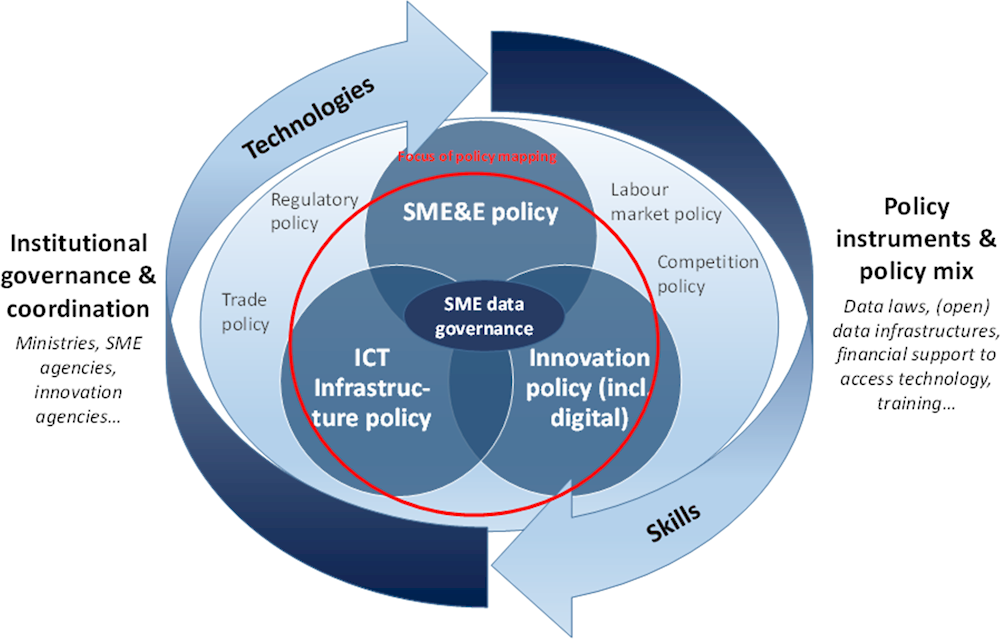

Cutting across multiple policy domains

With barriers to better data governance arising in multiple areas, public intervention is becoming more pervasive across different (and non-IT) policy domains. Against this backdrop, the mapping exercise has screened several policy areas simultaneously in order to identify relevant institutions and initiatives that aim to achieve one (or several) of the policy objectives identified above, as well as assess to which extent they address the specific challenges faced by SMEs in this area.

It looked at policies aiming to scale up SME’s internal capacity to access, share, manage, protect and leverage the value of their data, as well as at more structural elements, which shape the overall business framework and market conditions related to data. In line with the OECD SME&E Outlook and Strategy (OECD, 2019[18]) (OECD, 2021[64]), the framework is thus based on the assumption that looking at specific SME-targeted measures to encourage better SME data governance is a too narrow focus to understand how SMEs are effectively enabled (or hindered) in their data transition, and a broader set of policy measures and levers need to be considered.

The mapping exercise starts therefore with an institutional mapping of the national governance arrangements and structures pursuing the SME data governance objectives above, on the basis of keywords and concepts search and text analysis (e.g. data access, data use, data protection, data infrastructure, cybersecurity etc.). Then the relevant policy initiatives these institutions administrate (alone or through joint implementation with other institutions) are identified, still on the basis of the same concepts and further text analysis.

For initiatives and institutions, where objectives on data governance are not articulated specifically, but which are likely to have an impact on SMEs’ capacity to turn data into value (either through greater access, upskilling or capacity building), additional criteria related to specific data-driven technologies are used (i.e. AI, machine learning, big data/ data analytics, cloud computing services, block chain, hardware/ software, 5G, 3D printing, IoT, robotics, etc.).

The mapping is consolidated based on an analysis of each institution and policy measure with a view to ensuring their respective relevance to the topic. Table 3.3 provides an overview of what the exercise entailed.

Table 3.3. What does the mapping of SME data governance policies entail? A schematic overview

|

What it is |

What it is not |

|---|---|

|

Basic (SME) digitalisation support (e.g., related to e-commerce or building website activities) Generic R&D/ innovation support Innovation clusters/ networks/ platforms without an explicit tech/ data dimension e-Government policies |

Source: Author’s own elaboration.

Identifying typologies of policy instruments

Governments have a diverse set of policy instruments at their disposal to address generic or SME-specific data-related challenges (see Table 3.4). Some guiding instruments have coordination functions and ensure overarching policy governance (e.g. Multi-annual Strategies or Action Plans).

Table 3.4. Policy instruments to strengthen SME data governance and selected country examples

|

Instrument typologies |

Instrument examples |

Country initiatives |

|---|---|---|

|

Financial support |

e.g., vouchers, tax incentives, grants, subsidies to foster the access to and uptake of digital technologies in SMEs |

|

|

Non-financial support |

e.g., technical assistance, capacity building, access to facilities (labs), training to enable SMEs to participate in data-driven activities, as well as guidelines and information material on the subject |

|

|

Platforms and networking infrastructure |

e.g., data (sharing) infrastructures such as open data portals; R&D and open innovation initiatives; clusters/ networks/ platforms with a tech/ data dimension, providing knowledge-related/ scientific services, incl. IT-enabled organisational and marketing practices |

|

|

Regulation |

e.g., Data laws/ Directives |

|

|

Public governance |

e.g., National Strategies and Action Plans, including in particular Digitalisation Agendas, Innovation Plans, SME Strategies, Smart Specialisation Strategies, AI Strategies, Industry 4.0 Strategies, etc…) |

|

Note: Instrument typologies reflect the framework developed in the OECD SME and Entrepreneurship Outlook and will also be used to structure the SME&E data lake knowledge infrastructure. The typology of instruments is drawn from Meissner and Kergroach (2019[65])

Source: Authors’ own elaboration.

Methodology and sources

Policy information is drawn from official sources (e.g. national strategies, action plans, websites of relevant Ministries and agencies, etc.), as well as OECD reports and publications, through desk research. In particular, the work builds on recent work on SME digitalisation (OECD, 2021[3]) and ongoing OECD activities on data governance, carried out as part of phase III of the OECD Going Digital project (see Box 3.2). Information is collected at institutional level. The information collected is structured and encoded, and made available through an online interface for the purposes of easing consultations and enabling re-use.

The policy work builds on similar exercises (EC/OECD, 2021[66]) (UNESCO, 2018[67]) (EC/OECD, 2016[68]) (OECD, 2012[69]) and follows the approach proposed by Meissner and Kergroach (2019[70]) to monitor and benchmark innovation policy mixes. Developments are also coordinated with the EC/OECD project on foreign direct investment (FDI) spillovers on SME productivity and innovation that follows a similar approach for better understanding how public policies at national and regional levels can help strengthen FDI-SME linkages and increase productivity and innovation spillovers for local development and resilience (OECD forthcoming, 2022[71]).