The Georgian economy had been experiencing steady growth since 2015, up to the outbreak of the COVID-19 pandemic in 2020. GDP growth rose from below 3% in 2015 and 2016 to 4.8% y-o-y in 2017, and stabilized around 5% in the following years (Table 0.1). Exports of goods and services have reached 54.8% of GDP in 2019, compared to 40.8% in 2015. In particular, exports towards the EU have risen since the application of the EU-Georgia Deep and Comprehensive Free Trade Area (DCFTA) in 2014, reaching 24.2% of total exports in 2019 (German Economic Team, 2019[2]). Although this increase was accompanied by a diversification of exported goods, with a growth of processed goods, the main export basis has remained low value added, limiting the export potential (Economic Intelligence Unit, 2019[3]). The current account deficit has been reducing, while FDI stock increased to up to 100% in 2018.

The Government of Georgia (GoG) has conducted a set of reforms in recent years, which included a long-awaited reform of the framework for insolvency (further detailed in Part 1), a modernisation of the labour code, and continued efforts to foster infrastructure development and integration in global value chains. Moreover, within the framework of an extended fund facility signed with the IMF in 2017, the government has adopted a second-pillar pension reform. These policy efforts have led to significant improvements in the business environment, as reflected by Georgia’s position in international assessments: Georgia ranks 12th out of 180 countries in the Heritage Foundation’s 2021 Index of Economic Freedom, scoring higher than the European and World averages. Since 2016, the country has gained eleven positions, thanks to improvements in judicial effectiveness, labour freedom and fiscal policy (Heritage Foundation, 2021[4]). Georgia ranks 5th out of 162 countries in the Fraser Institute’s Economic Freedom of the World 2021 and 74th out of 141 countries in the World Economic Forum’s Global Competitiveness Index 2019 thanks to its business enabling environment, ICT adoption, labour market and future workforce skills.

However, several challenges remain. Georgia still suffers from high level of unemployment, stagnating at about 20% over the period 2015-2020 (down to 18.5% in 2020), and of poverty, which still affects nearly 20% of the Georgian population. Moreover, the country still entails a large rural population (about 41% in 2020) and informal economy. The skills mismatch is also a persistent issue, although the Government has tried to tackle it by introducing a comprehensive educational reform in 2019, which has been partially stalled by the pandemic (IMF, 2021[5]). The productivity levels remain relatively low, albeit increasing, and regional interconnectivity is still limited.

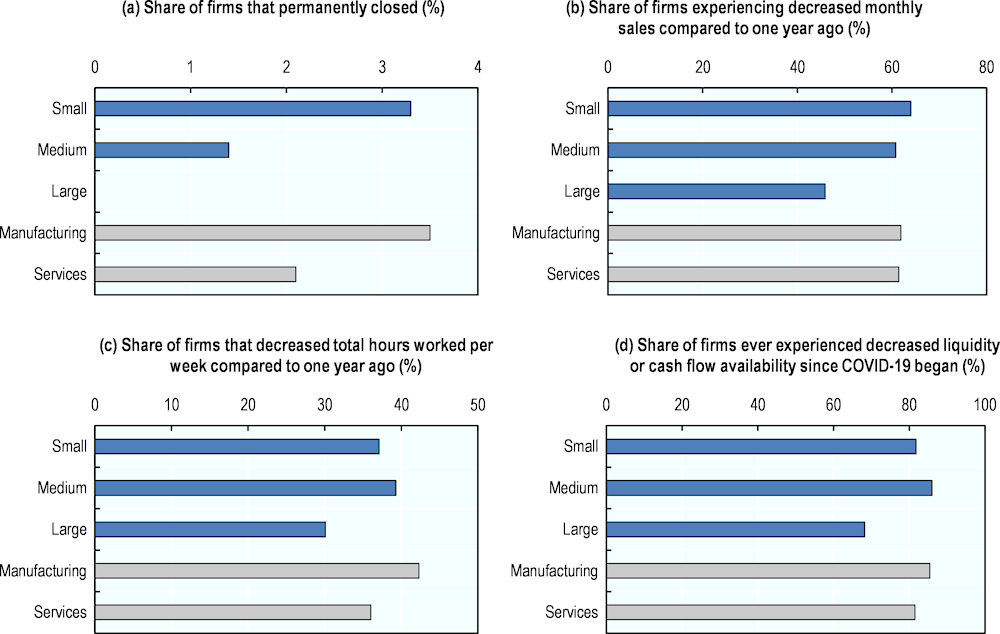

Moreover, the country has been severely hit by the COVID-19 pandemic: despite its initial success in limiting new infections during the first wave, Georgia recorded a surge in daily new cases during the following waves, becoming one of the most affected countries in the world on a per capita basis, both in terms of deaths and cases. Vaccination is slowly advancing, with international community aid providing additional doses of vaccines, but is still at low rates (23% of the population had been fully vaccinated by mid-September 2021). During the successive waves, the government has enacted a range of containment measures to limit the spread of the virus, which have taken a toll on the economy (OECD, 2020[6]). The Georgian GDP decreased by 6.2% in 2020. This is partially explained by the shock to the service sector, notably tourism, which holds a prominent place in the Georgian economy – services exports dropped by 63.5% in 2020. Unemployment and poverty significantly rose from the previous year despite the mitigating effect of government measures. These substantial anti-crisis measures however worsened the state of public finances, as the deficit reached 9.3% of the GDP and the public debt 60% of GDP. In addition to this, inflation reached a peak of 7%, in April 2020, while the lari was depreciated by 14% against the United States Dollar (USD) in the same year. The crisis is further exacerbated by the large informal sector, the high share of vulnerable workers, high unemployment and low saving rates (OECD, 2020[6]).

Nonetheless, Georgia has been experiencing recovery throughout 2021. The GDP contraction persisted in the first quarter of 2021, which registered -4.5%, but the trend was reversed in the second quarter of the year. GDP growth is now expected to reach 7.7% in 2021, mainly due to a reprise in key sectors such as tourism, manufacturing, construction and services, as well as to an increase in remittances and exports, which have been faster than anticipated (German Economic Team, 2021[7]). Public deficit is expected to narrow to 6.5% of GDP, and public debt should decrease compared to the 2020 level (German Economic Team, 2021[7]). These improvements are expected to continue in the following years, as projections envisage the achievement of the 3% target for the fiscal deficit before 2025, as well as a continuous decline of public debt in the years to come (World Bank, 2021[8]). However, inflation has risen to 12.8% y-o-y in August 2021, due to an increase in utility and commodity prices as well as elevated input costs due to the currency depreciation (IMF, 2021[9]), but it is expected to diminish from the beginning of 2022 onwards (IMF, 2021[9]). The lari has indeed been stabilised throughout 2021, and it has slightly appreciated, 0.8%, in real effective terms (IMF, 2021[5]). The positive trend should continue, as current World Bank forecasts expect a GDP growth of around 6% in 2022 as well as in 2023 (World Bank, 2021[10]). The recovery however is highly dependent on the country capability to vaccinate its population, and hence to avoid new waves of infections, and on its capacity to maintain a stable political environment that will foster the necessary reforms.