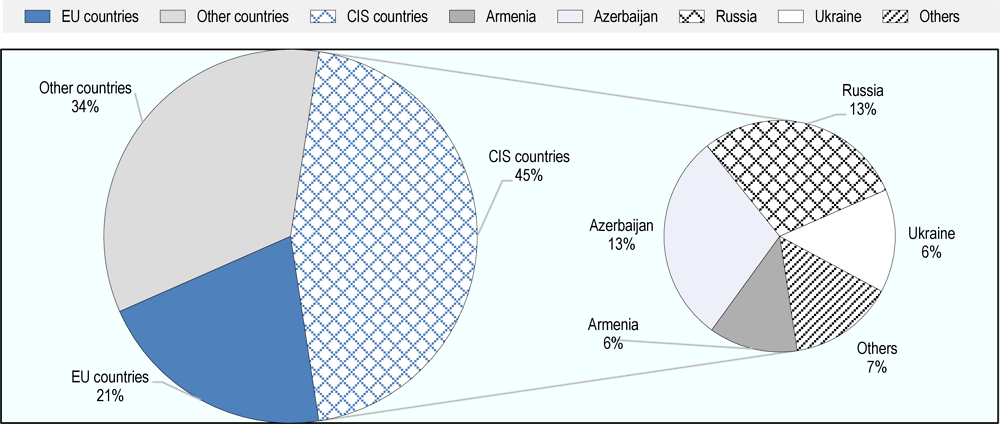

Over the past five years, Georgia has considerably improved the institutional and operational environment for businesses with the implementation of its SME Development Strategy 2016-2020. SMEs now benefit from an improved institutional and regulatory framework, which is reflected in international assessments such as the OECD SME Policy Index: Eastern Partner countries 2020 (the “SMEPI”), in which Georgia stands out as the best performer among EaP countries, including on the SMEPI’s “Pillar A”, which assesses the institutional, regulatory and operational environment (OECD et al., 2020[1]). Georgia also considerably expanded and formalised public-private participation in policymaking: several dedicated platforms have been set up, such as the Private Sector Development Advisory Council and the Consultation Council on Georgian Trade under the MoESD, which have helped to formalise public-private consultations and hold meetings more regularly. As a result, private sector participation has become more inclusive and comments provided by the private sector have increasingly been reflected in draft laws (Institute for Development of Freedom and Information, 2019[16]).

With regards to the operational environment, Georgia has significantly expanded the availability of e-government services. The single portal www.my.gov.ge, launched in 2012 and operated by a new Digital Governance Agency under the Ministry of Justice of Georgia since 2020 (previously by the Data Exchange Agency), appears as one of the most advanced one-stop solutions of the Eastern Partner region. Already offering close to 500 services to citizens and businesses in 2019, the platform was further developed in response to the COVID-19 pandemic and now provides about 700 online services in a wide range of areas. The number of users also increased (+40% in 2020), making this governmental website one of the most visited ones according to the UNDP (2021[17]).

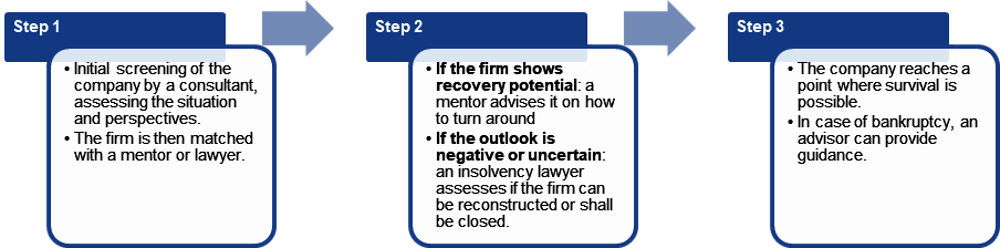

In addition, the government significantly reformed the insolvency and rehabilitation system, for a long time considered as one of the biggest weaknesses in the country’s business environment. A new insolvency law, “On Rehabilitation and Collective Satisfaction of Creditors”, was adopted in September 2020 and entered into force on 1 April 2021. This reform notably promotes rehabilitation and job preservation over liquidation while also emphasising creditor protection (Government of Georgia, 2020[18]). To this end, it introduces new concepts such as regulated agreements, a facilitated procedure under which the debtor can negotiate debt restructuring with creditors to aim for the continuation of the company’s activities. The law also empowers insolvency practitioners and increases the transparency of proceedings by introducing a dedicated electronic system through which applications can be filled, convocations to creditors’ meetings, minutes and decisions can be quickly published and information exchanged. In this regard, the order of the Minister of Justice №696 „On the approval of the insolvency practitioner, the production of an unified registry of insolvency practitioners and the approval of the selection terms and conditions through the electronic system of insolvency practitioners", issued on 30 March 2021, defines the types and conditions for the authorisation of the insolvency practitioner, and rules for maintaining a unified registry of such practitioners. It also determines the main issues related to certification as well as the rules and conditions to appoint a practitioner as a rehabilitation/bankruptcy manager or rehabilitation/CVA supervisor through the electronic system.

The Government of Georgia also approved the “Law on Entrepreneurs”, which came into force in 2021 and aims at improving the legal framework, regulating internal corporate relations and increasing transparency in this area while promoting entrepreneurial freedom. Additionally, the National Agency of Public Registry aims to create an electronic portal provided by the law to promote digitalisation.

Moreover, the Government of Georgia has taken several steps to facilitate SMEs’ access to information on new laws and regulations. Regarding approximation with EU standards for instance, businesses can turn to information centres and to the dedicated web portal dcfta.gov.ge. Yet SMEs continue to report finding it difficult to stay up-to-date on regulatory changes and related opportunities, according to interviews with private sector associations.

In addition to strengthening its regulatory environment, Georgia has also achieved significant progress in developing regulatory impact assessment (RIA). RIA is a policy tool used to analyse the costs, benefits and effects of a new or existing regulation, allowing the government to evaluate their policies and adapt them if needed. It now has to be performed for a set of identified business-related draft laws introduced by the Government, and a dedicated methodology has been adopted early 2020 (Government of Georgia, 2020[19]). Nevertheless, the regulatory impact specifically on SMEs through an “SME test” is not systematically considered. Such an “SME test” evaluates the specific impact of regulations on SMEs through an ex-ante and ex-post analysis of the costs and benefits of the initiative, and involves SMEs and their representative organisations in the process.

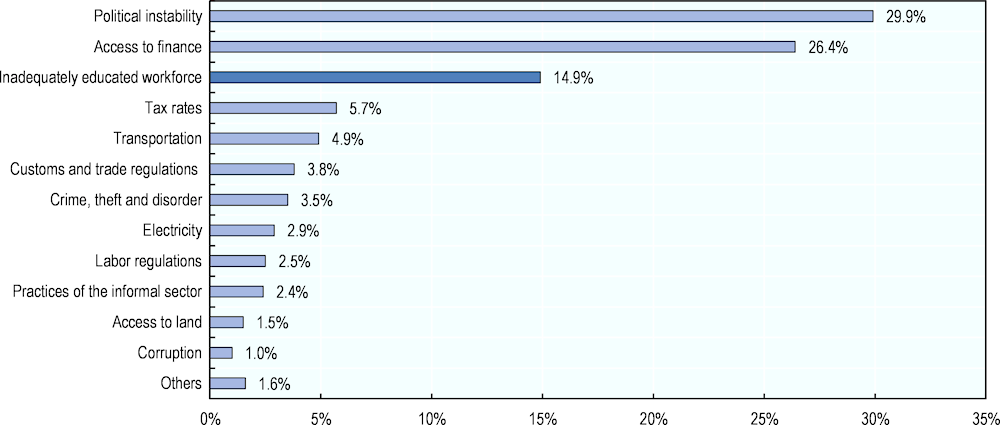

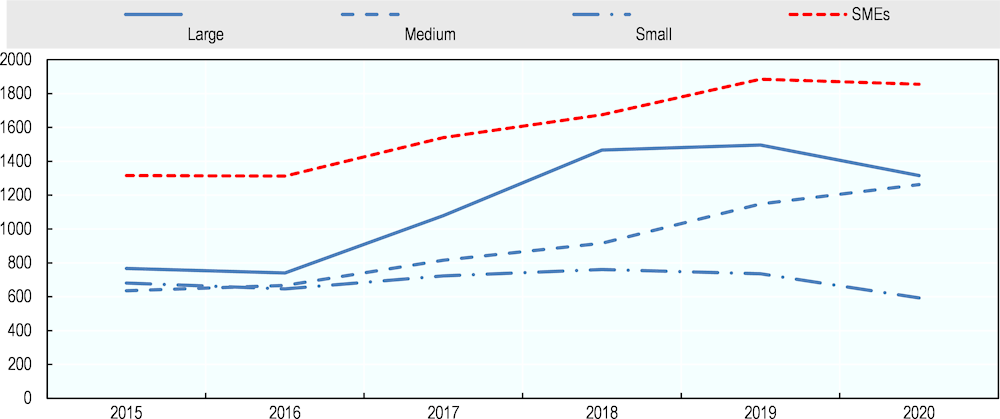

Unsurprisingly, the economic crisis triggered by the pandemic has led to significant difficulties for companies, including an increase in business failures (see Figure 0.6 in the Introduction). Georgian SMEs have been particularly affected by containment measures, which caused a sharp drop of revenues and liquidity shortages: in October 2020, 82% and 86% of small and medium firms, respectively, reported having experienced decreased liquidity or cash flow availability since the pandemic began (against 68% of large firms) (World Bank, 2020[15]). Some 5.4% of small and 2% of medium businesses were confirmed or assumed permanently closed by October 2020 (0.4% of large ones), but this number is expected to rise as governmental support measures are gradually lifted.