This Annex presents the details on (i) the incorporation of the effects of the COVID-19 pandemic and associated government response measures in the Baseline scenario, (ii) the quantification of the various policy instruments in the Regional Action and Global Ambition plastics scenarios, and (iii) the climate change mitigation scenario.

Global Plastics Outlook

Annex B. Details on the Baseline, Regional Action, Global Ambition, and Climate Mitigation scenarios

The COVID-19 update of the Baseline scenario

The pre-COVID socioeconomic trends that drive the Baseline scenario projection as laid out in OECD (2019[1]) have been updated to reflect the consequences of the COVID-19 pandemic and government response measures. As described in more detail in (Dellink et al., 2021[2]), a detailed assessment, as of April 2021, is made of the economic shocks caused by the pandemic, the lockdown measures and the government stimulus packages. The scenarios are based on the following modelling assumptions:

Increases in regional unemployment levels in 2020 are based on the OECD Economic Outlook 108 (OECD, 2020[3]), the updates on GDP forecasts in the Interim Outlook (OECD, 2021[4]) and on the IMF Economic Outlook for the countries that are not covered by the OECD forecasts (IMF, 2020[5]). For the few countries missing in both databases, ad-hoc assumptions are made based on effects in similar countries.

Sectoral demand shocks are implemented for 2020 following Arriola and Van Tongeren (2021[6]). For energy sectors, the shocks are based on (IEA, 2020[7]).

Government stimulus packages are implemented as a reduction in capital and labour taxes for firms and as a reduction in income taxes for households. These packages are based on Arriola et al. (2021[6]).

Trade shocks are implemented as an increase in the costs of international trade (“iceberg costs”), with a differentiation between services sectors and agriculture and manufacturing. This mimics the trade shocks in Arriola et al. (2021[6]).

Reductions in regional labour productivity reflect productivity losses during lockdown (incl. effects of teleworking) and is included crudely as a uniform decline in productivity in all sectors and regions, based on Arriola et al. (2021[6]).

Finally, regional total factor productivity shocks reflecting the combined effects of all elements not captured explicitly above are added based on the macroeconomic decline in GDP (OECD, 2020[3]). This approach ensures that the immediate effects of the pandemic on the macro economy are scaled to reach the GDP growth rates for 2020 as forecast by (OECD, 2020[3]) and by the IMF for the countries that are not covered by the OECD forecasts (IMF, 2020[5]). In addition, a rebound effect on total factor productivity is included for 2021 and 2022 for those countries where the short-term forecasts are more optimistic than can be explained by the recovery rates calibrated in the model.

All shocks are assumed to fade gradually over time after 2020, each year becoming less strong than the year before. These recovery rates are region-specific and based on the GDP forecasts until 2025 made by IMF. However, long-term economic activity levels – and the associated environmental pressures – do not necessarily return to the levels as projected in the Baseline excluding the COVID shocks. The main reason is that the shocks alter savings and investment behaviour and thus long-term economic growth and environmental pressure.

The Slow recovery scenario

The Slow recovery scenario reflects a situation in which recovery from the initial 2020 shock to the economy caused by the COVID-19 pandemic and government response measures will be roughly twice as slow as in the reference Baseline scenario. The shock in 2020 is identical to the COVID-19 scenario but the recovery is slower (annual recovery rates are half as high and there is no rebound effect in 2021).

Quantification of the Regional Action and Global Ambition plastics scenario

The circular plastics scenarios are designed to reduce plastic leakage to the environment, considering plastics use in the different steps of the lifetime of products. The policy package addresses three main aspects: (i) Restrain production and demand and design for circularity, (iii) Enhance recycling, and (iv) Close leakage pathways. Different policy instruments are implemented for each of these three ‘pillars’ (Table A B.1).

Table A B.1. Details on the implementation of the circular plastics scenarios

|

Pillar |

Policy instrument |

Regional Action scenario |

Global Ambition scenario |

|---|---|---|---|

|

Restrain plastics production and demand and design for circularity (hereafter Restrain demand) |

Packaging plastics tax |

EU: USD 1 000/tonne by 2030, constant thereafter Rest of OECD: USD 1 000/tonne by 2040, constant thereafter Non-OECD: USD 1 000/tonne by 2060 |

Global: USD 1 000/tonne by 2030, doubling by 2060 |

|

Non-packaging plastics tax |

OECD: USD 750/tonne by 2040, constant thereafter Non-OECD: USD 750/tonne by 2060 |

Global: USD 750/tonne by 2030, doubling by 2060 |

|

|

Ecodesign for durability & repair |

Global: 10% lifespan increase, 5‑10% decrease in demand for durables, increase in demand for repair services such that ex ante total expenditures are unchanged |

Global: 15% lifespan increase, 10-20% decrease in demand for durables, increase in demand for repair services such that ex ante total expenditures are unchanged |

|

|

Enhance recycling |

Recycled content target |

OECD: 40% recycled content target Non-OECD: 20% recycled content target |

Global: 40% recycled content target |

|

EPR for packaging, electronics, automotive and wearable apparel |

OECD + EU: 20% points increase in recycling, tax on plastics inputs – USD 300/tonne by 2030, constant thereafter, subsidy on waste sector such that the instrument is budget neutral |

Global: 20% points increase in recycling, tax on plastics inputs - USD 300/tonne by 2030, constant thereafter, subsidy on waste sector such that the instrument is budget neutral |

|

|

Enhance recycling through waste management |

EU, Japan & Korea: 60% recycling rate target by 2030, 70% by 2060 Rest of OECD, the People’s Republic of China (hereafter ‘China’): 60% recycling rate target by 2060 Rest of non-OECD: 40% recycling rate target by 2060 |

EU, Japan & Korea: 60% recycling rate target by 2030, 80% by 2060 Rest of OECD, China: 80% recycling rate target by 2060 Rest of non-OECD: 60% recycling rate target by 2060 |

|

|

Close leakage pathways |

Improved plastic waste collection |

OECD: full reduction of mismanaged waste shares* Non-OECD: halving of mismanaged waste shares* |

Global: full reduction of mismanaged waste shares* |

|

Improved litter collection |

High income countries collection rates increase 5%-points; middle income countries income-scaled increase |

Low income countries collection rates increase 10%-points; high income countries collection rates increase 5%-points; middle income countries income-scaled increase |

* Waste streams from uncollected litter and from markings and microbeads are not included in this policy, as they are not managed as waste.

The climate change mitigation scenario

The purpose of the climate policy package is to illustrate the potential interactions between policies focused on plastics and climate policies. This climate scenario is therefore not meant to represent an actual possible decarbonisation pathway, but it is rather a stylised climate policy package. The climate policy package consists of two of the major decarbonisation instruments: a carbon pricing trajectory and a structural transformation of the power sector.

Carbon pricing trajectory

The carbon pricing trajectory is designed following the WEO SDS scenario from 2020 to 2050 and maintains a constant carbon price between 2050 and 2060. This assumption leads to a world average carbon price of USD 69 in 2060, compared to USD 6 in the Baseline scenario. Table A B.2 provides the regional details of the carbon pricing scenario. While, in the Baseline, carbon pricing is limited between USD 0 and USD 12 in 2060 for aggregate regions, the climate policy package increases them to between USD 5 and USD 160. Overall, carbon pricing is higher in OECD countries, compared to non-OECD countries.

Table A B.2. Carbon pricing in the Baseline and Climate Mitigation scenarios

USD per tonne of CO2 in 2060

|

Region |

Baseline |

Climate Mitigation |

|---|---|---|

|

OECD |

7 |

155 |

|

OECD America |

3 |

157 |

|

OECD Europe |

12 |

151 |

|

OECD Pacific |

7 |

160 |

|

Non-OECD |

6 |

42 |

|

Eurasia |

1 |

93 |

|

Middle-East and Africa |

0 |

5 |

|

Other America |

0 |

70 |

|

Other Asia |

9 |

54 |

|

World |

6 |

69 |

Source: OECD ENV-Linkages model, based on IEA (2018[8]).

Structural transformation of the power sector

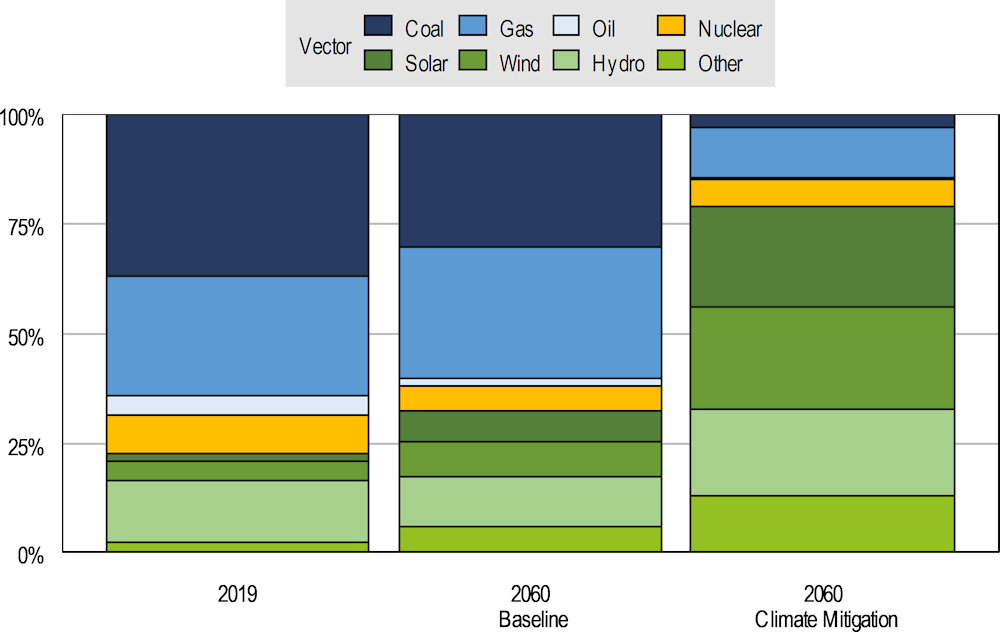

On top of the carbon prices trajectory, the climate policy package also includes the structural transformation of the electricity generation sector. As depicted in Figure A B.1, the share of the different primary sources (coal, oil, gas, nuclear, hydro, wind, solar and other) are set according to the WEO 2018 projections between 2020 and 2050 and it assumes a constant share of the different electricity vectors between 2050 and 2060. Overall, the share of fossil-powered electricity generations decreases from 69% in 2019 to 62% in 2060 in the Baseline, while in the climate policy package this share decreases to 15% by 2060.

Figure A B.1. World-average electricity mix in the Baseline and Climate Mitigation scenarios

References

[6] Arriola, C., P. Kowalski and F. Van Tongeren (2021), “Assessment of the Covid-19 pandemic: insights from the METRO model”, OECD Trade Policy Papers 252, https://doi.org/10.1787/18166873.

[2] Dellink, R. et al. (2021), “The long-term environmental implications of COVID-19”, OECD Environment Working Papers 176, https://doi.org/10.1787/123dfd4f-en.

[7] IEA (2020), World Energy Outlook 2020, OECD Publishing, Paris, https://doi.org/10.1787/557a761b-en.

[5] IMF (2020), World Economic Outlook, October 2020: A Long and Difficult Ascent, International Monetary Fund, Washington, D.C., https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020 (accessed on 22 January 2021).

[8] International Energy Agency (2018), World Energy Outlook 2018, OECD Publishing, Paris, https://doi.org/10.1787/weo-2018-en.

[4] OECD (2021), OECD Economic Outlook, Interim Report March 2021, OECD Publishing, Paris, https://doi.org/10.1787/34bfd999-en.

[3] OECD (2020), OECD Economic Outlook, Volume 2020 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/39a88ab1-en.

[1] OECD (2019), Global Material Resources Outlook to 2060: Economic Drivers and Environmental Consequences, OECD Publishing, Paris, https://doi.org/10.1787/9789264307452-en.