Digital labour platforms have emerged as a new way of organising work. Thus far, their impact in terms of formal employment creation remains rather disappointing. This chapter discusses the typology of digital labour platforms that mediate work and shows how digital labour platform workers were affected by the COVID‑19 pandemic. It then examines factors that increase the risk of informal employment on various digital labour platforms, and suggests ways in which digital labour platforms may help in formalising workers and employment relationships. The chapter concludes by offering policy solutions to regulate digital labour platform work, with a view to increasing their formal employment potential and tackling the vulnerabilities of informal workers.

Informality and Globalisation

5. Digital labour platforms: Opportunities and challenges for formal employment

Abstract

Digital labour platforms have disrupted traditional business models

Digital platforms, also referred to as online platforms, are a product of technological innovation and a new manifestation of globalisation (OECD, 2019[1]). They are online entities encompassing a broad range of activities, which have in common the use of digital technologies to connect the demand and supply of particular services and products (OECD, 2019[2]; OECD, 2019[1]; ILO, 2022[3]).

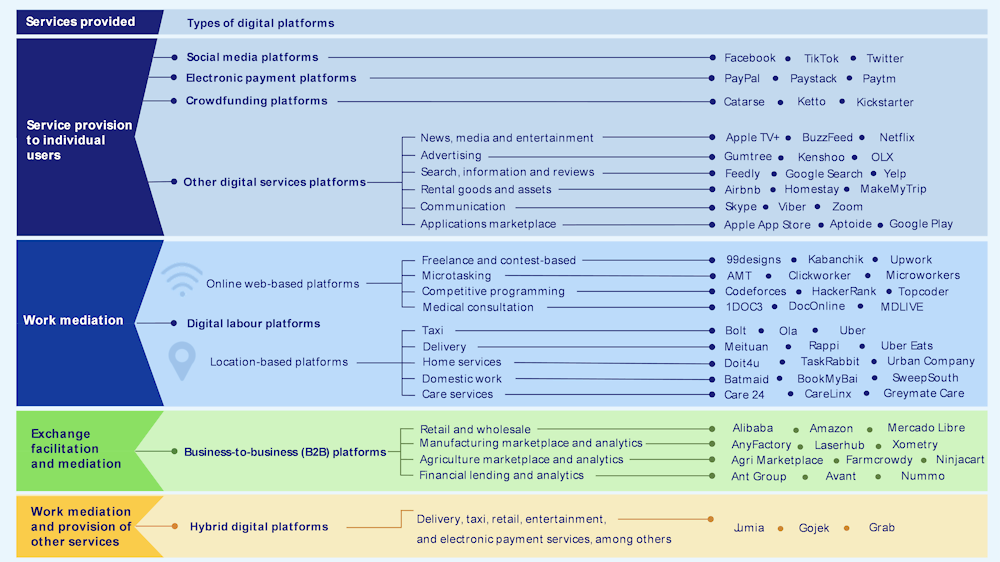

Digital platforms are extremely diverse (Figure 5.1). One of their important subsets is constituted by digital labour platforms that mediate work, the dichotomy of which includes (ILO, 2021[4]; ILO, 2022[5]):

Online web-based platforms for online delivery of services [e.g. Upwork, Amazon Mechanical Turk (AMT)]. These platforms allow for a digital delivery of non-material services by a workforce that is potentially scattered around the world.

Location-based platforms (e.g. delivery platforms such as Uber Eats). These platforms allow workers to serve clients locally, and require the workers involved to be located in a specific area.

Digital labour platforms that mediate work provide new ways of organising production and work processes. As such, they also present a number of challenges to employers, workers and governments (ILO, 2022[5]; OECD/ILO/European Union, 2023[6]). Informal employment and social protection of workers is one of these challenges, although digital labour platforms also embed opportunities for formalisation.

Work through digital labour platforms is rapidly expanding, although it still represents a relatively small share of total employment

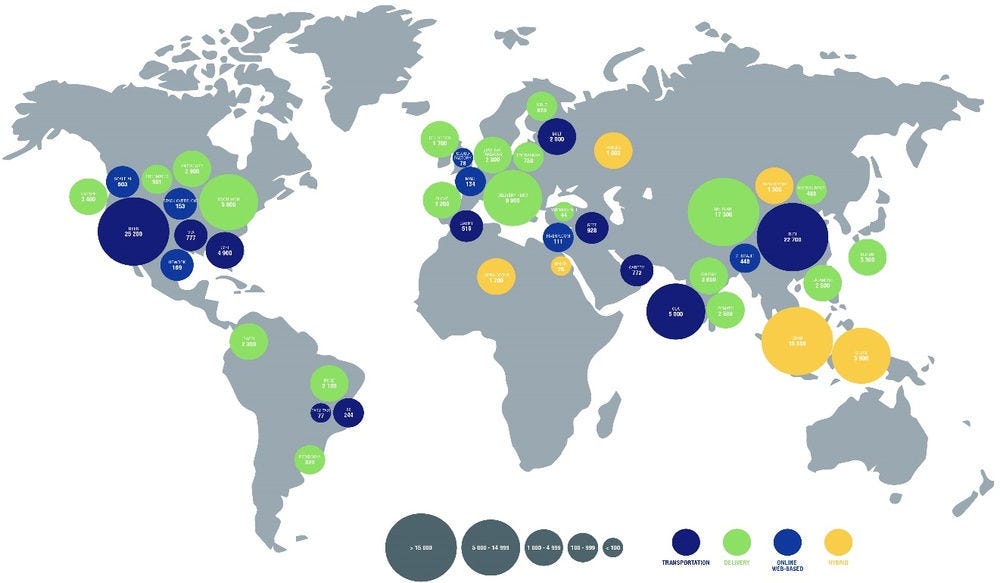

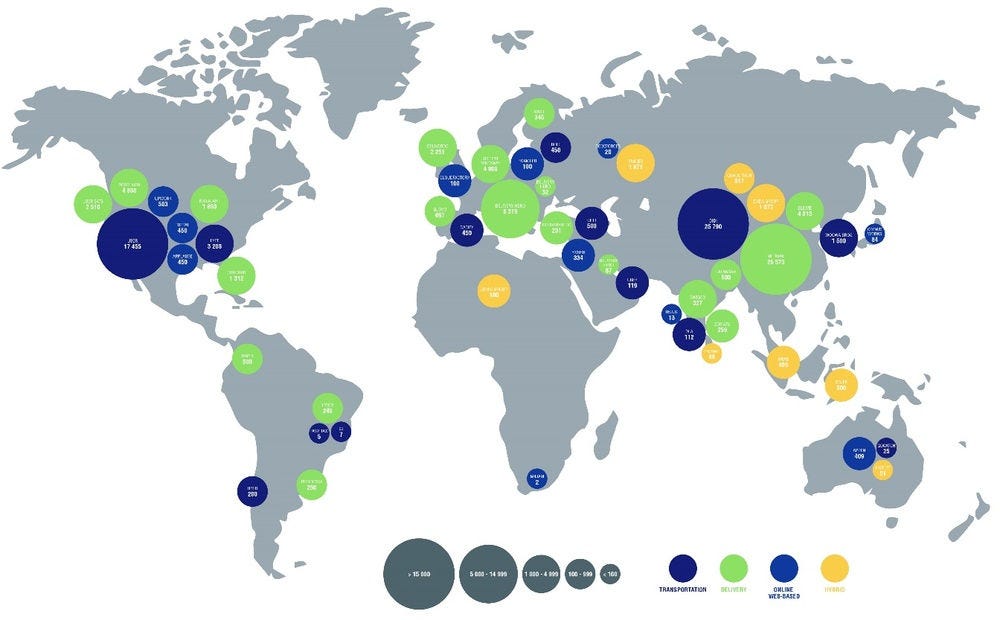

Work through digital labour platforms is penetrating a number of sectors of the economy (Figure 5.1) in all regions (Figure 5.2 and Figure 5.3), even though the share of digital labour platform workers is still small (ILO, 2021[4]; Schwellnus et al., 2019[7]). The number of online web-based and location-based platforms rose from an estimated 142 in 2010 to more than 777 in 2020 (ILO, 2021[4]). In 2021, there were approximately 14 million active workers on the 5 largest English-speaking online web-based platforms alone (Kässi, Lehdonvirta and Stephany, 2021[8]).

The majority of the global online workforce on online web-based platforms are based in Asia (ASEAN, 2023[9]), most notably India (33% of English-speaking online platform workers in 2021), followed by Bangladesh (15%) and Pakistan (9%) [see (Kässi and Lehdonvirta, 2018[10]) for the methodology]. Beyond English-language platforms, by 2015, Chinese-language online web-based platforms already had at least 12 million registered workers (Kuek et al., 2015[11]). The Asian region is also the world leader in terms of employment on online location-based platforms. By 2020, the online location-based platform Grab had 2.8 million active drivers in all countries of operation (Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Viet Nam), and more than 9 million micro-entrepreneurs in the region had earned income through Grab’s non-driver services. Gojek in Indonesia and Ola Cabs in India each employed 1 million drivers around 2020 (Asian Development Bank, 2021[12]).

Figure 5.1. Typology of digital platforms

Figure 5.2. Total funding from venture capital and other investors, selected categories of digital labour platforms, by region, 1998‑2021 (in USD millions)

Note: For details of construction, please refer to (ILO, 2021[4]).

Source: (ILO, 2021[4]), based on Crunchbase database. Courtesy of the ILO, with adaptations.

Figure 5.3. Estimated annual revenue of digital labour platforms, selected categories, by region, 2021 (in USD millions)

Note: For details of construction, please refer to (ILO, 2021[4]).

Source: (ILO, 2021[4]), based on Crunchbase database. Courtesy of the ILO, with adaptations.

In Africa, the development of digital work has lagged behind, but is nevertheless growing in importance. In Ghana, an estimated 60 000‑100 000 workers rely on digital labour platforms for their livelihoods. In Kenya, there are more than 35 000 such workers, and this number is expected to grow to 100 000 in 2023 (Fairwork, 2021[13]). In South Africa, the number of digital labour platform workers is growing by more than 10% each year and could reach the millions by 2030 (AUC/OECD, 2021[14]). In Egypt, more than 200 000 drivers were registered on Uber alone in 2020 (Fairwork, 2021[15]).

Latin America and the Caribbean (LAC) has also witnessed a growth of digital work. Wealth inequality, high informality and high rates of within-continent migration (especially from Venezuela) create fertile grounds for the proliferation of location-based platforms (Morales, 2023[16]). For example, country-specific studies show that in Ecuador, the number of digital labour platform workers was around 40 000 in 2020, with 1.5 million users relying on this type of work (Fairwork, 2021[17]). The commonality of the Spanish language throughout LAC also creates particularly fertile grounds for the development of this regional (rather than global) online workforce on online web-based platforms, mediated by the common language (Galperin and Greppi, 2017[18]).

In Eastern Europe and Central Asia, by 2019, Russian-language online web-based platforms alone had at least 8 million registered workers, scattered throughout 14 Former Soviet Union countries and in other countries with significant Russian-speaking diasporas (Shevchuk, Strebkov and Tyulyupo, 2021[19]). Local language platforms serving local markets have also flourished, with Serbia and Ukraine becoming the leaders of digital labour platform work in the Eastern European region throughout the 2010s (Aleksynska, Bastrakova and Kharchenko, 2018[20]).

The COVID‑19 pandemic generalised the use of digital labour platforms and enhanced our understanding of challenges associated with this work

The COVID‑19 crisis had complex effects on digital labour platform workers, with sizeable variations observed by sector of economic activity and by country (OECD, 2021[21]; ILO, 2022[5]). The crisis also accentuated the challenges associated with digital platform work, in addition to the opportunities that it provides (Box 5.1).

At the onset of the crisis, the demand for work increased in areas not requiring physical proximity, but decreased in areas requiring physical proximity. For example, the demand for ride-hailing and home services declined drastically during the initial lockdowns, making workers on location-based platforms that specialised in these areas among the hardest hit by lockdown measures (Moulds, 2020[22]). The decline in demand persisted even after the restrictions were lifted because many consumers stopped using these services in order to avoid the risk of contagion. In contrast, lockdowns and mobility restrictions led to a surge in demand for delivery platforms, among others (Fairwork, 2021[23]; OECD, 2020[24]).

Both labour demand and supply increased drastically on online web-based platforms, mainly led by clerical and data entry tasks, professional services, and software development and technology. This reflected the cost-saving strategies of enterprises, the need for software solutions to enable the smooth functioning of a remote working environment, and the search for online work opportunities among many workers who lost jobs in offline economies due to lockdowns (ILO, 2021[4]). The increase in the use of both location-based and online web-based platform work tended to be larger in more developed and technologically advanced countries, in countries with better access to infrastructure and connectivity, in countries with higher skill levels, and in countries with more widespread use of the Internet (OECD, 2021[21]).

Box 5.1. Digital labour platform work tested by COVID‑19

The COVID‑19 crisis posed two major risks to digital labour platform workers: (i) exposure to the virus, and (ii) work and income loss due to lockdown measures and changing consumer behaviour (OECD, 2020[24]). The key challenge to handle these risks was related to the self-employment status of the majority of workers, which is often coupled with informality, particularly in developing countries. Most of these workers were not covered by social protections, including health insurance, work-related injury, disability, or unemployment insurance. Even if they were formal, many self-employed workers did not have paid sick leave, sick pay, or unemployment benefits. The situation was even more dramatic for informal self-employed workers, who could not afford to self-isolate or to take days off in the absence of paid sick leave and sickness benefits even if they tested positive for COVID‑19 (ILO, 2021[4]). This presented important risks not only to workers but also to their clients.

The incidence and impact of these risks differed according to the type of work, individual and family characteristics, government lockdown restrictions, and mitigation measures, as well as specific measures undertaken by the digital platforms themselves to help their workers.

In 2020, the Organisation for Economic Co‑operation and Development (OECD), together with Appjobs and the Appjobs Institute, carried out a survey of platforms (digital labour platforms as defined in Figure 5.1, as well as several others) and a survey of workers in order to understand the types of special measures that the platforms provided during the crisis. This survey covered 64 platforms mediating services as diverse as delivery (27 platforms), ride hailing (8 platforms), babysitting (4 platforms), property rental (3 platforms), cleaning (3 platforms), car sharing (2 platforms), removals and storage (2 platforms), gardening (2 platforms), pet sitting (2 platforms), and a variety of other services (11 platforms) in OECD member countries (OECD, 2020[24]).

More than 50% of the surveyed platforms reported taking measures to promote social distancing and/or the safe provision of services, such as introducing contactless delivery or temporarily ceasing high-risk services; 25% of platforms reported providing personal protective equipment or hygiene products to workers; and 23% of platforms reported providing full or partial pay for sick or self-isolating workers, generally up to a maximum period of two weeks.

Through the complementary survey of platform workers (working both on location and online), 35% of respondents confirmed that their platform(s) had taken measures to assist them during the crisis. However, only 44% of those workers were satisfied with the measures taken. They wished to have more assistance, better employment opportunities, more work through the platform, more financial support, access to benefits, a safer work environment, and better general treatment from the platform(s).

Similar examples were reported in other parts of the world. According to the International Labour Organization’s (ILO’s) rapid assessment surveys, a majority of location-based workers (71%) who were working at the time of the surveys reported that their platform(s) had introduced measures to mitigate the risks associated with the COVID‑19 crisis. Among app-based taxi drivers, this share ranged from 24% (Kenya) to 81% (India). Among delivery workers, this share ranged from 48% (Chile) to 92% (Kenya). Various measures were cited, including compulsory mask wearing, contactless and cashless delivery, limiting the number of passengers, and sanitising hands, equipment and vehicles (Espi-Sanchis, 2022[25]).

In Kenya, some platforms offered safety training and subsidised the cost of safety clothing, gloves and masks for their “partners” (Fairwork, 2021[26]). In Indonesia, the Gojek ride-sharing platform provided direct cash support to active drivers and paid for the rides for its partners and their family members to get vaccinated. It also provided mattresses with direct access to oxygen when there was a spike of COVID‑19 cases (Dang, 2022[27]). Nevertheless, in countries such as Brazil, Chile and Ecuador, the support workers received from platforms was deemed “insufficient” and led to the first international digital labour platform workers’ movement to request better protections and working conditions (Fairwork, 2021[17]).

Source: Authors’ compilation. Author’s computations based on the ILO rapid assessment surveys; for details, see (Espi-Sanchis, 2022[25]).

Work through digital labour platforms carries a risk of informal employment, but also opportunities for formalisation

The proliferation of digital labour platforms was initially heralded as a revolutionary solution to unemployment problems by providing access to more work and markets, and hence moving people out of poverty (Kuek et al., 2015[11]). At the same time, there has been a growing understanding of the risks associated with platform work, including in terms of informal employment.

Indeed, one of the challenges for modern labour markets is that a large share of workers operating on digital labour platforms are informal. There are two sources of this informality.

First, the vast majority of digital labour platform workers are classified as independent contractors, or self-employed workers (Berg et al., 2018[28]; ILO, 2021[4]; Schwellnus et al., 2019[7]). In principle, as self-employed workers, according to national rules, they can (and often should) be registered for tax purposes. They should also register for social security when the system in place requires this. If they are registered as self-employed workers, they are part of the formal sector, and thus are considered to have a formal job. However, the vast majority of digital labour platform workers in developing countries remain unregistered and hence are informal. Often this happens because platforms have disrupted traditional ways of doing business and allowed non-professionals to take up jobs available through the platforms (for example, Uber and several other transportation apps initially allowed anyone to work as a driver, while in most countries traditional passenger transportation drivers must be licensed and undergo health and security checks). In addition, many workers operating on digital labour platforms lack clarity on how to provide a service legally and how to report it to the authorities (Williams, Llobera Vila and Horodnic, 2020[29]). The available information on the registration status of digital labour platform workers suggests that, indeed, the share of non-registered (and hence informal) self-employed workers who work through digital labour platforms is higher than the share of informal workers in the traditional offline economy. Empirical evidence for this exists in Eastern Europe (Aleksynska, 2021[30]) and in India (Berg, 2016[31]). As a result, social protection is less frequently enjoyed by digital labour platform workers as compared with other workers, especially in developing countries where social protection institutions for the self-employed are weak (ILO, 2022[5]).

Second, even for those self-employed workers who are registered, and are hence de jure are part of the formal sector, there is a risk of sliding into dependent self-employment, and even into a disguised employment relationship – a situation where the worker is misclassified as an independent, self-employed worker, even though he or she is, in fact, in a subordinate employment relationship (ILO, 2016[32]). Algorithmic management, the use of approval rates to attribute work, time tracking, price-setting, and the system of non-transferable ratings that is practised by digital labour platforms (Berg, Cherry and Rani, 2019[33]) enhance worker dependency on a platform or a particular client of a platform. As a result, de facto, up to one-half of self-employed platform workers are actually in a disguised employment relationship or in a grey zone, even if they consider themselves to be independent workers (Aleksynska, Bastrakova and Kharchenko, 2018[20]). In other words, these workers share the vulnerabilities of employees and should benefit from labour protections, but they do not (OECD, 2019[2]). The extent of this phenomenon depends on the business model practised by each individual platform. For example, in developed countries, a series of landmark legal cases suggested that work on some location-based platforms can, in some instances, be considered as a disguised employment relationship [e.g. Paris Criminal Court Decision of 19 April 2022, regarding Deliveroo France workers. See also other examples in (ILO, 2022[5])].

At the same time, work through digital labour platforms also represents an opportunity for formalisation (OECD, 2019[2]). Available technologies for digital work can be used to facilitate the formalisation of own-account workers on the digital labour platforms, as well as their inclusion in social security schemes whenever possible. Indeed, digital labour platforms create a unique setting where workers’ and clients’ identities are recorded through digital accounts, and all transactions are tracked. The digitalisation of transactions improves monitoring of economic activity, reduces its costs, and allows for traceability, and hence for transparency and accountability (ILO, 2022[5]), all of which are important elements for formalisation. Seizing this opportunity for formalisation, however, requires creating an enabling environment by governments, and co‑operation between digital labour platforms and public agencies (in particular, social security and tax authorities). For effective future co‑operation, it would be important for public authorities to acquire the consent of the digital labour platforms, especially in light of individual data protection requirements. Data protection laws may need to be modified, and new legal frameworks obliging digital labour platforms to provide information on all transactions carried out may need to be established (ILO, 2022[5]). In this light, co‑operation with various ministries (such as the ministry of justice or the ministry of finance) is important.

The potential of digital labour platforms to create genuinely formal jobs is not yet fully grasped

In order to determine whether the proliferation of digital labour platforms increases the share of formal employment, it is important to understand whether: (i) digital labour platforms create new jobs; (ii) the new jobs that are created are actually formal; and (iii) conversion from informal to formal jobs is happening.

Digital labour platforms have new job creation potential in some sectors, but not in others

Digital labour platforms allow the monetisation of tasks that previously would not have been performed for money. For example, location-based platforms allow for the commodification of what might previously have been done within a household. Some of the work outsourced from developed to developing countries through online web-based platforms, especially in creative and multimedia services or software development (OECD, 2018[34]), would simply not be done in the absence of these platforms, as it would have been too expensive to perform in a developed country. In this sense, online labour platforms led to an increased demand for these services, which likely led to work creation in certain countries and sectors (Schwellnus et al., 2019[7]). Moreover, digital labour platforms also make it easier for parties to find each other and to match demand with supply. They solve a co‑ordination problem, regardless of whether the worker is located in a developed country or not (De Stefano, 2016[35]). By doing this, they lower the transaction costs of finding labour and minimise friction in the labour markets (McKinsey Global Institute, 2015[36]), which can have the effect of raising employment, too.

On the other hand, much of the work channelled through digital labour platforms today – whether taxi driving, domestic work, cleaning, or auditing services – existed prior to the emergence of the platforms, and often co‑exists today in the physical labour market. In other words, digital labour platforms have used technology to mediate work and help outsource services, rather than to actually create new jobs. Many jobs that already existed before the emergence of these platforms have simply changed their nature (ILO, 2016[32]; Schwellnus et al., 2019[7]). This especially concerns location-based platforms [which have simply reorganised work that already existed in a particular sector (ILO, 2022[5])], as well as some online web-based platforms that serve local markets.

Moreover, a large share of work undertaken through digital labour platforms is available as tasks or “gigs”, which can often be fractionalised and outsourced further, rather than being a genuine full-time job. It is for this reason that digital labour platform workers are often referred to as “gig” workers. In their turn, many workers use platforms as a secondary activity to complement their primary source of income (Aleksynska, 2021[30]; Berg, 2016[31]), as well as because there is an excess of labour supply on platforms and simply not enough full-time work available (ILO, 2022[5]). As a result, the net full-time job creation impact of the digital labour platforms that are able to fully match labour supply has been considered relatively disappointing (ILO, 2021[4]).

Digital labour platforms enhanced informalisation trends in some sectors, but created opportunities for formalisation in others

How much of this new job creation is actually formal? The answer to this question is, again, country and sector specific.

In certain settings, the emergence of platforms has meant entrenching informality. For example, taxi drivers in India were traditionally self-employed before location-based platforms appeared. By adhering to these platforms, many drivers actually lost autonomy and the minimum price-setting guaranteed by municipalities; they saw an increase in their dependency and precarity (Rani and Gobel, 2022[37]; Rani and Dhir, 2020[38]). In some instances, digital labour platforms simply revealed an already high level of informality by making invisible economic activity visible. For example, city hitchhiking was not unusual and not formally prohibited in several Eastern European countries, but its extent was revealed by the arrival of location-based apps in the transport sector (Aleksynska, 2021[30]).

With the advent of digital labour platforms, some enterprises started more systematically outsourcing activities such as accounting, marketing, information technology, or legal services to platform workers, rather than hiring these specialists as wage employees. In other words, platform work allowed enterprises to more easily substitute wage employment with services delivered by self-employed individuals who, particularly in the context of developing countries, are largely informal. In this sense, in some countries platform work is often seen as a continuation of the outsourcing trend that started before the platforms emerged and that was associated in many settings with worsening working conditions (OECD, 2021[39]). As such, the development of digital labour platform work is also often seen as a continuation of the trend towards informality and precarity (Kahancova, 2016[40]; Meszmann, 2016[41]). Moreover, this has been happening within the local labour markets in developing countries. Indeed, it is often believed that online web-based platforms create work opportunities across borders, but in reality, much of the services work is non-transferable and has been channelled through online web-based platforms within local markets rather than within international labour markets through a simple modification of working relations rather than genuine new jobs creation (Meil and Akgüç, 2021[42]).

Many sectors, including logistics and business process outsourcing (BPO), are also experiencing “uberisation”. For example, in the early 2000s, India was able to leverage BPO to generate employment, including formal employment (the famous example being call centres). Two decades later, BPO services are provided through platforms that aggregate freelancers and microtaskers, and no longer rely on wage employment (Rani and Furrer, 2020[43]). Moreover, workers with high levels of education and skill are becoming more precarious in their employment, alongside the simultaneous deskilling of workers – a challenge for developing countries in particular as highly skilled workers remain scarce and the costs to develop them particularly elevated (Berg et al., 2018[28]).

But it does not have to be this way. In addition to technologies allowing for formalisation (at least in principle), digital labour platforms themselves also have a role to play in helping formalise their workers. For example, in Indonesia, the location-based platform Gojek offers help to its drivers to subscribe to the government health insurance programme, while at Grab Bike, workers are automatically enrolled in the government’s professional insurance programme (Fanggidae, Sagala and Ningrum, 2016[44]). Given this, digital labour platforms do have the potential to serve as a bridge towards formality (OECD, 2019[2]).

In addition, some of the traditional jobs that existed prior to the emergence of these platforms were formalised thanks to being channelled to location-based platforms. For example, for domestic workers, digital labour platforms can act as temporary agency platforms and thus favour formalisation. In some national legislation (for example, in the People’s Republic of China), access to social security is conditional on being employed by an enterprise. In this case, being employed by a temporary agency, including a temporary agency platform, is the only opportunity for domestic workers to access formal wage jobs.

Despite its challenges, in developing countries, platform work is sometimes seen as a step up compared with traditional informal employment

Although digital labour platform work comes with challenges to some workers and societies, many workers still often prefer it to traditional informal employment, especially in the developing countries with widespread informality. How can this paradox be explained?

First, much depends on the individual worker’s trajectory. In developed countries, “uberisation” is often seen as a threat to traditional formal employment: workers joining digital labour platforms give up the rights and protections available through standard employment in exchange for the promise of greater freedom and autonomy, as compared to an employment relationship (which, in reality, is often illusory). In developing countries, however, many platform workers only had informal employment to start with, often with no rights whatsoever. In this regard, beyond formal employment, digital labour platforms can offer advantages such as secured financial transactions, dispute mediation services, or enhanced protection in terms of income stability when income disbursal is regulated through the platform. Depending on the initial work trajectory of each individual worker, digital labour platform work can in certain cases allow their movement towards fairer and less vulnerable employment (Box 5.2).

Second, when workers create accounts on digital labour platforms, they have to abide by the terms of service set up by those platforms. These terms govern how and when workers will be paid, how work will be evaluated, and what recourse and mediation is available in case of problems. Terms of service also outline the responsibilities and obligations of workers, platform operators and clients (Berg et al., 2018[28]). In addition, workers often have to supply sensitive personal information, such as copies of identification documents and bank account details (ILO, 2021[4]). All of this creates a perception of formality for workers, an improvement on a situation where no contract existed before. Yet, this type of “formality” is actually private: workers may comply with private formal arrangements designed and valid within a platform, but this does not mean that they are formal with respect to their country’s employment laws. In other words, the perception of formality that digital labour platforms offer to workers differs from policy makers’ understanding of formality. Moreover, private regulation of each platform actually substitutes public regulation. Such substitution of private regulation for public regulation raises broader questions about the societal desirability of such an outcome.

Third, the intense competition between digital labour platforms means that, on the one hand, platforms have been motivated by their bottom-line profits and unwilling to change their underlying model that relies on self-employed “partners” rather than employees. In fact, most of the platforms believe that they would go out of business if they had to reclassify their workers as employees (Uber, 2020[45]). On the other hand, platforms also need to compete among themselves in order to attract and retain workers and clients. Social responsibility towards workers has become a valid concern and an important reputational tool that platforms increasingly have to reply upon. The COVID‑19 crisis has particularly intensified the quest for social responsibility among digital labour platforms and increased pressure from clients and society at large to improve working conditions. As a result, several platforms have modified their terms of service or committed to providing fairer treatment to their “partners”. In some instances, platforms have also co‑operated with governments to provide specific protections to workers during the crisis. Most of these measures remain private, disparate, and in many instances insufficient compared with what is prescribed by local laws (Box 5.1). Yet, given the lack of enforcement of the local laws, and the lack of protection in other jobs, platform work can still represent an improvement, at least for some workers.

Box 5.2. Working conditions on digital labour platforms: Protections and vulnerability as a continuum

The Fairwork Foundation aims to certify the production networks of the digital labour platform economy. It does so on the basis of the Fairwork project, established by the Oxford Internet Institute and the WZB Berlin Social Science Center, which currently operates in 26 countries across 5 continents.

As of 2022, Fairwork researchers have undertaken a global survey of 800 workers in 75 countries working on 17 digital labour platforms, including web-based and location-based platforms. The objective was to evaluate the working conditions on digital platforms, and then to score and rank the platforms against the five principles of fair work: fair pay, fair conditions, fair contracts, fair management and fair representation. Higher scores indicate that a greater number of principles is satisfied. Even if “fair work” does not mean “formal work”, and formal work is not always fair either, formality is an important condition for fair and decent jobs. As such, the results of the survey allow a better understanding of whether platform work is indeed a step up compared with fully unprotected, vulnerable employment.

The results show that none of the digital labour platforms in any of the reviewed developing countries fully satisfy all five principles of fair work.

In Bangladesh, the situation seems to be the worst, as six out of the ten largest location-based platforms operating in the country received a score of 0 (no respect for any of the fair work principles), and all remaining platforms received a score of 1 (the maximum score is 10). In India and Indonesia, two out of ten platforms largest platforms received a score of 0, and in Kenya, three of the ten largest platforms received a score of 0.

Meanwhile, in Ghana, three out of the largest ten location-based platforms received a score of 5 or above. In South Africa, one platform received a score of 9 and three received a score of 8, suggesting that it is possible for platforms to implement better standards.

Results in terms of contracts and management practices are promising in that workers are somewhat protected on a daily basis from minor risks. However, pay remains highly irregular, and there is no worker representation or safety and health protection.

The situation also seems to be systemic, as the global competition in the digital work economy encourages such practices towards their workers, and the current absence of regulations does not remedy the situation.

Note: See the Fairwork Foundation website and reports for details on the certification procedure.

Source: Authors’ elaboration based on the Fairwork 2021 Annual Report (Fairwork, 2021[13]) and various country reports.

Key policy messages

Regulating digital labour platforms is challenging but not impossible, and is often demanded by workers, clients and businesses.

There exist several broad frameworks to address the deficit of decent work and the social protection challenges in digital labour platform work (Lane, 2020[46]; ILO, 2016[32]; OECD, 2019[2]). Based on those, a number of tools can be singled out that are specific to tackling the informality of digital labour platform workers, as well as to reducing the vulnerability of informal platform workers.

Bringing digital labour platform work under the scope of existing regulations

Many digital labour platforms position themselves as intermediaries between the workers and the clients that only provide the matching opportunity. Yet, they in fact often provide services in traditional sectors of economic activity for which regulations usually already exist. For example, most countries, including developing countries, have regulations in the passenger transportation sector (Box 5.3) or domestic work sector. Some of these regulations exist at the municipal level, while others are nation-wide. These regulations typically require that workers in these sectors comply with professional licensing and insurance obligations, and often be formally registered with tax and/or social security authorities. The emergence of digital labour platforms disrupted existing markets in that they allowed non-professionals to provide work in these sectors, thus further increasing the pool of informal workers. Bringing platform work under the scope of existing sectoral regulations can help reduce the pool of informal platform workers by restricting the use of these platforms to those workers who are professionals in their sector, and also by encouraging formalisation of informal non-professionals. Enforcing unfair competition laws can also help ensure that platforms are not paying too little in taxes, not perpetuating unjustifiably low fares, and not discouraging wage employment.

Box 5.3. Bringing platform work under the scope of existing regulations

The vast majority of location-based platforms build their business models around the idea that they are not employers, but rather mere intermediaries providing the infrastructure for a self-employed worker to find clients. Several jurisdictions reacted to this through court decisions that are now used as legal precedent at both national and regional levels.

One example of regional regulation is the European Union (EU)-level European Court of Justice 2017 ruling (in Case C-434/15) on the status of applications that provide intermediation services in the field of passenger transport, such as Uber. According to the ruling, services provided by such applications must be regarded not as “an information society service” but as “a service in the field of transport”.

This landmark ruling allowed EU member states to extend the scope of the existing sectoral (transportation) laws to transport applications. For example, the Constitutional Court of Slovakia referred to this European Court of Justice 2017 Judgment in its decision, ruling that Uber should be viewed as a transportation company and hence comply with the existing laws on professional licensing of drivers and with the safety requirements applicable to the vehicles driven. Hungary amended its transport law to bring transportation application companies under the scope of current transport regulations. Such legal changes resulted in all drivers having to comply with professional licensing and insurance obligations. Some other non-EU countries in the region, such as Serbia, adopted similar legal amendments.

Source: (Aleksynska, 2021[30]).

Encouraging the formalisation of self-employment and ensuring that digital labour platforms are paying their share

Many self-employed platform workers do not register as self-employed. Moreover, a significant share of them do not believe that registration is necessary (Aleksynska, Bastrakova and Kharchenko, 2018[20]). Encouraging registration with tax and social security authorities whenever possible is the first step towards formalisation. Many countries have simplified tax regimes for micro-entrepreneurs (also called solo self-employed or auto-entrepreneurs). Governments should continue their efforts to create such simplified regimes where they are not yet in place, enforce them where they exist, and inform workers about these regimes and the benefits of formalisation. At the same time, governments should consider policies to ensure that digital labour platforms pay their fair share of taxes and social security contributions (which could differ from those for traditional businesses), taking into account the high share of dependent self-employment created through these platforms.

Strengthening and enforcing regulations to correctly classify workers as employees

The risk of a disguised employment relationship means that workers are deprived of the labour and social security protections that are due to them. Many developing countries do not have legal instruments that allow for the clear identification of the existence of the employment relationship. In some cases, only judicial practice exists, but it remains ineffective and slow. In this regard, it is important to strengthen the existing regulations, including mandating, through labour laws, a series of criteria to determine the legal nature of the work relationship. Clear laws enabling the determination of an employment relationship and appropriate worker classification, and their effective enforcement, can reduce the incentive for enterprises to unduly rely on self-employed workers. They can also help workers better understand their rights and empower workers to claim their rights as employees.

Empowering workers to challenge their employment status

For an individual worker, it may be prohibitively costly to challenge their employment status, and may cost them the very work opportunity they need. Workers may also not be aware of their rights, and usually do not have the time or money to file court complaints. In their turn, digital labour platforms may deactivate workers’ accounts if they learn that workers have decided individually to contest their employment status, and workers may fear retaliation if they attempt this. Given this, it is up to governments to protect workers against retaliation and to facilitate workers’ classification, including through information campaigns, more efficient courts, reduced court fees, simplified procedures, and mass reclassifications by sector of activity.

Modernising laws to address digital labour platform modes of work

Several countries have recognised that digital labour platform modes of work create a genuine ambiguity about employment status, with workers finding themselves in a “grey zone” between dependence and self-employment (OECD, 2019[2]). In order to minimise this grey zone as much as possible and to protect digital labour platform workers, some countries, such as Canada, Italy and Spain, have created a third employment category that lies between self-employment and wage employment. However, even if this has helped to formalise workers, worries remain that this has not changed working conditions, and in some instances has created additional confusion for workers and businesses (Cherry and Aloisi, 2016[47]). Others treat digital labour platforms as temporary work agencies, for which international guidance already exists (OECD, 2019[2]). In Chile, a new bill intends to add a chapter to the Chilean labour code, creating a special legal regime for digital labour platform work. It contains special protections for this form of work, and also extends some of the protections afforded by the general rules of the labour code to platform workers, most notably in the matters of working hours and remuneration (Leyton et al., 2022[48]). Beyond labour laws, some countries have also modified the provisions of other regulations. For example, regarding passenger transportation, Estonia adopted a law in 2017 specifying the conditions for providing transport services mediated by digital labour platforms and aligning their position with that of traditional taxi services. Under this law, neither traditional taxi drivers nor drivers associated with new digital providers need to comply with the previous conditions for professional training. Instead, transport providers are now under obligation to provide their own training for their drivers. Similarly, Lithuania amended its Road Transport Code in 2016; the updated provisions allow passenger transport to be organised by both natural and legal persons in both taxi and ordinary passenger cars. In return, passenger transport enterprises must provide passenger data to road transport control authorities, declare the service to the municipal authority, and declare the income received from these activities to the State Tax Inspectorate. The Road Transport Code no longer requires passenger transport operators to obtain a permit to carry passengers (OECD, 2018[49]). Latvia amended its Road Transport Law in 2018, providing for equal licensing requirements for any personal transport-operating entity and obliging “ride-sharing” apps to accept only electronic payments, to register in the Enterprises Register as legal entities and to provide full accounting of business activity.

Leveraging technologies to formalise

Digital labour platforms’ transactions are traceable. This traceability offers a real opportunity to support the formalisation of digital labour platform workers and to bring them into tax and social security systems. Digital accounts that track workers’ output for clients and their earnings through dedicated platforms can be used for the inclusion of own-account workers in the platform economy not only in the tax system in order to formalise them, but also in social security schemes to ensure access to social protections. Making this a reality is a question of political will, co‑operation between platforms and government authorities, and compliance. There is also a need for new legal frameworks which would build bridges between labour and commercial laws, as well as for laws on data privacy. There are several examples of how this can happen successfully. For example, the Estonian Tax and Customs Board initiated a pilot project for the transport sector in co‑operation with Uber in order to connect the transport provider’s digital payment system directly to the state digital taxation system. This reduces undeclared payments, decreases the administrative burden for service providers, puts platforms and their users on equal footing with the traditional economy, and helps generate tax revenues (National Training Fund, 2017[50]). Also in Estonia, there is an ongoing discussion on possible broader co‑operation with digital labour platforms, such as using workers’ digital accounts to track their income for social security purposes. While it is not fully operationalised yet, it is nevertheless technically possible, since Estonia’s digital tax system can already access the total amount of transactions on the platforms directly through the banking system. For effective future co‑operation, it would be important to obtain the consent of the platforms, or to impose an obligation for them to provide such data, in accordance with the country’s individual data protection requirements. Data protection laws may also need to be modified.

Including digital labour platform workers within existing social protection schemes

Developed and developing countries alike have been actively experimenting with ways to extend social insurance coverage to self-employed workers as well as microenterprises and small enterprises. In India, the Code on Social Security was introduced in September 2020 to extend protection to all workers, including platform workers, irrespective of the existence of an employment relationship (ILO, 2021[4]). In LAC, a number of countries have introduced a “monotax” system with the aim of encouraging the formalisation of self-employed workers, including platform workers (ILO, 2021[4]). One of the leading examples is Uruguay, where monotax participants pay a flat rate covering tax and social security contributions, which entitles them (or their workers) to the same benefits as employees (other than unemployment benefits); they can also choose to voluntarily contribute to social health insurance. Specific measures were also introduced to extend monotax coverage to workers on taxi platforms: obtaining a licence to operate is conditional on individual workers being registered with social insurance and tax authorities under the same conditions as employees. The apps allow drivers to register while automatically adding a social security contribution to the price of service (Freudenberg, 2019[51]). In Egypt, during the COVID‑19 crisis, the government announced that it planned to “identify and support two million gig workers in the country by the end of the year 2021” (Fairwork, 2021[15]). In order to do so, the government planned to register digital labour platform workers’ employment status as “irregular employment”, and under this status grant them access to free social security insurance, including healthcare coverage, life insurance, disability benefits, and other state welfare programmes such as a three-month COVID‑19 grant (Fairwork, 2021[15]). Although this initiative was welcomed as a crisis measure, in the long term it may also create adverse incentives for the platforms not to pay their fair share of social security provision for their workers. More generally, it is important that all workers, regardless of their employment status, have access to an adequate set of social protections (OECD, 2019[2]; ILO, 2016[32]).

Supporting the universal right of all workers to bargain collectively

Worldwide, the development of digital labour platform work has so far proven particularly challenging to both worker organisation and representation (Johnston and Land-Kazlauskas, 2019[52]). Many digital labour platform workers face a labour monopsony situation in which they have an unbalanced power relationship in relation to the platform and/or clients. Digital labour platforms also have more power compared with workers because they can simply deactivate the accounts of those workers who join workers’ rights movements. This makes workers vulnerable and potentially in need of the protections that are normally granted only to employees (OECD, 2019[2]). However, as self-employed workers, digital platform workers usually cannot be part of a trade union. Collective bargaining agreements often do not apply to them, and workers do not have a clearly attributable employer who would serve as a collective bargaining counterpart. Moreover, the universal right to collective bargaining may conflict with competition laws in certain jurisdictions (ILO, 2016[32]). Nevertheless, workers throughout the world have taken different steps to organise. In 2018, the first Platform Staff Association in South America registered with the Ministry of Labour of Argentina, with a view to solving the problems encountered in the digital labour platform work environment (ILO, 2020[53]). Elsewhere, as dialogue with these platforms is difficult, digital labour platform workers increasingly engage in dispute actions such as strikes, demonstrations and litigation. The number of such actions around the world has been rising since 2015, with at least 1 253 occurring in 57 countries between January 2017 and July 2020 (Bessa et al., forthcoming[54]). The worsening conditions during the COVID‑19 crisis have further pushed many platform workers to take action. Workers in Brazil, Chile, Ecuador and several other LAC countries initiated the first international gig workers’ movement. In 2020, they organised multiple transnational actions, demanding better working conditions and employee status (Fairwork, 2021[17]). In view of workers’ needs to organise, governments should aim to establish a legislative framework to remove impediments to the affiliation to existing trade unions of all workers, regardless of their employment status, as a prerequisite for ensuring inclusive union strategies and actions in favour of platform workers.

Encouraging platforms to exercise social responsibility

The fact that different digital labour platforms offer different working conditions (Box 5.2) means that platforms make choices, through their business models, of what can be possible. Encouraging competition between digital labour platforms, user awareness of working conditions, and social responsibility on the part of the platforms themselves can be an important step forward to protect workers regardless of their formality status. For example, BigBasket, a platform that has a significant presence in India, instituted a “Gig Workers Payment Policy” to ensure that its partner workers earn at least the national minimum hourly wage after all work-related costs are accounted for (Fairwork, 2021[13]). Several other platforms around the world have committed to improving a range of other conditions; however, these improvements remain disparate, and there is definitely scope for scaling them up.

References

[30] Aleksynska, M. (2021), “Digital Work in Eastern Europe: Overview of Trends, Outcomes and Policy Responses”, ILO Working Paper 32, http://www.ilo.org/global/publications/working-papers (accessed on 9 May 2022).

[20] Aleksynska, M., A. Bastrakova and N. Kharchenko (2018), Work on Digital Labour Platforms in Ukraine: Issues and Policy Perspectives, ILO, Geneva, http://www.ilo.org/publns. (accessed on 9 May 2022).

[9] ASEAN (2023), ASEAN Employment Outlook.

[12] Asian Development Bank (2021), Asian Economic Integration Report 2021. Making Digital Platforms Work for Asia and the Pacific, https://www.adb.org/sites/default/files/publication/674421/asian-economic-integration-report-2021.pdf (accessed on 18 May 2022).

[14] AUC/OECD (2021), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, OECD Publishing, Paris/African Union Commission, Addis Ababa, https://doi.org/10.1787/0a5c9314-en.

[31] Berg, J. (2016), “Income security in the on-demand economy: Findings and policy lessons from a survey of crowdworkers”, Conditions of Work and Employment Series, No. 74, ILO, Geneva, http://www.ilo.org/publns (accessed on 12 May 2022).

[33] Berg, J., M. Cherry and U. Rani (2019), “Digital labour platforms: a need for international regulation?”, Revista de Economía Laboral - Spanish Journal of Labour Economics, Vol. 16/2, pp. 104-128, https://econpapers.repec.org/article/reljournl/y_3a2019_3av_3a16_3an_3a2_3ap_3a104-128.htm (accessed on 12 May 2022).

[28] Berg, J. et al. (2018), Digital labour platforms and the future of work: Towards decent work in the online world, ILO, Geneva.

[54] Bessa, I. et al. (forthcoming), “Worker Protest in the Platform Economy”, ILO, Geneva.

[47] Cherry, M. and A. Aloisi (2016), “’Dependent Contractors’ in the Gig Economy: A Comparative Approach”, SSRN Electronic Journal, https://doi.org/10.2139/SSRN.2847869.

[27] Dang, L. (2022), Responsible Business for Protection of the Well-Being and Health of Platform Workers: experience of Go-Jek in Southeast Asia, Workshop on Managing Technology’s Implications for Work, Workers and Employment Relationships in ASEAN.

[35] De Stefano (2016), “The rise of the «just-in-time workforce»: On-demand work, crowdwork and labour protection in the «gig-economy»”, Conditions of Work and Employment Series, No. 71, ILO, Geneva.

[25] Espi-Sanchis, G. (2022), Using data from rapid surveys for employment policy: Applications in the COVID-19 era and beyond, ILO Technical Brief, Geneva, https://www.ilo.org/employment/Whatwedo/Publications/WCMS_849245/lang--en/index.htm.

[13] Fairwork (2021), Fairwork 2021 Annual Report.

[17] Fairwork (2021), Fairwork Ecuador Ratings 2021: Labour Standards in the Gig Economy, Fairwork Foundation, Berlin, https://fair.work/en/fw/publications/fairwork-ecuador-ratings-2021/#continue (accessed on 13 May 2022).

[15] Fairwork (2021), Fairwork Egypt Ratings 2021: Towards Decent Work in a Highly Informal Economy, https://fair.work/wp-content/uploads/sites/131/2022/02/Fairwork-Report-Egypt-2021-revised.pdf (accessed on 23 May 2022).

[26] Fairwork (2021), Fairwork Kenya Ratings 2021: Labour Standards in the Gig Economy, Fairwork Foundation, Berlin, https://fair.work/en/fw/publications/fairwork-kenya-ratings-2021-labour-standards-in-the-gig-economy/ (accessed on 13 May 2022).

[23] Fairwork (2021), Skills for the Planetary Labour Market: Indian Workers in the Platform Economy, Fairwork Foundation, Berlin, https://fair.work/en/fw/publications/skills-for-the-planetary-labour-market-indian-workers-in-the-platform-economy/ (accessed on 13 May 2022).

[44] Fanggidae, V., M. Sagala and D. Ningrum (2016), On-Demand Transport Workers in indonesia: Toward understanding the sharing economy in emerging markets, FairWork Foundation, http://www.justjobsnetwork.org.

[51] Freudenberg, C. (2019), Rising platform work - Scope, insurance coverage and good practices among ISSA countries, International Social Security Association (ISSA), Geneva, https://ww1.issa.int/node/180775 (accessed on 23 May 2022).

[18] Galperin, H. and C. Greppi (2017), “Geographical Discrimination in Digital Labor Platforms”, SSRN Electronic Journal, https://doi.org/10.2139/ssrn.2922874.

[5] ILO (2022), Decent Work in the Platform Economy. Reference Document for the Meeting of Experts on Decent Work in the Platform Economy, ILO, Geneva.

[3] ILO (2022), World employment and social outlook: trends 2022, International Labour Office, Geneva, https://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/---publ/documents/publication/wcms_834081.pdf.

[4] ILO (2021), 2021 World Employment and Social Outlook 2021: The Role of Digital Labour Platforms in Transforming the World of Work, International Labour Organization: Geneva, http://www.ilo.org/publns. (accessed on 9 May 2022).

[53] ILO (2020), “Interactions between Workers’ Organizations and Workers in the Informal Economy: A Compendium of Practice”, ILO, Geneva, https://www.ilo.org/travail/info/publications/WCMS_735630/lang--en/index.htm.

[32] ILO (2016), Non-standard employment around the world: Understanding challenges, shaping prospects, International Labour Office, Geneva, http://www.ilo.org/global/publications/books/WCMS_534326/lang--en/index.htm (accessed on 3 February 2022).

[52] Johnston, H. and C. Land-Kazlauskas (2019), Organizing on-demand: Representation, voice, and collective bargaining in the gig economy, Conditions of Work and Employment Series, No. 94, ILO, Geneva, http://www.ilo.org/publns. (accessed on 23 May 2022).

[40] Kahancova, M. (2016), The rise of the dual labour market: fighting precarious employment in the new member states through industrial relations (PRECARIR) Country report: Slovakia, Central European Labour Studies Institute (CELSI), https://ideas.repec.org/p/cel/report/19.html (accessed on 10 May 2022).

[10] Kässi, O. and V. Lehdonvirta (2018), “Online labour index: Measuring the online gig economy for policy and research”, Technological Forecasting and Social Change, Vol. 137, pp. 241-248, https://ilabour.oii.ox.ac.uk/online-labour-index/ (accessed on 17 May 2022).

[8] Kässi, O., V. Lehdonvirta and F. Stephany (2021), “How many online workers are there in the world? A data-driven assessment”, Open Research Europe, Vol. 1, p. 53, https://doi.org/10.12688/OPENRESEUROPE.13639.3.

[11] Kuek, S. et al. (2015), The Global Opportunity in Online Outsourcing, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/22284 (accessed on 12 May 2022).

[46] Lane, M. (2020), “Regulating platform work in the digital age”, Going Digital Toolkit Policy Note, Vol. 1.

[48] Leyton, J. et al. (2022), “New regulation of platform work in Chile: a missed opportunity?”, Fairwork Policy Brief, https://fair.work (accessed on 23 May 2022).

[36] McKinsey Global Institute (2015), A Labour Market that Works. Connecting talent with opportunity in the digital age.

[42] Meil, P. and M. Akgüç (2021), “Moving on, out or up: The externalization of work to B2B platforms”, in Drahokoupil, J. and K. Vandaelem (eds.), A Modern Guide To Labour and the Platform Economy, Edward Elgar Publishing.

[41] Meszmann, T. (2016), The rise of the dual labour market: fighting precarious employment in the new member states through industrial relations (PRECARIR) Country report: Hungary, Central European Labour Studies Institute (CELSI), https://ideas.repec.org/p/cel/report/12.html (accessed on 10 May 2022).

[16] Morales, I. (2023), The Gig Economy in Latin America: A Better Alternative to Informality?, https://www.panoramas.pitt.edu/economy-and-development/gig-economy-latin-america-better-alternative-informality (accessed on 19 May 2022).

[22] Moulds, J. (2020), Gig workers among the hardest hit by coronavirus pandemic | World Economic Forum, The World Economic Forum, https://www.weforum.org/agenda/2020/04/gig-workers-hardest-hit-coronavirus-pandemic/ (accessed on 13 May 2022).

[50] National Training Fund (2017), Impact of shared economy on a position of employees and proposed changes in legislation, https://ipodpora.odbory.info/soubory/dms/wysiwyg_uploads/bba5a5c7366cdaf3/uploads/2_IMPACT_SHARED_ECONOMY_2017_EN.pdf (accessed on 23 May 2022).

[39] OECD (2021), OECD Employment Outlook 2021: Navigating the COVID-19 Crisis and Recovery, OECD Publishing, Paris, https://doi.org/10.1787/5a700c4b-en.

[21] OECD (2021), “The role of online platforms in weathering the COVID-19 shock. OECD Policy Responses to Coronavirus (COVID-19)”, https://www.oecd.org/coronavirus/policy-responses/the-role-of-online-platforms-in-weathering-the-covid-19-shock-2a3b8434/.

[24] OECD (2020), What have platforms done to protect workers during the coronavirus (COVID 19) crisis?, OECD, Paris, https://www.oecd.org/coronavirus/policy-responses/what-have-platforms-done-to-protect-workers-during-the-coronavirus-covid-19-crisis-9d1c7aa2/ (accessed on 13 May 2022).

[1] OECD (2019), An Introduction to Online Platforms and Their Role in the Digital Transformation, OECD Publishing, Paris, https://doi.org/10.1787/53e5f593-en.

[2] OECD (2019), OECD Employment Outlook 2019: The Future of Work, OECD Publishing, Paris, https://doi.org/10.1787/9ee00155-en.

[34] OECD (2018), Online work in OECD countries. Policy Brief on the Future of Work, OECD, Paris.

[49] OECD (2018), Taxi, ride-sourcing and ride-sharing services - Background Note by the Secretariat, http://www.oecd.org/daf/competition/taxis-and-ride-sharing-services.htm (accessed on 23 May 2022).

[6] OECD/ILO/European Union (2023), Handbook on Measuring Digital Platform Employment and Work, OECD Publishing, Paris.

[38] Rani, U. and R. Dhir (2020), “Platform Work and the COVID-19 Pandemic”, The Indian Journal of Labour Economics, Vol. 63/S1, pp. 163-171, https://doi.org/10.1007/s41027-020-00273-y.

[43] Rani, U. and M. Furrer (2020), “Digital labour platforms and new forms of flexible work in developing countries: Algorithmic management of work and workers”, Competition & Change, Vol. 25/2, pp. 212-236, https://doi.org/10.1177/1024529420905187.

[37] Rani, U. and N. Gobel (2022), “Job instability, precarity, informality and inequality: Labour in the gig economy”, in Ness, I. (ed.), Handbook of the gig economy, Routledge.

[7] Schwellnus, C. et al. (2019), “Gig economy platforms: Boon or Bane?”, OECD Economics Department Working Papers, No. 1550, OECD Publishing, Paris, https://doi.org/10.1787/fdb0570b-en.

[19] Shevchuk, A., D. Strebkov and A. Tyulyupo (2021), “The Geography of the Digital Freelance Economy in Russia and Beyond”, in Will-Zocholl, M. and C. Roth-Ebner (eds.), Topologies of Digital Work, Dynamics of Virtual Work, Springer Nature Switzerland, https://doi.org/10.1007/978-3-030-80327-8_2.

[45] Uber (2020), Annual Report 2019., https://s23.q4cdn.com/407969754/files/doc_financials/2019/ar/Uber-Technologies-Inc-2019-Annual-Report.pdf.

[29] Williams, C., M. Llobera Vila and A. Horodnic (2020), “Tackling Undeclared Work in the Collaborative Economy and Bogus Self-Employment”, European Platform Tackling Undeclared Work.