As weather patterns diverge from historic norms, the physical impacts of climate change are becoming increasingly visible. Climate change is both heightening risks to infrastructure services and influencing demand for them. Investing in climate-resilient infrastructure systems is cost effective, can save lives and support continued economic growth. However, such investment faces a significant finance gap and challenging macroeconomic conditions. This chapter explores the crucial role that finance can play in achieving climate-resilient infrastructure. It highlights the need to make climate resilience the norm for all infrastructure financing and investments by increasing awareness around climate-related risks, improving risk-sharing arrangements and strengthening the enabling environment. The chapter also highlights the potential of using public finance to unlock private investment in infrastructure.

Infrastructure for a Climate-Resilient Future

3. Unlocking finance for climate-resilient infrastructure

Abstract

Key policy insights

The mainstreaming of climate resilience into infrastructure financing and investment is the exception rather than the norm. Finance flows for climate-resilient infrastructure are limited relative to the levels needed to address the growing impacts of climate change.

There is a compelling economic argument for investing in climate-resilient infrastructure. Investing upfront in climate resilience can yield benefits over the lifetime of the asset. These benefits can include greater service reliability and quality, lower maintenance costs and reduced exposure to climate-related risks. In many cases, they lower overall costs to address climate risk.

Weaknesses in the enabling environment and lack of risk awareness are preventing consideration of the benefits of increased climate resilience in public and private investment decisions. A systemic approach is needed to make physical climate risk visible in investment decisions, and thereby demonstrate that resilience is a source of value rather than just a cost.

Mobilising private financing and investment will be critical for achieving resilient infrastructure systems. Addressing regulatory barriers, ensuring effective risk sharing and, in some cases, the strategic use of public support will be critical for unlocking this potential.

Integrating climate resilience into long-term planning, and linking planning to financing, will be critical for ensuring the effective use of public resources, reducing perceived risk to the private sector and building in flexibility to address uncertainty over time.

Given pressures on existing funding sources for infrastructure, there is an important role for developing new funding models, including land value capture.

3.1. Introduction

The physical impacts of climate change are becoming increasingly visible, as weather patterns diverge from historic norms (See Box 3.1). Climate change is exacerbating risks to the provision of infrastructure services due, for example, to the flooding of transport links. It is also influencing demand for infrastructure services. Milder winters and warmer summers, for example, will reduce energy demand in winter and increase it in summer, while rising seas will require improvements in coastal defences.

Investing proactively to achieve climate-resilient infrastructure systems is cost effective, can save lives and support continued economic growth. For example, one major study found an average of USD 4 of benefits for every USD 1 invested in climate-resilient infrastructure (Hallegatte, Rentschler and Rozenberg, 2019[1]). Analysis in the United States found that adaptation could reduce annual losses to infrastructure by an order of magnitude (Neumann et al., 2021[2]). However, this potential has yet to be fully realised. Mobilising finance for climate-resilient infrastructure – and ensuring that all infrastructure finance is climate resilient – will be critical to achieve climate-resilient infrastructure systems.

The need to increase investment flows for climate-resilient infrastructure exists against the context of a significant overall infrastructure finance gap and challenging macroeconomic conditions. The economic consequences of COVID‑19, and subsequent economic difficulties and geopolitical issues, have contributed to rising public debt, inflation and interest rates (OECD, 2023[3]). This has increased the cost of new infrastructure, limited the capacity of the public to finance new investments and diverted the private sector to other areas. Given these pressures, and the urgent need to enhance resilience to climate change, it will be essential to maximise the impact and efficiency of public investment, in parallel to unlocking increased private investment.

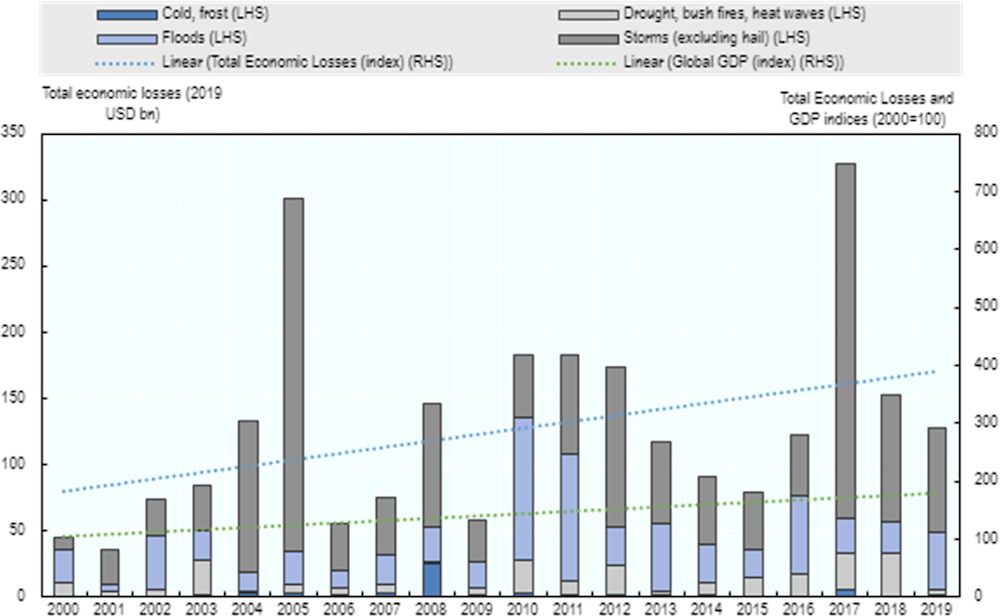

Box 3.1. Historic losses from weather-related catastrophes

Data from Swiss Re’s sigma database indicate that losses from weather-related catastrophes have been increasing at a faster rate than global gross domestic product (GDP). This is consistent with an increase in weather-related hazards – such as drought, floods and wildfires – driven by climate change. The trend is also influenced by improvements in reporting and increases in the value of the assets located in exposed areas. Annual average economic losses from weather-related catastrophes were more than 200% higher in 2015‑19 than in 2000‑04 (in constant dollars).

Figure 3.1. Economic losses from weather-related catastrophes

Note: This figure shows reported total economic losses resulting from weather-related catastrophes for all countries between 2000 and 2019 (LHS, in constant 2019 USD billion), as well as the trend in total losses and trend in global GDP (RHS, trend line based on an index with 2000=100).

Source: OECD calculations based on loss data provided by Swiss Re sigma and GDP data reported in the IMF World Economic Outlook database (Swiss Re, 2020[4]).

There are two critical elements to the climate-resilient infrastructure financing challenge1:

Making climate resilience the norm for all new infrastructure investments: targeted, early action to mainstream climate resilience into infrastructure projects adds an average of 3% to total project costs (Hallegatte, Rentschler and Rozenberg, 2019[1]). As such, this challenge is predominantly about mainstreaming climate resilience into business-as-usual finance flows and decision making rather than the total volume of finance required.

Investing in infrastructure that targets climate resilience: additional infrastructure investments will be required to address climate impacts. This includes construction of protective infrastructure such as flood defences. It also includes new investments to address weaknesses in existing infrastructure systems, such as burying transmission lines or adding redundancy to transport networks. Additional finance will be needed for these investments.

Integrating climate resilience into infrastructure assets influences the business case for investing in those assets. This is context specific, but generally there is a trade-off between capital costs and revenues. Integrating climate resilience can (modestly) increase capital costs, but it should lead to more reliable revenues, lower maintenance requirements, lower risk and potentially higher co-benefits. However, the capital costs are visible, while the benefits will materialise over time. As a result, these benefits are not fully valued in public and private decision making. Consequently, investment in resilience looks like a cost to be minimised rather than a source of value to be realised.

Unlocking finance for climate-resilient infrastructure will require understanding the value of enhanced resilience (the “climate resilience dividend”). This value needs to be reflected in investment decisions. Furthermore, financial structures must match the needs of potential investors, which could be a particular challenge in emerging and developing markets.

This chapter highlights the need to enable finance to flow to investments in climate-resilient infrastructure:

Strengthen key areas of the enabling environment to help capture the resilience dividend within public and private investment and hence support finance flows at the project level through better risk awareness.

Implement a strategic approach to understand how climate risks will affect infrastructure systems, determining priorities and then building resilience into investment pipelines.

Harness finance and funding sources for climate-resilient infrastructure.

3.2. Overview of finance flows for climate-resilient infrastructure

Increasing finance for climate-resilient infrastructure fits within the broader challenge of filling the infrastructure finance gap (see Box 3.2). Trillions of dollars of additional investment will be required every year for infrastructure investment: there are widespread needs to replace and retrofit ageing infrastructure, in particular. Developing countries have an urgent need to expand access to infrastructure services, such as clean water and electricity, to support progress towards the Sustainable Development Goals (SDGs). This can be particularly challenging in low-income countries that face climate-related disasters (see Chapter 5).

A key driver of infrastructure investment needs is the transition to net zero. The transition will require significant increases and reallocation of investments to decarbonise key infrastructure sectors. This includes large-scale rollout of renewables and electrification of the transport sector. The OECD report Investing in Climate, Investing in Growth (2017) estimated that USD 6.9 trillion of investment in infrastructure is required annually on average between 2016 and 2030 to meet development and climate needs globally. More recent analysis has estimated the transition to clean energy alone will require USD 4.5 trillion of investment per year by the early 2030s (IEA, 2023[5]).

Box 3.2. Mobilising institutional investment for infrastructure

Mobilising private investment will be critical for filling the overall infrastructure finance gap, given the scale of financing needs and continuing pressures on public budgets. Institutional investors have been identified as a key finance source for two key reasons: the scale of assets under management (estimated at USD 53 trillion in 2022 for pension assets) (OECD, 2023[6]) and the potential for matching long-term infrastructure assets to long-term liabilities. Institutional investors surveyed by the OECD with approximately USD 9.8 trillion of assets under management in 2022 allocated USD 302.6 billion (representing 3%) to infrastructure investments (OECD, 2024[7]).

The following areas have been identified for unlocking this potential:

Increase standardisation, where feasible, in terms of contractual terms, data, technical specifications, etc.

Bundle infrastructure investments to match investor needs.

Improve the enabling environment for investment in infrastructure, including capacity, strong institutions and having an independent judicial system.

Develop market for infrastructure through government development of project pipelines and more predictable policy.

Examine the risk allocation and risk sharing between public and private sectors to ensure investable projects. In developing countries, use blended finance instruments to match the risk and return expectations of institutional investors.

There is no recent, comprehensive and global dataset on infrastructure finance flows. One study estimated that global infrastructure investment was USD 2.3 trillion in 2015 (Global Infrastructure Hub, 2017[10]). In 2022, G20 governments budgeted USD 978 million for infrastructure investment, which is around 1% of GDP. The private sector invested a further USD 424 billion in infrastructure projects globally, allocating 71% of tracked private funding to projects in high-income countries. A third source of finance is corporate private investment in infrastructure, such as private utilities financing projects from their own balance sheet. Corporate finance exceeds project finance in some sectors, but there are no data available on overall trends. Based on the data available, global infrastructure investment likely remains below required levels, as bankable projects are not sufficiently developed, especially in emerging economies and developing countries. A business case is needed to increase the flow of private finance towards climate resilience.

The Climate Policy Initiative (CPI) examined the extent to which finance flows for infrastructure were consistent with five principles of climate resilience (e.g. ensuring physical climate risk assessments inform project design) (CPI, 2022[11]). These principles build on Mullan and Ranger (2022[12]) and are aligned with the approach of this report (Chapter 1). The CPI analysis found that USD 31 billion of infrastructure finance went towards climate-resilient projects in 2019/20, accounting for a small fraction of overall infrastructure investment. At a city level, similar analysis has found that only 9% of total urban climate finance was committed to climate adaptation, with the remainder targeted at mitigation (CCFLA, 2021[13])(Chapter 6).

These estimated flows for climate-resilient infrastructure are a fraction of overall needs. Hallegatte, Rentschler and Rozenberg (2019[1]) estimate mainstreaming climate resilience increases the costs of infrastructure projects by 3%. Applying this increase to the estimated USD 6.9 trillion required for total infrastructure investment (OECD/The World Bank/UN Environment, 2018[14]) would equate to USD 207 billion per year. In addition, financing additional infrastructure towards weather-related disasters, such as flood defences, and addressing existing infrastructure assets are likely to generate significant costs. For example, upgrades to flood protection in London alone are estimated at USD 20 billion over the course of this century (DEFRA and EnvAgency, 2023[15]).

3.3. Mainstreaming climate resilience into infrastructure finance

For an infrastructure project to be financially viable, projected revenues need to cover operating costs (OPEX) and provide a return on investment for the capital expenditure (CAPEX) commensurate with the risk. The attractiveness of an investment is therefore enhanced by shorter lead times before operation, lower CAPEX, lower OPEX, lower risk and/or higher projected revenues.

This consideration applies to publicly funded infrastructure too. However, public projects are usually assessed based on their expected social costs and benefits over the lifetime of the asset. This is the case even if the benefits do not directly accrue to the government. For example, public investment in flood defences is partly justified based on the expected reductions in flood damage over time, even where those benefits accrue predominantly to property owners. As with privately financed infrastructure, increases in expected social benefits and/or reductions in upfront costs will improve the viability of a project.

Figure 3.2 shows how these factors can affect the cash flow of infrastructure assets by strengthening climate resilience over the life cycle of an asset. Initial preparatory work to understand vulnerability to climate risks and develop adaptation options can increase upfront costs. This, in turn, could increase project timelines. Longer timelines decrease the expected return from the project. However, these upfront costs should be more than offset by more reliable future cash flows. Revenues will be more predictable as there is less likelihood of unanticipated disruption and lower economic losses. Revenues may also be higher if the perception of increased reliability and lower risks lead to increased demand relative to alternatives. Climate-resilient infrastructure should also be at less risk of damage or premature obsolescence due to future climate change impacts. In principle, this reduction in risk should result in lower financing costs and/or lower insurance premiums towards damages over the life cycle of the infrastructure asset.

Figure 3.2. Stylised impact of climate resilience on project cashflow

Source: Build Resilience to Unlock Investment (Mott MacDonald, n.d.[16]) https://www.mottmac.com/views/build-resilience-to-unlock-investment#:~:text=Our%20methodology%20helps%20to%20quantify,the%20resilience%20of%20their%20infrastructure.

However, consideration of climate resilience remains the exception rather than standard practice (OECD, 2018[17]; CPI, 2022[11]). As a key underlying challenge, decision makers in the public and private sectors do not consistently consider physical2 risks. As such, there is no incentive to invest upfront when the benefits of those investments are not perceived as relevant. This perception can be due to a lack of capacity and awareness to understand and manage climate risks. The benefits of increased resilience may also not translate into cashflow due to weaknesses in the enabling environment and insufficient data on the business case for investing in climate resilience. Such weaknesses can include insufficient regulation, inappropriate design codes and moral hazard arising from the expectation of government bailouts if a climate-related disaster occurs. Other weaknesses are transition risks due to changing demand and supply patterns from climate change.

Examples of good practices from across the OECD demonstrate how to strengthen the enabling environment to help make climate resilience the norm. These practices target the barriers that prevent investment decisions from considering the economic benefits of climate resilience. They also provide incentives to support greater investment. The following four areas will be critical for driving increased finance flows for climate-resilient infrastructure: promoting transparency and awareness, mainstreaming climate resilience into public funding, examining regulation of privately owned infrastructure and examining risk financing arrangements.

3.3.1. Increasing transparency and awareness of climate-related risks in investment decisions

Increased transparency on climate-related risks will help investment decisions integrate physical climate risks and potential future costs, providing a market signal to better manage relevant risks. A general lack of awareness of these risks can be material to investors, due to the perceived complexity of those risks and the lack of comparable data and metrics. The following tools and mechanisms can help address these challenges.

Disclosure

Requirements on infrastructure operators to disclose climate-related risks have been used to raise awareness within organisations, while also helping efforts to understand interdependencies between infrastructure networks. In the United Kingdom, the Climate Change Act includes the Adaptation Reporting Power, which requires utility companies to assess risk and publish how they intend to manage those risks. An evaluation of the most recent round of reports found the quality was generally high. There was evidence it was leading to increased preparedness in the infrastructure sector (CCC, 2022[18]).

Broader efforts within the financial sector to disclose climate-related risks should also provide an impetus to make physical climate risk visible. One study found that physical climate risks could reduce the net asset value of infrastructure portfolios by an average of 4%, and 27% in a worst-case scenario (EDHECInfra, 2023[19]). The Task Force on Climate-related Financial Disclosure (TCFD) recommendations provided a voluntary basis for reporting (TCFD, 2021[20]). These have informed the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards, which are intended to be integrated into regulatory frameworks across jurisdictions. As the standards focus on financially material information, they would cover infrastructure-related risks (insofar as they are expected to be financially material). The EU European Sustainability Reporting Standards have a broader perspective. They also cover the impact on the environment (“double materiality”) and a broader set of environmental, social and governance factors.

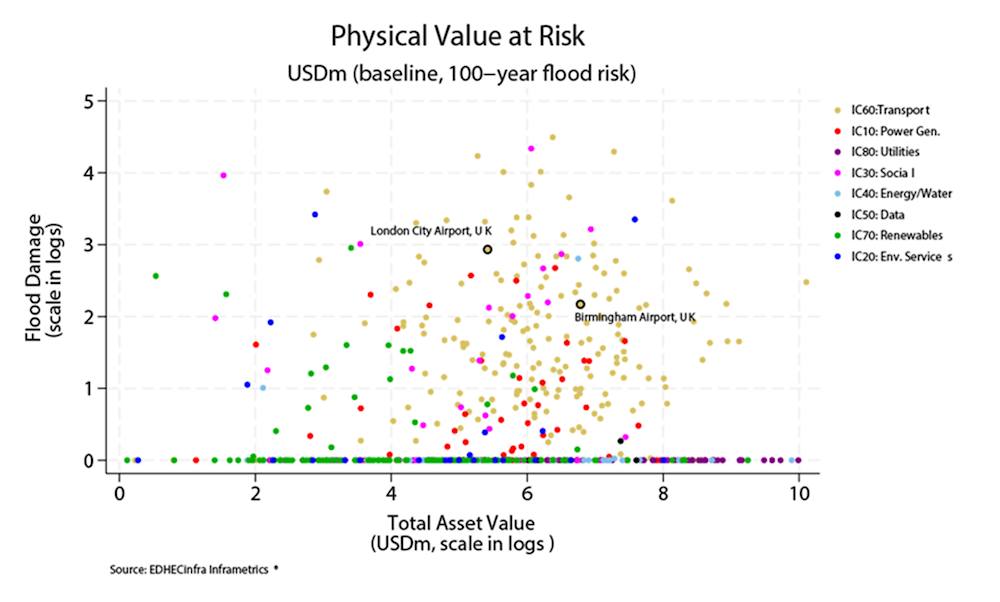

Box 3.3. Infrastructure asset values and physical climate risk

EDHECInfra has modelled the potential exposure of infrastructure assets to physical climate risks (storms, floods and cyclones). This analysis shows that risk exposure varies significantly across infrastructure assets, but the transport sector is particularly exposed to flood risk.

Figure 3.3. Exposure to physical climate risk by asset value of infrastructure sectors

Source: It’s getting physical: Some investors in infrastructure could lose more than half of their portfolio to physical climate risks by 2050 (EDHECInfra, 2023[21]) https://edhec.infrastructure.institute/wp-content/uploads/2023/07/p1102.pdf

Most listed companies carry out sustainability reporting. This is not standardised in most cases but includes elements of climate resilience. In many cases, it reflects TCFD recommendations. Climate resilience can be informed through governance, strategy and risk management of the TCFD recommendations. Critically, it requests organisations to disclose their processes for identifying, assessing and managing climate risk (TCFD, 2021[22]). Such sustainability reporting provides important disclosure of an organisation’s level of engagement and management of climate risk. Applying such reporting to infrastructure assets would support improved reporting on climate resilience.

Further action would help translate these disclosure requirements into greater visibility of physical climate risk. An analysis of reports under the TCFD found that less than half covered physical climate risks. Furthermore, they tended to treat risks only partially, covering a subset of potential climate hazards. Disclosures were not readily comparable between institutions due to different metrics and assumptions (Zhou and Smith, 2022[23]). Addressing these gaps will require common metrics and assumptions, building on work already undertaken (EBRD and GCECA, 2018[24]). It will also require efforts to provide underlying data and information on climate-related hazards, such as regularly updated hazard maps.

Standards, labels and taxonomies

Robust analysis of the exposure of infrastructure assets to physical climate risks is a crucial element for mainstreaming climate resilience into infrastructure finance. A growing ecosystem of private data providers has emerged to help make risk visible in investment decisions. However, recent analysis has found that results from different providers are inconsistent, even when using the same analytical approach (Hain, Kölbel and Leippold, 2022[25]). Efforts to facilitate the sharing of data and best practice methodologies would facilitate better understanding and consistency in the analysis of climate risk over time.

The Physical Climate Risk Assessment Methodology (PCRAM) provides a common approach for analysing the impact of physical climate risks on infrastructure investments (Mott MacDonald, n.d.[16]). This approach is also intended to provide a common language for discussing physical climate risks between the infrastructure and financial sectors. PCRAM translates physical climate risks and adaptation measures into key performance indicators, such as (financial) internal rate of return and life cycle costs, across possible future scenarios. The Institutional Investors Group on Climate Change is further developing PCRAM.

Infrastructure standards and labels also have a critical role in making the resilient dividend visible. Standards that integrate climate resilience provide a signal that climate risks have been identified and managed. In so doing, they provide a means for operationalising resilience requirements within contracting processes. However, further efforts are required to mainstream climate resilience across standards covering the infrastructure life cycle (Cançado and Mullan, 2020[26]). As an encouraging sign, resilience is being integrated into two major initiatives to improve the quality of infrastructure investments: the Blue Dot Network (strengthening resilience is a core motivation behind its development) and FAST-Infra (adaptation and resilience is one of its four pillars of sustainability). Moreover, resilience is considered in sustainability standards that regulate the issuance and subscription of various capital market instruments from which infrastructure projects receive financing (Box 3.4).

Green finance taxonomies provide a positive signal for investment in climate-resilient infrastructure. The EU Taxonomy for Sustainable Activities provides criteria by which investments, including infrastructure, can be identified as contributing significantly to climate change adaptation. The base requirement is to identify and address climate risks, while also encouraging use of Nature-based Solutions (NbS) or green-blue infrastructure.

Box 3.4. Improving climate resilience of infrastructure through standards and guidelines of GSS bonds

Standards and taxonomies that bring forward climate resilience in infrastructure finance can be further mainstreamed through their application in sustainable bonds issuance. Debt markets use a growing number of guidelines to regulate the issuance and subscription of bonds that achieve green and social objectives, including climate adaptation and resilience. For instance, green, social and sustainability (GSS) bonds allow investors to contribute to the green transition, as well as social causes, by using the proceeds of bonds to finance eligible projects. The sustainable debt market has grown substantially in the last 15 years, reaching in 2023 H1 a total of USD 4.2 trillion of issuance to date, with green bonds accounting for most issuances.

In the framework of these bonds, issuers employ standards and guidelines to ensure sound green and/or social credentials of financed projects. Private sector issuance standards include the International Capital Market Association (ICMA) Sustainable Finance Principles and Guidelines for green and social bonds, and the Climate Bonds Initiative (CBI) Climate Bonds Standard and Certification for green bonds. Such voluntary guidance aims at defining the nature, scope and characteristics of GSS instruments. In so doing, it sets a framework for the identification, financing, monitoring and impact reporting of eligible projects that receive the proceeds of GSS bonds.

Both ICMA and CBI green bond standards classify adaptation and resilience-related activities through dedicated eligible project categories, even though underlying definitions are not as standardised. Establishing standardised guiding principles and taxonomies in climate resilience and adaptation funding is crucial; they help define eligible projects and ensure comparability for investors. Moreover, standards need to be linked to finance to enable effective allocation of funds to projects with maximum resilience and adaptation benefits. This, in turn, facilitates transparent tracking of progress and fostering collaboration among stakeholders.

Sustainable infrastructure as an asset class can be at the core of various projects that receive funding through GSS bonds issuance. By definition, sustainable infrastructure covers multiple eligible project categories in terms of applicability of labels. This is true especially in climate adaptation and resilience project categories where the characteristics of these projects match with adaptation and resilience definitions employed by private sector standards for use-of-proceeds bonds.

In general, using standards and taxonomies related to climate resilience in financial markets applications might benefit both the financing mechanisms and the standards themselves. With respect to financing mechanisms, the standards and taxonomies have a strong sustainability component. Meanwhile, using them in a financing application might increase their development, focus and applicability.

Source: Sustainable Debt Market Summary H1 2023 (Climate Bonds Initiative, 2023[27])https://www.climatebonds.net/files/reports/cbi_susdebtsum_h12023_01b.pdf .

Applying mandatory climate risk screening provides a further tool for identifying and managing climate-related risks. A critical tool for governments is the application of climate risk screening within Strategic Environmental Assessment (SEA) and environmental impact assessment (EIA) processes. Lending institutions have also adopted risk screening to manage their exposure to climate-related risks. For example, the European Investment Bank screens all its financed projects to make sure they are adapted to climate change.

3.3.2. Mainstreaming climate resilience into public funding

Public funding arrangements for infrastructure may need to be revised to ensure they are conducive to the mainstreaming of climate resilience into infrastructure finance. Critical areas for achieving this include budget allocations, project appraisals and procurement.

Climate change will affect budgetary needs for infrastructure. The role of the budget process in supporting climate resilience is not systematically considered. Moreover, there is a lack of data on how well budgetary processes and outcomes align to climate resilience (Mullan and Ranger, 2022[12]). Consequently, infrastructure may be provided at the lowest upfront cost rather than maximising net benefits over the lifetime of the asset. There can also be distortions if different institutions share funding responsibilities. For example, the European Structural and Investment Funds cover capital costs, but regional and local authorities cover operations (See Chapter 6). Green budgeting approaches are not yet widespread. However, governments are exploring such approaches to support the more effective allocation of public resources towards green priorities. The Region of Brittany (France) and the City of Venice (Italy) provide two examples (OECD, 2022[28]).

Public sector approaches for project appraisal and procurement should consider the performance of projects over their entire life cycle, including the effects of climate change. For example, the United Kingdom has developed supplementary guidance for integrating climate change adaptation into policy appraisal decisions, including methods for accounting for uncertainty (HM Treasury, 2023[29]). A growing number of OECD countries, including EU member states, Japan and the United States, have adopted life cycle costing within their procurement frameworks. Procurement processes can also facilitate innovation by specifying performance standards rather than requiring use of specific technologies or approaches. The use of standards (discussed above) can be used to identify relevant performance standards.

Public-private partnerships (PPPs) are long-term contracts in which the private sector delivers and funds public infrastructure, sharing the associated risks (OECD, n.d.[30]). The success of PPPs in delivering climate-resilient infrastructure depends crucially on how climate-related risks are allocated within the contract. Failures to adequately define risks in advance, misallocation of risks and differences between the de facto and de jure allocation of risk have all been found to undermine resilience (OECD, 2018[17]). Efforts to build capacity for climate-resilient PPPs are under way. For example, the Global Centre on Adaptation developed a training course and certification on this theme for infrastructure practitioners (GCA, n.d.[31]). The World Bank’s PPP Legal Resource Centre provides an inventory of resources for designing and implementing climate-resilient PPPs. In any of these efforts, an open and competitive procurement of projects and anti-corruption measures will be essential to ensure a robust foundation for infrastructure development.

3.3.3. Economic regulation of privately owned Infrastructure

Many OECD countries have natural infrastructure monopolies – such as water supply and sanitation networks, or electricity distribution – that are owned, provided and managed by private utility companies. Given their monopoly position, these private utilities are subject to economic regulation of service standards and price levels. This has been the usual model in the United States and increasingly common in OECD countries since the wave of privatisations in the 1980s and 1990s.

The incentive and ability of regulated utilities to invest in climate-resilient infrastructure will depend upon the regulatory regime that governs them. Typically, these regulatory models aim to balance service quality and price, while allowing investors to earn a reasonable return. For example, in the United States, state Public Utility Commissions determine prices, allowable investments and service standards for privately owned utilities that provide electricity, gas, telecoms and water (Monast, 2021[32]).

Several aspects of utility regulation can be involved to mainstream climate resilience into investment decisions depending on the specific regime. In the United Kingdom, for example, the water regulator has an explicit objective to “deliver a resilient water sector”, which is then reflected in its operations.

The following elements of the regulatory framework could be examined to support investment by regulated utilities in climate-resilient infrastructure:

Allowable investments: ensure that rules determining whether investments are reasonable account for the value of increased climate resilience.

Performance standards: determine whether rules are suitable for a changing climate, both in terms of risks to infrastructure provision (e.g. loss of service) and also risks from infrastructure provision (e.g. failures of dams or wildfires from electricity distribution networks).

Additional requirements: regulators can also support efforts to make physical climate risks visible through requirements to undertake stress tests, identify interdependencies and develop adaptation plans.

As with other aspects of regulatory policy, there is a need to balance competing objectives such as between affordability and reliability. The risk-based approach (outlined in Chapter 1) provides a basis for making trade-offs and communicating clear expectations, objectives and targets to guide investment decisions.

3.3.4. Ensuring risk finance and risk-sharing arrangements provide incentive for risk management and enable rapid recovery

The allocation of climate-related risks, both contractually and in practice, provides a critical driver for investments in climate resilience. These risks include damage to infrastructure assets from climate extremes, loss of service (e.g. power cuts) and premature obsolescence of assets that were not designed to account for climate change. Unclear or misallocated risks can generate moral hazard, reducing the incentive to invest in adaptation and exacerbating the cost of climate extremes by delaying reconstruction. These can represent contingent liabilities for governments, even if the infrastructure is privately owned. The OECD Recommendation on Building Financial Resilience to Disaster Risks outlines best practices for managing the financial consequences of extreme events.

The appropriate model for allocating risks between parties will be context specific. The OECD’s Principles for Private Sector Participation in Infrastructure (OECD, 2007[33]) reiterate the general principle that risks should be allocated to the party best able to assess and manage those risks. In the context of climate resilience, this implies that relevant risks should be identified and clearly allocated through contractual and legal provisions. The legal allocation of risk should align with the ability of different parties to bear the risks. For example, following severe flooding in Colombia in 2010/11, the government strengthened requirements for infrastructure concessionaires to secure adequate insurance coverage for extreme events (OECD, 2014[34]).

Box 3.5. Insurance for public assets

Governments (national or subnational) could acquire indemnity-based property insurance coverage from private insurance markets to protect against damages to publicly-owned infrastructure assets (and other public assets). In some cases, ministries responsible for managing public assets are required or encouraged to purchase adequate insurance coverage from private markets (e.g., Colombia, Viet Nam).

In a few countries, a public insurance arrangement has been established to provide insurance coverage for publicly-owned assets, including infrastructure assets. In Australia, Comcover insures the public assets of the federal government and collects premiums from the ministries responsible for those assets. A number of state governments in Australia have established similar arrangements. In the Philippines, a public insurer (Government Service Insurance Service (GSIS)) provides insurance coverage for all public properties owned by both national and local levels of government. All government agencies and government-controlled operations are required to acquire insurance for their assets from GSIS. GSIS transfers some of the risks that it has assumed to international reinsurance markets. In Iceland and France, programmes established to support the availability of insurance for natural hazard (and other disaster) risks provide coverage for publicly-owned assets (including infrastructure assets) as well (in Iceland, the acquisition of this coverage by public asset owners is mandatory).

Many governments (implicitly) self-insure these risks. To that end, they do not make any ex ante arrangements to manage the financial impacts of climate-related catastrophes on public assets (i.e. any damage or losses are funded using budgetary tools or ex post debt financing). The transfer of public infrastructure risks to private insurance or reinsurance markets will be most beneficial for countries that face constraints in fiscal capacity or access to debt markets as post-disaster reconstruction of public infrastructure can entail significant costs that, if uninsured, would have to be borne by the public sector. Public insurance arrangements that pool public asset risks could allow for countries to achieve greater risk diversification prior to transferring those risks to private reinsurance markets, which should result in reduced insurance costs.

Source: Building Financial Resilience to Climate Impacts: A Framework for Governments to Manage the Risks of Losses and Damages: (OECD, 2022[35]) https://doi.org/10.1787/9e2e1412-en

The insurance sector plays a critical role in enhancing the efficient management of climate-related risks and encouraging climate resilience in various ways.3 Most obviously, the acquisition of insurance coverage by private or public owners of infrastructure assets provides, in exchange for a premium, a source of funding to respond to any damages and losses from a storm, flood or other weather-related catastrophe (Box 3.5). Quick access to funding can support speedier rehabilitation of damaged infrastructure assets. It can also reduce the level of service disruption (and income loss in the case of revenue-generating assets). For example, cities in the Philippines are buying parametric insurance through a joint insurance pool to reduce insurance costs and ensure rapid disbursement of pay-outs following disasters (Box 3.6).

Box 3.6. Philippine City Disaster Insurance Pool

The Philippines sits in one of the world’s most disaster-prone areas, exposed to many climate hazards such as typhoons, floods and droughts. In the wake of disasters, funding is needed for humanitarian response and rebuilding for greater resilience. While Philippine cities have access to disaster recovery funds, mobilising funding quickly can be a challenge. Delays in early recovery measures can hurt short-term well-being and long-term recovery.

With technical assistance from the Asian Development Bank (ADB), the Philippine Department of Finance developed the Philippine City Disaster Insurance Pool (PCDIP) to provide rapid post-disaster pay-outs for local governments. It enables city governments to jointly buy insurance through a single platform. This reduces the price of premiums by sharing risk, sharing set-up costs, increasing funding stability and reducing capitalisation requirements. Capitalised by an ADB loan, the PCDIP is tailored to the specific needs and capacities of city governments to deliver timely payments and build financial sustainability in the long run. The PCDIP also operates as a platform for knowledge sharing and capacity building.

The insurance works as follows:

An external provider provides risk modelling to set each city’s premiums.

City governments buy parametric insurance based on the type of natural hazards they perceive as a threat. They select the frequency and preferred size of pay-outs, given the funding available for premium payments. Parametric insurance allows for more rapid disbursement than traditional non-parametric insurance. It pays out based on physical features of the disaster (such as wind speed) rather than damages suffered (which can take more time to determine).

Once a disaster strikes, an independent scientific agency verifies the parameters driving pay-outs. Pay-outs can be expected in no more than 15 business days of qualifying disaster events.

A pilot consisting of ten cities is under way, the first such scheme in Southeast Asia. The increased predictability of and access to pay-outs is expected to boost cities’ fiscal resilience and create more fiscal headspace for post-disaster response and recovery.

Source: G20/OECD Report on the Collaboration with Institutional Investors and Asset Managers on Infrastructure: Investor Proposals and the Way Forward (OECD, 2020[9]) https://web-archive.oecd.org/2020-07-24/560068-Collaboration-with-Institutional-Investors-and-Asset-Managers-on-Infrastructure.pdf

The insurance sector also has significant expertise in risk assessment and risk management that can be transferred through the process of acquiring insurance. The purchase of insurance coverage will normally involve an assessment of climate (and other) risks to the asset. It will also advise on how infrastructure operators can mitigate that risk through investments in adaptation and risk reduction.

Insurance can have a critical role in pricing climate-related risks. The premium charged for insurance coverage usually reflects the risk level. As such, it can provide an incentive for infrastructure operators to invest in risk reduction to benefit from reduced premiums. Insurance is one among many approaches to funding rehabilitation of damaged infrastructure. Some infrastructure operators (public and private) may choose to manage those costs through self-insurance (including savings or reserves) or risk financing (loans and debt).

3.4. Mobilising additional finance for resilient infrastructure systems

The scale and severity of climate change impacts will shape demands and needs for infrastructure services. There is thus a need to not only make all infrastructure assets climate-resilient, but also mobilise additional finance to meet these changing needs and demands. For example, changes in tourism patterns driven by climate will shape demands for transport links. Increased drought risk will require packages of measures that could include increased storage capacity, reclaiming water, demand-reduction management practices and renovation of pipes to reduce leakages. Mainstreaming resilience at the project level is necessary but not sufficient to achieve the needed transformation and awareness towards the risk. This section explores opportunities to shape and deliver a strategic approach to unlocking both public and private finance for the additional investments needed to achieve climate-resilient infrastructure services.

3.4.1. Developing a pipeline of investable projects

Strong infrastructure planning processes (see Chapters 2 and 6) provide the foundation for identifying needs arising from a changing climate. In the Netherlands, for example, the Delta Programme identified the need to strengthen 1 500 km of flood defences by 2050 as part of a broader package of measures (Ministry of Infrastructure and Water Management, 2023[36]). In Paris (France), the local authority identified measures to address the consequences of increasingly severe and frequent heatwaves. This, in turn, identified the potential for NbS to reduce urban temperatures (Ville de Paris, 2023[37]) (see Chapters 4 and 6).

Overall, strategic planning should be strengthened and linked to the development of pipelines of bankable projects. In Ghana, the Global Centre on Adaptation’s National Infrastructure Investment Pipelines process brought in expertise from multilateral development banks (MDBs) at the outset. This ensured that results would be useful for building a project pipeline. In the United Kingdom, the National Infrastructure Commission has integrated resilience into its regular assessments of the country’s infrastructure needs (NIC, 2023[38]). In general, infrastructure pipelines should be integrated into broader development plans at the relevant spatial levels (see Chapters 5 and 6).

Integrating climate resilience from the outset of the infrastructure planning process increases flexibility to identify possible needs for climate-resilient infrastructure. As such, this can facilitate implementation of innovative or cross-cutting approaches, such as NbS. It can also help mainstream climate resilience at the project level. This is possible because these processes can make use of the data and information gathered during planning rather than having to start with a blank sheet for each project.

The specific challenges faced by developing countries in mobilising private sector finance are explored further in Chapter 5.

Technical assistance for project preparation

Translating plans for new infrastructure into bankable projects can be lengthy, complex and uncertain. However, this process is at the crux of addressing the infrastructure investment gap, especially in emerging economies and developing countries. This can be particularly the case for climate-resilient infrastructure, given the need to incorporate climate data into project design. Technical and/or financial support, including for project preparation facilities, reduces the risk of projects being stuck on the drawing board. As such, it also helps generate a pipeline of bankable projects. In addition, it provides an opportunity to integrate climate resilience from the outset of the project development, when there is generally more flexibility to make changes.

Governments can support development of financially viable infrastructure investments through technical assistance and guidance for project developers. For example, the United States Environmental Protection Agency hosts the Water Infrastructure and Resiliency Finance Center, which helps local communities to identify and implement options for financing resilient infrastructure. This initiative includes networking between local authorities, and providing training and links to potential funding mechanisms (see also Chapter 6).

Scaling up the resources and effectiveness of project preparation facilities would help drive increased investment flows for climate-resilient infrastructure (IEG, 2023[39]). For example, the Global Infrastructure Facility supports preparation of projects that deliver development impact. The Facility, instigated by the G20, has financial support from seven countries and the World Bank. It partners with developing country governments and MDBs to cover infrastructure planning, as well as project definition, structuring and procurement. It is committed to ensuring that supported projects are aligned with climate change objectives (GIF, 2023[40]).

Currently, most MDBs have project preparation facilities that support sustainable infrastructure and address green transition ambitions, including climate resilience.

3.4.2. Structuring financial products for climate-resilient infrastructure

Expanding use of green/resilience bonds

Green, social and sustainability (GSS) bonds are financial products that enable investors to channel financing towards the achievement of sustainability objectives, while also ensuring stable financial returns (Box 3.7). These instruments are well established in financial markets, having gained substantial trading volume within the last decade due to high market preference.

GSS bonds finance sustainable activities by employing proceeds to fund infrastructure projects that achieve positive green and/or social impacts. Among GSS bonds, green bonds hold the largest issuance and subscription shares by representing almost 85% of the GSS bonds market (Luxembourg Stock Exchange, 2023[41]). They fund projects that range from climate change mitigation to biodiversity conservation. The popularity of GSS bonds has been growing over the past decade, given that they provide a ready investment opportunity into sustainable finance.

Adaptation and resilience projects are generally eligible for green bond financing but are not used as frequently as their mitigation counterparts. One analysis found that only 4% of green bond issuance (by value) was linked to adaptation (Munday, Bullock and McMahon, 2023[42]). In a different analysis, 13% of GSS bonds and 23% of issuers screened by the Climate Bonds Initiative in 2022 had some degree of resilience-related use-of-proceeds (CSI, 2022[43]).

Expanding use of green bonds will require addressing the limited knowledge and capacity to assess climate risk and identify eligible projects. Screening criteria for resilience-related activities are high level, complicating identification of eligible projects. Moreover, even when resilience projects are identified, they often do not reach the minimum bond issuance size required by investors. They may also be issued in soft currencies, which do not match investors’ preferences (GCA, 2021[44]). These challenges can be especially acute for subnational governments that may have constraints on borrowing, and lower technical and financial capacity (see Chapter 6).

Blue bonds provide another potential instrument for financing climate-resilient infrastructure. These bonds – which are one possible type of adaptation bond – fund projects and initiatives that promote sustainable marine and ocean-related conservation activities. Within this bond category, sovereign entities are among the most active issuers, funding various projects to strengthen marine conservation and resilience. Climate-resilient infrastructure projects can receive funding from blue bonds, provided they comply with standards and taxonomies used by issuers to screen the eligibility of projects (see Box 3.7).

Box 3.7. Cases of adaptation, resilience and blue bonds that could inform climate resilience of infrastructure assets

Seychelles sovereign blue bond

The Republic of Seychelles launched in 2018 the world’s first sovereign blue bond in 2018. It is , designed to demonstrate the potential for this type of instrument to support sustainable marine and fisheries projects in the country. The bond’s issuance, raising USD 15 million and with a ten-years maturity, was supported by the World Bank Treasury, which provided a USD 5 million World Bank partial credit guarantee.

Proceeds from the bond financed the expansion of marine protected areas, and improved governance of priority fisheries and the development of the Seychelles’ blue economy. The bond fell, under the sector categories of terrestrial and aquatic biodiversity conservation, and environmentally sustainable management of living natural resources and land use.

The bond is not issued in accordance with any issuance framework and does not comply with international private sector standards for GSS bonds issuance. However, it makes use of internationally recognised schemes and practices for sustainable fisheries.

The Netherlands’ green bonds and blue projects

The Netherlands’ sole green bond was issued in 2019 and raised EUR 15.6 billion. It focuses on climate change adaptation, one of the pillars of the country’s environmental strategy in the context of both national and international initiatives. The bond holds the CBI Certification Mark.

The related green bond framework aligns with the proposed EU taxonomy criteria regarding flood risk prevention and protection, and Nature-based Solutions for flood- and drought-risk prevention and protection. In addition, it addresses the applicable “do no significant harm” criteria and minimum social safeguards on a best-efforts basis.

Some financed projects can be defined as “blue” since they are part of the Delta Programme. This programme ensures that flood risk management, freshwater supply and spatial planning will be climate-proof and water resilient by 2050.

Expenditures include reinforcing flood defence infrastructure, monitoring and management of water levels, water distribution infrastructure and related measures to anticipate on higher water levels. These are consistent with SDGs 6 and 13, and with the EU taxonomy environmental objectives of climate change adaptation and sustainable use and protection of water and marine resources.

Fiji sovereign adaptation bond

In 2017, Fiji became the first developing economy to issue a sovereign green bond (USD 19.5 million). The related framework was developed in compliance with the ICMA Green Bond Principles. It considered eligible use-of-proceeds such as resilience to climate change, water efficiency and sustainable management of natural resources, among others.

In practice, 91% of proceeds were allocated to climate adaptation activities. Financed projects tackled construction and renewal of water collection, treatment and supply infrastructure, forest management and afforestation, among others.

The issuance of such a bond created a business case for climate change adaptation. In a developing economy, it is hard to mobilise the private sector to collect large-scale financing.

Blending public finance to support private investment

The strategic use of public resources can be used to improve the risk-return profile for infrastructure investments. This can take the form of government guarantees, equity stakes and concessional debt finance. For developing countries, this includes blended finance, which is defined by OECD as “the strategic use of development finance for the mobilisation of additional finance towards sustainable development in developing countries” (OECD, n.d.[49]). Blended finance is primarily made available by MDBs and donors. While it contributes to basic development, it also looks to establish the market foundations that will eventually attract private investors (Migliorati, 2020[50]). Blended finance focuses on achieving development and impact through mobilisation of private capital. It is considered catalytic because, by mobilising capital, it creates a direct causality that unlocks further mobilisation and potential investment (OECD, 2018[51]).

In OECD countries, governments use tools such as guarantees to make investing in domestic infrastructure more appealing for private investors and to support subnational governments’ access to finance (see Chapter 6). For example, the UK Infrastructure Bank administers government guarantees to qualifying projects to mobilise private finance. It also provides access to other concessional finance for private sector and local authorities.

At the international level, initiatives such as the Private Infrastructure Development Group (PIDG) can enable blended financing to be more systematically mobilised. In other words, it links donor funding more directly to private sector capital mobilisation. The latest annual strategy for PIDG commits to only funding infrastructure projects that contribute to climate adaptation, resilience and/or mitigation (PIDG, 2023[52]).

When early adaptation goals and implementation efforts accompany private sector financing, blended finance can be effective to ensure adaptation is well supported. In particular, it can be used as an incentive to mainstream adaptation elements into project development. For this, early engagement is key, including identification of the types of financial structures to be used.

Grants can be used to support integration of adaptation into early stages of projects, and also improve the return for climate-resilient infrastructure. To that end, it could provide funding for feasibility studies or early-stage adaptation when cash flow can be uncertain. Private financing will be protected by a junior tranche from concessional finance and a mezzanine tranche from concessional public financing (OECD, 2023[53]).

3.4.3. Identifying relevant funding streams

Finance for climate-resilient infrastructure depends upon securing sufficient funding to repay the capital costs, cover ongoing operations and maintenance, and provide a return to investors (if applicable). Insufficient funding can undermine climate resilience by preventing projects from going ahead. It can also lead to insufficient maintenance that reduces asset lifetimes and increases vulnerability to climate change impacts (Hallegatte, Rentschler and Rozenberg, 2019[1]).

Funding mechanisms will depend upon the type of asset and broader context. However, the funding streams relevant for climate-resilient infrastructure will generally be the same as those for any type of infrastructure and subject to the same considerations. These funding streams typically include (OECD, 2022[54]):

Taxes – provision of grants and subsidies from general taxation, earmarked tax revenues. These revenues may be transferred between levels of government.

User charges – payments from beneficiaries of the infrastructure services provision, such as road tolls, utility tariffs, sales of services.

Ancillary revenues – advertising, sale of data, property income (e.g. rents from retail in transport hubs).

Land value capture – capturing some of the increment in property values that results from infrastructure provision.

International transfers – official development assistance, climate finance, philanthropy, EU funding.

Filling the funding gap for climate-resilient infrastructure may need to depend largely on taxes and user charges given the scale of investment required. Shifting the burden of infrastructure provision to user charges can support efficiency and generate additional resources. However, distributional impacts need to be identified and managed such as by combining water pricing with targeted subsidies for low-income households.

Transfers can be particularly relevant for climate-resilient infrastructure by helping address financial constraints faced by those communities most affected by climate change. At the national level, this includes transfers to subnational authorities (see Chapter 6). At the international level, climate finance is a valuable resource for supporting climate-resilient infrastructure investment in developing countries. Between 2016-21, 31% of public climate finance for adaptation went to two infrastructure sectors: water supply and sanitation (21%) and transport and storage (10%) (OECD, 2023[53]). Average public climate finance for these sectors is around USD 5.4 billion per year, predominantly provided as concessional loans.

The following sections explore some newer instruments that can be used to fund climate-resilient infrastructure.

Public funding for resilience benefits

Governments are directly supporting provision of climate-resilient infrastructure through grants and subsidies to cover upfront capital costs. This can be done by providing dedicated funding streams for climate resilience, or by prioritising climate-resilient proposals when allocating grants for infrastructure. The EU Structural and Investment Funds includes grants for infrastructure provision in member states. In keeping with the EU’s commitment for 30% of the budget to support climate action, some grant programmes have criteria that favour climate-resilient proposals. The US Inflation Reduction Act included more than USD 1 billion of funding for incentives and grants to support installation of climate-resilient infrastructure. Canada has established a CAD 2 billion Disaster Mitigation and Adaptation Fund (Infrastructure Canada, n.d.[55]) that subsidises construction or retrofitting of resilient infrastructure.

Governments could also support delivery of “resilience services” following the model of payments for ecosystem services. Projects that reduce stormwater runoff, such as through provision of green infrastructure, generate credits. These credits have a market value because they can be sold to other property owners who can use them to meet their own regulatory requirements for stormwater management. In principle, this approach could be extended to other forms of positive externality – such as reducing urban heat island effect or providing protection from other forms of flood risk. This has been implemented in some areas for measures to reduce stormwater runoff and, hence, the risk of surface flooding. The District of Columbia (United States) implemented a Stormwater Retention Credit Trading Programme, for example.

Harnessing land value capture for climate-resilient investments

Some forms of investment in climate resilience will result in increases in the value of nearby land. For example, construction of flood defences can increase the value of homes nearby, which may no longer be at risk of flooding events. NbS (see Chapter 4) for flood management can also create amenity value through, for example, the creation of urban green space. Capturing some of these gains can provide local governments with an important source of revenue to pay for climate resilience (OECD, 2022[54]).

The term “land value capture” refers to various taxes, user charges and fees, and other revenue sources that seek to capture this gain. Most countries have these instruments in some form, but a majority lack a legal definition of, or justification for, land value capture. Working with partners, the OECD has developed a taxonomy with five types of value capture instruments (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[56]):

Infrastructure levy: taxes or fees levied on landowners possessing land that has gained value due to government-initiated infrastructure development

Developer obligations: cash or in-kind contributions that defray costs for additional infrastructure or services that need to be provided due to private development

Charges for development rights: cash or in-kind contributions payable in exchange for development rights or development potential above a set density baseline

Land readjustment: the practice of pooling fragmented land parcels for joint development, with owners transferring a portion of their land for public use

Strategic land management: the practice of governments actively buying, developing, selling and leasing land to advance public needs and recoup value increments borne through public action.

All of these instruments for land value capture can be relevant for climate resilience. Infrastructure levies, for example, can be applied to property owners benefiting from public infrastructure that is created to protect assets facing increased climate risks. Similarly, developer obligations and charges for development rights can help ensure that upfront investments protect new assets. In Germany, for example, urban renewal measures – including for climate adaptation – are charged back to local landowners (Box 3.8).

Box 3.8. Infrastructure levy for urban renewal measures in Germany

In Germany, the urban renewal measures levy (Städtebauliche Sanierungsmaßnahmen) applies in designated renewal areas. Local governments implement these charges and receive the revenues by recovering the land value increase. Landowners, tenants, leaseholders and other affected parties have the right to participate in consultations. The levy is widely used and accepted. Examples where a landowner pays a levy include:

green and open spaces for climate protection and adaptation

construction or expansion of renewable energy systems

renewed infrastructure to reduce the pollution and noise from buildings, businesses and traffic facilities

equipment of areas with playgrounds and sports fields.

Source: Global Compendium of Land Value Capture Policies (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022[56]) https://doi.org/10.1787/fa744789-en

Asset recycling

Asset recycling is the process of selling or divesting assets, and using proceeds to fund another investment. This provides short-term funding but does not generate any “additional” funding over the long term as future income from the assets is forgone (OECD, 2022[54]). Asset recycling can support climate finance and in particular climate resilience, which may struggle to attract financing that requires an identified revenue stream.

In asset recycling, the private sector partner takes over the financing risk, while the public owner supports the transaction through information and data sharing. However, for transactions related to climate finance and climate resilience, the public sector partner may need to take on a bigger share of financial risk. This could engage the public sector by risk sharing, which would unlock financing towards climate resilience.

References

[26] Cançado, D. and M. Mullan (2020), Stocktake of Climate-resilient Infrastructure Standards, Global Center on Adaptation, Rotterdam.

[18] CCC (2022), “Understanding climate risks to UK infrastructure: Evaluation of the third round of the Adaptation Reporting Power”, report commissioned by the Department of Environment, Food and Rural Affairs, Climate Change Committee, July, https://www.theccc.org.uk/publication/understanding-climate-risks-to-uk-infrastructure-evaluation-of-the-third-round-of-the-adaptation-reporting-power/.

[13] CCFLA (2021), 2021 State of Cities Climate Finance, Cities Climate Finance Leadership Alliance, https://citiesclimatefinance.org/publications/2021-state-of-cities-climate-finance/.

[27] Climate Bonds Initiative (2023), Sustainable Debt Market Summary H1 2023, https://www.climatebonds.net/files/reports/cbi_susdebtsum_h12023_01b.pdf.

[57] Climate Bonds initiative (2021), Sustainable Debt Global State of the Market, https://www.climatebonds.net/resources/reports/sustainable-debt-global-state-market-2021 (accessed on 21 March 2023).

[11] CPI (2022), Tracking Investments in Climate Resilient Infrastructure Building Resilience Against Floods and Droughts, Climate Policy Initiative, San Francisco.

[43] CSI (2022), Sustainable Debt Global State of the Market, Climate Bonds Initiative, London, https://www.climatebonds.net/files/reports/cbi_sotm_2022_03e.pdf.

[15] DEFRA and EnvAgency (2023), “Funding Thames Estuary 2100: Costs and investment”, 19 April, Department of Environment, Food and Rural Affairs, and Environment Agency, London, https://www.gov.uk/guidance/funding-thames-estuary-2100-costs-and-investment.

[47] DSTA (2020), State of the Netherlands: Green Bond Report, Dutch State Treasury Agency, https://www.climatebonds.net/files/files/Dutch_sovereign_Green%2Bbond%2Breport.pdf.

[24] EBRD and GCECA (2018), “Advancing TCFD guidance on physical climate risks and opportunities”, report commissioned by the European Bank for Reconstruction and Development and the Global Centre of Excellence, Four Twenty Seven and Acclimatise, https://www.physicalclimaterisk.com/media/EBRD-GCECA_draft_final_report_full.pdf.

[19] EDHECInfra (2023), Highway to Hell, EDHC Infrastructure & Private Assets Research Institute, https://edhec.infrastructure.institute/wp-content/uploads/2023/12/p108_Highway-to-Hell.pdf.

[21] EDHECInfra (2023), “It’s getting physical: Some investors in infrastructure could lose more than half of their portfolio to physical climate risks by 2050”, EDHEC Infrastructure and Private Assets Research Institute, https://edhec.infrastructure.institute/wp-content/uploads/2023/07/p1102.pdf.

[44] GCA (2021), Green Bonds for Climate Resilience – State of Play and Roadmap to Scale, Global Center on Adaptation, Rotterdam.

[31] GCA (n.d.), “Knowledge Module for PPPs on Climate-Resilient Infrastructure”, webpage, https://gca.org/knowledge-module/ (accessed on 10 February 2024).

[40] GIF (2023), GIF 2023 Annual Highlights Report, Global Infrastructure Facility, https://www.globalinfrafacility.org/sites/gif/files/2023-11/COP28%20Preview_2023%20GIF%20AHR_3.pdf.

[10] Global Infrastructure Hub (2017), Global Infrastructure Outlook, (database), https://outlook.gihub.org/ (accessed on 10 February 2024).

[25] Hain, L., J. Kölbel and M. Leippold (2022), “Let’s get physical: Comparing metrics of physical climate risk”, Finance Research Letters, Vol. 46, p. 102406, https://doi.org/10.1016/j.frl.2021.102406.

[1] Hallegatte, S., J. Rentschler and J. Rozenberg (2019), Lifelines, World Bank, Washington, DC, https://doi.org/10.1596/978-1-4648-1430-3.

[29] HM Treasury (2023), “Green Book supplementary guidance: Climate change and environmental valuation”, 21 April, HM Treasury, London, https://www.gov.uk/government/publications/green-book-supplementary-guidance-environment.

[5] IEA (2023), World Energy Outlook 2022, IEA, Paris, https://www.iea.org/reports/world-energy-outlook-2022/an-updated-roadmap-to-net-zero-emissions-by-2050.

[39] IEG (2023), The Triple Agenda, Volume 2, report commissioned by the Indian G20 Presidency, Independent Expert Group, https://www.cgdev.org/sites/default/files/triple-agenda-roadmap-better-bolder-and-bigger-mdbs.pdf.

[55] Infrastructure Canada (n.d.), “Disaster Mitigation and Adaptation Fund: Program Details”, webpage, https://www.infrastructure.gc.ca/dmaf-faac/details-eng.html (accessed on 10 February 2024).

[41] Luxembourg Stock Exchange (2023), Luxembourg Stock Exchange DataHub, (database), https://www.luxse.com/discover-lgx/additional-lgx-services/lgx-datahub (accessed on 15 January 2024).

[50] Migliorati, F. (2020), Alternative Infrastructure Financing: Catalysing Institutional Investments in the Energy Sector to Help Meet the Green Energy Target in Asean Countries, LUISS, http://tesi.luiss.it/29069/1/704761_MIGLIORATI_FRANCESCO.pdf.

[46] Ministry of Economy (2019), Fiji Sovereign Green Bond – 2019 Update, Ministry of Economy, Fiji, https://www.rbf.gov.fj/wp-content/uploads/2020/03/Fiji-Sovereign-Green-Bond-Impact-Report-2019.pdf.

[36] Ministry of Infrastructure and Water Management (2023), Now for the Future: National Delta Programme 2024, Ministry of Infrastructure and Water Management, The Netherlands, https://english.deltaprogramma.nl/documents/publications/2023/09/19/delta-programme-2024-english.

[32] Monast, J. (2021), “Ratemaking as climate adaptation governance”, Frontiers in Climate, Vol. 3, https://doi.org/10.3389/fclim.2021.738972.

[16] Mott MacDonald (n.d.), “Build Resilience to Unlock Investment”, webpage, https://www.mottmac.com/views/build-resilience-to-unlock-investment#:~:text=Our%20methodology%20helps%20to%20quantify,the%20resilience%20of%20their%20infrastructure. (accessed on 10 February 2024).

[12] Mullan, M. and N. Ranger (2022), “Climate-resilient finance and investment: Framing paper”, OECD Environment Working Papers, No. 196, OECD Publishing, Paris, https://doi.org/10.1787/223ad3b9-en.

[42] Munday, P., S. Bullock and J. McMahon (2023), “Crunch time: Can adaptation finance protect against the worst impacts from physical climate risks?”, 13 January, S&P Global, https://www.spglobal.com/en/research-insights/featured/special-editorial/look-forward/crunch-time-can-adaptation-finance-protect-against-the-worst-impacts-from-physical-climate-risks.

[2] Neumann, J. et al. (2021), “Climate effects on US infrastructure: the economics of adaptation for rail, roads, and coastal development”, Climatic Change, Vol. 167/3-4, p. 44, https://doi.org/10.1007/s10584-021-03179-w.

[38] NIC (2023), Second National Infrastructure Assessment, National Infrastructure Commission, London, https://nic.org.uk/studies-reports/national-infrastructure-assessment/second-nia/#tab-foreword.

[7] OECD (2024), Annual Survey of Large Pension Funds and Public Pension Reserve Funds 2023, OECD, Paris, https://www.oecd.org/finance/private-pensions/survey-large-pension-funds.htm.

[58] OECD (2023), “Enhancing the insurance sector’s contribution to climate adaptation”, Business and Finance Policy Papers, No. 26, OECD Publishing, Paris, https://doi.org/10.1787/0951dfcd-en.

[3] OECD (2023), OECD Economic Outlook, Volume 2023 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/7a5f73ce-en.

[6] OECD (2023), Pension Markets in Focus 2023, OECD Publishing, Paris, https://doi.org/10.1787/28970baf-en.

[53] OECD (2023), Scaling Up Adaptation Finance in Developing Countries: Challenges and Opportunities for International Providers, Green Finance and Investment, OECD Publishing, Paris, https://doi.org/10.1787/b0878862-en.

[28] OECD (2022), Aligning Regional and Local Budgets with Green Objectives: Subnational Green Budgeting Practices and Guidelines, OECD Multi-level Governance Studies, OECD Publishing, Paris, https://doi.org/10.1787/93b4036f-en.

[35] OECD (2022), Building Financial Resilience to Climate Impacts: A Framework for Governments to Manage the Risks of Losses and Damages, OECD Publishing, Paris, https://doi.org/10.1787/9e2e1412-en.

[54] OECD (2022), G20-OECD Policy Toolkit to Mobilise Funding and Financing for Inclusive and Quality Infrastructure Investment in Regions and Cities, OECD Publishing, Paris, https://doi.org/10.1787/99169ac9-en.

[9] OECD (2020), G20/OECD Report on the Collaboration with Institutional Investors and Asset Managers on Infrastructure: Investor Proposals and the Way Forward, https://web-archive.oecd.org/2020-07-24/560068-Collaboration-with-Institutional-Investors-and-Asset-Managers-on-Infrastructure.pdf.

[8] OECD (2020), Green Infrastructure in the Decade for Delivery: Assessing Institutional Investment, Green Finance and Investment, OECD Publishing, Paris, https://doi.org/10.1787/f51f9256-en.

[17] OECD (2018), “Climate-resilient Infrastructure”, OECD Environment Policy Papers, No. 14, OECD Publishing, Paris, https://doi.org/10.1787/4fdf9eaf-en (accessed on 12 December 2018).

[51] OECD (2018), Making Blended Finance Work for the Sustainable Development Goals, OECD Publishing, Paris, https://doi.org/10.1787/9789264288768-en.

[34] OECD (2014), Climate Resilience in Development Planning: Experiences in Colombia and Ethiopia, OECD Publishing, Paris, https://doi.org/10.1787/9789264209503-en (accessed on 8 June 2018).

[33] OECD (2007), OECD Principles for Private Sector Participation in Development, OECD Publishing, Paris, https://www.oecd.org/daf/inv/investment-policy/38309896.pdf.

[30] OECD (n.d.), OECD Principles for Public Governance of Public-Private Partnerships, https://www.oecd.org/gov/budgeting/oecd-principles-for-public-governance-of-public-private-partnerships.htm.

[49] OECD (n.d.), OECD-DAC Blended Finance Principles for Unlocking Commercial Finance for the Sustainable Development Goals, https://web-archive.oecd.org/2022-08-19/469783-OECD-Blended-Finance-Principles.pdf.

[56] OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center (2022), Global Compendium of Land Value Capture Policies, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/4f9559ee-en.

[14] OECD/The World Bank/UN Environment (2018), Financing Climate Futures: Rethinking Infrastructure, OECD Publishing, Paris, https://doi.org/10.1787/9789264308114-en.

[52] PIDG (2023), Strategy 2023-30, Private Infrastructure Development Group, London, https://www.pidg.org/pdf/PIDG_Strategy_2023.pdf.

[4] Swiss Re (2020), sigma: Natural catastrophes and man-made disasters: 1990-2019, (database).

[22] TCFD (2021), Implementing the Recommendations of the Task Force on Climate-related Financial Disclosure, Task Force on Climate-related Financial Disclosures, https://assets.bbhub.io/company/sites/60/2021/07/2021-TCFD-Implementing_Guidance.pdf.

[20] TCFD (2021), Recommendations of the Task Force on Climate-related Financial Disclosures, Task Force on Climate-related Financial Disclosures, https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Report-062817.pdf.

[48] The Nature Conservancy (2023), Belize Blue Bonds for Ocean Conservation First Annual Report November 4, 2021–March 31, 2023, The Nature Conservancy, https://www.nature.org/content/dam/tnc/nature/en/documents/Belize-Blue-Bonds-2023-Impact-Report.pdf.

[37] Ville de Paris (2023), “« Paris à 50 °C », un exercice grandeur nature pour se préparer aux chaleurs extrêmes”, 9 November, Ville de Paris, https://www.paris.fr/pages/paris-50-c-un-exercice-grandeur-nature-pour-se-preparer-aux-chaleurs-extremes-24322.

[45] World Bank (2018), “Seychelles launches world’s first sovereign blue bond”, 29 October, Press Release, World Bank, Washington, DC, https://www.worldbank.org/en/news/press-release/2018/10/29/seychelles-launches-worlds-first-sovereign-blue-bond.

[23] Zhou, L. and P. Smith (2022), Physically Fit? How Financial Institutions Can Better Disclose Climate-Related Physical Risks in Line with the Recommendations of the TCFD, World Resources Institute, Washington, DC, https://www.wri.org/research/physically-fit-financial-institutions-climate-recommendations-tcfd.

Notes

← 1. As outlined in Chapter 1, these two elements should be guided by a risk-based approach, which balances any additional costs of achieving enhanced resilience against the expected benefits across a range of scenarios.

← 2. Physical climate risks encompass the risks arising from the consequences of climate change. These consequences can be bothw direct (such as damage to assets) and indirect (such as changing patterns of demand for infrastructure services).

← 3. See (OECD, 2023[58]) for a more comprehensive overview of the potential insurance sector contribution to adaptation.