Chapter 3 describes and assesses the design of inheritance, estate, and gift taxes across OECD countries. Beginning with a discussion of tax revenues, the chapter provides a comparative examination of the main design features of OECD countries’ inheritance, estate, and gift taxes.

Inheritance Taxation in OECD Countries

3. Inheritance, estate, and gift tax design in OECD countries

Abstract

This chapter describes and assesses the design and implementation of inheritance, estate, and gift taxes across OECD countries.1 After a brief discussion of tax revenues across countries and over time, the chapter provides a comparative overview of the main design features of OECD countries’ inheritance, estate, and gift taxes2 including rules regarding taxable events, tax exemption thresholds, tax rate schedules, the treatment of various tax-preferred assets, tax filing and payment procedures, valuation rules, gift tax design and the interaction between the tax treatment of unrealised capital gains at death and inheritance and estate taxes. The final section of the chapter discusses tax planning and avoidance opportunities as well as tax evasion risks. The discussion in this chapter primarily draws upon responses to an OECD questionnaire on inheritance, estate, and gift taxes provided by country delegates to Working Party No. 2 on Tax Policy Analysis and Tax Statistics of the OECD’s Committee on Fiscal Affairs.

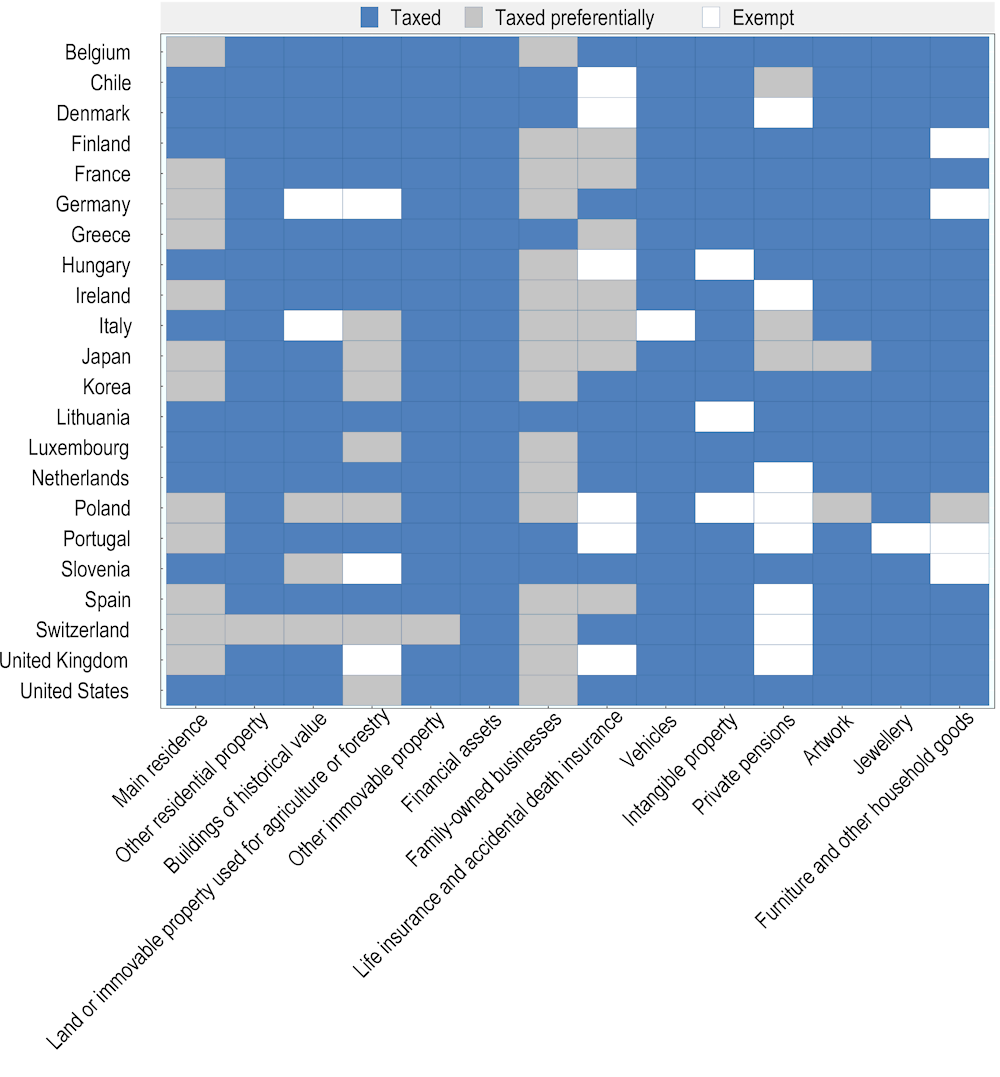

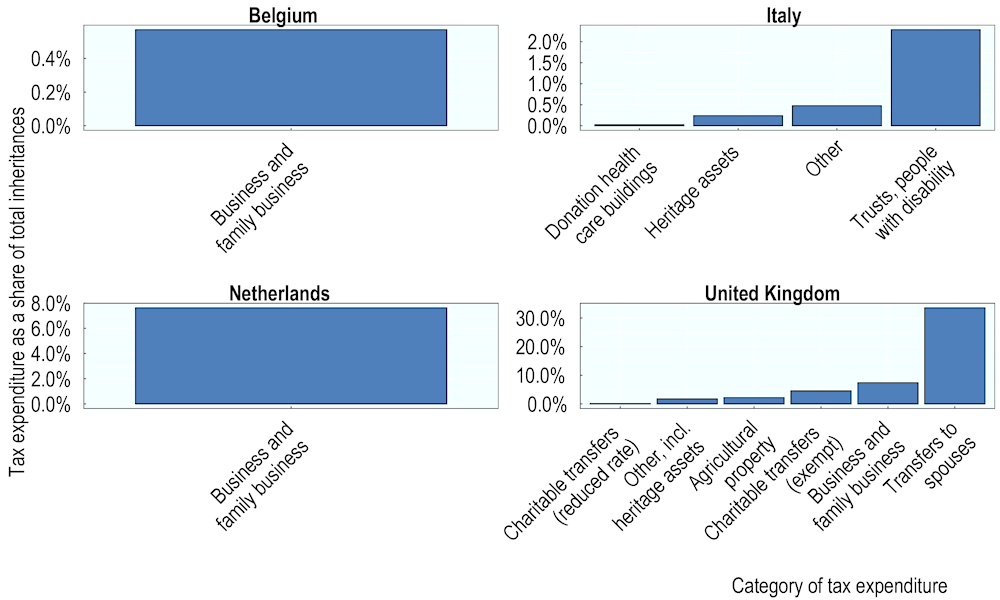

There are many common design features of inheritance, estate, and gift taxes across OECD countries. The majority of countries levy recipient-based inheritance and gift taxes, but a minority levy donor-based estate taxes. Most countries favour spouses and direct descendants through higher tax exemption thresholds and lower tax rates. Countries also typically exempt charitable giving and apply preferential tax treatment to certain assets, which contributes to a narrowing of the tax base. The most commonly tax-favoured assets include the main residence, business assets, pension assets, and life insurance policies. In a number of countries, the tax treatment of inter vivos (between living people) gifts as well as other tax design features have created opportunities for tax planning and avoidance. Overall, this chapter emphasises the importance of tax design to ensure that inheritance, estate, and gift taxes achieve their objectives.

3.1. Use of inheritance, estate, and gift taxes across OECD countries

3.1.1. The majority of OECD countries tax inheritances

24 of 36 OECD countries levy wealth transfer taxes. Of these, 20 levy inheritance taxes on the beneficiaries of wealth transfers. Only four countries (Denmark, Korea, the United Kingdom, and the United States) levy estate taxes on deceased donors. Most countries that levy inheritance or estate taxes also levy a gift tax on inter vivos transfers, typically on the beneficiary. One country – Ireland – levies a combined inheritance and gift tax (a tax on lifetime wealth transfers), which considers all wealth transfers received by beneficiaries over their lifetime. Latvia and Lithuania tax inter vivos gifts through the personal income tax (PIT), but Latvia does not tax inheritances while Lithuania levies a separate inheritance tax.

A minority of OECD countries tax inheritances or estates at the sub-central level. Central governments may retain partial authority over the design of inheritance taxes, but in some countries sub-central governments have substantial autonomy. The regions in Belgium and the cantons in Switzerland have full autonomy over the imposition and design of inheritance, estate, and gift taxes. The local municipalities in Lithuania and the regions in Spain instead levy inheritance taxes in concert with the central government, which sets the main design features from which sub-central governments can deviate. The United States levies an estate tax at the federal level and some states additionally levy inheritance taxes. The report examines the taxes levied by the central/federal government in Lithuania, Spain, and the United States, and examines the taxes levied at the local/regional level in Belgium (Brussels-Capital Region) and Switzerland (Canton of Zurich).

Ten OECD countries have abolished their estate or inheritance taxes and two countries have never taxed wealth transfers (Table 3.1). Austria, Czech Republic, Norway, Slovak Republic, and Sweden have abolished their inheritance or estate taxes since 2000. Israel and New Zealand abolished these taxes between 1980 and 2000, Australia, Canada, and Mexico abolished these taxes before 1980, and Estonia and Latvia have never levied inheritance or estate taxes. In response to the OECD questionnaire, countries reported their motives for repealing or not imposing inheritance, estate, and gift taxes. Lack of political support for inheritance and estate taxes was a key driver of the repeal or non-imposition of inheritance and estate taxes. This is consistent with evidence that inheritance and estate taxes tend to be unpopular (Section 3.14). Unpopularity may have also stemmed in some cases from tax design. For instance, before repealing its inheritance tax, Sweden had very low tax exemption thresholds (around USD 31 000 for spouses and USD 8 000 for children). Tax minimisation opportunities that primarily benefited wealthier taxpayers also eroded the legitimacy of inheritance, estate, and gift taxes, generating support for their removal (Henrekson and Waldenström, 2016[1]). Some countries reported high administrative burdens compared to relatively meagre revenues, in part due to the preferential treatment granted for certain assets.

Table 3.1. Current and historical inheritance and estate taxes in OECD countries

|

Country |

Tax name (national language) |

Tax name (English) |

Tax first introduced |

Current tax introduced |

Year of repeal |

Government level1 |

|---|---|---|---|---|---|---|

|

Current inheritance and estate taxes |

||||||

|

Belgium |

Droit de succession |

Inheritance Duty |

1795 |

1936 |

.. |

Regional / State2 |

|

Chile |

Impuesto a las Herencias y Donaciones |

Inheritance and Gift Taxes |

1915 |

1915 |

.. |

National |

|

Denmark |

Boafgiftsloven |

Inheritance Estate and Gift Taxes |

1792 |

1995 |

.. |

National |

|

Finland |

Perintövero |

Inheritance Tax |

1940 |

1940 |

.. |

National |

|

France |

Droits de mutations titre gratuit |

Tax on Free Transfers |

1791 |

1791 |

.. |

National |

|

Germany |

Erbschaftsteuer und Schenkungsteuer |

Inheritance Tax and Gift Tax |

1906 |

1974 |

.. |

National |

|

Greece |

Φόρος Κληρονομιάς |

Inheritance Tax |

1836 |

2001 |

.. |

National |

|

Hungary |

öröklési illeték |

Inheritance Duty |

1918 |

1918 |

.. |

National |

|

Iceland |

Erfðafjárskattur |

Inheritance Tax |

1792 |

2004 |

.. |

National |

|

Ireland |

Capital Acquisitions Tax |

Capital Acquisitions Tax |

1894 |

1976 |

.. |

National |

|

Italy |

Imposta sulle successioni e donazioni |

Inheritance and Gift Tax |

1862 |

2006 |

.. |

National |

|

Japan |

相続税 |

Inheritance Tax |

1950 |

1950 |

.. |

National |

|

Korea |

상속세및증여세법 |

The Inheritance Tax and Gift Tax |

1950 |

1950 |

.. |

National |

|

Lithuania |

Paveldimo turto mokesčio įstatymas |

Law on Inheritance Tax |

19903 |

2003 |

.. |

National / Local |

|

Luxembourg |

Droits de succession |

Inheritance Tax |

1817 |

1817 |

.. |

National |

|

Netherlands |

Erfbelasting en schenkbelasting |

Inheritance and Gift Tax |

1859 |

1956 |

.. |

National |

|

Poland |

Podatek od spadków i darowizn |

Tax on Inheritance and Donation |

1920 |

1983 |

.. |

National |

|

Portugal |

Imposto do selo sobre transmissões gratuitas |

Stamp Duty on Inheritance and Gifts |

1959 |

2004 |

.. |

National |

|

Slovenia |

Davek na dediščine in darila |

Inheritance and Gift Tax |

1988 |

2006 |

.. |

National |

|

Spain |

Impuesto sobre Sucesiones y Donaciones |

Inheritance and Gift Tax |

1798 |

1988 |

.. |

National / Regional4 |

|

Switzerland |

Erbschafts- und Schenkungssteuer |

Inheritance and Gift tax |

1870 |

1986 |

.. |

Regional / State5 |

|

Turkey |

Veraset ve İntikal Vergisi |

Inheritance and Gift Tax |

1959 |

1959 |

.. |

National |

|

United Kingdom |

Inheritance Tax |

Inheritance Tax |

1894 |

1986 |

.. |

National |

|

United States |

Estate and Gift Tax |

Estate and Gift Tax |

1916 |

1916 |

.. |

National6 |

|

Past inheritance and estate taxes |

||||||

|

Australia |

Estate Tax |

Estate Tax |

1851 |

1914 |

1979 |

National / State |

|

Austria |

Erbschaftssteuer |

Inheritance Tax |

1759 |

1955 |

2008 |

National |

|

Canada |

Estate Tax |

Estate Tax |

1941 |

1958 |

1972 |

National |

|

Czech Republic |

Zákon o dani dědické, darovací a dani z převodu nemovitostí |

Act on Inheritance Tax, Gift Tax and Real Estate Transfer Tax |

1993 |

1993 |

2014 |

National |

|

Estonia |

.. |

.. |

.. |

.. |

.. |

.. |

|

Israel |

חוק מס עזבון |

Inheritance Tax Law |

1949 |

1949 |

1980 |

National |

|

Latvia |

.. |

.. |

.. |

.. |

.. |

.. |

|

Mexico |

Impuesto sobre Herencias y Legados |

Inheritance and Bequest Tax |

19267 |

1926 |

1961 |

National / State |

|

New Zealand |

Estate duty |

Estate Duty |

1866 |

1866 |

1992 |

National |

|

Norway |

Avgift på arv og gave |

Inheritance and Gift Tax |

1792 |

1792 |

2014 |

National |

|

Slovak Republic |

Daň z dedičstva |

Inheritance tax |

1993 |

1993 |

2004 |

National |

|

Sweden |

Arvskatt |

Inheritance Tax |

1884 |

1884 |

2004 |

National |

1. This refers to the government level that has primary responsibility for legislating the tax, including the right to introduce or to abolish a tax, set tax rates, define the tax base, or grant tax allowances or reliefs. In some countries, one level of government has legislative authority but revenues accrue to another level of government. A cell with “..” indicates that the country has not abolished their inheritance, estate, and gifts taxes or that they have never levied inheritance, estate, and gift taxes. Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the canton of Zurich.

2. Information on Belgium refers to the Brussels-Capital Region.

3. Due to tax relief inheritances were effectively untaxed between 1990 and 1998.

4. The central government administers the Inheritance and Gift Tax, however, regional governments may regulate tax base allowances, tax rates, tax deductions, and certain administrative procedures.

5. Information on Switzerland refers to the Canton of Zurich.

6. State-level inheritance taxes are not presented in this report, though some states levy an inheritance tax in addition to the federal Estate Tax.

7. This refers to taxes at the federal level. Prior to 1926, some local municipalities levied taxes on inheritances and gifts.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes (2020).

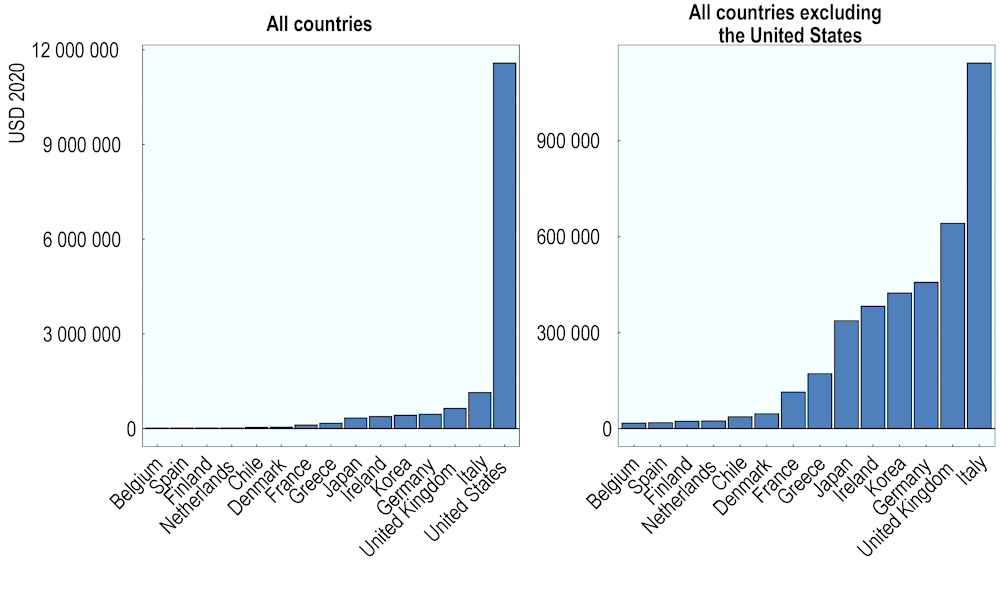

3.2. Tax revenues and shares of taxable estates

3.2.1. Revenues from inheritance and estate taxes are typically low, as a majority of estates go untaxed in a number of countries

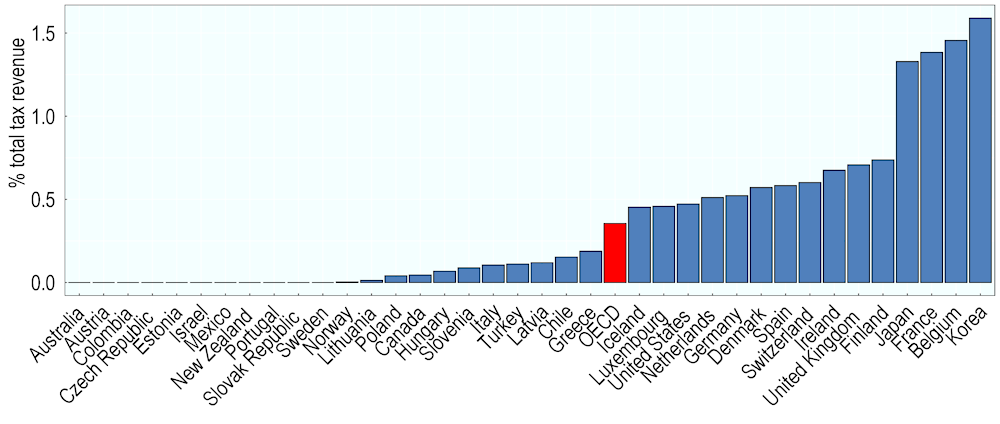

Revenues from inheritance, estate, and gift taxes form a very small portion of total tax revenues across OECD countries (Figure 3.1). On average (unweighted) across the OECD, 0.36% of total tax revenues are sourced from these taxes and, among countries that levy these taxes, 0.51% of total tax revenues on average are sourced from these taxes. Revenues from inheritance, estate, and gift taxes exceed 1% of total taxation in only four OECD countries (Belgium, France, Japan, and Korea). As discussed further, this largely reflects broader tax bases and higher tax rates, particularly for heirs that are not close family, in these countries. The inheritance tax in Korea is examined in greater detail in Box 3.1. Twenty countries raise less than a quarter of a percent in total taxation from inheritance, estate, and gift taxes, and revenue is zero in eight countries (Australia, Estonia, Israel, Mexico, New Zealand, Portugal, Slovak Republic, and Sweden). Of these countries, all except Portugal3 do not levy taxes on inheritances, estates, and gifts.

Figure 3.1. Inheritance, estate, and gift tax revenues, 2019, all OECD countries

Note: Data are for 2018 for Australia, Greece, Japan, Mexico, and the OECD average.

Source: OECD Revenue Statistics.

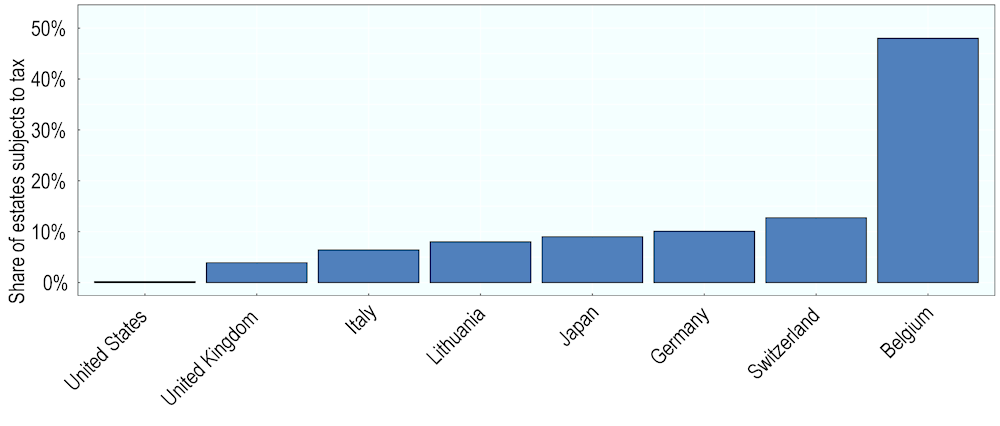

Low inheritance and estate tax revenues are in part due to the low shares of taxable estates amongst total estates and transfers. Figure 3.2 shows the share of estates that were subject to inheritance or estate taxes in eight countries for which data were available. Most estates are not subject to inheritance or estate taxes and, in seven countries, less than 13% of estates were taxed. The shares of estates that were subject to inheritance or estate taxes ranges from 0.2% (United States) to 48% (Belgium, Brussels).

Figure 3.2. Share of estates subject to inheritance or estate taxes, select countries

2019 or latest available year

Note: Results presented for countries for which data were available. Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes (2020).

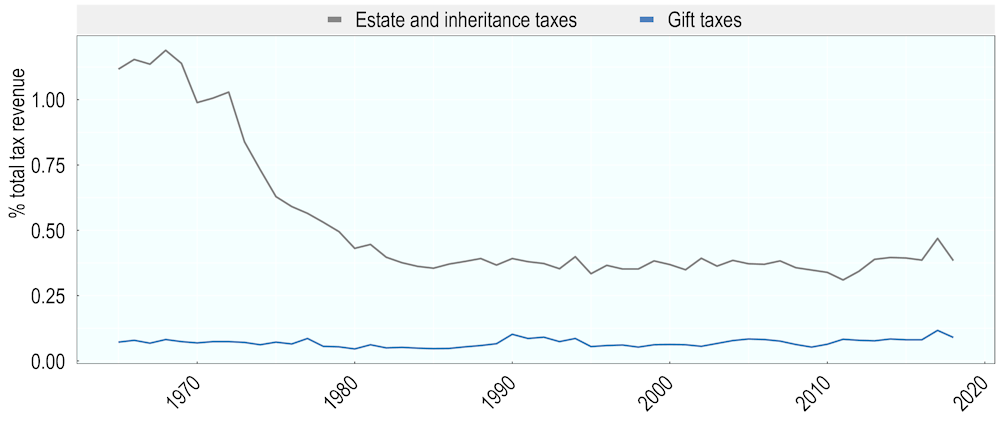

3.2.2. Tax revenues dropped sharply in the 1970s and have remained relatively stable since

The share of total tax revenues collected from inheritance and estate taxes decreased sharply during the 1970s on average across OECD countries and has remained stable since (Figure 3.3).4 The ratio of inheritance and estate tax revenues to GDP experienced a sharp drop on average (unweighted) across OECD countries during the 1970s. This was primarily driven by developments in Australia, Canada, Ireland, New Zealand, Portugal, and the United Kingdom. Several of these countries either abolished or curtailed their inheritance or estate taxes during this time and/or saw tax revenues eroded by increasingly sophisticated tax planning. Inheritance and estate tax revenues were relatively stable between the mid-1980s and 2018. In contrast, revenues from gift taxes have been stable across the whole period in Figure 3.3, though they are substantially lower than revenues from inheritance and estate taxes.

Figure 3.3. Inheritance, estate, and gift tax revenues, 1965-2019, OECD average

Note: Figure shows unweighted average across all OECD countries.

Source: OECD Revenue Statistics.

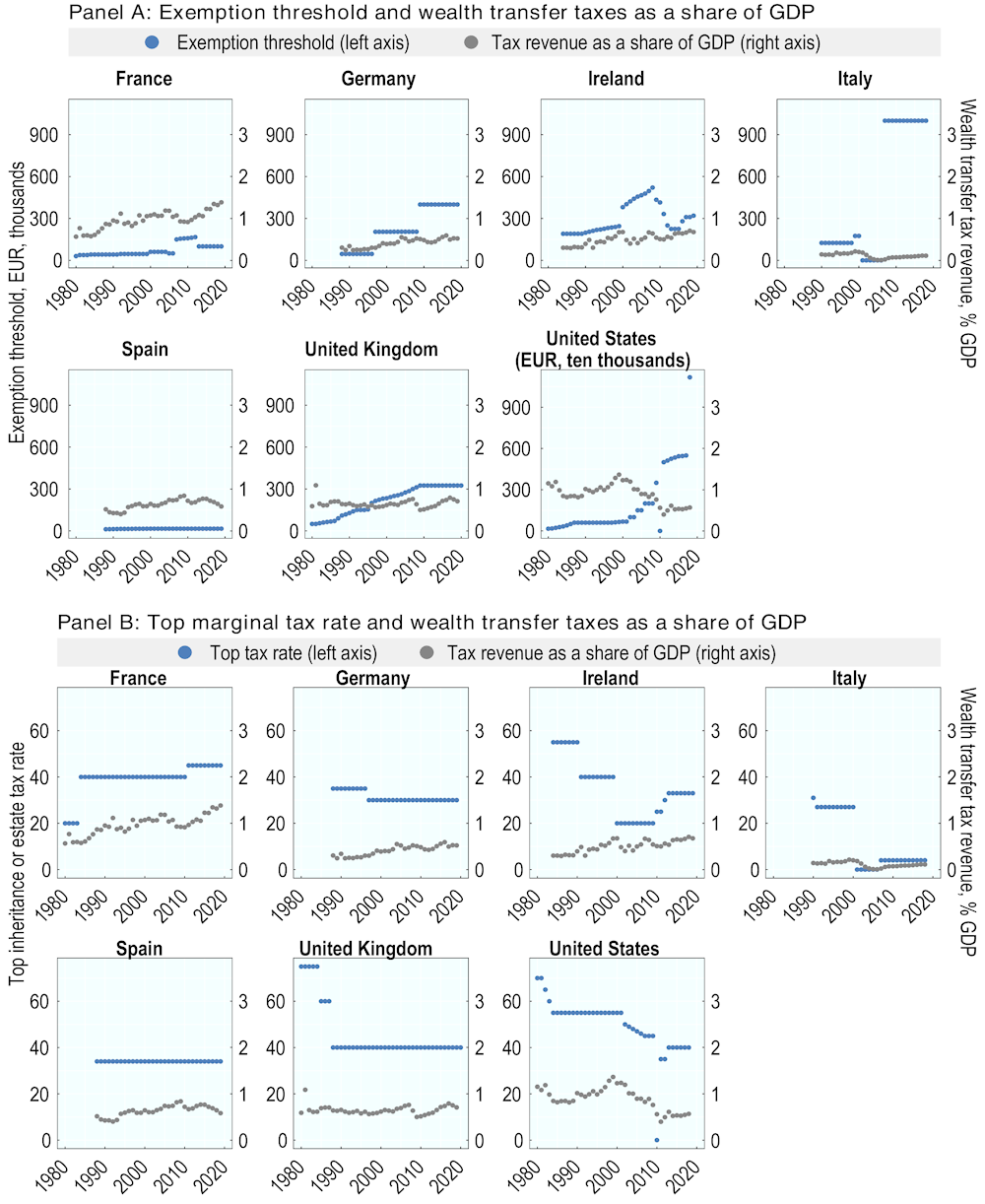

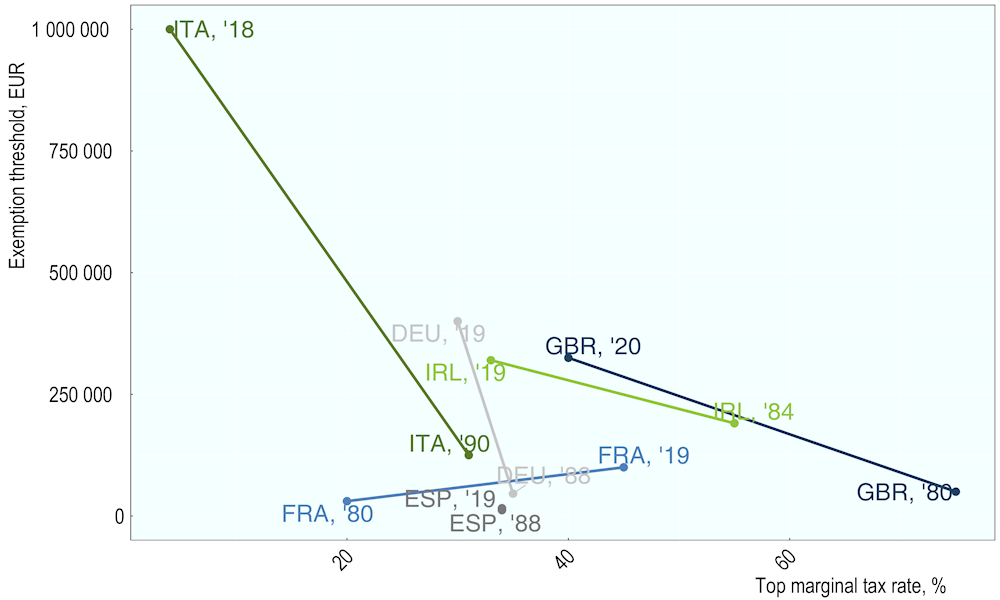

Inheritance and estate tax exemption thresholds have increased since the 1980s in several countries. Panel A of Figure 3.4 compares the exemption threshold for the donor’s children (left axis) and inheritance and estate tax revenues as a share of GDP (right axis), between 1980 and 2020 (tax exemption data drawn from (Nolan et al., 2020[2]). Tax exemption thresholds for children have increased in all countries, either through periodic changes (e.g. Germany, Italy) or through yearly adjustments (e.g. United Kingdom). All else being equal, higher exemption thresholds would be expected to lead to lower revenue, but there is little evidence of this in Figure 3.4. Despite higher exemption thresholds, revenues from inheritance taxes have risen in France and Germany and remained largely stable in the United Kingdom. However, a decline in revenue was discernible in Italy and the United States at the time of substantial increases to tax exemption thresholds.

In parallel to narrower tax bases, there was a trend towards lowering top tax rates in most countries. Panel B of Figure 3.4 compares the top marginal estate or inheritance tax rate for the donor’s children (left axis) and inheritance and estate tax revenue as a share of GDP (right axis), between 1980 and 2020 (tax rates data drawn from (Nolan et al., 2020[2]) A steady decrease in top marginal tax rates in the United States was accompanied by steadily declining tax revenues, while revenues in Italy decreased slightly around the time of a major drop in the top tax rate. The significant drop in top marginal tax rates in the United Kingdom, from 75% to 40% between 1980 and 1988, had no discernible impact on revenues, which remained largely stable throughout the period. Significant variation in top marginal rates in Ireland, dropping from 55% in 1984 to 20% in 2000 before rising to 33% in 2013, do not appear to affect tax revenue trends, which have shown a steady increase throughout the period. In contrast to other countries in Figure 3.4, France raised its top marginal tax rate between 1980 and 2020, and saw an increase in inheritance tax revenues over the period.

Figure 3.4. Inheritance and estate tax exemption thresholds and top marginal tax rates compared to inheritance, estate, and gift tax revenues as a share of GDP, 1980-2020, select countries

Note: Tax exemption thresholds and top marginal tax rates are shown for the donor’s children. United States: The left axis of Panel A represents ten thousands, not thousands as for other countries, as the exemption threshold for children was around USD 11.6 million in 2020.

Source: OECD Revenue Statistics (2020) and Nolan, B., J. Palomino, P. Van Kerm and S. Morelli (2020), 'The Wealth of Families: The Intergenerational Transmission of Wealth in Britain in Comparative Perspective', Nuffield Foundation, Oxford.

The stability or slight increase in inheritance, estate, and gift tax revenues in most countries in Figure 3.4, despite increases in tax exemption thresholds and decreases in top marginal rates, may reflect different factors. The fact that tax revenues have held up is likely due in part to the rise in the importance of inherited wealth (Figure 1.15). In some countries, it may also reflect tax reforms involving an increase in effective tax burdens, such as compensating base broadening measures. Countries may have also offset the lower tax burden on the donor’s children, observed in some countries in Figure 3.4, with lower tax exemptions and higher tax rates for other heirs. Revenue trends may also possibly reflect greater tax compliance and more effective tax administration.

While inheritance, estate, and gift taxes are generally a minor source of revenue, they can support important objectives beyond raising revenue. In response to the OECD questionnaire, the most common rationale cited by countries for levying an inheritance or estate tax was to redistribute wealth, increase equality of opportunity or tax unearned windfalls. Chapter 2 outlines and assesses the various equity arguments in favour of inheritance taxation, underlining that it can enhance equality of opportunity as well as horizontal and vertical equity, and reduce wealth inequality over time.

Box 3.1. The distribution of wealth transfers and inheritance taxation in Korea

Drawing on data provided by the Korea Institute for Public Finance (KIPF), which provided financial support for this project, this box examines Korea’s estate tax. Korea’s estate tax, in place since 1950, shares many features of inheritance and estate taxes in other OECD countries. It applies to resident donors’ worldwide assets and to non-resident donors’ local assets (Table 3.2), spouses benefit from the most generous tax treatment (Figure 3.8), and estates are taxed at progressive rates (Figure 3.11). Korea, like nearly all countries that levy an inheritance or estate tax, also levies a gift tax on inter vivos transfers (Table 3.9). Unlike most OECD countries, only different-sex married couples benefit from spousal treatment (Table 3.5) and only one set of rates applies across different groups of heirs (Figure 3.12).

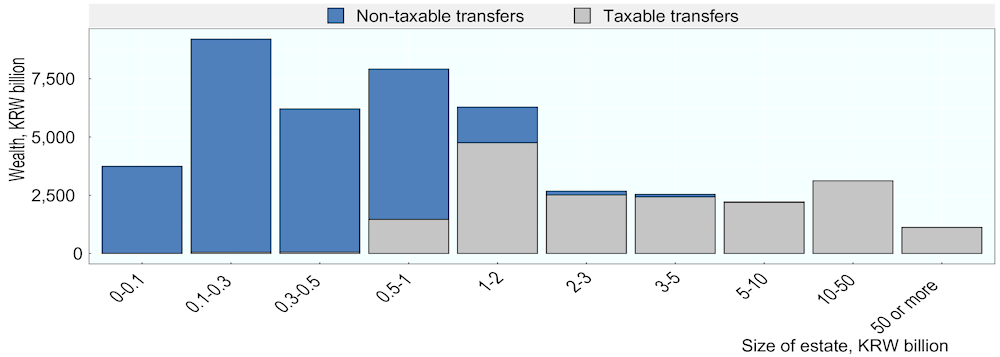

Korea’s estate tax is levied mostly on wealthier taxpayers. While only 2.2% of successions give rise to estate taxes (Figure 3.2), taxable wealth transfers amount to 39.3% of total transferred wealth. Donors whose wealth transfers are subject to the estate tax made taxable transfers of KRW 18 278 billion (USD 15.5 billion) in 2018, compared to KRW 28 344 billion (USD 24.0 billion) by the remaining 97.8% of donors whose wealth transfers were not subject to estate taxes (Figure 3.5). This is partly due to the standard deduction of KRW 500 million (around USD 420 000), plus the spousal deduction of KRW 3 billion (USD 2.5 million).

Figure 3.5. Total wealth transferred by size of the donor's estate, 2018

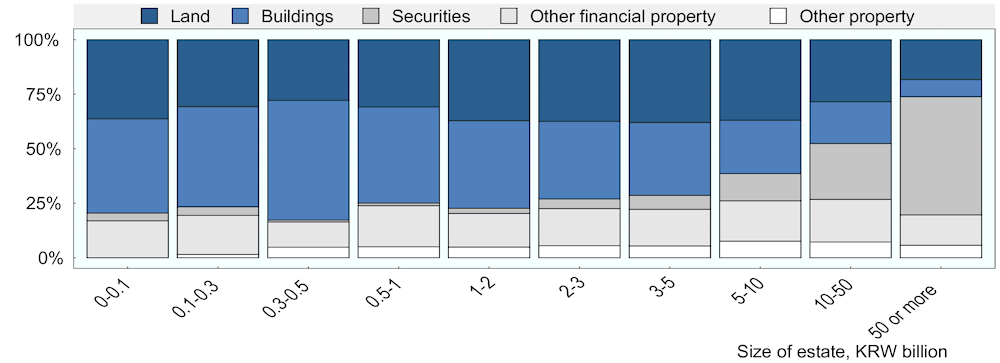

Figure 3.6 illustrates the asset composition of taxable estates by the size of the donor’s estate. The main component of taxable estates up to KRW 2 billion (USD 1.7 million) is buildings, while the main component of taxable estates between KRW 2 and 50 billion (USD 1.7 million to 42.4 million) is land. Securities comprise 54% of the estates over KRW 50 billion (USD 42.4 million), compared to 26% and 12% of donors’ assets for estates worth KRW 10 to 50 billion (USD 8.5 million to 42.4 million) and estates worth KRW 5 to 10 billion (USD 4.2 million to USD 8.5 million), respectively.

Figure 3.6. Asset composition of taxable estates by size of the donor's estate, 2018

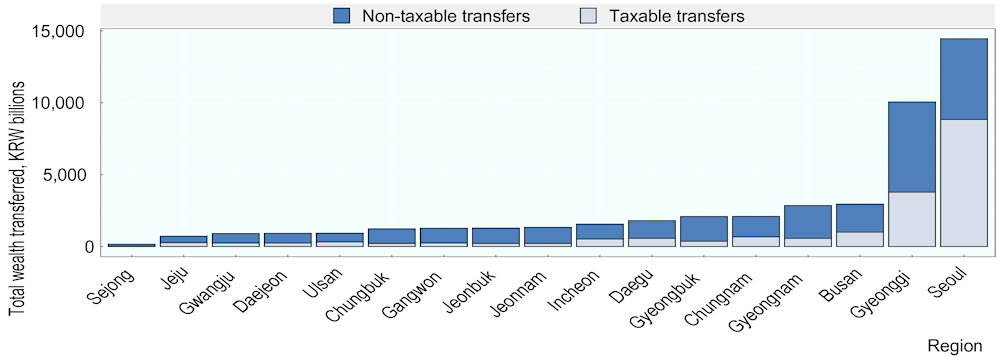

Wealth transfers are highly concentrated among donors in the capital, Seoul, and the region surrounding the capital, Gyeonggi Province (Figure 3.7). Taxable transfers in Seoul amount to KRW 8 833 billion (USD 7.5 billion), followed by KRW 3 782 billion in Gyeonggi (USD 3.2 billion), with the smallest taxable transfers taking place in Sejong (KRW 25.5 billion or USD 22 million). In total, 72% of taxable transfers and 46% of non-taxable transfers are made by donors in the Seoul Capital Area (Seoul, Gyeonggi, and Incheon).

Figure 3.7. Total wealth transferred by tax administration area, 2018

Estate taxes have received much attention in recent years, particularly as ownership of several chaebol – large industrial groups run by founders and their families – will shift to the next generation in the coming years. As in other countries, business assets are subject to the estate tax and benefit from some preferential treatment (see section 3.8.3), but the question of business succession has generated substantial commentary.

3.3. The different types of wealth transfer taxes

3.3.1. Most OECD countries levy inheritance taxes on the recipients of wealth transfers

Wealth transfer taxes can take different forms. For end-of-life bequests, countries may impose donor-based estate taxes, levied on the deceased donor’s total net wealth, or recipient-based inheritance taxes, levied on the value of the assets that beneficiaries receive from the deceased donor. For inter vivos transfers made during the donor’s life, countries can apply gift taxes, which are levied on the beneficiary in most countries.

The most common approach across OECD countries is to tax wealth transfers received by beneficiaries through an inheritance tax. Out of the 24 countries that tax bequests, 20 OECD countries apply recipient-based inheritance taxes. These countries typically apply different treatment – including different tax exemption thresholds and tax rates – to different heirs depending on their relationship with the donor. Four countries levy an estate tax (Denmark, Korea, the United Kingdom, and the United States), but some additional criteria such as the beneficiaries’ relationship to the donor may be taken into consideration to determine the tax liability. All these countries levy accompanying gift taxes (except Lithuania, which taxes gifts through the PIT).

Most countries treat each inheritance as a separate event. This approach implies that, for example, in a country applying a EUR 300 000 tax exemption threshold, a beneficiary receiving two inheritances of EUR 200 000 each would not be liable for inheritance taxes, whereas a beneficiary receiving one inheritance of EUR 400 000 would be liable. An alternative approach would consider all wealth received by beneficiaries over their lifetime through a tax on lifetime wealth transfers, which is the case in Ireland. In the above scenario, the two beneficiaries would face the same tax liability as they have received the same amount of wealth.

Inheritance or estate taxes are typically levied on net asset values, but some countries apply conditions on debt deductibility. In 12 countries, all the donor’s debts are deductible for tax purposes (Belgium, Denmark, Finland, Hungary, Ireland, Korea, Luxembourg, Netherlands, Poland, Slovenia, Switzerland, and the United States). In some countries, debts that were contracted to purchase exempt assets are not deductible (Chile, France, Germany, Italy, Japan, and the United Kingdom) and in others, loans from heirs or close family to the donor are not deductible (Spain). A minority of countries allow debts to be deducted on the condition that they were contracted in normal circumstances or that they were not contracted with the intention to reduce the taxable base (France, Greece, and Japan). Debts are not deductible in Lithuania.

3.3.2. The type of tax chosen involves trade-offs

Inheritance taxes have a number of advantages compared to estate taxes. As discussed in Chapter 2, if promoting equality of opportunity is a major objective of inheritance taxation, there is a strong case for a recipient-based inheritance tax rather than an estate tax levied on donors. It is the amount of wealth received by each recipient that should matter for equality of opportunity rather than the overall amount bequeathed by the donor. In addition, because the tax liability will depend on the wealth received by each individual, donors that spread a bequest among more recipients may reduce the total tax liability. This may incentivise the division of estates and reduce concentrations of wealth. Inheritance taxes also allow countries to focus more on beneficiaries’ personal situations, such as age, disability, and previous wealth received. The double taxation argument against wealth transfer taxes is also weaker in the case of inheritance taxes that are levied on recipients as there is no double taxation of the donor themselves and the inherited wealth is also only taxed once in the hands of the recipient. On the other hand, estate taxes may be easier to collect than inheritance taxes, as they are levied on the overall estate.

A tax on lifetime wealth transfers has a number of advantages over inheritance and estate taxes, but may be more difficult to administer. A tax on lifetime wealth transfers is levied on the gifts and bequests that beneficiaries receive over their lifetime. For each new wealth transfer, the tax liability is determined by taking into account the amount of wealth previously received by the beneficiary. Such a tax may be levied above a lifetime tax exemption threshold, i.e. above an amount of wealth that beneficiaries are entitled to receive tax-free during the course of their life. Such a tax improves horizontal equity, by ensuring that individuals who receive the same amount of wealth pay the same amount of tax, regardless of whether they receive one large transfer or several smaller transfers. A tax on lifetime wealth transfers also improves vertical equity, particularly if tax rates are progressive, ensuring those who receive more wealth over their lifetime pay more tax than individuals who only receive a small amount. A tax on lifetime wealth transfers may also incentivise donors to spread their wealth among several beneficiaries, including those that have received less wealth over their life. In its purest form, a lifetime wealth transfers tax would not consider who the beneficiary received the wealth from, however, in the case of the Capital Acquisitions Tax in Ireland – the only lifetime wealth transfers tax in an OECD country – different tax exemptions apply to three groups of donors (parents, other close family, other donors). Taxing lifetime wealth transfers also limits the importance of timing for gifts and inheritances, reducing avoidance opportunities. A tax levied on lifetime transfers increases the administrative complexity of the tax, but countries may choose between tracking taxpayers’ history of wealth transfers and relying on self-reporting (as is the case in Ireland). Some tax administrations may need to invest in establishing or updating comprehensive records, which may be easier thanks to increasing digitalisation.

Gift taxes can be integrated with inheritance and estate taxes to ensure neutrality between inter vivos and end-of-life transfers and act as a backstop to prevent avoidance of inheritance and estate taxes. A gift tax levied on inter vivos transfers is an important complement to inheritance and estate taxes. Aligning the design of gift taxes and inheritance and estate taxes improves neutrality between transferring wealth during life or at death and ensures that the timing of the wealth transfer will be less central to the tax treatment.

A question that may arise is whether wealth transfers should be taxed through the personal income tax when they are received by beneficiaries. For instance, Latvia and Lithuania tax gifts through the personal income tax (PIT). Batchelder (2020[3]) recently proposed such an integrated approach for the United States, where inheritances would be taxed under income and payroll taxes above a large lifetime exemption. Such an approach would level the playing field between earned labour and/ or capital income and inheritances, but could create some difficulties. In particular, it would be necessary to apply income averaging to address the lumpiness of inheritances. Depending on tax design, taxing inheritances under the PIT could also lead to very high marginal effective tax rates for recipients who earn labour income and receive inheritances, which could have strong disincentive effects on labour supply. If inheritances were taxed jointly with capital income under a dual income tax, they would not introduce such labour supply distortions, but would still require income averaging for individuals who receive large amounts of capital income. In contrast, taxpayers who have greater control over the timing of their income may be able to minimise personal income in the year they receive an inheritance. If inheritances were redefined as personal income, there would also be important implications regarding the allocation of taxing rights between countries in the case of cross-border inheritances. Such effects can be avoided by having a separate tax on bequests. More generally, as discussed in Chapter 2, the distributional and behavioural effects of income and inheritance, estate, and gift taxes are likely to be different and may also justify a separate tax treatment.

3.4. Rules determining tax liability

3.4.1. Rules governing liability for inheritance and estate taxes vary substantially across countries

Liability for inheritance or estate taxes most commonly depends on the nationality or tax residence of the donor or the physical location of assets (Table 3.2). The most common approach across OECD countries is to levy inheritance or estate taxes on total worldwide assets of tax-resident donors and on total or immovable assets located within the jurisdiction for non-resident taxpayers. Three countries tax citizen donors, regardless of whether they are tax residents. One country – the United Kingdom – levies estate taxes on domiciled taxpayers, whose strongest ties are in the country, but not on tax residents, who may be domiciled abroad.5 A minority of countries do not tax nationals’ or residents’ foreign immovable property; only moveable property located abroad and assets located within the jurisdiction. Some countries apply different taxes or thresholds to non-residents. For example, Belgium and Luxembourg apply a special transfer tax to non-residents, rather than the usual inheritance tax that would apply to residents, and the United States applies a significantly lower tax-free threshold to non-residents. The regional or local tax residency of the donor or the location of the assets are determining factors for the countries that levy inheritance taxes at the regional or local level.

Table 3.2. Taxable persons and assets

|

Taxable persons |

Taxable assets |

Countries |

|---|---|---|

|

Donor is a tax resident or tax domicile |

Worldwide assets |

Belgium, Denmark, Finland, France, Germany1, Ireland, Italy, Japan, Korea, Netherlands2, Slovenia, Switzerland, United Kingdom3, United States |

|

All assets within the jurisdiction and moveable property outside the jurisdiction |

||

|

Donor is a national |

Worldwide assets |

Chile, United States |

|

All assets within the jurisdiction and moveable property outside the jurisdiction |

Hungary |

|

|

Beneficiary is a tax resident or tax domicile |

Worldwide assets |

Finland, France, Germany, Ireland, Japan6, Lithuania, Poland, Spain |

|

Beneficiary is a national |

Worldwide assets |

Hungary, Poland |

|

Taxable person is not a tax resident, tax domicile or national |

Immovable and moveable property within jurisdiction |

Chile7, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Korea, Lithuania, Portugal8, Spain, United Kingdom, United States |

|

Immoveable property within jurisdiction |

Belgium9, Denmark, Finland10, Luxembourg11,Poland, Slovenia, Switzerland |

1. A German national is considered a taxable person if the donor has been non-resident for tax purposes for less than five years.

2. A Dutch national is considered a taxable person if the donor has been non-resident for tax purposes for less than ten years.

3. This includes taxpayers who were actually tax-domiciled in the United Kingdom in the preceding three years, even if were tax residents abroad, and taxpayers who were tax resident in the United Kingdom for 15 of the past 20 years, even if they were domiciled abroad. Some assets are exempt from inheritance taxation; non-domiciled taxpayers are exempt on certain types of collective investment funds (open-ended investment company and authorised unit trust) and non-resident taxpayers are exempt on government bonds.

4. A Greek national is considered a taxable person if the donor has been non-resident for tax purposes for less than ten years preceding the inheritance.

5. This applies if the donor is not a Hungarian citizen and no inheritance tax has been imposed on assets outside Hungary.

6. A Japanese national is considered a taxable person if both the beneficiary and the donor left have been non-resident for tax purposes for less than ten years. Non-citizen, tax resident beneficiaries are taxed on assets situated within Japan.

7. It includes property located outside the jurisdiction that was acquired using Chilean resources.

8. If the inheritance consists of listed shares, the beneficiary must be a tax resident.

9. Immovable property is subject to a transfer tax, if the donor is not a tax resident.

10. Includes shares or other rights in a corporate body where more than 50% of total gross assets consist of real property situated in Finland.

11. Immovable property is subject to a transfer tax, if the donor is not a tax resident.

Note: Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes (2020)

Nine countries levy inheritance or estate taxes depending on the situation of the beneficiary (Table 3.2). Beneficiaries are typically liable if they were tax residents at the time that they received the inheritance. Hungary and Poland, on the other hand, tax citizen beneficiaries. Lithuania, Poland, and Spain are the only countries to exclusively consider beneficiaries; the remaining countries consider the residency or nationality of both beneficiaries and donors.

There are various administrative reasons why the donor’s tax residence or citizenship is the most common connecting factor to determine where transferred assets are taxable. From an administrative perspective, it may be easier to identify the taxable event, as the distribution of a person’s wealth following their death is tied to additional procedures like probate and there will likely already be people administering the donor’s affairs. It is unclear whether the incentive for avoidance-related migration is stronger for beneficiaries or donors, however, as the donor is already linked to their wealth, and beneficiaries are only linked to wealth after they receive it, it may be easier to apply tail provisions, discussed in the following sub-section, to donors than to beneficiaries.

3.4.2. The risks of tax-related emigration, double non-taxation and double taxation can be minimised through tax design

Several jurisdictions apply “tail provisions”, where taxpayers continue to be liable for inheritance or estate taxes for a number of years after leaving the country. In some countries, citizens and/or former tax residents are treated as tax residents for inheritance tax purposes if the donor passes away soon after the donor or beneficiary has left their home country.6 Such tail provisions limit the risk of inheritance or estate tax avoidance by emigrating shortly before the donor’s death. These provisions may also mitigate the need for provisions such as exit taxes, where citizens and former tax residents renounce their status. To distinguish avoidance-related emigration from genuine emigration, tail provisions may expire after a set number of years, so genuine emigrants cease to be liable for inheritance or estate taxes in their home country.

Provisions to relieve double taxation vary across countries. Given the differences across countries in rules determining liability for inheritance or estate taxation, double (or multiple) taxation may arise in cross-border wealth transfers. Double taxation relief is available under double tax treaties in some cases, although treaty networks to prevent inheritance or estate double taxation are very limited. A majority of countries levying inheritance or estate taxes provide unilateral relief. Under domestic legislation, relief is typically provided for inheritance and gift tax paid abroad in respect of assets located abroad (e.g. a tax credit or an exemption). In some cases, however, unilateral relief may be incomplete. For instance, relief may only be granted for taxes paid on certain types of foreign property. There may also be mismatches between inheritance tax rules regarding what is considered a local compared to a foreign asset and between valuation methods for the same property (European Commission, 2011[4]). In some countries, there is no relief provided for gifts, either through unilateral or double tax treaty relief.

Reforms could be considered to avoid risks of double taxation and double non-taxation by better aligning taxing rights across countries. Given the limited number of double tax treaties, there might be merit in focusing first on improving and harmonising domestic rules for inheritance or estate tax relief (European Commission, 2011[4]). As part of these efforts, the order of priority of taxing rights could also be clarified. Countries may coordinate on certain rules; for example, assigning the primary right to apply inheritance or estate taxes to the country where the taxpayer has the closest link; providing tax relief in the country where the beneficiary has personal links for the tax paid on the inheritance in the country where the donor had personal links; and establishing mutual agreement procedures for situations where a beneficiary or a donor had personal links to more than one country (e.g. resident in one country and domiciled in or a national of another). Consistent application of such rules across countries could reduce risks of double taxation and double non-taxation in cross-border inheritances.

3.5. Tax exemption thresholds

3.5.1. Close family members often benefit from more generous tax exemption thresholds

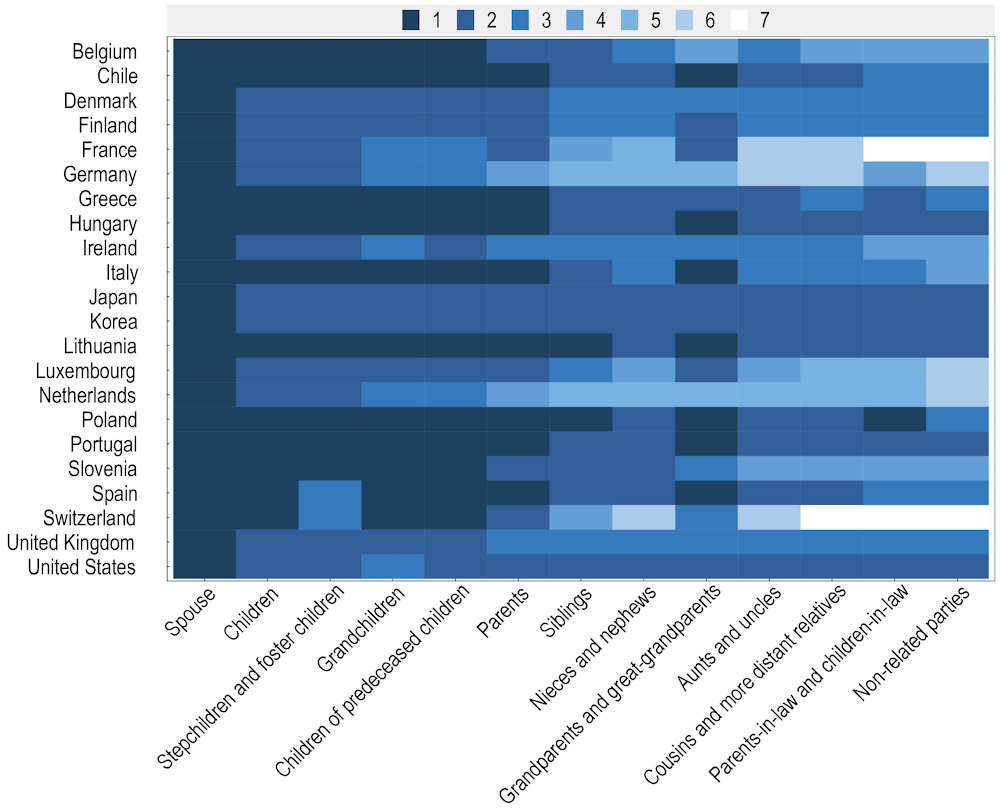

Inheritance and estate tax exemption thresholds typically depend on the relationship between the donor and the heir, with more favourable exemption thresholds applying to closer family members. Figure 3.8 shows family members arranged according to proximity to the donor, with darker shading indicating more favourable inheritance or estate tax treatment and lighter shading indicating less favourable tax treatment. Across countries, the donor’s spouse and children are either exempt or benefit from the highest exemption thresholds. It is worth mentioning that these heirs are typically entitled to a share of the donor’s estate under forced heirship rules (see Box 3.2). Some countries apply the same tax treatment to the immediate family and beyond (e.g. Poland), but in others, the most favourable treatment is restricted to the closest family members (e.g. Ireland). The tax treatment of parents and grandparents is generally among the more generous, while cousins receive the same tax treatment as aunts and uncles in most countries. Where more distant relatives receive the same treatment, it is usually because countries group together relatives that are not close family. As shown in Tables 3.3, some countries in practice have only two or three groups of beneficiaries, while countries such as France and Switzerland have as many as seven groups.

Table 3.3. Number of beneficiary groups, according to applicable tax rates and exemption thresholds, per country

|

Number of beneficiary groups |

Countries |

|---|---|

|

2 |

Hungary, Japan, Korea, Lithuania, Portugal |

|

3 |

Chile, Denmark, Greece, Finland, Spain, United Kingdom, United States |

|

4 |

Belgium, Ireland, Italy, Poland, Slovenia |

|

6 |

Germany, Luxembourg, Netherlands |

|

7 |

France, Switzerland |

Note: This table considers the tax rate schedule and the tax exemption threshold that apply to heirs. Countries may have fewer beneficiary groups when considering only one of these dimensions or under relevant legislation. Belgium: refers to the Brussels-Capital Region. Korea: assumes that the standard deduction applies. Poland: the Tax on Inheritance and Donation Act specifies three beneficiary groups, but was amended in 2006 to exempt a subset of Group I beneficiaries. Switzerland: refers to the Canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes 2020.

Figure 3.8. Tax exemption thresholds according to relationship with the donor, most to least favourable

Note: The category “siblings” includes step-siblings. Beneficiaries are ordered first with respect to the applicable rates schedule and then to the tax-free threshold. This figure assumes that beneficiaries are adults and do not have a disability. Belgium: refers to the Brussels-Capital Region. Korea: assumes that the standard deduction applies. Lithuania: Step-siblings are not exempt. Netherlands: foster children are treated as children if they have been supported by the deceased for at least 5 years before their 21st birthday; otherwise they are treated as other family. Poland: Siblings receive the most favourable treatment and step-siblings receive the 4th most favourable treatment. Spain: children and grandchildren aged under 21 receive the most favourable tax treatment. Switzerland: refers to the Canton of Zurich, foster children receive the 6th most favourable tax exemption. United States: The Generation Skipping Tax (GST) applies to asset transfers to recipients, usually grandchildren, who are two or more generations younger than the donor. As the GST applies at the same rate and above the same exemption threshold as estate taxes, the effective taxation of wealth transfers is the same whether donors transfer directly to their grandchildren, or whether they transfer to their children, who then transfer the wealth to their children (the original donor’s grandchildren).

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes 2020

Box 3.2. Forced heirship rules

Forced heirship rules limit the freedom of donors to decide how their assets are distributed upon death. Countries may consider that spouses and parents have a responsibility to provide for their close family and so regulate the transfer of assets to them. Such rules may also limit unfair behaviour, preventing donors from favouring one child above another or from causing financial hardship to their spouse, while retaining some flexibility for donors to bequest a portion of their assets as they wish.

Most countries have some form of forced heirship (Table 3.4). Of the 24 OECD countries that levy inheritance or estate taxes, only three countries allow full testamentary freedom, where donors can dispose of their assets as they wish. Nineteen countries allow partial testamentary freedom but require donors to leave a fixed share of their wealth to specified persons. In the majority of countries that apply these rules, spouses and children are entitled to a share of the estate. Where spouses are the only forced heirs, children are entitled to some form of financial support. In other countries, a broader (parents, spouses, and children) or narrower (only children) category of beneficiaries are considered forced heirs. More distant relatives, such as grandchildren, can be considered forced heirs in 12 countries when the donor does not have closer relatives (Belgium, Chile, Germany, Italy, Japan, Korea, Lithuania, Netherlands, Portugal, Slovenia, Spain, and Switzerland).

Table 3.4. Forced heirship rules

|

Designated heirs |

Countries |

|---|---|

|

Parents, spouses, and children |

Hungary, Poland, Switzerland |

|

Spouses and children |

Belgium, Chile, Denmark, Germany, Greece, Italy, Japan, Korea, Lithuania, Portugal, Slovenia, Spain |

|

Spouses (some provision for children) |

Ireland1 |

|

Children |

Finland, France, Luxembourg, Netherlands |

|

No forced heirs |

Latvia, United Kingdom, United States |

1. Children can apply for a provision of maintenance if the donor failed for provide for them in the will.

Note: The information in this table considers that donors have a spouse, children, and parents. Different rules may apply where this is not the case; in some countries, more distant family members are forced heirs where the donor does not have closer relatives. Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the Canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes (2020).

While forced heirship rules may help protect heirs, they may also prevent donors from sharing their wealth more widely or donating it to charitable causes. Forced heirship rules may also counter efforts to reduce wealth inequality by mandating that a minimum share of the donor’s wealth pass to their closest heirs. Inheritance and estate tax revenue may also be limited if countries mandate that donors pass a significant share of their wealth to heirs that benefit from higher tax exemptions and lower tax rates.

3.5.2. Spouses are exempt or benefit from the highest tax exemption threshold

In all countries that levy inheritance and estate taxes, spouses benefit from the most generous tax exemption thresholds (Figure 3.8, Table 3.5). The surviving spouse is fully exempt from inheritance or estate taxes in most countries (Denmark, France, Hungary, Ireland, Japan, Lithuania, Luxembourg, Poland, Portugal, Slovenia, Switzerland, the United Kingdom,7 and the United States). In other countries, spouses benefit from the highest tax-free threshold, applying only to spouses (Finland, Germany, Korea, and the Netherlands) or the highest tax-free threshold that also applies to other close family members (Belgium, Chile, Greece, and Italy). In the United Kingdom, the unused fraction of the donor’s tax-free threshold can pass to the surviving spouse. If, for example, the donor uses half of their exemption threshold bequeathing wealth to a taxable heir (i.e. any heir but their spouse), the surviving spouse would combine their own tax-free threshold with the remaining unused half of their deceased spouse’s tax exemption threshold, allowing spouses to use the full value of their tax exemptions between them.

Table 3.5. Tax treatment for the donor’s spouse and children

|

Country |

Spousal treatment for married (MA), civil union (CU), and cohabiting couples (CH) |

Tax exemption threshold spouse |

Tax exemption threshold children |

|---|---|---|---|

|

Belgium |

MA, CU |

USD 17 133 |

USD 17 133 |

|

Chile |

MA, CU |

USD 36 952 |

USD 36 952 |

|

Denmark |

MA, CU |

Exempt |

USD 46 147 |

|

Finland |

MA, CU |

USD 102 798 |

USD 22 844 |

|

France |

MA, CU1 |

Exempt |

USD 114 220 |

|

Germany |

MA, CU |

USD 571 0982 |

USD 456 879 |

|

Greece |

MA, CU |

USD 171 329 |

USD 171 329 |

|

Hungary |

Exempt |

Exempt |

|

|

Ireland |

MA, CU |

Exempt |

USD 382 636 |

|

Italy |

MA, CU |

USD 1 142 197 |

USD 1 142 197 |

|

Japan |

MA |

Exempt |

USD 337 1593 |

|

Korea |

MA |

USD 2 541 778 |

USD 423 6304 |

|

Lithuania |

MA |

Exempt |

Exempt |

|

Luxembourg |

MA, CU |

Exempt |

Depends on value of estate5 |

|

Netherlands |

MA, CU, CH6 |

USD 755 3677 |

USD 23 924 |

|

Poland |

MA |

Exempt |

Exempt |

|

Portugal |

MA, CU |

Exempt |

Exempt |

|

Slovenia |

MA, CU, CH |

Exempt |

Exempt |

|

Spain |

MA, CU |

USD 18 226 |

USD 18 2268 |

|

Switzerland |

MA9 |

Exempt |

Exempt |

|

United Kingdom |

MA, CU |

Exempt |

USD 641 026 |

|

United States |

MA |

Exempt |

USD 11 580 000 |

1. Civil partners must have a valid will naming their partner as one of the beneficiaries. In case of intestate succession, the partner does not benefit from spousal treatment.

2. In case of acquisitions mortis causa, the threshold may increase by up to EUR 256 000 for spouses and by up to EUR 52 000 for children (depending on age). However, this additional exemption is reduced by the net present value of survivor pensions.

3. It assumes that the child is the only heir. The tax-free threshold is equal to 30 million yen + (6 million yen * number of statutory heirs).

4. It assumes that the child is the only heir and receives the full standard deduction of KRW 500 million. The alternate itemised deduction consists of a basic allowance of KRW 200 million and additional allowances for direct descendants, elderly and minor heirs and heirs with a disability, and a housing allowance.

5. Children are exempt on the inheritance that they would be attributed under intestate laws, defined as a share of the estate, and are taxed above this amount.

6. Co-habiting partners must have lived together for at least five years (six months if they have signed a notarial cohabitation agreement) and must have a valid will naming their partner as one of the beneficiaries. In case of intestate succession, the partner does not benefit from spousal treatment.

7. Inherited pension wealth counts towards the spouse’s tax exemption threshold.

8. As many regions apply additional tax-exemption thresholds to donor’s children, the tax exemption provided by the central government should be viewed as a lower bound.

9. Civil partners benefit from a small additional tax-free threshold, but this is less favourable than the full exemption available to married couples.

Note: Exemption thresholds are reported in USD 2020. This table assumes that beneficiaries are adult6s and do not have a disability. Data on tax treatment for civil union and cohabitating couples was not available for Hungary. Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes.

The tax treatment of spouses and partners may depend on the type of union (Table 3.5). In most OECD countries, couples are able to choose between marriage, a civil union, and cohabitation, which can determine the applicable inheritance or estate tax treatment. Two countries apply the same tax treatment to all married, civil union, and co-habiting partners, while 13 apply the same tax treatment to married partners and civil partners. Additional criteria may apply to non-married partners; for example, the Netherlands requires co-habiting partners to have lived together for at least five years8 and France requires civil partners to have a valid will. Six countries only grant special treatment to married couples. Couples under the same type of union benefit from the same tax treatment regardless of sexual orientation, but some countries restrict certain unions to different- or same-sex couples.9

The tax exemption thresholds for children are typically among the highest, but the level varies across countries

The tax treatment of direct descendants is among the most favourable; the same as or second only to the spouse in nearly all countries (Figure 3.8, Table 3.5). The donors’ children are fully exempt from inheritance taxes in Hungary, Lithuania, Poland, Portugal, Slovenia, and Switzerland (Canton of Zurich) and benefit from the highest tax-free threshold in Belgium, Chile, Greece, Italy, and Spain. In these 11 countries, children receive the same treatment as the donor’s spouse. Children benefit from the second highest tax-free thresholds (after the spouse) in Finland, France, Germany, Ireland, Japan, Luxembourg,10 and the United Kingdom.11 In Luxembourg the tax-free threshold for children is a share of the donor’s estate, so the threshold rises with the donor’s wealth. There is an additional threshold for children in Korea12 and an additional threshold for lineal descendants in the United Kingdom when donors bequeath their residence. The donor’s children receive the same exemption as all heirs other than the spouse in Denmark (although children are taxed at lower rates than other heirs) and Japan. Stepchildren are nearly always treated as children for tax purposes. Figure 3.8 shows that, with the exception of Spain and Switzerland, stepchildren receive the same tax treatment as the donor’s children in all countries.

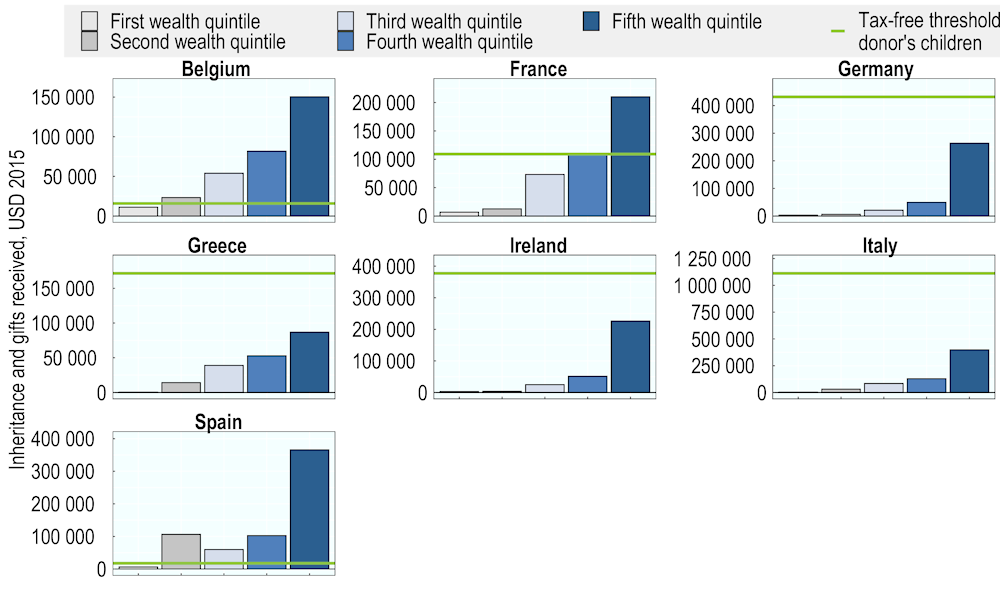

Tax exemption thresholds for transfers to children vary widely (Figure 3.9, Figure 3.10). Several countries provide relatively low tax-exemption thresholds for the donor’s children, including four countries with thresholds under USD 25 000 (Belgium, Finland, Netherlands, and Spain). At the upper end, however, there are large differences between countries, as tax-free thresholds range from around USD 640 000 (the United Kingdom) to around USD 1.1 million (Italy) and around USD 11.6 million (the United States). Figure 3.10 compares applicable inheritance or estate tax exemption thresholds for children in different countries with the average value of inheritances received across the wealth distribution. The tax-free thresholds in Germany, Greece, Ireland, and Italy are above the average value of inheritances received by heirs across the wealth distribution, while the threshold is above all but the highest quintile of inheritances in France. The relatively low tax-free thresholds in Belgium and Spain are still above the value of the average inheritance for the lowest quintile. These comparisons should be interpreted with caution, however, as the value of inheritances varies within quintiles and factors such as the asset type affect the tax liability. In addition, survey data may underestimate wealth at the top of the wealth distribution (see Chapter 1).

Figure 3.9. Tax exemption thresholds for donor's children, USD

Note: Tax exemption thresholds are reported in USD 2020. Children of the donor are exempt in Hungary, Lithuania, Poland, Portugal, Slovenia, and Switzerland. This figure assumes that beneficiaries are adults and do not have a disability. Belgium: refers to the Brussels-Capital Region. Luxembourg: exemption thresholds depend on the value of the estate; children are exempt on the inheritance that they would be attributed under intestate laws, defined as a share of the estate, and are taxed above this amount. Switzerland: refers to the Canton of Zurich. United Kingdom: assumes that the donor uses the residence nil-rate band, but not the transferable nil-rate band (which applies if the donor’s spouse had already passed away and did not made full use of the tax-exemption threshold).

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes

Figure 3.10. Tax exemption threshold for donors’ children compared to the average value of inheritances received by all heirs in each quintile, select countries

2015 or latest available year

Note: Tax exemption thresholds and inheritances are reported in USD 2015. Children of the donor are exempt in Hungary, Lithuania, Poland, Portugal, Slovenia and Switzerland. Data from the Wealth Distribution Database were not available for Finland and the Netherlands and the remaining countries that levy inheritance or estate taxes were not included in the Wealth Distribution Database. This figure assumes beneficiaries are adults (over 21 years old) and do not have a disability. Belgium: refers to the Brussels-Capital Region. Switzerland: refers to the Canton of Zurich.

Source: OECD Wealth Distribution Database, oe.cd/wealth.

3.5.3. Special tax exemption thresholds apply to minor heirs and heirs with a disability in a few countries

Few countries provide special treatment for minor heirs. In Ireland, where a donor’s child passes away before the donor but has children themselves, the grandchildren under 21 years of age will receive the same treatment as the donor’s children; otherwise, they are treated as grandchildren. In Korea, minors receive an additional deduction per year until they reach 20 years of age, but estates must choose itemised deductions, rather than the standard deduction, to obtain this relief. In Spain, children and grandchildren receive a more favourable tax treatment if they are under 21 years of age. Property left in trust for orphaned minor children in the United Kingdom can qualify for treatment that is slightly more favourable than the standard tax treatment for trusts.

Some countries apply special treatment to heirs who have a disability. In Ireland, gifts and inheritances received by heirs who have a disability are exempt if used for qualifying expenses, which include costs for medical treatment and associated maintenance. In five countries, heirs who have a disability benefit from an additional tax-free threshold (Italy, Korea, Netherlands, Switzerland, and Spain) or a reduction of the tax liability (Greece). The additional allowance in Korea is only available where estates opt for itemised deductions. Above the additional tax-free allowance, beneficiaries with a disability are taxed at usual rates in all countries. One country (Spain) conditions the additional thresholds on the degree of disability.

3.5.4. Tax exemption thresholds should balance the notion of care, with efficiency and equity objectives

Overall, there is a strong case for exempting small inheritances. Tax-free thresholds that effectively exempt small inheritances can reduce the administrative burden, both for taxpayers and tax administrations, and may be equitable given the equalising effect of small inheritances on the distribution of wealth (see Chapters 1 and 2). As discussed in Section 3.14, tax exemption thresholds may also increase the political acceptability of inheritance and estate taxes (Bastani and Waldenström, 2021[5]). In some countries, tax exemption thresholds increase annually. Indexing thresholds to inflation ensures that tax exemption thresholds retain their real value and may lessen political pressure to make large periodic adjustments.

There are several justifications for applying exemptions or higher tax-free thresholds to spouses. Full exemptions or higher exemption thresholds for spouses reflect couples’ pooled resources and shared ownership of assets. This may prevent the surviving spouse experiencing hardship upon their spouse’s death. Exemptions may also address gender imbalances in asset ownership, particularly in cases where one partner performs non-market work to support their partner’s ability to engage in paid work and accumulate wealth and pension rights. Finally, taxing wealth when it transfers from one spouse to another and then to the couple’s children may amount to double-taxation (Boadway, Chamberlain and Emmerson, 2010[6]). The risk of inheritance tax avoidance is generally limited when transferring wealth between spouses, as the wealth will eventually pass to the next generation, where it may be subject to taxation (Boadway, Chamberlain and Emmerson, 2010[6]).13 Couples have a tax incentive to enter a civil union or to marry when more favourable tax treatment applies to these unions than to cohabitation or civil union, respectively. In cases where countries restrict access to civil unions and marriage based on the partners’ sexual orientation, this may have significant implications for inheritance and estate tax treatment.

Higher tax-free thresholds for donors’ children may be justified, but depending on their level, they might significantly reduce the tax base. A common justification for providing a more generous tax treatment of gifts and bequests to donors’ children is based on the notion care, which may be particularly important when children are young, as the inheritance may contribute to living and education expenses. It also makes the tax more acceptable given that taxpayers place great value on passing on wealth to their children. Economically, it may be argued that wealth transfers to children may be less elastic than transfers to more distantly related heirs and could therefore be taxed at higher effective tax rates. However, it is likely that the negative behavioural response of donors in the form of reduced incentives to work and accumulate wealth might be more significant in response to high tax levels on transfers to children than in response to high tax levels on transfers to more distantly related heirs (see Chapter 2). In addition, parents may respond by changing the form of their transfers, for example by increasing in-kind giving. Thus, there might be some justification for higher tax exemption thresholds for transfers to direct descendants. However, if tax exemption thresholds for wealth transfers to children are very high, they may significantly reduce the revenue raising capacity of inheritance and estate taxes and may mean that a significant share of wealth transfers fully escape inheritance or estate taxation (Figure 3.2).

Narrowing tax exemption differentials between close and distant heirs where these differentials are significant may raise efficiency and reduce avoidance. In some cases, lower tax exemption thresholds (often combined with higher tax rates) on transfers to more distant relatives and non-family members may be questionable. These differentials raise a horizontal equity issue, where two individuals receive the same wealth but benefit from vastly different tax exemption thresholds depending on who they receive the wealth from. Applying higher tax rates to more distant family members also distorts donors’ choices about how to distribute their wealth, incentivising them to concentrate their wealth transfers among closer family members. Reducing the difference in the tax treatment between closely related and distantly related heirs may encourage donors to spread their wealth among more heirs and thereby reduce concentrations of wealth, as well as improve horizontal equity.

3.6. Statutory tax rates

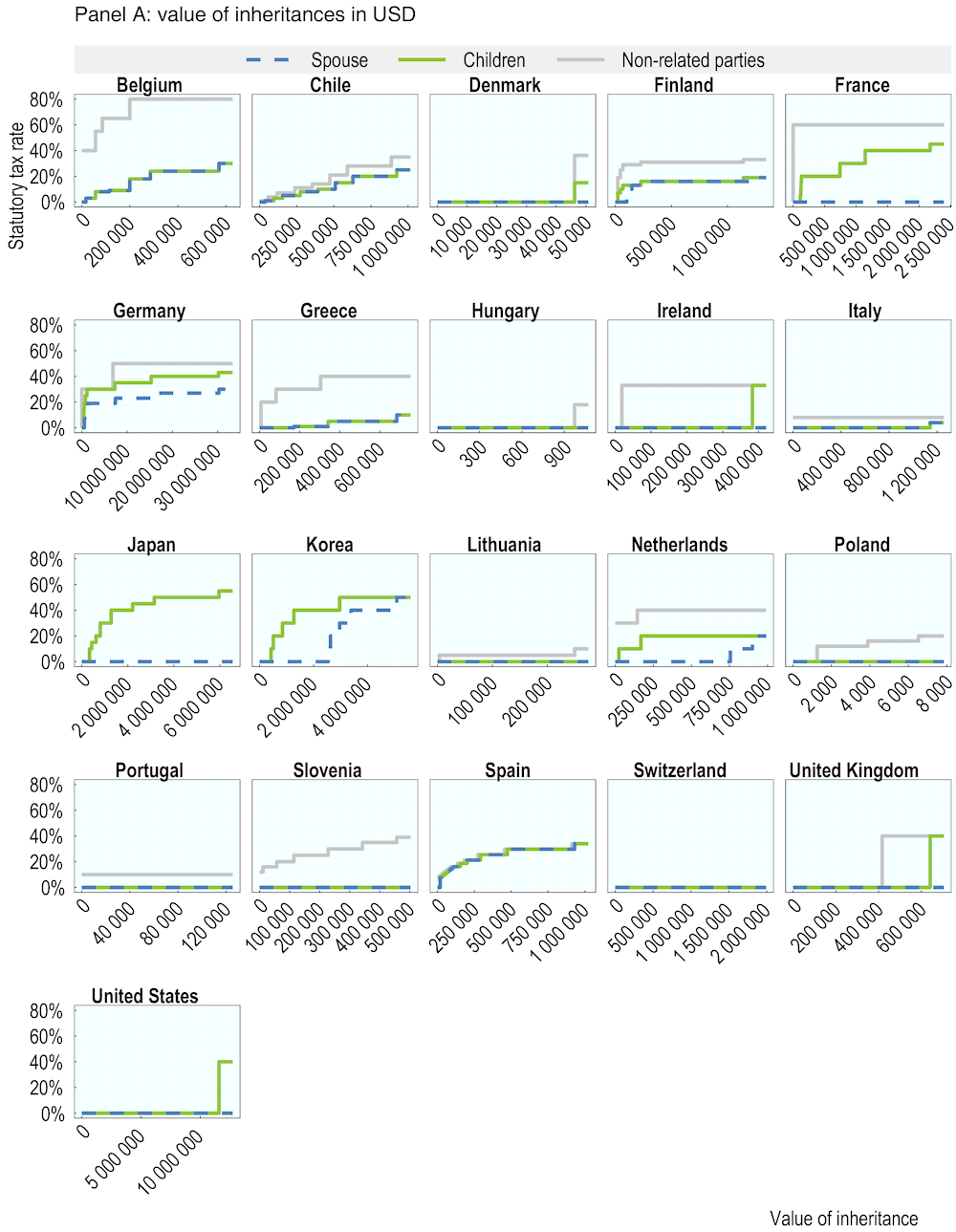

3.6.1. Tax rates typically depend on the amount of the wealth transfer and the relationship between the donor and the beneficiary

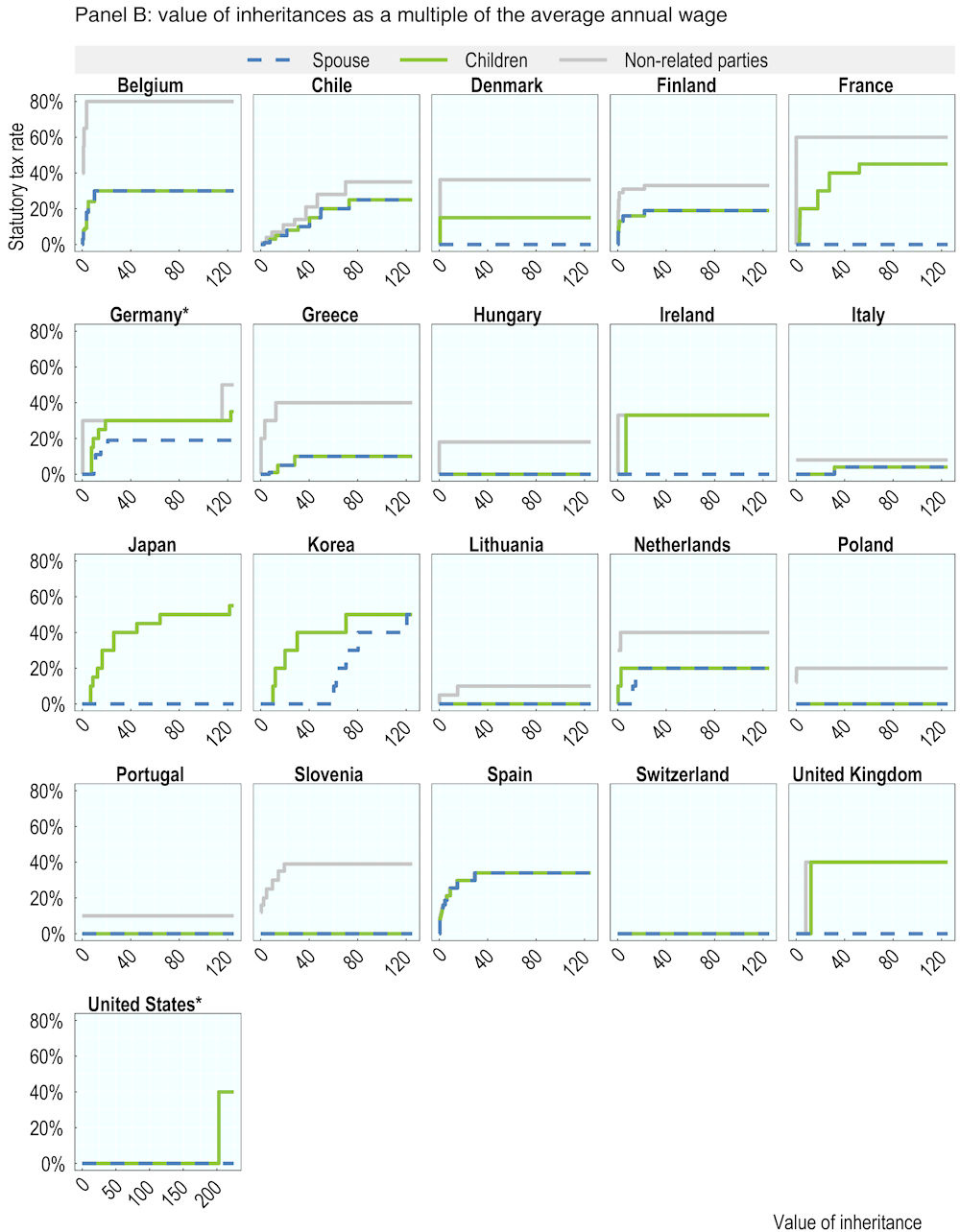

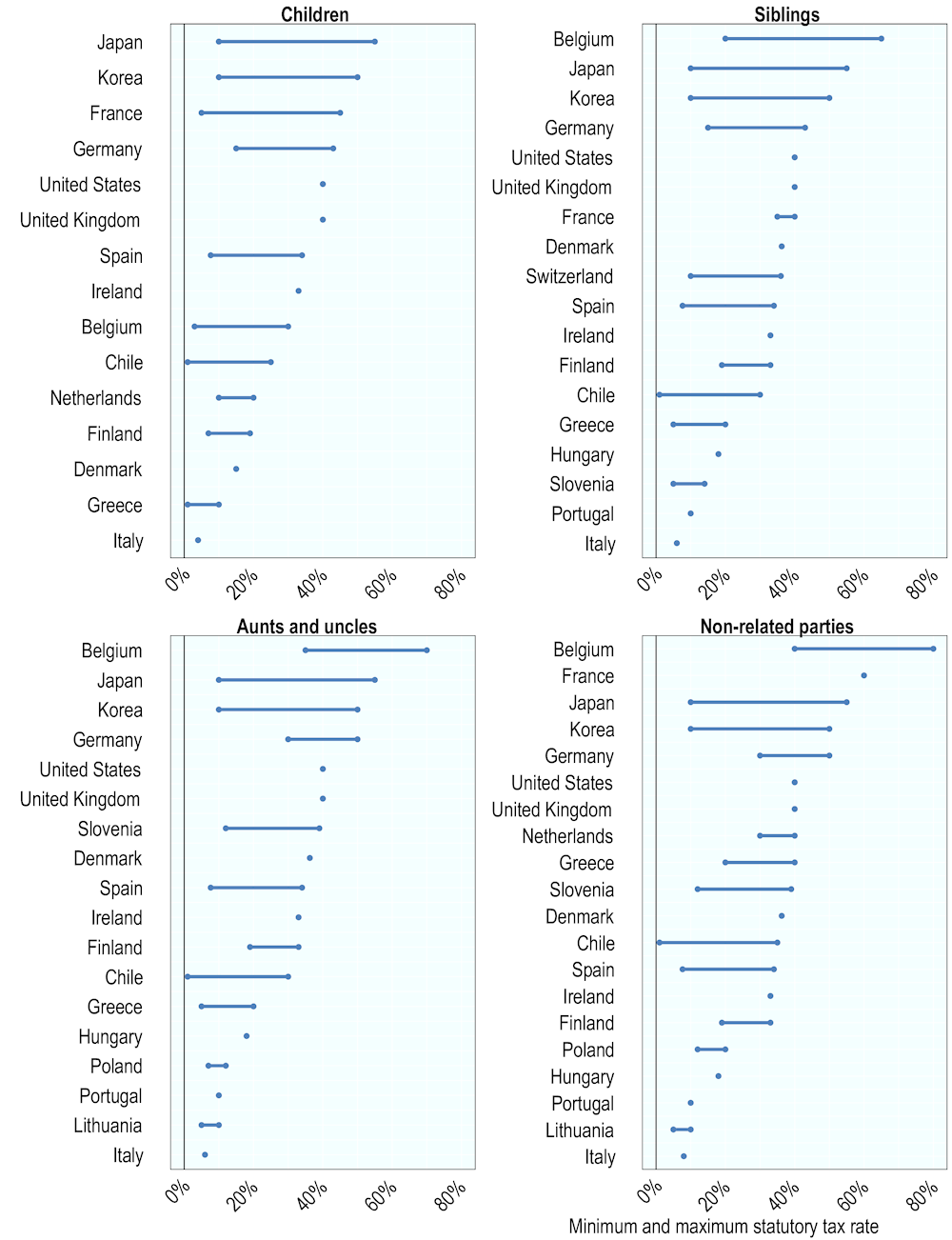

Inheritance and estate tax rates vary substantially across countries, as do the wealth levels to which they apply. Seven countries apply flat inheritance or estate tax rates, while 15 apply progressive rates. Of these 15 countries, all but one apply multiple progressive rate schedules, where, first, the marginal rate rises with the value of the inheritance and second, separate and typically higher tax rate schedules apply to more distant family and non-relatives (Belgium, Chile, Finland, France, Germany, Greece, Japan, Lithuania, Luxembourg, Netherlands, Poland, Slovenia, Spain, and Switzerland). Korea applies one progressive rate schedule to all heirs.

Flat inheritance or estate tax rates range from 4% to 40% (Figure 3.11). The same flat rates apply to all heirs in Ireland (tax rate of 33%), Hungary (18%), Portugal (10%), the United Kingdom (40%), and the United States (40%). Italy and Denmark apply a flat tax rate that depends on the relationship between the donor and the beneficiary: ranging from 4% for the closest family members to 8% for other beneficiaries in Italy, and from 15% to 36.25% in Denmark.

Progressive rates range from 1% (Chile) to 80% (Belgium) (Figure 3.11, Figure 3.12). Nearly all countries with progressive tax rates apply several schedules, depending on the proximity between the donor and the beneficiary. Progressive rates for spouses and children are typically lower and vary less widely across countries than the rates that apply to other family and non-related persons. For example, the minimum rate that applies to children ranges from 1% (Chile and Greece) to 10% (Japan, Korea, and the Netherlands) but the minimum rate that applies to siblings ranges from 1.2% (Chile)14 to 35% (France). Top marginal rates applying to children range from 10% (Greece) to 55% (Japan), while top marginal rates applying to wealth transfers to siblings range from 14% (Slovenia) to 65% (Belgium).

Within some countries, tax rate schedules vary widely depending on the relationship between donors and beneficiaries. Among countries that apply multiple tax schedules that depend on proximity between the donor and the beneficiary, some exhibit only small differences between the tax rate schedules that apply to groups of beneficiaries (e.g. Chile, Poland, and Slovenia). However, in other countries, tax rates are much higher for wealth transfers beyond close family. In Belgium and Germany, for example, the donor’s children benefit from rates as low as 3% (Belgium) and 7% (Germany), but the lowest rate for aunts and uncles is 30% (Germany) and 35% (Belgium).

Top marginal tax rates kick in at relatively low levels of transferred wealth in several countries with progressive tax rates. For instance, Belgium applies six marginal rates to the donor’s children, with rates increasing for inheritances up to roughly USD 570 000. Beyond that threshold, inheritances are taxed at the top marginal rate. In contrast, the top marginal rate in Germany applies at around USD 33.3 million for the donor’s children. Panel B of Figure 3.11, which shows tax thresholds as a multiple of countries’ annual average wage, shows that for children, the threshold for the top marginal rate was lowest in the Netherlands (2.8 times annual average wage), Belgium (10.1), and Finland (22.1). For non-related heirs, the threshold for the top marginal rate was lowest in France (0.04 times annual average wage), Hungary (0.07), and Poland (0.3).

Figure 3.11. Statutory inheritance and estate tax rate schedules for spouse, children, and non-related parties

Note: *Germany applies additional rates that are not included in this graph. Spouse: 23% from 129-264 times average wage, 27% from 264-513 times average wage, and 30% above 513 times average wage. Children: 40% from 257-506 times average wage and 43% above 506 times average wage).

* United States: x-axis shows 0-200 times average wage; all other charts show 0-125 times average wage on x-axis.

Tax exemption thresholds are reported in USD 2020. This figure assumes that beneficiaries are adults (over 21 years old) and do not have a disability. Belgium: refers to the Brussels-Capital Region. Chile: a surcharge of 20% on the tax liability applies to 2nd rank relatives (siblings, nieces, nephews, aunts, uncles, cousins, great-aunts, great-uncles) and a surcharge of 40% applies to other beneficiaries. Japan: Assumes that there is only one heir, so the tax-free threshold is USD 337 159 [36 million yen = 30 million yen + (6 million yen * number of statutory heirs)]. Poland: Siblings receive the most favourable treatment and step-siblings receive the 4th most favourable treatment. Switzerland: refers to the canton of Zurich. United Kingdom: Assumes that the taxpayer applies the residence nil-rate band.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes

Figure 3.12. Minimum and maximum statutory inheritance and estate tax rates, four groups of beneficiaries

Note: Children are exempt in Hungary, Lithuania, Poland, Portugal, Slovenia, and Switzerland. Siblings are exempt in Lithuania, Poland. Belgium: refers to the Brussels-Capital Region. Lithuania: step-siblings are not exempt from inheritance taxes. Poland: Siblings receive the most favourable treatment and step-siblings receive the 4th most favourable treatment. Switzerland: refers to the Canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes

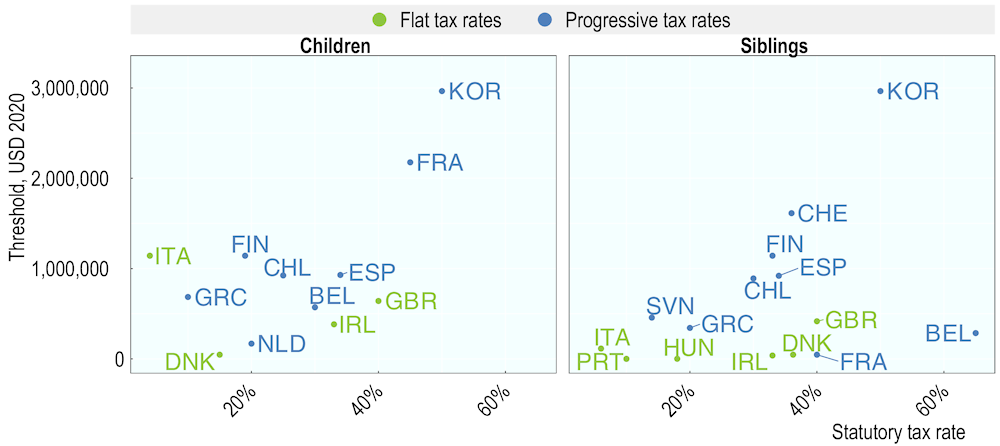

Figure 3.13 shows countries with higher top marginal tax rates levy those on higher-value inheritances, while countries with lower top marginal tax rates apply these at lower thresholds. In addition to the tax rate schedules, the thresholds at which tax rates apply is a key determinant of heirs’ tax liability and the overall progressivity of the inheritance or estate tax. Figure 3.13 shows that countries with relatively high top marginal tax rates apply these at relatively high levels, while the reverse tends to be true for countries with low top marginal tax rates. For example, for the donor’s children, Korea applies a top marginal tax rate of 50% once the inheritance exceeds around USD 3 million, while the Netherlands applies a top marginal tax rate of 20% once the inheritance exceeds around USD 170 000. The relationship between top marginal tax rates and applicable thresholds is particularly strong for the donor’s children, but is also visible for the donor’s siblings. Among countries that levy flat rates, there is no clear connection between the level of the rate and the level of the threshold; relatively similar tax rates apply in Denmark (36.25%) and the United States (40%), but at very different thresholds (around USD 11.6 million in the United States, compared to around USD 46 000 in Denmark).

Figure 3.13. Maximum statutory inheritance and estate tax rates and applicable threshold (USD), donor's children and siblings

Note: Tax exemption thresholds are reported in USD 2020. The category “siblings” includes step-siblings. Three points have been removed for readability: Germany (43% applying at USD 30 153 991 [children] or USD 29 719 956 [siblings]), Japan (55% applying at USD 5 956 474 [children and siblings]), and the United States (40% applying at USD 11 580 000 [children and siblings]). Children are exempt in Hungary, Lithuania, Poland, Portugal, Slovenia, and Switzerland. Siblings are exempt in Lithuania, Poland. Belgium: refers to the Brussels-Capital Region. Lithuania: step-siblings are not exempt from inheritance taxes. Poland: Siblings receive the most favourable treatment and step-siblings receive the 4th most favourable treatment. Switzerland: refers to the canton of Zurich.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes

3.6.2. Progressive tax rates have several advantages compared to flat tax rates

Progressive inheritance or estate tax rates enhance vertical equity effects. Progressive rates increase vertical equity by ensuring that those who receive more wealth pay more tax. Illustrative simulations in Chapter 2 showed that where countries have a preference to prevent the build-up of excessive wealth over generations, progressive inheritance taxes and taxes on personal capital income can be powerful tools. Moreover, unlike flat rates, progressive rates can encourage donors to distribute their wealth among more heirs in order to avoid top marginal rates. As discussed, top marginal tax rates kick in at relatively low levels of transferred wealth in several countries with progressive rates. Where this is the case, applying higher tax rates to very high-value inheritances could improve the progressivity of inheritance and estate taxes. This requires finding a balance so that tax rate levels are not excessively high, as high tax rates strengthen the case for tax reliefs and may induce greater avoidance and evasion behaviours.

Progressive tax rate schedules may help avoid significant increases in marginal effective tax rates. If tax rates increase gradually with the value of the inheritance received, progressive rate schedules may avoid large increases in marginal tax rates. As flat inheritance and estate tax rates are typically high in OECD countries, they often result in high marginal tax rates above tax-free thresholds (Figure 3.11). For example, while Italy levies flat rates that vary between 4% and 8% (depending on the beneficiary), Denmark (depending on the beneficiary), Ireland, the United Kingdom and the United States all levy flat rates above 30%.

It is unclear whether progressive tax rates are more complex to administer. Progressive tax rates may be more complex to administer than flat rates, as taxpayers need to be attentive to multiple rates and thresholds. In addition, taxpayers may engage in greater avoidance behaviour to avoid higher marginal rates. Valuation may also be more contentious under progressive tax schedules, as small changes in value could push taxpayers into a higher marginal tax bracket. However, complexity generally stems more from tax base issues, as discussed later in the chapter, and countries did not report rates schedules to be a source of complexity or a factor in the decision to abolish inheritance or estate taxes.

3.7. Effective tax rates

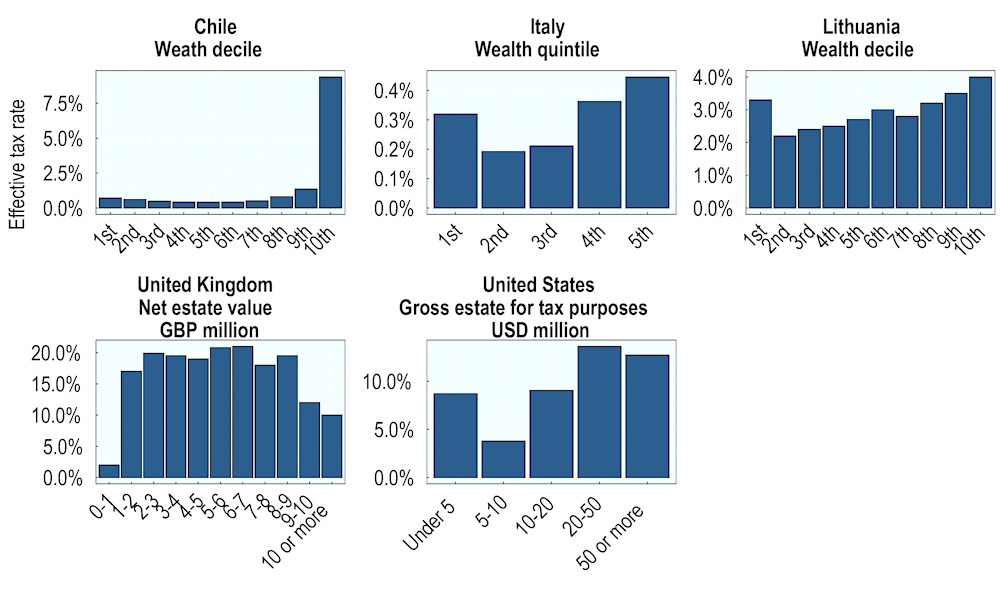

3.7.1. Effective tax rates are significantly lower than statutory tax rates and in some cases decline for the largest estates

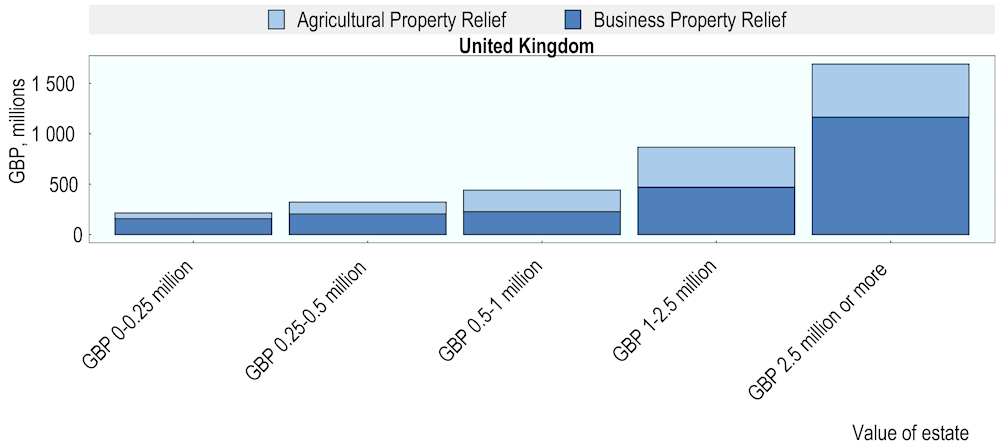

Effective tax rates (ETRs) are significantly lower than statutory tax rates and decline for the largest estates in some countries (Figure 3.14). Backward-looking effective tax rates illustrate the combined effect of tax design measures – including rates, exemptions, and the special treatment for certain assets – on taxpayers’ effective tax burdens.15 Figure 3.14 shows ETRs for five countries for which data were available. Care should be taken when comparing between countries, as these indicators were provided by participating countries and partly reflect differences in methodology. Several broad insights arise from these indicators. The tax burden tends to be lower at the bottom end of the wealth distribution and higher at the upper end of the distribution. However, in some countries, for donors in the lowest wealth grouping, the ETR is higher than the ETR for donors in the lower middle or middle of the wealth distribution. This may in part reflect the fact that poorer households tend to hold assets that do not benefit from special treatment. The figures also show that the tax rates faced by the wealthiest donors exhibit different patterns across countries. In Chile, the ETR at the top of the wealth distribution is far above even the ETR of the ninth wealth decile. In contrast, the ETRs of the wealthiest donors in the United Kingdom and the United States are below those of other wealthy donors. For example, the ETR on an estate owning GBP 8-9 million was twice as high as the ETR for estates owning GBP 10 million or more (19.5% versus 10.0%). This is in part due to a greater share of their estate being covered by a tax relief such as agricultural or business property relief (Office of Tax Simplification, 2018[7]).

Figure 3.14. Effective tax rates across wealth groups or estate values, select countries

2019 or most recent year

Note: United States: data are based on 2018 federal estate tax returns, which in most cases were filed for deaths occurring in 2017, as tax returned are submitted the year after the donor's death. In 2017, the filing threshold was USD 5.49 million of gross estate and from 2018, the filing threshold was USD 11.18 million.

Source: OECD Questionnaire on Inheritance, Estate, and Gift Taxes. Data for Italy are published in (Acciari and Morelli, 2020[8]).