This chapter gives an overview of the performance of the overall economy, macroeconomic developments and challenges, governance and institutions, and general incentives in China for investments by firms, including farms, input suppliers, and food companies. It discusses basic conditions for investment established by the overall regulatory environment; trade and investment policy, which influences the flow of goods, capital, technology, knowledge and people needed to innovate; and access to credit. The general fiscal policy and the treatment of agriculture are then discussed. Specific obstacles and incentives for investment in the agricultural sector are dealt with in later chapters of this report.

Innovation, Agricultural Productivity and Sustainability in China

Chapter 3. Economic and institutional environment in China

Abstract

3.1. Macroeconomic policy environment and governance

Stable and sound macroeconomic policies are integral in creating a favourable environment for innovation. At the broadest level, policies that lead to high economic growth and low and stable inflation help to create a basic condition for long-term investment. Higher productivity and better use of natural resources are in turn helped by long-term investments, which introduce new products, production methods, or business practices (OECD, 2015a).

The People’s Republic of China’s (hereafter “China”) economic rise has often been described as one of the greatest economic success stories in modern times. Behind the strong growth rates were key reforms which increased the role of the market and reduced direct control by the government. In the early years of economic reform, introducing the Household Responsibility System (HRS) in agriculture, which reallocated all arable land from collective farms to individual households, laid the foundation for strong agricultural productivity growth.

Rising incomes in these initial reform years stimulated domestic demand, and the high savings rate was transformed into physical capital investments in non-agricultural sectors in both rural and urban areas (FAO, 2006). Moreover, under the 9th Five Year Plan (1996-2000), large state-owned enterprises (SOEs) were restructured, corporatized, and were expected to operate on profit, while small- and medium-sized firms were privatised, all of which contributed to China’s successful performance. The productivity gains from these reforms along with large-scale investment in capital produced remarkable achievements in China’s economic development (World Bank, 2013).

Table 3.1. Key indicators of economic performance

|

|

1990 |

1995 |

2000 |

2005 |

2010 |

2012 |

2013 |

2014 |

2015 |

2016e |

2017e |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Real GDP growth1 (%) |

.. |

11.0 |

8.4 |

11.3 |

10.6 |

7.9 |

7.8 |

7.3 |

6.9 |

6.7 |

6.4 |

|

General government financial balance2 |

.. |

-1.1 |

-2.8 |

-0.9 |

-0.7 |

0.1 |

-0.5 |

-0.6 |

-1.3 |

-1.8 |

-2.3 |

|

Current account balance2 |

3.2 |

0.7 |

1.7 |

5.8 |

3.9 |

2.5 |

1.5 |

2.7 |

3.0 |

2.4 |

2.4 |

|

Inflation (annual %, CPI all items) |

3.1 |

16.8 |

-0.8 |

1.8 |

3.2 |

2.6 |

2.6 |

2.1 |

1.5 |

2.1 |

2.2 |

Note: e: OECD Economic Outlook estimate.

1. Year-on-year increase.

2. As a percentage of GDP.

Source: OECD (2017a), OECD Economic Outlook, http://dx.doi.org/10.1787/eco_outlook-v2017-1-en.

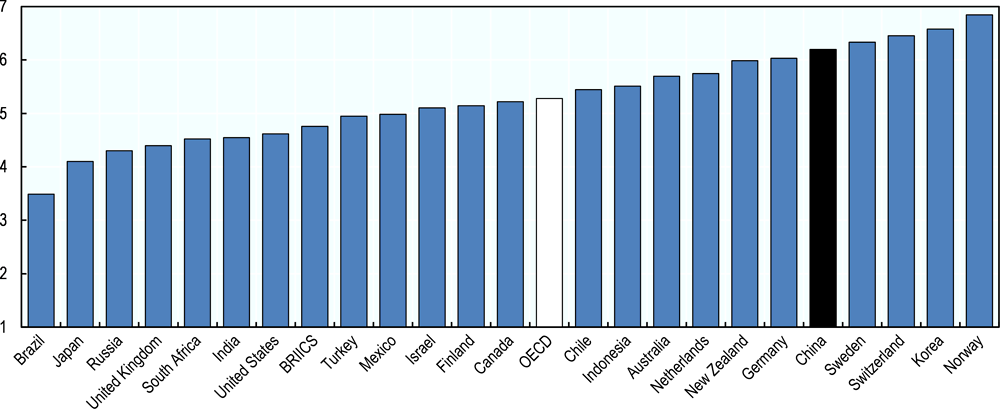

Although China has entered into a lower but likely more sustainable growth trajectory, its macroeconomic environment remains competitive (Figure 3.1). When considering macroeconomic factors such as government budget balance, gross national savings, inflation, government debt, and the country’s credit rating, China ranks among the top countries globally. Helped by its low and stable inflation rate, relatively strong growth, and stable market, the Chinese economy should remain attractive for private investment.

Figure 3.1. Global Competitiveness Index: Macroeconomic Environment, 2016-17

Note: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregate does not include Lithuania.

Source: World Economic Forum (2016), The Global Competitiveness Report 2016-2017: Full data Edition, https://www.weforum.org/reports/the-global-competitiveness-report-2016-2017-1.

Governance and institutions

Good governance systems and high-quality institutions provide economic actors with the assurance that the government is accountable, transparent and predictable. They are a fundamental pre-condition both to encourage public and private investment in the economy and to enable those investments to achieve the intended benefits, both for investors and the host country. Moreover, governance systems play an important role in addressing market failure, influencing the behaviour of firms as well as the efficient functioning of input and output markets (OECD, 2015a).

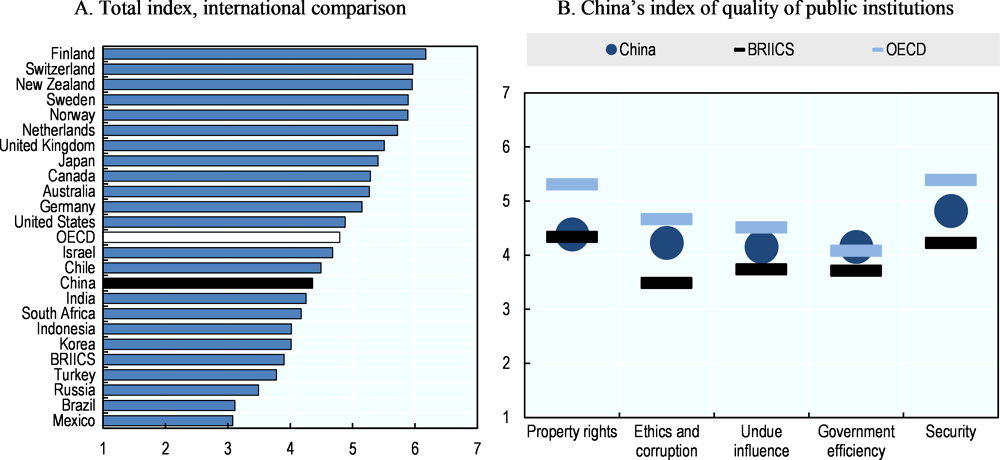

The government of China has always played a strong role in the development of the country. China’s position in the governance indicator sets the quality of its institutions just below the OECD average, but the highest among the BRIICS (Figure 3.2.A). The breakdown of quality indices of public institutions show that property rights and security are among the relatively low performing factors of governance, but government efficiency is scored higher than OECD average (Figure 3.2.B).

Figure 3.2. Global Competitiveness Index: Quality of public institutions, 2016-17

Note: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Lithuania.

Source: World Economic Forum (2016), The Global Competitiveness Report 2016-2017: Full data Edition, www.weforum.org/reports/the-global-competitiveness-report-2016-2017-1.

Box 3.1. Political institutions in China

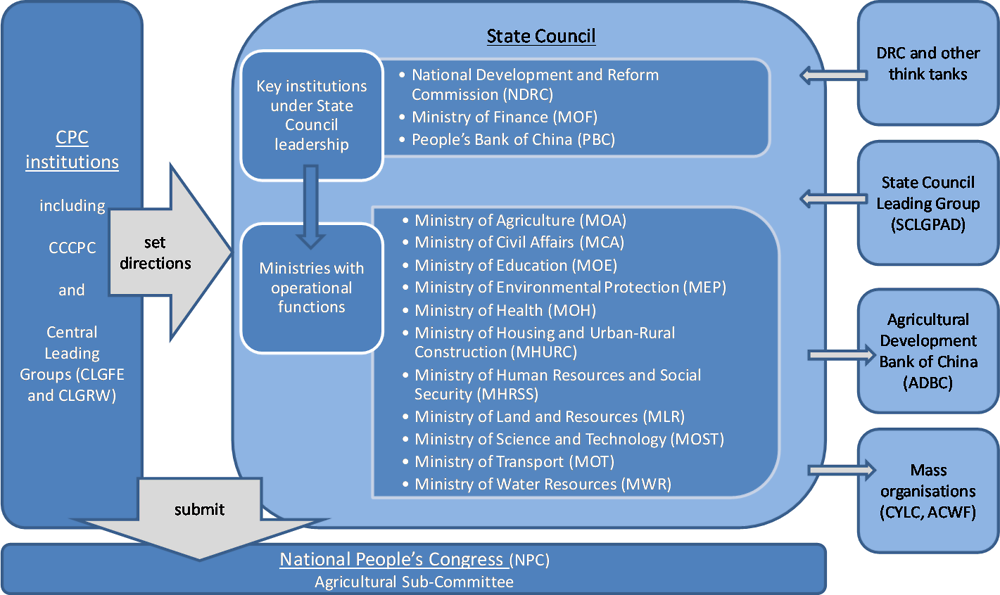

The Communist Party of China (CPC) occupies the dominant political role in China. The CPC, by its own definition, represents the population at large and interprets and expresses the will of the people. The CPC governs all central and sub national level State organs. Currently, the head of the CPC is also the President of the State.

According to the Constitution, the National People’s Congress (NPC), and its permanent office the Standing Committee, is the “highest organ of state power”. The NPC exercises the power of legislation, decision, supervision, election, appointment and dismissal. The President is the head of state, and among other functions promulgates laws, appoints the premier, vice premiers, state councillors, ministers of various ministries and state commissions according to decisions of the NPC and its standing committee. The State Council is the highest body of state administration, and it supervises ministries, commissions and bureaus.

The Central Committee of the Communist Party of China (CCCPC) sets the country’s broad policy directions. Elected by the Party, the CCCPC issues top priority political documents and determines the long-term strategy for the country’s social, economic and political development. The co-ordination institutions under the CCCPC function as a platform for policy discussions with related government bodies, determine general policy principles and work jointly with three key State Council institutions including the National Development and Reform Commission (NDRC), Ministry of Finance (MOF) and People’s Bank of China (PBC). Think tanks under the State Council such as the Development Research Center of the State Council (DRC) provide advice in this process. Finally, the ministries and agencies perform operational functions involving them in day-to-day operations and the practical implementation of rural policies and directives under the State Council’s leadership.

Figure 3.3. Central-level institutional framework for rural policy

Source: OECD (2009), OECD Rural Policy Reviews: China 2009, http://dx.doi.org/10.1787/9789264059573-en.

Competitive environment

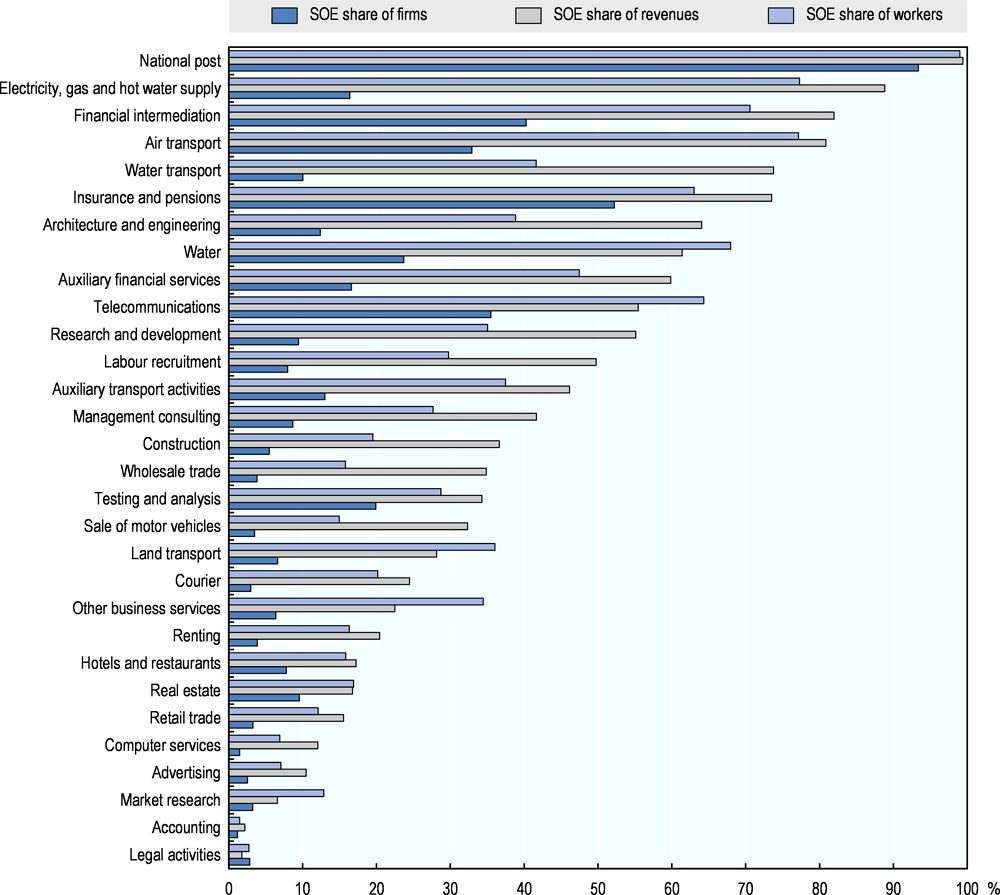

Many sectors in China face low competition as some have been dominated by the State-Owned Enterprises (SOEs). However, a number of SOE reforms have been directed towards liberalising the business sectors for private investment. In particular, policies have promoted restructuring and sale of small and medium-sized SOEs. The achievements of SOE reforms have been twofold: the importance of SOEs in the overall economy has diminished since the start of liberalisation, and those that remain have been forced to improve their efficiency.

The relative importance of SOEs in the Chinese economy has declined over time. In 2012, only 5% of enterprises were state-owned, and SOEs accounted for about a quarter of revenue and profits (OECD, 2015b). In some sectors, oligopolistic market conditions still hinder the competition and entrepreneurship (OECD, 2017b). Some areas of the service sector are still dominated by SOEs in terms of revenue and workers (4). Sector-specific guidelines calling for an opening to private capital were issued in 2010 and 2012 covering energy, finance, telecommunications, transport and other areas. While lifting restrictions, the guidelines lack detail on what forms of investment will be permitted and whether any other limitations might apply (OECD, 2013). In agriculture, the share of SOEs is one of the lowest across the sector, accounting for 4% of sown land area in 2013. While SOEs account for 28% of cotton production, their share in grain and meat production was as low, at 6% and 3% in 2013, respectively. However, the role of SOEs are increasing its prominence in grain trading and farm inputs markets such as COFCO, Sinograin, Beidahuang Group and ChemChina.

Figure 3.4. Share of SOEs in workers, revenues and the number of firms in China, 2013

Notes: Sectors are classified according to the United Nations ISIC Rev. 3 two-digit sector codes except for the following services, which are classified according to the four-digit sector codes: national post, courier services, legal activities, accounting and auditing, architecture and engineering, advertising, market research, labour recruitment, testing and analysis, and management consultancy.

Source: OECD (2015b), OECD Economic Surveys: China 2015, http://dx.doi.org/10.1787/eco_surveys-chn-2015-en.

Of particular concern is the financial services sector, where five state-controlled banks account for 48% of net profits and 57% of gross profits. The portion increases to almost three quarters among development and commercial banks, where are partially owned by the government. All the main operating entities in the insurance and securities sector are either SOEs or have a link to the state (OECD, 2015b). Rates of return of SOEs – the amount of output relative to the amount of capital and raw materials they consume – are lower than their private sector counterparts.

Ensuring fair competition in the input and output market is also a key role of the government in improving competitiveness of the agricultural sector. Developing an efficient and reliable service sector is particularly important to promote more competitive agriculture in China: the OECD-WTO Trade in Value Added Database indicates the share of domestic services in the value added of food and agriculture industries is significantly lower than in OECD countries. Continued restructuring and reform of state-owned enterprises and introducing more competition to the service sector would improve the innovation environment and enhance more “servicification” of agriculture and food industries.

3.2. Regulatory environment

Regulations constitute a basic economic environment within which all firms operate and make investment decisions. The regulatory environment affects how agricultural productivity and innovation will be affected by the operation and investment decisions of input suppliers, food companies, farms, and firms. Competitive market conditions such as low barriers to entry and exit can enable innovation, technological transfer and productivity growth, particularly by entrepreneurs. Regulations also play an important role in the creation of incentives to use natural resources in an environment-friendly manner. This section reviews regulatory environment in China from the perspective of the ease of entry for business into a new market, the ease of conducting business in a given market, and the standards that must be adhered to in order to operate.

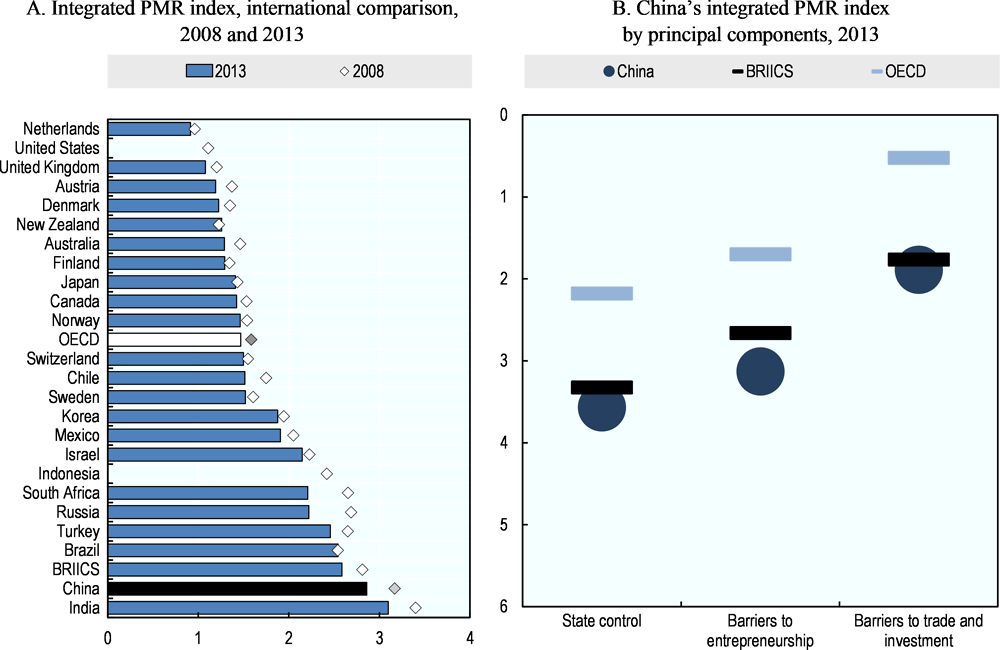

Regulatory environment for entrepreneurship

As a result of China’s continuous reforms, markets play an increasing role in resource allocation. The 2008 Anti-Monopoly Law provides a modern competition policy framework and prices of most goods are market determined with a few exceptions such as water and electricity. However, the OECD’s Product Market Regulation (PMR) indicators, which measure the degree to which a country’s regulatory framework promotes or inhibits competition in product markets, show some areas for improvement. While the PMR indicators cover state control, barriers to entrepreneurship and barriers to trade and investment, the integrated PMR index for 2013 indicates that China is more restrictive than all OECD countries and BRIICS countries, with the exception of India. A more disaggregated analysis shows that China is more restrictive than OECD and BRIICS countries on average on the components including state control, barriers to entrepreneurship and barriers to trade and investment.

Figure 3.5. Integrated Product Market Regulation (PMR) indicator

Notes: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Latvia and Lithuania. For Indonesia and the United States, 2013 data are not available.

Source: OECD (2014), Product Market Regulation Database.

The dominance of SOEs in some sectors is a key factor explaining China’s poor performance on the index of state control and on corresponding indices such as state ownership, government involvement in network sectors, and direct control over business enterprises.

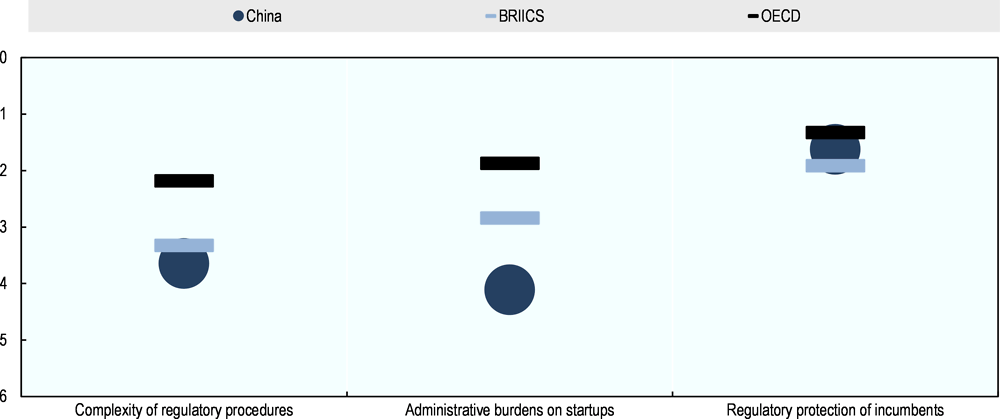

The index of barriers to entrepreneurship in the OECD PMR database is composed of start-up and exit constraints, an efficient licensing and permit system, clarity of procedures, and ease of administrative processes on firms. China’s indicators are particularly restrictive for license and permit systems and administrative burdens for entrepreneurship. Administrative burden is the most restrictive factor for entrepreneurship in China. Recently, China has increased its policy efforts to simplify regulatory procedures. The business system reform includes the simplification of business registration and the integration of different business certifications to a single certificate. As yet, the impacts of these reforms are not reflected in the indicators.

Figure 3.6. Barriers to entrepreneurship indicator for China by regulatory area, 2013

Notes: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Latvia and Lithuania.

Source: OECD (2014), Product Market Regulation Database.

The Ease of Doing Business Report of the World Bank provides a comparative assessment of the business regulatory environments globally. Countries are ranked according to the distance to frontier (DTF) scores, which is an aggregate of ten criteria elaborated upon in the report. Criteria include the ease to start a business, register property, get credit and trade across borders. China is ranked at number 78 out of 190 economies in the 2017 Report (Table 3.2). Among BRIICS countries, the Russian Federation and South Africa are ranked higher than China. Among the specific regulatory areas, the report finds that dealing with construction permits, protecting minority investors, starting a business, getting electricity and paying taxes are particularly affecting the business environment in China. This is consistent with the OECD PMR indicators, suggesting that the regulatory environment could be further improved to foster entrepreneurs and attract foreign direct investment.

Table 3.2. China’s ranking in World Bank’s Ease of doing Business, 2016

|

|

Rank (out of 190 economies) |

|---|---|

|

Overall rank |

78 |

|

Ranking by specific regulatory area: |

|

|

Starting a business |

127 |

|

Dealing with construction permits |

177 |

|

Getting electricity |

97 |

|

Registering property |

42 |

|

Getting credit |

62 |

|

Protecting minority investors |

123 |

|

Paying taxes |

131 |

|

Trading across borders |

96 |

|

Enforcing contracts |

5 |

|

Resolving insolvency |

53 |

Source: World Bank (2017), Doing Business 2017: Equal Opportunity for All, World Bank.

Regulations on natural resources

Regulation on natural resources are central to ensuring the long-term sustainable use of natural resources and in large part determine access to and use of land, water and biodiversity resources. They also impose limits on the impact of industrial and agricultural activities on natural resources (e.g. water pollution, soil degradation, greenhouse gas emissions). The design of natural resources and environmental policies is important in terms of their incentives for innovation and sustainable productivity growth. As Chapter 4 provides a more in-depth review of regulatory policies on land and water use, this section covers other areas of environmental regulations in China.

As discussed in Chapter 2, a number of studies have highlighted the negative effect of air pollution on crop yields in China (e.g. Marshall, Ashmore and Hinchcliffe, 1997; Tai, Val Martin and Heald, 2014). The basic legal regulation to address air pollution in China is the Law on Atmospheric Pollution Prevention and Control, which states that the improvement of atmospheric environment quality must start with the control of all the sources of pollutants, including those from agriculture. The law lays out atmospheric pollution prevention and control measures for pollution arising from agricultural and other activities. For example, it requires agricultural producers to improve the method of applying fertilisers, to reduce the use of pesticides and to reduce emissions of ammonia, volatile organic compounds and other atmospheric pollutants. The law also applied a coordinated control to particulate matters, sulphur dioxide, nitrogen oxides, volatile organic compounds, ammonia and other air pollutants, as well as greenhouse gases.

At national level, the Ministry of Environmental Protection (MEP), in co-operation with relevant State Council agencies, is responsible for the monitoring and assessment of the implementation of these targets and publicly releases the assessments. In particular, the MEP is tasked with developing atmospheric emission standards, based on atmospheric quality standards and national economic and technologic conditions.

China’s Environment Protection Act went into effect in January 2015. Together with the Regulations on the livestock pollution enacted in 2014, the Act strengthened the regulation on livestock manure management at the farm level, including increased financial penalties for livestock breeders that mismanage waste. Local authorities are using tougher environmental rules to close down or relocate pig farms, in particular those located close to densely populated areas. It is reported that more than half of small farms in Guangdong province were shut down while the remaining farms were requested to reduce their herds. Similarly, in Fujian province, local authorities closed more than 13 000 backyard farms over pollution worries (GAIN Report-CH15034, 2015).

While the government emphasises the importance of preventing and controlling agricultural non-point source pollution, regulations on fertiliser are not applied at the farm level. Provinces produce guidelines on fertiliser application, but these remain advisory and non-enforceable (Smith and Siciliano, 2015). However, China has recently strengthened the comprehensive regulation on pesticide initially enacted in 1997, covering its registration, production, marketing and application, prohibiting the use of pesticide beyond the range of application or recommended dosage as well as the use of highly toxic pesticide.

Regulations on food safety

Since 2004, No. 1 Documents of the CCCPC and State Councils have been emphasising the efforts to enhance regulation and supervision of the quality and safety of agricultural products, and to make comprehensive improvements in these aspects. In developing an appropriate sanitary and phytosanitary (SPS) regulatory environment, including implementation provisions, experience has shown that technology-neutral, science-based approaches are most effective in diffusing innovation and least market-distorting, provided that care is taken to ensure agricultural specificities and societal choices are taken into account.

In China, food safety and quality issues have become the national strategic objective, responding to a growing public concern. In 2013, China established the Food and Drug Administration (CFDA) on the basis of the former State Food and Drug Administration. CFDA is responsible for supervising food safety covering the entire food chain from production to circulation and consumption, as well as drug safety. The Food Safety Law was also revised in 2015 to establish a more scientific and strict supervision system of food safety. First, the Law strengthened regulations in the entire process of food manufacturing, retail, and catering services, including prohibiting the use of highly toxic pesticides for vegetables, fruits, tea and Chinese herbal medicine, and other crops. Second, the Law increased both regulatory penalties and the accountability of local government officials and regulators. Third, it improved the risk monitoring, assessment and food safety standards and other systems. Fourth, it introduced compensation for whistle-blowers, a liability insurance system and created a monitoring system with the involvement of consumers, industry associations, media and other bodies.

The No. 1 Document of 2016 calls for a national strategy on food safety and quality which is to include the monitoring of chemical residues in agricultural products, standardisation in farm operations, a food safety regulatory system, and an information platform for full traceability. The new strategy targets: 1) the development of a quality and safety standard system for agricultural products, covering origin and production processes; 2) the strengthening of law enforcement in food safety and quality; 3) the introduction of risk monitoring on a quarterly basis in 150 large and medium-sized cities in the five major categories of products; 4) creating the first batch of 107 cities, which will serve as a basis for establishing production standards and applying the social co-governance model of supervision to improve quality and safety of agricultural products; and 5) establishment of the national quality and safety traceability platform of agricultural products in 2017.

The government also decided that the limits on pesticide and veterinary medicine residues must be close to those established in the Codex Alimentarius by 2020. To reach the target, stricter regulations on agricultural inputs will be enforced and the use of pesticides with high effectiveness, low toxicity and low residues will be more widely adopted. Standardised agriculture, horticulture, and livestock and aquaculture demonstration areas will continue to receive support for purposes of safety and quality assurance.

China also started a campaign to establish counties of quality and safe agricultural products focusing on counties specialising in producing vegetable products. The central government set aside funds for supporting this initiative, mainly to establish and design institutions and rules and to provide personnel training. China has also started to develop its quality and safety traceability system for agricultural products, which is expected to cover the full supply chain ranging from production to final consumption. In 2015, the priority has been put on the construction of a national traceability information platform.

3.3. Trade and investment

Trade facilitates the flow of goods, capital, technology, knowledge and people needed to innovate. Openness to trade and capital flows is conducive to innovation as it increases access to new technologies, ideas and processes, including from foreign direct investment (FDI) and related technological spill-overs, reinforces competition, provides a larger market for innovators, and facilitates cross-country collaboration. Trade and investment openness can influence innovation throughout the food supply chain, from input suppliers to food service and retail firms. Input and output markets that operate effectively can foster productivity growth. Trade and investment openness can also facilitate the development of market mechanisms to foster more environmentally sustainable production (OECD, 2015a).

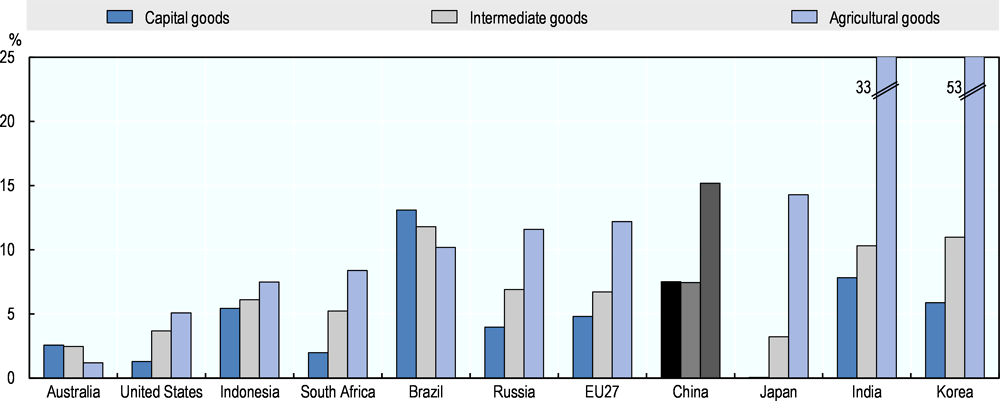

China joined the WTO in 2001 and during its accession process agreed substantial liberalisation as regards both import and export restrictions. The entirety of China’s import duties is bound and most bindings are very close to applied rates. Due to its WTO commitments, China has very little room to raise its level of tariff protection. On goods overall, China bound its tariffs at 10% (simple average), which is substantially lower than many BRIICS countries (e.g. Brazil’s simple average bound rate is 31%) but substantially higher than OECD countries (e.g. the United States rate is 3.5%).

China’s applied import duties are slightly higher than those of the European Union and some other emerging economies such as Brazil and the Russian Federation (Figure 3.7). China’s applied tariff rates were 9.6% overall, averaging 15.2% for agricultural goods and 8.6% for non-agricultural goods. Import tariffs on capital goods, however, are lower, averaging 7.5%. Investment goods are major imports for China: machinery comprised 28% and transport equipment 6% of its total imports, respectively. Tariffs on imports of intermediate goods, very significant in determining China’s integration in global value chains, were comparable to the Russian Federation and the European Union, at 7.4%.

China's overall main trade policy objective is to accelerate its opening up to the outside world. This policy is enshrined in the Decision on Major Issues Concerning Comprehensively Deepening Reforms, adopted in November 2013, which calls for “the construction of a united and open market system with orderly competition that will play a decisive role in allocating resources” (WTO, 2014). One of the main objectives of the ongoing reform agenda, this policy is included in China’s five-year plan for 2016-2020. China’s strategy of trade opening has included negotiating preferential regional trade agreements.

Figure 3.7. Tariffs for industrial and agricultural goods, 2015*

Notes: * or latest available year; MFN: Most favoured Nation.

Tariff rates for agricultural products include both ad valorem duties and specific duties in ad valorem equivalent, while tariff rates for non-agricultural products only include ad valorem duties.

Source: UNCTAD (2017), Trade Analysis Information System (TRAINS) for non-agricultural products and WTO (2017), World Tariff Profiles for agricultural products.

China has pursued a “going out” policy encouraging Chinese companies to invest and acquire market share abroad. China’s state-owned enterprises (SOEs) have a prominent role in this process. The key objective cited for both the government’s “going out” policy and by the firms themselves is the acquisition of natural resources (Kowalski et al., 2013). The role of SOE in exporting agro-food products is relative minor, and the SOEs attached to State Owned Farms such as Bright Foods and Beidahuang Group are actively engaging in overseas investment. The strategy of overseas investment in agriculture has shifted from acquiring agricultural land and production abroad to a broader scope of investment. Contrary to the situation in many OECD countries, Chinese SOEs are more successful at exporting than their private counterparts (Manova and Zhang, 2009). This export premium has been attributed to their large size and their easier access to credit. Increased support to Chinese firms exporting or investing abroad through finance and taxation, as well as through diplomatic, legal and information services is also provided.

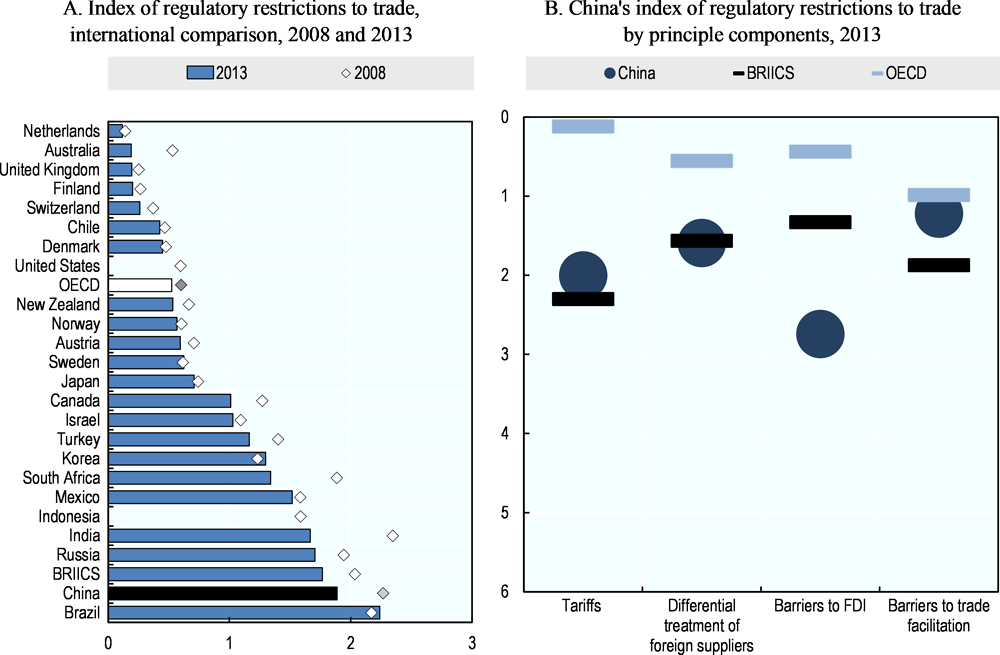

China’s integration into global supply chains over the past decades has brought many changes to its regulations on trade and investment. Today, its restrictiveness to trade and investment is of a similar magnitude to that of other BRIICS countries (Figure 3.8.A). One area China has made great strides since joining the WTO is in tariff levels, where it is now more open than many other BRIICS countries. It is at a similar level to other countries in terms of discriminatory regulation toward foreign suppliers. In terms of overall barriers to trade facilitation it ranks closer to many OECD countries (Figure 3.8.B). China has continued to strengthen its IPR enforcement system, both at the administrative and judicial levels. However, despite the efforts undertaken by the authorities to combat infringement, enforcement of IPRs continues to be a major challenge (WTO, 2016).

Figure 3.8. Index of regulatory restrictions to trade and investment

Notes: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Latvia and Lithuania. For Indonesia and the United States, 2013 data are not available.

Tariff index is based on an average of effectively applied tariff, scaled within a range between 0 and 6 points, whereby a tariff below 3% is attributed zero points and a tariff above 19.6%, 6 points.

Barriers to trade facilitation refer to the extent to which the country uses internationally harmonised standards and certification procedures, and Mutual Recognition Agreements (MRAs) with at least one other country.

Source: OECD (2014), Product Market Regulation Database.

Trade and investment performance is determined by many factors, one of which is the ease of importing and exporting. Fast and efficient border procedures and port clearance reduce costs and costly delays, in turn benefiting business and final consumers. China ranks similarly overall to other BRIICS countries in terms of trade facilitation performance (Figure 3.9). In a few areas, however, there is room for improvement. In particular, China is found to rank quite poorly on automated border procedures as well as co-operation with neighbouring and third country border agencies.

Figure 3.9. Trade Facilitation Indicators: China's performance, 2017*

Notes: * or latest available year.

Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Latvia and Lithuania.

Source: OECD (2017c), Trade Facilitation Indicators, http://www.oecd.org/trade/facilitation/indicators.htm.

China is the world's second-largest recipient of foreign direct investment (FDI) after the United States. Foreign investment in China can take several forms, including joint ventures, wholly foreign-owned enterprises, participation in partnership enterprises, or mergers and acquisitions of Chinese domestic enterprises. FDI is destined in its vast majority to the eastern region of the country and is still largely concentrated in the manufacturing sector, although FDI in real estate and services has been growing in recent years. However, the share of FDI in overall gross capital formation declined to 2.7% in 2015, one-fifth of the share 20 years ago (OECD, 2017b).

FDI used to be concentrated on the manufacturing sector, but inflows into the service sector have increased more rapidly in recent years and it has become the dominant sector for the receipt of FDI. In 2006, the inflow of FDI to the service sector was half that of the manufacturing sector, but it increased to more than double that of the manufacturing sector in 2015. However, many service sectors remain off-limits to foreign investors, limiting the competition in those sectors (OECD, 2017b).

China's policy towards foreign investment has been to encourage direct inward FDI as well as joint ventures between Chinese and foreign companies, particularly with regard to R&D activities. Foreign enterprises that engage with domestic firms in R&D activities benefit from preferential enterprise income tax treatment. In some cases, they are encouraged to apply for government-sponsored R&D projects and innovation capacity-building projects. Eligible foreign-invested R&D centres have been exempted from customs duties, value-added tax, and consumption tax on imported inputs needed for R&D consumables since 2009. China also actively guides foreign investment in the regions, which have not traditionally been strong recipients of FDI.

China took measures aimed at simplifying the rules governing FDI and easing restrictions on use of capital for investment between 2012 and 2013. As a result, measures of its restrictiveness to FDI have fallen. In particular, China implemented simplified procedures and regulations for foreign currency registration and opening and use of accounts. The restrictions on reinvestment in yuan for foreign companies were abolished. Despite recent measures to reduce barriers to foreign investment, China remains more closed than the OECD average (Figure 3.10). The recent FDI reform in October 2016 to move from approval-based to a filling system will further bring the FDI regime closer to international levels of openness (OECD, 2017b). In part, this is due to the substantial state-owned and state-controlled sector, which does not often welcome foreign investment (although foreign investors are allowed to own shares in state-controlled enterprises in some sectors).

The Ministry of Commerce (MOFCOM) and NDRC issue a “Catalogue for the Guidance of Foreign Investment in Industries”, which lists the sectors where foreign investment is “encouraged”, “restricted”, and “prohibited”. According to the most recent catalogue released in 2015, the FDI in breeding of transgenic crops, livestock aquatic animals and production of transgenic seeds or seedlings is prohibited, together with R&D, breeding, planting and production of rare and unique varieties. The restriction means that foreign companies are not allowed to conduct transgenic breeding technology research in China. Non-transgenic plant breeding and seed production are in one of the “restricted” areas of FDI and require a joint venture with Chinese companies.

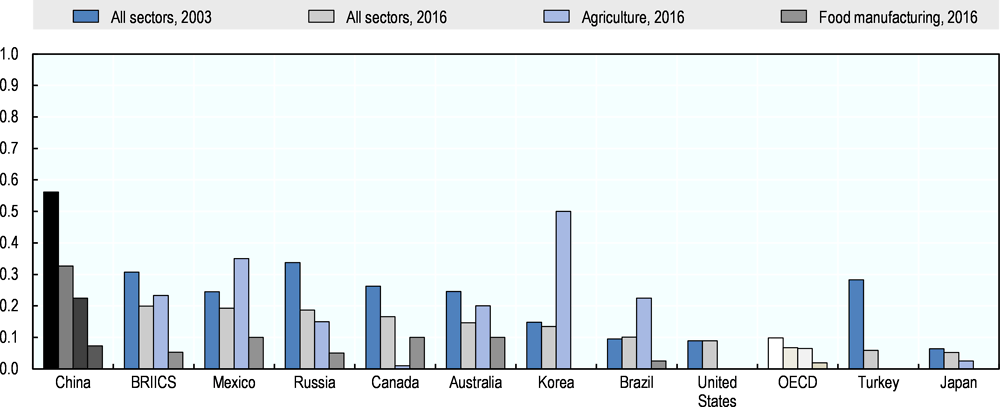

Figure 3.10. Foreign Direct Investment (FDI) Regulatory Restrictiveness Index by sector, 2003 and 2016

Note: The OECD aggregates do not include Lithuania.

Source: OECD (2017d), "OECD FDI Regulatory Restrictiveness Index", OECD FDI Statistics (database), http://www.oecd.org/investment/fdiindex.htm.

3.4. Finance policy

A well-functioning financial system is critical to efficiently channel funds and finance to firms looking for innovation and growth. Innovation typically requires borrowing or other types of external funding, particularly by start-up businesses. A domestic financial system with sufficient provision of varied services to borrowers of different profiles facilitates the innovation process. As innovation usually requires long-term investment, a strong long-term finance segment is of critical importance. An adequate domestic financial system is important from the perspective of innovating small- and medium-sized enterprises (SMEs), as they are likely to depend more on self-financing.

China’s financial sector is dominated by large state-owned commercial banks (SOCBs), which account for more than 50% of commercial bank assets in China. While reforms of the SOCBs resulted in improved efficiency and health of the financial system, gaps remain in terms of financial access for SMEs. Lending, particularly by the largest banks, is still concentrated on SOEs, where carrying out the state’s development plans is the primary objective (OECD, 2013).

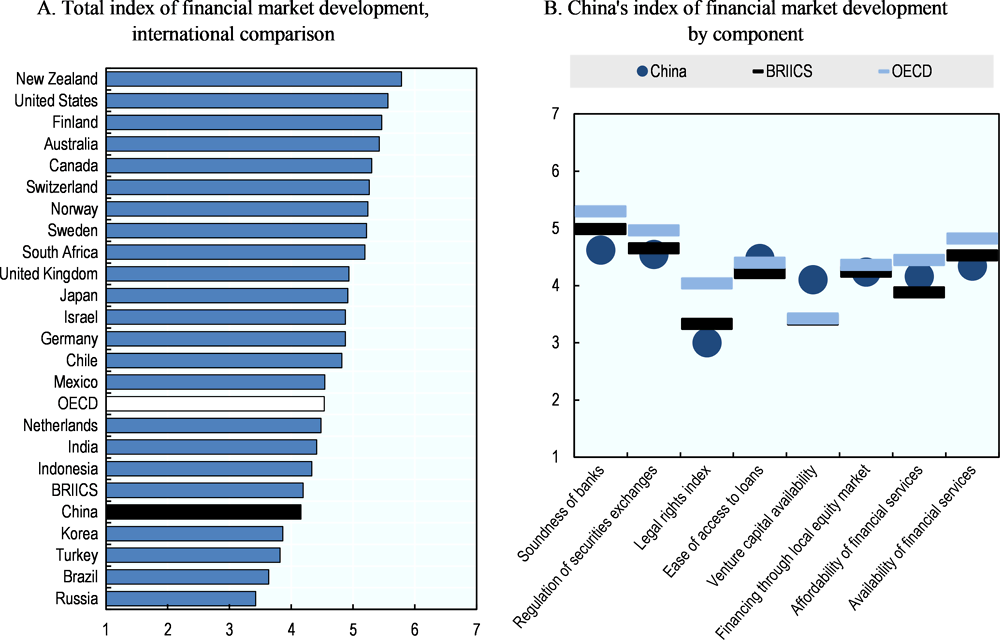

According to the Global Competitiveness Report, China’s index of financial market development ranks lower than the OECD and BRIICS averages (Figure 3.11A). Among seven components of the total index, ease of accessing loan and venture capital availability are above OECD and BRIICS averages. However, on the legal rights index and regulation of security exchanges components, China scored lower than OECD and BRIICS averages (Figure 3.11B).

Figure 3.11. Global Competitiveness Index: Index of financial market development, 2016-17

Note: Indices for BRIICS and OECD are the simple average of member-country indices. The OECD aggregates do not include Lithuania.

Source: World Economic Forum (2016), The Global Competitiveness Report 2016-2017 (Executive Opinion Survey), https://www.weforum.org/reports/the-global-competitiveness-report-2016-2017-1.

Access to financial services is a critical element to unleashing innovation. In China, rural financial institutions play a vital role in the agriculture sector, in addition to informal rural finance such as familial lending, and rotating saving and credit association in the local community. The government of China has made some efforts to strengthen the rural financial landscape. Since the early 2000s, institutional reforms and policies have aimed towards greater market orientation and increased access to formal financing for rural households and SMEs. The government has also taken steps to promote the development of the bond market by expanding coverage of corporate issuers to include all SMEs, adding an additional source of funding to small businesses. Rural financial institutions have improved their ability to support agriculture. Agriculture-related loans and loans to farmers are playing a dominant role in providing continued support to agriculture and rural development (IMF, 2015). The government also expanded the mandate of the Agricultural Development Bank to finance food industries and rural development projects.

At the same time, the government has gradually liberalised access of new financial institutions to rural financing such as village and township banks, micro-credit companies, farmer cooperatives, mutual financial cooperation. It also includes the establishment of county-level small and medium-sized banks and financial leasing companies. The government also broaden the scope of mortgage collateral to include rural land contract management rights, farmers’ homestead use rights, farmers’ housing and other assets to improve accessibility to credit for farmers.

In China, rural credit co-operatives (RCCs) have been the largest provider of small-scale rural credit. RCCs used to belong to the China Agricultural Bank until being separated from it in 1996, but remain under the control of local governments. To promote more competition in rural financial markets, the government promoted the entry of newly created financial institutions targeting rural households and SMEs, such as Village and Township Banks. However, these have been slow to penetrate the lending market and have not been able to meet the demand for very small-scale agriculture and household businesses (ADB, 2014a and 2014b). The rural financial market is still largely dominated by of RCC system, which includes Rural Commercial Banks and Rural Cooperative Banks (Box 3.2).

To improve financial access in rural area, the government is creating a policy incentive to increase rural credit. For example, interest income from small loans to farmers and premiums from agricultural insurance are exempted from financial institutions’ sale taxes. Financial institutions are allowed to deduct certain loan loss reserves for agriculture-related loans from corporate income tax. New rural financial institutions also receive subsidies equivalent to 2% of loan balance.

The current credit environment and financial system available for the agriculture sector can be improved. For example, the availability of acceptable collateral for loans remains a challenge. Real estate is the most common form of collateral used for borrowing. However, in China the state or collective owns the land and the farmer only has contract rights. Prior to 2014, land contract rights and farmhouses, two major properties owned by farmers, could not be collateralised. In October 2014, the Minister of Agriculture announced a pilot programme that grants farmers the right to “possess, use, benefit from and transfer their land, as well as the right to use land contract rights as collateral or a guarantee”. The results of the pilot programme prompted the government to expand the programme nationwide in 2015 (Yining, 2015).

Emerging farm operation units with more complex organisational structures have added demands that the current rural financial system cannot meet. New types of operation (e.g. large family farms, farmer professional co-operatives and agri-business enterprises) should be able to collateralise a wider variety of farm assets. Moreover, the government should enhance competition among financial institutions and facilitate the entry of new players.

Box 3.2. Development of rural financial institutions in China

Rural Credit Cooperatives (RCCs), Rural Commercial Banks (RCBs), and the Postal Savings Bank of China (PSBC) are the three main financial institutions in rural areas. RCCs are the largest provider of small-scale rural credit. Restructuring of the RCCs in the early 2000s resulted in many being converted into RCBs. RCBs are the fastest growing banking institution in rural China. Annual assets growth from 2010-14 was 44% while all other institutions grew only 16% annually (CRBC 2014 report). Further restructuring of China’s financial system in 2007 created the Postal Savings Bank of China (PSBC). The PSBC has a mandate to “to develop commercially viable loan products for rural enterprises, migrant workers and farmers.” In 2014, there were 39 000 PSBC office outlets, 70% of which were in county and village locations (ADB, 2014b).

Table 3.3. Rural financial institutions in China

|

Number of banks 2014 |

Total assets at end-2014 (CNY billion) |

Share of total banking assets (%) |

||

|---|---|---|---|---|

|

2011 |

2014 |

|||

|

Rural Credit Cooperatives (RCC) |

1 596 |

8 831 |

6.4 |

5.1 |

|

Rural Commercial Banks (RCB) |

665 |

11 527 |

3.8 |

6.7 |

|

Rural Cooperative Banks (RCoB) |

89 |

957 |

1.2 |

0.6 |

|

Postal Savings Bank of China (PSBC)1 |

1 |

6 300 |

3.8 |

3.7 |

|

Village and Township Banks (VTB)2 |

1 153 |

520 |

0.3 |

0.3 |

|

Rural Mutual Cooperatives & Lending Companies |

63 |

278 |

-- |

0.2 |

|

Micro-credit Companies (MCC)3 |

7 893 |

819* |

-- |

0.5 |

Note: NGO Microfinance institutions numbered about 100 in 2012 (ADB, 2014a). *Loan portfolio.

1. 2014 assets from http://english.chinapost.com.cn/html1/report/161048/2953-1.htm.

2. Assets as of August 2013 (ADB, 2014b).

3. 2014 assets (ADB, 2014a).

Source: Adapted from Jinchang Lai 2012 presentation (Lai, 2012). CRBC annual report, unless otherwise stated.

Despite more liberalisation of the financial sector in China, new entities have been slow to enter the market for lending to rural households and SMEs due to the higher risk and transaction costs of micro lending. Assessing credit risk requires gathering information which may be difficult to quantify and verify, requiring more personal contact and visits by a credit officer. Banking policies that prohibit VTBs and MCCs to operate beyond county boundaries constrain access for households and SMEs beyond their operational borders. Moreover, there may be private lenders wanting to lend to SMEs, but these small businesses cannot meet the collateral requirements of commercial banks (ADB, 2014a).

3.5. Tax policy

The principal link between tax policy and innovation is that taxation affects the returns to innovation and thus the decisions of firms and individuals to invest. Taxation also affects the relative price of production factors and therefore priority areas for innovation. Beyond that, taxation often acts as a targeted tool to stimulate innovation, e.g. through providing preferential treatment to private businesses that invest in R&D, preferential regimes for young innovative companies, VAT concessions on innovative products, etc. Furthermore, tax policy can steer innovation towards specific areas, for example, to address particular societal concerns and towards greener technologies and practices, or environmental R&D. Tax policies can also work on the consumer side of innovation by creating incentives for households to purchase products with particular characteristics, for example, by providing consumer tax concessions on newly developed national products or environmentally friendly goods.

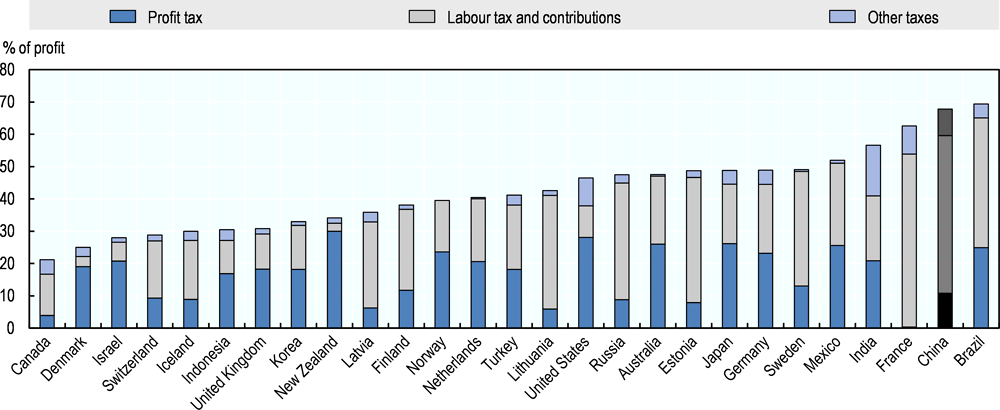

Enterprises operating in China are subject to several different types of taxes, including corporate income taxes and indirect taxes (including value added tax, business tax, and consumption tax), as well as mandatory contributions related to labour. The overall tax burden in China remains relatively low compared to OECD countries. The tax revenue to GDP ratio in China was 18.5% in 2015, which is lower than most of the OECD countries (WTO, 2016). However, the tax burden on enterprises is relatively high and the government is now in the process of tax reform shifting from business tax to value-added tax (Figure 3.12). The total tax an enterprise must pay in China in 2015 is among one of the highest in the world, at 68.5% of profit. Mandatory social security contributions account for the bulk of China’s total tax rate on enterprises (48.8%).

Despite its higher total tax rate on enterprises, China offers some reductions and tax rebates to provide incentives in certain priority areas. For example, corporate income tax is exempted on the profits earned from agricultural production and primary processing of agricultural products. China also provides an exemption from value-added tax on the sales of self-produced primary agricultural products. The sales of non-self-produced agricultural products are also subject to a reduced rate of value-added tax. Since 2009, agricultural machines in 14 major categories enjoy a low value-added tax rate of 13%. Additionally, income tax is exempted for income received from transferring agricultural machinery technology for entities with an annual net income below CNY 300 000 (USD 45 180). China was exempting value-added tax on the sales of fertiliser, but this exemption was removed in September 2015 as part of the effort to achieve the policy goal of zero growth of fertiliser consumption by 2020.

Until the early 2000s, farmers were subject to agricultural tax and levies imposed by the local governments. In 2000, China started a pilot reform of the rural tax system in Anhui Province to reduce the burden of farmers and regulate the tax system, and the reform was extended nationwide in 2003. The government phased out agricultural tax by 2006, removing all informal fees and formal agricultural tax.

In many OECD countries, the government offers tax incentives to encourage private enterprises to invest in R&D. China also offers tax incentives specifically to agriculture R&D activities. An additional 50% of R&D costs is deductible for corporate income tax and 150% amortisation of intangible assets. These provisions aim to promote private R&D and encourage collaboration between public R&D performers and private enterprises. Tax breaks are given to technology companies but also to any companies for expenditures on staff education or R&D. Corporate income tax can be reduced from 25% to 15% for qualified High-New-Technology Enterprises (HTNE) as well as Advanced Technology Service Enterprises (ATSE). ATSE businesses can also deduct education fees up to a certain amount. Agricultural machinery manufacturing enterprises receive a preferential treatment of 15% deduction of corporate income tax as HTNE.

Multiple incentives are also directed to the agribusiness sector. Under the Enterprise Income Tax Law (EITL), Foreign Invested Enterprises (FIEs) or domestic companies investing in forestry, animal husbandry and the fishing industry are exempted from corporate income tax. China also offers these companies a variety of value-added tax (VAT) exemptions and reductions.

Figure 3.12. Total tax rate on enterprises, 2015

Source: World Bank Group and PwC (2017), Paying Taxes 2017: The Global Picture, PwC, World Bank and IFC, http://www.doingbusiness.org/data.

3.6. Summary

Although its GDP growth rate has slowed recently, China enjoys a favourable macroeconomic environment which ranks among the top of both OECD and emerging countries in terms of budget balance, gross national savings, inflation, government debt, and credit rating. However, the quality of governance is still lower than the OECD average, most notably in the area of property rights protection. Effective protection of property rights is key to attracting private investment, including in agriculture. The government should strengthen the enforcement of intellectual property rights by raising awareness of laws and increasing penalties for infringements to ensure adequate protection for domestic and foreign innovators.

Reforms have significantly reduced regulatory barriers to entrepreneurship, but there is still a large scope to reduce complexity and transaction costs related to compliance. Overall, China’s regulations remain more complex and costly to comply with compared to OECD countries. China should continue its efforts to reduce administrative burdens and compliance costs for enterprises, and improve transparency and provision of public services.

With markets increasingly playing a primary role in resource allocation in China, the competitive environment should be improved further, including strengthening the institutional capacity to ensure effective enforcement of Anti-Monopoly Law. While the importance of State Owned Enterprises in China has gradually declined, some areas of the service sector (e.g. financial services) are still dominated by SOEs and oligopolistic companies. An earlier OECD study finds that SOEs are not very efficient producers and users of knowledge and have inefficient incentives to undertake risky investment in R&D (OECD, 2008). The government should continue opening up more sectors to private investment based on clear rules.

China has built a regulatory framework for environmental protection. For example, the Environment Protection Act recently introduced provisions for increased financial penalties for livestock breeders that mismanage waste. China also recently strengthened the regulation on pesticide use. However, regulations often control at the product level (e.g. maximum residue) rather than at the production process one. Regulatory measures as well as a monitoring system should be applied more at the farm level, clarifying the minimum (mandatory) levels of environmental quality with which farmers need to comply.

Effective enforcement of environmental regulations and increasing producer awareness remain a major challenge in China. Further monitoring and liability management will be necessary to make progress, but this is costly under China’s small and fragmented agricultural structure. Compliance to environmental regulation can be enforced more effectively with complementary incentive measures. For example, making direct payments conditional on the recipient’s compliance with environmental standards could increase the farmer’s incentive to comply with environmental regulations; such a measure would also reduce the cost of monitoring environmental regulations at the farm level, given the domination of China’s farm structure by small-scale producers. However, experience in OECD countries shows that such conditionality would not be effective unless it is adapted to the diversity of local farming practices and conditions.

China has been benefiting from opening up for trade, facilitating knowledge flows embedded in agro-food trade, and has lower trade barriers in both tariffs and trade facilitation compared to other BRIICS countries. The recent FDI reform to move from an approval-based to a filling system will bring the FDI regime closer to international levels of openness, but China still maintains barriers to FDI. For example, in the food and agriculture sector, foreign companies are not allowed to conduct research on transgenic crop breeding in China. Non-transgenic plant breeding and seed production is one of the “restricted” areas of FDI and requires foreign investors to establish a joint venture with Chinese companies.

Both the affordability and availability of financial services in China are limited compared to most OECD countries. Recent reforms allowing farmers to collateralise land use rights and gradually liberalising access of new financial institutions to rural financing increases the accessibility of finance by farmers, but diverse financial services should also be made accessible for farmers, in particular emerging types of large farms operated by land co-operatives and enterprises.

References

ADB (2014a), Access to Finance: Microfinance Innovations in the People’s Republic of China, Asian Development Bank, Manila, Philippines. http://www.adb.org/sites/default/files/publication/153012/access-finance-microfinance-innovations-prc.pdf.

ADB (2014b), “The People’s Republic of China: Knowledge Work on Credit Growth in Microfinance and Rural Finance”, ADB Consultant’s Report, Asian Development Bank, Manila, Philippines. http://www.adb.org/sites/default/files/project-document/80709/credit-growth-micro-rural-finance-prc.pdf.

CRBC (2014), China Banking Regulation Commission 2014 Annual Report, China Financial Publishing House, Beijing.

FAO (2006), Rapid growth of selected Asian economies: Lessons and implications for agriculture and food security China and India, Policy Assistance Series 1/2, RAP Publication 2006/05, Food and Agriculture Organization of The United Nations, Bangkok, http://www.fao.org/docrep/009/ag088e/AG088E00.htm#TOC.

GAIN Report-CH15034 (2015), “China – Peoples Republic of: Livestock and Products Annual: China’s Increasing Appetite for Imported Beef”, USDA Foreign Agricultural Service, 23 September 2015.

International Fertilizer Association (2017), Production and International Trade Statistics, International Fertilizer Industry Association Paris, https://www.fertilizer.org/statistics (accessed 20 October 2017).

IMF (2015), “People’s Republic of China: 2015 Article IV Consultation – Press Release; Staff Report; and Statement by the Executive Director for the People’s Republic of China”, IMF Country Report No. 15/234, International Monetary Fund, Washington DC, https://www.imf.org/external/pubs/ft/scr/2015/cr15234.pdf.

Kowalski, P. et al. (2013), “State-Owned Enterprises: Trade Effects and Policy Implications,” OECD Trade Policy Papers, No. 147, OECD Publishing, Paris, http://dx.doi.org/10.1787/5k4869ckqk7l-en.

Lai, J. (2012), “Rural Finance in China: Opportunities and Challenge”, Presentation at the CICA Annual Meeting, Hong Kong, www.cica.ws/pdf/hongkong/Jinchang%20Lai.pdf.

Manova, K. and Z. Zhang (2009), “China’s Exporters and Importers: Firms, Products and Trade Partners”, NBER Working Paper, No. 15249, The National Bureau of Economic Research.

Marshall, F., M. Ashmore and F. Hinchcliffe (1997), “A hidden threat to food production: Air pollution and agriculture in the developing world”, Gatekeeper series No. 73, International Institute for Environment and Development.

OECD (2017a), OECD Economic Outlook, Volume 2017 Issue 1: Preliminary version, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_outlook-v2017-1-en.

OECD (2017b), OECD Economic Surveys: China 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-chn-2017-en.

OECD (2017c), Trade Facilitation Indicators, www.oecd.org/trade/facilitation/indicators.htm (accessed July 2017).

OECD (2017d), “OECD FDI Regulatory Restrictiveness Index”, OECD FDI Statistics (database), www.oecd.org/investment/fdiindex.htm (accessed June 2017).

OECD (2015a), “Analysing Policies to improve agricultural productivity growth, sustainably: Revised framework”, www.oecd.org/agriculture/policies/innovation.

OECD (2015b), OECD Economic Surveys: China 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-chn-2015-en.

OECD (2014), Product Market Regulation Database, 2014, www.oecd.org/economy/pmr.

OECD (2013), Economic Outlook for Southeast Asia, China and India 2014: Beyond the Middle-Income Trap, OECD Publishing, Paris, http://dx.doi.org/10.1787/saeo-2014-en.

OECD (2009), OECD Rural Policy Reviews: China 2009, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264059573-en.

OECD (2008), OECD Reviews of Innovation Policy: China 2008, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264039827-en.

Smith, L.E.D. and G. Siciliano (2015), “A comprehensive review of constraints to improved management of fertilizers in China and mitigation of diffuse water pollution from agriculture”, Agriculture, Ecosystems & Environment, 209, pp15-25.

Tai, A. P. K., M. Val Martin and C. L. Heald (2014), “Threat to future global food security from climate change and ozone air pollution”, Nature Climate Change, Vol. 4, pp. 817-821.

UNCTAD (2017), Trade Analysis Information System (TRAINS).

World Bank (2017), Doing Business 2017, World Bank and the International Finance Corporation, World Bank Publications, Washington, DC.

World Bank (2013), China 2030: Building a Modern, Harmonious, and Creative Society, World Bank, http://dx.doi.org/10.1596/978-0-8213-9545-5.

World Bank Group and PwC (2017), Paying Taxes 2017: The global picture, World Bank Group and PwC.

World Economic Forum (2016), “The Global Competitiveness Report 2016-2017: Full data Edition”, Geneva 2016. https://www.weforum.org/reports/the-global-competitiveness-report-2016-2017-1.

WTO (2017), World Tariff Profiles, http://stat.wto.org/Home/WSDBHome.aspx (accessed 20 October 2017).

WTO (2016), “Trade Policy Review: China”, Report by the Secretariat, WT/TPR/S/342, World Trade Organization, Geneva.

WTO (2014), “Trade Policy Review: China”, Report by the Secretariat, WT/TPR/S/300/Rev.1, World Trade Organization, Geneva.

Yining, D. (2015). “Land for collateral to be tested”, Shanghai Daily, 25 August 2015, http://www.shanghaidaily.com/business/finance/Land-for-collateral-to-be-tested/shdaily.shtml (accessed 26 February 2016).