This chapter provides an overview of developments in agricultural policies in China. It also reports on trends in the level and compositions of support and discusses the likely impacts of agricultural policy measures on structural change, environmental performance and innovation in the sector.

Innovation, Agricultural Productivity and Sustainability in China

Chapter 5. Agricultural policy in China

Abstract

Agricultural policy includes measures that are specifically designed for and applied to the agricultural sector, which create a direct incentive for investment in agriculture and innovation, including technological adoption and structural change. Some agricultural policies are specifically targeted to improving environmental performance at the farm level. This chapter first reviews agricultural policy objectives in the People’s Republic of China (hereafter “China”), then domestic agricultural policy and agricultural trade policy. The structure of agricultural policy is assessed using OECD indicators of support. The section concludes with a summary of findings regarding extent to which agricultural policies in China are oriented towards innovation for improving productivity growth and sustainability.

5.1. Agricultural policy objectives

China’s agricultural policy objectives have evolved over the last three decades, reflecting the changing role of agriculture at different stages of economic development. The objective of agricultural policy initially focused on a quantitative increase of food production to satisfy a growing population, but has evolved to ensure food safety, increase farmers’ income, boost competitiveness and improve the environmental performance of agriculture (Box 5.1).

Box 5.1. Evolution of agricultural policy objectives in China

Since the foundation of the People’s Republic of China in 1949, China exploited the agricultural sector to promote industrial development, through such policies as agricultural tax and maintaining low prices of agricultural products relative to industrial ones. Through over 30 years of reform and opening-up, China has adjusted the goals of its agricultural policies to the different stages of economic development. Since the 1990s, China’s agricultural policies shifted fundamentally, from exploiting agriculture to promoting and subsidising the sector. The development of agricultural policies since reform and opening-up in the late1970s can be divided into three stages, based on the changes of their priorities and goals.

The first stage was between the beginning of reform and opening-up in the late 1970s and the mid- to late 1990s. The primary policy goal in this period was to increase food production and ensure food security. The policy was designed to ensure a steady supply of grain and other agricultural products and to stabilise food prices. At the beginning of reform and opening-up in 1978, China’s central policy documents emphasised increasing food production to feed its population of nine hundred million, and clarified that it must depend on domestic resources to do so (CCCPC, 1979, 1983). China began the negotiation on its accession into WTO before 1990, with a major policy goal of increasing the competitiveness of its agriculture (OECD, 2005).

The second stage was from the late 1990s up to the first decade of this century. At this stage, while food self-sufficiency remained the policy focus, increasing farmers’ income was included as the most important policy goal among topics included in the No. 1 Documents of 2004, 2008, 2009 and some other years. The No. 1 Documents in many years began to emphasise other policy goals, such as ensuring the quality of agricultural products and food safety, enhancing agricultural competitiveness, and protecting the agricultural ecosystem.

The third stage started in 2010, when achieving sustainable agricultural development became a primary policy objective. In particular, the 2014 No. 1 Document emphasised food quality and safety in addition to quantity, placing greater importance on sustainable agricultural development in the long term (while ensuring sufficient food supply). Ensuring food security and increasing farmers’ income remain top policy priorities.

In this stage, non-agricultural sectors support agriculture and an institutional framework and a policy system are being built to support agriculture (Cheng, 2011).This is reflected in policies such as the minimum purchase price; temporary purchasing and storage; the target price and direct food subsidies; subsidies for agricultural materials, superior crop varieties and for the agricultural insurance premium; and the abolition of the agricultural tax.

1. The No. 1 Central Document is the most important policy document in China jointly issued by the Central Committee of the Communist Party (CCCPC) and the State Council. This document determines the most important issues and focus of the year. The issues related to agriculture, farmers and rural area (the Three Nongs) have been selected as the topic of this document consecutively since 2004.

Food security has long been a central objective of China’s agricultural policy. A number of policy documents issued during the past years set the basic goal of increasing food production and achieving food self-sufficiency with domestic resources. The goal is to ensure basic supply of grain and other major agricultural products, and access to food by urban and rural residents. The white paper of The Grain Issue in China in 1996 put forward the goal of raising food self-sufficiency level to 95%.

The Chinese government has long stressed the significance for China’s economic and social development of realising self-sufficiency of grains with domestic resources and of ensuring food security. This involved ensuring food production, protecting basic farmland, determining permanent farmland, improving productivity, and achieving self-sufficiency of grain (State Council, 2014). However, in recognition of the economic and environmental cost of maintaining self-sufficiency policy, China announced a new food security strategy in 2014, aiming to ensure food security by making use of both domestic and international resources, and promoting sustainable agricultural development (Box 5.2). This is an important step in changing the nature of food security policy in China.

Box 5.2. New Food Security Strategy in China

China has introduced a series of policies and measures to ensure food security, including a system of protecting basic farmland, strengthening the capacity of food production, and establishing systems of price support and direct payment, food storage, and food regulation. Rapid industrialisation and urbanisation caused structural problems in satisfying domestic food demand with available domestic agricultural resources, increasing environmental pressure. In 2014, China introduced a new food security strategy to ensure food production with available domestic resources, importing moderately and utilising science and technology (State Council, 2014).

The new strategy emphasises the importance of basing food supply on domestic resources, which is determined by the nature of food and China’s domestic circumstances. China’s large population makes it the world’s largest food producer and consumer. Due to concerns regarding risks arising from over-reliance on imports, food self-sufficiency is still seen as central to China’s ability to maintain its food security and control its economic and social development.

However, policy makers recognise that China is not fully capable of maintaining self-sufficiency of all agri-food products, and that the economic and environmental costs of maintaining self-sufficiency is high. The new food security strategy requires proper allocation and conservation of domestic resources to meet the basic demand for grain, supported by “moderate import” to ensure food security. China has been importing international agricultural resources to complement domestic agricultural production and balance seasonal fluctuation of production in different areas. China’s economic growth proves that moderately importing agricultural products and properly utilising agricultural resources overseas can, to a certain extent, complement the shortage of domestic agricultural resources and contribute to realising grain self-sufficiency, thereby ensuring food security. The new food security strategy calls for more efforts to use international markets of agricultural products and agricultural resources, and to effectively adjust and supplement domestic food supply as a strategic choice.

Finally, the new strategy gives more weight to sustainable agricultural development, recognising that increasing domestic production cannot be achieved without paying the price of a degraded environment. For a long time, China has given excessive weight to the increase of total food production. For example, the National Medium- and Long-Term Outline Plan for Food Security (2008-2020) sets clear binding requirements for domestic food production, i.e. “the self-sufficiency level for food should be over 95%, and that for cereal should reach 100%”. This policy emphasis on self-sufficiency neglects economic, social and environmental costs: for example, farmland is overused, the use of pesticide and fertiliser exceeds safety standards, and farmland and water resources suffer serious pollution and degradation. Such circumstances and practices cause potential problems for food security and sustainable agricultural development in the medium- and long term. The new food security strategy focuses on not only food quantity and current food supply, but food quality and safety and sustainable agricultural development. Based on the need to ensure sustainable agricultural development and long-term food security, and on concerns about the negative externality of increasing the quantity of food production. China has decided to transform its food production strategy from yield growth to sound and sustainable development (Cheng, 2015).

During the late 1990s, China’s rural economy experienced structural problems such as falling prices of agricultural products, declining profit of township enterprises, lower income growth for farmers, and widening income disparity between urban and rural residents.1 The 2004 No. 1 Document gave priority to increasing farmers’ income as the goal of its agricultural policy for the first time, calling for comprehensive policies to accelerate the rapid growth of farmers’ income and to reverse the trend of widening income disparity (State Council, 2004). In 2012, China set the goal of building a moderately prosperous society, doubling its gross domestic product (GDP) and per capita income of urban and rural residents compared with 2010 levels, and alleviating poverty for all rural residents based on the current poverty line by 2020. The 2016 No. 1 Document pointed out that a moderately prosperous society cannot be built unless farmers attain a moderately high standard of living (State Council, 2016).

Since WTO accession in 2001, China has opened up its agricultural market, thereby increasing the challenges arising from international competition. China considers competitiveness of its agricultural sector as an important policy objective, together with developing multiple roles of agriculture and promoting integrated growth of rural and urban areas; these objectives have been included in China’s No. 1 Documents since 2004.

By increasing its grain output for 12 consecutive years since 2004, China has increased the pressure on natural resources and the environment, including extensive use of agricultural resources, severe pollution of farmland and its functional degradation, waste of water resources, water pollution, groundwater over-exploitation, grassland and wetland degradation and deterioration of the ecological environment (Cheng, 2013). The 2014 No. 1 Document was the first to propose establishing a long-term framework of sustainable agricultural development: to develop eco-friendly agriculture, to implement pilot projects of temporary retirement of agricultural resources, and to strengthen ecological protection (State Council, 2014).

In 2015, the State Council authorised the Ministry of Agriculture (MOA) and other government agencies to issue the Agricultural Sustainable Development Plan (2015-2030), which sets the goals and paths of sustainable agricultural development (MOA, et.al. 2015). This plan requires that China accelerates its development of resource-saving, environment-friendly and ecosystem-protecting agriculture, and that it takes effective measures to change the mode of agricultural development from extensive management — which consumes resources and damages environment — to intensive farming focusing on quality and efficiency. Considering factors such as capacity of agricultural production resources, environmental capacity and ecological types, the plan divides China into optimised, moderate and protected development areas. Based on a principle of adjusting measures to local conditions, different priorities for achieving sustainable agricultural development were set in different areas.2 The strategy of differentiating policy priorities regionally and locally would support the locational adjustment of agricultural production to reflect resource availability (Box 5.3).

Box 5.3. Zero-Growth Action Plan for Chemical Fertilizers and Pesticides

In 2015, China announced the Zero-Growth Action Plan for Chemical Fertilizers and Pesticides. This initiative is designed to realise zero growth of the usage of fertilisers and pesticides by 2020. The goal of the action plan is to restrict the annual growth of chemical fertiliser use to below 1% during 2015-2019 and to achieve zero-growth by 2020 for major agricultural crops, relative to the annual growth rate of nitrogen and phosphorus uses at 3.9% and 2.5% during 2000-2013, respectively. The target on pesticides limits the average use per unit of land falls below that of the last three years.

In the Action Plan for chemical fertilisers, issues related to current practices are highlighted: excess application of fertiliser of 21.9 kg/mu (328.5 kg/ha) as compared the worldwide average of 8 kg/mu (120 kg/ha); uneven fertiliser use across regions and products, with excessive use observed in eastern China, the lower Yangtze River area, as well as for cash and horticulture products; low utilisation rate of organic fertilisers at around 40% of overall fertiliser use; and the unbalanced structure of fertiliser uses.

The Action Plan proposes soil testing to encourage farmers to use organic fertiliser and support the development of effective fertiliser. However, implementation details will vary across Chinese regions due to uneven regional practices in fertiliser application. For instance, in regions where fertilisers are currently used excessively, such as Northeast China, the North China Plain, and the mid- and lower Yangtze River area, nitrogen and phosphorus inputs will be regulated whereas the use of potassium will be capped. In Southwestern China, nitrogen use will be capped, use of phosphorus fertilisers will be adjusted, and potassium use will be increased; in Northwest China, the focus is to match the use of fertilisers and water resources, while capping the use of both nitrogen and phosphorus.

The initial steps of the Zero-Growth Action Plans include several pilot projects. In 2014, the central government started to support the demonstration project of more efficient slow-release fertilisation on maize production in five provinces. Another pilot project that started in 2011 provides subsidies to lower farmers’ costs of applying low-toxicity biological pesticides. In 2014, this project was expanded to 42 major vegetable, fruits and tea production counties in 17 provinces. A third project is the government support for soil testing and formula fertilisation.

5.2. Domestic agricultural policy

Domestic agricultural and associated trade measures affect farmers’ investment decisions and the choice of production practices. Several dimensions of agricultural policies are important: 1) the extent to which market-distorting instruments are used to support producers; 2) the extent to which policies facilitate structural adjustment; 3) the extent to which policies provide targeted support to promote the adoption of innovation and sustainable production practice at the farm level.

Level of support for agricultural producers

OECD indicators of producer support allow a quantitative evaluation of support to agriculture, including such measures as: 1) the share of farm revenue which can attributed to the government support, including both price support and budgetary transfer to individual producers (%PSE); 2) the extent to which the producer support is provided through most market-distorting measures such as Market Price Support (MPS) and input subsidies; and 3) the extent to which agriculture is supported through general service to the sector (General Service Support Estimate, GSSE) or support to individual producers (Producer Support Estimate, PSE). OECD classifies GSSE and PSE measures according to their purpose and implementation criteria, respectively. This information provides a comparison of producer support in China with OECD countries and major emerging economies in a consistent method since 1995. It also helps identify whether existing policy measures boost agricultural innovation, agricultural productivity and sustainability performance.

Box 5.4. OECD support indicators

The OECD indicators were developed to monitor and evaluate developments in agricultural policy, to establish a common base for policy dialogue among countries, and to provide economic data to assess the effectiveness and efficiency of policies. The support indicators are different ways to analyse agricultural policy transfers and measure their levels in relation to various key economic variables. The names, abbreviations and definitions of the selected indicators are listed below.

Producer Support Estimate (PSE): the annual monetary value of gross transfers from consumers and taxpayers to agricultural producers, measured at the farm-gate level, arising from policy measures that support agriculture, regardless of their nature, objectives or impacts on farm production or income.

Percentage PSE (%PSE): PSE transfers as a share of gross farm receipts (including support).

Producer Single Commodity Transfers (producer SCT): the annual monetary value of gross transfers from consumers and taxpayers to agricultural producers, measured at the farm gate level, arising from policy measures directly linked to the production of a single commodity such that the producer must produce the designated commodity in order to receive the transfer.

Producer Percentage Single Commodity Transfers (producer %SCT): the commodity SCT as a share of gross farm receipts for the specific commodity.

General Services Support Estimate (GSSE): the annual monetary value of gross transfers to general services provided to agricultural producers collectively (such as research, development, training, inspection, marketing and promotion), arising from policy measures that support agriculture regardless of their nature, objectives and impacts on farm production, income, or consumption. The GSSE does not include any transfers to individual producers.

Percentage GSSE (%GSSE): transfers to general services (GSSE) as a share of Total Support Estimate (TSE).

Total Support Estimate (TSE): the annual monetary value of all gross transfers from taxpayers and consumers arising from policy measures that support agriculture, net of associated budgetary receipts, regardless of their objectives and impacts on farm production and income, or consumption of farm products.

Percentage TSE (%TSE): TSE as a share of GDP.

Source: OECD (2016).

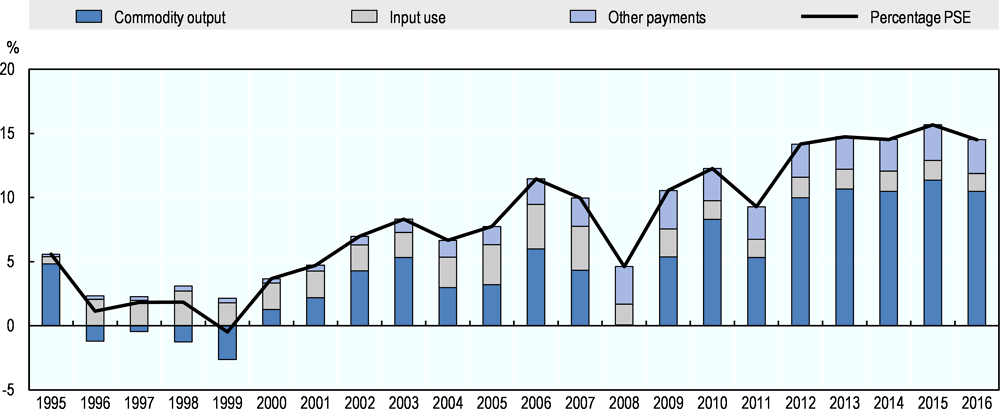

China’s Producer Support Estimate (PSE) shows a drastic evolution of producer support policy in the last two decades (Figure 5.1). Between 1996 and 1999, the MPS was negative, and the budgetary payments were dominated by input payments such as fertiliser subsidy. MPS became positive in 2000-01 but the payments based on agricultural inputs still dominated the producer support. Since 2002, MPS has increased at a faster pace than budgetary payment and has become the main instrument for supporting agricultural producers. In 2008, domestic prices in China remained stable in spite of a price spike of agricultural products in international markets, leading to negative market price support.

Figure 5.1. Evolution of support for China’s agricultural producers, 1995 to 2016

Source: OECD (2017), "Producer and Consumer Support Estimates", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-pcse-data-en.

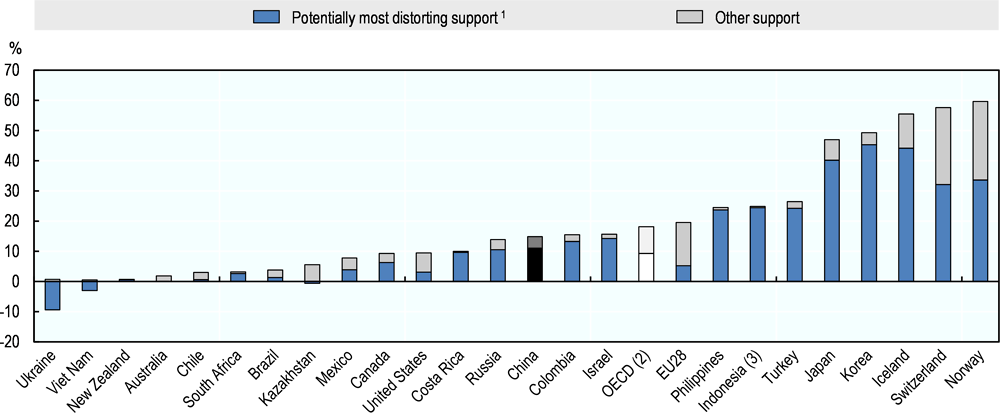

Despite yearly fluctuations, %PSE in China shows an increasing trend. China’s level of producer support in 2014-16 is close to the average of OECD members and higher than that of Russia, Canada, the United States, Brazil, South Africa, and Australia, but lower than that of Norway, Switzerland, Japan, Korea, and the European Union (Figure 5.2).

MPS accounts for 72% of China’s PSE in 2014-16. The payments based on current land area account for more than half of the budgetary payment since 2011, exceeding the share of input subsidy since 2008. The majority of the payments based on inputs support the farmer’s investment and technological adoption, such as subsidies for farm mechanisation, and farm extension and advisory services. However, the most distortive forms of support — based on commodity output and variable input use — accounted for 74% of total producer support in 2014-16, which is higher than the OECD average of 51%.

Figure 5.2. Composition of the Producer Support Estimate, 2014-16

1. Support based on output (including market price support and output payments) and on the unconstrained use of variable inputs.

2. The OECD aggregate does not include Lithuania.

3. For Indonesia, data refer to 2013-15 average.

Source: OECD (2017), "Producer and Consumer Support Estimates", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/545b3853-en.

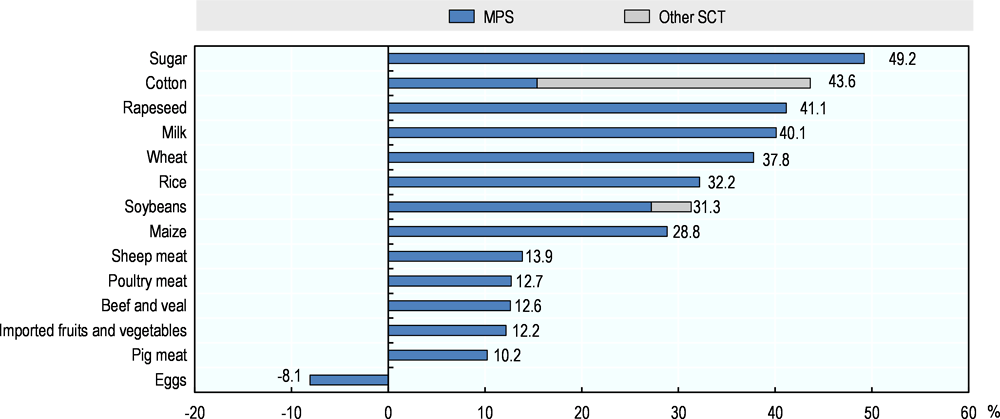

With a low average tariff on agricultural products, domestic prices of many agricultural commodities have been aligned with prices on international markets. However, certain commodities which are covered by the minimum price system or by temporary purchasing and storage (such as rice and wheat) are priced at higher levels than on international markets. In particular, China increased minimum purchase prices and enlarged the scope of commodities covered by the temporary purchase and storage system between 2008 and 2013, resulting in large increase in MPS of these commodities (which is a part of support based on commodity output in Figure 5.1).3 Among the commodities covered, the top five in terms of the amount of MPS are rice, pork, corn, wheat and milk. Meanwhile, sugar, cotton and rapeseed received the highest level of single commodity transfer, in terms of share in gross farm receipts of each commodity (Figure 5.3). The level of single commodity transfer of rice and wheat increased from 6% and -9% in 1995-97 to 38% and 32% in 2014-16, respectively.

Figure 5.3. Support to specific commodities in China: Single Commodity Transfer, 2014-16

Source: OECD (2017), "Producer and Consumer Support Estimates", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/545b3853-en.

Price support policies remain the main instrument of domestic agricultural policy in China. The price support policies are composed of a minimum purchase price policy, and a temporary purchasing and storage system. The minimum purchase price policy was implemented in 2004, mainly for rice and wheat in major grain producing regions. The National Development and Reform Commission (NDRC) sets the minimum purchase price in consultation with the Ministry of Agriculture and other government institutions, considering various factors including prices of agricultural inputs, cost of production, reasonable profit, and market supply and demand.

Minimum purchase prices are announced before sowing season to help farmers make production decisions. The central government authorises the state-owned China Grain Reserves Corporation (Sinograin) and other state-owned companies to openly purchase at the minimum purchase price in the main grain-producing regions in cases where the market price is continuously below the minimum price.4

China raised minimum purchase prices of rice and wheat continuously between 2008 and 2014, which boosted grain output throughout this period (Table 5.1). This policy contributed to the maintenance of food self-sufficiency, but gradually pushed up domestic food prices above international prices, leading to a significant rise in policy-based stocks of rice and wheat. Considering high domestic prices as well as large domestic grain stock, the government maintained the minimum purchase price of grain in 2015 at the same level as 2014. However, the government reduced the minimum purchase price of early indica rice in 2016 and 2017 as well as the minimum price of middle and late rice and japonica rice in 2017.

With a sharp decline in food prices in 2008 after the price hike in world markets, China implemented a temporary purchase and storage policy primarily to stabilise market prices and to ensure adequate supplies of corn, soybeans, canola, cotton, sugar, meat and other agricultural products.5 While the policy for corn and soybeans is applied in northeast China and Inner Mongolia, the policy for rapeseed is implemented in 17 rapeseed-producing areas including Jiangsu, Hubei, and Anhui. The temporary purchase and storage policy was extended to frozen pork in 2009 and to cotton in 2011. With the introduction of a pilot programme for the target price system, the temporary purchase and storage policy was scaled down to corn and frozen pork in 2015.

Table 5.1. China’s Minimum Purchase Price (MPP) and Temporary Purchase and Storage Price (TPSP) for grain, 2004 to 2016

Yuan per tonne

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Minimum Purchase Price (MPP) |

|||||||||||||

|

Rice |

|||||||||||||

|

Early indica |

1 400 |

1 400 |

1 400 |

1 400 |

1 540 |

1 800 |

1 860 |

2 040 |

2 400 |

2 640 |

2 700 |

2 700 |

2 660 |

|

Medium and late indica |

1 440 |

1 440 |

1 440 |

1 440 |

1 580 |

1 840 |

1 940 |

2 140 |

2 500 |

2 700 |

2 760 |

2 760 |

2 760 |

|

Japonica |

1 500 |

1 500 |

1 500 |

1 500 |

1 640 |

1 900 |

2 100 |

2 560 |

2 800 |

3 000 |

3 100 |

3 100 |

3 100 |

|

Wheat |

|||||||||||||

|

White wheat |

|

|

1 440 |

1 440 |

1 540 |

1 740 |

1 800 |

1 900 |

2 040 |

2 240 |

2 360 |

2 360 |

2 360 |

|

Red wheat |

1 380 |

1 380 |

1 440 |

1 660 |

1 720 |

1 860 |

2 040 |

2 240 |

2 360 |

2 360 |

2 360 |

||

|

Mixed wheat |

|

|

1 380 |

1 380 |

1 440 |

1 660 |

1 720 |

1 860 |

2 040 |

2 240 |

2 360 |

2 360 |

2 360 |

|

Temporary Purchase and Storage Price (TPSP) |

|||||||||||||

|

Corn |

|

|

|

|

1 500 |

1 500 |

1 800 |

1 980 |

2 120 |

2 240 |

2 240 |

2 000 |

.. |

|

Soybean |

3 700 |

3 740 |

3 800 |

4 000 |

4 600 |

4 600 |

.. |

.. |

.. |

||||

|

Oil seed |

|

|

|

|

4 400 |

3 700 |

3 900 |

4 600 |

5 000 |

5 100 |

5 100 |

.. |

.. |

|

Cotton |

|

|

|

|

|

|

|

19 800 |

20 400 |

20 400 |

.. |

.. |

.. |

1. The minimum purchase price and temporary purchase and storage price are applicable to Grade-3 products of the national quality standard with a price difference of 40 yuan per tonne between each grade.

2. The temporary purchase and storage price in 2008 are also applicable to medium and late indica rice and japonica, with 1 880 yuan per tonne and 1 840 yuan per tonne respectively.

3. The temporary purchase and storage price for corn varies in the major grain producing areas in the Northeast. It was 2 260 yuan per tonne for Inner Mongolia and Liaoning, 2 240 yuan per tonne for Jilin, and 2 220 yuan per tonne for Heilongjiang.

4. The temporary purchase and storage prices for soybean and cotton were cancelled in 2014, and replaced with the experimental target price subsidy system; the temporary purchase and storage price for oilseed was terminated in 2015.

Source: NDRC.

In contrast to its minimum price purchase policy, the government announces temporary purchase prices only during the harvest season. The state-owned companies purchase at the temporary purchase price if the market price is lower. However, intervention prices may differ across provinces, and purchases are not undertaken systematically every year (OECD, 2013). The temporary purchase prices of corn, soybean and rapeseed were continuously raised between 2008 and 2012.

The amounts of crops purchased by state-owned companies at minimum price or temporary purchase and storage price change from one year to the next, depending on the relative levels of market prices and those offered by the government. In some years, the government becomes the dominant buyer of grains. In 2015, the government purchased a record amount of 175 million tonnes of grains, out of which just 18.5 million tonnes had been auctioned (Renmin Daily, 2016) due to high prices and inconsistent quality (GAIN-CH15058, 2015). As international prices fell, the price gaps continued to increase, with the exception of cotton, for which the price gap declined quite strongly. As a result, the value of overall market price support in 2015 reached the highest level since 1993, when the OECD started to apply the PSE methodology for China (OECD, 2017).

Overall, price support is still a dominant instrument to support producers, accounting for 80% of the Producer Support Estimate in 2013-15. This policy succeeded in boosting domestic food production and maintaining the target level of food self-sufficiency. However, it raised domestic prices above international prices, increasing the cost to consumers and to the government, who were forced to cover high costs of storage. Previous OECD studies find that these policy instruments, in general, reduce the competitiveness of the sector by preventing farmers from responding to market signals and are unable to target specific policy objectives such as the environmental performance of agriculture (van Tongeren, 2008).

Payments to support farm income or reduce cost

Recognising the distortive effects of price support policies, China started to replace its price support system with a target price system for agricultural products (State Council, 2014). If the average market price of the product is below the pre-determined target price, farmers can receive direct payments covering the price difference.6 In 2014, China initiated the pilot programmes of target price payment for soybeans in northeast and Inner Mongolia with the target price of soybeans at 4 800 yuan per tonne, and for cotton in Xinjiang Province with the target price of cotton at 19 800 yuan per tonne. In 2016, the target price of soybeans remained unchanged while that of cotton was lowered to 18 600 yuan per tonne. In addition, China introduced a direct payment to rapeseed producers in 2015, replacing the temporary purchase programme.

In 2015, China reduced the temporary purchase price of corn to 2 yuan per kg, 10.7% lower than that in 2014. In 2016, China abolished the temporary purchase and storage policy for corn, replacing it with a new mechanism of market-based storage acquisition that allows market supply and demand to determine prices, while farmers would receive direct payments. The reform was implemented in key maize producing areas: in Heilongjiang, Jilin, Liaoning and Inner Mongolia, where a temporary purchase and storage programme was in place. As a result, the domestic prices of soybeans, cotton, rapeseed and corn declined gradually close to international prices.

China has developed four main direct payment programmes since the early 2000s: direct payment for grain producers; payments to compensate farmers for an increase in prices of agricultural inputs, in particular for fertilisers and fuels; subsidies for improved seeds; and subsidies for purchases of agricultural machinery. Direct payment to grain producers was implemented in 2004 as a payment based on current area of production, in which provincial government decides which grains are eligible for this subsidy. In practice, the payment is given to farmers based on the actual taxed land area and taxed output,7 rather than the actual planting area, which makes the subsidy more decoupled from current production in practice. The total amount of payment was CNY 11.6 billion (USD 1.4 billion) in 2004, up to CNY 15.1 billion (USD 1.98 billion) in 2007, and has remained at that level since then.

The agricultural input payments were implemented in 2006 to reduce farmers’ input costs, given the rising prices of agricultural materials like diesel oil and fertiliser. The subsidy rose from CNY 12 billion (USD 1.51 billion) in 2006 to CNY 71.6 billion (USD 10.3 billion) in 2008 as a result of increases in input prices. The payment is made on current area production, but rate of the subsidy is calculated based on input price.8 In practice, some local governments provide payments based on taxed land area, which resulted in a decline of production incentive. In 2008, China combined agricultural input payments and direct payment to grain producers into a comprehensive income subsidy, which targets subsidising farmers’ income instead of promoting food production.

The subsidy for improved seeds was implemented on a pilot basis in 2002 to motivate farmers to plant high-oil soybean in the northeast in 2002. The variety of products receiving the subsidy increased from soybean to rice, wheat, corn, canola, cotton, potatoes, peanuts, barley, pigs, dairy cattle, and beef, but only a subsidy for rice, wheat, corn and cotton is available nationwide. The payment is made based on current area or animal number, and the rate of subsidy depends on the varieties. The subsidy rapidly increased to CNY 12.1 billion (USD 1.74 billion) in 2008 from CNY 100 million (USD 12.08 million) in 2002 and CNY 2.85 billion (USD 344.28 million) in 2004, and the amount of subsidy reached CNY 20.35 billion (USD 3.24 billion) in 2015. Subsidies in improved animal variety were launched in 2005, and rose to CNY 1.2 billion (USD 190 million) in 2014; these subsidies support farmers in purchasing semen of quality boars, dairy cows and beef cattle or in purchasing stud rams and male yaks.

These three subsidies have been the main instruments of China’s direct payment policy. In 2015, the government applied a pilot programme to combine the three subsidies, all paid on a per unit of land basis, into a single payment, called the “agricultural support and protection payment”, in the five provinces of Anhui, Hunan, Shandong, Sichuan and Zhejiang. The payments consist of two components. Under the new programme, all of the original expenditure for the direct payment for grain producers and the subsidy for improved seeds, and four-fifths of the original expenditure for the agricultural input payments was paid per unit of land directly to owners of land contract rights. This part is intended to protect arable land fertility and to preserve grain production capacity. One-fifth of original expenditure for the agricultural input payments and the future increase in expenditure for the agricultural support and protection payment are set aside for “new-style” farms that rent land, “family farms”, co-operative farms, and farms run by agribusiness companies; it is disbursed in the form of credit guarantees, interest rate subsidies and technical advisory service rather than area based payment (MOA-MOF, 2016). This approach reflects a shift of agricultural policy orientation from boosting production to preserving production capacity and promoting structural adjustment towards large-scale operations. It is an important step to further decouple payments from production and input prices and give producers freedom over what they produce.

The subsidy for purchases of agricultural machinery is another major direct payment programme implemented since 2004. The programme, under which farmers receive a discounted price on new machinery with the price difference settled between the government and suppliers, aims to encourage farmers to use advanced and suitable farm machines (Ni, 2013). In 2004, the central government allocated CNY 70 million (USD 8.46 million) to purchase advanced farm machines in 66 counties, and the subsidy later became available nationwide. The subsidy increased to CNY 23.65 billion (USD 3.84 billion) in 2014. In 2016, buyers of 11 categories (including 43 sub-categories) of farm machinery can effectively receive a reimbursement of up to 30% of the purchase prices. This programme is implemented at the provincial level, and it is up to provincial governments to decide the models of machinery eligible for the subsidy. China also introduced a subsidy for scrapping and renewing agricultural machines in 2013 in Shanxi, Jiangsu, Xinjiang, and Heilongjiang provinces, i.e. providing a small amount of subsidy for tractors and combine-harvesters to be scrapped when purchasing new farm machines.

The introduction of this subsidy responds to Chinas rising cost of labour driven by a shrinking rural labour force and to the need to facilitate substitution of family labour input with machine services. It also facilitates consolidation of farms to large-scale operations (van den Berg et al., 2007). Zhang, Yang and Reardon (2015) argue that the machinery subsidies assisted the emergence of farm machine service providers which allow farmers to outsource some of the power-intensive steps of farm operations (Box 2.2). New types of farm organisation, such as Farmer Professional Co-operatives (FPCs), are increasingly becoming a major recipient of the subsidy. FPCs and other types of co-operatives received 30% of the national subsidy for the purchase of agricultural machinery in 2012 (Zhong, 2014).

The subsidy for agricultural insurance premium became one of the key support programmes for producers. The programme was launched in 2007 to enhance the farmer’s capacity to manage risks and recovery of production after disaster. The central government subsidises insurance premiums for 15 products, including all the major crop and livestock commodities, at the rate of 40% of the premium in central and western provinces and 35% in the eastern provinces. Provincial and county governments provide additional subsidies, but as from 2016 the share covered by the central government subsidy was increased to 47.5% for the central and western provinces and to 42.5% for the eastern provinces (MOF, 2016).

The subsidy programme is implemented throughout China, and local governments can subsidise the insurance premium of special agricultural products. The central government steadily increased the subsidy from CNY 2.14 billion to CNY 24.47 billion (USD 0.29 billion to USD 3.97 billion) between 2007 and 2014. In addition to crop and livestock insurance programmes, the target price insurance for agricultural products was introduced in some provinces and autonomous regions in 2014. The 2016 No. 1 Central Document required the government to introduce experimentation of target price insurance, income insurance and weather index insurance programmes for major agricultural products, to improve the forest insurance system, and to support local governments in developing insurance for specialty agricultural products, fishery, and agricultural machinery.

In addition to these major programmes, China has also implemented subsidies to support the sowing of improved quality seeds and the extension of improved breeds of livestock via the New Variety Extension Payment. Other support policies include a subsidy for technologies key to preventing and mitigating agricultural disasters as well as increasing yield,9 policies supporting standardised animal production, subsidies for animal epidemic prevention,10 policies supporting the establishment of primary processing facilities in producing areas of agricultural products, and policies supporting the building of a traceability system for agricultural products.

Besides supporting individual producers, the central government provides a financial incentive for recent years’ major grain-, oilseed- or pig-producing counties, based on production records. Such counties have received CNY 35.5 billion (USD 5.35 billion) each year. The reward for major grain-producing counties is in the form of general transfer payment, while that for super grain-producing counties is used specifically to support food production and the food industry. The central government also awards the top five grain-producing areas. The rewards for major oil-producing and pig-producing counties must be used to support oil and pig production as well as related industry development. The goal is to enhance financial resources in these counties and motivate local governments to focus on food production and pig breeding.

Box 5.5. Policies supporting new types of professional farm operation in China

A series of policies have been released to encourage the development of new types of professional farm operations such as large family farms, co-operatives and corporate farms, with an expectation that such farms will dominate future agricultural production. First, the new type of agribusinesses like large grain producers and family farms have been given access to agricultural subsidies. For example, a part of new agricultural support and protection subsidy is reserved for those farmers in the form of credit guarantees, interest rate subsidies and technical advisory payments. The famers are allowed to pledge the operational rights of land to finance such farm investments as purchasing and renting machinery. An agricultural credit guarantee system is established to provide credit guarantee and risk compensation for the loans of large grain producers.

Second, local government has established a special fund for farmers’ co-operatives to provide information, technology, training, quality standards and certification as well as marketing services. Moreover, specialised co-operative organisations and their processing and distribution businesses enjoy tax reductions and exemptions, and are given priority in applying for national agricultural projects. Certain agri-business enterprises are also subject to preferential policies in land use, taxation and credit loans. In addition, the Chinese government is enhancing agricultural vocational education to develop professional skills for new types of farmers, experienced farmers, large farming households, family farm owners, agricultural machinery operators, agricultural information collectors and staff in agricultural enterprises. Management training is arranged for managers of farmers’ co-operatives, agri-business enterprises, farmer brokers, agricultural service providers, and grassroots leaders in rural areas.

Figure 5.4. Framework of supporting new types of professional farms

Agricultural policies targeted at environmental sustainability

The steady growth of the sector, especially for products with high self-sufficiency targets, has been aided partly by the intensive use of chemical inputs such as mineral fertilisers and pesticides, and the severe exploitation of land and water resources. Intensive use of chemical inputs in the crop sectors has led to soil degradation and pollution, water pollution, and damaged bio-diversity. Water resources have also been heavily exploited by agriculture, especially for irrigation, at the national scale, particularly in areas where irrigation is intensive or water resources scarce. Intensive use of inputs and natural resources are partly supported by the government subsidy based on output and input use, such as water and other purchased inputs. The development of the livestock sector has created serious stress on China’s grassland areas. The release of animal manure and waste water from intensive livestock and aquaculture farms further pollutes the environment, especially water resources.

In response to growing environmental concerns, China started to implement agri-environmental policies, including soil and water protection, agricultural pollution control, and protection and restoration of the ecological environment. While the objective of agricultural policies has historically been largely oriented to increasing agricultural production, improving the environmental performance of agriculture recently became one of the major policy objectives (Box 5.2).

Agri-environmental payments

The “grain for green project” (officially called the “Returning Farmland to Forests Programme”) has been in place since 1999 to retire cultivated lands in environmentally sensitive areas and convert them to pastureland or forest. While the grain for green project covered 27.7 million hectares of farmland in 25 provinces in 1999-2000, only 6.7 million hectares of farmland were converted in 2006-09, well below the original target of 15.7 million hectares, due to growing concerns over grain security (OECD, 2011). However, China started to scale up this programme in 2014.11 In 2015, the central government allocated CNY 4.964 billion (USD 789.95 million), returning 10 million mu (0.7 million hectares) of farmland to forest and grassland. The subsidy for converting farmland to forest is to be provided at CNY 22 500/ha (USD 3 580/ha) and for converting farmland to grassland at CNY 15 000 (USD 2 387) (OECD, 2016b).

In 2003, China also began projects to convert grazing land to grassland to contain desertification of grassland and to protect the ecological environment. From 2011, new measures were implemented to improve the policy comprising the rational distribution of grassland fencing, the construction of stalls to support feeding and artificial forage land (Ni, 2013). In addition, the central government increased the subsidy rate and standard. The rate of subsidy was increased from CNY 17.5 to CNY 20 per mu (USD 31.7 to USD 46.42 per hectare) of fence built in Qinghai-Tibet Plateau area, and CNY 16 (USD 34.83) in other areas. Moreover, a subsidy to sow grass was doubled to CNY 20 per mu (USD 46.42 per hectare). The rate for artificial forage construction was CNY 160 per mu (USD 371.52 per hectare).

In addition, China introduced the Grassland Ecological Protection Subsidy for eight western provinces in 2011 and another five provinces in 2012, covering all pastoral and semi-pastoral counties. The subsidy aims to promote protection of grassland and to enhance incomes of animal herders. Since 2011, the rules have remained the same: payments are made for the suspension of grazing (CNY 6 per mu; USD 13.9 per hectare), as a reward for not exceeding the stock-carrying capacity of grassland (CNY 1.5 per mu; USD 3.48 per hectare), and as subsidies for improved breeds of animals, improved varieties of pasture grass and as a general input subsidy (CNY 500 per household; USD 77.36 per household) (OECD, 2015). The total budget allocated from the central government was CNY 15.77 billion (USD 2.56 billion) in 2014 and CNY 19 billion (USD 3.03 billion) in 2015.

The central government also launched a subsidy for wetland protection in 2010 to monitor and restore major wetlands, natural reserves and national wetland parks. In 2014, China started pilot projects for returning farmland to wetland and providing compensation for its protection and restoration. From 2009, the central government included a subsidy for using agricultural machinery for sub-soiling and land preparation in the newly added comprehensive subsidy fund. In 2013, China launched pilot projects of a subsidy for using agricultural machinery for sub-soiling and land preparation in autumn in suitable areas like the northeast and the Huanghuaihai Plain, to help farmers or farm machinery service providers these activities.

Box 5.6. Agricultural Resource Respite Pilot Policy

To deal with the pollution of key agricultural resources such as land and water, China initiated the Agricultural Resources Respite Pilot Policy. The first component of this policy carries out comprehensive prevention and control of heavy metal pollution to soil through conducting national surveys, surveillance and dynamic early warning of soil heavy metal pollution. Pilot projects of restoring farmland with heavy metal pollution aim to restore polluted farmland and enable the rice produced from heavily polluted land to meet required standards, or for other crops to be produced. In 2015, the central government invested CNY 2.79 billion (USD 444 million) in preventing and treating heavy metal pollution in 30 cities and regions. For moderately polluted arable land in those regions, demonstrative restoration of heavy metal polluted land is to be conducted without interrupting production activities, whereas for the heavily polluted arable land, production is to be stopped while restoration is undertaken. In the latter case, farm households in the demonstration projects are to be properly compensated.

The second component implements agricultural non-point pollution control and management, including the construction of a national agricultural non-point pollution monitoring and control network, with particular emphasis on building the prevention and control demonstration areas surrounding Tai Hu, E Hai, Chao Hu, and the Three Gorges Reservoir. In areas with particularly serious pollution from livestock and aquaculture operations, agricultural film residues and straw burning, this pilot policy also emphasises solutions such as pollution controls of large-scale livestock and poultry farms as well as aquaculture farms, adoption of decomposable biological agricultural films, recycling of residues of agricultural films, and comprehensive utilisation of crop residues.

The third component of the pilot policy is to explore and build the agricultural ecological compensation mechanism to provide subsidies to farm households for the reduction of chemical fertiliser and pesticide use and increased adoption of high efficiency, low toxicity and low residue pesticides. This compensation mechanism is to be strengthened in important watersheds where agricultural non-point pollution is particularly serious.

By the end of 2015, the central government had invested about CNY 4.8 billion (USD 763.85 million) through providing materials and funds to encourage farmers to apply soil improvement technology and to make better use of organic fertilisers like straws. From 2014, the “soil organic matter enhancement project” was renamed the Farmland Protection and Quality Improvement Project. The central government committed CNY 800 million (USD 127.39 million) in 2015 to support and encourage farmers to return crop residues to the fields, to better utilise green manure and organic fertiliser, and to improve soil and foster soil fertility.12

With increasing environmental issues related to livestock waste, China started to support large-scale livestock farms in having standardised renovation and construction, making better use of waste, and controlling the pollution discharge from livestock production. Since 2007, the central government has spent CNY 2.5 billion every year (about USD 330-400 million) supporting the construction of standardised large-scale pig farms. Moreover, to dispose of dead livestock and poultry in an environmentally-friendly way, the central and local governments have subsidised intensive pig farms for their pro-environment disposal of dead pigs at CNY 80 (USD 12.68) per head since 2012. In 2015, China also started a pilot project in nine provinces on the comprehensive treatment of livestock manure, including a subsidy for equipment and its use in the recycling process.

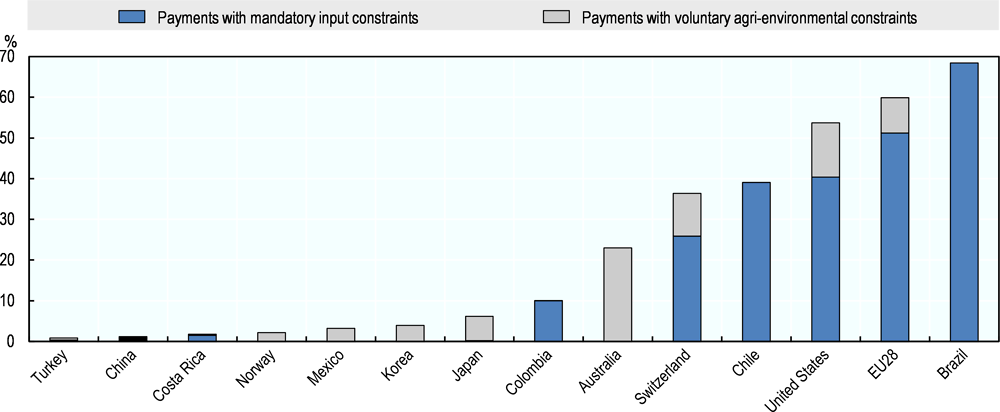

The announcement of the Agricultural Sustainable Development Plan (2015-30) was an important step in accelerating the development of resource-saving, environmentally-friendly and ecosystem-protecting agricultural policy in China. China has been increasing policy efforts to introduce a subsidy and reward mechanism for adopting more environmentally friendly practices, and restoring and protecting ecological environment as well as providing technical assistance. Nonetheless, policies to maintain self-sufficiency in grain production still account for a large part of producer support. The OECD indicator of producer support shows that China’s payments conditional on the adoption of specific production practices was 1.2% of total producer support in 2014-16, whereas in the European Union and the United States the majority of support has such conditionality (Figure 5.5).13

Figure 5.5. Support conditional on the adoption of specific production practices, 2014-16

Source: OECD (2017), "Producer and Consumer Support Estimates", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/545b3853-en.

In this setting, China should also ensure that its ongoing policy programmes do not impede its sustainability objectives. Previous OECD work has demonstrated that input subsidies and market price support are particularly problematic (Van Tongeren, 2008). China should review its policies and strive to reduce environmentally harmful support; it should also ensure that it effectively meets its intention to move towards decoupled farm payments, which are much less likely to motivate farmers to misuse resources. It should also strive to ensure that its productivity and environmental objectives can support each other. China is shifting its agricultural policy orientation from boosting production to preserving production capacity and promoting structural adjustment. The reform to consolidate direct payments to producers and decouple them from input price movements is an important step in this policy direction.

Although monitoring of environmental performance at farm level is a challenge for many OECD governments, it is particularly challenging for China, which is dominated by a large number of small-scale farms. Scaling up soil testing at the field level will increase monitoring costs.14 Making existing direct payments conditional on the recipient’s compliance with environmental standards could be an effective policy tool to reduce the cost of monitoring environmental regulation at the farm level. However, experience in OECD countries shows that such conditionality may not be effective unless it is adapted to the diversity of local farming practice and conditions.15 The European Union’s experience in attaching cross-compliance requirements to direct payment programmes can be relevant for China (Box 5.7).

Box 5.7. Cross-compliance in the European Union

The EU approach to cross-compliance includes partial or full loss of payments if the farmer fails to comply with mandatory standards stemming from existing legislation and the maintenance of good agricultural and environmental conditions. Cross-compliance creates a link between several separate policies, amongst them income support and selected statutory standards or requirements. These relate to environment, animal and plant health, public health and animal welfare and identification and registration of animals, and are enshrined in existing laws. By introducing reduction of payments due to non-compliance, the effectiveness of enforcement of existing environmental laws could be expected to increase.

Primary legal enforcement of environmental legislation is carried out through European Union member states' sanctioning systems. Cross-compliance assists in reinforcing respect for the basic requirements and standards, avoiding support to farmers that do not abide by these rules.

The European Union uses a system in which both statutory requirements and voluntary commitments are complementary. Farmers receiving agri-environment payments for voluntary commitments must in any case respect the mandatory standards. In that sense, the European Union cross-compliance system already provides the baseline for calculation of payments for agri-environmental measures. EU member states and regional authorities define the cross-compliance standards on the basis of the EU framework, adapting them to local conditions in order to deal with heterogeneity in local circumstances.

Cross-compliance neither directly pursues an income support objective nor comprises the primary mechanism for enforcing environmental legislation. Rather, cross-compliance is a tool linking payment schemes to respect for a wide array of mandatory requirements and fostering adherence to them.

Source: OECD (2010a), Annex B.

5.3. Agricultural trade policies

Overall, China has had low tariffs on agricultural products for most commodities since its accession to the WTO. At present, the simple average applied tariff rate of China’s agricultural imports is 15.6%. According to World Tariff Profiles 2015 (WTO, 2015), China’s tariff rate on agricultural products is relatively low, with bound tariffs accounting for 64.4% and slightly high applied tariffs accounting for 66.3% for duties less than 15%. Imported agricultural products in the 15%-duty category account for 78.9% of total imports (Table 5.2). In addition, there is no tariff peak over 100%, and a very limited number of tariffs over the range of 50% to 100%.

Table 5.2. China’s tariffs on agricultural products

Frequency distribution by duty ranges (in %)

|

|

|

Duty-free |

0<=5 |

5<=10 |

10<=15 |

15<=25 |

25<=50 |

50<=100 |

>100 |

|---|---|---|---|---|---|---|---|---|---|

|

Final bound |

|

6.0 |

7.0 |

25.8 |

25.6 |

26.2 |

7.0 |

2.3 |

0.0 |

|

MFN applied |

2014 |

7.5 |

9.1 |

25.7 |

24.0 |

24.7 |

6.4 |

2.6 |

0.0 |

|

Imports |

2013 |

0.9 |

42.1 |

24.4 |

11.5 |

5.1 |

12.4 |

3.5 |

0.0 |

Source: World Trade Organization, International Trade Centre and UNCTAD (2015), World Tariff Profile, WTO Publications, Switzerland.

By April 2016, China had endorsed twelve Free Trade Agreements (FTAs) with Australia, South Korea and other countries. The China-ASEAN FTA is to be upgraded after another round of negotiation. Eight FTAs are under negotiation and four are planned. In addition, the Asia-Pacific trade arrangements are preferential trade arrangements. According to relevant free trade area agreements, China is committed to opening up agricultural products to the outside world, except those on the negative list like grain (rice, corn and wheat), vegetable oil (soybean oil and palm oil, etc.), sugar, tobacco, and cotton.

Specifically, the Early Harvest programme of the China-ASEAN FTA covers products included in Chapter One to Eight of Customs Tariff. China protects such agricultural products as corn, rice, indica rice, wheat, sugar, tobacco, and combed cotton. The excluded products of the China-Chile FTA are grain, vegetable oil, sugar, tobacco, and cotton. The same applies to the China-Australia FTA and China-New Zealand FTA. The China-ASEAN FTA has opened markets of vegetables, fruits, and aquatic products, and the market of animal by-products is nearly open in the China-Australia FTA and China-New Zealand FTA.16 China’s agricultural markets are becoming more open to the outside world as China establishes more free trade areas with other countries.

China currently imposes import tariff quotas on wheat, corn, rice, sugar, cotton, wool and wool top. Based on regulations on tariff quotas of products, issued by NDRC and the Ministry of Commerce, the tariff quota of wheat is 9.636 million tonnes 10% of non-state trade; that of corn 7.2 million tonnes, 40% of non-state trade; and that of rice 5.32 million tonnes (half long-grain rice and half medium- and short-grain rice), 50% of non-state trade in 2016. The amount of sugar within the tariff quota is 1.945 million tonnes, 70% of which is state trade; the quantity of cotton is 894 000 tonnes, 33% of state trade; the amount of wool is 287 000 tonnes, and wool top 80 000 tonnes (Table 5.3).

The in-quota duty rate for wheat, corn, unhusked rice and rice is 1%, and the out-of-quota most favoured nation tariff is 65%; the in-quota duty rate of sugar is 15%, and the out-of-quota most favoured nation tariff is 50%; the in-quota duty rate of cotton is 1% and the maximum 40% of sliding duty rate is for the out-of-quota cotton; the in-quota duty rate of wool and of wool top is 1% and 3% respectively, and their out-of-quota duty rate is 38%.17

Table 5.3. China’s agricultural products in tariff-quota management

|

|

Quota |

State trade |

In-quota duty |

MFN rate |

|---|---|---|---|---|

|

|

(million tonnes) |

(per cent) |

||

|

Wheat |

9.64 |

90 |

1 |

65 |

|

Rice |

7.20 |

60 |

1 |

65 |

|

Unhusked |

5.32 |

50 |

1 |

65 |

|

Sugar |

1.95 |

70 |

15 |

50 |

|

Cotton |

0.89 |

33 |

1 |

sliding tax |

|

Wool |

0.29 |

|

1 |

38 |

|

Wool top |

0.08 |

|

3 |

38 |

Source: NDRC and MOC.

5.4. General support to the agricultural sector

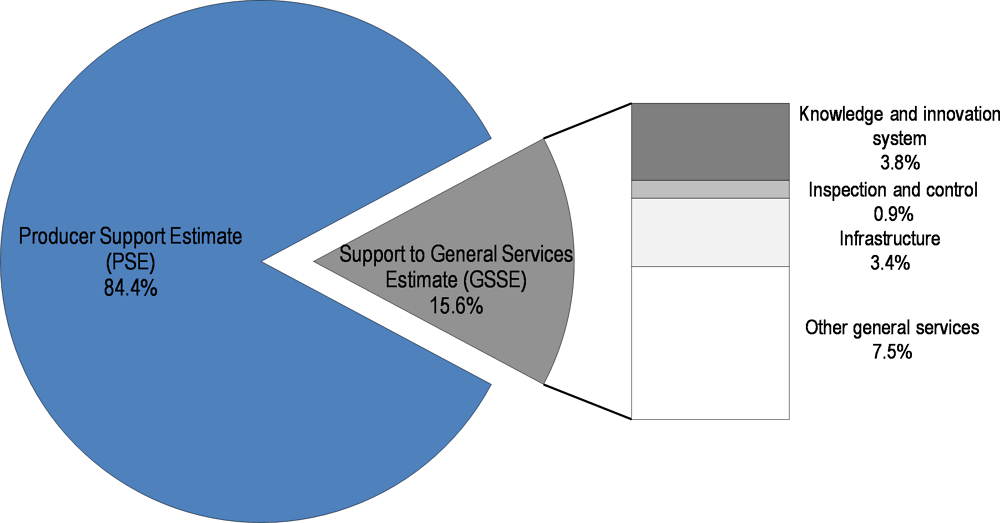

The OECD producer indicator also provides a measurement of budgetary transfers on general service support to the agricultural sector. It includes agricultural R&D, education and training, inspection and quarantine management, and infrastructure investment – all of which potentially have a positive long-term impact on China’s agricultural innovation and productivity growth. China also provides marketing promotion and public stockholding as a part of general service to the sector. Their importance in total support to agriculture compared with support to individual producers reflects the policy emphasis on providing long-term investment to the sector.

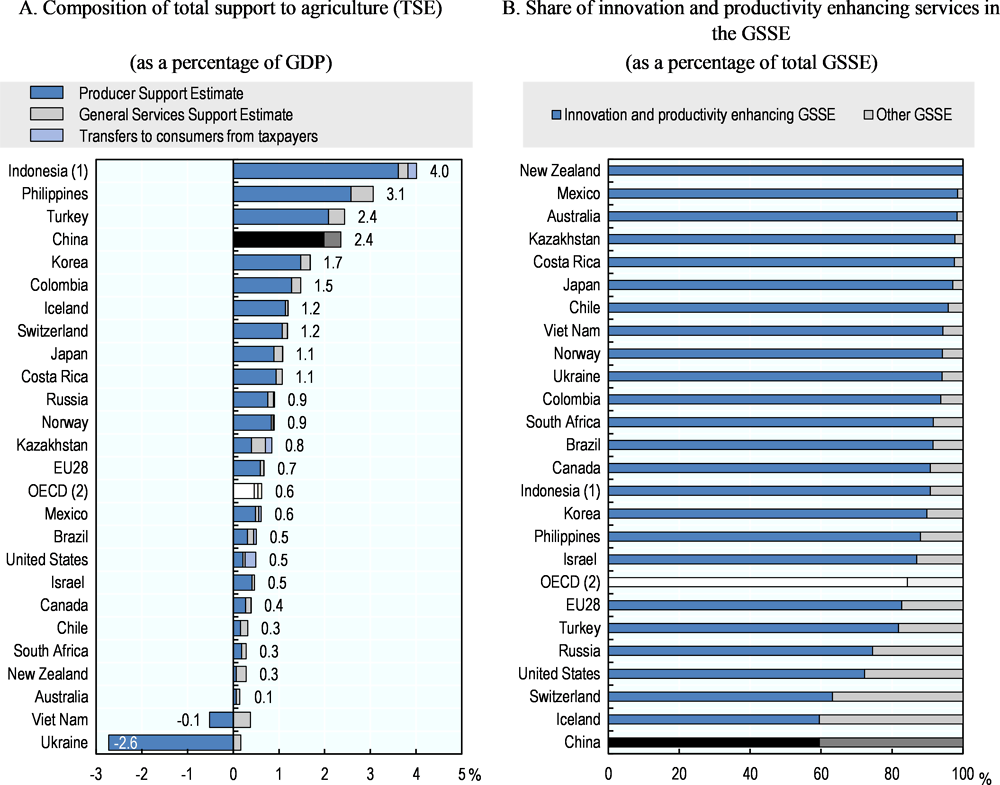

China’s expenditure for general services support has grown at a slower pace than support to individual producers, reducing the share of GSSE from 44% in 1995-97 to 16% in 2014-16 (Figure 5.6). The share of China’s total support to agriculture including both GSSE and PSE as a share of gross domestic product (%TSE) was 2.4% in 2014-16. This indicator represents the burden of policies supporting agriculture on the whole economy. For China, this indicator is the fourth highest (Figure 5.7A).

Figure 5.6. Composition of support to agriculture in China, 2014-16

Source: OECD (2017), "Producer and Consumer Support Estimates", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/545b3853-en.

The cost of public stock holding has the largest share in GSSE in China, while its share declined from more than half until 2004 and 38% in 2014-16. China has gradually been increasing its innovation and productivity-enhancing service expenditures. As China attaches more importance to agricultural R&D, education and training, and technology extension, the share of support for the agricultural knowledge and innovation system has increased from 8% in 1995-97 to 25% in 2014-16. As a consequence, the share of innovation and productivity-enhancing services in GSSE, which also include the development and maintenance of infrastructure, was 59% in 2014-16 – lower than OECD average of 83% (Figure 5.7B).

Figure 5.7. Composition of support to agriculture, 2014-16

1. Data for Indonesia refer to 2013-15.

2. The OECD aggregates do not include Lithuania.

Source: OECD (2017), “Producer and Consumer Support Estimates”, OECD Agriculture statistics (database). http://dx.doi.org/10.1787/545b3853-en.

5.5. Summary

Over the last three decades, agricultural policy objectives in China evolved significantly, reflecting the different roles that agriculture plays at different stages of economic development. The policy objectives have been diversified from increasing the quantity of food production to ensuring food safety, increasing farmers’ income, enhancing competitiveness and improving environmental performance.

Recently, the emphasis of food security policy shifted from boosting production towards using more international resources and markets while preserving domestic production capacity. This is a reasonable policy direction considering the cost of maintaining high self-sufficiency rate in grain production in China. Greater integration with international markets and decoupling of support from production would optimise the domestic agricultural structure and reduce the pressure on the environment and national resources. Recent reform to replace intervention prices by direct payments based partly on area planted is one step in this direction. Reform of the price support policy for rice and wheat is already underway, reducing or capping the minimum purchase prices. In the future, China should consider shifting the domestic price support to rice and wheat to a direct payment system.

China has been increasing public expenditure for the general service support to enhance innovation and productivity growth, such as public investment in R&D and infrastructure; however, the cost of public stockholding remains the largest part of the expenditure to general service support to agriculture. The portfolio of agricultural support could be further rebalanced to reflect the policy emphasis on long-term productivity growth and sustainability.

China developed area-based direct payment programmes such as direct payments for grain producers, agricultural input payments and an improved seed variety subsidy. Recent policy reform consolidated these payments into a single payment supporting the maintenance of grain production capacity rather than boosting production itself. It also focuses more on larger farms. However, the policy should not interfere with farm management decisions, including what to produce and what size of operation farmers choose. The payments targeted to large-scale farms could be counter-productive. Moreover, the income support through direct payment only has a transitory role to support the farmer’s adjustment to a new policy and market environment. The payments should be decoupled from commodity production and introduced as a transitional measure which is time-bound. Such payments would enhance production diversification to higher value crops and allow producers to set aside farmland while maintaining production capacity.

The subsidy for agricultural insurance premiums launched in 2007 became one of the key programmes to support producers. However, it is not a cost-efficient programme for increasing farm income as these instruments generate high transaction costs and rent-seeking behaviour by farmers and insurance companies. Insurance subsidies may lead to unsustainable choices of production and farm practices in the short term. They may also crowd out on-farm diversification strategies as well as the development of agricultural insurance markets. In general, insurance subsidies risk crowding out market-based solutions and own-farm risk management strategies, and may transfer to taxpayers a part of the risks that should be borne by farmers.

Improving the environmental performance of agriculture has recently become a major objective of agricultural policy. China has been increasing policy efforts through strengthening regulations as well as introducing incentive measures. However, existing agricultural policy instruments are still largely focused on maintaining grain self-sufficiency. Price support policies induce intensive production, leading to an excessive use of inputs. Existing agricultural policy instruments should be reviewed to improve their coherence with environmental objectives.

Designing agri-environmental policies requires the definition of environmental quality reference levels and environmental targets, which play a crucial role in choosing policy instruments. While the reference level is the minimum level of environmental quality that famers are required to provide at their own expense, environmental targets represent a voluntary (desired) level of environmental quality. To establish a solid framework of agri-environmental policies, China should further clarify reference environmental quality levels and targets which are well adapted to local ecological conditions.

China has built a regulatory framework of environmental protection, but effectively enforcing environmental regulations and increasing producer’s awareness remains a major challenge. The compliance to environmental regulation can be enforced more effectively with complementary incentive measures. For example, making direct payments conditional on the recipient’s compliance with environmental standards could increase the farmer’s incentive to comply with environmental regulations and reduce the cost of monitoring environmental regulations at the farm level, given that the farm structure in China is dominated by small-scale producers. However, experience in OECD countries shows that such conditionality would not be effective unless it is adapted to the diversity of local farming practices and conditions.

In addition to strengthening the enforcement of environmental regulations to ensure compliance, agricultural policy can introduce mechanisms to encourage the adoption of environmentally friendly production practices. For example, while payments for long-term resource retirements and for restoring environmental condition have been introduced in China, payments linked to specific environmental actions by producers account for only 1.2% of total producer support and 4.2% of budgetary transfer to producers in 2014-16. In contrast, the majority of payments in the European Union and the United States have such conditionality. Voluntary targeted payments rewarding better practices in key environmental areas are one potential tool to compensate for the additional costs associated with improving environmental performance beyond the reference level. Such payments can be introduced by reorganising the existing area-based direct payments so that some part of the payments is conditional on famer’s additional adoption of environmentally friendly production practices. Considering China’s small and fragmented farm structure, community-based policy which supports groups of farmers in localities such as watershed areas in setting up voluntary co-operative arrangements among themselves to collectively address common problems such as water pollution and soil erosion may also reduce the monitoring cost of small farms and may increase the policy impacts on environmental conservation.

References

Central Committee of the Communist Party of China (1983), “Some Issues Concerning China’s Current Rural Economic Policies 1983” (in Chinese).

Central Committee of the Communist Party of China (1979), “Decision on Some Issues concerning the Acceleration of China’s Agricultural Development”, Editors of the book: Decision of the Central Committee of the Communist Party of China on Some Issues concerning the Improvement of Rural Reform and Development, People’s Publishing House, 2008 (in Chinese).

Cheng, Guoqiang (2015), “China Needs New Concepts of Food Security”, China Financial and Economic News, 2 June 2015 (in Chinese).

Cheng, Guoqiang (2013), “Global Agricultural Strategies: China’s Food Security Framework from a Global Perspective”, China Development Press (in Chinese).

Cheng, Guoqiang (2011), “China’s Agricultural Subsidies”, China Development Press (in Chinese).

GAIN-CH15058 (2015), “China – Peoples Republic of: Grain and Feed Update. Government Cut to Corn Prices Reshapes Feed Market”, USDA FAS, 6 November.

MOA and MOF (2016), “Administrative Notice of Managing Funds for Agricultural Support, Protection and Subsidy”, 2016-6-23

MOA, NDRC, MOST, MOF, MLR, MEP, MWR and State Forestry Administration (2015), National Agricultural Sustainable Development Plan (2015-2030) (in Chinese), http://www.moa.gov.cn/zwllm/zwdt/201505/t20150527_4619961.htm.

MOF (2016), “Administrative Notice of Managing Insurance premium Subsidy”, 2016-12-19.

NI, Hongxing (2013), “Agricultural Domestic Support and Sustainable Development in China”, ICTSD Programme on Agricultural Trade and Sustainable Development; Issue Paper No. 47; International Centre for Trade and Sustainable Development, Geneva, Switzerland, www.ictsd.org.

OECD (2017), “Producer and Consumer Support Estimates”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/545b3853-en.

OECD (2016), OECD’s Producer Support Estimate and Related Indicators of Agricultural Support: Concepts, Calculations, Interpretation and Use (The PSE Manual), OECD publishing, Paris, www.oecd.org/tad/agricultural-policies/full%20text.pdf.

OECD (2015), “China”, in Agricultural Policy Monitoring and Evaluation 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/agr_pol-2015-10-en.

OECD (2013), “China”, in Agricultural Policy Monitoring and Evaluation 2013: OECD Countries and Emerging Economies, OECD Publishing, Paris, http://dx.doi.org/10.1787/agr_pol-2013-11-en.

OECD (2011), “China”, in Agricultural Policy Monitoring and Evaluation 2011: OECD Countries and Emerging Economies, OECD Publishing, Paris, http://dx.doi.org/10.1787/agr_pol-2011-23-en.

OECD (2010a), Guidelines for Cost-effective Agri-environmental Policy Measures, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264086845-en.

OECD (2010b), Environmental Cross Compliance in Agriculture, OECD, Paris, www.oecd.org/tad/sustainable-agriculture/44737935.pdf.

OECD (2005), OECD Review of Agricultural Policies: China 2005, OECD publishing, Paris, http://dx.doi.org/10.1787/9789264012615-en.

Renmin Daily (2016), “China Grain Reserves Corporation purchased 175 million tonnes of policy grains in 2015”, http://paper.people.com.cn/rmrb/html/2016-01/06/nw.D110000renmrb_20160106_6-02.htm, viewed 2 March 2016 (in Chinese).

State Council (2016), “Suggestions on Implementing New Development Concepts, Accelerating Agricultural Modernization and Building a Well-off Society in an All-round Way” (in Chinese).

State Council (2014), “Several Opinions on Comprehensively Deepening Reform in Rural Areas and Accelerating Agricultural Modernization”, (in Chinese).

State Council (2004), “Several Opinions on Promoting Income Growth of Farmers”, (in Chinese).

van Tongeren, F. (2008), “Agricultural Policy Design and Implementation: A Synthesis”, OECD Food, Agriculture and Fisheries Papers, No. 7, OECD Publishing, Paris, https://doi.org/10.1787/243786286663.

van den Berg, M.,H. Hengsdijk, J. Wolf, M. van Ittersum, G. Wang and R. Rötter (2007), “The impact of increasing farm size and mechanization on rural income and rice production in Zhejiang province, China”, Agricultural Systems, 94. 841-850.

World Trade Organization, International Trade Centre and UNCTAD (2015), “World Tariff Profile”, WTO Publications, Switzerland, https://www.wto.org/english/res_e/booksp_e/tariff_profiles15_e.pdf.

Zhang, X., J. Yang and T. Reardon (2015), “Mechanization Outsourcing Clusters and Division of Labor in Chinese Agriculture”, IFPRI Discussion Paper 01415, International Food Policy Research Institute.

Zhong, Zhen (2014), “Specialized Farmers’ Cooperatives Development in China”, FFTC Agricultural Policy Articles 2014-11-13, FFTC Agricultural Policy Platform http://ap.fftc.agnet.org/ap_db.php?id=349.

Notes

← 1. Both a widening income gap between farmers in developed areas and underdeveloped areas and between farmers in major grain-producing areas and other areas.

← 2. The priorities include protecting farmland, promoting sustainability of farmland; saving and efficiently using water, ensuring agricultural water availability; controlling environmental pollution, improving agricultural and rural environment; restoring agricultural ecological environment; improving ecological functions; protecting soil and water resources; optimising agricultural and rural environment, protecting and restoring agricultural ecological environment.

← 3. In 2014-16, the domestic price of rice exceeded the international price by 48%; and wheat and corn prices were 62% and 41% higher than international prices, respectively. Although a target price subsidy was implemented for soybeans and cotton in 2014, their domestic prices remained higher than international prices by 27% and 41% in 2014-16, respectively. However, it is foreseen that prices of soybeans and cotton will be gradually brought into line with the international market, as China reduces the direct market intervention through minimum price purchases and replaces them with deficiency payments for these products.

← 4. Major producing areas of early indica rice comprise five provinces (Anhui, Jiangxi, Hubei, Hunan, and Guangxi); those of late rice (including medium and late indica rice and japonica) comprise eleven provinces (Jilin, Heilongjiang, Anhui, Jiangxi, Hubei, Hunan, Sichuan, Liaoning, Jiangsu, Henan, Guangxi); those of wheat comprise six provinces (Hebei, Jiangsu, Anhui, Shandong, Henan and Hubei).

← 5. In 2008, rice was subject to temporary purchase and storage policy, while no minimum purchase price policy applied to rice.

← 6. Special sites are set up to monitor the average market purchase price in a certain period. Subsidies are granted based on actual planting area, yield or trading volume.

← 7. It is an average output when agricultural tax was levied in the 1980s and 1990s.