In Japan, agriculture has been treated differently from the rest of the economy based on the implicit assumption that small-scale family farms needed government support as they were disadvantaged within the economy as a whole. The evolution of the agricultural structure has shifted this policy paradigm towards developing policy and market environments that are more conducive to innovation and entrepreneurship. This chapter reviews how the general policy environment could be yet more conducive to innovation and entrepreneurship in agriculture, and more coherent with sustainability policy objectives.

Innovation, Agricultural Productivity and Sustainability in Japan

Chapter 3. General policy environment for food and agriculture in Japan

Abstract

3.1. Macroeconomic policy environment

In 2013, Japan launched “Abenomics”. This was characterised by its three pillars designed to overcome two decades of sluggish growth: a bold monetary policy, flexible fiscal policy, and a growth strategy. The growth strategy included agricultural policy reform as a major topic. Real output growth nearly doubled to an annual pace of 1.1% during the 2012-16 period in comparison to 1997-2002 period, thanks in part to Abenomics. On a per capita basis, real output growth nearly matched the OECD average (OECD, 2017[1]). Abenomics has also brought improvements to the labour market. Japan’s unemployment rate today is the lowest in the OECD area and net household financial wealth is among the highest. A shortage of labour has become a major constraint in many industries, including agriculture.

Gross general government debt increased from 68% of GDP in 1992 to 224% in 2017, the highest ever recorded in the OECD area (Table 3.1). Core consumer price index (CPI) inflation has been above zero since 2014, the longest period since 1995-98. However, OECD (2017[1]) questions the fiscal sustainability due to the risk of rising government bond yields and with the large amount of government debt, as well as an expected rise in social security spending.

Table 3.1. Key indicators of Japan’s economic performance, 1990 to 2019

|

|

1990 |

1995 |

2000 |

2005 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018e |

2019e |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Real GDP growth, % |

5.6 |

2.7 |

2.8 |

1.7 |

4.2 |

-0.1 |

1.5 |

2.0 |

0.4 |

1.4 |

1.0 |

1.7 |

1.2 |

1.2 |

|

General government financial balance1 |

2.2 |

-4.3 |

-7.4 |

-4.4 |

-9.1 |

-9.1 |

-8.3 |

-7.6 |

-5.4 |

-3.6 |

-3.4 |

-3.5 |

-3.0 |

-2.5 |

|

General government gross debt2 |

66.1 |

89.8 |

130.9 |

159.1 |

187.0 |

202.3 |

209.9 |

212.9 |

218.3 |

216.6 |

222.4 |

224.1 |

225.5 |

225.2 |

|

Current account balance1 |

1.6 |

2.2 |

2.7 |

3.6 |

3.9 |

2.1 |

1.0 |

0.9 |

0.8 |

3.1 |

3.8 |

4.0 |

3.7 |

4.1 |

|

Exchange rate (Yen per USD)3 |

144.8 |

94.1 |

107.8 |

110.1 |

87.8 |

79.7 |

79.8 |

97.6 |

105.8 |

121.0 |

108.8 |

112.2 |

108.9 |

109.3 |

|

Inflation, annual %, CPI all items |

2.8 |

-0.1 |

-0.5 |

-0.6 |

-0.6 |

-0.3 |

0.0 |

0.3 |

2.8 |

0.8 |

-0.1 |

0.5 |

1.2 |

1.5 |

|

Unemployment rate, %4 |

2.1 |

3.1 |

4.7 |

4.4 |

5.0 |

4.6 |

4.3 |

4.0 |

3.6 |

3.4 |

3.1 |

2.8 |

2.5 |

2.5 |

Note: e = OECD Economic Outlook estimate

1. As a percentage of GDP

2. As a percentage of GDP at market value

3. Period average

4. End year, as a percentage of total labour force

Source: OECD (2018[2]), OECD Economic Outlook (database), https://doi.org/10.1787/494f29a4-en.

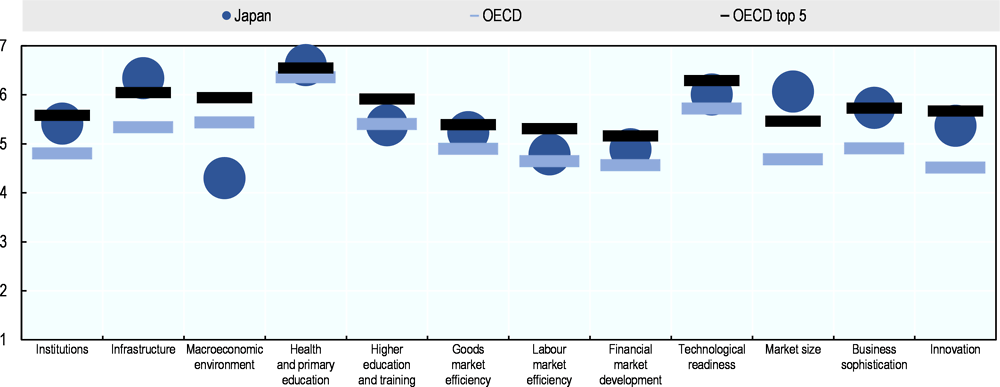

The World Economic Forum Global Competitiveness Index for 2017-18 ranks Japan ninth out of 137 countries. Japan scored particularly high on the quality of physical and digital infrastructure as well as health and primary education (Figure 3.1). However, it ranked only 23 for higher education and training. A high level of government debt and unbalanced government budgets make the macroeconomic environment Japan’s lowest performing area, ranking 93. Public institutions are considered relatively competitive and are ranked 17. In the area of public institutions, protection of property rights ranks in the top 10, but the burden of government regulation is particularly high and Japan is thus ranked 59.

The innovation system is one of Japan’s most highly scored areas (ranked 8). In terms of number of patent applications, it ranks first in the world. Private R&D expenditure and the availability of scientists and engineers are also among the top 10. However, it is ranked at only 23 for university-industry collaboration in R&D.

Figure 3.1. Global Competitiveness Index: All components, 2017-18

Note: Indices for OECD are the simple average of member-country indices. OECD top 5 refers to the average of the scores for the top 5 performers among OECD countries for the overall index (Switzerland, United States, Netherlands, Germany and Sweden).

Source: WEF (2017[3]), The Global Competitiveness Report 2017-2018: Full Data Edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

3.2. Public governance

Japan’s quality of governance is considered to be very good according to the World Bank’s Worldwide Governance Indicators (WGI). The WGI measures six broad aspects of governance: voice and accountability, political stability, government effectiveness, regulatory quality, rule of law and control of corruption. Japan scores higher than the OECD average in all areas except for voice and accountability, which indicates citizen participation in selecting their government, freedom of expression and association, and a free media (Table 3.2).

The highest percentile rank is in government effectiveness, indicating that the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government's commitment to such policies are perceived as very high.

Table 3.2. Governance indicators for Japan, 2016

Percentile rank: Lowest (0) to highest (100)

|

|

Japan |

High income (OECD) countries |

|---|---|---|

|

Voice and accountability |

78 |

87 |

|

Political stability |

86 |

73 |

|

Government effectiveness |

96 |

88 |

|

Regulatory quality |

90 |

88 |

|

Rule of law |

88 |

88 |

|

Control of corruption |

91 |

85 |

Source: World Bank (2018[4]), Worldwide Governance Indicators (database), http://info.worldbank.org/governance/wgi/.

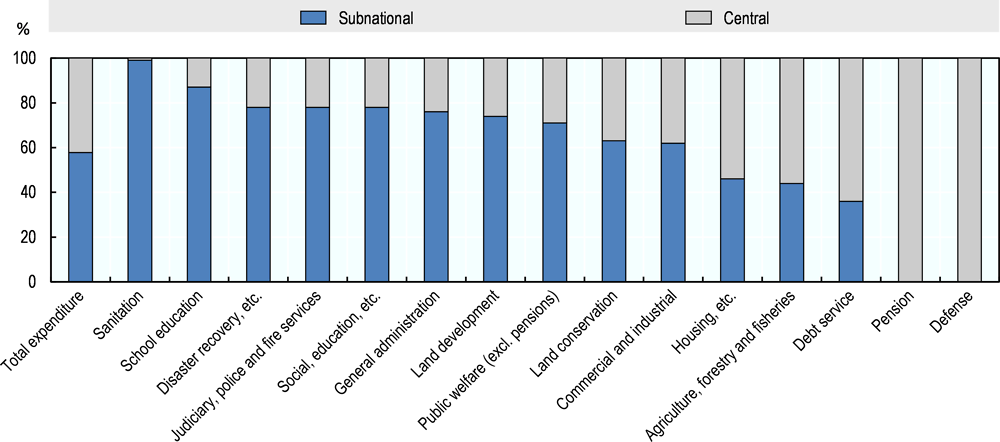

In Japan, subnational governments (SNGs) play an important role, including the implementation of agricultural policies.1 Japanese SNG revenue and spending as a share of GDP are both close to the average of OECD countries. Japanese SNGs were responsible for 74% of general government spending (excluding social security), one of the highest shares in the OECD area. However, the central government tends to delegate administrative functions to SNGs while retaining authority over finance and programme design (OECD, 2016[5]). The prefectures are in charge of most public infrastructure, education and welfare, livelihood support in towns and villages, child welfare policy, and employment training. The municipalities have extensive responsibilities for urban planning, municipal roadways, some harbours, some public housing, and sewers.

Decentralisation of government fiscal and regulatory authorities has been pursued in the last decades to increase flexibility of policy implementation at the local level. However, SNGs still depend on grants and subsidies from the central government for 43% of their revenue, which is higher than the OECD average of 37% in 2016. In agriculture, forestry and fisheries, the grants and subsidies from the central government account for 56% of the expenditure, which is one of the highest among the policy areas (Figure 3.2). This indicates that local governments have a lower degree of autonomy in implementing agricultural policy.

While the promotion of agriculture and food security are both considered to be the responsibility of the national government, more flexible design and implementation of agricultural policy at the local level would contribute to more diverse agricultural production based on local characteristics.

Figure 3.2. Allocation of spending responsibility by function in Japan, 2016

Source: MIC (2018[6]), White Paper on Local Public Finance 2018, http://www.soumu.go.jp/iken/zaisei/30data/2018data/30010000.html.

3.3. Trade and investment policy

Trade policy

Japan ranks fourth worldwide in terms of the value of exports and imports, which accounted for about 16% of GDP in 2016. The share of trade in Japan’s GDP is about half the OECD average, reflecting the large size of the Japanese economy. In 2015, the United States was the largest export market, with a share of 20.2%, followed by the People’s Republic of China (hereafter “China”) with 17.5%. Asian countries (China, Association of Southeast Asian Nations (ASEAN) countries and the Newly Industrialised Economies) account for about half of both Japanese exports and imports.

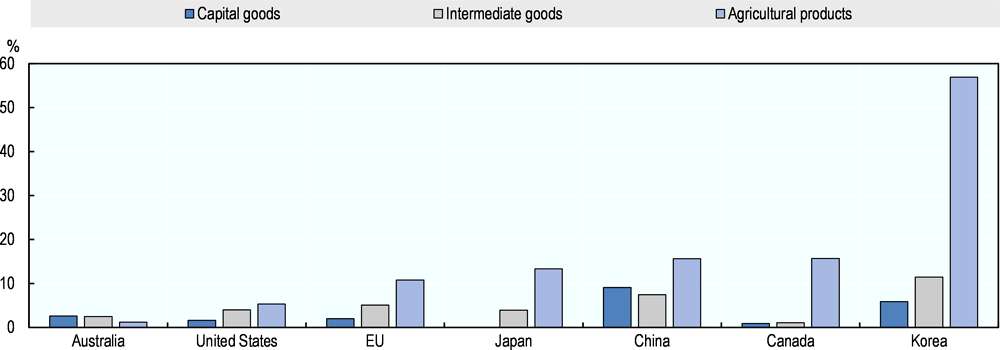

Japan continues to promote the multilateral trading system, as well as bilateral and regional trade agreements, considering that these are complementary to and not substitutes for the multilateral trading system (WTO, 2017[7]). The country’s overall simple-average applied Most Favoured Nation (MFN) tariff rate is about 6%. Of the 101 highest tariffs, 95 had non-ad valorem rates. The simple average applied rate is 13.3% (down from 14.9% in FY2014) for agriculture (World Trade Organization (WTO) definition), and 2.5% for non-agricultural products (down from 3.7% in FY2014) (WTO, 2018[8]).

Japan has bound 98.2% of its tariff (159 lines are unbound). The difference between the average bound MFN tariff (6.2%) and the average applied MFN tariff (6.1%) continues to be negligible; this reflects a high degree of predictability in the tariff. However, the average bound rate remains considerably higher for agricultural products (16.7%) than for non-agricultural products (3.6%) (Figure 3.3). Japan makes use of tariff quotas; there are 158 tariff lines (1.7%) subject to MFN out-of-quota tariffs, of which 11 are under state trading. The quota allocation method and process remain somewhat intricate, while procedures for the allocation of tariff quotas have remained unchanged since 2014 (WTO, 2017[7]).

Figure 3.3. Import tariffs for industrial and agricultural goods

Note: Tariff rates for agricultural products include both ad valorem duties and specific duties equivalent to ad valorem duties, while tariff rates for non-agricultural products only include ad valorem duties.

Source: (Non-agricultural products) UNCTAD (2018[9]), Trade Analysis Information System (TRAINS), http://unctad.org/en/Pages/DITC/Trade-Analysis/Non- Tariff-Measures/NTMs-trains.aspx. (Agricultural products), WTO (2018[8]), World Tariff Profiles 2018 (database), http://www.wto.org/statistics.

Foreign Direct Investment (FDI) policy

Foreign Direct Investment (FDI) inflows bring important benefits, such as enhancing competition, local technical capabilities and innovation. Access to imported inputs and inflows of FDI and expertise can reduce costs and enhance productivity through technology spill-overs. FDI outflows contribute to diversifying the supply chain and to exploiting opportunities for overseas markets. In the food and agricultural sector, promoting the FDI outflow would increase the export of Japan’s technology and production systems, increasing its capacity to supply high-quality and specialised food and agricultural products that are adapted to the needs of overseas markets.

In 2016, the stock of inward and outward FDI remained at around 4% and 27% of GDP, respectively. FDI inflow to Japan continues to be smaller than in other major developed economies. FDI inflow to food and agricultural is lower than for other sectors, but outflow is higher. The stock of inward and outward FDI in the food and agriculture sector are 1% and 45% of value-added in the sector, respectively.

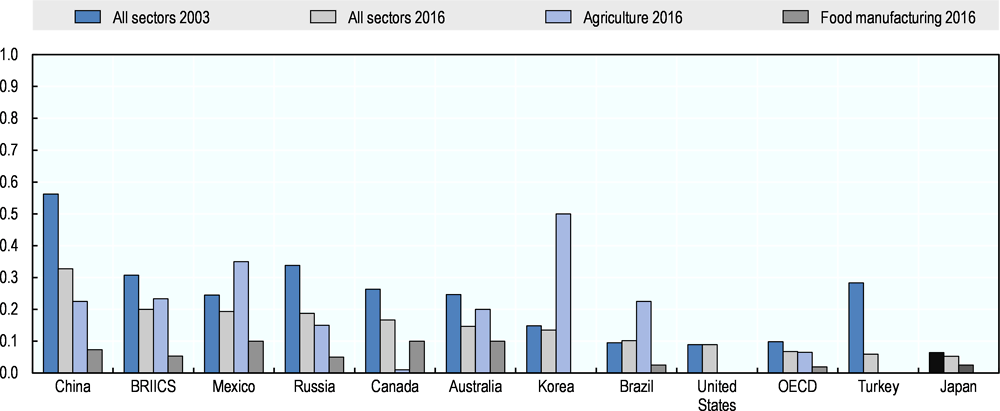

Despite its relatively low FDI inflow, Japan maintains a policy of low regulatory restrictiveness on FDI (Figure 3.4). The government set a target to double the stock of inward FDI in 2020 to JPY 35 trillion (USD 312 billion) from JPY 19.2 trillion (USD 241 billion) in 2012. In 2017, the top three largest investors to Japan were the United States, the Netherlands and France. FDI from Asia to Japan mainly comes from Singapore and Hong Kong, China (JETRO, 2018[10]).

Figure 3.4. OECD FDI Regulatory Restrictiveness Index by sector, 2003 and 2016

Note: The FDI Restrictiveness Index covers four types of measures: 1) foreign equity restrictions, 2) screening and prior approval requirements, 3) rules for key personnel, and 4) other restrictions on the operation of foreign enterprises. Countries are ranked according to “All sectors 2016” levels. Indices for OECD and BRIICS are the simple average of member-country indices.

Source: OECD (2019[11]), “OECD FDI regulatory restrictiveness index”, OECD International Direct Investment Statistics (database), https://doi.org/10.1787/g2g55501-en.

3.4. Policy environment for entrepreneurship

Developing a policy environment to support entrepreneurship is important to promote innovation in agriculture, as entrepreneurs bring innovative ideas, products and processes to markets. In Japan, the entry and exit of new enterprises is relatively inactive. The entry and exit rate of enterprises from 2004 to 2009 was about 4.5% on average, less than half the rate recorded in the United Kingdom and the United States (OECD, 2015[12]). In 2013, the government announced plans to increase this rate to 10%. The dispersion in productivity and labour income between firms is relatively large in Japan and has been widening (OECD, 2017[1]).

Although regulatory barriers to entrepreneurship have fallen below the OECD average, they are well above the leading OECD economies (OECD, 2013[13]). Less restrictive product market regulations promote: entry by new firms; effective diffusion of knowledge from both domestic and overseas sources; improved managerial performance; and private investment in innovation (OECD, 2015[12]). OECD (2017[1]) lists the priorities for regulatory reform to facilitate entry of firms in Japan as: reducing the high level of regulatory protection for incumbents; reducing administrative burdens on start-ups in line with the best-performing countries; and reducing the complexity of regulatory procedures.

On the exit side, the prevalence of personal guarantees and the stringency of the personal insolvency regime are the most important impediments to entrepreneurship (OECD, 2017[1]). Generous support to SMEs also contributes to the survival of non-viable firms, which reduces the efficiency of resource allocation by trapping capital and labour in low-productivity activities and discourages potential entrepreneurs (Box 3.1). In addition to removing the remaining institutional constraints for entrepreneurship, increasing entrepreneurship requires improving its image: less than a third of the working-age population views entrepreneurship as a good career choice, the lowest among OECD countries (OECD, 2016[5]).

Box 3.1. SME policy in Japan

SMEs account for 70% of employment in Japan, compared to 60% for the OECD area. However, SMEs generate only slightly more than 50% of national value added in Japan, less than in most other OECD countries, indicating lower labour productivity of SMEs. The share of SMEs is particularly high in the food manufacturing industry. In 2016, SMEs accounted for 73% of total employment and 72% of total sales in the food manufacturing industry, while the share of SMEs in employment and sales in manufacturing was 67% and 43%, respectively (METI, 2017[14]).

The government supports SMEs in the form of credit guarantees and low interest loans by public financial institutions, as well as preferential tax rates. Government guarantees for loans to SMEs in Japan were exceptionally high at 5.2% of GDP in 2015.The share of guarantees covering 100% of loans was 40% in 2015. However, given the heavy reliance on bank lending to SMEs, the share of SME loans that are publicly guaranteed is around 11%, compared to 12% in the United States and 15% in Korea (OECD, 2017[1]).

With the increasing importance of incorporated farms and the diversification of their operations from primary agricultural production, the link between SME and agricultural policies becomes more important. The government has promoted the partnership between farmers and SMEs in developing business plans. The law on promoting agriculture-commerce-industry co-operation was elaborated in 2008, and SMEs or farmers are eligible for subsidies, credit guarantees, and preferential lending and taxes if the government approves the business partnership plan to develop new products or services between non-agricultural SMEs and farmers. As of June 2018, 778 business plans were approved.

As part of the reforms to further strengthen agricultural competitiveness, the government reviewed the performance of major agricultural input industries in 2016. They found that the fertiliser and compound feed industries had too many manufacturers offering too many brands of a similar quality, leading to higher retail prices. While the four largest companies account for 80% of domestic sales of farm machinery in Japan, the eight largest companies provide 50% of fertilisers and many small manufacturers remain in the market (MAFF, 2016[15]). Moreover, some regulatory standards on agricultural inputs increase cost and impede innovation in input industries. In addition to the high price of agricultural inputs, the marketing cost of agricultural products is high. In Japan, agricultural co-operatives play a major role in the whole process, from distribution of inputs to marketing of outputs. But their operation is inefficient in some cases.

Based on these assessments, the policy package to improve competitiveness in Japanese agriculture (The Plan to Create Dynamism through Agriculture, Forestry and Fisheries and Local Communities) was announced in November 2016. This programme promotes voluntary industrial restructuring, as well as regulatory reform of agricultural inputs and agricultural product marketing. The JA group, consisting of all primary, prefectural and national level agricultural co-operatives in Japan, implemented a reform to shift more resources from financial services to farming and marketing support, and to offer more competitive services in input supply and product marketing (Box 3.2). Regulatory schemes to mandate prefectures to perform R&D on agricultural machinery, as well as uniformly produce original seed and breeders’ seed, were abolished to enhance innovation in agricultural input industries.

Box 3.2. Agricultural co-operatives in Japan

The agricultural co-operatives in Japan (Nokyo, also known as Japan Agricultural Co-operative, or JA) are mutual aid organisations established voluntarily by farmers and non-farm members to improve members’ agricultural income. Each member has equal voting rights, but non-farm members (associate members) have no voting rights. Co-operative organisations are usually established to help small enterprises compete with larger ones and, as such, the JA benefits from reductions in corporate tax rates and exemption from certain regulations such as the Antimonopoly Act unless they engage in unfair trading practices or otherwise seek to limit competition.1

The JA provides four major services to its members: 1) farming and marketing support such as the supply of farm inputs, sales of member’s outputs and farm management assistance; 2) financial services such as credit or saving; 3) insurance services including life insurance, fire insurance and car insurance; and 4) welfare services such as medical and home nursing.

In 2017, the JA operated local services in 679 municipalities. It also has regional headquarters in each prefecture as well as national headquarters that administers the entire group (JA Zenchu), a marketing body that is responsible for wholesale business and supply of production inputs (JA Zen-Noh), a finance body (Norinchukin Bank), and an insurance body (JA Zen-kyoren).

Due to this wide range of services and well-developed network, almost all farmers in Japan are members of the JA, although membership is voluntary. Official membership is limited to farmers (usually those who cultivate more than 0.1 hectares of land and engage in more than 90 days of farming), but non-farmers can become associate members by paying the membership fee. As of 2015, there are 4.43 million official members and 5.94 million associate members.

Each regional JA usually has farm advisors (total of 13 750 in 2016) to provide technical farming and marketing support to farmers. The JA has a large market share in major domestic agricultural products (approximately 30% in rice and vegetables) and in input markets (50% for fertiliser, 60% for pesticides and about 30% for compound feed). However, in many cases, the profit structure of the JA shows that profits from credit and insurance services cover losses in the agricultural business and technical advisory service.

In 2015, the government revised the Agricultural Co-operative Act as part of a key reform of the Japanese agricultural sector. The revised Act aims to strengthen local JA’s farming and marketing support business by requiring each local JA to appoint a majority of directors from business farmers and professional salespersons. Also, the Act states that the agricultural co-operatives should not force their members to participate and engage in JA business projects and should allow farmers to select their service freely. In addition, the reform also renounces the exclusive status of JA-Zenchu to audit local JAs.

1. The Anti-Monopoly Act (AMA) provides the main framework of Japan's competition policy. Its overarching objective is to promote, inter alia, fair and free competition, stimulate the creative initiative of entrepreneurs, and encourage business activities for enhanced economic development and consumer welfare (WTO, 2017[7]). Certain industries or business practices are exempt from the AMA, including certain conduct of agricultural co-operatives. The Japan Fair Trade Commission provides a guideline on specific cases where the AMA can be applied to the conduct of agricultural co-operatives (e.g. allowing the use of collective facilities or the condition for purchasing inputs).

3.5. Financial market policy

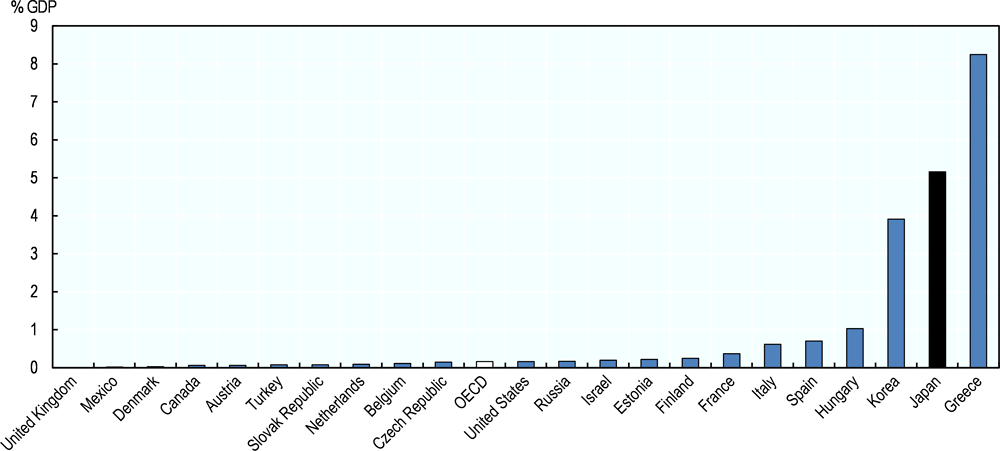

The role of commercial banks in agricultural finance is relatively small, accounting for 15% of total lending to agriculture in 2016, and a large part of lending finances household consumption rather than agricultural operations (SMTB, 2013[16]). Instead, government financial institutions and JA accounted for 47% and 39% of agricultural finance, respectively. In addition, the government plays an important role in credit guarantees, similar to the system provided for SMEs. Japan’s credit guarantee system is one of the most generous in the OECD area (Figure 3.5). OECD (2015[12]) reports that government support constitutes 10% of SME financing, increasing to 20%, if guarantees are included. In agriculture, the Agriculture Credit Guarantee Fund Associations established at the prefecture level guarantees 100% of the credit provided by private financial institutions, including JAs. Agriculture, Forestry and Fisheries Credit Foundations at the national level also provide credit insurance, which guarantees 70% of the credit. Guarantees of 100%, however, weakens market forces, giving banks little incentive to monitor loans (OECD, 2017[1]).

Figure 3.5. Credit guarantees for small and medium-sized enterprises in Japan, 2015*

Note: *or latest available year. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Source: OECD (2017[17]), Financing SMEs and Entrepreneurs 2017: An OECD Scoreboard (database), https://doi.org/10.1787/fin_sme_ent-2017-en.

MAFF provides various subsidised credit programmes, which are channelled mainly through JAs and the Japan Financial Corporation (JFC), established by the national government. The JFC operates the largest subsidised credit programme, which provides long-term, low-interest credit for up to 25 years for certified farmers. As of 2017, this programme had an outstanding credit of JPY 570 billion (USD 5.1 billion), which is equivalent to 11% of value added in agriculture. Another important programme are the subsidised long-term credits of up to 15 years that are mainly provided by the JA. These institutional credit programmes account for 70% of credit to farm operations.

The share of private banks in implementing subsidised credit programmes is negligible at 0.2%. Commercial banks play a minor role in agricultural finance, except for a small number of large, corporate farms that rely on regional commercial banks. Several reasons have been pointed out, such as: the large role of government financial institutions and co-operatives; the difficulty to collateralise farmland due to strict regulations; agriculture-specific weather and market risks; the lack of schemes to securitise debt and liquidate between financial institutions; and the lack of complete financial statements (SMTB, 2013[16]; BoJ, 2017[18]).

However, direct finance in agriculture has developed less than has credit finance, due partly to the restriction on investment in agricultural corporations that own farmland. The revision of farmland regulations in 2016 extends the possibility for non-farm corporations to invest up to 50% in the ownership of agricultural corporations, when previously only those with a business relationship could invest up to 25%.

In February 2013, the government established the public-private Agriculture, Forestry and Fisheries Fund Corporation for Innovation, Value-Chain and Expansion in Japan (A-FIVE), an investment fund in which the government owns 94% of shares. It was founded for a period of 20 years with a total funding of JPY 31.9 billion (USD 328 million).

A-FIVE provides long-term investments to joint enterprises composed of farmers and companies from other industries to add value to agricultural products in an innovative way, making new combinations, and creating value chains. Half of the investments are co-financed by the private sector and A-FIVE normally invests in limited partnerships established by the private sector, which then invests in business operations mainly owned by primary producers to diversify primary agricultural production. As of the end of FY2017, A-FIVE had invested in 127 projects amounting to about JPY 11.4 billion (USD 102 million).

3.6. Infrastructure development policy

Japan is an outlier in terms of public capital stock, which reached 107% of GDP in 2013, compared to between 34% and 65% of GDP in other OECD countries (OECD, 2017[1]). The marginal return on additional public investment in Japan is estimated to be negative (Fournier, 2016[19]). With public investment falling, the ageing of public infrastructure (Table 3.3) puts financial pressure on local governments. Local authorities need to carefully select which infrastructure to maintain in order to limit maintenance costs in the context of a falling population. However, infrastructure management, particularly for transport, is exceptionally complicated and costly, and many rural communities face unusually severe accessibility challenges. In addition, most of the country is vulnerable to natural disasters, notably earthquakes, typhoons and tsunamis. The Cabinet Office (2013[20]) finds a wide regional variation in the marginal productivity of public capital, suggesting that public investment should focus on projects with the highest returns.

The Ministry of Finance (MOF) (2014[21]) found several major infrastructures in Japan to be saturated. For instance, between 1986 and 2014, the national network of main roads nearly tripled in length, while the number of passenger kilometres driven rose only 3.2%. Japan’s road network of 1.27 million km is the sixth largest in the world, falling slightly short of the Russian Federation (1.28 million km) and exceeding that of Canada (1.04 million km), two countries over 20 times the size of Japan (OECD, 2016[5]).

As noted above, the population decline creates significant problems with respect to the operation, maintenance and development of infrastructure. First, a declining population means that the fixed costs of infrastructure are shared amongst fewer people. Second, some infrastructure degrades faster when not used at sufficient capacity. For example, some water lines and older pipes degrade faster without flowing water. Third, decisions about where to upgrade, extend, maintain or decommission infrastructure assets can have a huge impact on property values and settlement patterns (OECD, 2016[5]).

Table 3.3. Indicators of infrastructure ageing in Japan

As a percentage share

|

|

SNG share of sector assets |

Share of assets over 50 years old |

||

|---|---|---|---|---|

|

2018 |

2023 |

2033 |

||

|

Road bridges (length > 2km) |

92 |

25 |

39 |

63 |

|

Tunnels |

72 |

20 |

27 |

42 |

|

River management facilities |

65 |

32 |

42 |

62 |

|

Sewerages |

100 |

4 |

8 |

21 |

|

Port quays (water depth > 4.5m) |

91 |

17 |

32 |

58 |

Source: MLIT (2018[22]) White Paper on Land, Infrastructure, Transport and Tourism in Japan.

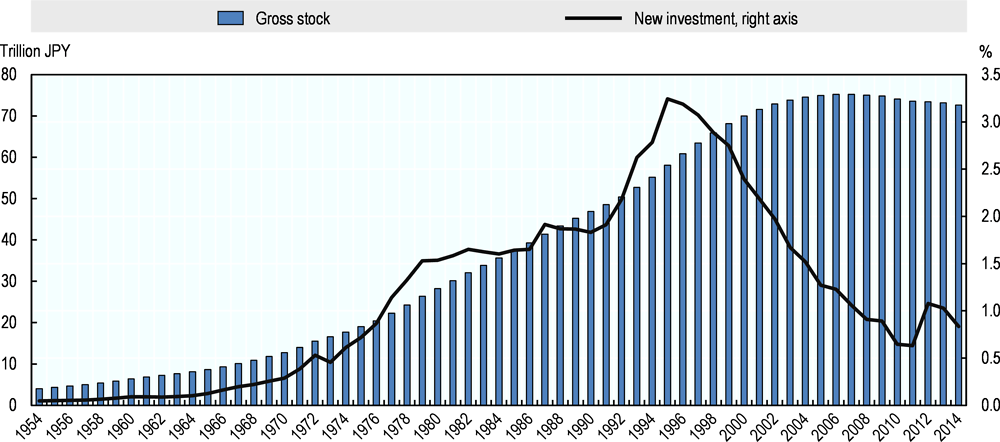

According to the Cabinet Office (2017[23]), new investment in agricultural infrastructure such as irrigation facilities and farm roads has declined since 1995, and the share of investment in agricultural infrastructure declined from 13% in 1960 to 4.7% in 2014. Gross stock of agricultural infrastructure also peaked in 2007 and started to decline gradually. Nonetheless, gross stock of agricultural infrastructure exceeds JPY 70 trillion (USD 667 billion), which is 7.6% of total value of infrastructure stock and 1 690% of value added in agriculture. Effective maintenance and renewal of existing infrastructure are fast becoming the most important parts of infrastructure policy, including in agriculture.

Figure 3.6. Evolution of agricultural infrastructure in Japan, 1954 to 2014

Source: Cabinet Office (2017[23]), “Measuring Infrastructure in Japan 2017”, https://www5.cao.go.jp/keizai2/ioj/docs/pdf/ioj2017.pdf (in Japanese).

Information and Communication Technology (ICT) infrastructure

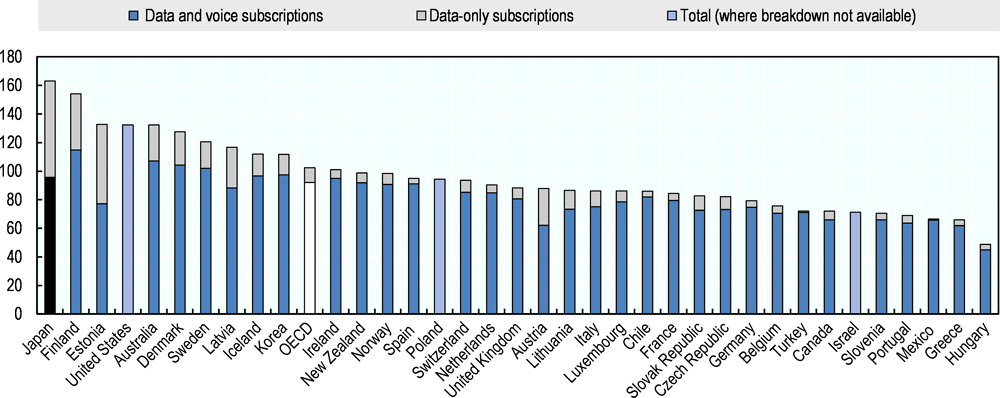

Japan’s ambitious 2013 declaration to be the World’s Most Advanced Information Technology (IT) Nation aims to achieve this goal by 2020. Acknowledging that Japan has not been able to fully utilise IT, the government launched a strategy to make IT an engine of growth by encouraging the creation of new and innovative industries and services (IT Strategic Headquarters, 2013[24]). Japan's mobile broadband penetration is the highest in the OECD area (163 subscriptions per 100 inhabitants in 2017), and it has the second-highest share of fibre in its fixed broadband connections (Figure 3.7).

Figure 3.7. Mobile broadband subscriptions per 100 inhabitants in OECD countries, 2017

Source: OECD (2018[25]), Broadband Portal (database), http://www.oecd.org/sti/broadband/broadband-statistics/.

The development of a physical Information and Communication Technology (ICT) infrastructure has opened the possibility for agriculture to reap the benefits of ICT to improve productivity and sustainability performance at the farm level: using satellite data to monitor crop growth, land quality, water resources, or other environmental outcomes; combining sensors, automated farm machinery and advanced analytics software to fine-tune and automate agricultural production; and machine learning to automate agronomic advisory services. Further, ICT connects farmers with consumers and other industries in new ways; and experimenting with blockchain technology and other innovative data management systems can improve the efficiency and transparency of agro-food value chains.

At the core of these innovations lies “datafication”, or the increasing capacity to capture, analyse and exchange agriculture and food data. While the digital transformation and increased capacity to create and share data provide an opportunity to develop new digital services for agriculture, various agriculture-related data, including agricultural land, weather, and research outcomes that are relevant for agricultural production and farm management, are collected and stored separately. As the capacity to store personal and sensitive data grows, farmers and consumers are increasingly asking for clarity that their data is being handled appropriately. Moreover, limited linkages between different agricultural ICT services make it difficult for farmers to integrate and fully utilise the services. The capacity to make use of digital technologies in agriculture depends not only on access to ICT infrastructure, but also on development of a range of data collection and analysis services and also on the regulatory environment (OECD, 2019[26]).

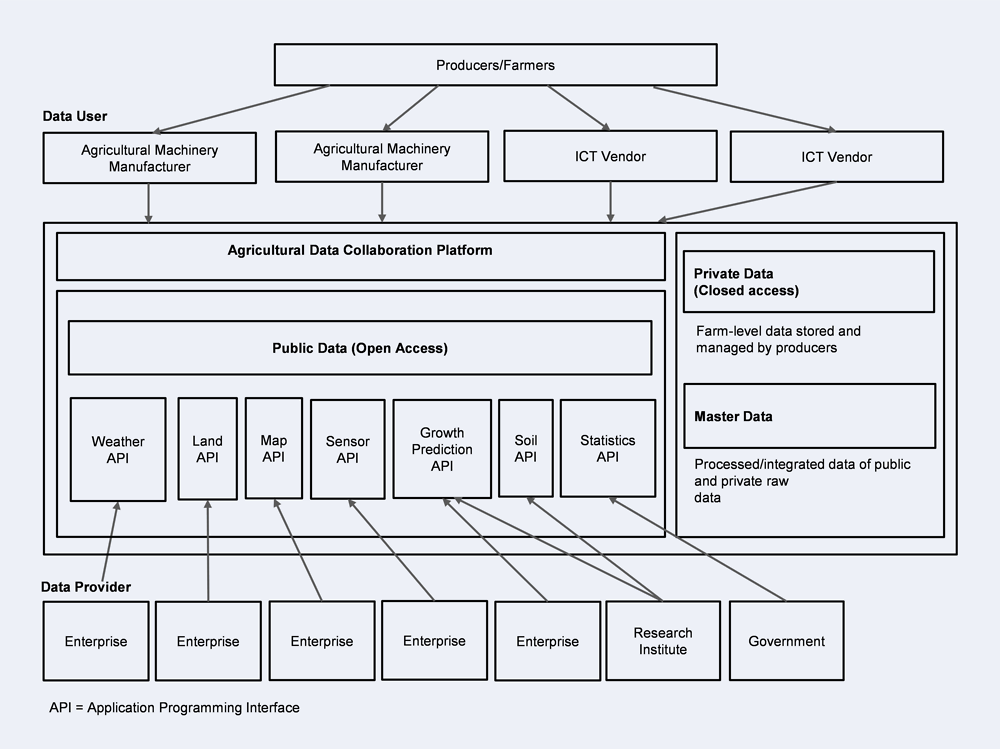

Japan has been increasing its efforts to develop soft infrastructure for the digitalisation of agriculture. For example, it has developed guidelines for agriculture-related data contracts to build assurance in activities operated by different players in the digital space. It also launched a pilot project in 2017 to develop a platform for agricultural data collaboration as part of its effort to develop metadata standards and interoperability protocols for agricultural data (Box 3.3).

Box 3.3. Developing soft infrastructure for digitalisation in agriculture

In 2016, the Cabinet Office published the guideline “Standard Term of Use on Agricultural IT Service”, describing the ownership of data by types. It identifies the ownership of processed data such as yield projection and optimum production process should depend on the types of data, but raw data such as production and yield records should belong to the person providing the data (producers). As more diverse agriculture related data services emerged, MAFF developed a Guideline on Data Contract in Agriculture in 2018 with a participation of stakeholders. This guideline categorises three types of situation: one party (typically producers) providing their data to the other party; both parties create new data; and multiple parties share their data. It then provides detailed considerations when writing a contract depending on the type of situation and clarifies legal provisions associated with the types.

The Agricultural Data Collaboration Platform Council (WAGRI) was established in August 2017 by the providers and users of agricultural data from different fields. The prototype agricultural data collaboration platform was released in December 2017 and launched a full-scale operation in April 2019. The platform co-ordinates, shares and supplies agriculture-related data (Figure 3.8). It includes public data, such as the position and size of agricultural lands, and meteorological information, including temperature and precipitation. Future development plans include consolidating data held by farmers, agricultural machinery manufacturers, ICT vendors and others, and utilisation of Big Data to optimise agricultural production management. However, the profit-sharing mechanism for data providers, and rules for the use of such data, remain to be developed.

Figure 3.8. Expected structure of the agricultural data collaboration platform

Source: Adapted from MAFF (2017[27]), Annual Report on Food, Agriculture and Rural Areas in Japan, FY2016.

3.7. Natural resource management policy

General environmental policy

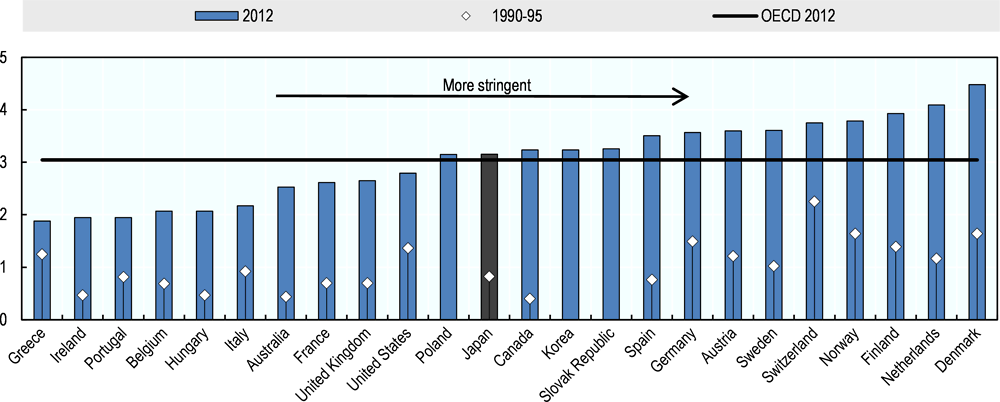

Japan’s main environmental pressures come from transport, agriculture, industry and, in particular, the growth of energy demand and final consumption by the private sector. OECD (2010[28]) finds that Japanese environmental regulations are strict and well enforced, and enjoy strong monitoring capacities. Environmental policy is more stringent than the OECD average (Figure 3.9). Particularly since the 1990s, significant progress has been made in tackling non-conventional air pollutants (e.g. dioxins, benzene) and waste management (OECD, 2010[28]). Strict standard-setting and financial support for R&D of new environmental technologies and treatment methods have had a positive impact on innovation. This technology-forcing impact has helped assure timely implementation of stringent regulations (OECD, 2010[28]).

Figure 3.9. Stringency of environmental policy in selected OECD countries, 1990-95 and 2012

Note: For Korea, Poland and the Slovak Republic, 1990-95 average is not available.

Source: Botta and Koźluk (2014[29]), “Measuring Environmental Policy Stringency in OECD Countries: A Composite Index Approach”, http://dx.doi.org/10.1787/5jxrjnc45gvg-en.

Main environmental regulations

General environmental regulations cover pollution from the agricultural sector. The Basic Environment Act stipulates the basic principles for environmental policies, clarifies responsibilities of the national government to prevent pollution including water and soil, as well as taking measure on global environmental issues. Each environmental standard is set by specific laws based on the principles, and most of the laws are administered by MOE.

The Water Pollution Prevention Act provides a regulatory framework on point-source pollution on water quality. In agriculture, only the point source pollution from livestock farms are subject to the regulation which requires farms to report their operations and measure the quality of water emissions.2 Stricter regulations are applied to livestock operations located near closed sea areas. Local governments may also impose a higher standard considering the local ecological condition. The Act also regulates discharge water in public water areas and several pesticides are designated for control. The Water Supply Act sets standards for drinking water quality. Pesticides which are most likely to be detected in the purified water are listed as items to be monitored by water suppliers.

For soil safety, the Act on Prevention of Soil Contamination of Agricultural Land monitors the use of agricultural land to prevent agricultural products being produced in contaminated land. Cadmium, copper, and arsenic are listed as designated hazardous substances. In case the agricultural land exceeds the contamination limit (cadmium: above 0.4 mg/kg in rice; copper: above 125 mg/kg in land; or arsenic: above 15 mg/kg in land), local governments are responsible for recovering the land, although the national government often provides financial support. Since 1971, 7 592 hectares of agricultural land exceeded the limit but 7 055 hectares of the land completed the treatment as of FY2016.

The Basic Act on Biodiversity and the National Biodiversity Strategy provides the target and the direction for the measures on the conservation and sustainable use of biodiversity. The Act on the Prevention of Adverse Ecological Impacts Caused by Designated Invasive Alien Species prohibits the cultivation, storage, transportation, import and distribution of designated species that are likely to cause Japan’s ecosystem and farming. Agriculture is closely related to biodiversity, and impacts ecosystem both positively and negatively (Hardelin and Lankoski, 2018[30]). Recognizing the importance of correlation between agriculture and biodiversity, MAFF announced its comprehensive biodiversity strategy in 2007 and later revised in 2012. The strategy states government’s engagement of conserving rural areas (Satoyama), evaluating biodiversity, and raising awareness through symposiums.

Specific regulation on farm inputs and emissions

Fertiliser

The Fertilizer Regulation Act controls production and import of fertilisers. The Act categorises fertilisers into two groups – special fertiliser and normal fertiliser. Chemical fertiliser is included in the normal fertiliser category, while simple and organic fertiliser such as rice bran and manure is categorised in special fertiliser. The official standard is set for each type of normal fertiliser, and registration is required for both production and import. The official standard states minimum main ingredients value and maximum permissible value for harmful substances. Fertilisers that are derived from industrial waste need to submit toxicity testing results on plants for registration. The Act also requires producers and importers to attach warranty labels such as the guaranteed active ingredient quantity.

Prefectures often set their fertiliser application guidelines but the Fertilizer Regulation Act does not impose regulations on fertiliser use. In 2017, 47% of farmers in Japan did not conduct soil diagnosis but 68.2% answered that they wish to use a technological instrument to identify the amount of nutrients in the soil (MAFF, 2018[31]). Farm-level assessment and providing training opportunities would promote more efficient and sustainable use of fertiliser. Moreover, the development of accessible soil testing system and affordable fertilisers that have less impact on the environment, e.g. slow release fertilisers, would contribute to reducing nitrogen and phosphorus inputs.

Pesticides

The Agricultural Chemicals Control Act allows only registered pesticides for production, import, distribution and use. Registration is examined based on scientific data including toxicity, residue in crops and soil and safety assessment on human health and environment. MOE establishes specific conditions for pesticide registration with a view to prevent adverse effects on human health caused by pesticide residues in food and feed crops and by water contamination. These conditions also aim to mitigate impacts on certain aquatic animals and plants, however, the effects on local biodiversity are not taken into account unlike the registration procedure in the United States (Box 3.4). The Act sets usage standards to each registered pesticide to prevent excessive pesticides to remain in food. Prefectural governments are allowed to impose additional regulations on certain pesticides which could affect local ecological conditions. The Act was revised in 2018 to require all registered pesticides to be periodically re-evaluated every 15 years.

To prevent the adverse effects on human health, the Food Sanitation Act administered by the Ministry of Health, Labour and Welfare establishes agricultural chemical MRLs in foods. Agricultural chemical residues in food must be below 0.01ppm for all pesticides except when residue limit levels are separately stipulated. Foods found to contain residues exceeding the MRL level are regarded as violations of the Act and are not permitted to be marketed or are rejected at port.

MOE has been conducting several ecological assessments on the impact of pesticide use on several species such as dragonflies and wild bees. Further data collection and research are planned as the correlation between the use of pesticides and the population of these organisms is still uncertain (MOE, 2017[32]; MOE, 2014-2016[33]; MOE, 2017[34]; MOE, 2014-2016[33]). The Agricultural Chemicals Control Act plans to expand the scope of ecological assessment to terrestrial animals and plants in April 2020.

Box 3.4. Pesticide Registration and Biodiversity in the United States

In the United States, the Environmental Protection Agency (US EPA) is responsible for reviewing data to determine pesticide registration. The Endangered Species Act (ESA) requires federal agencies to ensure that any authorisation, funding, or implementation will not likely jeopardise the continued existence of any listed species or destroy any critical habitat for those species.

As part of the registration process, the ESA requires the US EPA to assess whether use of the pesticide affects the listed endangered or threatened species and their habitat. When the US EPA determines that use limitations are necessary to protect listed species, it seeks to establish either generic or geographically-specific pesticide use limitations enforceable under the Federal Insecticide, Fungicide, and Rodenticide Act. If a geographically-specific pesticide use limitation is necessary, this information appears on an Endangered Species Protection Bulletin and is referenced on the pesticide label.

Source: US EPA (2019[35]), About pesticide registration, https://www.epa.gov/pesticide-registration/about-pesticide-registration.

Livestock manure management

In 1999, regulatory standards for manure management were established under the Act on Proper Management and Promotion of Use of Livestock Manure. The law sets a mandatory standard for livestock manure management facilities and practice that applies to livestock farms operating more than a certain number of animals (10 for cattle or horses, 100 for pigs, and 2 000 for poultry). As of 2017, almost all livestock farms were in compliance with the facility standard.

Livestock manure with minimum inorganic fertiliser improves soil fertility and crop productivity and mitigate soil degradation (Das et al., 2017[36]). In 2015, 87% of livestock waste was recycled as fertilisers or other sorts of resources (MAFF, 2018[37]). The government has tried to increase the utilisation of livestock waste as a substitute for inorganic fertiliser use. Japan amended the official standard for fertiliser under the Fertilizer Regulation Act in 2012 to add standards for compound fertiliser that allow livestock waste to be combined with inorganic fertilisers for commercial sales. However, the current standard restricts compost included to a maximum of 50%. As the application of livestock manure for rice paddy fields has been decreasing due to the complex nature of its application, revision of the standard to include livestock waste for commercial fertilisers should be considered to allow further development and innovation.

Climate change policy

According to the 1997 Kyoto Protocol, Japan was subject to 6% of 1990 emission reduction in 2008-2012. The average emission during the period increased by 1.4%, but achieved the target through securing 3.6% of GHG absorption by its forest resources and investing 5.9% amount of emission reduction or removal enhancement projects in developing countries (Clean Development Mechanism). Japan did not commit to the second commitment period (2013-2020), but based on the Cancun Agreements from the United Nations Framework Convention on Climate Change Conference of the Parties (COP16), Japan announced in 2013 a target of 3.8% or more emission reduction in 2020 compared to the 2005 level.

Japan ratified the Paris Agreement in 2016 and submitted its climate action plan, aiming for a 26% reduction of 2013 emissions by 2030 (equivalent to approximately 1.42 billion tonnes of CO2). Based on the Agreement, the government created a national global warming countermeasures plan in 2016. This plan targets the reduction of GHG emissions by 26% in 2030 and by 80% in 2050 by reducing domestic emissions and securing absorption volume. It also seeks to reduce fuel consumption by shifting to energy efficient horticulture-greenhouse and agricultural machinery, minimizing CH4 emissions by changing rice cultivation methods, and reducing N2O emissions by improving nitrogen-use efficiency. The plan also includes provisions to enhance soil carbon sequestration.

Based on the national commitment plan, the GHG reduction target was set as 2.8% for the agriculture, forestry and fishery sectors, which includes forest absorption of 2% and farmland carbon sequestration of 0.6%. Practically, a 0.2% GHG reduction commitment is expected by these sectors. The share of GHG emissions from agriculture is minor but the absolute level of agriculture GHG emissions is high compared to other OECD countries.

The Act on Promotion of Global Warming Countermeasures requires large-scale GHG emitters to report the amount of GHG they emit, but does not require business operators – including those in the agricultural sector – to reduce GHG emissions. Japan introduced an environmental tax on petroleum and coal in 2012 to finance energy-oriented CO2 emissions reduction measures, but diesel fuel used for agriculture is exempted from this taxation. Additionally, heavy crude oil used for agriculture is exempted from the petroleum and coal tax as well as the environmental tax. Also, Japan established J-Credit Scheme, which certifies the amount of GHG emissions reduced and removed through efforts such as energy-saving activities. Under this scheme, however, very few agricultural projects are registered as GHG offset projects. In 2018, agriculture accounted for 2% (five projects) and food-related industry accounted for 7% (19 projects) as offset projects (MAFF, 2018[38]).

In 2017, MAFF announced the Global Warming Countermeasures Plan to reduce GHG emissions from agriculture, forestry and fisheries. It outlines broad directions on GHG reductions, R&D, and international co-operation. Along with this plan, MAFF issued the Climate Change Adaptation Plan including the road map until 2025. This plan states five basic policy principles for adaptation: 1) development of a ten-year adaptation plan based on national assessments and on-site needs; 2) promotion of R&D for high-temperature-resistant variety and adaptation techniques, as well as switchover of breed and plant variety types; 3) preparation for natural disasters and extreme weather events; 4) capitalisation of opportunities by warmer climate conditions; and 5) enhancement of co-operation and clarification of responsibilities between national and local governments. The plan then addresses issues and forecasts by commodities and sets the specific countermeasures.

Water resource management

Agricultural water use is dominated by a water-intensive paddy field rice sector that relies on the natural supply of the rainy season during early summer as well as on irrigation, primarily from surface sources. The area of paddy field accounts for 54% of the total farmland. Agriculture uses 68% of the total water withdrawals from rivers, of which 94% was for paddy field irrigation in 2015. While Japan has abundant rainfall, using river water without dams or reservoirs is difficult due to very steep river channels. The paddy water used upstream returns to rivers, and the returned water is withdrawn again downstream. The paddy fields store the water withdrawn from the river, and plays an important role in groundwater recharge and ecosystem conservation in a watershed or hydrological cycle system.

Agricultural irrigation facilities such as water ducts are important social capital stocks. However, many of these facilities are now due for renewal or rehabilitation; over 20% of facilities exceed the average life span and this number is expected to increase by about 40% over the next ten years. Moreover, recent progress of farm scale expansion has increased the stress on the water supply network, which can hinder efficient farming operations. The improvement of water management using ICT and the Internet of Things (IoT) is essential in the coming years (Box 3.5).

Box 3.5. Use of ICT for water management

Water management is one of the foremost important tasks in paddy rice production. Farmers need to monitor the water level and water temperature every day to control the water in each growing stage of rice since water condition affects the quality and the yield. Water management is time consuming and represents a large part of rice production labour. IoT enables farmers to track water levels and temperatures in paddy fields and manages water levels using a remotely controllable water supply valve via data on their tablet device collected by sensors.

In a test demonstration, the time necessary for water management decreased by 40% on average. This is particularly useful to mitigate the labour shortage in rural areas. The accumulated data can also be used to analyse rice quality and yield in order to improve production for the coming planting year. From FY2018, promotion of water management using ICT has expanded, and the government expects an increase in the number of districts that can efficiently control agricultural water distribution (MLIT, 2018[22]).

Water use rights for irrigation are granted to the owners of irrigation facilities, based on the River Act. With the exception of a few large-scale irrigation systems, the Land Improvement Districts (LIDs) implement the operation and maintenance for most of the irrigation infrastructures such as reservoirs, intakes, pumps and main canals. The LID functions as a water user association that collects from its members a part of the cost to develop or rehabilitate facilities, as well the costs for the operation and management. It also obliges its members to provide labour to maintain irrigation facilities. This participatory irrigation management scheme has contributed to the long-term operation and maintenance of irrigation facilities in Japan.

The share of the cost for the development or rehabilitation of irrigation facilities depends on the scale and type of the project. The Land Improvement Act stipulates that the national government covers two-thirds of the total cost for national projects on the condition that the benefitted area is over 3 000 hectares, and covers half the costs for prefectural projects on condition that the benefitted area is over 200 hectares. MAFF set guidelines for local governments in terms of cost sharing rates; for example, in the case of new development of irrigation and drainage facilities by a national project, the share of construction costs is 17% for prefectural governments, 6% for local municipalities, and 10.4% for the LIDs, while for a rehabilitation project, the share of the cost is 19.4% for prefectural governments, 9% for local municipalities, and 5% for the LIDs.

New investment in irrigation facilities has declined over time, and the operation and maintenance of the existing infrastructure has become the main task of LIDs. LIDs allocate operation and maintenance costs to members based on the area of paddy land or upland area, often without consideration of the types of crops planted or even whether the land is fallow (Kuramoto et al., 2002[39]). This is partly because rice could be cultivated again in the future or as a second crop even in paddy fields with drainage improved for crop diversification. However, the current cost-sharing mechanism does not provide water saving incentives and impedes the diversification of production away from rice.

Due to mergers of the LIDs, the number of LIDs has declined by 53% and membership in LIDs declined by 29% to 3.6 million between 1975 and 2016, but the share of rented land increased significantly. According to MAFF, owners of 56% of rented land continue to be members of LIDs, although the Land Improvement Act stipulates that cultivators should be a member of the LID in principle. Land owners tend to have less incentive than cultivators to pay the cost of renewal, rehabilitation and maintenance of irrigation facilities. In order to reflect the opinions of the cultivators with respect to the operation and management of LIDs, the Land Improvement Act was amended in 2018 so that more than three-fifths of LIDs directors must be appointed from the cultivators themselves.

The sustainable operation and maintenance of irrigation facilities requires water users to cover the cost of renewal or rehabilitation work on irrigation systems. This should create incentives for more efficient water use in farming (Shobayashi, Kinoshita and Takeda, 2010[40]). Instead of charging the renewal or rehabilitation of irrigation systems on an individual project basis, current and future users should share the cost of maintaining the infrastructure equally.

Land use policy

As a consequence of the post-war land reform programme that redistributed farmland from land owners to tenant farmers, the structure of farmland holdings in Japan are small and fragmented. Stringent regulations for the acquisition of farmland was imposed to maintain this reform, and non-farmers were denied the possibility of purchasing farmland. However, this regulation has been gradually removed to facilitate structural change through a land lease market (Box 3.6). While the conversion of farmland to non-agricultural use has also been limited, speculation by farmers hoping to convert their farmland to non-farm use has been high where urban areas were close by, increasing the difficulty of consolidating farmland.

In 2014, Farmland Banks (Public Corporations for Farmland Consolidation to Core Farmers through Renting and Subleasing) were established in all prefectures to reinforce the intermediary role of the government in land transactions. These replaced the Farmland Holding Rationalization Enterprise established at the prefectural and municipal levels. In addition to intermediate farmland transactions, Farmland Banks can improve farmland conditions and infrastructure (e.g. expansion of plot size and investment in drainage facilities) without the consent and cost sharing of land owners, and then lease the consolidated farmland to business farmers. This system was introduced because even though business farmers want productive farmland, land owners who rent their land to Farmland Banks are generally not willing to invest in farmland as they plan to retire from agriculture (OECD, 2016[5]).

To provide additional incentives, MAFF introduced subsidies to land owners leasing land through a Farmland Bank. In addition, the land owners also benefit from 50% reduction of the real estate tax for three to five years, while the tax rate on idle land was increased 1.8 times if owners did not lease out idle land to a Farmland Bank or resume cultivation.

Box 3.6. Farmland regulations in Japan

To enforce the post-war land reform programme to redistribute farmland from landlords to tenant farmers, the Agricultural Land Act (ALA) imposes strong regulations on farmland, limiting the size of land holdings and imposing rent control. The ALA strictly protects tenants’ rights, prohibiting land owners from cancelling a tenancy contract without the tenant’s agreement. It limits acquisition of farmland to those who actually cultivate the land. Land transactions are approved by local agricultural committees established in municipalities. Local mayors appoint committee members, of which half of the members have to be certified farmers.

Since the basic principle of the ALA is to promote the ownership of land by its actual user, an individual can acquire farmland only if he or she engages in on-farm work (owner-cultivator principle). Corporations meeting the definition of an Agricultural Production Corporation (APC) are allowed to own farmland such as the restriction on the ownership share by non-farmers and the requirement for the board of directors to engage in farming. However, these conditions made it impossible for most of the companies to obtain farmland rights.

In 2003, an exemption was added to the ALA allowing non-APC companies to obtain tenancy rights to land in a special structural reformation district if companies sign an agreement with local government regarding their farming plan and involvement in local collective activities.3 In 2016, the APC system was reformed so that non-agricultural corporations can invest in up to half of an agricultural corporation. The requirement on the board of directors was also relaxed so that only one member or a farm manager need to engage in farm work.

The ALA also regulates farmland conversion to non-agricultural uses, requiring the approval of the local governments. This approval depends on several criteria including the productivity of farmland, such as irrigation access, land fertility and size. A farmland zoning system was also introduced through the Agricultural Promotion Areas Law in 1969. This law requires local governments to prepare a comprehensive regional agricultural promotion plan including for agricultural land use. Farmland within designated farmland zones in the local plan is prohibited from land conversion. As of 2016, 90% of farmland was inside the farmland zone.

3.8. Key points

Agriculture has long been treated differently in Japan from other parts of the economy based on the implicit policy assumption that government needs to support small-scale family farms that are disadvantaged in the economy. The evolution of the agricultural structure will require a shift in the policy paradigm towards developing policy and market environments that are more conducive to innovation and entrepreneurship.

Japan maintains a relatively open trade and investment environment, and continues to promote the multilateral trading system, as well as bilateral and regional trade agreements, while high border protection exists on some agricultural products.

Despite very low restrictions on FDI, the level of FDI inflow stock remains low, including in food and agriculture. Outward investment in food sector is relatively high, reflecting the expansion of a production network in the food manufacturing industry across borders. A more demand-oriented strategy combining export and local production would fully capture the growing demand for Japanese food products in world markets.

General regulatory barriers to entrepreneurship in Japan have fallen below the OECD average and the revisions of farmland regulations to expand the eligibility of non-farmers to own and rent farmland lowered entry barriers into agriculture.

Large, incorporated farms increasingly dominate this sector face, and similar management issues as SMEs in other sectors, such as human capital development, business succession and business matching.

Developing a well-functioning input and output market is crucial to ensure the competitiveness of the agriculture sector. The JA provides integrated services for members, including banking, insurance, farm input supply, marketing, technical advice, and welfare service. The profit structure of the JA shows that profits from banking and insurance cover losses in other business activities. The JA also benefits from a reduction in corporate tax rates and exemption from certain regulations.

Given its advantageous market position, the JA maintains large shares of certain input and output markets. Japan recently implemented a number of reforms, including of JA groups, to facilitate more competition in domestic input industries and wholesale markets. The JA faces a challenge in meeting the specialised and diversified needs of professional farms. A more competitive market environment between the JA and other players would improve the function of farm input and output markets, and facilitate the emergence of alternative farm service providers.

The share of commercial banks in agricultural finance is relatively small. Instead, government financial institutions and JAs channel generous government credit programmes to producers. High levels of guaranteed credit are likely to reduce incentives for commercial banks to develop credit evaluation systems and risk management skills for agricultural financing, or to monitor borrowers.

Japan has developed high-quality physical and digital infrastructures. It has the world’s sixth largest road network and the highest rate of mobile broadband subscriptions. The focus of infrastructure development policy has shifted from new investment to effective management of aging infrastructures, including agricultural infrastructures such as irrigation and drainage facilities.

Japan has an opportunity to make more use of a well-developed digital infrastructure to improve productivity growth and sustainability in agriculture. Facilitating the use of hard digital infrastructures requires the redesign of physical and institutional infrastructures such as radio regulation, design of farm roads and road safety regulations. Recent government initiatives to establish a guideline on agricultural data-related contracts and the platform to share data are part of an effort to develop soft infrastructures so as to facilitate digitalisation of agriculture.

Japan’s general regulatory framework on environmental conservation is strict, well enforced, and based on strong monitoring capacities. While point source pollution from the livestock sector is controlled by water quality and offensive odour regulations, nonpoint source pollution from the crop sector is not subject to general environmental regulations. Japan uses limited economic instruments in the area of natural resource management, with a few exceptions such as the greenhouse gas emission trading scheme.

Japan shares governance responsibilities between central, prefectural and local governments, but the central government is responsible for a particularly high share of agriculture spending. As policy objectives widen from national food security and income support to production of non-commodity outputs, which are often local public goods, subnational approaches to policy decision making and financing became more important.

Excluding only a few large-scale irrigation systems, the Land Improvement Districts (LIDs) operate and maintain most of the irrigation infrastructures. LIDs allocate operation and maintenance costs to members according to the land area, often without consideration for the types of crops planted or even whether the land is fallow, based on the assumption that rice could be cultivated again in the future or as a second crop. The current system provides little incentive for producers to economise on water use, and impedes the structural change of agriculture away from rice. Land consolidation into a smaller number of large operations and the development of sensor technology increase the feasibility of imposing a fee based on on-farm water use.

Japan has invested heavily in irrigation infrastructure over the last 50 years, but more than 20% of the core irrigation facilities already exceed their expected lifespan. While members of the LIDs cover operational and maintenance costs of irrigation facilities, the governments share the cost of rehabilitating irrigation facilities with LIDs. At present, the development, renewal or rehabilitation costs are paid by LID members on an individual project basis, which may create imbalances of cost and benefit between current and future irrigation water users. The sustainable operation and maintenance of irrigation facilities requires current and future users to cover the cost of renewal or rehabilitation of irrigation systems equally.

The consolidation of fragmented farmland has been a major policy issue in Japan for the last five decades. The Farmland Bank system, established in 2014, increased financial and regulatory incentives for land transactions through Farmland Banks. However, financial incentives attached to these transactions may have discouraged more diverse formats of land consolidation adapted to local conditions, such as contracting out farming operations, the collective use of farm machinery, and the formation of community farm organisations.

References

[18] BoJ (2017), Agri-finance: current situation and challegnes for regioanl bank (in Japanese), https://www.boj.or.jp/announcements/release_2017/data/rel170522c2.pdf.

[29] Botta, E. and T. Koźluk (2014), “Measuring Environmental Policy Stringency in OECD Countries: A Composite Index Approach”, OECD Economics Department Working Papers, No. 1177, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jxrjnc45gvg-en.

[23] Cabinet Office (2017), Measuring infrastructure in Japan 2017 (in Japanese), https://www5.cao.go.jp/keizai2/ioj/docs/pdf/ioj2017.pdf.

[20] Cabinet Office (2013), Annual Report on the Japanese Economy and Public Finance 2014 - Reviving the Japanese Economy, Expanding Possibilities, https://www5.cao.go.jp/keizai3/2013/0723wp-keizai/summary.html.

[36] Das, S. et al. (2017), “Composted Cattle Manure Increases Microbial Activity and Soil Fertility More Than Composted Swine Manure in a Submerged Rice Paddy”, Frontiers in Microbiology, Vol. 8, http://dx.doi.org/10.3389/fmicb.2017.01702.

[19] Fournier, J. (2016), “The Positive Effect of Public Investment on Potential Growth”, OECD Economics Department Working Papers, No. 1347, OECD Publishing, Paris, https://dx.doi.org/10.1787/15e400d4-en.

[30] Hardelin, J. and J. Lankoski (2018), “Land use and ecosystem services”, OECD Food, Agriculture and Fisheries Papers, No. 114, OECD Publishing, Paris, https://dx.doi.org/10.1787/c7ec938e-en.

[24] IT Strategic Headquarters (2013), Declaration to be the World’s Most Advanced IT Nation., http://japan.kantei.go.jp/policy/it/2013/0614_declaration.pdf.

[10] JETRO (2018), JETRO Invest Japan Report 2018, https://www.jetro.go.jp/ext_images/invest/ijre/report2018/pdf/jetro_invest_japan_report_2018en.pdf.

[39] Kuramoto, N. et al. (2002), “Trends and issues of land improvement burden on leading farms”, Choki Kinyu, Vol. 87, pp. 1-185.

[38] MAFF (2018), J-credit system and agricultural sector (in Japanese), http://www.maff.go.jp/j/kanbo/kankyo/seisaku/s_j-credit/maffpro/maffpro.html (accessed on 2019).

[31] MAFF (2018), Survey on present situation concerning environmentally friendly agricultural production (in Japanese), http://www.maff.go.jp/j/finding/mind/attach/xls/index-18.xlsx (accessed on 5 February 2019).

[37] MAFF (2018), The utilization of biomass sources (Japanese), http://www.maff.go.jp/j/shokusan/biomass/pdf/meguji1.pdf.

[27] MAFF (2017), Annual Report on Food, Agriculture and Rural Areas in Japan, FY2016, http://www.maff.go.jp/e/data/publish/attach/pdf/index-57.pdf.

[15] MAFF (2016), Situations surrounding fertilizers (in Japanese), http://www.maff.go.jp/j/seisan/sien/sizai/s_hiryo/attach/pdf/past-2.pdf.

[14] METI (2017), Census of Manufacture 2017, http://www.meti.go.jp/english/statistics/tyo/kougyo/index.html.

[6] MIC (2018), White Paper on Local Public Finance 2018, http://www.soumu.go.jp/iken/zaisei/30data/2018data/30010000.html (accessed on 24 August 2018).

[22] MLIT (2018), White Paper on Land, Infrastructure, Transport and Tourism in Japan 2018 (in Japanese), http://www.mlit.go.jp/hakusyo/mlit/h29/hakusho/h30/pdf/np202000.pdf.

[32] MOE (2017), Impacts of pesticide use on dragon flies and wild bees in Japan (in Japanese), https://www.env.go.jp/water/dojo/noyaku/ecol_risk/konchurui.pdf.

[34] MOE (2017), Impacts of pesticides on dragonflies and wild bees in Japan (in Japanese), https://www.env.go.jp/water/dojo/noyaku/ecol_risk/konchurui.pdf.

[33] MOE (2014-2016), Environmental assessments on the use of pesticides (in Japanese), https://www.env.go.jp/water/dojo/noyaku/ecol_risk/post_2.html.

[21] MOF (2014), Current Status and Challegnes of Infrastracture Development (in Japanese), https://www.mof.go.jp/about_mof/councils/fiscal_system_council/sub-of_fiscal_system/proceedings/material/zaiseia261020/01.pdf.

[26] OECD (2019), Digital Opportunities for Better Agricultural Policies: Insights from Agri-Environmental Policies, COM/TAD/CA/ENV/EPOC(2018)3/FINAL.

[11] OECD (2019), “OECD FDI regulatory restrictiveness index”, OECD International Direct Investment Statistics (database), https://dx.doi.org/10.1787/g2g55501-en (accessed on 21 January 2019).

[25] OECD (2018), Broadband Portal (database), http://dx.doi.org/www.oecd.org/sti/broadband/broadband-statistics/.

[2] OECD (2018), “OECD Economic Outlook No. 103 (Edition 2018/1)”, OECD Economic Outlook: Statistics and Projections (database), https://dx.doi.org/10.1787/494f29a4-en (accessed on 21 January 2019).

[17] OECD (2017), Financing SMEs and Entrepreneurs 2017: An OECD Scoreboard, OECD Publishing, Paris, https://dx.doi.org/10.1787/fin_sme_ent-2017-en.

[1] OECD (2017), OECD Economic Surveys: Japan 2017, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-jpn-2017-en.

[5] OECD (2016), OECD Territorial Reviews: Japan 2016, OECD Territorial Reviews, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264250543-en.

[12] OECD (2015), OECD Economic Surveys: Japan 2015, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-jpn-2015-en.

[13] OECD (2013), OECD Economic Surveys: Japan 2013, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-jpn-2013-en.

[28] OECD (2010), OECD Environmental Performance Reviews: Japan 2010, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264087873-en.

[40] Shobayashi, M., Y. Kinoshita and M. Takeda (2010), “Issues and Options Relating to Sustainable Management of Irrigation Water in Japan: A Conceptual Discussion”, International Journal of Water Resources Development, Vol. 26/3, pp. 351-364, http://dx.doi.org/10.1080/07900627.2010.492609.

[16] SMTB (2013), Findings from the difference between agricultural finance in the United States and Japan, https://www.smtb.jp/others/report/economy/10_3.pdf.

[9] UNCTAD (2018), UNCTAD | Trade Analysis Information System (TRAINS), https://unctad.org/en/Pages/DITC/Trade-Analysis/Non-Tariff-Measures/NTMs-trains.aspx (accessed on 21 August 2018).

[35] US EPA (2019), About Pesticide Registration, https://www.epa.gov/pesticide-registration/about-pesticide-registration.

[3] WEF (2017), The Global Competitiveness Report 2017-2018: Full data edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

[4] World Bank (2018), Worldwide Governance Indicators (database), http://info.worldbank.org/governance/wgi/#home.

[8] WTO (2018), World Tariff Profiles 2018 (database), http://www.wto.org/statistics.

[7] WTO (2017), Trade policy review of Japan, https://www.wto.org/english/tratop_e/tpr_e/s351_e.pdf.

Notes

← 1. Japan’s SNGs are separated into two tiers: 47 prefectures, and 1 718 municipalities and the 23 special wards within Tokyo.

← 2. The minimum size of a livestock barn is 50m2 for hog farms, 200m2 for cattle farms, and 500m2 for horse farms.

← 3. Special zones have been a prominent feature of Japanese regulatory reform efforts, most notably the Special Zones for Structural Reform launched by the government in 2002. By the end of 2014, there were 1 235 such zones. These created the opportunity to experiment and pilot reform ideas in specific places with the hope that such experiments would be a way to circumvent bureaucratic resistance to reform (OECD, 2016[5]).