This chapter describes the challenging economic context and critical factors driving a slowdown in economic activity in Latin America and the Caribbean (LAC) in 2023 following a rebound in growth after the COVID-19 pandemic. It also presents the socioeconomic challenges facing the region, where poverty and extreme poverty remain above pre-pandemic levels in more than half of LAC countries. The chapter first analyses macroeconomic policy in LAC, with a special focus on debt and taxes. It then reviews social conditions, presenting recent developments concerning poverty, inequality, and informality. Key policy messages point to the need to promote further and better investment to achieve more dynamic and sustainable growth and generate quality employment. It also highlights the need to protect the most vulnerable and, at the same time, ensure price stability.

Latin American Economic Outlook 2023

Chapter 1. Macro-structural perspective

Abstract

Macro-structural perspective (infographic)

Introduction

Economic activity in Latin America and the Caribbean (LAC) will slow sharply in 2023 due to cyclical dynamics, subdued potential growth and low investment levels. The slowdown follows a post-pandemic rebound in growth as fiscal and monetary stimuli, more favourable external conditions, and the reopening of economies drove the recovery after 2020. The current slump in growth has been driven by a deterioration of external conditions, the roll-back of public transfers enacted to mitigate the effects of the pandemic and monetary policy tightening to curb inflation.

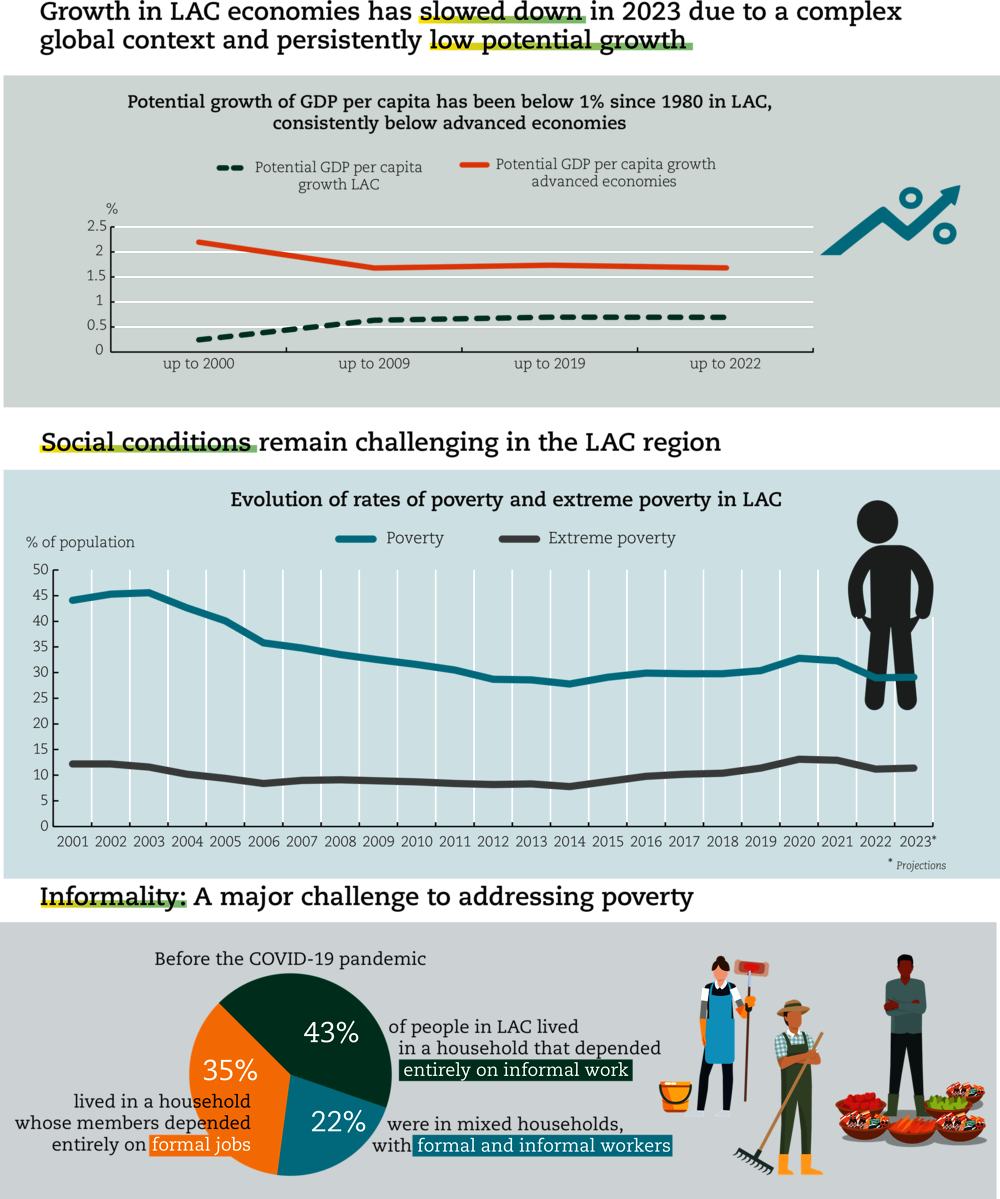

Although the relatively strong economic recovery in LAC came with an increase in employment and household income, challenging social conditions remain. Increased inflation eroded purchasing power, especially for the poorest, and poverty and extreme poverty in the region remain above pre-pandemic levels in more than half of LAC countries. In 2022, 29% of the population was in poverty and 11.2% in extreme poverty. One of the main challenges to address this situation is labour informality, entailing lower wages and lack of access to social protection systems. Before the pandemic, 42.8% of the LAC population lived in a household that depended entirely on informal employment and 21.8% lived in mixed households, i.e. households with both formal and informal workers. This implies that 64.6% of the regional population depended totally or partially on informal employment. Similarly, inequality in income distribution in Latin America, measured through the Gini index, remained relatively high and stagnant between 2017 and 2021; it did show a slight improvement from 0.46 in 2020 to 0.45 in 2022.

This chapter first examines the global context, which remains fragile. It then presents the macroeconomic performance in LAC, highlighting the region’s heterogeneity, external accounts, inflationary conditions and tight fiscal space. It explores possible actions to improve taxation systems in order to promote investment, recover fiscal space and improve progressiveness, with a specific focus on corporate income tax. The chapter next examines social conditions in LAC, with a focus on poverty, extreme poverty, inequality and the evolution of informality at the household level. It concludes by presenting the main policy messages.

The global outlook remains fragile

The global economic outlook began to improve after the impacts of the pandemic, but the growth prospects remain weak. Although, for 2023, GDP growth has been stronger than expected, it remains subdued, and will moderate further in 2024. Core inflation is proving persistent and the impact of higher interest rates around the world is increasingly being felt, particularly in property and financial markets. Global growth is projected to moderate from 3.3% in 2022 to 2.9% in 2023 and 2.7% in 2024, with inflation projected to decrease in 2023 and in 2024 (OECD, 2023[1]; OECD, 2023[2]).

The global economy is expected to remain sub-par in 2024, due to macroeconomic policy tightening needed to rein in inflation. Risks to this outlook are tilted to the downside. Tight monetary policy for a more extended period could induce new episodes of financial fragility that further deteriorate credit conditions and depress demand more than anticipated. Lower-than-expected recovery in the People’s Republic of China (hereafter “China”), geopolitical tensions, climate risks, debt distress, stickier inflation and geoeconomic fragmentation could also cloud the outlook (OECD, 2023[1]; OECD, 2023[2]).

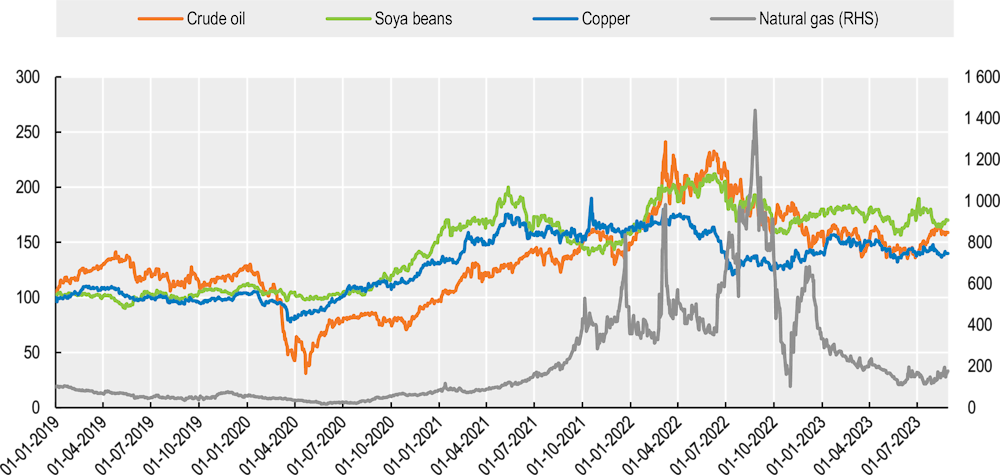

Most commodity prices are normalising, easing inflation pressures (Figure 1.1). Russia’s war of aggression against Ukraine pushed prices up against a backdrop of supply-demand imbalances from the COVID-19 pandemic. As a result of uncertainty stemming from the war, the prices of oil, gas, coal and industrial metals spiked in 2022 and fluctuated at higher levels in the following months. Food and energy prices have receded since the second half of 2022, but remain above levels recorded before the pandemic and the war in Ukraine. Even though Russia’s invasion of Ukraine continues, a mild winter in 2022/23, the slowdown of global economic activity and the lifting of COVID-19 restrictions in China have helped decrease commodity prices.

Figure 1.1. International commodity prices, January 2019 to August 2023

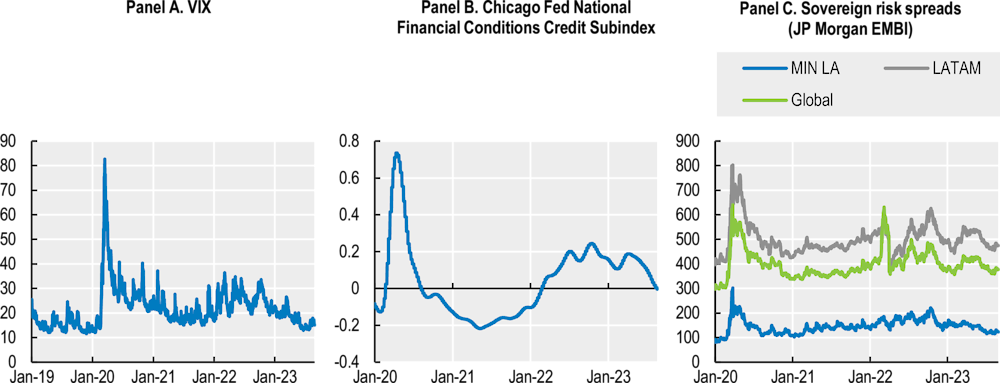

Monetary policy dynamics in advanced economies affect the behaviour of capital markets. Following financial turmoil in March 2023 in the United States and Switzerland, stock market volatility measured by the Volatility Index (VIX index) has subsided and is back to pre-pandemic levels (Figure 1.2, Panel A). Credit conditions in the United States, measured by the Chicago Fed National Financial Conditions Credit Subindex, eased after turmoil caused by three failed US regional banks was resolved (Figure 1.2, Panel B). Similarly, risk premia in emerging sovereign bond markets, measured by the J.P. Morgan Emerging Market Bond Index (EMBI), have narrowed since the episode of financial fragility and remain well below the early months of the COVID-19 pandemic, signalling a recovery in appetite for emerging markets’ assets. In LAC, sovereign bond spreads have remained higher than the global average but with high heterogeneity across countries. The average is affected by specific countries (Argentina, Ecuador, Venezuela and, more recently, Bolivia). Spreads in other LAC countries included in the EMBI are below the global average, suggesting that governments and firms can tap into international capital markets (Figure 1.2, Panel C), albeit at higher costs considering the increase in interest rates.

Figure 1.2. Volatility and risk premia in financial markets

Note: Data from January 2020 until August 2023. In Panel A, a higher VIX index suggests that market participants anticipate more significant price swings and potential fluctuations. In Panel B, positive values on the Chicago Fed National Financial Conditions Credit Subindex indicate tighter financial conditions than average. In contrast, negative values indicate financial conditions that are looser than average. In Panel C, a larger index indicates that investor sentiment and risk appetite towards emerging market debt is decreasing. For Panel C, MIN LA refers to the country with the lowest sovereign risk spread.

Source: (Refinitiv Eikon, 2023[3]).

Growth in LAC reflects a complex juncture and pending structural challenges

Gross domestic product (GDP) growth in LAC rebounded to above 6% in 2021 and was close to 4% in 2022. The recovery was mainly driven by fiscal and monetary stimuli, better external conditions, and base effects. In 2022, however, external conditions were less favourable, public transfers were rolled back, monetary policy tightened and the effects of the reopening of economies dissipated. Nevertheless, activity in 2022 was more resilient than initially anticipated due to good performance of the labour market. But recovery has been uneven across the LAC region. By 2022, most LAC countries – including the largest economies – had regained pre-pandemic GDP levels; the exceptions were Ecuador and several Caribbean countries, which experienced deep economic recessions in 2020 and have suffered the impact of declining tourism flows and limited fiscal space (ECLAC, 2022[4]; Galindo and Nuguer, 2023[5]; Adler and Chalk, 2023[6]; Banco de España, 2023[7]).

There is little space for demand policies at this juncture. Headline inflation rates have receded in most countries, thanks to lower energy and food prices. However, inflation rates remain high in several countries, mainly due to the protracted dynamics of service prices. Consequently, most central banks are maintaining a contractionary monetary policy stance, with interest rates above neutral levels. The LAC region has little fiscal space. Much of the fiscal stimulus of 2020 has been withdrawn, while debt levels remain high and gradual fiscal consolidations continue (CAF, 2023[8]; ECLAC, 2023[9]). Risks to the outlook stem from a sharper and faster-than-expected slowdown across the region’s key partners, as well as tightening financial conditions and political uncertainty within the region, and an escalation of Russia’s war in Ukraine (Galindo and Nuguer, 2023[5]; Adler and Chalk, 2023[6]; IMF, 2023[10]; CAF, 2023[11]).

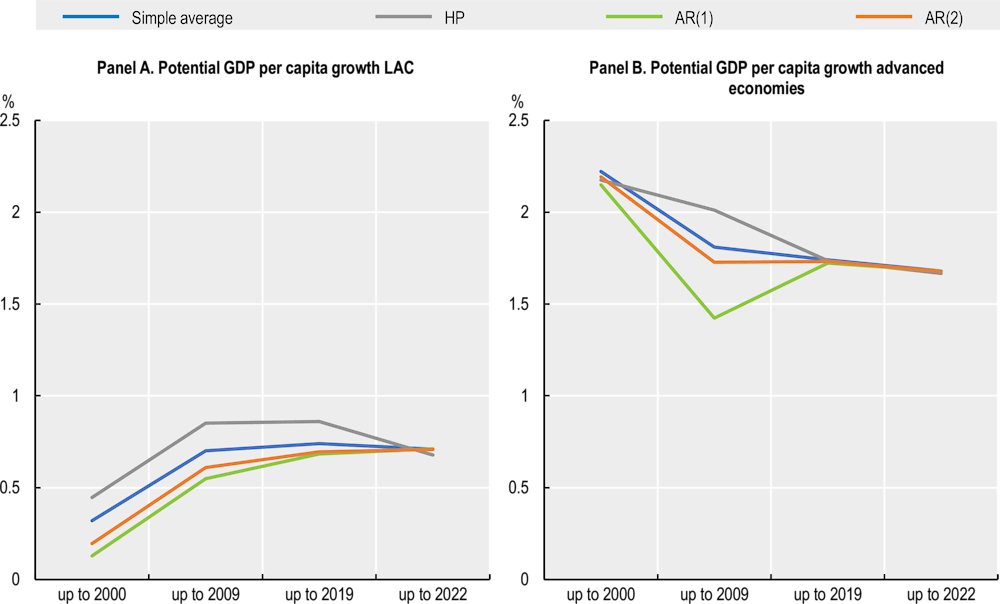

Low investment levels have been associated with low potential growth in the region. In the past decades investment has been one of the most important determinants of economic growth in Latin America (De Gregorio, 1992[12]). At only 20% over GDP, the LAC region exhibits one of the lowest levels of investment across all regions (Chapter 2) and therefore more and better investment is needed to boost potential growth. GDP per-capita growth was a pre-pandemic structural development challenge in LAC and remains a key determinant of slow progress in economic development. Potential GDP per-capita growth has been below 1% since 1980, although it increased slightly following the commodity boom (between 2003 and 2013). Since then, per-capita potential output growth has stagnated, remaining consistently below rates in advanced economies, thus hindering convergence (Figure 1.3).

Furthermore, higher productivity growth – based on more and better investments – should be central to closing the gap with developed economies (Chapters 2 and 3). Labour productivity in the LAC region, compared to the United States, explains almost the entire gap in per-capita GDP (Chapter 3). Countries that have managed to close the gap and increase productivity have diversified towards more technology and knowledge-intensive activities across all economic sectors. This has been achieved thanks to adequate investment in physical and human capital, as well as the implementation of deep production development policies that have helped the upgrading, diversification and structural change of these economies (OECD et al., 2022[13]; Álvarez et al., 2019[14]; ECLAC, 2022[15]).

Figure 1.3. Potential GDP per-capita growth in LAC and advanced economies

Note: Average growth is a simple average over the period analysed. HP = the Hodrick-Prescott filter, which was used as an alternative model due to its resilience to short-term shocks to create a smoothed curve (lambda equal to 100). AR = autoregressive model, which uses GDP per-capita growth data. The number of lags (1 and 2) was determined by analysing the autocorrelation function and choosing the model that maximised the log-likelihood. The LAC and advanced economies series refer to countries covered by the IMF’s World Economic Outlook database, April 2023.

Source: Authors’ calculations based on (IMF, 2023[10]).

The insufficient level of investment in LAC can be partly explained by the region’s low levels of national savings. Individuals, business, and governments save money to smoothen their consumption (protect themselves against shocks) and invest respectively to improve their well-being, become more productive, and provide more public services. These savings in their turn, can be used to finance investments, thus there is a positive relationship between investment levels and domestic savings. On average in LAC for every 1 percentage point of GDP increase in national saving, domestic investment increases by 0.39 percentage points, although with strong heterogeneity in the region (Cavallo and Pedemonte, 2015[16]). Nevertheless, the region has consistently presented low levels of gross domestic savings accounting on average for around 20% of GDP since 2000. This is considerably lower than the 35% of GDP that East Asia and Pacific economies save. Economies with low levels of savings must look to borrow abroad to finance their investments but this can be more costly and increase the risk of crisis as international financial flows are volatile (Cavallo and Serebrisky, 2016[17]; World Bank, 2023[18]).

A complex global context and longstanding structural issues in the LAC region signal the importance of attracting and mobilising investment as a critical driver of regional production transformation (Chapter 3). This stands out even more prominently in a context where major world economies are taking decisive steps forward in promoting national industries: e.g. the United States with the Inflation Reduction Act and the Chips Act, or the European Union (EU) with its European Green Deal. This trend may significantly transform the global trade and investment landscape, opening new opportunities but also presenting challenges. Against this backdrop, LAC countries must create the conditions to benefit from the ongoing transformations and foster investments in sectors with emerging opportunities (Chapter 3).

External accounts are expected to improve

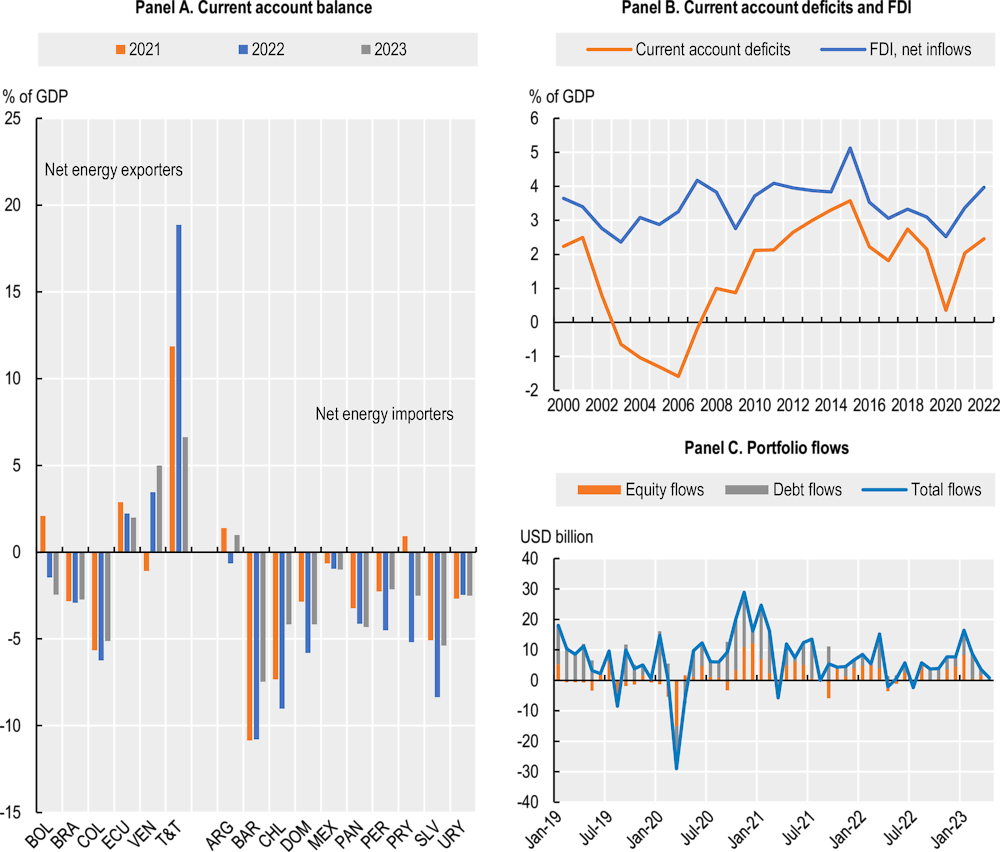

Current account deficits persisted in most LAC countries in 2022, particularly in net energy importers (Figure 1.4, Panel A). Current account dynamics have been marked by changes in terms of trade – particularly swings in energy and food prices – and domestic demand dynamics. External accounts should improve in 2023 as intermediate inputs and commodity prices normalise, and as domestic demand slows. Despite such normalisation, as commodity prices remain above historical means, the strain on net commodity exporters should not be significant.

Figure 1.4. LAC current account balance and capital flows to LAC countries

Note: FDI = foreign direct investment.

Source: (IMF, 2023[10]), (IIF, 2023[19]) and (World Bank, 2023[18]).

The capital account continues to play a crucial role in financing the deficits of the current account. Portfolio flows to emerging markets have weakened in 2023, but most LAC countries have been able to tap into international capital markets (Figure 1.4, Panel C; see also Chapter 4). Current account deficits remain manageable in most LAC countries, mainly financed by foreign direct investment (FDI) (Figure 1.4, Panel B). FDI inflows have consistently helped to finance current account deficits since the mid-1980s. In 2022, FDI inflows experienced a 55.2% increase (reaching 4% of GDP), the highest level of the last three decades. This substantial increase was mainly driven by investments in services, hydrocarbons and manufactures. Regarding the main components of FDI, equity accounted for 36% in 2022, reaching levels similar to 2019 but still below 2013 levels. At 43%, reinvested earnings remained the main source of FDI in 2022 (ECLAC, 2023[20]). Not just the quantity but also the quality of FDI matters. Quality FDI can contribute to increasing productivity, increasing investment in research and development (R&D), delivering more quality jobs, and driving the development of key sectors (Chapter 2 and 3) (OECD, 2019[21]; OECD et al., 2021[22]).

The export basket needs greater value added and diversification

The LAC share in global exports has not changed in recent decades, remaining at values of 4% to 5%. Furthermore, if Mexico is excluded from LAC data, the overall export share falls by 1 percentage point. This contrasts with significant increases in the share of other developing regions. For example, East Asia and Pacific, driven by China, has seen its share in global exports increase from 19% in 1990 to 32% in 2022. Low participation of Latin American firms in international trade is partly due to the limited use of regional trade as part of a strategy to expand global export. In turn, one reason for this is that trade liberalisation has not generated high and sustained increases in intraregional trade. To foster regional integration and drive trade in LAC, it will be important to simplify border requirements and formalities, and lower tariffs and non-tariff barriers. Better connectivity is also needed to promote the exchange of merchandise, services and regional goods, including energy (Sanguinetti et al., 2021[23]).

LAC export performance over the last two decades shows scope to diversify and add greater value to the export basket. LAC weight in world shipments of manufactures (including those based on natural resources) has not exceeded 5%. Regarding services, the region’s share in world exports has fallen since 2000, to 2.6% in 2021; it is just 1.7% in so-called modern digitally deliverable services (ECLAC, 2023[24]). Over this period, the main change in the structure of regional exports of goods has been the growing weight of primary goods. Within total merchandise exports, their share increased from an average of 27% between 1999 and 2001 to an average of 36% between 2019 and 2021. This increase correlates with a fall in the weight of low- and high-tech manufactures. Contrasting dynamics can be observed at the subregional level, however. In South America between the two periods, the share of primary goods increased by more than 16 percentage points to 58% of total exports. Central America shows the opposite trend: the weight of primary products in its export basket fell by more than 9 percentage points while the weight of natural resource-based manufactures and low- and medium-technology manufactures increased. Finally, in Mexico, the share of raw materials in total exports remained stable at around 11%, one of the lowest levels in the region. Mexico’s main export segment is medium-technology manufactures, which account for almost half of the total value of its goods exports, and whose weight has increased by close to 10 percentage points in the last 20 years (Table 1.1).

Table 1.1. Distribution of LAC goods exports by technology intensity, 1999-2001 and 2019-21

LAC, selected subregions and Mexico (percentages)

|

|

Primary goods |

Manufactures based on natural resources |

Low-tech manufactures |

Medium-tech manufactures |

High-tech manufactures |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

|

1999-2001 |

2019-21 |

1999-2001 |

2019-21 |

1999-2001 |

2019-21 |

1999-2001 |

2019-21 |

1999-2001 |

2019-21 |

|

|

Latin America and the Caribbean |

26.7 |

36.2 |

18.2 |

18.3 |

13.5 |

7.8 |

25.3 |

26.4 |

16.4 |

11.3 |

|

Latin America and the Caribbean (excluding Mexico) |

40.1 |

53.8 |

28.8 |

25.3 |

11.4 |

6.8 |

13.9 |

11.1 |

5.8 |

3 |

|

South America |

41.9 |

58.4 |

29.4 |

25.1 |

9.4 |

4.2 |

14.2 |

10 |

5.1 |

2.3 |

|

Mexico |

11.3 |

11.2 |

6.1 |

8.4 |

15.8 |

9.4 |

38.4 |

48.1 |

28.4 |

23 |

|

Central America |

34.9 |

25.6 |

16 |

20.3 |

21.9 |

26.8 |

10.1 |

17.6 |

17.2 |

9.8 |

|

The Caribbean |

20.4 |

11.4 |

30.2 |

38.7 |

37.2 |

21.5 |

9.1 |

19.2 |

3 |

9.1 |

Source: Based on United Nations Comtrade Database on International Trade Statistics (COMTRADE).

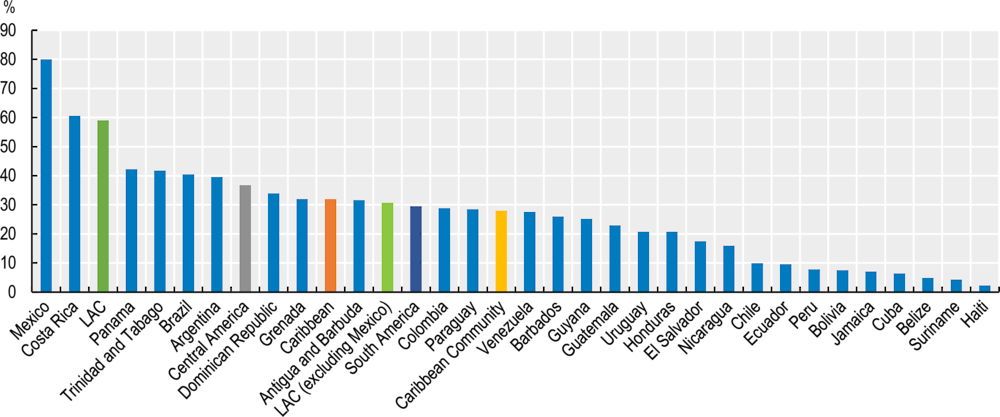

The heterogeneity of export patterns across LAC countries can also be seen in the share of medium- and high-technology in total manufactures exports. This proportion, which peaks at 80% in Mexico, equals or exceeds 40% in only six countries and is less than or equal to 10% in nine countries, all in South America and the Caribbean (Figure 1.5) (ECLAC, 2023[24]).

Figure 1.5. Share of high- and medium-tech manufactures in total manufactures exports, latest year

Note: Panama’s exports include re-exports.

Source: (ECLAC, 2023[24]) based on United Nations, United Nations International Trade Statistics Database (COMTRADE).

While growth of services exports in LAC has been low compared to the world trend, it has been above regional goods export growth. Between 2005 and 2019, regional services exports had an average annual growth rate of 5.6%. Although lower than the average expansion of world exports of services in the same period (6.3%), this exceeds the average annual growth rate expansion of regional exports of goods (4.2%). The value of LAC services exports reached an all-time high in 2019, exceeding USD 190 billion. In 2020, the COVID-19 pandemic led to an 18% plunge in global services trade due to the collapse in tourism and lower demand for transport services associated with the contraction in goods trade. At 37%, the drop in the LAC region services exports in 2020 was much larger than the global average, reflecting that tourism’s share (47%) in pre-pandemic exports was twice as large as its share in world exports (23%).

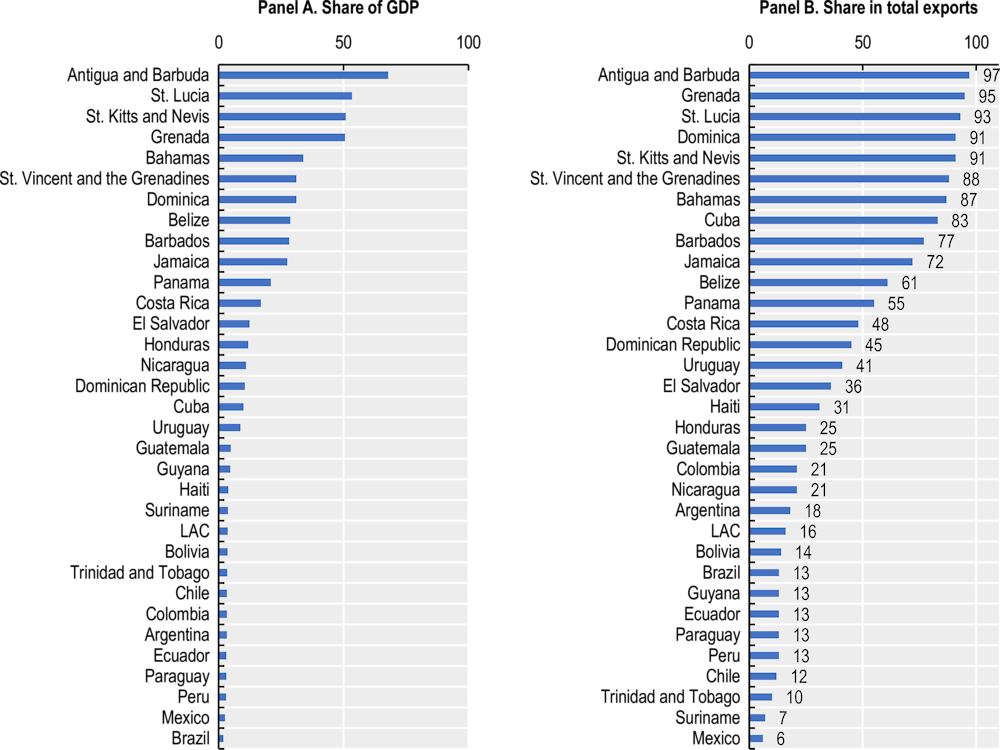

The relative importance of trade in services varies widely across LAC countries. In general, its weight in GDP and total exports is inversely proportional to the size of the economies. Thus, for example, services account for more than 70% of total exports in Cuba and several economies of the English-speaking Caribbean but fall to more than 40% in Uruguay, Dominican Republic, Costa Rica, Panama and Belize (Figure 1.6).

Figure 1.6. Share of services exports in GDP and total exports, 2019

Inflation eases but several central banks are expected to maintain a restrictive stance

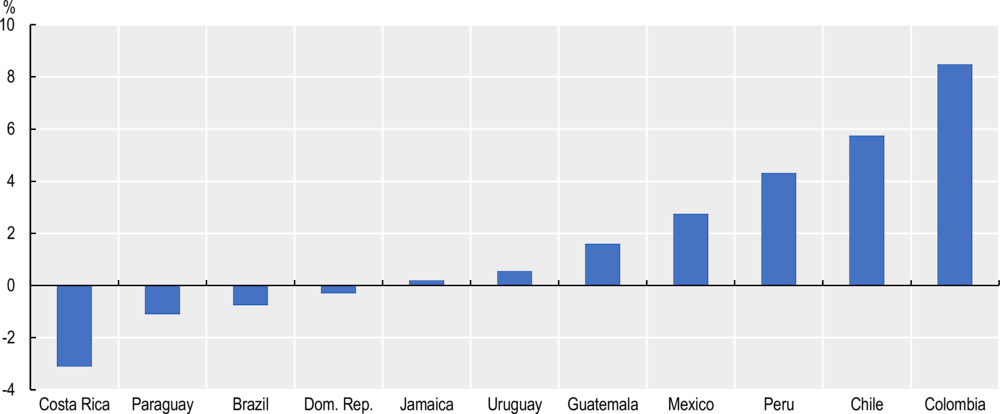

Inflation in LAC has been declining in recent months, as food prices trend down and the effects of tighter monetary policies materialise. It peaked in mid-2022, rising to the highest level since the 2008 financial crisis. Several factors drove this inflation, including external factors in some countries, such as trade disruptions and supply bottlenecks caused by the pandemic and compounded by Russia’s war in Ukraine, which further affected commodity prices. Domestic factors, such as the size of fiscal stimulus to address the pandemic and the consequent recovery, also played a role in some countries. Although these dynamics exerted particular pressure on energy and food prices, inflation has spread to other price categories in almost all countries. Inflation increased in all LAC countries, irrespective of their monetary regimes, although less so for the dollarised countries and more so in countries with no inflation-targeting regime. While inflation has been easing since mid-2022, for some LAC economies, it remains above central bank targets. Since the second half of 2021, countries with inflation-targeting regimes have rapidly increased interest rates to anchor inflation expectations. For some LAC economies, inflation rates remain above their targets in the first half of 2023 (Figure 1.7), particularly for those countries in which demand pressures were higher, such as Colombia and Chile. The normalisation of commodity prices is contributing to the decline in headline inflation, which is already below the upper band of the target range in several countries. However, stickier service prices have made the decline in core inflation more protracted (Adler and Chalk, 2023[6]; Galindo and Nuguer, 2023[5]; ECLAC, 2022[4]; Banco de España, 2023[7]; CAF, 2023[11]).

Figure 1.7. Difference between headline inflation and the upper inflation target, 2023 (%)

Note: Data include only economies that use inflation-targeting regimes. Data from January 2023 until August 2023.

Source: Authors’ calculations based on (Refinitiv Eikon, 2023[3]).

The decline in headline inflation is partly explained by the decrease in prices of energy and core components. Energy has made negative contributions to headline inflation over the last nine months. Similarly, the prices of core goods have started to decline, thanks to a reduction of supply bottlenecks and currency appreciation. However, inflationary pressures in food continue to be high and services continue to contribute significantly to inflation, without any noticeable easing of pressures (Banco de España, 2023[7]; CAF, 2023[11]).

Most central banks in the LAC region maintained a tight monetary policy stance during the first half of 2023, aiming to anchor inflation expectations while awaiting consolidation of its decline. Only a few countries, such as Costa Rica, started to reduce their policy rates in the first half of 2023. Other elements – such as the speed of the slowdown in economic activity, volatility in international financial markets and the resulting exchange rate fluctuations, or the impact of climate shocks such as El Niño – may condition monetary policy and the use of macroprudential instruments to preserve macrofinancial stability (ECLAC, 2022[4]; Banco de España, 2023[7]; CAF, 2023[11]).

Fiscal space remains limited despite the roll-back of fiscal stimuli

Fiscal accounts have been improving in LAC since 2021, as public revenues increased, and spending support introduced during the pandemic was rolled back. Consequently, a positive shift is seen (on average) in the fiscal accounts of central governments since the 2020 deficits (-6.9% of GDP) that resulted from the response to the COVID-19 crisis. Fiscal deficits narrowed to an average of -2.4% of GDP in 2022, compared to -4.2% in 2021. Caribbean economies continue to exhibit fiscal and primary balance deficits but have also been gradually improving (ECLAC, 2023[9]; CAF, 2023[8]).

In turn, narrowing fiscal deficits and the swift recovery of nominal GDP growth have contributed to decreases in public debt. In 2020, central government gross public debt (as a percentage of GDP) in the LAC region reached 56.3% (spiking to 87.4% in the Caribbean, its highest level in the last 30 years). In 2022, average debt levels declined to 51.5% of GDP (77.3% in the Caribbean). However, substantial heterogeneity is evident across countries in terms of debt levels, ranging from more than 100% of GDP in some Caribbean states (e.g. Barbados, Suriname) to less than 40% in Chile, Guatemala, Paraguay and Peru (ECLAC, 2023[9]; CAF, 2023[8]).

Despite recent consolidation efforts, fiscal space remains limited in LAC; as such, fiscal stability should not be compromised. On average, debt is above pre-pandemic levels and interest payments represent a larger fraction of spending, reducing the scope for countercyclical policies and investment. For debt to stabilise or decrease, it remains fundamental to promote economic growth at higher levels than real interest rates. Further public and private investments should be a key driver in the growth agenda for LAC countries (Chapters 2 and 3). Otherwise, the primary surplus should be high enough to compensate for the growth shortfall over interest rates.

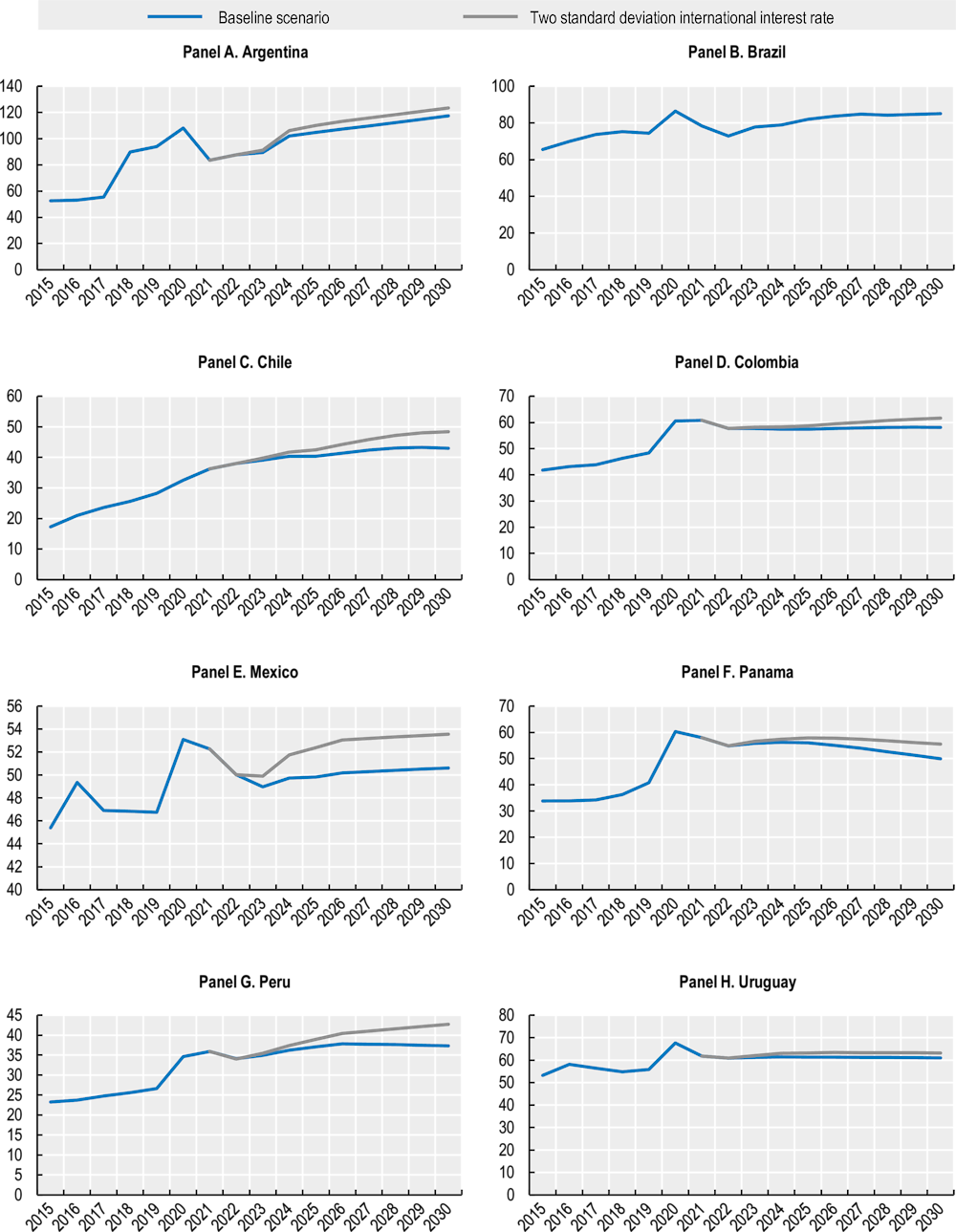

Debt levels are likely to stabilise at manageable levels in most LAC economies. However, debt dynamics vary significantly across countries, depending on economic growth, primary balances, headline inflation, interest rates, exchange rates and the currency composition of the debt. Regarding the latter, a shock in international interest rates could derail debt dynamics, depending on exposure to foreign currency debt and the interplay with economic growth. For instance, in Argentina, Chile, Panama and Peru, a two-standard deviation shock in international interest rates could increase debt levels by approximately 5% of GDP by 2030 (Figure 1.8) (CAF, 2023[8]).

Figure 1.8. Debt dynamics for selected LAC economies

Note: Debt dynamics are modelled by a behavioural equation defined in Bohn (1998) and IMF (2018).

It considers four variables that affect debt to GDP ratios (bt): real GDP growth (gt); real domestic and external interest rates (Id, I*); variation of the exchange rate (dt); and primary fiscal balance in terms of GDP (SPt). Random external interest rate shocks reflect an exercise of 1 000 stochastic simulations based on a “joint normal” distribution of the four fundamentals of the debt/GDP behaviour equation to compute the covariance matrix. For Uruguay only one standard deviation is calculated, and for Brazil only the base scenario is shown.

Source: (CAF, 2023[8]).

Both the composition of fiscal consolidation and its timing will be important to shape inclusive economic development (Powell and Valencia, 2023[25]). In the short term, the region must continue its fiscal consolidation efforts while, as a priority, protecting the most vulnerable from inflation. This can be done by strengthening the targeting of social protection systems and maintaining or implementing targeted support policies to counterbalance the negative effects of high inflation (OECD et al., 2021[22]).

For the long term, fiscal policy must protect public investment with adequate fiscal frameworks. Capital investments are essential for the production transformation and can (in the short term) help to offset the contractionary effects of fiscal adjustment. Nevertheless, in episodes of fiscal consolidation, governments find it easier to reduce capital expenditure than current expenditure, as the former tends to have lower political costs than cutting government consumption (Ardanaz and Izquierdo, 2022[26]). This not only has impacts on long-term growth but can also affect economic recovery. Protecting investment during the fiscal consolidation period can mitigate economic contraction and, in some cases, lead to an expansion (Ardanaz et al., 2021[27]). To protect public investment, the LAC region must develop or strengthen fiscal frameworks where fiscal rules can be an important tool. In addition, to protect investment, fiscal rules must be flexible enough to accommodate exogenous shocks. This can be accomplished by including cyclically adjusted fiscal targets, setting well-defined escape clauses and practising differential treatment of investment expenditures (OECD et al., 2022[13]; Arreaza et al., 2022[28]; Cavallo et al., 2020[29]).

Increasing fiscal space and public investment should be driven by better fiscal institutions, more efficient and effective public spending, more progressive tax revenues (OECD et al., 2022[13]; OECD et al., 2023[30]; ECLAC, 2022[31]), and better debt management. Stronger fiscal institutions increase confidence, which reduces risk premia and widens fiscal space by easing the required adjustment to stabilise debt (Arreaza et al., 2022[28]). Moreover, high debt levels in many LAC countries can hinder growth by reducing public investment, increasing financing costs and dampening private investment.

Aligning fiscal and monetary policy is fundamental for promoting sustainable growth. As demand is subdued by fiscal consolidation, this can help to reduce inflationary pressures. In addition, fiscal consolidation can create fiscal space by decreasing risk premia and minimising financing expenses, thus reducing the neutral monetary policy interest rate (Galindo and Nuguer, 2023[5]; Adler and Chalk, 2023[6]).

Tax systems need improvement to finance public services and investments

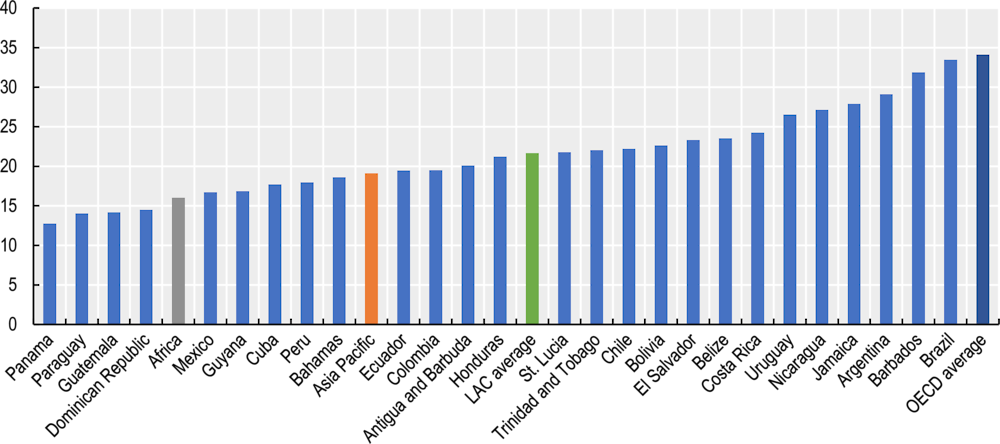

The LAC region must recover fiscal space to finance the investments needed for the production transformation, increase quality public services and ensure fiscal sustainability. This can be achieved via diverse instruments, including spending and taxes. More effective and efficient spending could be achieved through effective focalisation of public expenditures (including social spending and subsidies), as well as striving for a better balance between capital investment and current expenditure (OECD et al., 2021[22]; Izquierdo, Pessino and Vuletin, 2018[32]). Regarding taxes, the average tax-to-GDP ratio in the LAC region in 2021 was 21.7%, considerably lower than the average of 34.1% in OECD economies. In 2021, the level of tax revenues varied widely across LAC countries, from 12.7% of GDP in Panama to 33.5% in Brazil (Figure 1.9) (OECD et al., 2023[30]).

Figure 1.9. Tax-to-GDP ratios in LAC countries and in other regions, 2021

Most LAC economies need to increase tax revenues and reform their tax systems to pursue diverse social, economic and investment objectives. In a highly unequal region, improving the redistributive power of the tax system should be a priority (OECD et al., 2022[13]). Tax systems have a direct impact on key policy priorities, including job formalisation, entrepreneurship, investment and overall economic growth. Similarly, the tax system has a role in driving the green transition and reducing gender inequalities. To achieve these goals, relevant policy options include: reducing tax evasion and avoidance; increasing tax compliance; strengthening tax administration; increasing the progressivity of personal income tax; and eliminating tax expenditures that provide little benefit in terms of equity or job creation (Nieto-Parra, Orozco and Mora, 2021[34]). Achieving such goals will also require a gradual and well-co-ordinated approach to financing the green transition and reducing the dependence of some countries on hydrocarbon revenues.

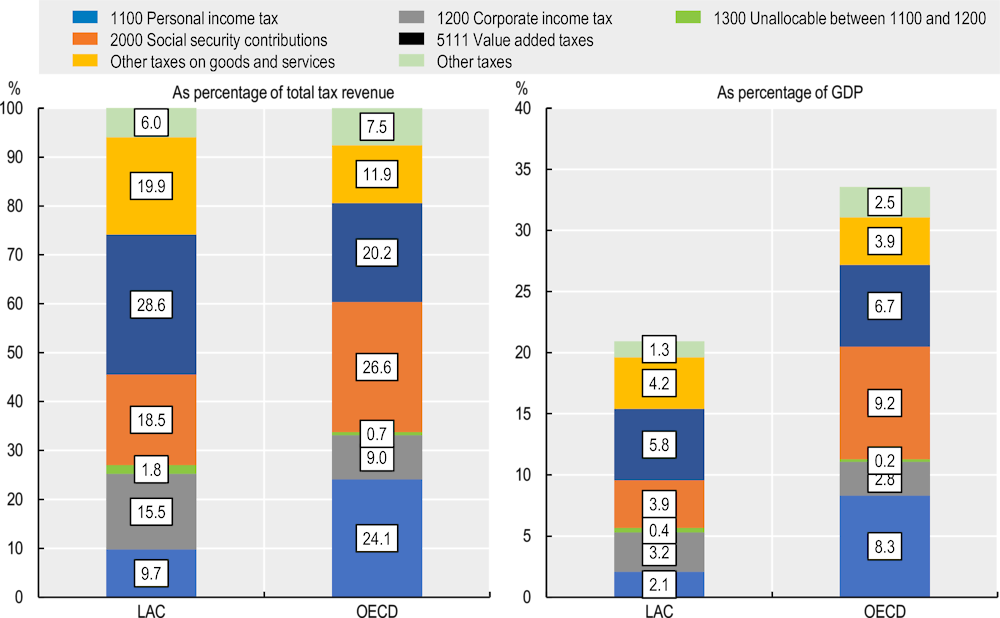

By rebalancing the tax mix, LAC economies can achieve more progressive tax systems and reduce income inequalities. At present, LAC tax structures rely on indirect taxes more than direct taxes. Indirect or consumption taxes tend to be regressive as they place the greatest burden on low-income households. In 2020, general consumption taxes (mainly value-added tax [VAT] and sales taxes) accounted for almost half of tax revenues in LAC countries, compared to 32.1% in OECD countries (Figure 1.10). In contrast, income taxes are more progressive, as high-income households contribute a more significant proportion of their earnings in taxes than lower-income households. In 2020, taxes on income and profits accounted for 25.2% of tax revenues in LAC on average, relative to 33.1% on average in the OECD. Within income taxes, taxes on corporate income accounted for 15.5% of total tax revenues in LAC, while personal income tax represented only 9.7%. High corporate tax rates may hinder investment and entrepreneurship. In OECD economies, personal income taxes account for a larger share of tax revenues (24.1%) than corporate income taxes (9.0%) (OECD et al., 2023[30]).

Figure 1.10. Average tax structure in the LAC region and OECD, 2020

In addition to raising revenue, tax systems can also help pursue environmental objectives. Increased environmental taxes can advance the green transition and digital transformation by reducing pollution, shifting consumption patterns in a more sustainable direction and stimulating technological innovation. The LAC region still has great potential to use environment-related taxes more effectively. On average in 2021, environmentally related tax revenues amounted to 1.0% of GDP in LAC countries – just half of the OECD average of 2.0% (OECD et al., 2023[30]).

However, environmental taxes may have negative repercussions on the most vulnerable populations and cause distorting effects that may affect economic activity. These taxes can, for example, further expose the most vulnerable by increasing the price of fossil-fuel-intensive products and services. Hence, it is essential to develop and enhance compensation schemes. These can include well-targeted cash and in-kind transfers, complemented by active labour market policies and self-employment and entrepreneurship programmes (OECD et al., 2022[13]). Environmental taxes may also distort tax bases or accentuate pre-existing distortions, with potential adverse effects on economic activity and entrepreneurship. It is thus necessary to use some of the revenue from environmental taxes to offset these effects (OECD, 2010[35]). If well designed, environmental taxes will produce the desired changes among consumers and businesses and should automatically phase out gradually.

Tax systems in LAC can also serve to promote gender equality. While men and women are generally subject to the same tax regulations, gender inequalities within the tax system can inadvertently be perpetuated by social and economic differences, such as income disparities or varying levels of labour participation. Within the region, the burden of both direct and indirect taxation affects women more than men. For instance, tax systems generally do not account for how women take on a larger share of unpaid work, making the tax burden disproportionate at the household level. Another example of gender bias in tax policy is tax relief for male-dominated economic sectors. It is therefore important to advance tax systems that remove all gender biases, whether explicit (i.e. when tax laws identify and treat women and men differently) or implicit (i.e. when tax laws or regulations treat women and men similarly but have an unequal outcome when applied). Removing both explicit and implicit biases in a country’s tax system can increase gender equality – e.g. by changing the nature of asset ownership – while also increasing female labour force participation and entrepreneurship. This allows women to contribute to economic growth. Awareness of these issues is growing in the LAC region. Economies such as Argentina, Mexico and Uruguay have already implemented tax policies or reforms to improve gender equity; more needs to be done, however, and by a larger share of LAC economies (Astudillo et al., 2022[36]; OECD, 2022[37]; OECD et al., 2021[22]).

Fiscal measures should be co-ordinated under a well-defined sequence of policies. There needs to be a national dialogue and consensus, based on empirical evidence, regarding the timing and dimensions of required public spending and taxes. Such consensus can help to renew the social contract (OECD et al., 2021[22]).

Corporate tax incentives need to be improved to increase investments

Different types of tax instruments can influence private investment decisions. These can be taxes generally applied to companies, including income taxes, payroll taxes, taxes on goods and services (e.g. VAT) and other more specific taxes, such as corrective taxes and wealth taxes. In addition, certain provisions seek to reduce the cost of capital, such as investment credits or accelerated depreciation mechanisms. Each instrument has comparative advantages that are important to consider when designing an investment incentive programme (ECLAC, 2022[31]; ECLAC, 2013[38]).

In LAC, the vast majority of tax incentives focus on corporate income taxes (CIT), although some are also linked to import tariffs, VAT and other indirect taxes. Tax incentives are defined as targeted tax provisions that provide favourable deviations from standard tax treatment in a country, resulting in reduced or postponed tax liability (Celani, Dressler and Wermelinger, 2022[39]; OECD, 2022[40]). Incentives focused on CITs are a widely used tool to boost private investment, but they have a cost in public revenues. Such incentives can promote investment and positively affect output, employment, productivity and other objectives related to sustainable development. Nevertheless, if mismanaged or abused, incentives can lead to lower tax revenues, economic distortions, erosion of the principle of equity, and increased administrative and compliance costs, while potentially triggering harmful tax competition (Celani, Dressler and Wermelinger, 2022[39]).

Variations in the corporate tax base can significantly impact tax liabilities and can play a role in international competition and in promoting/discouraging investment. Fiscal depreciation rules or other related provisions (e.g. allowances for corporate equity, half-year conventions, inventory valuation methods) can help to explain variations in the tax bases across jurisdictions. To measure these provisions and compare them across economies, effective tax rates (ETRs) are a better measure than statutory tax rates (STR), as the former provide a more accurate picture of the actual tax liabilities faced by companies (OECD, 2022[41]).

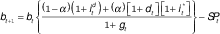

In LAC, the effective average and marginal tax rates on corporate income are relatively high (Figure 1.11). This is due to relatively high STRs and to capital allowances that treat certain assets less generously compared to estimates of economic depreciation and with respect to other countries. These relatively higher ETRs could discourage potential investments (Hanappi et al., 2023[42]).

Figure 1.11. Corporate effective tax rates in LAC, 2021

Note: Forward-looking effective tax rates. “Other countries” includes data from emerging Europe (9 countries), Middle East and Central Asia, emerging Asia, and Sub-Saharan Africa (16).

Source: (Hanappi et al., 2023[42]).

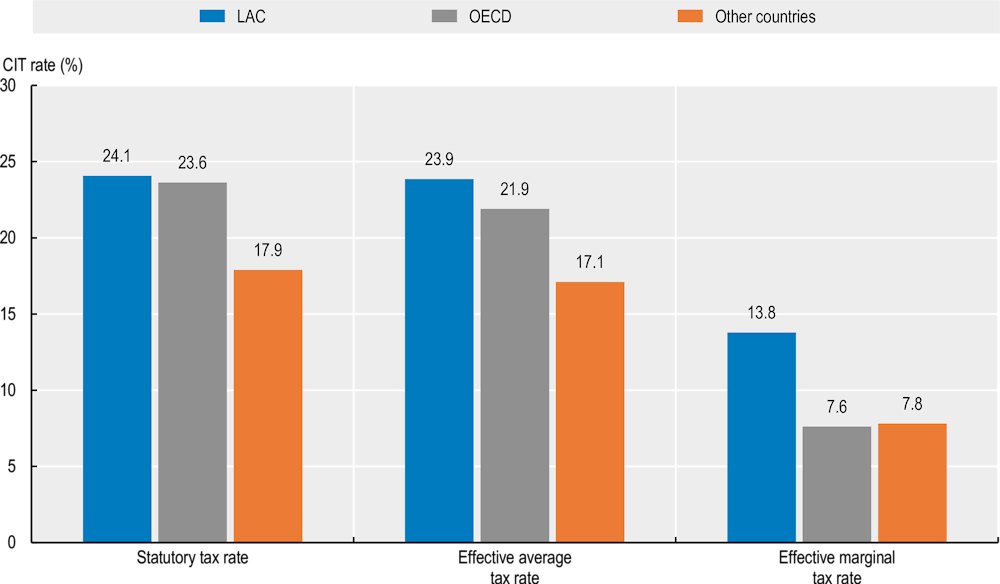

Several LAC countries grant targeted tax incentives or preferential tax treatments that reduce ETRs in specific activities, sectors and locations. Analysis currently exists for three countries (Dominican Republic, Ecuador and Paraguay) and three different industries (textile, metals and tourism) (Figure 1.12). While the Dominican Republic and Ecuador have a 25% standard ETR, they offer sector-specific tax incentives that substantially lower effective taxation in some of the industries. For example, ETRs can be as low as 0% in textiles in Dominican Republic and are up to 45% lower than standard taxation in the Ecuadorian metals industry (13.7% compared to 24.8%). While Paraguay does not use CIT incentives, it applies a relatively low standard CIT rate, resulting in the lowest ETR in the metals and tourism industries across the three countries (OECD, 2022[40]; Hanappi et al., 2023[42]; Celani, Dressler and Wermelinger, 2022[39]).

Figure 1.12. Impact of sector-specific investment tax incentives on ETRs, selected LAC countries

Note: This figure considers investment tax incentives and STT on 1 January 2020. Effective average tax rates (EATRs) are calculated for a standardised investment in a single non-residential building asset. STT considers country-specific standard CIT rates, asset-specific capital allowance rates and cost recovery method. Temporarily or permanently tax-exempt income does not give rise to standard capital allowances.

Source: (OECD, 2022[40]; Celani, Dressler and Wermelinger, 2022[39]).

Revenues foregone due to tax incentives, deductions and reduced rates (among other factors) are significant in LAC. In 2021, foregone revenues averaged 3.7% of GDP, equivalent to 19% of general government tax revenues. If tax incentives are poorly designed, their effectiveness may be limited; they could also lead to windfall gains for projects that would have been carried out regardless of the incentives.

Tax incentives should be rationalised and properly designed to ensure that they achieve their development objectives. To accomplish this, LAC economies need to enhance their institutional frameworks to ensure good governance and reduce wasteful effects. This entails creating transparent and clear tax incentives with binding legal requirements for their quantification, including cost-benefit analyses and robust evaluation processes. Tax incentives with explicit terms of duration, clear eligibility criteria and corresponding review mechanisms have a higher success rate. Bringing together all aspects related to incentive design in a unified body of law, including information on the policy objectives of the incentives, could contribute positively (OECD, 2019[21]; ECLAC-OXFAM, 2019[43]; OECD, 2015[44]; Celani, Dressler and Wermelinger, 2022[39]; ECLAC, 2022[31]).

Evaluation of tax incentives is underdeveloped in the LAC region, with few comprehensive studies undertaken so far. Periodic reviews are a relevant exercise to determine whether tax incentives are justified. These involve weighing the costs associated with applying the incentive against the benefits to society, depending on the associated objective (industrial development, job creation or environmental protection, among others). The adoption of tax incentive programmes should also include an evaluation of their opportunity cost in comparison with other policy instruments that can also have a positive influence on investment dynamics, such as public investments, public procurement, targeted subsidies and government-guaranteed liquidity instruments. These comprehensive reviews must be complemented by an institutional framework that ensures good governance and creates binding legal requirements for the quantification of tax incentives, as well as for ongoing cost-benefit analysis and robust evaluation processes (OECD et al., 2023[30]).

Socioeconomic conditions remain challenging in the LAC region

Poverty and extreme poverty remain above pre-pandemic levels in LAC in more than half of LAC countries

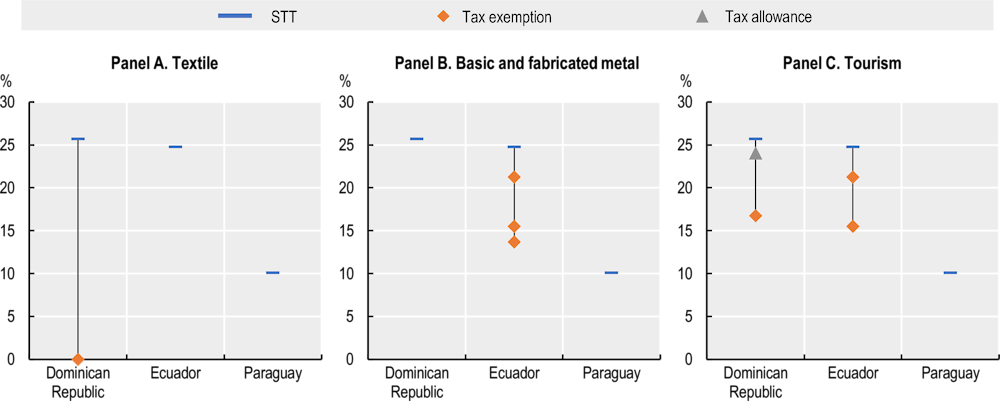

In 2022, 29% of the LAC population was in poverty and 11.2% in extreme poverty (Figure 1.13). Estimates for 2023 show that both poverty and extreme poverty should remain at similar levels to 2022. Furthermore, poverty and extreme poverty remain above pre-pandemic levels in more than half of LAC countries. The poverty rate improved slightly between 2020 and 2022. After a sharp increase in 2020 due to the COVID-19 crisis, poverty decreased marginally in 2021 and 2022 owing to the strong economic rebound. However, extreme poverty has increased steadily every year since 2014, with the exception of it falling moderately in 2021 then returning in 2022 to the 2020 level. Poverty and extreme poverty combined were driven by two opposing factors in 2022. On the one hand, economic growth (while considerably lower than in 2021) generated an increase in employment and household income. On the other hand, 2022 was characterised by accelerated inflation, which eroded income purchasing power (ECLAC, 2023[45]; Cherkasky, 2022[46]).

Figure 1.13. Evolution of rates of poverty and extreme poverty in LAC

Note: Weighted average for the following countries: Argentina, Venezuela, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Bolivia and Uruguay. *Estimates for 2023 are projections.

Source: (OECD et al., 2022[13]; ECLAC, 2023[45]).

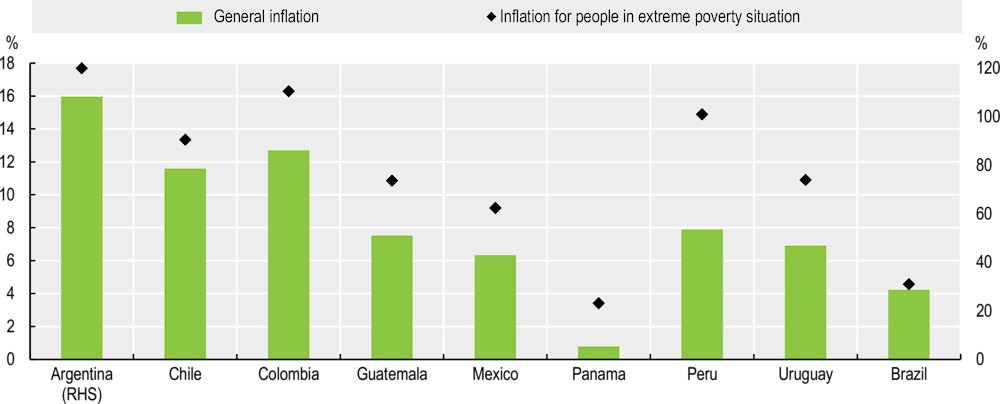

The detrimental effect of inflation on household incomes in LAC during the first halve of 2023 was considerably higher for households in extreme poverty, as they confronted an average price increase that was 4.1 percentage points higher than that of an average household at the national level (Figure 1.14). From a sample of LAC economies, Argentina and Peru showed the highest difference between the impact of inflation on the average population and on extremely poor households. For Argentina, this difference reached 11.6 percentage points and for Peru, this difference reached 7.0 percentage points.

Figure 1.14. Impact of inflation on the general population and on the extremely poor in 2023

Note: Data from January to July 2023. Year-on-year average growth in national consumer price indices (CPI) versus average growth in extreme poverty thresholds. In the case of Panama data are up to June 2023 and for Chile the data are from 2022. Extreme poverty thresholds are based on the cost of a basic food basket that covers basic needs and provides the minimum caloric requirement of the members of a reference household. For Colombia and Peru, the food and non-alcoholic beverages item of their CPI was taken into consideration. In the case of Panama, the data include the districts of Panama and San Miguelito. For Uruguay, inflation in Montevideo is considered. To calculate inflation for people in extreme poverty in Brazil, the averages of the baskets of the 17 capitals considered by Dieese in the basic basket were used. Argentina is represented on the right axis.

Source: Authors’ elaboration based on data from national statistical offices on CPI and poverty thresholds.

Economies in the LAC region have begun implementing policies to alleviate the effects of high inflation on the most vulnerable. These include policy tools such as: cash transfers; the sale or distribution of food at low prices or free of charge to isolated and socially marginalised populations; fuel and transport price subsidies; VAT reductions for some core products in the consumption basket of the poorest and most vulnerable; support for the food supply sector (with emphasis on family farming); the abolition or reduction of tariffs on some food goods; and reductions of certain charges. Several LAC economies have applied social measures – e.g. VAT or import exceptions, price freezes, or general measures to boost the supply of food – alongside price or competitiveness measures. Argentina provided income support to protect low-paid workers. Brazil expanded the coverage and amount of transfers in Auxílio Brasil and Auxílio Gás. Chile implemented the Apoya winter voucher to help the most vulnerable sectors cope with rising food price. Colombia expanded coverage of its Solidarity Income programme. Mexico established the Package Against Inflation and Scarcity, which strengthens traditional food security programmes. Peru implemented a one-off payment to beneficiaries of the non-contributory Juntos programmes (Pensión 65 and Contigo). Uruguay earmarked additional transfers to strengthen existing social programmes (ECLAC, 2023[45]). Looking forward, it is important that these support measures become targeted to low-income households and preserve incentives to reduce energy consumption (OECD, 2023[2]).

Inequality and low social mobility persist in the LAC region despite some progress

Inequality in income distribution in Latin America, measured through the Gini index, remained relatively stagnant from 2017 to 2022 after a significant decline in the 2000s and a smaller reduction in the 2010s. In 2022, the Gini index for the Latin American average showed a slight reduction, moving to 0.45 from 0.46 in 2020. Countries that showed the highest Gini coefficients (indicating higher inequality) in 2022 were Brazil and Colombia, with averages above 0.50. The lowest Gini coefficients were recorded in Argentina, Dominican Republic and Uruguay, with indices between 0.38 and 0.40 (ECLAC, 2023[45]).

To explain the evolution of inequality among LAC countries, it is useful to refer to the evolution of average household income. In countries where inequality increased, the higher-income quintiles gained more than the poorest (e.g. Uruguay). In contrast, three distinct patterns are observed in countries where inequality decreased. The first corresponds to countries (Dominican Republic, Argentina and Costa Rica) where the income of the poorest quintiles remained unchanged, while those of the highest-income quintile declined. The second pattern shows countries (Brazil, Panama and Peru) where the income of the poorest quintile increased significantly, while incomes in the rest of the quintiles fell, with higher-income households most affected. The third corresponds to countries (Chile, Ecuador and Mexico) where the incomes of the poorest quintile increased with those of almost all the other quintiles, but at a faster rate than in the highest-income quintile (ECLAC, 2023[45]).

Low levels of intergenerational mobility are a major contributor to the fact that inequality across LAC countries has not changed substantially or sustainably (CAF, 2022[47]). An analysis by the Development Bank of Latin America (CAF) takes a long-term perspective on how intergenerational mobility in the region evolved throughout the 20th century and the early 21st century. Persistence of low social mobility, the analysis shows, is closely related to the inequality of opportunity prevailing in the region. In turn, inequalities faced by people from different socioeconomic backgrounds define their opportunities for human capital formation, access to quality jobs and asset accumulation throughout their lives (CAF, 2022[47]).

Educational mobility is one dimension of intergenerational inequality. In LAC, the educational expansion in the last decades that benefited children and youth from disadvantaged families occurred at lower educational levels (mainly primary and, to a lesser extent, secondary). At higher educational levels, especially at university, the expansion of access was more concentrated among young people from middle and high socioeconomic families. Less progress at higher levels of education limits upward mobility, resulting in little progress in terms of relative mobility (CAF, 2022[47]).

Improving social mobility in LAC countries can strengthen incentives to put more effort and investment into education and training, thereby raising productivity. Moreover, if the region addresses the high intergenerational persistence resulting from inequality of opportunity, it can help increase people’s trust in each other and in institutions. In that context, policy makers should consider policy actions in terms of relative mobility (ranking an individual against their peers) rather than only in terms of absolute mobility (comparing only to their parents) (CAF, 2022[47]).

Stronger social protection systems and more investments are needed to drive formalisation

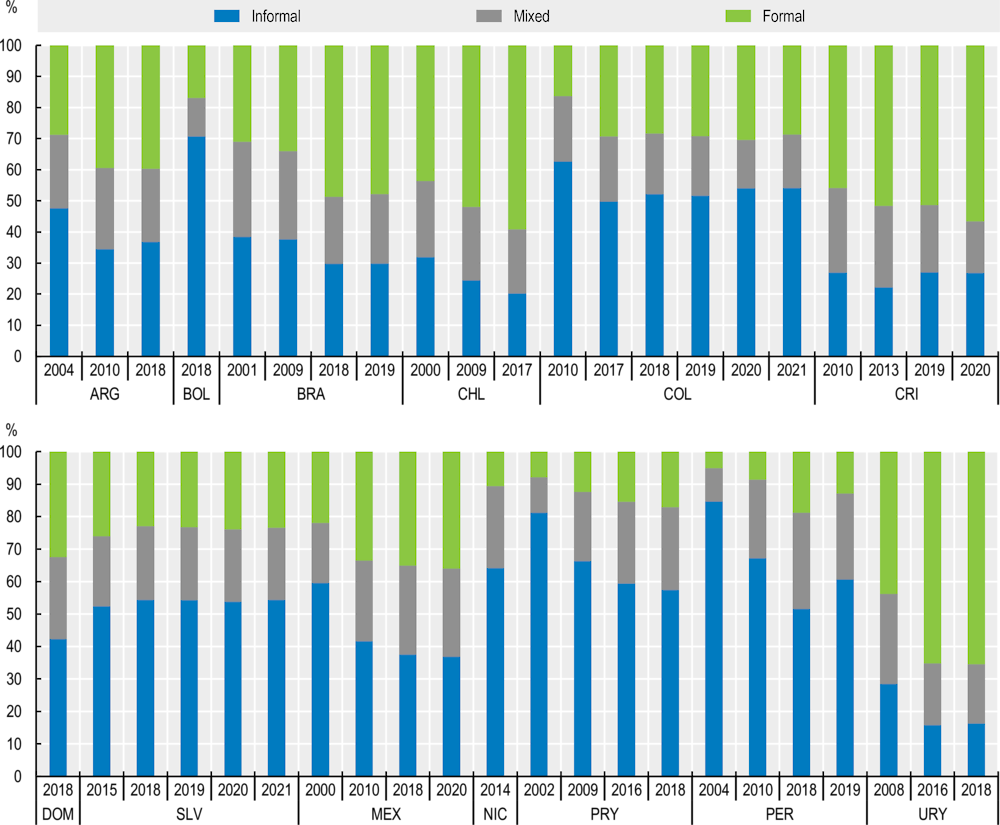

Informality of work continues to be a main challenge to addressing poverty and extreme poverty in LAC, where the average informal employment rate was 48.7% in 2022 (ECLAC/ILO, 2023[48]). Informality at the household level also remains high. Before the pandemic (2018/19 depending on data availability), 42.8% of people in the region lived in a household that depended entirely on informal employment and 21.8% were in mixed households (with formal and informal workers). Taken together, a total of 64.6% of the region’s people depended totally or partially on informal employment. Only the remaining one-third (35.4%) lived in households that depended entirely on formal employment. Among the countries with available data at the household level, people in Bolivia and Peru are especially vulnerable, with more than 60% of households depending exclusively on informal employment. By contrast, in Uruguay, Chile and Costa Rica more than half of people live in completely formal households (Figure 1.15) (OECD et al., 2022[13]; OECD, forthcoming[49]).

Figure 1.15. Evolution of household informality in selected LAC economies

Informality has remained persistently high across most LAC countries over the last two decades. While negative economic shocks tend to increase informality levels, the specific features of the COVID-19 pandemic led to mixed results in the evolution of informality rates. One key factor was the prevalence of widespread informality in sectors that were heavily affected by lockdown and containment measures, compounded by the limited availability of telework opportunities. Similarly, a substantial number of workers within the informal sector became inactive, signifying their exclusion from the labour force (Acevedo et al., 2021[50]). As a result, informality showed different patterns across LAC economies when comparing indicators immediately post-COVID-19 with those of 2019. In Uruguay and Chile, labour formality grew, though for different reasons. In Uruguay, formalisation occurred due to a decline of total employment, with a larger fall in informality than formality. In Chile, total employment grew, and the process of formalisation occurred because informal job losses were offset by growth in formal jobs. Conversely, in the Dominican Republic, Ecuador and Peru, the labour market informalised, mainly because informal employment growth exceeded that for formal employment. Finally, in Argentina, Brazil, Costa Rica, Mexico and Paraguay, the share of informal employment in total employment remained similar to the level of 2019 (OECD, 2023[51]; OECD, forthcoming[49]).

Gaining a perspective on informality within households is essential for policy design. Informality has traditionally been measured at the individual level, which is useful for understanding its heterogeneity and making international comparisons. Nevertheless, this ignores the household context. The informal or formal status of working members within a household may have important implications for its dependent members. The formal employment of at least one household member may increase the household’s access to social insurance schemes, which often cover the contributor’s spouse and/or children. For this reason, households with only informal workers face vulnerabilities that are different – and often of a different magnitude – than mixed households. Adding the household dimension thus presents an opportunity to design targeted public policies that better address specific needs to mitigate the vulnerabilities and negative consequences of informality on individuals and households (OECD, forthcoming[52]). This is of particular importance in the post-pandemic context, in which, due to fiscal restrictions, countries need to improve the targeting and conditionality of social protection measures.

The investment agenda in LAC economies is an opportunity to drive job formalisation. Physical investments in economic sectors can create job opportunities that, if matched with the effective development of human capital, could reduce informality. Investments in human capital should aim to improve workers’ skills to align with labour market demands, especially for those economic activities that are prioritised under the production development policies of LAC countries. In other words, specific support should be provided to informal workers to guarantee that the LAC investment agenda will leave no one behind (Chapter 3).

Key policy messages

The LAC region needs to address both short- and long-term challenges to minimise negative effects on the most vulnerable populations and achieve higher levels of well-being. Advancing production transformation, largely through increased investment and the implementation of well-designed production development policies, will be key to tackle LAC’s structural challenges of low potential growth and low productivity. The region’s investment agenda should prioritise the creation of quality formal jobs and investment in human capital creation.

To successfully implement this agenda, it will be necessary to regain monetary and fiscal policy space. On the monetary front, central banks should focus on guaranteeing price stability, thus anchoring long-term inflation expectations. Co-ordinating fiscal and monetary policies is essential, as policy makers must protect the most vulnerable individuals from the impact of significant price increases and prevent fiscally induced demand pressures on prices.

Regarding fiscal policy, public revenues need to be enhanced progressively. These additional resources can then be allocated towards financing improved public services that enhance long-term growth and overall well-being, and implementing production transformation policies. These revenues can also help to mitigate the adverse effects of economic shocks and contribute to establishing stronger social protection systems that are universal, comprehensive, resilient and sustainable (Box 1.1).

Overall, context-specific socioeconomic characteristics, challenges and possible solutions call for tailored approaches across LAC countries. However, some overarching considerations can help countries establish effective “policy menus” and achieve a good policy mix.

Box 1.1. Key policy messages

Strengthen investment and fiscal frameworks to address low growth in LAC

-

More and better investment is needed in both physical and human capital to increase productivity and thus potential growth.

-

Deeper and well-designed production development policies are needed to address the stagnant productivity challenge.

-

The region must strengthen its fiscal frameworks, with fiscal rules at the core, to safeguard investments.

Support measures to protect the vulnerable from high inflation moderates

-

Ensure that long-term inflation expectations are anchored while protecting the most vulnerable from high inflation.

-

Support credible monetary frameworks via independent central banks and by implementing inflation-targeting regimes.

Expand fiscal space to finance investments under a sustainable fiscal framework

-

The nature of fiscal consolidation and its timing will be important for shaping inclusive economic growth and development.

-

Taxation systems may be improved by balancing policies that can be implemented in the short term with long-term policies. Policy makers may take action to achieve the following goals:

-

Reduce tax evasion and avoidance.

-

Increase tax compliance and strengthen tax administration.

-

Improve the weight of personal income taxes within total taxes in countries highly dependent on indirect taxes and high corporate income taxes.

-

Increase environmentally related taxes and revise general energy subsidies while protecting the most vulnerable populations from potential negative impacts of the green transition agenda.

-

Better promote gender equality throughout the tax system.

-

Rationalise tax incentives and align them with development goals and production transformation strategies. Improve their design by creating binding legal requirements with explicit terms of duration and clear eligibility criteria under a unified body of law.

-

Align the treatment of capital allowances with investment development goals, as certain assets are treated less generously.

-

Undertake periodic reviews of investment tax incentives.

-

Continue improving the well-being of the most vulnerable populations

-

Strengthen measures to protect the most vulnerable individuals and households while continuing to advance towards stronger universal social protection systems.

-

Ensure that the investment agenda in LAC economies helps to create quality formal jobs and includes the necessary investment in human capital.

References

Acevedo, I. et al. (2021), Informalidad en los tiempos del COVID-19 en América Latina: Implicaciones y opciones de amortiguamiento, Inter-American Development Bank, https://doi.org/10.18235/0003220.

Adler, G. and N. Chalk (2023), “In Latin America, Fiscal Policy Can Lighten the Burden of Central Banks”, IMF Blog, International Monetary Fund, https://www.imf.org/en/Blogs/Articles/2023/04/13/in-latin-america-fiscal-policy-can-lighten-the-burden-of-central-banks.

Álvarez, F. et al. (2019), RED 2018: Institutions for productivity: towards a better business environment, Development Bank of Latin America (CAF), Caracas, http://scioteca.caf.com/handle/123456789/1410.

Ardanaz, M. et al. (2021), “The Output Effects of Fiscal Consolidations: Does Spending Composition Matter?”, IDB Working Paper, No. IDB-WP-1302, http://publications.iadb.org/en/output-effects-fiscal-consolidations-does-spending-composition-matter.

Ardanaz, M. and A. Izquierdo (2022), “Current expenditure upswings in good times and public investment downswings in bad times? New evidence from developing countries”, Journal of Comparative Economics, Vol. 50(1), pp. 118-134.

Arreaza, A. et al. (2022), Reglas fiscales para la recuperación en América Latina: experiencias y principales lecciones, Development Bank of Latin America and the Caribbean (CAF), Caracas, https://scioteca.caf.com/handle/123456789/1905.

Astudillo, K. et al. (2022), “Making the Invisible Visible: Applying a Gender Perspective to Strengthen Tax Policy in Latin America and the Caribbean”, Technical Note, No. IDB-TN-2504, Inter-American Development Bank, https://doi.org/10.18235/0004350.

Banco de España (2023), Informe de Economía: Moderación de la inflación, pausa en el endurecimiento monetario y vulnerabilidades fiscales, primer semestre 2023, Banco de España, Departamento de Economía Internacional y Área del Euro, https://www.bde.es/f/webbe/SES/Secciones/Publicaciones/InformeEconomiaLatinoamericana/2023/S1/Fich/EconomiaLatinoamericana_012023.pdf.

CAF (2023), Latin American and Caribbean Outlook, April 2023, Development Bank of Latin America and the Caribbean Internal Document, available upon request.

CAF (2023), Panorama Fiscal en América Latina y el Caribe, Development Bank of Latin America and the Caribbean Internal document, available upon request.

CAF (2022), Inherited Inequalities: The Roles of Skills, Employment and Wealth in the Opportunities of New Generations, Executive Summary, Development Bank of Latin America and the Caribbean (CAF), Bogota, https://scioteca.caf.com/bitstream/handle/123456789/1981/RED2022-Executive%20Summary.pdf?sequence=5&isAllowed=y.

Cavallo, E. et al. (2020), “Growth-friendly fiscal rules? Safeguarding public investment from budget cuts through fiscal rule design”, IDB Working Paper, No. IDB-WP-1083, Inter-American Development Bank, https://publications.iadb.org/en/growth-friendly-fiscal-rules-safeguarding-public-investment-budget-cuts-through-fiscal-rule-0.

Cavallo, E. and M. Pedemonte (2015), “What is the Relationship between National Saving and Investment in Latin America and the Caribbean?”, IDB Working Paper Series, No. IDB-WP-617, http://publications.iadb.org/en/what-relationship-between-national-saving-and-investment-latin-america-and-caribbean.

Cavallo, E. and T. Serebrisky (2016), Saving for Development: How Latin America and the Caribbean Can Save More and Better, Inter-American Development Bank, https://publications.iadb.org/en/saving-development-how-latin-america-and-caribbean-can-save-more-and-better.

Celani, A., L. Dressler and M. Wermelinger (2022), “Building an Investment Tax Incentives database: Methodology and initial findings for 36 developing countries”, OECD Working Papers on International Investment, No. 2022/01, OECD Publishing, Paris, https://doi.org/10.1787/62e075a9-en.

Cherkasky, M. (2022), Inflación global en el bienio 2021-2022 y su impacto en América Latina, Estudios y Perspectivas, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/es/publicaciones/48504-inflacion-global-bienio-2021-2022-su-impacto-america-latina.

De Gregorio, J. (1992), “Economic growth in Latin America”, Journal of Development Economics, Vol. 39/1, pp. 59-84, https://www.sciencedirect.com/science/article/pii/030438789290057G?ref=pdf_download&fr=RR-2&rr=80a169e11c62d712.

ECLAC (2023), Fiscal Panorama of Latin America and the Caribbean 2023: Fiscal Policy for Growth, Redistribution and Productive Transformation, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48900-fiscal-panorama-latin-america-and-caribbean-2023-fiscal-policy-growth.

ECLAC (2023), Foreign Direct Investment in Latin America and the Caribbean 2023, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48979-foreign-direct-investment-latin-america-and-caribbean-2023.

ECLAC (2023), International Trade Outlook for Latin America and the Caribbean 2022: The Challenge of Boosting Manufacturing Exports, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48651-international-trade-outlook-latin-america-and-caribbean-2022-challenge-boosting.

ECLAC (2023), Social Panorama of Latin America and the Caribbean 2023: Labour inclusion as a key axis of inclusive social development, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://repositorio.cepal.org/server/api/core/bitstreams/a4d96610-6048-4044-bf89-2eb3c31fc369/content.

ECLAC (2022), Economic Survey of Latin America and the Caribbean 2022: Trends and Challenges of Investing for a Sustainable and Inclusive Recovery, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48078-economic-survey-latin-america-and-caribbean-2022-trends-and-challenges-investing.

ECLAC (2022), Preliminary Overview of the Economies of Latin America and the Caribbean 2022, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48575-preliminary-overview-economies-latin-america-and-caribbean-2022.

ECLAC (2022), Towards Transformation of the Development Model in Latin America and the Caribbean: Production, Inclusion and Sustainability, United Nations Economic Commission for Latin America and the Caribbean, Santiago, https://www.cepal.org/en/publications/48309-towards-transformation-development-model-latin-america-and-caribbean-production.

ECLAC (2013), Política tributaria para mejorar la inversión y el crecimiento en América Latina, United Nations Economic Commission for Latin America and the Caribbean, Santiago, http://www.cepal.org/es/publicaciones/5361-politica-tributaria-mejorar-la-inversion-crecimiento-america-latina.

ECLAC/ILO (2023), Employment Situation in Latin America and the Caribbean: Towards the Creation of Better Jobs in the Post-pandemic Era, ECLAC and International Labour Organization, https://repositorio.cepal.org/handle/11362/48988.

ECLAC-OXFAM (2019), Los incentivos fiscales a las empresas en América Latina y el Caribe, https://www.cepal.org/es/publicaciones/44787-incentivos-fiscales-empresas-america-latina-caribe.

Galindo, A. and V. Nuguer (2023), Preparing the Macroeconomic Terrain for Renewed Growth, Inter-American Development Bank, https://doi.org/10.18235/0004780.

Hanappi, T. et al. (2023), “Corporate Effective Tax Rates in Latin America and the Caribbean”, Technical note No IDB-TN- 2782, http://dx.doi.org/10.18235/0005168.

IIF (2023), The Institute of International Finance database, https://www.iif.com/Research/Download-Data.

IMF (2023), World Economic Outlook: A Rocky Recovery, International Monetary Fund, https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023.

Izquierdo, A., C. Pessino and G. Vuletin (eds.) (2018), Better Spending for Better Lives: How Latin America and the Caribbean Can Do More with Less, Inter-American Development Bank, https://doi.org/10.18235/0001217-en.

Nieto-Parra, S., R. Orozco and S. Mora (2021), “Fiscal policy to drive the recovery in Latin America: the “when” and “how” are key”, VOXLACEA, https://vox.lacea.org/?q=blog/fiscal_policy_latam.

OECD (2023), Global Revenue Statistics Database, https://www.oecd.org/tax/tax-policy/global-revenue-statistics-database.htm.

OECD (2023), Informality and Globalisation: In Search of a New Social Contract, OECD Publishing, Paris, https://doi.org/10.1787/c945c24f-en.

OECD (2023), OECD Economic Outlook, Volume 2023 Issue 2: Preliminary version, OECD Publishing, Paris, https://doi.org/10.1787/7a5f73ce-en.

OECD (2023), OECD Economic Outlook, Volume 2023 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/ce188438-en.

OECD (2022), Corporate Tax Statistics: Fourth Edition, https://www.oecd.org/tax/beps/corporate-tax-statistics-database.htm.

OECD (2022), Multi-dimensional Review of the Dominican Republic: Towards Greater Well-being for All, OECD Development Pathways, OECD Publishing, Paris, https://doi.org/10.1787/560c12bf-en.

OECD (2022), Tax Policy and Gender Equality: A Stocktake of Country Approaches, OECD Publishing, Paris, https://doi.org/10.1787/b8177aea-en.

OECD (2019), FDI Qualities Indicators: Measuring the sustainable development, OECD Publishing, https://www.oecd.org/investment/fdi-qualities-indicators.htm.

OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

OECD (2010), Taxation, Innovation and the Environment, OECD Publishing, Paris, https://doi.org/10.1787/9789264087637-en.

OECD (forthcoming), Key Indicators of Informality based on Individuals and their Household (KIIbIH), OECD Publishing, Paris, https://www.oecd.org/dev/key-indicators-informality-individuals-household-kiibih.htm.

OECD (forthcoming), Portraying Informality and Households’ Vulnerabilities in Latin America, OECD Publishing, Paris.

OECD et al. (2023), Revenue Statistics in Latin America and the Caribbean 2023, OECD Publishing, Paris, https://doi.org/10.1787/a7640683-en.

OECD et al. (2021), Latin American Economic Outlook 2021: Working Together for a Better Recovery, OECD Publishing, Paris, https://doi.org/10.1787/5fedabe5-en.

OECD et al. (2022), Latin American Economic Outlook 2022: Towards a Green and Just Transition, OECD Publishing, Paris, https://doi.org/10.1787/3d5554fc-en.

Powell, A. and O. Valencia (eds.) (2023), Dealing with Debt: Less Risk for More Growth in Latin America and the Caribbean, Inter-American Development Bank, https://doi.org/10.18235/0004707.

Refinitiv Eikon (2023), Refinitiv Eikon Datastream, https://www.refinitiv.com/en/products/datastream-macroeconomic-analysis.

Sanguinetti, P. et al. (2021), Pathways to integration: trade facilitation, infrastructure, and global value chains, Development Bank of Latin America and the Caribbean (CAF), Caracas, https://scioteca.caf.com/handle/123456789/1907.

World Bank (2023), World Development Indicators, https://datos.bancomundial.org/indicator/CM.MKT.LCAP.GD.ZS?end=2020&start=1975&view=chart.