Recurrent taxes on immovable property are not among the largest for governments as a whole in terms of their revenue collection, but because of their immovable tax base, this type of tax is frequently the tax over which local governments can exert the most control. This autonomy is especially valuable as it allows local governments to adjust their revenues intake to fulfil local demands, increasing political accountability. As a result, recurrent taxes on immovable property can raise enough revenues to fund important public services at the local level, such as housing and community amenities, public order and safety as well as a portion of local expenditure on education, health or social protection.

Making Property Tax Reform Happen in China

1. The role of recurrent taxes on immovable property

Abstract

Key messages

1. Recurrent taxes on immovable property represent a significant portion of local governments’ revenue, although they are only the fourth most important type of tax in terms of overall tax revenue.

2. Recurrent taxes on immovable property are the taxes over which SNGs have most discretion and, thus, have a key role in increasing subnational autonomy and reducing the vertical fiscal gap.

3. Recurrent property taxes revenues are often enough to supply various public goods commonly assigned to local governments such as housing and community amenities and public order and safety but usually cannot finance the entirety of local expenditure on education, health or social protection.

4. The reliance on recurrent taxes on immovable property is correlated with a country’s level of development – not only developed countries tend to rely more on immovable property taxation, but also the more a country develops, the more it tends to increase its reliance on these taxes.

5. The share of local property tax revenues in total local taxation is smaller in China than in the average OECD country, and this gap can be narrowed with a recurrent levy on residential properties.

Property tax revenues and levels of government

Although property taxes are only the fourth most important type of taxes in terms of general government tax revenues, recurrent tax on immovable property represent a significant portion of local governments’ revenues

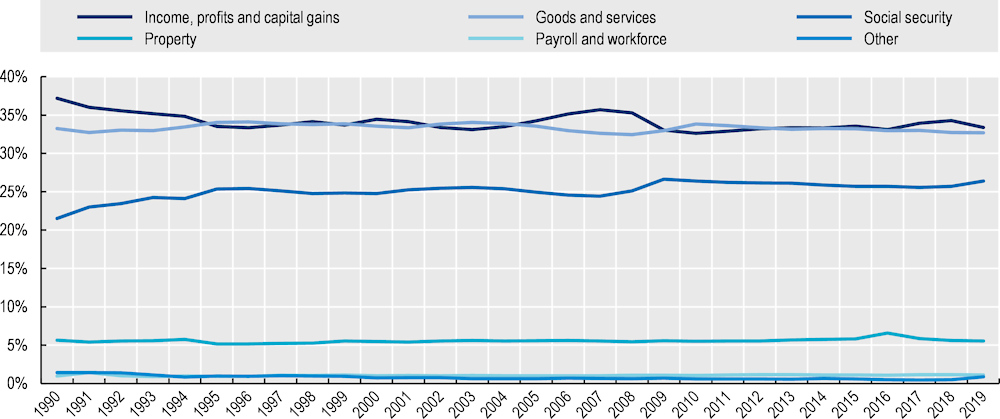

The OECD classifies taxes into six broad categories: 1) taxes on income, profits and capital gains; 2) social security contributions; 3) taxes on payroll and workforce; 4) taxes on property; 5) taxes on goods and services; and 6) other taxes. In terms of tax revenues, taxes on property are the fourth most important category, behind taxes on income, profits and capital gains; taxes on goods and services; and social security contributions. The average share of property tax revenues as a percentage of total taxation in OECD countries is roughly 5.5%, as of 2019, and has not varied much throughout the last three decades (Figure 1.1).

Figure 1.1. Tax revenue as a percentage of total taxation in OECD countries

Source: OECD Revenue Statistics.

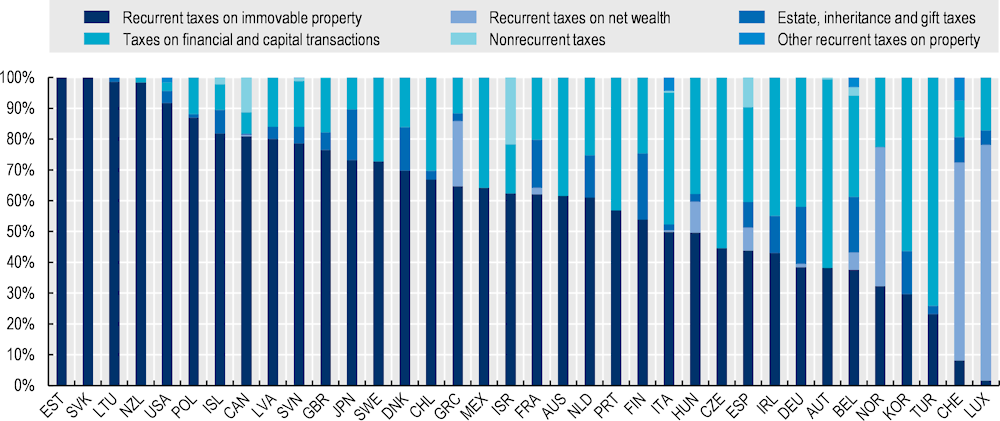

The main subject of this report is recurrent taxes on immovable property, which is a subcategory of taxes on property. For most OECD countries, recurrent taxes on immovable property is the most important category of taxes on property and accounts for, on average, 61% of property tax revenue and 3.2% of total taxation. Figure 1.2, below, depicts tax revenues for each category of property taxes as a percentage of total property tax revenue. In 27 out of 36 OECD countries, recurrent taxes on immovable property are the most important type of property tax in terms of revenue. In countries in which this is not true, a significant levy on net wealth or financial or capital transactions are in place, meaning that in OECD countries recurrent tax on immovable property is by far the most important tax applied to immovable properties.

Brys et al. (2016[1]) suggest that recurrent taxes on immovable property are the least harmful for economic growth, and at the same time, usually do not harm equity. Thus, it is often recommended to boost the share of revenues from these taxes relative to others, more distortive taxes, such as transaction taxes.

Figure 1.2. Tax revenue from categories of property taxes as a percentage of property tax revenue, 2019

Note: Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics.

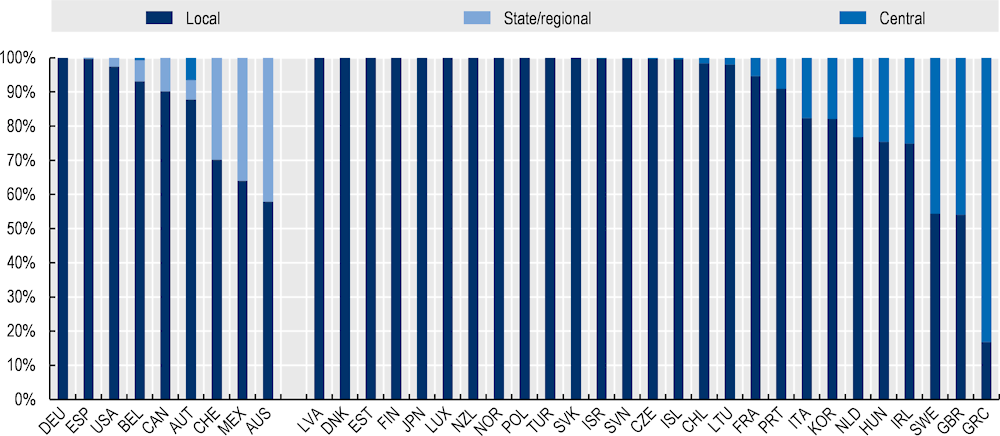

Most of the revenues from recurrent taxes on immovable property are assigned to local governments. Even in countries in which there are three levels of government, local governments tend to get the largest share. Figure 1.3 reveals that in all OECD countries1 with state/regional level of government, local governments receive the majority of the revenues from these taxes. In countries with only two levels of government (local and central), only in Greece does the central government control more than half of the revenues from recurrent taxes on immovable property. A notable exception regards the United Kingdom, where recurrent taxes on residential properties accrue mainly to local governments while non-residential recurrent property taxes accrue to the upper levels of government (including to a certain degree by Scotland and Wales) and are distributed to local governments through grants.

Figure 1.3. Distribution of recurrent taxes on immovable property revenues across levels of government, 2019

Note: Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics (for recurrent taxes on immovable property) and OECD Fiscal Decentralisation database (for SNGs’ revenue)

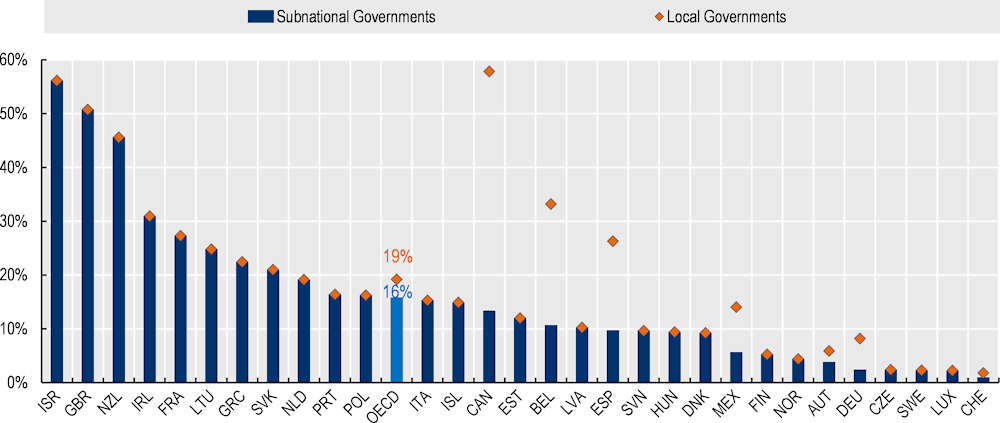

Due to the fact that recurrent property tax revenues accrue mainly to local governments, despite their small share in the total taxation revenues, they do represent a significant portion of subnational governments’ (SNGs) revenues. Figure 1.4, below, reveals that, on average, recurrent taxes on immovable property represent 16% and 19% of SNGs’ and local governments’ revenues in OECD countries, respectively. In Israel and in the United Kingdom, this type of tax represents roughly half or more of total SNGs’ revenues, and in Canada it reaches 58% of total local governments’ revenues.

Reliance on recurrent property tax as a source of tax revenue does not depend on whether the country is federal or unitary. For instance, in federal countries SNGs reliance on recurrent property taxation ranges from almost none (Switzerland with 2%) to significant (United States with 20%). The same can be said for unitary countries – Israel’s and the United Kingdom’s SNGs’ reliance on recurrent taxes on immovable property are rather large and contrast with the meagre reliance of SNGs in Sweden, Luxembourg and Germany, for instance. It is interesting to notice that countries from an Anglo-Saxon tradition tend to rely more on recurrent property taxes – SNGs from the United Kingdom, Ireland and the United States rely more on this type of tax than the average OECD country.

Figure 1.4. Recurrent taxes on immovable property as a percentage of local and state government’s revenues, 2019

Note: SNGs’ revenues are consolidated (defined as total revenue minus the inter-governmental transfer revenue of that government level). Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics (for recurrent tax on immovable property) and OECD Fiscal Decentralisation database (for SNGs’ revenue)

Recurrent taxes on immovable properties and subnational autonomy

Recurrent taxes on immovable property are the taxes over which SNGs have most discretion and, therefore, they tend to increase subnational autonomy and reduce the vertical fiscal gap

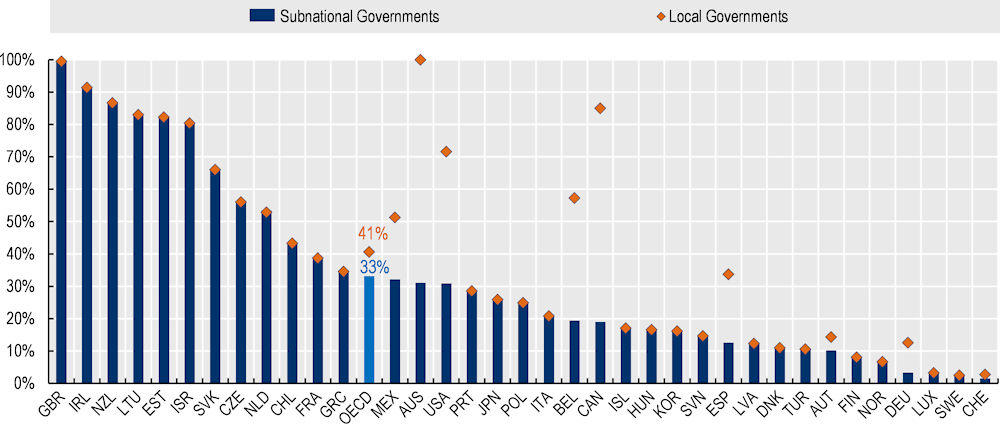

When considering the importance of recurrent taxes on immovable property as a percentage of subnational tax revenue (instead of total revenues), this type of tax has an even more prominent role. Figure 1.5 shows that recurrent taxes on immovable properties represent roughly 33% and 41% of all subnational and local taxation revenue, respectively. In the case of local governments, they represent more than half of the local tax revenue in 14 countries, and in all OECD countries from an Anglo-Saxon tradition (Australia, the United Kingdom, Ireland, New Zealand, Canada and the United States) their share reaches more than 70% of all local tax revenue.

Figure 1.5. Recurrent tax on immovable property as a percentage of local and state government’s taxation, 2019

Note: Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics.

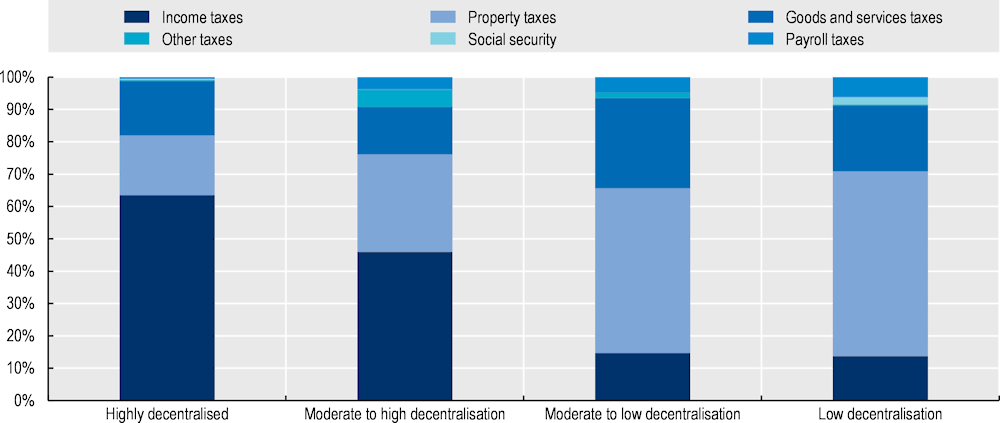

Figure 1.6. The subnational tax mix shifts from property to income as decentralisation increases

1. Each column represents a quartile of OECD countries in order of decreasing subnational revenues as a share of total government revenue. Revenues from tax-sharing agreements where the SCG does not control the rate are not included. Where data for 2018 was not available at the time of publication, data for 2017 was substituted.

2. Countries were grouped into four categories based on their quartiles with regard to subnational revenue as a percentage of general government’s revenue.

Source: Forman, Dougherty and Blöchlinger (2020[2]), based on data from OECD Global Revenue Statistics.

The composition of SNGs’ tax mix appears strongly related to the extent of decentralisation, as shown in Figure 1.5. In more centralised countries, SNGs rely largely on immovable property taxes. Among the bottom 50% of OECD countries in terms of SNGs’ revenues as a percentage of general government revenue, property taxes constitute 48% of SNGs’ tax mix, on average. As decentralisation increases, income taxes start to play a greater role. Countries in the top quartile in terms of SNGs’ revenue as a percentage of general government revenues have income taxes constituting on average 62% of their SNGs’ tax mix. The subnational tax mix has changed relatively little in the last 20 years, with a decline in the share of property taxes and a rise in the share of consumption and income taxes – especially personal income tax. Since around 2010, the property tax share has again been on the rise. Overall, the subnational share of total taxation has hardly increased.

This prominence of recurrent property taxation can be explained to some extent by the fact that SNGs’ tax mix is usually less diversified than central governments’, since not all taxes are well-suited to be collected at the subnational level. Important aspects to be considered when decentralising the collection of a type of tax are tax mobility and tax competition. Recurrent taxes on immovable properties are both, by definition, levied on immovable assets (low tax mobility) and, as discussed previously, not highly distortive. Thus, they tend to be less prone to regional tax competition when properly designed and as a result, are especially suited to be levied at the subnational level. Nevertheless, when they are levied on business, tax competition can occur in some circumstances since companies might prefer to move to where they pay less taxes.

In addition to these elements, it is worth adding that the lower the administrative capacity of a government the more preferred it usually is to have one tax with large revenue capacity than multiple taxes with small revenue capacity2 (Mikesell, 2012[3]). That is because there is a fixed cost associated with the administration of each tax and when a type of tax has a small revenue capacity, it might not generate enough revenues to compensate for the additional administrative and compliance burden, not to mention the added complexity to the tax system. In other words: it tends to be easier to administrate one big tax than multiple small taxes and, thus, for governments with limited administrative capacity, one big tax is preferred over multiple small taxes. Therefore, the assignment of multiple minor taxes to subnational governments is not administratively the same as the assignment of a large tax such as the recurrent taxes on immovable property.

Not only are recurrent taxes on immovable property among the most important sources of own-source revenue for local governments, but they also tend to be the one in which SNGs have the most leeway to set their own tax policy (Dougherty, Harding and Reschovsky, 2019[4]). More specifically, SNGs have more discretion over certain aspects of their recurrent property taxation policy such as over decisions to introduce or to abolish a tax, to set tax rates, to define the tax base, or to grant tax allowances/reliefs to households and firms. In that manner, SNGs can use this tax power to tune their fiscal policy to the needs of the local population. Such aspects of recurrent taxes on immovable property cannot be overlooked since much of the economic and political benefit of decentralised public finance comes from the ability of SNGs to make their own decisions.

More precisely, the modern theoretical underpinnings of decentralisation originated with Oates (1972[5]), who posits the decentralisation theorem that, assuming no cost savings from centralisation, aggregate welfare across a set of jurisdictions will be superior when each jurisdiction is allowed to select its own public consumption bundle as opposed to when uniform consumption is provided across all jurisdictions. And enhancing SNG fiscal autonomy allows the bundle of public goods consumed to be selected locally, thus better matching local preferences.

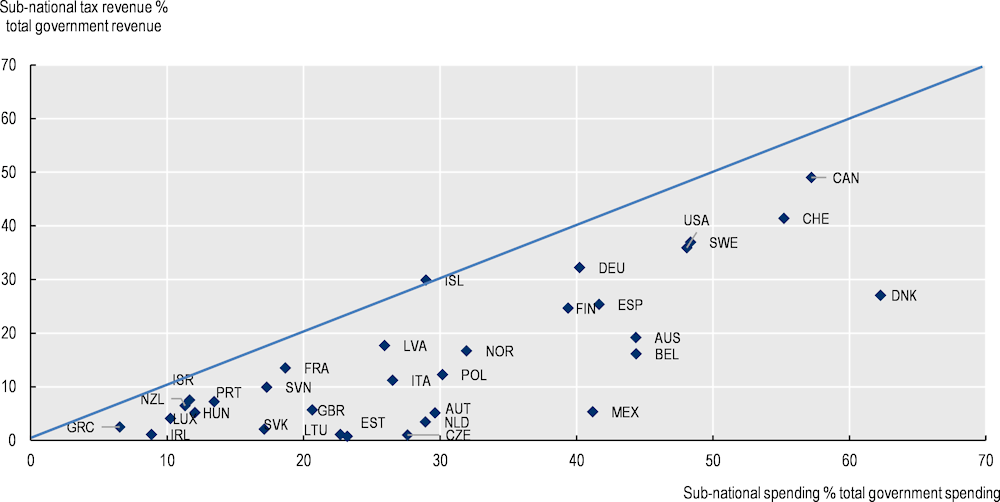

Moreover, increasing subnational own revenues also aligns the incentives of SNGs to reduce moral hazard issues related to fiscal decentralisation. Although the degree of decentralisation varies widely among countries, there is a commonality: spending decentralisation is greater than revenue decentralisation in all countries (Figure 1.7). That is, SNGs own revenues are not sufficient to meet their expenditures. This aspect of fiscal federalism is known as vertical fiscal gap. In order to provide the necessary resources for SNGs, inter-governmental transfers are necessary to fill the gap.

These inter-governmental transfers could also engender a costly misalignment of incentives (Forman, Dougherty and Blöchliger, 2020[2]). More specifically, a “common pool” problem may arise when decentralisation narrows the subnational revenue base and raises the vertical fiscal gap (de Mello, 2000[6]). In this situation, the political costs of raising taxes to transfers to SNGs is borne by the central government but the benefits of the expenditure are enjoyed locally. Rodden (2002[7]) found evidence that SNGs’ reliance on inter-governmental transfers is negatively correlated with fiscal performance, particularly when SNGs have easy access to credit. In addition, when SNGs have more autonomy, not only can they be held accountable for their tax policy, but they also have the tax power to raise revenues themselves, not resorting to the “common pool” of higher levels of government taxation. Although in no country do SNGs have the taxing power necessary to finance all of their expenditures, generally, the lower the fiscal gap, the lower the risk of having common pool problems. And to minimise this risk, recurrent taxes on immovable property are among the best tools that there are.

Figure 1.7. Shares of subnational expenditure and revenue in OECD countries, 2020

Note: The 45 degrees line shows a situation where revenue decentralisation equals spending decentralisation. The farther away a country is from that line, the larger its vertical fiscal gap.

Source: OECD Fiscal Decentralisation database.

Table 1.1. Local expenditure on selected government functions and property tax revenues, both as a percentage of GDP (as of 2018)

|

Social protection |

Education |

General public services |

Recreation, culture and religion |

Health |

Housing and community amenities |

Environmental protection |

Public order and safety |

Local Property Tax |

|

|---|---|---|---|---|---|---|---|---|---|

|

FRA |

2.1% |

1.3% |

2.1% |

1.0% |

0.1% |

0.9% |

0.9% |

0.4% |

2.5% |

|

ISR |

0.9% |

2.2% |

0.6% |

0.7% |

0.0% |

0.3% |

0.4% |

0.0% |

2.0% |

|

JPN |

3.9% |

2.7% |

1.6% |

0.4% |

1.8% |

0.6% |

1.0% |

1.0% |

1.9% |

|

AUS |

0.1% |

0.0% |

0.6% |

0.5% |

0.0% |

0.3% |

0.3% |

0.1% |

1.7% |

|

ISL |

2.6% |

4.4% |

1.5% |

2.0% |

0.0% |

0.4% |

0.2% |

0.1% |

1.7% |

|

GBR |

3.2% |

2.2% |

0.7% |

0.2% |

0.2% |

0.7% |

0.4% |

0.8% |

1.6% |

|

DNK |

18.1% |

2.8% |

1.1% |

0.7% |

7.9% |

0.1% |

0.2% |

0.1% |

1.3% |

|

BEL |

1.4% |

1.4% |

1.3% |

0.7% |

0.0% |

0.2% |

0.4% |

0.8% |

1.2% |

|

POL |

2.6% |

3.4% |

1.2% |

1.0% |

2.0% |

0.5% |

0.4% |

0.2% |

1.1% |

|

ESP |

0.6% |

0.2% |

2.0% |

0.6% |

0.1% |

0.3% |

0.6% |

0.4% |

1.1% |

|

ITA |

0.7% |

0.8% |

2.4% |

0.2% |

6.6% |

0.4% |

0.8% |

0.2% |

1.0% |

|

FIN |

5.3% |

3.5% |

3.9% |

0.9% |

5.6% |

0.2% |

0.1% |

0.2% |

0.8% |

|

LVA |

1.1% |

3.9% |

0.6% |

0.9% |

0.9% |

1.0% |

0.2% |

0.2% |

0.8% |

|

PRT |

0.6% |

0.7% |

1.7% |

0.4% |

0.3% |

0.4% |

0.5% |

0.1% |

0.7% |

|

NLD |

3.0% |

3.9% |

0.9% |

0.8% |

0.5% |

0.3% |

1.2% |

0.3% |

0.7% |

|

KOR |

2.8% |

3.9% |

2.1% |

0.6% |

0.5% |

0.9% |

0.7% |

0.2% |

0.7% |

|

SVN |

0.9% |

3.0% |

0.7% |

0.7% |

1.0% |

0.4% |

0.2% |

0.1% |

0.5% |

|

IRL |

0.8% |

0.2% |

0.1% |

0.1% |

0.0% |

0.3% |

0.2% |

0.1% |

0.4% |

|

DEU |

2.7% |

1.2% |

1.4% |

0.4% |

0.2% |

0.3% |

0.3% |

0.3% |

0.4% |

|

SVK |

0.5% |

2.6% |

0.9% |

0.4% |

0.2% |

0.4% |

0.4% |

0.1% |

0.4% |

|

NOR |

4.9% |

3.8% |

1.3% |

1.0% |

2.2% |

0.8% |

0.7% |

0.2% |

0.4% |

|

HUN |

0.7% |

0.9% |

1.6% |

0.7% |

0.3% |

0.4% |

0.2% |

0.0% |

0.4% |

|

SWE |

6.4% |

5.3% |

2.6% |

0.8% |

6.5% |

0.6% |

0.4% |

0.2% |

0.4% |

|

GRC |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.3% |

|

LTU |

0.8% |

2.8% |

0.5% |

0.5% |

1.4% |

0.4% |

0.3% |

0.1% |

0.3% |

|

EST |

0.7% |

3.5% |

0.6% |

0.8% |

1.3% |

0.3% |

0.3% |

0.0% |

0.2% |

|

CZE |

0.8% |

3.1% |

1.2% |

0.8% |

1.4% |

0.6% |

0.7% |

0.2% |

0.2% |

|

AUT |

1.8% |

1.4% |

1.2% |

0.5% |

1.7% |

0.1% |

0.2% |

0.1% |

0.2% |

|

CHE |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.2% |

|

LUX |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

|

% of blue cells |

19% |

19% |

29% |

42% |

45% |

58% |

74% |

84% |

- |

Note: Values are painted in blue in case they are both 1) greater than zero and 2) smaller than recurrent taxes on immovable property revenues of the respective country. Last row refers to the percentage of blue cells in the column (i.e. that is, the percentage of countries that can fund the local government expenditure on the respective function using only their local revenues from recurrent taxes on immovable property).

Source: OECD Revenue Statistics and OECD System of National Accounts.

Public goods financed with revenues from recurrent taxes on immovable property

Recurrent taxes on immovable property revenues are often enough to supply all public goods commonly assigned to local governments such as housing and community amenities and public order and safety, but cannot finance the entirety of local expenditure on education, health or social protection

Local governments in every country provide a wide range of goods and services. A principles-based intuition about which types of services local governments usually provide can be obtained through an analysis of the characteristics of these goods. Some goods supplied by the government have private goods features (i.e. excludable and/or rivalrous) such as sewage, waste collection and some types of recreation like museums. In principle, it makes sense for some of those goods to be at least partially financed by their consumers through government fees, since they can be easily identified, and free-rider behaviour can be partially avoided. Other goods provided by local governments such as those related to public order and safety, recreation and housing benefit local dwellers as a whole (i.e. non-excludable and/or non-rivalrous) and, thus, in principle should be funded with local taxes imposed on residents.

In practice local and regional/state governments are sometimes responsible for the provision of a substantial share of health, education and social protection expenditures. These countries tend to be on the right side of Figure 1.7 (e.g. Canada, Denmark, Switzerland, Sweden and the United States). Usually revenues generated by recurrent taxes on immovable properties are not sufficient to finance these costlier services, but they are, in many OECD countries, enough to cover those services whose benefits are accrued to local communities, mentioned in the previous paragraph (see Table 1.1).

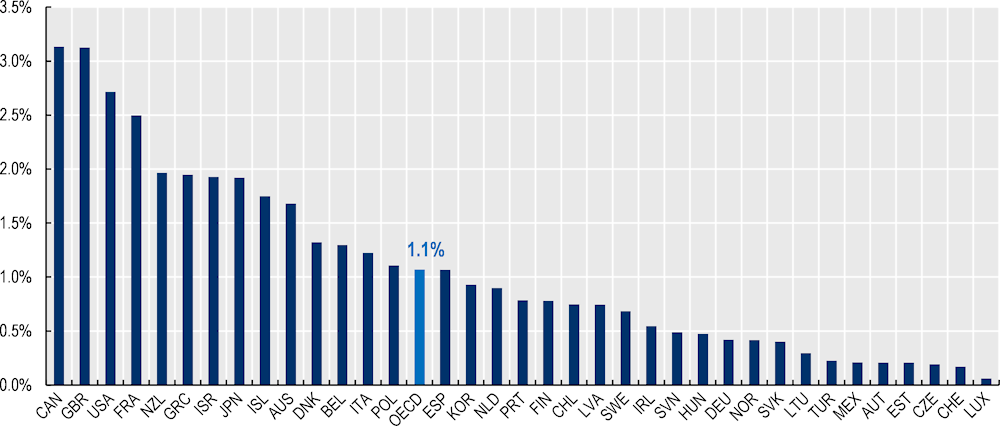

Revenues from recurrent taxes on immovable property as a percentage of GDP ranges from 0.1%, in Luxembourg, to 3.1%, in Canada (Figure 1.8). On average in OECD countries this share is 1.1%.

Figure 1.8. Recurrent taxes on immovable property as a percentage of GDP, 2019

Note: Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics.

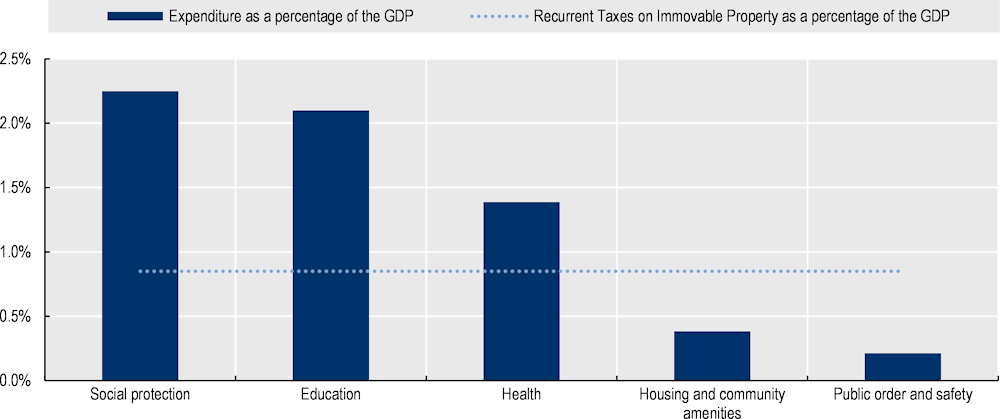

In comparison, local government expenditure on social protection, education, health, housing, and public order/safety are, respectively, 2.2%, 2.1%, 1.4%, 0.4% and 0.2% of GDP (Figure 1.9). Thus, roughly half of the local revenues from recurrent taxes on immovable property can be used to fund, on average, the entirety of local expenditure on housing and community amenities,3 and public order and safety. If channelled to fund social protection or education instead, they can fund about half of all local expenditures on these items individually. In the case of health, it could fund roughly 61% of all local health expenditures (see Table 1.1, above, for a country-specific analysis).

Figure 1.9. Recurrent tax on immovable property local revenues and local government expenditure on selected functions as a percentage of GDP, 2018

Source: OECD Revenue Statistics and OECD System of National Accounts.

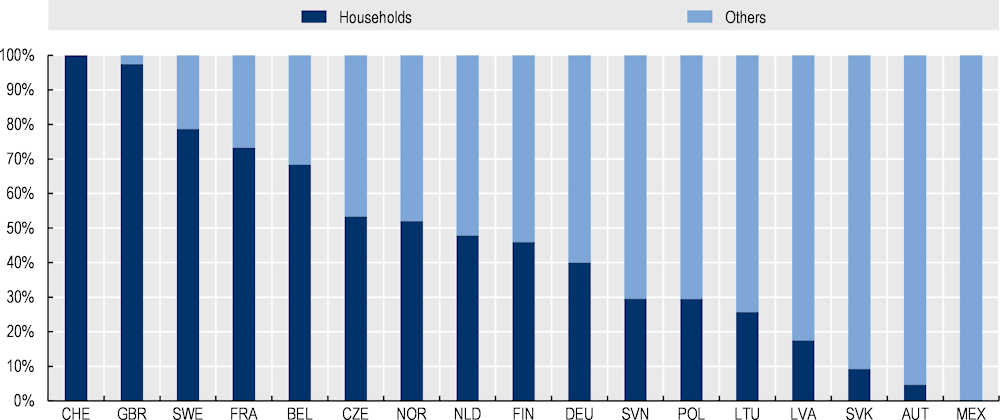

All calculations so far considered all revenues collected through the use of recurrent taxes on immovable properties. Nevertheless, these taxes are levied on multiple types of properties. OECD Revenue Statistics divides the tax base into two broad tax bases: households4 and others (mostly business/producers). Figure 1.10 reveals that, on average, 46% of recurrent taxes on immovable properties revenues stem from households whereas the remaining 54% from other types of properties. Therefore, when considering only the levies on households,5 recurrent taxes on immovable properties generate revenues, as a percentage of GDP, from 0.1% in Mexico6 to 1.73% in France, averaging roughly 0.38%.7 Thus, the portion of recurrent taxes on immovable property that is levied on residences is, alone, enough to cover the average local expenditure on housing and community amenities, of 0.37% of GDP. Box 1.1 covers the role of recurrent taxes on immovable property in the United Kingdom.

Figure 1.10. Share of revenues from recurrent tax on immovable property by tax base, 2019

Note: Values as of 2019 or closest year with available data.

Source: OECD Revenue Statistics.

Box 1.1. A brief look of the role of recurrent taxes on immovable property in the United Kingdom

The United Kingdom recurrent tax on immovable property (the Council Tax) applies to residential properties in England, Wales and Scotland. It was first introduced in 1993 and, at that time, it represented roughly 0.8% of the United Kingdom’s GDP, a value that has gradually increased to 1.6%, in 2019. The introduction of the Council Tax significantly changed the source of income of British municipalities. In 1992, the year before the reform, recurrent taxes on immovable property represented only 1.6% of local taxation, against 74% in 1993, the year of the introduction of the new taxes, and from 1994 onwards it has accounted for virtually 100% of total local taxation. It replaced the Community Charge, which was a poll tax in the form of a single flat rate set by local governments on every adult. The Council Taxes, through the use of bands for property values and certain exemptions and discounts, are more progressive than the Poll Tax, and their features haven’t changed much since inception.

The business property taxes, in contrast to the levy on households, are managed by the central government, who took over rate-setting in 1990. Since 2009, though, local authorities have been permitted to levy a supplementary local rate (known as a business rate supplement) below an upper limit of 2% of rateable value. Taxes are paid into a central pool and distributed to local governments through inter-governmental transfers largely on a per capita basis. In contrast to the levies on households, the taxes levied on business properties saw their value decrease from 1.7% to 1.4% of GDP and from 5.7% to 4.4% of total taxation from 1993 to 2019.

Together both levies account for approximately 3.1% of the United Kingdom’s GDP, about one-third of total local revenues, and represents 9.5% of all taxation in the country, as of 2019. Naturally, their revenues are used to fund important public services at the local level. The levy on households alone is enough to (but not earmarked to) fund roughly all local expenditure on public order and safety (0.8% of GDP), housing and community amenities (0.5% of GDP) and recreation (0.2% of GDP) – all activities that impact the life of local dwellers, potentially being capitalised into house prices. The business property taxes, that are collected by the central government but distributed back to local governments, generate enough revenue to cover all local costs with environment protection (0.4% of GDP) and economic affairs (0.9% of GDP), which refers to general economic and commercial policies, such as those related to the regulation and support of sectors such as agriculture, manufacturing, construction, energy, transport (i.e. construction and maintenance of road transport systems and facilities for all means), communication (i.e. maintenance of communication systems such as postal, telephone, telegraph, wireless and satellite communication systems) and tourism. It is worth highlighting that both sources of revenues are not earmarked to these types of expenditures.

Sources: OECD Revenue Statistics and COFOG data; Slack and Bird (2014[8]).

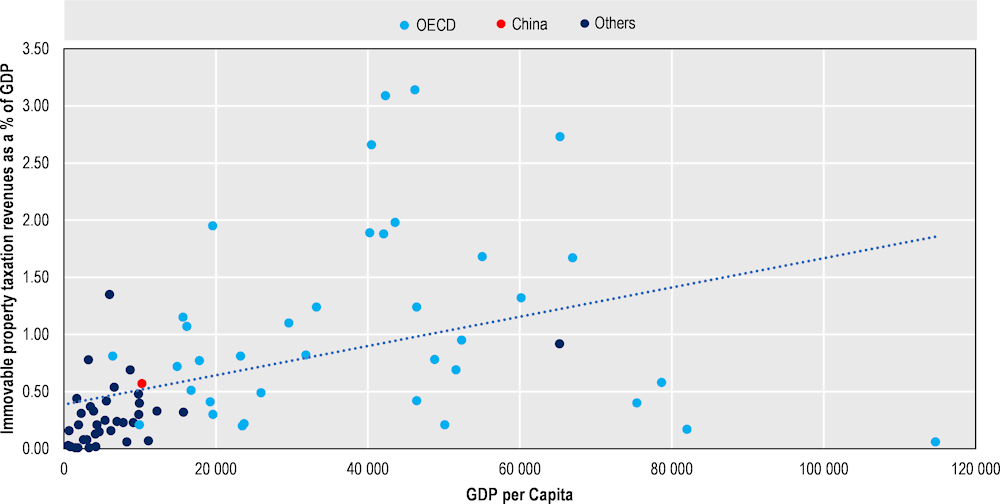

Property taxes and the stage of development

Reliance on recurrent taxes on immovable property is, to some extent, correlated with income levels. Figure 1.11 reveals that, despite the substantial cross-country variation, especially for more advanced OECD countries, there is an overall tendency to rely more on immovable property taxation than in developing ones. Advanced economies that rely the least on immovable property taxation tend to be small or to have a small population such as Luxembourg, Switzerland, Ireland and Norway. Notably more advanced large countries tend to rely the most on these taxes, such as the United States, Canada, France and Japan.

Figure 1.11. GDP per capita against immovable property taxation as a percentage of GDP (as of 2019)

Note: Countries covered: ARG, AUS, AUT, BEL, BGR, BRA, CAN, CHE, CHL, CHN, CIV, CMR, COL, CRI, CZE, DEU, DNK, DOM, ECU, EGY, ESP, EST, FIN, FRA, GBR, GRC, GTM, GUY, HND, HUN, IDN, IRL, ISL, ISR, ITA, JAM, JPN, KAZ, KEN, KOR, LTU, LUX, LVA, MAR, MEX, MLI, MNG, MRT, MUS, NER, NIC, NLD, NOR, NZL, PAN, PER, PHL, POL, PRT, PRY, RWA, SGP, SLV, SVK, SVN, SWE, SWZ, TGO, THA, TUN, TUR, URY, USA, ZAF.

Source: OECD Revenue Statistics and World Bank Data.

Clements et al. (2015[9]) explored more rigorously what determines the level of recurrent property taxation and concluded that the country-wise effect of development, urbanisation, openness to trade and legal heritage are positive and significant. In a panel data analysis, they gathered evidence that this effect also occurs over time – that is an improvement in a country’s level of development over time tends to be correlated with an increase in the reliance on recurrent taxes on immovable property. In summary, not only developed countries tend to rely more on immovable property taxation, but also as a country develops, it tends to increase its reliance on these taxes.

China’s reliance on recurrent taxes on immovable property is close to the average for its income level (see the red dot in Figure 1.11). Nevertheless, this does not mean that China should not reform its property tax system. China has been developing rapidly, which entails that there is room for increasing its reliance on immovable property taxation, following the steps of other large and developed economies. In addition, there are many other reasons for shifting towards recurrent taxes on immovable property, which are treated in detail throughout this report.

The role of property taxes in China’s taxation

The share of local property tax revenues in total local taxation is smaller in China than in the average OECD country

Since the late 1980s, China has introduced a myriad of taxes on properties. According to OECD Revenue Statistics, the following property taxes are levied in China8 (for more details see Annex A):

House Property Tax: Ad valorem levy on the residual value of properties and rental income. House properties owned by individuals for non-business purposes are exempt. This tax was introduced in 1986 and revised in 2011.

Urban Maintenance and Construction Tax: A recurrent tax on immovable property levied on land areas and collected from business, implemented in 1985.

Stamp tax: Introduced in 1988 and applies to enterprises and individuals who execute or receive certain types of documentation.

Stamp Tax on Securities Transactions: Similar to above, introduced in 1992.

Deed tax: Payable by the transferee upon the transfer of landed property, introduced in 1997.

Urban and Town Land-use Tax: A value-added tax particularly used in city maintenance and construction.

Land Appreciation Tax: A tax levied on units and individuals for their value-added incomes derived from transference of use rights of state-owned land and property right of buildings and attached installations thereon – it is in place since 1994.

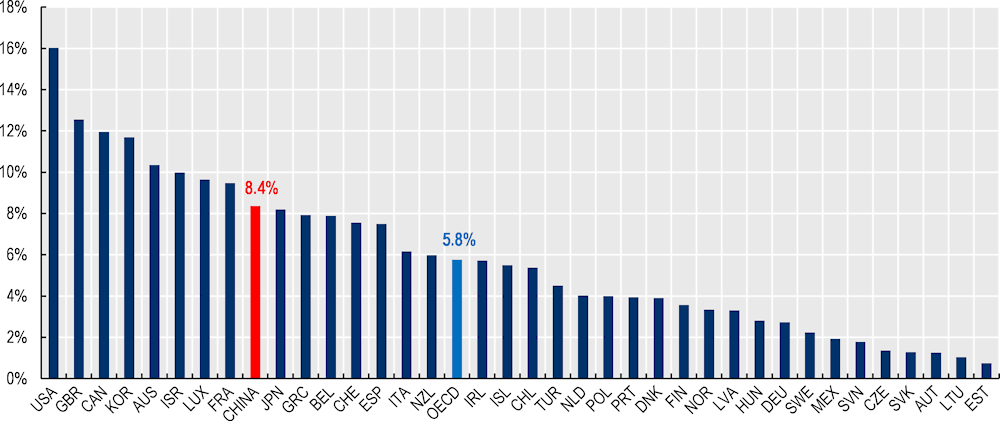

Revenues from these taxes on real property accounted for 8.4% of total taxation in China, a share that is higher than OECD’s average of 5.8% (Figure 1.12). This result put China in a position similar to France and Japan, both countries that rely substantially on property taxes.

Figure 1.12. Property taxes’ revenues as a percentage of total taxation by country, 2018

Source: OECD Revenue Statistics.

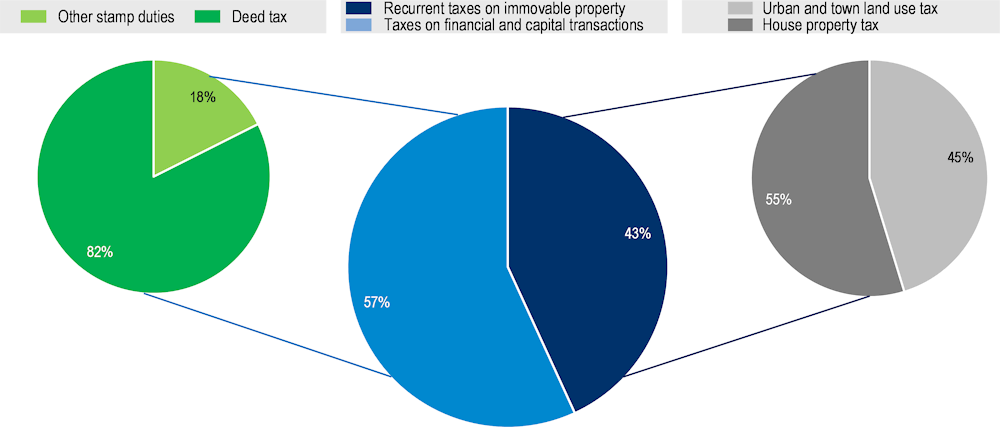

Nevertheless, it is worth noting that the composition of China’s property tax revenues is markedly different than most OECD countries. According to OECD Revenue Statistics, in 17 OECD countries with data available on the tax base of recurrent taxes on immovable properties, 16 of them collect some portion of their revenues from households (Figure 1.10, above), while China does not.9 Revenues collected from these levies on residences range from 0% to 2.1% of GDP in OECD countries, averaging 0.41%. China, on the other hand, collects 43% of its property tax revenues from taxes on financial and capital transactions (Figure 1.13, below), against an average of 25% in OECD countries (Figure 1.10). Transaction taxes are considered highly distortionary, and hence, damaging to economic growth. For this reason, OECD usually recommends countries to reduce these levies in detriment of a greater use of recurrent property taxes (Hagemann, 2018[10]).

Figure 1.13. China’s property tax revenues breakdown by specific taxes, 2018

Source: OECD Revenue Statistics.

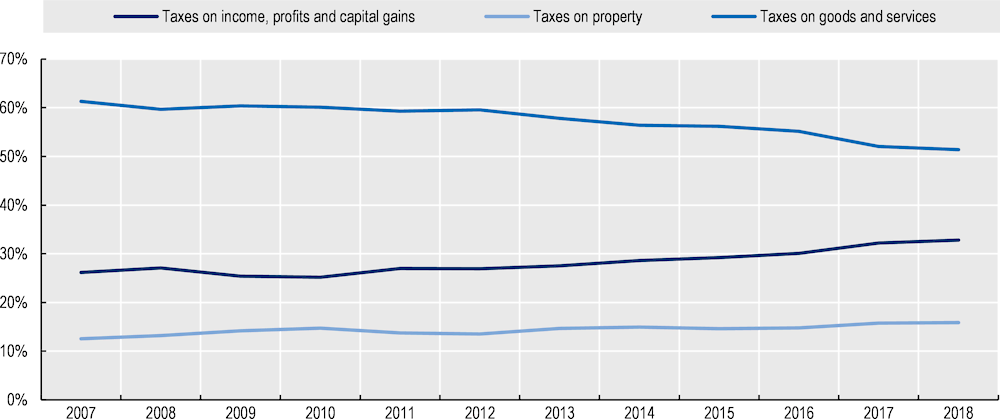

Apart from the stamp tax on securities transactions and part of the urban maintenance and construction tax, all other Chinese property taxes accrue to local governments. In conjunction, these taxes on properties have become increasingly important in China’s cities – its share in local taxation has increased from 13% in 2007 to 16% in 2018 (Figure 1.14). Despite this fact, this value is below the average share of property taxation in local government total taxation in OECD countries, which is around 40% (refer to Figure 1.6).

Figure 1.14. Chinese local government’s tax revenues as a percentage of total local taxation, 2018

Note: Local governments tax share in general government’s taxation is roughly 50%, as of 2018.

Source: OECD Revenue Statistics.

The legal framework currently in place in China gives local governments power to provide land for urban development (Liu, 2021[11]). More specifically, local governments have the power to control and regulate land use, such as by converting rural land into urban land through land expropriation. The expropriated rural land is then sold through market competition to real estate developers that usually offer a higher price for this land than the local government pays to compensate rural villages. As a result, this operation generates revenue for local governments. Liu (2021[11]) shows that land concession revenues are significant – for comparison’s sake, they have ranged from 30% to 60% of the locally general budgetary revenues over the past two decades.10

Moreover, China’s local governments have exploited their land concession power by using their future revenues as a collateral for loans. Despite a restriction on local government borrowing that was in place until 2014, local governments used urban development investment corporations to borrow, often using land as collateral. Liu (2021[11]) cites a State Audit Report that estimated the amount of outstanding local debt reached 28.6% of China’s GDP in 2013. To put this value in perspective, in OECD countries local government debt averages 7.2% of GDP and is only higher than 28.6% in Japan (33.2%).11 This problem was alleviated after 2014, when the central government imposed a debt ceiling on local borrowing and allowed some local governments to issue bonds directly, in order to improve their debt management.

Local governments’ reliance on profits from land concession transactions and relatively high indebtedness poses a challenge to local finances. Relying on revenues from land concession transactions can be unsustainable in the long run, given that this source of revenue depends on the exploration of the limited supply of land (OECD, 2017[12]). In addition, reliance on these sources of revenue can incentivise urban sprawl. It is thus important to strengthen local finances, and a recurrent levy on owned residential property is an attractive option. As discussed throughout this chapter, such a levy is widely used across OECD countries and often represents a significant proportion of local revenues.

References

[1] Brys, B. et al. (2016), “Tax Design for Inclusive Economic Growth”, OECD Taxation Working Papers, No. 26, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jlv74ggk0g7-en.

[15] CDRF (2020), Background document on China’s property taxation, China Development Research Foundation.

[9] Clements, B. et al. (2015), “Taxing Immovable Property: Revenue Potential and Implementation Challenges”, IMF Working Paper, Vol. WP/13/129.

[6] de Mello, L. (2000), “Fiscal Decentralization and Intergovernmental Fiscal Relations: A Cross-Country Analysis”, World Development, Vol. 28/2, pp. 365-380, http://dx.doi.org/10.1016/s0305-750x(99)00123-0.

[4] Dougherty, S., M. Harding and A. Reschovsky (2019), “Twenty years of tax autonomy across levels of government: Measurement and applications”, OECD Working Papers on Fiscal Federalism, No. 29, OECD Publishing, Paris, https://dx.doi.org/10.1787/ca7ebc02-en.

[13] Eurostat (2019), Manual on sources and methods for the compilation of COFOG statistics — Classification of the Functions of Government (COFOG) — 2019 edition, http://dx.doi.org/10.2785/110841.

[2] Forman, K., S. Dougherty and H. Blöchliger (2020), “Synthesising good practices in fiscal federalism: Key recommendations from 15 years of country surveys”, OECD Economic Policy Papers, No. 28, OECD Publishing, Paris, https://dx.doi.org/10.1787/89cd0319-en.

[10] Hagemann, R. (2018), “Tax Policies for Inclusive Growth: Prescription versus Practice”, OECD Economic Policy Papers, No. 24, OECD Publishing, Paris, https://dx.doi.org/10.1787/09ba747a-en.

[11] Liu, Z. (2021), “Municipal finance and property taxation in China”, in Local Public Finance and Capacity Building in Asia: Issues and Challenges, OECD Publishing, Paris, https://dx.doi.org/10.1787/73c69466-en.

[3] Mikesell, J. (2012), “Administration of Local Taxes An International Review of Practices and Issues for Enhancing Fiscal autonomy”, in Primer on Property Tax: Administration and Policy, John Wiley & Sons, Ltd, pp. 89-124, http://dx.doi.org/10.1002/9781118454343.ch4.

[5] Oates, W. (1972), Fiscal Federalism, Edward Elgar Publishing.

[14] OECD (2020), Global Revenue Statistics Database, OECD, Paris, https://www.oecd.org/tax/tax-policy/global-revenue-statistics-database.htm.

[12] OECD (2017), OECD Economic Surveys: China 2017, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-chn-2017-en.

[7] Rodden, J. (2002), The Dilemma of Fiscal Federalism: Grants and Fiscal Performance around the World, Midwest Political Science Association, https://doi.org/10.2307/3088407.

[8] Slack, E. and R. Bird (2014), “The Political Economy of Property Tax Reform”, OECD Working Papers on Fiscal Federalism, No. 18, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jz5pzvzv6r7-en.

Notes

← 1. All OECD countries with available data.

← 2. Although it is in general better to have small and relevant taxes than having a myriad of taxes with limited revenue raising capacity, it is also important to keep in mind that overreliance on just one or a few types of tax can be risky. That is because any event/policy change that damages these sources of revenue would more vigorously affect a government’s revenue.

← 3. Housing and community amenities refer to housing development, community development, water supply and street lighting. Housing development regards the development and regulation of housing standards; slum clearance related to provision of housing; acquisition of land needed for construction of dwellings; construction or purchase and remodelling of dwelling units for the general public or for people with special needs. Community development concerns, among others, planning of new communities or of rehabilitated communities and administration of zoning laws and land-use. For more details see Eurostat (2019[13]).

← 4. Taxes on dwellings occupied by households, regardless of housing tenure (owner-occupiers, tenants or landlords) are classified under households.

← 5. Tax revenues under the code 4110 (recurrent taxes on immovable property applied to households) in OECD Revenue Statistics for 2019 (or closest year with data available).

← 6. Based on comments from Mexican delegates to OECD Working Groups.

← 7. Considering only countries with data available with that level of resolution (the countries in Figure 1.10).

← 8. Based on OECD (2020[14]) and CDRF (2020[15]). Urban maintenance and construction tax, and securities stamp transaction tax were assumed to be property taxes, following the methodology from OECD (2020[14]).

← 9. According to OECD Revenue Statistics, China has no revenues collected under the code 4110 (recurrent taxes on immovable property applied to households).

← 10. Note these figures may be overestimated as local governments can typically only make use of about 30% of the funds collected from land transfer fees (CDRF, 2020[15]).

← 11. OECD Fiscal Decentralisation database.