The main motivations for introducing recurrent taxes on immovable property are to increase tax system efficiency, boost subnational revenue autonomy, make the real estate market more stable and improve quality of land use. Yet recurrent taxes on immovable property may distort investment allocation decisions and can have positive or negative distributive effects. In order to achieve these multiple advantages while minimising the potential downsides, different tax designs are employed across various OECD countries. Tax rates may vary horizontally (i.e. with property use, property characteristics and/or owner characteristics), vertically (i.e. with property value) and regionally (i.e. across jurisdictions). Most countries provide targeted tax benefits, most of which are aimed at low income homeowners and businesses, with substantial differences in the form of the benefits and on their eligibility. This chapter explores such differences in tax design across OECD countries.

Making Property Tax Reform Happen in China

2. Designing recurrent taxes on immovable property

Abstract

Key messages

1. The wider the tax base of recurrent taxes on immovable property, the more a country can increase tax revenues while minimising allocative distortions.

2. The introduction of recurrent taxes on immovable property can be made in conjunction with the reduction of the levies on property transactions. Such a reform might leave the immovable property prices relatively unaffected and the tax system more growth-friendly and easier to administer.

3. Letting tax rates vary within pre-established bands might improve horizontal equality, mitigating tax avoidance and competition, while providing to local governments sufficient autonomy to tune their fiscal policy to local needs, property type distribution and tax revenue capacity.

4. The use of tax reliefs and exemptions are widely employed in OECD countries. Countries differ significantly with regard to exemptions granted, which reflects the wide range of policy objectives that can be achieved through the use of this instrument. However, these policy objectives can often be achieved more efficiently through other means.

5. Tax reliefs and exemptions are commonly employed to support business. Nevertheless, evidence shows that they have only a limited effect.

6. In countries in which prices of immovable properties vary widely across jurisdictions, progressivity can be improved by giving a tax-free basic allowance that could vary across provinces and cities. An even better effect on the distribution of income can be achieved in a less complex way by providing a tax relief to low-income households or using other tools, such as personal income taxes or even policies unrelated to the tax system such as income transfer programmes.

7. Recurrent taxes on immovable property can be used to reduce house price volatility and to make housing more affordable to low-income households. These desired effects depend on the incidence of the tax, which is defined by the supply and demand elasticities of housing and on the frequency of reassessments – the more reassessments the greater the effect.

8. Granting limited autonomy to local governments over their tax policies and inter-governmental co‑ordination in land-use policies can alleviate urban sprawl, leading to a more sustainable and efficient land use in the long run.

Importance of design features

The design features of a tax system determine to a great extent its distributional and allocative impacts

Although taxes are often used to pursue policy objectives, arguably their most important role is to raise revenues to fund government expenditures. Unfortunately, rarely, if ever, can a tax raise revenues without creating economic distortions. Taxes affect relative prices and, as a result, may change behaviour in a way that is harmful to economic activity. Furthermore, taxes levied on households with limited income (i.e. ability to pay) may create economic hardships. Therefore, taxes should be designed so that they can raise sufficient revenues while minimising economic distortions and allocating their burden in a fair and equitable manner.

Each type of tax (e.g. income, product, property, etc.) has its own economic properties. Furthermore, tax design (e.g. definition of tax rates, bases, among other elements) can have large effects on its capacity to raise revenues, on resource allocation and on the income distribution. Moreover, the effects of different taxes are interdependent. Therefore, since tax reforms should ideally consider the impact of the reformed tax in conjunction with other taxes frequently multiple taxes are reformed together.

During the past decades, tax reforms across OECD countries have focused on narrowing the growing income gap1 while minimising the adverse effects on growth. Consensus has steadily grown on the following ranking of taxes, from least to most harmful to economic growth: recurrent taxes on immovable property, consumption taxes, personal income taxes and corporate income taxes (Hagemann, 2018[1]). However, even for the growth-friendly recurrent taxes on immovable property, their impacts on growth depend on their design features and administrative efficiency. Moreover, recurrent taxes on immovable property are often considered to be more regressive than other important taxes such as income taxes. Nevertheless, while it is indeed true that income taxes tend to be more progressive than recurrent taxes on immovable property, the latter can be designed and administered in a manner that they do not increase income inequality.

This chapter focuses on the design features of recurrent taxes on immovable property so that a government can: 1) raise an adequate level of tax revenues; 2) improve the income distribution; and 3) minimise adverse impacts on resource allocation. First, the chapter delineates general principles of taxation, highlighting specific principles for recurrent taxation on immovable property. Second and third sections discuss tax scope, rates and reliefs. Lastly, the fourth, fifth and sixth section examine potential impacts of a property tax reform on the overall tax system, housing investments, house prices and land use.

General principles of tax design

Ideally taxes should be able to provide a stable and significant source of revenue while minimising allocative distortions in a fair, equitable and transparent manner; nevertheless, seldom can an individual tax achieve all these goals simultaneously

Taxation is often used as a means to support the achievement of fiscal policies’ goals, which can be summarised by three functions of government (Musgrave, 1959[2]) – allocative (i.e. efficient use of resources, provision of goods and services), redistribution (i.e. reduction of inequalities) and stabilisation (i.e. full employment and price stability). These functions of government, along with other principles/criteria, are often used by economists to design/evaluate tax systems, such as capacity to generate revenues and transparency. The list below summarises some of these principles – based on Slack (2012[3]):

1. Capacity to generate revenues: Net (of administrative and compliance costs) tax revenues should be sufficient to fund government spending.

2. Allocation of resources: This refers to the effects of taxes on the behaviour of individuals and/or businesses. Some taxes are designed to change behaviour (e.g. sin taxes are designed to reduce, for instance, tobacco consumption), but, in most cases, behavioural changes may influence resource allocation in an undesirable manner. For recurrent taxes on immovable property, shifts in behaviour may involve decisions about where to open/locate a business, where to live and about how much to invest in land and buildings, including deciding whether buying or renting a house.

3. Equity: Taxes are commonly analysed through the lenses of the benefit principle and of taxpayers’ ability to pay. The benefit principle refers to the idea that public services should preferably be funded by those who benefit from their supply. Although the application of the principle is straight-forward, beneficiaries of public services are not always easily identifiable (e.g. for streetlight, public infrastructure, national security, among others), and in these cases, the tax burden should ideally be borne proportionally to taxpayers’ ability to pay. For recurrent taxes on immovable property, the ability to pay is often estimated through taxpayers’ property value, income and, sometimes, personal characteristics such as age, phase of life, number of dependents, among others. Both vertical equity (i.e. the higher the income the higher the tax burden) and horizontal equity (i.e. taxpayers with similar conditions should have similar tax burden) are desirable.

4. Stability: Taxes should provide a stable source of revenue to fund the relatively stable government expenditures. This principle is linked to the concept of buoyancy, which is related to the relation between tax revenues and economic activity. In general, a small buoyancy means that the source of revenue tends to be more stable under economic fluctuations, which is desirable for its predictability. Nevertheless, in the long-term a source of revenue that is not directly linked to economic activity might create imbalances between government revenues and the necessary funds to supply public service. In the case of recurrent taxes on immovable property, the tax base tends to be relatively less buoyant than for other taxes.

5. Transparency: Tax obligations should be transparent. That is, taxpayers should be able to understand how charges were calculated and for what purposes these funds are being used.

It is often the case that a tax reform cannot follow all these principles simultaneously. Some decisions regarding tax design might involve a gain in one of the principles, such as equity, at the cost of damaging another principle, such as allocative efficiency. As a result, although it is possible to lay out a set of good practices based on these principles, in some cases there is no best option that satisfies everyone – trade-offs exist. Hence, tax design is a political choice that depends on country-specific factors and conditions such as culture, the tax system in place, the state of the economy, the income distribution, among others.

Scope of taxes

Wide tax bases tend to increase revenue-raising capacity while minimising allocative distortions

The scope of property taxes refers to the types of property that are taxed. It is a crucial element of any tax system that has implications on all the principles mentioned in the previous section. By and large, for multiple reasons economists recommend policy makers to set tax bases as wide as possible and tax rates as low as possible (Cornia, 2012[4]). First, a wider tax base has a larger revenue generation capacity as more properties are taxed. Second, a narrow tax base can encourage tax avoidance, since potential taxpayers may shift their type of property to avoid taxes. Third, since many public services benefit all the population, in case all citizens contribute financially for their provision, the tax system can become fairer and more equitable, following the benefit principle. Fourth, a wide tax base is more diversified than a narrow one, entailing that the former is less vulnerable to sector-specific shocks. Fifth, the revenue-raising capacity of a wide tax base allows tax rates to be lower, which reduces the income effect on taxpayers (i.e. the change in demand for a good or service caused by a change in a consumer's purchasing power resulting from a change in income) and, as a result, minimises possible changes of behaviour, reducing popular resistance and increasing compliance.

Therefore, a narrow tax base may facilitate free-rider behaviour (i.e. enjoying the benefits of services provided with tax revenues without bearing its costs) and requires a higher tax rate to collect the same amount of revenue, which can affect the decisions of the group that is being taxed, creating stronger resistance to the tax reform, as well as room for tax avoidance and delinquency. In the case of the property tax, a wide tax base means that all types and forms of land use (e.g. improved and unimproved land for multiple uses such as residential, businesses, agricultural, industrial, land dedicated to special infrastructure purposes, etc.) are taxed and that exemptions are kept to a minimum.

Covering the tax scope in the legislation in a precise manner can help maintain the salient recurrent taxes on immovable property applied to a wide tax base (Plimmer, 2012[5]). Tax bases that are covered in a legislation that cannot be easily changed may resist better recurring political pressures to benefit select groups of taxpayers. In addition, the clearer the definition of the tax scope, the less room there is for changes as a result of judicial interpretation or administrative regulation.

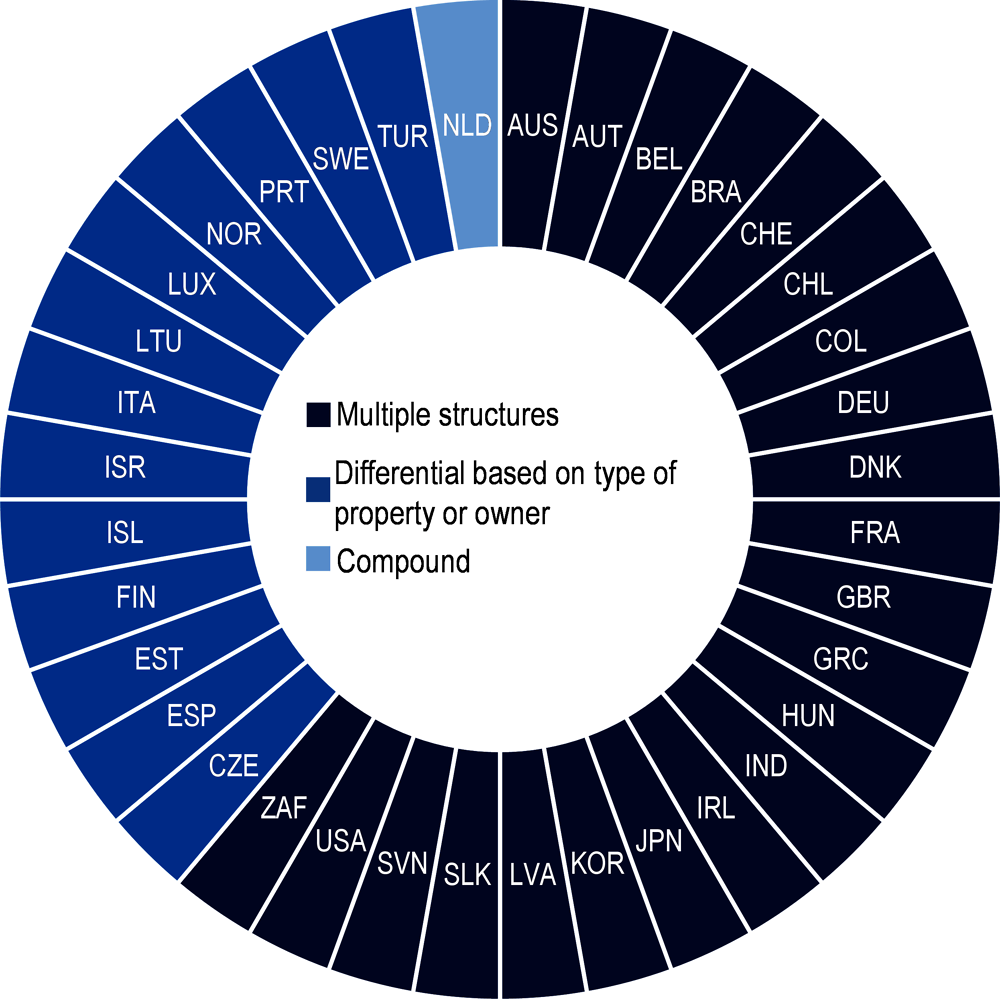

Most OECD countries have a single integrated property tax that applies to different types of property, but there are also cases in which different levies are applied to different types of property

The scope of the recurrent property tax can be assessed along two lines: 1) the purpose of use (i.e. residential and business property; rented or owner-occupied); and 2) the taxed items (i.e. land and improvements). All OECD and partner countries analysed2 (Figure 2.1, left plot) levy taxes on both types of properties (residential and business), and in all countries but Lithuania both owner-occupied and rented houses are taxed3 (in Lithuania only owner-occupied properties are taxed). Most countries have a single integrated property tax that applies to these two types of property – notable exceptions are Australia, Belgium, Ireland and the United Kingdom. Australia has two types of recurrent taxes on immovable property – the Council rate, which applies to owner-occupied and rented residential properties and business properties, and a land tax, which applies only to residential rented and business properties. Similarly, Ireland has two levies – the Local Property Tax (LPT), which applies to owner-occupied and rented residential or business properties, and the Non Principal Private Residence (NPPR), which only applies to residential rented and business properties. Belgium also has two separate types of recurrent taxes on immovable property, being the "Ménages" tax applied to residential property (owner-occupied and rented) and the "Societés" applied only to business. The United Kingdom also levies a separate levy to residential properties (owned-occupied and rented) and a different one to business.

Figure 2.1. Scope of immovable property taxes across OECD countries

Source: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

Regarding the taxed items (land and improvements), in most countries (26 out of 31) both land and buildings are taxed (Figure 2.1, right plot). Only three OECD countries feature a pure land tax, which can help to promote densification (a discussion on the benefits of taxation on land can be found on Box 2.6). These are found in the state of New South Wales in Australia, Denmark and Estonia. On the other hand, property taxes in Ireland, Lithuania and Netherlands comprise improvements only.

Concerning improvements, each country considers a different set of taxable items. For instance, in the United Kingdom certain items of plant and machinery can also be included in the assessment. In Australia assessments include basic site improvements such as sewerage, but not the value of buildings or other capital improvements. In the Irish LTP, the assessment considers shed, outhouse, garage, yard and other building structures.

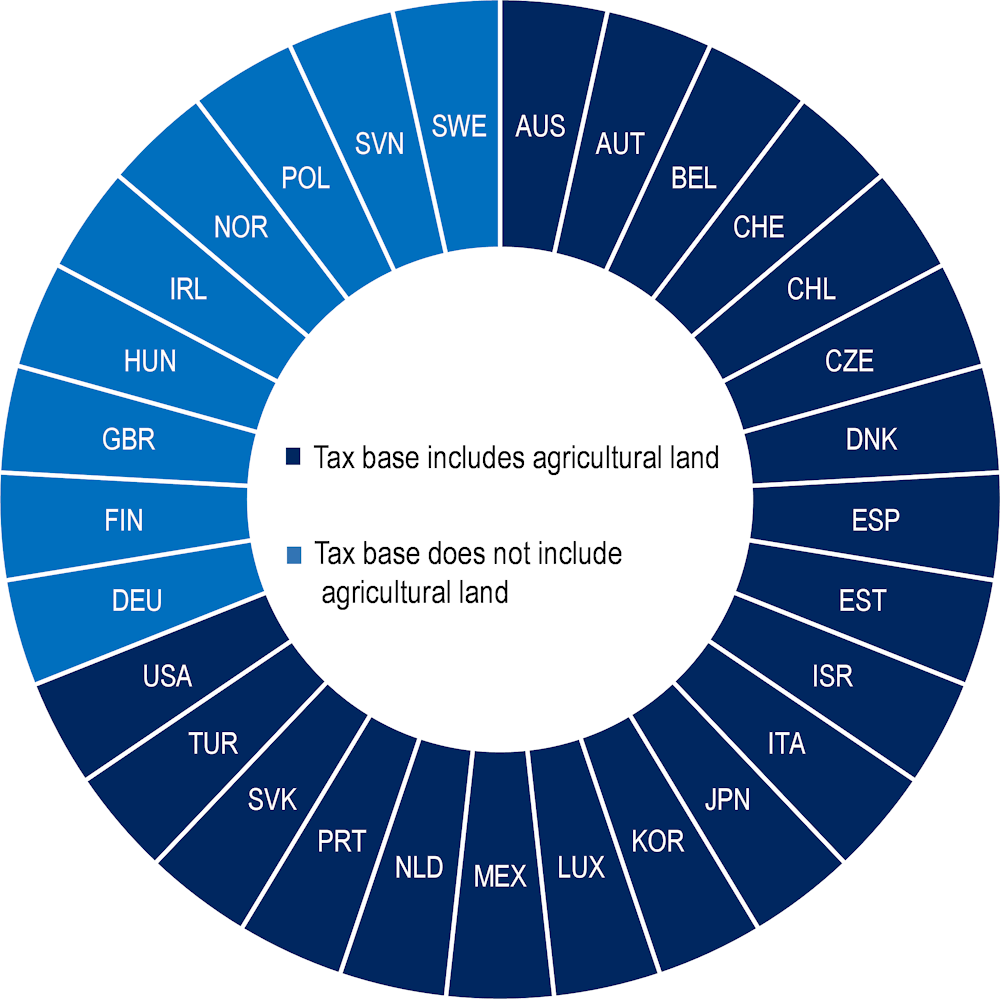

Some OECD countries do not tax agricultural lands in order to protect them from urbanisation

Agricultural land is one type of property that is excluded from the tax base in some countries (Figure 2.2). Precisely, 8 out of 29 countries do not include agricultural land in their tax base. Farmlands are usually favoured in order to protect them from conversion to urban use. Such protection can also be granted in other forms. As Maurer and Paugam (2000[6]) pointed out, another way to protect farmland is through favouring them in property value assessments – that is, rather than assessing agricultural land at their market value, their values can be assessed considering their value in current use. In that manner, it is likely that agricultural land will have a smaller cadastral value in comparison to other types of land, which reduces their tax obligations in comparison to urban land. Countries such as Canada (in some jurisdictions) and New Zealand employ this strategy (Maurer and Paugam, 2000[6]).

Figure 2.2. Agricultural land treatment in OECD countries for recurrent property taxes

Source: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

It is worth noting that a favourable property tax treatment is often not sufficient to protect farmland from urbanisation due to the fact that effective tax rates that are applied to land are typically small. More precisely, differences in tax obligations between urban and agricultural land are commonly not large enough to compensate for the much higher prices that the land could have in case it was converted to urban land (Maurer and Paugam, 2000[6]). Furthermore, favourable treatment of rural land can increase speculation at the urban fringe, potentially leading to an increase in urban land prices (Slack, 2012[3]). As a result, granting favourable tax treatment to agricultural land might not be the most efficient way to protect farmland – land-use planning and transport policies tend to have a greater influence on land-use decisions (Brandt, 2014[7]).

Property tax bases in China

China levies urban land-use taxes that are not applied to residential households.4 These taxes are levied on land areas. Properties exempt include, among others, land for directly productive use of agriculture, forestry, animal husbandry, fishery industries, municipal roads, squares, greenbelts and energy, transportation and water conservancy facilities. The most unusual type of property that China exempts is personal residence. In addition, China also levies a tax on the residual value of properties or rental income (house property tax). Again, house properties owned by individuals for non-business purposes are exempt.

As a result, the Chinese system has two recurrent levies on properties with some degree of overlap with regard to taxed items and a significant amount of exemptions in terms of number of properties – the urban home ownership rate in China reaches 96%. A levy on personal residence buildings can, thus, widen substantially its property taxes’ tax base and reduce, proportionally, tax rates in a manner that the tax burden on other types of property are reduced. This can potentially make the Chinese system more growth-friendly through a reduction in allocative distortions.

Tax rate and reliefs

Tax rates may vary horizontally (i.e. with property use, property characteristics and/or owner characteristics) and vertically (i.e. with property value)

Tax rate setting is directly linked to the definition of tax bases. Since tax revenues are the result of the interaction between tax rates and tax bases, the decision regarding the level of tax rate necessary to raise a certain amount of tax revenue greatly depends on the tax bases that the rates are applied to. In the case of recurrent taxes on immovable property, tax rates may vary horizontally (i.e. with property use, property characteristics and/or owner characteristics), vertically (i.e. with property value) or even regionally/locally.

Despite these numerous possibilities of setups, a case for uniformity of tax rates across different types of property can be made. First, uniformity increases transparency, reduces complexity of the tax system and minimises distortions on land-use decisions. A second consideration regards tax avoidance – when tax rates differ widely across tax bases, taxpayers may avoid taxation by concealing the true nature of their property. On the other hand, non-uniform tax rates can be used to foster some types of development or decisions; for instance, it is common to encourage homeownership with tax exemptions and reduced rates on owner-occupied houses, as homeownership can reduce wealth inequality (Kaas, Kocharkov and Preugschat, 2015[8]).

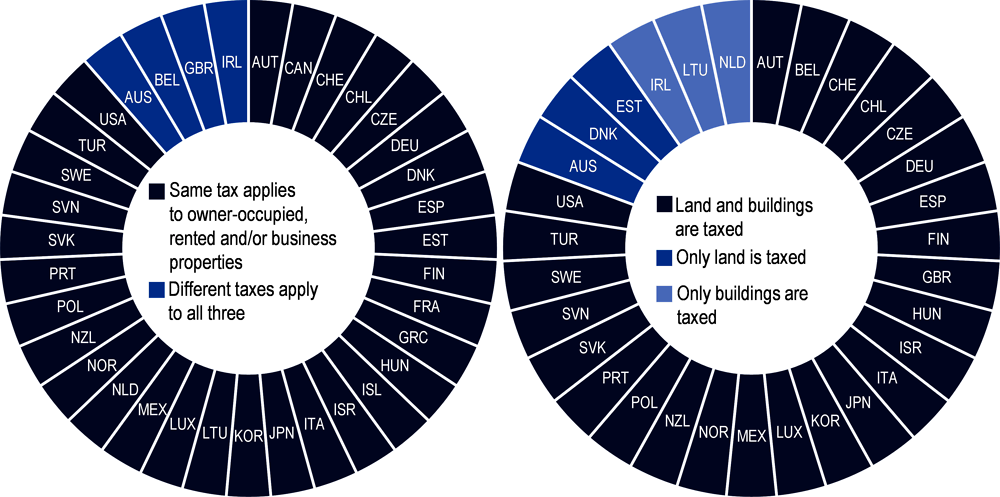

In OECD countries tax rates are usually allowed to vary by jurisdiction with property characteristics within pre-established bands

Figure 2.3 depicts property tax rate structures across OECD and partner countries. It shows four classifications: 1) Multiple structures, which regards the situation in which within the same country there are different structures depending on the jurisdiction and, thus, one single classification does not represent the structure of the country; 2) Based on type of property or owner; 3) Compound, which is the case in which different levels of government levy their own recurrent property taxes that are compounded into the final levy; and 4) Uniform, which concerns the structure in which tax rates do not vary with the property use, characteristics, owner or jurisdiction.

No OECD or partner country has a uniform tax structure5 and only the Netherlands reported to have a compound structure, which means that the majority of OECD and partner countries have either a multiple structure or a structure in which the tax rate varies with the type of the property or owner. In the latter case, limiting the range from which tax rates vary can reduce tax competition across jurisdiction (for business property taxation) and reduce the incentives for tax avoidance. For this reason, it is common practice across OECD and partner countries to limit the range within which tax rates can vary both across jurisdictions and with regard to property type and owner.

Figure 2.3. Property tax rate structures in OECD and partner countries

For instance, in Chile, tax rates vary with property use – tax rate is 1.0% for agricultural properties, vary between 0.98% to 1.143% for non-agricultural residential properties and is 1.2% for non-agricultural and non-residential properties. In Finland business and residential properties are taxed differently – general property taxes (land and commercial buildings) are allowed to vary from 0.93% to 2.00% while residential building taxes are allowed to range from 0.41% to 1.00% (separate tax rates can be used for leisure homes, undeveloped residential land and power plants). In Turkey, tax rates vary with the characteristics of the location of the property – tax rates vary from 0.1% to 0.3% and are doubled for properties within the borders of metropolitan municipalities and contiguous areas. In Spain, not only are different rates applied to urban properties (from 0.4% to 1.10%) and rural properties (from 0.3% to 0.9%) but these rates can also increase up to 1.3% depending on certain circumstances (for instance, when a municipality provides certain services, or when it is the capital of a province or region). Furthermore, Spain’s local governments may establish a surcharge of up to 0.5% to the vacant urban properties or different rates depending on the use of the property. Annex B has a summary of the tax rates applied across OECD countries.

Tax rates can be made progressive, nevertheless effects on income distribution from recurrent taxes on immovable property depend greatly on home ownership patterns

In some countries tax rates grow with asset values, which are correlated with taxpayers’ ability to pay.6 Nevertheless, there is a significant distinction that needs to be made between property values and income. Property values are, indeed, correlated with the owner’s/tenant’s income but this correlation is not perfect. Thus, it is possible for tax rates that are progressive in terms of property values to be, in some cases, actually regressive in terms of income. More notably, although imposing progressive tax rates tend to increase the equity of the property tax system due to the correlation between income and assessed values, it may aggravate the liquidity problem of asset rich income poor households.

The effect of recurrent taxes on immovable property on the distribution of income depends greatly on home ownership patterns in a country. For instance, in Ireland, a shift in the tax mix towards residential property taxes7 may have had an adverse effect on the income distribution because of Ireland’s high rates of home ownership throughout the income distribution (O’Connor et al., 2015[10]). By contrast, in a country where home ownership is highly concentrated at the top of the income distribution, an increase in recurrent taxes on immovable property will have less negative distributional effects on low and middle-income households. Nevertheless, in practice middle-income families tend to hold a high proportion of their wealth in immovable property (i.e. the family home) whereas top earners may hold a significant proportion of their wealth in more liquid forms that are not subject to property taxes (Brys et al., 2016[11]).

Another problem with the introduction of progressive tax rates for property tax is that introducing tax progressivity for a specific type of asset (i.e. property in this case), as opposed to overall wealth, can be distortion-prone, and thus, sub-optimal. Properties are just one type of asset and in case progressive rates are only applied to property taxes, then the resulting progressivity of the overall tax system will depend greatly on the differences of the composition of taxpayers’ asset portfolio across income brackets. This can be worrisome, since property ownership is usually more evenly distributed than ownership of other types of assets, and thus, the introduction of progressive rates might not have the desired effect. In addition, in case only one type of asset is taxed at progressive rates, investors might decide to change their investments depending on the value of the asset to be invested in, leading to distortions (see section on “Housing investments” for a detailed analysis and solutions for these distortions).

Despite these considerations it should be noted that the pro-growth nature of recurrent tax reforms can alleviate potential regressive distributional effects. For instance, Vermeulen (2018[12]) analysed the potential impact of a shift towards recurrent taxes on immovable property on the distribution of disposable income in the Netherlands. The analysis concluded that this shift would yield a moderately positive impact on employment that minimised adverse distributional effects. In other words, after taking into account an increase in employment generated by the pro-growth features of these taxes, the impact on the distribution of disposable income would be minimal – it would only exceed 4% of the disposable income in less than 5% of the households in the lower-income group.

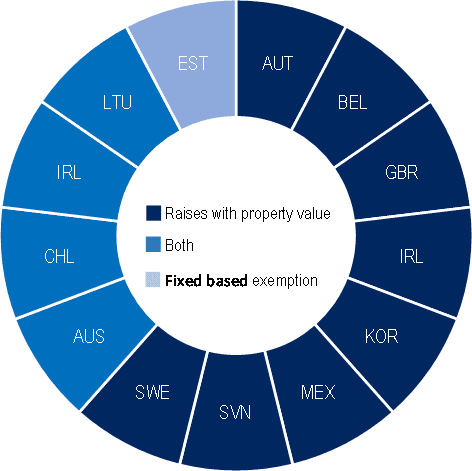

Some OECD and partner countries increase the progressivity of their recurrent taxes on immovable property by increasing tax rates with property values and by imposing a lump-sum exemption

Thirteen OECD countries reported to have a progressive feature in their tax rate structure (Figure 2.4). No country reported to increase tax obligations with owner’s/tenant’s income, eight countries reported to raise tax rates only with property values, only Estonia applies a fixed lump-sum exemption alone and four countries employ both methods. The tax rate structure differs widely across these countries. For instance, Mexico City (the largest and most representative city in Mexico) applies a myriad of tax rates that ranges from 0.017% to 0.23% (approximate numbers) of the cadastral values. Ireland only applies a higher rate for properties valued over EUR 1 million. For Australia’s land tax, a marginal rate of 1.6% applies above a tax-free threshold of AUD 412 000, and 2% on landholdings that exceed AUD 2 519 000. In Sweden, the tax rates rise with the value of the property, however, there are relatively low limits for how much property owners have to pay. In the United Kingdom, only businesses are subjected to progressive property tax rates. In these cases, there are only two possible rates, and the applicable rate is selected based on the size of the property.

Figure 2.4. Property tax rate structures with progressive features

Source: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

Effective tax rates can differ across country depending on valuation rules, tax bases and taxable values

A comparison of statutory values of tax rates across countries may be misleading for at least three reasons. First, many governments set the taxable value of a property below assessed (or cadastral) property values (see Box 2.1 for more details). Second, valuation methods may change the relation between the property value as recorded and the real market value of properties. Therefore, countries differ with regard to the percentage of market value that is being captured through the valuation process. Third, the taxable items differ across countries – land, buildings or land and buildings can be taxed, which may drastically change the tax burden. In order to have a better idea of the actual tax burden, a different indicator can be used, such as the percentage of tax revenue as a percentage of GDP or the ratio between the tax revenues and the number of properties.

Nevertheless, the tax rate structure, here referring to the relative changes in tax rate within a country, can be compared across countries to grasp the relative tax burdens of properties – that is, the differences of tax burden for different types of property and property values. The idea is to analyse which country over or under tax which types of properties or property owners. Still, caution is advised since valuation methods may vary depending on property types within the same country, which can distort even relative comparisons. For instance, it is common for countries to use a market-based valuation method for residential properties and a cost approach8 for properties for which there is no active market, such as industrial properties, transport infrastructures (e.g. train stations) and large buildings (e.g. football stadiums). In these cases, the valuation method may create relative distortions, hindering a fair comparison of tax rates across property types.

Box 2.1. Taxable property value as a fraction of assessed values across OECD countries

In some countries it is practice to set all taxable property value below assessed property values (i.e. taxable values are a fraction of assessed values). In other countries the taxable values of certain types of property (e.g. owner-occupied property) are set below assessed values. In the OECD Survey on Recurrent Taxes on Immovable Property, eight countries reported to follow these practices.

Some countries use this instrument with the purpose of alleviating tax hikes that may occur due to property revaluations (e.g. Denmark, Spain, Sweden), others as a way to reduce the tax burden over some portion of properties (e.g. Chile, Italy, Japan, the United Kingdom).

In Chile, for urban properties (residential and non-residential), both land and buildings are taxed. Land is valued using 60% of the market value, while buildings are valued through the cost approach. In Chile’s case the combination of these two methods leads to, on average, a taxation of only 63%/79% of the market value of residential/non-residential properties. The difference between these averages is a result of non-residential properties having more building value than residential properties, as assessed by the cost method.

In Denmark, the government has imposed a limit on how much the taxable land value is allowed to increase each year. The taxable land value is the minimum of the assessed land value or the taxable land value of the previous year increased by a factor capped at 7%.

In Finland, the target rates are 75% for buildings and for lands. In practice, the land values often lag behind due to limits to increases in values.

In Italy, the 50% of exemption is applied for partially destroyed or unfit for use properties.

In Japan, the assessed value of some types of residential land is multiplied by a special measure rate (one third for small residential land, and two-thirds for other residential land).

In Spain, cadastral values (assessed value) coincide with the taxable property value. However, when the real estate is subject to reassessment, a decreasing reduction coefficient is applied over a period of 9 years (0.9 in the first-year linear decreasing to 0.1 in the ninth). This reduction aims to soften the increase in the tax burden resulting from value reassessments.

In Sweden, two years prior to the taxation assessment, only 75% of the market value of the property is taxed.

In the United Kingdom, there is one very small exception where the taxable value for stud farms is discounted by a flat amount.

Sources: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

Tax benefits are an important tool to improve the progressivity of the property tax system, reduce the liquidity problem of asset-rich income-poor households, promote non-profit activities and incentivise building construction/renewal

Tax obligations are also often reduced by tax benefits granted under certain criteria that the property or the property owner fulfils. Some benefits are temporary or phased in to alleviate transitional issues. Others are permanent and aim at achieving various policy goals. When permanent, these benefits are often targeted at taxpayers who do not have sufficient ability or liquidity to pay or to encourage economic, environmental or social activities that the government wants to promote.

Tax benefits, thus, can make recurrent taxes on immovable property more progressive and help the achievement of policy goals. Nevertheless, these benefits come at the cost of either a loss of tax revenues or a compensation for this loss of revenues that must be paid by other taxpayers in the form of higher tax obligations. In addition, there are also costs in the form of distortions of land-use decisions. Due to these costs, tax benefits may be politically and/or socially contentious and must, in order to be considered fair in the eyes of the taxpayers, reflect the cultural and societal views of the respective society (Plimmer, 2012[5]).

Issues with tax reliefs and exemptions arise when they are provided to specific individuals or companies that have the ability to pay the tax in full. When such concessions are done mainly for political reasons, the tax system can become inefficient and unfair. Since it is important for the compliance of taxpayers that the tax system is considered both efficient and fair, the arbitrary provision of tax benefits to certain groups might create popular resistance against tax reforms, undermining potential improvements in the tax system (see Box 2.2 for more on tax incentive for business). This is easier said than done, especially in the case when local governments can give tax reliefs and exemptions as they tend to be more vulnerable to local political pressures.

Before exploring the main practices adopted across OECD countries, it is worth highlighting the main types of tax reliefs as well as their properties. The following discussion is based on Langley and Youngman (2021[13]). Tax reliefs differ markedly with regard to, at least, four aspects: 1) how they reduce the tax liability (i.e. exemptions/deductions reduce the taxable value of a property whereas abatements/credits reduce the tax obligation); 2) which taxpayers they apply to; 3) the level of government that is paying the costs of the relief programme; and 4) the timing of the payment. There is no best tax relief programme since there are many trade-offs involved in their design. Some properties and examples of tax reliefs granted by US states are described below:

Flat-value exemptions/credits tend to make the property tax distribution more progressive, given that these reliefs represent a larger share of the tax obligations applied to low-income property values.

Percentage exemptions/credits are better employed to shift the tax burden away from the group that is receiving the benefit. That is because they do not substantially affect the distribution of property taxes among taxpayers that are in the same group. Thus, for instance, a revenue-neutral tax rate reduction for pensioners would shift the burden away from pensioners to other taxpayers and will only improve the progressivity of the tax in case pensioners (i.e. the group receiving the benefit in this case) have lower incomes than the average taxpayer.

Lump-sum credits is the only tax benefit that can provide relief to taxpayers without changing the marginal tax rate of its beneficiary (i.e. if the tax rate increases, the benefit will remain constant). That is because: 1) reliefs that reduce a percentage of taxable value/tax obligation are also applied to tax hikes, reducing the marginal tax rate for beneficiaries; and 2) exemptions reduce the taxable amount to which the tax increase is applied.

Income-based tax credits refer to reliefs in which the tax obligation is reduced by either a fixed amount or a percentage depending on the income of the taxpayer. Income-based programmes are usually more cost-effective given that they are more targeted towards low-income taxpayers, but their administrative and compliance burdens tend to be higher, since information on income is necessary.

Deferrals regard a tax relief that does not reduce tax obligations but rather delay tax payments to some future period, usually when the property is sold or the owner dies. In case interest rates applied to the deferred values are in line with market values, there are not real costs to either the taxpayer or to the tax administration. In other words, the tax obligation is not changed but, at the same time, the beneficiary can have a temporary full reduction in their tax obligations. Usually only some types of taxpayers are eligible for deferrals, such as low-income seniors. Nevertheless, since seniors often want to leave their property to their heirs without many tax obligations attached, participation rates tend to be very low.

With respect to the level of government that is responsible for funding the tax relief, when funding is provided by upper levels of government, disparity in revenue capacity across local governments is less of a concern. In other words, programmes that are funded by upper levels of government are typically applied to all localities for which this level of government is responsible. Thus, even taxpayers from poorer local governments that would not have the necessary funds to establish such a programme can benefit from it.

Lastly, regarding taxpayer eligibility, the higher the coverage of the programme, the higher the costs. Nevertheless, limiting eligibility can be problematic and lead to distortions in case limitations were introduced only for the sake of reducing costs. For instance, in case the objective of the programme is to grant relief to low-income households, this goal can be better achieved in case all low-income households are eligible, regardless of, for instance, the age of the homeowner or the ownership status of the property (these two requirements are commonly found in OECD countries). In addition, other commonly found requirements are income ceilings, net worth limits, maximum property value and residency requirements.

Box 2.2. Property tax incentives for business in the United States

Tax incentives

Each one of the 50 US states employ at least one type of property tax incentive for business. There are many different types of incentives provided such as property tax abatement programmes, firm specific property tax incentives, tax increment financing, enterprise zones and the combination of property tax exemptions with industrial development bonds. Some states employ multiple programmes. This box explores these programmes in more detail.

Property tax abatement programmes allow partial or full reduction in property tax liability for certain types of properties. There are a myriad of property tax abatements in the United States. Tax abatements may vary depending on the types of eligible properties. In the United States the most common types of properties that benefit from tax abatements are industrial (51 programmes) and commercial (44) properties, but there is a wide variety of other types. Regarding the type of tax that is abated, there also is a significant variation, being the most common in the United States the following: real property taxes (70 programmes), personal property taxes (46) and taxes on improvements (24). The form of abatement can also vary, and in US states, among the most common there are exemptions (50 programmes), tax credits (12) and freezes (8). They can also be geographically targeted. Concerning the duration of abatements, 10 years is the most common in US states, but they are frequently renewable. Lastly, nearly half of these programmes have no limiting provisions; about one third of the programmes can be terminated in case companies do not meet policy targets (e.g. regarding job creation targets); about one fifth include “clawbacks” that attempt to require these companies to pay back some portion of the abatement; and 7% have a pre-established end date.

Firm-specific property tax incentives regard partial or full reductions in property tax liability for some specific companies. They are offered on a case-by-case basis and commonly to companies considering relocation. There is little systematic data on these incentives. Nevertheless, it is worth noting that there is a significant concern regarding these benefits – once a firm-specific incentive is given to one firm, similar companies will lobby for their own tax incentive package. Granting similar incentives to many companies can greatly reduce tax revenues.

With tax increment financing (TIF), growth in property taxes or other revenues in a specific territorial area is earmarked to support economic development in that area. These funds are commonly used to improve infrastructure. It is worth noting that TIF is not a tax reduction programme, but an earmarking one. As a result, it aims at promoting business through an improvement in the conditions of the area not through a tax reduction. More advanced schemes allow the issuance of bonds backed by future revenue growth, which can make these programmes self-financing. Usually there is an end date for TIF in which afterwards tax revenues will accrue normally to governments.

Enterprise zones are a more all-encompassing type of tax benefit. The objective is to promote business development in a region facing economic problems (i.e. unemployment, poverty and low-income) through the provision of special tax treatment and other benefits. In 2010 there were 48 enterprise zone programmes in 42 US states plus the District of Columbia. Most programmes (31 out of 48) include some type of property tax benefit such as a reduction or exemption. Another goal is to increase employment opportunities for residents in the zone.

Impact

Despite this widespread use of property tax incentives for business in the United States, evidence suggests that they have only a limited impact on general economic growth (Kenyon, Langley and Paquin, 2012[14]). That is because property taxes are only a small portion of all costs for most firms and, thus, they are commonly outweighed by other factors that are relevant for business placement such as labour market, proximity to suppliers and consumers, as well as transportation costs. There is also evidence that these benefits can have a significant impact on economic growth for individual jurisdictions. Nevertheless, these benefits cease to exist when neighbouring jurisdictions adopt similar measures, reducing their relative property tax advantage and leading to an overall reduction in property tax revenues.

Principles

Despite their downsides, there are ways that these tax incentives can be designed to maximise their potential benefits. First, criteria for granting incentives can increase investment quality (i.e. restricting incentives to projects that meet certain standards). Second, incentives can be limited to mobile facilities that export goods or services out of the region – in that way the room for tax exporting1 can be minimised. Third, place limits on the number or total dollar value of incentives in order to curb a continued growth in tax benefits over time. Fourth, enforce an open process for deciding on incentives. Fifth, encourage co‑operation with other localities to avoid potentially harmful tax competition.

1. Tax exporting refers to the practice of one jurisdiction imposing tax burdens on residents/businesses of another.

Sources: Kenyon, Langley and Paquin (2012[14]).

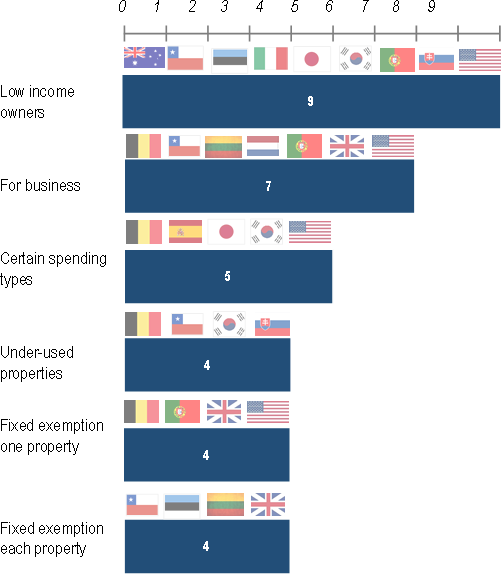

Figure 2.5 shows which types of property/owner tax reliefs are provided in OECD countries (Box 2.3 explores the specific case of US States and Annex C provides in detail the reliefs provided by OECD countries). Tax reliefs are more commonly applied to low-income owners and certain businesses, such as new businesses or businesses from a specific sector. In some countries reliefs apply to all properties that a taxpayer owns (Chile, Estonia and Lithuania), while in others these benefits are restricted to one property, such as the main residence (Belgium, Portugal and the United States). For the United Kingdom some reliefs apply to all properties while others just to one property. Under-used properties (e.g. if the number of people living in a house is below a critical number) also enjoy tax benefits in some countries (Belgium, Chile, Korea and the Slovak Republic), as well as certain types of spending on property (e.g. investments).

Figure 2.5. Recurrent taxes on immovable property in OECD countries: Tax reliefs

Note: For more details regarding the US system see Boxes 2.2 and 2.3

Source: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

It is interesting to note that some countries (Estonia, Italy, Japan, Portugal, the Slovak Republic and the United States) did not report having a progressive tax rate structure but these countries provide benefits to low-income households in the form of tax reliefs. These reliefs can improve the income distribution without the need to introduce progressive tax rates, and are likely to broaden political support for a property tax reform. However, the overall consistency of such allowances with other parts of the tax and transfer system must be carefully checked.

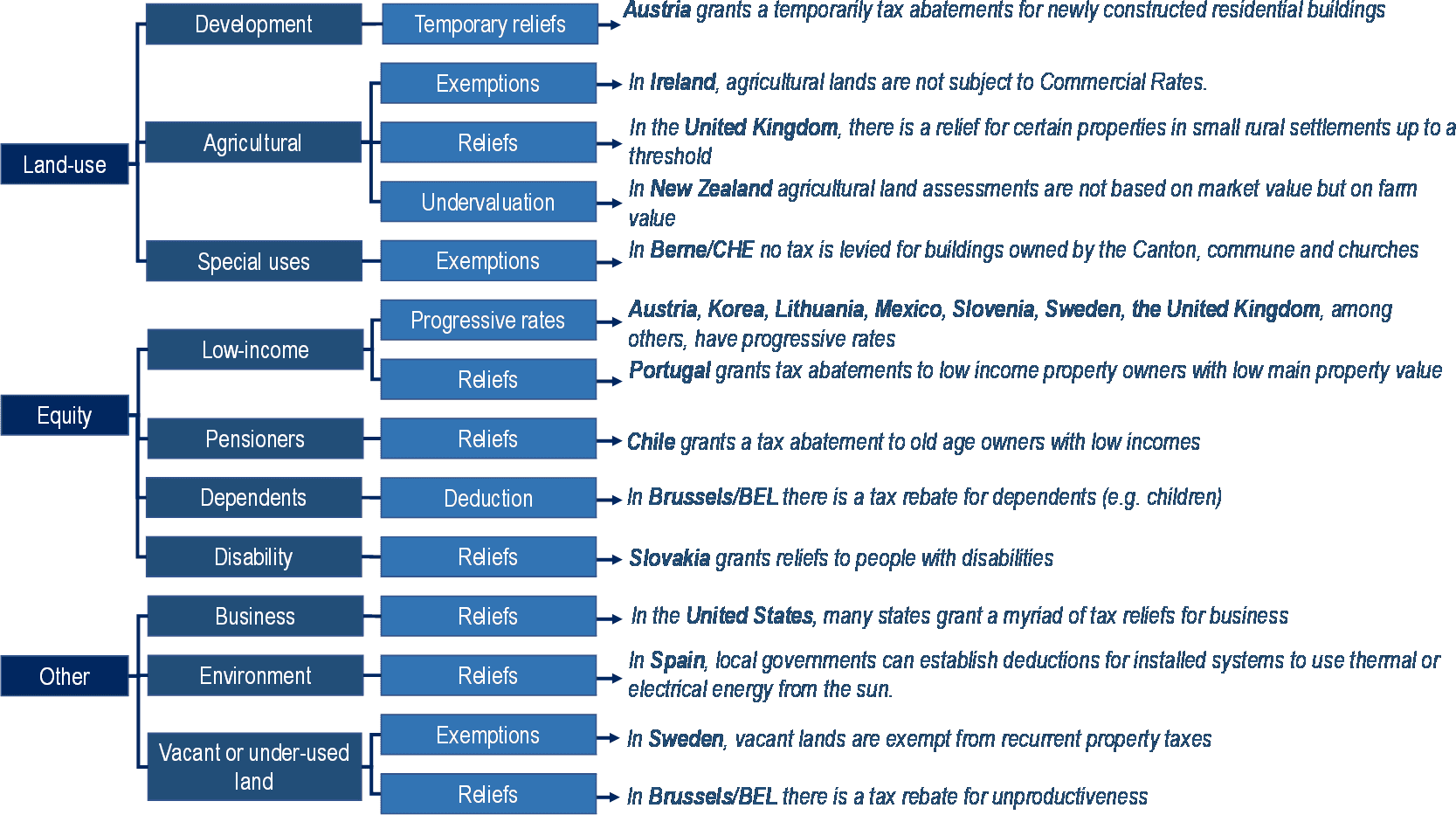

Apart from low-income households, pensioners also often benefit from tax reliefs (in Australia, Chile, Estonia, the Slovak Republic and some US states) as they tend to compose the group of asset-rich but cash-poor taxpayers. Newly constructed buildings are also subjected to tax reliefs in many OECD countries with the purpose of promoting the construction sector while improving the quality of the buildings or to promote the supply of new homes (Australia, Belgium, Norway,9 Slovenia and some US states). In Spain, local authorities are allowed to establish tax deductions for installed systems that use thermal or electrical energy from the sun. Properties that are put to some specific use are also commonly exempt, such as properties used by charities, churches, government, non-profit and international organisations (Berne-Switzerland, Finland, Ireland, Lithuania, Slovenia, the United Kingdom and some US states).

Special tax treatments applied to under-used properties differ significantly across OECD countries. Seven countries (Belgium, Chile, Ireland, Korea, the Slovak Republic, Sweden and the United Kingdom) provide benefits or exemptions to these types of properties. These benefits can be given on the grounds that the tax burden should be a charge on the actual use of urban services. Nevertheless, from a land-use perspective, the absence of taxation on vacant lots does not discourage speculation nor encourages advancement of development (Maurer and Paugam, 2000[6]).

To summarise, Figure 2.6, below, provides a list of tax reliefs that are granted the most by OECD countries and gives one example of a country that provides the respective relief.

Figure 2.6. Common tax reliefs and exemptions in OECD countries along with country examples

Note: For New Zealand the information comes from Maurer and Paugam (2000[6]).

Source: Responses from OECD Survey on Recurrent Taxes on Immovable Property.

Box 2.3. Recurrent property tax exemptions in US states

Types of Programmes

As in multiple countries, many exemptions granted by US states aim at reducing the public opposition towards recurrent taxes on immovable property. All but three states have at least one of the two programmes: homestead exemptions and property tax credits. Homestead exemptions reduce the amount of property value subject to taxation while property tax credits directly reduce the tax obligation. Both can be reduced either by a fixed dollar amount or by a percentage of the value.

Despite these commonalities among states, the design of these exemption programmes varies markedly across them. As of 2012, 59% of state programmes provided flat dollar exemptions while 19% provided percentage exemptions and roughly 20% employed property tax credits or other benefits based on a more complicated formula.

States vs. Local Funding

The costs of these programmes are, in some cases, funded by the state and, in others, by the local governments. As of 2012, most commonly (57% of the cases) local governments bear these costs while in 28% of the cases the state fully covers local revenue losses. In the remaining 15% of the cases, the cost is shared between states and local governments. Usually, costlier and broad-based programmes are funded by states whereas cheaper and more specific programmes are funded by local governments.

Programme costs

In proportion to total property tax revenues, the costs of these tax benefits are normally small but vary widely across states. In 14 of the 45 states with these programmes, total savings are less than 0.5% of property tax revenues while in 27 states, the savings are less than 2.5%. In 9 states the costs are equal to or exceed 10% of total property tax revenues.

Eligibility

It is also worth highlighting that most states employ more than one property tax exemption or credit programme. These programmes usually differ in terms of eligible taxpayers. The most common groups are homeowners, seniors, veterans, or the disabled.

Homeowner’s programmes in 26 states are for nearly all homeowners, but usually limited to owner-occupied primary residences. In an “average state” the median homeowner receives a 12.5% cut compared to 25% in the top quarter of states that offer more generous programmes. Seniors’ property tax relief programmes are present in 18 states. These programmes tend to grant larger benefits in comparison to the benefits granted to homeowners. The median benefit is a tax cut of nearly 30% in the typical state. More than half of these programmes provide a median tax cut of at least 25%, while only a sixth of them provide a median tax savings of less than 10%. In the typical state, roughly 20% of homeowners are eligible for these senior targeted programmes. It is worth noting that eligibility rates vary significantly across states depending on whether there is an income ceiling. In the seven states that provide property tax relief to seniors regardless of income, 25–30% of homeowners are typically eligible. But in seven states with low-income cut-offs (USD 10 000 to 30 000), only 5–10% of homeowners qualify.

Regarding veterans, only 10 states provide property tax exemptions or credits for all veterans, even those without disabilities. The average tax cut is just 3.2%. Tax reliefs usually differ when veterans have service-connected disabilities are considered (15% of veterans qualify in the typical state). Currently, 31 states provide property tax exemptions or credits specifically to veterans with service-connected disabilities. It is worth noting that only 0.6% of homeowners are eligible for these programmes in the median state and, thus, their impacts tend to be small.

In 23 states there are programmes covering disabled homeowners. The criteria used to determine the eligibility of taxpayers vary across states. In the median state, 2.3% of homeowners are eligible for these types of programmes, and they receive a median property tax cut of 21%.

Sources: Langley (2015[15]).

Under certain circumstances, there might be other policy tools that can achieve the same desired goals that tax reliefs programmes aim at achieving but, potentially, in a more cost-effective manner. Tax reliefs tend to increase the complexity of the tax system and can create distortions. As explored throughout this section, most tax relief programmes target low-income earners. In the realm of intergovernmental relations, equalisation grants are widely employed to offset differences in revenue-raising capacity or public service cost across jurisdictions and, as a result, can at times be an effective tool to reduce income inequality within a country – see Dougherty and Forman (2021[16]). In the realm of social programmes, there are a myriad of anti-poverty and housing policies that can be used to improve the situation of low-income earners. As it will be discussed further in the last chapter of this report, bundling a reform of recurrent taxes on immovable property with other policies outside the realm of taxation can be a good strategy to offset undesired effects of property taxation and, in this context, can also be an alternative to the use of tax reliefs.

In that light, addressing distributive problems using income-transfer programmes can be even more transparent, since it is unlikely that many taxpayers will notice a clear link between their income bracket and the tax benefit that they receive. In addition, the outcomes of tax relief programmes depend greatly on many elements, such as the distribution of homeownership in a country and tax evasions rates. For that reason, Kitchen (2012[17]) argues that “uncertainty over regressivity of the property tax and the tendency to provide relief that varies directly with property values argues strongly in favour of eliminating property tax credits and using other components of the state, region or provincial government’s income-transfer system to improve inequities in the overall distribution of income.”

Exemptions in the Chinese property tax system

It is worth noting that many of the properties that are exempt in OECD countries are also exempt from China’s land tax – such as land used by state organs, religious temples, parks, among others (CDRF, 2020[18]). In addition, exemptions can be based on criteria that vary across jurisdictions. That is, in the case of China, in which the price of immovable property varies widely across jurisdictions, progressivity can be achieved in a fair manner by giving a tax-free basic allowance that could vary across provinces and cities (Brys et al., 2013[19]). A similar outcome can be achieved in a less complex way by providing a tax reduction to low-income occupiers. Such tax benefits based on income are already in place in China’s property tax system – taxpayers who are facing financial difficulties may enjoy a reduction or exemption from China’s house property tax for a determined period.

Impact on the overall tax system

A revenue-neutral shift from transaction taxes towards a well-designed recurrent tax on immovable property has the potential to increase economic growth while improving the income distribution

When carrying out tax reforms, policy makers balance efficiency and pro-growth objectives of tax reforms with distributional objectives, while also taking into account the impact on revenues, tax avoidance and evasion opportunities, as well as the costs of compliance, administration and enforcement. Such objectives rarely can be achieved in isolation – that is, when reforming a specific form of taxation, the actual impact of the reform might deviate from the expected impact in case the interplay between taxes and benefits are not considered. In particular, recurrent taxes on immovable property are a form of capital/property taxation and user fees (depending on the incidence considered) and, thus, their impact can be better assessed in conjunction with other taxes such as capital taxes and user fees. Income taxes are also particularly relevant to properly assess the distributive impact of a certain types of design for recurrent taxes on immovable property. This section analyses how recurrent taxes on immovable property can be reformed in a harmonised and consistent manner with the tax system already in place (see the Greek and Italian case in Box 2.4).

First, recurrent property taxes are considered among the least damaging to economic growth, even when compared to other property taxes such as inheritance taxes, net wealth taxes and transaction tax (Hagemann, 2018[1]). Property transaction taxes, especially, are generally considered to have distortionary effects. For instance, imposing taxes on a house transaction will, for example, discourage the owner from moving to an area with better labour market opportunities. As a result, revenue-neutral shifts from transaction taxes towards immovable property taxation tend to have positive allocative impacts by minimising the influence of the tax system on transaction decisions.

Second, as discussed previously, the impact of recurrent property taxes on the distribution of income greatly depends on the design of the tax and on the distribution of homeownership in a country. When considering revenue-neutral shifts towards recurrent taxes on immovable property, the progressivity of the taxes that are being discontinued/reduced are of great importance to determine the overall effect of the reform on the progressivity of the tax system.

Although the distributive impact of recurrent taxes on immovable property can be increased through an adequate tax rate and relief structure, as discussed previously, it still is the case that, in principle, some other types of taxes are better equipped to improve tax system’s progressivity. In the case of property taxes, it is unclear whether transaction taxes are either regressive or progressive10 but net wealth taxes and inheritance taxes tend to be more progressive than recurrent taxes on immovable property (Cournède, Fournier and Hoeller, 2018[20]). That is because in general wealth is much more unequally distributed than home ownership and even income, entailing that the distributive effects for both net wealth and inheritance taxes are larger than for immovable property taxes and income taxes.

Therefore, in summary, reforms aimed at increasing the share of recurrent taxes on immovable property tend to improve the allocation of resources while the impact on income distribution is heavily dependent on the distribution of homeownership in a country, on the tax design and, in case of revenue-neutral reforms, the tax that is being shifted from. When a country’s tax design involves a mildly progressive tax rate structure and/or a sound tax relief policy that benefits asset rich income poor households, the progressivity of recurrent taxes on immovable property tends to improve. Thus, in principle, a reform that simultaneously reduces transaction taxes while increasing recurrent taxes on immovable property might not only improve economic output but also possibly make the income distribution more equal. For this reason, it has been relatively common for OECD and partner countries to shift from transaction taxes to recurrent taxes on immovable property.

Recurrent taxes on immovable property are not the best tool to reduce income inequality

Joumard et al. (2012[21]) analysed the income redistribution effects via taxes and cash transfers and they concluded that the latter reduce income dispersion more than the former in most OECD countries. In other words, cash transfers tend to be more effective in improving the progressivity of fiscal policy than tax reforms. More specifically, family, housing, disability and unemployment benefits are especially important to improve income distribution. Regarding taxes, income tax tends to be the most progressive tax, but its overall effect on the distribution of income depends on its design and, thus, varies by country.

As a result, usually taxes are not the best fiscal policy tool to reduce income inequality, nor are recurrent taxes on immovable property the best type of tax in this respect. Nevertheless, a shift towards recurrent property taxation can improve both efficiency and equity, especially in more globalised economies (Dougherty and Akgun, 2018[22]). The main motivations for the introduction of recurrent taxes on immovable property are: 1) increasing tax system efficiency; 2) increasing subnational revenue autonomy; 3) making the real estate market more stable; and 4) improving the quality of land use. In case improving the progressivity of the tax system is the main goal of the reform, a shift towards other taxes is often a better option – notably income taxes, inheritance taxes and wealth taxes.11 In addition, a revenue-raising recurrent property tax reform could have a more substantial effect on income equality if revenues collected are used to fund progressive policies such as cash transfers to low-income households and the design of the tax does not exacerbate income inequality.

China’s tax system and the introduction of recurrent taxes on immovable property

As noted above, the impact of recurrent property taxes on the distribution of income greatly depends on the distribution of housing assets in a country. According to McGregor (2021[23]), approximately 70% of China’s household wealth is held in real estate. In addition, the urban homeownership rate in China is roughly 98%, among the highest in the world (CDRF, 2020[18]). In this situation, recurrent taxes on immovable property can be an effective tool in reducing wealth inequalities (OECD, 2019[24]).

In addition, as suggested by Ahmad (2021[25]), the cost of the provision of public services can be explicitly linked to the revenues raised by the new recurrent levy on residential property. In that scenario, even if the new tax may not be progressive, the overall fiscal system could become more progressive if the revenues raised were spent on programmes/services that have an income-equalising effect. As discussed in the last chapter, this strategy could also increase the public support for tax reform.

With regard to the other property taxes, among the main Chinese local taxes there are the house property tax (3.51% of local tax revenue as of 2018),12 the urban land-use tax (3.36%) and the land value added tax (6.8%). Hence, the absence of a major tax managed at the local level might lead to a low efficiency of the tax administration and collection activities, as well as to an increase in compliance costs for taxpayers. Moreover, China also levies a deed tax that accounts for roughly 7.4% of total taxation at the local level.13 As a result, in case the introduction of recurrent taxes on residential property is combined with the discontinuation or reduction of other property taxes, especially the deed tax, the Chinese tax system could become more growth-friendly and simpler to administer. Such a reform might leave the housing price level relatively unaffected, as these measures have opposite price effects (Brys et al., 2013[19]). Another interesting option is to introduce recurrent taxes on immovable property along with a reform on inheritance taxes. As OECD (2019[26]) recommended, the introduction of these taxes together could lead to a reduction in wealth inequalities.

Box 2.4. Italian and Greek property tax reforms that reduced the number of tax levied

In Italy, the property tax on primary residences (ICI) was abolished in 2006 but reintroduced in 2013 under a new single municipal tax (IMU), which incorporates three taxes:

1. the IMU (“Imposta Municipal Propria”), which is a real estate tax paid by owners of secondary residences only. The taxable base is determined in connection with the value of the property according to the cadastre. The regular tax rate is 0.76% of the taxable base, but municipalities may increase or reduce the rate, with a maximum of 0.3%.

2. the TASI or “tax for indivisible services” is a supplementary real estate tax, which is supposed to meet the expenses for the delivery of lighting, street cleaning, green areas and services that are provided equitably by municipalities to all citizens;

3. and the TARI (waste tax), which must cover the costs of the service of collection and treatment of waste.

Both the IMU and the TASI were repealed on primary residences (except luxury homes) in 2014 and 2015. From 2020 onwards, in order to simplify the fiscal system, the government unified its local property taxes by abolishing the municipal service tax TASI and merging it with the IMU local property tax (both taxes are described below). The sum of TASI and IMU rates remain the same. Despite a reform of cadastral values is still pending to fully exploit the potential of the property tax, municipalities can intervene to re-evaluate cadastral rents of under-valuated areas or properties. In 2019, the recurrent property tax accounted for 1.2% of GDP, in line with the OECD average.

In Greece, a new property tax (Unified Property Tax, ENFIA) was established in 2014 to replace two previous property taxes, the real estate-based wealth tax (FAP) and the property tax that is collected through the Electric company utility bill. The new tax applies to individuals and legal entities owners of land and buildings. The ENFIA comprises a “main tax” and a “supplementary tax”. The main tax applies for buildings, plots, fields and so on. The main tax is calculated on the basis of “objective values” based on several criteria such as the location of the property, its size, use, age, the floor on which the property is located, etc. The supplementary tax (so called sumptuary tax) is imposed on very expensive property. The tax rate ranges from 0.1 to 1% of the assessed value. In 2018, the government reassessed the “objective values”, resulting in a decrease of paid taxes for 23% of property owners (23%), a stability for 62% and an increase for the remaining 15% of taxpayers.

Sources: OECD (2020[27]) and OECD (2021[28]).

Housing investments

The impact of property taxes on housing investments can be non-neutral and distortive

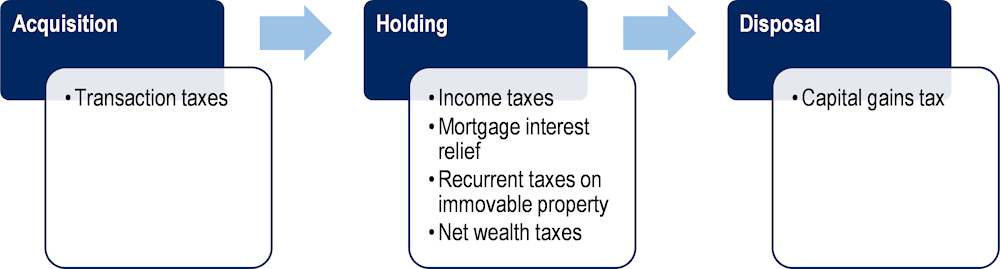

The non-neutrality of the taxation of housing assets has the potential to distort investment allocation decisions (Millar-Powell et al., 2022[29]). In this light, the effects of recurrent taxes on immovable property can be better understood when analysed in the broad context of taxation on housing investments. Multiple other tax levies and reliefs affect housing investments, and their effects are felt in different investment phases. Transaction taxes can be levied when the asset is acquired; income taxes, recurrent taxes on immovable property and net wealth taxes can be levied during the holding period; and capital gains taxes can be levied upon disposal of the asset. Mortgage interest relief, which can apply during the holding period, is one example of the range of deductions, credits and exemptions that apply to housing investments (Figure 2.7). Box 2.5 delves into the details of these taxes and reliefs in OECD countries.

Figure 2.7. Taxes levied over the life of housing investments

Box 2.5. Taxes levied over the life of housing investments in OECD countries

Taxes on acquisition of housing assets

Transaction taxes are levied on owner-occupied and rented housing in 30 out of the 40 countries analysed. They are generally applied at flat rates, but occasionally can depend on the value of the asset (for example, in Canada). Transaction taxes are typically levied on the purchase of an existing housing asset, and not on the sale of the asset. New residential housing may be exempt from transaction taxes, but some countries levy Value Added Taxes (VAT) when a new property is sold for the first time. The buyer may be liable for remitting the transaction tax or the VAT, but the economic incidence of the tax will depend on many factors and may lie on the buyer, the seller or they may share the burden.

Taxes on holding of housing assets

Taxation of rental income is more common than taxation of imputed rent. Different tax treatment of income typically applies to owner-occupied and rented housing. The return generated by owner-occupied housing in the form of imputed rent is typically tax exempt. Only four countries (Denmark, Greece, the Netherlands and Switzerland) tax imputed rental income, though this is generally at low rates and only when at least partially debt-financed in the case of the Netherlands. In contrast, 34 out of 40 countries tax actual rental income, while two (Belgium and the Netherlands) apply a tax on deemed rather than actual rental income. Rental income is typically taxed at progressive rates. However, four countries tax rental income at flat rates (Denmark, Iceland, Italy and Slovenia). In some cases, tax rates on rental income are applied at concessionary levels, or on a reduced base (e.g. Latvia, Spain, Iceland and Italy). There are also income-based exemptions applied to the taxation of rental income in Korea and the Slovak Republic.

Mortgage interest relief is widely available in the countries analysed. Twenty-one out of the 40 countries provide tax relief (via either a deduction or a tax credit) for mortgage interest on owner-occupied property. In 17 countries, this tax relief takes the form of a tax deduction for mortgage interest. The total value of the deduction is capped in two countries (Estonia and Luxembourg), while two countries restrict eligibility for mortgage interest relief to taxpayers who earn below an income threshold (Chile) or to taxpayers whose housing asset falls below a value threshold (Korea). Four countries provide a tax credit for mortgage interest, which is capped in Belgium, Italy and Spain but not in Japan. 27 out of the 40 countries also provide mortgage interest relief for rented property. The majority of these 27 countries provide an uncapped tax deduction for mortgage interest on rented property, though interest is not deductible in Chile if taxpayer income exceeds a threshold and tax relief is capped in Estonia. Some regions in Belgium provide a capped tax credit for mortgage principal repayments (but not for interest payments) for loans contracted before 2015.

No country provides an allowance for housing equity. In the area of corporate finance, different tax treatment may apply to firms that finance investments with debt and firms that finance with equity. In order to mitigate this differential treatment and reduce the incentive for firms to use debt finance, some countries provide an Allowance for Corporate Equity (ACE). Individual taxpayers may face similar incentives to employ debt finance; however, no country attempts to address any resulting incentives in a similar way (e.g. an allowance for housing equity).

The few countries that impose a net wealth tax have special treatment for owner-occupied housing. In all six countries with net wealth taxes, owner-occupied and rented property are included in the tax base (Argentina, Colombia, France, Norway, Spain and Switzerland). However, all six countries have a considerable minimum wealth threshold before a positive rate or rates apply and several provide special treatment for residential property. A 30% rate reduction applies for owner-occupied housing in France and Spain applies a specific exemption threshold to the main residence of up to EUR 300 000, which is in addition to the EUR 700 000 general net wealth tax exemption threshold. Only 25% of the owner-occupied property value is subject to the tax in Norway, which rises to 90% in the case of rented property (secondary homes). The basic general allowance in the wealth tax is NOK 1 500 000 (EUR 150 000) per taxpayer.

Taxes on disposal of housing assets

Concessionary rates are often applied to capital gains on owner-occupied property. Countries tax capital gains at a mix of progressive and flat rates and capital gains are typically taxed on a realisation rather than an accrual basis. Beyond these two commonalities, however, the tax treatment of owner-occupied and rented housing differs substantially. Of the 40 countries analysed, only 14 countries tax capital gains on owner-occupied housing. These taxes are often imposed at concessionary or zero rates and in many cases are subject to a minimum holding period test. At least some capital gains for rented housing are taxed in 34 out of the 40 countries. However, concessionary (or zero) rates are often applicable for rented housing and, as is the case for owner-occupied housing, these concessionary rates are generally subject to a minimum holding period test.

Sources: Millar-Powell et al. (2022[29]).

Debt-financed investments on owner-occupied properties are commonly taxed at lower effective rates relative to investments on other assets due to the lack of imputed rent taxes, capital gain taxes and mortgage interest reliefs

Not only is it challenging to analyse the joint effect of these tax levies/reliefs on housing investments, but these effects are also asymmetrical across investment’s, taxpayer’s and property’s characteristics. Three of the most important determining factors in the tax system that can affect the tax treatment of housing investments are related to: 1) whether the property is owner-occupied or rented; 2) whether the property is debt-financed or equity-financed; and 3) taxpayer’s income and wealth (Millar-Powell et al., 2022[29]). In principle, unless it is a policy objective to provide benefits14 to some type of investments, properties or taxpayers, these differences are non-desired consequences of the design of the tax system and, thus, should be minimised. In general, owner-occupied and debt financed properties are favoured in terms of marginal effective tax rates in comparison to rented and equity financed properties. The effect of taxpayers’ income and wealth and the length of the investment is not clear cut – it depends heavily on the characteristics of the tax system. According to Millar-Powell et al. (2022[29]), regarding:

Debt-financed and equity-financed properties: Mortgage interest relief is considered the cause of the differences in tax treatment between them. Tax relief for mortgage interest can significantly reduce the tax burden on housing, as it allows taxpayers to reduce their taxable income by the partial or full value of the interest they have paid on their mortgage. In the case of owner-occupied housing, which receives a tax subsidy on average, the reduction in tax liability provided by mortgage interest relief tends to outweigh the combined effect of all other taxes levied on a housing investment.

Owner-occupied and rented properties: There are two main drivers for the tax benefits that owner-occupied properties enjoy. First, with respect to income taxes, rental income is commonly taxed while imputed rents are often not. Second, while many countries provide tax exemptions for capital gains on owner-occupied housing, capital gains on rented housing are typically subject to taxation.

Taxpayer’s income and wealth levels: There are many potential drivers that may affect their tax treatment. First, tax deductions that allow taxpayers to reduce their taxable income at their marginal personal income tax rate may provide a greater benefit to high-income earners, who are often taxed at higher marginal rates. In this light, mortgage interest deduction provides a greater benefit to taxpayers with higher income because many countries provide a deduction at the taxpayer’s marginal rate, which is higher for high-income taxpayers in progressive tax systems, and because most countries do not cap the mortgage interest relief. Second, taxation of the main residence raises complex distributional questions since higher-income households hold more wealth in main residences than lower-income ones, but main residences of lower-income households tend to make up a larger share of their assets. In any case, the very poorest of households tend to not own a home and in this situation concessionary taxation of owner-occupied property relative to other forms of assets could provide a greater tax benefit to those in the middle and top of the income distribution compared to those at the very bottom. When tax benefits are extended to second homes, high-income taxpayers tend to benefit the most since they more commonly have multiple properties.

It is worth noting that due to the amount of exclusive benefits that debt-financed investments on owner-occupied receives, investment decisions can be distorted in a manner that favour this type of investment. First, the income generated by owner-occupied properties are often exempt of taxation while the income generated by other assets are not. Second, capital gains of owner-occupied properties are commonly not taxed. Third, interest paid to finance these investments are often subjected to tax relief, either as a tax credit or a deduction against labour and/or other income. While, from a neutrality perspective, this tax relief is difficult to justify, this position reflects the fact that a large number of countries place considerable importance on the policy objective of supporting home ownership15 (OECD, 2018[30]).

Distortions can be alleviated by levying recurrent taxes on immovable property, capping deductions or providing tax credit when granting tax reliefs for mortgage interest, and capping the value of owner-occupied houses that benefits from exemption from taxation capital gains