This chapter provides an overview of the Internet of Things (IoT), which refers to the interconnection of physical devices via the Internet. It discusses how IoT devices collect and share data to improve various processes, and can be used in several applications and sectors, including agriculture, energy, and healthcare. It also discusses the growth and adoption of IoT devices worldwide, along with associated challenges such as cybersecurity threats. Additionally, the text explores the convergence of IoT with other technologies like big data analytics and artificial intelligence. Finally, it outlines the structure of the book, which includes chapters on measuring IoT diffusion and case studies in the manufacturing and healthcare sectors.

Measuring the Internet of Things

1. Setting the scene

Abstract

The Internet of Things: What it is and what it is for

The Internet of Things (IoT) refers to “the inter-networking of physical devices and objects whose state can be altered via the Internet, with or without the active involvement of individuals” (OECD, 2015[1]). The IoT is an aggregation of uniquely identifiable “endpoints” that communicate bi-directionally over a network in a seamless way. The main driver of value of the IoT is the capacity to collect, store and share data about the environments and assets it monitors, thereby helping improve different processes as these become measurable and quantifiable. Depending on the IoT device, the processing of IoT data can be performed either locally by the object itself or in some other network location, e.g. another IoT device, a mobile device, the cloud or a data centre.

There are many type of IoT devices that serve varied functions, spanning from sensors for agriculture to smart meters for energy efficiency and wearables to monitor health conditions, just to name a few. IoT domains of application are also heterogeneous: they range from consumer applications to industrial ones, carrying the promise to deliver efficiency gains, such as cost reduction, energy savings, improved healthcare, decreased pollution or reduction in road congestion. The IoT is changing agriculture, energy, healthcare, manufacturing, transportation and cities, and has the potential to profoundly transform these sectors, contributing to economic growth and well-being.

The diffusion of IoT devices is driven by the declining cost of sensors, high mobile adoption and expanded Internet connectivity. IoT Analytics (2020[2]), a private company that mapped 1 414 IoT projects from 620 IoT platforms in the public domain, estimates that, in 2020, for the first time, there were more IoT connections (e.g. 11.7 billion connected cars, smart home devices, connected industrial equipment) than non-IoT connections (10 billion smartphones, laptops and computers). Other estimates suggest that by 2023, there will be 29.3 billion networked devices worldwide and 14.7 billion – half of the total – will be machine-to-machine (M2M) connections (Cisco, 2020[3]). The United Nations Conference on Trade and Development (UNCTAD, 2021[4]) estimates the market size of IoT technologies – as measured by revenues – at USD 130 billion in 2018, with expected growth of up to USD 1.5 trillion in 2025. In its estimates, the IoT accounts for the highest share of the market size of 11 “frontier technologies”,1 at 37% in 2018 and 47% in 2025 (UNCTAD, 2021[4]). However, the diffusion of IoT devices has also increased cybersecurity threats, and security risks and privacy concerns appear among the main barriers to adoption.

The IoT both enhances and is enhanced by other technologies such as big data analytics, cloud computing, artificial intelligence (AI) and machine learning (ML), which make it possible to process and capitalise on the large volumes of IoT data. As the value of the IoT gets unlocked with AI and ML algorithms applied to IoT data, the term artificial intelligence of things has also emerged recently. Edge computing – a decentralised and distributed form of computing – contributes to the convergence of these technologies (AIOTI, 2020[5]). Blockchain, augmented reality and virtual reality are other technologies that complement or enhance the IoT.

Although there is no agreed classification of the IoT, a frequent classification divides IoT application domains into commercial, consumer, enterprise and industrial IoT. Commercial IoT concerns applications developed to provide a better experience to guests in places like hotels and restaurants, through connected lighting or building access in smart buildings and smart offices for example. Consumer IoT hosts a great variety of IoT-connected devices, such as health monitors, smart home applications and connected automobiles. Enterprise IoT connects diverse technologies to enable new business applications that connect with physical objects and enterprise systems (e.g. enterprise resource planning, customer relationship management). Enterprise IoT applications can be implemented across multiple sectors, including agriculture and healthcare, as well as government and cities. The Industrial Internet of Things (IIoT) focuses on the specialised requirements of industrial applications, such as manufacturing, oil and gas, and utilities.

The surveys on information and communication technology (ICT) Usage by Businesses show that energy, transportation/storage and information and communication are the leading sectors for IoT adoption in Europe, while in Canada, utilities, information and cultural industries, mining, and oil and gas extraction rank at the top. IoT Analytics (2020[2]) found that most IoT projects are in the manufacturing/industrial sector, with transportation/mobility, energy, retail and healthcare having also increased their relative share in comparison to past analyses. The Economist Intelligence Unit (EIU, 2020[6]) also reports manufacturing, transportation and logistics, as well as utilities as the main sectors for the IoT, followed by the healthcare sector. In Italy, the Osservatorio Internet of Things estimates that the highest share of the market in the country is represented by utilities, followed by transportation and smart buildings (Osservatorio Internet of Things, 2021[7]).

Measuring the IoT: Some considerations

Several government authorities, organisations and market players (telecommunication providers) collect metrics on the diffusion of connected devices (OECD, 2018[8]). The OECD has collected data from regulatory authorities since 2012 on the number of M2M-embedded subscriber identity modules (SIMs). As of June 2021, there were about 385 million M2M SIM card subscriptions in the OECD area, compared to 132 million in 2015 (OECD, 2022[9]). However, while being an important component of the IoT – this category comprises only a small subset of all devices that are currently connected or will be so in the future. The fifth-generation technology standard for broadband cellular networks (5G) promises to become central to the IoT due to its low latency and capacity to support massive M2M communication. OECD countries have made significant progress in 5G commercial deployments: by June 2022, 5G commercial services were available in 36 out of the 38 OECD countries (OECD, 2022[10]). However, most commercial 5G services currently rely on presently deployed fourth generation of broadband cellular network technology (4G) core networks aimed at enhanced mobile broadband. The second phase of the deployment of 5G networks is more oriented to the IoT. 5G private networks are also being deployed in smart factories around the world, e.g. Factory 56 in Sindelfingen (Germany) or Factory Zero in Detroit (Unites States) (OECD, 2022[10]).

Mobile connectivity, however, is just one type of connectivity used for IoT devices and networks. Different IoT applications make use of different connectivity technologies as they have specific requirements. These requirements have driven the emergence of a new wireless communication technology: low-power wide‑area network (LPWAN). Cisco (2020[3]) estimates that in 2018 there were 223 million LPWA connections (all M2M), representing 2.5% of total device connections. The company forecasts an increase up to 1.9 billion LPWA connections by 2023, or 14% of total device connections. Cisco adopts a different definition of the IoT than the OECD; they estimate that mobile M2M connections were 1.2 billion in 2018, expected to grow to 4.4 billion by 2023.

In recent years, national statistical offices in OECD member countries have introduced questions in their ICT usage surveys to estimate the use of the IoT by businesses, households and individuals. These data start offering a more complete overview of IoT adoption by sectors and of usage by individuals. However, measures of other dimensions, such as social and economic impacts, are at present scattered.

Several management consultancies have produced estimates on the diffusion of IoT devices and the potential economic impact of the IoT, though academic research is quite limited on the topic, mostly due to the relative recentness of the technology and the difficulties in defining it for analytical purposes. Edquist, Goodridge and Haskel (2019[11]) suggest a potential global annual average contribution to growth of 0.99% per year in 2018-30, approximately USD 849 billion per year of world gross domestic product in 2018 prices. Espinoza et al. (2020[12]) used a growth accounting framework to evaluate the likely impact of the IoT on productivity. They found a positive impact of the IoT on labour productivity growth, though relatively small (0.01 percentage points in the United States and 0.006 in ten European Union countries).2 Cathles, Nayyar and Rückert (2020[13]), based on data from the European Investment Bank Investment Survey 2019 (EIBIS 2019), found IoT adoption in firms to be positively associated with productivity. They also found complementarities among advanced digital technologies, i.e. three-dimensional (3D) printing, advanced robotics, the IoT and cognitive technologies such as AI and big data.

The IoT is multidimensional and manifold: in the IoT ecosystem, not only are the “things” connected to the Internet rapidly growing in quantity and variety but the domains in which they are flourishing are also heterogeneous. The IoT does not only refer to the connected devices but to the entire ecosystem in which the “things” sense and communicate, which is composed of various layers: the enabling infrastructure, which includes telecommunication, cloud and data services, the devices embedded in “things”, which contain software and application programming interfaces to connect to objects, the operating platform (i.e. the integral support software that connects everything in an IoT system) and the application (“user”) layer (OECD, 2018[8]). Several economic actors are involved in each of these key-enabling layers (see Table 1.1 for examples of major market players), such as the designers and producers of connected devices sold to consumers, the IoT module providers (i.e. chips, processors, software and application programming interfaces), network integrators or service providers, and data aggregators. All of the above elements can be measured; therefore, possible IoT metrics can measure a variety of dimensions, following different approaches.

Table 1.1. Major players in the IoT value chain

|

|

Technology leaders |

New entrants |

|---|---|---|

|

Application layer |

Amazon, Apple, Cisco, GE, Google, IBM, Microsoft |

Alibaba, Huawei, Samsung, Schneider, Siemens, Tencent |

|

Data layer |

AWS, Google Cloud Services, Infosys, Fortinet, IBM, Microsoft, Oracle, SAS, Tableau |

Alteryx, Cloudera, Dataiku, Hortonworks, RapidMiner |

|

Connectivity layer |

Arista Networks, AT&T, Cisco, Dell, NTT, Ericsson, Nokia, Orange |

Bharti Airtel, China Telecom, Citrix, Coriant, Equinix, Tata Comms |

|

Device layer |

AMD, Apple, Fitbit, Honeywell, Intel, Nvidia, Sony |

AAC Tech, Ambarella, Garmin, Goertek, HTC, GoPro, LinkLabs |

Note: This list is not exhaustive and is for illustrative purposes only.

Source: IRENA (2019[14]), Innovation Landscape Brief: Internet of Things, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Internet_of_Things_2019.pdf?rev=4a5a17b14dbb4bd7be9e8a33c593e458.

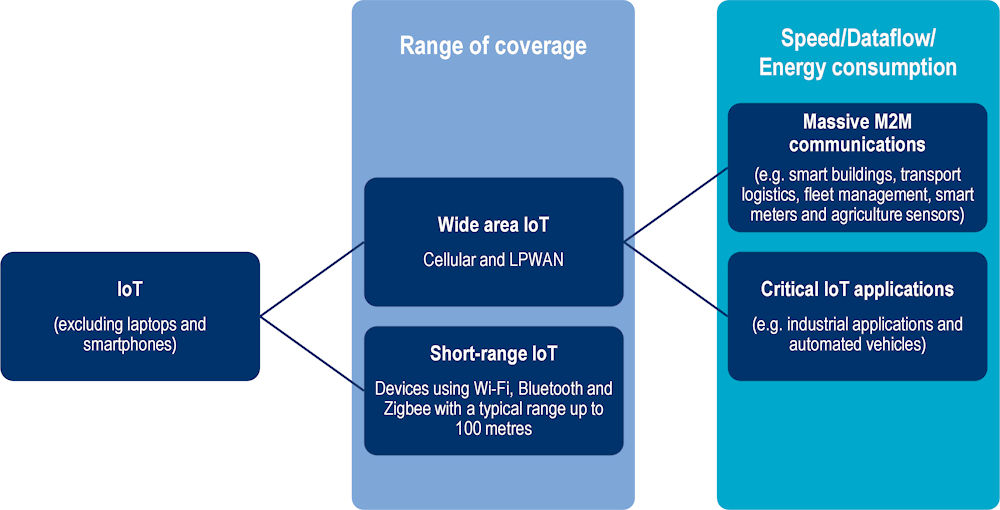

Given the variety of different IoT use cases and their different levels of development across sectors, it is necessary to narrow the scope to specific use cases for measurement purposes. In this light, previous OECD work (2018[8]) proposes prioritisation criteria and suggests measuring specific IoT applications instead of attempting to measure the IoT in general. To this end, it developed a taxonomy identifying sub‑categories of the IoT, classified according to their connectivity requirements. In addition, the proposed taxonomy of the IoT for measurement purposes (Figure 1.1) provides an approach according to dimensions, mainly based on implicit underlying technical criteria: the range of coverage and the specific functionalities of the IoT. These are considered from the combined angle of: i) the future market developments (main usage scenarios); ii) the IoT ecosystem approach; and iii) the way stakeholders from the private sector developing the IoT business cases (e.g. Cisco and Ericsson) are measuring the IoT.

Figure 1.1. Underlying criteria of the OECD taxonomy of the IoT for measurement purposes

Source: Updated from OECD (2018[8]), “IoT measurement and applications”, https://doi.org/10.1787/35209dbf-en.

Outline of this book

In this book, Chapter 2 focuses on the initiatives undertaken by national official statistical agencies and Eurostat to measure IoT diffusion, focusing on ICT usage surveys. It provides an overview and discussion of the definitions adopted and presents results for businesses, households and individuals. Chapter 3 provides further metrics on IoT diffusion, including trends in IoT-related semiconductors, patents, venture capital investments and firms. Chapters 4 and 5 present the results of two case studies on the manufacturing and healthcare sectors respectively.

References

[5] AIOTI (2020), IoT and Edge Computing Convergence, Alliance for IoT and Edge Computing Innovation.

[13] Cathles, A., G. Nayyar and D. Rückert (2020), “Digital technologies and firm performance: Evidence from Europe”, EIB Working Papers, No. 2020/06, European Investment Bank, https://ideas.repec.org/p/zbw/eibwps/202006.html.

[3] Cisco (2020), Annual Internet Report (2018-2023) White Paper, Cisco, https://www.cisco.com/c/en/us/solutions/collateral/executive-perspectives/annual-internet-report/white-paper-c11-741490.html.

[11] Edquist, H., P. Goodridge and J. Haskel (2019), “The Internet of Things and economic growth in a panel of countries”, Economics of Innovation and New Technology, https://doi.org/10.1080/10438599.2019.1695941.

[6] EIU (2020), The Internet of Things: Applications for Business, The Economist Intelligence Unit, https://pages.eiu.com/rs/753-RIQ-438/images/18062020_CTE%20Report_Final.pdf?utm_source=mkt-email&utm_medium=landing-page&utm_campaign=jun_20_pp_iot&utm_term=Read-the-report&utm_content=anchor-1.

[12] Espinoza, H. et al. (2020), “Estimating the impact of the Internet of Things on productivity in Europe”, Heliyon, Vol. 6/5, https://doi.org/10.1016/j.heliyon.2020.e03935.

[2] IoT Analytics (2020), “Top 10 IoT applications in 2020”, https://iot-analytics.com/top-10-iot-applications-in-2020/ (accessed on 27 January 2021).

[14] IRENA (2019), Innovation Landscape Brief: Internet of Things, International Renewable Energy Agency, Abu Dhabi, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Internet_of_Things_2019.pdf?rev=4a5a17b14dbb4bd7be9e8a33c593e458.

[10] OECD (2022), “Broadband networks of the future”, OECD Digital Economy Papers, No. 327, OECD Publishing, Paris, https://doi.org/10.1787/755e2d0c-en.

[9] OECD (2022), Broadband Portal, OECD, Paris, http://www.oecd.org/sti/broadband/broadband-statistics/.

[8] OECD (2018), “IoT measurement and applications”, OECD Digital Economy Papers, No. 271, OECD Publishing, Paris, https://doi.org/10.1787/35209dbf-en.

[15] OECD (2016), “The Internet of Things: Seizing the Benefits and Addressing the Challenges”, OECD Digital Economy Papers, No. 252, OECD Publishing, Paris, https://doi.org/10.1787/5jlwvzz8td0n-en.

[1] OECD (2015), OECD Digital Economy Outlook 2015, OECD Publishing, Paris, https://doi.org/10.1787/9789264232440-en.

[7] Osservatorio Internet of Things (2021), Il mercato dell’Internet of Things in Italia: tra COVID-19 e nuove opportunità per le imprese. Ricerca 2020 - 2021, http://www.osservatori.net (accessed on 30 September 2021).

[4] UNCTAD (2021), Technology and Innovation Report 2021, United Nations Conference on Trade and Development, https://unctad.org/system/files/official-document/tir2020_en.pdf.

Notes

← 1. Artificial intelligence, IoT, big data, blockchain, 5th generation mobile network (5G), three-dimensional (3D) printing, robotics, drones, gene editing, nanotechnology and solar photovoltaic.

← 2. Austria, Belgium, Finland, France, Germany, Italy, the Netherlands, Spain, Sweden and the United Kingdom.