This chapter presents the findings from two case studies on adopting the Internet of Things (IoT) in manufacturing in Brazil and Germany. The studies are intended to complement information from information and communication technology (ICT) usage surveys of the drivers and obstacles to IoT diffusion and the impact of IoT applications. Their findings aim to improve the evidence base for policy making in relation to manufacturing and to gain insights relevant to IoT applications in other domains.

Measuring the Internet of Things

4. Case study on Internet of Things in manufacturing

Abstract

This chapter discusses the main IoT applications in the manufacturing sector, where the current adoption of the IoT and the scope for further use seem among the highest. The drivers for IoT adoption and its effects on productivity are analysed based on two case studies of manufacturing firms in Brazil and Germany. Their findings provide a useful complement to the evidence from ICT usage surveys presented in Chapter 2.

Main uses of the IoT in manufacturing

Through the IoT, manufacturing processes can be improved in several ways. Sensor data from machinery can, for instance, help monitor the status of production equipment in real time and predict machine failure, thus enabling maintenance before the failure occurs (predictive maintenance); location sensors can track incoming supply and outgoing goods, thus enabling more efficient planning (tracking and monitoring); sensors provide manufacturers with a comprehensive view of what is occurring at every point in the production process, thus helping to make real-time adjustments (production optimisation) and monitor the inventory stock in real time, thus helping inventory optimisation. Smart meters and IoT sensors can monitor energy consumption and allow organisations to deploy practices for more effective usage of resources (energy/resource optimisation). An emerging use in manufacturing is the creation of digital twins, i.e. the exact reproduction through digital data of a physical object which allows to test processes first on the digital rather than on the real object, thus saving costs and resources.

Predictive maintenance

One of the most important use cases of Industry 4.0 is predictive maintenance. Predictive maintenance can identify maintenance issues in real time differently than traditional maintenance methods, which deal with machine failures as they emerge (reactive maintenance) or are based on asset inspections at regular times (preventive maintenance). In predictive maintenance, sensor data from machinery are used to determine failure ahead of time, thus allowing machine owners to reduce maintenance costs and downtime. Predictive maintenance can extend the lifespan of industrial assets, improve their utilisation and thus also production output. It also has the potential to promote sustainable practices in production by maximising the useful lives of production (Lee, Kao and Yang, 2014[1]).

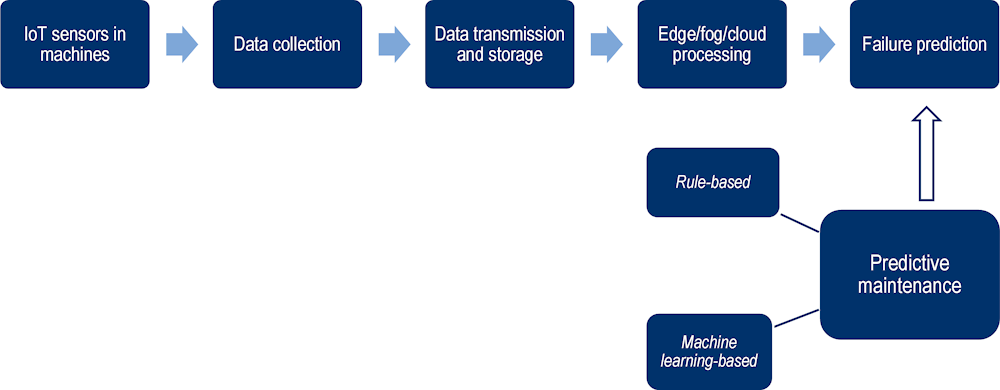

The process of predictive maintenance is illustrated in Figure 4.1. IoT sensors in machinery collect relevant data, which are then transmitted by the IoT hardware to a central cloud system for storage and processing. Data scientists then have two general approaches to predictive maintenance analysis at their disposal: they can manually discover patterns in the data and define explicit databased rules for maintenance (rule‑based predictive maintenance) or rely on machine learning (ML)-based predictive maintenance. In this case, the data science team needs to create a labelled dataset containing incidents of past machine failures in combination with other data. The algorithm can then be trained on this dataset and predict future machine failures. The predictions can then be integrated into a human-machine interface and help engineers find the ideal maintenance time.

The possibility of remotely controlling equipment and ensuring its maintenance through the prediction of failures also allows for the creation of new service-oriented business models, i.e. servitisation with remote monitoring and predictive maintenance enabled by the IoT. Equipment manufacturers can offer a payment model based on use, i.e. Hardware as a Service. This model would allow the creation of a data‑centred (digitallybased) service value chain beyond the traditional product-centric value chain.

Predictive maintenance is not only used in smart manufacturing: industries relying on predictive maintenance include transportation, oil and gas and process industries. Infrastructure sectors, such as railway, adopt the IoT for real-time monitoring, predictive maintenance and on-demand component replacement to keep trains operating at all times, thus reducing the need for significant number of trains on standby to cover any unforeseen failures and maintenance issues.

Figure 4.1. From IoT sensors to machine failure prediction: IoT-enabled predictive maintenance

Source: Based on Nangia, S., S. Makkar and R. Hassan (2020[2]), “IoT based predictive maintenance in manufacturing sector”, https://www.researchgate.net/publication/340443898_IoT_based_Predictive_Maintenance_in_Manufacturing_Sector.

Production optimisation

In a standard quality control process, manufacturers produce an item, their quality control unit tests it and they hope to identify and rectify defects before the product reaches the market. The IoT makes this process proactive, with sensors collecting complete product data through different stages of the product cycle. The products can also be tested at each manufacturing step to check if their attributes are within specifications. In addition, monitoring manufacturing equipment helps quality control personnel check if and where equipment settings diverge from standards. The IoT’s support in monitoring both equipment settings and the outcomes of each production step allows manufacturers to detect quality problems at the source so that measures for improvement can be taken early in the process.

More efficient energy use and reduced emissions

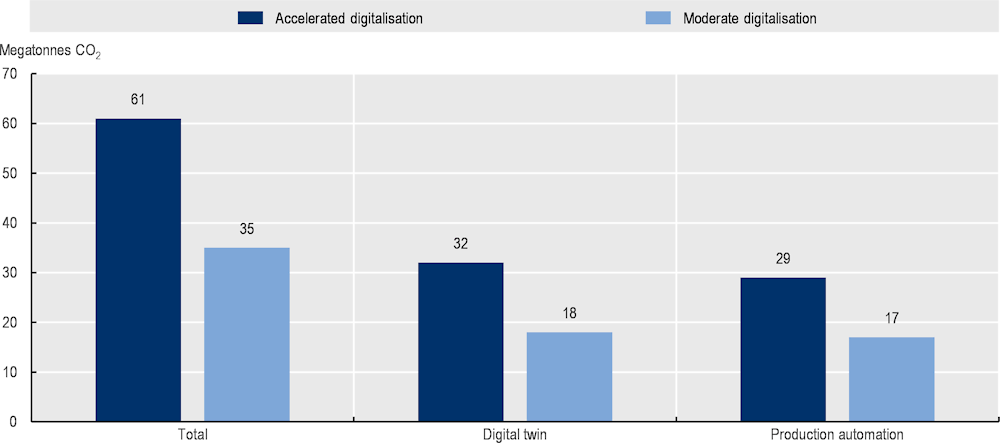

IoT sensors and smart meters allow organisations to measure the specific use of water, electricity and other resources and deploy practices for their more efficient use. In their study estimating the contribution of digital technologies to climate protection, Bitkom (2021[3]) – a German business association representing more than 2 700 digital economy companies – reports that the greatest potential for carbon dioxide (CO2) savings is in the field of industrial production. The study estimates 2 scenarios: in one of accelerated digitalisation in 2030, up to 61 megatons of CO2 can be saved, while in a scenario with a moderate digitalisation rate, savings go down to 35 megatons, corresponding to 16-10% of the expected emissions for industrial manufacturing processes in 2030 (Figure 4.2). Key technologies contributing to these results are production automation and digital twin; Industrial IoT (IIoT) is one of the main technologies contributing to their deployment.

Figure 4.2. Estimated potential CO2 savings thanks to digital technologies in Germany

Note: Potential savings refer to industrial production in 2030.

Source: Bitkom (2021[3]), Klimaeffekte der Digitalisierung – Climate Effects of Digitization, https://www.bitkom.org/sites/main/files/2021-10/20211010_bitkom_studie_klimaeffekte_der_digitalisierung.pdf.

Use of the IoT in manufacturing: Current scenario

Data from the ICT Survey show that, on average, 31% of enterprises in the manufacturing sector in European countries and 22% in Canada have adopted IoT technologies, well below the energy sector, which leads with 47% in European countries (Figure 2.9) and 46% in Canada (Figure 2.6). On average, enterprises using the IoT in the manufacturing sector in European countries adopt this technology mainly to ensure their premises’ security (76%), to monitor production processes and logistics (42%) and to optimise energy consumption (37%). Only one-fourth of enterprises using the IoT do so for condition-based maintenance and only about 11% to improve customer service. However, these figures conceal great differences across countries (Figure 2.10). Consistently, the same proportions in usage are reported for Italy by the Osservatorio Internet of Things (2021[4]), which found that in 2019 the most popular IoT applications in manufacturing were related to factory management (smart factories, 66% of cases), especially for real-time control of production and energy consumption. These were followed by applications focusing on the traceability of goods within the warehouse or along the supply chain (smart logistics, 27%), whereas smart lifecycle projects aimed at the optimisation of the development processes of new models and product updates were limited (7%) and still mainly at an early stage of deployment.

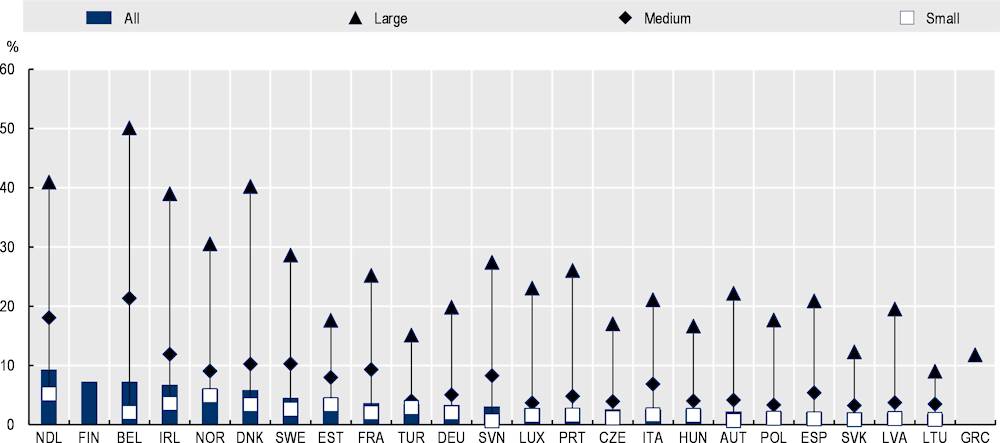

Eurostat data also confirm the early-stage integration of data analytics from IoT devices and the use of big data analytics by firms. Data sourced from smart devices and sensors are used only by 3.2% of enterprises in the manufacturing and energy sector, with some countries standing out in their use (about 10% of enterprises in the Netherlands and about 7% in Belgium and Finland). These numbers also conceal high discrepancies between firms of different sizes (Figure 4.3).

Market studies, such as the IoT Business Index 2020 carried out by the Economist Intelligence Unit and sponsored by leading semiconductor company Arm, indicate that scaling up adopted IoT solutions, both to add more connected products and systems or multiple cloud solutions and applications, is a key barrier for deployment (Forbes, 2020[5]). Nearly one-third of projects fail in the proof-of-concept stage (Microsoft, 2020[6]), with security and privacy risks, integration costs and lack of standards and interoperability being reported as the factors that slow down or halt the deployment of the IoT.

Figure 4.3. Share of businesses in the manufacturing and energy sector analysing big data from smart devices or sensors, selected European countries, by size, 2019

Note: Data for big data analysis by firm size are not available for the manufacturing sector only.

Source: Eurostat (2022[7]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

However, manufacturing is expected to lead in IoT adoption, given the high potential impact of IoT solutions in this sector. GSMA Intelligence (2019[8]) estimated that manufacturing businesses benefitted by USD 92 billion in 2018 in productivity gains from the use of the IoT, or 53% of the total estimated productivity benefits from the adoption of the IoT globally. Predictive maintenance applications have shown high potential for reducing costs: for example, Vodafone found that the IoT reduces costs among industrial adopters by 18% on average and increases uptime and productivity (OECD, 2017[9]).

IIoT as an enabling technology of Industry 4.0

The IoT is one of the main drivers of digital transformation in the manufacturing sector and one of the key enabling technologies of Industry 4.0. The latter is often considered a synonym of the IIoT, although Industry 4.0 is a broader concept which relies on the adoption of several technologies, such as cyber‑physical systems (CPS), the IoT, big data, artificial intelligence (AI), cloud and edge computing, virtual and augmented realities (Figure 4.4). Smart factories use those technologies to move the production process from traditional automation to a fully connected, flexible and optimised system and design customised products at mass production prices. Industry 4.0 includes horizontal integration of data flow between partners, suppliers and customers, as well as vertical integration within the organisation’s borders – from development to final product. The result is a system in which all processes are fully integrated with information in real time and the speed and rate of changes in consumer trends acts as a driver.

The digital transformation of the manufacturing sector is high on the political agenda and several countries have introduced policies to support advancement towards Industry 4.0. Starting with Germany and the launch of Industrie 4.0 in 2011, leading economies such as Japan (Society 5.0), the United States (Industrial Internet Consortium) and the People’s Republic of China (Made in China 2025) have adopted initiatives to support the digitalisation of manufacturing. As of 2017, 15 European Union countries had adopted initiatives for digitising industry (EC, 2017[10]). Smart factories are central to the Korean government’s plan for the Fourth Industrial Revolution (Box 4.1). Industry 4.0 is also one of the strategic verticals of the Brazilian Internet of Things Plan. Support for investment in Industry 4.0 has received new impetus as part of the national recovery and resilience plans in the European Union. In Italy, for instance, the Transition Plan 4.0 foresees an investment of EUR 24 billion up to 2022.

Figure 4.4. Combination of digital technologies for the smart factory

Source : Jung, W. et al. (2021[11]), “Appropriate smart factory for SMEs: Concept, application and perspective”, https://doi.org/10.1007/s12541-020-00445-2.

Since 2016, the World Economic Forum (WEF) and consulting firm McKinsey & Company have tracked the frontrunners in advanced manufacturing: as of March 2021, there were 69 such “lighthouses” in the world (WEF, 2021[12]) operating across industry sectors. These factories employ a range of digital technologies, reporting positive impacts on cost reduction, equipment efficiency, energy savings and productivity gains, among others, to which IIoT also contributes (Table 4.1).

Table 4.1. Selected examples of impacts of IoT use in lighthouse factories

|

Company |

Country/ Economy |

Industry |

Description |

Detail on IoT use |

Impact |

IoT use function |

|---|---|---|---|---|---|---|

|

Micron |

Chinese Taipei |

Semiconductors |

Micron’s high-volume advanced semiconductor memory manufacturing facility developed an integrated IoT and analytics platform, ensuring that manufacturing anomalies can be identified in real time while providing automated root cause analysis to accelerate new product ramp-up by 20%, reduce unplanned downtime by 30% and improve labour productivity by 20%. |

|

|

|

|

Novo Nordisk Device Manufacturing & Sourcing |

Denmark |

Pharmaceuticals |

Novo Nordisk has invested in optimisation, automation and advanced analytics, building a robust IIoT operating system to be scaled across their manufacturing footprint, increasing equipment efficiency and productivity by 30%. |

|

|

|

|

Saudi Aramco |

Saudi Arabia |

Gas treatment |

The Khurais oil field was built as a fully connected and intelligent field, with over 40 000 sensors covering over 500 oil wells spread over 150 x 40 km. This enabled autonomous process control, remote operation and monitoring of equipment and pipelines, resulting in the maximisation of oil well production, with at least 15% attributed to smart well completion technology alone. |

|

|

|

|

Ericsson |

United States |

Electronics |

Ericsson built a US-based, 5th generation mobile network (5G)-enabled digital native factory. Leveraging agile ways of working and a robust IIoT architecture, the team was able to deploy 25 use cases in 12 months and, as a result, increased output per employee by 120% and reduced lead time by 75% and inventory by 50%. |

|

|

|

|

Hitachi |

Japan |

Industrial equipment |

By leveraging a range of IIoT technologies and data analytics in engineering, production and maintenance operations, Hitachi Omika Works has reduced the lead time of core products by 50% without impacting quality. |

|

|

|

Note: The solutions described in the table are enabled by a range of digital technologies; results are only reported for specific uses of the IoT, while results from other technologies are not shown.

Sources: Compilation based on WEF (2019[13]), Global Lighthouse Network: Insights from the Forefront of the Fourth Industrial Revolution, http://www3.weforum.org/docs/WEF_Global_Lighthouse_Network.pdf; WEF (2020[14]), Global Lighthouse Network: Four Durable Shifts for a Great Reset in Manufacturing, https://www.weforum.org/whitepapers/global-lighthouse-network-four-durable-shifts-for-a-great-reset-in-manufacturing (accessed on 29 January 2021); WEF (2021[12]), Global Lighthouse Network: Reimagining Operations for Growth, http://www3.weforum.org/docs/WEF_GLN_2021_Reimagining_Operations_for_Growth.pdf.

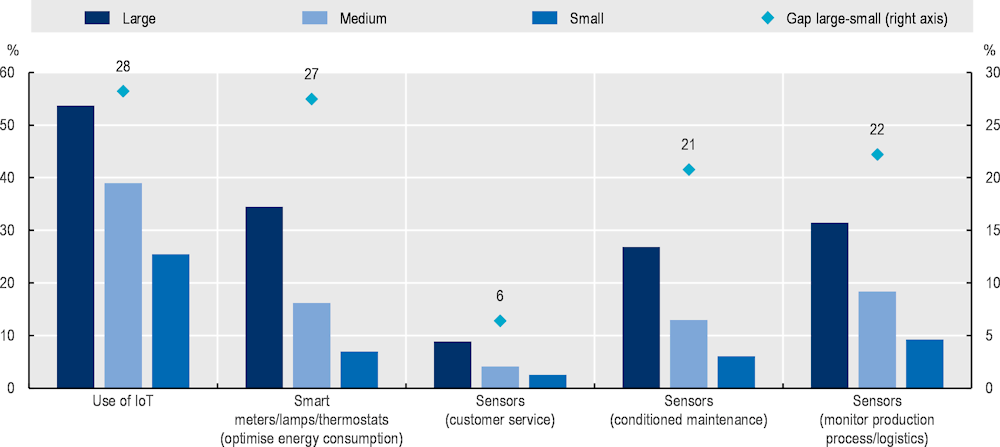

Figure 4.5. Use of IoT devices in the manufacturing, energy and construction sectors in selected European countries, by firm size, 2021

Note: Weighted average of European countries for which data are available, as shown in Figure 2.1. Sectors included are manufacturing, electricity, gas, steam and air conditioning supply, water supply and construction.

Source: Eurostat (2022[7]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

Lighthouses embody the highest advancements in the implementation of Industry 4.0 technologies. However, they are not representative of the degree of diffusion of digital technologies in firms across the spectrum of different sizes. Taking the IoT only, in Canada, there is a gap of about 25 percentage points between small and large firms (Figure 2.6), while in Korea, there are about 23 percentage points (Figure 2.7). The low level of digitalisation of Korean small and medium-sized enterprises (SMEs) has been tackled since 2014 by the government through the Korea Smart Factory Initiative (Box 4.1).

Although data for the manufacturing sector only do not exist for European countries, aggregate data for manufacturing, energy and construction sectors suggest that severe gaps exist between large and smaller companies, as high as 27 percentage points for the overall use of IoT devices (Figure 4.6). Furthermore, while large and medium companies in the manufacturing, energy and construction sectors use IoT devices (for the different surveyed uses) on average at a higher rate than in other sectors, smaller firms lag behind as compared to their counterparts in other sectors.

Box 4.1. The Korea Smart Factory Initiative: Supporting SMEs to adopt digital technologies in manufacturing

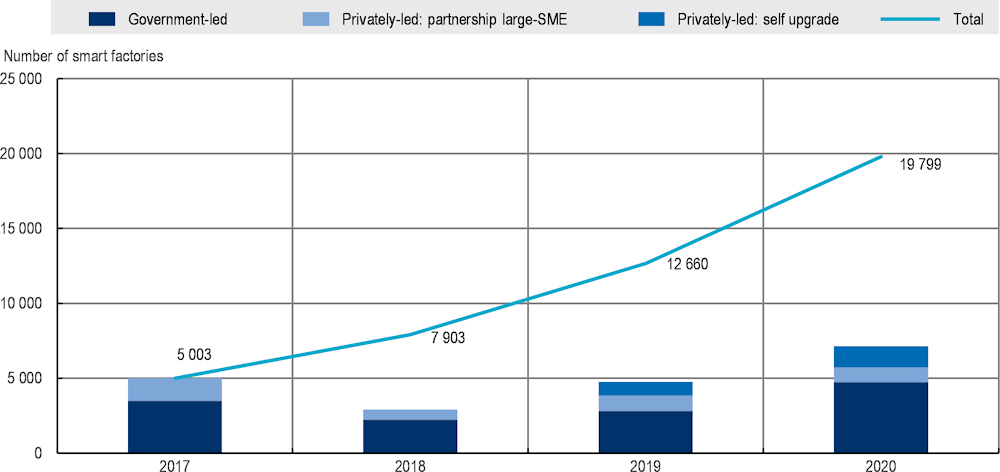

In 2014, the Ministry of Trade, Industry and Energy (MOTIE) launched the Korea Smart Factory Initiative as part of the Manufacturing Industry Innovation 3.0 strategy. The initial goal was to build 10 000 smart factory sites for Korean SMEs (firms with more than 10 employees) by 2020, then revising this goal to 30 000 by 2022 (out of total 67 000 SMEs in the country). The Smart Factory Initiative represents the main government instrument to assist Korean SME manufactures with funding, technology development and know-how to adopt digital manufacturing practices. The initiative is implemented through two methods: government support or large corporation voluntary support. At the end of 2020, Korea had 19 799 mostly government-led smart factories (Figure 4.6).

Figure 4.6. Smart factories in Korea by method of support, 2017-20

Source: Ministry of SMEs and Startups of Korea (2021[15]), Key Achievements of Smart Factories in 2020.

Korea distinguishes four levels of development towards a smart factory (Table 4.2). In 2020, most SMEs were at the Basic or Intermediate I level (74.5% and 23.7% respectively), only 1.8% were at the Intermediate II level and none of the SMEs had reached the Advanced level.

Table 4.2. Levels of smart factory

|

Development stage |

Korea |

Germany |

Goal |

Main ICT tools |

|---|---|---|---|---|

|

Basic |

Level 1 – Identify |

Lv 1-Lv2 |

Construct the information system to identify materials |

Barcodes and radio frequency identification (RFID) |

|

Level 2 – Monitor |

Gather and monitor in real time data from the workforce, machines, equipment and materials |

Sensors |

||

|

Intermediate I |

Level 3 – Analyse |

Lv 2-Lv3 |

Control, measure and analyse data collected in Level 2 |

Sensors and analysing tools |

|

Intermediate II |

Level 4 – Optimise |

Lv 4-Lv5 |

Gather, analyse and simulate data to optimise the production process (workforce, machines, equipment, materials, operating conditions) |

Sensor controller optimisers |

|

Advanced |

Level 5 – Customise |

Lv5 |

Customise the production process by optimising the workforce, machines, equipment, operation and environment conditions |

AI, augmented reality/virtual reality, CPS |

Source: Adapted from Smart Factory Korea (2021[16]), Introduction to Smart Factory, https://www.smart-factory.kr/smartFactoryIntro.

The performance of the SMEs supported by the programme is estimated to be good, as their productivity increased, while product defect rate, production cost and delivery time were reduced. It is estimated that private support by large companies performed better than government support (Table 4.3).

Table 4.3. Performance of the Korea Smart Factory Initiative, by support method (%)

|

Productivity increase |

Decrease in defect rate |

Cost reduction |

Shortening of delivery time |

|

|---|---|---|---|---|

|

SMEs supported by large companies |

49.5 |

48.7 |

26.2 |

21.4 |

|

SMEs supported by the government |

28.0 |

44.8 |

14.0 |

16.1 |

Source: Yu, J. (2018[17]), “Korea Smart Factory Initiative”, Colloquium on Digital Industrial Policy Programme, 12 November 2018.

Based on a review of existing surveys of SMEs in a number of countries (mostly European), Rauch, Erwin and Dominik (2021[18]) found that the IIoT is the third technology mostly adopted by SMEs among the technologies of Industry 4.0 (Table 4.4). However, SMEs limit their adoption of the IIoT (and Industry 4.0 concepts) to monitoring industrial processes (Moeuf et al., 2018[19]) without real applications in production planning and without real changes in the business model. SMEs mostly invest in the IIoT by retrofitting legacy equipment with actuators and sensors for data collection and introducing machine and process control systems to monitor the status of manufacturing systems in real time. In most cases, data analytics is based on simple and commercially available data monitoring and analysis tools, while the use of ML or more complex AI technologies is still in its early stages.

Case study: Objective and data collection

While ICT usage surveys provide information on the diffusion of the IoT in manufacturing, statistical evidence on the uses and effects of IoT adoption is still limited. The objective of the two case studies presented here is to gain a richer understanding of the uses of the IoT in the manufacturing sector, the main functions the IoT is used for and the related impacts. Therefore, the nature of these case studies is qualitative as they are not intended to represent all IoT manufacturing firms.

The case studies provide an in-depth analysis of IoT use in a small sample of small, medium and large manufacturing firms in Brazil and Germany, based on available information and complemented by interviews. The criterion for firm selection is the implementation of an IoT solution (devices and system) in order to perform at least one of the following functions:

tracking and monitoring

predictive maintenance

production optimisation

energy/resource optimisation

product customisation/feedback from customers.

In order to have different complementary technologies, sectors and enterprise sizes, several examples are included for the same IIoT function.

The case studies provide a technical description of the solution adopted, describe the implementation process and analyse the value for the company. They also provide a description of the company together with background information, e.g. size, location and industry.

During the interviews, the following questions were asked:

Was the investment in the IIoT (or the implementation of the IIoT technology) triggered by a specific need, e.g. client request/production or process improvement?

If yes, which one?

Was the IIoT the specific focus of the digital investment, or was it just a component of a larger digitalisation toolkit (e.g. with AI, cloud computing, big data analysis)?

If yes, why?

If not, why does the IIoT represent strategic importance?

What other digital technologies are used to complement the IIoT solution? (e.g. three-dimensional [3D] printing, AI …)?

How was the technology upgrade implemented: retrofitting or investment in new machinery?

What were the types of effort needed, e.g. in terms of skills?

Did the company rely on any public support for the implementation (advisory or financial)?

What was the cost of the solution (also expressed in magnitude)?

Does the firm track the benefits of the IIoT solution implemented (specifically)?

What are the benefits of the IIoT (if possible quantitative, otherwise based on a qualitative assessment)?

What connectivity solution was adopted and why?

What are the positive lessons learned from the implementation (e.g. benefits)?

What are the negative lessons learned from the implementation (e.g. obstacles)?

Results from the case study in Germany

Background on the IIoT in Germany

Manufacturing industries play a key role in the German economy, as some 15 million jobs depend directly and indirectly on this sector. In the overall economy, SMEs account for more than 99% of companies and 60% of jobs (BMWK, 2019[20]). Some of these SMEs are global market leaders in their product segments and are essential drivers for innovation and technology diffusion. Unlike other large European economies such as France and the United Kingdom, corporations play a less important role in the German industry: among the largest 10 000 industrial firms in Germany, 39% are family-owned (Die Deutsche Wirtschaft, 2021[21]). These firms – SMEs and, to some extent, larger family-owned enterprises – constitute the so‑called German Mittelstand (German middle class).

German industry, however, is less advanced in digital transformation than other sectors such as ICT, finance and services (DIHK, 2021[22]). Given the strong economic role of the Mittelstand, public support is provided to enhance their digital transformation, e.g. Mittelstand Digital and Mittelstand 4.0 competency centres.

Industry 4.0 is the focus of the federal government’s digital agenda. It involves using ICT in the production process to enable autonomous components’ communication with the production equipment, orders of new material or maintenance services. This means that humans, machines and industrial processes are intelligently connected (BMWK, 2020[23]). Therefore, the IIoT and Industry 4.0 are often used interchangeably.

Public support for IIoT uptake includes showcases about the IoT potential for SME users as well as smart factory labs where firms can experiment with new production processes enabled by the IoT. Experts from Mittelstand 4.0 agencies act as multipliers and transfer IoT-related know-how through various channels, e.g. workshops, training and networking events. In addition, several programmes provide funds for research and innovation in the IIoT, in particular the Automatics for Industry 4.0 and the Smart Services World with a fund of about EUR 100 million each (BMWK, 2020[23]). Various public funds support the financing of innovative start-ups at the federal and state levels (BMWK, 2020[24]).

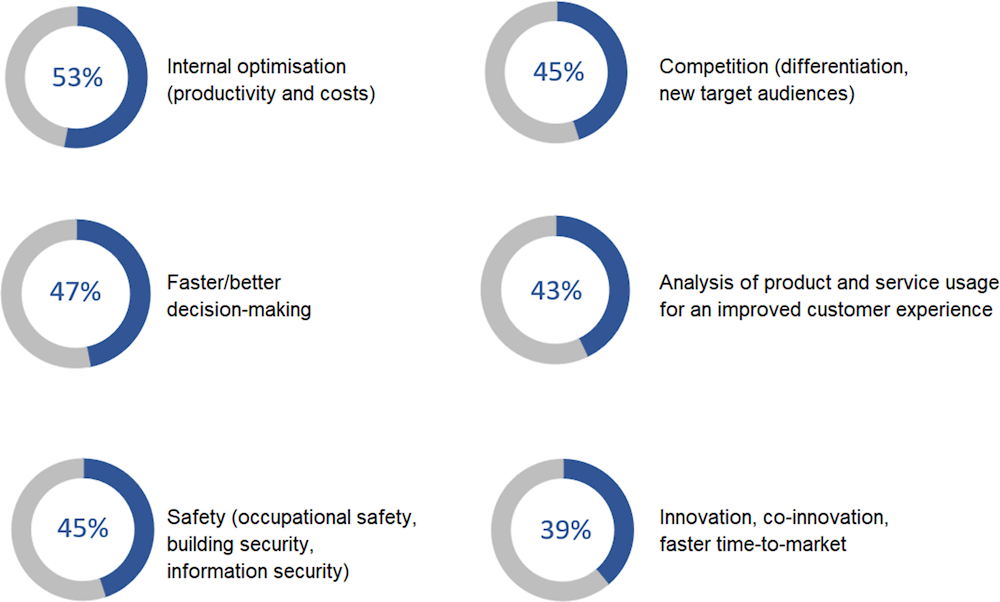

A recent study (IDC, 2020[25]) provides insights into IIoT uptake by German firms with 100 employees and more. It shows that IIoT implementation is strategically motivated by its potential to optimise productivity and costs, speed up and improve decision-making processes and differentiate from competitors (Figure 4.7).

Figure 4.7. Key objectives of IIoT projects in German firms

Note: N = 254; multiple answers possible; abbreviated.

Source: IDC (2020[25]), Industrielles IoT in Deutschland 2021 – Innovative Technologien und Trends für IIOT [Industry IoT in Germany 2021 - Innovative technologies and trends for the IIoT], IDC Central Europe GmbH.

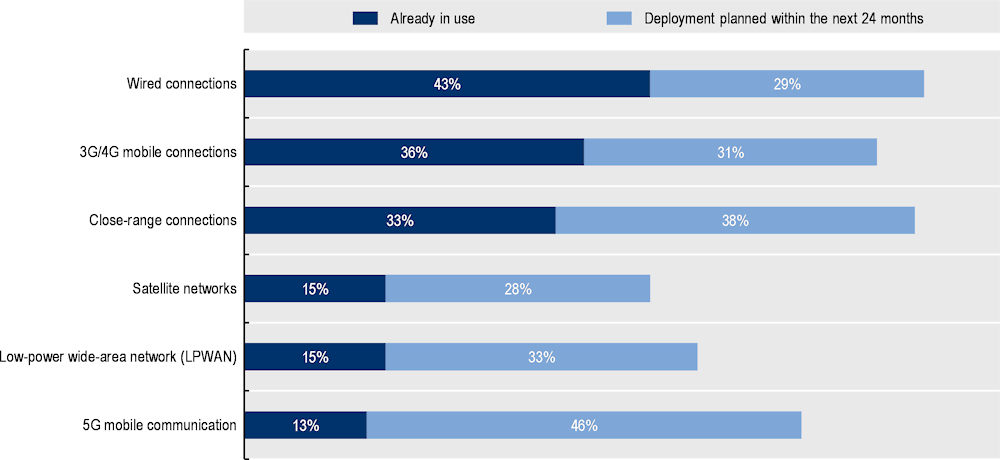

With regard to connectivity, those IIoT projects deploy a mix of different technologies. Fixed connections play a major role at present but wireless connections are increasingly important, with 59% of IIoT projects using or planning to use 5G (Figure 4.8).

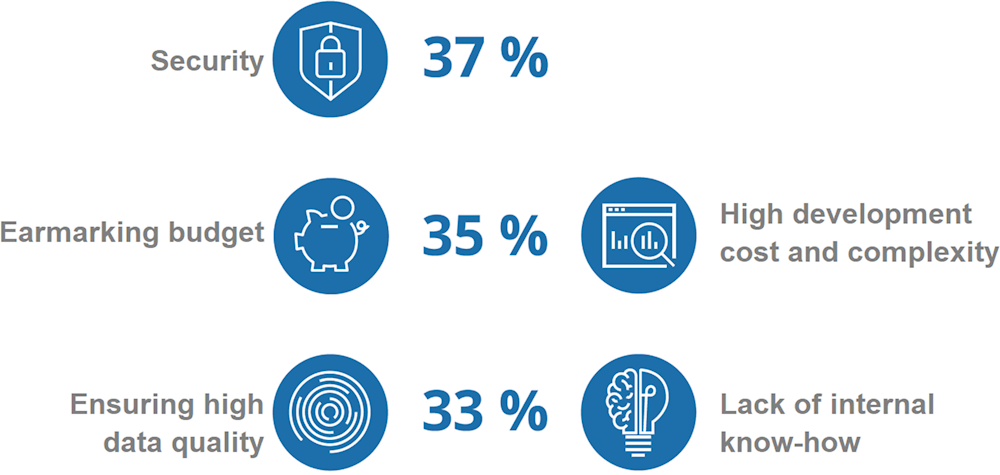

More than one-third of companies see major challenges in implementing the IIoT in the fields of security, financing, data quality and complexity of the projects (Figure 4.9). Moreover, they point to a lack of internal know-how.

Figure 4.8. Connection types used in IIoT projects in German firms

Note: N = 254; multiple answers possible; abbreviated.

Source: IDC (2020[25]), Industrielles IoT in Deutschland 2021 – Innovative Technologien und Trends für IIOT [Industry IoT in Germany 2021 - Innovative technologies and trends for the IIoT], IDC Central Europe GmbH.

Figure 4.9. Top five obstacles to IIoT uptake in German firms

Note: N = 254; without “Don’t not”; abbreviated.

Source: IDC (2020[25]), Industrielles IoT in Deutschland 2021 – Innovative Technologien und Trends für IIOT [Industry IoT in Germany 2021 - Innovative technologies and trends for the IIoT], IDC Central Europe GmbH.

Industrial IoT in Germany: Case studies and lessons learned

Overview

The next sections present the findings from the analysis of a set of IIoT providers and IIoT-using firms. The analysis aims to provide insights into the potential, challenges and benefits of the IIoT. Firms were selected so as to cover different characteristics, as detailed in Box 4.2, and based on desk research and experts’ views. While covering different firms’ characteristics, the set of firms selected should not be regarded as representative of the whole German industry.

Box 4.2. Firms’ characteristics considered in the selection process

1. Role in the IIoT

industrial enterprise/user

enabler/solutions provider

2. Technological focus/industry

3. Geographical market (sales market)

national

international

4. Company size

small (less than 49 employees)

medium (49-250 employees)

large (more than 250 employees)

5. Experience in the IoT

early adopter (5-10 years)

IoT pioneer (more than 10 years)

6. Strategic objectives of IoT implementation (referring to the user)

enhance customer service

optimise internal processes

develop new business models.

Based on the above-mentioned criteria, a long list of 60 companies was established and a total of 35 candidates approached. Finally, a set of nine firms were selected, consisting of five IIoT providers and four IIoT-using firms, based on the above-mentioned search criteria and their availability for an interview.

The set of IIoT providers includes two large companies (LAP and q.beyond), a medium-sized company (TELOGS) and two small companies, one with a long-standing experience in the IIoT (Schildknecht) and one start-up (PANDA). These firms cover a range of different technologies, e.g. retrofit, AI, laser.

In the selection process of IIoT-using firms, SMEs were found either without sufficient maturity for IIoT solutions or for tackling more urgent issues such as supply chain interruptions or excess demand following the COVID-19 pandemic. Therefore, the analysis has focused on firms with 250 employees and above. The largest company included in the set is TRUMPF GmbH & Co. KG, one of the top 100 industrial enterprises and the leading firm in machinery and plant engineering in Germany (Die Deutsche Wirtschaft, 2021[21]). The other two firms in the selection, Siegwerk and Wanzl, belong to the largest family-owned industrial enterprises. The fourth company, Kreyenberg, is a family-owned industrial enterprise that moved into industry from the craft business.

In-depth interviews (about 60 minutes) were carried out with all 9 companies about their company background, the strategic role of the IoT for their businesses and their experiences with regard to the potential and challenges of the IoT, costs and benefits, as well as success factors for IoT uptake.

Table 4.4. Main characteristics of the German firms selected for the case study in manufacturing

|

Company |

Role in the industrial IoT |

Technological focus/industry |

Geographical market |

Company size |

Experience in the IoT |

Strategic objectives of IoT implementation |

|---|---|---|---|---|---|---|

|

Kreyenberg GmbH |

Industrial enterprise/ user |

Machining/ Supplier |

National |

Medium |

Early adopter |

|

|

Siegwerk Druckfarben AG & Co. KGaA |

Industrial enterprise/ user |

Manufacturing of print=s, inks and coatings for packaging |

International |

Big |

Early adopter |

|

|

TRUMPF SE & Co. KG |

Industrial enterprise/ user |

Manufacturing of machine tools, laser technology and electronics for industrial applications |

International |

Big |

IoT pioneer |

|

|

Wanzl GmbH & Co. KgaA |

Industrial enterprise/ user |

Manufacturing of shopping and luggage transport trolleys |

International |

Big |

Early adopter |

|

|

LAP GmbH Laser Applikationen |

Enabler/ solutions provider |

Laser projection for worker guidance in manufacturing industries |

International |

Big |

Early adopter |

|

|

PANDA GmbH |

Enabler/ solutions provider |

AI-based IoT solutions for production processes |

National |

Small |

Early adopter |

|

|

q.beyond AG |

Enabler/ solutions provider |

IoT edge solutions |

National |

Big |

IoT pioneer |

|

|

Schildknecht AG |

Enabler/ solutions provider |

Wireless IoT solutions |

International (Europe) |

Small |

IoT pioneer |

|

|

TELOGS GmbH |

Enabler/ solutions provider |

Intralogistics |

International |

Medium |

Early adopter |

|

Main findings

The interview findings provide useful insights into the drivers, obstacles and benefits of IoT uptake by manufacturing firms in Germany. Further information about case study findings is provided in Annex 4.A.

The strategic objective for IIoT uptake most frequently reported is to optimise production processes and/or strengthen customer relationships:

In large firms, IoT uptake is part of a broader digital transformation strategy and aims to achieve both objectives. Smaller firms tend to implement narrower projects with a more operational focus.

Many firms also regard the IoT as having the potential to enable new business models.

The motivation and opportunities to adopt the IoT are strongly firm-specific. In particular, uptake is higher among firms facing challenges for which a ready-made IoT solution is available.

IIoT uptake depends on firms’ size, sector and business model:

Small companies have limited resources to start and undertake IoT projects. They do not have the skilled staff or even a dedicated department for digitalisation: a digitalisation expert is typically employed in companies with at least 250 employees. Therefore, they often lack sufficient inhouse expertise to assess the potential of the IoT and manage its implementation.

The type of IoT devices and applications adopted are strongly influenced by the sector in which firms operate, e.g. hazard detection in the chemistry sector, radio interference in metal companies. In addition, sector-specific standards and processes affect IoT adoption in firms.

Industrial production processes and machine parks, which are at the core of IIoT solutions, differ significantly from company to company with regard to the level of automation, supported applications, level of standardisation and age of the machines in place.

Data represent both a driver and a precondition for many IIoT solutions: the more data are available to the using firm and the better their quality, the higher the potential benefits from many IoT solutions.

Costs are a significant hurdle, especially in smaller companies with their limited budgets:

Firms’ interest in the IIoT competes with other important projects and day-to-day business activities in terms of time and resources.

IIoT providers with a specific focus on SMEs offer solutions to meet their needs, e.g. simple and fast IoT solutions at a fixed price that can be expanded at a later stage.

Public funds for training, trials and financial support are essential to lower barriers for SMEs to define and implement IoT projects.

As a positive cost-benefit balance is key to driving IIoT uptake, benefits need to be identified:

For some specific IoT solutions, positive effects are easy to trace, e.g. remote monitoring can reduce travelling up to 100% and results in measurable cost reductions.

However, a cost-benefit analysis is hardly feasible for most IIoT solutions, e.g. AI-based IoT for predictive maintenance, which are implemented within complex and constantly changing systems.

Early adopters are typically convinced about the positive effects of the IIoT on efficiency and competitiveness. They have learned to assess the “broader picture” of IIoT adoption rather than the effect of single IoT solutions. They also report a positive contribution of the IIoT to address pressing challenges, e.g. maintaining production running despite a shortage of skilled workers. The positive feedback from these companies typically serves as an incentive for new IIoT adopters.

Technical and operational aspects can be a challenge for IIoT implementation:

Digital security and data protection concerns are among the major barriers to IIoT uptake. These concerns are even stronger for the IoT than for other ICT tools due to the much larger number of connected devices. While digital security and data protection issues tend to be neglected by firms at the early stage of IoT adoption, they become an obstacle to further deployment.

Interoperability and scalability also play an important role. Many firms prefer flexible, scalable and versatile solutions which can be easily integrated into the user’s technical systems. Technology-neutral solutions are preferred by many enterprises that use different technical standards and interfaces.

Some firms employ machinery whose design and installation are highly customised, thus making their replacement costly. Instead of replacing old machinery with new ones equipped with the IoT devices, firms, especially SMEs, tend to rely on retrofit solutions, with the old machinery remaining in operation while IoT solutions are plugged in.

Finally, soft factors play an important role in IoT uptake:

Decision makers’ positive attitude towards innovative technologies is essential. It sets the precondition to drive IoT adoption.

An open-minded corporate culture also facilitates the implementation of the IoT.

The involvement of employees increases the probability of success of the IoT. Workers’ concerns about the IoT should be addressed from the beginning. Also, it is important to show the potential benefits of IoT solutions and provide training for all employees involved in the process.

Results from the case study in Brazil

Background on IIoT in Brazil

This section1 presents an overview of the manufacturing industry2 in Brazil. It also includes evidence on the use of ICT in Brazilian companies, so as to assess the technological readiness of the Brazilian economy in general and that of manufacturing companies.

Since the 1990s, the economic weight of the manufacturing sector has been declining in Brazil. In 1985, the sector accounted for 36% of gross domestic product, whereas it only represented 11.3% in 2021.

The manufacturing industry is labour-intensive in Brazil. In 2020, the sector had 6.9 million formal employment contracts, corresponding to 14.8% of the total number of contracts. Industrial activities in Brazil have been traditionally concentrated geographically along the South-Southeast axis, in particular in the state of São Paulo, although concentration has decreased over the last decade. In terms of socio‑economic and demographic indicators, the South and Southeast regions present a higher level of social and economic development and host a large portion of the Brazilian population. Regarding ICT adoption, over the last decade, there has been a significant increase in basic connectivity among Brazilian enterprises, with most companies having Internet connections via fibre optics. However, using ICT is far from widespread, a decisive factor in their overall performance. For instance, although most companies use ICT in their everyday tasks, only 54% have a website and 36% pay for online advertising.3

Broadband access via fibre connections is available in all Brazilian regions. In 2019, 67% of all firms with Internet access had a fibre connection. In the South and Southeast regions, where manufacturing is concentrated, this share was 66% and 69% respectively. However, 91% of large firms in Brazil had a fibre connection against only 65% of small ones (CGI.br, 2020[26]). The availability of fibre connections makes it possible for firms to access fast-speed Internet, a key feature for the adoption of the IoT: in 2019, 70% of Brazilian firms reported download speeds of over 10 Mbps (CGI.br, 2020[26]).

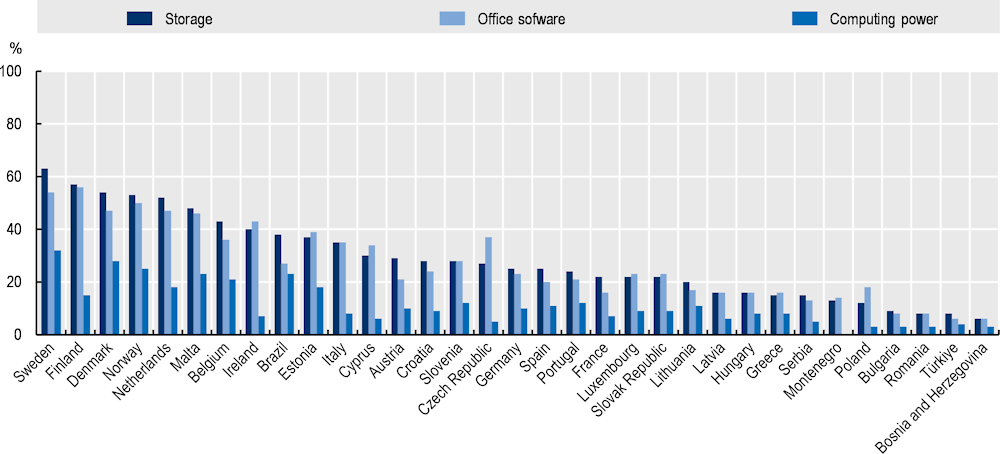

Cloud computing is another key requisite for the large-scale use of the IIoT. Indeed, the need to process and store large volumes of data in real time and with high speed requires companies to use cloud services to optimise their processes. The available evidence suggests that Brazil occupies an intermediate position in comparison to European countries (Figure 4.10).

In 2021, 14% of Brazilian enterprises reported using smart devices or IoT applications, a proportion that was higher among large enterprises (21%). The use of the IoT was lower in manufacturing (11%) relative to information and communication (36%) and real estate, professional, scientific and technical, and administrative and support service activities (18%). Among manufacturing firms, the main purpose for using IoT sensors and smart devices was to support security (86%) and energy consumption (51%). Applications directly connected to production processes were less mentioned (46%) (CGI.br, 2022[27]).

Figure 4.10. Use of cloud computing services in enterprises with Internet access, Brazil, 2019, and European countries, 2020

Sources: CGI.br (2020[26]), ICT Enterprises 2019: Survey on the Use of Information and Communication Technologies in Brazilian Enterprises, https://cetic.br/en/pesquisa/empresas/indicadores/; Eurostat (2022[7]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

Industrial IoT in Brazil: Case studies and lessons learned

Overview

The case study in Brazil comprises in-depth interviews4 with six IIoT-using enterprises in the manufacturing sector and four IIoT-supplying enterprises, complemented by further company information. The interviews were conducted on line between 23 February and 27 April 2022.

The process of selection and invitation of the enterprises were supported by recognised organisations in the field, such as the Centre for the Fourth Industrial Revolution (C4IR Brazil)5 and the Brazilian Industrial Internet Association (ABII).6 Field data collection was co‑ordinated by Cetic.br/NIC.br, with the support of an outsourced research company (Ipec). All results were transcribed (in Portuguese) for supporting analysis.

Most of the IIoT providers are small companies involved in the integration of sensor parts, installation of devices and data analysis for customers. There was greater diversity for IIoT-using enterprises, with companies of different sizes and economic activities. Due to the geographic distribution of manufacturing activities in Brazil, most enterprises interviewed were in the South and Southeast regions of the country. Table 4.5 shows the main characteristics of the enterprises studied.

Table 4.5. Main characteristics of the Brazilian firms selected for the case study in manufacturing

|

Company |

Role in the industrial IoT |

Technological focus/industry |

Geographical market |

Company size |

Experience in the IoT |

|---|---|---|---|---|---|

|

Ergomais |

Industrial enterprise/user |

Manufacturing of ergonomic products |

National |

Small |

Starter |

|

ASW Brasil Tecnologia em Plástico |

Industrial enterprise/user |

Manufacturing of power grid distribution components |

International |

Small |

Starter |

|

Selco Tecnologia |

Industrial enterprise/user |

Manufacturing of compressors and automotive parts |

International |

Medium |

Starter |

|

Indústrias Mangotex Ltda |

Industrial enterprise/user |

Rubber components for the automotive industry |

International |

Large |

Early adopter |

|

Rochel Ferramentaria Ltda |

Industrial enterprise/user |

Machinery devices |

National |

Small |

Starter |

|

Embraer |

Industrial enterprise/user |

Aviation |

International |

Large |

Early adopter |

|

Hedro Sistemas Inteligentes |

Enabler/solution provider |

Firmware IoT solutions |

National |

Small |

Early adopter |

|

HarboR Informática Industrial Ltda |

Enabler/solution provider |

Cloud and data IoT and AI solutions |

International |

Small |

Starter |

|

AIQuatro |

Enabler/solution provider |

Firmware, cloud and data IoT and AI solutions |

National |

Small |

Starter |

|

Dynamox SA |

Enabler/solution provider |

Firmware, cloud and data IoT and AI solutions |

International |

Medium |

Early adopter |

Main results

The following section presents the main findings from the interviews as well as further information from the studied cases. The dimensions covered by the questionnaire were divided into four parts: i) implementation and solutions; ii) connectivity and technologies; iii) perceived benefits and barriers; and iv) lessons learned. Further details about the case studies’ findings are provided in Annex 4.B.

Implementation and solutions

Most IIoT implementation projects in the firms studied were in an early phase. The projects were limited to only some of their machines in order to evaluate the opportunity to enlarge the use of these technologies. Although most enterprises stated that the cost of installing sensors in their machines was modest, they were quite reluctant to scale up their use.

In general, respondents reported that the implementation of IIoT solutions brought benefits to enterprises, in particular in functions related to predictive maintenance. Energy efficiency or production automation solutions were rarely mentioned and there was no mention of uses related to quality control or product customisation. Therefore, among the enterprises interviewed, the IIoT seems to be used in specific segments of the production line, mainly to improve production support processes.

The limited scope of IIoT use suggests that implementation is at an experimental stage. This hypothesis was confirmed by several respondents, who pointed out that the IIoT applications were being tested to learn about their benefits and to prepare the enterprise for a possible, larger utilisation of the IIoT. Most IIoT applications are used in old machinery to optimise their use or in pilot projects to evaluate new solutions. The interviewees indicated that projects were perceived as a transition to new modes of production.

In the enterprises interviewed, IIoT sensors are mainly used for monitoring and collecting data on production machines, thus, digitising processes previously carried out by employees. Digitisation has made data collection more efficient and has improved data quality. Some respondents stressed the importance of the daily operation of IIoT sensors, which makes it possible to collect data throughout the day and generate more accurate and timely information about the performance of machines that are crucial for enterprises.

Few IIoT-using enterprises reported strategic use or advanced analysis of the data generated through the IIoT. In general, the companies providing IIoT solutions provided the sensor data analysis as an additional service. IIoT-using enterprises reported either that they were satisfied with a basic use of the information collected through the IIoT or that it was difficult to motivate their teams to carry out more complex analyses of the IIoT data.

Regarding machine adaptation, IIoT-using firms reported that IIoT solutions do not demand complex specifications and only require the installation of sensors, which are usually plugged into the existing equipment. As for the IIoT providers, the interviewees pointed out the low production costs of the sensors and their flexibility of use and indicated that their revenues come mainly from maintenance and data analysis services.

Connectivity and technologies

Most IIoT-using firms reported that few modifications were required to connect the machinery in use to the Internet in order to implement IIoT solutions. Some indicated that it was necessary to increase the contracted Internet speed or change the routers’ positions. The need to install private networks was not mentioned and some reported using mobile connections. IIoT-producing enterprises confirmed that IIoT devices have few requirements for connectivity, a characteristic that, in their view, makes their implementation feasible for firms.

Very few enterprises reported using the IIoT in combination with other Industry 4.0 technologies, such us 3D printing and AI. Many respondents stated that greater integration of production lines with customers and suppliers would be necessary to implement Industry 4.0. Most enterprises reported using cloud services and even before the implementation of the IIoT.

Perceived benefits and barriers

Most respondents reported that the use of IIoT applications increased their firm’s competitiveness by reducing the costs associated with machine breakdowns and production outages. Interestingly, some firms expressed the view that implementing the IIoT in their processes was inevitable since their competitors were already using this technology.

Although the strategic use of the data generated by the IIoT seems basic, the enterprises interviewed regard it as a valuable resource to improve their performance. They also expressed the view that the development of data-driven decision making was inevitable and should be promoted. However, it is likely that IIoT-using firms will continue to rely on the use of data intelligence provided by IIoT suppliers, as most respondents pointed out a lack of human and technical resources and regarded the creation of a data department in their firm as unnecessary.

Despite the simplicity and the low cost of IIoT solutions, the interviewees showed some reluctance to scale up their use. Some respondents stressed that the implementation of IIoT solutions needs the support and commitment of senior management. Others pointed out the importance of effective strategies to change long-established routines in firms. This involves showcasing the potential benefits of the IIoT for the firm and dealing with workers’ concerns about their being replaced by the technology. Similarly, some IIoT suppliers pointed out the need to convince company managers of the benefits of the IIoT as well as resistance to changes in production and organisation in adopting firms.

Importantly, the interviews showed low awareness among IIoT-using firms of digital security risks that may arise from greater interconnection between machines and devices. As most firms rely on standard Internet connections to operate their IIoT devices, the respondents did not reference the need to improve network security or implement digital security risk mitigation practices. On the contrary, IIoT providers seem to have been made more aware of digital security risks by the cloud computing companies through which they provide IIoT services.

Lessons learned

Among the requirements for successful implementation of the IIoT in firms, the interviewees highlighted the need to involve teams from all relevant departments, raise their awareness of the benefits of the technology and promote a company mindset more open to change. IIoT implementation is generally regarded as a process driven by the whole firm rather than limited to a specific area or department.

Respondents also stressed the importance of public-private partnerships in providing financial and technical support to firms. Demonstration environments for IIoT solutions appear to be important for enterprises, as they put providers and users in relation, thus raising awareness of the potential benefits of the technology. Dedicated business events are also regarded as critical for sharing experiences about IIoT adoption by firms.

Public policies were widely cited as an important channel to finance technological upgrades in firms, in particular in the form of non-refundable loans and tax relief on the acquisition of components. For instance, one IIoT-using firm reported having benefitted from the support of C4IR Brazil as part of its programme to promote Industry 4.0 among SMEs. IIoT providers are also regarded as key stakeholders for IIoT deployment, in particular to raise skills in IIoT-using firms.

Final remarks

In most cases, the use of the IIoT in the manufacturing industry in Brazil appears still incipient and limited to a few processes and machines. All enterprises interviewed, whether implementing a one-off project or in an advanced stage of adoption, have stressed the benefits of adopting IIoT solutions, in particular in terms of improved predictive maintenance, less severe breakdowns and less frequent production outages.

All respondents have highlighted that IIoT solutions are relatively easy to install, affordable and do not demand major adaptation of the machines in use. Connectivity requirements are also considered simple, making it feasible to expand IIoT solutions to all machines in the firm. Changing the firm’s mindset and ensuring senior management’s commitment are key factors for successful IIoT adoption.

At present, data analysis services are mainly provided by IIoT providers and account for a large part of their revenues. These firms are moving towards AI and cloud computing applications that constantly monitor customers’ machines.

As for the role of policy, non-refundable loans, tax relief, technology demonstrations and business events are all regarded as important measures to promote IIoT diffusion.

Conclusion

The case studies presented in this chapter provide examples of the potential benefits of IoT use in manufacturing. However, these findings are qualitative in nature. They should be supported by more quantitative analysis on the effects of IoT adoption on firms’ performance, e.g. productivity and growth. The scope of the analysis should also be enlarged so as to cover all firms and sectors.

Annex 4.A. Case studies on the IIoT in Germany

IIoT providers

PANDA GmbH

The company PANDA GmbH7 was founded in 2018 as a spin-off of a project with the Helmut Schmidt University in Hamburg. The company has about 30 employees and serves mainly larger industrial companies, especially in the national market. The company’s main focus is on the use of AI in industrial manufacturing. PANDA’s main customers are machine manufacturers that integrate AI solutions into new machines and machine operators that use AI as part of retrofit solutions. The better the data quality in the production processes, the more efficiently AI methods can be applied.

PANDA supports its customers in identifying and sustainably eliminating the causes of system downtimes and rejects with the help of sensors and AI. For this purpose, an AI construction kit was developed that is specially tailored to the needs and challenges of German mechanical engineering champions. This enables customers to find the causes of production problems in a data-driven manner and to implement pattern-based control strategies. After an onsite inspection and a sensor selection, a customised AI solution is designed based on a modular system. The solutions are scalable and can be easily integrated into the customers’ existing technical infrastructure (mostly in the switch boxes of machines). Subsequently, the technical implementation on site, e.g. attaching sensors, cables and network, can be completed within one week. After a two-week period of collecting data from the customer, an evaluation of the production data can commence on site.

Most customers decide to evaluate and control individual production chains or individual machines in an automated way. For example, the AI algorithm can be used for quality control, advanced condition monitoring and predictive maintenance.

The modular AI system comprises more than 40 algorithms that process data from mainly visual and acoustic sensors. The algorithms are based on open-source software. PANDA also uses inhouse hardware, such as industrial computers and a variety of (standardised) plug-and-play sensors.

Implementing PANDA’s AI solutions has had a very positive impact on the efficiency of the customers’ production processes. Overall, data from PANDA’s customers prove that 50% of machine failures and malfunctions can be detected and recognised in due time with relatively simple sensors. For production processes of critical products with rare defects (due to human error), automating quality control can achieve cost savings of 30-50%. In the case of common errors, the AI can identify and correct causes far more quickly and easily.

AI also helps customers optimise machine settings and improve fine-tuning during production. By reducing cycle times, cost savings can be achieved and an increase of 5-10% in the number of products can be realised. AI can also automate manual work steps, e.g. in robotics: robots are programmed and tend to be inflexible for unexpected events. Therefore, the work of the robots can be improved by using AI in the camera systems for example, making the robots “smarter” so that they can better handle fluctuations and deviations.

However, since AI is only relevant in business since about 2016, industrial enterprises do not yet have sufficient awareness of the commercially viable use of AI in their business model. Mechanical engineering in particular is a very traditional industry. They need to be convinced by traceable economic arguments such as cost savings and reduction of competitive pressure.

The IIoT also poses a major infrastructure issue due to its complexity and the paradigm shift of introducing IT technologies into the mechanical engineering world. Through close involvement and consultation with customers and the demonstration of benefits, possible concerns can be resolved for practical implementation.

LAP GmbH Laser Applikationen

LAP8 was founded in 1984 and is a leading global supplier of systems that improve quality and efficiency through laser projection, measurement and other processes. The company has more than 300 employees who work at 8 locations in America, Asia and Europe and generated a turnover of EUR 63 million in 2019. LAP’s customers are companies of different sizes from a wide range of industrial sectors in the national and international markets; however, the focus lies on industrial manufacturing and healthcare applications.

The company’s laser solutions are used in various industrial IoT environments. Laser projection systems are used as visualisation aids (digital templates) to guide their customers’ employees. The target group is workers in the production process who are supported by laser contours displayed on a wide variety of material surfaces. The laser system projects clearly visible assembly instructions directly onto the work tool or components, e.g. where a hole must be drilled or a rivet must be placed. The application possibilities in industrial production are broad. The solution is utilised, for example, for the production of large-scale rotor blades for wind turbines, on which the digital template guides the workers step by step through the production process.

On the other hand, the aerospace industry relies on composite parts manufactured using LAP’s laser projection systems. The information for the laser projection system is obtained from customers’ computer-aided design data and is processed in the laser projectors (hardware) and the corresponding control software installed on site. LAP’s project management and service department is involved in delivering the projects to customers. Since manual production remains very important in many industries, laser technology leads to a noticeable increase in efficiency and quality. In many production scenarios, laser projection systems and digital laser templates are now a recognised standard manufacturing tool. The solution is flexible, scalable and can be integrated into most existing customer environments.

The experience of LAP indicates that increasing efficiency for the production process constitutes the main driver to adapt the IoT solution. Many customers state their intention to produce more efficiently, in a more cost-effective and faster way, while maintaining overall product quality.

The solution must be flexible, scalable and versatile from a customer’s perspective. Some customers use laser systems to manufacture small batch sizes since laser systems are cost-effective and can be implemented quickly. Due to production complexity, the equipment needs to be increasingly deeper integrated into the customers’ technical infrastructure. At the same time, the technical infrastructure has to be flexible and versatile. Thus, standardised interfaces and protocols are essential so that a large number of customers can deploy these solutions.

The customers’ data represent the solution’s driver and prerequisite. The more data are generated in production, the more these can be specifically evaluated. In this context, laser systems are one additional source of data within the overall production process.

The customers’ workers have to be included in the implementation process from the beginning: the laser projection does not represent a full automation solution but rather a partial automation which means that workers are supported in selected manufacturing activities while still performing the manual work. However, it is highly important that workers perceive the benefits and relief in their daily activities.

Therefore, companies are advised to include system users in the implementation process and train them accordingly. Positive experiences during the implementation phase and also later during operation are key success factors. In addition, the visibility and measurability of efficiency gains in industrial production are also important for companies. In an evaluation, it was observed that production speed could be increased by 50% through laser support, in addition to the increase in production quality.

q.beyond AG

q.beyond9 was established in September 2020 by a rebranding of QSC AG, which was founded in 1997. The company has about 1 100 employees nationwide and generated about EUR 155 million in revenue in 2021. This information technology (IT) solutions provider integrates relevant technologies in the field of IoT, cloud and IT outsourcing, and systems applications and products (SAP) services and operates its own data centres. The customer focus of q.beyond is on German SMEs, mainly medium-sized businesses in the retail, industry and energy sectors. q.beyond generated about two-thirds of its revenues in these three sectors in 2020.

The IoT first played a role for q.beyond in 2011 when Federal Ministry of Education and Research (Bundesministerium für Bildung und Forschung)-funded project SensorCloud was launched to transfer sensor-based data to the cloud. At that time, however, no standardised devices were available. In 2018, q.beyond decided to take up IoT deployment with a focus on edge computing, especially for the industry segment. It developed its own hardware and related services in the context of its product and service portfolio, enabling SMEs and the German Mittelstand to implement Industry 4.0. Industrial IoT solutions are provided to machine producers to develop smart machines as well as machine users to connect their existing machines (retrofit). These clients typically intend to provide remote services (machine manufacturers), optimise their processes (machine users) or develop new services and business models.

q.beyond provides customer-oriented IoT solutions combining consulting, hardware and software development, and a scalable IoT cloud solution based on hyper scalers such as Amazon Web Services, Microsoft Azure, SAP and others. The offers reflect the clients’ demand for low risks and operating costs. For example, a functional IoT demonstrator is ready within 100 days at a fixed rate and fully managed edge devices are provided on a rental basis, including applications at a monthly rate of approximately EUR 150, depending on the number and complexity of applications licensed or hosted on those edge devices. Data centres operated in Germany are able to meet the need for high data security. q.beyond reported growing revenues in its cloud and IoT segment (about 18% in 2020) and sees IIoT integration as a growth driver.

Overall, q.beyond observes that industrial enterprises are aware of the IoT potential for their business in a very general sense. They understand that the IoT can strengthen their competitiveness and can also help to overcome the shortage of skilled workers, which is one of their most pressing problems. Nevertheless, it is a challenge for companies to make the necessary decisions in day-to-day business and to move projects forward. Small companies have no fixed responsibilities for digitisation projects or specialised departments. According to q.beyond, this can be typically found in companies with at least 250 employees. Very small companies need a public support structure to get closer to the IoT. A cost-benefit analysis is important for them, as they are concerned about costs and vendor lock-ins. If the benefits are obvious, they are convinced to implement the IoT.

German SMEs in the industry sector are a very heterogeneous group; accordingly, their needs for the IIoT are very different, e.g. their machine parks differ regarding age and connectivity. A comprehensive initial analysis is often required to create a uniform database to proceed with further data analysis. Most clients are very sensitive about the data generated by their machines and would prefer the data to remain in the device or on premises as this is also associated with value creation. The IoT, however, requires connectivity of the machines, at least to provide software updates, remote services or manage disruptions. The concerns about allowing access to the machine data need to be met by trustful services. Moreover, the clients themselves need control to work with the data.

Schildknecht AG

Schildknecht10 is a provider of industrial wireless solutions based in Baden Wurttemberg. It was founded in 1981, has 15 employees and generates about EUR 2 million in revenue per year. The company has a strong engineering focus and specialises in software development. Schildknecht’s customers include companies of different sizes from a wide range of industrial branches in the national and international markets.

Schildknecht is an “IoT pioneer” with long-standing experience: it started to develop IoT solutions in 2009 and launched its first IoT edge gateway in 2013. Since then, Schildknecht has developed its own product line (DATAEAGLE) for radio data transmission systems. In addition, it is an IoT system provider in the field of remote maintenance, telemetry and machine to machine (M2M) solutions, as well as condition monitoring. Its focus is on the provision of safe and stable radio transmissions for industrial use (e.g. for cranes, transport vehicles, the paper and pulp industry). Tasks outside the core business (e.g. hardware production or data analytics) are consistently outsourced.

The IoT focuses on connecting machines and plants across the value chain, i.e. between different locations and companies. This approach often requires international connectivity, e.g. cranes in remote places worldwide. In order to connect IoT devices, Schildknecht makes use of cellular connectivity.

International connectivity challenges are solved by roaming via embedded subscriber identity module (eSIM) to automatically connect to the most suitable network out of 400 mobile service providers. Given the heterogeneous customer group of Schildknecht, the size and duration of IoT projects vary significantly: they range from highly standardised short projects to complex projects in close co‑operation with their customers.

According to Schildknecht’s experience, the customer’s motivation to start IoT projects strongly depends on the sector conditions and requirements (e.g. companies in the crane industry generally have similar needs). Besides that, the reasons for implementing the IoT are company-specific and can be driven either by technical or marketing issues. Moreover, some companies have a demand to solve a narrowly defined specific task (e.g. to optimise the maintenance of a specific machine), while others have a vague plan to implement the IoT or are forced into stronger digitalisation, e.g. by their shareholders. Overall, the “pain point” needs to be persistent and inconvenient enough to trigger the IoT investment.

Schildknecht states that small companies typically have limited budgets for digitalisation and often prefer uncomplicated projects at low costs to start with the IoT. To meet this need, Schildknecht has developed low‑threshold retrofit projects that can provide a ready-to-run solution within three days for a fixed budget. The scalability of those projects can become a challenge, as clients are reluctant to deal with this issue from the beginning. At a later stage, however, it is more difficult to solve. Schildknecht perceives that an adequate strategic priority for IoT projects set by top management is key for their successful implementation. This precondition can often be found in family-owned medium-sized businesses with fast and uncomplicated decision-making processes. Conversely, large companies tend to have unclear responsibilities in their hierarchical structures that could delay the implementation of IoT projects. Besides that, they often prefer insourcing IoT projects, even if this approach involves many more resources.

In line with the strategic priority and top management support is the need to involve the employees in the IoT implementation from the beginning in order to ensure broad acceptance across the company. Overall, IoT projects are perceived as most useful if they are able to deal with specific “pain points” and result in obvious benefits. Then, hurdles are easy to overcome. For example, a small greenhouse operator with a strawberry plantation invested in sensor-based watering to avoid getting up at night. Another example is the automatic, radio-based recording of user frequency at rest areas of Austrian railways that enables databased optimisation of the cleaning service. The rapid improvement of quality and cleanliness of the rest areas immediately proved the IoT solution’s advantages.

TELOGS GmbH

TELOGS GmbH11 was founded in 2000 and now has its headquarters in Wettenberg in the district of Gießen in central Germany and another service location near Berlin. The company has about 60 employees and generates a turnover of more than EUR 10 million. The company’s main focus is providing automated intralogistics systems and support services, including maintenance, inspection and servicing, as well as consulting and planning. TELOGS is a general contractor and a specialist in brownfield approaches, i.e. the modernisation and expansion of older machinery (retrofit).

Germany represents the company’s core market, where the company serves medium to large customers from a very wide range of sectors, including pharmaceuticals, mechanical engineering, food industry, among others. An important business area of the company is (digital) retrofit, an important concept in the IoT context: old machines and plants are integrated into modern IT systems. The reasons for retrofit solution demand among TELOGS’ customers are manifold: higher probability of failure of electrical components, spare parts no longer available, technical know-how in the companies decreasing with regard to old machines, equipment manufacturers no longer on the market or with a different business model (i.e. support for the machine no longer given), outdated IT landscape and lower equipment safety. As a result, the availability of many machines usually decreases noticeably after 10 to 12 years. Nevertheless, in many companies, there is little motivation to switch off the old machines, as they tend to be very customised in design and installation and thus can only be replaced with great effort. With many TELOGS solutions, the machines remain in operation almost continuously during the retrofit.

TELOGS’ portfolio of solutions in intralogistics ranges from IT and/or programmable logic controller (PLC) modernisation and upgrading of the control system to complete conversion, including replacement and expansion of the mechanical assemblies (with the modernisation of mechanics, control technology and drive technology).

TELOGS supports its customers during and after implementation via the IoT: with the help of remote maintenance, the customer’s current system status is visible to TELOGS. Through networking, TELOGS can connect to the displays of the machines and directly support technicians on site with troubleshooting and maintenance.

Customers generally fear operational downtime when retrofit measures to maintain machine performance are carried out. Therefore, TELOGS often implements a multistage plan with continuous modernisation that is implemented over several weeks, months or even years (with larger machine parks) and carries out the retrofit while the machines remain in operation. The retrofit measures significantly reduce maintenance costs for TELOGS’ customers and extend the machine’s life to 10 years with 97-98% operational reliability.

TELOGS closely involves its customers in the retrofit process. First, a joint concept is developed and the actual and target status is defined from scratch. Clear objectives, a common understanding and a jointly agreed plan at the beginning of an IoT project are key success factors. In this context, it has also proven important that process risks are significantly reduced, e.g. through the development of fallback scenarios, and that machines typically continue to be productive during the retrofit.

TELOGS’ customers positively emphasise that there is also no intervention in the building structure and that resources are conserved. Some fundamental challenges of retrofitting are the different technical interfaces and lack of technical standards. Technical integration can only be resolved through close co‑operation and co‑ordination between TELOGS and the technicians on site. Due to interferences in the processing or storage area and high process risks with wireless solutions, TELOGS relies on optical transmissions while using Ethernet to connect the controls to the host system. TELOGS uses virtual private network access for the remote maintenance connection to the customer’s machines. Although TELOGS’ portfolio in terms of retrofit covers a very large variety of solutions, some limitations remain, as it is impossible to increase the performance of the mechanics of the machines. Likewise, process changes can only be implemented to a limited extent. Furthermore, retrofitting is not economical with a massively damaged machine fleet.

IIoT users

Kreyenberg GmbH

Kreyenberg12 is a family-owned company headquartered in the Norderstedt area in northern Germany near Hamburg. Kreyenberg has developed into a major supplier of precision mechanics and machining technology. The company has over 200 employees and generates a turnover of over EUR 20 million. Kreyenberg has a high level of vertical integration in mechanical engineering and frequently supplies its (mostly national) customers with components that they are unable or unwilling to manufacture themselves. The company serves customers from a very wide range of sectors, including automotive, aerospace, mechanical engineering and medical technology, among others.

One major focus of the company is on computer-controlled manufacturing using the IoT for process optimisation. Within the scope of machining, the company masters many production processes and is a supplier of complex components and electronic modules. During production, networked computer numerical control (CNC) machines are used. By using control technology, these machines can automatically produce high-precision pieces and even complex shapes. For this type of manufacturing, 3D data (digital twin) of the desired component is always necessary. Based on these data and its tool database, a numerical control (NC) programme is created describing the strategy to manufacture the component.