In spite of remarkable growth rates, the North of Thailand remains one of the less developed and most unequal regions of the country. Certain provinces and areas are transforming into thriving hubs for manufacturing, logistics (connectivity with the Greater Mekong Subregion) and tourism services, while others lag behind and rely on rural activities with low productivity. To achieve long-term sustainable and inclusive growth, the North needs to identify and develop new sources of innovation and entrepreneurship. Based on workshops in Chiang Mai and Chiang Rai, this chapter proposes a process for creating an effective strategy for developing the region and key actions to strengthen local governments so they can be active partners in implementing the strategy. The chapter also discusses selected urban policies to transform Northern urban areas into liveable and productive cities, such as the creation of metropolitan authorities. Finally, the chapter focuses on actions that Northern provinces could take to leverage their rich network of universities and science parks and thereby nurture local entrepreneurial spirit.

Multi-dimensional Review of Thailand

Chapter 2. Developing the potential of Thailand’s North: An action plan

Abstract

The preceding analysis shows that boosting regional development must be a cornerstone of Thailand’s future development strategy. Thailand will need to develop new capabilities in terms of organisation and economic geography. The slower pace of economic transformation, quality job creation and reduction of regional inequalities in the new millennium has put pressure on the political system and the ability of the state to respond to growing needs for better public services and environmental management. Boosting convergence means building the capacity of all regions, provinces and municipalities to ensure they can make the most of their potential.

To develop concrete ideas for action the Analysis to Action phase of the Multi-dimensional Review of Thailand focuses on the North of Thailand. This is one of the fastest growing and most diverse regions of Thailand. Yet it is also the second poorest. It offers a wide range of opportunities and challenges.

Governmental learning workshops conducted in Chiang Rai and Chiang Mai helped to adapt the recommendations formulated in the In-depth Analysis and Recommendations volume of the Multi-dimensional Review of Thailand (OECD, 2018[1]) to the Northern context and to identify concrete steps for policy implementation along the three dimensions of regional development (Box 2.1).

Box 2.1. The Governmental Learning methodology and workshops

The Governmental Learning workshops aimed to inspire key actors to propose recommendations for action and concrete steps for policy implementation (Blindenbacher and Nashat, 2010[2]). They consisted of three sessions held in Chiang Rai and Chiang Mai during November 2018, and included the participation of public and private local stakeholders.

Session I: Internalisation. During this session, participants reflected on the content, recommendations and relevant experience of other counties presented in MDCR Volume 1 – Initial Assessment and MDCR Volume 2 – In-depth Analysis and Recommendations. The goal of this session was to brief participants about the MDCR national recommendations and to discuss their adaptation to the Northern context.

Session II: Prioritisation. Each participant selected a recommendation to put into action, based on their prior experiences, background and knowledge of regional needs. The OECD team then moderated a debate at the end of which priorities were clustered into three to four themes, and working groups were formed accordingly.

Session III: Action plan. Working groups translated the recommendations into concrete plans for action and strategies for implementation. The authors of the policy recommendations were available to answer questions from the working groups and provide feedback during the development of their plans and strategies. The different groups then presented their plans and strategies in a final plenary session. The plans of action proposed in this report are based on the outcomes of the workshops.

Source: Adapted from (Blindenbacher and Nashat, 2010[2]).

The next section provides a diagnostic of the context, challenges and potential of the Northern region of Thailand. The following section presents the suggested Action Plan and way forward.

The Northern Region: Context, challenges and opportunities for socio-economic development

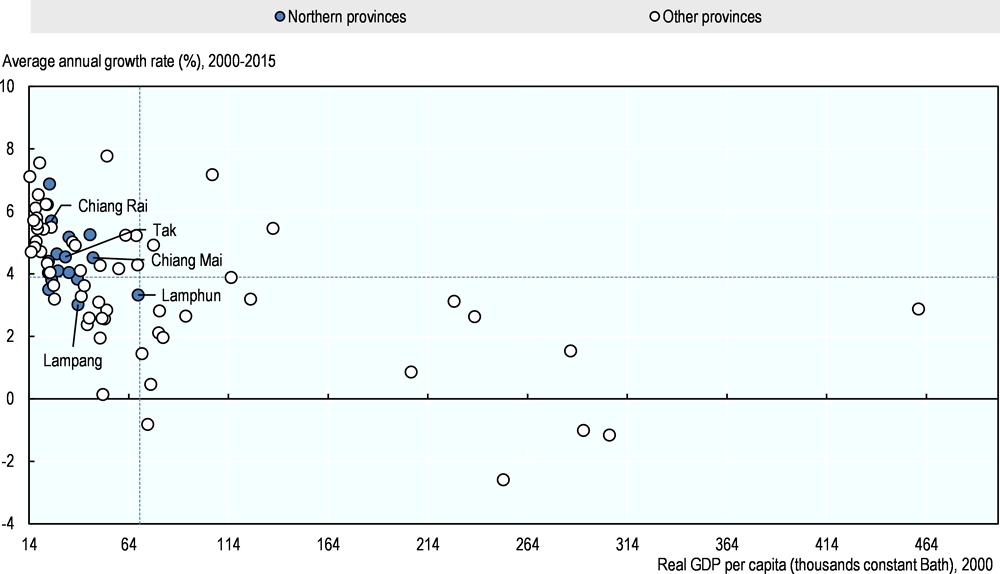

Over recent decades, government policies have triggered structural transformation and boosted the growth of the North of Thailand. Until the 1970s, agriculture dominated the regional economy and manufacturing activities were typically organised in small-scale companies. The 1980s were a turning point. The establishment and consolidation of a special economic zone transformed Lamphun province into a major manufacturing hub and created new jobs in the trade and service sectors in neighbouring provinces. The abundant supply of cheap labour from neighbouring countries such as Myanmar, as well as foreign direct investment from Japan, contributed to the growth in momentum. Since the 2000s, the manufacturing industry has expanded and the financial sector has gained in importance (Figure 2.1).

Figure 2.1. The agricultural and manufacturing sectors contribute one-third of regional GDP

Source: Authors’ work based on GDP data provided by the National Economic and Social Development Council (NESDC).

Structural transformation and proximity to the Ping river boosted the productivity of the local agricultural sector. The former brought capitalisation and industrialisation of agriculture, while the latter helped to commercialise local products. Kamphaeng Pet, for example, hosts the largest plantation of tapioca in the country and has benefitted notably from a rapid increase in the volume of trade in this root. Meanwhile, coffee and niche products such as longan and local herbs have become trademarks of Chiang Rai. In Chiang Mai, the integration of local landowners and farmers in the agro-industry value chain has generated local jobs and business opportunities.

Tourism and recreational activities are another major regional asset. Tourists are discovering new destinations in addition to Chiang Mai, which has traditionally been the regional hotspot. In 2016 and 2017, Chiang Rai recorded the second highest number of visitors at 3.5 million (visitor numbers to Chiang Mai are three times higher). Tourists were attracted by the rich cultural heritage of the area, Lanna handicrafts and the local celebrations of the Songkran festival. Government programmes such as the One-Tambon-One-Product projects have contributed to the development of local artisanal products that attract visitors from the rest of Thailand and other countries. In 2017, revenue from tourism in the North amounted to THB 175 billion, averaging THB 10.3 billion per province (THB 99 billion in Chiang Mai and THB 26 billion in Chiang Rai). Since 2018, the government has introduced tax deductions to encourage tourism to all Northern provinces, with the exception of Chiang Mai, as part of a nationwide effort to promote travel to less visited provinces.

Figure 2.2. Northern provinces have been growing fast

The North is eager to deepen the structural transformation process that has so far contributed to regional growth. Increasing productivity in both the agriculture and non-agriculture sector fuelled growth in the past decade (Figure 2.2). Productivity growth in non-agriculture activities is improving steadily, with the manufacturing industry scoring the highest increase in productivity between 2001 and 2015 (6% per year), amounting now to THB 169 956 per worker. The relatively high GPP per worker in industry also yields higher wages, which may attract further workers to the labour force in the future. Similarly, more and more workers will be employed in the service and transportation sectors.

Cities are catalysts of investments and growth. Today, Chiang Mai is the second largest city in Thailand by population and a centre of innovation and entrepreneurship. Chiang Rai is confident that cross-border infrastructural investments will bring more visitors to the city’s main attraction – Wat Rong Khun and other temples – and to other destinations in the province. In addition, urban clusters have been developing across the border with Myanmar. The agglomerations of Mae Sai and Wan Sa-te, and Mae Sot and Myawadi, are signs of growing economic integration of the North with the ASEAN region. Urban areas on the border function as Thailand’s gateways to the economic corridor developing between Kunming in China’s Yunnan Province, and Mandalay in Central Myanmar.

With the third highest number of universities in Thailand after the Bangkok Metropolitan Area and the Northeast, the North has the means to support structural transformation with innovation. Furthermore, in addition to the notable universities and research centres of Chiang Mai and Chiang Rai, eight provincial universities (rajabhat) have become centres of support for local communities and local small and medium-sized enterprises (SMEs).

The economic engine of the North faces several challenges, however, that could undermine its momentum. In spite of fast GDP growth, the North remains a poor region with high inequality. The average household monthly income in the region is lower than in the rest of the country (THB 19 509 against THB 23 542 at the national level), and three of its provinces have the lowest values in Thailand (Chiang Rai at THB 13 497, Chiang Mai at THB 14 950 and Mae Hong Son at THB 15 119).1 Sectors like mining, public utilities and transportation contribute significantly to provincial wealth but have a low labour intensity. As a result, the income generated may be confined to a relatively small share of the local population, rather than benefiting the whole community. Today, the North is the third most unequal region in the country, after the Northeast and the South.

The agricultural sector, while still significant at the regional level, is underperforming. Agriculture contributes 18% on average to provincial GDP, with the local contribution ranging from 4% (in Lamphun) to 27% (in Phichit). Half of the labour force is employed in the agricultural sector, ranging from a minimum of 31% (in Chiang Mai) to a maximum of 66% (in Mae Hong Son). Since 2001, the productivity (the added value per worker) of the agricultural sector has increased by 2% a year and amounted to THB 35 625. Nonetheless, the sector grew much slower than manufacturing (4 percentage points lower) and agricultural value added per worker in the North lags much behind the national average (THB 50 506).

Fast urbanisation may risk hindering, rather than promoting, sustainable economic growth. In Chiang Mai, for example, more and more urbanites are moving from the city centre to the outskirts, where larger and cheaper plots of land are available. In contrast to 20 years ago, most commutes now originate outside of the city centre and rely on car or motorbike. The car ownership rate in Chiang Mai is similar to that in Bangkok (304 and 316 cars per 1 000 individuals, respectively) and is increasing rapidly. At the same time, the proportion of trips by public transport is decreasing (Jittrapirom, 2015[4]). Without appropriate transport infrastructure, motorisation is likely to transform Northern cities into congested agglomerations, with serious consequences for citizens’ well-being and the environment.

Proposed actions: Building capabilities to exploit the full potential of the North

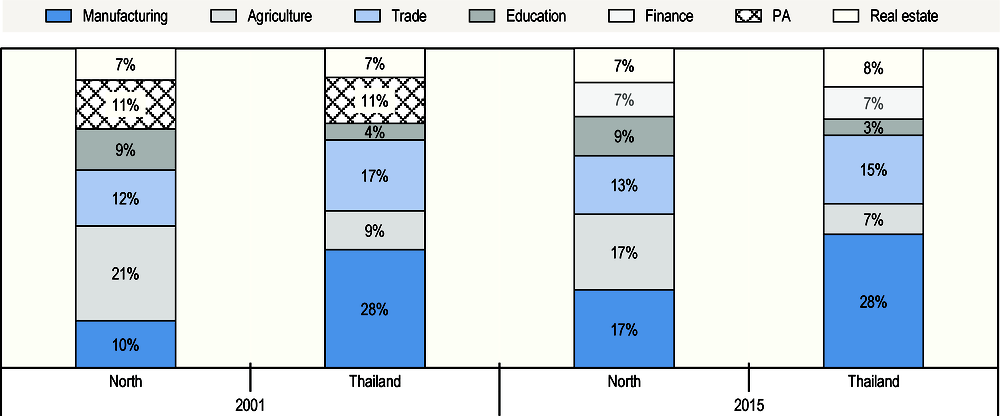

Building on the OECD’s recommendations in previous volumes and the workshops with local stakeholders in Chiang Mai and Chiang Rai, the following actions can help the Northern Region of Thailand kick-start a new dynamic of development. The overarching objective is to develop the capabilities to exploit the North’s full potential. Three capabilities are key in this context – an effective strategy and strong LAOs, Metropolitan areas that drive the region’s development, and universities and colleges that act as key drivers of development (Figure 2.3).

Building capabilities and creating successful strategies is a process of trial and error that requires the collaboration of many players. The following actions should thus be read as a guide to such a process. The scorecard in chapter 4 of this report proposes a set of indicators for measurement of performance throughout the process. In combination this action plan and the scorecard can thus help to transform the North of Thailand into a ‘Policy Lab’ where innovative actions and ideas for regional development can be tested.

Figure 2.3. An action plan to unlock the potential of Northern provinces

Source: Authors’ work based on the results of the Governmental Learning workshops and (OECD, 2018[3]).

An effective strategy and strong LAOs drive the development of the North of Thailand

Unlocking the potential of the Northern Region requires an effective strategy for the region as well as strong LAOs that can be key partners in the implementation of the strategy.

Getting regional development planning right will require placing local innovation and discovery in the driver’s seat. Mastering this process of discovery at the central, provincial and sub-provincial levels of government is key to successful economic development and continued productivity and employment growth.

Local authorities will need fiscal, political and administrative power to support and follow up on the results of the strategy process, develop local potential and swiftly remove obstacles to business. Moreover, the government could award provinces that successfully implement innovative regional development strategies with access to additional public funds.

Create a strategy for developing the Northern Region, building on local discovery (Expected result 1)

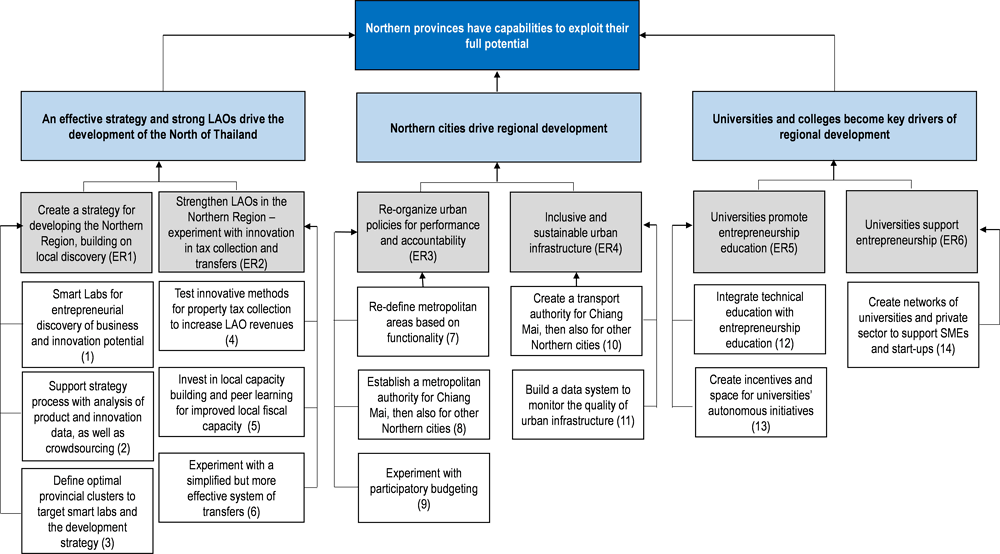

‘Smart Labs’ are proposed here as the centre piece of a strategy creation process. These labs should be supported with analysis of economic, social and geographic data to identify potential for specialisation, as well as optimal clusters of provinces. Together with such data analysis, smart labs can provide the basis for investment decisions and performance monitoring (Figure 2.4).

Figure 2.4. A four-step approach to designing and implementing innovative regional development strategies

Source: Authors’ work.

Several conditions apply: Getting regional development strategies right requires 1) placing local innovation and discovery in the driver’s seat 2) a strong focus on performance and 3) co-ordination to ensure coherence of plans and policies.

The first overarching lesson from the “smart specialisation” agenda and past attempts at regional development in the European Union and elsewhere is that this process of discovery must be driven and mastered by local and regional actors. The role of government intervention is important but it is subsidiary. Policy intervention is required not to select the areas or activities for investing public resources but to facilitate and support the discovery process (OECD, 2013[5]).

Second, Strong evaluation and performance measurement frameworks must be built into all approaches from the beginning and should be widely accessible to guarantee transparency and accountability, as key building blocks of local ownership. Policy makers could use the scorecard presented in Chapter 4 to track the outcomes of innovative regional development strategies.

Third, the outcomes of the Smart Labs will take the form of sectoral strategies that should be combined into a “regional masterplan”. This masterplan should guarantee coherence between the provincial-level outcomes of the process, existing place-based policies, and the National Economic and Social Development Plan (NESDP).

Smart Labs for entrepreneurial discovery of business and innovation potential (Recommendation 1)

“Smart Labs” are proposed here as the centre piece of a strategy creation process. They bring together private and public agents to identify and agree on the key development opportunities of a provincial cluster. The purpose of Smart Labs is threefold. First, the knowledge and views of participants complement the results of the data analysis, which may not capture local cultural nuances and specificities driving local comparative advantage. Second, they provide participants with an opportunity to agree on the bottlenecks that the central and local government need to remove to unleash the potential of comparatively advantageous sectors. Table 2.1 summarises the concrete steps that the North could take to operationalise Smart Labs, based on the experience of the Dolosaskie region of Poland.

Table 2.1. Concrete actions to operationalise Smart Labs

|

Action |

How |

Who |

Why |

|---|---|---|---|

|

Face-to-face interviews |

Interviews with CEO/owner of a company. Interviews last around 2 hours, follow a pre-compiled questionnaire with a mix of quantitative and qualitative questions, and lead to a post-interview summary assessment |

Interviewers: seasoned experts from international organisations and/or regional consultants adequately pre-trained Interviewees: interviewees are selected based on a number of criteria including size, age, geographical distribution and likelihood of being involved in innovation |

|

|

Smart Lab |

|

Maximum 20 participants:

|

|

Source: Authors’ work based on (Foray and Rainold, 2013[6]; World Bank, 2016[7]).

Box 2.2 discusses the successful implementation of a form of Smart Labs in Peru (Mesa Ejecutiva). Lastly, the Smart Labs are a crucial step to ensure that all stakeholders in charge of the implementation of regional development strategies are actually involved in the planning process.

Box 2.2. The impact of innovative regional development strategies in Peru: Smart specialisation and the Forestry “Mesa Ejecutiva”

Between December 2014 and May 2016, the Ministry of Production of Peru launched the “Mesa Ejecutivas” initiative. A Mesa Ejecutiva is a public-private working group that takes concrete action to enhance the productivity of a sector. One example of such action is the forestry sector, a sector where Peru could develop a significant comparative advantage, but local obstacles present frequent challenges.

The Forestry “Mesa Ejecutiva”

Peru has about 18 million hectares of forests, half of which are available for concession use. The trees are of a high-quality type of wood, which is ready to be processed. However, until the beginning of the 2010s, less than 2 million hectares were exploited. Peru used to export only approximately USD 150 million worth of forest products per year (and import USD 1.2 billion), compared to Chile’s USD 5.5 billion.

Administrative complexity and unclear property rights were two of the reasons behind the under-exploitation of this resource. Many different government agencies and organisations regulate and oversee activity in the forestry industry. Until the beginning of this decade, the roles of these agencies often overlapped, thus making information exchange difficult. As a result, there was no clear picture of the industry’s assets and liabilities. Moreover, illicit and harmful extraction practices were common, given that property rights were not clearly defined.

|

Pre-Mesa Ejecutiva |

Post-Mesa Ejecutiva |

|---|---|

|

The procedure to register plantations on private property lands took between 6 and 12 months |

The Registration Procedure at the National Forest Plantation Registry (RNPF) lasts at most three days. It is automatic and free of charge. |

|

The extraction permit procedure took between 4 and 8 months |

No extraction permit is required apart from in exceptional cases. |

|

The Forest Management Plan was not acknowledged as an Environmental Impact Assessment (EIA). |

The Management Plan is explicitly acknowledged as equivalent to an EIA. |

|

The country has no history of legislation for the forest plantation industry. |

Forest plantations have their own legislation now within forest regulation. |

|

Authorities and citizens could not easily access information on concessions, titles, assessments’ outcomes or sanctions, because information was fragmented and not easily accessible. |

Data are now concentrated in a unique and online database accessible to anyone. |

|

There were no identified and available lands for forest plantations. |

Relevant agencies have prepared a methodology that results in a single systematised and integrated database. Work is validated in the field and provides detailed information on the current state of lands (occupation, invasion, deforestation, etc.). |

|

The last public forest concession tender processes in the country led by regional governments occurred between 2002 and 2004. |

The Loreto Regional Government launched the first call for forest concessions. Other regional government are following. |

In December 2014, the central and six regional governments established the Forestry Mesa Ejecutiva to overcome existing barriers to the development of the forestry industry. The Mesa Ejecutiva helped to identify three types of bottlenecks hindering growth: (1) poor regulation and overwhelming red tape, (2) lack of innovation and low productivity, and (3) insufficient access to funding for local landowners. Moreover, the Mesa Ejecutiva helped to address co-ordination issues within and between the public and private sectors.

The Forestry Mesa Ejecutiva helped to establish property rights and regulated the forestry industry. Within few months, it had scored several major achievements. For example, it promoted implementation of the Law for Forestry and Wildlife, discussion of which had slowed due to the involvement of numerous actors. Moreover, the public-private workshops facilitated access to finance for landowners, and made co-ordination and data sharing across interested agencies possible.

The Mesa Ejecutiva also facilitated the establishment of a Pucallpa Forest “technological innovation centre” in the forestry industry. The centre will foster innovation in production processes, transfer technology to small and medium enterprises, and attract qualified foreign experts. Its laboratories will award quality certifications, help standardise manufacturing, improve wood drying and cutting, and thus instil the competitiveness required to take full advantage of the Peruvian industry sector. The following table summarises some of the main outcomes of the Forestry Mesa Ejecutiva.

In November 2016, the Governor of one the most important of Peru’s six forestry regions created a regional Mesa Ejecutiva to focus on specific regional problems. The regional Mesa Ejecutiva included smaller landholders, who were under-represented in the original Mesa Ejecutiva.

Source: Ministry of Production (2016), Mesas Ejecutivas: A New Tool for Productive Diversification (Ghezzi, 2017[8]).

Support strategy process with analysis of product and innovation data, as well as crowdsourcing (Recommendation 2)

Several tools of data analysis and crowdsourcing could support the regional strategy process. Depending on data availability, LAOs in Thailand can employ several indicators and methodologies to measure the scope for local specialisation.

1) The Herfindahl-Hirschmann (HH) index of economic concentration measures the size of local economic sectors in relation to the overall provincial GPP. Sectors are classified according to the International Standard Industrial Classification (ISIC) at the two-digit group level. An index value closer to 1 indicates a province’s economy is highly concentrated in a few sectors (i.e. concentration is very high). Conversely, values closer to 0 reflect provincial economies that are more homogeneously distributed among a series of sectors. Chapter 4 provides more details.

The North has the second highest concentration index in the country, but presents high within-region variability. As of 2016, economic activity in the North is as concentrated as in the South and is second to the East, where manufacturing is the dominant sector. Chiang Mai and Lampang are the Northern provinces with the most diversified economies, while Phayao and Phichit have the most concentrated. In fact, Phichit is among the top 10% most concentrated economies in the country due to its traditionally large agricultural sector (accounting for around 40% of GPP in 2016). Between 2012 and 2016, the Herfindahl-Hirschmann index in the region has decreased because the economic activity is spread more evenly across sectors.

2) The Product space methodology. This methodology is based on the idea that a country is more likely to specialise in and trade goods whose production requires similar capabilities, such as those relating to institutions, infrastructure, physical factors, technology or some combination thereof (Hidalgo et al., 2007[9]). For example, a country specialising in processing rice will probably possess most of the conditions suitable for manufacturing starches from rice. It would possess the appropriate soil and climate, together with the requisite packing technologies and machines. It would also have the human capital, notably agronomists, who could apply their knowledge on rice starches.

If micro-data allow, the product space methodology could help identify more precisely the current and future potential of growth of provinces. Since trade data are not available at the subnational level, Thailand could replace them by computing the net value added by sector based on information from the industrial census. The analysis will be efficient if net value added is computed at the finest level of detail, for example at the ISIC four-digit level. Annex 2.B provides some extra details on the steps and computations needed to operationalise the product space methodology at the subnational level.

3) Innovation maps could make regional development strategies even more effective and inclusive. In particular, Northern authorities and the Board of Investments (BOI) could map all local firms that applied for grants. Since the application process necessarily requires the disclosure of planned private R&D investment, such mapping could help infer entrepreneurs’ perception of ongoing and emerging business and technology trends. Next, the BOI could classify grants in accordance with international guidelines, which sort firms according to their type of business activities and their technological potential. The OECD and the Eurostat have successfully defined such categories.

Innovation maps helped identify key priorities for business innovation spending and steer smart specialisation policies in Poland. In 2015, the National Centre for Research and Development of Poland and the World Bank produced an initial set of innovation maps for a number of regions. The maps were based on more than 1 000 applications filed within the framework of a new innovation support programme, and showed current local private investment and the ambitions of local entrepreneurs. For instance, “electronics and IT engineering” was the business area that attracted the majority of private investments, followed by “mechanical engineering” and “material engineering”. “Health and medicine” was the key technology in which the private sector wanted to invest (World Bank, 2016[7]).

4) Crowdsourcing tools would contribute to the participation in the regional planning process of firms that have not been involved in Smart Labs. These firms could provide useful insights into the obstacles of doing business or untapped local potential, for instance by filling regular online questionnaires. In exchange, participating companies could receive information on their performance relative to their industry peers or access to technology and business newsletters. Outstanding and insightful firms can be included in the next meetings of Smart Labs.

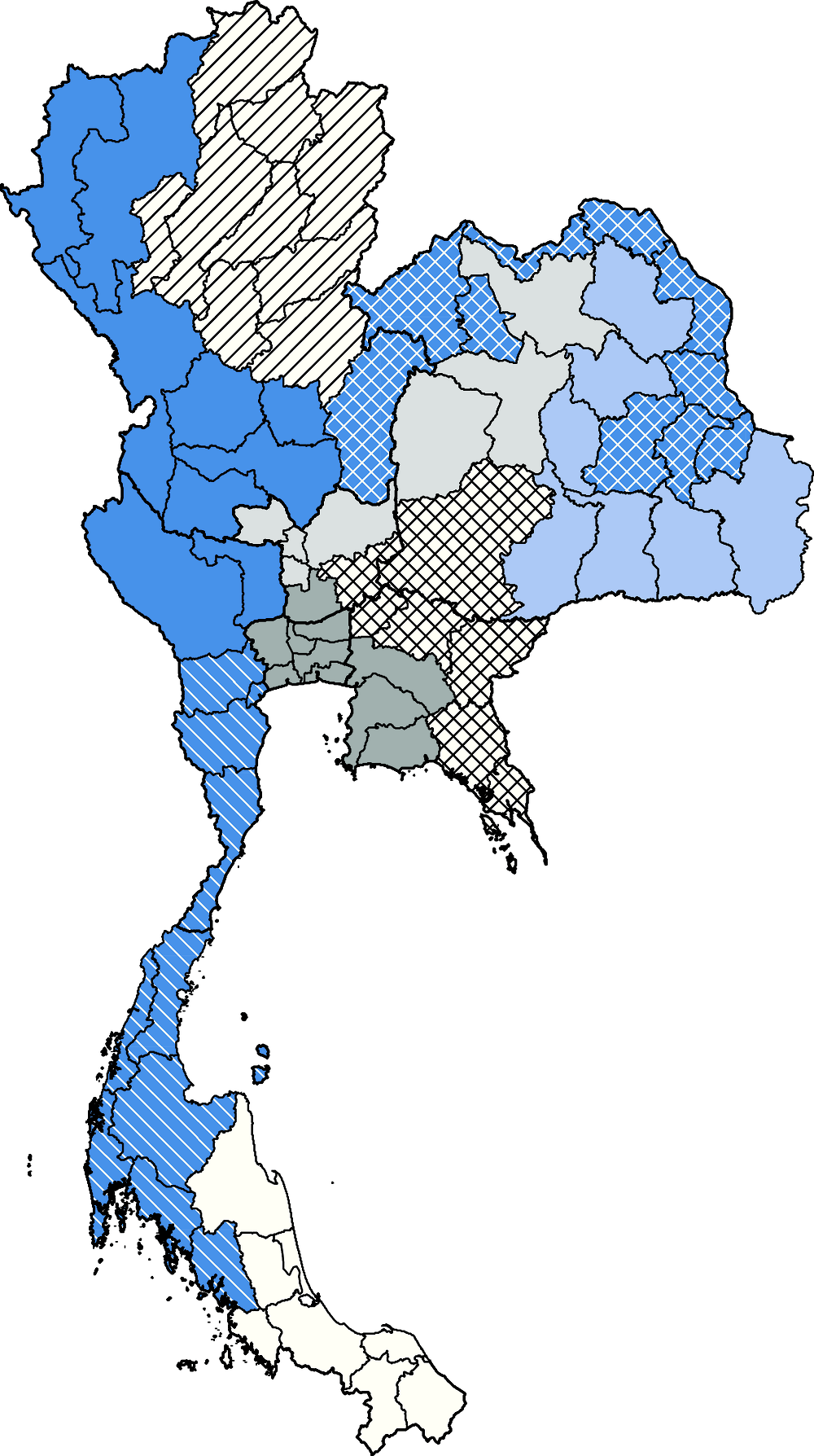

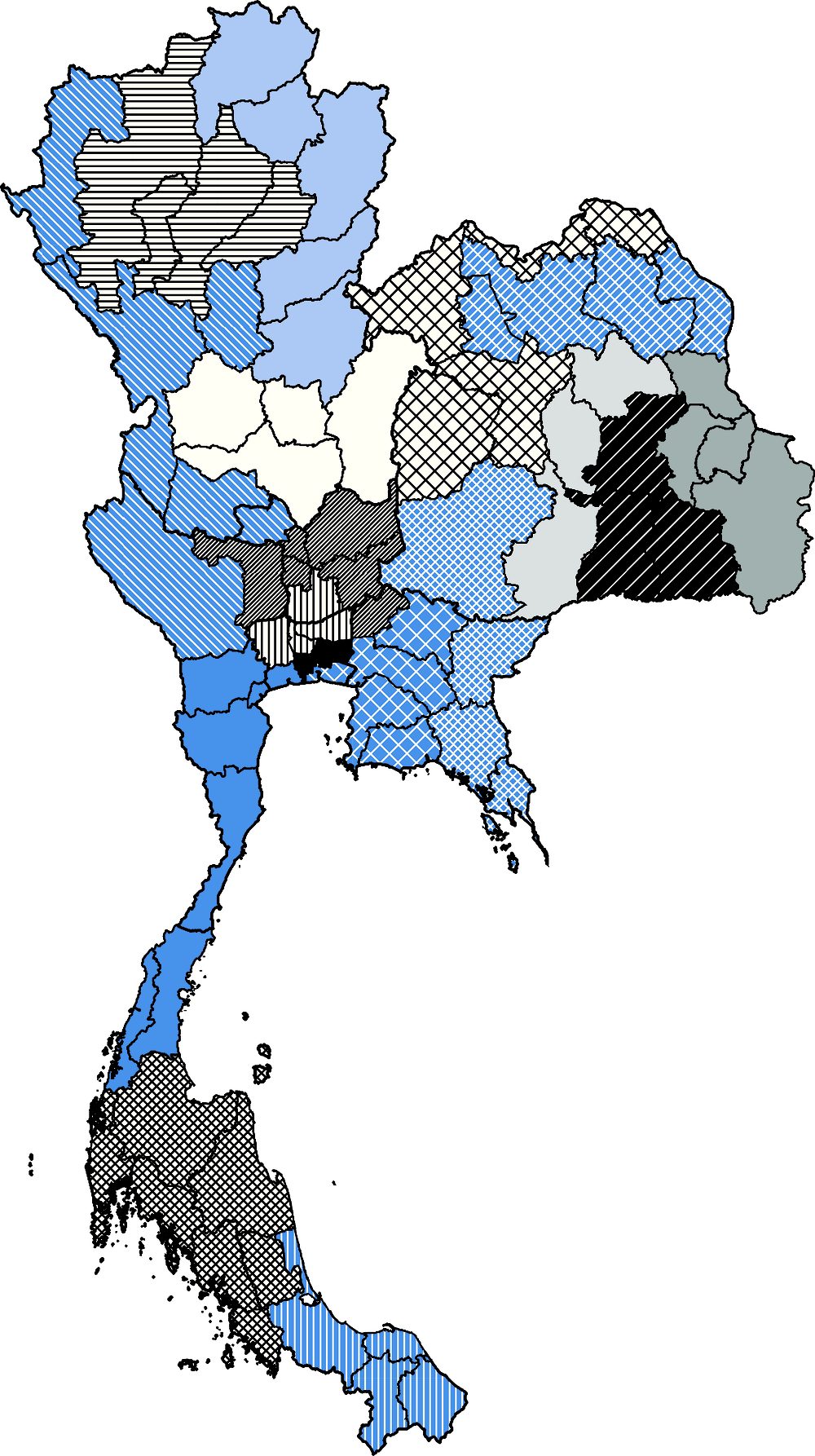

Figure 2.5. The definition of homogeneous clusters of provinces should help regional development strategies to adapt to within-region diversities

Note: Bold lines indicate current regional borders, while thinner lines are the current provincial borders. The Max-p clustering method identifies seventeen regions in total that contains at least 8% of the overall population. Each region has been assigned to a unique pattern.

Source: Authors’ work based on data provided by the NESDC.

Define optimal provincial clusters to target smart labs and the development strategy (Recommendation 3)

To be effective and coherent, smart regional strategies need to account for the diverse ambitions, contexts and assets within the North. Regions in Thailand often encompass provinces that face different social, economic and environmental challenges, and that have different visions for their development. As an illustration, consider the three Northern provinces of Chiang Mai, Chiang Rai and Tak. The results of the survey, workshops and interviews suggest that Chiang Mai is prepared to establish centres of agricultural innovation, while Chiang Rai is capable of stimulating sustainable tourism, and Tak is ready to emerge as a logistics hub connecting Thailand with neighbouring Myanmar.

Regional strategy processes should take provincial clustering into account. Figure 2.5 displays a possible set of clusters of provinces that are similar with respect to a broad set of social, environmental and economic characteristics. Box 2.2 provides further details about the clustering methodology and the indicators used.

The scope of innovative regional development strategies may transcend existing regional boundaries, requiring effective co-ordination mechanisms. Thai regions resulting from the clustering exercise comprise a mosaic of different provincial clusters and cross traditional regional boundaries. In the North, Chiang Mai, Chiang Rai and Tak belong to three separate clusters, reflecting differences in underlying characteristics.

Figure 2.5 shows that certain provinces are more similar to neighbouring administrations that belong to different regions than to provinces within the same region. When designing the process for innovative regional development strategies, central and local administrators should create and deepen mechanisms for inter-provincial and inter-regional co-ordination, in order to address these cross-border affinities.

Box 2.3. An innovative methodology to define provincial clusters in Thailand

The Max-p clustering method

The Max-p clustering method involves the clustering of provinces into the maximum number of homogeneous regions such that a regional attribute is above a predefined threshold value (Duque, Anselin and Rey, 2012[10]).

Figure 2.5 presents a set of nine clusters that contain at least 8% of the country population. This configuration should be robust to the population threshold chosen. On the one hand, the lower the threshold, the less stringent the constraints imposed on the clustering algorithm, and the higher the number of clusters. On the other hand, the configuration should only partly change and the same pattern of clusters should emerge. Annex Figure 2.A.1 shows a set of clusters each containing at least 4% of the country population. The configuration and geography of clusters does not change significantly from Figure 2.5 as the population threshold is raised.

Differently from other clustering techniques, the Max-p method requires that provinces within the same cluster also share a border. The underlying algorithm endogenously identifies the number of clusters and the number of provinces within the cluster.

A mix of “Human Achievement Indicators” and indicators of economic performance

The analysis behind Figure 2.5 relies on a broad set of social, economic and environmental characteristics as measured by the “Human Achievement Indicators” (HAI) and more standard indicators of economic development. The indicators are: GDP per capita; average household income; CO2 emissions; Gini indicator of interpersonal inequality and poverty incidence (with respect to national poverty definition); access to Internet, phone connection and roads; school attendance – overall and in vocational training; school performance as measured by the IQ score of primary students and the ONET score of upper secondary students; access to social security and underemployment (proportion of highly educated graduates in low skilled jobs); proportion of households that are exposed to droughts or floods. All HAI were provided by NESDC.

Source: (Duque, Anselin and Rey, 2012[10]).

Strengthen LAOs in the Northern Region – experiment with innovation in tax collection and transfers (Expected result 2)

Participants of the workshops held in Chiang Rai and Chiang Mai discussed three broad sets of actions necessary to implement decentralisation: (1) test innovative methods for property tax collection; (2) invest in local capacity building; and (3) experiment with a simplified but more effective system of transfers.

Test innovative methods for property tax collection to increase LAO revenues (Recommendation 4)

Starting from 2020, a new property tax will improve the fiscal autonomy of local authorities in Thailand, although limitations remain. The new “Land and Building Tax” act is set to replace the previous regressive and outdated property tax. It aims at decreasing income disparity, encouraging land use and increasing public revenue. Local administrations will be able to tax at a higher rate than the rate set by the central government. However, local surcharge rates cannot exceed the pre-determined ceiling. The tax system will not apply to owners of agricultural land worth up to THB 50 million, which, according to the National Statistical Office (NSO), make up more than 90% of landowners.

The new tax regime will be effective only if central and local authorities revise their cadastral information, possibly according to international standard procedures. The value of land plots and buildings that is currently in use stems from the 1980s and requires updating. In this regard, the “Land and Building Tax” act could have been more ambitious and propose more innovative methods to appraise the value of parcels.

Northern authorities could pioneer an innovative, collaborative and transparent cadastral database. Complete cadastral registers usually rely on a combination of administrative sources and collection sources. Table 2.2 summarises OECD guidelines to harmonise registers along these two axes. Importantly, registers should be integrated, accessible to all relevant agencies – to improve effectiveness – and to citizens – to strengthen transparency and accountability. A cadastral database could also include geospatial and aerial data (Box 2.5). In this regard, in 2014 the Treasury Department developed the application “Smart GIS TD: Smart App for Smart Service” to facilitate land evaluation using GIS data and broaden the property tax base in 24 provinces. The app became accessible to all other provinces shortly thereafter.

Table 2.2. Data sources for the standardised cadastral database

|

Administrative sources |

|---|

|

|

Collection sources |

|

Source: Authors’ work based on (Eurostat/OECD, 2015[11]).

Box 2.4. Spatial data to improve property tax collection in India

The Jawaharlal Nehru National Urban Renewal Mission was an ambitious city-modernisation scheme launched by the Government of India under the Ministry of Urban Development. It provided financial incentives to municipalities that reformed their property tax systems. In particular, it emphasised the need for implementation of an online system for property tax through the proper mapping of properties using a GIS system.

The East Delhi Municipal Corporation has created an up-to-date map of parcels by combining an aerial survey of the region with satellite data. Authorities conducted a door-to-door field survey of individual properties to classify properties as commercial, residential or educational.

The Bhopal Municipal Corporation has also introduced a GIS-based system that will facilitate the management of property tax online. Residents will use an e-government platform to pay water charges and property tax through one bill, unlike the present situation where users pay water charges and property tax separately to the corporation. The GIS-based system allows for the provision of a unique property code for all commercial and residential units in Bhopal, based on which one bill will be prepared per code. The code remains the same even in the event of a change in property ownership.

Invest in local capacity building and peer learning for improved local fiscal capacity (Recommendation 5)

Ad-hoc committees should ensure effective compilation and management of the cadastral database. National and regional authorities need to make sure that the different LAO administrations have the capacity to update the registry on a regular basis. In this regard, in January 2019 the Department of Local Administration under the Ministry of Interior released two software packages to train LAOs in using GIS data for mapping lands and assets (LTAX 3 000 and LTAX GIS). The central government could experiment with fiscal incentives (e.g. access to ad-hoc funding) to reward Northern LAOs that download these packages and keep on updating their staff’s land evaluation skills. Moreover, these conditional funds should encourage information sharing between LAOs, relevant agencies and citizens.

Training offered to municipal staff and officials could help to improve local fiscal capacity. Municipalities could earmark a stable percentage of their annual budget for staff and official training, and allot time for the pursuit of continuing education. Local universities and local administrations, together with the Ministry of Interior and the Ministry of Education, could design certificate programmes to update staff’s skills in, for example, technical writing, workforce development and retention, and financial accounting. In light of the innovative methods needed to improve property tax collection, the coursework could also include workshops on geospatial data analysis and provide hands-on sessions.

Local administrators in the North need a space for mutual learning and peer reviewing. A “Northern Municipal League” could set up peer groups of public sector employees to discuss challenges, needs, and local priorities in regular and informal meetings. These meetings, moreover, would provide opportunities to share successful strategies and strengthen relationships that lead to municipal partnerships. The League also could envisage a mayoral mentor programme, pairing interested mayors who face common issues and have analogous ambitions.

Experiment with a simplified but more effective system of transfers (Recommendation 6)

The redesign of the grant system would strengthen the autonomy and capacity of LAOs. The current system of inter-governmental grants is often ineffective, as general grants fail to achieve their objective of equalising fiscal capacity across LAOs and do not reward autonomous initiative by local administrations. Furthermore, the allocation of earmarked grants is conditional to the implementation of central government’s plans and programmes, and thus undermines LAOs’ accountability and entrepreneurship.

The North could test new accurate models to redistribute general grants according to LAOs’ needs. Thailand could consider altering the general grant formula to take into account better the differences in tax-raising capacity and service needs among LAOs. The formula could also factor in service costs. In this regard, Italy and Japan can serve as a benchmark for a similar reform in the North of Thailand (Box 2.6).

Box 2.5. Data-driven approaches to equalising fiscal capacity and spending needs across regions: The cases of Italy and Japan

Italy: Grants to equalise costs of provision of local public services

Italy has been introducing grants that equalise the spending capacity of local authorities. The aim is twofold. In terms of equity, equalisation grants guarantee that all authorities have enough resources to provide local services with uniform standards of quantity and quality. In terms of efficiency, equalisation grants cover only “standard costs” of provision of public services. The grants therefore stimulate higher accountability of local administrators, since expenditure levels above standard costs must be financed directly by local resources.

In Italy, equalisation grants are distributed according to a two-stage procedure. An equalisation fund is defined every fiscal year. A fixed amount of resources is then redistributed based on the estimation of “standard costs” for each local public service and municipality. The estimation of “standard costs” takes into account the type of services provided, the territorial features, and the social-economic and demographic characteristics of the resident population. As of today, the distribution of equalisation grants based on standard costs applies to municipalities only. The evaluation of standard costs for regions is ongoing.

Japan: Local tax allocation to level local fiscal capacities

Japan reallocates a part of national tax income to its regions depending on local basic needs and capacities. In 2016, a predetermined share of the following tax revenues was redistributed: income tax and corporate tax (33.1%), liquor tax (50%) and consumption tax (22.3%). The reallocation depends on the difference between the standard financial requirements and the standard financial revenues of a local body, as summarised in the following table. The calculation of expenditure needs is based on an assessment of service standards for each local government, which in turn depends on per-unit expenses, indicators of fiscal cost, and ad-hoc adjustment coefficients of each administrative service or task. The calculation of standard financial revenues is based on standardised local tax revenues multiplied by 75%, in order to incentivise local tax efforts and to create fiscal room for policy initiatives. The local transfer tax and other general subsidy allocations are then added together.

Table 2.3. Calculation of the Local Allocation Tax in Japan

|

Financing gap = (Standard financial requirements) – (Standard financial revenues) |

|

Standard financial requirements = unit cost of service provision x measurement unit x adjustment coefficient |

|

Standard financial revenues = standard local tax revenues x 0.75 + local transfer tax allocation, etc. |

|

Unit cost: per-unit expense of each administrative service/task |

|

Measurement unit: population and other indices to assess the fiscal cost of each service/task |

|

Adjustment coefficient: to reflect differences in cost of provision owing to natural or social conditions (e.g. extreme climate, demographic factors, remote location) |

Based on the Italian and Japanese experience, Thailand could experiment with similar systems in the North by first addressing their limitations. For instance, allocations should reflect actual needs and not historical levels of provision. The criteria for service-cost equalisation cannot be manipulated. Finally, equalisation objectives must be balanced against the need for greater resource efficiency, especially in provinces where the population is shrinking because of ageing or outflow migration of the young labour force.

Source: (OECD, 2018[3]).

In addition to a new model for general grants, Northern provinces could experiment with a result-oriented and participatory approach to allocating conditional grants. Access to these grants could depend on the achievement of a broad set of social, environmental and economic targets. Targets should be the result of negotiation between representatives from the central government, LAOs, enterprises (ideally through the Smart Labs) and citizens. They should suit the characteristics and needs of different provinces or clusters of provinces – as defined in Figure 2.5.

Moreover, targets should be clearly identified and their achievement measured through a series of indicators that can be compared across provinces and, when possible, internationally. Italy has been testing this new way of earmarking conditional grants and can serve as a useful example for a similar reform in Thailand (Box 2.6).

Box 2.6. Performance-based grants in Italy

Italy has been reforming its approach to regional development policy since the 1990s. Changes concern not only underlying principles, but also policy delivery mechanisms. As in Thailand, the trend towards decentralisation to lower levels of administration has required new ways of co-ordinating a growing number of actors in the field of regional development. In this context, at the beginning of the 2000s, Italy embraced a result-oriented approach to planning and expenditures: the National Performance Reserve.

|

Objective |

Indicator |

|---|---|

|

Education: Improve students’ competencies, reduce dropout and broaden learning opportunities for the population. |

% of early school leavers % of students with poor competencies in reading % of students with poor competencies in maths |

|

Child and elderly care: Increase the availability of child and elderly care to favour women’s participation in the labour market. |

% of municipalities with child care services % of children (age 0-3) in child care % of elderly people benefiting from home assistance |

|

Urban waste management: Protect and improve the quality of the environment, in relation to urban waste management. |

Amount of urban waste disposed in refuse tips % of recycled urban waste % of composted waste |

|

Water service: Protect and improve the quality of the environment in relation to integrated water services. |

% of water distributed % of population served by waste water treatment plants |

Initially, the National Performance Reserve had three main objectives: (i) the simplification of public administration, (ii) improvement of spending efficiency, and (iii) the promotion of projects that require co-ordination among local administrators (also known as “Territorial Integrated Projects”). To achieve these objectives, a new mechanism envisaged the redistribution of 4% of 2000-06 EU Structural Funds among Italy’s 21 regions conditional on the achievement of a series of targets. The targets were the result of a two-year negotiation that involved high-profile political representatives of the central and regional governments.

The National Performance Reserve evolved throughout the 2000s. The Italian National Strategic Framework 2007-13 introduced a new set of targets to improve citizens’ quality of life and increase the propensity of business to invest in the south of Italy.

Source: (OECD, 2009[12]).

Northern cities drive regional development

Re-organise urban policies for performance and accountability (Expected result 3)

Re-define metropolitan areas based on functionality (Recommendation 7)

Thailand needs to define metropolitan areas to target the right pool of users of urban infrastructure. Accordingly, the NSO should define metropolitan areas to include not just the administrative boundaries of a city but also its neighbouring communities, to the extent that they belong to the same local labour market, as suggested by commuting patterns. These metropolitan areas therefore form integrated regions and include places where people live and work.

Northern cities are characterised by urban sprawl, with residents looking for cheaper housing, household incomes increasing and growing car ownership facilitating commuting. Redefinition of metropolitan areas could empower cities to deploy policies that target the preferences of individuals that reside in one administration and commute to the centre of business in another. For instance, the metropolitan area of Chiang Mai would extend beyond Chiang Mai city (thesaban) and include neighbourhoods in neighbouring Lampung province as well. Adjusting the target of urban policies thus requires a redefinition of urban areas in the North.

Box 2.7. The FUA methodology

The definition of FUAs in OECD countries uses population density to highlight urban cores and travel-to-work flows, in order to identify hinterlands where labour markets are highly integrated with the cores. The methodology consists of three main steps.

STEP 1. Identification of core municipalities through gridded population data

The first step of the methodology uses gridded population data to define urbanised areas or “urban high-density clusters” across the national territory, ignoring administrative borders, since urban cores are defined through gridded population data. The population grid data (1 km²) for Thailand would come from the Landscan project developed by Oak Ridge National Laboratory.

In most OECD countries, an urban core consists of a high-density cluster of contiguous grid cells of 1 km2 with a density of at least 1 500 inhabitants per km2. Different thresholds can be applied, depending on whether the metropolitan areas develop in a less compact manner. A municipality is defined as being part of an urban core if at least 50% of the population of the municipality lives within the urban cluster.

STEP 2. Connecting non-contiguous cores belonging to the same functional urban area

Urban cores as identified in Step 1 would normally approximate contiguous built-up surfaces. However, certain cities may develop in a polycentric way, hosting densely inhabited cores that are physically separated, but economically integrated. Using commuting data, the FUA methodology assesses the relationship between urban cores and the surrounding area, leading to the identification of urban areas with a polycentric structure.

In OECD countries, two urban cores are considered integrated (and thus part of the same polycentric metropolitan area) if more than 15% of the resident population of any of the cores commutes to work in the other core.

STEP 3. Identification of the urban hinterlands

The final step of the methodology consists of delineating the hinterland of the metropolitan areas. The “hinterland” can be defined as the “worker catchment area” of the urban labour market, outside the densely inhabited core. The size of the hinterland, relative to the size of the core, gives a clear indication of the influence of cities over surrounding areas. Urban hinterlands are defined as all municipalities with at least 15% of their employed residents working in a certain urban core.

Source: OECD (2013), Definition of Functional Urban Areas (FUA) for the OECD metropolitan database, Mimeo.

Urban policy in the North could be more effective if metropolitan areas were identified based on the “functional urban areas” (FUAs) methodology. FUAs combine satellite data with commuting patterns to define the urban area where people live and move on a regular basis (Box 2.7). Borders of FUAs thus overstep traditional administrative borders and the ensuing governance fragmentation (OECD, 2018[3]). The computation and definition of FUAs is standard across the world. Adopting FUAs would allow Northern cities to benchmark their performance with respect to social, economic and environmental indicators to leading global metropolitan areas.

Table 2.4. Current statistical definition of urban areas underestimates the size, potential and issues of Northern cities

|

City |

Province |

Population (GHSL, 2015) |

Population (NSO est., 2015) |

|---|---|---|---|

|

Chiang Mai |

Chiang Mai |

493 149 |

174 235 |

|

Phitsanulok |

Phitsanulok |

165 001 |

89 480 |

|

Chiang Rai |

Mae Sai |

153 994* |

|

|

Mae Sot |

Tak |

131 230* |

52 350 |

|

Nakhon Sawan |

Nakhon Sawan |

95 821 |

95 237 |

|

Lampang |

Lampang |

85 299 |

69 226 |

|

Chiang Rai |

Chiang Rai |

83 166 |

64 817 |

|

Kam Phaeng Phet |

Kam Phaeng Phet |

72 315 |

31 192 |

Note: * The population figures for Mae Sot, Tak, also include residents in the sister city of Myawadi, Myanmar. Given the uniform distribution of population density – adjusted by built-up area – as registered by the satellite, Tak and Myawadi can be considered as part of the same FUA. Similarly, Mae Sai forms an urban cluster with Wan Sa-te, in Myanmar.

Source: Authors’ work based on the Global Human Settlement Layer, https://ghsl.jrc.ec.europa.eu.

Current statistical definitions of urban areas underestimate the size, potential and potential issues of Northern cities. The FUA methodology is not yet applicable in Thailand, because data on commuting patterns are not available. However, satellite data alone can provide a sense of the actual size of Northern FUAs, their untapped potential and overlooked challenges (OECD, 2018[3]). Table 2.4 shows that the number of individuals living in cities (thesaban nakhon), as “traditionally” defined by the NSO, is systematically lower than the number of urban dwellers, as defined through the Global Human Settlement Layer (GHSL). The FUA of Chiang Mai is almost four times higher than that of Chiang Mai city alone.

Establish a metropolitan authority for Chiang Mai, then also for other Northern cities (Recommendation 8)

The definition of Functional Urban Areas goes hand-in-hand with the establishment of a metropolitan authority. By definition, FUAs extend beyond administrative borders, encompass several sub-provincial administrations (amphoe, tambon or muban), and may even overstep the border with neighbouring provinces. Northern cities can introduce “metropolitan authorities” that co-ordinate policies in the FUAs in order to achieve collective development objectives, integrate local labour markets and provide services that benefit all residents of the functional urban area. If local governments were left to pursue local policies in isolation, the well-being of FUAs’ residents might weaken.

Any metropolitan area needs at least an executive branch. The act that established the Greater London Authority in 1999 in the United Kingdom created the position of mayor of London and the London Assembly. Likewise, the creation of any FUA-type metropolitan authority in the North could go hand-in-hand with the introduction of a mayor in charge of urban policies in the area. Moreover, citizens should be able to elect their mayor, since local elections would strengthen the administrative leadership and enhance its political accountability to citizens – two prerequisites for effective urban policies (Diop, 2007[13]).

Experiment with participatory budgeting (Recommendation 9)

Participatory budgeting could be an additional mechanism to reinforce the political accountability of urban policies. It allows citizens to negotiate with the public administration over the municipality’s budgetary allocation and its investment priorities. In so doing, participatory budgeting improves the information that policy makers need to match closely citizens’ needs and preferences. Moreover, because of the bottom-up nature of the process, it forces mayors and local politicians to commit to citizens’ wishes. Participatory budgeting has thus improved local well-being in several emerging countries. For instance, in Brazil it contributed to reducing infant mortality rates and to strengthening local institutions (Gonçalves, 2014[14]).

Northern cities could also earmark local budget to projects that citizens select. Thailand has already experienced such forms of participatory budgeting. In the 1990s, the administration of Khon Kaen city together with local universities organised town hall meetings and focus groups to identify the problems, needs and priorities of citizens. Similarly, in Prachin Buri province, the Suan Mon Tambon Administrative Organisation organised civic committees that proposed and reviewed the composition of the budget (Fölscher, 2007[15]). Northern cities could explicitly dedicate a share of their budget to financing projects that enhance community well-being, selected through public consultation.

Participatory budgeting is not a silver bullet to improve local accountability and capacity. It requires progress in fiscal decentralisation reforms, the empowerment of local administrations and clarification of their fiscal responsibilities.

Inclusive and sustainable urban infrastructure (Expected result 4)

Create a transport authority for Chiang Mai, then also for other Northern cities (Recommendation 10)

Once defined, FUAs need efficient public transport to foster integration and improve citizens’ well-being. An efficient public transport system is fundamental to integrating local labour markets and to making people, goods and services move faster within the city. An efficient public transport system also would reduce the share of household budget spent on transport and cut commuting times. Shorter travel times to centres of business are normally associated with better socio-economic and health outcomes (Weiss et al., 2018[16]).

Northern cities need Transport Authorities. In Chiang Mai, for example, the co-existence of a multitude of micro-providers has jeopardised the reliability of public transport, and opened the way to the motorisation of the city. The existing public transport network does not always serve the suburbs, where more and more citizens are living. To address commuters’ preferences and behaviour, the Chiang Mai Transport Authority should cover the whole Chiang Mai FUA.

Five conditions are central to the successful creation of the Transport Authority of Chiang Mai and of any other Northern city in need. First, authorities should have the capacity to set integral mobility strategies. Second, institutional arrangements should be in place to co-ordinate land-use and housing strategies metropolitan-wide. Thirdly, financial and technical capacity should be developed internally. Fourthly, authorities should have legal authority and political support, and finally, once established, authorities should be able to deliver public value. Creating these conditions should be a priority in setting up a transport authority for Northern cities (OECD, 2016[17]). Table 2.5 summarises international experiences in meeting these five conditions.

Table 2.5. Conditions to implement an effective transport authority

|

How |

International examples |

|---|---|

|

Secure capacity to develop integral strategies |

|

|

The transport authority will need to have capacity to plan and manage public transport policies, investment and regulation at the metropolitan level, in order to implement effective transport demand management policies. Granting it authority and responsibility over walking and cycling policies, as well as over road safety and traffic management, should also be considered. |

The TfL (London), the Urban Development Planning Authority Curitiba (URBS) (Curitiba) and the Land Transport Authority (LTA) (Singapore) have responsibility over all public transport modes, plus cycling and walking facilities. They also have capacity for setting transport demand management strategies, such as parking, road pricing schemes (e.g. congestion charges and low-emission zones [TfL and LTA]) and the vehicle quota system for controlling vehicle ownership (e.g. LTA). Both TfL and LTA have responsibility over road safety and freight regulation. |

|

Develop an institutional arrangement that guarantees integrated land use and transport planning |

|

|

The transport authority will need to be embedded in an institutional configuration in which long-term land-use planning and regulation at the metropolitan scale is guaranteed. |

Transport planning by TfL is carried out within a wider metropolitan integrated planning framework, that co-ordinates with spatial and economic development strategies. In Curitiba, close co-operation between the metropolitan authorities responsible for mobility (URBS) and land-use planning (Instituto de Pesquisa e Planejamento Urbano de Curitiba [IPPUC]) has been key to the creation of the Integrated Transport Network and its development within a transit-oriented development scheme. |

|

Build internal financial and technical capacity |

|

|

Secure funds for the transport authority by:

Once funding needs are identified, explore national and local funds that could alternatively be allocated to the new authority (e.g. local property tax or local tax on motor and diesel fuel). |

Staff Successful urban transport authorities have been distinguished by a highly qualified team. The size of the staff can vary, depending on the responsibilities performed and whether personnel working for subsidiary institutions are contemplated or not as part of the staff. Budget In terms of budget, worldwide examples show that metropolitan transport institutions need significant funds. Therefore, fare revenues need to be complemented by other sources. |

|

Gain legal authority and political support |

|

|

Legal authority International and local organisations should engage in defining the necessary reforms to establish a Law for Land Transport and Traffic. The outcome of this reform should be a clear and solid legal framework. Political support Support should come from the Ministry of Transport, as well as all other agencies involved with land management, the LAOs involved and local stakeholders (e.g. the management and employees of the current providers of transport services). The inclusion of taxi drivers, informal providers of transport means as well as international companies acting in the area – such as Uber and Grab – is advisable. |

Legal authority Examples of authorities that have been supported by dedicated legislation include TransLink (Vancouver) through the Greater Vancouver Transportation Authority Act in July 1988 and TfL (London) through the Greater London Authority Act in 2000. In the case of the Syndicat des Transports Parisiens (STP) in Paris, created by decree in September 1949, jurisdiction of this authority was enlarged in 1968 to cover seven departments in the Paris region, and it was granted financial autonomy. In 2000, Law 2000-1208 ratified the addition of the Paris region as a member of the transport authority’s board, and the institution changed its name to Syndicat desTransports de l’Île de France. Political support Leadership from key political actors and/or support from other authorities, such as relevant ministries, facilitate the creation and are key to the consolidation of urban transport authorities. For instance, TransLink (Vancouver) enlarged its funding base by gaining political support from municipalities, which agreed to the transfer of property tax and several transport-related levies, such as the fuel tax and parking sales tax, to the metropolitan transport authority. |

|

Ensure delivery of public value |

|

|

Recognising areas in which the new authority should focus to attain sustainable and inclusive mobility goals in the metropolitan area will be essential for the authority to deliver public value. Key actions to that end include: 1) Prioritise investment and road space for walking, cycling and public transport 2) Increase efforts to improve transport planning and data collection 3) Develop a well-integrated transport network 4) Implement transport demand management policies and effective vehicle regulation 5) Adopt a “safe-system approach” for improving road safety – that is, a holistic and proactive approach, managed so that the elements of the road transport system combine and interact to guide users to act safely. |

TfL’s demonstrated ability to improve public transport in early years played an important role in the public acceptance of restrictions on car use, which were implemented in stages. |

Source: (OECD, 2016[17]).

Chiang Mai and the other Northern cities could dynamically assess commuters’ behaviour and adapt the scale and scope of the Transport Authority accordingly through regular surveys. As of today, the availability of mobility data is very limited. Population censuses in OECD countries usually provides useful insights; this is not the case in Thailand. The lack of similar data is an obstacle to the definition of FUAs and to the design of informed urban mobility policies. The Chiang Mai Mobility and Transport Survey (CM-MTS) is one of the few existing household travel surveys. It collects information about 19 385 surveys carried out by 6 189 persons in 2 319 households within the Chiang Mai city area between 2011 and 2012. These data provide a comprehensive snapshot of the travel behaviour of the city’s residents (Jittrapirom and Emberger, 2013[18]). Northern cities could implement similar surveys, update them regularly and extend them to the residents of the FUAs to capture the actual commuters’ needs.

Build a data system to monitor the quality of urban infrastructure (Recommendation 11)

In addition to an efficient transport network, access to and quality of services such as water, sanitation and electricity are fundamental for citizen’s well-being and quality of life.

Tailor-made and granular household surveys could help to assess the access to and quality of urban infrastructure in Northern cities. Northern cities could pilot surveys that are representative at the sub-provincial level and that evaluate the quality of (and access to) urban services. The “Basic needs survey” conducted by the Department of Community Development, under the Ministry of Interior, already measures the quantity of clean water that is daily available. It also could measure, for example, the frequency and length of power outages in urban dwellings. Night light data and remote sensing data could complement traditional sources of data for improved poverty prediction and mapping at the neighbourhood level.

Universities and colleges become key drivers of regional development

Universities promote entrepreneurship education (Expected result 5)

Integrate technical education with entrepreneurship education (Recommendation 12)

Entrepreneurship requires people with an entrepreneurial mindset and the skills to run and grow a firm. Northern entrepreneurs are generally satisfied with the knowledge that students develop in class. However, they find that fresh graduates lack the motivation, attitude and self-confidence to “run the extra mile”, innovate and thus create value.

Northern universities could provide the future entrepreneurs of the region with the right mix of hard and soft skills. Traditional coursework focuses on developing the hard skills needed to run a business, such as business administration knowledge, marketing, financing and accounting. Students could spend more time developing soft skills and overall entrepreneurial attitude. By pooling resources and teaching staff from all types of universities, local schools could introduce courses that train students with technical skills and simultaneously create an entrepreneurial mind-set.

Create incentives and space for universities’ autonomous initiatives (Recommendation 13)

Northern universities could assign a member of their top-level management exclusively to the development of entrepreneurship education. This manager should be responsible for definition of the overall goal of the entrepreneurship education programme, the degree of curricular integration, resource allocation, research, evaluation, and enhancement of the role of entrepreneurship in research and teaching. The creation of this management position requires universities to enjoy a certain degree of autonomy from the Ministry of Education.

Entrepreneurship programmes need to be dynamic and take into account research and real business needs. Universities could organise performance assessments on a regular basis by seeking feedback from local entrepreneurs, alumni entrepreneurs and students. Schools could, moreover, track and survey alumni with entrepreneurial careers. In order to internalise this feedback and adapt coursework accordingly, universities will ultimately need a measure of autonomy from the Ministry of Education.

Innovative and interactive pedagogic methods can indirectly develop entrepreneurial skills, attitudes and behaviours. Schools and teaching staff could complement traditional lecturing with more innovative teaching methods, such as video and online assignments, problem-based learning and project work on real technologies. These methods make students more responsible and critical about what they learn, and create space for co-operative and collective learning. Self-organisation, critical thinking and co-operation are all distinct traits of successful entrepreneurs.

Universities support entrepreneurship (Expected result 6)

Create networks of universities and private sector to support SMEs and start-ups (Recommendation 14)

Universities in selected Northern provinces already support local entrepreneurship and innovation. Some of them help reduce the cost of establishing new companies by providing legal assistance and facilitating access to credit. Others train and mentor existing local entrepreneurs in order to strengthen their managerial skills and support the development of their products. For example, the Chiang Mai University and its Science and Technology Park functions as a successful incubator of local start-ups in the agricultural and pharmaceutical sector. The “Business Incubation Unit” of the Mae Fah Luang University has helped establishing local business for processing agricultural products. Rajabhat and Rajamangala universities reach out to entrepreneurs in local communities and support the development of new ideas and local business.

Northern universities need an integrated approach to the development of local business. The strategies to support local entrepreneurship of global and local universities seem to be disconnected. In order to further contribute to the regional entrepreneurial ecosystem, the Chiang Mai University, the Mae Fah Luang University, the Rajamangala and Rajabhat universities could create a network to share their respective complementary know-how, assets and skills, and reach.

The North should create an Institute for Entrepreneurship and SMEs, following the lead of successful OECD experiences. By combining the know-how of both global and applied universities, the institute would guarantee the integration of both hands-on and theoretical entrepreneurship education in the curricula. The institute mission does not require a large staff, but rather a simple and dynamic structure that easily adapts to the local context. In terms of budget, the effort would therefore be limited and local and central government, together with the local chapters of Federation of Thai industries and Chambers of Commerce, could contribute. Looking at OECD experiences could help Northern authorities set up the institute. For instance, in 2006 the region of Brandenburg, Germany funded an entrepreneurship institute gathering nine public universities and the regional development agency. The institute has only eight employees and an annual budget of EUR 100 000, financed by the European Structural Funds, the Ministry of Economics of Brandenburg and project-related fees for services. Each partner organisation runs additional projects and employs supplementary personnel according to project needs.

Alongside the Institute for Entrepreneurship, the North needs new ways forge alliances between universities and the private sector. Northern universities and enterprises could create Centres of Excellence to encourage the development of research with a high potential for commercial application. These Centres enable knowledge transfer by facilitating collaboration between enterprises and research institutions – including both global and local universities. To establish provincial or regional Centres of Excellence, the North could draw on best practices from OECD countries, such as Austria (Box 2.8).

Box 2.8. The Christian Doppler Research Association, Austria: A role model for university-business co-operation in OECD countries

History, mission and performance of the Christian Doppler Research Association (CDRA)

In 1989, Austria established the Christian Doppler (CD) Research Association as a Centre of Excellence to support knowledge transfer and co-operation between science and industry. The Association envisages the establishment of temporary laboratories at universities that work on “application-oriented fundamental research”.

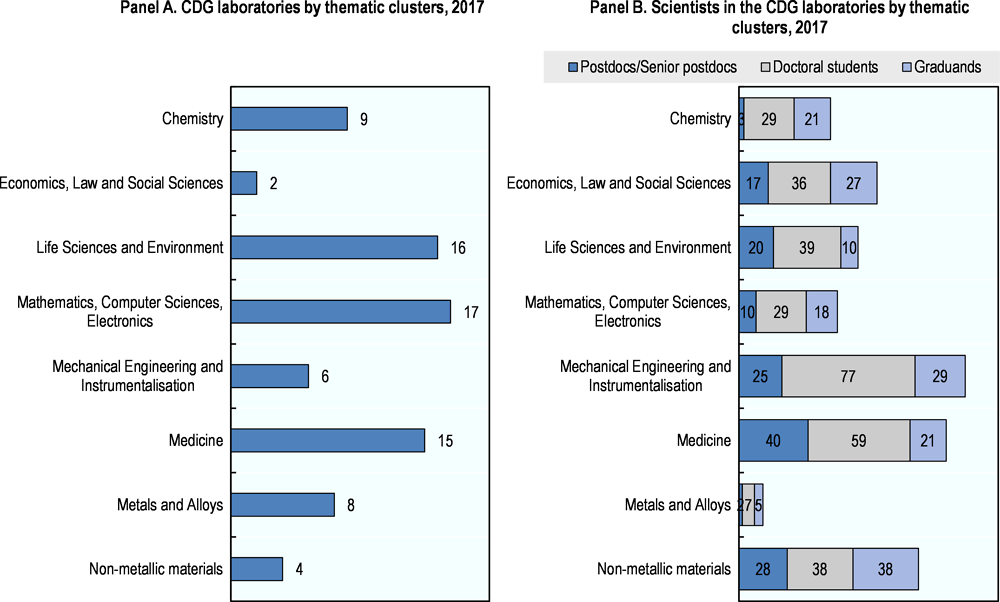

Since the founding of the Research Association, the number of CD Laboratories and involved commercial partners has grown constantly. In 2017, 148 companies were involved in 87 CD Laboratories. In comparison, in 2016, 136 companies collaborated in 81 labs. The overall expenditure of the research units amounted to EUR 26.2 million in 2017, compared to EUR 24 million in 2016.

The CD labs are divided into eight different thematic clusters and employ around 630 scientific staff.

Both industry partners and research partners seemed satisfied with the outcomes of the CD labs. During the 2012 and 2017 evaluations, industry partners acknowledged the opportunities the CD programme provided to obtain continuous access to cutting-edge research and innovation. They praised programme management for its efficiency, transparency and flexibility. The CD association also enjoys a strong academic reputation. In 2017, the scientific output of researchers in CD labs amounted to 469 publications (including 371 peer-reviewed publications), 1 061 presentations at conferences and 4 granted patents.

Figure 2.6. Measuring the performance of the Christian Doppler Labs

Source: Information retrieved from the Christian Doppler (CD) Research Association’s official website, www.cdg.ac.at.

Eight key reasons that make CD labs a role model:

1. Integration into the scientific environment of universities and non-university research institutions. The structure of CD labs limits administrative costs and extra red tape.

2. Bottom-up orientation. Laboratories are set up as initiatives of one or more companies. The business partner not only founds the lab, it also defines its focus and shapes its rules and processes.

3. Rigorous scientific quality monitoring. Interested companies apply with a research plan that is then refined by relevant universities. The CD Association’s management and international peers review the applications and select the most promising and financially viable.

4. Maximum duration of seven years. The performance of the labs is evaluated after two years. If the interim evaluation is positive, the contract is prolonged for a maximum of five more years.

5. Compact research groups and strong leadership (5-15 people). The Head of the Laboratory enjoys significant autonomy with respect to the management of researchers and the lab’s research agenda.

6. Guaranteed scientists’ freedom of initiative. Researchers spend 70% of their time on company-specific research and the remainder on other relevant research. By engaging with the business sector, scientific partners receive resources to promote the careers of young scientists.

7. Joint financing by the public purse and companies. Company-partners contribute 50% of the lab’s budget (40% in the case of SMEs). All financial support take the form of funds; in-kind services are not considered. The public sector covers the remainder of the budget.

8. International involvement. One of the two participants in the initiative – either the scientific partner or the commercial partner – has to be Austrian.

Source: (OECD, 2018[19]) and presentation by the Federal Ministry of Science, Research and Economy of Austria at the “Vision 2030 for Higher Education and Research”, Seminar in Helsinki (14 June 2017).

The Action Plan: A summary

Table 2.6. An effective strategy and strong LAOs drive the development of the North: Action plan

|

Recommendation |

Action |

Who |

||

|---|---|---|---|---|

|

Expected result 1: Create a strategy for developing the Northern Region, building on local discovery |

||||

|

Smart Labs for entrepreneurial discovery of business and innovation potential (1) |

|

NESDC, NSO, local universities and selected stakeholders taking part in the Smart Labs. |

||

|

Support strategy process with analysis of product and innovation data, as well as crowdsourcing (2) |

Apply product space methodology to the most detailed level of production to identify the current and potential strengths of each province. |

NESDC, NSO, local universities |

||

|

Define optimal provincial clusters to target smart labs and the development strategy (3) |

Cluster contiguous provinces based on their Human Achievement Index, balancing indicators measuring current and future capabilities. |

OECD, NESDC |

||

|

Expected result 2: Strengthen LAOs in the Northern Region – experiment with innovation in tax collection and transfers |

||||

|

Test innovative methods for property tax collection to increase LAO revenues (4) |

|

Department of Land Administration, Valuers Association of Thailand, Geo-Informatics and Space Technology Development Agency (GISTDA) |

||

|

Invest in local capacity building and peer learning for improved local fiscal capacity (5) |

|

Department of Land Administration, Department of Community Development |

||

|

Experiment with a simplified but more effective system of transfers (6) |

General grants:

Conditional grants:

|

Office of the Prime Ministry, Ministry of Interior (Department of Community Development), NESDC regional office |

||

Table 2.7. Action plan to transform Northern cities into drivers of regional development

|

Recommendation |

Action |

Who |

|---|---|---|

|

Expected result 3: Re-organize urban policies for performance and accountability |

||

|