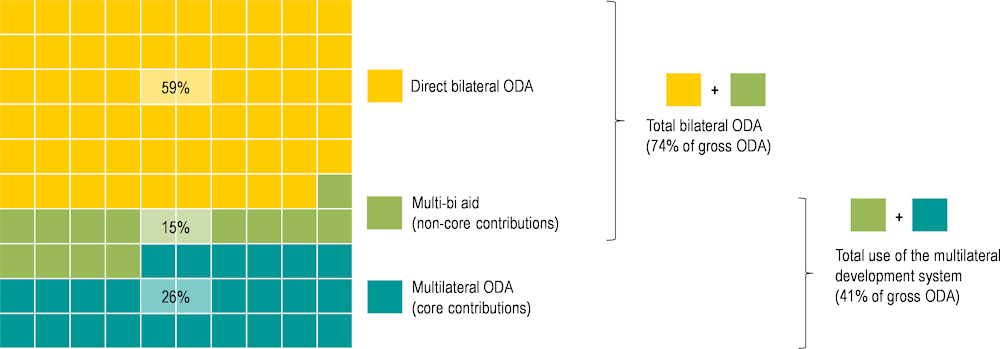

Multilateral development organisations are at the heart of the development co-operation system. They channel a large and growing share of total official development assistance (ODA). The volume of ODA channelled through multilateral development organisations amounted to USD 78.6 billion in 2020, or 41% of total ODA (Figure 1.1). This amount is made up of: (i) contributions to the budgets of multilateral organisations (known as “core” or “multilateral ODA”), representing 26% of total ODA; and (ii) non-core contributions earmarked through multilateral organisations (so-called “multi-bi aid”), accounting for 15% of total ODA. These non-core, or earmarked, contributions are resources channelled through multilateral organisations over which the donor retains some degree of control and that can be earmarked for a specific country, project, region, sector or theme. Although smaller in volume and share, earmarked contributions have been rising steadily over the past two decades, while the share of core contributions has remained constant.

Multilateral Development Finance 2022

1. Overview

Copy link to 1. Overview1.1. Multilateral development finance in context

Copy link to 1.1. Multilateral development finance in contextFigure 1.1. More than 40% of total ODA is channelled through multilateral development organisations

Copy link to Figure 1.1. More than 40% of total ODA is channelled through multilateral development organisationsDAC countries’ and other official providers’ bilateral and multilateral ODA

Note: Calculations based on gross disbursements, in 2020 constant prices.

Source: Authors’ calculations based on the OECD Creditor Reporting System, (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

Multilateral development organisations form a complex ecosystem. The analysis in this report shows that the number of active multilateral entities has grown steadily over the past few decades. Today, the multilateral development system comprises more than 200 entities. In the long run, this continued fragmentation could pose risks to systemic coherence and accountability, especially if new ad hoc structures continue to be created and superimposed on the pre-existing multilateral architecture.

The centre of gravity of the multilateral development system remains in a handful of multilateral organisations. Ten multilateral entities, out of more than 200, account for 70% of total financing from the multilateral development system. The largest multilateral development banks (MDBs) are over-represented among these “vital few”, along with the development institutions of the European Union. The multilateral development system also includes a multitude of smaller and more specialised entities. United Nations (UN) funds and programmes, UN agencies and vertical funds account for a large share of the remaining 30% of multilateral financing. This part of the system is more fragmented and includes entities with smaller portfolios and greater thematic specialisation, which often channel funds earmarked by bilateral providers.

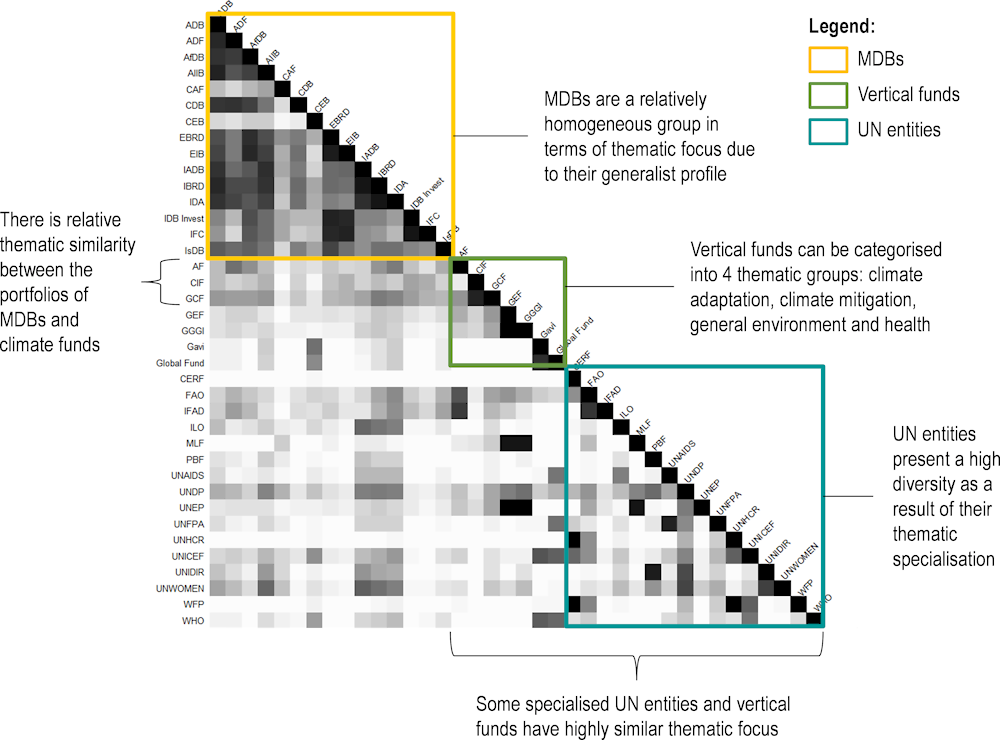

The large number of organisations that make up the multilateral development system has resulted in a multifaceted and versatile architecture. Rather than a monolithic structure, the multilateral development system is an intricate institutional patchwork of entities with diverse constituencies (global, regional or South-South), geographic scope (regional or global), thematic focus (single-focus or wide-ranging), financing instruments (grants, concessional and non-concessional loans, equity, guarantees) and operational models (banks, funds, agencies). While this contributes to the versatility of multilateral development finance, the increasingly crowded and complex multilateral architecture makes it difficult to obtain a clear understanding of the division of roles and to identify potential overlaps in the organisations’ portfolios (Figure 1.2).

Figure 1.2. Multilateral development organisations form an intricate patchwork with diverse thematic focus

Copy link to Figure 1.2. Multilateral development organisations form an intricate patchwork with diverse thematic focusMatrix of portfolio similarity scores across multilateral development organisations (2012-20 average)

Note: Calculations are based on commitments, in 2020 constant prices. Darker shading reflects a high level of thematic similarity between two portfolios. The portfolio similarity scores of multilateral development organisations are calculated with cosine similarity, following the approach used in Comparing multilateral and bilateral aid: a portfolio similarity analysis (OECD, 2022[2]), https://www.oecd.org/dac/2022-mdf-comparing-multilateral-bilateral-aid.pdf.

Source: Authors’ calculations based on OECD Creditor Reporting System, (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

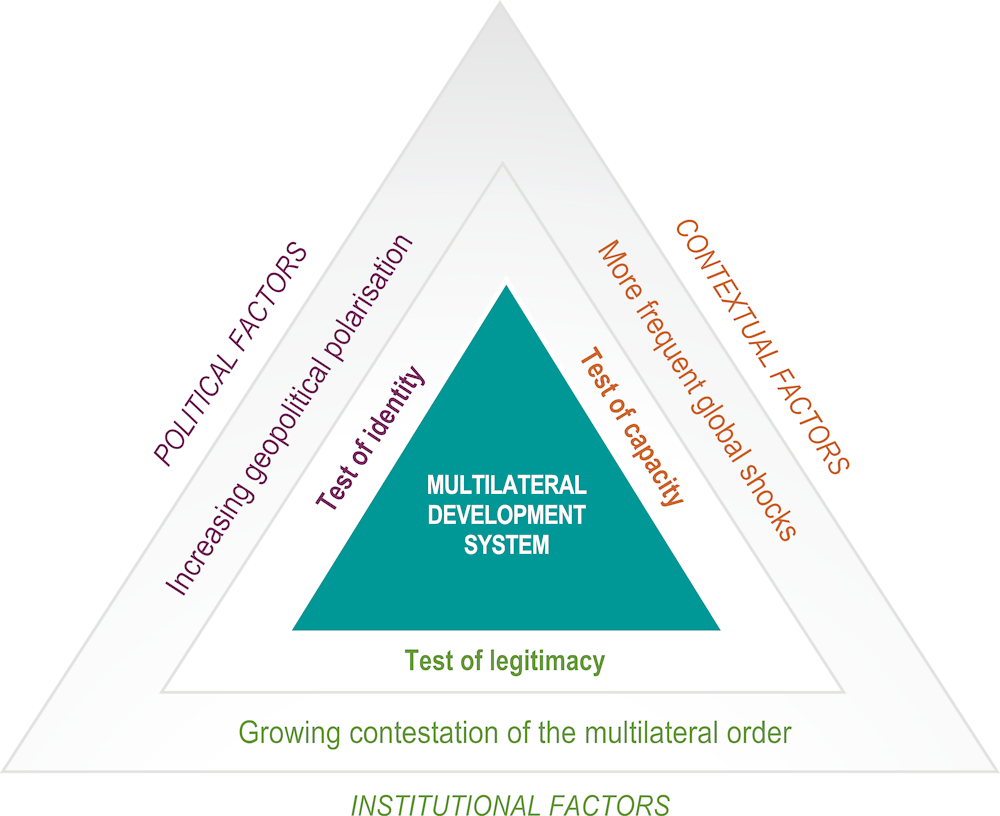

Multilateral development finance faces growing pressures in an unstable global context. A combination of three forces (contextual, institutional and political) is putting the system to the test (Figure 1.3). First, successive crises are stretching multilateral resources across an ever-increasing list of development priorities and testing the system’s capacity to remain relevant in a more shock-prone world. Second, growing geopolitical polarisation is affecting the multilateral space and may result in tensions between diverging and competing values and priorities. Third, the rules-based multilateral order inherited from the Second World War is seeing its legitimacy challenged, and faces mounting contestation and criticism, including from some of its former champions. Failure to adjust to these forces could put the multilateral development system on the verge of a triple crisis of capacity, legitimacy and identity.

Figure 1.3. A triangle of forces is reshaping the multilateral development system

Copy link to Figure 1.3. A triangle of forces is reshaping the multilateral development system

Source: Authors’ illustration.

The new global context calls for reassessing the adequacy of the current multilateral architecture and governance. The triple crises of the COVID-19 pandemic, Russia’s invasion of Ukraine and the threat of climate change have exposed some key shortcomings of the multilateral development system and highlighted the need to better equip its organisations. As a result, greater attention has been drawn to the need to scale up multilateral development finance, as evidenced by recent calls to reform the global financial architecture and revisit the toolkit and operational model of the major international financial institutions (US Department of the Treasury, 2022[3]) (Government of Barbados, 2022[4]). However, some other parts of the reform agenda appear to have lost steam. This includes efforts to rationalise and improve the coherence of the multilateral architecture, as well as to increase funding to the core functions of the system to build its resilience to deal with future crises (UN, 2022[5]).

Looking forward, the three global forces may further complicate the reform of the multilateral system. First, as already observed during the COVID-19 pandemic, more frequent crises could increase policymakers’ short-term focus on emergency responses at the expense of longer-term investments to strengthen the multilateral development system. In addition, the increased financing needs from successive shocks could translate into a further expansion, fragmentation and complexity of the multilateral system. Second, the shift to a more polarised geopolitical order could make it even more difficult to achieve the level of consensus required to undertake fundamental reforms. Finally, the reduced trust in multilateral approaches could in the long term affect the willingness of member states to continue investing in the multilateral development system.

1.2. Funding to the multilateral development system

Copy link to 1.2. Funding to the multilateral development systemDespite DAC member countries’ tightening budget constraints during the pandemic, inflows to the multilateral system continued to rise in 2020. Over the past decade, the multilateral development system has channelled growing volumes of ODA to developing countries. Between 2012 and 2019, core and non-core contributions to multilateral development organisations increased from USD 56.8 billion to USD 70.6 billion (up 24%). The outbreak of the COVID-19 pandemic in 2020 seems to have accelerated this trend, with DAC members’ multilateral contributions reaching an all-time high of USD 76.4 billion in 2020.

However, the increase in multilateral contributions was not enough to meet the growing funding needs resulting from multiple concurrent crises. Funding shortages plagued humanitarian agencies throughout 2021, especially as scale-up was required for several concurrent emergencies, including in Afghanistan and Ethiopia, and the ongoing effects of the COVID-19 crisis continued to impact vulnerable communities. The funding gap increased further in 2022 as developing countries faced soaring food and energy prices and the additional impact of Russia’s war against Ukraine. As of early October 2022, the UN Office for the Coordination of Humanitarian Affairs (UNOCHA) reported a record shortfall of USD 31.4 billion, corresponding to 63% of total funding requirements (UNOCHA, 2022[6]).

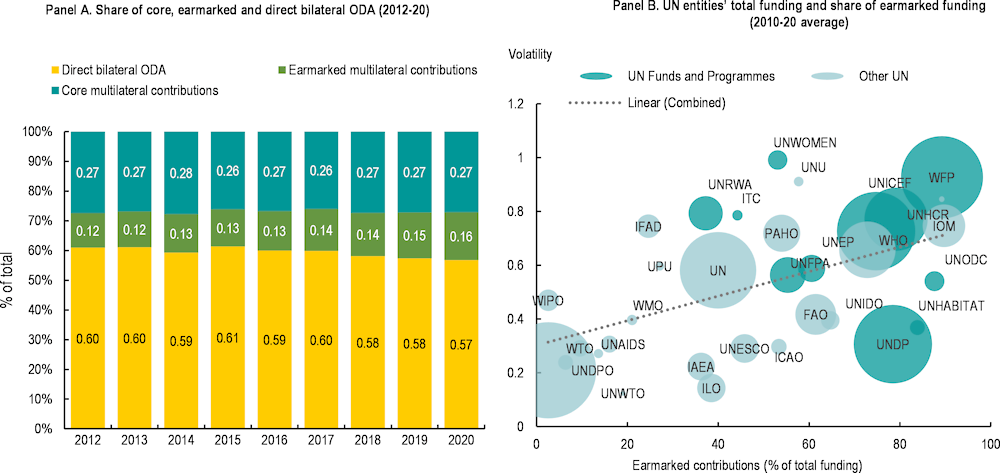

In addition, some worrying funding patterns risk constraining multilateral development organisations’ flexibility to respond and adapt to new challenges. This is, for example, the case of donors’ increasing tendency to earmark their contributions. Funds earmarked through the multilateral development system represent a growing share of Development Assistance Committee (DAC) members’ ODA. The share of DAC members’ non-core (earmarked) contributions in their total ODA grew from 13% to 16% between 2015 and 2020, while the share of their core contributions increased only slightly, from 26% to 27% (Figure 1.4). With a growing portion of development finance channelled through the multilateral development system earmarked for specific objectives, core functions are receiving less funding proportionally. In the long run, this could lead to a gradual erosion of the critical functions of the multilateral system, such as providing strategic and long-term oversight of key reforms, and adapting to the evolving and expanding nature of global development challenges.

Figure 1.4. The rise of earmarked ODA contributes to volatile funding for multilateral organisations

Copy link to Figure 1.4. The rise of earmarked ODA contributes to volatile funding for multilateral organisations

Note: Calculations are based on gross disbursement, in 2020 constant prices. In Panel B, the vertical axis corresponds to a measure of volatility, calculated as the relative standard deviation (also known as coefficient of variation). The horizontal axis shows earmarked contributions as a share of total funding (core and non-core, earmarked, contributions) received by UN entities. The size of the bubbles corresponds to the average annual funding volume of the different UN entities.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

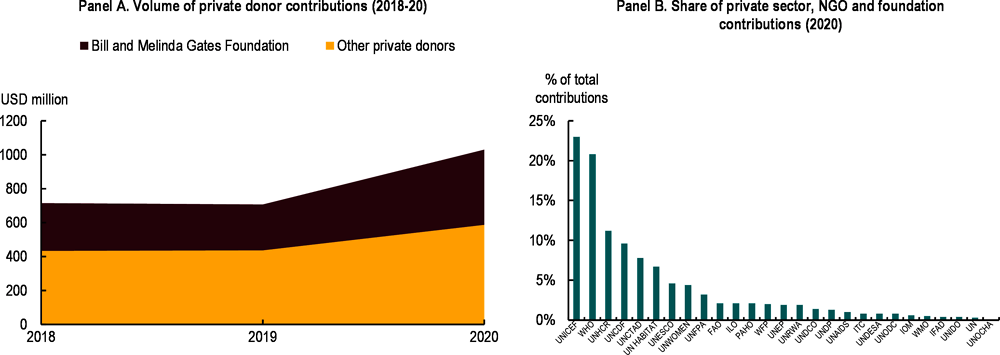

The UN Development System (UNDS), which is very reliant on earmarked contributions, has been seeking to overcome these vulnerabilities through system-wide reforms and greater engagement of private actors. UN member states adopted the Funding Compact in 2019 as a framework to align their financial support to the UNDS with the 2030 Agenda for Sustainable Development. However, the Funding Compact has seen mixed progress so far. In order to respond to growing demand from developing countries, many UN entities are increasingly seeking to diversify their funding base, including through contributions from the private sector. In fact, for some UN entities, the share of contributions received from private stakeholders, foundations and NGOs already represents more than 20% of total donor contributions (Figure 1.5). While the diversification of funding sources is a positive development, an over-reliance on private actors could ultimately have the same adverse effects as an uncontrolled rise of earmarked funding from donor governments and should thus be monitored with care. Potential implications include the disregard of programme priorities defined by intergovernmental bodies, high transaction costs and reduced coherence of multilateral strategies.

Figure 1.5. Private contributions to the UNDS increased significantly in 2020, but their share of total funding varies considerably across UN entities

Copy link to Figure 1.5. Private contributions to the UNDS increased significantly in 2020, but their share of total funding varies considerably across UN entities

Note: In Panel B, private, foundations and NGOs’ contributions are calculated as a share of each UN entity’s total funding (excluding local resources).

Source: Authors’ calculations based on (UNCEB, 2022[7]) “Financial Statistics”, https://unsceb.org/financial-statistics.

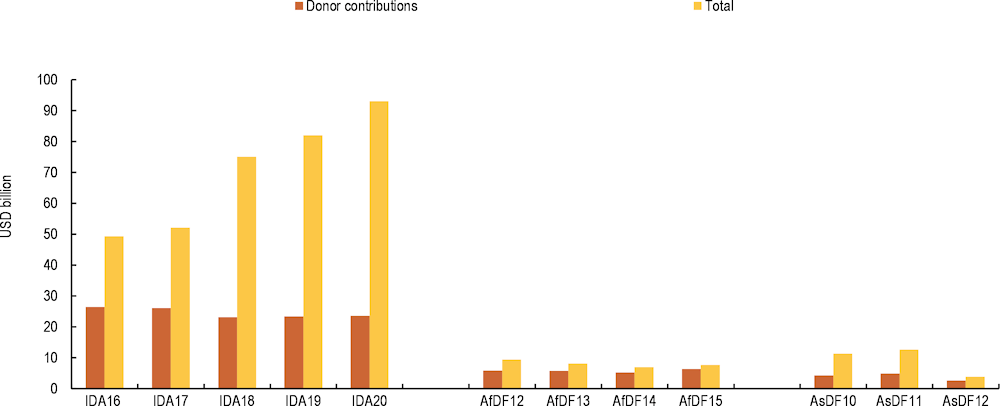

The MDBs’ ability to raise financing from capital markets provided them with the flexibility to ramp up their lending during the pandemic. Successive bonds issuances, backed by recent capital increases, have allowed MDBs to scale up their lending in recent years. On the other hand, donor contributions to MDBs’ concessional windows have been stagnating (Figure 1.6) and MDBs’ financing headroom could narrow in the future due to the combined effect of tightening financial conditions and member governments’ hesitation to further bolster their capital base. As a consequence, MDBs are increasingly under pressure from their shareholders to revisit and optimise their capital adequacy approaches. For example, the recent G20 review of MDBs’ capital adequacy frameworks, released in July 2022, provided recommendations to unlock additional MDB lending capacity. Some of these initiatives open up new entry points for DAC members and other official donors as investors or guarantee providers to MDBs.

Figure 1.6. Donor contributions to the replenishments of MDBs’ concessional windows have stagnated

Copy link to Figure 1.6. Donor contributions to the replenishments of MDBs’ concessional windows have stagnatedDonor contributions and total envelope of MDB concessional window replenishments

Source: Authors’ analysis based on replenishment reports of the IDA (International Development Association), AfDF (African Development Fund) and AsDF (Asian Development Fund).

Increased funding to vertical funds helps scale up multilateral development finance but risks exacerbating pressures on the system. Recent crises show that donor governments continue to resort to vertical funds in the face of emerging global challenges. For example, a new fund for Pandemic Preparedness and Response (PPR) was officially established in September 2022 to tackle the COVID-19 pandemic. With the heightened visibility provided to global health issues in recent years, the two major health funds – the Global Fund to Fight AIDS, Tuberculosis and Malaria (Global Fund) and Gavi, the Vaccine Alliance – also benefitted from successful replenishments. However, in the absence of a reform of traditional multilateral organisations, the creation of new vertical funds risks entrenching existing weaknesses in the multilateral development system. Most vertical funds ultimately rely on the implementing capacity of existing multilateral organisations, as they channel a large part of their resources through other multilateral entities such as UN entities and MDBs (Akmal et al., 2021[8]). Therefore, while the establishment of new funds may be an effective way to respond to emerging development challenges, it is not a substitute for multilateral reform in the long term.

1.3. Financing from the multilateral development system

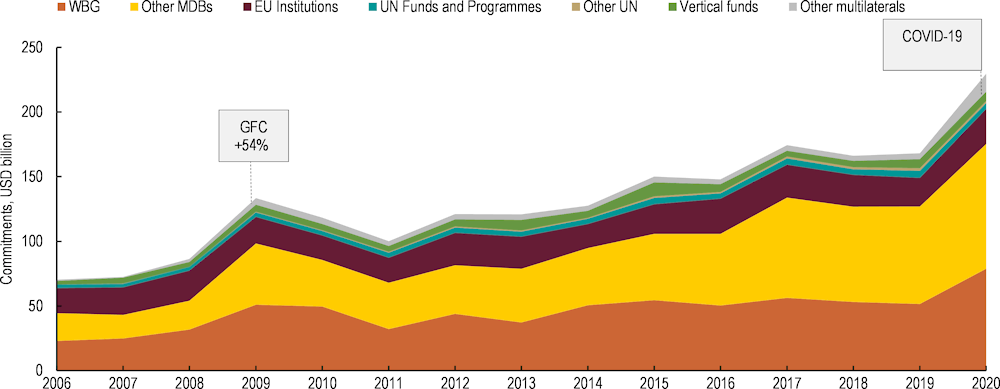

Copy link to 1.3. Financing from the multilateral development systemThe multilateral development system played a crucial role in the COVID-19 crisis response. Financing from the multilateral development system reached an all-time high in 2020. Multilateral disbursements rose by 31% in 2020, reaching USD 185.1 billion, while multilateral commitments increased by 37% (Figure 1.7). MDBs have been driving the rapid increase in financing provided by multilateral development organisations. Commitments from the WBG and other MDBs increased by 50% and 29%, respectively, between 2019 and 2020. Taken together, the MDBs accounted for 79% of the total USD 61.5 billion increase in multilateral commitments in 2020. The share of financing from the International Monetary Fund (IMF) reported to the OECD Creditor Reporting System (CRS) increased by more than six times between 2019 and 2020, reaching USD 10 billion, up from only USD 1.6 billion in 2019 and an average of USD 1.3 billion between 2010 and 2019.

Compared to the response to the global financial crisis, the increase in multilateral financing to tackle the COVID-19 crisis was larger in volume but less significant in relative terms. The surge in multilateral commitments was USD 20 billion higher in 2020 compared to 2009. Yet the relative increase in total multilateral development finance in response to the pandemic in 2020 was around 18 percentage points lower than during the global financial crisis. In the case of MDBs, the relative increase observed in 2020 was about half as large as the rise in MDBs’ financing in 2009. This is despite the fact that for developing countries, the socioeconomic consequences of the pandemic were more serious than the impact of the global financial crisis.

Figure 1.7. The multilateral response to the pandemic was larger in volume than to the global financial crisis, but was smaller in relative terms

Copy link to Figure 1.7. The multilateral response to the pandemic was larger in volume than to the global financial crisis, but was smaller in relative terms

Note: GFC=global financial crisis. Calculations are based on commitments, in 2020 constant prices.

Source: Authors’ calculations based on (OECD, 2022[1]), “Creditor Report System”, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

Multilateral development finance retains its particular focus on middle-income countries. In recent years, multilateral development finance has increasingly focused on middle-income countries, driven by the growth in MDBs’ outflows. This trend, already highlighted in the previous edition of this report (OECD, 2020[9]), continues. Between 2018 and 2019, for example, the share of financing provided by multilateral organisations to middle-income countries increased from 68% to 70%, largely driven by a growing share of multilateral financing to lower-middle income countries (LMICs). The initial pandemic response further geared multilateral development finance towards LMICs. In 2020, LMICs received 42% of the financing provided by multilateral organisations, up from 38% the previous year.

The contribution of multilateral development finance is critical to support a recovery that is both inclusive and sustainable in developing countries. The multilateral development system is faced with the challenge of helping realise the promise of building back better in developing countries. In order to build the resilience of developing countries against future shocks, multilateral development finance needs to incorporate a joint focus on social inclusiveness and environmental sustainability. Looking forward, these two pillars provide a compass to ensure multilateral development finance helps address the recent rise in poverty and inequality (including gender-based), as well as the impacts of the twin climate and biodiversity crises.

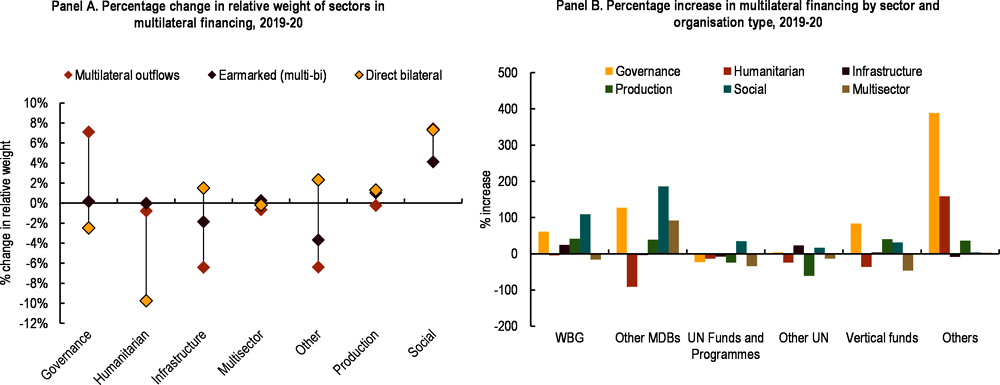

Recent crises resulted in increased multilateral focus on the fight against poverty and inequality. The COVID-19 pandemic saw increased multilateral financing to poverty and inequality-oriented sectors. Social sectors accounted for 24% and 25% of multilateral outflows and earmarked flows, respectively, in 2020, up from 17% and 18% the previous year (Figure 1.8). The shift to social sectors in multilateral organisations’ portfolios was the most pronounced for MDBs, driven by their strong contribution to strengthening social protection systems. Health spending was another key driver of the surge in social sector financing in the first year of the pandemic. However, the focus on the COVID-19 response appears to have crowded out financing to some other health areas. For example, basic nutrition and basic health infrastructure saw a decrease in financing of 72% (USD 700 million) and 20% (USD 240 million), respectively, compared to 2019.

Figure 1.8. Multilateral portfolios pivoted towards poverty and inequality-oriented sectors in 2020

Copy link to Figure 1.8. Multilateral portfolios pivoted towards poverty and inequality-oriented sectors in 2020

Note: Calculations are based on commitments, in 2020 constant prices. The chart in Panel B is based on commitments from multilateral outflows only (excluding earmarked flows).

Source: Authors’ calculations based on (OECD, 2022[1]), “Creditor Report System”, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

Preventing the rise in poverty and inequality from becoming entrenched will require sustained support from multilateral organisations. The succession of multidimensional crises has undone several years of progress in the fight against poverty and inequality. In the years leading up to the COVID-19 pandemic, developing countries were making significant progress on reducing poverty. The pandemic and Russia’s war against Ukraine, which led to an additional 75 million to 95 million people living in extreme poverty, marked the end of a two-decade downward trend in extreme poverty (Gerszon Mahler et al., 2022[10]). It also set back hard-won progress in multiple areas of sustainable development. Recent crises have demonstrated that the multilateral development system can play a key role in support of the poor and marginalised; for example, through reforms and activities aimed at strengthening social protection systems, and access to health and education opportunities. The vast protracted effects of recent crises on poverty and inequality, with millions of people thrown back into extreme poverty and an exacerbation of existing inequalities, require multilateral organisations to provide continued support to key areas with a recognised contribution to the fight against poverty and inequality in coming years.

On the sustainability front, the multilateral development system is a major and growing actor in the area of green finance. Multilateral climate finance has grown at a rapid pace since 2016, from USD 25.4 billion in 2016, to USD 50.5 billion in 2020. Thanks to this rapid growth, the multilateral development system accounted for 44% (USD 36.9 billion) of total climate finance provided or mobilised by developed countries in 2020 (USD 86 billion in 2020). MDBs provided the vast majority of climate-related multilateral outflows in 2020 (93%), followed by vertical funds (6%). The past decade has also seen a growth of multilateral financing for biodiversity. A recent study, for example, shows that multilateral development finance for biodiversity-related activities increased by 325% between 2011 and 2020, from USD 1.6 billion to USD 7 billion (Casado-Asensio, Blaquier and and Sedemund, 2022[11]). Yet, persistent bottlenecks in multilateral green finance continue to constrain resource mobilisation and effective resource deployment. These bottlenecks owe in part to the complexity of the multilateral climate finance architecture, as well as to the intricate application processes and requirements involved in accessing funds – especially challenging for the low-income countries which need these resources most.

Looking forward, greater effort by multilateral development organisations will be required to close the growing gap in green finance. The twin climate and biodiversity crises call for a strong response from multilateral stakeholders. According to recent estimates from the Intergovernmental Panel on Climate Change (IPCC), the volume of climate finance flows needs to increase by three to six times by 2030 to limit global warming to below 2°C (Intergovernmental Panel on Climate Change, 2022[12]). While public finance alone will not suffice to close the climate investment gap, multilateral providers can send a clear signal to private investors by increasing their efforts to align their official development finance flows with the Paris Agreement.

1.4. Policy recommendations

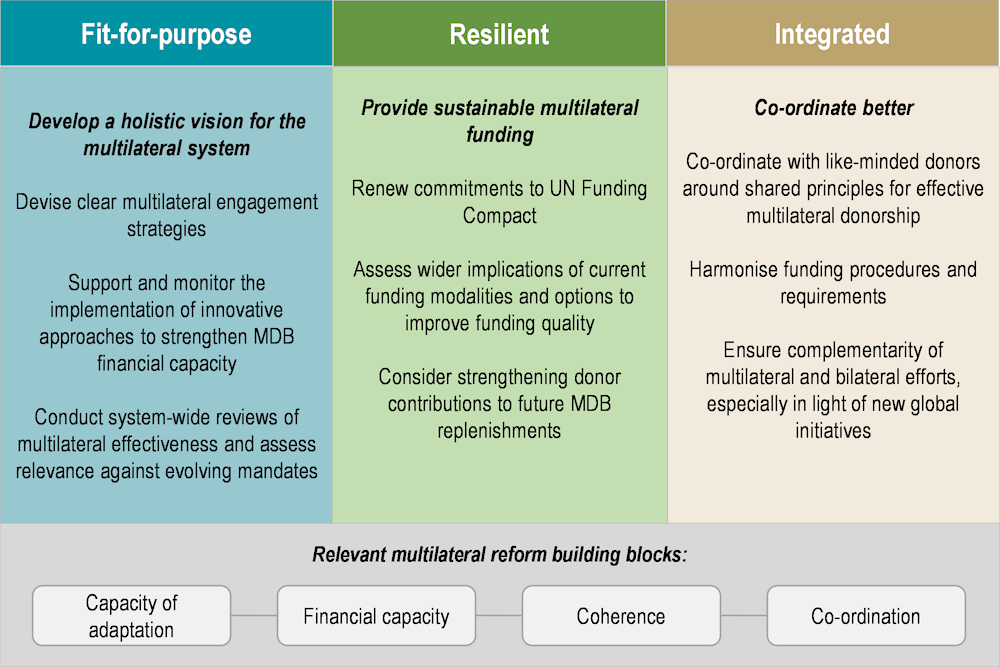

Copy link to 1.4. Policy recommendationsThe 2020 edition of the Multilateral Development Finance Report proposed three key reform areas and six building blocks (transparency, system coherence, co-ordination, financial capacity, prioritisation and capacity of adaptation) to help multilateral development finance meet 21st century development challenges (OECD, 2020[9]). A review of progress reveals a mixed picture: while greater attention has been drawn to the need to scale up multilateral development finance, some parts of the reform agenda appear to have lost steam, and others have stalled. In particular, the focus on emergency response and increased financial capacity seems to be at the expense of other reforms to the multilateral architecture (coherence building block) and increasing investments in the core functions of the system to build resilience in the face of future crises (capacity of adaptation). The recommendations made in this report aim to maintain the focus on these building blocks, and are targeted at the main funders and shareholders of the multilateral development system (the DAC and its members), and the multilateral organisations in the system.

For the DAC and its members:

As the majority funders and shareholders of the multilateral development system, DAC members have a shared responsibility to ensure the system is adequately equipped and structured to support the global development agenda. Chapter 3 of this report makes key policy recommendations for how the DAC can help build a more fit-for-purpose, resilient and integrated multilateral development system (Figure 1.9):

Figure 1.9. How the DAC can contribute to a more fit-for-purpose, resilient and integrated system

Copy link to Figure 1.9. How the DAC can contribute to a more fit-for-purpose, resilient and integrated system

Note: The building blocks refer to key areas of reform to strengthen the multilateral development system identified in the previous edition of the report (OECD, 2020[9]), and further discussed in Chapter 2 of this report.

Source: Authors’ illustration.

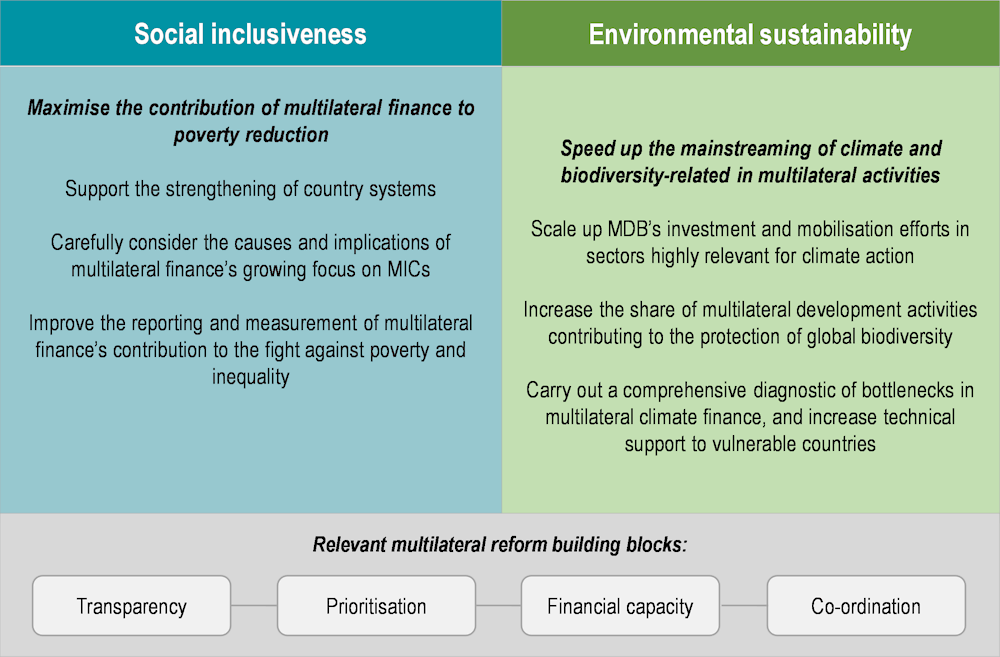

For multilateral development organisations:

Greater effectiveness and prioritisation of multilateral development finance will be crucial to tackle the broad range of development challenges resulting from multiple concurrent global crises. Ensuring complementarity between multilateral and bilateral efforts, and addressing the lack of whole-of-system accountability, will be key for the greatest development impact. It will be equally important to ensure that multilateral development finance helps realise the promise of building back better in developing countries, by contributing to both pillars of the recovery – social inclusiveness and environmental sustainability. Chapter 4 concludes with detailed recommendations, summarised in Figure 1.10:

Figure 1.10. Multilateral actions for social inclusiveness and environmental sustainability

Copy link to Figure 1.10. Multilateral actions for social inclusiveness and environmental sustainability

Source: Authors’ illustration.

References

[8] Akmal, M. et al. (2021), “Is the Global Partnership for Education Redundant?”, CGD NOTES, https://www.cgdev.org/publication/global-partnership-education-redundant.

[11] Casado-Asensio, J., D. Blaquier and J. and Sedemund (2022), Multilateral institutions’ biodiversity-related development finance: trends over 2011-20.

[10] Gerszon Mahler, D. et al. (2022), “Pandemic, prices and poverty”, World Bank Blogs, https://blogs.worldbank.org/opendata/pandemic-prices-and-poverty.

[4] Government of Barbados (2022), The 2022 Bridgetown Agenda for the Reform of the Global Financial Architecture, https://www.foreign.gov.bb/the-2022-barbados-agenda/.

[12] Intergovernmental Panel on Climate Change (2022), Climate Change 2022: Mitigation of Climate Change, https://www.ipcc.ch/report/ar6/wg3/.

[2] OECD (2022), Comparing multilateral and bilateral aid: a portfolio similarity analysis, OECD, Paris, https://www.oecd.org/dac/2022-mdf-comparing-multilateral-bilateral-aid.pdf.

[1] OECD (2022), “Creditor Reporting System”, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

[9] OECD (2020), Multilateral Development Finance 2020, OECD Publishing, Paris, https://doi.org/10.1787/e61fdf00-en.

[5] UN (2022), “Funding Compact Indicator Table”, United Nations, Geneva, https://www.un.org/ecosoc/sites/www.un.org.ecosoc/files/files/en/qcpr/2022/Annex-FundingCompact-IndicatorsTable-Ver2b-25Apr2022.pdf.

[7] UNCEB (2022), “Financial Statistics”, UN System Chief Executives Board for Coordination, New York, https://unsceb.org/financial-statistics.

[6] UNOCHA (2022), “Global Humanitarian Overview 2022”, UN Office for the Coordination of Humanitarian Affairs, New York, https://hum-insight.info/ (accessed on 30 September 2022).

[3] US Department of the Treasury (2022), Remarks by Secretary of the Treasury Janet L. Yellen at the Center for Global Development, https://home.treasury.gov/news/press-releases/jy0997.