The multilateral development system has channelled record volumes of financing to support developing countries in recent years. Even so, it is still not enough to meet the magnitude of challenges they face. Multilateral organisations’ ability to adapt to shifting priorities during the COVID-19 pandemic was key for avoiding further economic and social damage to developing countries. Looking forward, similar agility will be required of multilateral development finance to accompany developing countries as they transition from short-term crisis response to longer-term investment in a sustainable recovery. A key challenge will be to ensure that multilateral development finance helps materialise the promise of building back better, by contributing to both pillars of the recovery – inclusiveness and sustainability.

Multilateral Development Finance 2022

4. Financing from the multilateral system

Copy link to 4. Financing from the multilateral systemAbstract

4.1. The multilateral development system played a crucial role in the COVID-19 crisis response

Copy link to 4.1. The multilateral development system played a crucial role in the COVID-19 crisis response4.1.1. Multilateral outflows reached record volumes in 2020, with similar figures expected for 2021

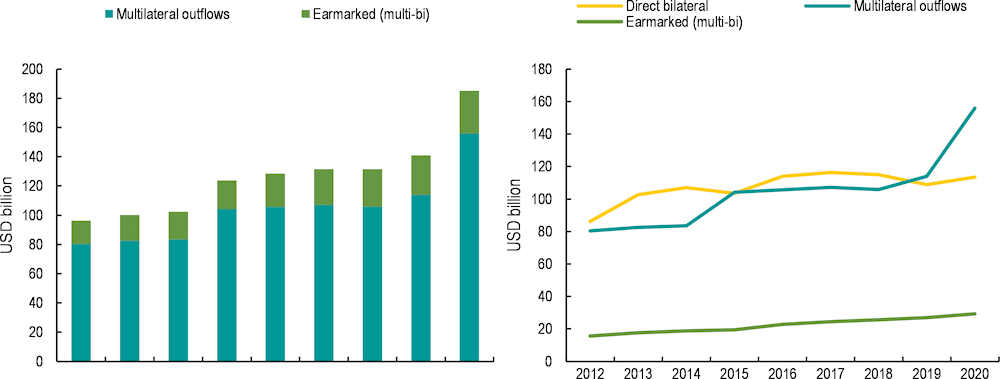

Copy link to 4.1.1. Multilateral outflows reached record volumes in 2020, with similar figures expected for 2021The financing provided by multilateral development organisations reached a record high in 2020, with multilateral disbursements amounting to USD 185.1 billion in 2020, up by 31% on 2019. By contrast, direct bilateral aid increased by only 4% between 2019 and 2020, from USD 108.8 billion to USD 113.6 billion (Figure 4.1). The surge in financing from the multilateral development system was mostly driven by the increase in multilateral outflows (activities financed from multilateral organisations’ core budgets). Multilateral outflows amounted to USD 155.9 billion in 2020, representing 84% of the financing from the multilateral development system, up from 81% in 2019. Non-core contributions earmarked through multilateral development organisations amounted to USD 29.2 billion.

Figure 4.1. The rise in multilateral development financing was largely driven by multilateral outflows

Copy link to Figure 4.1. The rise in multilateral development financing was largely driven by multilateral outflows

Note: Calculations are based on gross disbursements, in 2020 constant prices.

Source: Authors’ calculations based on the Creditor Reporting System, (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

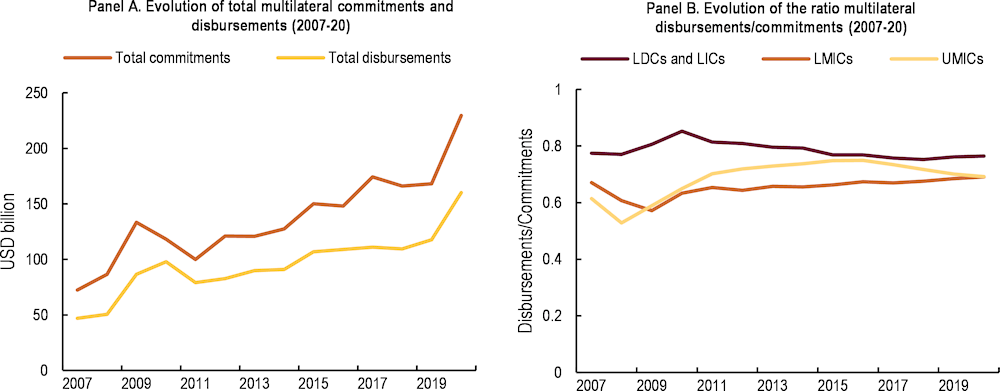

Multilateral organisations successfully delivered on their commitments during the initial crisis response. While there is typically a difference between commitments and disbursements, the gap did not grow despite the large-scale and rapid expansion of commitments. Figure 4.2 shows that the ratio of disbursements over commitments even increased, though slightly, for LDCs and LICs as well as for LMICs. Only in the case of upper middle-income countries (UMICs) did commitments increase faster than disbursements.

Figure 4.2. Multilateral disbursements kept up with commitments during the initial crisis response in 2020

Copy link to Figure 4.2. Multilateral disbursements kept up with commitments during the initial crisis response in 2020

Note: Calculations are based on gross disbursements and commitments, in 2020 constant prices.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

4.1.2. The international financial institutions drove the rapid surge in multilateral financing during the first year of the crisis

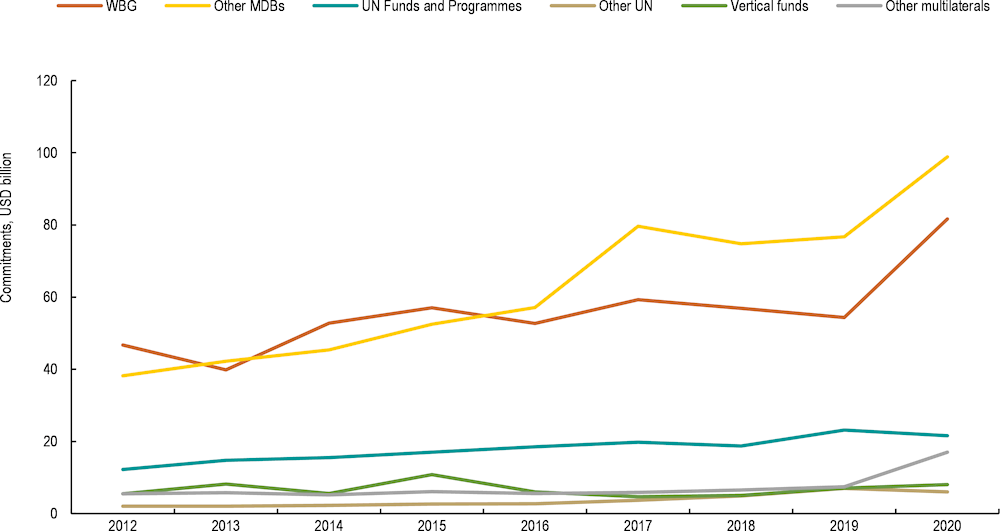

Copy link to 4.1.2. The international financial institutions drove the rapid surge in multilateral financing during the first year of the crisisA breakdown of multilateral outflows by type of multilateral organisations reveals that MDBs drove the rapid increase in outflows. Commitments from the World Bank Group (WBG) and other MDBs increased by respectively 50% and 29% between 2019 and 2020 (Figure 4.3). Taken together, the MDBs accounted for 79% of the total USD 61.5 billion increase in multilateral financing in 2020. This seems surprising in light of the analysis presented in Chapter 3, which shows that inflows to MDBs remained flat or even decreased in 2020. However, this is explained by MDBs unique financing model, which allowed them to rely on multi-year replenishments and to tap into international capital markets to scale up their financing.

Figure 4.3. Despite decreasing or stalling donor contributions, MDBs continued providing growing volumes of financing in recent years

Copy link to Figure 4.3. Despite decreasing or stalling donor contributions, MDBs continued providing growing volumes of financing in recent yearsMultilateral commitments, by organisation type (2012-20)

Note: Calculations are based on commitments, in 2020 constant prices.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

A series of exceptional measures taken by the MDBs was behind a large part of the 2020 surge in multilateral financing. The World Bank Group, for example, drew down IBRD’s USD 10 billion crisis buffer in addition to board-approved sustainable annual lending limits. Its concessional window, IDA, fully used all the remaining IDA18 resources in its fiscal year 20 (FY20) and frontloaded about half of the three-year envelope of IDA19 resources in FY21. As mentioned in Chapter 3, IDA donor and borrower country representatives agreed to advance IDA20 by 12 months to enable surge financing to continue in the coming years (World Bank Group, 2021[2]). The ADB disbursed funds through a newly created specialised budget support instrument, the COVID-19 Pandemic Response Option (CPRO), which provides rapid fiscal support for governments to implement countercyclical expenditure programs to mitigate the impacts of the pandemic (Sato, Aboneaaj and Morris, 2021[3]).

The UN also contributed to the multilateral COVID-19 response through a three-pronged approach: (i) the United Nations Office for the Coordination of Humanitarian Affairs (UNOCHA) used the Global Humanitarian Response Plan (GHRP) to respond to immediate health and multi-sectoral humanitarian needs in especially vulnerable countries; (ii) the WHO’s Strategic Preparedness and Response Plan (SPRP) was used to support public health measures to stop the transmission of the virus and care for those affected; and (iii) the UN Framework for the Immediate Socio-Economic Response helped to mitigate the social and economic impact of COVID-19. In parallel, the UN launched two inter-agency appeals to fund the different components of the comprehensive COVID-19 response: the UN Response and Recovery Trust Fund (UNRRTF), a multi-partner trust fund created as a vehicle for providing strategic financial support to the immediate socioeconomic response; and humanitarian appeals to fund the GHRP. In addition, donor contributions to country-based pooled funds (CBPF) and the Central Emergency Response Fund (CERF) were also instrumental in the COVID-19 response.

Other multilaterals delivered the largest increase in relative terms compared to 2019. Financing from the IMF increased by more than six times between 2019 and 2020, reaching USD 10 billion, up from only USD 1.6 billion the previous year and from an average of USD 1.3 billion between 2010 and 2019 (see Box 4.1). Over the same period, commitments from the European Commission and the EU Development Fund increased by 24% and 59%, respectively, from USD 549 million to USD 681 million and from USD 275 million to USD 436 million.

Box 4.1. The IMF made extensive use of its concessional facilities to support low-income countries during the pandemic

Copy link to Box 4.1. The IMF made extensive use of its concessional facilities to support low-income countries during the pandemicThe IMF provided financial support to 53 of 69 eligible low-income countries in 2020 and the first half of 2021, disbursing about USD 14 billion at a 0% interest rate through the concessional Poverty Reduction and Growth Trust (PRGT). Most of this support was provided through the fund’s emergency financing instruments—the Rapid Credit Facility (RCF) and Rapid Financing Instrument (RFI) – which provide immediate, one-off disbursements to countries facing urgent balance-of-payments needs. The fund was able to respond to a record number of requests for financial assistance through a series of temporary access limit increases to the RCF and RFI, and temporary increases in the Poverty Reduction and Growth Trust’s (PRGT) overall access limits (IMF, 2022[4]).

In addition, 29 of the IMF’s poorest and most vulnerable countries received debt service relief through the Catastrophe Containment and Relief Trust (CCRT). Between April 2020 and October 2021, the CCRT delivered grant-based relief totalling USD 739 million for debt repayments that were due to the IMF. Unrelated to the pandemic, the IMF also approved substantial debt relief to Somalia and Sudan under the Highly Indebted Poor Countries (HIPC) initiative. Both countries cleared their arrears to the IMF and the World Bank, allowing them to resume financial engagement, and reached the HIPC Decision Point1 in March 2020 and June 2021, respectively. The total debt relief from the IMF for these two countries will amount to USD 1.7 billion (including interim assistance).

The efforts made by the IMF to scale up and accelerate its financial support to developing countries during the crisis have not been without controversy. For example, the approach has resulted in large volumes of IMF financing provided with little or no conditionality in the first compasses of the crisis. Examples include the greater use of the RFI (a facility that does not require borrowing countries to enter into a fully-fledged IMF programme) and the issuance of USD 650 billion in special drawing rights (SDRs), which are automatically allocated to shareholding countries with no strings attached. While this shift ensured a swift response of the institution to the financing needs of developing countries, it has also raised concerns that the IMF is turning into an aid agency and abandoning its traditional role of preventing and mitigating financial crises (Rogoff, 2022[5]).

The progressive transition back to IMF programmes with conditionality is now raising equally difficult questions for the institution. In particular, the shifting global context, marked by successive crises, makes it challenging to find a new equilibrium between the different IMF instruments (conditional and non-conditional). For example, in contrast with the above-mentioned concerns regarding the lack of conditionality of IMF support during the COVID-19 crisis, the Bridgetown agenda for the Reform of the Global Financial Architecture, released by the Government of Barbados in September 2022, called on the IMF to return access to its unconditional rapid credit and financing facilities to previous crisis levels in order to help developing countries facing successive and interconnected crises (Government of Barbados, 2022[6]), Ultimately, the frontline role played by the IMF during the COVID-19 crisis calls for rethinking the roles and capacities of the major IFIs in times of crises, as well as the articulation, timing and sequencing of their support.

1. In the context of the HIPC Initiative, the point at which a country’s eligibility for assistance is determined by the IMF and World Bank Executive Boards on the basis of a debt-sustainability analysis and three years of sound performance under IMF- and World Bank-supported adjustment programs.

4.1.3. Multilateral finance was not sufficient to cover developing countries’ COVID-related spending

Copy link to 4.1.3. Multilateral finance was not sufficient to cover developing countries’ COVID-related spendingDespite its unprecedented magnitude, the volume of multilateral financing provided to developing countries was still not enough to meet the needs generated by successive crises. Total commitments from multilateral organisations allocated to low and middle-income countries in 2020 amounted to 1.3% of their 2019 GDP, compared to a 9.6% output loss. For UMICs, multilateral outflows added up to less than 1% of their GDP, while they were the most affected income group in terms of output, with a 15.6% drop. Funding shortages also plagued humanitarian agencies throughout 2021, especially as scale-up was required for several concurrent emergencies – notably Afghanistan and Ethiopia – and to combat the on-going effects of the COVID-19 crisis, which continued to impact vulnerable communities (UNOCHA, 2021[7]). As of end of September 2022, UNOCHA’s Global Humanitarian Overview reported a record shortfall of USD 31.1 billion, corresponding to almost two-thirds of total funding requirements (UNOCHA, 2022[8]).

Multilateral finance was important for financing some of the policy measures to fight the socioeconomic consequences of the pandemic, especially in low-income countries. Commitments from multilateral organisations amounted to 23.4% of the size of recovery measures in low and middle-income countries, excluding China. More specifically, multilateral commitments to LDCs and LICs were equivalent to 250% of their domestic recovery spending, compared to 11.9% of the recovery package for UMICs.

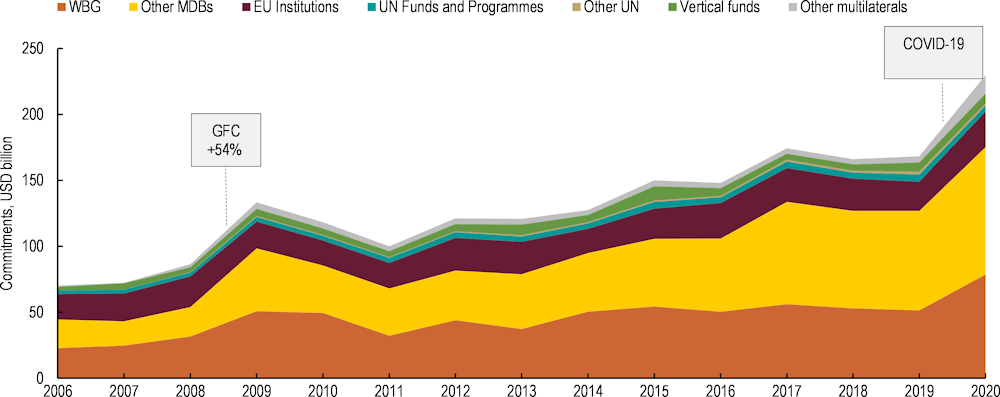

Compared to the response to the global financial crisis, the increase in multilateral commitments to face the COVID-19 crisis was larger in volume but less significant in percentage. Total multilateral commitments in response to the pandemic in 2020 increased by 37%, compared to a 54% increase in the aftermath of the global financial crisis (Figure 4.4). This is despite the fact that for developing countries, the socioeconomic consequences of the pandemic were more serious than the impact of the global financial crisis. For example, real GDP growth in emerging and developing economies had fallen from 6.1% in 2008 to 2.4% in 2009 (IMF, 2010[9]), while it declined from 3.7% in 2019 to –2.1% in 2020 (IMF, 2021[10]). However, in absolute terms, multilateral commitments increased by USD 62 billion between 2019 and 2020, compared to USD 47 billion between 2008 and 2009.

Figure 4.4. The multilateral response to the pandemic was larger in volume than to the global financial crisis, but smaller in relative terms

Copy link to Figure 4.4. The multilateral response to the pandemic was larger in volume than to the global financial crisis, but smaller in relative termsEvolution of multilateral commitments (2006-20)

Note: GFC=global financial crisis. Calculations are based on commitments, in 2020 constant prices.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

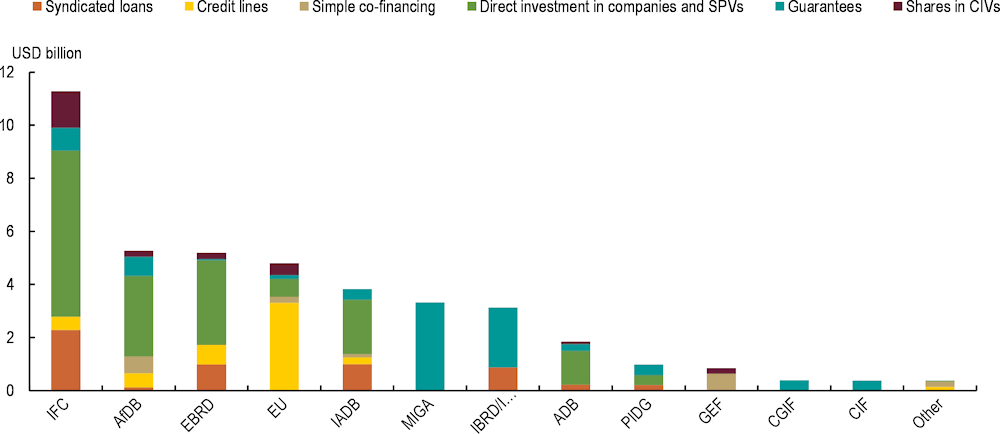

While the capacity to mobilise private finance remains a core strength of the multilateral development system, the amounts involved remain well below what is needed. Multilateral organisations, and the MDBs in particular, play a key role in mobilising private finance for development. In 2020, the International Financial Corporation (IFC) was the multilateral provider that mobilised the largest amounts of private finance for development, followed by the AfDB, EBRD and EU institutions (Figure 4.5). However, total amounts mobilised remain far from the promise made in Agenda 2030 to move “from billions to trillions”. In fact, they are not even keeping pace with recent increases in developing countries’ financing needs. The Global Outlook on Financing for Sustainable Development 2023, for example, estimates that the SDG financing gap in developing countries (excluding China) increased by more than 50% as a result of the COVID-19 pandemic, to reach USD 3.9 trillion in 2020 (OECD, 2022[11]). Over the same period, amounts of private finance mobilised by multilateral organisations for development increased by 20%, and thus went from representing 1.3% of the SDG financing gap in 2019, to less than 1% in 2020.

Moreover, there is currently a lack of harmonised approaches to measure and monitor the development quality of the amounts mobilised from the private sector. Approaches to managing and measuring the environmental, social and economic impact of private finance are highly disparate across the development finance institutions and investment funds involved in private finance mobilisation. Important aspects such as transparency, the protection of human rights and local stakeholder consultation are not systematically taken into account. The OECD-UNDP Impact Standards for Financing Sustainable Development (OECD/UNDP, 2021[12]) provides a framework to guide public and private actors in their investment practices and decision making. The standards are designed to support donors in deploying public resources through development finance institutions (DFIs) and private asset managers, in a way that maximises their positive contribution to the SDGs.

Figure 4.5. The International Financial Corporation mobilised the largest amounts of private finance for development in 2020

Copy link to Figure 4.5. The International Financial Corporation mobilised the largest amounts of private finance for development in 2020Amounts by multilateral provider, 2020

Source: Authors’ calculations based on Total Official Support for Sustainable Development, (OECD, 2022[13]), https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/mobilisation.htm.

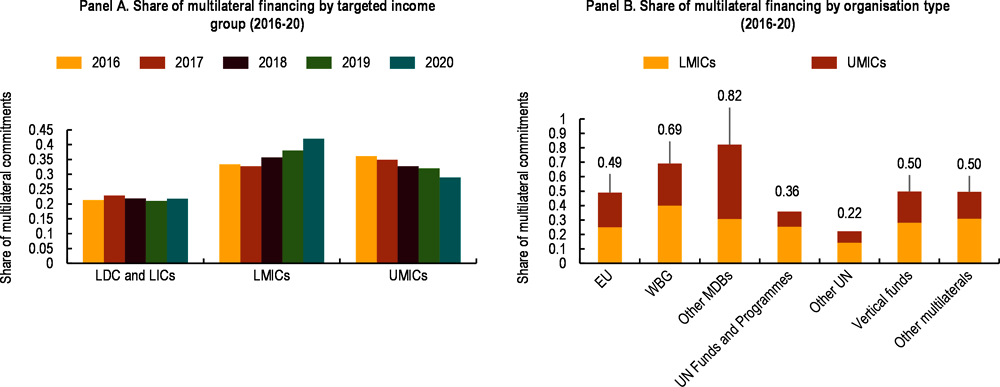

4.1.4. Multilateral development finance still favours middle-income countries

Copy link to 4.1.4. Multilateral development finance still favours middle-income countriesIn recent years, multilateral development finance has increasingly focused on middle-income countries. This trend, already highlighted in the previous edition of this report (OECD, 2020[14]), has continued since 2018. Between 2018 and 2019, the share of financing provided by multilateral organisations to middle-income countries increased from 68% to 70% (Figure 4.6). This trend is largely due to the increasing share of multilateral financing to lower-middle income countries (LMICs), which rose from 36% in 2018 to 38% in 2019. In contrast, the share of financing to upper-middle income countries remained relatively stable over the same period, from 33% to 32%, while the share of flows to low-income countries slightly decreased, from 22% to 21%.

The initial pandemic response further channelled multilateral development finance to lower-middle income countries, while maintaining a steady share to LICs. In 2020, LMICs received 42% of the financing provided by multilateral organisations, up from 38% the previous year. The multilateral response to the pandemic also led to a slight rise in the share of multilateral finance targeting LICs, from 21% to 22%, and to a decrease in the share to UMICs, from 32% in 2019 to 29% in 2020.

The shift towards LMICs largely reflects the MDBs’ financing patterns. The World Bank and the main regional development banks, who traditionally service middle-income countries, have driven the increase in multilateral finance in recent years, including 2020. In fact, the analysis shows that the countries who experienced the greatest increases in multilateral finance commitments between 2019 and 2020 are all middle-income countries. They include LMICs such as Nigeria, India and Bangladesh, as well as UMICs such as Brazil and the Philippines. MDBs allocated 19% of their financing to LDCs and LICs in both 2019 and 2020, while the share of their financing to LMICs rose from 41% to 43%, and the share of their financing to UMICs decreased from 35% to 33%. In parallel, the share of LDCs and LICs benefitting from financing from the UNDS decreased from 43% in 2019 to 38% in 2020, after having sharply increased from 36% in 2018. This was matched by an increase in financing without a specified country destination from 24% in 2019 to 31% in 2020, while the shares of LMICs (20% in 2019 and 19% in 2020) and UMICs (13% in 2019 and 12% in 2020) remained relatively stable. Vertical funds have seen a different trend in recent years, with an increasing focus on lower-income countries. The share of their financing to LDCs and LICs jumped from 24% in 2018 to 40% in 2019 and thereafter increased slightly to 41% in 2020. Their share of financing to UMICs decreased from 20% in 2019 to 11% in 2020, while their share to LMICs remained stable (25% in 2019 and 24% in 2020).

Figure 4.6. LMICs benefited the most from the surge in multilateral development finance in 2020

Copy link to Figure 4.6. LMICs benefited the most from the surge in multilateral development finance in 2020

Note: Calculations are based on commitments, in 2020 constant prices. UN F&P= UN Funds and Programmes.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

This recent increased focus of multilateral finance on middle-income countries has occurred despite a growing tendency of these countries to borrow from commercial markets. In the years leading up to 2020, many governments turned to issuing sovereign debt in international markets, partly because their financing needs exceeded available concessional resources. Despite increased borrowing costs, this trend continued in 2020, with governments and companies from developing economies issuing USD 757 billion in hard-currency bonds in 2020, the most in more than two decades, to expand their fiscal space for crisis response (Bloomberg, 2020[15]). Lee and Aboneaaj (2021[16]) recommend that if this trend were to continue despite tightening market conditions, multilateral organisations, notably the MDBs, should direct more of their support towards poorer countries that still face barriers to accessing commercial credit, especially as the terms of even non-concessional MDB lending remain highly attractive for debt-burdened countries.

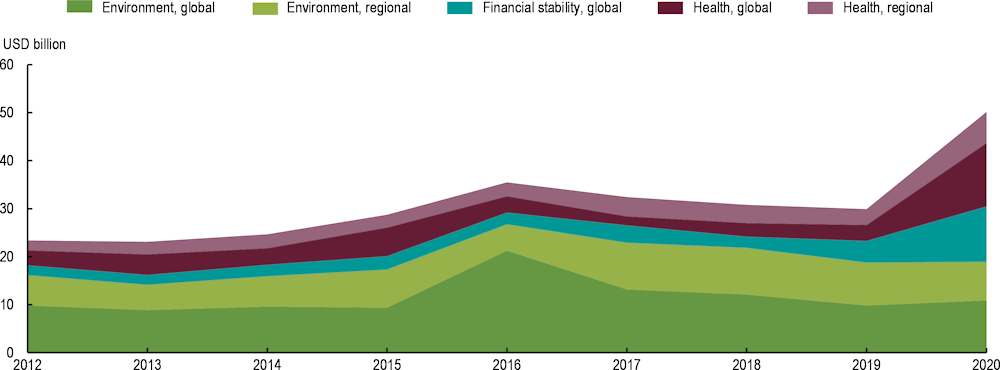

4.1.5. Multilateral development organisations are increasingly incorporating the support to global and regional public goods in their agendas

Copy link to 4.1.5. Multilateral development organisations are increasingly incorporating the support to global and regional public goods in their agendasMultilateral support to global and regional public goods has evolved over time in response to crises and shifts in the global development agenda. The contribution of multilateral development organisations to activities supporting the provision of global and regional public goods, such as global health, climate, or financial stability, more than doubled between 2012 and 2020, from USD 23 billion to over USD 50 billion (Figure 4.7). However, this increase has not been sustained over the entire period, or across sectors. In the first half of the decade and up until 2016, for example, the growth of multilateral expenditure supporting the provision of global and regional public goods was mostly driven by a rise in spending on environment-related activities, probably due to increased awareness and visibility of sustainable development in the lead up to the adoption of the Agenda 2030 and the SDGs. Following a slowdown between 2017 and 2019, a second surge in multilateral financing to activities related to global and regional public goods was registered in 2020, this time driven by an increase in contributions to global health and financial stability, as a result of the COVID-19 health emergency and the ensuing economic crisis. Looking forward, the growing importance of global and regional public goods in the multilateral aid portfolio requires greater efforts to monitor the allocation and impact of multilateral resources allocated to these priorities (Box 4.2).

Figure 4.7. Multilateral financing in support of global and regional public goods has more than doubled

Copy link to Figure 4.7. Multilateral financing in support of global and regional public goods has more than doubledMultilateral financing (ODA and OOF) for global and regional public goods, in USD billion (2012-20)

Note: ODA=official development assistance; OOF=other official flows. Calculations are based on commitments, in 2020 constant prices, and include both multilateral outflows and funding earmarked through the multilateral development system. The list of purpose codes used for this analysis is detailed in the statistical methodology annexed at the end of the report.

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

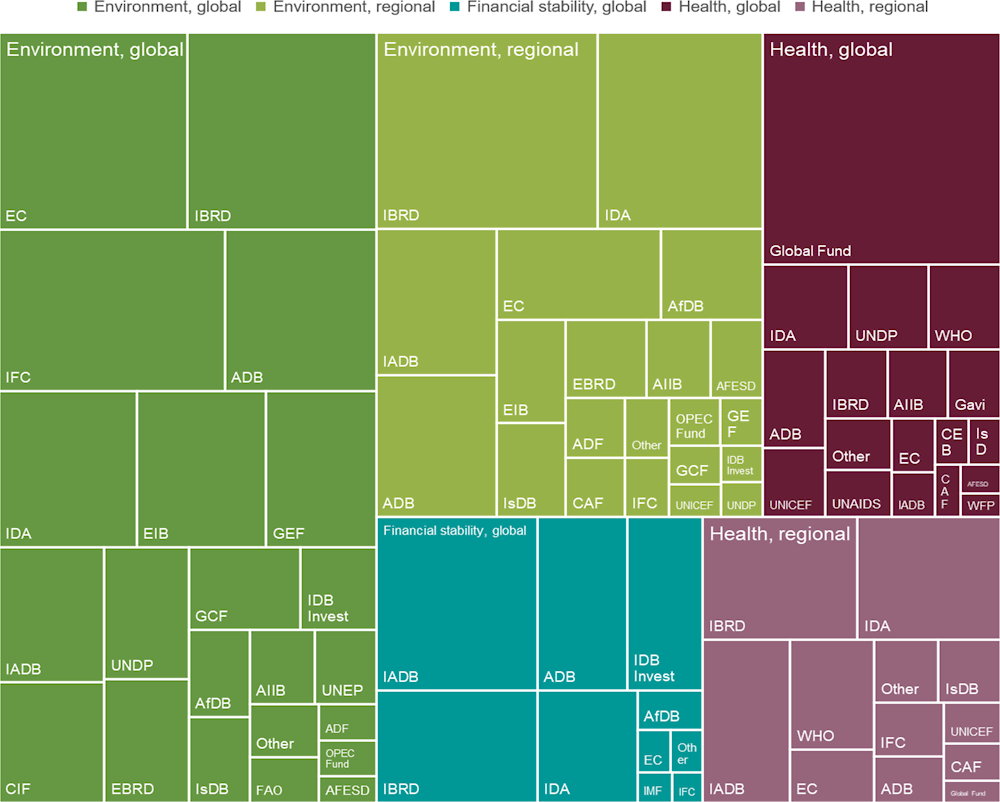

MDBs and vertical funds provide 84% of the multilateral development system’s total contributions to activities supporting the provision of global and regional public goods. MDBs, which account for 75% of the total, make an especially important contribution to regional public goods (Figure 4.8), in line with the regional mandate of most multilateral development banks. For example, their financing flows account for 86% of the system’s support to regional public goods in the environment sector and 78% in the health sector. Their contribution to global public goods is also high for activities supporting financial stability (97%) and the environment (66%), but less significant for global health (27%), where some vertical funds, such as the Global Fund, appear to dominate the landscape. This reflects in part the fact that the business model of the MDBs, based on government lending, is mainly relevant for global and regional public goods that require investments at the country level (such as the development of physical infrastructure for climate mitigation), but less so for global public goods where benefits are less visible at the local level.

Figure 4.8. MDBs and vertical funds provide the largest volumes of GPG-related finance

Copy link to Figure 4.8. MDBs and vertical funds provide the largest volumes of GPG-related financeMultilateral financing (ODA and OOF) for global and regional public goods, in USD billion (2020)

Note: The analysis of financing flows may not reflect adequately the important role played by norms-setting organisations, including some major UN entities. ODA=official development assistance; OOF=other official flows. Calculations are based on commitments, in 2020 constant prices, and include both multilateral outflows and funding earmarked through the multilateral development system. The list of purpose codes used for this analysis is detailed in the statistical methodology annexed at the end of the report.

Source: Authors’ calculations based on (OECD, 2022[1]), “Creditor Report System”, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

Box 4.2. Total official support for sustainable development (TOSSD) offers a new perspective on multilateral finance for global and regional public goods

Copy link to Box 4.2. Total official support for sustainable development (TOSSD) offers a new perspective on multilateral finance for global and regional public goodsRecent crises have underscored the need for better tracking and monitoring of investments in global and regional public goods. Both the COVID-19 pandemic and the climate crisis have shown that public goods are essential for sustainable development, but remain largely underfunded. Drawing lessons from the COVID-19 pandemic, the G20 High-Level Independent Panel on the Financing of Global Commons for Pandemic Preparedness and Response called on countries to substantially increase investments in global public goods. Similarly, in the outcome document of the 2021 Financing for Development Forum, 19 UN member states committed to undertake “further deliberations on financing of global public goods in order to accelerate the achievement of the 2030 Agenda for Sustainable Development, the Addis Ababa Action Agenda, the Paris Agreement and the Sendai Framework for Disaster Risk Reduction.”

However, no comprehensive measure of public financing exists to track progress and build accountability for such commitments. As shown above, the OECD Creditor Reporting System (CRS) can provide some initial insights into official providers’ support to global and regional public goods. For example, it demonstrates that official providers of development finance often finance public goods through their aid budgets and shows that the share of donor funding going to global or regional public goods has increased significantly over the past two decades. However, the CRS provides only a partial picture due to its focus on international development assistance, which excludes contributions to global and regional public goods that are not primarily development-related.

The new total official support for sustainable development (TOSSD) framework can provide a more detailed perspective on domestic and international support for global and regional public goods. Since the Addis Ababa Conference on Financing for Development, which called for a holistic approach that enhances synergies among all types of actors and resources, the international community, with the support of the OECD, has been working to develop TOSSD as a new statistical framework for the SDG era. The TOSSD framework provides a comprehensive picture of both external official support for sustainable development in developing countries, and of public support to global and regional public goods. It is composed of two pillars: (i) cross-border resource flows to developing countries; and (ii) global and regional expenditures on international public goods (IPGs), development enablers, and global challenges.

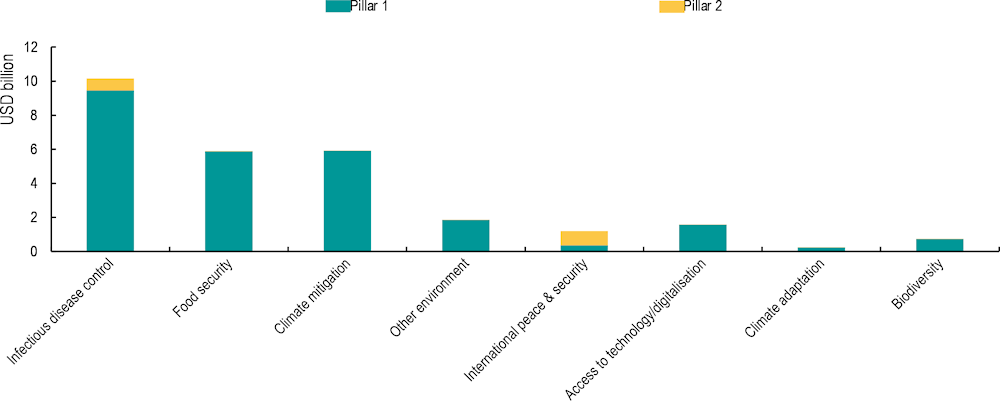

Multilateral organisations’ contribution to global and regional public goods spans both pillars of the TOSSD framework. The analysis of GPG-related multilateral outflows in TOSSD shows that the nature of these expenditures varies across public goods. However, the large majority of multilateral outflows is provided as cross-border resource flows to developing countries, under Pillar 1 of the TOSSD framework (Figure 4.9). For example, more than 90% of multilateral outflows supporting climate mitigation, climate adaptation, biodiversity, infectious disease control, and food security fall under TOSSD Pillar 1. By contrast, a majority of multilateral outflows in support of international peace and security is provided through global and regional expenditure.

Figure 4.9. The nature of multilateral support to global and regional public goods varies across sectors

Copy link to Figure 4.9. The nature of multilateral support to global and regional public goods varies across sectorsMultilateral disbursements for global and regional public goods (2020)

Note: The chart is based on multilateral disbursements in USD billion, and does not include multi-bi aid (bilateral aid earmarked through multilateral development organisations). The list of purpose codes used for this analysis is detailed in the statistical methodology annexed at the end of the report. TOSSD is a new statistical measure, its data coverage has not yet reached its full potential, but will improve over the next few years.

Source: Authors’ calculations based on TOSSD (OECD, 2022[17]), www.tossd.org and the OECD Creditor Reporting System, (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

TOSSD data on global and regional public goods-related expenditure can help to build the evidence base for multilateral decision making. Strengthening the measurement of multilateral flows to global and regional public goods would provide a more comprehensive picture of current trends and financing gaps. It would also contribute to discussions held with various multilateral forums, such as the UN, G20 and G7, on support measures to prevent, and increase resilience to, future shocks. Lastly, by providing an alternative statistical framework, TOSSD also has the potential to reduce multilateral and bilateral providers’ temptation to report such expenditure as ODA where primary benefits are global rather than developmental.

4.2. The contribution of the multilateral development system is critical to meet the challenges of the recovery in developing countries

Copy link to 4.2. The contribution of the multilateral development system is critical to meet the challenges of the recovery in developing countries4.2.1. The sustainability and inclusiveness pillars of the recovery provide a compass for multilateral action in the next decade

Copy link to 4.2.1. The sustainability and inclusiveness pillars of the recovery provide a compass for multilateral action in the next decadeThe multilateral development system is faced with the challenge of helping realise the promise of building back better in developing countries. As discussed in Section 4.1, multilateral development finance played a counter-cyclical role in the first year of the COVID-19 crisis, providing much-needed finance to help developing countries cope with the impact of the pandemic on their health systems and economy. Looking forward, the multilateral development system will have an equally important role to play in supporting countries’ recovery, and realising the promise of the build back better agenda. Yet, as mentioned in Chapter 2, it will have to do so in a challenging and demanding context, marked by a succession of crises with cascading and mutually reinforcing impacts, which are likely to stretch its capacity further.

Environmental sustainability and social inclusiveness are equally important for building the resilience of developing countries to future shocks. The Global Outlook on Financing for Sustainable Development 2023 (OECD, 2022[11]) makes the case that the recovery from the recent crises requires a joint focus on sustainability and inclusiveness. The report also highlights how these two pillars can complement one another in building developing countries’ resilience to future shocks. Looking forward, these two pillars provide a compass to guide the multilateral system in contributing to the recovery by helping address the concurrent impacts of recent crises on poverty and inequality (including gender-based), as well as on climate and biodiversity.

4.2.2. Recent crises have increased the multilateral focus on reducing poverty and inequality

Copy link to 4.2.2. Recent crises have increased the multilateral focus on reducing poverty and inequalityThe multilateral response to the COVID-19 pandemic helped mitigate the social impact of the crisis

Copy link to The multilateral response to the COVID-19 pandemic helped mitigate the social impact of the crisisThe COVID-19 pandemic has resulted in increased multilateral financing to poverty and inequality-oriented sectors. In the two years leading up to the COVID-19 crisis, the volume of financing from multilateral development organisations to sectors considered likely to provide direct benefits to the poor experienced a steep increase.

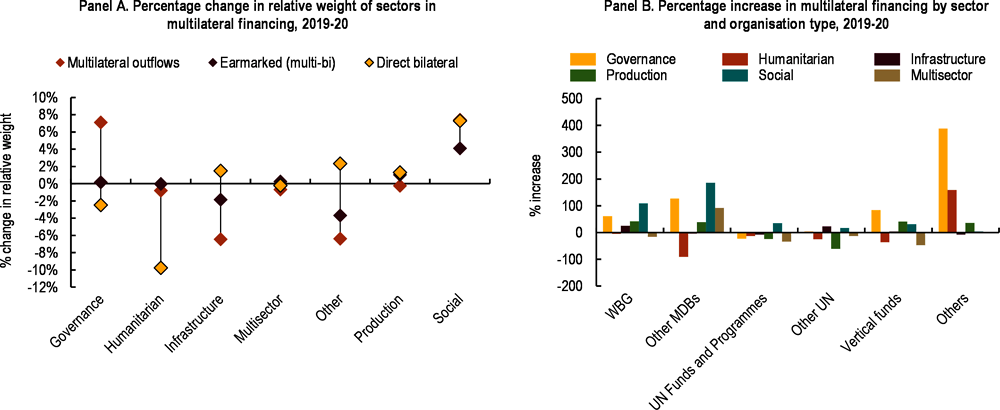

Social and governance sectors received a higher share of overall multilateral commitments in 2020. Social sectors accounted for 24% and 25% of multilateral outflows and earmarked flows respectively in 2020, up from 17% and 18% the previous year (Figure 4.10, Panel A). Over the same period, the share of multilateral outflows to governance-related sectors rose from 12% to 19%, driven by the steep increase in budget support that the main MDBs and the IMF extended to their client countries. These loans have often supported the fiscal measures put in place by developing countries to alleviate the socio-economic consequences of the pandemic. The increase in financing commitments to social and governance sectors is particularly pronounced for MDBs, but less so for more specialised organisations, such as UN entities and vertical funds (Figure 4.10, Panel B). This reflects in part MDBs’ broad and versatile portfolios, which allow them to adapt to shifting priorities by repurposing their programmes. In contrast, specialised entities are constrained by their more focused mandates.

Figure 4.10. Multilateral commitments increased the most for social and governance sectors in 2020

Copy link to Figure 4.10. Multilateral commitments increased the most for social and governance sectors in 2020

Note: Calculations are based on commitments, in 2020 constant prices. The chart in Panel B is based on multilateral outflows (excluding earmarked flows).

Source: Authors’ calculations based on the OECD Creditor Reporting System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

One of the key drivers of the rise in MDBs’ commitments to social sectors was their increased focus on social protection. For example, the World Bank committed USD 9.2 billion in additional financing for social protection and jobs activities as part of its COVID-19 response – USD 4.1 billion through IBRD and USD 5.1 billion through IDA (Lee and Aboneaaj, 2021[16]). According to a recent study, the World Bank’s support for social protection in response to the COVID-19 pandemic was significantly larger in scale and reach than in the aftermath of the global financial crisis (McCord et al., 2021[20]). The global financial crisis response was characterised by a small number of large loans, primarily to UMICs whose pre-existing systems had significant absorptive capacity, alongside extremely small-scale programmes in IDA countries. In comparison, the scale of the response in 2020 was greater, and included for instance the first World Bank concessional loan to India for national-scale social protection provision, with 800 million beneficiaries. Support for social protection was also explicitly identified as a core priority in both the IDB and ADB pandemic responses. By the end of 2020, 25% of IDB approvals for COVID-19 response lending supported the provision of safety nets for vulnerable populations (USD 2 billion out of a total USD 8 billion), making social protection the highest funded sector in the IDB response (McCord et al., 2021[20]).

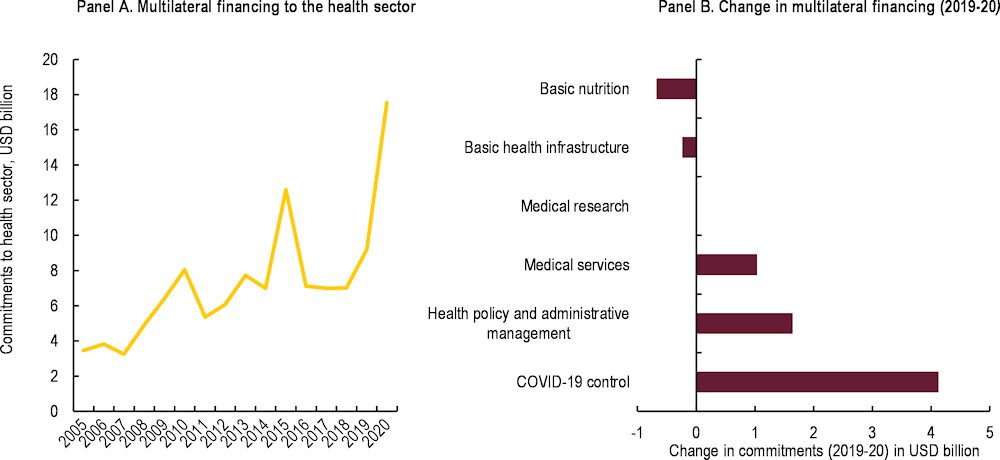

The steep increase in health spending during the first year of the pandemic was another key driver of the surge in financing for social sectors. Commitments to the health sector rose by 91% between 2019 and 2020, from USD 9 billion to USD 18 billion (Figure 4.11, Panel A). Nearly half of this increase was due to spending related to COVID-19 control, which amounted to USD 4 billion. However, other areas, such as health policy and administrative management, and medical services, also benefited from the increase in health sector support. Multilateral commitments to health policy and administrative management rose from USD 2 billion in 2019 to USD 4 billion in 2020, and to medical services from USD 0.7 billion to USD 1.7 billion over the same period. Conversely, the focus on the COVID-19 response appears to have crowded out financing to some other health-related issues. For example, some areas such as basic nutrition and basic health infrastructure experienced a decrease in financing, amounting to respectively 72% (USD 700 million) and 20% (USD 240 million) compared to 2019 (Figure 4.11, Panel B).

Figure 4.11. Support for COVID-19 control drove the steep increase in multilateral health finance in 2020

Copy link to Figure 4.11. Support for COVID-19 control drove the steep increase in multilateral health finance in 2020

Note: Calculations are based on commitments, in 2020 constant prices. For the chart in Panel A, the 18 following health-related purpose codes were included in the analysis: Health policy and administrative management (12110), Medical education/training (12181), Medical research (12182), Medical services (12191), Basic health care (12220), Basic health infrastructure (12230), Basic nutrition (12240), Infectious disease control (12250), Health education (12261), Malaria control (12262), Tuberculosis control (12263), Health personnel development (12281), NCDs control, general (12310), Control of harmful use of alcohol and drugs (12330), Promotion of mental health and wellbeing (12340), Other prevention and treatment of NCDs (12350), Research for prevention and control of NCDs (12382), and Covid-19 control (12264).

Source: Authors’ calculations based on the OECD Creditor Reporting.System (OECD, 2022[1]), https://stats.oecd.org/Index.aspx?DataSetCode=crs1

A strong recovery will require increased multilateral focus on poverty and inequality

Copy link to A strong recovery will require increased multilateral focus on poverty and inequalityThe succession of multidimensional crises has set back several years of progress in the fight against poverty and inequality. In the years prior to the COVID-19 pandemic, developing countries were making significant progress in reducing poverty. The pandemic, which is estimated to have seen an additional 97 million people fall into extreme poverty (World Bank Group, 2021[21]), marked the end of a-two decade downward trend in extreme poverty. It also set back hard-won progress achieved in multiple areas of sustainable development. These long-term development setbacks will also disproportionately affect the outcomes and financing needs of the most vulnerable, turning the COVID-19 crisis into a pandemic of inequality.

Preventing high rates of poverty and inequality from becoming entrenched will require sustained support from multilateral organisations. The pandemic and Russia’s invasion of Ukraine are driving heightened financing needs from developing countries in key areas of human development, such as health and education. Recent crises have demonstrated that the multilateral development system can play a key role in supporting the poor and marginalised, for example through reforms and activities aimed at strengthening social protection systems, and providing access to health and education opportunities. The vast protracted effects of recent crises on poverty and inequality, with millions of people falling back into extreme poverty and an exacerbation of existing inequalities (including gender-based), require multilateral organisations to sustain their support in the coming years for key areas that make a recognised contribution to reducing poverty and inequality. This may include revisiting their existing policies and systems to ensure they are aligned with poverty and inequality reduction objectives.

Some organisations have already incorporated a strong focus on poverty and inequality in their mandate and strategies. For example, the World Bank Group has a clear and longstanding dual mandate of ending extreme poverty and promoting shared prosperity. It operationalises this mandate by producing global poverty and inequality data, and by integrating poverty and inequality considerations into policies and programmes, including the Systematic Country Diagnostics developed in close collaboration with its client countries. Similarly, the UNDP has taken steps to operationalise the pledge to leave no one behind and has undertaken an evaluation to assess how the organisation’s conceptual and operational frameworks translate the pledge of leaving no one behind into concrete action (UNDP, 2021[22]).

Multilateral activities with a focus on addressing inequalities, including gender-based, have the potential to make the recovery more sustainable and effective. A substantial body of evidence shows that inclusive economies are more resilient and productive (Cingano, 2014[23]). Increasing the share of multilateral investments that promote greater equality and access to opportunities could thus be highly cost-effective and yield large economic and developmental returns over the long run. Gender equality provides a concrete example of the benefits of reducing inequalities in productivity and development outcomes. For example, several studies have shown that advancing women’ and girls’ equality, and closing the gender gap, could increase global GDP (McKinsey&Company, 2015[24]) (IMF, 2018[25]).

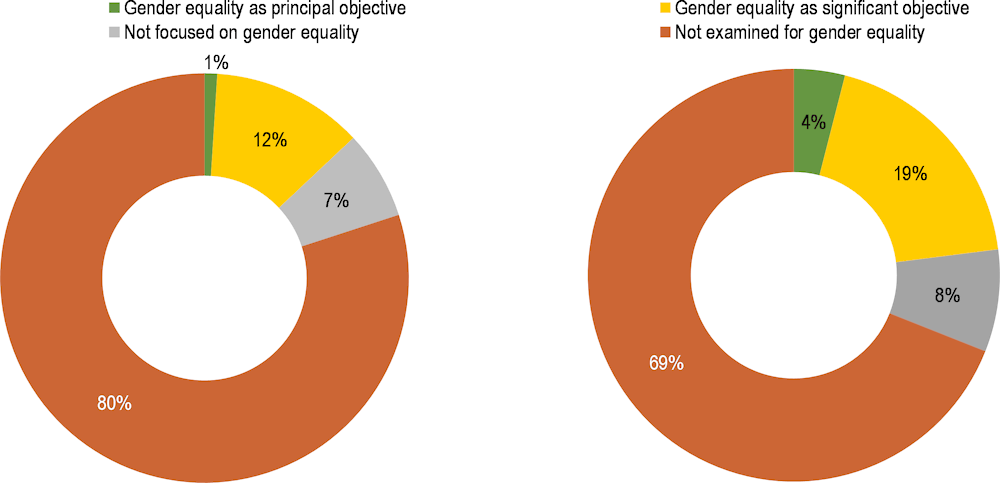

The analysis in this report suggests that multilateral development organisations have ample room for improvement in this area. In 2019-2020, for example, only 13% of multilateral organisations’ ODA and 23% of other official flows (OOF) were reported to the OECD as addressing gender equality (OECD, 2022[26]), compared to 45% and 32% respectively for ODA and OOF from DAC members. These low figures reflect in part the lack of systematic and comparable reporting on this topic among multilateral entities. Between 2019 and 2020, only around one-fifth (20%) of ODA and one-third (31%) of OOF from multilateral organisations was examined for gender equality. Given the key role the multilateral development system plays in supporting an inclusive recovery in developing countries, it appears particularly important to strengthen the reporting and tracking of multilateral outflows that support gender equality in order to provide a comprehensive picture of multilateral organisations’ contributions in this area.

Figure 4.12. Multilateral development organisations can improve their gender equality focus and reporting

Copy link to Figure 4.12. Multilateral development organisations can improve their gender equality focus and reportingTotal ODA (left) and OOF (right) by all multilateral organisations reporting to the OECD, 2019-20 average

Note: The charts are based on commitments on multilateral outflows (excluding multi-bi, earmarked aid flows) reported to the OECD by multilateral organisations. ODA=official development assistance; OOF=other official flows.

Source: Development finance for gender equality and women's empowerment: A snapshot, (OECD, 2022[26]), https://www.oecd.org/dac/Gender_ODA_2022.pdf.

The inclusion of gender sensitive planning in multilateral organisations’ COVID-19 response varied significantly, even across institutions with similar operational models. Recent research on MDBs’ social protection response to the pandemic showed that most of their projects carried out in 2020 (73%) included gender targets in their project design (Webster et al., 2021[27]). This study also reveals that while many World Bank projects launched during the first wave of the MDBs pandemic response (between April and June 2020) lacked gender equality targets, those launched during the second wave (between October and December 2020) had a greater gender focus. In contrast, other MDBs, such as the ADB and the AfDB, included gender sensitive planning consistently in the project design throughout all phases of their pandemic response.

Improved reporting on poverty and inequality-related markers would make it easier to oversee multilateral contributions to these areas, and to identify potential gaps and inefficiencies. For example, there is currently no agreed definition of what constitutes a poverty-reducing development activity. Similarly, as noted in recent OECD analysis (2022[26]), the fact that multilateral organisations do not consistently examine or report their financing flows against the DAC policy markers on gender equality or on the inclusion and empowerment of persons with disabilities makes it difficult to provide a reliable picture of the volume of multilateral activities targeting inequality.

4.2.3. A sustainable recovery requires greater multilateral support to address the growing climate and biodiversity emergencies

Copy link to 4.2.3. A sustainable recovery requires greater multilateral support to address the growing climate and biodiversity emergenciesThe multilateral development system is a major and growing actor in the area of green finance

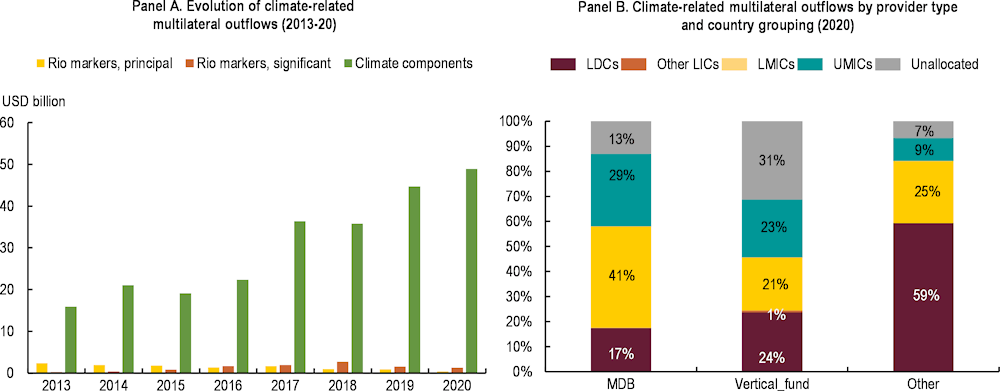

Copy link to The multilateral development system is a major and growing actor in the area of green financeMultilateral organisations, and MDBs in particular, channel the majority of official development finance for climate. The climate component of multilateral activities has grown at a rapid pace since 2016, from USD 22.3 billion in 2016, to USD 48.9 billion in 2020 (Figure 4.13, Panel A). Thanks to this rapid growth, the multilateral development system accounted for 44% (USD 36.9 billion) of total climate finance provided or mobilised by developed countries in 2020 (USD 86 billion). MDBs provided the vast majority of climate-related multilateral outflows in 2020 (93%), followed by vertical funds (6%). Other multilateral entities, namely IFAD and the Nordic Development Fund, accounted for the remaining 1%.

The growing role played by MDBs in multilateral climate finance may exacerbate its focus on middle-income countries. Multilateral development banks and vertical funds provide climate-related finance to different country groupings. The breakdown of climate-related activities by country groupings shows that multilateral organisations differ in their country focus. A large share of MDBs’ climate finance (70%) is provided to middle-income countries (41% to LMICs, 29% of UMICs, compared to 17% for LDCs). In comparison, vertical funds channel a larger share of climate-related finance to LDCs (24%). They also provide a relatively large share of climate-related finance that is unallocated by income group (31%), mainly corresponding to multi-country, regional or global activities. Lastly, both IFAD and the Nordic Development Fund (other multilaterals) mostly target LDCs, which reflects their focus on lower-income countries (Figure 4.13, Panel B). Given the differences in country allocation observed across multilateral entities, the increasing volumes of climate finance provided by MDBs may result in a greater focus on middle-income countries over time. While a focus on middle-income countries can be explained by the important role they can play in climate mitigation, close monitoring is required to ensure multilateral climate finance remains targeted to where it can make the greatest difference.

Figure 4.13. Climate-related multilateral outflows have grown at a rapid pace since 2016

Copy link to Figure 4.13. Climate-related multilateral outflows have grown at a rapid pace since 2016

Note: Calculations are based on commitments, in 2020 constant prices.

Source: Authors’ calculations based on climate-related development finance at the activity level, (OECD, 2022[28]), https://www.oecd.org/development/financing-sustainable-development/development-finance-topics/climate-change.htm.

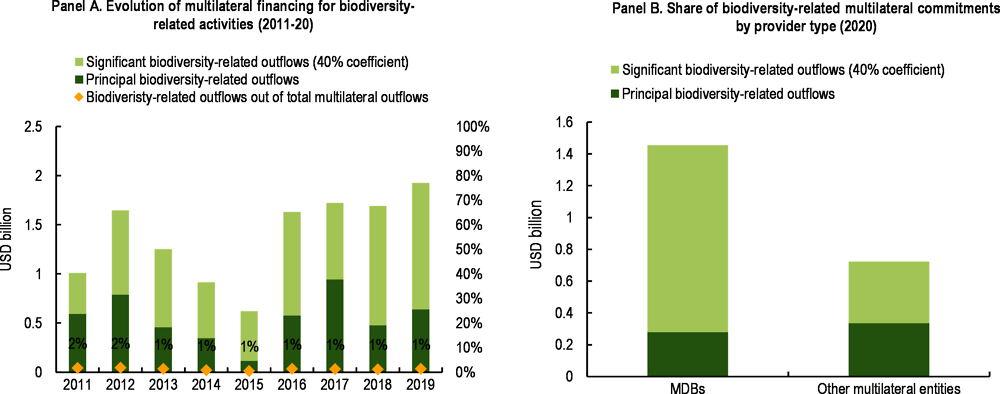

The past decade has also seen a growth in multilateral financing for biodiversity. A recent study shows that multilateral development finance for biodiversity-related activities increased by 210% between 2011 and 2020, from USD 1 billion to USD 3.1 billion (Casado-Asensio, Blaquier and Sedemund, 2022[29]). In relative terms, however, the share of biodiversity-related flows in total multilateral development finance has remained relatively stable over 2011-20, at around 1%, peaking at 2% in 2011 and 2020. The World Bank Group and the Global Environment Facility (GEF) are the two largest multilateral providers for biodiversity-related activities, representing 55% of total multilateral commitments (Figure 4.14).

Figure 4.14. Multilateral development finance for biodiversity-related activities has increased markedly since 2017

Copy link to Figure 4.14. Multilateral development finance for biodiversity-related activities has increased markedly since 2017

Note: Charts are based on multilateral commitments, in USD billion, constant 2020 prices.

Source: (Casado-Asensio, Blaquier and Sedemund, 2022[29]), Multilateral institutions’ biodiversity-related development finance: trends over 2011-20.

Persistent bottlenecks in climate and biodiversity-related finance suggest the need for greater mainstreaming

Copy link to Persistent bottlenecks in climate and biodiversity-related finance suggest the need for greater mainstreamingGreater efforts by multilateral development organisations will be required to address the growing gap in green finance. The twin climate and biodiversity crises call for a strong response from multilateral stakeholders. According to recent estimates from the Intergovernmental Panel on Climate Change (IPCC), the volume of climate finance needs to increase by three to six times by 2030 to limit global warming to below 2°C (Intergovernmental Panel on Climate Change, 2022[30]). While public finance alone will not suffice to close the climate investment gap, multilateral providers can send a clear signal to private investors by increasing their efforts to align their official development finance flows with the Paris Agreement. Although it has had less visibility, the protection of biodiversity also has a large financing gap. The USD 3.1 billion in multilateral finance for biodiversity-related activities contrasts with the USD 500 billion spent annually by governments on support that is potentially harmful to biodiversity (OECD, 2020[31]). The 15th meeting of the Conference of the Parties (COP 15) to the Convention on Biological Diversity represents an opportunity to raise biodiversity’s profile and garner broad support and concrete commitments from public and private financiers.

Currently, bottlenecks in multilateral climate finance impede greater resource mobilisation and effective resource deployment. While the sustained increase in multilateral financing for climate action observed in recent years represents real progress, persistent blockages in the allocation of these resources continues to hinder developing countries’ access to climate finance. These bottlenecks owe in part to the complexity of the multilateral climate finance architecture, and the intricate application processes and requirements involved in accessing these resources. Recent research shows that particularly vulnerable countries that would benefit the most from climate finance, tend to face difficulties in accessing green funds in part due to their limited administrative and technical capacities (Box 4.3).

Multilateral financing for biodiversity remains highly concentrated in the portfolios of a few institutions, suggesting potential to further mainstream the topic. The top four multilateral providers of biodiversity-related finance (GEF, ADB, IBRD, and IDA) committed on average over USD 500 million in financing for biodiversity-related activities between 2011 and 2020 (Casado-Asensio, Blaquier and Sedemund, 2022[29]). The relative importance of biodiversity differs markedly across multilateral institutions. Around 65% of GEF’s activities are related to biodiversity, reflecting the importance of biodiversity in its mandate and its central role in delivering the objectives of the Convention on Biological Diversity (CBD, 2020[32]). At the other end of the spectrum, although MDBs have only a limited share of activities related to biodiversity, the sheer volume of their financing commitments makes them important actors in this area. Other institutions, such as the GCF, are becoming increasingly important due to their growing focus on biodiversity. For example, the GCF increased the relative weight of biodiversity in its operations from 4% in 2015 to 61% in 2020. This shows that increased awareness of the interlinkages between biodiversity and other key areas of the global development agenda (such as climate change and global health) could lead to further multilateral investment in biodiversity-related activities.

Box 4.3. Despite progress, small island developing states still face hurdles accessing green funds

Copy link to Box 4.3. Despite progress, small island developing states still face hurdles accessing green fundsGreen fund disbursements to small island developing states (SIDS) more than quadrupled between 2013 and 2020, from USD 55 million to USD 239 million. This increase is mainly due to a surge in financing from the Green Climate Fund (GCF), especially oriented at infrastructure projects targeting SIDS in the Oceania region.

The emergence of the GCF onto the multilateral green fund landscape has made the existing architecture more complicated, but it has also brought some welcome improvements. While the Global Environment Fund (GEF) was the leading green fund for SIDS between 2013 and 2020, its dominant position has been increasingly challenged by the GCF, which became the top green fund provider for SIDS in 2019 and 2020. GCF commitments are associated with larger global deals (when including co-financiers). They are also disbursed more quickly than the other major green funds (GEF, CIFs and the Adaptation Fund).

Constant vigilance is required in the coming years because green funds’ commitments, which provide an indication of future trends, declined abruptly in 2019 and did not regain previous levels in 2020. Following a period of uninterrupted growth between 2015 and 2018, which saw green funds’ commitments reach an average USD 378 million per year between 2017 and 2018, commitments dropped abruptly in 2019 to USD 228 million, back to their 2016-17 levels.

Several factors continue to constrain SIDS’ access to green funds:

Climate adaptation and biodiversity-related activities still attract relatively little financing compared to mitigation projects. SIDS are among the countries most affected by climate change, and thus have a crucial need for support to adapt to the consequences of the climate crisis. However, the volume of financing for climate adaptation is much smaller than for climate mitigation projects. Some studies suggest that this may stem from greater need for adaptation projects to present a compelling business case for this type of project compared to climate mitigation projects (Lindenberg and Pauw, 2013[33]).

Low rates of return on mitigation projects in SIDS could prevent key financiers from dedicating their resources to them. All SIDS have committed to ambitious climate action, including to achieve 100% renewable energy production by 2030. However, these countries could see their ability to access new mitigation finance decline in the future due to the growing importance given by climate funds to the need to prove return on investment in terms of CO2-equivalent reductions in order to approve financial involvement in mitigation projects. This raises the question of how to measure return on climate mitigation projects in countries with low absolute emissions, but which still in need of funding to transition to net-zero.

Lack of technical capacity and other governance issues in SIDS result in frequent bottlenecks and delays in the disbursement of green funds to these countries. By the end of 2020, only 52% of GCF commitments had been disbursed (commitments made mainly between 2015 and 2017). This ratio was similar (53%) for the CIFs, although it corresponds to commitments from earlier years (mostly made between 2012 and 2015). GEF shows a lower disbursement-to-commitment ratio, at 33%, mainly corresponding to transactions committed between 2013 and 2015 (and some in 2008). This seems to mainly be linked to SIDS’ limited technical and human resource capacities to manage complex projects.

A comprehensive diagnostic of those problems could help improve SIDS’ absorption capacities and attractiveness for green-related investment projects. This could help identify current gaps and needs for specific support measures, such as international technical assistance and capacity building to increase the chances of success of local project managers applying for funds, and adopting alleviating measures to allow green investments in SIDS to come to fruition. Also, as more complex deals seem to be a cause for delaying disbursements to SIDS, re-considering the complexity and number of co-financiers involved in each deal could be another option to explore to increase green financing for SIDS and other countries with specific vulnerabilities.

Source: (Piemonte, forthcoming[34])

4.3. Outlook and policy recommendations

Copy link to 4.3. Outlook and policy recommendations4.3.1. The shift from emergency response to recovery requires better co-ordination

Copy link to 4.3.1. The shift from emergency response to recovery requires better co-ordinationMultilateral organisations were able to rapidly ramp up their financing to support the crisis response in developing countries. As argued in Chapter 3, the successful scaling up of finance relied largely on MDBs’ access to capital from international markets. The multilateral crisis response to COVID-19 confirmed multilateral organisations’ ability to: (i) quickly disburse funds in response to crises thanks to their strong relations with partner countries; and (ii) flexibly shift priorities through the sectoral re-allocation of funds.

The pandemic response saw a reshuffling of the constellation of players in the multilateral development system. The IMF gained new prominence in the field of multilateral development finance, and MDBs became more active in sectors traditionally dominated by other organisations. New multilateral channels were also created, adding to the complexity of an already crowded multilateral architecture.

With the financing needs of developing countries now shifting from emergency response to recovery, there may be a need to clarify co-ordination mechanisms and agree on an effective division of labour to avoid redundancies and other inefficiencies in the medium to long term. Recent research suggests that improving co-ordination among MDBs requires filling a critical missing gap in the global governance architecture – a body responsible for holding MDBs accountable as a group for crisis response and ongoing support for global and regional public goods (Lee and Aboneaaj, 2021[16]).

4.3.2. Multilateral development finance is called on to play a pivotal role in developing countries’ recovery from successive crises

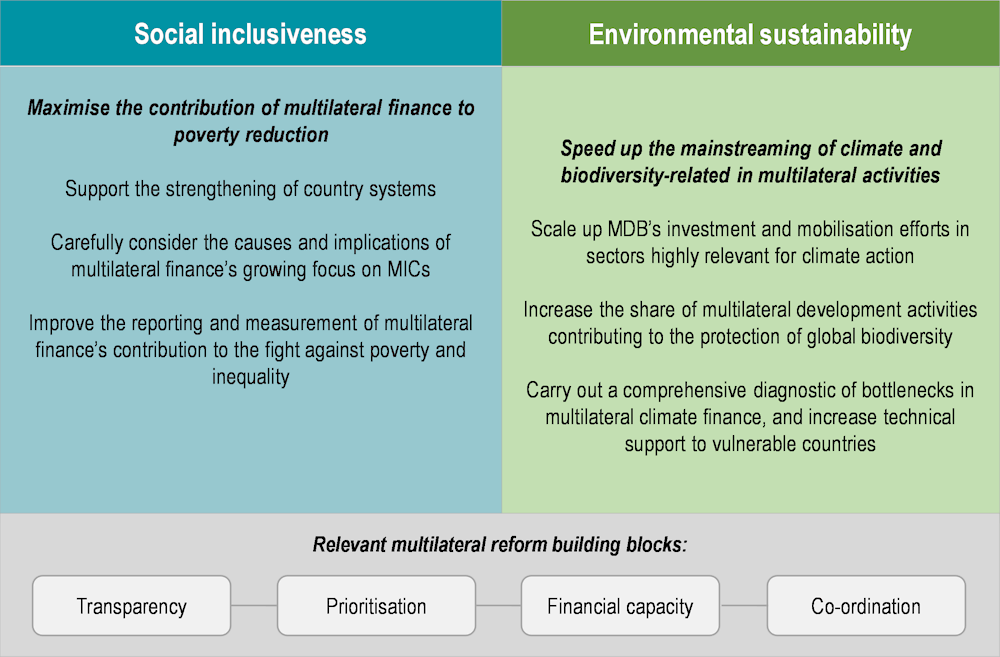

Copy link to 4.3.2. Multilateral development finance is called on to play a pivotal role in developing countries’ recovery from successive crisesAdapting multilateral development finance will be crucial to tackle the broad range of development challenges that are intensifying with the emergence of consecutive global crises. Figure 4.15 summarises key policy recommendations to ensure that multilateral development finance contributes to the two pillars of sustainable development: social inclusiveness and environmental sustainability.

Given the large impact of recent crises on developing countries, an abrupt drop following the exceptional levels of multilateral support registered in 2020 could impede a strong, inclusive and sustainable recovery. The analysis in this chapter showed that following the global financial crisis, multilateral commitments registered two consecutive years of decline, by -11% in 2010 and -16% in 2011. The huge combined effect of the COVID-19 crisis and Russia’s large-scale war against Ukraine, which led to an unprecedented rise in global poverty and inequality, calls for multilateral efforts in the coming years to be sustained.

Ensuring greater effectiveness and prioritisation of multilateral development finance will be particularly important to make the most of scarce resources. In the context of growing financing needs and constrained development budgets, avoiding overlaps and redundancies across multilateral organisations’ mandates and portfolios, ensuring complementarity between multilateral and bilateral efforts, and addressing the lack of whole-of-system accountability will be key to achieve the greatest development effectiveness and impact. It will be equally important to ensure that multilateral development finance helps realise the promise of building back better in developing countries, by contributing to both pillars of the recovery – social inclusiveness and environmental sustainability (Figure 4.15). Increasing the focus of multilateral programmes on those furthest behind, as well as on areas with the greatest impact, such as the climate agenda, will be an effective way to maximise multilateral development finance.

Figure 4.15. Ensuring a dual focus of multilateral development finance on social inclusiveness and environmental sustainability will be important to support the recovery in developing countries

Copy link to Figure 4.15. Ensuring a dual focus of multilateral development finance on social inclusiveness and environmental sustainability will be important to support the recovery in developing countries

Source: Authors’ illustration.

Ensure that the needs and priorities of the poor and marginalised become a priority in multilateral investments

Copy link to Ensure that the needs and priorities of the poor and marginalised become a priority in multilateral investmentsRevisit the objectives, policies and allocations of multilateral organisations to ensure they are aligned with poverty and inequality reduction objectives. In the context of increasingly constrained development budgets, this could also help maximise scarce official resources by ensuring greater focus and impact on those furthest behind.

Increase multilateral support to country systems in order to ensure the effective mitigation of poverty and inequality. As noted in this chapter, a large share of the recent surge in multilateral finance was channelled to developing countries through budget support and policy-based lending from IFIs. For these forms of financing to benefit the poor and disadvantaged, beneficiary countries need well-functioning public financial management and redistributive systems. In fact, a larger amount of multilateral finance in response to the COVID-19 crisis was channelled through countries’ own social protection systems than after the global financial crisis, mainly thanks to the greater support for building domestic systems and programmes in the years preceding the pandemic. This suggests that multilateral support for country systems is a key enabler of effective crisis response that can more effectively target and support the most vulnerable and disadvantaged populations.

Rethink the growing focus of multilateral development finance on middle-income countries. The multilateral response to the COVID-19 pandemic has exacerbated the recent increase in multilateral financing for middle-income countries – mostly MDBs’ non-concessional financing. As these countries tend to enjoy greater access to commercial debt and alternative means of financing than LDCs and other low-income countries, a rethink is needed of whether the current allocation of multilateral development finance adequately meets the financing needs of developing countries.

Harmonise approaches to measure the contribution of multilateral development finance to reducing poverty and inequality. The lack of a shared approach makes it difficult to measure and assess the effectiveness of the multilateral development system in reducing poverty and inequality, and to propose options to improve multilateral support in this area. The DAC Community of Practice on Poverty and Inequalities, which convenes all relevant multilateral actors, could be a useful platform to seek agreement among multilateral stakeholders on potential ways to track development financing for poverty and inequality reduction, and to monitor and evaluate the relevance, effectiveness and impact of multilateral providers’ interventions. The revised GPEDC monitoring framework could also enable better tracking and monitoring of multilateral organisations’ activities for poverty and inequality reduction, and clarify their contributions to the international pledge to “leave no one behind” (Box 4.4).

Box 4.4. A strengthened focus on poverty and inequality reduction in the new GPEDC monitoring framework

Copy link to Box 4.4. A strengthened focus on poverty and inequality reduction in the new GPEDC monitoring frameworkThe Global Partnership for Effective Development Co-operation (GPEDC) is the primary multi-stakeholder vehicle for driving development effectiveness. It supports the implementation of effective development co-operation principles, promotes mutual accountability, and works to sustain political momentum for more effective development co-operation and partnerships. Since 2013, the flagship instrument of the GPEDC – its global monitoring exercise – has provided an overview of progress towards more effective development co-operation and partnerships. A summary of performance and trends for multilateral organisations from the 2018 Global Partnership monitoring exercise can for example be found in the OECD 2020 Multilateral Development Finance report (OECD, 2020[14]).

The monitoring process and framework was comprehensively reformed over 2020-22, and the new monitoring exercise will be rolled out in 2023. This new exercise will continue to generate country-level evidence on the performance of multilateral and bilateral partners on their alignment to partner countries’ priorities and results, predictability of disbursements to the public sector, transparency, and use and strengthening of public financial management systems of the partner countries where they operate.

From 2023 for the first time, the new framework will also measure multilateral and bilateral providers’ efforts to leave no one behind, as pledged in the 2030 Agenda, and to the implementation of the Kampala Principles for Private Sector Engagement in Development Co-operation (Global Partnership for Effective Development Co-operation, 2019[35]). Finally, the new framework will also highlight existing evidence on how bilateral partners fund the multilateral development system (e.g. amount and share of funding to the multilateral system, and the share of core vs. earmarked funding as available from the OECD and other sources).

Mainstream climate and biodiversity further in multilateral development finance

Copy link to Mainstream climate and biodiversity further in multilateral development financeTake greater and bolder action to reduce the growing green and climate financing gap. The large climate financing needs estimated by the IPCC to limit global warming to below 2°C call for greater efforts by development partners to finance climate mitigation and adaptation activities in developing countries. The multilateral development system plays a crucial role in providing green finance and technical assistance. Thanks to their proven ability to rapidly scale up financing, and their investment track-record in sectors highly relevant for climate change, such as renewable energy and transport, expectations are growing on MDBs and vertical funds to continue increasing their focus on climate finance. Multilateral organisations can also advise and incentivise governments to integrate global and regional public goods-related concerns into public budgeting decisions through the targeted and conditional provision of low-cost financing options.

Mainstream biodiversity further in multilateral development finance. Despite robust growth over the past decade, the share of biodiversity-related flows in total multilateral development finance remains relatively low. Biodiversity only represents 1% to 2% of multilateral development organisations’ portfolios, as compared to 6.3% on average for bilateral providers (Casado-Asensio, Blaquier and Sedemund, 2022[29]). If multilateral institutions, especially MDBs, were to increase the shares of their biodiversity-related investments to match the averages of bilateral donors, an additional USD 6.1 billion per year could be invested in biodiversity. The upcoming Conference of the Parties to the Convention on Biological Diversity (COP15) provides an opportunity for multilateral stakeholders to reinforce their commitments to the protection of global biodiversity, notably by promoting increased financing from the Global Environment Facility and the MDBs.

MDBs should continue to lead multilateral efforts to catalyse private finance for sustainable development through innovative instruments and partnerships. Over the past decade, multilateral development banks have pioneered multiple innovations to mobilise green finance from the private sector. Recent OECD analysis, for instance, stressed the role of MDBs in bringing the global green, social, sustainability and sustainability-linked bonds market to scale through large-scale issuances, including in local currencies in emerging markets (OECD, 2022[36]). The mobilisation of green equity is another recent innovation being trialled by MDBs. For example, the Trade and Development Bank (TDB), a regional development finance institution covering Eastern and Southern Africa, is currently considering the introduction of green shares, which are non-voting equity securities. By issuing these shares, TDB would make a commitment to investors to deploy four times the value of the green share proceeds in climate-related projects.

Scale up support to vulnerable countries in accessing multilateral climate finance. Scaling up the provision of technical assistance and capacity-building can help ensure that even the poorest and most vulnerable countries, which tend to be the most affected by climate change, are able to access multilateral climate finance. This would help tackle some of the existing bottlenecks in climate finance, in particular in the case of countries most in need (LDCs, SIDS, landlocked developing countries and fragile states), which lack the technical capacity, resources and governance to identify, apply to, and manage funding for climate action. A comprehensive review of current bottlenecks in climate finance could also help re-consider the complexity of the current climate finance architecture and projects, and provide options for an alternative climate finance offer tailored to the needs of the poorest and most vulnerable countries.

Improve co-ordination and co-operation on the provision of global and regional public goods and the implications for multilateral development co-operation. The analysis in this chapter has revealed the increasing share of multilateral finance going to a range of inter-linked global challenges – from climate and biodiversity risks, peace and security and infectious diseases to financial and macroeconomic stability. Mitigating these risks and building resilience to these types of shock requires greater international co-ordination and co-operation. In particular, increased financing (both in terms of aid and other financing) and deeper consideration of how to balance emergency response needs with surge capacity and risk mitigation measures are needed. This will also require environmental considerations to be mainstreamed in multilateral organisations’ overall financing decisions.

Increase transparency and monitoring of multilateral organisations’ support to climate change and biodiversity protection. This could be achieved through a more systematic, consistent and comparable reporting of official development finance to these areas. At the moment, the co-existence of different approaches to report and measure these flows (e.g. climate component vs Rio markers) makes it difficult to accurately track, monitor and analyse multilateral organisations’ contribution in these important areas of the 2030 Agenda.

References

[18] Bejraoui, A. et al. (2021), “TOSSD - Tracking global health expenditure in support of the SDGs”, OECD Development Co-operation Working Papers, No. 103, OECD Publishing, Paris, https://doi.org/10.1787/cb8be42b-en.

[15] Bloomberg (2020), “Pandemic-Stoked Bond Sales Set New Bar for Emerging Markets”, https://www.bloomberg.com/news/articles/2020-12-30/pandemic-stoked-bond-sales-set-new-bar-for-emerging-markets.

[29] Casado-Asensio, J., D. Blaquier and J. Sedemund (2022), Multilateral institutions’ biodiversity-related development finance: trends over 2011-20.

[32] CBD (2020), Contribution to a draft resource mobilization component of the post-2020 biodiversity framework as a follow-up to the current strategy for resource mobilization. Third report of the panel of experts on resource mobilization., Subsidiary Body on Implementation, CBD/SBI/3/5/Add.3, Convention on Biological Diversity, https://www.cbd.int/doc/c/5c03/865b/7332bd747198f8256e9e555b/sbi-03-05-add3-en.pdf (accessed on 13 September 2022).

[23] Cingano, F. (2014), “Trends in Income Inequality and its Impact on Economic Growth”, OECD Social, Employment and Migration Working Papers, No. 163, OECD Publishing, Paris, https://doi.org/10.1787/5jxrjncwxv6j-en.

[19] Elgar, K. et al. (forthcoming), The Role of Development Co-operation in the Provision of Global Public Goods: Trends and Key Considerations.

[35] Global Partnership for Effective Development Co-operation (2019), Kampala Principles for Private Sector Engagement in Development Co-operation, https://www.effectivecooperation.org/system/files/2019-07/Kampala%20Principles%20-%20final.pdf.

[6] Government of Barbados (2022), The 2022 Bridgetown Agenda for the Reform of the Global Financial Architecture, https://www.foreign.gov.bb/the-2022-barbados-agenda/.

[4] IMF (2022), “Responding to the Pandemic: IMF Concessional Financing Support for Low-income Countries”, https://www.imf.org/en/About/FAQ/low-income-countries-concessional-financing-support#:~:text=The%20Fund%20provided%20financial%20support,Poverty%20Reduction%20and%20Growth%20Trust.

[10] IMF (2021), World Economic Outlook, IMF, Washington D.C., https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021.

[25] IMF (2018), “Economic Gains from Gender Inclusion: Even Greater than You Thought”, IMFBlog, https://blogs.imf.org/2018/11/28/economic-gains-from-gender-inclusion-even-greater-than-you-thought/?utm_medium=email&utm_source=govdelivery.

[9] IMF (2010), World Economic Outlook: Rebalancing Growth, IMF, Washington D.C., https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/World-Economic-Outlook-April-2010-Rebalancing-Growth-23342.

[30] Intergovernmental Panel on Climate Change (2022), Climate Change 2022: Mitigation of Climate Change, https://www.ipcc.ch/report/ar6/wg3/.

[16] Lee, N. and R. Aboneaaj (2021), MDB COVID-19 Crisis Response: Where Did the Money Go?, CGD, Washington D.C., https://www.cgdev.org/publication/mdb-covid-19-crisis-response-where-did-money-go.

[33] Lindenberg, N. and P. Pauw (2013), “Don’t lump together apples and oranges - Adaptation finance is different from mitigation finance”, The Current Column, https://www.idos-research.de/uploads/media/German-Development-Institute_Lindenberg_Pauw_04.11.2013.pdf.

[20] McCord, A. et al. (2021), Official development assistance financing for social protection - Lessons from the Covid-19 response, ODI, London, https://odi.org/en/publications/official-development-assistance-financing-for-social-protection-lessons-from-the-covid-19-response/.

[24] McKinsey&Company (2015), The Power of Parity: How Advancing Women’s Equality can Add $12 Trillion to Global Growth, https://www.mckinsey.com/~/media/mckinsey/industries/public%20and%20social%20sector/our%20insights/how%20advancing%20womens%20equality%20can%20add%2012%20trillion%20to%20global%20growth/mgi%20power%20of%20parity_full%20report_september%202015.pdf.