This chapter discusses the use of artificial intelligence (AI) in the German economy, barriers to further diffusion, and AI compute infrastructure. Germany is advancing AI capabilities by modernising its AI infrastructure, and German firms with a strong foundation in academic research are flourishing. However, AI adoption by German firms has been slow, yet increasing, facing challenges including skills shortages, limited awareness of potential AI use cases, regulatory uncertainties, and lagging digitalisation. Several actions could support AI diffusion in Germany, including building confidence to implement AI solutions through clear regulatory guidance, increasing access to open and industrial datasets, leveraging various channels to increase venture capital (VC) availability, and simplifying procurement procedures. Assessing Germany’s current and future AI compute supply and needs, while making current capacity more accessible to AI start-ups and small and medium-sized enterprises (SMEs), would help to inform investment decisions and promote inclusive infrastructure to serve Germany’s AI ecosystem.

OECD Artificial Intelligence Review of Germany

4. AI transfer, applications and computing infrastructure

Abstract

The effective and widespread utilisation of AI hinges on the seamless transfer, development, and commercialisation from academia to the private sector of research findings and applications with real-world potential. This points out to the critical need to bridge the gap between academic insights and commercial implementations for the benefit of the broader economy. The diffusion of AI in companies is challenged by the complexity of integrating new technologies into existing workflows and adapting organisational structures to leverage its full potential. In its 2018 National AI Strategy and its 2020 update, the German Federal Government is taking targeted measures to strengthen transfer, to maintain the competitiveness of the German and European economies and expand them through widespread application of innovative technologies (German Federal Government, 2020[1]).

Box 4.1. Transfer and applications: Findings and recommendations

Transfer to small and medium-sized enterprises and start-ups

Findings

While use of AI in Germany proceeded at a relatively moderate pace to date, factors such as rising labour shortages and rapid technological progress (namely generative AI and its potential productivity gains) have triggered increased interest in AI. Recent data suggest that Germany might be at a turning point in AI adoption.

Wider diffusion of AI in firms is hindered by delayed digitalisation, weak connectivity and low understanding of the benefits AI could bring. Firms do not have the data streams to train, test and implement AI applications. Uncertainty over regulatory compliance for personal data and concerns about trade secrets also prevent firms from investing in AI solutions. Another obstacle is a lack of trained personnel to identify, develop, and maintain AI solutions. Little awareness of successful cases makes it hard for SMEs to estimate their return on investment in AI.

Germany supports the diffusion of AI in firms through several programmes and a mix of instruments, including grants, collaboration with research institutes, advisory and consulting services, awareness-raising events and training.

The number of active AI start-ups in Germany has increased significantly over the past 15 years. The large share of AI start-ups originating from universities underscores the strong relationship between AI start-ups and the scientific community. However, transfer units at universities are understaffed, and publications are still the main key performance indicators (KPIs).

The amount of VC invested in German AI start-ups has increased since 2018 but remains smaller than in the United States (US), the People’s Republic of China (hereafter “China”), the United Kingdom (UK), India and Israel. While public support is available at early stages – namely through the EXIST programme – AI start-ups do not have access to financing for subsequent growth stages, also called the “valley of death”.

Recommendations

Improve the visibility of programmes supporting AI application by SMEs.

Develop regulatory guidance on data protection regulation and on provisions applicable to data identified as trade secrets.

Help SMEs access quality data by increasing the availability of open government data, supporting firms in improving their data maturity.

Revise tax incentives, strengthen research and development (R&D) grants and consider additional financial support (e.g. small vouchers to implement generative AI solutions) to support AI uptake in SMEs.

Improve access to financing for AI start-ups.

Revise and simplify procurement procedures to ensure that start-ups and established companies have equal access to opportunities.

AI infrastructure

Findings

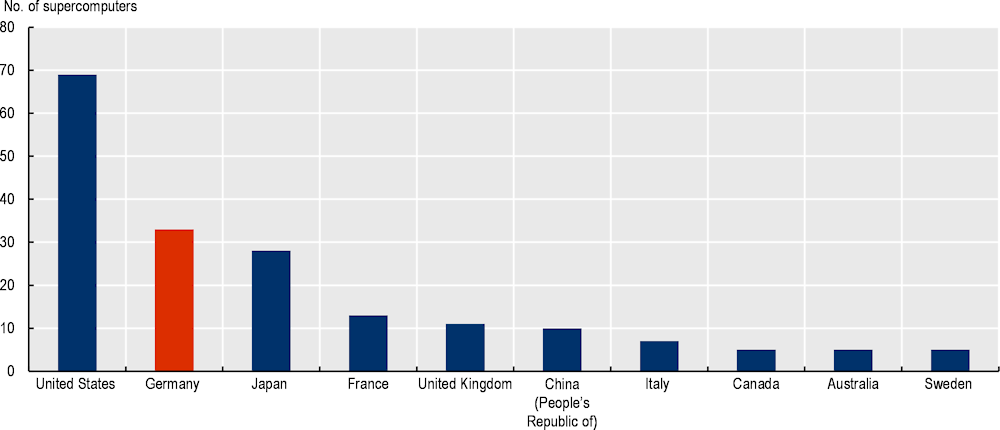

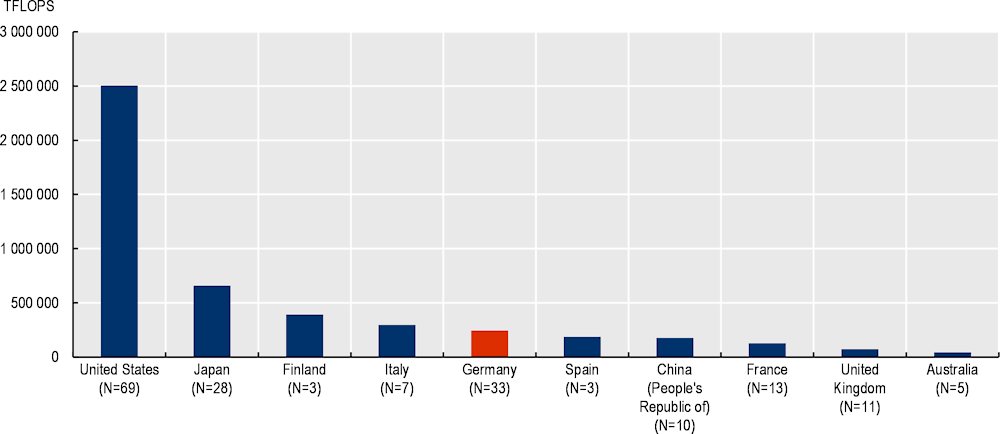

Germany holds a leading position in computing infrastructure for research and academia, anchored by the Gauss Centre for Supercomputing’s three national centres.

While it is possible for private-sector partners (start-ups, SMEs, large companies) to use the Gauss Centre’s systems alone or as part of research consortia for some projects, the systems are used primarily for pre-commercial research purposes.

The vision for Gaia-X is to establish a decentralised and interoperable data exchange for business and research partners to share data and access services at scale.

While the federal government funds relevant AI projects as part of Gaia-X, and the German Gaia-X Hub is active, it has low awareness and few links with the German AI ecosystem. Information on the types of datasets and users related to AI are not tracked, pointing to a gap in KPIs that could help to inform AI policy.

Many interviewees pointed to a specialised talent gap for operating AI infrastructure efficiently and effectively. Some suggested the need for access to skilled labour in tandem with access to computing time.

An AI strategy update could include an AI compute plan to address the AI needs and readiness of different actors in Germany such as the private sector, public sector, SMEs, start-ups, researchers and others.

Recommendations

Assess the current and future AI compute infrastructure landscape to gauge existing capacity and potential gaps in meeting demand from stakeholders.

Designate a portion of AI compute infrastructure for start-ups and SMEs, with a streamlined application process and fewer administrative barriers.

Expand support services to include time for compute resources, technical assistance and advice on using AI compute infrastructure effectively and efficiently.

Develop a dedicated programme offering expertise and training in the effective and efficient use of AI compute infrastructure.

Engage in activities to increase awareness about Gaia-X in the AI ecosystem.

Conduct an assessment of Gaia-X datasets that are of particularly high value for AI, and label them accordingly.

AI diffusion in firms

While larger companies are ahead in AI integration, SMEs' interest and usage are cautiously growing, as indicated by recent surveys. This is driven in part by factors like labour shortages and generative AI. Key sectors like information and communication technology (ICT) and knowledge-intensive services show significant AI adoption. Challenges for firms include skill shortages, data protection concerns, low digitalisation, and limited awareness of AI use cases. The German government promotes AI adoption through financial support targeting both research transfer and practical implementation in SMEs, educational initiatives, and platforms for data exchange.

German firms take a cautious approach to adopting AI solutions, with some leading in their sectors

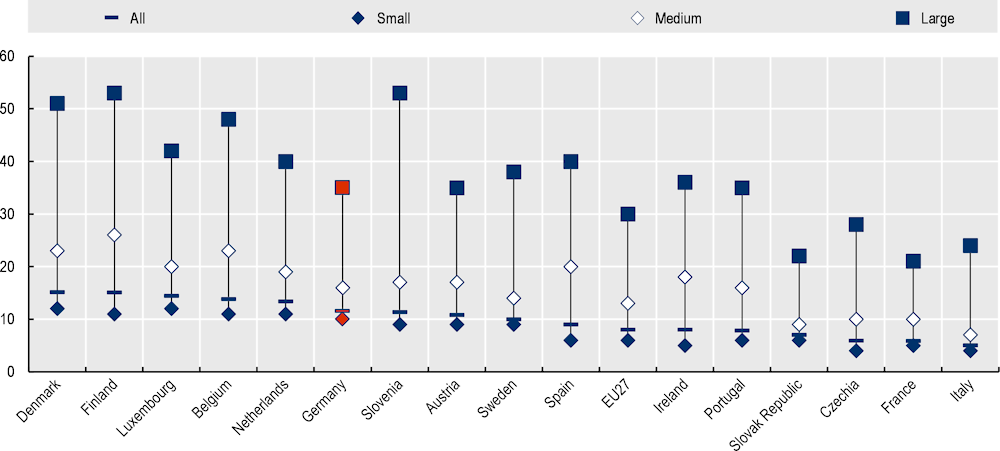

According to the latest comparable data at the European Union (EU) level, 12% of German firms used at least one AI system in 2023 (Figure 4.1). This figure showed an increase compared to the 2021 level (10.6%) and was higher than the EU average (8%). Over one-third of German large companies used AI, with adoption rates at 10% for small and 16% for medium-sized companies. These aligned favourably with the EU average, but they fell below those of EU countries at the forefront in AI adoption, including for large firms. German firms were above the EU average in all sectors, although with notable differences in rates of AI adoption (Figure 4.2).

Figure 4.1. AI uptake by German firms is above EU average, but below EU frontrunners

As a percentage of firms with ten or more employees, 2023

Note: EU frontrunners are the top five countries with the highest AI use by firms, simple average.

Source: Eurostat (2023[2]), Digital Economy and Society Database, https://ec.europa.eu/eurostat/databrowser/explore/all/science?lang=en&subtheme=isoc&display=list&sort=category (accessed on 16 October 2023).

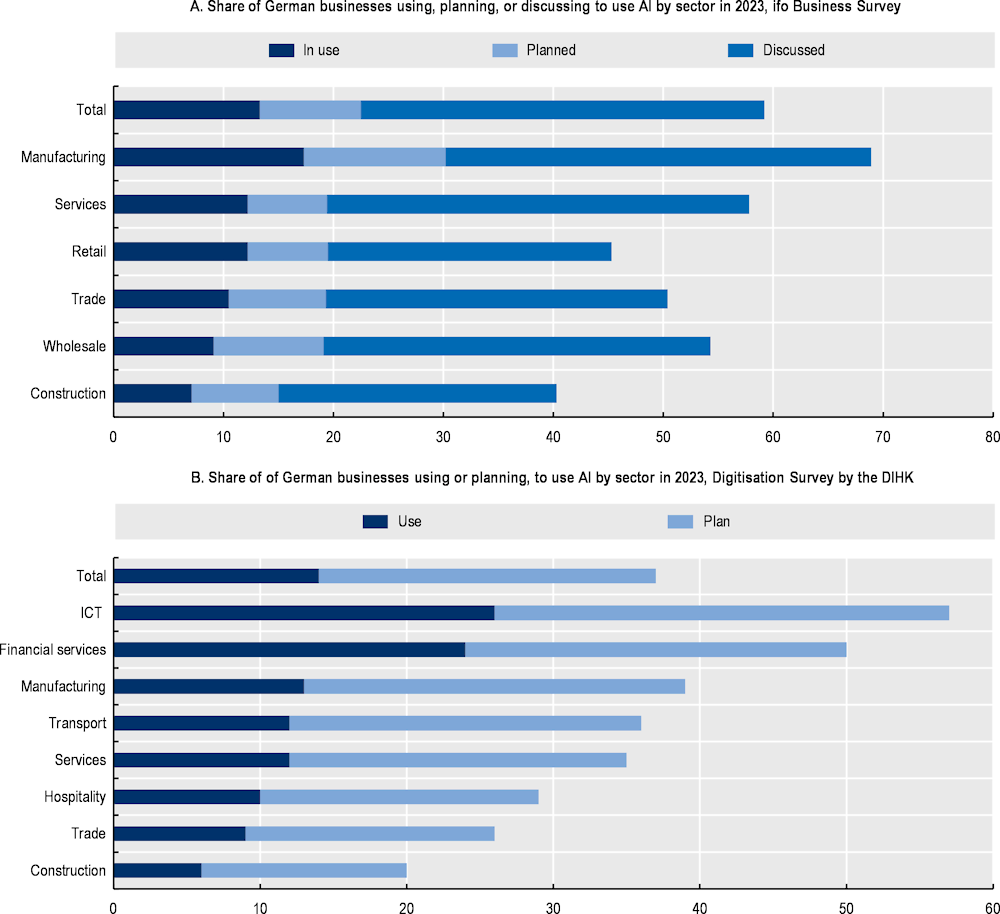

Recent data from national surveys also show increased adoption and interest in AI solutions in Germany. As of June 2023, 13.3% of the companies surveyed were already using AI, while 9.2% had intentions to do so (ifo Institute, 2023[3]). Additionally, 36.7% were engaged in conversations about potential AI use cases (Figure 4.3, Panel A). A second national survey found a similar overall adoption rate of AI applications across firms, standing at 14%, while 23% indicated plans for future adoption (Figure 4.3, Panel B) (DIHK, 2023[4]). A third national survey found that 15% of German companies use AI, an increase of 6 percentage points from the previous year (bitkom, 2023[5]). Rates of adoption by sector differed from the EU survey, particularly concerning the relative use in the manufacturing sector. However, it is important to stress that the two national surveys cited here lack detailed information at the firm level, such as whether AI is applied to enhance internal processes, improve customer relations, or develop new products and services. Neither is there a breakdown of AI usage by company size.

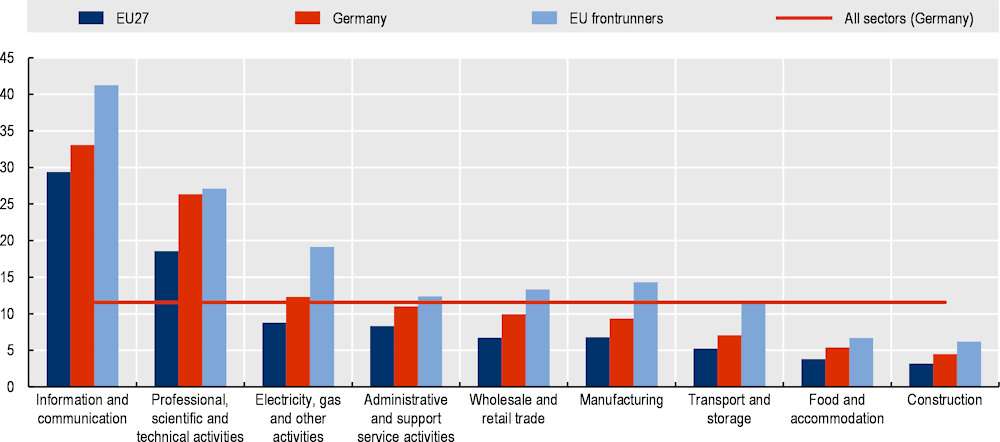

Figure 4.2. Firms in ICT and knowledge-intensive sectors lead in AI use

As a percentage of firms with ten or more employees, 2023

Note: EU frontrunners are the top five countries with the highest AI use by firms, simple average.

Source: Eurostat (2023[2]), Digital Economy and Society Database, https://ec.europa.eu/eurostat/databrowser/explore/all/science?lang=en&subtheme=isoc&display=list&sort=category (accessed on 16 October 2023).

While comparisons with non-EU countries pose challenges due to differences in survey questions and coverage (Montagnier and Ek, 2021[6]), recent findings from the Business Trends and Outlook Survey provide some insights for the US. In 2023, only 3.9% of US firms used AI to produce goods and services. The information sector used AI the most, at 13.8%. Notably, an additional 6.5% and 22% of firms reported plans for adoption within the next six months (US Census Bureau, 2023[7]). These data refer to the use of AI to develop new products and goods, while recent data on broader use and by economic sectors is lacking. McElheran et al. (2023[8]) found a low average diffusion among US firms (6%), although with higher concentration among specific sectors and a smaller number of very large firms (over 5 000 employees). Weighted by employment, average adoption in US firms was slightly over 18%. However, the analysis is based on 2018 data from the Annual Business Survey and current rates are likely to be higher, particularly in view of recent developments in AI.

Adoption of AI across sectors is illustrated by the AI-related activities of large German companies. In 2017, Siemens established an AI-lab that currently has 250 researchers. In 2022, AI was one of Siemens’ eleven core technological research and development focuses (Siemens, 2023[9]). Furthermore, in 2023 the company announced an increase in around EUR 0.5 billion in R&D in AI and the industrial metaverse (Siemens, 2023[10]). Bosch also set up an AI centre (the Bosch Centre for Artificial Intelligence, BCAI) in 2017 to develop innovative AI technologies. Likewise, SAP established an AI central team in 2016. Some of Siemens, Bosch and BMW’s manufacturing plants figure in the World Economic Forum’s Global Lighthouse Network of the most advanced Industry 4.0 production facilities worldwide (WEF, 2023[11]).

German companies ranked third in the automotive sector in 2019 among peer countries regarding AI deployment at scale (Capgemini, 2019[12]). AI is mainly leveraged in this sector for: i) design and customisation purposes to expedite idea implementation and reduce innovation cycles; ii) optimising autonomous vehicle development; and iii) developing driving and costumer assistants (Capgemini, 2023[13]).

Mercedes-Benz became the first car manufacturer to receive US government approval for a Society of Automotive Engineers (SAE) Level3 autonomous driving feature. The company self-certified its Drive Pilot feature in Nevada, allowing the car to handle all driving tasks while requiring the driver to be ready to take control at any moment (The Verge, 2023[14]). In its subsidiary brand Audi, Volkswagen Group also uses the FelGAN software for design inspiration. This in-house development by corporate information technology (IT) and Audi Design suggests photorealistic designs or recombines existing designs in a targeted manner. In production, AI is being used to detect anomalies via sound or specific patterns and to detect out faulty parts. Machine learning and digital copies of models, called digital twins, help to make production more energy and cost-efficient.

Figure 4.3. Recent national surveys show increased use and interest for AI by German firms

Notes: Panel A: The ifo Institute asked about attitudes towards AI on behalf of the Hanseatic Blockchain Institute e.V. as part of the ifo Business Survey for June 2023. The ifo Business Survey is based on approx. 9 000 monthly responses from businesses in manufacturing, the service sector, trade, and construction (ifo Institute, 2023[3]). Panel B: The German Chamber of Commerce and Industry (Deutsche Industrie und Handelskammer, DIHK) asked the question about the application of AI by sector as part of their Digitisation Survey 2022/2023. The analysis is based on the responses of 4 073 companies from 8 different economic sectors.

Sources: Panel A: ifo Institute (2023[3]), “Artificial intelligence in use at 13.3% of companies in Germany”, https://www.ifo.de/en/facts/2023-08-02/artificial-intelligence-use-companies-germany (accessed on 16 October 2023); Panel B: DIHK (2023[4]) , Digitale Innovationen, Technologien und Produkte, https://www.dihk.de/de/themen-und-positionen/wirtschaft-digital/digitalisierung/digitalisierungsumfrage-2023 (accessed on 24 October 2023).

Generative AI can increase the competitiveness of German firms

Increased use and interest in AI solutions appears to be influenced by the advent of generative AI (ifo Institute, 2023[3]). Labour shortages have also compelled companies to explore solutions to reduce costs and enhance process efficiency. This is in line with findings showing that employers in Germany are more likely to cite skills shortages as a reason to adopt AI in the manufacturing and finance sectors than employers in other OECD countries (Austria, Canada, France, Ireland, the UK and the US), and that improving workers performance and cost efficiencies are even more prevalent reasons for AI adoption among German employers (Lane, Williams and Broecke, 2023[15]).

The link between AI use and firm productivity is still being investigated as existing literature remains inconclusive (Calvino and Fontanelli, 2023[16]). Nevertheless, empirical evidence suggests positive and significant productivity impacts for Germany. One study found that AI use among German firms contributed to approximately 6% of total annual cost savings for the German business sector in 2019 (Rammer, Fernandez and Czarnitzki, 2022[17]). The study also found that AI adoption increases annual worker productivity growth within-firm. Calvino and Fontanelli (2023[16]) also identified positive and significant effects of AI on productivity in a sample of German AI adopters with online presence.

Recent research suggests that adopting generative AI could lead to substantial productivity gains across diverse sectors. Estimates range from 0.1% to 0.6% annually over the next ten to twenty years (McKinsey Global Institute, 2023[18]), and up to 1.4% over a ten-year period (Briggs and Kodnani, 2023[19]). Workers’ exposure to ChatGPT was also associated with increased firm value (Eisfeldt et al., 2023[20]) and revenue growth in SMEs (Soni, 2023[21]).

Various studies have investigated the productivity effects of generative AI tools in experimental settings. Dell’Acqua et al. (2023[22]) found that the use of generative AI can significantly improve the performance of highly skilled workers, particularly consultants, by up to 40% compared to those who do not utilise it. However, for tasks beyond the current capabilities of AI, consultants using AI were 19% less likely to produce correct solutions. In coding, developers using GitHub Copilot – an AI programming assistant that provides relevant code and functions – completed tasks 55.8% faster than those without the tool (Peng, Kalliamvakou and Cihon, 2023[23]). Less experienced programmers, older programmers, and those working long hours derived the most significant benefits from using the AI tool. Similarly, (Brynjolfsson, Li and Ray, 2023[24]) found that call centre agents with access to a conversational assistant experienced a 14% boost in productivity. In line with (Noy and Zhang, 2023[25]), the most significant gains were observed among new or low-skilled workers. However, research on the labour-market effects of generative AI is relatively recent and further peer-reviewed research is needed for more definitive conclusions to be drawn.

Generative AI has a wide range of possible applications at firm level. Potential use cases with the highest estimated value are software engineering, customer relations, marketing and sales, and R&D (McKinsey Global Institute, 2023[18]). In SMEs, usage can be diverse, spanning from content creation and automation of paperwork, to prototyping and customer support and interaction (Table 4.1).

Generative AI can also be used in robotics, where large language models (LLMs) can enhance robot intelligence, favour human-robot interaction, and increase autonomy (Zenga et al., 2023[26]). Robotics can also be combined with image, audio, and video generation models to produce advanced systems with multimodal capabilities combining these functions (Lorenz, Perset and Berryhill, 2023[27]). With 397 industrial robots per 10 000 employees in 2021, Germany’s manufacturing industry has the highest robot to employee density in Europe (The Robot Report, 2022[28]). Germany is one of the top five adopters worldwide with 36% of the market share within the EU (IFR, 2023[29]). Germany is well positioned to seize the opportunities of LLMs to improve robots’ capacity further and lead in intelligence robotics. The recent Action Plan on Robotics Research, launched by the Federal Ministry of Education and Research (Bundesministerium für Bildung und Forschung, BMBF) in November 2023 (BMBF, 2023[30]), aims at strengthening Germany’s position in AI-based robotics including through the creation of a Robotics Institute Germany.

Large German companies are increasingly exploring potential uses of generative AI in their products. Siemens recently partnered with Microsoft to speed up code generation for industry automation using ChatGPT (Siemens, 2023[10]). The enterprise software firm SAP has invested in three generative AI companies in Germany (Aleph Alpha) and abroad (Anthropic, in the US, and Cohere, a US/Canadian company). BMW partnered with Zapata and MIT’s Centre for Quantum Engineering to address their plant scheduling optimisation challenge using generative AI techniques (Markets and Markets, 2023[31]). Mercedes-Benz is currently testing a GPT-based voice control system in its vehicles in the US. The assistant is supposed to provide information about destinations or answer knowledge-based questions. Based on the results of this beta test, Mercedes will assess whether to offer an LLM for “dialogical communication” in its vehicles in the future (Handelsblatt, 2023[32]).

Stakeholders consulted in the context of this study noted that, despite growing interest, companies have yet to fully comprehend the specific applications of generative AI within their operations. Furthermore, generative AI applications in an industrial setting (e.g. for predictive maintenance) are still being explored. However, it was widely acknowledged that the availability of standardised AI solutions, including generative AI, will ease integration into business operations. This could potentially result in significant adoption rates, especially among SMEs. Notably, sectors like retail and trade leverage AI to enhance marketing efforts, while the professional activities sector focuses on automating production processes (Eurostat, 2023[2]). Consequently, the potential use cases of generative AI are likely to its adoption for these specific purposes further.

Table 4.1. Uses of generative AI in SMEs

|

Use case |

Description |

|---|---|

|

Content creation |

Marketing content: Generate text for ads, social media, and campaigns, blogging and search engine optimisation |

|

Personalised customer communications |

Generate personalised emails and content based on customer data |

|

Customer support |

Provide first level support through AI chatbots |

|

Product design and development |

Create new product designs or modify existing ones |

|

Graphic design |

Design logos, marketing materials, and other materials |

|

Prototyping and 3D modelling |

Assist in creating designs for rapid iteration and testing |

|

Automation of paperwork and reports |

Draft reports, generate invoices, and handle routine paperwork tasks |

|

Language translation |

Translate content into multiple languages |

Source: Soni, V. (2023[21]), “Impact of generative AI on small and medium enterprises’ revenue growth: The moderating role of human, technological, and market factors”, https://researchberg.com/index.php/rcba/article/view/169.

Interviewees also pointed out that LLMs currently on the market have only been trained on small portions of German text, resulting in less accurate results. The restricted availability of open data for training German LLMs was identified as a current limitation, coupled with the need for significant computing capacity. Both academia and business sectors said that Germany urgently needs to develop its own LLM, both for higher accuracy and to ensure compliance with EU legal requirements, particularly regarding data protection (Löser et al., 2023[33]; AKI, 2023[34]).

Bottlenecks could hamper wider AI adoption

Notwithstanding the increased interest of German companies in AI, the experts interviewed pointed to challenges that may delay and even hamper AI diffusion in German firms, particularly in SMEs.

The main obstacle cited by employers for AI diffusion in firms is the shortage of AI skills. SMEs often cannot obtain the required AI talent to identify, develop, implement, and maintain AI applications.

Companies often do not see the advantage AI could bring to their business models. The experts described traditional German companies, and in particular SMEs, as “too successful to innovate”. These companies may have been highly successful in the past, but their success has led to complacency, making them resistant to investing in or adapting to new and potentially disruptive innovations, potentially limiting long-term competitiveness and growth. Moreover, estimating the return on investment (ROI) for AI applications is challenging, given that most require customisation to align with each firm’s unique work environments and processes. The interviewees noted that firms considering AI investments face decision-making challenges due to limited awareness of successful use cases.

Significant concerns arise from uncertainties regarding regulatory compliance. In this context, the primary challenge for companies actively using AI is the uncertainty related to regulatory compliance with data protection legislation for AI applications. In a survey conducted by the German Centre for European Economic Research (Leibniz-Zentrum für Europäische Wirtschaftsforschung, ZEW), 76% of the participating companies noted that this issue is very or somewhat important (Rammer, 2021[35]). The experts interviewed affirmed that German companies, especially SMEs and start-ups, encounter challenges with the General Data Protection Regulation (GDPR), since they often lack the human resources necessary to navigate the regulation and ensure legal compliance. Similarly, they expect the adoption of the European Union Regulation on Artificial Intelligence (the “EU AI Act”, see Chapter 6) (EU, 2024[36]) to be challenging for most SMEs and that compliance with the Act’s requirements will increase the costs of AI use.

There is a path dependency between the level of digitalisation and the use of AI. Germany lags in connectivity, with less fast Internet subscriptions and a very low share of high-speed fibre connectivity that is increasing but slowly (Figure A A.7). German mobile broadband subscribers also consume less data than the OECD average due to cost considerations. The German Federal Government’s Digitisation Index 2022 shows that digitalisation is least advanced in small German companies with 1 to 49 employees and is significantly below the EU average for all German company size classes. Even though medium-sized companies with 50 to 249 employees are making progress in digitisation, their index value is still below the baseline value of 2020 (German Federal Government, 2023[37]). According to Eurostat data on the digital intensity level in businesses, German SMEs are the seventh most advanced in the EU, lagging EU frontrunners, i.e. Finland, Denmark, Sweden, Ireland, Netherlands, and Malta (Eurostat, 2023[38]). This finding is also linked to German SMEs often lacking trust in AI solutions due to concerns about confidentiality. According to the experts interviewed, SMEs specialised in a particular niche product/market are afraid that competing companies will gain access to their expertise as a result of the use of new technologies, thereby losing their competitive edge in the market.

The low degree of digitalisation and data readiness in companies makes it challenging for firms to adopt AI solutions, as these complementary assets are significantly linked to AI use (Calvino and Fontanelli, 2023[16]). The development of AI systems hinges on each organisation and sector having a digital data strategy, since data are required for training, testing, validating and evaluating AI models. However, SMEs often lack sufficient quantity and quality data, in a structured format and do not have the competences to integrate data from different data sources. Accessing computing resources and cloud services, essential for computationally intensive tasks like deep learning, is also an obstacle.

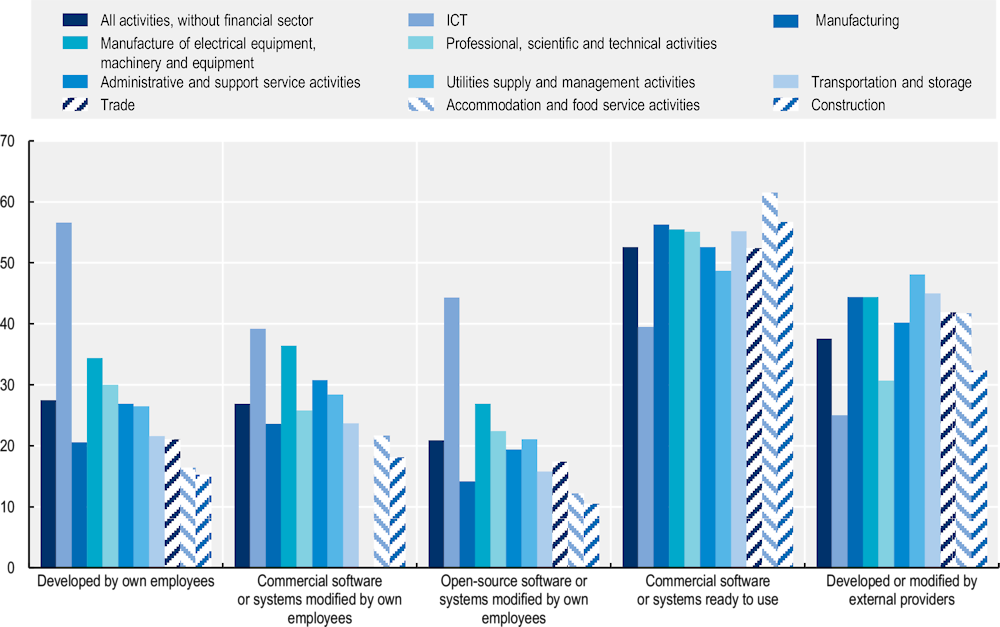

AI adoption in the manufacturing sector

Adoption of AI in Germany’s manufacturing sector has been relatively slow to date, even though AI is one of the crucial enabling technologies of Industry 4.0, i.e. the paradigm shift in manufacturing processes conceptualised and promoted by Germany since 2011. Primary AI applications in industrial settings include predictive maintenance, quality control, process optimisation, and human-robot collaboration (Emerj, 2022[39]; Peres et al., 2020[40]). The diverse nature of industrial systems and applications makes it essential to have customised, firm-specific AI applications. In the EU, the majority of sectors rely on “AI as a service,” aside from ICT, utilising commercial software or ready-to-use systems. Nevertheless, over one third of equipment manufacturers either develop their own AI systems or adapt commercially available ones (Figure 4.4).

Integrating AI into corporate structures and value chains requires substantial investment and organisational changes. However, due to insufficient evidence of successful industrial AI applications, many manufacturing firms fail to see any ROI. Interviews with a leading transfer institution indicated that most projects stall at the proof-of-concept level. Challenges such as a lack of skills to maintain solutions (e.g. for retraining and re-deployment), lack of clear ROI and a shortage of substantial evidence of industrial success impede progress in market uptake beyond this stage. A provider of AI solutions emphasised that the delayed adoption of industrial AI is also linked to cultural and competency issues at company level. The prevailing focus on engineering hampers broader organisational transformations.

Figure 4.4. Firms in most sectors are buyers of AI solutions, yet some need to develop their own

As a percentage of firms with ten or more employees in the EU27, using at least one AI technology, 2021

Source: Eurostat (2023[2]), Digital Economy and Society Database, https://ec.europa.eu/eurostat/databrowser/explore/all/science?lang=en&subtheme=isoc&display=list&sort=category (accessed on 16 October 2023).

Integrating AI into industrial business models and processes requires large volumes of quality data from various sources to train machine learning and deep learning models effectively. However, interviewees highlighted that both data availability and quality are significant bottlenecks. Obtaining substantial amounts of data proves challenging, especially in manufacturing environments with diverse data sources such as embedded machinery sensors and digitised processes like inventory management. Therefore, digitalising data is a prerequisite for SMEs to embrace industrial AI.

Implementing a data strategy and making organisational changes to align business models with industrial AI can enhance data collection, curation, and storage. Current research is look at ways to address initial data scarcity challenges by exploring the use of synthetic data, which entails creating data that resembles a real operational environment. It also looks at transfer learning or applying knowledge from one source domain to enhance learning in a new one with limited data (Peres et al., 2020[40]).

To increase availability of data for specific sectors, the EU and Germany have financed sectoral data spaces. “Data spaces” refers to secure and controlled virtual environments where data is stored, shared, and processed. These spaces are designed to facilitate seamless and trusted data exchange among stakeholders, fostering collaboration, innovation, and the development of new services and applications. In May 2023, the Federal Ministry for Economic Affairs and Climate Action of Germany (Bundesministerium für Wirtschaft und Klimaschutz, BMWK) published the funding concept for Manufacturing-X, with an allocation of EUR 152 million (Plattform Industrie 4.0, 2023[41]). Unlocking the untapped potential of industrial data is among the key objectives of the updated German data strategy released in 2023 (Box 4.2). The creation of sectoral data spaces, including Manufacturing-X, is part of the actions foreseen in the strategy. Manufacturing-X is planned to be an open, decentralised and collaborative data space for Industry 4.0 by financing application-oriented R&D projects implementing cross-industry use cases.

Box 4.2. The German National Data Strategy aligns with European and national laws

The German National Data Strategy aligns with European and national laws and encompasses various initiatives to promote responsible and effective data utilisation across sectors

The European strategy for data, introduced in February 2020, aims to establish a unified market for data to enhance Europe's global competitiveness and data sovereignty. It includes measures such as creating common European data spaces, making data more accessible across the EU, and investing in infrastructure and governance mechanisms. Two key legislative acts, the European Data Governance Act and the Data Act, are integral to achieving the strategy's goals by facilitating data sharing, increasing data availability, and clarifying conditions for data usage.

The European Data Governance Act, entered into force in June 2022 and applicable since September 2023, seeks to increase trust in data sharing, strengthen mechanisms to increase data availability and overcome technical obstacles to the reuse of data. The Act also supports the set-up and development of common European data spaces in strategic domains such as health, environment, energy, manufacturing, or public administration. The Act includes four sets of measures to: i) facilitate the reuse of certain public sector data; ii) ensure trustworthy data intermediaries; iii) promote citizen and business data sharing; and iv) facilitate cross-sector and cross-border data usage.

The Regulation on harmonised rules on fair access to and use of data – the Data Act – entered into force in January 2024, complementing the European Data Governance Act. While the Data Governance Act regulates processes and structures that facilitate voluntary data sharing, the Data Act clarifies who can create value from data and under which conditions. This legislation aims to enhance data availability for the benefit of companies, citizens, and public administrations by: i) establishing clear rules on data use and associated conditions for companies and consumers involved in data generation, particularly in the Internet-of-Things context; ii) addressing contractual imbalances to promote fair data sharing practices; iii) allowing public sector bodies to access and utilise private sector data for specific public interest purposes; and iv) introducing rules to enable customers to easily switch between different data processing service providers.

Based on European and national law and linked to various national initiatives, the German National Data Strategy (Nationale Datenstrategie), outlines a comprehensive approach to utilise data responsibly, effectively, and sustainably. It targets various sectors including the public sector, research, businesses, and individuals. Key points of the strategy include:

1. Expanding data: Initiatives to generate more data, facilitate access to government datasets, and promote data usage for the common good.

2. Enhancing data quality: Introduction of standardised data descriptions, labeling mechanisms, and quality assurance to ensure uniformity and trustworthiness of data.

3. Promoting data usage and culture: Encouragement of data-based government actions, support for the development of sectoral data spaces, and fostering of comprehensive data skills among the population to cultivate a responsible data culture.

4. Roadmap: A roadmap outlines the implementation plan until Q4/2024, considering EU legislation, federal legislation, relevant structures and networking initiatives.

Sources: EC (2020[42]), A European Strategy for Data, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0066; EC (2022[43]), European Data Governance Act, https://digital-strategy.ec.europa.eu/en/policies/data-governance-act; EC (2024[44]), Data Act, https://digital-strategy.ec.europa.eu/en/policies/data-act; German Federal Government (2023[45]), Fortschritt durch Datennutzung [Progress through Data Utilisation], https://www.bmi.bund.de/SharedDocs/downloads/DE/veroeffentlichungen/2023/datenstrategie.pdf.

Data spaces can make it easier for SMEs to implement AI by providing a platform to access and integrate data from various sources, including public databases, research institutions, and other businesses. SMEs can also monetise their data by sharing them on the platform and contributing to innovation along the supply chain. However, the low data maturity and lack of human resources may prevent some SMEs from participating in data spaces.

Germany’s institutions have many programmes to promote the use of AI in firms, especially SMEs

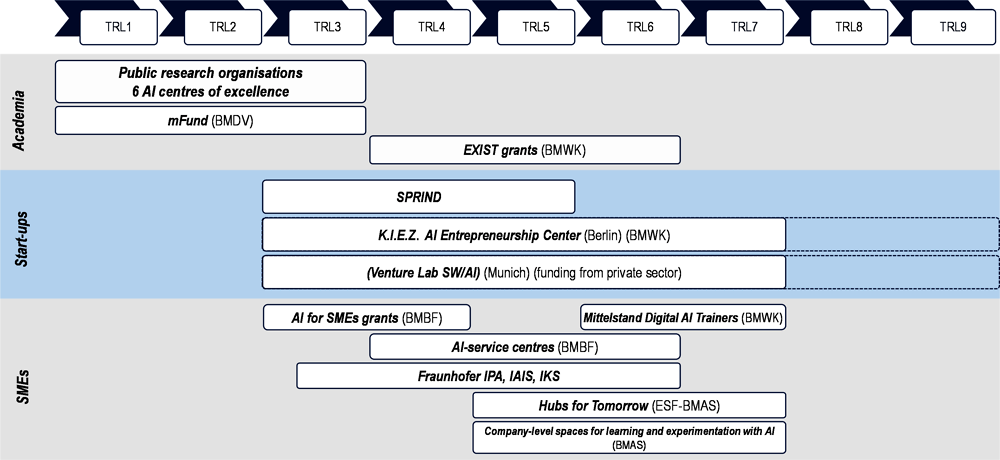

In Germany, several programmes and institutions support transferring AI research results from academia to private sector commercial use (Figure 4.5). Notably, the national AI strategy allocated EUR 166 million to this area of action, i.e. 8% of the total allocated funding from the strategy to date.

Established in 2020, the “AI for SMEs grants” (Künstliche Intelligenz für KMU, KI4KMU) is a funding programme managed by the BMBF. It specifically caters to SMEs with a maximum of 249 employees and an annual turnover of EUR 50 million or an annual balance sheet total of EUR 43 million (BMBF, 2020[46]). The programme co-finances innovative projects led and co-ordinated by SMEs in collaboration with entities such as universities and start-ups that serve as technology suppliers or test users. These projects are expected to demonstrate a substantial level of novelty compared to the prevailing international state of the art in AI-related science and technology.

The programme encompasses diverse topics, including automated information processing, digital assistants, computer vision/image comprehension, language and text comprehension, privacy-by-design approaches, data-driven systems, data engineering, traceability, and explainability of processes and systems for automated decision support and decision making. It also fosters new approaches to creating transparency in AI systems. Each project is encouraged to focus on a specific domain, such as renewable energies, ecology, environmental protection, logistics, mobility, automotive, production technologies, process control and automation, innovative user-oriented services, and the data and ICT economy.

With grants of a value up to EUR 1 million, covering around 50% of the costs, funding is awarded through a selection process, with applications accepted twice a year. The programme has already supported 61 projects involving 107 SMEs. The funding period typically spans over two to three years. The funding period typically spans over two to three years. The programme has sparked significant interest among SMEs, with six to eight times more applications than the available funding capacity in each round. Since the initial projects started in 2020, only a few are finished, outcomes of most projects are still in progress, and results are not yet available.

Figure 4.5. Programmes and transfer institutions in Germany support AI research transfer from the lab to the firm

Note: The figure is for illustrative purpose only and it is not exhaustive.

Source: OECD elaboration based on information gathered in the context of the review.

In November 2022, the BMBF helped to create four AI Service Centres (KI-Servicezentren) across Germany. These centres are designed to enhance access to computing infrastructure, provide expertise in AI, and support the widespread transfer of AI through a catalogue of services, including hardware, software, data and models, solution development, customisation of AI models to specific requirements, consulting, and training (BMBF, 2022[47]). Endowed initially with a minimum of EUR 10 million each for a 60-month period, these centres offer computing and consulting services free of charge to SMEs and start‑ups. They are expected to be self-sustaining once the initial funding concludes. The four centres are the following:

WestAI (Dortmund/Bonn/Jülich/Aachen/Paderborn) combines the large computing capacities of the Jülich Super Computing Centre (JSC) and RWTH Aachen University with the AI expertise of the Lamarr Institute for Machine Learning and Artificial Intelligence (LAMARR) and the University of Paderborn.

AI Service Centre for Sensitive and Critical Infrastructures (KI-Servicezentrum für sensible und kritische Infrastrukturen, KISSKI) (Hanover/Göttingen/Kassel) focuses on AI for sensitive and critical infrastructures, especially in the health and energy industries.

Hessian AI Service Centre (Darmstadt) concentrates on the so-called third wave of AI, e.g. large generalisable models or data-intensive applications.

AI Service Centre Berlin Brandenburg (Hasso Plattner Institute) is dedicated to the challenges and opportunities of AI in regions affected by structural change.

The BMWK‘s Digital Strategy 2025 aims to drive innovative digitalisation in the economy and society (BMWi, 2016[48]), establishing 26 regional hubs called Mittelstand1 4.0 Competence Centres, a total of 26 regional hubs for SMEs (BMWi, 2020[49]) to support SMEs with inter-business connections, knowledge transfer, and digital transformation. In 2019, the addition of AI trainers enhanced their role in educating SMEs about AI (BMWK, 2023[50]). Currently, 80 such AI trainers are active at a national level their number should increase in 2024. Funding for these centres ended in 2020, but the BMWK introduced support for Mittelstand-Digital Centres (Mittelstand-Digital Zentren) focused on the platform economy and AI. As of 2023, 30 such centres assist SMEs, with a shift towards AI in 2024 (BMWK, 2023[51]), Initially broadly dedicated to digitalisation enterprises, the network of Mittelstand Digital Centres shifted its focus to AI in 2024. This emphasis will concentrate on promoting the use of AI applications in SMEs and ensuring access to and preparation of high-quality data (Mittelstand-Digital, 2023[52]).

In co-operation with the German Chamber of Commerce and Industry (Deutsche Industrie- und Handelskammer, DIHK), the Mittelstand-Digital Centres host events to help businesses to incorporate AI. These events include individual consultation sessions and seminars on a range of AI topics, such as AI utilisation in office management and AI-based monitoring of office facilities (DIHK, 2023[4]).

Hubs for Tomorrow (Zukunftszentren) are a project funded in 2019 by the European Social Fund (ESF) and the Federal Ministry of Labour and Social Affairs (Bundesministerium für Arbeit und Soziales, BMAS), as well as partially by various Länder. The Hubs are essential for companies seeking guidance, mediation, and information regarding digitalisation and AI applications. They assist SMEs in accessing advice and training with minimal barriers. Currently, 12 regional Hubs are active in Germany. The programme has a funding pool of approximately EUR 125 million sourced from the ESF, federal funding, and supplementary state funding (BMAS, 2022[53]).

The “company level spaces for learning and experimentation with AI” (KI Lern- und Experimentierräume), part of the New Quality of Work Initiative (Initiative Neue Qualität der Arbeit, INQA) and financed by the BMAS, offer spaces for developing AI skills. The programme, running from September 2019 to September 2024, gives SMEs the opportunity to explore AI in an operational context. The results of the projects shed light on how AI can change the world of work and the opportunities and benefits of AI for SMEs (KOMKI, 2023[54]).

The Foundation Mittelstand – Society – Responsibility (Stiftung Mittelstand – Gesellschaft – Verantwortung) spearheads en[AI]ble, a project to promote the transfer from research to business and facilitate the widespread and profitable adoption of AI technology within the Mittelstand (Stiftung Mittelstand-Gesellschaft-Verantwortung, 2023[55]). The BMAS also funded it as part of the INQA and ran from September 2020 to September 2023. The initiative aimed to address the common challenges companies, particularly SMEs, face that struggle with the lack of competencies and resources needed to assess and implement AI solutions tailored to their specific needs. To help close the gap, en[AI]ble created a customised AI qualification programme, specifically designed to align with the Mittelstand’s requirements. This qualification aims to empower employees, staff associations, managers within SMEs, and consultants with the skills to evaluate AI applications effectively.

The Fraunhofer Society (Fraunhofer-Gesellschaft) represents a distinct German research transfer landscape feature. It focuses on crucial and future-relevant technologies for results in business and industry and plays a central role in the innovation process. It operates 76 institutes and research facilities in Germany and has an annual research volume of EUR 3 billion (Fraunhofer-Gesellschaft, 2023[56]). Three Fraunhofer Institutes are particularly relevant for the transfer of AI research: i) Fraunhofer Institute for Intelligent Analysis and Information Systems (IAIS); ii) Fraunhofer Institute for Manufacturing Engineering and Automation (IPA); and iii) Fraunhofer Institute for Industrial Engineering (IAO).

Notably, the Fraunhofer IPA and IAO offer three free of charge programmes in their jointly managed AI Innovation Centre Learning System and Robotics (KI‑Fortschrittszentrum Lernende System und Robotik) to get companies closer to AI potential use in their businesses. First, the AI Explorer programme offers knowledge to companies exploring AI or robotics applications without a specific concept. In workshops, Fraunhofer employees assess the company's AI and robotics landscape, providing guidance on practical implementation. Second, the Quick Checks programme enables companies to assess the feasibility of individual AI or robotics applications. Fraunhofer employees evaluate project feasibility based on the presented use case. Third, within the Exploring Projects programme, Fraunhofer staff can develop proofs-of-concept – standalone, fully operational systems not integrated with the firm's core processes. Fourth, the AI Innovation Seed format focuses on the consideration and development of innovative cross-company solutions in the field of AI. To date, about 250 companies have participated in the programmes, including large companies and SMEs from the manufacturing sector. Over 30% of these projects resulted in operational AI systems implemented by firms.

One of the main activities of the German Research Centre for Artificial Intelligence (Deutsches Forschungszentrum für Künstliche Intelligenz, DFKI), funded by the BMBF, is to transfer AI research findings into business applications. The centre engages in public-private research partnerships with software, automotive and manufacturing companies, with an annual project volume of EUR 82.6 million in 2022 (DFKI, 2023[57]).

The Platform Learning System (Plattform Lernende Systeme) is a network of experts on the topic of AI. Its aim is to act as an independent broker to promote interdisciplinary exchange and social dialogue on AI. Founded in 2017 by the BMBF, it relies on about 200 members from science, business and society to develop positions on opportunities and challenges in working groups and identify options for action for the responsible use of AI. One example of such guidance is the AI Roadmap for SMEs (Lernende Systeme, 2021[58]), which features use cases and practical implementation plans for AI in medium-sized businesses.

Despite numerous programmes available, SMEs and other businesses remain unaware

The platform also maps out the federal government’s current programmes and activities related to AI (Lernende Systeme, 2023[59]). Despite the existence of the platform, interview participants believed that the landscape of financial and non-financial support to implement AI solutions in firms is too scattered and fragmented, explaining why they are often unaware of available initiatives and unable to find those best suited to their needs. The platform could be improved by transforming it into a more interactive tool where firms could self-assess their AI readiness, understand their specific needs, and find the most appropriate support for their needs. Business associations also have a role to play in increasing awareness about current initiatives related to AI transfer to firms.

Table 4.2. Selected transfer initiatives to increase diffusion of AI in firms

|

Initiative |

Funded by |

Year of launch/establishment |

Year of termination |

Key objectives |

|---|---|---|---|---|

|

AI for SMEs grants |

BMBF |

2020 |

Ongoing |

Co-finance innovative projects led and co-ordinated by SMEs in collaboration with entities such as universities and start-ups |

|

Four AI Service Centres: i) WestAI; ii) KISSKI; iii) hessian AI Service Centre; iv) AI Service Centre Berlin Brandenburg |

BMBF |

2022 |

Ongoing |

Enhance access to computing infrastructure, provide expertise in AI, and support the widespread transfer of AI through a catalogue of services |

|

DFKI |

BMBF |

1988 |

Ongoing |

Transfer research funding in business applications through public-private research partnerships with software, automotive and manufacturing companies |

|

AI trainers |

BMWK |

2019 |

Ongoing |

Strengthen Mittelstand 4.0 Competence Centres’ and Mittelstand Digital Centres’ ability to support SMEs in understanding challenges and opportunities of AI |

|

Mittelstand Digital Centres |

BMWK |

2020 |

Ongoing |

Currently 30 centres that help inform SMEs about innovation drivers, with a shift of focus to AI in 2024 |

|

Company level spaces for learning and experimentation with AI |

BMAS |

2019 |

2023 |

Consults SME on how AI can change the world of work and what opportunities and benefits AI can offer to SMEs |

|

Hubs for tomorrow |

BMAS |

2019 |

Until 2026 |

Currently 12 regional Hubs that provide companies with guidance, mediation, training, and information regarding digitalisation and the introduction of AI applications |

|

en[AI]ble |

BMAS |

2020 |

2023 |

Facilitate the widespread and profitable adoption of AI technology within SMEs through customised AI qualification |

|

IPA |

Industrial and service companies, federal and Länder governments |

1959 |

Ongoing |

Support companies with consulting, funding and implementation services such as feasibility studies, quick checks and workshops as well as the development of complex technical production modules based on machine learning |

|

IAO |

Industrial and service companies, federal and Länder governments |

1981 |

Ongoing |

Work with companies to create AI-based systems that operate according to ethical principles and implement the latest results from AI research to relieve employees of complex processes and create new types of service offerings for customers |

|

IAIS |

Industrial and service companies, federal and Länder governments |

2006 |

Ongoing |

Aid companies in the optimisation of products, services and processes and in the development of new digital business models in the fields of AI, machine learning and big data |

|

AI Innovation Centre Learning System and Robotics |

Fraunhofer IPA and IAO |

2019 |

Ongoing |

Help companies in exploring potential AI use in their businesses through three different programmes |

AI start-ups

In Germany, AI startups have a strong foundation in academic research and are predominantly active in software and IT. They face funding challenges, relying more on cash flow and public grants than on VC, which is less available than in leading AI countries. Government programmes like EXIST support early-stage growth, fostering innovation and entrepreneurship.

AI start-ups are leading innovation in Germany, with many stemming from academic research

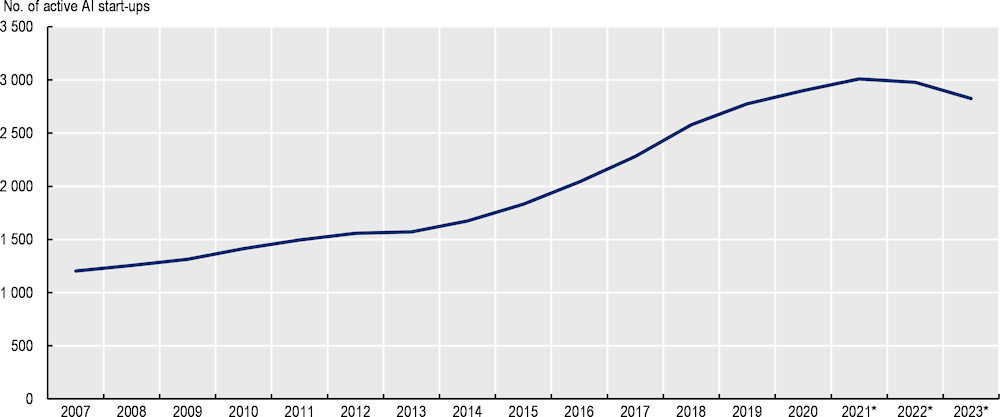

One way for AI research to reach the market is through innovative start-ups developing a concept into a solution to meet unmet demands. The number of actively operating AI start-ups in Germany has increased significantly over the past 15 years, rising from around 1 200 in 2007 to approximately 3 000 in 2021, even if a slight decline is expected for 2022 and 2023 (Figure 4.6). This decline can be attributed, in part, to several factors. Some start-ups exited the market during the economically challenging COVID-19 pandemic and the 2022 economic slowdown. On a more positive note, some strong start-ups reached the 12-year mark and are no longer considered AI start-ups. Interest in founding AI-related ventures resurged in 2023, particularly in light of the rapid adoption of new AI applications based on analysing vast datasets, such as ChatGPT (Rammer, 2023[60]).

German AI start-ups are predominantly (57%) active in the field of software programming and IT services. This includes database and data analysis services, hosting, cloud computing services, IT infrastructure installation and maintenance, hardware design and software architecture. Consulting services (business, tax, legal, financial consulting, advertising) account for 19%, with the remaining AI start-ups distributed across various sectors (Rammer, 2023[60]).

Young and small companies are leading AI innovation. In a recent study on AI adopters with online presence, 40% of German AI companies identified as micro start-ups, founded after 2015 and featuring ten or fewer employees. Nearly half of AI companies in Canada shared similar characteristics, but only 28% in the UK and 27% in the US. Conversely, older and larger firms represented 2.3% of AI companies in Germany (Dernis et al., 2023[61]).

AI start-ups and the scientific community in Germany have a solid, interdependent relationship. This is obvious in the genesis of its AI start-ups: 41.5% of AI-related start-ups originate from academic research, whereas a mere 2.4% of all start-ups originate in scientific institutions (KI Bundesverband, 2023[62]). This underscores the strong and interdependent relationship between AI start-ups and the scientific community. However, interviews participants highlighted that transfer units at universities are often understaffed, and publications are still the main KPIs for universities, resulting in limited incentive for individual researchers to engage in knowledge transfer activities or transferring research findings to industry. Indeed, Germany has an untapped potential to expand its transfer structures within universities significantly.

Figure 4.6. . The number of AI start-ups in Germany has increased in the past decade

Number of economically active AI start-ups in Germany

Note: The years marked with * are projected values.

Source: Rammer, C. (2023[60]), Das Ökosystem für KIStartups. Vermarktung, Finanzierung, Fachkräfte und Vernetzung in Unternehmensgründungen im Bereich Künstliche Intelligenz, https://www.zew.de/publikationen/das-oekosystem-fuer-ki-startups-in-deutschland-vermarktung-finanzierung-fachkraefte-und-vernetzung-in-unternehmensgruendungen-im-bereich-kuenstliche-intelligenz (accessed on 17 October 2023).

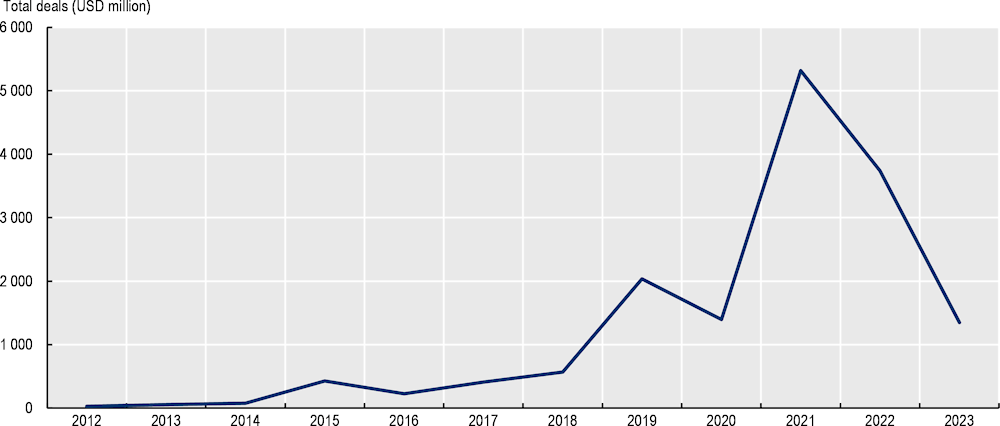

Funding for growth phases is limited

Start-ups’ ability to stay dynamic and grow in the market depends considerably on the availability of risk capital. In Germany, VC investments in AI start-ups were particularly low in 2018 (at USD 758 million) but have since grown to reach USD 3.7 billion in 2022 (Figure 4.7). This follows the global trend of increased investments in AI start-ups, particularly in generative AI. Globally, the annual value of VC investments in AI start-ups grew dramatically by over 300% between 2015 and 2022 (over USD 31 billion to nearly USD 125 billion) (OECD.AI, 2023[63]). The biggest increase happened between 2020 and 2021, when such investments jumped by more than 130% (from about USD 92 billion to USD 215 billion), with the vast majority flowing to AI firms in China and the US.

Figure 4.7. VC investments in German AI start-ups have increased since 2018

Sum of VC investments in AI in Germany

Note: The values for 2023 are estimated. Please see the methodological note available at www.oecd.ai/p/methodology for more information.

Source: OECD.AI (2023[64]), VC Investments in AI by Country, https://oecd.ai/en/data?selectedArea=investments-in-ai-and-data&selectedVisualization=vc-investments-in-ai-by-country (accessed on 13 March 2023).

VC investments in Germany mostly support start-ups developing AI solutions for business processes and support services, such as Celonis, an AI-based data processing platform, Wefox InsureTech, and Forto Logistics, digital freight forwarder and shipping management platform. Several promising sustainability start-ups that receive VC investments, such as Enpal and Twaice, have put AI at their core (see Chapter 8). Germany has also seen the emergence of very successful VC-backed start-ups in the field of LLMs (Aleph Alpha) and language translation (DeepL).

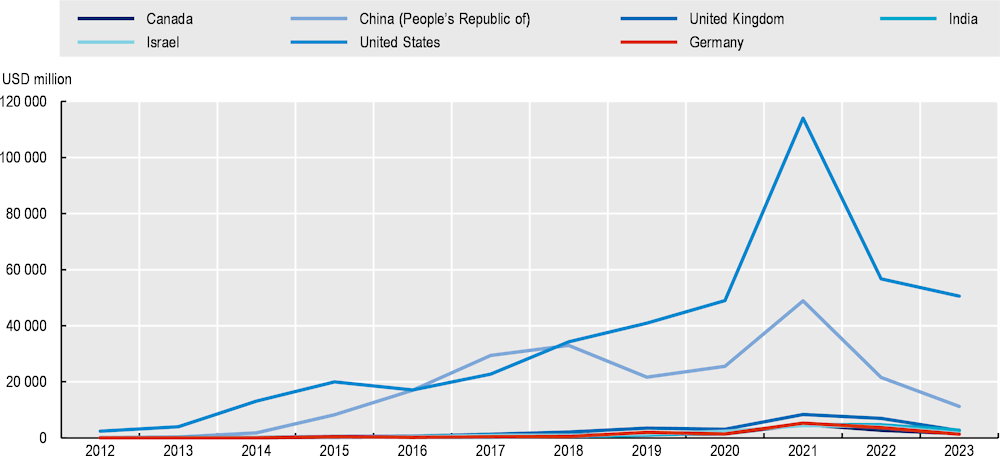

However, the availability of VC funding in Germany is still significantly lower than the amounts invested in AI start-ups in the US and China, where VC investment amounts are 14 and 5 times higher, respectively. It is also lower than VC funding in the UK, India and Israel (Figure 4.8). Most VC investors funding AI start-ups in Germany are foreign, highlighting German investors’ aversion to risk.

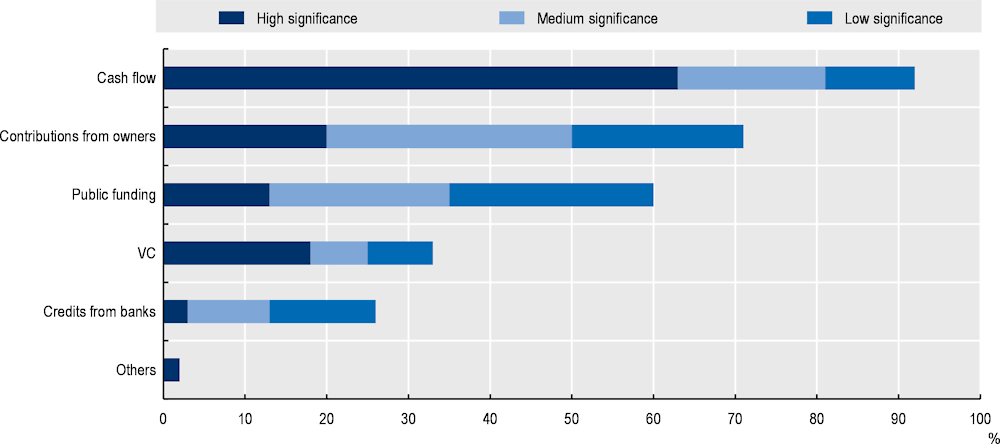

While the supply of risk capital in Germany is limited, there may also be factors on the demand side that explain a lower reliance from AI start-ups on this source of funding. Around half of AI start-ups deliberately decide to refrain from VC funding (Rammer, 2023[60]), primarily because they want to keep complete control over strategic business decisions and have received adequate funding from alternative sources. In contrast to other external investors, venture capitalists may have a vested interest in exerting influence over strategic trajectory, encompassing factors such as the pace of expansion or the markets to be targeted. As a result, the primary funding source for AI start-ups in Germany is cash flow, i.e. revenue generated from ongoing operations (Figure 4.9). Compared to all start-ups in Germany, AI start-ups, including those operating in less pioneering sectors, demonstrate a heightened reliance on contributions from owners and public funding, with VC coming third. Traditional bank financing is less prevalent. Given the substantial technological and market uncertainties associated with pioneering technological advances, conventional bank loans prove to be less suitable. In contrast, funding through public grants and VC emerges as more apt for supporting these high-risk investments (Rammer, 2023[60]).

Figure 4.8. Availability of VC funding in Germany is lower than in leading countries

Sum of VC investments in AI by country

Note: The values for 2023 are estimated. Please see methodological note available at www.oecd.ai/p/methodology for more information.

Source: OECD.AI (2023[63]), Worldwide VC Investments in AI, https://oecd.ai/en/data?selectedArea=investments-in-ai-and-data (accessed on 13 March 2023).

These findings emphasise the importance of diverse funding channels for AI start-ups in Germany. Even though approximately half of German AI start-ups choose not to seek VC funding in order to maintain complete control over their business decisions, this funding avenue is significant. However, compared to other countries, the comparatively limited availability of VC funding in Germany might prompt AI start-ups facing financial constraints to consider this funding option or relocate elsewhere. Specifically, with its substantial VC investments, the US stands out as an appealing destination for such a move (Rammer, 2021[35]). Recognising the pivotal role of public funding for German AI start-ups (Figure 4.9), it is imperative that Germany maintains financing programmes.

At the pre-seed and seed financing stages, Germany primarily backs AI start-ups through the EXIST Business Start-up Grant, a programme co-financed by the BMWK and the ESF. EXIST nurtures an entrepreneurial culture in academic institutions, fosters innovation-driven spin-offs, and helps university graduates, scientists, and students to establish technology-driven, knowledge-based start-ups. As part of the national AI strategy, Germany has established a new AI focus within the current EXIST funding programme for science start-ups with several individual measures.

Four prominent German AI regions (Berlin, Darmstadt, Munich and Hamburg) have initiated model projects funded by the EXIST programmes. The primary objective of these EXIST-AI model projects is to identify early-stage AI start-up concepts and provide them with the necessary resources for scaling. These projects also focus on networking within the start-up ecosystem, building connections between universities, start‑up teams, and businesses, and prioritising scaling and internationalisation. One new pilot project AI Entrepreneurship Centre (Künstliche Intelligenz Entrepreneurship Zentrum, K.I.E.Z.) from the Berlin research association Science & Startups. K.I.E.Z. offers tailored opportunities for rapid and sustainable growth to AI start-ups within a prominent European and global ecosystem. Its primary goal is to promote the success of science-based AI start-ups and advance technology transfer.

UnternehmerTUM is the Centre for Innovation and Entrepreneurship Support at the Technical University of Munich. It offers a wide range of programmes and resources to support entrepreneurs, start-ups, and innovation projects. This includes incubators, accelerator programmes, advisory services, and access to networks and resources for promoting innovation and entrepreneurship in the Munich region. It plays a significant role in the Bavarian start-up scene where it contributes to promoting technology, innovation, and entrepreneurship (UnternehmerTUM, 2023[65]).

EXIST is considered a successful programme, but the application process is regarded as long, cumbersome and too centralised. The programme has two application rounds per year (in January and July). Interviews participants advocated for a more decentralised approach, that would count on universities for the screening and evaluation of proposals. EXIST is also limited to the early stages of start‑ups growth.

Like other countries, the most significant gaps for financial support pertain to later growth stages – the so‑called “valley of death”. This is due to limited development of risk capital market in Germany. Furthermore, interviewees highlighted that public procurement rules are unfavourable for start-ups, leading to lower exposure to innovative AI solutions for the public sector and preventing them from accessing a market which could support their growth.

Figure 4.9. German AI start-ups rely on cash flows and contributions from owners rather than VC

Importance of different funding sources for financing AI start-ups, share of all AI start-ups in percentages, 2023

Source: Rammer, C. (2023[60]), Das Ökosystem für KIStartups. Vermarktung, Finanzierung, Fachkräfte und Vernetzung in Unternehmensgründungen im Bereich Künstliche Intelligenz, https://www.zew.de/publikationen/das-oekosystem-fuer-ki-startups-in-deutschland-vermarktung-finanzierung-fachkraefte-und-vernetzung-in-unternehmensgruendungen-im-bereich-kuenstliche-intelligenz (accessed on 17 October 2023).

Although innovative start-ups are already providing solutions to the public sector (see Chapter 8), there is unexploited potential, as also recognised by the 2022 Start-up Strategy (BMWK, 2022[66]). The strategy highlights both the needs to make public procurers more aware of the existing opportunities for innovative procurements in the public procurement law, and to encourage start-ups to make greater use of these opportunities.

Germany has recognised the strategic importance of innovation procurement in the national policy frameworks for public procurement, innovation, and R&D (PwC, 2020[67]). In 2009, Germany implemented a legal change in its procurement framework to allow government agencies to specify innovative aspects of procured products as selection criteria in tender calls. However, innovation-promoting instruments are only partially known in public procurement organisations, and often, a lack of market knowledge makes it difficult to prepare tenders. Furthermore, requirements for suitability are often high in terms of turnover, references, number of employees and other criteria (BMWK, 2023[68]). The Competence Centre for Innovative Procurement (KOINNO) is the most crucial actor at the national level supporting innovation procurement policy implementation. KOINNO offers tools and specific consultancy services to public institutions for innovative management and innovative products. While providing guidance to public entities is a positive step to increase the public procurement of AI-driven innovations, there may room to analyse further which factors prevent start-ups from further participating in public calls and explore options for revising some requirements.

Germany could leverage a number of channels to increase VC funding availability in the country, as recommended in the 2022 OECD Review of Innovation Policy in Germany (Box 4.3). Additionally, to cater to AI start-ups’ needs, the federal government could establish a dedicated fund to support science-based start-ups on the model of the Deep Tech plan in France. Launched in 2019 with a budget of EUR 3 billion spanning from 2019 to 2025 and overseen by the French Public Investment Bank (Banque publique d’investissement, BPI), the Deep Tech plan supports the creation and growth of deep tech start-ups, as well as the regional and sectoral innovation ecosystems. As of 2022, the plan facilitated the creation of 870 deeptech start-ups, for a total funding of EUR 2 billion. In 2022, resources allocated to the Deep Tech plan have been increased through the France 2030 programme, to add EUR 500 million. Another EUR 100 million fund dedicated to deep tech will provide equity support to start-ups at various stages of development (Bpifrance, 2023[69]; Ministre de l'Économie, des Finances et de la Souveraineté industrielle et numérique, 2023[70]).

Box 4.3. How to promote financial markets that are conducive to scaling up breakthrough innovations?

Recommendations from the 2022 OECD Review of Innovation Policy

Revisit the legal framework for German capital-collecting institutions to encourage investment in risky innovation. The federal government should consider requiring institutional funds to allocate a percentage to VC or private equity funds for innovative firms. For example, German pension funds, insurance companies and public financing organisations provide very little risk capital, even though they are among the only sources that could provide the levels of funding (including investments in private companies through VC funds and investments in listed companies) that are necessary to scale the most promising innovations. Another approach might be to facilitate employee stock-ownership plans.

Expand tax incentives, especially those that allow private investors to offset capital losses against other income, or to exempt future profits when investing in the VC asset class. Such incentives should apply to both the VC segment (pre-initial public offerings) and investment through the stock market (development and growth financing). France and the UK, for example, each have six different tax-incentives to improve the supply of private capital for VC markets.

The federal government should support the development of financial instruments at the EU level that would help scale and retain innovative firms. The volume of finance necessary to scale some of the most promising firms is often available neither in Germany nor within the EU, meaning that firms regularly move to countries where finance is more easily available, such as the UK or the US. The German government should advocate the establishment of EU-level private equity development for investment in pre-public technology and digital innovators. The Federal Agency for Disruptive Innovation (Bundesagentur für Sprunginnovationen, SPRIND) could play a more prominent role in developing a domestic VC market for higher-risk investments.

Source: OECD (2022[71]), OECD Reviews of Innovation Policy: Germany 2022: Building Agility for Successful Transitions, https://doi.org/10.1787/50b32331-en.

Recommendations for AI transfer to SMEs and start-ups

Improve the visibility of government programmes supporting AI application by SMEs

Germany is implementing many programmes to develop and integrate AI in business. However, targeted beneficiaries may not be aware of the programmes or find it challenging to navigate the opportunities. To increase awareness and user-friendliness, the platform that centralises government offers, Lernende Systeme, could be improved to offer a more interactive experience. For instance, it could include a self-assessment tool for firms to their level of AI readiness, define their needs, and be directed to the most fitting support initiative. The platform could also maintain an open and searchable catalogue of AI success stories, applications, and use cases with information on the economic impact of AI to help firms grasp what they can achieve.

Develop regulatory guidance to foster AI implementation

To give SMEs confidence in adopting AI, data protection authorities should provide clear regulatory guidelines and advice on technologies for the ethical and responsible use of data. In this regard, their mandate should include supporting innovative players towards compliance with GDPR. Regulatory guidance should also be provided with respects to provisions applicable to data identified as trade secrets. The federal government, in collaboration with business associations, should also implement programmes to provide guidance on the implementation of the EU AI Act.

Increase the availability of public open data, support firms in improving their data maturity, and promote data-sharing initiatives to help SMEs access quality data

Availability of and access to open and industrial data have emerged as bottlenecks for AI development. The federal government could introduce and enforce legislation that mandates government agencies at all levels to publish non-sensitive data in open formats. This will make a wide range of information available for training AI models on German content. Programmes supporting SMEs in transfer activities could strengthen their focus on improving data maturity in firms. Support could be accompanied by collaboration with research or government entities to assist SMEs in sharing, accessing and using data from sectoral data spaces. Establishing data quality standards could help SMEs ensure that shared data are reliable and accurate and comply with legislation.

Revise tax incentives, strengthen R&D grants and introduce vouchers to support AI uptake by SMEs

Germany is implementing programmes to foster the development and integration of AI within business. However, these initiatives, particularly those providing grants for AI R&D, face high demand and are unable to meet the needs of many SMEs. There is an opportunity to allocate additional resources to reinforce support for SMEs engaged in AI research, development, and implementation in co-operation with research partners or start-ups. Financial support could be provided through tax policies. Germany could consider revising existing tax incentives, tailoring them specifically to businesses investing in AI technologies. This could include tax credits for AI research expenditures, training to enhance AI and data-related skills, or investment to improve data maturity. Furthermore, given generative AI’s potential to enhance productivity, the federal government could consider establishing vouchers of modest amounts (e.g. EUR 5 000-10 000) to support SMEs’ collaborations with advisors and consultants to tailor generative AI solutions to their businesses.

Improve access to financing for AI start-ups

While public support to new and small firms is available and effective in pre-seed and seed rounds, AI start-ups face challenges accessing capital to scale up. The availability of VC could be increased by revisiting the legal framework for capital-collecting institutions. For instance, institutional funds, like pension funds and insurance companies, could be required to allocate a percentage to VC or private equity for innovative firms. To mobilise corporate financing, the federal government could introduce and expand tax incentives, allowing private investors to offset capital losses against other income or providing exemptions for future profits when investing in the VC asset class. Moreover, public support could be enhanced by establishing a targeted funding programme to boost AI start-ups in their growth phase. Such a programme should prioritise science-based projects that demonstrate the potential to bring significant technological advancements and economic benefits.

Revise and simplify public procurement procedures to ensure that start-ups and established companies have equal access to opportunities

Access to public procurement contracts could provide AI start-ups with a market for their products and services. However, public procurement organisations only partially employ innovation-promoting instruments, and their requirements are often high in terms of turnover, references, number of employees, and other criteria. The federal government should provide guidelines to ensure that start-ups – particularly those with science-based innovations – have equal access to procurement opportunities alongside established companies. Furthermore, the federal government should analyse what factors prevent start-ups from participating in public calls and explore ways to revise some requirements.

AI infrastructure

As a key player in AI research and development, Germany is advancing its AI capabilities by investing in AI compute, which involves specialised hardware and software stacks. The country's strategic investment in modernising computing infrastructure and participating in the Gaia-X project reflects its commitment to enhancing AI applications and data sharing.

Germany’s national AI strategy focuses on boosting compute infrastructure, especially for research and academia, and promoting data access

Along with data and algorithms, AI infrastructure, also known as “AI compute” is a substantial component of AI development. It is expected to drive and improve AI’s capabilities over time. It is distinct from other AI inputs like data or algorithms because it is grounded in “stacks” or layers of physical infrastructure and hardware, along with AI-specific software (OECD, 2023[72]). Advancements in AI compute have enabled a transition from general-purpose processors, such as central processing units (CPUs), to specialised hardware requiring less energy for more computations per unit of time. Today, advanced AI is predominantly trained on specialised hardware optimised for certain types of operations, such as graphics processing units (GPUs), Tensor Processing Units, and others. Advanced AI research is becoming more computationally intensive and expensive, and many countries do not have the AI compute capacity to implement their national AI strategies. The demand for AI compute has grown dramatically, especially for deep learning neural networks. Securing specialised hardware purpose-built for AI can be challenging due to complex supply chains, as illustrated by bottlenecks in the semiconductor industry (Khan, Mann and Peterson, 2021[73]).

The 2018 German national AI strategy and the 2020 update include significant investments in AI computing infrastructure. Namely, the strategies commit significant investments to develop advanced AI infrastructure to support national scientific, R&D, and academic applications, and to facilitate data sharing and use. The 2020 strategy update puts forward an AI Made in Europe approach, outlining various initiatives including modernising existing supercomputing infrastructure and increasing computing capacity through new ones. The strategy allocates EUR 512 million towards developing data infrastructure and supporting the Gaia-X project. These investments aim to provide more data from previously inaccessible data pools, to bolster Germany’s AI centres of excellence and align them with regional AI application hubs (German Federal Government, 2020[1]).

According to the German Data Centre Association, the demand for AI infrastructure and services is growing in Germany, with many AI applications requiring infrastructure with high security and data protection requirements. Accordingly, the industry association notes in its 2023-24 German Datacentre Outlook that many companies plan to install related capacity in Germany in the years ahead (GDA, 2023[74]).

Germany’s strategic approach to AI computing infrastructure focuses on building modern infrastructure to support research excellence. The commitment to modernising existing German AI infrastructure includes undertaking the accelerated expansion of the Gauss Centre for Supercomputing to exascale capability, along with investments in high-performance computing capacity jointly with relevant Länder, to support scientific, research, and academic applications. Germany’s national computing capacity for AI is also bolstered by a significant country-wide network of universities and research institutes, that have invested in computing infrastructure for their students and researchers. Germany’s strategic approach also includes cloud initiatives, namely the commitment to establish a high-performance and secure federated data infrastructure to support interoperable data sharing through the project Gaia-X (German Federal Government, 2020[1]).

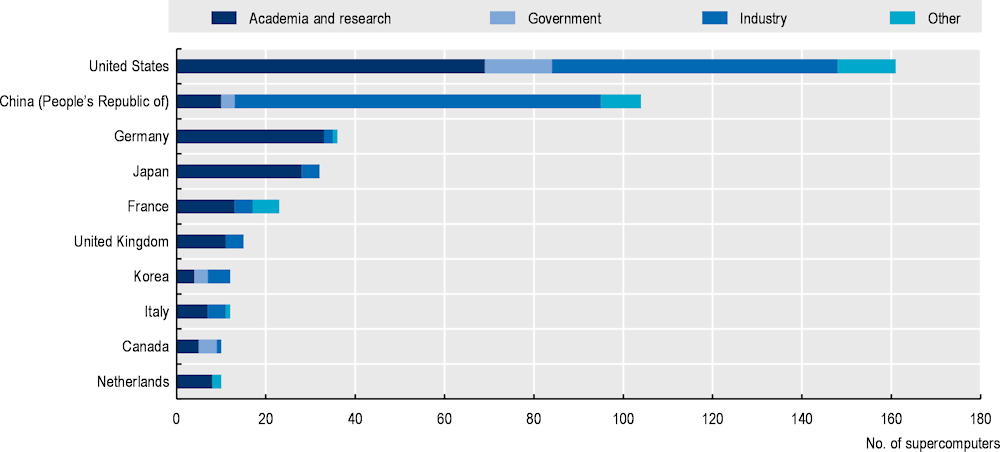

Germany has world-class computing infrastructure for research and academia