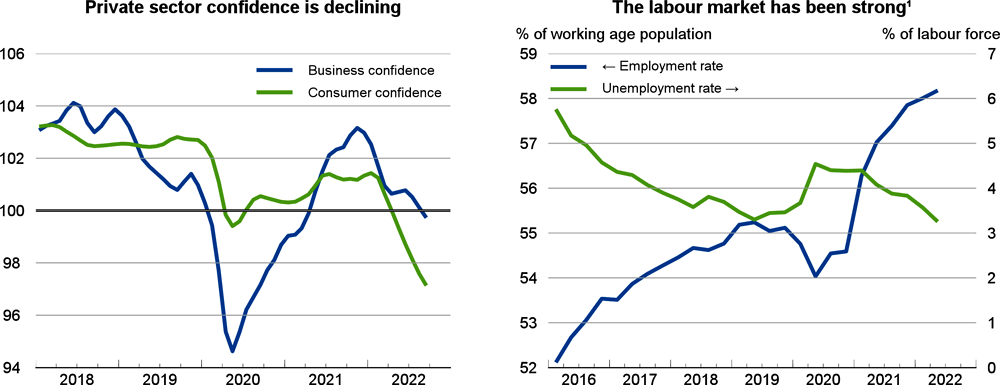

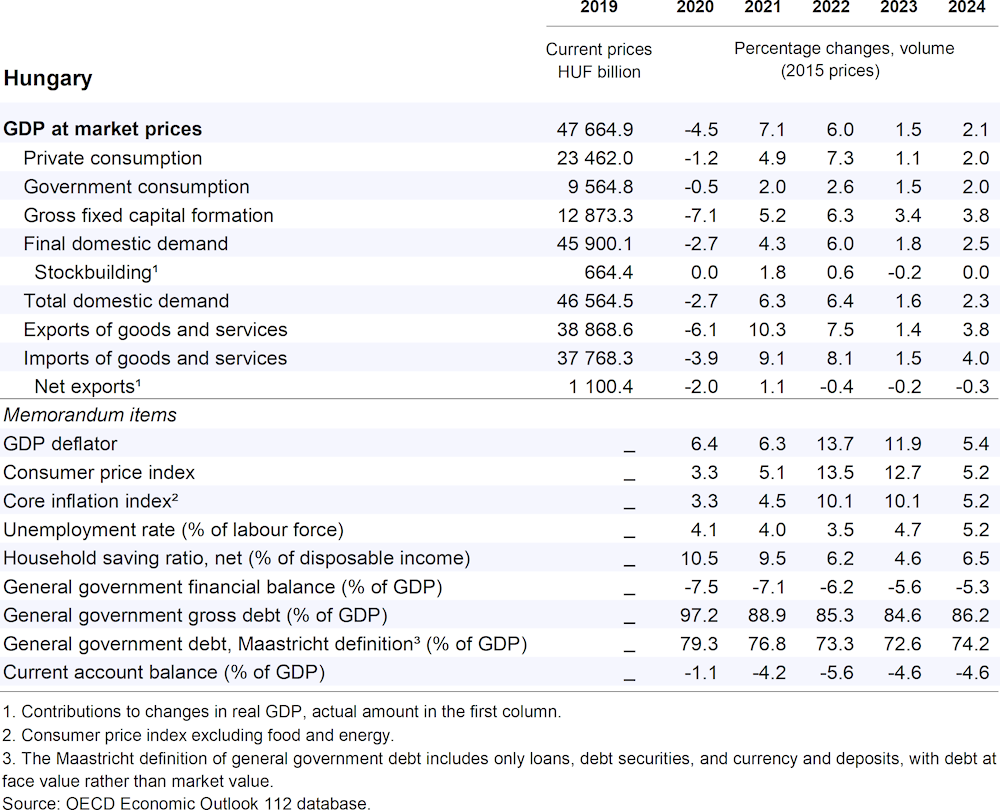

Growth is projected to decline from 6% in 2022 to 1.5% in 2023, before recovering to 2.1% in 2024. The slowing reflects persistently high inflation, the economic fall-out of Russia’s war of aggression against Ukraine, weaker external demand and negative confidence effects. Private consumption is likely to be dampened by increasing unemployment and a deceleration of real wages. Business investment is projected to slow in the face of high interest rates and falling demand, although this is to be partly offset by higher public investment amidst an inflow of EU funds.

Further monetary tightening may be warranted to contain inflation. Fiscal policy will turn restrictive in 2023, but more restraint is needed to reduce inflationary pressures. Support to groups that are vulnerable to high energy prices and to improve the often-poor thermal efficiency of the housing stock should be financed through savings elsewhere. Productivity growth should be raised by accelerating the digitalisation of the economy, fostering competition in product markets, and strengthening labour mobility.